Notícias do Mercado

-

23:51

Japan Foreign Investment in Japan Stocks increased to ¥1154.2B in December 9 from previous ¥-349.3B

-

23:51

Japan Merchandise Trade Balance Total came in at ¥-227.4B, above forecasts (¥-1680.3B) in November

-

23:51

Japan Exports (YoY) above expectations (19.8%) in November: Actual (20%)

-

23:51

Japan Foreign Bond Investment dipped from previous ¥522.2B to ¥-605.7B in December 9

-

23:50

Japan Imports (YoY) above forecasts (27%) in November: Actual (30.3%)

-

23:45

When is the Australian employment report and how could it affect AUD/USD?

November month employment statistics from the Australian Bureau of Statistics, up for publishing at 00:30 GMT on Thursday, will be the immediate catalyst for the AUD/USD pair traders.

Market consensus suggests that the headline Unemployment Rate may remain unchanged at 3.4% on a seasonally adjusted basis whereas Employment Change could ease to 19K versus the previous addition of 32.2K. Further, the Participation Rate is expected to improve a bit to 66.6% versus 66.5% prior.

Considering the Reserve Bank of Australia (RBA) policymakers’ recently cautious comments, coupled with the easing Covid trouble in China, today’s Aussie jobs report become crucial for the AUD/USD pair traders. It should be noted that the Aussie Consumer Inflation Expectations for December, scheduled for 00:00 GMT on Thursday, expected 5.7% versus 6.0% prior, also becomes important for the Aussie pair traders. Additionally important will be China’s Industrial Production and Retail Sales numbers for November, up for publishing at 02:00 GMT, expected 3.6% and -3.6% versus 5.0% and -0.5% in that order.

Ahead of the event, analysts at Westpac said,

Leading indicators suggest there will be another robust print for employment growth in November (Westpac forecast: 27k, median +19k, previous +32k). With participation expected to hold steady, another modest decline in the unemployment rate is anticipated (Westpac forecast: 3.3%, median 3.4%). Falling petrol prices should help ease Melbourne Institute inflation expectations in December.

How could the data affect AUD/USD?

AUD/USD remains troubled around 0.6860-50 after refreshing the six-month high before a few hours. While the pre-data anxiety could be linked to the Aussie pair’s latest resistance to rise, downbeat expectations from the scheduled data also challenge the bulls of late.

Should the actual data arrive stronger, the Aussie pair can manage to cheer the broad US Dollar weakness with upside moves towards refreshing the multi-month top, currently around 0.6880. The pullback moves, however, need validation from November’s peak surrounding 0.6800. Hence, the odds favoring a short-term advance by the AUD/USD are higher even if the bearish bias for the RBA and the scheduled data probe the bulls.

Key Notes

AUD/USD dribbles below 0.6900 after unimpressive Fed, focus on Australia, China data

AUD/USD Forecast: Eyes on Australian employment and inflation data

About the Employment Change

The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

About the Unemployment Rate

The Unemployment Rate released by the Australian Bureau of Statistics is the number of unemployed workers divided by the total civilian labor force. If the rate hikes, indicates a lack of expansion within the Australian labor market. As a result, a rise leads to weaken the Australian economy. A decrease of the figure is seen as positive (or bullish) for the AUD, while an increase is seen as negative (or bearish).

-

23:38

AUD/NZD remains quiet around 1.0630 despite upbeat NZ GDP

- AUD/NZD has remained sideways despite the release of solid NZ GDP data.

- A sheer expansion in NZ's economic activities has triggered the risk of further upside in inflation.

- Going by the consensus, the Australian economy added fresh 19K jobs in November.

The AUD/NZD pair is displaying topsy-turvy moves around 1.0630 in the early Asian session. The cross has corrected gradually after hitting a fresh eight-day high at 1.0662 on Wednesday. The asset has remained muted despite the release of solid New Zealand Gross Domestic Product (GDP) data.

The quarterly GDP data for the third quarter of CY2022 has been recorded at 2.0%, higher than the expectations of 0.9% and the prior release of 1.7%. Also, the annual GDP data has soared to 6.4% vs. the consensus of 5.5% and the former figure of 0.4% in the same period. No doubt, a stellar expansion in NZ economic activities is going to provide a cushion to the New Zealand Dollar but will accelerate inflation risks ahead.

The Reserve Bank of New Zealand (RBNZ) is working hard in softening inflationary pressures with extreme policy tightening measures. RBNZ Governor Adrian Orr is going through sleepless nights in strategy-making to contain stubborn inflation. And, a sheer expansion in the extent of economic activities has accelerated the risk of further escalation in the Consumer Price Index (CPI).

On the Australian front, investors are awaiting the release of the Employment data. As per the consensus, the Australian economy has added fresh 19K jobs in November against the former addition of 32.2K. The Unemployment Rate is seen unchanged at 3.4%.

Apart from the payroll data, investors will also focus on 12-month consumer inflation expectations data, which is expected to decline to 5.7% against 6.0% released earlier. A decline in the one-year consumer inflation forecast will delight the Reserve Bank of Australia (RBA).

-

23:34

AUD/JPY Price Analysis: Stays pressured towards 92.40 support

- AUD/JPY holds lower ground after failing to cross the 200-DMA, 21-DMA.

- Three-month-old descending trend line also exerts downside pressure on prices.

- Bullish MACD signals, short-term upward-sloping support line challenge AUD/JPY sellers.

AUD/JPY takes offers to refresh intraday low around 92.80 during early Thursday, after failing to cross the key hurdles in the last two days.

In doing so, the AUD/JPY pair justifies the latest failure to cross the 21-DMA, the 200-DMA and a downward-sloping resistance line from early September ahead of Australia’s employment report and Consumer Inflation Expectations.

Given the quote’s repeated failures to cross the aforementioned key hurdles, the cross-currency pair is likely to decline toward an eight-day-old ascending support line, near 92.40.

However, the bullish MACD signals suggest a lesser downside gap past 92.40, which if broken will highlight the 92.00 threshold for the AUD/JPY pair sellers.

In a case where the cross-currency pair remains weak past 92.00, the monthly low near 91.15 and October’s trough surrounding 90.85 could challenge the bears before directing them to the 90.00 psychological magnet.

Alternatively, the 21-DMA and the descending trend line from September, respectively around 92.90 and the 93.00 round figure, guard the AUD/JPY pair’s short-term upside ahead of the 200-DMA resistance near 93.25.

Should the AUD/JPY manages to cross the 93.25 hurdle, multiple levels near 94.10-15 could challenge the bulls.

AUD/JPY: Daily chart

Trend: Limited downside expected

-

23:14

USD/CHF floats at 9.5-month low around 0.9250 after Fed’s verdict, SNB eyed

- USD/CHF remains sidelined at the lowest levels since March 31, probes two-day downtrend.

- Fed failed to impress US Dollar buyers but the USD/CHF bears remain cautious ahead of the SNB.

- SNB is expected to announce 0.50% rate hike but USD/CHF bulls need more than that to recover.

USD/CHF holds lower grounds near 0.9260, after declining to the fresh low in 9.5 months, as the pair traders await the Swiss National Bank (SNB) Monetary Policy Meeting early Thursday. That said, the Swiss currency pair recently cheered the broad US Dollar weakness to refresh the multi-day low as the Federal Reserve (Fed) fell short of impressing the Greenback bulls despite mildly hawkish announcements.

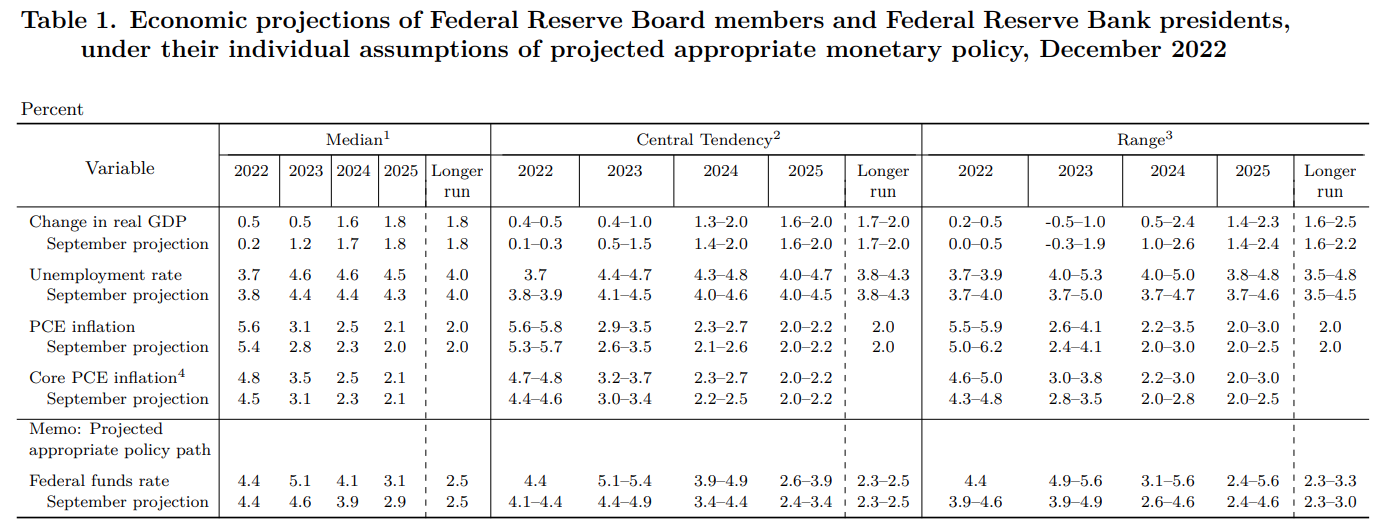

Fed delivered the 50 bps rate hike, as expected, and upwardly revised the dot-plot to suggest 5.1% as the terminal rate versus 4.6% shown in September’s Statement of Economic Projections (SEP). The US central bank also revised the inflation forecasts towards the north but the growth estimations were cut down for 2023 and 2024.

Elsewhere, Fed Chairman Jerome Powell defended his hawkish image while noting that the ultimate level of rates is more important than how fast they go. The policymaker also added that the Federal Open Market Committee (FOMC) needs to hold rates at their peak until policymakers are "really confident" that inflation comes down in a sustained way.

Following the Fed announcements, the US equities closed on the negative side but the US Treasury bond yields were down too, which in turn weighed on the USD/CHF prices.

Looking forward, USD/CHF traders should keep their eyes on the SNB announcements as the Swiss National Bank is widely expected to unveil a 0.50% rate hike and may sound a bit hawkish.

With this in mind, Citibank signaled, “Strong Franc, slowing Swiss economy, falling energy prices but also the shift in emphasis to balance sheet reduction speak against big rate hikes. However, interest rate differentials are already historically wide and with fewer meetings available, the SNB has to make bigger steps to keep up. We, therefore, expect a 75 bps hike this week.

Also read: SNB Preview: Forecasts from five major banks, new tightening to come

Technical analysis

USD/CHF bears remain in the driver’s seat unless the USD/CHF prices offer a daily closing beyond August month’s low near 0.9370.

-

23:04

Gold Price Forecast: XAU/USD awaits direction after Fed policy inspired-volatility, US Retail Sales eyed

- Gold price still seeks a decisive move despite detailed Fed policy guidance.

- The US Dollar faced pressure as the Fed decided to adopt a calm approach for further policy tightening.

- A decline in the United States Retail Sales data will bolster further inflation softening.

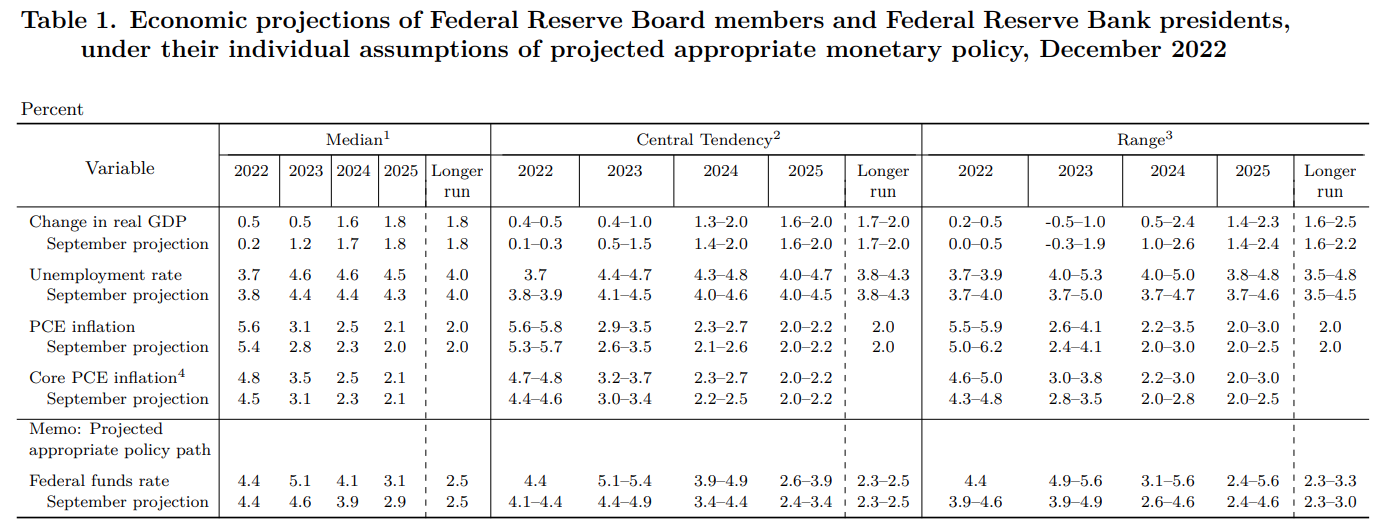

Gold price (XAU/USD) is hovering around $1,810.00 in the early Asian session after displaying volatile moves over the interest rate decision and policy guidance by the Federal Reserve (Fed). The precious metal displayed wild gyrations in a $1.796-1,814 range and has now turned extremely quiet as investors are digesting Fed chair Jerome Powell’s commentary before making an informed decision.

The US Dollar Index (DXY) registered a fresh six-month low at 103.49 as the Fed decided to move forward with a calm approach for further policy tightening. S&P500 settled Wednesday on a bearish note as a higher terminal rate projection by the Fed at 5.1% has triggered a risk of liquidity squeeze from the economy, which may escalate recession risks further. Although, the Fed has provided a diplomatic view on recession citing that "No one knows if we are going to have a recession or not."

Meanwhile, the 10-year US Treasury yields have dropped further to 3.48% as less-hawkish Fed monetary policy has triggered demand for US Treasury bonds. Going forward, investors will keep an eye on United States Retail Sales data, which will release on Thursday. The monthly Retail Sales data (Nov) is expected to contract by 0.1% while the prior release was an expansion by 1.3%. A decline in retail demand will bolster further softening in inflation data.

Gold technical analysis

Gold price is auctioning in a Rising Wedge chart pattern on an hourly scale that indicates volatility contraction while reaching near the other end of the tunnel. The 50-and 200-period Exponential Moving Averages (EMAs) at $1.803.67 and $1,790.00 respectively are aiming higher, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped into the 40.00-60.00 range, which indicates a loss in the upside momentum.

Gold hourly chart

-

23:02

GBP/JPY Price Analysis: Subdued around 168.20s, with buyers eyeing a break of 169.00

- GBP/JPY begins the Asian session on the wrong foot, slightly down by 0.07%.

- Risk appetite improvement on Wednesday underpinned the GBP/JPY.

- GBP/JPY Price Analysis: Bullish biased, might accelerate the uptrend once it breaches 169.00.

After a volatile Wall Street session spurred by the US Federal Reserve (Fed) monetary policy decision, the GBP/JPY trims some of its Tuesday’s losses, courtesy of a risk-on impulse, despite a hawkish message delivered by Fed Chairman Jerome Powell. Nevertheless, a positive reaction by the GBP/USD pair lifted the GBP/JPY off the weekly lows of 166.70s weekly lows. As the Asian session begins, the GBP/JPY is trading at 168.28, registering minuscule losses of 0.07%.

GBP/JPY Price Analysis: Technical outlook

At the beginning of the week, the GBP/JPY edged toward the psychological 169.00 barriers, though Tuesday probed to be a negative day. The GBP/JPY slid almost 0.70% to the 168.00 area as traders booked profits after a soft US inflation report, augmenting speculations that the Fed would pivot. So risk-perceived or high beta currencies, like the Pound Sterling (GBP), weakened against safe-haven peers like the Japanese Yen (JPY).

Wednesday was different, though it witnessed the GBP/JPY falling below the 20-day Exponential Moving Average (EMA) at 167.22. Still, it recovered ground and printed a daily close above 168.00. Given the backdrop and oscillators slightly skewed to the upside, the GBP/JPY remains bullish.

Therefore, the GBP/JPY first resistance would be December’s 13 daily high of 169.27, followed by the 170.00 psychological price level. A breach of the latter will expose the YTD high of 172.12. As an alternate scenario, the GBP/JPY first support would be 168.00, which, once cleared, could send the pair tumbling toward the 20-day EMA at 167.22.

GBP/JPY Key Technical Levels

-

22:54

AUD/USD dribbles below 0.6900 after unimpressive Fed, focus on Australia, China data

- AUD/USD remains sidelined near three-month high after refreshing the top.

- Fed failed to impress US Dollar bulls by marching wide forecasts on rates and economic projections.

- Australian jobs report, Consumer Inflation Expectations and China Industrial Production could entertain Aussie pair traders.

- Fears of RBA’s slower rate hikes, Covid-led easing in China data challenge bulls.

AUD/USD portrays the typical pre-data anxiety as it seesaws around a multi-day high, refreshed before a few hours, during the early Thursday in the Asia-Pacific region. In doing so, the Aussie pair struggles to defend the post-Fed gains ahead of the employment data from Australia and China’s Retail Sales, as well as Industrial Production. That said, the Aussie pair takes rounds to 0.6860-50, after refreshing the multi-day high with 0.6881.

Federal Reserve (Fed) delivered the 50 bps rate hike, as expected, and also upwardly revised the dot-plot to suggest 5.1% as the terminal rate versus 4.6% shown in September’s Statement of Economic Projections (SEP). Further details of the event suggested that the inflation forecasts were upwardly revised and the growth estimations were cut down for 2023 and 2024.

Additionally, Fed Chairman Jerome Powell tried to maintain his hawkish image while noting that the ultimate level of rates is more important than how fast they go. The policymaker also added that the Federal Open Market Committee (FOMC) needs to hold rates at their peak until policymakers are "really confident" inflation comes down in a sustained way.

However, most of these actions were already anticipated and there was nothing out of the box that could have inspired the US Dollar to pare the latest losses. As a result, the US Dollar Index (DXY) stayed depressed near the six-month low despite a temporal bounce.

The US equities closed on the negative side but the US Treasury bond yields were down too, which in turn favored the AUD/USD buyers amid optimism surrounding its key customer China.

Moving on, Australia’s employment report for November, Consumer Inflation Expectations for December and China’s data dump for November will be crucial for the AUD/USD pair traders for immediate directions. The initial forecasts suggest easing in Aussie Employment Change and inflation data, as well as a static Unemployment Rate. On the other hand, downbeat Retail Sales and Industrial Production is expected from China.

To sum up, the US Dollar’s failure to cheer the mildly hawkish Fed announcements may not hold the AUD/USD to remain firmer amid downbeat forecasts for the scheduled data from Australia and China.

Technical analysis

A successful break of the downward-sloping resistance line from June, near 0.6880 by the press time, appears necessary for the AUD/USD buyers to keep the reins.

-

22:36

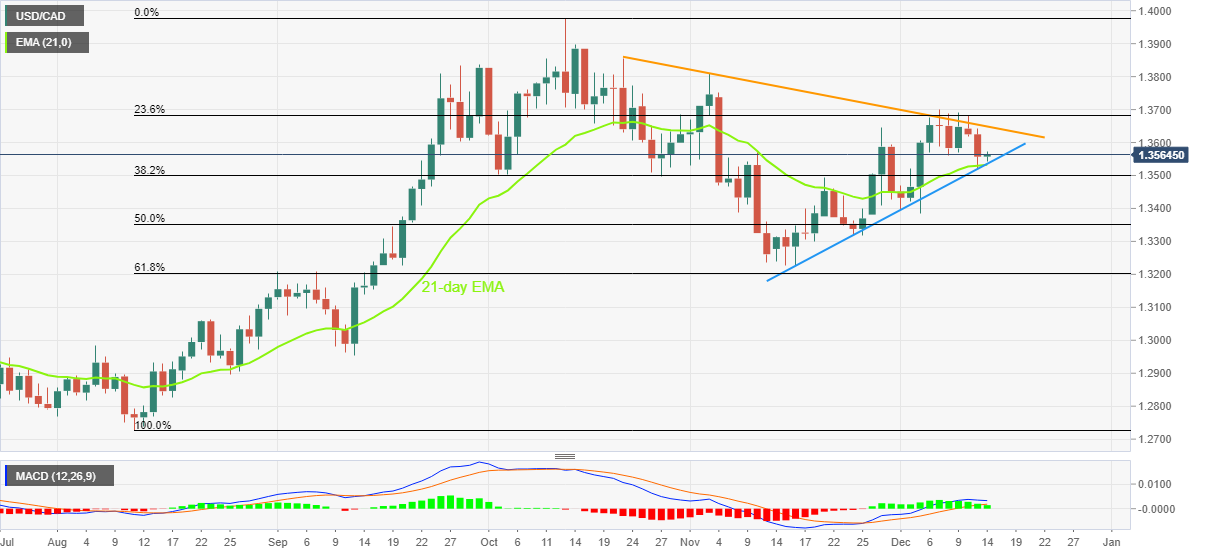

GBP/USD: Cable seesaws at six-month high ahead of Bank of England-inspired ‘Super Thursday’

- GBP/USD grinds higher after refreshing the multi-day top.

- US Dollar remains pressured after unimpressive Federal Reserve decision.

- Statistics from United Kingdom have been mixed, mostly upbeat for GBP/USD.

- Bank of England is up for 50 bps rate hike and can please Cable buyers if avoiding recession fears.

GBP/USD remains firmer around the six-month high, making rounds to 1.2420-30 after refreshing the multi-day top, as the Cable pair traders await the Bank of England (BOE) decision during early Thursday. The British Pound recently cheered broadly softer US Dollar as the Federal Reserve (Fed) failed to impress the greenback buyers. However, the fears of a recession in the United Kingdom (UK), highlighted by the recently softer British data, seem to challenge the Cable bulls of late.

Economics from United Kingdom have been too shallow to favor GBP/USD bulls

Although the GBP/USD pair stays sturdy near the multi-day high and is up for the weekly gain, the major reason is the broad US Dollar weakness than the fundamental strength of the United Kingdom, as portrayed by the latest statistic from Britain.

That said, UK’s headline Consumer Price Index (CPI) eased from the 41-year high of 11.1% to 10.7% YoY in November, compared to the 10.9% YoY market forecast. Further, the British Unemployment Rate matched 3.7% market forecast during the three months to October while Claimant Count Change marked a positive surprise of 30.5K in November versus -13.3K expected and -6.4K prior. Alternatively, Average Earnings and monthly Gross Domestic Product (GDP) for October could be cited as the positive catalysts for the pair.

Divide amongst Bank of England policymakers can tease Cable sellers

In addition to the mixed UK data, a division among the Bank of England (BOE) policymakers also challenges the GBP/USD pair buyers. Although the “Old Lady”, as the BOE is informally termed sometimes, is likely to announce 50 basis points (bps) of an interest rate lift, not all policymakers are in favor of the move as Silvana Tenreyro and Swati Dhingra voted for smaller increases of a quarter and half a percentage point respectively in November meeting. Also, BOE Governor Andrew Bailey’s comments suggesting the terminal rate not be as high as previously predicted by the markets offer extra challenges for the rate-setters and the Cable buyers.

Federal Reserve failed to recall US Dollar bulls

While the aforementioned discussion highlighted the pessimism surrounding the UK economy, the United States Federal Reserve (Fed) fell short of convincing the US Dollar buyer and superseded major negatives for the GBP/USD pair.

That said, the Fed delivered the 50 bps rate hike, as expected, and also upwardly revised the dot-plot to suggest 5.1% as the terminal rate versus 4.6% shown in September’s Statement of Economic Projections (SEP). Further details of the event suggested that the inflation forecasts were upwardly revised and the growth estimations were cut down for 2023 and 2024.

Additionally, Federal Reserve (Fed) Chairman Jerome Powell tried to maintain his hawkish image while noting that the ultimate level of rates is more important than how fast they go. The policymaker also added that the Federal Open Market Committee (FOMC) needs to hold rates at their peak until policymakers are "really confident" inflation comes down in a sustained way.

Despite all the details that could have lured the US Dollar bulls, the Fed failed to impress the greenback buyers as most of them were expected. Also, the recently softer US inflation data and receding Covid fears from China exerted additional downside pressure on the USD and favored the GBP/USD buyers.

Conclusion

To sum up, the GBP/USD pair traders have recently cheered the US Dollar weakness, rather than having strong fundamentals to refresh the multi-day top. As a result, the Bank of England (BOE) may not be able to keep the Cable bulls on board amid the looming economic crisis, namely the recession fears and British workers’ agitations.

Hence, the 50 bps rate hike may not help the GBP/USD to go much higher to the north of the recent tops and could trigger the pair’s pullback should the details of the BOE monetary policy meeting appear pessimistic.

Alternatively, a surprise 75 bps rate hike won’t hesitate to propel the British Pound toward the north.

Technical analysis

GBP/USD pokes 61.8% Fibonacci retracement level of its January-September downside, also known as the golden ratio, as it seesaws around a six-month high. In addition to the key Fibonacci ratio of around 1.2350, the overbought conditions of the Relative Strength Index (RSI) line, placed at 14, also challenge the Cable buyers.

It should be noted that the British Pound also portrays a bull cross between the 50-DMA and the 100-DMA and signals further upside. That said, it is a condition where the near-term moving average crosses the longer one from below and suggests the quote’s further advances.

In a case where the British Pound crosses the 1.2350 hurdle, May’s peak surrounding 1.2665 will act as the last defense of the GBP/USD pair buyers.

Following that, early April’s low near 1.2975, as well as March’s bottom near 1.30000 will be in focus.

On the flip side, an upward-sloping support line from early November puts a floor under the GBP/USD prices near 1.2315, a break of which could quickly drag the Cable towards the 200-DMA support of 1.2105.

It should be noted that the 50% Fibonacci retracement level and the 50-DMA, respectively around 1.2050 and 1.1715, could gain the GBP/USD bear’s attention past 1.2105.

GBP/USD: Daily chart

Trend: Further upside expected

-

22:32

NZD/USD recovers to near 0.6460 on upbeat NZ GDP data and Fed’s less-hawkish policy

- NZD/USD is aiming to surpass the 0.6460 resistance on solid NZ GDP data.

- The US Dollar Index is exposed to downside risks as the Fed has shifted its approach to less-hawkish policy moves.

- The next catalyst that could be painful for the Fed is the stubborn Average Hourly Earnings.

The NZD/USD pair has recovered to near the critical resistance of 0.6460 after some rhetoric volatile moves in the late New York session. The Kiwi asset is aiming to surpass the 0.6460 hurdle as Statistics New Zealand has reported upbeat Gross Domestic Product (GDP) data.

The quarterly GDP data for the third quarter of CY2022 has landed at 2.0%, higher than the expectations of 0.9% and the prior release of 1.7%. Also, the annual GDP data has soared to 6.4% vs. the consensus of 5.5% and the former figure of 0.4% in the same period.

No doubt, an expansion in the antipodean will support the New Zealand Dollar but will also create more troubles for the Reserve Bank of New Zealand (RBNZ). The NZ central bank is working day and night in bringing price stability in times of stubborn inflation by announcing policy tightening measures at regular intervals. An expansion in the extent of economic activities indicates that the overall demand is robust, which is not an incentive to manufacturers for cutting the price of goods and services.

Meanwhile, the US Dollar Index (DXY) is displaying sideways moves around a fresh six-month low at 103.49. The USD Index is expected to remain on tenterhooks as the Federal Reserve (Fed) has confirmed a smaller and slower interest rate hike approach after softening inflation data consecutively for two months.

Fed chair Jerome Powell has hiked its terminal rate projection from 4.6% to 5.1%, which is to be achieved by the conclusion of CY2023. The Fed is subjected to keep policy restrictive till the achievement of price stability. While Fed chair Jerome Powell has not given any verdict on the recession whether it will arise or not. The next trigger that could create troubles for the Fed is the escalating Average Hourly Earnings, which could keep retail demand solid ahead.

-

22:19

EUR/JPY Price Analysis: Fluctuates around 144.60s after piercing the 20/50-day EMAs

- The EUR/JPY is recovering from Tuesday’s losses and rose 0.38% on Wednesday.

- EUR/JPY: Break above 145.30s could pave the way for further gains.

The EUR/JPY erases some of Tuesday’s losses and clings to gains above the psychological 144.00 figure, after a volatile trading session in Wall Street, following the US Federal Reserve (Fed) decision to hike rates by 50 bps. As the Asian Pacific session begins, the EUR/JPY is trading at 144.60.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart suggests the cross is slightly upward biased, though with some risks skewed to the downside. For the cross to extend its weekly gains, the EUR/JPY needs to clear the weekly high reached on December 14 at around 145.34, which would exacerbate a rally toward the November 23 pivot high at 146.13. Once cleared, the next resistance would be the November 9 daily high of 147.11.

EUR/JPY’s failure to clear the weekly high could pave the way for consolidation and a fall toward the week’s lows. The EUR/JPY key support levels would be the 20-day Exponential Moving Average (EMA) at 144.20, followed by the 50-day EMA at 143.97. A breach of the latter would be crucial, exposing 143.17, the current week’s low, which, once removed, will drag prices toward the 100-day EMA at 142.64.

From a momentum point of view, the Relative Strength Index (RSI) suggests that neither buyers/sellers are in charge, with RSI almost flat, nearby 50. However, the Rate of Change (RoC) suggests that buyers are gathering momentum. Therefore, further EUR/JPY upside is expected.

EUR/JPY Key Technical Levels

-

22:00

EUR/USD Price Analysis: Bulls seek a drive through 1.0700

- EUR/USD bulls press up against key resistance and eye higher.

- The Euro is eyeing a move through 1.0700.

As per the prior analysis, EUR/USD soars as US CPI comes in below expectations, the Euro is reaching key resistance as shown above but is leaving a W-formation in its tracks. This is a reversion pattern whereby bulls would be expected to move in at a discount from the neckline should there be a testest thereof.

EUR/USD daily charts

1.0700 is a key level where a measured move of -0.272% of the potential correction's range to support meets the prior mid-summer resistance looking left. We have 1.0790 thereafter as the next level.

The above chart marks 1.0600 as a key support area and 1.0520s below it as being the CPI take-off point.

-

21:58

NZ GDP beats expectations, Kiwi unchaged

The Gross Domestic Product (GDP), released by Statistics New Zealand has been released as follows and is better than expected:

New Zealand GDP Q3

+2.0% QoQ vs. expected +0.9%, prior +1.7%.

+6.4% YoY vs. expected +5.5%, prior +0.4%.

NZD/USD is unchanged at 0.6457.

More to come...

About NZ GDP

The Gross Domestic Product (GDP), released by Statistics New Zealand, highlights the overall economic performance on a quarterly basis. The gauge has a significant influence on the Reserve Bank of New Zealand’s (RBNZ) monetary policy decision, in turn affecting the New Zealand dollar. A rise in the GDP rate signifies improvement in the economic conditions, which calls for tighter monetary policy, while a drop suggests deterioration in the activity. An above-forecast GDP reading is seen as NZD bullish

-

21:56

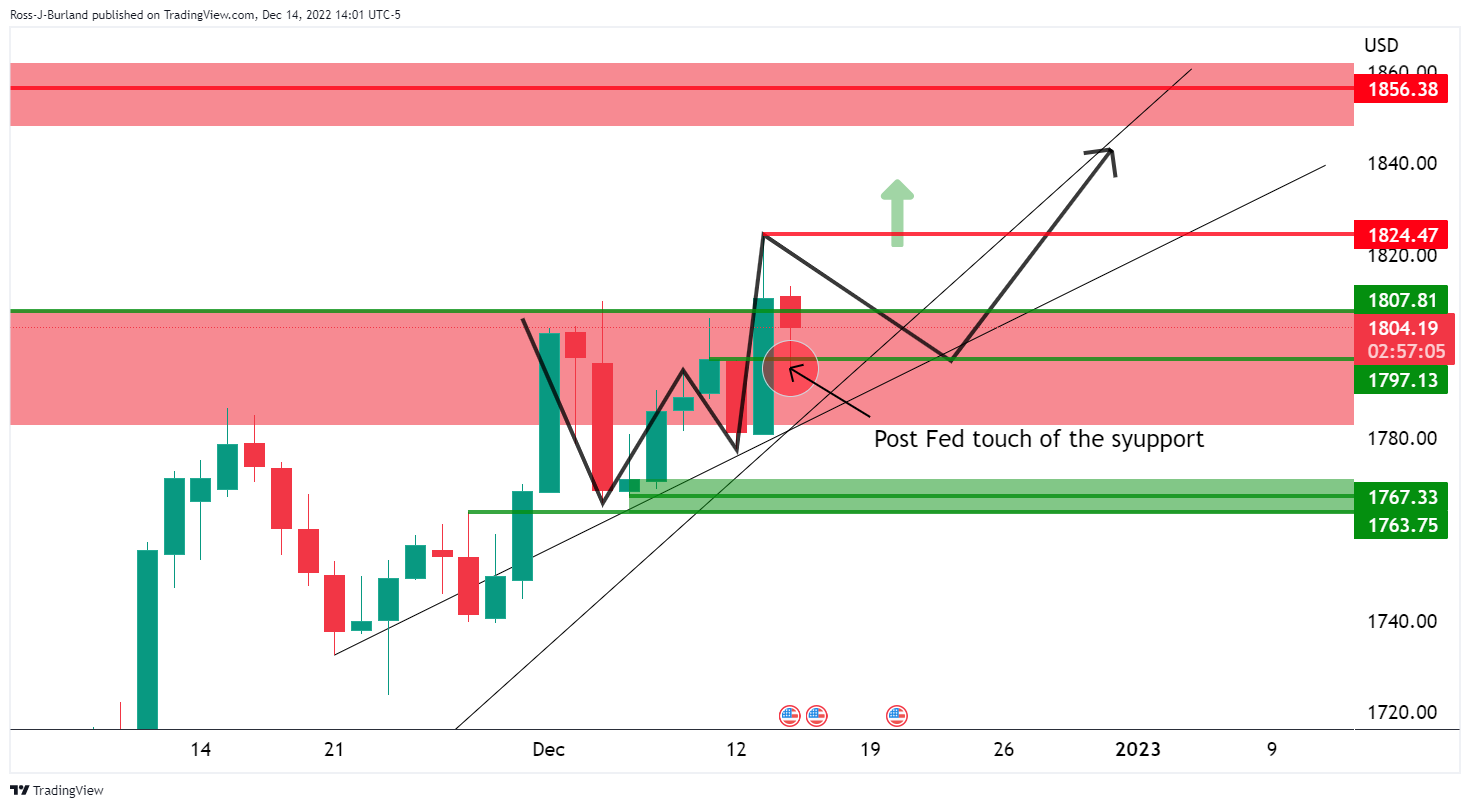

USD/CAD back to square one near 1.3550 after wild gyrations post-Fed’s hawkish guidance

- USD/CAD has reached to near 1.3550 after volatile moves backed by Fed’s hawkish guidance.

- Fed’s terminal rate projection has escalated to 5.1% and it has promised a restrictive policy till inflation reached 2%.

- Oil prices could face volatility ahead as official US oil inventory data has reported a build-up of 10.231M barrels.

The USD/CAD pair has returned from where it started near 1.3550 after wild gyrations in the late New York session. The upside in the Loonie asset remained capped around 1.3610 while the downside got restricted near 1.3520. The Canadian Dollar major asset got severe hiccups after hawkish guidance by the Federal Reserve (Fed) chair Jerome Powell in its last monetary policy announcement of CY2023.

The market mood seems complicated for now as the US Dollar Index (DXY) is hovering near a fresh six-month low and the S&P500 settled with losses on Wednesday. It seems that the market participants need ample time to digest the hawkish guidance from the Fed as an interest rate hike by 50 basis points (bps) is in line with the expectations.

Demand for US Treasury bonds remained elevated as the concept of a smaller and slower interest rate hike is in place now. The 10-year US Treasury yields have dropped to near 3.47%.

An interest rate hike by 50 bps has pushed interest rates to 4.00-4.25% and Fed policymakers see the terminal rate at 5.1% by the end of CY2023. This indicates that there is still room for more rate hikes but the extent will remain smaller. Apart from the higher terminal rate, commentary that has escalated volatility in the global market is the promise of keeping policy restrictive till the inflation plummeted to 2%.

On the oil front, oil prices have extended their gains to near $77.50 in hopes of recovery in economic projections. A deceleration in the rate hike process might not haunt firms in executing expansion plans, which would accelerate oil demand in the near term. West Texas oil could see some volatility in the near term as official United States oil inventory data has reported a sheer increase in oil stockpiles by 10.231M for the week ending December 09. It is worth noting that Canada is a leading exporter of oil to the US and higher oil prices strengthen the Canadian Dollar.

-

21:45

New Zealand Gross Domestic Product (YoY) came in at 6.4%, above expectations (5.5%) in 3Q

-

21:45

New Zealand Gross Domestic Product (QoQ) above forecasts (0.9%) in 3Q: Actual (2%)

-

21:21

S&P 500 meets key daily support after hawkish Fed hike

- Wall Street buckles on a hawkish hike but US stocks are supported.

- The S&P 500 index is retesting the W-formation's neckline and potential support at a 78.6% Fibonacci retracement level.

US stocks turned lower after the Federal Reserve raised rates by half a percentage point. However, while the Fed has downshifted the pace of tightening, the message given to the financial markets is that they’re not done yet.

The federal funds target range now stands at 4.25%-4.50%. At the same time, the Fed expects further rate hikes to over 5%, which is more than before. There are no signals yet of a pause in the rate hike cycle, however, the benchmarks started to correct the initial knee-jerk sell-off in the mid-latter part of the event.

The S&P 500 was moving off its lows of 3,965.65 to retest the 4,030s. At the time of writing, the index is trading down 0.6% at 3,995.33. There has been a mirror image in price action across the Nasdaq and Dow Jones as well.

While the Fed has signalled its plans to keep lifting rates next year to combat high inflation Fed's chair Jerome Powell was speaking and his comments seemed to have given mixed messages to the market. Consequently, we were seeing two-way price action on Wall Street. In US Treasury yields, they have flipped with the 10-year falling back from a high of 3.5610% to print 3.477% currently and on the way towards the day's low of 3.46%.

Fed key takeaways

- The Federal Reserve hikes 50 basis points, as expected

- Target Range stands At 4.25% - 4.50%.

- The vote was unanimous.

- The guidance in the statement repeats that: "The Committee anticipates that ongoing increases in the target range will be appropriate."

Powell's comments

Opening comments:

We still have "some ways to go".

We expect ongoing hikes are appropriate to get sufficiently restrictive.

US economy slowed ‘significantly from last year.

Without price stability, no sustained strong labour market.

Strongly committed to inflation target.

Yet to feel full effects of tightening, have more work to do.

Not at restrictive policy stance yet.

Recent comments:

Getting close to sufficiently restrictive rates level.

No rate cuts until confident inflation moving toward 2%.

By middle of 2023 should begin to see slower inflation from housing services sector.

Size of february rate hike will depend on incoming data.

Powell speech: No one knows if we are going to have a recession or not

Powell speech: Focus is on moving policy stance to become restrictive enough, not on rate cuts

S&P 500 technical analysis

The index is moving within a bullish cycle and channel, currently retesting the W-formation's neckline and potential support at a 78.6% Fibonacci retracement level. If bulls were to step in here, there would be prospects of an upside continuation towards channel resistance and prior highs near 4,200.

-

21:19

Forex Today: The Fed could not save the US Dollar

What you need to take care of on Thursday, December 15:

The American Dollar remains on the back foot after the US Federal Reserve announced its monetary policy decision. Financial markets were pretty much on hold ahead of the event, with major pairs confined to tight intraday ranges.

The central bank delivered a 50 basis point rate hike as widely anticipated, while the accompanying statement was pretty much a copy of the previous one.

On guidance, the document showed that "the Committee anticipates that ongoing increases in the target range will be appropriate." Additionally, the Fed's revised Summary of Economic Projections (SEP), the so-called dot plot, showed that the median view of the policy rate at the end of end-2023 stood at 5.1%, up from 4.6% in September's SEP. Finally, growth forecasts have been downwardly revised for 2023 and 2024, while PCE inflation was upwardly revised to 3.1% from 2.8% for 2023, also adjusted to the upside in 2024 and 2025.

Chairman Jerome Powell came out with hawkish comments. Among other things, Powell noted that the ultimate level of rates is more important than how fast they go, adding that the FOMC needs to hold rates at their peak until policymakers are "really confident" inflation comes down in a sustained way.

Finally, he said that the focus remains on moving the policy stance to become restrictive enough, not on rate cuts. His words take their toll on equities, with US indexes plummeting but the dollar barely able to post a short-lived advance. The movements were short-lived, as the greenback quickly resumed its decline as stocks bounced off their lows.

Meanwhile, US Treasury yields edged marginally lower after ticking higher post-Fed.

EUR/USD trades just ahead of the 1.0700 figure, while GBP/USD stands at 1.2430.

The AUD/USD pair flirted with 0.6800 but trimmed losses and hover around 0.6860 ahead of Australian and Chinese first-tier figures. Australia will publish November employment figures on Thursday. The country is expected to have added 19,000 job positions in the month, while the Unemployment Rate is foreseen unchanged at 3.4%. The Participation Rate, however, is expected to have ticked higher, from the current 66.5% to 66.6%. The country will also release December Consumer Inflation Expectations, foreseen at 5.7%, declining from 6% in November.

The USD/CAD pair is down to 1.3545, helped by stronger oil prices. The barrel of WTI currently stands at $77.35.

Gold ended the day little changed at around $1,807 a troy ounce.

Early on Thursday, the focus will be on the Bank of England's and the European Central Bank's monetary policy decisions.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:00

South Korea Export Price Growth (YoY) came in at 8.6%, below expectations (15.9%) in November

-

21:00

South Korea Import Price Growth (YoY) registered at 14.2%, below expectations (18.6%) in November

-

20:26

US Dollar bears move in as markets turn on a dime during Fed event

- US Dollar is back on its backside following a mixed reaction to the Fed event.

- Two-way price action was the outcome in financial asset classes to the Fed and US Dollar prints fresh bear cycle low.

The US Dollar is tailing off from the highs that were made on the knee-jerk in what was perceived to be a hawkish rate hike of 50 basis points by the United States Federal Reserve. At the time of writing, DXY, an index that measures the US Dollar vs. a basket of currencies, is correcting all of the post-Fed announcement rally from the high of 104.163 to the current level of 103.448.

While the Fed has signalled its plans to keep lifting rates next year to combat high inflationFed's chair Jerome Powell is currently speaking and his comments have given mixed messages to the market. Consequently, we are seeing two-way price action in asset classes, including the US Dollar and bonds. More on Powell below.

US Treasury yields have spun around in the 10-year from a high of 3.5610% to print 3.47% currently, well on course towards the day's low of 3.46%.

Fed key takeaways

- The Federal Reserve hikes 50 basis points, as expected

- Target Range stands At 4.25% - 4.50%.

- The vote was unanimous.

- The guidance in the statement repeats that: "The Committee anticipates that ongoing increases in the target range will be appropriate."

Powell's comments

Opening comments:

We still have "some ways to go".

We expect ongoing hikes are appropriate to get sufficiently restrictive.

US economy slowed ‘significantly from last year.

Without price stability, no sustained strong labour market.

Strongly committed to inflation target.

Yet to feel full effects of tightening, have more work to do.

Not at restrictive policy stance yet.

Recent comments:

Getting close to sufficiently restrictive rates level.

No rate cuts until confident inflation moving toward 2%.

By middle of 2023 should begin to see slower inflation from housing services sector.

Size of february rate hike will depend on incoming data.

DXY technical analysis

The M-formation is a reversion pattern that has shown up on the daily chart above. While on the front side of the trendline, a move into the neckline could be the next phase of the bearish cycle prior to a downside continuation to test 102.00 and below.

-

20:21

NZD/USD fluctuates around 0.6450/60 following Fed Powell’s press conference

- The US Federal Reserve raised rates as expected, though pushed back against a Fed pivot.

- Officials expect the Federal Funds rate to peak at around 5.1% in 2023, while rate cuts are seen until 2024.

- According to the Federal Reserve’s projections, the US economy is foreseen to grow by 0.5% in 2022 and 2023.

The NZD/USD remains volatile, fluctuating on Wednesday, following the Federal Reserve’s decision to raise rates by 50 bps while emphasizing the need for a higher “terminal” rate than September’s projections, as reported by the Summary of Economic Projections (SEP). At the time of writing, the NZD/USD remains volatile, trading at 0.6450s, below its opening price.

Federal Reserve Chair Jerome Powell Q&A’s remarks

As the Federal Reserve Chair Jerome Powell takes its Q&A after the release of the monetary policy statement, the NZD/USD has bounced off the day’s lows, almost erasing some of the losses attained at the release of the Fed decision. He reiterated the central bank’s commitment to getting inflation to the 2% target and said that they expect ongoing rate increases to get sufficiently restrictive.

Powell added that 50 bps hikes are still large, and forward decisions would depend on incoming data and would be done meeting by meeting, “taking forceful steps.” The Fed Chair added that history cautions against prematurely loosening policy and reiterated that the central bank would stay on course until inflation reaches the 2% target.

Summary of the Federal Reserve statement

The Federal Reserve Open Market Committee (FOMC) made the widely anticipated decision to raise the Federal Funds rate (FFR) toward 4.25-4.50%. The US central bank decision was spurred by a tight labor market and inflation reflecting various supply and demand imbalances due to the pandemic, higher food and energy prices, and broader price pressures. Policymakers added that further increases in policy are needed for inflation to return back over to the 2% target and stated that “cumulative tightening of monetary policy,” inflation, and economic and financial developments, to achieve the Fed’s target.

According to the Summary of Economic Projections, Federal officials predict a “terminal” rate average near 5.10%, with GDP anticipations at 0.5% for both 2022 and 2023; inflation is expected to reach 3.5% by 2023 before declining further in future years down toward the 2% US central bank, target.

NZD/USD 5-minute Chart

The NZD/USD dropped toward its lows around 0.6402 and so far rallied back towards the pre-release of the Federal Reserve’s policy decision while the Fed Chair Powell takes the stand. It should be said the NZD/USD is back trading in the green, though it would remain volatile. On the upside, the NZD/USD key resistance levels lie at 0.6500, followed by the YTD high of 0.6575, ahead of the 0.6600 mark. On the flip side, the NZD/USD first support would be the 0.6400 mark, followed by the 20-day Exponential Moving Average (EMA) at 0.6288.

-

20:08

Powell speech: No one knows if we are going to have a recession or not

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 50 basis points to the range of 4.25-4.5% following the December policy meeting.

Key quotes

"Data we have received so far on inflation for October and November do show a welcome reduction in price pressures; need substantially more evidence though to be confident inflation coming down."

"That recent data gives us greater confidence in our forecasts."

"Inflation in non-housing services is fundamentally about the labor market and wages."

"We see little progress in average hourly earnings coming down."

"We will be looking for wages moving down to more normal levels."

"Our policy is getting close to sufficiently restrictive."

"No one knows if we are going to have a recession or not."

"If lower inflation reports continue, that would increase likelihood of significantly less of an increase in unemployment."

"Largest pain would come from failure to raise rates high enough."

-

20:00

Powell speech: Focus is on moving policy stance to become restrictive enough, not on rate cuts

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 50 basis points to the range of 4.25-4.5% following the December policy meeting.

Key quotes

"Expect a very large drop in inflation next year, but the jump-off point at beginning of the year is higher."

"Drop in inflation will come from goods sector and by the middle of next year from housing services."

"For the non-housing services sector, that is the key one that needs to get into better balance."

"We want strong wage increases, but consistent with 2% inflation."

"Right now wages are running well above that consistent with 2% inflation."

"Our focus is on moving our policy stance to become restrictive enough, it's not on rate cuts."

"I wouldn't see us considering rate cuts until FOMC is confident inflation moving down in a sustained way."

"There are no rate cuts in the SEP."

"Hard to say how the end of zero-Covid policy in China will affect US inflation."

"China faces very challenging situation on reopening."

-

19:53

Powell speech: By now we would have expected faster progress on inflation

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 50 basis points to the range of 4.25-4.5% following the December policy meeting.

Key quotes

"I don't think SEP projections qualify as projecting a recession but economy will have very slow growth."

"4.7% unemployment rate is still a strong labor market."

"Firms want to hold on to workers as it's been hard to hire."

"That doesn't sound like a labor market that will have a lot of layoffs."

"Having moved so quickly, we think the appropriate thing to do is to move to a slower pace of rate hikes."

"That will allow us to better balance risks."

"SEP reflects any data that comes out before the meeting and during the meeting. Participants can even change their dots during the meeting."

"By now we would have expected faster progress on inflation."

-

19:48

Powell speech: Expect shelter inflation to come down sometime next year

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 50 basis points to the range of 4.25-4.5% following the December policy meeting.

Key quotes

"We will make February decision based on financial conditions, economy."

"How high to raise rates depends on progress on inflation, where financial conditions are and how restrictive we think we need to be."

"At a certain point policy, will be restrictive enough."

"Strong view on FOMC is we need to hold rates at peak until we are really confident inflation is coming down in a sustained way."

"Expect shelter inflation to come down sometime next year."

"Expectation services inflation will not move down quickly, so we'll have to raise rates higher. That's why we have a higher peak rate."

-

19:45

Powell speech: Peak rate could move down if inflation data is soft

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 50 basis points to the range of 4.25-4.5% following the December policy meeting.

Key quotes

"Important financial conditions reflect our policy restraint."

"Focus is not on short-term moves in financial conditions, but persistent moves."

"We are not at a sufficiently restrictive policy stance yet."

"I would also point you to our projections for our peak level of the funds rate."

"Fed policymaker projections are best assessment of where Fed policy rate will be."

"At each subsequent SEP this year, we have increased our estimates of peak rate."

"Can't tell you confidently we won't upgrade the peak at next meeting too, depends on data."

"If data comes in worse, peak could move up but could also move down if inflation data is soft."

"Earlier this year was important to move quickly on rates; now not so important how fast we go."

"Ultimate level of rates is more important."

-

19:43

GBP/USD drops towards bull cycle support, 1.2350, on hawkish Fed hike

- GBP/USD has dropped on a stronger US Dollar and hawkish Fed hike.

- The bears are targeting the 1.2350s that guard the trendline support and 1.2250 then 1.2200 below there.

GBP/USD is offered towards a key support line and trades around 1.2350 after the United States Federal Reserve raised rates by 50 basis points in what has been perceived as a hawkish hike. This is at the conclusion of the Federal Open Market Committee's two-day meeting on Wednesday. The Fed has signalled plans to keep lifting them next year to combat high inflation. Fed's chair Jerome Powell is currently speaking and fanning the flames of a higher terminal rate in his initial comments. More on Powell below.

Meanwhile, the US Dollar, as measured by the DXY index, is high by 0.11% at the time of writing, making fresh gains on Powell's hawkish remarks. US Treasury yields have also rallied with the 10-year Treasury yield now printing a high of 3.56% on the day from 3.46% the low.

Fed key takeaways

- The Federal Reserve hikes 50 basis points, as expected

- Target Range stands At 4.25% - 4.50%.

- The vote was unanimous.

- The guidance in the statement repeats that: "The Committee anticipates that ongoing increases in the target range will be appropriate."

Watch Fed Chair Powell live

Fed chairman, Jerome Powell's press conference si underway and this can be watched in the live link above.

Jerome Powell was expected to bring clarity to the interest rate decision and the statement for where the committee views the future of its inflation fight. He was expected to reiterate Fed will raise rates and keep them high until inflation shows concrete signs of coming back to the central bank’s 2% target. This would imply a higher terminal rate which would be expected to support US Treasury yields and the US Dollar, a headwind for the Pound Sterling.

Powell comments so far

We still have "some ways to go".

We expect ongoing hikes are appropriate to get sufficiently restrictive.

US economy slowed ‘significantly from last year.

Without price stability, no sustained strong labour market.

Strongly committed to inflation target.

Yet to feel full effects of tightening, have more work to do.

Not at restrictive policy stance yet.

GBP/USD technical analysis

The bears are targeting the 1.2350s that guard the trendline support and 1.2250 then 1.2200 below there.

-

19:40

AUD/USD sellers take over and drag the pair toward its lows around 0.6810s post-Fed’s decision

- The US Federal Reserve hiked rates by 50 bps, and the AUD/USD tumbled from around 0.6880s toward its day’s lows.

- Federal Reserve policymakers expect the Federal Funds rates to peak around 5.1%.

- AUD/USD: Break below 0.6800 can exacerbate a fall toward the 20-DM; otherwise, a rally above 0.6900 is on the cards.

The AUD/USD dropped from daily highs nearby 0.6900, toward its daily lows of 0.6820, following the US Federal Reserve (Fed) monetary policy decision on Wednesday, with Jerome Powell and Co., raising rates by 50 bps, as most analysts expected. However, the monetary policy statement remained unchanged from November’s. Therefore, the AUD/USD is trading volatile, around 0.6800/20, at the time of writing.

Summary of the Fed’s decision

The Federal Reserve Open Market Committee (FOMC) made the widely anticipated decision to raise the Federal Funds rate (FFR) toward 4.25-4.50%. The US central bank decision was spurred by a tight labor market and inflation reflecting various supply and demand imbalances due to the pandemic, higher food and energy prices, and broader price pressures. Officials noted that further increases in policy are needed for inflation to return back over to the 2% target and stated that “cumulative tightening of monetary policy,” inflation, and economic and financial developments, to achieve the Fed’s target.

According to the Summary of Economic Projections, Federal officials predict a “terminal” rate average near 5.10%, with GDP anticipations at 0.5% for both 2022 and 2023; inflation is expected to reach 3.5% by 2023 before declining further in future years down toward the 2% US central bank, target.

Source: Federal Reserve

AUD/USD 5-minute Chart

The AUD/USD tumbled from around 0.6875 toward its daily low of 0.6818 on the release of the monetary policy statement, though it had erased some of its losses, but remains volatile as the Federal Reserve Chair Jerome Powell takes the stance.

A fall below 0.6800 could pave the way toward the 20-day Exponential Moving Average (EMA) at 0.6726. On the upside, a rally above 0.6900 could be expected if Powell turns more dovish as expected.

AUD/USD Key Technical Levels

-

19:40

Powell speech: Historical record cautions strongly against premature loosening

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 50 basis points to the range of 4.25-4.5% following the December policy meeting.

Key quotes

"50 basis point rate hike is still large."

"We still have some way to go on rate hikes."

"Our projections are not a plan; no certainty on the economy."

"Our decisions will depend on incoming data in its totality."

"We will continue to make decisions meeting by meeting."

"We are taking forceful steps."

"Historical record cautions strongly against premature loosening."

"We still stay the course to get the job done."

-

19:38

Powell speech: FOMC continues to see risks to inflation as to the upside

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 50 basis points to the range of 4.25-4.5% following the December policy meeting.

Key quotes

"Inflation data received in October and November show a welcome reduction in price increases."

"Inflation expectations remain well anchored but that is not grounds for complacency."

"FOMC continues to see risks to inflation as to the upside."

"Financial conditions fluctuate in short term, but important that over time they reflect policy restraint."

"We are seeing effects on demand in interest-rate sensitive sectors, but takes time for the rest of the economy."

-

19:34

Powell speech: Higher rates weighing on business fixed investment

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 50 basis points to the range of 4.25-4.5% following the December policy meeting.

Key quotes

"We've covered a lot of ground, full effects of tightening yet to be felt."

"We have more work to do."

"Without price stability, no sustained strong labor market."

"We expect ongoing hikes are appropriate to get sufficiently restrictive."

"US economy has slowed significantly from last year."

"Activity in housing has weakened significantly."

"Higher rates also weighing on business fixed investment."

"Labor market remains extremely tight."

"Although job vacancies are down from earlier in year, labor market still out of balance."

-

19:17

EUR/USD fell toward 1.0640s after the Federal Reserve hiked rates by 50 bps

- Federal Reserve maintained a neutral-hawkish tone in the monetary policy statement, almost unchanged from November’s.

- Fed officials expect the Federal Funds rate to get as high as 5.1%, vs. 4.6% in September.

- Inflation in the United States is expected to hit the 2% threshold by 2024.

The EUR/USD dropped toward 1.0630s after the Federal Reserve (Fed) raised rates by 50 bps, as widely expected by analysts while maintaining a dovish tone, as investors prepared for the Fed Chair Jerome Powell press conference around 18:30 GMT. At the time of writing, the EUR/USD trades volatile, around the 1.0640/1.0660 range.

Summary of the Federal Reserve monetary policy statement

The Federal Reserve Open Market Committee (FOMC) decided to hike the Federal Funds rate (FFR) as expected toward the 4.25-4.50% range, acknowledging that the labor market remains tight and that inflation remains elevated, “reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.”

FOMC officials added that “ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” Additionally, policymakers expressed that it would take the “cumulative tightening of monetary policy,” inflation, and economic and financial developments.

Regarding the Summary of Economic Projections (SEP), most officials expect the “terminal” rate at around 5.10% according to the median and foresee the Gross Domestic Product (GDP) for 2022 at 0.5% and in 2023 at 0.5%. Inflation is expected to fall to 3.5% in 2023 and will hit the 2.1% mark by 2025.

Source: Federal Reserve

EUR/USD 5-minute Chart

EUR/USD Key Technical Levels

-

19:15

Gold Price Forecast: XAU/USD bears pile in on hawkish Fed statement, critical daily support under pressure

- Gold price has dropped on the Federal Reserve statement and interest rate decision.

- Fed hikes rates with a hawkish statement by 50 basis points, as expected, US Dollar and US Treasury yields rally.

- There are prospects of a move in Gold price towards $1,850s on the upside or a break below $1,800 opens $1,770/50.

The United States Federal Reserve has hiked rates by 50 basis points at the conclusion of the Federal Open Market Committee's two-day meeting on Wednesday and signalled plans to keep lifting them next year to combat high inflation.

The US Dollar and US Treasury yields have rallied on a hawkish statement and the Gold price has dropped to $1,795 the low so far to test a critical area of daily support as illustrated in the technical analysis below.

Fed key takeaways

- The Federal Reserve hikes 50 basis points, as expected

- Target Range stands At 4.25% - 4.50%.

- The vote was unanimous.

- The guidance in the statement repeats that: "The Committee anticipates that ongoing increases in the target range will be appropriate."

Watch Fed Chair Powell live

Today's Federal Open Market Committee meeting is bringing an assortment of moves to chew on, including the Fed chairman, Jerome Powell's press conference up next. this can be watched in the live link above.

Jerome Powell will be looked at to bring clarity to the interest rate decision and the statement for where the committee views the future of its inflation fight. He is expected to reiterate Fed will raise rates and keep them high until inflation shows concrete signs of coming back to the central bank’s 2% target. This might imply a higher terminal rate for which would be expected to support US Treasury yields and the US Dollar, a headwind for the Gold price.

Gold technical analysis

Prior to the announcement of a 50bp hike, Gold price was at $1,810 and had carved out a W-formation. This is a reversion pattern and was expected to see the price retest at least the neckline support as follows:

After the Fed

From here, there are prospects of a move towards $1,850s on the upside while a break of the support of the W-formation opens the risk of a run to test below $1,800 and towards $1,770/50 below the bullish trendline supports.

-

19:14

Fed's median view of fed funds rate at end-2023 rises to 5.1% from 4.6% in September

The Federal Reserve's revised Summary of Economic Projections (SEP), the so-called dot plot, showed that the median view of the policy rate at end-2023 stood at 5.1%, up from 4.6% in September's SEP.

Additional takeaways

"Fed's median view of fed funds rate at end-2024 4.1% (prev 3.9%)."

"Fed's median view of fed funds rate at end-2025 3.1% (prev 2.9%)."

"Fed's median view of fed funds rate in longer run 2.5% (prev 2.5%)."

"Fed sees US GDP growing 0.5% in 2023 (prev 1.2%); 1.6% in 2024 (prev 1.7%); 1.8% in 2025 (prev 1.8%); longer-run at 1.8% (prev 1.8%)."

"Fed sees PCE inflation at 3.1% in 2023 (prev 2.8%); 2.5% in 2024 (prev 2.3%); 2.1% in 2025 (prev 2.0%); longer-run 2.0% (prev 2.0%)."

"Fed sees year-end US jobless rate at 4.6% in 2023 (prev 4.4%), 4.6% in 2024 (prev 4.4%); 4.5% in 2025 (prev 4.3%); longer-run at 4.0% (prev 4.0%)."

"Fed sees core PCE inflation at 3.5% in 2023 (prev 3.1%), 2.5% in 2024 (prev 2.3%), 2.1% in 2025 (prev 2.1%)."

"Only two policymakers project year-end 2023 fed funds rate below 5%."

-

19:01

United States Fed Interest Rate Decision meets forecasts (4.5%)

-

19:00

Breaking: Fed hikes policy rate by 50 bps to 4.25-4.5% as expected

The US Federal Reserve on Wednesday announced that it raised the policy rate, federal funds rate, by 50 basis points to the range of 4.25-4.5% following the December monetary policy meeting. This decision came in line with the market expectation.

Follow our live coverage of the Fed's policy announcements and the market reaction.

In its policy statement, the Fed reiterated that ongoing interest rate increases will be appropriate to attain a 'sufficiently restrictive policy stance.'

Additional takeaways as summarized by Reuters

"Will take into account cumulative tightening, policy lags and economic and financial developments in setting rate hike pace."

"Inflation remains elevated, Fed is highly attentive to inflation risks."

"Job gains have been robust, unemployment rate low."

"Recent indicators point to modest growth in spending and production."

"Vote was in favor of policy was unanimous."

Market reaction

The US Dollar Index recovered modestly from the multi-month lows with the initial reaction and was last seen trading flat on the day at around 104.00.

-

18:49

EUR/GBP seesaws around 0.8590 as BoE and ECB’s decisions loom

- The Euro tumbles against the Pound Sterling ahead of BoE and ECB’s decisions.

- EU’s Industrial Production in November was weaker than expected, exerting pressure on the Euro.

- The Bank of England and the European Central Bank are expected to hike rates by 50 bps, favoring the GBP.

The EUR/GBP stalled at the 20-day Exponential Moving Average (EMA) at 0.8622 and retraces below the 0.8500 psychological mark, courtesy of broad Pound Sterling (GBP) strength, ahead of monetary policy decisions by the Bank of England (BoE) and the European Central Bank (ECB) on Thursday. Therefore, the EUR/GBP is trading at 0.8584, below its opening price, at the time of writing.

Sentiment remains optimistic ahead of the Federal Reserve monetary policy decision, as shown by US equities. Aside from this, the Euro (EUR) remains downward pressured against the British Pound (GBP), on the economic outlook of both countries. Although in the Euro area, the economic downturn expected in Germany eased, estimations that Germany and Italy would hit a recession remained due to its dependence on industry and reliance on expensive energy.

In the meantime, the Eurozone economic docket featured November’s Industrial Production (IP) for the bloc, with data coming worse than expected at a 2% contraction, beneath estimates of a 1.5% MoM drop, while year-over-year IP remained unchanged at 3.4%.

In the UK, inflation cooled in November from 11.1% to 10.7%, surprising economists who had expected it to remain flat at 10.9%. However, core CPI was still three times higher than what BoE targets as its goal of 2%. A further decrease may be necessary for households within Britain that have struggled with increasing expenses throughout 2020 due mainly to economic hardships caused by Covid-19 pandemic restrictions.

What to watch

The Bank of England (BoE) and the European Central Bank (ECB) are expected to hike rates by 50 bps, which would favor the UK. If both central banks increased rates as expected, the BoE would have the upper hand at 3.50% vs. 2.50% by the ECB. Therefore, further EUR/GBP downside is expected, with traders eyeing a clear break below the 200-day Exponential Moving Average (EMA) at 0.8585.

EUR/GBP Key Technical Levels

-

18:44

EUR/USD Price Analysis: Bulls eye a run to test 1.0700 and the bears eye 1.0600

- EUR/USD traders get set for the Fed and eye1.0600 as a key support area and 1.0520s below it.

- EUR/USD resistance is marked up as 1.0700 and 1.0790 thereafter.

As per the prior analysis, EUR/USD soars as US CPI comes in below expectations, EUR/USD has continued to test higher in the 1.06 area, taking on the support quarter to reach a high of 1.0671 as the following analysis illustrates.

All will now depend on the Federal Reserve at the top of the hour but the key levels are identified below:

EUR/USD prior analysis

It was stated, that in the above daily chart, the market was shown to be on the front side of the bullish trend and there was every possibility that the price would continue higher into the in-the-money shorts towards 1.0800/50 in the days or weeks ahead.

EUR/USD update

As illustrated, the price has moved into the target area and is leaving a W-formation in its tracks. This is a reversion pattern whereby bulls would be expected to move in at a discount from the neckline should there be a testest thereof.

This marks 1.0600 as a key support area and 1.0520s below it as being the CPI take-off point. Above the spot, we have 1.0700 as a key level where a measured move of -0.272% of the potential correction's range to support meets the prior mid-summer resistance looking left. We have 1.0790 thereafter as the next level.

-

18:38

Fed Press Conference: Chairman Jerome Powell speech live stream – December 14

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 19:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

-

17:58

USD/JPY Price Analysis: Bulls and bears await the Fed, the lines are drawn

- USD/JPY now all depends on the outcome of the Federal Reserve.

- USD/JPY bears need to get below 134.00 while the bulls need to get above 135.60 and then 138.00.

As per the prior analysis, USD/JPY bears are moving in again ahead of the Fed, the bears have stayed the course and there are high probabilities of a downside continuation, depending on the outcome of the Federal Reserve today.

USD/JPY prior analysis

It was stated that USD/JPY was eying up the 130.00 area that could be tested in the coming days or weeks if the bears stay the course.

It was said that eyes were turning to the Fed and on a dovish outcome, the level could be reached before the close of the week, noting that tt has not been uncommon for the yen to fly 500 pips in a week:

USD/JPY update

As illustrated, the continuation is in process with a fresh low already in place ahead of the Fed. The bears need to get below 134.00 while the bulls need to get above 135.60 and then 138.00.

-

17:29

USD/CHF Price Analysis: Tumbles below 0.9300 to fresh 7-month lows

- The USD/CHF extends its weekly losses to more than 1%.

- The divergence between the USD/CHF price action and oscillators could suggest that selling pressure is fading.

- USD/CHF Price Analysis: Break below 0.9200 to exacerbate a fall to YTD lows; otherwise, a rally above 0.9300 is almost certain.

The USD/CHF prolongs its fall to a fresh seven-month low, ahead of the Federal Reserve monetary policy decision, tumbles below 0.9300 after Tuesday’s volatile session, witnessing further weakness on the US Dollar (USD), spurred by a soft inflation report. Therefore, the USD/CHF so far is down in the week by 1.11%, and on Wednesday down 0.47%, trading at 0.9243 at the time of typing.

USD/CHF Price Analysis: Technical outlook

The USD/CHF bias remains downwards, as the daily chart depicts, with prices falling to multi-month lows below 0.9300. It should be said that oscillators had barely reacted to price action, with the Relative Strength Index (RSI) remaining slightly above oversold territory. At the same time, the Rate of Change (RoC) continued to aim toward the zero line, suggesting that selling pressure is abating.

Therefore, if the USD/CHF drops below 0.9200, a fall toward February 21 daily low at 0.9150 is on the cards, followed by a re-test of the YTD lows of 0.9091. Nevertheless, with oscillators diverging from the USD/CHF price action, the USD/CHF first resistance would be the 0.9300 psychological level, followed by the December 13 daily high of 0.9375 ahead of the 0.9400 mark.

USD/CHF Key Technical Levels

-

16:58

Silver Price Forecast: XAG/USD advances steadily toward the high $23.80s ahead of the FOMC’s decision

- Silver remains trading at around $23.80s ahead of the Federal Reserve's last monetary policy meeting of 2022.

- Last Tuesday’s softer inflation CPI in the US paved the way for 50 bps rate hikes.

- Most analysts estimate that the Fed will raise rates by 50 bps.

Silver price is trading with solid gains as investors prepare for the Federal Reserve’s (Fed) monetary policy decision on Wednesday, following the release of softer-than-expected inflation data in the United States (US). Therefore, most analysts expect the US central bank to adjust the tightening size, though the rates’ peak remains unknown. At the time of writing, the XAG/USD is trading at $23.85, above its opening by 0.64%.

Sentiment remains upbeat, as shown by US stocks climbing ahead of the Fed’s decision. The main spotlight in the economic calendar is the Federal Reserve Open Market Committee (FOMC) decision, with analysts estimating a 50 bps rate hike by the Fed. The CME FedWatch Tool portrays odds for a 50 bps are at 82% vs. 18% chances of a 75 bps increase.

During a speech on November 30, Federal Reserve Chairman Jerome Powell said that interest-rate hikes in a smaller size might be “appropriate,” adding that it could happen as soon as the December meeting. Therefore, traders began to repriced in a less hawkish Fed, although Powell pushed back against a Fed pivot, stating that “the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level.”

In the meantime, the US Dollar Index, a gauge of the buck’s value against a basket of six currencies, stumbles 0.26%, down at 103.734, following a softer-than-estimated US inflation data on Tuesday.

The US Department of Labor revealed that November’s Consumer Price Index (CPI) rose less than the 7.3% YoY expected to 7.1%. The so-called core CPI for the same period, which excludes volatile items like food and energy, printed 6.0% vs. 6.3% estimates. The reaction to the data sent the S&P 500 rallying to fresh three-month highs.

Money market futures seem to indicate an upcoming rise in the Federal Funds rate, making it peak at 5.01%. Eurodollar futures portrayed traders speculating that the Federal Reserve would make its first rate cut of around 20 bps by September 2023.

Silver (XAG/USD) Price Analysis: Technical outlook

XAG/USD remains upward biased and rallied above $24.00, on traders speculating that the Federal Reserve might not be as aggressive as inflation continues to slow down. Silver’s rally stalled at around $24.00 per troy ounce as traders brace for the US central bank decision. It should be said that a dovish statement could pave the way above $24.00, exacerbating a rally toward $25.00. Otherwise, a hawkish-than-expected reaction could send the white metal sliding below $23.00, ahead of a fall below the 20-day Exponential Moving Average (EMA) at $22.38.

-

16:34

Fed preview: Powell to deliver a relatively hawkish press conference – BBVA

In a few minutes, at 19:00 GMT the Federal Reserve will announce its decision on monetary policy. Market participants expect a 50 basis points rate hike. According to the Research Department at BBVA, in spite of positive inflation data and signs since the last meeting, to avoid an unwanted further decline in interest rates along the yield curve, Fed Chair Jerome Powell will likely accompany the FOMC decision with a still relatively hawkish press conference.

Key Quotes:

“Chair Powell will face two challenges in the press conference: i) trying to convey a clear hawkish message with signs arising in the minutes of the last meeting and in recent speeches that Fed officials no longer hold a consensus view on what to do next, and ii) attempting to avoid an unwanted further decrease of interest rates along the curve by stressing that inflation remains too high and the job of bringing it down is not done, and thus the Fed will stick to it. Chair Powell will stress the updated projections to convey a hawkish message but the growing weakness in core goods inflation is now difficult for the Fed to ignore.”

“Although the Fed will stick to a hawkish tone and updated projections will show higher rates, inflation easing will most likely pick up in coming months. That together with divisions arising within the FOMC will keep alive the discussion on both the terminal rate.”

“For now, we stick with our 4.75%-5.00% peak rate forecast and we continue to think

that the Fed will move to the sidelines until late 2023, but the discussion in 2023 will likely shift from (high) inflation to (weak) growth.”

-

16:26

USD/MXN Price Analysis: A rebound after the collapse to 19.50, on volatile times

- Key events ahead: FOMC statement in a few hours, Banxico decision on Thursday.

- USD/MXN makes sharp moves, and holds bullish bias.

- Volatility is likely to remain elevated in the currency market.

The USD/MXN is rising significantly on Wednesday before the Federal Reserve announces its decision on monetary policy. On Tuesday, the pair suffered the biggest daily decline in months. Volatility jumped after US Consumer Price Index data and is set to remain elevated ahead of the FOMC. The Bank of Mexico will announce its decision on Thursday.

Recently the USD/MXN peaked at 19.91, near the 100-day Simple Moving Average. It failed to hold above 19.85 and then also pulled back under 19.80. The correction extended on Wednesday’s Asian session to 19.50 and it was followed by a rebound.

As of writing, USD/MXN is moving to the upside, trading around 19.70. Still, no clear signs emerge from the chart. The pair could consolidate between 19.85 and the 19.50 support area, reinforced by the 20-day SMA.

Technical indicators continue to favor the upside with RSI moving north without much conviction; Momentum held above the midline. A consolidation below 19.50 would change the outlook to neutral/bearish. On the upside, above 19.80, USD/MXN could rise further to test the 100-day SMA, exposing 20.00. A return above would put the pair back in the 19.80/20.20 range.

USDMXN daily chart

-638066319502598796.png)

-

15:53

Gold Price Forecast: XAU/USD looks for further strength after crucial break of 200DMA – Credit Suisse

Gold has cleared its 200-Day Moving Average at $1,790. Economists at Credit Suisse expect the yellow metal to enjoy further gains.

Initial support seen at $1,778

“Gold has finally cleared the crucial 200DMA, currently seen at $1,790 and with an existing base in place we look for further strength to the 50% retracement of the 2022 fall at $1,843 next, then the $1,877/1,896 June high and 61.8% retracement.”

“Support is seen at $1,778 initially, with $1,766 ideally now holding to keep the immediate risk higher. Below can see a retest of the ‘neckline’ to the base at $1,729 but with fresh buyers expected here.”

-

15:50

AUD/USD steady around 0.6860 ahead of the FOMC statement

- Federal Reserve will announce interest rate decision at 19:00 GMT.

- US Dollar holds onto losses, US yields move modestly lower.

- AUD/USD retreats after approaching 0.6900 and the 200-day SMA.

The AUD/USD is moving sideways around 0.6860, up for the day, ahead of the Federal Reserve decision on interest rates. The pair is about to post the highest daily close since mid-September but critical events lie ahead.

It is up to the Fed

The Federal Reserve will announce its decision at 19:00 GMT. It is expected to slow the pace of interest rate hikes to 50 basis points. The focus will be on the statement, the macroeconomic forecasts and Powell’s press conference. Analysts will look for clues about the future path of Fed’s policy.

The outcome of the FOMC meeting will play a key role for the Dollar going forward. A more hawkish Fed will likely help USD recover strength while signs about a near-term peak in the rate cycle could boost the AUD/USD pair. On Thursday, Australia will release the November employment report.