Notícias do Mercado

-

23:49

GBP/JPY drops below 168.00 on less-hawkish BOE guidance, UK Retail Sales eyed

- GBP/JPY has slipped below the 168.00 cushion as investors see BOE interest rates near peak.

- BOE’s Mann favored a 75 bps rate hike citing the further risk of higher inflation due to the tight labor market.

- UK annual Retail Sales may contract by 5.6% while monthly data will drop to 0.3%.

The GBP/JPY pair has surrendered the crucial support of 168.00 in the early Asian session amid mixed responses from Bank of England (BOE) policymakers on interest rates. The cross is following the footprints of GBP/USD, portraying a risk-off impulse that has been supported by the market participants.

The asset witnessed intense pressure after BOE Governor Andrew Bailey announced its December monetary policy. The BOE hiked its interest rates by 50 basis points (bps) to 3.5%, in line with the market consensus. What impacted the strength of the pound Sterling was the statement that more interest rate hikes may be required ahead. This bolsters the case that the BOE interest rate is near its peak, however, the policy will remain restrictive till the achievement of price stability.

Two BOE Monetary Policy Committee (MPC) members voted for the maintenance of a status quo by the central as they believed that the current monetary policy is tight enough to contain inflationary pressures. While BOE policymaker Catherine Mann favored a 75 bps rate hike citing the further risk of higher inflation due to the tight labor market and a recent jump in earnings by the households, which may offset the recent decline in November’s inflation report.

Going forward, investors will keep an eye on United Kingdom Retail Sales data, which will release on Friday. As per the projections, the annual economic data (Nov) is expected to contract by 5.6% against a contraction of 6.1% released earlier. While the monthly data would drop to 0.3% from the former release of 0.6%.

On the Tokyo front, investors are keeping an eye on Jibun Bank PMI data. The Manufacturing PMI is expected to decline to 48 vs. 49 in the prior release. The Services PMI is seen higher at 51.1 against the prior figure of 50.3.

-

23:34

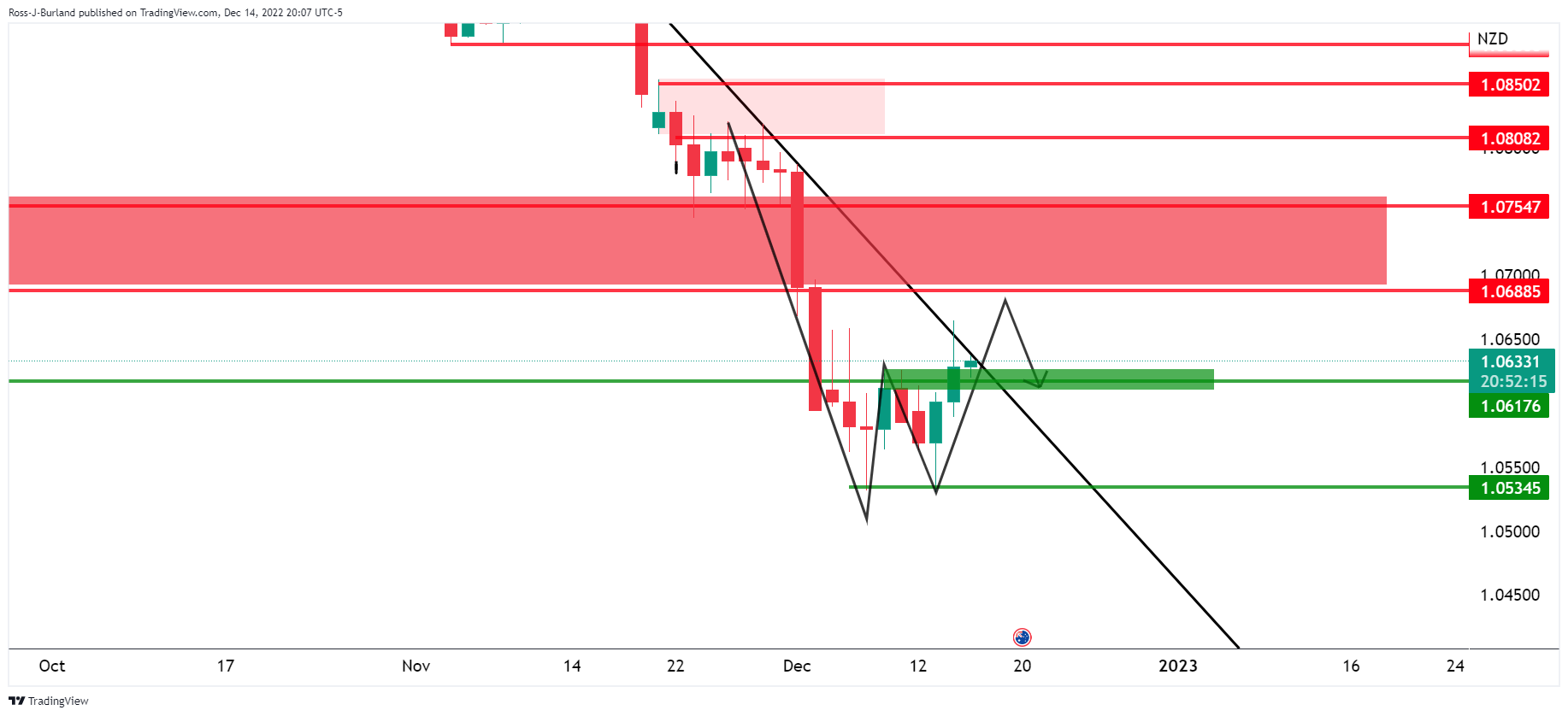

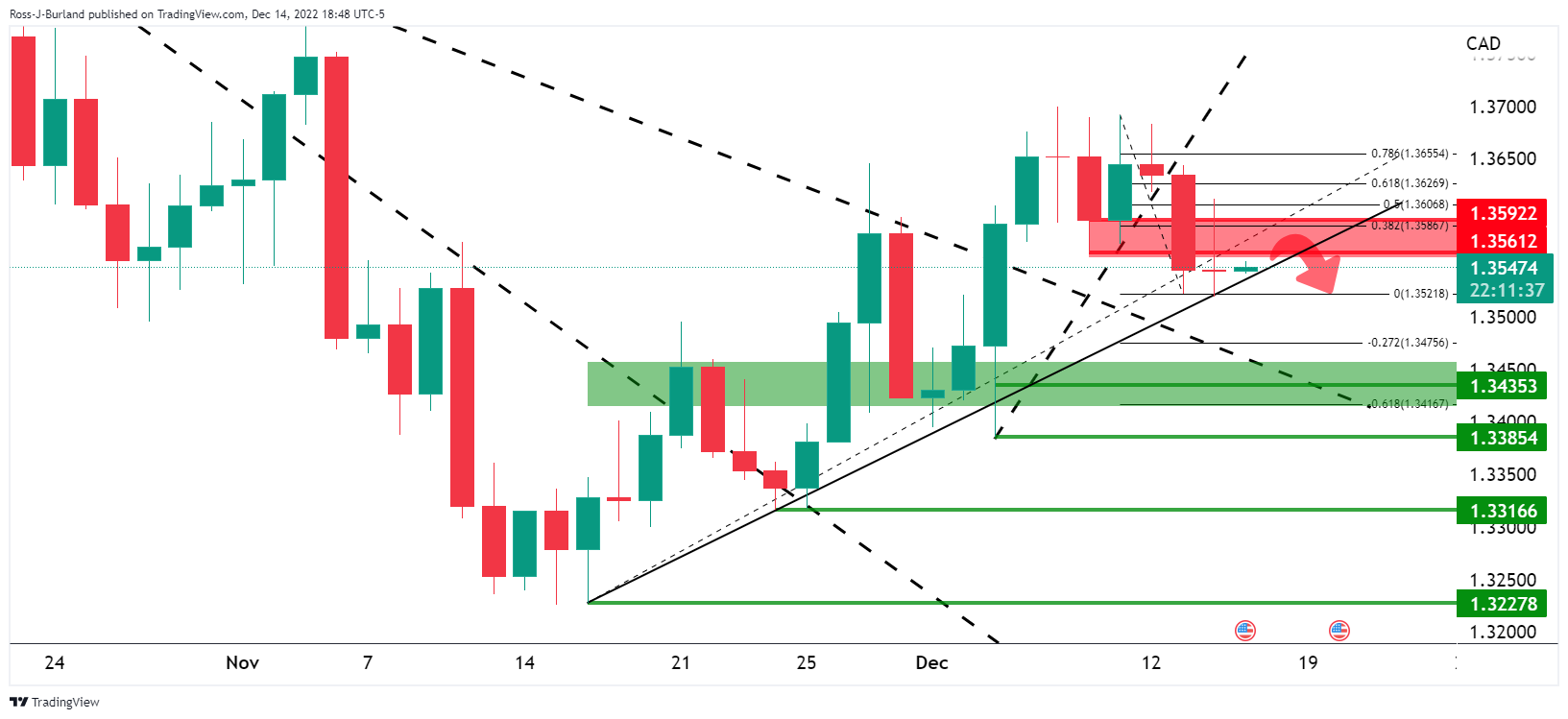

USD/CAD Price Analysis: Bears moving in and eye 1.3600/20

- USD/CAD is decelerating on the bid and the bears are moving in.

- Bears eye a 50% mean reversion and the micro bullish trendline.

As per the prior analysis, USD/CAD Price Analysis: Bears eye a break of bull cycle trendline, the Canadian Dollar was out of favour on Thursday and USD/CAD remains within the bull cycle trend as the following analysis will illustrate.

USD/CAD prior analysis

It was stated that the M-formation was a reversion pattern that could draw the price into the neckline. It was suggested that if this were to act as a resistance, the micro trendline would come under pressure and open the risk of a substantial continuation to the downside for the days ahead.

However, we have seen the price revert and burst through the neckline and thus rendering the setup useless. Instead, the bulls are back in control and staying the course with prospects of a move into the 1.37s and 1.38s.

USD/CAD update

USD/CAD H4 chart

The price is decelerating on the bid and the bears are moving in. This puts the focus on a move into the 50% mean reversion and micro bullish trendline. The 61.8% ratio is just below and could be tapped into for a test of 1.3600 prior to the next bullish impulse.

-

23:34

USD/JPY Price Analysis: Buyers stepped in around the 200-DMA and lifted the pair toward 138.00

- Risk aversion amidst further Federal Reserve tightening spurred the rally on the USD/JPY.

- USD/JPY Price Analysis: Range-bound, about to clear crucial DMAs.

The USD/JPY bounces off the 200-day Exponential Moving Average (EMA) and rises above the 137.00 mark on Thursday, courtesy of a risk-off impulse spurred by the US Federal Reserve (Fed) rate hike. Investors bracing for further tightening, keep the US Dollar (USD) bid against the Japanese Yen (JPY). At the time of writing, the USD/JPY exchanges hands at 137.74 as the Asian session begins, 50 pips shy of the 20-day Exponential Moving Average (EMA) at 137.99.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart illustrates the pair range-bound, within the 133.60-138.00 range, during the last eleven days. At the bottom of the range lies the 200-day EMA at 135.15, and on the top is the 20-day EMA. Oscillators like the Relative Strength Index (RSI) in the bearish territory is almost flat, while the Rate of Change (RoC) portrays that buying pressure is almost non-existent, opening the door for a mean reversion.

For that scenario to play out, the USD/JPY must fail to clear the 138.00 mark. After that, the USD/JPY next support would be the 137.00 mark, which, once cleared, could expose the December 14 daily high of 135.99, ahead of the 200-day EMA at 135.16.

As an alternate scenario, the USD/JPY first resistance would be the 138.00 mark. A breach of the latter will expose essential supply zones, like the 100-day EMA at 139.70, ahead of the psychological 140.00 figure.

USD/JPY Key Technical Levels

-

23:29

AUD/JPY Price Analysis: Bears eye 91.10 on breaking fortnight-old support

- AUD/JPY licks its wounds at weekly low, sidelined of late.

- Clear break of 50-SMA, two-week-old ascending trend line favor sellers.

- Area comprising lows marked since early October gains the bear’s attention.

- Buyers need validation form 200-SMA before retaking control.

AUD/JPY holds lower ground near 93.30 during Friday’s Asian session, after posting the biggest daily loss in two weeks the previous day.

In doing so, the cross-currency pair braces for further downside as it already broke the key support late Thursday.

That said, a clear downside break of convergence of the 50-SMA and a fortnight-old ascending trend line, around 92.40-50 by the press time, keeps AUD/JPY bears hopeful of witnessing further downside.

The AUD/JPY sellers also take clues from the bearish MACD signals while aiming for the 92.00 threshold as the immediate support.

It’s worth noting that the horizontal region comprising multiple lows marked since early October, near 91.10, appears the key support to watch past 92.00, a break of which will highlight the October month low near 90.85 for the AUD/JPY bears.

Alternatively, recovery remains elusive below the 92.40-50 support-turned-resistance.

Even so, a downward-sloping resistance line from November 01, close to the 93.00 round figure, could challenge the AUD/JPY bears.

In a case where the pair manages to remain firmer past 93.00, the 200-SMA and 50% Fibonacci retracement of the pair’s late October moves, near 93.30, will be crucial to watch.

AUD/JPY: Four-hour chart

Trend: Further downside expected

-

23:10

GBP/USD: British Pound eyes further downside ahead of United Kingdom statistics

- GBP/USD licks its wounds after posting the biggest daily loss in six weeks.

- Bank of England’s dovish rate hike, broad risk-aversion wave favored British Pound sellers.

- Mixed data from United States failed to stop US Dollar bulls.

- United Kingdom Retail Sales, Purchasing Managers’ Indexes will be important for Cable traders.

GBP/USD bears take a breather around 1.2180 during early Friday in Asia, following the heaviest daily slump in 1.5 months, as the British Pound traders await key data from the United Kingdom. That said, Cable witnessed heavy losses the previous day as the Bank of England (BOE) couldn’t please the bulls despite announcing an interest rate hike. It’s worth noting that the overall hawkish moves by major central banks allowed the US Dollar to regain upside momentum and exerted downside pressure on the quote.

Bank of England’s dovish hike recalled GBP/USD bears

Bank of England (BOE) raised the policy rate by 50 basis points (bps) to 3.5% as expected but couldn’t please the GBP/USD buyers.

On the other hand, statements like “Majority of MPC judges further increases in bank rate may be required," gained major attention and drowned the Cable prices afterward. Also adding strength to the bearish bias was the pattern of the Monetary Policy Committee’s (MPC) voting pattern as two out of nine MPC members voted against raising rates.

It should be noted that the “Old Lady”, Bank of England’s informal name, appreciated the government's new Autumn Statement and signaled fewer rate hikes, which also weighed on the GBP/USD prices.

Fears surrounding United Kingdom economy also weigh on British Pound

In addition to the BOE’s dovish rate hike and downbeat economic projections, the looming fears of a recession in the United Kingdom also gained major attention after the policymakers conveyed fears of soaring energy bills and cold weather. On the same line could be the looming labor strikes in Britain. It’s worth noting that the political jitters surrounding Brexit are an extra burden on the GBP/USD prices.

US Dollar cheered risk aversion, ignored mixed United States data

Although the BOE announced a dovish hike, the Old Lady managed to join the likes of the US Federal Reserve (Fed), Swiss National Bank (SNB) and the European Central Bank (ECB) as it offered a 0.50% rate increase. Although the major central banks eased the volume of the interest rate increases, all of them showed readiness to keep the rates higher for a longer time, which in turn joined the inflation fears and highlighted the recession woes. As a result, the traders rushed to the US Dollar for risk safety and the same weighed on the GBP/USD prices.

In doing so, the US Dollar paid little attention to the mostly downbeat data at home. That said, the United States Retail Sales flashed -0.6% MoM figure in November versus 0.1% expected and 1.3% prior while manufacturing survey details from Philadelphia Fed and New York Fed came in disappointing for the said month. Further, Industrial Production eased in November and the Jobless Claims also dropped for the week ended on December 09.

United Kingdom Retail Sales, Purchasing Managers’ Indexes eyed

Having witnessed the BOE-led slump, GBP/USD traders will pay attention to the United Kingdom Retail Sales, the key for the British Gross Domestic Product (GDP), as well as the first readings of the December month Purchasing Managers’ Indexes (PMIs) from S&P Global/CIPS.

Forecasts suggest that the UK Retail Sales may improve to -5.6% YoY versus -6.1% prior while the Retail Sales ex-Fuel could arrive at -5.8% YoY from -6.7% previous readings. Further, the UK’s S&P Global/CIPS Manufacturing PMI could ease to 46.3 from 46.5 prior while the more important Services PMI may also drop to 48.5 from 48.8 prior. As a result, the Composite PMI could also decline to 48.0 from 48.2 previous readings.

Hence, the scheduled data portray a mixed picture for the GBP/USD prices but the Bank of England (BOE) inspired pessimism could keep the British Pound depressed.

GBP/USD technical analysis

With its daily closing below a six-week-old ascending trend line, GBP/USD confirmed a rising wedge bearish chart formation and suggests further downside. The bearish bias also takes clues from the absence of the overbought Relative Strength Index (RSI), located at 14.

Although the theoretical target of rising wedge confirmation directs the British Pound bears toward October’s low near 1.0925, the 200-DMA and 50-DMA, respectively around 1.2100 and 1.1730, could offer intermediate halts during the expected south run.

Also likely to act as an intermediate halt for the Cable is the 1.2000 psychological magnet and July’s low near 1.1760.

Alternatively, the British Pound’s recovery remains elusive unless the quote defies the rising wedge breakdown, by rising back beyond the support-turned-resistance line near 1.2355.

Even so, the 61.8% Fibonacci retracement level of the GBP/USD pair’s Januaray-September downside, around 1.2450, will precede the stated wedge’s upper line, close to 1.2610, to challenge the bulls.

Overall, GBP/USD is in the bear’s territory but the 200-DMA may offer immediate support.

GBP/USD: Daily chart

Trend: Further downside expected

-

23:06

USD/CHF drops from above 0.9300 as US Dollar corrects, risk-off profile still solid

- USD/CHF is struggling to capture 0.9300 despite downbeat market sentiment.

- S&P500 faced intense selling pressure amid mounting recession risks.

- SNB Jordan hiked interest rates by 50 bps, as expected, to 1% to keep inflation stable at around 2%.

The USD/CHF pair has been struggling to sustain above the immediate hurdle of 0.9300 in the early Asian session. The Swiss Franc major asset witnessed a strong reversal in the New York session amid negative market sentiment, which improved the appeal for safe-haven assets. At the press time, the major has dropped to near 0.9276 but is expected to find support ahead.

S&P500 faced severe pressure on Thursday amid mounting recession risk as an interest rate peak projection above 5% is sufficient to create havoc among firms that are debt-laden. Also, companies would prefer to postpone their expansion plans to dodge higher interest obligations. No doubt, the United States Consumer Price Index (CPI) data has softened but the battle against stubborn inflation is far from over.

The US Dollar Index (DXY) has corrected marginally after a rally to near 104.80. The corrective move doesn’t seem to be a reversal for now and the USD Index may resume its upside journey ahead. Meanwhile, the 10-year US Treasury yields are continuously facing pressure and have dropped to near 3.45%.

The asset displayed some volatility on Thursday after the Swiss National Bank hiked its interest rates by 50 basis points (bps), as expected, to 1%. SNB Chairman Thomas J. Jordan is required to avoid sheer divergence in the policy rate with European Central Bank (ECB). Also, Switzerland's inflation rate is comfortably above 2%, which is needed to remain stable.

-

22:40

EUR/USD retreats from 1.0600, downside looks likely despite higher ECB rate peak guidance

- EUR/USD has found an intermediate cushion around 1.0600, the downside remains favored on risk-off mood.

- The ECB sees two more 50 bps interest rate hikes consecutively to combat ramp-up inflation.

- Fed’s higher interest rate peak guidance has renewed recession fears in the US economy.

The EUR/USD pair has picked bids after dropping to near the round-level support of 1.0600 in the early Asian session. The major currency pair has turned sideways around 1.0620 but is likely to witness pressure amid negative market sentiment.

The US Dollar Index (DXY) has corrected gradually to near 104.60 after a firmer rally to near 104.80 as investors parked their funds in safe-haven to dodge sheer volatility. S&P500 witnessed an intense sell-off on Thursday as recession risk soars after the Federal Reserve (Fed) hiked interest rate guidance as the road to success on roaring inflation is far from sight.

On Thursday, the Euro bulls displayed wild gyration after the European Central Bank (ECB) President Christine Lagarde hiked interest rates by 50 basis points (bps) to 2.50%. The EUR/USD pair printed a fresh six-month high at 1.0700 but failed to hold gains and dropped significantly.

The commentary from ECB President that food and energy inflation will continue to rise from January has created havoc among investors in the Eurozone economy. The households are already facing tremendous pressure due to the higher headline Consumer Price Index (CPI) and further escalation in catalysts will dampen the market mood. ECB’s Lagarde sees two more 50 bps rate hikes consecutively to contain inflation, which indicates higher inflation peak guidance than estimated earlier at 3%.

On the United States front, investors are awaiting S&P PMI data for further guidance. As per the consensus, the preliminary Manufacturing PMI would remain steady at 47.7 while the Services PMI might escalate to 46.8 from the former release of 46.2.

-

22:37

Australia S&P Global Composite PMI dipped from previous 48 to 47.3 in December

-

22:37

EUR/JPY Price Analysis: Soars to fresh 5-week highs, holds to gains above 146.40

- The Euro gained traction against the Japanese Yen for fundamental reasons, supported by a bounce at the 20-day EMA.

- EUR/JPY Price Analysis: Upward biased above 146.00; otherwise, a fall towards 145.00 is on the cards.

The EUR/JPY soared more than 150 pips on Thursday following the European Central Bank’s (ECB) decision to hike rates by 50 bps while guiding that it would continue to raise rates. Consequently, the EUR/JPY rallied, and as the Asian session began, the EUR/JPY exchanges hands at 146.36, below its opening price.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart suggests the pair is upward biased since it cleared all the daily Exponential Moving Averages (EMAs). Nevertheless, it was further cemented by Thursday’s price action, with the EUR/JPY breaking November’s 23 immediate resistance at 146.13, which opened the door for a new 5-week high at 146.72. Oscillators are mixed, with the Relative Strength Index (RSI) in bullish territory but flat, while the Rate of Change (RoC) on its 9-day period suggests that prices could be close to overextending and subject to a mean reversion move.

The EUR/JPY key resistance levels lie at 147.11 November 9 swing high. A breach of the latter will expose the October 31 daily peak of 147.75, followed by the YTD high at 148.40.

As an alternate scenario, EUR/JPY’s failure to hold to gains above 146.00 could play for the sellers’ hands. Therefore, the EUR/JPY first support would be the 145.00 psychological mark, followed by the 20-day EMA at 144.56, followed closely by the 50-day EMA at 144.13, and the 100-day EMA at 142.75.

EUR/JPY Key Technical Levels

-

22:35

New Zealand Business NZ PMI down to 47.4 in November from previous 49.3

-

22:35

Australia S&P Global Services PMI down to 46.9 in December from previous 47.6

-

22:35

Australia S&P Global Manufacturing PMI: 50.4 (December) vs previous 51.3

-

22:19

AUD/USD licks its wounds near 0.6700 after downbeat Aussie PMIs

- AUD/USD stabilizes, holds lower grounds, after falling the most in 33 months.

- Preliminary S&P Global PMIs for Australia came in softer for December.

- Central bank moves, downbeat China data amplified risk-aversion and underpinned US Dollar demand.

- US PMIs, risk catalysts will be in focus for fresh impulse.

AUD/USD stays depressed around 0.6700, after falling the most since March 2020, as risk-aversion joins downbeat Aussie data. That said, the Australian Dollar’s latest weakness could be linked to the softer activity numbers for the nation published early Friday morning in the Asia-Pacific region.

The preliminary readings of the S&P Global PMIs for Australia showed an overall decline in December. That said, the headlines Manufacturing PMI dropped to 50.4 from 51.3 prior while Services PMI fell to 46.9 versus 47.6. Further, the Composite PMI also weakened to 47.3 from 48.0 previous readings.

It’s worth noting that the hawkish central bank actions joined the downbeat China data and superseded the mostly upbeat Aussie jobs report to drown the AUD/USD prices the previous day.

That said, the US Federal Reserve, Bank of England, Swiss National and the European Central Bank all of them announced a 0.50% rate hike and showed readiness to keep the higher rates for longer. The same raised fears of economic slowdown as forecasts concerning inflation and growth have been disappointing.

Additionally, China’s Retail Sales slumped to -5.9% in November versus -3.6% expected and -0.5% prior while Industrial Production came in at 2.2% compared to 3.3% market forecasts and 5.0% previous readings. Further, Australia’s Consumer Inflation Expectations dropped to 5.2% for December versus 5.7% expected and 6.0% prior while a jump in Employment Change and a static Unemployment Rate failed to impress the Australia Dollar (AUD).

It should be noted that the data from the US have been mixed and couldn’t provide any clear directions. That said, the US Retail Sales flashed -0.6% MoM figure in November versus 0.1% expected and 1.3% prior while manufacturing survey details from Philadelphia Fed and New York Fed came in disappointing for the said month. Further, Industrial Production eased in November and the Jobless Claims also dropped for the week ended on December 09.

Amid these plays, the Wall Street benchmarks closed in the red and the US Treasury yields regain upside momentum, which in turn underpinned the US Dollar’s demand and weighed on the AUD/USD.

Moving on, the first readings for the US S&P Global PMIs for December will be important for clear directions.

Technical analysis

A daily closing below an upward-sloping support line from November 21, now resistance near 0.6715, teases AUD/USD sellers. However, the 100-DMA support around 0.6670 challenges the immediate downside.

-

22:00

USD/CAD aims to retest five-week high at 1.3700 despite downbeat US Retail Sales data

- USD/CAD is looking to recapture a five-week high at 1.3700 amid a risk-off market mood.

- Soaring recession risk resulted in a steep fall in risk-perceived currencies like S&P500.

- Oil price is oscillating in a range of $75.50-77.50 as investors await fresh trigger for decisive action.

The USD/CAD pair is aiming to continue its upside momentum and retest the fresh five-week high at 1.3700 ahead. The Canadian Dollar major asset is expected to extend its upside recovery amid a solid risk aversion theme underpinned by the market participants.

S&P500 plummeted on Thursday as the recession risk soared after the Federal Reserve (Fed) stepped up interest rate peak guidance to achieve price stability, portraying a risk-off mood. The US Dollar Index (DXY) showed a solid recovery to near 104.80. The USD Index has corrected marginally to near 104.60, however, the upside momentum is still intact.

Meanwhile, US government bonds continued to gain demand from the market participants as the Fed shifted to a slower and smaller interest rate hike approach. The 10-year US Treasury yields have dropped further to near 3.45%.

On Thursday, the United States Retail Sales data displayed a downbeat show despite accelerating employment numbers and earnings in November. The monthly Retail Sales data (Nov) reported a contraction of 0.6% while the street was expecting a contraction of 0.1%. A decline in retail demand indicates more downside pressure on inflation ahead as lower consumer spending is the key to a lower Consumer Price Index (CPI). This will force producers to cut prices of goods and services ahead.

Meanwhile, oil prices are displaying topsy-turvy moves after a sheer bullish reversal. The black gold is oscillating in a range of $75.50-77.50 as investors await a fresh trigger for decisive action. It is worth noting that Canada is a leading oil exporter to the United States and higher oil prices support the Canadian Dollar.

-

22:00

NZD/USD plunges beneath 0.6400 amidst risk-off mood and mixed US data

- Slightly negative US economic data bolstered the US Dollar amidst risk aversion.

- US Retail Sales plunged, while unemployment claims continued to show a resilient labor market.

- NZD/USD Price Analysis: Undergoing a pullback but a daily close below 0.6400, traders could expect downward pressure.

The New Zeland Dollar (NZD) dropped sharply against the US Dollar (USD) after a central bank bonanza witnessed 50 bps rate hikes by the US Federal Reserve (Fed), the Bank of England (BoE), and the European Central Bank (ECB), in the last couple of days. Most policymakers coincide with inflation being too high, opening the door for further tightening. Therefore, the NZD/USD plummets more than 1.81%, trading at 0.6347 after hitting a daily high of 0.6443.

US Dollar rises amidst a tranche of negative US data

Wall Street is set to finish the day with losses. Economic data from the United States (US) showed signs that Fed’s policy is being felt by Americans, as November Retail Sales shrank 0.6% MoM vs. estimates of 0.1% contraction, reported the US Department of Commerce. At the same time, the US Bureau of Labor Statistics (BLS) revealed the Initial Jobless Claims for the last week dropped by 211K against estimates of a 232K rise, showing the labor market resilience, despite the Fed’s aggressive rate hikes to cool down inflation.

Further data showed that the Philadelphia Fed Manufacturing Index and the New York Fed Manufacturing Index missed estimates, further deepening their contraction to -13.8 and -11.2, respectively. Later, Industrial Production (IP) shrank by 0.2% MoM, below expectations for a 0.1% increase.

Aside from this, the New Zealand economic docket featured the Manufacturing PMI for November, which fell to 47.4 below October’s 49.3 print. Meanwhile, New Zealand’s GDP data for Q3 revealed a remarkable growth of 2.0%, far surpassing expectations from the Reserve Bank of New Zealand, which had anticipated only a 0.8% expansion. This was an upward revision on the prior quarter’s revised 1.9%.

Given the backdrop, the NZD/USD extended its losses, as bad news for the US economy might dent sentiment, augmenting appetite for the greenback. Therefore, the NZD/USD ongoing correction could drop toward the 20-day Exponential Moving Average (EMA) at 0.6293 before resuming upwards.

NZD/USD Price Analysis: Technical outlook

The NZD/USD daily chart portrays a drop below 0.6400, registering a new six-day low. It should be said that the fall halted around 0.6319 before tumbling to the 20-day EMA at 0.6293, which, once cleared, could have exposed the 200-day EMA at 0.6249. However, if the NZD/USD fails to reclaim 0.6400, that could open the door for further losses. Otherwise, once 0.6400 is reclaimed, the next resistance would be the 0.6500 mark, ahead of the December 13 swing high at 0.6515.

-

21:37

Gold Price Forecast: XAU/USD bears eye a run below trendline support

- Gold Price is pressured and taking on a critical micro trend line.

- This leaves the bias on the downside while below $1,780/00 and a break of $1,702 open risk to $1,670.

The Gold Price is consolidated towards the lows of the US session range near $1,777.00. XAU/USD fell from a high of $1,808 to a low of $1,774 on Thursday due to a stronger US Dollar.

''Gold fell amid the decline in investor demand,'' analysts at ANZ Bank said. ''Nevertheless, the global economy is at an inflection point. Tighter monetary policies amid high inflation are likely to slow economic growth in 2023. This backdrop is typically positive for gold,'' the analysts argued.

''Synchronised rate hikes have weighed on gold in 2022. Although we expect the US fed funds rate to peak at 5%, a pause in rate hiking should turn market sentiment in favour of gold,'' the analysts forecast.

Fed sentiment weighs

On Wednesday, the Federal Reserve projected continued rate hikes to above 5% in 2023, a level not seen since a steep economic downturn in 2007. Due to the hawkish rate hike, investor fears have intensified that the Federal Reserve's battle against inflation using aggressive interest rate hikes could lead to a recession. This has filled a bid into the US Dollar. However, the analysts at ANZ Bank argue that ''we approach the end of US Dollar dominance, and a depreciation in the currency would add further support to investor demand.''

''With the Fed suggesting rates will remain high through 2023, the risk of weak economic growth next year. Gold prices tend to come under pressure ahead of recessions, but then outperform other markets (such as equities) during them,'' the analysts argued.

On the flip side, analysts at TD Securities expect gold prices to be weighed down by trend follower short acquisitions, ''with prices already flirting with key triggers for several subsequent selling programs just below the $1785/oz mark. In turn, the bar is low for CTAs to add 7% of their maximum historical length to their short position in the yellow metal.''

Gold technical analysis

The price is on the backside of the bearish cycle and has been advancing through the various resistances higher in a short squeeze. If the bulls can get a close above $1,800, then there will be prospects for a continuation towards $1,850 and $1,880.

On the other hand, as illustrated below, zoomed in on the daily chart, the micro trendline was broken in today's bearish impulse. This leaves the bias on the downside while below $1,780/00 and a break of $1,702 open risk to $1,670:

-

21:00

United States Net Long-Term TIC Flows fell from previous $118B to $67.8B in October

-

21:00

United States Total Net TIC Flows rose from previous $30.9B to $179.9B in October

-

20:49

EU leaders urge gas price cap deal as level remains open

European Union governments have agreed on a 9th package of sanctions against Russia over Moscow's invasion of Ukraine, EU diplomats said.

Bloomberg reported that European Union leaders ''threw their weight behind a quick agreement on a natural gas price cap to put an end to months of political wrangling over an unprecedented intervention to contain the impact of an energy crisis. But they still have yet to settle on a price level.''

''At a summit in Brussels, the leaders agreed to a joint statement calling on the ministers to “finalize” on Monday their work on the so-called market correction mechanism. A deal on the gas price cap would also unlock a broader package of measures to rein in high energy prices that sent businesses and consumers reeling.''

Meanwhile, the package will be formalised through what the EU calls a "written procedure" by Friday noon.

"Sanctions agreed. Written procedure until tomorrow noon," one of the diplomats said.

WTI update

Meanwhile, WTI Price Analysis: Bears eye a break of $75.70 for the sessions ahead, West Texas Intermediate WTI crude oil which climbed into resistance earlier this week on the back of restrictions on the flow between Canadian and the United States, has seen the bears move in at critical resistance:

WTI is in a bearish cycle, leaving the downside exposed. However, despite breaking the micro trendline, the structure at $75.70 is important and will need to be cleared to confirm the meanwhile downside bias.

-

20:29

Silver Price Analysis: Highs locked in, focus is on the downside on break of $22.9600

- Silver bears are taking on the bullish correction that has so far made a 50% mean reversion of the prior bearish impulse.

- A downside extension towards $22.7250, $22.6070 and $22.4655 could be on the cards.

Silver has been on the back foot due to a rise in the US Dollar following hawkish outcomes from the central bank meetings this week. XAU/USD bears are on the prowl and have already tested a key area of the support structure. If the bears can fend off the bull's correction below $23.2070, then there will be near-term prospects of a downside continuation. Analysts at TD Securities argued that a break below the $22.50/oz mark is needed for trend followers to flatten out their remaining length.

Silver H1 charts

Zoomed in:

The bears are taking on the bullish correction that has so far made a 50% mean reversion of the prior bearish impulse near $23.2070. Should the bears commit, then a downside extension towards $22.7250, $22.6070 and $22.4655 will be on the cards.

-

19:40

WTI Price Analysis: Bears eye a break of $75.70 for the sessions ahead

- WTI bears are moving in again after a breach of resistance.

- $75.70 structure is important on the hourly chart.

As per the prior analysis, WTI Price Analysis: Bulls attempt to take on the daily trendline resistance, West Texas Intermediate WTI crude oil that climbed into resistance earlier this week on the back of restrictions on the flow between Canadian and the United States, the bears have moved in at critical resistance:

WTI prior analysis

Bulls met key resistance and continue to struggle towards the closing sessions for the week. On the lower time frames, it was explained that a break of resistance opened the risk of a move into test $77.50 for the days ahead. The price has met $77.74 but has since been rejected as follows:

WTI update, H1 chart

The price is in a bearish cycle, so the focus is on the downside but despite breaking the micro trendline, the structure at $75.70 is important and will need to be cleared to confirm the meanwhile downside bias. A break of $77.74, on the other hand, could be followed by bullish commitments and flip the switch in a short squeeze putting heart onto the shorts accumulated in December's downtrend.

-

19:34

Forex Today: US Dollar boosted by growth-related fears

What you need to take care of on Friday, December 16:

The US Dollar soared to fresh weekly highs against most major rivals, ending the day with substantial gains amid a risk-averse environment. The greenback rallied since early Asia, as China published discouraging macroeconomic figures.

The country reported November Retail Sales, which plunged by 5.9% YoY, while Industrial Production in the same period rose by 2.2%, below the 3.6% expected. The USD also benefited from hawkish US Federal Reserve Chairman Jerome Powell's hawkish words, reacting late to the US Fed's decision.

On Thursday, The Bank of England, the Switzerland National Bank and the European Central Bank announced their decisions. The three banks hiked rates by 50 bps, although they had different impacts on financial markets.

The UK MPC had quite a split vote, as out of the nine MPC members, 2 voted to maintain rates unchanged, 6 for a 50bps hike, and 1 for a 75bps hike. Also, the BOE removed the wording that "policy is not on a pre-set path" and the part on any changes to the "scale, pace and timing" to the bank rate will depend on the outlook. It was a dovish hike, and GBP/USD plunged, now trading at around 1.2280.

Meanwhile, the Switzerland National Bank also hiked rates by 50 bps to 1%, as expected, but market players ignored it. It is worth adding that Chairman Thomas Jordan noted that further rate hikes could not be ruled out.

Then, it was the turn of the ECB. The central bank delivered as expected. Additionally, Lagarde announced further quantitative tightening through the end of the APP program. The current portfolio will decline at a measured and predictable rate beginning in March 2023, announcing there won't be reinvestments of maturing securities. The monthly average decline will be €15 billion until the end of the second quarter of 2023.

Within the press conference, Lagarde said that policymakers expect to raise rates "significantly further" because inflation is far too high, adding that it is "obvious" that more 50 bps hikes should be expected for a period of time. Finally, she said that a potential recession would be short-lived and shallow. She predicted at least two more 50 bps hikes. The EUR/USD pair soared with the headline, peaking at 1.0735. However, Wall Street's soft opening revived growth-related concerns. US indexes plummeted, and the dollar soared, with EUR/USD currently trading at around 1.0620.

AUD/USD is down to 0.6690, while USD/CAD is up to 1.2670. USD/JPY, in the meantime, surged to 137.80.

Crude oil prices eased, with WTI settling at $76.10 a barrel. Gold trades at around $1,778 a troy ounce.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:28

Argentina Consumer Price Index (MoM) dipped from previous 6.3% to 4.9% in November

-

19:09

The Mexican Central Bank raised rates by 50 basis points

The Mexican Central Bank has raised rates by 50 basis points.

Reuters reported that the Mexican Central Bank board member Gerardo Esquivel voted in favour of raising the target for the overnight interbank interest rate by 25 basis points to 10.25%:

''The decision to raise the interest rate by 50 basis points was not unanimous, however, the board considers it will still be necessary to raise the reference rate in its next monetary policy meeting.Subsequently, it will assess if the reference rate needs to be further adjusted as well as the pace of adjustments based on the prevailing condition.''

USD/MXN update

The decision was anticipated and has little impact on the Mexican Peso. Overall, however, the bulls are in control although have been forced back from daily resistance.

-

19:09

USD/CAD rallies to 1.3650 on a buoyant US Dollar and falling oil prices

- US Dollar remains underpinned by a hawkish Federal Reserve 0.50% rate hike.

- The Federal Funds rate is expected to peak at around 5.10%, per the SEP dot plot.

- USD/CAD: The uptrend is intact, though a clear break above 1.3700 could expose the YTD high of 1.3977.

The USD/CAD rebounds around the 20-day Exponential Moving Average (EMA) and climbs more than 100 pips on Thursday, following the last Federal Reserve (Fed) meeting, which witnessed a 50 bps rate hike to the 4.25-4.50% range Wednesday. Therefore, the US Dollar (USD) stages a comeback after the Canadian Dollar (CAD) pushed the pair toward its weekly lows of around 1.3518. At the time of writing, the USD/CAD is trading at 1.3670, above its opening price by 0.92%.

Federal Reserve's officials to lift rates at around 5%

US equities remain on the defensive as investors assess the Fed’s increase in borrowing costs. In the last meeting of the year, the Fed hiked rates and updated its September projection, including an upward revision of the Federal Funds rate (FFR). Policymakers expect the FFR to sit at around 5.1% through 2023, pushing back investors’ speculations for a Fed pivot, even though money markets are pricing in the first rate cut by December of 2023, according to Eurodollar futures, after an estimated peak of the FFR around 5%.

Delving into the Summary of Economic Projections (SEP), the US Gross Domestic Product (GDP) for 2022 is projected at 0.5% and in 2023 at 0.5%, while inflation is expected to fall to 3.5% in 2023 and will hit 2.1% by 2025.

Aside from this, the US economic docket featured November Retail Sales, which took an unexpected dive from -0.1% to a contraction of 0.6% MoM. On the other hand, Initial Jobless Claims came in lower than anticipated - a sign of strength within the labor market affirmed by Fed Chair Powell’s remarks this week.

After an initial decrease of 0.1% in October, US Industrial Production continued to shrink by a further 0.2%, making it two months of decline consecutively – something not seen since 2009’s recessionary period. The Capacity Utilization rate eased from October’s 79.9% to 79.7% in November.

The US Dollar Index (DXY), which tracks the American Dollar value against a basket of six currencies, soar sharply, up by 1.02% at 104.673. Meanwhile, falling oil price, led by the Western Texas Intermediate (WTI), is dropping 0.92%, at $76.69, a headwind for the Canadian Dollar.

USD/CAD Price Analysis: Technical outlook

Although the USD/CAD uptrend remains intact, it should be said that the ongoing rally could halt at around the 1.3689/1.3700 area. However, the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest that buyers are gathering momentum, but a decisive breach above 1.3700 Is needed, so the USD/CAD might test higher prices.

Therefore, the USD/CAD key resistance levels are 1.3700, followed by November’s 3 high of 1.3808, ahead of the YTD high of 1.3977.

-

19:00

Argentina Gross Domestic Product (YoY) above forecasts (5.8%) in 3Q: Actual (5.9%)

-

19:00

Mexico Central Bank Interest Rate meets expectations (10.5%)

-

18:42

AUD/USD drops heavily in risk-off markets following hawkish BoE, ECB and Federal Reserve

- The Australian Dollar is under pressure in a risk-off environment.

- The US Dollar has picked up the bid after a slew of hawkish central bank interest rate decisions.

- The Federal Reserve, Bank of England and European Central Bank have all sounded off a hawkish tone for subsequent meetings, risk-off.

AUD/USD is down heavily on the day, falling from 0.6869 to a low of 0.6681 as in-the-money longs get squeezed out of what has been several days of a demand for the Australian Dollar. The pair is down by over 2.5% on Thursday in a move that started in Asia, accelerated in Europe and continued in New York trade. AUD/USD is now trading near a one-week low around 0.6695 as investors fret over hawkish tones from a slew of central banks this week, including the Bank of England (BoE), the European Central Bank (ECB) and the Federal Reserve (Fed).

Australian Dollar down in risk-off markets

As a high beta currency, AUD suffers at times of risk-off. US stock indexes fell sharply on Thursday, with the Dow Jones Industrial Average (Dow) on track for its steepest single-day fall in three months. The Federal Reserve's guidance for protracted policy tightening quelled hopes of the rate-hike cycle ending anytime soon. The two-day Federal Open Market Committee (FOMC) meeting ended with a 50 bp hike in the target range to 4.0-4.75%, as expected. However, as the dust settled, financial markets eventually focused on the entirety of Federal Reserve chairman Jerome Powell’s message, which was overwhelmingly hawkish and negative for risk appetite and the Australian Dollar.

Bank of England and European Central Bank weigh

In Europe, the Bank of England delivered its ninth straight rate rise and the eighth of 2022. However, the key takeaway from the event is that even though UK inflation has peaked, the BoE believes more increases will be necessary. The European Central Bank also raised rates by half a percentage point. This was the ECB's fourth successive interest rate hike. The ECB outlined plans to shrink its bloated balance sheet from March, hoping that higher borrowing costs will finally arrest runaway inflation. While the ECB announced a smaller 50bp hike today, it stressed that this slowdown was not a pivot, adding that the terminal rate may have to be higher than the market had priced to date.

As per usual, the Australian Dollar is being driven, in the main, by external factors. With that being said, Australia released a highly anticipated employment report on Thursday. The data reflected a solid labour market performance in November. 64.0k jobs were added vs. 19.0k expected and a revised 43.1k (was 32.2k) in October. A total gain came from 34.2k full-time jobs and 29.8k part-time jobs. The Unemployment Rate was steady at 3.4%, as expected, but the participation rate rose a couple of ticks to 66.8%, bolstering the positive sentiment in the report and reaffirming the Reserve Bank of Australia's (RBA) view of a very tight labour market.

Markets assess grounds for further Reserve Bank of Australia rate hikes

The key issue for the markets will be what the Reserve Bank of Australia is going to do in February. The decision in December to raise the cash rate and maintain a strong tightening bias points to RBA ‘s firm commitment to the inflation target. WIRP now suggests 55% odds of a 25 bp hike on February 7, up from 45% at the start of this week, while the swaps market is pricing in a peak policy rate near 3.90% vs. 3.65% at the start of this week.

All in all, the US Dollar is getting traction as markets digest the central bank decisions and hawkish guidance, weighing on the commodity complex (an AUD proxy) and risk assets. DXY, an index that measures the US Dollar, is trading higher near the highs of the day, around 104.80 after two straight down days. However, there is a technically bearish bias in DXY while the index remains on the front side of the bear trend as follows:

AUD/USD and DXY technical analysis

DXY is consolidating below last month's low of near 105.30 and has pierced last week's low of near 104.10:

The US Dollar M-formation is a reversion pattern on the daily charts above which has seen the price rally into the neckline resistance area that meets the bearish trendline. US Dollar Bears need to commit at this juncture or face prospects of the bulls taking on last month's lows of near 105.30 in what could turn into a short squeeze. If on the other hand, the US Dollar bears do commit, then a downside extension will be on the cards with eyes on the June lows near 101.30.

AUD/USD bears lurking

As for AUD/USD, the price has broken channel support and there are eyes on a break to the Volume Point of Control (VPC) of the late August to mid-October bear cycle:

The neckline of AUD/USD M-formation could serve as the resistance of a restest in the coming days and that could lead to a downside continuation below the now counter-trendline to target the 0.65s.

-

18:00

GBP/USD tanks more than 200-pips toward 1.2150s after BoE’s dovish hike

- The Pound Sterling losses ground against the US Dollar even though the Bank of England lifted rates by 0.50%.

- US Retail Sales for November disappointed, though they showed the effects of the Federal Reserve policy.

- GBP/USD: The dip towards the confluence of the 20/200-DMAs, could pave the way for a re-test of 1.2400

The Pound Sterling (GBP) failed to gain traction amidst a Bank of England (BoE) 50 bps rate hike, though risk aversion maintains the US Dollar (USD) bid, after hitting six-month lows around 103.448, per the US Dollar Index (DXY). Mixed economic data released by the United States (US) and the aftermath of further rate hikes by the Federal Reserve (Fed) weighed on the GBP. At the time of writing, the GBP/USD is trading at 1.2160, down more than 2%.

Dovish hike by the Bank of England weighed on the GBP/USD

US equities dwindled after the Fed’s decision, which opted to slow the rate increases but updated its terminal rate. The so-called dot plot, where policymakers project the Federal Funds rate (FFR) in the future, was revised from September’s 4.6% to 5.1%, catching investors off guard, as most analysts estimated an adjustment to 4.9%.

Data-wise, the US economy experienced a setback in November as Retail Sales unexpectedly contracted, down 0.6% MoM compared to the anticipated -0.1%. Meanwhile, Initial Jobless Claims rose by 211K despite estimates of 230K, revealing the strength and robustness of today’s labor market acknowledged by Fed Chair Powell during his Wednesday press conference.

Earlier, the Philadelphia and New York Business Indexes reported disappointing figures, with the former sliding 13.8 points below expectations while the latter dropped 11.2, further away from its predicted contraction rate of 1%.

In a move widely expected by analysts, the Bank of England hiked interest rates to 3.50%, an increase of 50 basis points and the highest rate since the financial crisis. However, the decision was not unanimous; two members (Sylvana Tenreyro and Swati Dhingra) opted for no change, while Catherine Mann voted for an even higher increase of 75bps. The BoE said that further rate increases might be required to achieve the bank’s 2% goal. They added, “if the outlook suggested more persistent inflationary pressures, it would respond forcefully, as necessary.”

GBP/USD Price Analysis: Technical outlook

The GBP/USD remains upward biased even though Thursday’s session is witnessing a 240 pip fall, spurred by a perceived “dovish” hike by the Bank of England. Nevertheless, it should be said that the GBP/USD rally from around 1.1700 to 1.2446 resulted from overall US Dollar (USD) weakness. However, the confluence of the 20 and 200-day Exponential Moving Average (EMA) at around 1.2117/15 could halt the downfall if buyers stepped in around the latter.

Although falling, the Relative Strength Index (RSI) is still in bullish territory, while the Rate of Change (Roc) suggests that selling pressure is increasing.

Therefore, the GBP/USD first support would be the 1.2115/17 area, followed by 1.2100. On the flip side, the GBP/USD first resistance would be the 1.2200 mark, followed by the December 5 daily high at 1.2344.

-

17:47

United States 4-Week Bill Auction up to 3.78% from previous 3.65%

-

16:44

EUR/GBP surges above 0.8700 after hawkish ECB, dovish BoE

- The Euro soars more than 100 pips against the Pound Sterling.

- ECB Lagarde opened the door for further 50 bps rate hikes in subsequent meetings.

- BoE’s decision ended 75 bps rate hikes, though it stated its commitment to tame inflation.

The EUR/GBP rallies as the New York session progresses after the Bank of England (BoE) and the European Central Bank (ECB) decisions to hike rates by 50 bps each in their last monetary policy meetings of 2022. At the time of writing, the Euro (EUR) has gained traction against the Pound Sterling (GBP) and is trading at 0.8705, above its opening price by 1.30%.

ECB and BoE raised rates by 50 bps

Risk aversion keeps the EUR/GBP soaring sharply. The ECB’s decision to raise rates by 50 bps was widely expected, but the Quantitative Tightening (QT) announcement surprised the markets. The ECB’s QT will start in March 2023 at a €15 billion pace, and it will run through Q2 and be set on an ongoing basis. The ECB updated its inflation forecasts for 2024 and 2025, expecting to hit 3.4% and 2.3%, respectively. Due to the upward revisions on inflation, the ECB stated that rates would still need to rise “significantly further.”

Meanwhile, ECB’s President Christine Lagarde said that it was “obvious” to expect 50 bps rate hikes for some time, adding that February, March, and April could also witness a 0.50% hike to the depo facility. Following Lagarde’s remarks, market pricing puts the ECB terminal rate at around 3%.

Elsewhere, the Bank of England hiked rates by 50 bps, lifting the Bank Rate to 3.50%, as widely expected by analysts. The decision was not unanimously approved, with a 7-2 split, with BoE members Tenreyro and Dhingra opting for a no change, while Catherine Mann voted for a 75 bps rate hike. The BoE’s said that further rate increases might be required to achieve the bank’s 2% goal. They added, “if the outlook suggested more persistent inflationary pressures, it would respond forcefully, as necessary.”

EUR/GBP Reaction

After the decisions, the EUR/GBP extended its gains due to the “hawkishness” perceived on the ECB’s side, while the BoE reiterated in its previous meeting that the terminal rate was substantially lower than what markets were pricing. Since the decision, the EUR/GBP climbed from 0.8610 to 0.8723 daily highs.

EUR/GBP Key Technical Levels

-

16:16

US: November's retail sales report was ugly – Wells Fargo

Data released on Thursday showed a larger-than-expected decline in retail sales during November. Analysts at Wells Fargo point out that sales in categories more reliant on credit started to turn and holiday sales categories flopped. While they expect spending to contract in 2023, they point out it's too soon to call this the start of a sustained decline in goods spending.

Key Quotes:

“It's worth mentioning that despite the pullback in sales last month, the overall level of sales remains elevated, suggesting consumers are continuing to spend at a decent clip this holiday season. Specifically, sales at holiday retailers were still higher than in September, and 5% higher than where they stood last year. But the decline in November suggests some consumer momentum may be starting to fizzle out.”

“Given all the headwinds for consumer spending we have been surprised at the resilience and admittedly had to push out the timing of the eventual retrenchment in spending. While we do expect consumer spending to contract in 2023, this ugly November report might be a bit of a head-fake. Specifically it may be more indicative of the long-delayed pivot form goods to services. Yes, goods spending growth slowed on trend throughout 2022, but it has not yet entered a sustained decline.”

-

16:08

Fed signals a more hawkish outlook – BBVA

As expected, on Wednesday, the Federal Reserve raised the Fed Funds rate by 50 basis points. The Research Department at BBVA, for now, stick to their call for two 25bp rate hikes during the first quarter of next year, with the rate peaking at 4.75-5.00%.

Key Quotes:

“Hawkish signs indicate that, although inflation is starting to show clear signs of easing, the Fed felt a strong need to reverse the recent decline or avoid a further easing of rates along the yield curve. Although explicitly questioned, Chair Powell avoided signaling that the Fed is uncomfortable with the easing of financial conditions that has occurred after the positive inflation data of recent months, as he only indicated that the Fed’s “focus is not on short-term moves but on persistent moves”, which could likely mean that the Fed expects financial conditions to reverse its path or at least not continue easing.”

“For now, we stick to our call for two 25bp rate hikes in 1Q23, with the fed funds rate peaking at 4.75-5.00%.”

-

16:03

USD/JPY jumps above 137.50 as the US Dollar strengthens

- US Dollar gains momentum while Wall Street tumbles.

- Japanese Yen fails to benefit from risk aversion.

- USD/JPY likely to challenge key resistance around 138.00.

The US Dollar strengthened across the board during the American session, the day after the FOMC meeting and following weaker-than-expected US economic data. The USD/JPP jumped above 137.50, toward the weekly high, despite amid risk aversion.

Wall Street tumbles, the world raises rates

The Japanese yen is among the weakest currencies of the America session as yields rise sharply in Europe and as Treasuries remain steady. In Wall Street, the Dow Jones is falling by 1.95% and the Nasdaq drops more than 2%.

Risk aversion is not helping the Yen so far on Thursday as central bank around the world continue to hike interest rates; the exception is the Bank of Japan.

In the US, economic data released on Thursday came in mixed, offering some divergence. Retail Sales fell more than expected and so did Industrial Production in November, while Initial Jobless Claims fell to 211K, the lowest level in eleven weeks.

Looking again at the 138.00 zone

The rally in USD/JPY sent the price near the weekly took it reached on Monday around the 138.00 zone. The pair peaked at 137.60 and is trading just a few pips below the 20-day Simple Moving Average (currently at 137.85). A consolidation above 138.00 should open the doors to more gains.

A failure to break the 138.00 zone would keep the current range 138.00/135.00 (20 and 200-day SMAs) intact. A close below 135.00 would point to more losses.

Technical levels

-

15:55

Gold Price Forecast: XAU/USD tends to perform well during recessions – ANZ

Gold prices tend to come under pressure ahead of recessions, but then outperform other markets (such as equities) during them, strategists at ANZ Bank report.

Gold has performed well during past recessions

“We expect the US to enter a recession in 2023, with GDP falling to 0.2% YoY and contracting by 0.8% QoQ in Q3. The economic growth outlook is compounded by weakness in Europe as it faces ongoing geopolitical risks and energy shortages. This backdrop is typically positive for Gold.”

“Gold prices tend to come under pressure ahead of recessions, with returns over the six months before a recession averaging 2%. It then tends to outperform equities during recessions, with average returns of 16%. For the six months after a recession, Gold continues to deliver decent gains.”

-

15:35

EUR/USD to move lower in 2023 as Fed to push rates above 5% next year – Danske Bank

The US Federal Reserve hiked the Federal Funds Rate by 50 bps as widely anticipated. The updated ‘dots’ signal policy rates above 5% in 2023. EUR/USD recovered near pre-meeting levels despite the hawkish rate projections. But economists at Danske Bank expect the pair to tick down next year.

FOMC signals Fed Funds above 5% in 2023

“We maintain our call for terminal rate at 5.00-5.25%, well in line with the new projections.”

“While Powell noted that Fed looks through short-term volatility in financial conditions, we think the recent easing supports the case for inflation risks still being tilted to the upside.”

“We continue to see modest near-term upside risks to USD rates, and forecast EUR/USD moving lower in 2023, as broad USD strength plays a key role in maintaining financial conditions restrictive.”

-

15:30

Colombia Retail Sales (YoY) declined to 1.9% in October from previous 7.2%

-

15:30

United States EIA Natural Gas Storage Change came in at -50B, below expectations (-45B) in December 9

-

15:23

Colombia Industrial output (YoY) fell from previous 6.9% to 5.3% in October

-

15:17

Gold Price Forecast: XAU/USD drops below $1,800 on USD strength, despite falling US bond yields

- Gold price slides below $1,800 after hawkish commentary by Fed Chair Jerome Powell.

- The US Dollar remains bid, a headwind for the precious metals space.

- US Retail Sales disappointed, portraying the effects of “cumulative tightening” by the Fed.

Gold price extended its losses following a more “hawkish” than expected Federal Reserve’s (Fed) decision on Wednesday. Even though the 50 bps rate hike by the Federal Reserve, the subsequent language used by its Chairman Jerome Powell further cemented the case for a higher “terminal” rate. At the time of writing, the XAU/USD is trading at $1,782 a troy ounce.

Wall Street is trading with losses after the Fed’s decision. Jerome Powell and Co.’s decision to hike rates but also revise its September projections, lifting the dot plots above the 5% threshold, caught traders off guard, which were expecting a Fed pivot after “just” two months of lower inflation. At his press conference, Jerome Powell said the labor market remains out of balance and that“we have more work to do.” He emphasized that the Fed needs “substantially more evidence of lower inflation” and that the Fed isn’t at a sufficiently restrictive stance yet and still has “some ways to go.”

In the meantime, the US Dollar Index (DXY), a gauge of the buck’s value against a basket of peers, remains positive but trading off the day’s highs of 104.406, weighed by the European Central Bank (ECB) press conference of its President Christine Lagarde. At the time of typing, the DXY is trading at 103.870, gaining 0.26%. Hence, as the US Dollar remained bid, Gold dropped from its multi-month highs of $1,824.47, plunging 1.22% on Thursday.

Elsewhere, the economic docket in the United States (US) featured November Retail Sales, which missed expectations, plummeting 0.6% MoM vs. estimates of 0.1% contraction. Meanwhile, Initial Jobless Claims rose by 211K, less than estimates of 230K, displaying the tightness of the labor market, which was acknowledged by Fed Chair Powell during its Q&A press conference Wednesday.

Additionally, the Philadelphia Fed Business Index and the New York Fed Manufacturing Index missed forecasts by far, with the former sliding -13.8 vs. 10.0 expected, while the latter dropped -11.2 vs. -1.0 contraction.

Of late, Industrial Production (IP) in the US contracts by 0.2% vs. an increase of 0.1%. November’s figures followed the previous month’s 0.1% contraction, while the Capacity Utilization rate eased from October’s 79.9% to 79.7% in November.

Aside from this, XAU/USD has failed to gain traction, even though the EUR/USD is closing to the 1.0700 mark, which would usually be helpful for Gold prices. Though traders taking profits after a volatile trading session appears to be the reason behind the yellow metal fall.

Gold Price Analysis: Technical outlook

XAU/USD remains neutral to upward biased, though it’s testing the 20-day Exponential Moving Average (EMA) at $1,772.50. Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) suggests sellers are gathering momentum. So, in the near term, XAU/USD might test the 20-day EMA, and once cleared, it could pave the way toward the 200-day EMA at $1,762.07.

-

15:13

EUR/USD erases gains after a jump to six-month highs on Lagarde’s comments

- ECB raises rates by 50 basis points as expected.

- Lagarde mentions next rate hikes likely to also be 50 bps.

- US economic data mixed, stocks extend slide.

- EUR/USD off highs, back to the 1.0670 area after rising to 1.0735.

The EUR/USD jumped to 1.0735, a fresh six-month high, during ECB Lagarde’s presser. The Euro is among the top performers on Thursday while the US Dollar lost momentum after mixed US data.

ECB boosts EZ yields, EUR

The European Central Bank (ECB) raises key interest rates by 50 basis points to the highest levels since 2009. In the statement, the ECB said it expects to keep rising rates as inflation “remains far too high”. During the press conference, ECB President Christine Lagarde signaled that the next rate hikes will continue to be of 50 basis points.

The comments from the ECB President boosted the Euro across the board, not only versus the US Dollar. EUR/GBP also soared to three-week highs at 0.8700 while EUR/CHF printed monthly highs at 0.9916.

In the US economic data came in mixed. On the positive side, Initial Jobless Claims dropped more than expected to 211K, the lowest level in weeks. Retail Sales in November fell by 0.6%, more than the 0.1% decline of market consensus. The Philly Fed recovered from -19.4 to -13.8. The Empire Index tumbled to -11.2 from 4.5. Industrial Production contracted 0.2% in November against expectations of a 0.1% expansion.

Despite falling versus the Euro, the US Dollar is holding strong across the board on the back of risk aversion and amid steady Treasury yields. In Europe, yields are jumping following the ECB meeting. The German 10-year yield is up by more than 8% to 2.10%, the highest in a month.

The divergence between US Treasuries and EZ bonds on Thursday is adding support to the EUR/USD. The pair moved off highs and is hovering around 1.0680, marginally higher for the day, on its way to the strongest close since mid-June.

The Euro needs to rise and hold above 1.0700 to keep the doors open to more gains. A slide under the 20-hour Simple Moving Average at 1.0650 would change the intraday bias from bullish to neutral/bearish. The next key barriers are seen at 1.0600 and 1.0570.

Technical levels

-

15:08

The BoE does not really provide much of an impetus to support GBP – TDS

As expected, the Bank of England raised Bank Rate by 50 bps to 3.50%. The BoE did not provide much for GBP to chew on, economists at TD Securities report.

Not much of a surprise from the BoE

“As broadly expected, the BoE hiked 50 bps to 3.50% and signalled that more hikes are likely. The vote was biased to the downside, with the two most dovish MPC members calling for no hike while hawk Mann voted for 75 bps.”

“Less forward guidance over policy hikes implies less marginal support for GBP.”

“On balance, we think GBP has run most of the course but prefer to see weakness emerge on the crosses (like vs EUR). There is some risk that this bleeds into the USD given holidays approaching as well, but we think the hurdle is high to see major USD weakness emerge.”

-

15:00

United States Business Inventories below expectations (0.4%) in October: Actual (0.3%)

-

14:45

Lagarde speech: Info predicates 50 bps next meeting, possibly next one as well

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in December.

Key takeaways

"Given financing conditions and expected terminal rate in projection, we need to continue to fight against inflation."

"Info predicates 50 bps next meeting, possibly next one as well, possibly thereafter."

Market reaction

Although the risk-averse market environment seems to be helping the US Dollar limit its losses for the time being, EUR/USD clings to daily gains at around 1.0700 following these comments.

-

14:43

EUR/CHF to head back to the 0.95 area into next spring – ING

Economists at ING expect EUR/CHF to trend lower in 2023 and see the pair in the 0.95 region into next spring.

EUR/CHF to struggle to hold any gains over 0.99

“If we are right with our call for the Dollar to strengthen into the first quarter of 2023, then EUR/CHF will have to come lower – helped in part by SNB intervention.”

“Our call is that EUR/CHF continues to struggle to hold any gains over 0.99 and heads back to the 0.95 area into next spring.”

-

14:39

EUR/GBP could move modestly lower – Danske Bank

The Bank of England (BoE) hiked the Bank Rate by 50 bps to 3.50%. Economists at Danske Bank believe that the EUR/GBP pair is set to move marginally lower.

A dovish 50 bps as BoE nears the end of hiking cycle

“In line with our expectation, the BoE today hiked policy rates by 50 bps, bringing the Bank Rate to 3.50%.”

“We expect the increasingly weak growth outlook to support a near-term ending to the hiking cycle.”

“We maintain our call for a 25 bps hike in February with risks to our call skewed towards additional hikes in 2023 if inflation pressures show increasing persistence.”

“We see a case for the EUR/GBP cross to move modestly lower as a global growth slowdown and the relative appeal of UK assets to investors are a positive for GBP relative to EUR.”

-

14:33

Fed unlikely on its own to reverse bearish trend for the USD – MUFG

The US Dollar has remained at stronger levels following the Fed’s hawkish policy update. However, the Fed is unlikely on its own to reverse the bearish tend, economists at MUFG Bank report.

Fed to step down the pace of hikes again to 25 bps in February

“The Fed’s hawkish policy update will provide more support for the US Dollar in the near-term as it serves as a reminder to market participants not to get too carried away in pricing in bigger dovish pivot from the Fed. However, it is unlikely on its own to reverse the bearish tend that has been in pace for the USD since the October US CPI report was released.”

“Building evidence of softening inflation will discourage the Fed from raising rates as much as planned especially if evidence emerges as well of weakness in the labour market.”

“We still expect the Fed to step down the pace of hikes again to 25 bps in February and doubt it will raise rates above 5.00%.”

-

14:31

Lagarde speech: Food and energy inflation will continue to rise

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in December.

Key takeaways

"Inflation in December may be a bit lower."

"January and February inflation are likely to be higher."

"What matters is the destination."

"Food and energy inflation will continue to rise."

"We hope for ESM ratification by Italy in short order."

"ESM can be activated if necessary."

-

14:22

Lagarde speech: Not everybody agreed on actual tactics

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in December.

Key takeaways

"New market expectations will be embedded in future projections."

"There was general consensus on the assessment of the economy."

"There was general agreement on orientation in strategy."

"Not everybody agreed on actual tactics."

"There was very broad majority that we should show perseverance."

"Some might have wanted to do a bit more, bit less."

"We had broad majority for decision."

-

14:20

US: Industrial Production contracts by 0.2% in November vs. +0.1% expected

- Industrial Production in the US continued to contract in November.

- US Dollar Index continues to push lower toward 103.50.

Industrial Production in the US declined by 0.2% on a monthly basis in November, the Federal Reserve reported on Thursday. This reading followed October's 0.1% contraction and missed the market expectation for an expansion of 0.1%.

Further details of the publication revealed that the Capacity Utilization rate declined modestly to 79.7% from 79.9% in October.

Market reaction

The US Dollar Index stays on the back foot and continues to edge lower toward 103.50. The sharp increase seen in the EUR/USD pair, however, seems to be weighing heavily on the index rather than these data.

-

14:15

United States Industrial Production (MoM) registered at -0.2%, below expectations (0.1%) in November

-

14:15

United States Capacity Utilization came in at 79.7%, below expectations (79.8%) in November

-

14:13

GBP/USD set to drop towards 1.2250 – Scotiabank

GBP/USD was capped at 1.2450 yesterday. The pair could dip to the mid-1.22s in the next 1 -2 days, in the view of economists at Scotiabank.

Intraday price signals are tilting bearish

“Intraday price signals are tilting bearish, with the GBP/USD pair capped at 1.2450 late yesterday for a second time this week.”

“The technical pointers clearly suggest developing downside risk towards 1.2550 at least in the next 1 -2 trading sessions.”

See – GBP/USD: Beyond 1.2450, next hurdles are located at 1.2610 and 1.2750 – SocGen

-

14:10

Lagarde speech: Obvious that we should expect 50 bps hikes for period of time

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in December.

Key takeaways

"Significant and steady pace have to be read together."

"Obvious that we should expect 50 bps hikes for period of time."

"QT would represent roughly half of redemptions over that period."

Market reaction

EUR/USD rose sharply on these comments and was last seen trading at fresh multi-month highs above 1.0700.

-

14:05

Lagarde speech: Risk to inflation primarily on the upside

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in December.

Key takeaways

"Wages to growth at rates well above historic averages."

"Most measures of underlying inflation around 2%."

"Further above-target revisions in some indicators warrant monitoring."

"Risks to growth on the downside, especially in the near term."

"Risk to inflation primarily on the upside."

"Banks in the Eurozone have adequate capital."

-

13:59

Lagarde speech: Depreciation of Euro has added to inflation.“

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in December.

Key takeaways

"High inflation, tighter financing conditions dampen spending and production."

"Global growth slowing also due to tighter financial conditions."

"Weaker economy could lead to a somewhat higher unemployment rate."

"Job creation is expected to slow."

"Fiscal measures could exacerbate inflationary pressures."

"Price pressures are strong across sectors partly due to high energy costs."

"Supply bottlenecks are gradually easing."

"Depreciation of Euro has added to inflation."

"Wage growth is strengthening."

-

13:48

US: Philadelphia Fed Manufacturing Index rises to -13.8 in December vs. -10 expected

- Philly Fed Manufacturing Index improved modestly in December.

- US Dollar Index clings to daily gains above 104.00.

The Federal Reserve Bank of Philadelphia's Manufacturing Business Outlook Survey's diffusion index for current general activity rose to -13.8 in December from -19.4 in November. This print came in worse than the market expectation of -10.

"The survey’s indicators for general activity, new orders, and shipments were all negative, and the firms reported a decline in employment, on balance," the publication read. "The survey’s broad indicators for future activity improved and indicate firms expect growth overall over the next six months."

Market reaction

The US Dollar continues to outperform its rivals after this data with the US Dollar Index rising 0.5% on the day at 104.12.

-

13:41

US: Weekly Initial Jobless Claims decline to 211K vs. 230K expected

- Initial Jobless Claims in the US decreased by 20,000 in the week ending December 10.

- US Dollar Index stays in positive territory above 104.00.

There were 211,000 initial jobless claims in the week ending December 10, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 231,000 (revised from 230,000) and came better than the market expectation of 230,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 227,250, a decrease of 3,000 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending December 3 was 1,671,000, an increase of 1,000 from the previous week's revised level," the DOL noted.

Market reaction

This data failed to trigger a noticeable market reaction and the US Dollar Index was last seen rising 0.5% on the day at 104.15.

-

13:38

EUR/USD rebounds to mid-1.0600s on ECB's hawkish rate hike, weaker US macro data

- EUR/USD trims a part of its intraday losses in reaction to the ECB’s hawkish 50 bps rate hike.

- Disappointing US macro data caps the attempted USD recovery and offers additional support.

- Traders now look to the ECB’s post-meeting press conference for some meaningful impetus.

The EUR/USD pair manages to recover a few pips from the daily low and climbs back above mid-1.0600s after the European Central Bank (ECB) announced its policy decision.

As was priced in the markets, the ECB delivered a 50 bps rate hike at the end of the December policy meeting this Thursday and indicated that it will raise borrowing costs further. In the accompanying policy statement, the central bank noted that inflation remains far too high and is projected to stay above the target for too long.

A more hawkish forward guidance, saying that rates will still have to rise significantly at a steady pace to ensure a timely return of the 2% inflation target, provides a modest lift to the shared currency. The upside for the EUR/USD pair, however, remains capped amid a goodish US Dollar recovery from a six-month low touched earlier this Thursday.

The Fed on Wednesday signalled that it will continue to raise rates to crush inflation. In fact, the so-called dot plot projected at least an additional 75 bps increase in borrowing costs by the end of 2023, lifting the terminal rate rising to 5.1%. This, along with a fresh wave of the global risk-aversion trade further benefits the safe-haven buck.

On the economic data front, the US monthly Retail Sales declined by 0.6% in November, down sharply from the 1.3% increase reported last month and missing estimates for a modest 0.1% fall. Adding to this, the Philly Fed Manufacturing Index also fell short of market expectations and tumbled to -11.2 for December from 4.5 in the previous month.

The data fueled speculations that the Fed will pivot from an ultra-hawkish stance to something more neutral. This is reinforced by depressed US Treasury bond yields depressed, which keep a lid on the attempted USD recovery and lends additional support to the EUR/USD pair. Traders now look to the post-ECB press conference for some meaningful impetus.

Technical levels to watch

-

13:34

US: Retail Sales decline by 0.6% in November vs. -0.1% expected

- Retail Sales in the US fell at a stronger pace than expected in November.

- US Dollar Index stays in positive territory above 104.00 after the data.

Retail Sales in the United States declined by 0.6% on a monthly basis to $689.4 billion in November. This reading followed October's 1.3% increase and came in worse than the market expectation for a contraction of 0.1%.

"Total sales for the September 2022 through November 2022 period were up 7.7% from the same period a year ago," the publication read. "Retail trade sales were down 0.8% from October 2022, but up 5.4% above last year."

Market reaction

The US Dollar Index retreated from daily highs with the initial reaction and was last seen rising 0.45% on the day at 104.10.

-

13:33

Canada Employment Insurance Beneficiaries Change (MoM) up to -3.2% in October from previous -5.6%

-

13:32

United States Philadelphia Fed Manufacturing Survey came in at -13.8 below forecasts (-10) in December

-

13:31

United States Initial Jobless Claims below expectations (230K) in December 9: Actual (211K)

-

13:31

United States Continuing Jobless Claims in line with forecasts (1.671M) in December 2

-

13:31

United States NY Empire State Manufacturing Index below forecasts (-1) in December: Actual (-11.2)

-

13:30

United States Retail Sales (MoM) came in at -0.6% below forecasts (-0.1%) in November

-

13:30