Notícias do Mercado

-

23:19

Australia CFTC AUD NC Net Positions up to $-37.8K from previous $-40.6K

-

23:19

European Monetary Union CFTC EUR NC Net Positions: €124.7K vs previous €124.9K

-

23:19

United States CFTC Oil NC Net Positions: 229.6K vs previous 231.7K

-

23:18

United States CFTC Gold NC Net Positions up to $125.6K from previous $115.1K

-

23:18

United States CFTC S&P 500 NC Net Positions declined to $-230.1K from previous $-203.7K

-

23:18

United Kingdom CFTC GBP NC Net Positions: £-25.7K vs £-28.2K

-

23:18

Japan CFTC JPY NC Net Positions up to ¥-53.2K from previous ¥-66K

-

21:37

Silver Price Analysis: XAG/USD Bounced at the 20-DMA, reclaims $23.00 on risk aversion

- Silver prices bounce and cling to gains, despite a buoyant US Dollar.

- Near-term, XAG/USD might consolidate, as mixed signals between the RSI/RoC suggest caution is warranted.

Silver is recovering some ground after falling to weekly lows during the New York session of $22.56. However, a late buying impulse keeps XAG/USD trading in the green with gains of 0.41%. At the time of writing, the XAG/USD is trading at $23.21, above its opening price, and set to finish the week with losses of 1.23%.

Silver Price Analysis: Technical outlook

The XAG/USD daily chart depicts that the non-yielding metal remains upward biased after testing an upslope support trendline drawn from November lows. However, failure to crack the latter and its confluence with the 20-day EMA triggered Silver recovery. Also, the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest that buyers are gathering momentum, and a daily close above the December 15 close of $23.05 could keep the trend intact.

In the near-term, the XAG/USD one-hour chart suggests that Silver’s dip below $22.60 opened the door for sellers to lean onto the 200-Exponential Moving Average (EMA) at $23.22 as immediate intraday resistance. Furthermore, mixed signals between the RSI – aiming upwards, and RoC – depicting buying pressure losing momentum might refrain traders from opening new positions.

Nevertheless, if XAG/USD breaks above the 200-EMA, the immediate ceiling level would be the daily pivot at $23.33, followed by the R1 pivot at $23.69. On the downside, the XAG/USD first support would be the 50-EMA at 23.16. A breach of the latter will expose December’s 15 daily low at $23.06, ahead of the $23.00 mark.

Silver Key Technical Levels

-

20:00

Colombia Interest rate meets forecasts (12%)

-

19:55

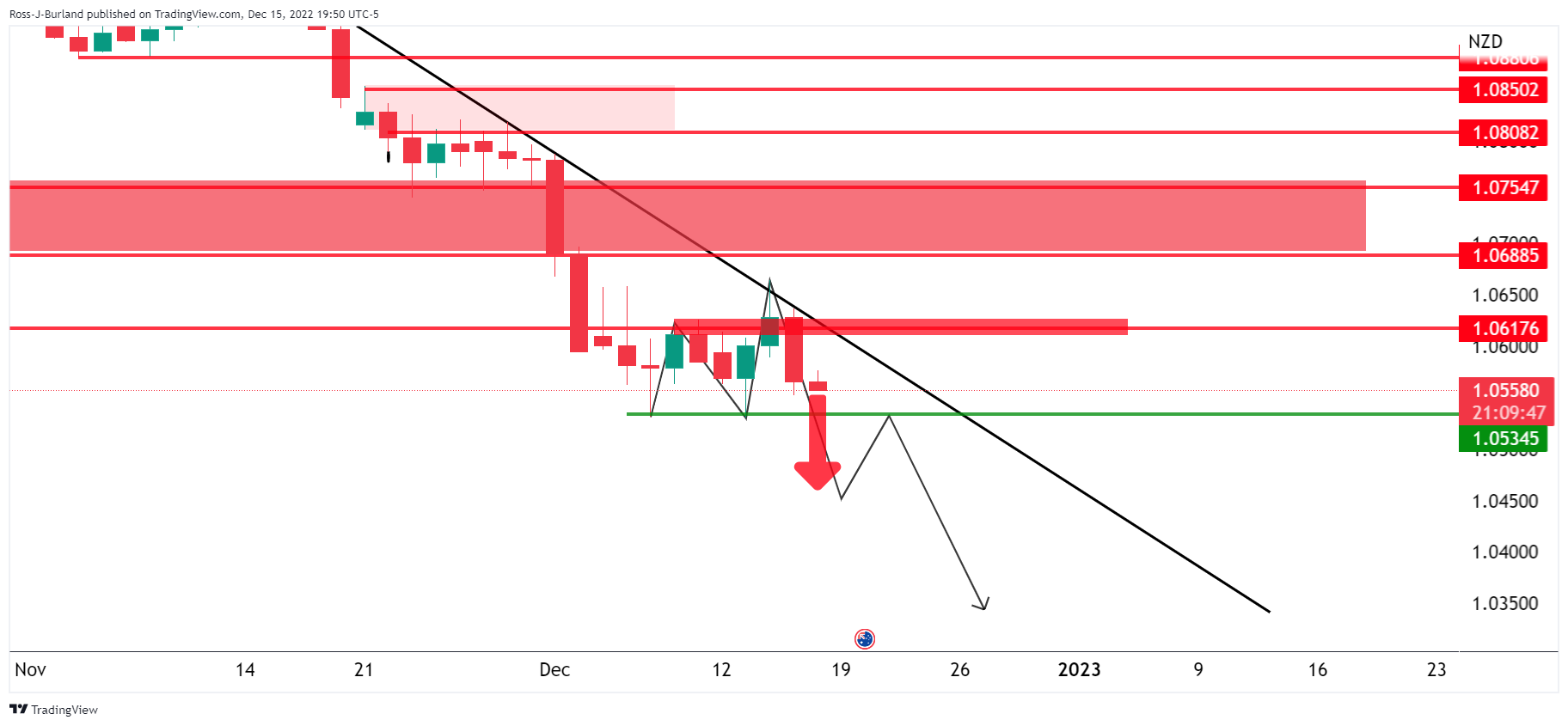

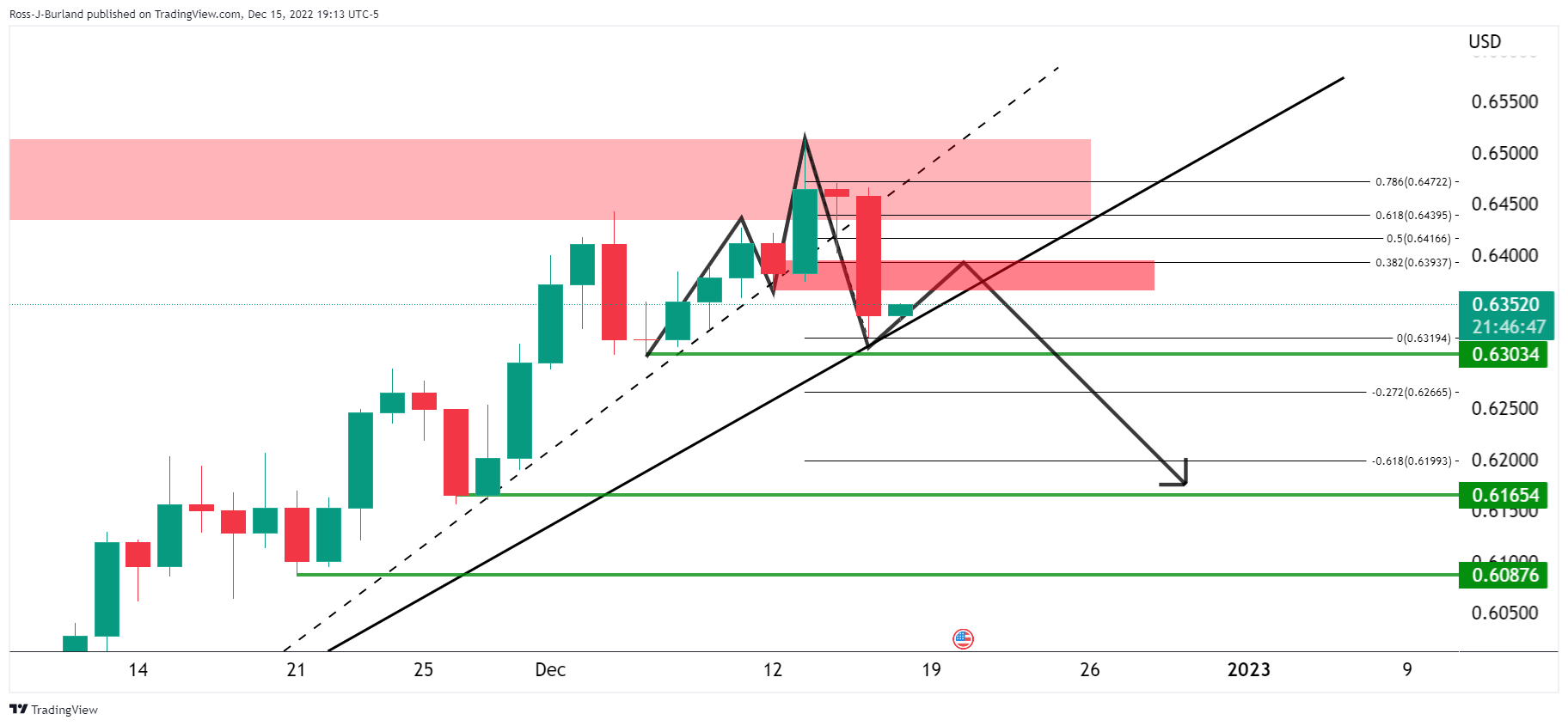

AUD/USD Price Analysis: Struggles at the 20-day EMA, drops below 0.6700

- Risk aversion weighed on high-beta currencies like the Australian Dollar.

- Global central banks hiking rates and eyeing additional increases sounded recession alarms, dampening investors’ mood.

- AUD/USD Price Analysis: Downward biased, after tumbling from weekly highs, heading to the 50-day EMA.

The Australian Dollar (AUD) slides against the US Dollar (USD) amidst a dampened market sentiment as an economic slowdown looms, after a central bank bonanza, featuring the US Federal Reserve (Fed), the Bank of England (BoE), and the European Central Bank (ECB) raising rates by 50 bps each. Additionally, policymakers emphasized the need to do what’s needed to tackle inflation, which keeps investors uneasy. Therefore, the AUD/USD is trading at 0.6690, below its opening price.

AUD/USD Price Analysis: Technical outlook

After Thursday’s drop from around 0.6870 toward 0.6670, the AUD/USD is poised for a deeper correction. Market sentiment, and technical factors led by buyers unable to decisively clear the 200-day Exponential Moving Average (EMA) at 0.6831, exacerbated the Aussie Dollar’s fall toward current exchange rates. On its way south, the AUD/USD cleared the 20-day EMA at 06724, which halted Friday’s upside, as the AUD/USD is set to finish the week with losses of 1.60%.

Furthermore, a break below December 15 swing low at 0.6676 could exacerbate the AUD/USD’s fall toward the 50-day EMA at 0.6658, accelerating the downtrend to the 0.6600 mark. Oscillators like the Relative Strength Index (RSI) crossed to bearish territory, while the Rate of Change (RoC), is headed to the downside, cementing the case for a deeper correction.

As an alternate scenario, if the AUD/USD reclaims the 0.6700 mark, a test of the 200-day EMA at 0.6831 is on the cards. A breach of the latter will expose 0.6916 September’s 13 high, followed by the 0.7000 psychological mark.

AUD/USD Key Technical Levels

-

19:35

United States Baker Hughes US Oil Rig Count dipped from previous 625 to 620

-

17:49

USD/CAD edges higher and meanders around 1.3690s on US Dollar strength

- S&P Global PMIs for the United States sound the alarms of an upcoming recession.

- Federal Reserve tightening hit consumers while the labor market remains stable.

- USD/CAD Price Analysis: A decisive break above 1.3700 can pave the way for a test of 1.3800.

After hitting a daily low of 1.3617, the USD/CAD climbs toward the 1.3700 figure in the North American session after the US Federal Reserve (Fed) decided to raise rates by 50 bps last Wednesday and sparked recessionary woes. Therefore, the USD/CAD is trading at 1.3684, above its opening price by 0.16%.

Fed’s policy begins to hit lagging indicators

Sentiment remains downbeat as US equities tumble. The Federal Reserve’s tightening cycle is finally catching up with the economy after several data released during the week pointed to an economic slowdown in the United States (US). On Friday, December’s S&P Global PMIs figures were worse than expected, reigniting recession fears.

Before the Fed’s decision, inflation in the US eased from 7.7% YoY to 7.1%, while core figures cooled down to 6% YoY from 6.1% in the previous month. Although the US Fed Chair Jerome Powell welcomed the news, he insisted that inflation is high and that the Fed still has some ways to go.

On Thursday, after the Fed’s decision, Retail Sales were the next piece of the puzzle that signaled that, indeed, the US economy is decelerating, dropping 0.6% MoM vs. estimates of 0.1% contraction and trailing October’s 1.3% increase. Also, Manufacturing Indices revealed by the Philadelphia and New York Fed pointed to worsening conditions, implying that the US is headed into a recession.

However, not everything was negative. The labor market is yet to feel the effects of the US central bank policies. Initial Jobless Claims for the last week rose by 211K despite estimates of 230K, revealing the strength and robustness of today’s labor market.

Given the fundamental backdrop and the lack of tier 1 Canadian data, the USD/CAD is driven by the US Dollar’s dynamics. The USD Dollar Index, a gauge of the buck’s value against a basket of peers, rises 0.01% at 104.591, a tailwind for the USD/CAD. In the meantime, and due to the linkage of the Loonie (CAD) with oil prices, Western Texas Intermediate (WTI) is dropping 1.74%, down to $74.91 per barrel, weighing on the CAD.

Fed’s Daly and Williams crossed wires

Of late, it should be said that Fed officials have been crossing newswires. The New York Fed President Joh Williams expects rates to peak at around 5% to 5.50% in 2023. He added that supply chains are improving, though his base case is that the economy would not fall into a recession. Later, the San Francisco Fed President Mary Daly said that everyone at the Fed expected rates to be held for all of 2023, and added that she does not know why the markets are so optimistic about inflation.

USD/CAD Price Analysis: Technical outlook

The USD/CAD remains upward biased, though unable to crack the 1.3700 figure so far. Break above will open the door for further gains, eyeing the November 3 daily high at 1.3808, ahead of the YTD high of 1.3977. Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC), suggest that upward pressure is mounting, so buyers might be preparing to assault the 1.3700 mark before the weekend. As an alternate scenario, the USD/CAD first support would be the day’s low at 1.3617, followed by 1.3600.

-

16:33

USD/JPY Price Analysis: Drops toward the 78.6% Fibo level at 136.60s as bulls take a respite

- The USD/JPY failed to gain traction despite rising US Treasury yields.

- USD/JPY Price Analysis: Remains upward biased, though a pullback toward 136.00 is on the cards.

The USD/JPY fell after testing the 20-day Exponential Moving Average (EMA) around 137.88 and dropped below the 137.00 mark in the North American session amid a risk-off impulse. At the time of writing, the USD/JPY is trading at 136.63, below its opening price by 0.84%, after hitting a high of 137.80.

USD/JPY Price Analysis: Technical outlook

From a daily chart perspective, the USD/JPY remains range-bound, within the boundaries of the 20-day EMA and the 200-day EMA, each at 137.88-135.14, respectively. The Relative Strength Index (RSI), at bearish territory, aims downward, while the Rate of Change (RoC) is almost flat, signaling that buying pressure has faded.

Short term, the USD/JPY one-hour chart suggests that buyers are taking a respite after hitting 138.17. The major dived towards the confluence of the 78.6% Fibonacci retracement and the 100-EMA around 136.60, appearing to find support. Nevertheless, if the latter is breached, a fall toward the S1 daily pivot at 135.96 is on the cards. Contrarily, if the USD/JPY rallies toward the 61.8% Fibonacci level at 136.96, a test of the 137.00 figure is likely. Break above will expose the December 13 daily high at 137.97, ahead of the 138.00 mark.

USD/JPY Key Technical Levels

-

16:33

AUD/USD: Fed’s policy to continue supporting the US Dollar – Danske Bank

The AUD/USD pair dropped sharply on Thursday and it stabilized slightly below 0.6700 on Friday. According to analysts from Danske Bank, the AUD/USD pair will move lower over the next months. They forecast it at 0.66 in three months and at 0.65 in six months.

Key Quotes:

“Lower-than-expected inflation prints from the US, consequent speculation on Fed possibly easing its monetary policy earlier and the turnaround in Chinese Covid-policies have continued to support AUD/USD.”

“The Reserve Bank of Australia (RBA) hiked rates again by 25bp in the December meeting. While RBA signalled that rate hikes would continue in 2023, markets are pricing around 50% probability of a pause in the hiking cycle amid weakening economy and especially the housing market.”

“We still think that especially the Fed will have to continue tightening financial conditions in early 2023, which supports broad USD. While the worsening Covid-situation is weighing on Chinese economy during winter, the gradual reopening could support Australian export prices going forward. We maintain a modestly downward-sloping forecast profile.”

-

16:29

USD/JPY: Global inflation outlook and US treasury yields – Danske Bank

The USD/JPY pair is about to end the week hovering around 136.50/80, near the same level it had a week ago. Analysts from Danske Bank forecast the pair at 137 in a month, at 139 in three months, and then to move lower, reaching 128 in twelve months.

Key Quotes:

“Upside risks to USD/JPY come from a continued pressure for higher global yields, although intervention will likely cap sudden moves higher. If global slowdown turns into a more severe recession and speculators unwind short JPY positions, flatter yield curves and cheaper energy can quickly become a tailwind for JPY.”

“The key driver of USD/JPY remains the global inflation outlook and US treasury yields. Following the lower than expected US October and November CPI prints, JPY has strengthened quite significantly but remains weak in a historical perspective. With the US labour market still in good shape, we continue to see a pressure on Fed to tighten further and elevated energy prices will weigh on the JPY in the short term. Looking further ahead, we do expect a stronger JPY.”

-

16:08

Mexico: Lower growth and inflation in 2023, Banxico to decouple from the Fed – BBVA

On Thursday, the Bank of Mexico rose the key interest rate by 50 basis points to 10.5%, following the same hike from the Federal Reserve. According to the Research Department at BBVA, Banxico will decouple from the Fed in 2023 and they see lower growth and inflation in Mexico.

Key Quotes:

“We expect lower growth and inflation in 2023. GDP would grow 3.0% in 2022 driven by the manufacturing sector. We stick to our 0.6% GDP growth forecast for 2023 but with an upward bias considering the 3Q22 data, INEGI’s revisions, and the effect of nearshoring.”

“November will mark the peak of core inflation; headline inflation is already declining. We are more optimistic than the consensus for 2023.”

“We anticipate that Banxico will decouple from the Fed in 2023; we expect the start of a rate cut cycle by the third quarter of next year.”

“We expect the exchange rate will be 19.6 pesos per dollar by December 2022 and 20.1 pesos per dollar by the end of 2023.”

-

15:58

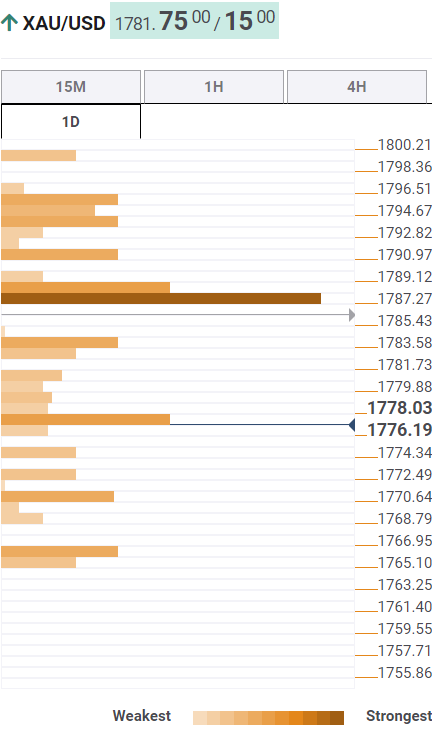

Gold Price Forecast: XAU/USD could gain traction if stabilizes above $1,790

Gold managed to rise slightly above the 200-day SMA despite Thursday's sharp decline. While above here, XAU/USD retains a bullish bias, FXStreet's Eren Sengezer reports

The $1,780/$1,775 area aligns as initial support

“In case XAU/USD stabilizes above $1,790 (200-day SMA) and confirms that level as support, it could test $1,800 in the short term before targeting $1,830 (Fibonacci 50% retracement of the long-term downtrend) and $1,860 (static level).”

“On the downside, $1,780/$1,775 area (Fibonacci 38.2% retracement, 20-day SMA) aligns as initial support before $1,740 (static level) and $1,720 (100-day SMA, 50-day SMA).”

-

15:49

Gold Price Forecast: XAU/USD rises to $1,793 after US data, neutral for the week

- Gold rebounds from weekly lows after being able to hold above $1,770.

- Wall Street indices drop more than 1% on Friday, adding to weekly losses.

- US data: Preliminary November S&P Global PMI below expectations.

Gold price rebounded further from weekly lows following the release of the US S&P Global PMI report, hitting a fresh daily high at $1,793. It is about to end the week at the same level it had seven days ago.

Moving away from $1,770

XAUD/USD broke above $1,785 after the release of the US S&P Global PMI report that came in below expectations. According to the preliminary report, in December the S&P Global Manufacturing PMI fell from 47.7 to 46.2, against market consensus of 47.7. The S&P Global Services PMI fell unexpectedly from 46.2 in November to 44.4 in December.

The economic numbers weighed on the US Dollar that pulled back across the board momentarily. The decline in equity prices in Wall Street limited the downside for the greenback.

The $1,800 area still critical

As of writing, XAU/USD is hovering around $1,790 around the same level it had a week ago. Gold price managed to remain above the key short-term support of $1,770 on Friday.

The weekly chart shows Gold price unable to post a close above $1,800. Technical indicators are starting to favor a correction in the short term. It the yellow metal manages to firmly break $1,800 with a confirmation close, it would suggest more gains ahead toward $1,860 initially and then an approximation to $1,900.

XAU/USD weekly chart

-

15:49

EUR/USD likely to see 1.10 over the next month – Nordea

EUR/USD rose to 1.07 after the hawkish ECB surprise. Economists at Nordea expect the pair to stretch higher toward 1.10 over the next month.

EUR/USD seen at 1.13 by the end of 2023

“A high possibility of a new year rally in stock markets (which would favour a weaker USD) together with a rate differential which has moved in favour of the EUR imply a high likelihood for EUR/USD to move even higher than the current 1.06. We believe that from a tactical perspective, EUR/USD is most likely to see 1.10 over the next month.”

“Our 3M forecast of EUR/USD at 0.99 seems too optimistic on behalf of the USD given how markets have changed their view on the Fed compared to the ECB lately. However, we still maintain our downside bias in EUR/USD in 3M to 6M as we see stocks taking a tumble lower on the back of higher rates than markets currently anticipate.”

“Overall, EUR/USD down to the 1.04 area seems more reasonable than 0.99 in the next 3M. Longer out, a successful reopening in China and a pause in rate hikes point toward a higher EUR/USD. We see EUR/USD at 1.13 by the end of 2023.”

-

15:35

Gold Price Forecast: XAU/USD’s end of 2023 target raised to $1,900 – ANZ

Economists at ANZ Bank have raised their Gold price forecast for the end of next year to $1,900.

Some scope for a retracement of recent gains in the near term

“Short term, we see some scope for a retracement of recent gains. This would be largely off the back of a stronger USD. Investor positioning shows non-commercial short positions built to a sizeable level in Q3 2022, but some of those positions have been trimmed as expectations of a slower rate hike cycle developed.”

“As global growth slows through Q2 amid elevated geopolitical risks, we expect safe haven buying to lift the gold price. We have subsequently raised our year-end (2023) target to $1,900.”

See – Gold Price Forecast: XAU/USD may shine again, seen at $1,850 by end-2023 – Commerzbank

-

15:31

EUR/USD fluctuates around 1.0620s on softer US PMIs, and risk aversion

- S&P Global PMIs in the United States sparked recession jitters and bolstered the US Dollar.

- Eurozone data was better than estimated, though inflation remains high, while PMIs in contractionary territory.

- EUR/USD Price Analysis: Daily close below 1.0592 to exacerbate a fall to the 20-day EMA.

The EUR/USD remains subdued during the North American session, following monetary policy meetings by the Federal Reserve (Fed) and the European Central Bank (ECB), with both entities raising rates amidst a period of high and stickier inflation. However, a surprisingly hawkish tone employed by the ECB President Christine Lagarde capped the fall of the Euro (EUR) vs. the US Dollar (USD) amid a wide interest rate differential. Therefore, the EUR/USD is trading at 1.0620s, fluctuating.

Recession fear in the United States increased after the dismal PMIs report

Investors' sentiment remains sour after worldwide central banks continue to tighten monetary conditions. A light US economic docket featured the release of the S&P Global PMI for December missed the estimates, reigniting recessionary fears in the United States (US) economy. Manufacturing PMI dived to 46.2 vs. 47.8 expected, while the Services Index slid to 44.4 from 46.5 foreseen. Consequently, the S&P Global Composite Index dropped to 44.6 against the estimated 46.9.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said, “Business conditions are worsening as 2022 draws to a close, with a steep fall in the PMI indicative of GDP contracting in the fourth quarter at an annualized rate of around 1.5%.” Williamson added that hiring has slowed in the manufacturing and services segment. The survey suggests that Fed rate hikes, although taming inflation, recession risks tilted to the upside.

Of late, the New York Fed President John Williams commented that the labor market remains tight, and that would warrant further action by the Federal Reserve, said in a Bloomberg interview. Williams expects inflation to get towards 3 to 3.5% in 2023, though he added “that the real issue is how do we get it all the way” to the Fes’s 2% target.

Euro area data was encouraging though inflation remains in double digits

Meanwhile, the calendar was busy in the European session, with S&P Global PMIs released for the Euro area, France and Germany, with most of the figures being better than expected. Regarding the Harmonized Index for Consumer Prices (HICP), inflationary data for the Eurozone was 10.1% YoY, below the 10.6% of the previous month, though higher than the estimate of 10% reading. The core reading was unchanged at 5%.

Additionally, some ECB policymakers expressed that inflation poses a challenge, and most members expect further rate hikes at the following meetings.

EUR/USD Price Analysis: Technical outlook

From a daily chart perspective, the EUR/USD is still upward biased, though it should be said that a close below 1.0592 could pave the way for further downside. After the EUR/USD rallied to multi-month highs around 1.0736, since then, it has been a one-way drive south, though the Euro is set to finish the week positive. Oscillators with the Relative Strength Index (RSI) and the Rate of Change (RoC), suggest that a correction might be underway. Though the fall’s scope is unknown, it will face its first support at around 1.0500, closely followed by the 20-day Exponential Moving Average (EMA) dynamic support at 1.0479.

-

15:13

USD/MXN should be trading back at 19.00 sooner rather than later – ING

The Mexican Peso (MXN) has been underperforming recently. However, economists at ING expect the USD/MXN pair to move back toward 19.00.

Banxico dances toe-to-toe with the Fed

“Banxico followed the Fed again by hiking the policy rate by 50 bps to 10.50%. That keeps the 600 bps+ policy spread over US rates and should keep the MXN supported. Banxico also said that further rate hikes should be expected. In practice, this should mean another 50 bps hike in February to match the Fed.”

“MXN underperformance should not last long. High rates, low volatility, and Mexico proving the most likely candidate for nearshoring benefits all suggest that USD/MXN should be trading back at 19.00 sooner rather than later.”

-

14:56

US: S&P Global Services PMI slumps to 44.4 in December vs. 46.8 expected

- S&P Global Services PMI continued to decline in December.

- US Dollar Index stays in negative territory below 104.50.

S&P Global Services PMI declined to 44.4 in December's flash estimate from 46.2 in November. This print fell short of the market expectation of 46.8. Regarding the price pressure in the service sector, "inflationary pressures in the service sector cooled notably in December, as input costs rose at the softest pace since October 2020," said S&P Global. "Despite some material and labor costs rising, reports of lower wholesale and fuel prices eased pressure on cost burdens."

Further details of the publication revealed that the Composite PMI dropped to 44.5 from 46.4 in the same period.

Commenting on the data, "business conditions are worsening as 2022 draws to a close, with a steep fall in the PMI indicative of GDP contracting in the fourth quarter at an annualised rate of around 1.5%," noted Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Market reaction

The US Dollar came under modest selling pressure on this report and the US Dollar Index was last seen posting small daily losses at 104.42.

-

14:52

USD/CHF retreats from four-day highs after US S&P Global PMI

- Swiss franc weakens amid higher European bond yields.

- US Dollar firm on the back of risk aversion.

- USD/CHF up on Friday, but still down for the week.

The USD/CHF is rising for the second day in a row. It hit a four-day high at 0.9318 and the pulled back following the US S&P Global PMI that came in below expectations. Still, the Dollar continues to receive support from risk aversion.

USD/CHF off highs, still up

The USD/CHF pulled back to 0.9290 after the economic report but it is still up for the day supported by a stronger US Dollar across the board and a weaker Swiss Franc, following the European Central Bank meeting.

On Wednesday, USD/CHF bottomed at 0.9212, the lowest level since early March. It then started a bullish correction that gained momentum after central bank’s meetings. The Swiss National Bank, the Federal Reserve and the European Central Bank raised rates by 50 basis points to control inflation.

The hawkish tone of the ECB boosted German yields, and weighed on the Swiss Franc. The 10-year German yield jumped from 1.95% to 2.20%. The EUR/CHF cross rose from held above 0.9830 and now is testing 0.9900.

The last economic report of the week, showed the preliminary November US S&P Global Manufacturing PMI fell from 47.7 to 46.2, while the Service PMI fell from 46.2 to 44.4 against expectations of a recovery to 46.8. The numbers weakened the Dollar that pulled back across the board.

On a weekly basis, USD/CHF is still headed toward the lowest close since April, far from the bottom. It is the fourth weekly decline in a row. The rebound from the lows show some difficulties for the pair in extending the downside.

Technical levels

-

14:50

US: S&P Global Manufacturing PMI drops to 46.2 in December vs. 47.7 expected

- S&P Global Manufacturing PMI continued to edge lower in early December.

- US Dollar Index declined below 104.50 with the initial reaction.

The economic activity in the US manufacturing sector continued to contract at an accelerating pace in early December with S&P Global Manufacturing PMI dropping to 46.2 from 47.7 in November. This reading came in worse than the market expectation of 47.7.

"Manufacturers registered one of the sharpest declines in new orders since the 2008-9 financial crisis during December, as customer spending waned," S&P Global said in its publication. "The further acceleration in the pace of contraction in new business led to a steeper decrease in production levels."

Market reaction

With the initial reaction, the US Dollar Index declined modestly and was last seen losing 0.2% on the day at 104.38.

-

14:45

United States S&P Global Services PMI came in at 44.4 below forecasts (46.8) in December

-

14:45

United States S&P Global Manufacturing PMI below forecasts (47.7) in December: Actual (46.2)

-

14:45

United States S&P Global Composite PMI declined to 44.6 in December from previous 46.4

-

14:39

EUR/USD is unlikely to shoot further higher from here – MUFG

EUR/USD surged to its strongest level in over six months at 1.0737 on Thursday. Nonetheless, economists at MUFG Bank expect the pair to struggle to see more gains from here.

Scope for further notable gains in EUR/GBP

“The worsening risk sentiment means EUR/USD is unlikely to shoot further higher from here. Gains for the Euro versus the higher-beta G10 currencies seems more likely. That would be consistent with market conditions turning more volatile which could be the key consequence of some of these central bank meetings this week.”

“Following the more cautious message on future rate hikes by the BoE we see scope for further notable gains in EUR/GBP. Higher EUR/GBP is also consistent with worsening risk sentiment and higher volatility when EUR tends to outperform GBP.”

-

14:32

EUR/CHF could struggle to break above the 0.99 level – Rabobank

From its September low around 0.9410, EUR/CHF has recovered some ground. In view of the safe haven dynamic of the Franc, the growth risks in the Eurozone complicates the outlook for the pair, economists at Rabobank report.

Hawkish tone of the ECB initially provided further support for EUR/CHF

“The hawkish tone of the ECB initially provided further support for EUR/CHF. However, the ECB’s policy is essentially aimed at curbing an inflation rate which is to a large extent being led by higher energy and food prices. Tighter financial conditions combined with the risk that energy prices may rise again next year are bad news for growth.”

“In view of the fact that imports of expensive energy imports have weighed heavily on the Eurozone’s current account, the EUR could be more sensitive to a deterioration in risk appetite next year. Commonly, if the risk appetite in the Eurozone is under pressure, the CHF benefits from a safe haven bid.”

“Given our view that the EUR is not out of the woods, we see risk that EUR/CHF could struggle to break above the 0.99 level on a three-month view.”

-

14:06

EUR/USD: Three reasons why Euro may be prone to more weakness – Scotiabank

EUR/USD struggles despite hawkish ECB and rise in EZ yields. The pair may remain better offered for now for three reasons, according to economists at Scotiabank.

Cautious on the EUR’s near-term outlook

“Positioning (markets were long EUR running into the ECB).”

“Risk aversion (higher yields globally are weighing on stocks and lifting the USD).”

“Technical considerations (the EUR was starting to look overbought after its run higher).”

“We are cautious on the EUR’s near-term outlook but remain bullish from a longer run point of view.”

-

13:39

Fed's Williams: Possible Fed will hike more than FOMC terminal rate forecast

In an interview with Bloomberg TV on Friday, New York Federal Reserve President John Williams said that it was possible for the FOMC to hike more than the terminal rate projected in the dot plot.

Additional takeaways

"Fed is well on its way to where it needs to be."

"No need for funds rate over 6%."

"Supply chains are improving around the world."

"Seeing more factors helping to lower inflation."

"We are seeing good news in inflation data."

"Core services inflation remains an issue."

"US is not in a recession, doesn't expect it to fall into recession."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen trading flat on the day at 104.58.

-

13:37

GBP/USD recovers few pips from over a one-week low, manages to defend 200-day SMA

- GBP/USD oscillates in a narrow band near a one-week low touched earlier this Friday.

- The dismal UK data, dovish BoE weigh on the Sterling Pound and acts as a headwind.

- A combination of factors underpins the USD, which also contributes to capping the pair.

The GBP/USD pair struggles to capitalize on its modest intraday bounce from the 1.2120 area, or over a one-week low and remains on the defensive through the early North American session. The pair, so far, has managed to defend a technically significant 200-day SMA and is currently trading around the 1.2175 region.

A combination of factors undermines the British Pound, which, along with some dip-buying around the US Dollar, acts as a headwind for the GBP/USD pair. A dovish outcome from the Bank of England meeting on Thursday, with two MPC members voting to keep interest rates unchanged, undermines the GBP, which is further pressured by the disappointing UK macro data.

The UK Office for National Statistics reported that domestic Retail Sales fell 0.4% in November and were down 5.9% YoY. Furthermore, sales excluding volatile auto and fuel dropped by 0.3% during the reported month, missing consensus estimates. The data fuels concerns that the economy has entered a prolonged recession and favours the GBP/USD bears.

The US Dollar, on the other hand, draws support from a goodish pickup in the US Treasury bond yields, bolstered by a hawkish commentary by the Federal Reserve earlier this week. In fact, the US central bank signalled that it will continue to raise rates to crush inflation and projected at least an additional 75 bps increase in borrowing costs by the end of 2023.

Adding to this, the risk-off impulse - as depicted by a follow-through steep decline in the equity markets - and growing recession fears drive some haven flows towards the Greenback. This is seen as another factor capping gains for the GBP/USD pair. That said, some cross-driven strength stemming from an intraday pullback in the EUR/GBP cross helps limit the downside.

Nevertheless, spot prices remain on track to register modest weekly losses as traders look forward to the flash US PMI prints for December. Apart from this, the US bond yields and the broader risk sentiment will influence the USD price dynamics. This, in turn, should allow traders to grab short-term opportunities around the GBP/USD pair on the last day of the week.

Technical levels to watch

-

13:30

Canada Wholesale Sales (MoM) came in at 2.1%, above expectations (1.3%) in October

-

13:30

Canada New Housing Price Index (YoY) dipped from previous 5.1% to 4.1% in November

-

13:30

Canada Foreign Portfolio Investment in Canadian Securities climbed from previous $-22.27B to $8.46B in October

-

13:30

Canada Canadian Portfolio Investment in Foreign Securities declined to $-1.67B in October from previous $9.56B

-

13:30

Gold Price Forecast: XAU/USD may shine again, seen at $1,850 by end-2023 – Commerzbank

Gold price has had an eventful year, even though by the middle of December it is almost back at the level it was at the beginning of the year. Economists at Commerzbank expect the yellow metal to fall to $1,750 earlier next year before trending back higher towards $1,850 by end-2023.

Gold should be supported by the weakening of the USD

“We expect the Gold price to initially fall back towards $1,750 until it is clear that the Fed's cycle of interest rate hikes is over.”

“According to Fed Fund Futures, the market still sees the interest rate peak at slightly below 5%. In the short term, there is thus a need for an upward adjustment of interest rate expectations, which should weigh on Gold.”

“After what is expected to be the last interest rate hike in March, a period of unchanged rates is likely to follow before the Fed cuts the key rate again toward the end of 2023 in view of a weak economy and lower inflation. The Fed, on the other hand, is not yet forecasting this. As soon as the Fed also adopts this view, Gold should rise again. This should be the case in the second half of next year.”

“Gold should also be supported by the weakening of the US Dollar expected by our currency strategists.”

“We expect XAU/USD to rise in the second half of the year to $1,850 by the end of 2023.”

-

13:30

Canada New Housing Price Index (MoM) unchanged at -0.2% in November

-

12:45

AUD/USD struggles below 0.6700 mark amid risk-off, 100-day SMA holds the key for bulls

- AUD/USD turns lower for the second straight day and is pressured by a combination of factors.

- The Fed’s hawkish outlook, a pickup in the US bond yields act as a tailwind for the greenback.

- The risk-off mood further benefits the safe-haven USD and weighs on the risk-sensitive Aussie.

The AUD/USD pair meets with a fresh supply following an intraday uptick to the 0.6735 area and turns lower for the second straight day on Friday. Spot prices remain depressed near the 0.6680-0.6675 zone, or over a one-week low, flirting with the 100-day SMA support heading into the North American session.

A more hawkish commentary by the Federal Reserve earlier this week pushes the US Treasury bond yields higher and acts as a tailwind for the US Dollar, which, in turn, weighs on the AUD/USD pair. In fact, the US central bank signalled that it will continue to raise rates to crush inflation and projected at least an additional 75 bps increase in borrowing costs by the end of 2023.

Apart from this, the risk-off mood underpins the safe-haven buck and exerts additional pressure on the risk-sensitive Australian dollar. Worries that rapidly rising borrowing costs will lead to a deeper global downturn temper investors' appetite for perceived riskier assets. This is evident from a sea of red across the equity markets and driving haven flows towards the buck.

The intraday fall for the AUD/USD pair could also be attributed to some technical selling, especially after the overnight breakdown below a multi-week-old ascending trend line. Bearish traders now await sustained weakness below the 100-day SMA before positioning for a further appreciating move. This, in turn, will suggest that spot prices have topped out in the near term.

Next on tap is the US economic docket, featuring the release of the flash PMI prints for December. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to the AUD/USD pair. Trades will further take cues from the broader risk sentiment to grab short-term opportunities on the last day of the week.

Technical levels to watch

-

12:44

EUR/CHF to remain at levels below parity going forward – MUFG

The Swiss Franc is the top performing G10 currency after the US Dollar. Economists at MUFG Bank expect the EUR/CHF to remain below parity in the coming months.

SNB hikes but intervention a tool also

“The SNB hiked by 50 bps, taking the key policy rate to 1.00%. So despite a policy rate that is much lower than elsewhere, the SNB also stepped down the pace from 75 bps at the last meeting in September and signalled the potential for further hikes going forward. The stepdown in pace was well justified though with inflation in Switzerland much more under control than elsewhere.”

“The SNB can also play a key role in influencing expectations of CHF direction. SNB President Jordan stated that the SNB bought CHF for monetary policy purposes. Holding over USD800 bn of foreign currency to sell will act as a powerful influence in keeping the Franc strong in 2023.”

“We see EUR/CHF remaining at levels below parity going forward.”

-

12:16

GBP/USD: Net loss on the week suggests more weakness – Scotiabank

GBP/USD is trading modestly higher. However, net losses on the week leave the pair prone to more weakness, economists at Scotiabank report.

Intraday gains back through 1.2225 may provide some short-term relief

“Net losses on the week (so far) for the GBP leaves Cable looking vulnerable to more corrective pressure to the downside.”

“Support is 1.2100/05.”

“Intraday gains back through 1.2225 may provide some short-term relief but we expect better selling pressure to emerge near 1.2350.”

See: Sterling is not granted much potential for a recovery – Commerzbank

-

12:14

BOE Survey: Median expectation for peak bank rate is 4.25%

The Bank of England has recently published the finding of its latest Market Participants Survey that showed the median expectation for peak bank rate stood at 4.25%.

Additional takeaways

"Bank rate expected to peak in March 2023."

"29.8% chance of cut to bank rate within the next year."

"Participants see 76 bln sterling of QE unwind from November 2022-September 2023, 80 billion sterling unwind from September 2023 to September 2024."

"CPI seen at 8.3% in 6 months, 5.5% in one year, 3% in 2 years, 2% in 3 years."

Market reaction

GBP/USD extended its recovery after this publication and was last seen posting modest daily gains at 1.2193.

-

12:02

EUR/USD will find difficult to persistently leave the gravity force of parity – Danske Bank

EUR/USD holds above the 1.06 level. Nonetheless, economists at Danske Bank believe that the pair will struggle to leave the gravity force of parity.

Multiple potential EUR/USD drivers

“Looking ahead it is a tough balancing act for FX markets. On the one hand, higher EUR rates is a clear boost to the carry-attractiveness of the EUR. On the other hand, higher real rates is set to hit Eurozone growth, which is already suffering from the last year’s negative terms-of-trade shock. This will hurt the investment case of Eurozone assets making the EUR look less attractive compared to peers.”

“In the near term, our bearish case for EUR/USD is under pressure. However, we still think EUR/USD is a sell-on-rallies rather than a buy-on-dips.”

“Our adjusted MEVA-model estimates has EUR/USD close to 0.90 as fair (based on terms of trade, unit labour costs and real rates) and unless global growth prospects accelerate next year we think it will remain difficult for EUR/USD to persistently leave the gravity force of parity.”

-

12:01

India FX Reserves, USD climbed from previous $561.16B to $564.07B in December 9

-

12:01

India Bank Loan Growth came in at 17.5%, above expectations (16.8%) in November 28

-

11:59

USD/CAD recovers modest intraday losses, remains below 1.3700 ahead of US PMIs

- USD/CAD attracts some dip-buying on Friday and is supported by a combination of factors.

- Retreating oil prices undermines the Loonie and acts as a tailwind amid a modest USD uptick.

- A sustained move beyond the 1.3700 mark is needed to support prospects for additional gains.

The USD/CAD pair reverses an intraday dip to the 1.3620-1.3615 area and hits a fresh weekly high during the mid-European session on Friday. Spot prices, however, struggle to capitalize on the move and remain below the 1.3700 mark, though the bias seems tilted in favour of bullish traders.

Crude oil prices extend the previous day's retracement slide from over a one-week high and undermine the commodity-linked Loonie. This, along with the emergence of some US Dollar dip-buying, is seen acting as a tailwind for the USD/CAD pair. Investors seem worried that rapidly rising borrowing costs could lead to a deeper global economic downturn and dent fuel demand, which, in turn, is exerting pressure on the black liquid for the second straight day.

The USD, on the other hand, draws support from a more hawkish commentary by the Federal Reserve and is looking to build on the overnight solid rebound from a six-month low. It is worth recalling that the US central bank signalled on Wednesday that it will continue to raise rates to crush inflation. This, in turn, triggers a further recovery in the US Treasury bond yields. Apart from this, the risk-off impulse offers additional support to the safe-haven buck.

The prospects for further policy tightening by major central banks, along with recession fears, take its toll on the global risk sentiment. This is evident from a sea of red across the equity markets, which drives investors to take refuge in traditional safe-haven assets. The USD/CAD bulls, meanwhile, await a sustained strength beyond the 1.3700 round-figure mark before positioning for an extension of the upward trajectory witnessed over the past month or so.

Traders now look forward to the US economic docket, featuring the release of the flash PMI prints for December. This, along with the US bond yields and the broader risk sentiment, will drive the USD demand and provide some impetus to the USD/CAD pair. Apart from this, oil price dynamics should also contribute to producing short-term opportunities on the last day of the week.

Technical levels to watch

-

11:56

AUD/USD to suffer a deeper down move on failure to hold 0.6640/10 – SocGen

AUD/USD stabilises after 2.35% drop yesterday, most since March 2020. Holding above 0.6640/10 support zone is crucial to avoid a deeper fall, economists at Société Générale report.

Move beyond 0.6900 essential for affirming continuation in up-move

“Establishing itself beyond 0.6900 is essential for affirming continuation in up-move.”

“A short-term consolidation is not ruled out; lower end of recent range at 0.6640/0.6610 is first layer of support. In case this gets violated, a deeper down move is likely towards 0.6520, the 50% retracement of the bounce and 0.6340.”

-

11:15

SNB: Situation in Switzerland will be of greater significance for the FX market – Commerzbank

The Swiss central bankers once again changed their intervention strategy. In the opinion of economists at Commerzbank, the situation in Switzerland will be of greater significance for the FX market.

The Franc will become a currency that is more complex to value

“Interventions in favour of the Franc would no longer be caused by CHF depreciation. There will only be interventions in favour of the Franc if the SNB considers it necessary from a monetary policy point of view.”

“We now have to figure out whether the SNB’s monetary policy strategy is working out, in particular whether inflation develops as the central bankers had hoped. And if that is not the case, we have to form an opinion as to whether the SNB will prefer to ‘only’ hike interest rates or whether it might prefer to intervene or do both.”

“One thing is clear: the times when Swiss inflation data was almost irrelevant for the CHF exchange rates are likely to be well and truly over. The Franc will become a currency that is more complex to value.”

“Just to ensure that there are no misunderstandings: interest rate policy remains the most important monetary policy tool. But at least the SNB took a first step towards exchange rate policy. That is quite wise for a small, open economy. It sounds quite sensible that in the future the situation in Switzerland will be of greater significance for the FX market.”

-

11:14

China: Foundation for economic recovery is not solid

Citing Chinese state media, Reuters is reporting headlines from China's annual Central Economic Work Conference.

Key takeaways

"Foundation for China's economic recovery is not solid."

"China's economy faces relatively big pressures from shrinking demand, supply shock and weakening expectations."

"China will implement prudent monetary policy in 2023."

"China will implement proactive fiscal policy in 2023."

"China's monetary policy will be precise and forceful."

"China will keep liquidity reasonably ample."

"China should better coordinate epidemic prevention and control and economic and social development."

"China will step up macro economic adjustments, strengthen policy coordination."

"China will expand domestic demand, prioritise consumption recovery."

"China will continue to give full play to the role of exports in supporting the economy."

"Housing is for living, not for speculation."

"China will ensure healthy development of property market."

"China will meet reasonable financing needs of the property industry."

"China will effectively prevent and mitigate the risks of high-quality leading property developers."

"China will support rigid and improved housing demand."

"China will encourage private investment in key investment projects."

"China will safeguard bottom lines for preventing systemic risks."

Market reaction

Markets remain risk-averse with the US stock index futures losing around 1% following these comments.

-

10:39

EUR/USD to see an excess of bullishness in the coming days – SocGen

The ECB outlined plans to begin quantitative tightening. Thus, the Euro has still got plenty of upward momentum, in the view of Kit Juckes, Chief Global FX Strategist at Société Générale.

1.0735 will be a crucial barrier to overcome

“With QT coming in Europe (and remember, it was the cocktail of QE and negative rates that saw EUR/USD average 1.13 in the 5 years to 2019, down from 1.33 in the 5 years to 2014), the Euro has still got plenty of upward momentum.”

“A January hangover seems more than likely but not before an excess of bullishness in the coming days, even if yesterday’s high (1.0735) will be a crucial barrier to overcome.”

-

10:33

Gold Price Forecast: XAU/USD hangs near one-week low; risk-off mood limits downside

- Gold price surrenders its modest intraday gains and hangs near a one-week low set on Thursday.

- A more hawkish stance adopted by major central banks acts as a headwind for the commodity.

- The emergence of some US Dollar buying further contributes to capping gains for the XAU/USD.

- The prevalent risk-off environment lends support and helps limit the downside for Gold price.

Gold price struggles to capitalize on its modest intraday uptick and attracts fresh sellers near the $1,785 region on Friday. The XAU/USD slips below the $1,780 level during the first half of the European session and hovers around a one-week low touched on Thursday.

Hawkish central banks act as a headwind for Gold price

The prospects for further policy tightening by major central banks turn out to be a key factor acting as a headwind for the non-yielding Gold price. In fact, the Federal Reserve signalled on Wednesday that it will continue to raise rates to crush inflation. Moreover, policymakers see the terminal rate rising to 5.1%, up from the 4.6% level forecasted in September. The European Central Bank (ECB) also struck a hawkish tone on Thursday and indicated that more interest rate hikes are needed to tame inflation. The Bank of England, meanwhile, offered a similar message and said that more rate hikes were likely in its fight against stubbornly high inflation.

Modest USD uptick contributes to cap Gold price

Apart from this, the emergence of some US Dollar dip-buying, bolstered by a goodish pickup in the US Treasury bond yields, further contributes to capping the upside for the Dollar-denominated Gold price. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, is now looking to build on the previous day's solid rebound from its lowest level since mid-June. That said, the downside remains cushioned, at least for the time being, amid the prevalent risk-off environment, which tends to benefit the safe-haven XAU/USD.

Risk-off impulse could limit losses for Gold price

The market sentiment remains fragile amid concerns that rapidly rising borrowing costs could trigger a deeper global economic downturn. This is evident from a further steep decline in the equity markets, which might force investors to take refuge in traditional safe-haven assets and lend some support to Gold price. This makes it prudent to wait for strong follow-through selling before confirming that the XAU/USD has topped out and positioning for any meaningful corrective pullback in the near term.

Gold price technical outlook

From a technical perspective, the recent two-way price moves around the very important 200-day Simple Moving Average (SMA) might be categorized as a bullish consolidation phase. Moreover, oscillators on the daily chart are holding in the positive territory and support prospects for further gains. That said, repeated failures to find acceptance, or capitalize on the move beyond the %1,800 mark warrant some caution for aggressive traders.

Gold price key levels to watch

-

10:30

Russia Interest rate decision meets forecasts (7.5%)

-

10:13

EUR/GBP to reach 0.89 in the first quarter of 2023 – ING

EUR/GBP bore the brunt of yesterday's Euro strength. Economists at ING expect the pair to hit 0.89 in the first quarter of next year.

November UK Retail Sales figures look very poor

“EUR/GBP faces the double whammy not only from the hawkish ECB but also from what the hawkish ECB means for the global risk environment. Sterling is a high beta on global risk given its large current account deficit and the large role of financial services in the UK economy.”

“We have an 0.89 forecast for EUR/GBP in 1Q23 and yesterday's ECB move supports the forecast. We have also just seen November UK Retail Sales figures, which all look very poor.”

“Interestingly, the Swiss National Bank (SNB) will protect the Swiss Franc a lot more than the BoE will protect Sterling and that is why we see GBP/CHF heading lower too.”

-

10:02

Greece Unemployment Rate (QoQ): 11.6% (3Q) vs previous 12.4%

-

10:01

Italy Consumer Price Index (YoY) meets forecasts (11.8%) in November

-

10:01

Italy Consumer Price Index (MoM) meets forecasts (0.5%) in November

-

10:01

Italy Consumer Price Index (EU Norm) (YoY) came in at 12.6%, above forecasts (12.5%) in November

-

10:01

Italy Consumer Price Index (EU Norm) (MoM) came in at 0.7%, above expectations (0.6%) in November

-

10:01

European Monetary Union Trade Balance s.a. above forecasts (€-48.6B) in October: Actual (€-28.3B)

-

10:01

European Monetary Union Harmonized Index of Consumer Prices (MoM) meets forecasts (-0.1%) in November

-

10:00

European Monetary Union Harmonized Index of Consumer Prices (YoY) came in at 10.1%, above expectations (10%) in November

-

10:00

European Monetary Union Core Harmonized Index of Consumer Prices (MoM) meets expectations (0%) in November

-

10:00

European Monetary Union Core Harmonized Index of Consumer Prices (YoY) in line with forecasts (5%) in November

-

10:00

European Monetary Union Trade Balance n.s.a. above expectations (€-48.9B) in October: Actual (€-26.5B)

-

09:55

Market is trading NOK at too weak levels – Commerzbank

Antje Praefcke, FX Analyst at Commerzbank, believes that Norges Bank is unlikely to take a dovish approach. Thus, the Norwegian Krone is undervalued at current levels.

Assuming that NB will immediately take a dovish approach is wrong

“Norges Bank was one of the first central banks to start the rate hike cycle. This is why, similar to the Fed, it might be one the first ones to end and reverse it. However, to assume that it will immediately take a dovish approach is wrong in my opinion, as the data does not suggest that.”

“I stick to my view that the market is trading NOK at too weak levels.”

-

09:52

ECB’s Holzmann: The choice was between hawkish 50 bps or dovish 75 bps rate hike

European Central Bank (ECB) policymaker Robert Holzmann said on Friday that “the choice was between hawkish 50 basis points (bps) or dovish 75 bps rate hike.”

Additional quotes

“ECB to go deep into restrictive territory if needed.”

“Does not want to say where the terminal rate is.”

Related reads

- EUR/USD sticks to modest intraday gains, hovers around mid-1.0600s post-Eurozone PMIs

- EUR/GBP prolongs the post-ECB rally, climbs to one-month high around 0.8770 region

-

09:48

ECB’s Rehn: 50 bps hikes likely in Feb, March

European Central Bank (ECB) Governing Council member Olli Rehn said on Friday, “50 basis points (bps) hikes are likely in February and March.”

He added that there is “quite some way to go with rate hikes.”

Market reaction

EUR/USD is off the highs, trading around 1.0610 despite the hawkish comments from the ECB policymaker.

-

09:46

EUR/GBP prolongs the post-ECB rally, climbs to one-month high around 0.8770 region

- EUR/GBP gains traction for the second straight day and climbs to a nearly one-month high.

- The ECB’s hawkish outlook continues to underpin the Euro and extends support to the cross.

- The dismal UK Retail Sales data weigh on the British Pound and provide an additional lift.

The EUR/GBP cross is building on the previous day's strong positive move and gaining traction for the second successive day on Friday. The momentum extends through the first half of the European session and lifts spot prices to a nearly one-month high, around the 0.8770 region in the last hour.

A more hawkish stance adopted by the European Central Bank (ECB) on Thursday continues to underpin the shared currency, which turns out to be a key factor acting as a tailwind for the EUR/GBP cross. In fact, the ECB indicated that it will need to raise borrowing costs significantly further to tame inflation, which remains far too high and is projected to stay above the target for too long.

Adding to this, Friday's release of the better-than-expected flash Eurozone PMIs, suggesting that the economic downturn in the region eases in December, offers additional support to the Euro. The British Pound, on the other hand, is pressured by dismal domestic data, showing that Retail Sales fell again in November and fueling concerns that the economy has already entered a prolonged recession.

Apart from the aforementioned fundamental factors, sustained strength beyond a previous strong support breakpoint, around the 0.8700 mark, seems to have prompted some technical buying. any subsequent move up, however, is more likely to confront stiff resistance near the 0.8800-0.8810 supply zone. The latter should act as a pivotal point, which if cleared will be seen as a fresh trigger for bulls.

Technical levels to watch

-

09:32

UK Preliminary Services PMI advances to 50.0 in December vs. 48.5 expected

- UK Manufacturing PMI dropped to 44.7 in December, a big miss.

- Services PMI in the UK comes in at 50.0 in December, beating estimates.

- GBP/USD remains heavily offered near 1.2140 on mixed UK PMIs.

The seasonally adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) dropped further to 44.7 in December versus 46.3 expected and 46.5 – in November’s final reading.

Meanwhile, the Preliminary UK Services Business Activity Index for December arrived at 50.00 when compared to November’s final print of 48.8 and 48.5 expected.

Chris Williamson, Chief Business Economist at S&P Global, commented on the survey

“The December data add to the likelihood that the UK is in recession, with the PMI indicating a 0.3% GDP contraction in the fourth quarter after the 0.2% decline seen in the three months to September.”

“For now, the downturn looks to be relatively mild, and the easing in the rate of decline in December is encouraging news, as is the further marked cooling of inflationary pressures.”

FX implications

Mixed UK Services PMI fails to move the GBP/USD pair. The spot is trading at 1.2140, down 0.29% on the day.

-

09:30

United Kingdom S&P Global/CIPS Manufacturing PMI came in at 44.7, below expectations (46.3) in December

-

09:30

United Kingdom S&P Global/CIPS Services PMI above expectations (48.5) in December: Actual (50)

-

09:30

United Kingdom S&P Global/CIPS Composite PMI came in at 49, above forecasts (48) in December

-

09:29

USD Index may have put in some kind of low near 103.50 on Wednesday – ING

The Dollar mounted a modest fightback yesterday. Economists at ING expect the US Dollar Index (DXY) to have found support from this week’s events.

A poor environment for equities and commodities

“Slowdown fears will remain in the ascendancy and this looks like a poor environment for equities and commodities (though this latter asset class could find support from the supply side).”

“We would like to think DXY has put in some kind of low near 103.50 on Wednesday and that this week's re-assessment of global growth can provide the defensive, high-yielding Dollar with some support.”

“Let's see whether 104.00/104.20 support can hold out short-term and indeed whether the Dollar can hold out at these levels until January when seasonal trends turn more supportive.”

-

09:13

EUR/USD sticks to modest intraday gains, hovers around mid-1.0600s post-Eurozone PMIs

- EUR/USD regains some positive traction on Friday amid a modest USD weakness.

- The ECB’s hawkish outlook acts as a tailwind for the Euro and remains supportive.

- A combination of factors should limit the USD losses and cap the upside for the pair.

The EUR/USD pair attracts some dip-buying on Friday and reverses a part of the overnight retracement slide from its highest level since June 9. The pair sticks to its modest intraday gains through the first half of the European session and is currently trading around mid-1.0600s.

The European Central Bank struck a hawkish tone on Thursday and indicated that it will need to raise borrowing costs significantly further to tame inflation. This, in turn, continues to act as a tailwind for the shared currency. Apart from this, the emergence of fresh US Dollar selling is seen lending some support to the EUR/USD pair.

On the economic data front, the flash version of the Eurozone PMIs showed a slight improvement in the private-sector business activity during December. The gauge, however, remains in contraction territory, which, along with looming recession risks, might hold back bulls from placing fresh bets around the Euro and cap the EUR/USD pair.

The USD downtick, meanwhile, is likely to remain limited amid a hawkish assessment of the FOMC decision on Wednesday, signalling that it will continue to raise rates to crush inflation. Furthermore, the prevalent risk-off mood should help revive demand for the safe-haven greenback and contribute to keeping a lid on the EUR/USD pair.

Even from a technical perspective, repeated failures to find acceptance above the 1.0700 mark could be seen as the first sign of bullish exhaustion. This makes it prudent to wait for some follow-through buying before positioning for an extension of the EUR/USD pair's well-established uptrend witnessed over the past month or so.

Traders now look to the release of the flash US PMI prints for the current month, due later during the early North American session. This, along with the broader risk sentiment, will influence the USD price dynamics and provide some impetus to the EUR/USD pair. Nevertheless, spot prices remain on track to register the highest weekly close since May.

Technical levels to watch

-

09:09

FX option expiries for Dec 16 NY cut

FX option expiries for Dec 16 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0400 1.7b

- 1.0430 479m

- 1.0450 2.1b

- 1.0500 2.1b

- 1.0550 455m

- 1.0600 528m

- 1.0650 425m

- 1.0700 718m

- 1.0750 596m

- 1.0800 1.1b

- GBP/USD: GBP amounts

- 1.2000 350m

- 1.2100 337m

- 1.2300 460m

- 1.2500 571m

- USD/JPY: USD amounts

- 135.00 1.7b

- 136.00 1.2b

- 137.00 786m

- 137.90 400m

- 138.10 400m

- 140.00 1.8b

- USD/CHF: USD amounts

- 0.9400 500m

- 0.9800 358m

- 1.0000 1.1b

- AUD/USD: AUD amounts

- 0.6700 875m

- 0.6725 300m

- 0.6800 437m

- 0.6840 837m

- 0.6900 325m

- 0.7060 561m

- USD/CAD: USD amounts

- 1.3350 850m

- 1.3400 1b

- 1.3565 567m

- 1.3600 310m

- 1.3700 595m

- NZD/USD: NZD amounts

- 0.6300 533m

- 0.6600 302m

- EUR/GBP: EUR amounts

- 0.8400 850m

- 0.8900 729m

- 0.9000 399m

- 0.9050 475m

-

09:04

Sterling is not granted much potential for a recovery – Commerzbank

As generally expected, the Bank of England (BoE) hiked the key rate by 50 bps to 3.50%. Why did Sterling ease following the decision? In my view of Antje Praefcke, FX Analyst at Commerzbank, there are three different possible explanations.

If you hesitate once, no one will trust you again

“(1.) The market might still assume that the BoE will not act with sufficient determination against inflation. Always along the lines of: if you hesitate once no one will trust you again.”

“(2.) Or the market is concerned that the BoE might hike its key rate too quickly after all and then overshoot, thus exacerbating the economic misery that is already foreseeable.”

“(3.) The market seems to generally question the willingness of central banks to tighten monetary policy. After the BoE hesitated for months, the market now thinks it can be least trusted to suddenly turn into an uber-hawk so that Sterling does not stand a chance either against the euro or the Dollar.”

“I tend towards a mix between (1.) and (3.). However, whichever explanation you pick, the result is fundamentally the same: Sterling is not granted much potential for a recovery and is likely to generally remain under depreciation pressure.”

-

09:02

Italy Global Trade Balance increased to €0.104B in October from previous €-1.023B

-

09:02

Eurozone Preliminary Manufacturing PMI improves to 47.8 in December vs. 47.1 expected

- Eurozone Manufacturing PMI arrives at 47.8 in December vs. 47.1 expected.

- Bloc’s Services PMI rises to 49.1 in December vs. 48.5 expected.

- EUR/USD extends gains above 1.0650 on the encouraging Eurozone PMIs.

The Eurozone manufacturing sector contraction eased in December, the latest manufacturing activity survey from S&P Global research showed on Friday.

The Eurozone Manufacturing purchasing managers index (PMI) arrived at 47.8 in December vs. 47.1 expectations and 47.1 last. The index reached a three-month top.

The bloc’s Services PMI stood at 49.1 in December vs. 48.5 expected and November’s 48.5, hitting a four-month high.

The S&P Global Eurozone PMI Composite climbed to 48.8 in December vs. 48.0 estimated and 47.8 previous. The gauge registered fresh four-month highs.

Comments from Chris Williamson, Chief Business Economist at S&P Global

“While the further fall in business activity in December signals a strong possibility of recession, the survey also hints that any downturn will be milder than thought likely a few months ago.”

“The data for the fourth quarter are consistent with GDP contracting at a quarterly rate of just less than 0.2%, and forward-looking indicators are currently boding well for the rate of decline to ease further in the first quarter.”

FX implications

EUR/USD extends gains above 1.0650, cheering the upbeat euro area PMIs. The spot is adding 0.22% on the day.

-

09:02

Italy Trade Balance EU came in at €-2.123B, above expectations (€-4.583B) in October

-

09:00

European Monetary Union S&P Global Composite PMI came in at 48.8, above expectations (48) in December

-

09:00

European Monetary Union S&P Global Services PMI came in at 49.1, above forecasts (48.5) in December

-

09:00

European Monetary Union S&P Global Manufacturing PMI came in at 47.8, above expectations (47.1) in December

-

08:51

German central bank projects a recession in 2023

Germany’s central bank, the Bundesbank, said in its latest report, “a recession is now expected for Germany in 2023.”

Additional takeaways

But the downturn is not seen as severe.

Sees 2023 GDP growth at -0.5% vs. 2.4% previous.

Sees 2024 GDP growth at 1.7% vs. 1.8% previous.

Sees 2023 inflation at 7.2% vs. 4.5% previous.

Sees 2024 inflation at 4.1% vs. 2.6% previous.

Related reads

- German Preliminary Manufacturing PMI rises to 47.4 in December vs. 46.3 expected

- ECB’s Villeroy: Must not speculate on the number of rate hikes

-

08:46

ECB’s Villeroy: Must not speculate on the number of rate hikes

European Central Bank (ECB) Governing Council member and French central bank governor Francois Villeroy de Galhau made some comments on the interest rates and economic outlook on Friday.

Key quotes

ECB does not want to provoke a recession.

Should escape a 'hard landing' for the economy.

Too early to talk about the terminal rate.

Must not speculate on the number of rate hikes.

Market reaction

EUR/USD was last seen trading at 1.0640, up 0.15% on the day.

-

08:46

EUR/USD: Unlikely to see a short-term top is in place while above 1.0600/10 – ING

EUR/USD holds in positive territory on Friday. It is hard to say with any confidence that a short-term top is in place as the pair continues to trade and close above 1.0600/10, in the opinion of economists at ING.

Sticking with bearish EUR/USD views into the New Year

“For the time being, we will stick with our bearish EUR/USD views into the New Year.”

“Today's data calendar features the provisional PMI releases for December. These are all expected to remain firmly in recession territory. And we will also see the eurozone October trade balance, which is expected to bounce back from a EUR37 bn deficit in the prior month.”

“Let's see whether today's EUR/USD rally stalls at the 1.0665/0680 area. However, as long as EUR/USD continues to trade and close above 1.0600/10, it is hard to say with any confidence that a short-term top is in place.”

-

08:33

German Preliminary Manufacturing PMI rises to 47.4 in December vs. 46.3 expected

- German Manufacturing PMI arrives at 47.4 in December vs. 46.3 expected.

- Services PMI in Germany jumps to 49.0 in December vs. 46.3 expected.

- EUR/USD remains unfazed at around 1.0635 on upbeat German PMIs.

The German manufacturing and services sectors’ activtiy downturn eased further in December as price pressures continue to cool down, the preliminary manufacturing activity report from S&P Global/BME research showed this Friday.

The Manufacturing PMI in Eurozone’s economic powerhouse came in at 47.4 this month vs. 46.3 expected and 46.2 prior. The index jumped to two-month highs.

Meanwhile, Services PMI jumped from 46.1 in November to 49.0 in December as against the 46.3 estimated. The PMI hit the lowest level in two months.

The S&P Global/BME Preliminary Germany Composite Output Index arrived at 48.9 in December vs. 46.5 expected and November’s 46.3. The gauge reached a three-month peak.

Key comments from Phil Smith, Economics Associate Director at S&P Global

“The latest flash PMI survey paints a somewhat less gloomy picture of Germany’s economy as we head towards the end of the year.”

“Although still in contraction territory, the headline index pointed to a shallower downturn in overall business activity in December, as the declines in both manufacturing and services eased.”

FX implications

EUR/USD is keeping its range play intact around 1.0635 on the upbeat German data. The spot is trading 0.14% higher on the day.

-

08:30

Hong Kong SAR Unemployment rate above expectations (3.5%) in November: Actual (3.7%)

-

08:30

Germany S&P Global/BME Manufacturing PMI came in at 47.4, above forecasts (46.3) in December

-

08:30

Germany S&P Global/BME Services PMI above forecasts (46.3) in December: Actual (49)

-

08:30

Germany S&P Global/BME Composite PMI came in at 48.9, above forecasts (46.5) in December

-

08:28

Silver Price Analysis: XAG/USD seems vulnerable near one-week low, could slide to $22.00

- Silver edges lower for the second successive day and drops to over a one-week low.

- The technical setup favours bearish traders and supports prospects for further losses.

- Attempted recovery back above the $23.00 round figure is more likely to get sold into.

Silver adds to the previous day's heavy losses and remains under some selling pressure for the second successive day on Friday. The white metal maintains its offered tone through the early European session and drops to over a one-week low, around the $22.75-$22.70 region in the last hour.

Looking at the broader picture, the overnight sustained break through a one-week-week-old ascending channel and the 100-hour SMA was seen as a fresh trigger for bearish traders. Furthermore, acceptance below the 200-hour SMA, along with bearish oscillators on hourly charts, supports prospects for a further near-term depreciating move for the XAG/USD.

That said, technical indicators on the daily chart - though have been losing positive traction - are still holding in the bullish territory. Hence, any subsequent fall is likely to find decent support near a horizontal resistance breakpoint, around the $22.00 mark. The latter should act as a pivotal point, which if broken should pave the way for deeper losses.

On the flip side, attempted recovery beyond the $23.00 mark (200-hour SMA) could attract fresh sellers near the 100-hour SMA, near the $23.40-$23.45 region. This is followed by the aforementioned ascending trend-channel support breakpoint, around the $23.70 zone, and the $24.00 level. A convincing breakout through the said barriers is needed to negate the negative outlook.

Silver 1-hour chart

Key levels to watch

-

08:20

Denmark: The decision to mirror ECB 1:1 should send EUR/DKK lower and down to 7.4365 again – Danske Bank

Danmarks Nationalbank (DN) hiked its key policy rate by 50 bps to 1.75%. The decision to mirror ECB 1:1 should send EUR/DKK back down to 7.4365 near-term, economists at Danske Bank report.

50 bps rate hike amid a still strong DKK

“DN raised its key policy rates 50 bps to 1.75% in response to the 50 bps rate hike from ECB earlier today. DN thus opted to follow ECB 1:1 this time despite the still strong DKK vis-à-vis EUR.”

“The market was expecting DN to hike about 10 bps less than ECB, so the decision to follow ECB 1:1 will likely send EUR/DKK lower and down to 7.4365 again, trigger renewed FX intervention selling over the coming weeks and trigger a further widening of the spread to ECB’s policy rate.”

“We still expect DN to hike 10 bps less than ECB in February and to follow ECB after that, i.e. we forecast DN to hike its key policy rate to 2.90% in May.”

-

08:15

France S&P Global Composite PMI below forecasts (48.9) in December: Actual (48)

-

08:15

France S&P Global Services PMI came in at 48.1, below expectations (49.1) in December

-

08:15

France S&P Global Manufacturing PMI came in at 48.9, above forecasts (48.2) in December

-

08:03

Austria HICP (YoY): 11.2% (November) vs previous 11.5%

-

08:02

Austria HICP (MoM) declined to 0.2% in November from previous 1.2%

-

07:52

EUR/USD: Revision of key rate expectations might end up being slightly positive for the Euro – Commerzbank

It is not of paramount importance for exchange rates how much currencies yield at the current end or close to it. What is more decisive is the yield expected long-term, in the view of economists at Commerzbank.

Fed will cut its key rate again quickly and significantly

“The market expects that following the rate hike cycle the Fed will cut its key rate again quickly and significantly. It only expects very moderate rate cuts at the end of the rate hikes. While that remains the case, any further Fed rate hike is likely to be seen as a mistake – or at least as less USD-relevant.”

“The areas below the curves of the key rate expectations are much more relevant than the position of the curve at present or in the near future. For that reason, we expect that a revision of the key rate expectations, which happens concurrently for ECB and Fed, might end up being slightly positive for the Euro.”

-

07:43

USD/JPY keeps the red below mid-137.00s amid softer USD, downside remains cushioned

- USD/JPY comes under fresh selling pressure on Friday amid a modest USD weakness.

- The Fed’s hawkish outlook to revive the USD demand and lend support to the major.

- Fading safe-haven demand could undermine the JPY and help limit losses for the pair.

The USD/JPY pair meets with a fresh supply on Friday and erodes a part of the previous day's rally to over a two-week high. The pair maintains its offered tone through the early European session, though has managed to recover a few pips from the daily low and is currently placed just below mid-137.00s.

The US Dollar struggles to capitalize on the overnight recovery move from a six-month low and comes under some renewed selling pressure on the last day of the week. This, in turn, is seen as a key factor acting as a headwind for the USD/JPY pair. That said, the Fed's hawkish outlook should help revive the USD demand and lend some support to the major, at least for the time being.

It is worth recalling that the US central bank struck a more hawkish tone on Wednesday and signalled that it will continue to raise rates to crush inflation. In the so-called dot plot, policymakers projected at least an additional 75 bps increases in borrowing costs by the end of 2023 and see the terminal rate rising to 5.1%, higher than the 4.6% level forecasted in September.

Apart from this, signs of stability in the financial markets could undermine the safe-haven Japanese Yen and contribute to limiting the downside for the USD/JPY pair. Even from a technical perspective, repeated failures to find bearish acceptance below the very important 200-day SMA and the subsequent bounce warrant caution before positioning for a further near-term depreciating move.

Market participants now look forward to the release of the flash US PMI prints, due later during the early North American session. The data might influence the USD price dynamics, which, along with the broader risk sentiment, should provide some impetus to the USD/JPY pair. Nevertheless, spot prices remain on track to post modest gains for the second successive week.

Technical levels to watch

-

07:33

Approaching the end of USD dominance – ANZ

The velocity of the USD’s rise has been driven by the pace and size of interest rate increases. In the view of economists at ANZ Bank, we are approaching the end of US Dollar dominance.

Scope for USD consolidation in the short term

“We expect currency volatility to continue into 2023, as the synchronised global tightening cycles and recession risks continue to drive returns.”

“We think the USD’s peak was set when the DXY touched 114 in September after rising over 20% since January. The USD’s exceptionalism premium has diminished on rising fears of a US recession. The energy and political risk premiums in Europe and the UK have also waned.”

“In the short term, there is scope for USD consolidation. We expect it to receive safe haven attention due to the rising fear of recessions , and there is also room forhawkish surprises from the Fed that are not currently reflected in the price.”

-

07:24

Forex Today: US Dollar consolidates recovery gains ahead of PMIs

Here is what you need to know on Friday, December 16: