Notícias do Mercado

-

20:00

Dow 15,861.28 +39.65 +0.25%, Nasdaq 3,969.50 +3.92 +0.10%, S&P 500 1,789.05 +7.05 +0.40%

-

19:20

American focus : dollar weakened on Yellen’s speech

The U.S. dollar fell against major currencies after the deputy chairman of the U.S. Federal Reserve Janet Yellen signaled that no major changes in the central bank will not if she will be his next head .

Yellen pointed out that the Fed will consider folding its program of bond purchases at 85 billion dollars a month for the next meetings on monetary policy, although she did not say if it supports these early steps .

"We take note on the costs and effectiveness of the program as it is implemented . At this stage, I think that the benefits exceed the costs , "- said Yellen in early hearings in the Senate Banking Committee , dedicated to her nomination to the post of chairman of the Fed.

The Fed announced that complete the program of bond purchases if the costs and risks become too great. Yellen signaled that , in its opinion , such a moment has not come yet .

She said that there are risks associated with too early or too late completion of the program , as well as the loose monetary policy of the Fed in general.

Impact on the dollar also provided data that was presented by the Ministry of Labour, which showed that the number of people who applied for the first time unemployment benefits fell again last week , registering with the fifth week in a row reduction , that is another sign of strengthening market labor. According to the report , the seasonally adjusted number of initial claims for unemployment benefits fell by 2,000 - to a level of 339,000 in the week ended November 9. Economists forecast that the value of this indicator reduced to the level of 331 thousand also add that the figure for the previous week was revised up from 336 thousand to 341 thousand

Earlier, the euro fell against the dollar, which was associated with the release of a weak report on the euro area. According to data from Eurostat , in the third quarter eurozone economy barely expanded , creating new concerns about the fact that the region faces a combination of stagnation , low prices and high unemployment that threatens to constrain development in the foreseeable future . According to the report , the euro zone 's gross domestic product in the third quarter increased by only 0.1 % compared with the previous quarter . Recall that the eurozone economy declined six consecutive quarters since the end of 2011 , but was able to stop this series in the second quarter of this year. Note that, according to the average forecast of experts economy in the third quarter was to expand by 0.2%.

Meanwhile, adding that economic activity slowed down in Germany and decreased in France during the third quarter. This suggests that began in the summer of eurozone recovery stalled. According to the German GDP rose in the 3rd quarter by 0.3 % compared with the 2nd quarter. French GDP , contrary to expectations, in the 3rd quarter decreased by 0.1 % after rising 0.5% in the 2nd quarter.

In addition, it was reported that in the 3rd quarter of 2013, Italy's GDP contracted by 0.1 % compared to the previous quarter due to growth in the manufacturing sector , while Spain's GDP grew by 0.1 percent.

Pound previously came under pressure after data on retail sales, which showed that at the end of last month in the UK retail sales unexpectedly fell , which was associated with a reduction in demand for electrical goods and clothing. Note that this result indicates the fragility of consumer demand , which was a factor in economic growth since the spring . According to the report , retail sales fell 0.7 % in October , compared with a rise of 0.6 % in September. Add that on an annualized basis , sales increased 1.8% after rising 2.2 % the previous month . Note that many economists had expected growth of 0.2 % on a monthly basis , and an increase of 3.3 % per annum.

The October result recorded deceleration after a 1.3 percent increase in sales in the third quarter, which was revised up from 1.5 %. This revision does not significantly affect the rate of economic growth, which was 0.8 % for the quarter - the fastest pace of expansion in three years. Recall that retail is just over 5 % of the economy.

-

18:21

European stocks close

European stocks advanced for the first time in three days as Federal Reserve chairman nominee Janet Yellen said she is committed to promoting a strong U.S. economic recovery and will ensure monetary stimulus isn’t removed too soon.

Yellen said the economy and labor market are performing “far short of their potential” and must improve before the central bank can begin reducing monetary stimulus.

Gross domestic product in the 17-nation euro area rose 0.1 percent in the three months through September, down from a 0.3 percent expansion in the second quarter, the European Union’s statistics office in Luxembourg said today. That’s in line with the median forecast in a Bloomberg News survey of 41 economists.

The Stoxx Europe 600 Index gained 0.8 percent to 322.43 at the close of trading.

National benchmark indexes rose in 16 of the 18 western European markets today. France’s CAC 40 added 1 percent, Germany’s DAX climbed 1.1 percent and the U.K.’s FTSE 100 increased 0.5 percent.

Bouygues jumped 6.2 percent to 29.52 euros. The French building and telecommunications company said third-quarter current operating profit rose to 542 million euros ($728 million) from 478 million euros a year earlier. Analysts surveyed by Bloomberg had forecast 465 million euros, according to the average of four estimates.

Zurich Insurance Group AG advanced 2.5 percent to 258.5 euros after it said third-quarter profit rose 64 percent, beating analysts’ estimates. Net income jumped to $1.1 billion from $672 million a year ago, Switzerland’s biggest insurer said in a statement. That beat the $993.5 million average estimate of eight analysts surveyed by Bloomberg.

Burberry Group Plc added 1.9 percent to 1,489 pence after saying first-half sales exceeded 1 billion pounds ($1.6 billion) for the first time as online revenue increased. Adjusted pretax profit for the six months ended Sept. 30 rose to 174 million pounds from 173 million pounds a year earlier, the U.K.’s largest luxury-goods maker also said in a statement.

RWE slipped 5.1 percent to 25.76 euros. The German utility company said that recurrent net income, the measure used to calculate the dividend, will drop to 1.3 billion euros to 1.5 billion euros in 2014 from around 2.4 billion euros forecast for this year.

German peer EON AG slid 1.7 percent to 13.54 euros. A gauge of utilities companies dropped the most of the 19 industry groups in the Stoxx Europe 600 Index.

-

17:23

Oil fell

West Texas Intermediate tumbled to a five-month low after an Energy Information Administration report showed a 4.6 percent surge in stockpiles at Cushing, Oklahoma, the delivery point for WTI futures.

Prices dropped as much as 1.5 percent and WTI’s discount to Brent widened more than $2.50 a barrel. Cushing inventories gained 1.69 million barrels in the week ended Nov. 8 to 38.2 million, a fifth consecutive increase, the EIA said. Total U.S. supplies jumped 2.64 million barrels. Analysts surveyed by Bloomberg had expected a gain of 800,000.

WTI for December delivery fell $1.17, or 1.2 percent, to $92.71 a barrel at 11:16 a.m. on the New York Mercantile Exchange. It traded at $93.03 before the report and slid as low as $92.51, the least since June 4. The volume of all futures traded was 31 percent above the 100-day average.

Brent for December settlement, which expires today, climbed $1.14, or 1.1 percent, to $108.26 a barrel on the London-based ICE Futures Europe exchange. The more actively traded January contract rose $1.21 to $108.10.

WTI’s discount to the North Sea grade widened to $15.55 after touching $15.86, the most since March 18. The differential expanded for a fifth day.

-

16:42

Gold continues to rise

The value of gold rises a second day in a row . Positive price dynamics caused by technical purchases of gold, which in the previous trading days significantly cheaper , providing favorable conditions for opening long positions. The increased interest in buying gold formed after November 12 quoted prices slipped to near month low - up to 1260.5 dollars per ounce.

Meanwhile, investment demand for gold bullion continues to decline. The assets of the world's largest holder of gold investment institutions exchange traded fund SPDR Gold Trust at the end of the trading day on November 13 2013. decreased by 2.71 m and descended to the level of 865.71 m , updating its lowest since the beginning of February 2009

Global demand for gold in the 3rd quarter fell by 21 % compared with the same period last year , as large metal sales by Western investors have a more pronounced effect than the steady physical demand for gold in Asia. On Thursday said the World Gold Council (WGC).

The net outflow of gold reserves of exchange-traded funds in the last quarter was 119 tonnes. That's about half the amount for which the funds' holdings of gold declined in the 2nd quarter. At the same time , in the 3rd quarter of 2012, investors were net buyers of gold exchange-traded funds and stocks increased by 138 tonnes.

However , the physical demand for the metal remains fairly stable. At the end of the third quarter , that is, from January to September , the demand for gold jewelry , bars and coins totaled 2,896 tons, which is 26 % higher than in the same period of 2012.

The cost of the December gold futures on COMEX today rose to $ 1293.80 per ounce.

-

16:00

U.S.: Crude Oil Inventories, November +2.6

-

14:36

-

14:29

Before the bell: S&P futures +0.11%, Nasdaq futures -0.26%

U.S. stock-index futures rose, as Janet Yellen signaled she plans to continue the Federal Reserve’s monetary stimulus.

Global markets:

Nikkei 14,876.41 +309.25 +2.12%

Hang Seng 22,649.15 +185.32 +0.82%

Shanghai Composite 2,100.51 +12.57 +0.60%

FTSE 6,651.33 +21.33 +0.32%

CAC 4,266.44 +26.50 +0.63%

DAX 9,114.95 +60.12 +0.66%

Crude Oil $93.24 (-0.68%).

Gold $1284.80 (+1.29%).

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y98.50, Y98.70, Y98.85, Y98.90, Y99.00, Y99.30, Y99.50, Y99.80, Y100.00, Y100.25, Y100.50

EUR/JPY Y132.90, Y133.25

EUR/USD $1.3315, $1.3350, $1.3370, $1.3390, $1.3480, $1.3485, $1.3500, $1.3525, $1.3590, $1.3600

GBP/USD $1.5800, $1.5865, $1.5920, $1.5950, $1.5995, $1.6000, $1.6020, $1.6050

EUR/GBP stg0.8400, stg0.8420, stg0.8450, stg0.8485

AUD/USD Y92.50, Y92.60, $0.9275, $0.9300

AUD/JPY Y95.00

USD/CAD C$1.0490

-

13:31

U.S.: Nonfarm Productivity, q/q, Quarter III +1.9% (forecast +1.3%)

-

13:30

U.S.: Initial Jobless Claims, November 339 (forecast 331)

-

13:30

Canada: New Housing Price Index , September 0.0% (forecast +0.2%)

-

13:30

Canada: Trade balance, billions, September -0.4 (forecast -1.2)

-

13:30

U.S.: International trade, bln, September -41.8 (forecast -38.7)

-

13:17

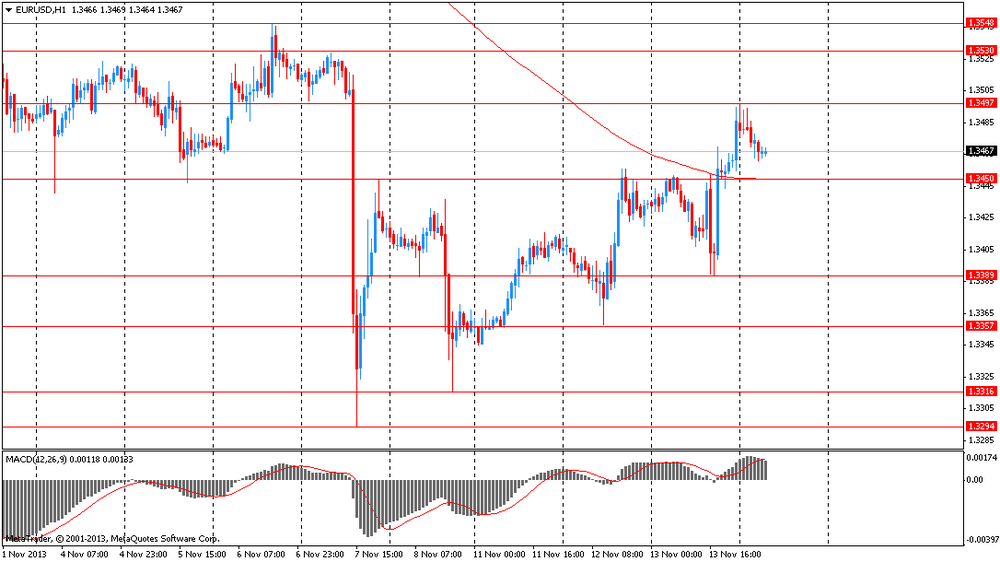

European session: euro fell sharply against the U.S. dollar

Data:

(time / country / index / period / previous value / forecast / actual value)

00:00 Australia Consumer Inflation Expectations November +2.0 % +1.9 %

00:00 U.S. Fed Chairman Bernanke Testifies

4:30 Japan Industrial Production m / m ( final data ) September +1.5 % +1.5 % +1.3 %

4:30 Japan Industrial Production y / y (final ) September +5.4 % +5.4 % +5.1 %

6:30 France GDP q / q ( preliminary data ) III m +0.5 % +0.1 % -0.1 %

6:30 France GDP y / y (preliminary data ) III m +0.4 % +0.2 % +0.2 %

7:00 Germany GDP q / q ( preliminary data ) III m +0.7 % +0.3 % +0.3 %

7:00 Germany GDP y / y (preliminary data ) III m +0.9 % +1.0 % +0.6 %

7:45 France Consumer Price Index m / m in October -0.2 % 0.0 % -0.1 %

7:45 France Consumer Price Index y / y in October +0.9 % +0.7 % +0.7 %

7:45 France Change the number of people employed in non-agricultural sector (preliminary ) III m -0.2 % -0.1 % -0.1 %

08:15 Switzerland PPI and import , m / m in October +0.1 % +0.3 % -0.4 %

08:15 Switzerland PPI and import y / y in October 0.0 % -0.3 % -0.3 %

09:00 EU ECB Monthly Report November

09:30 UK Retail Sales m / m in October +0.6 % +0.2 % -0.7 %

09:30 UK Retail Sales y / y in October +2.2 % +3.3 % +1.8 %

10:00 EU Eurogroup meeting

10:00 Eurozone GDP q / q ( preliminary data ) III m +0.3 % +0.2 % +0.1 %

10:00 Eurozone GDP y / y (preliminary data ) III m -0.6 % -0.3 % -0.4 %

Euro fell against the dollar, which has been associated with the release of a weak report on the euro area. According to data from the European Union's statistics agency Eurostat, for the third quarter of the euro zone economy barely expanded , creating new concerns about the fact that the region is faced with a combination of stagnation , low prices and high unemployment that threatens to hinder the development in the foreseeable future. According to the report, the euro zone 's gross domestic product in the third quarter increased by only 0.1 % compared with the previous quarter . Recall that the euro zone economy declined six consecutive quarters since the end of 2011 , but was able to interrupt the series in the second quarter of this year. Note that according to the average forecast of experts economy in the third quarter was to expand by 0.2 %.

Meanwhile , we add that economic activity slowed in Germany and fell in France during the third quarter. This suggests that began in the summer of eurozone recovery has stalled . According to reports, the German GDP rose in the 3rd quarter by 0.3 % compared with the 2nd quarter. French GDP , contrary to expectations , in the 3rd quarter decreased by 0.1 % after rising 0.5 % in the 2nd quarter.

In addition, it was reported that in the 3rd quarter of 2013, Italy's GDP contracted by 0.1 % compared to the previous quarter due to growth in the manufacturing sector , while Spain's GDP grew by 0.1 percent.

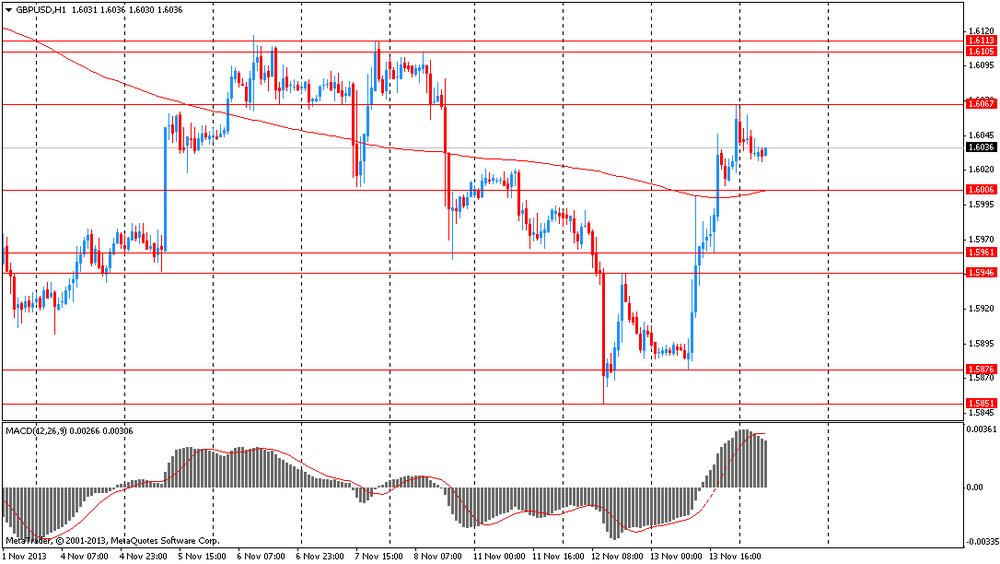

The pound rose against the dollar , recovering from an early fall on expectations the release of the United States .

Note that the initial pressure on the pound had retail sales data , which showed that by the end of last month in the UK retail sales unexpectedly fell, which was associated with a reduction in demand for electrical goods and clothing. Note that this result signals the fragility of consumer demand, which was a factor of economic growth since the spring . According to the report , retail sales fell 0.7 % in October , compared with growth of 0.6 % in September. Add that on an annualized basis , sales increased by 1.8 % after rising 2.2 % the previous month . Note that many economists had expected growth of 0.2 % on a monthly basis , and an increase of 3.3 % per annum.

The October result recorded a slowdown after a 1.3 percent increase in sales in the third quarter, which was revised up from 1.5 %. This revision does not significantly affect the rate of economic growth, which was 0.8 % for the quarter - the fastest pace of expansion in three years. Recall that retail is just over 5% of the total economy .

EUR / USD: during the European session, the pair fell to $ 1.3425

GBP / USD: during the European session, the pair dropped to $ 1.5986 , but then recovered to $ 1.6050

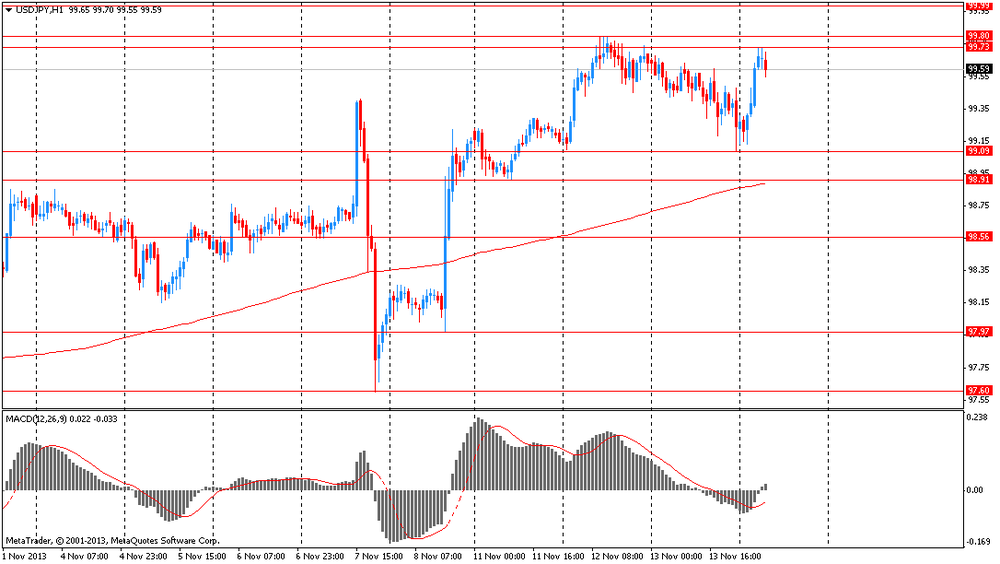

USD / JPY: during the European session, the pair rose to Y100.04

At 13:30 GMT in Canada will price index for housing in the primary market and the trade balance for September. Also this time the U.S. will report on its trade balance for September, the change in the level of labor productivity in the non-manufacturing sector and the change in the level of labor costs in Q3 . At 18:00 GMT the United States places the 30 - year bonds .

-

13:00

Orders

EUR/USD

Offers $1.3550, $1.3500/10, $1.3500, $1.3499

Bids $1.3400/390, $1.3350, $1.3320-00, $1.3295-94

GBP/USD

Offers $1.6200/10, $1.6180, $1.6160/65, $1.6140/50, $1.6120/25, $1.6100/05, $1.6070

Bids $1.5975/70, $1.5950/45, $1.5925/20

AUD/USD

Offers $0.9450, $0.9420, $0.9400, $0.9360/70, $0.9340/50

Bids $0.9250, $0.9200, $0.9195

EUR/JPY

Offers Y136.50, Y136.00, Y135.50, Y135.00

Bids Y134.00, Y133.50, Y133.25/20, Y133.10/00

USD/JPY

Offers Y101.00, Y100.50, Y100.20

Bids Y99.60, Y99.50/40, Y99.20, Y99.00, Y98.80

EUR/GBP

Offers stg0.8500, stg0.8475/80, stg0.8415/20, stg0.8416

Bids stg0.8380/70, stg0.8325/20, stg0.8300, stg0.8285

-

11:45

European stock rose

European stocks advanced for the first time in three days as Federal Reserve chairman nominee Janet Yellen said the U.S. economy must improve before monetary stimulus is pared. U.S. index futures and Asian shares climbed.

The Stoxx Europe 600 Index gained 0.6 percent to 321.8 at 10:36 a.m. in London. The gauge has rallied for the past five weeks as the Fed maintained the pace of its bond purchases and the European Central Bank lowered its key interest rate.

“Yellen’s comments are well timed as investors are nervous about tapering,” Witold Bahrke, who helps oversee $55 billion as a senior strategist at PFA Asset Management in Copenhagen, said by phone. “There is a lot of noise at the moment and not much news, but right now the noise is supportive.”

Yellen said the economy and labor market are performing “far short of their potential” and must improve before the central bank can begin reducing monetary stimulus.

“A strong recovery will ultimately enable the Fed to reduce its monetary accommodation and reliance on unconventional policy tools such as asset purchases,” Yellen, the Fed’s current vice chairman, said in testimony prepared for her nomination hearing before the Senate Banking Committee. “I believe that supporting the recovery today is the surest path to returning to a more normal approach to monetary policy.”

Gross domestic product in the 17-nation euro area rose 0.1 percent in the three months through September, down from a 0.3 percent expansion in the second quarter, the European Union’s statistics office in Luxembourg said today. That’s in line with the median forecast of 41.

Bouygues (EN) jumped 6.4 percent to 29.56 euros. The French building and telecommunications company said third-quarter current operating profit rose to 542 million euros ($728 million) from 478 million euros a year earlier. Analysts had forecast 465 million euros, according to the average of four estimates.

K+S gained 5.3 percent to 21.64 euros after reporting third-quarter operating earnings of 115.8 million euros. The median forecast of analysts in a survey was for 106.5 million euros. Europe’s biggest producer of potash also said it plans to make 500 million euros in savings over the next three years to raise its competitiveness and counter weak potassium and potash markets.

Zurich Insurance Group AG (ZURN) advanced 2.2 percent to 257.7 euros after it said third-quarter profit rose 64 percent, beating analysts’ estimates. Net income jumped to $1.1 billion from $672 million a year ago, Switzerland’s biggest insurer said in a statement. That beat the $993.5 million average estimate of analysts.

FTSE 100 6,661.9 +31.90 +0.48%

CAC 40 4,260.45 +20.51 +0.48%

DAX 9,118.15 +63.32 +0.70%

-

10:30

Option expiries for today's 1400GMT cut

USD/JPY Y98.50, Y98.70, Y98.85, Y98.90, Y99.00, Y99.30, Y99.50, Y99.80, Y100.00, Y100.25, Y100.50

EUR/JPY Y132.90, Y133.25

EUR/USD $1.3315, $1.3350, $1.3370, $1.3390, $1.3480, $1.3485, $1.3500, $1.3525, $1.3590, $1.3600

GBP/USD $1.5800, $1.5865, $1.5920, $1.5950, $1.5995, $1.6000, $1.6020, $1.6050

EUR/GBP stg0.8400, stg0.8420, stg0.8450, stg0.8485

AUD/USD Y92.50, Y92.60, $0.9275, $0.9300

AUD/JPY Y95.00

USD/CAD C$1.0490

-

10:18

Asia Pacific stocks close

Asian stocks rose, with the benchmark index heading for its biggest gain in four weeks, on speculation the next head of the Federal Reserve will maintain U.S. stimulus and as a falling yen boosted Japanese shares.

Nikkei 225 14,876.41 +309.25 +2.12%

S&P/ASX 200 5,355.43 +36.25 +0.68%

Shanghai Composite 2,100.51 +12.57 +0.60%

Sony Corp., a Japanese electronics maker that gets 68 percent of revenue abroad, added 2.3 percent.

Shandong Weigao Group Medical Polymer Co., a maker of medical products, jumped by a record 27 percent in Hong Kong after brokerages including UBS AG recommended the stock.

Tencent Holdings Ltd., Asia’s largest Internet company, gained 4.8 percent in Hong Kong after posting a 35 percent increase in revenue from online games

-

10:00

Eurozone: GDP (QoQ), Quarter III +0.1% (forecast +0.2%)

-

10:00

Eurozone: GDP (YoY), Quarter III -0.4% (forecast -0.3%)

-

09:31

United Kingdom: Retail Sales (YoY) , October +1.8% (forecast +3.3%)

-

09:30

United Kingdom: Retail Sales (MoM), October -0.7% (forecast +0.2%)

-

09:00

FTSE 100 6,694.5 +64.50 +0.97%, CAC 40 4,291.06 +51.12 +1.21%, Xetra DAX 9,141.65 +86.82 +0.96%

-

08:16

Switzerland: Producer & Import Prices, y/y, October -0.3% (forecast -0.3%)

-

08:16

Switzerland: Producer & Import Prices, m/m, October -0.4% (forecast +0.3%)

-

07:45

France: CPI, m/m, October -0.1% (forecast 0.0%)

-

07:45

France: CPI, y/y, October +0.7% (forecast +0.7%)

-

07:45

France: Non-Farm Payrolls, Quarter III -0.1% (forecast -0.1%)

-

07:40

European stocks are seen opening higher Thursday: the FTSE up 42, the DAX up 55 and the CAC up 31.

-

07:20

Asian session: The yen weakened

00:00 Australia Consumer Inflation Expectation November +2.0% +1.9%

04:30 Japan Industrial Production (MoM) (Finally) September +1.5% +1.5% +1.3%

04:30 Japan Industrial Production (YoY) (Finally) September +5.4% +5.4% +5.1%

The yen weakened against all of its major peers as Asian stocks gained and after data showed Japan’s growth slowed in the third quarter, adding to the case for the central bank to boost stimulus. Growth in Japan’s gross domestic product slowed to an annualized 1.9 percent in the July-September period from 3.8 percent in the second quarter, government figures showed today. The median estimate of economists surveyed by Bloomberg News was for a 1.7 percent increase.

The euro snapped a three-day advance after European Central Bank executive board member Peter Praet said the central bank can use negative interest rates. An official report is likely to show today that the euro region’s economy expanded 0.1 percent in the third quarter, based on a separate Bloomberg poll of economists. GDP grew 0.3 percent in the second quarter, marking an end to the longest recession on record.

The Bloomberg U.S. Dollar Index held a decline from yesterday after Federal Reserve chairman nominee Janet Yellen said the economy and labor market are performing “far short of their potential”. “A strong recovery will ultimately enable the Fed to reduce its monetary accommodation and reliance on unconventional policy tools such as asset purchases,” Yellen said in testimony prepared for her nomination hearing today before the Senate Banking Committee. “I believe that supporting the recovery today is the surest path to returning to a more normal approach to monetary policy.”

EUR / USD: during the Asian session the pair fell to $ 1.3560

GBP / USD: during the Asian session, the pair fell to $ 1.6025

USD / JPY: during the Asian session the pair rose to Y99.75

The European calendar gets underway at 0700GMT, when German third quarter flash GDP numbers are released. There is a slew of French data expected at 0745GMT, when September current account, Q3 payrolls, Q3 flash GDP and the October HICP numbers will be published. Spain's September industrial orders numbers will be released at 0800GMT, along with the Spanish September service survey. The ECB monthly bulletin will be released at 0900GMT, which is likely to replicate the opening statement read by President Draghi at Thursday's post-rate cut presser. At 0945GMT, ECB Governing Council member Erkki Liikanen will deliver a speech at EBA Research Workshop, in London. At 1000GMT, Bundesbank Vice President Sabine Lautenschlaeger and Buba Board member Andreas Dombret will hold a press conference, in Frankfurt. After individual releases earlier, 1000GMT sees the release of the amalgamated EMU numbers. At midday GMT, Eurogroup finance ministers meet in Brussels, with Greece amongst the topics to be discussed. UK retail sales for October will be released at 0930GMT.

-

07:00

Germany: GDP (QoQ), Quarter III +0.3% (forecast +0.3%)

-

07:00

Germany: GDP (YoY), Quarter III +0.6% (forecast +1.0%)

-

06:34

France: GDP, q/q, Quarter III -0.1% (forecast +0.1%)

-

06:34

France: GDP, Y/Y, Quarter III +0.2% (forecast +0.2%)

-

06:23

Commodities. Daily history for Nov 13’2013:

GOLD 1,272.40 1.20 0.09%

OIL (WTI) 93.79 0.75 0.81%

-

06:23

Stocks. Daily history for Nov 13’2013:

Nikkei 225 14,567.16 -21.52 -0.15%

S&P/ASX 200 5,319.18 -73.92 -1.37%

Shanghai Composite 2,087.94 -38.83 -1.83%

FTSE 100 6,630 -96.79 -1.44%

CAC 40 4,239.94 -23.84 -0.56%

DAX 9,054.83 -21.65 -0.24%

Dow 15,821.63 +70.96 +0.45%

Nasdaq 3,965.58 +45.66 +1.16%

S&P 500 1,782.00 +14.31 +0.81%

-

06:23

Currencies. Daily history for Nov 13'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3486 +0,39%

GBP/USD $1,6057 +0,97%

USD/CHF Chf0,9133 -0,45%

USD/JPY Y99,24 -0,39%

EUR/JPY Y133,83 -0,01%

GBP/JPY Y159,32 +0,56%

AUD/USD $0,9356 +0,61%

NZD/USD $0,8287 +0,81%

USD/CAD C$1,0455 -0,36%

-

06:05

Schedule for today, Thursday, Nov 14’2013:

00:00 Australia Consumer Inflation Expectation November +2.0% +1.9%

00:00 U.S. Fed Chairman Bernanke Speaks

00:30 Australia New Motor Vehicle Sales (MoM) October -0.1%

00:30 Australia New Motor Vehicle Sales (YoY) October -3.5%

04:30 Japan Industrial Production (MoM) (Finally) September +1.5% +1.5%

04:30 Japan Industrial Production (YoY) (Finally) September +5.4% +5.4%

06:30 France GDP, q/q (Preliminary) Quarter III +0.5% +0.1%

06:30 France GDP, Y/Y (Preliminary) Quarter III +0.4% +0.2%

07:00 Germany GDP (QoQ) (Preliminary) Quarter III +0.7% +0.3%

07:00 Germany GDP (YoY) (Preliminary) Quarter III +0.9% +1.0%

07:45 France CPI, m/m October -0.2% 0.0%

07:45 France CPI, y/y October +0.9% +0.7%

07:45 France Non-Farm Payrolls (Preliminary) Quarter III -0.2% -0.1%

08:15 Switzerland Producer & Import Prices, m/m October +0.1% +0.3%

08:15 Switzerland Producer & Import Prices, y/y October 0.0% -0.3%

09:00 Eurozone ECB Monthly Report November

09:30 United Kingdom Retail Sales (MoM) October +0.6% +0.2%

09:30 United Kingdom Retail Sales (YoY) October +2.2% +3.3%

10:00 Eurozone Eurogroup Meetings

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter III +0.3% +0.2%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter III -0.6% -0.3%

13:30 Canada Trade balance, billions September -1.3 -1.2

13:30 Canada New Housing Price Index September +0.1% +0.2%

13:30 U.S. International trade, bln September -38.8 -38.7

13:30 U.S. Initial Jobless Claims November 336 331

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter III +2.3% +1.3%

15:00 U.S. Federal Reserve Chairperson Designate Janet Yellen Testifies

15:30 U.S. Crude Oil Inventories November +1.6

17:15 Switzerland Gov Board Member Danthine Speaks

18:45 United Kingdom MPC Member Miles Speaks

-