Notícias do Mercado

-

23:59

US Dollar Index licks its wounds at six-month low near 104.00 ahead of Fed’s verdict

- US Dollar Index struggles to defend the bounce off the lowest levels since June, marked the previous day.

- DXY dropped the most in two weeks to refresh multi-day low on downbeat US inflation data.

- Hawkish Fed bets retreat as US CPI slows down the most in over a year.

- Fed’s 50 bps rate hike is almost given, signals for futures moves will be crucial to watch.

US Dollar Index (DXY) flirts with 104.00 during early Wednesday, after falling to the lowest levels in six months the previous day. In doing so, the greenback’s gauge versus the six major currencies portray the cautious mood ahead of today’s Federal Open Market Committee (FOMC) monetary policy meeting.

The DXY reported the biggest daily slump in two weeks while refreshing the multi-day low on Tuesday after the US inflation data raised hopes that Fed will ‘pivot’ sooner during early 2023.

That said, US Consumer Price Index (CPI) dropped to 7.1% YoY in November versus the 7.3% expected and 7.7% prior. Further, the CPI ex Food & Energy, known as the Core CPI, also declined to 6.0% YoY during the stated month compared to 6.1% market forecasts and 6.3% previous readings. “Traders of futures tied to the Federal Reserve’s policy rate boosted bets Tuesday that the U.S. central bank will notch down its interest-rate hike pace further early next year, after a government report showed inflation eased sharply in November,” said Reuters.

Additionally, helping the DXY to remain stable could be the headlines surrounding China that challenges the previous optimism for the dragon nation. the International Monetary Fund (IMF) Managing Director Kristalina Georgieva was spotted expecting slower economic growth for China due to the latest jump in the daily Covid cases. Additionally, Bloomberg came out with the news suggesting that the Chinese leaders delayed the economic policy meeting due to the COVID-19 problems.

Amid these plays, Wall Street closed positive but the S&P 500 Futures struggle for clear directions. Further, the US Treasury bond yields also remain sidelined after declining the most in a week to snap three-day uptrend.

Given the pre-Fed caution, the DXY may witness further sidelined performance as the latest US CPI challenges the policy hawks. Also, the already-given 50 bps rate hike and lesser odds of witnessing any surprises from the FOMC adds to the market’s action. However, a surprise from the Fed, either in the form of rate hike directions or economic projections, won’t be taken lightly.

Technical analysis

Unless providing a daily closing beyond a three-week-old descending resistance line, around 104.90 by the press time, DXY remains pressured towards May 2022 low of 105.30.

-

23:52

Japan Tankan Large Manufacturing Outlook meets forecasts (6) in 4Q

-

23:51

Japan Tankan Non - Manufacturing Outlook registered at 11, below expectations (16) in 4Q

-

23:51

Japan Machinery Orders (YoY) below forecasts (2.6%) in October: Actual (0.4%)

-

23:51

Japan Machinery Orders (MoM) above forecasts (2.6%) in October: Actual (5.4%)

-

23:50

Japan Tankan Non - Manufacturing Index above expectations (17) in 4Q: Actual (19)

-

23:50

Japan Tankan Large All Industry Capex registered at 19.2% above expectations (18.4%) in 4Q

-

23:50

Japan Tankan Large Manufacturing Index came in at 7, above expectations (6) in 4Q

-

23:49

FOMC Preview: Median dot to rise 50bp to a new peak of 5-5.25% – Goldman Sachs

Despite witnessing a sharp retreat in the hawkish Fed bets, Goldman Sachs (GS) defends its forecast of a median peak rate 5.00 to 5.25%.

The US bank initially stated, “Aside from a widely expected 50bp rate hike, the main event at the December FOMC meeting is likely to be an increase in the projected peak for the funds rate in 2023,” before adding that they expect the median dot to rise 50bp to a new peak of 5-5.25%, in line with their own forecast for Fed policy next year.

GS also stated that aside from the increase in the terminal rate, we do not expect major changes at the December meeting.

Key quotes

At some point the FOMC statement will likely be revised to say that ‘further’ rather than ‘ongoing’ rate hikes are appropriate, but not yet.

The economic projections are likely to show a bit less growth next year, but a broadly similar outlook.

And the dot plot is likely to show slightly larger cuts beyond 2023 from the new higher peak.

Also read: Federal Reserve Preview: How Powell may drain the Dollar of any dot-related gains

-

23:45

GBP/JPY eyes downside to near 167.00 as further BOE rate hike to bolster recession

- GBP/JPY is expected to decline further to near 167.00 on weak UK Employment data.

- Upbeat UK Average Earnings data to propel inflationary pressures ahead.

- Further BOE’s policy tightening will make the recession situation more vulnerable.

The GBP/JPY pair is struggling to hold itself above the cushion of 167.50 in the early Asian session. The cross witnessed a sharp sell-off on Tuesday as investors are hoping that the recession situation in the United Kingdom would get worsen if the Bank of England (BOE) escalate interest rates further. Meanwhile, the GBP/USD pair is displaying more pain amid a recovery in the US Dollar Index.

On Tuesday, the UK Office for National Statistics reported a significant jump in Claimant Count Change data. The initial jobless claims for November surprisingly reported a significant jump by 30.5K while the market participants were expecting a decline of 13.3K. Apart from that, Average Earnings soared to 6.1%, which has bolstered inflation expectations as higher households' earnings will result in robust retail demand.

The UK economy is already facing a recession situation and it is expected to get vulnerable further as the Bank of England (BOE) is set to hike its interest rates amid an absence of evidence that could convey a slowdown in inflationary pressures ahead.

On the Tokyo front, investors are expecting more stimulus packages from the Japanese administration in order to spurt the extent of economic activities. The Bank of Japan (BOJ) is already favoring the policy easing approach to accelerate inflation and is expected to continue further till inflation reaches to 2% target confidently.

GBP/JPY technical outlook

-638065719174622744.png)

On an hourly scale, the GBP/JPY pair has delivered a breakdown of the upward-sloping trendline plotted from December 2 low at 164.05. A bear cross, represented by the 20-and 50-period Exponential Moving Averages (EMAs) at 168.06, indicates more weakness ahead. The 200-EMA around 167.27 is still working as a support to the Pound Sterling.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which signifies that the downside momentum is active.

-

23:36

WTI stays defensive above $75.00 on mixed OPEC oil demand forecasts, API inventory build

- WTI crude oil fades bullish bias at one-week high, stays pressured at intraday low of late.

- OPEC defends yearly Oil demand forecasts but cuts quarterly projections for Q4 2022 and Q1 2023.

- API reports higher inventory build for the week ended on December 09.

- EIA inventories, FOMC announcements will be crucial as US inflation favors dovish Fed bets.

WTI crude oil traders struggle for clear directions around $75.30 during Wednesday’s Asian session. In doing so, the black gold differs from a three-day uptrend from the yearly low amid the market’s cautious mood ahead of today’s Federal Open Market Committee (FOMC).

Adding strength to the WTI inaction could be the mixed oil demand forecasts from the Organization of the Petroleum Exporting Countries (OPEC), as well as headlines surrounding China.

“Oil demand in 2023 will rise by 2.25 million barrels per day (bpd), or about 2.3%, the OPEC said in a monthly report, after growth of 2.55 million bpd in 2022. Both forecasts were unchanged from last month,” reported Reuters. The news also added, “While keeping the annual demand growth forecasts steady, OPEC trimmed the absolute demand forecasts in the fourth quarter of 2022 and the first quarter of 2023. Chinese demand, hit by COVID containment measures, has contracted in 2022,” OPEC said per Reuters.

On a different page, the International Monetary Fund (IMF) Managing Director Kristalina Georgieva was spotted expecting slower economic growth for China due to the latest jump in the daily Covid cases. Additionally, Bloomberg came out with the news suggesting that the Chinese leaders delayed the economic policy meeting due to the COVID-19 problems.

Oil bulls could have cheered the downbeat US inflation data but a surprise increase in the American Petroleum Institute’s (API) weekly inventory for the week ended on December 09, to 7.819M versus -6.289M prior, challenge the black gold buyers.

Above all, doubts over the market’s fears of fewer rate hikes and cautious mood ahead of the Fed’s verdict challenge the WTI traders.

Moving on, the risk surrounding China and pre-Fed moves could restrict WTI moves. Also likely to limit the Oil moves could be weekly official inventory data from the US Energy Information Administration (EIA), prior -5.187M.

Technical analysis

The 10-DMA precedes a five-week-old descending trend line to restrict short-term WTI crude oil upside near $75.40 and $78.80 in that order. The pullback moves, however, remain elusive unless refreshing the yearly low of $70.30.

-

23:13

NZD/USD Price Analysis: Bulls need clear break of 0.6480 to keep the driver’s seat

- NZD/USD struggles for clear directions at six-month high.

- Overbought RSI conditions, four-month-old horizontal resistance challenge bulls.

- Monthly support line, sustained trading beyond 200-DMA restrict bear’s entry.

NZD/USD remains sidelined around 0.6460 during Wednesday’s Asian session, after retreating from a six-month high before a few hours.

The quote rallied to the highest levels since June the previous day, and also posted the biggest daily gains in a fortnight, but failed to offer a daily closing beyond the key 0.6480 hurdle comprising tops marked in August, as well as during early December.

The pullback move also took clues from the overbought RSI conditions, suggesting further profit-booking on the road.

Though, an upward-sloping support line from early November, close to 0.6415 by the press time, puts a floor under the NZD/USD prices.

In a case where the Kiwi pair drops below 0.6415 support, a slump towards the November 29 peak of 0.6290 and then to the 200-DMA support of 0.6213 can’t be ruled out. However, a two-month-old ascending support line near 0.6190 could defend the bulls afterward.

On the flip side, a successful break of 0.6480 could propel the NZD/USD prices toward the tops marked in May and June, around 0.6568-75. Following that, a run-up towards March’s low near 0.6730 becomes more likely.

Overall, NZD/USD bulls stay in the driver’s seat but the pair’s further upside hinges on the 0.6480 breakout.

NZD/USD: Daily chart

Trend: Pullback expected

-

23:11

AUD/JPY Price Analysis: Doji around 92.80-93.30s suggests consolidation ahead

- Tuesday’s price action of the AUD/JPY formed a classic doji, meaning traders are undecided about the current trend.

- AUD/JPY: Break above 93.00 would exacerbate a rally: otherwise, a fall toward the 200-DMA is on the cards.

The Australian Dollar (AUD) reached a fresh 2-week high around 93.35 on Tuesday, though it retraced some of those gains and registered a daily close slightly above the 20-day Exponential Moving Average (EMA), sitting around 92.86. However, as the Asian Pacific session begins, the AUD/JPY is trading at 92.90, printing minuscule losses of 0.03%.

AUD/JPY Price Analysis: Technical outlook

From the daily chart, the AUD/JPY remains neutral though slightly tilted to the downside. Most Exponential Moving Averages (EMAs) concentrated around the 92.87-93.42 area, above the exchange rate, suggesting the AUD/JPY might fall in the near term. Additionally, Tuesday’s full price action forming a classic “doji,” portrays the indecision of buyers and sellers. Investors should be aware that the Relative Strength Index (RSI) is in bearish territory, almost flat, while the Rate of Change (RoC) shows buying pressure begins to build up.

Therefore, upwards, the AUD/JPY first resistance would be the psychological 93.00. Break above will expose the confluence of the 50-day EMA and the December 13 daily high at around 93.35, followed by the 94.00 figure, ahead of the October 21 swing high of 95.73.

On the flip side, the AUD/JPY first support would be the 93.00 mark. A breach of the latter will exacerbate a fall toward the 200-day Exponential Moving Average (EMA) at 92.01, followed by the October 13 swing low of 90.83, followed by the August 2 daily low of 90.52.

AUD/JPY Key Technical Levels

-

23:09

USD/CHF senses barricades around 0.9300 as less-hawkish Fed bets soar

- USD/CHF has sensed selling pressure while attempting to extend its recovery above 0.9300.

- The US Treasury yields have dropped to 3.50% as the Fed is set to slow down the extreme policy tightening pace.

- The SNB is expected to hike its interest rates by 50 bps to 1%.

The USD/CHF pair has faced hurdles in early Asia while attempting to cross the round-level resistance of 0.9300 after a rebound move from a fresh eight-month low of around 0.9231. The Swiss franc asset witnessed an intense sell-off on Tuesday after the release of a soft United States inflation report for November month.

Risk-perceived assets such as S&P500 extended their recovery dramatically as a significant decline in inflation data would trim weaker economic projections. The 500-stock basket surrendered some of its gains on settlement as investors are awaiting the interest rate decision by the Federal Reserve (Fed) for making informed decisions.

The US Dollar Index (DXY) is struggling to sustain above 104.00 as the Fed is expected to decelerate its interest rate hike pace led by a slowdown in inflation. Investors’ risk appetite has been strengthened as lower inflation has trimmed hopes of a recession in the United States economy. Meanwhile, the 10-year US Treasury yields have dropped to 3.50% as Fed chair Jerome Powell is expected to slow down the extreme policy tightening pace.

Meanwhile, Fed funds futures prices implied a better-than-even chance that the Fed will follow its expected half-point interest-rate hike this week with a smaller 25-basis-point rate hike in February, ultimately raising rates no higher than the 4.5%-4.75% range in its battle to beat inflation, as reported by Reuters.

On the Swiss franc front, Switzerland’s State Secretariat for Economic Affairs (SECO) in its latest economic forecasts said on Tuesday, the government expects the country's economic growth to slow next year but is unlikely to enter a recession. He further added that the energy situation in Europe is likely to remain tense with gas and electricity prices running high.

This week, the entire focus will remain on the monetary policy announcement by the Swiss National Bank (SNB). As per the consensus, SNB Chairman Thomas J. Jordan is expected to hike its interest rates by 50 basis points (bps) to 1%.

-

23:00

South Korea Unemployment Rate registered at 2.9% above expectations (2.8%) in November

-

22:56

AUD/USD seesaws near 0.6850 as pre-Fed anxiety probes RBA Governor Lowe’s optimism

- AUD/USD fails to cheer positive economic expectations of RBA Governor Philip Lowe near a three-month high.

- RBA’s Lowe appears optimistic on cross-border payments, economic growth due to the same.

- US inflation bolstered case of slower Fed rate hikes and drowned the US Dollar ahead of FOMC.

- China-linked headlines, pre-Fed caution probe Aussie Dollar bulls.

AUD/USD treads water around 0.6855 during early Wednesday, after a volatile day that offered the biggest jump in a fortnight and refreshed a three-month low.

While the downbeat US inflation number propelled the Aussie pair, chatters surrounding China and the cautious mood ahead of the Federal Open Market Committee (FOMC) monetary policy meeting test momentum traders.

It’s worth noting that Reserve Bank of Australia (RBA) Governor Philip Lowe spoke recently at the AusPayNet Annual Summit. "Overall, we are optimistic that least-cost routing will help counter the forces that are adding to merchants' payment costs, particularly for small businesses," Lowe said per Reuters.

That said, US Consumer Price Index (CPI) dropped to 7.1% YoY in November versus the 7.3% expected and 7.7% prior. Further, the CPI ex Food & Energy, known as the Core CPI, also declined to 6.0% YoY during the stated month compared to 6.1% market forecasts and 6.3% previous readings. “Traders of futures tied to the Federal Reserve’s policy rate boosted bets Tuesday that the U.S. central bank will notch down its interest-rate hike pace further early next year, after a government report showed inflation eased sharply in November,” said Reuters. The same drowned the US Dollar Index (DXY) to a six-month low of 103.61 and fuelled the AUD/USD prices before the quote retreated from 0.6893.

Elsewhere, the International Monetary Fund (IMF) Managing Director Kristalina Georgieva was spotted expecting slower economic growth for China due to the latest jump in the daily Covid cases. Additionally, Bloomberg came out with the news suggesting that the Chinese leaders delayed the economic policy meeting due to the COVID-19 problems.

Furthermore, increasing chatters that today’s Fed rate hike worth 50 basis points (bps) rate increase is the last and the US central bank is up for slowing down the rate lift from 2023-start keep the traders on the edge.

Amid these plays, Wall Street closed positive and the US 10-year Treasury yields slumped nearly 11 basis points (bps) to 3.50% by the end of Tuesday’s North American session.

Looking forward, AUD/USD could remain sidelined amid the pre-FOMC cautious mood. However, increasingly dovish expectations raise fears of a wild slump in case of a hawkish surprise from the Fed.

Technical analysis

A daily closing beyond the one-month-old ascending resistance line, near 0.6885 by the press time, becomes necessary for the bulls to keep the reins. However, the bears will wait for a clear break of the 100-DMA support, near 0.6675 at the latest, to take the risk of entry. Hence, AUD/USD may witness further grinding towards the north.

-

22:35

GBP/USD corrects to near 1.2350, upside seems favored on hopes of a smaller Fed rate hike

- GBP/USD is expected to conclude its corrective move to near 1.2350 as the risk-on impulse is rock solid.

- The odds of a 50 bps rate hike by the Fed have bolstered on soft US inflation report.

- UK’s headline CPI could rise surprisingly as the food price inflation has soared amid escalating food supply crisis.

The GBP/USD pair has corrected at a casual pace to near 1.2350 in the early Asian session after registering a fresh six-month high at 1.2444. The Cable is expected to rebound ahead as investors’ risk appetite is extremely solid after the release of soft US inflation data on Tuesday.

S&P500 displayed a juggernaut rally on Tuesday as lower-than-anticipated inflation data trimmed the risk of recession in the United States economy. Gains in the 500-stock basket of the US trimmed near settlement as anxiety among investors still sustain ahead of the interest rate decision by the Federal Reserve (Fed). However, the risk-on impulse is still solid and is expected to keep reins in the risk-sensitive assets.

The US Dollar Index has shown a fragile recovery after registering a fresh five-month low at 103.59. Less-confident recovery in the USD Index could get terminated amid a decline in safe-haven appeal. Soft US inflation data has accelerated hopes of a smaller and slower interest rate hike by the Fed, which has resulted in higher demand for US Treasury bonds. The 10-year US Treasury yields have dropped to 3.50%.

A note from Commerzbank dictates that “The 50 basis points hike, which is generally expected for tomorrow's FOMC meeting, can be considered almost certain after today's data.” We continue to assume that the Fed will reduce the size of the rate hikes again at the beginning of 2023, moving by only 25 bps in February and March.

On the United Kingdom front, investors have shifted their focus toward the inflation data. The annual Consumer Price Index (CPI) is expected to decline to 10.9% from the former release of 11.1% for November. While the core CPI is seen unchanged at 6.5%. UK’s headline CPI could display a surprise rise as the food price inflation has soared amid escalating food supply crisis.

-

22:29

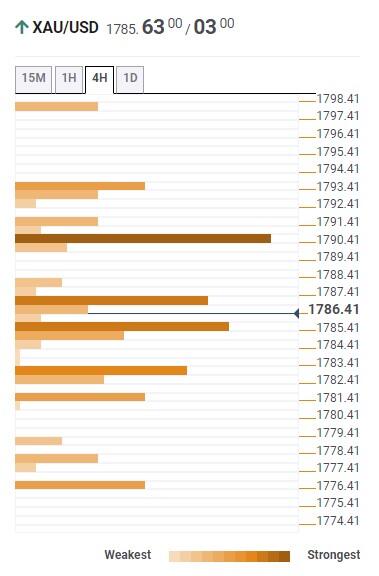

Gold Price Forecast: XAU/USD grinds near $1,820 hurdle with eyes on Fed

- Gold price seesaws around multi-day high after retreating from the key resistance.

- US Dollar plunged after inflation data as softer CPI figures cut hawkish Fed bets.

- Cautious mood ahead of FOMC, concerns surrounding China test XAU/USD bulls.

- US Federal Reserve is set for 50 bps rate hike but the future guidance will be key for Gold traders.

Gold price (XAU/USD) buyers struggle to defend the biggest daily jump in a fortnight as the metal seesaws around $1,810, following a retreat from the highest levels since late-June.

Slower-than-expected growth in the US inflation, actually the slowest in over a year, allowed Gold buyers to return to the desk and refresh multi-day high near $1,825. That said, the market’s anxiety ahead of today’s Federal Open Market Committee (FOMC) and a bit pale headlines from China seemed to have tested the XAU/USD bulls of late.

US Consumer Price Index (CPI) dropped to 7.1% YoY in November versus 7.3% expected and 7.7% prior. Further, the CPI ex Food & Energy, known as the Core CPI, also declined to 6.0% YoY during the stated month compared to 6.1% market forecasts and 6.3% previous readings. “Traders of futures tied to the Federal Reserve’s policy rate boosted bets Tuesday that the U.S. central bank will notch down its interest-rate hike pace further early next year, after a government report showed inflation eased sharply in November,” said Reuters. The same drowned the US Dollar Index (DXY) to a six-month low of 103.61 and propelled the Gold price.

On the other hand, the International Monetary Fund (IMF) Managing Director Kristalina Georgieva was spotted expecting a slower economic growth for China due to the latest jump in the daily Covid cases. Additionally, Bloomberg came out with the news suggesting that the Chinese leaders delayed the economic policy meeting due to the COVID-19 problems.

Above all, cautious mood ahead of today’s Fed, especially after Tuesday’s downbeat US inflation data, keeps the Gold traders on the edge.

Even so, Wall Street closed positive and the US 10-year Treasury yields slumped nearly 11 basis points (bps) to 3.50% by the end of Tuesday’s North American session.

Moving on, Gold traders may witness sidelined moves ahead of FOMC. Given the dovish expectations, with 50 bps rate hike on the card, surprise hawkish signals will be enough to recall the XAU/USD bears.

Gold price technical analysis

Gold price flirts with a six-month-old horizontal resistance surrounding $1,810 after faking the rising wedge confirmation the previous day. That said, the yellow metal also reversed from the stated one-month-old wedge’s upper line while consolidating the biggest daily gains in a fortnight.

Given the nearly overbought RSI and sluggish MACD signals, not to forget the XAU/USD pullback from the wedge’s top-line, currently around $1,820, the yellow metal may witness further grinding.

That said, a convergence of the 10-DMA and the wedge’s lower line offers strong downside support near $1,790, a break of which could quickly drag the quote towards September’s high near $1,735.

Alternatively, an upside clearance of the $1,820 hurdle won’t hesitate to propel the metal prices towards June’s peak surrounding $1,880.

Gold price: Daily chart

Trend: Limited upside expected

-

22:13

EUR/USD Price Analysis: Pierces and holds above 1.0600 and tests the 2020’s lows

- The Euro reached a seven-month high but cut some of its gains, up by 0.92%.

- A daily close above 1.0600 could pave the way for the EUR/USD toward 1.0700.

- EUR/USD: Break below 1.0600 could exacerbate a fall to 1.0500.

The EUR/USD hit a seven-month high at around 1.0673, but although it remains positive, it trimmed some of its earlier gains late in the New York session. Hence, the EUR/USD is trading at 1.0631, above its opening price by 0.89%, at the time of writing.

EUR/USD Price Analysis: Technical outlook

Tuesday’s price action depicts the EUR/USD trading at multi-month highs, punching through the 24-month-old downslope resistance trendline, broken around 1.0593, exacerbating a rally above the psychological 1.0600 mark. Additionally, the Euro is trading at around the 2020 lows, at 1.0635, which, once cleared, could open the door for a test of the 1.0700 mark.

The Relative Strength Index (RSI) is in bullish territory, about to enter the overbought region. Meanwhile, the Rate of Change (RoC) depicts that buying pressure is fading. Therefore, mixed signals suggest consolidation around the 1.0600-1.0630 area. A daily close above 1.0600 could exacerbate a rally toward 1.077, but it would depend on Wednesday’s Federal Reserve monetary policy meeting.

EUR/USD key resistance levels lie at 1.0673, followed by the psychological 1.0700 figure, followed by the May 30 swing high at around 1.0786. On the flip side, the EUR/USD first support would be the 1.0600 mark. Break below will expose the December 13 low of 1.0528, followed by the 1.0500 figure.

EUR/USD Key Technical Levels

-

22:08

USD/CAD declines towards 1.3500 as lower US Inflation cements less-hawkish Fed policy

- USD/CAD is declining towards the crucial support of 1.3500 as hopes of the Fed’s smaller rate hike have strengthened.

- A decline in gasoline cost and US PPI has trimmed inflation figures.

- Soft US inflation data has supported oil prices as the risk of recession has trimmed.

The USD/CAD pair is displaying back-and-forth moves around 1.3540 in the early Asian session. The Loonie asset has turned sideways after a breakdown of a five-day low of around 1.3561 on Tuesday. The major has been exposed to test the psychological support of 1.3500 as the risk-on impulse has strengthened after the release of a soft United States November inflation report.

The US Dollar Index (DXY) has registered almost a fresh six-month low at 103.59 and is expected to extend its losses further as a sheer decline in United States inflation has accelerated the odds of a slowdown in the current policy tightening pace of the Federal Reserve (Fed). S&P500 extended its upside on Tuesday as lower inflation has trimmed the risk of recession in the US economy. Meanwhile, the 10-year US Treasury yields have dropped significantly to 3.50%.

Fed policymakers were already discussing on slowing down the current interest rate hike to avoid financial risks. Now, a significant decline in inflation has bolstered the expectations.

The headline US Consumer Price Index (CPI) dropped to 7.1% from the expectations of 7.3% and the former release of 7.7%. Thanks to a decline in the cost of gasoline and prices of ultimate goods at the factory gate, which has resulted in a slowdown in inflationary pressures. Also, the core inflation that excludes oil and food prices declined to 6.0% vs. the consensus of 6.1% and the prior release of 6.3%.

On the oil front, oil prices have corrected after hitting $76.00 as a cool-off in ultra-hot US inflation has trimmed weaker economic projections. Meanwhile, investors are keeping an eye on oil inventories reported by the Energy Information Administration (EIA) for fresh cues. It is worth noting that Canada is a leading oil exporter to the US and higher oil prices support the Canadian Dollar.

-

21:46

New Zealand Current Account - GDP Ratio above forecasts (-8.7%) in 3Q: Actual (-7.9%)

-

21:45

New Zealand Current Account (QoQ) came in at $-10.2B below forecasts ($-10B) in 3Q

-

21:43

USD/JPY bears lurking at bulls come up for air

- USD/JPY is pressured on the front side of the trendline resistance.

- US Dollar was sent lower on the US CPI data and Fed expectations.

Against the Yen, the US Dollar dropped to a one-week low of 134.65 and is currently down 1.5% following the US Consumer Price Index that showed that inflation rose less than expected last month.

Subsequently, there are higher expectations that the Federal Reserve will slow the pace of rate increases after its two-day meeting on Wednesday.

US CPI below the mark

- US CPI MoM Nov: 0.1% (est 0.3%, prev 0.4%).

- US CPI Ex Food And Energy MoM Nov: 0.2% (est 0.3%, prev 0.3%).

- US CPI YoY Nov: 7.1% (est 7.3%, prev 7.7%).

- US CPI Ex Food And Energy YoY Nov: 6.0% (est 6.1%, prev 6.3%).

The Consumer Price Index has led to the markets pricing the terminal Fed rate down to 4.86% vs 4.98% prior to the report and US stocks on Wall Street opened bid in the cash market. The NASDAQ jumped over 400 points but was met with supply as traders took profits ahead of the Fed.

While the CPI report supported widely held expectations for a smaller Fed rate hike of 50 basis points and even as the Fed funds futures priced in a lower terminal rate, the US dollar found some traction late in the day. DXY, an index that measures the greenback vs. a basket of currencies, including the Yen, is down some 0.9% at 104.03 but off the lows of the day of 103.586.

USD/JPY technical analysis

USD/JPY is pressured on the front side of the trendline resistance and the 130.00 area could be tested in the coming days or weeks if the bears stay the course. If fact, as per the following weekly chart, if the Fed turns out to be uber-dovish, the level could be reached before the close of the week. It has not been uncommon for the yen to fly 500 pips in a week:

-

20:41

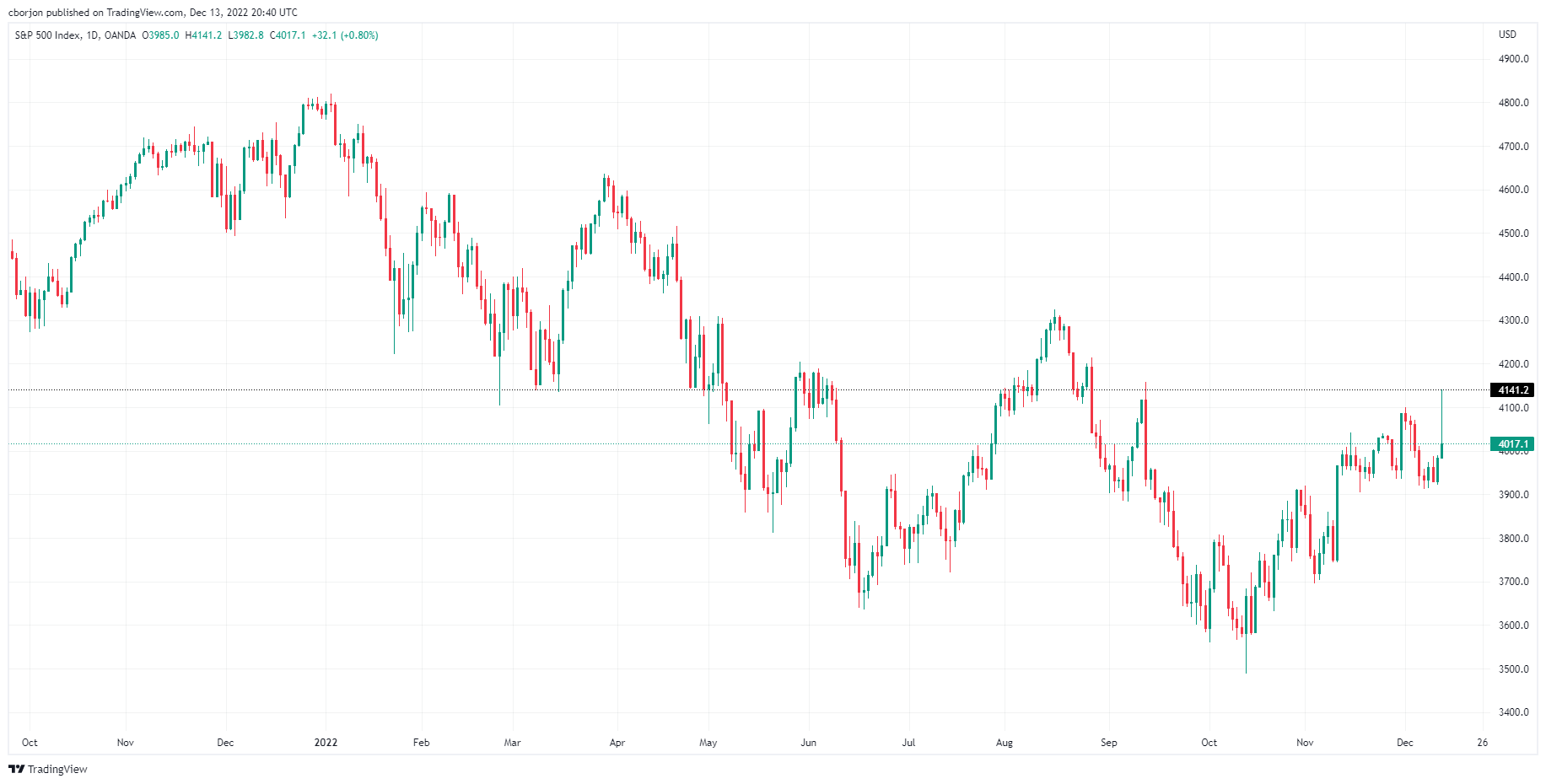

S&P 500 reclaims 4,000 following the release of a soft US inflation report

- The S&P 500, the Nasdaq 100, and the Dow Jones remain positive.

- Softer than expected, US CPI data augmented speculations that the Fed will be less aggressive.

- Traders expect the Federal Reserve to hike to 5% and cut rates ahead of Q4 2023.

US stocks remained volatile after the release of inflation data in the United States (US) and remain positive off the day's highs, with the S&P 500, the Nasdaq 100, and the Dow Joines Industrial Average, each gaining 0.98%, 1.33%, and 0.47%. At the time of writing, the S&P 500 sits around 4,026.90.

It should be said that the indices, albeit remaining positive, are trading well below the day’s highs, as shown by Tuesday’s price action, forming a vast “inverted hammer” candlestick. Some traders speculate that is the reflection of profit-taking ahead of Wednesday’s Federal Reserve monetary policy meeting.

Before Wall Street opened, the US Department of Labor revealed that November’s Consumer Price Index (CPI) rose less than the 7.3% YoY expected to 7.1%. The so-called core CPI for the same period, which excludes volatile items like food and energy, printed 6.0% vs. 6.3% estimates. The reaction on the data sent the S&P 500 rallying to fresh three-month highs.

Money market futures seem to indicate an upcoming rise in the Federal Funds rate, making it peak at 5%. Eurodollar futures portrayed traders speculating that the Federal Reserve would make its first rate cut of around 20 bps by September 2023. Meanwhile, the US Dollar Index appeared volatile as it fell to six-month lows near 103.586, although recovering shortly afterward and now resting comfortably at 103.987.

Elsewhere, US Treasury bond yields, namely the 10-year benchmark note rate, plunged 15 bps, from around 3.630% to 3.459%, though of late, recovered some ground, sitting around 3.514%.

Analysts at TD Securities said, “the November CPI report does not affect the expectation of a 50bp rate increase at tomorrow’s FOMC meeting. Additionally, given the strength in core services inflation, it is clear the Fed will need to remain in a tightening mode beyond the December meeting. We will be looking for any Fed communication tomorrow regarding a further downshift in the hiking pace for the February meeting.”

What to watch

Ahead of the week, the US economic docket will feature the Federal Reserve Open Market Committee (FOMC), where the Fed is expected to hike rates by 50 bps the Federal Funds rate (FFR). Additionally, the Summary of Economic Projections (SEP) would be released, and the dot-plot would portray the Fed officials’ expectations for interest rates.

S&P 500 Daily Chart

-

20:11

AUD/USD Price Analysis: Bulls are testing channel resistance, meeting the bears

- AUD/USD rallied to fresh bull cycle highs in North America but the bears are now moving in.

- AUD/USD bears seek a 50% mean reversion that meets prior resistance beat 0.6815, a level that guards 0.6800.

AUD/USD is higher by 1.6% and has rallied from a low of 0.6740 to a high of 0.6893 on the back of Tuesday's prelude event to Wednesday's Federal Open Market Committee meeting and interest rate decision.

However, while the data has been favourable to the bulls, there are technical structures forming that point to a meanwhile correction as the following analysis illustrates:

AUD/USD daily chart

The price is contained within a rising channel and is now pressing up towards the resistance of the same. Moreover, the W-formation, below, is a reversion pattern and the price could easily change course and move into the neckline for a test of support and bullish commitments:

AUD/USD H4 chart

The 4-hour chart is showing that the bears have already emerged:

A test below 0.6850 could be on the cards for the immediate future while a 50% mean reversion meets prior resistance beat 0.6815, a level that guards 0.6800.

-

19:37

Forex Today: US Dollar’s doom and gloom

What you need to take care of on Wednesday, December 14:

The US Dollar collapsed following the release of the United States Consumer Price Index. According to the Bureau of Labor Statistics, the Consumer Price Index (CPI) rose by 7.1% on a yearly basis in November, easing from 7.7% in October. In the same period, core CPI, which excludes volatile food and energy prices, rose by 6%, below the 6.1% expected.

The encouraging figures fueled speculation the US Federal Reserve will slow the pace of tightening and maybe announce the end of the current tightening cycle. Wall Street soared ahead of the opening, with the DJIA adding over 600 points but trimming most of its gains ahead of the close. Nevertheless, the Greenback remained on the back foot and near its recent multi-month lows.

The EUR/USD pair hovers around 1.0620 after peaking at 1.0672. GBP/USD, in the meantime, trades at 1.2350, ahead of the UK November Consumer Price Index.

The Australian Dollar holds on to substantial gains vs the USD, with the pair trading at around 0.6850. USD/CAD is down to 1.3540.

Crude oil prices kept advancing, with WTI trading at $75.20 a barrel. Oil surged after OPEC trimmed its forecast for oil demand by 140,000 bpd for the current quarter, citing slowing activity in China. OPEC also cut Q1 2023 forecast by 410,000 bpd.

The USD/JPY pair is down to 135.50, while the USD/CHF trades at 0.9290.

Spot gold peaked at $1,824.53 a troy ounce, now hovering around $1,810.00.

On Wednesday, the focus will be on the US Federal Reserve. The central bank is expected to hike rates by 50 bps and could anticipate the end of the tightening cycle. Chairman Jerome Powell has anticipated there’s a good chance the central bank will slow the pace of tightening as soon as in this meeting, and the encouraging inflation outcome for sure exacerbated the idea.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto vs. Inflation

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:17

NZD/USD is creeping lower into the closing hours of Wall Street

- NZD/USD bears move in as profit-taking ensues.

- The markets will look to he the NZ Half Year Economic and Fiscal Update on Wednesday and the Fed.

NZD/USD is higher by some 1.29% on the day as the markets take profits following a volatile spell on Wall Street and US data that showed softer inflation pressures in the month of November.

Both the Australian and New Zealand Dollars were tracking global shares higher into the US Consumer Price Index and rallied strongly when the data pointed towards a Federal Reserve pivot.

US CPI below the mark

- US CPI MoM Nov: 0.1% (est 0.3%, prev 0.4%).

- US CPI Ex Food And Energy MoM Nov: 0.2% (est 0.3%, prev 0.3%).

- US CPI YoY Nov: 7.1% (est 7.3%, prev 7.7%).

- US CPI Ex Food And Energy YoY Nov: 6.0% (est 6.1%, prev 6.3%).

The Consumer Price Index has led to the markets pricing the terminal Fed rate down to 4.86% vs 4.98% prior to the report. Consequently, US stocks on Wall Street opened bid in the cash market with the NASDAQ jumping over 400 points and rallying over 3.3%. However, there has been a sharp turnaround in markets that have resulted in a reversal in the Kiwi as well.

''This is likely just the first leg of volatility to be expected this week, with the Fed decision,'' analysts at ANZ Bank argued. ''Markets are now obviously going into it with a very dovish mindset – that’ll be fine if the Fed are dovish, but that doesn’t align at all well with recent comms, especially with US services inflation still rising, and the labour market so tight, and we may be in for a bumpy ride.''

''We get the he Half Year Economic and Fiscal Update today. This isn’t usually something FX markets watch, but if we do get extra bond supply, it could drive NZ interest rates up further, and that might be viewed in some quarters as a positive for the NZD.''

-

18:39

Gold Price Forecast: XAU/USD bulls cheer Fed pivot sentiment after US CPI miss

- The Gold price is making fresh bull cycle highs after the United States Consumer Price Index miss.

- The United States Federal Reserve interest rate announcement will be key for the Gold price.

- Gold price 4-hour chart shows the bears moving in and there are eyes on the prior resistance near $1,800.

The Gold price is higher after US Treasury yields declined due to a report that showed that inflation in the United States was less than estimated last month. At the time of writing, XAU/USD is higher by 1.5% and has travelled from a low of $1,781.02 to a high of $1,824.52.

The Consumer Price Index (CPI) rose +7.1% from a year earlier in November, compared with the consensus forecast for a +7.3% gain and the October reading of +7.7%. Prior to the data, markets were getting set in the case of a softer reading that could have been the catalyst for a dovish Federal Open Market Committee (FOMC) this week. As a consequence of the Consumer Price Index, the curve bull steepened sharply as the market lowered the terminal Federal Reserve rate and increased the number of cuts being priced in. Risk assets found a bid with the US stocks rallying hard, the commodities complex up and the US Dollar down.

''Given the strength in core services inflation, it is clear the Fed will need to remain in a tightening mode beyond the December meeting. We will be looking for any Fed communication tomorrow regarding a further downshift in the hiking pace for the February meeting,'' analysts at TD Securities said after today's Consumer Price index.

Federal Reserve and European Central Bank up next

The FOMC is meeting today and will wrap things up on Wednesday with their statement and interest rate decision followed by the Federal Reserve's chairman, Jerome Powell, who will speak with the press. Jerome Powell's press conferences are an event in themselves which can create immense volatility in financial markets.

Money markets are currently pricing a 50bps Federal Reserve rate hike after four successive 75bps rate increases. However, changes in the peak rate or whether policymakers think there will be a need to become more hawkish could be more fundamental than the interest rate decision itself and that is where Jerome Powell will be pushed by the press.

Nevertheless, another moderation in the monthly core Consumer Price Index in the United States has helped to reaffirm that the US Dollar peak could be here which is lifting spirits as reflected in the emerging market indexes. The Gold price, however, will now also depend on the outcome of the European Central Bank, (ECB)

There is the risk that the ECB sounds and acts more hawkishly than the Fed this week. If this were to transpire, the US Dollar is going to have a hard time correcting whatever potential unwind comes of a dovish Federal Reserve and today's inflation data.

ECB President Christine Lagarde will of course continue to underline their determination to fight inflation.

''We expect a 50bps hike, but can't completely rule out 75bps,'' analysts at TD Securities (TDS) said.''Focus is likely to be on Quantitative Tightening guidance, which the Governing Council has announced will come alongside the decision New forecasts are likely to show a worsening trade-off between growth and inflation, but the ECB likely only has another hike or two left before turning to QT as its main tool,'' the analysts at TDS added.

Gold technical analysis

The Gold price, as illustrated in the above daily and 4-hour charts, has carved out a bullish scenario, although there are prospects of a correction. Gold price 4-hour chart shows the bears moving in and there are eyes on the prior resistance near $1,800. This Gold price level correlates with a 50% mean reversion of the CPI rally and could serve as a foundation for further buying activity in the coming days.

-

18:10

EUR/JPY Price Analysis: Struggles at 145.30 and drops towards 143.60s

- The Euro rose to multi-week highs but retraced and cleared the 20 and 50-day EMAs.

- EUR/JPY: A decisive break below 143.00 could pave the way towards the 100 and 200-day EMAs, around 142.55 and 139.88.

The EUR/JPY erases some of its earlier gains after hitting a daily high at 145.34 and tumbles more than 140 pips in the mid-Tuesday North American session, down by 1.02%. At the time of typing, the EUR/JPY is trading at 143.58.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY remains neutral-biased. After clearing the top-trendline of a descending channel on Monday, the cross pairs those gains and is back within the boundaries of the former. In addition, on its way south, the EUR/JPY conquered the 20 and 50-day Exponential Moving Averages (EMAs) around 143.89/144.04, eyeing a test of the last week’s low around 143.09.

Oscillators like the Relative Strength Index (RSI) crossing below 50, in bearish territory and the Rate of Change (RoC) beneath 0, suggest that sellers are gathering momentum, which would put in play, the 100-day EMA and also the bottom of the descending channel ahead of the 200-day EMA at 139.88.

Therefore, the EUR/JPY first support would be 143.09. Break below will expose the 100-day EMA at 142.55, followed by the December 2 at 142.54, followed by the 200-day EMA at 139.88.

EUR/JPY Key Technical Levels

-

18:02

United States 30-Year Bond Auction down to 3.513% from previous 4.08%

-

17:32

USD/CHF falls to multi-month lows around 0.9230s on soft US CPI

- US CPI climbs toward 7.1% YoY, while core inflation drops to the 6% threshold.

- USD/CHF: A daily close below 0.9300 to pave the way towards 0.9150.

- Investors focus shifted toward the Federal Reserve monetary policy on Wednesday.

The USD/CHF stumbles and refreshes eight-month lows, around 0.9231, after hitting a daily high of 0.9375, following the release of US inflation figures, which eased a bit, taking pressure off the Federal Reserve (Fed), which would meet on Wednesday, for the last time in the year. At the time of writing, the USD/CHF is trading at 0.9280, below its opening price, by 0.85%.

US inflation eases, a headwind for the USD/CHF

Wall Street remains trading with gains while the US Dollar (USD) sinks. On Tuesday, the US Department of Labor revealed the Consumer Price Index (CPI) for November, which decreased year-over-year by 7.1%, below analysts' predictions of 7.3%. In addition, core CPI shifted upwards during September and then moved back down again - standing at 6% lower than initial projections of 6.3% for November figures.

The US Dollar Index, a gauge of the buck’s value against a basket of six currencies, is dropping 0.99%, at 103.961, after hitting a low of 103.586, undermined by falling US Treasury yields. In the fixed income space, the US 10-year T-bond yield is falling twelve bps, at 3.485%, as traders began to price in a less aggressive Federal Reserve.

On the Switzerland side, the Seco economic forecasts confirmed that the Swiss economy is estimated to grow significantly below-average rate of 1.0% in 2023, followed by 1.6% in 2024 GDP. It should be said that the projections assume no energy supply shortages in 2022 and 2023 next winter.

USD/CHF Price Analysis: Technical outlook

The USD/CHF broke to the downside, the falling wedge, though a daily close below 0.9300 would be needed, to further cement the downward bias, confirmed by oscillators. The Relative Strength Index (RSI), at bearish territory, points downward. In the case of the Rate of Change (RoC), it keeps pressuring to the downside, portraying that sellers are gathering momentum.

Hence, the USD/CHF key support levels are the 0.9200 figure, followed by the March 22 daily low at 0.9194, ahead of the February 21 daily low at 0.9150.

-

16:51

US: Broader inflation pressures are easing – RBC

Data released on Tuesday showed the US Consumer Price Index slowed to 7.1.% y/y from 7.7%. Analysts at RBC Capital Markets see the Federal Reserve raising the Fed Funds rate by 50 basis points on Wednesday and the tey pon out the more encouraging inflation signs make a pause in early 2023 more likely.

Key Quotes:

“November’s U.S. inflation report brought more green shoots that broader inflation pressures are easing. The headline CPI rate slowed to 7.1% from 7.7% year-over-year in October as price pressure for all major categories slowed.”

“Needless to say, despite green shoots in the near-term, price growth has further to fall before reaching the Fed’s 2% target. And consumer demand has been more resilient, adding some tailwinds to inflation trends. Still, higher interest rates will cut into household purchasing power in the year ahead and we look for inflation to continue to creep broadly lower. Overall, a smaller 50 bp hike is expected for the Fed’s meeting tomorrow, to be followed by another 50 bp over the first quarter next year before the Fed feels comfortable to pause the current cycle and reassess.”

-

16:40

USD: Another moderation in core CPI helps reaffirm USD has peaked – TD Securities

Inflation data from the United States released on Tuesday showed an increase in the Consumer Price Index in November of 0.1% below the 0.3% of market consensus. According to analysts from TD Securities another moderation in monthly core CPI helps to reaffirm that the USD peak is here.

Key Quotes:

“This print risks making the upcoming Fed meeting moot as claims of a "somewhat higher" terminal rate become harder to price in. USD positioning unwind flags overdone but with the risk that the ECB sounds and acts more hawkishly than the Fed this week means that a USD reversal is not harder to come by.”

“Near-term, we think USDJPY will remain heavy and risk a more significant break of the 200day especially if the Tankan survey shows more price passthrough (output prices are already at multi-decade highs). Strategically, we think a theme of divergence will dominate the yen (from a bullish side) as inflation peaks elsewhere (while it runs up further in Japan) and global central banks downshift or stop tightening (while the BOJ alters YCC).”

“For EURUSD, 1.0620 should be key resistance/pivot short-term, but the EUR was one of the first to lead USD underperformance so the risk here is that the move is tactically matured. We think this could be more likely on some crosses like the JPY.”

-

16:17

USD/MXN drops sharply toward 19.60 as US Dollar tumbles

- US Dollar plummets following the release of US inflation data.

- Mexican Peso has the best day in months versus US Dollar.

- USD/MXN back under 19.80 ahead of the Fed and Banxico.

The USD/MXN is falling sharply on Tuesday amid risk appetite and a weaker US Dollar across the board. The pair reversed sharply from monthly highs after the release of US inflation numbers.

The US Consumer Price Index rose below expectation in November and triggered a rally in Treasuries and sent the Dollar sharply lower. Attention now turns to the FOMC meeting. On Wednesday, the Federal Reserve will announce its decision on monetary policy. A 50 bps rate hike is expected.

The Bank of Mexico meets Thursday. Also a 50 bp rate hike to 10.5% is expected. “At the last policy meeting November 10, the bank hiked rates 75 bp to 10.0%. The vote was 4-1, with Deputy Governor Esquivel voting for a smaller 50 bp move. The bank said that the magnitude of future hikes will be decided the circumstances, suggesting greater data-dependence. Since then, headline inflation came in lower at 7.80% y/y in November, but core continues to accelerate to new highs. The swaps market is pricing in a policy rate peak near 10.75%”, explained analysts at Brown Brothers Harriman.

USD/MXN faces strong resistance near 19.80

The rally of the USD/MXN from the lowest level in years near 19.00 peaked on Monday at 19.92. It then started to pullback being unable to consolidate above the 19.80 key area and also rejected from above the 100-day Simple Moving Average (currently at 19.88).

A consolidation between 19.60 and 19.80 seems likely for now. A break under 19.60 should strengthen the Mexican Peso that could go toward the 20-day SMA at 19.47.

Technical levels

-

15:54

UK CPI Preview: Forecasts from five major banks, a November peak

The United Kingdom will release the Consumer Price Index (CPI) data on Wednesday, December 14 at 07:00 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of five major banks regarding the upcoming UK inflation print.

Headline is expected at 10.9% year-on-year vs. 11.1% in October while Core, which excludes volatile food and energy prices, is expected to remain steady at 6.5% YoY.

TDS

“Headline inflation likely ticked down to 10.9% YoY in November, in line with the BoE's November forecast, largely owing to base effects, while we think MoM price growth remained strong. Focus from the MPC should be more on core CPI though, and here we see slight upside risks as core goods inflation appears to have stayed strong despite mounting downside pressures. We forecast a rise to 6.6% YoY, while MPR forecasts implied a repeat 6.5% YoY reading. However, at the end of the day, given the substantial amount of volatility in the data, a minor upside surprise to the BoE's core forecast will likely not matter too much for the MPC.”

SocGen

“Despite a continued rise in core and food inflation, negative base effects should allow a marginal reduction in headline inflation from 11.1% to 11.0% in November, although risks are tilted to the upside. For core, both stronger services and goods inflation should contribute to an acceleration from 6.5% to 6.7%.”

Citibank

“UK inflation for November likely to show headline CPI decelerating marginally to 11.0% YoY while core CPI is expected to remain stable at 6.5%.”

ING

“Inflation looks like it has peaked, although BoE hawks will be keeping a close eye on the data due a day prior to its announcement. Headline CPI is likely to dip, however, core could be more sticky, and last month’s data saw core services inflation come in slightly higher than the bank had forecast in November.”

Deutsche Bank

“We expect CPI to have slowed from 11.1% to 10.9%. If our forecasts are broadly on the mark, we have crossed the peak in inflation. And now, the next stage begins. We anticipate CPI will be over 8% YoY next year before landing around 6% in the fourth quarter.”

-

15:39

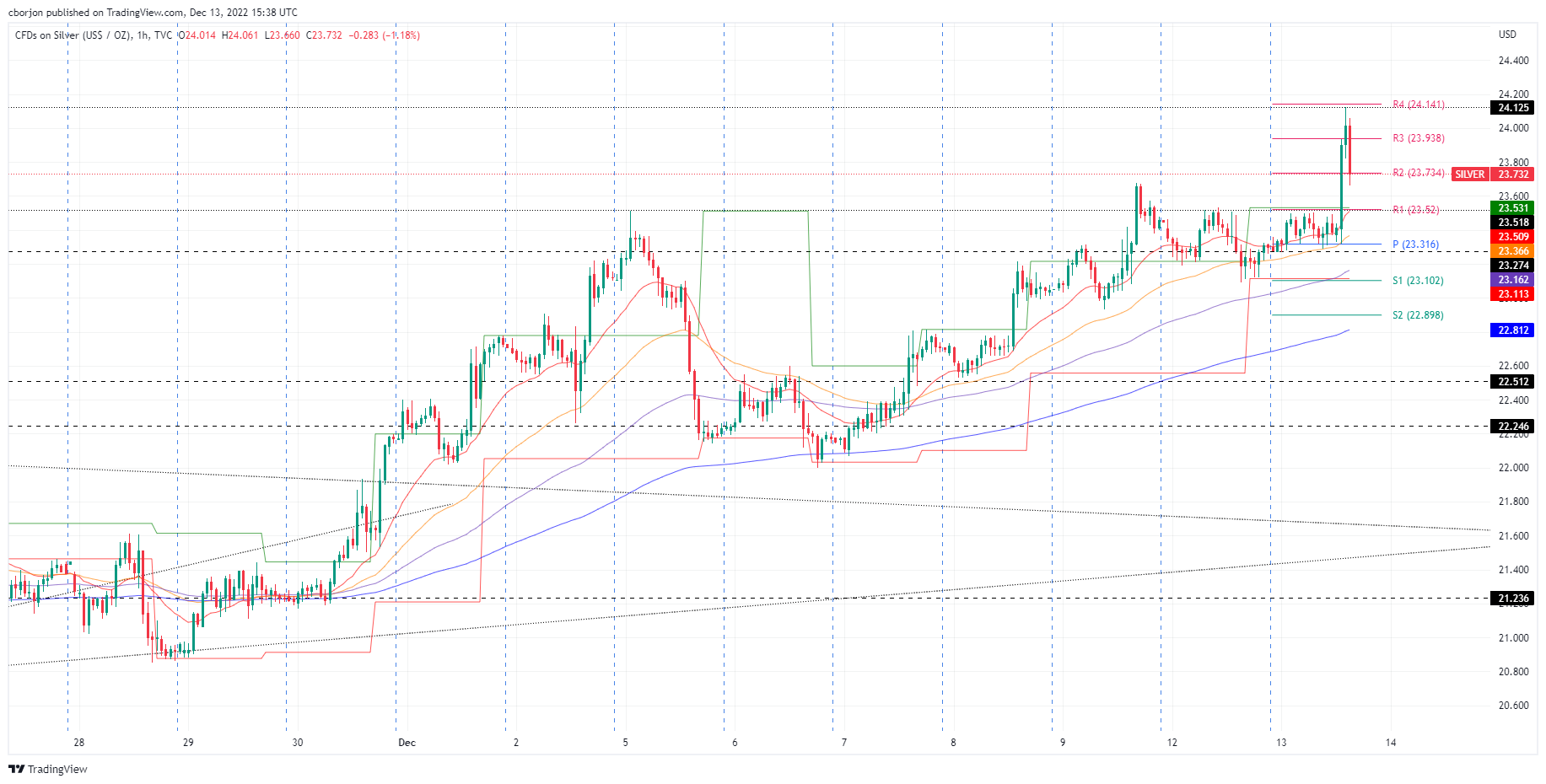

Silver Price Forecast: XAG/USD trades at multi-month highs around $23.70s

- Silver hit a six-month high at around $24.12 before reversing its curse, though it remains positive.

- Inflation in the United States continues its downtrend, still far from the 2% goal.

- The Federal Reserve is expected to hike rates by 50 bps, with odds around 90%.

Silver price advanced sharply above the $24.00 figure following the November inflation report in the United States (US) release, which ticked lower, easing pressure on the Federal Reserve (Fed). The US Dollar (USD) is plunging while precious metals advance. At the time of writing, the XAG/USD is trading at $23.74 after hitting an eight-month high of $24.12.

The Department of Labor reported that the Consumer Price Index (CPI) rose marginally by 0.1% from last month and decreased slightly on a year-on-year basis to 7.1%, missing previous analyst expectations of 7.3%. Even though inflation has dropped since its peak in June at 9.1%, the so-called core CPI suddenly shifted upwards during September. Nevertheless, in the last two months, core CPI moved downwards, with November figures standing at 6%, below what analysts had predicted as 6.3%.

Money market futures suggest that the Federal Funds rate (FFR) may reach a peak of 5% before being cut in September 2023, around 20 bps. At the same time, weakness was seen for the US Dollar Index, which sank to six-month lows around 103.586, though it is trimming some of its earlier losses, sitting at 103.900.

Elsewhere, US Treasury bond yields, namely the 10-year benchmark note rate, plunged 15 bps, from around 3.630% to 3.459%, while US 10-year TIPS yield, a proxy for real yields, dropped 11 bps to 1.215%, a tailwind for the precious metal segment.

Silver (XAG/USD) Reaction to US CPI report

XAG/USD remains upward biased and rallied above $24.00, on traders speculating that the Federal Reserve might not be as aggressive as inflation continues to slow down. Silver found solid resistance at the R4 daily pivot at $24.14, since then, retraced $0.40 towards current prices, erasing some of its earlier gains. A fall below the $2 daily pivot at $23.73 could pave the way toward the R1 level at $23.52, followed by the daily pivot at $23.31, which would turn the white metal flat compared to Tuesday’s opening price.

-

15:29

Fed to stay in inflation-fighting mode for a while yet – Wells Fargo

Inflation is more firmly on a downward trend. But economists at Wells Fargo suspect the FOMC remains concerned about the ongoing strength in labor costs.

There is still work left to be done in the fight against inflation

“The Consumer Price Index came in lower than expected in November, with the headline rising 0.1% and the core advancing 0.2%. Nevertheless, a sustained return to the Fed's inflation goal remains some ways away. Services ex-shelter and ex-travel picked up in November, and the overall core index is running at a 4.3% annualized rate the past three months.”

“While the pace of inflation is expected to slow further over the next few months, the roughly 5% pace of wage growth is likely to keep the Fed in inflation-fighting mode for a while yet.”

“We look for the Fed to proceed with its signaled 50 bps hike tomorrow, although the prospect of a further downshift to a 25 bps hike come its first meeting of 2023 has increased with this report.”

-

15:05

USD/JPY falls more than 250 pips after US CPI

- US inflation slows more than expected in November.

- Japanese yen soars across the board following the report.

- USD/JPY drops below 135.00 to one –week lows.

The USD/JPY collapsed after the release of US inflation data. The pair dropped from 137.60 to as low as 134.60, reaching the lowest level in a week and approaching the multi-month low of 133.58.

Inflation slows down, FOMC meeting

The US Consumer Price Index rose in November by 0.1%, below the 0.3% of market consensus. The annual rate fell from 7.7% to 7.1%, reaching the lowest level in almost a year. Inflation numbers eased expectations about the future path of Fed rate hikes.

Following the numbers the US dollar collapsed across the board and the Japanese Yen soared, boosted by a rally in Treasuries. US bond yields sank with the US 10-year falling from 3.60% to 3.43%. The DXY is falling by 1.15% under 104.00.

On Wednesday, the Federal Reserve will announce its decision on monetary policy. A 50 basis points rate hike is expected. New macroeconomic forecast will be released. Powell will hold a press conference.

USD/JPY looking at the recent low

The sharp decline in USD/JPY damaged significantly the outlook for the Dollar. Price is back under the 200-day Simple Moving Average. Currently is testing the 135.00 area and a break under 134.60 would expose the next support around 134.10. Below attention would turn to the monthly low at 133.60.

Technical levels

-

15:04

United States IBD/TIPP Economic Optimism (MoM) registered at 42.9 above expectations (41.3) in December

-

15:02

Brent Crude Oil to end 2023 at $80 – Deutsche Bank

Brent Crude Oil has moving back into positive territory on a YTD basis. Economists at Deutsche Bank see prices at $80 by the end of the next year.

Supply disruption to temporarily lift Brent to $100 in Q1 2023

“Our bias is to the downside in price beyond the next quarter, as we see 2023 global inventory unchanged from Q4 2022 but higher versus the 2022 average.”

“Although supply disruption temporarily lifts Brent to $100/bbl in Q1 2023, prices resume their decline to Brent $80/bbl at year end of 2023.”

-

14:54

USD/CAD sinks like a stone after US CPI data miss

- The Canadian Dollar is breaking out on the back of a soft US CPI report.

- The bears have eyes on 1.3380 as a possible last defence for a much deeper correction vs. the US Dollar.

The Canadian Dollar, which had already been picking up a bid prior to the North American day, rallied hard on the back of the US Consumer Price Index that missed market expectations to the downside. At the time of writing, USD/CAD is trading at 1.3555, down 0.56% on the day after falling from a high of 1.3644 to a low of 1.3520 so far.

US CPI missed the mark

- US CPI MoM Nov: 0.1% (est 0.3%, prev 0.4%).

- US CPI Ex Food And Energy MoM Nov: 0.2% (est 0.3%, prev 0.3%).

- US CPI YoY Nov: 7.1% (est 7.3%, prev 7.7%).

- US CPI Ex Food And Energy YoY Nov: 6.0% (est 6.1%, prev 6.3%).

The Consumer Price Index has led to the markets pricing the terminal Fed rate down to 4.86% vs 4.98% prior to the report. Consequently, US stocks on Wall Street have opened bid in the cash market with the NASDAQ jumping over 400 points and rallying over 3.3%. The Canadian Dollar is risk-sensitive, belonging to the commodity complex, and the prospects of a pivot at the Fed are fuelling the bid with the CRB index up some 1% on the data.

USD/CAD technical analysis

The Canadian Dollar is breaking out and while below 1.3560, the bears will have their eyes set on 1.3380 as a possible last defence for a much deeper correction vs. the US Dollar.

-

14:46

GBP/USD rallied to a new six-month high at around 1.2440s after a soft US CPI report

- US Core Consumer Price Index hits the 6% threshold, weakening the US Dollar.

- The Pound Sterling hit a fresh six-month high at around 1.2442 following the release of US inflation.

- GBP/USD: Break above 1.2450 could pave the way to 1.2500; otherwise, it could fall to 1.2350.

The GBP/USD soared sharply following the release of a softer-than-expected inflation report in the United States (US) reported by the Bureau of Labor Statistics (BLS) on Tuesday. On the release, the US Dollar (USD) continues to weaken as traders speculate that the Federal Reserve (Fed) might turn less “hawkish” than expected on Wednesday’s FOMC meeting. At the time of writing, the GBP/USD is trading at 1.2420.

In the release, the GBP/USD broke to levels last seen in June 2022, hitting a fresh six-month high at around 1.2442, though it remains volatile in the aftermath of the release of the Consumer Price Index (CPI).

The BLS revealed that the headline CPI increased 0.1% MoM from the previous month and, on an annual based, ticked lower to 7.1% vs. estimates of 7.3%. Although general inflation continued its downtrend since peaking In June at 9.1%, the so-called core CPI it’s the spotlight, as it suddenly turned north in September. However, November’s data showed inflation is easing, with core CPI at 6%, below the 6.3% consensus.

That said, money market futures have priced in that the Federal Funds rate (FFR) would likely peak at around 5%, with traders expecting the first rate cut of 20 bps at around September 2023, as shown by Eurodollar futures. In the meantime, the US Dollar Index tumbled sharply to six-month lows around 103.586 before trimming some of its losses, closing into the 103.900 mark.

GBP/USD Reaction to US CPI report

The GBO/USD one-hour chart suggests the pair is still upward biased, as shown by the Relative Strength Index (RSI) aiming higher, while the Rate of Change (RoC) so far failed to follow the lead of the former. Since then, the GBP/USD has hit the R4 daily pivot and is hoovering around the R3 daily pivot point at 1.2400 and the R4 pivot level. Therefore, the breach of the R4 pivot level could pave the way toward 1.2500. Otherwise, a fall below 1.2400 could open the door towards the R2 pivot at 1.2350, followed by 1.2310.

-

14:18

Fed: 50 bps are practically a done deal after US inflation confirms downtrend – Commerzbank

US consumer prices rose by only 0.1% in November. The easing of inflationary pressure is likely to prompt the Fed to slow the pace of interest rate hikes, economists at Commerzbank report.

US inflation continued its downward trend in November

“US consumer prices rose by 0.1% in November compared with October. This was below expectations. Excluding energy and food, the increase was 0.2%, also less than forecast. The YoY rate of the CPI covering all goods, which had stood at 9.1% in June, fell to 7.1%, and that of the index excluding energy and food from 6.3% to 6.0%.”

“The 50 basis points hike, which is generally expected for tomorrow's FOMC meeting, can be considered almost certain after today's data.”

“We continue to assume that the Fed will reduce the size of the rate hikes again at the beginning of 2023, moving by only 25 bps in February and March.”

-

14:10

EUR/HUF to see a gradual drift lower below 400 next year – ING

The EUR/HUF cross rate continues its volatile path. Economists at ING expect the pair to see a gradual turn lower below 400 in 2023.

HUF to be moved by non-monetary events and shocks in the short run

“We believe the Hungarian Forint is more likely to be moved by non-monetary events and shocks in the short run. The government's conflict with the EU over the rule of law will remain a major issue at least until the end of this year. We expect a positive outcome on the rule of law issue and an unlocking of the potential of the Forint.”

“As some form of positive outcome of this story seems to be priced in already, and also market positioning seems to have flipped to a slightly longer view in recent weeks, the EU story has become asymmetric for the HUF.”

“Instead of a jump in Forint strength, we expect a gradual drift lower below 400 EUR/HUF next year. However, our strong conviction regarding a positive outcome for Hungary makes the Forint our currency of choice in the CEE4 space.”

-

14:09

AUD/USD leaps towards channel resistance on soft US CPI

- AUD/USD jumps as risk appetite soars on softer than-expected US Consumer Price Index.

- AUD/USD bulls 0.7000 for the days/weeks ahead as Fed pivot is priced in further.

Risk appetite has been supported on the back of the US Consumer Price Index coming in softer than expected, fuelling the prospects of a pivot at the Federal Reserve. AUD/USD has subsequently got a boost from a weaker US Dollar that is tumbling on Wall Street as US equities soar.

AUD/USD is currently 1.7% higher, breaking prior bull cycle highs near 0.6844 and has printed a fresh high of 0.6877 so far on the day. following the data that arrived as follows:

US CPI below expectations

- US CPI MoM Nov: 0.1% (est 0.3%, prev 0.4%).

- US CPI Ex Food And Energy M/M Nov: 0.2% (est 0.3%, prev 0.3%).

- US CPI YoY Nov: 7.1% (est 7.3%, prev 7.7%).

- US CPI Ex Food And Energy Y/Y Nov: 6.0% (est 6.1%, prev 6.3%).

As a consequence of the Consumer Price Index, the terminal Fed rate is now down to 4.86% vs 4.98% prior to the report. US stocks on Wall Street are considerably higher with the NAS100 already trading around 500 points up on the day before the cash open.

As a consequence of the Consumer Price Index, the terminal Fed rate is now down to 4.86% vs 4.98% prior to the report which is weighing heavily on the US Dollar and US Treasury yields. DXY, an index that measures the US dollar vs. a basket of currencies fell to a low of 103.697 having been as high as 105.095 on the day. The Australian Dollar is highly correlated to US stocks and is riding the positive sentiment into the daily channel resistance as illustrated in the following technical analysis:

AUD/USD technical analysis

AUD/USD is carving out a W-formation which could hamstring the rally en route towards 0.6900. Nevertheless, should 0.6850 hold up on a retest of bullish commitments, then there will be prospects of a run towards 0.7000.

-

13:55

United States Redbook Index (YoY): 5.9% (December 9) vs 5.7%

-

13:51

Gold Price Forecast: XAU/USD rallies to fresh multi-month top on softer US CPI report

- Gold price regains strong positive traction on Tuesday and spikes to a fresh multi-month high.

- The intraday move-up picks up pace following the release of softer consumer inflation figures.

- Bets for less aggressive Federal Reserve drag US Treasury bond yields lower, along with US Dollar.

- The risk-on impulse could cap gains for the safe-haven Gold price ahead of the FOMC meeting.

Gold price catches fresh bids during the early North American session on Tuesday and jumps to a fresh five-month top following the release of the consumer inflation figures from the United States (US). The XAU/USD is currently placed around the $1,810 area and making a fresh attempt to build on its momentum beyond a technically significant 200-day Simple Moving Average.

Consumer inflation figures from United States come in softer than expected

The US Bureau of Labor Statistics reported that the headline Consumer Price Index (CPI) rose a modest 0.1% in November. The reading is well below the 0.3% expected and marks a notable slowdown from the 0.4% increase recorded in the previous month. Furthermore, the yearly rate decelerate from 7.7% in October to 7.1% during the reported month, again falling short of consensus estimates. Furthermore, the core CPI, which excludes food and energy prices, eased to 0.2% in November and fell to 6% on yearly basis from 6.3% in October.

Falling US Treasury bond yields weigh on US Dollar and benefit Gold price

The data reaffirms expectations that the Federal Reserve will slow the pace of its policy tightening and is evident from a fresh leg down in the US Treasury bond yields. This, in turn, drags the US Dollar to its lowest level since late June and turns out to be a key factor providing a strong lift to the Dollar-denominated Gold price. Bulls, however, seem reluctant to place aggressive bets and prefer to wait for more clarity on the Federal Reserve's rate hike path, which will determine the near-term trajectory for the non-yielding yellow metal.

Risk-on mood could cap gains for safe-haven Gold price

Apart from this, the risk-on impulse - as depicted by a strong rally in the US equity futures - further contributes to capping the upside for the safe-haven Gold price. The global risk sentiment remains well supported by the latest optimism over the easing of strict COVID-19 restrictions in China. Heading into the key central bank event risk, this might hold back traders from placing aggressive bullish bets and keep a lid on the XAU/USD. Nevertheless, the fundamental backdrop supports prospects for a further near-term appreciating move.

Gold price technical outlook

From a technical perspective, sustained strength beyond the $1,810-$1,812 horizontal resistance will mark a fresh bullish breakout and add credence to the positive outlook. Gold price might then accelerate the momentum towards the $1,830 intermediate hurdle en route to the next major barrier near the $1,745-$1,750 region.

On the flip side, the $1,800 round figure now seems to act as immediate support ahead of the $1,795-$1,95 area (200 DMA). Any subsequent slide might continue to attract some buyers at lower levels and remain cushioned near the $1,780-$1,777 support zone. The latter should act as a pivotal point, which if broken will set the stage for some meaningful downside for Gold price.

Key levels to watch

-

13:48

EUR/USD soars as US CPI comes in below expectations

- EUR/USD soars on the back of the sentiment for a Fed pivot following soft US Consumer Price Index (CPI).

- US CPI came in below expectations and sent risk assets higher, US Dollar lower.

EUR/USD has rallied heavily as the US Consumer Price Index has come in below expectations, leaving the door wide open for a pivot from the Federal Reserve that meets this week to decide on its monetary policy path. At the time of writing, EUR/USD is up on the day by over 1%, with the bulk of its gains coming in a knee-jerk reaction to the US inflation data as illustrated below.

The Euro reached a high of 1.0648 from 1.0555 off the bat vs. the US Dollar when US CPI printed as follows:

- US CPI MoM Nov: 0.1% (est 0.3%, prev 0.4%).

- US CPI Ex Food And Energy M/M Nov: 0.2% (est 0.3%, prev 0.3%).

- US CPI YoY Nov: 7.1% (est 7.3%, prev 7.7%).

- US CPI Ex Food And Energy Y/Y Nov: 6.0% (est 6.1%, prev 6.3%).

As a consequence of the data, the terminal Fed rate is now down to 4.86% vs 4.98% prior to the report which is weighing heavily on the US Dollar and US Treasury yields. DXY, an index that measures the US dollar vs. a basket of currencies fell to a low of 103.923 having been as high as 105.095 on the day as investors give a sigh of relief with the US benchmarks rallying - The Nasdaq jumped over 500 points.

EUR/USD technical analysis

(EUR/USD 30 min chart, above)

In the above daily chart, the market is on the front side of the bullish trend and there is every possibility that the price will continue higher into the in-the-money shorts towards 1.0800/50 in the days or weeks ahead.

-

13:31

United States Consumer Price Index Core s.a below expectations (300.896) in November: Actual (300.07)

-

13:30

United States Consumer Price Index ex Food & Energy (YoY) came in at 6%, below expectations (6.1%) in November

-

13:30

United States Consumer Price Index (MoM) below expectations (0.3%) in November: Actual (0.1%)

-

13:30

United States Consumer Price Index ex Food & Energy (MoM) came in at 0.2%, below expectations (0.3%) in November

-

13:30

Breaking: US annual CPI inflation declines to 7.1% in November vs. 7.3% expected

The US Bureau of Labor Statistics reported on Tuesday that inflation in the US, as measured by the Consumer Price Index (CPI), declined to 7.1% on a yearly basis in November from 7.7% in October. This reading came in below the market forecast of 7.3%.

Follow our live coverage of the market reaction to US inflation data.

Further details of the publication revealed that the annual Core CPI, which excludes volatile food and energy prices, declined to 6% from 6.3% in October. The monthly Core CPI came in at 0.2%, compared to analysts' estimate of 0.3%.

Market reaction

With the initial reaction, the US Dollar came under heavy selling pressure. The US Dollar Index was last seen trading at its lowest level since late June at 103.95, losing nearly 1% on a daily basis.

-

13:30

United States Consumer Price Index n.s.a (MoM) below expectations (298.045) in November: Actual (297.711)

-

13:30

United States Consumer Price Index (YoY) below expectations (7.3%) in November: Actual (7.1%)

-

13:29

US Dollar' Price Analysis: DXY fate lies in US CPI

The US Dollar is sitting in a technical bundle of key structures that has something for both the bulls and bears ahead of the release of US inflation data and the final Federal Reserve meeting of the year.

Traders are looking for signs of a Fed pivot, i.e., for its policy outlook to change course from its currently contractionary (tight) monetary policy to expansionary (loose).

A Fed pivot typically happens when economic conditions have fundamentally changed in such a way that the Fed can no longer continue its prior policy stance and the US Consumer Price Inflation data is used as a primary gauge in that respect. In fact, the DXY's biggest daily drop and second-largest daily gain in 2022 have come on the back of prior CPI data.

The Fed is widely expected to hike the funds rate by 50 basis points (bp) on Wednesday, after four consecutive 75 bp hikes. If the data comes in hotter than expected, this will be problematic for the Fed eager to slow the pace of tightening and potentially weigh on risk assets and thus lead to a stronger US Dollar.

The headline is expected at 7.3% YoY vs. 7.7% in October, while the core is expected at 6.1% YoY vs. 6.3% in October. Last week, the Producer Price Index came in higher than expected, raising concerns that inflation is likely to prove to be much stickier than the markets are pricing.

DXY technical analysis

The trendline was broken and the bulls are on the back side of it. If the data comes in hot, a move beyond the 50% mean reversion resistance near 1.05.65 could spell an upside correction continuation scenario for the near future. On the flip side, 103.00 will be a key target for the remaining weeks of the year should a Fed pivot be priced in even further.

-

13:14

USD Index: Failure to reclaim 105.80 could lead to one more leg of correction – SocGen

US Dollar is near six-month low. Reclaiming at 105.80 is crucial to highlight short-term bounce, economists at Société Générale report.

Short-term resistance is located at 108.20

“Daily MACD is within deep negative territory pointing towards an overstretched move however failure to reclaim at 105.80 could lead to one more leg of correction towards next support zone at 2017/2020 peaks of 103.80/103.00.”

“Short-term resistance is located at 108.20, the 38.2% retracement of recent down move.”

See: US Dollar to strengthen through the first quarter of 2023 – ING

-

12:54

AUD/USD sticks to gains near daily high, below 0.6800 ahead of the crucial US CPI report

- AUD/USD regains some positive traction on Tuesday amid a modest USD weakness.

- A positive risk tone and softer US bond yields keep the USD bulls on the defensive.

- Traders now look to the US CPI for a fresh impetus ahead of the key FOMC meeting.

The AUD/USD pair attracts fresh buying near the 0.6740-0.6735 region on Tuesday and reverses a major part of the previous day's retracement slide. The pair maintains its bid tone heading into the North American session and is currently placed near the daily peak, around the 0.6780 area.

A combination of factors prompts some selling around the US Dollar, which, in turn, is seen offering support to the AUD/USD pair. Against the backdrop of the uncertainty over the Fed's rate hike path, a softer tone surrounding the US Treasury bond yields keeps the USD bulls on the defensive. Moreover, the easing of COVID-19 curbs in China remains supportive of a generally positive risk tone, which further undermines the safe-haven buck and benefits the risk-sensitive Aussie.

That said, growing worries about a deeper global economic downturn should keep a lid on the risk-on rally in the markets. Traders might also refrain from placing aggressive directional bets ahead of the crucial US consumer inflation figures, due for release a while from now. The data will influence the USD price dynamics ahead of the highly-anticipated FOMC policy decision on Wednesday. This, in turn, will determine the next leg of a directional move for the AUD/USD pair.

Heading into the key data/event risks, the fundamental backdrop warrants some caution for bulls and before positioning for any further intraday appreciating move for the AUD/USD pair. Hence, any subsequent move up is more likely to confront stiff resistance near the 0.6800 mark. That said, some follow-through buying has the potential to lift spot prices back towards the monthly swing high, around the 0.6850 region touched last week.

Technical levels to watch

-

12:52

S&P 500 Index to end 2023 at 4500 – Deutsche Bank

S&P 500 Index has rallied 17% from its mid-October low. Economists at Deutsche Bank analyze how the equity index could evolve next year.