Notícias do Mercado

-

23:46

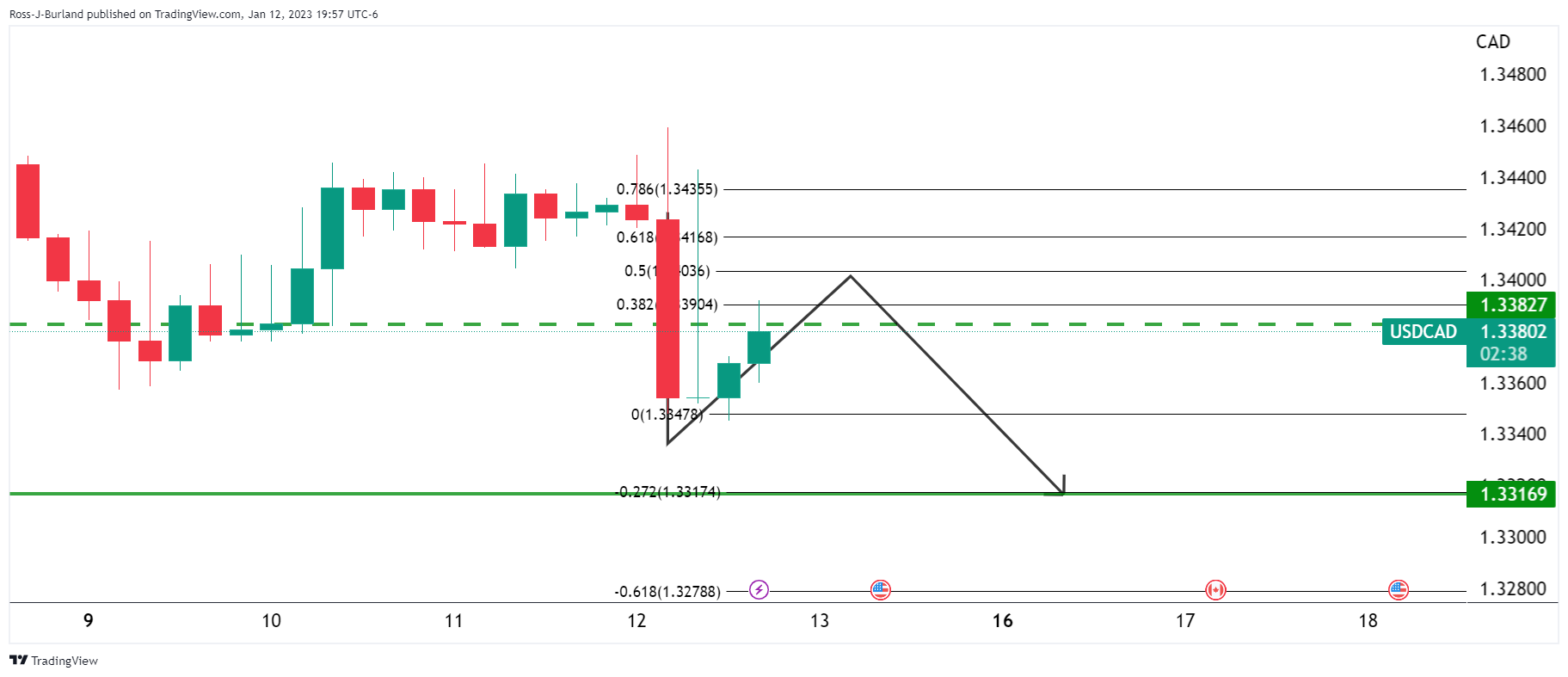

USD/CAD Price Analysis: Bulls eye a break of 1.3450 for a look in at the 1.35 area

- USD/CAD is based above a prior target low in the 1.3320s.

- USD/CAD is embarking on a correction but 1.3450 needs to give.

As per the prior analysis, the bears were in control and ran into the target in the 1.3320s but threw in the towel there. The price has since been established and moved in to test the 1.34s.

The bears are in charge now and the 1.3350s guard a run to the 1.3300 target:

USD/CAD update

At this juncture, the price is embarking on a correction but 1.3450 needs to give:

There is a price imbalance that has been left behind since the major sell-off at the start of the year that could be mitigated in the coming days towards 1.3550.

-

23:45

EUR/USD aims to surpass 1.0830 amid hawkish ECB bets

- EUR/USD is aiming to deliver a break of the consolidation above 1.0830 as hawkish ECB bets soar.

- The ECB is expected to hike interest rates by 50 bps in February and March, and by 25 bps in May.

- A recovery in the S&P500 futures indicates that the risk-off impulse is fading away.

The EUR/USD pair is regaining strength after a sell-off move on Monday. The major currency pair is oscillating below the immediate resistance of 1.0830 in the early Asian session. Risk-perceived currencies witnessed a healthy correction on Monday amid a recovery in the US Dollar Index (DXY).

Investors’ risk appetite is improving again as the S&P500 futures have recovered half of Monday’s losses in early Tokyo. There is no denying the fact that the 500-stock basket futures of the United States will display sheer volatility today as US markets are opening after a stretched weekend.

The USD Index is displaying signs of volatility contraction around 102.00 after a solid recovery as investors are expected to make significant positions after the release of the US Producer Price Index (PPI) data, which will release on Wednesday. As per the consensus, the economic data is expected to decline further. The headline PPI (Dec) is seen lower at 6.8% while the core PPI is seen declining to 5.9%. Producers might look to trim their losses inspired by lower prices through easing wage growth or by lay-offs, which would trim inflation projections further.

Apart from the US PPI data, monthly Retail Sales data will be keenly watched. The economic data is expected to expand by 0.1% vs. the contraction of 0.6% released earlier. It could provide strength to the US Dollar ahead.

On the Eurozone front, considering the stubborn nature of inflation and rising wage growth due to the tight labor market, European Central Bank (ECB) Governing Council member Olli Rehn said on Monday, “I see significant rate hikes at the next meetings,”

A poll from Bloomberg predicts that the ECB will reach to its terminal rate by May. ECB’s interest rate will peak at 3.25% from its current rate of 2%. Further outcomes from the poll claim that ECB President Christine Lagarde will hike the interest rates by 50 basis points (bps) in February and March meetings. And, a rate hike of 25 bps will be announced in May. Also, the central bank may not look for lowering interest rates in CY2023.

-

23:36

We could see another USD/JPY sell-off of roughly 3% – Goldman Sachs

As markets brace for Wednesday’s Bank of Japan (BoJ) monetary policy meetings, multiple investment banks and analysts convey their forecasts for the USD/JPY pair that’s been lately gaining more attention, especially after the BoJ’s tweak to the Yield Curve Control (YCC).

Analysts at Goldman Sachs (GS) are from the same lot and anticipate the Yen pair to decline further by suggesting a 3.0% drop, or a fall to just below the 125.00 level. However, the GS also states that the bigger driver of the cross should be US rates rather than domestic monetary policy.

The GS also signals that their economists expect the BoJ to keep YCC in place with possible further tweaks to improve its sustainability. However, the increased risk of a complete exit means they see more limited room for USD/JPY upside.

It’s worth noting that majority of market estimates don’t suggest any major change to the BoJ’s monetary policy. However, hints for the exit from the ultra-easy money days will be closely observed for clear directions.

That said, the Yen pair began the week’s trading by dropping to the lowest levels since late May 2022 before bouncing off 127.21, mildly offered near 128.30 by the press time.

Also read: USD/JPY Price Analysis: Bulls on course for a 129.50 target

-

23:31

Australia Westpac Consumer Confidence: 5% (January) vs 3%

-

23:28

NZD/USD Price Analysis: Teasing sellers inside weekly triangle, 0.6345 is the key

- NZD/USD struggles to defend bulls inside one-week-old ascending triangle.

- 200-SMA, previous resistance from mid-December adds to the downside filters.

- RSI retreat, sluggish MACD lures bears amid dull markets.

NZD/USD stays defensive around 0.6390, following a retreat from multi-day high, as traders await the key China Gross Domestic Product (GDP) for the fourth quarter (Q4) during early Tuesday. Also likely to have probed the Kiwi pair buyers are recently released downbeat quarterly economic forecasts by the New Zealand Institute of Economic Research (NZIER).

Also read: NZIER QSBO: New Zealand business confidence at lowest since 1974

That said, the quote pokes the support line of the weekly ascending triangle, close to 0.6375 by the press time, amid mildly bearish MACD signals and the RSI (14) weakness.

With this, the NZD/USD prices are likely to break the immediate support surrounding 0.6375. However, the 200-Simple Moving Average (SMA) level surrounding 0.6345 appears crucial for the bears.

Following that, the resistance-turned-support line from December 13, 2022, around 0.6265 at the latest, could challenge the Kiwi bears before giving them control.

On the flip side, the aforementioned triangle’s top line, close to 0.6425 by the press time, restricts the short-term NZD/USD upside.

Should the Kiwi pair buyers defy the triangle formation and keep the reins past 0.6425, the 0.6500 round figure and previous monthly peak near 0.6515 could challenge the quote’s upside momentum.

Overall, NZD/USD pair is likely to witness further weakness but the rejection of the bullish trend is yet absent from the radar.

NZD/USD: Four-hour chart

Trend: Further downside expected

-

23:20

GBP/JPY Price Analysis: Hovers around 156.40s on risk-off impulse

- GBP/JPY trimmed some of last Friday’s losses and reclaimed 156.00.

- GBP/JPY Price Analysis: Failure to crack 157.00, to pave the way towards 155.00 and beyond.

The British Pound (GBP) capped its two-day downfall and formed an inverted hammer nearly last week’s lows of 155.64, and rose above 156.00 on Monday. As the Tokyo session begins, the GBP/JPY is trading at 156.46, slightly below its opening price by 0.03%.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY remains downward biased, although the cross formed a double bottom. However, oscillators like the Relative Strength Index (RSI) at bearish territory and the Rate of Change (RoC) suggest that sellers remain in charge, even though the pair’s corrected upwards.

If the GBP/JPY fails to clear 157.00, that will open the door for further losses. Hence, the GBP/JPY first support would be 156.00. The break above will send the GBP/JPY tumbling toward the YTD Low of 155.35, followed by 155.00.

On the flip side, the GBP/JPY first resistance would be the 157.00 figure. A breach of the latte would clear the way toward January’s 13 daily high of 158.02, followed by the 159.00 figure and the 20-day Exponential Moving Average (EMA) at 159.63.

GBP/JPY Key Technical Levels

-

23:05

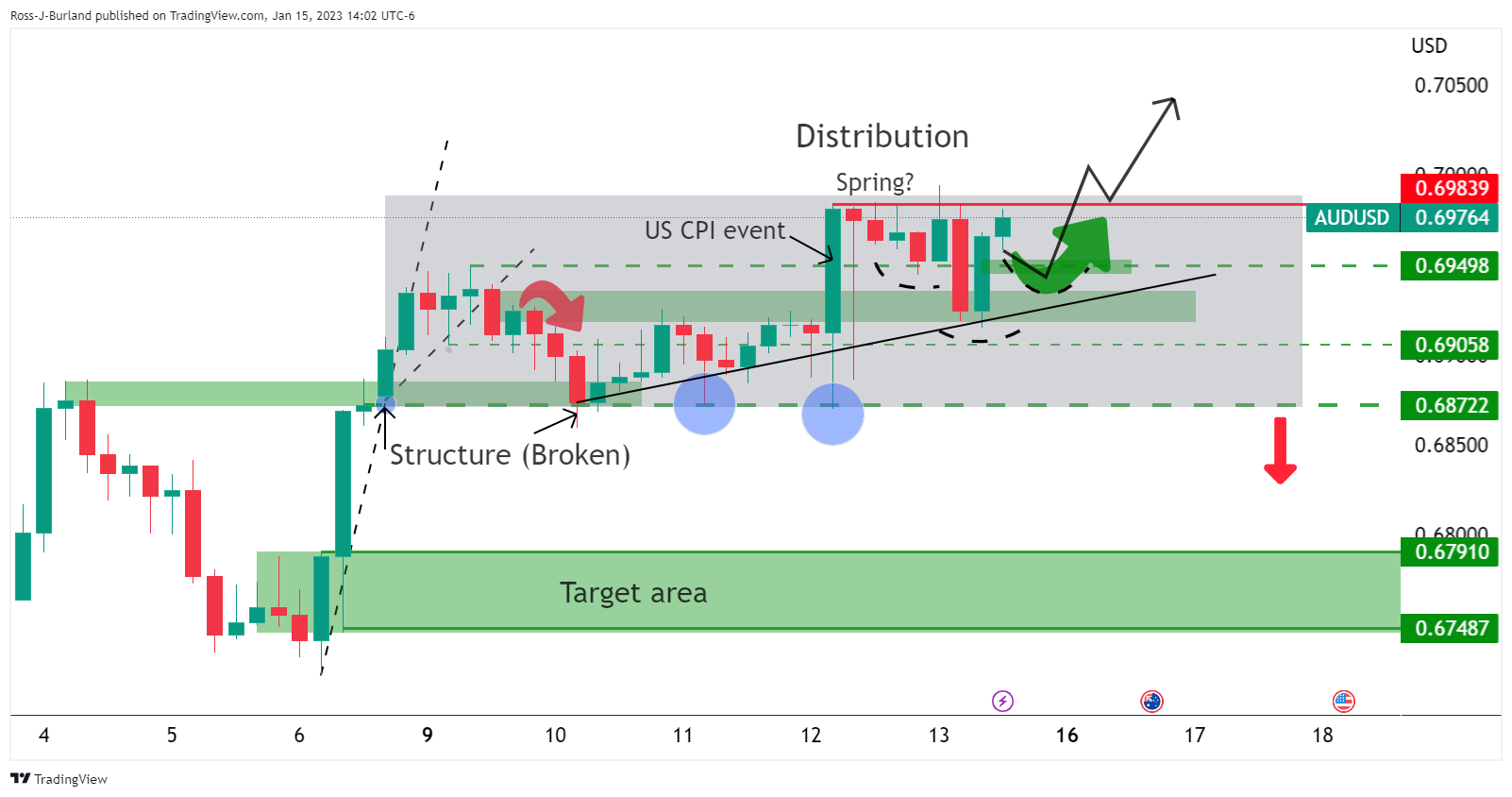

AUD/USD treads water around mid-0.6900s ahead of China Q4 GDP

- AUD/USD steadies after reversing from five-month high, inactive of late.

- Market sentiment remains dicey amid US holiday, cautious mood ahead of key data from China, Australia.

- China Q4 GDP bears downbeat forecasts, can help extend AUD/USD pullback in case of softer prints from Australia’s biggest customer.

AUD/USD remains sidelined around 0.6955 after retreating from the highest levels since August 2022 during Tuesday’s sluggish Asian session. In doing so, the Aussie pair portrays the market’s anxiety ahead of the key China Gross Domestic Product (GDP) for the fourth quarter (Q4), as well as some second-tier data from Australia, not to forget mixed concerns surrounding the US “soft landing,” and the Fed’s policy pivot.

The Aussie pair began the week on a negative note by snapping a three-day uptrend around the multi-day top. The underlying reason could be linked to the market’s reassessments of the dovish bias about the Federal Reserve (Fed), especially after Friday’s upbeat prints of the Michigan Consumer Sentiment Index (CSI) and 5-year inflation expectations. However, Martin Luther King’s Birthday restricted the market’s moves.

Even so, a sustained rebound in the US Treasury bond yields underpinned the US Dollar Index (DXY) recovery from the lowest levels since June 2022, which in turn probed the AUD/USD traders even as the equities were mildly positive.

Also likely to have challenged the AUD/USD bulls could be the easing in Australia’s TD Securities Inflation for December, 0.2% MoM versus 1.0% prior.

Furthermore, China’s reopening boosts AUD/USD considering the strong ties between Canberra and Beijing. However, the lack of easing in Beijing’s Covid numbers and geopolitical tensions with the US, mainly surrounding Taiwan, seems to challenge China-linked optimism and the Aussie pair of late.

Above all, anxiety ahead of the key data from major customer China and the US Retail Sales for December, expected 0.1% YoY versus -0.6% prior, scheduled for release on Wednesday, weigh on the AUD/USD prices of late.

To sum up, AUD/USD traders should pay attention to China Q4 GDP, expected -0.8% QoQ versus 3.9% prior, for fresh impulse but major attention will be given to the US Retail Sales and Australia’s employment data for December, up for publishing on Thursday.

Technical analysis

Nearly overbought conditions of the RSI (14) join the AUD/USD pair’s U-turn from a two-month-old ascending resistance line, close to 0.7025 at the latest, to tease the Aussie pair sellers. It’s worth noting, however, that, a daily closing below the 200-DMA, around 0.6825 at the latest, becomes necessary for the AUD/USD bears to retake control.

-

23:03

USD/CHF drops to near 0.9240 after a rangebound move, US PPI hogs limelight

- USD/CHF has dropped as the risk-off impulse is losing strength.

- A full-blown recession in the US economy could trigger a 15-20% fall in S&P500.

- A meaningful decline in the US PPI might trim inflation projections further and will also weigh on wage growth ahead.

The USD/CHF pair has sensed selling pressure after failing to surpass the critical resistance of 0.9280 in the early Asian session. The Swiss franc asset has picked offers and has dropped to near 0.9240. It seems that the risk-off impulse is fading away as the United States markets will open today after a stretched weekend on account of Martin Luther King Jr. Day.

On Monday, the S&P500 futures witnessed a moderate fall amid holiday-inspired anxiety among the market participants. No doubt, the 500-stock basket is displaying signs of recovery from the past few weeks as the Federal Reserve (Fed) is expected to reach the terminal rates sooner and is looking to trim the pace of hiking interest rates. However, price stability could not be achieved without entering into a recession in the United States economy.

Economists at UBS think that the upcoming 4Q corporate reporting season will provide a reality check. “Earnings headwinds – an aggressive Fed, a normalization in demand for goods popular during the pandemic, a stronger USD, and higher costs because of more expensive labor – have become strong enough for us to expect no growth in S&P 500 4Q earnings per share compared to the same period last year. The downside risks remain elevated, and stocks could fall 15-20% if the economy enters a full-blown recession.”

The US Dollar Index (DXY) turned sideways around 102.00 after a firmer recovery move from the fresh seven-month low at 101.36. The USD Index is likely to be guided by the release of the US Producer Price Index (PPI) data, which is scheduled for Wednesday. A meaningful decline in the US PPI might trim inflation projections further and will also weigh on wage growth ahead.

Meanwhile, investors are awaiting the commentary from global officials at World Economic Forum, happening in the Swiss Franc region. On the economic front, the absence of major triggers in the economic calendar this week will keep the focus of investors on the US economic calendar for any action.

-

22:42

AUD/JPY Price Analysis: Recovery stalls and bears to step in around 89.00

- On Wednesday, AUD/JPY seesaws around 89.20s, ahead of the Bank of Japan’s monetary policy decision.

- AUD/JPY Price Analysis: Bearish biased, and it might resume its downtrend soon.

The AUD/JPY snapped two days of consecutive losses on Monday and rebounded nearby last week’s lows of 88.62. The Australian Dollar (AUD) got bolstered by traders booking profits on Japanese Yen (JPY) longs (AUD/JPY shorts) as they get ready for the Bank of Japan’s monetary policy decision. The AUD/JPY is trading at 89.33 after hitting a daily low of 89.02 at the time of writing.

AUD/JPY Price Analysis: Technical outlook

After forming a double bottom in early 2023, the AUD/JPY shifted its bias to downwards, as it could not crack the 200-day EMA decisively. Therefore, sellers leaned to it, and the AUD/JJPY commenced a fall of almost 3% toward last week’s lows, breaking below the 20-day Exponential Moving Average (EMA) at 90.18.

Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) give bearish signals, opening the door for further losses.

Although the AUD/JPY had trimmed some of last Friday’s losses due to the bias of the pair, it could be viewed as an opportunity for sellers to re-engage on shorts at a better price. Therefore, the AUD/JPY first support would be the 89.00 mark, followed by the last week’s low of 88.62, followed by the YTD low of 87.41.

AUD/JPY Key Technical Levels

-

22:40

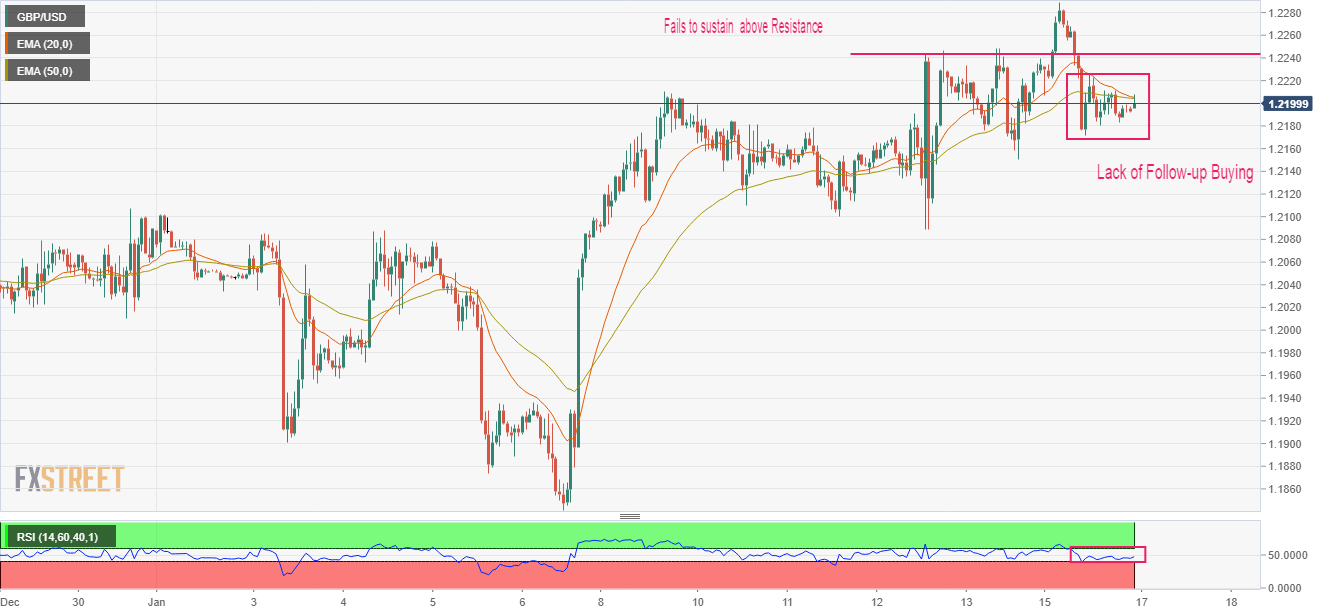

GBP/USD Price Analysis: Signs of bearish reversal solidifies as risk impulse sours

- The absence of follow-up buying after a corrective move indicates a lack of strength in the Pound Sterling.

- A recovery move in the US Dollar Index has been recorded amid a decline in investors’ risk appetite.

- The 20-and 50-period EMAs are on the verge of delivering a bear cross around 1.2200.

The GBP/USD pair is displaying a lackluster performance as the auction profile has trimmed to a narrow range of 1.2180-1.2210 in the early Tokyo session. Earlier, the Cable witnessed a steep fall after failing to hit the critical resistance of 1.2300. A sell-off in Cable was triggered due to a sheer recovery move by the US Dollar Index (DXY).

A corrective move in the S&P500 futures on Monday as caution soars in market sentiment ahead of the United States Producer Price Index (PPI) data, triggered a risk-aversion theme. Also, the speech from Bank of England (BoE) Governor Andrew Bailey citing weaker inflation projections failed to provide support to the Pound Sterling.

On an hourly scale, a failure by Pound Sterling in keeping the Cable above the horizontal resistance plotted around January 12 high at 1.2243, signaled a loss in the upside momentum. Also, chances of further weakness in the major are solid amid an absence of follow-up buying despite finding an immediate cushion at around 1.2175.

The 20-and 50-period Exponential Moving Averages (EMAs) are on the verge of delivering a bearish crossover of around 1.2205, which would be added to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which indicates that investors are awaiting a fresh trigger for a decisive move.

The Cable will display a sheer downside if it drops below Monday’s low at 1.2171 as it will drag the major toward January 11 low at 1.2100 followed by the psychological support at 1.2000.

On the flip side, a confident break above Monday’s high at 1.2285 will drive the asset toward December 5 high at 1.2344. A breach of the latter will expose the asset for to re-test a seven-month high at 1.2447.

GBP/USD hourly chart

-

22:29

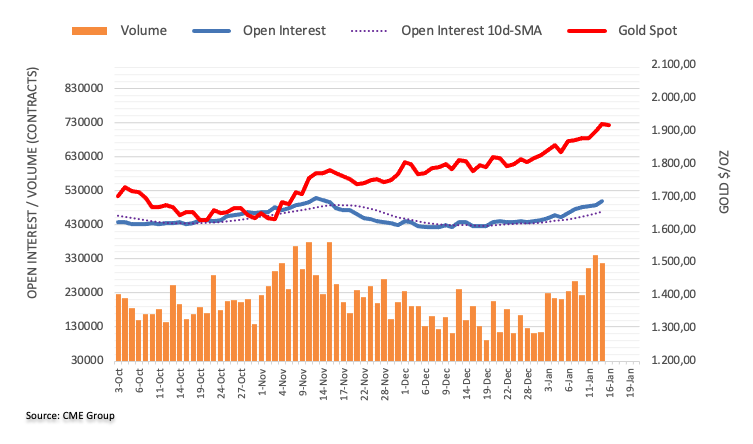

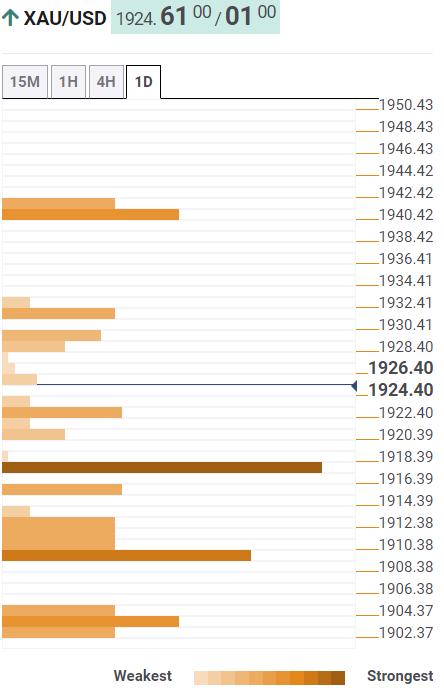

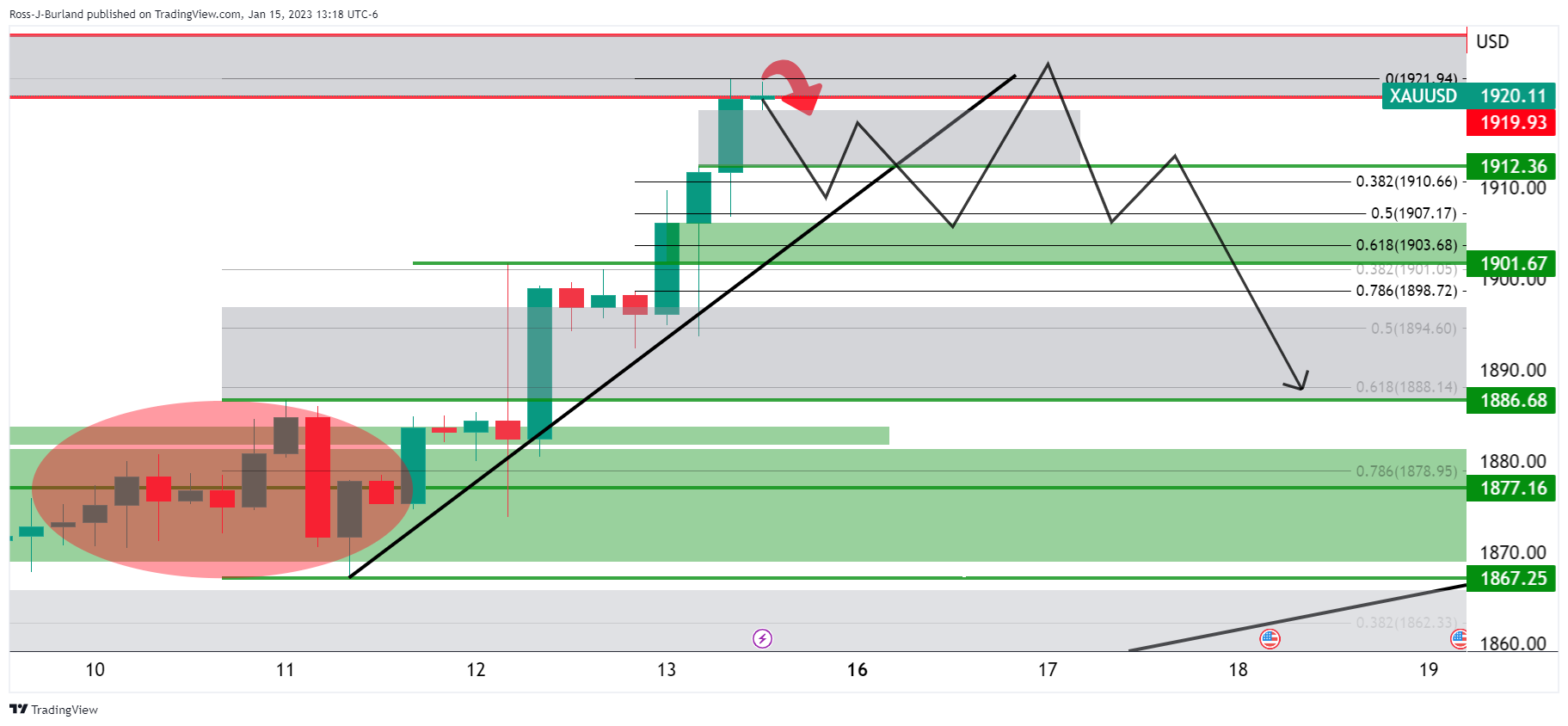

Gold Price Forecast: XAU/USD bulls run out steam as United States Treasury bond yields rebound

- Gold price retreats from multi-month high as bulls take a breather after two-day uptrend.

- United States holiday restricts XAU/USD’s downside moves ahead of a busy day.

- US 10-year Treasury bond yields, US Dollar Index recovered amid mixed clues.

- China Gross Domestic Product for Q4 will give immediate directions to Gold, clues for Federal Reserve’s next move are crucial.

Gold price (XAU/USD) marks a softer landing after rising to the highest levels since April 2022 in the last week. That said, the yellow metal printed the first daily loss in three amid a sluggish start to the week as markets in the United States were closed due to Martin Luther King’s Birthday. Even so, the US Treasury bond yields triggered the much-awaited rebound in the US Dollar and probed the XAU/USD bulls as traders have mixed feeling about the Federal Reserve’s (Fed) policy pivot.

United States Treasury bond yields drag Gold price

US 10-year Treasury bond yields defended the bounce off a five-week low marked the last Friday as traders reassess talks of the United States' “soft landing” and the Federal Reserve’s policy pivot during a slightly dull start of the week. That said, the benchmark bond coupons ended Monday’s North American trading session with mild gains of around 3.498%. On the same line, the two-year bond yields were floating around 4.22% and hence the yield curve inversion kept flashing the risk of recession. Even so, the concerns that the US could avoid a hard landing and China reopening helped the market sentiment to remain mildly positive and probed the Gold sellers.

Mixed US data probe XAU/USD bulls

The softer prints of the United States Consumer Price Index (CPI) and easing wage growth, together with downbeat services activities, allowed the Federal Reserve (Fed) doves to brace for the driver’s seat. However, Friday’s upbeat prints of the Michigan Consumer Sentiment Index (CSI) and 5-year inflation expectations allowed US Dollar bulls to remain hopeful of further rate hikes from the Fed. Other than the mixed US data, the Federal Reserve (Fed) policymakers’ rejection to praise the market’s dovish outlook also defend the US Dollar buyers, despite marking a multi-day low, which in turn probes the Gold price upside.

China optimism fades ahead of the key data

China’s reopening boosts Gold prices considering the dragon nation’s stand as the key XAU/USD consumer. However, the lack of easing in Beijing’s Covid numbers and geopolitical tensions with the US, mainly surrounding Taiwan, seems to challenge China-linked optimism in the Gold market. Also likely to probe Beijing-inspired optimism is the cautious mood ahead of today’s China Gross Domestic Product (GDP) for the fourth quarter (Q4), expected -0.8% QoQ versus 3.9% prior.

Gold price technical analysis

Gold price remains inside an eight-day-old bullish channel surrounding the highest levels since late April 2022. Even so, the looming bear crossing the Moving Average Convergence and Divergence (MACD) indicator joins the rejections of the short-term bullish trend by the Relative Strength Index (RSI) line, placed at 14, to lure short-term bears.

The nearby bearish trend, however, hinges on the quote’s successful rejection of the bullish channel, by breaking the $1,898 support.

Following that, a three-week-old ascending support line and the 100-SMA, respectively near $1,865 and $1,846, could probe Gold sellers. It’s worth mentioning that the XAU/USD weakness past $1,846 needs validation from a one-month-old horizontal support zone, close to $1,825.

On the contrary, the $1,930 round figure acts as an immediate upside hurdle for the Gold price to cross before regaining the buyer’s attention.

Even so, the aforementioned channel’s top line, near $1,936, appears the last defense for the XAU/USD bears, a break of which could propel Gold price toward the April 2022 peak surrounding $1,998.

Gold price: Four-hour chart

Trend: Pullback expected

-

22:16

NZIER QSBO: New Zealand business confidence at lowest since 1974

According to the latest New Zealand Institute of Economic Research (NZIER) Quarterly Survey of Business Opinion (QSBO), “New Zealand's business confidence in the fourth quarter of last year hit its lowest level since 1974 as companies grapple with higher interest rates, cost pressures and soft demand.” The survey also mentioned that business confidence is the weakest since the survey started in 1970 if adjusted seasonally.

“The survey was undertaken following the more hawkish than expected central bank meeting in November and this was weighing on sentiment,” said NZIER along with the findings.

Key finding (via Reuters)

A net 70% of firms surveyed expected general business conditions to deteriorate compared with 42% pessimism in the previous quarter.

Firms have become much more cautious and are now looking to reduce staff and investment plans.

A net 81% reported increased costs in the December quarter.

NZD/USD remains depressed

The news should have ideally weighed on the NZD/USD prices as it challenges the Reserve Bank of New Zealand’s (RBNZ) hawkish bias. However, the Kiwi pair remains pressured around 0.6380 by the press time, after a dull start to the week.

Also read: NZD/USD holds near strongest levels in a month

-

22:07

USD/CAD shifts auction profile above 1.3400 ahead of Canada Inflation

- USD/CAD has comfortably shifted its business above 1.3400 amid a recovery in the US Dollar Index.

- Caution is escalating despite overall optimism in the market ahead of US PPI data.

- The BoC will continue hiking interest rates despite softening of Canada’s inflation report.

The USD/CAD pair has shifted its auction profile above the round-level resistance of 1.3400 in the early Tokyo session. The Loonie asset has picked strength supported by the sheer recovery in the US Dollar Index (DXY). After a stellar recovery from a fresh seven-month low at 101.36, the USD Index is displaying signs of volatility contraction around 102.00.

S&P500 futures witnessed some sell-off on Monday after a four-day winning streak, however, the United States markets were closed on account of Martin Luther King Jr. Day. Growing caution for risk-perceived assets despite the fact that the Federal Reserve (Fed) is expected to slow down the pace of policy tightening may keep investors on the sidelines.

The USD Index is expected to dance to the tunes of the United States Producer Price Index (PPI) data, which will release on Wednesday. A change in the prices of goods and services at factory gates is going to provide more cues about inflation projections. The street sees a decline in headline factory gate prices of goods and services (Dec) to 6.8% from the former release of 7.4%. Also, the core PPI might trim to 5.9% from the former release of 6.2% in a similar period.

On the Loonie front, investors are awaiting the release of Canada’s inflation data, which is scheduled for Tuesday. According to the market estimates, the annual headline CPI will trim to 6.3% from the former release of 6.8%. However, the core inflation will escalate to 6.1% vs. the 5.8% released earlier. This might compel the Bank of Canada (BoC) to continue hiking interest rates as the road to 2% inflation seems far from over.

Meanwhile, the oil price has found an intermediate cushion of around $79.00 after a corrective move from above the crucial resistance of $80.00. The black gold is likely to resume its upside journey as bets for China’s economic recovery are soaring dramatically. It is worth noting that Canada is a leading exporter of oil to the United States and higher oil prices will support the Canadian Dollar.

-

21:55

Silver Price Forecast: XAG/USD holds to gain but stalls around $24.50, tumbles to $24.20s

- Silver price extended its gains to three consecutive days, remaining above the 20-day EMA.

- Last week low inflation figures in the US spurred speculations that the Fed might hike in 25 bps sizes.

- Current week’s US economic calendar to provide fresh impetus to Silver’s price action.

Silver Price is registering minimal gains on Monday amidst a dull North American session. The absence of US traders sparked by the Martin Luther King Jr day kept trading liquidity conditions dry. The US Dollar (USD) registered solid gains, capping Silver’s rally around the mid $24.00-$25.00 range. At the time of writing, XAG/USD Is trading at $24.29.

Last week's US data, sparked a repricing for a less aggressive US Federal Reserve

Spot Silver held to its gains after retracing from YTD highs of $24.54. Inflation figures released last week in the United States (US) signal the cycle of high prices has peaked. Hence, this spurred speculations that the US Federal Reserve, among other global central banks, might slow the size of rate hikes, weakening the greenback since the start of 2023.

In the meantime, the World Bank warned that the globe’s Gross Domestic Product (GDP) would jump just 1.7% in 2023, slashing its June forecast of close to 3% in June 2022.

Additional Federal Reserve speakers and a tranche of US economic data led by the Fed speaking alongside the release of earnings in Wall Street would keep traders entertained. US Retail Sales, the Producer Price Index (PPI), and Industrial Production will be released on Wednesday. US Housing Starts, Initial Jobless Claims, and the Philadelphia Fed Index would add to the update on the status of the US economy.

Silver Price Analysis: XAG/USD Technical Outlook

From a daily chart perspective, the XAG/USD remains upward biased. Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest that Silver buyers remain in charge. If XAG/USD achieves a daily close above $24.29, that would be the third consecutive trading day with gains, and it would poise XAG/USD for a re-test of the YTD highs, followed by $25.00.

-

21:48

USD/JPY Price Analysis: Bulls on course for a 129.50 target

- USD/JPY is gathering momentum after a test of the structure around 128.80.

- The 38.2% Fibonacci is a first target near 129.50 with 131.20's eyed thereafter.

As per the prior analysis, USD/JPY bulls move in and eye a correction towards 129.50, USD/JPY has indeed corrected higher and remains in the hands of the bulls as we enter the rollover and early hours of the Asian session.

As previously explained, there were prospects of a reversion into the M-formation\s bearish impulse on the prior leg:

USD/JPY update

USD/JPY H1 chart

We are seeing this correction get underway and bulls will now be looking for a bullish structure to lean against in aiming for a reversion of sorts as follows:

As illustrated, the price is on the backside of the trend and a breakout to the upside is gathering momentum after a test of the structure around 128.80. The 38.2% Fibonacci is a first target near 129.50 with 131.20's eyed thereafter.

-

21:00

New Zealand NZIER Business Confidence (QoQ) fell from previous -42% to -70% in 4Q

-

20:15

EUR/USD Price Analysis: Bears have been capped and eyes are on 1.0720

- EUR/USD's 1.0820 structure has been broken.

- Eyes are on a test below 1.0770 that guards the risk of a drop towards 1.0700/20 support.

As per the start of the week's analysis, EUR/USD Price Analysis: Bears attacking the bullish H4 trendline support, the bears needed to break trendline support on the lower time frames, such as the 4-hour chart as follows:

It was stated that The M-formation was compelling in this regard, but the neckline needed to hold for the open to reaffirm a bearish bias and prospects of a break of the trendline and downside potential for the week ahead.

Instead, the bulls moved in and took out the neckline as follows:

The move has been significant as it has taken out the 1.90775 horizontal resistance that could now start to act as support:

With that being said, the daily W-formation remains compelling as the price decelerates on the bid:

The bulls will be expected to defend the 1.0700 figure on a retest and that could lead to an onward continuation as illustrated in the chart above.

EUR/USD H1 chart

Meanwhile, the hourly trendline was broken and so to a micro horizontal structure that makes for a bearish prospect for the coming sessions:

1.0820 structure has been broken and all eyes are on a test below 1.0770 that guards the risk of a drop towards 1.0700/20 support.

-

19:37

Forex Today: US Dollar takes little advantage of dull trading

What you need to take care of on Tuesday, January 17:

The American currency started the week where it left the previous one, easing across the FX board. Market participants were still cheering, easing United States price pressures and the possibility of a soon-to-come US Federal Reserve pivot on monetary policy. Optimism, however, faded at the beginning of a quiet week, with US markets closed amid the Martin L. King holiday. The Greenback managed to recover ahead of the daily close but ended the day with modest gains against most major rivals, and it is still at risk of falling.

The main focus was on Japan Government Bonds (JGBs) as the yield on the 10-year note surged to 0.52%, pushing the upper end of the BoJ’s range. The Bank of Japan is having a monetary policy meeting this week, and raising yields spurred speculation policymakers will finally introduce a shift in their monetary policy. Governor Haruhiko Kuroda’s term ends next April, and speculative interest believes he will introduce changes to the ultra-loose policy before leaving. BoJ Deputy Chief Masayoshi Amamiya is the leading candidate for the next governor.

The Bank of Canada Consumer Survey showed that expectations for 1-year ahead inflation increased to a record 7.18% from 7.11% in the third quarter, while 2-year ahead inflation expectations fell to 5.14% from 5.22% in the third quarter.

The EUR/USD pair hovers around 1.0815, while GBP/USD trades a handful of pips below the 1.2200 mark. The AUD/USD pair briefly traded above the 0.7000 mark but settled at around 0.6950, while USD/CAD seesaws around 1.3400. The USD/JPY pair recovered from a fresh multi-month low of 127.21 and currently stands at 128.50.

Gold retains the $1,900 mark, now consolidating at $1,914, while Crude Oil Prices edged lower, and WTI settled at $79.12 a barrel.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Don’t miss the ship from fear of wet feet

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:25

NZD/USD holds near strongest levels in a month

- NZD/USD is flat into the early close on Wall Street.

- Kiwi traders will look to the Q4 NZIER QSBO survey.

NZD/USD travelled between a low of 0.6361 and a high of 0.6426, currently flat on the day albeit hovering near its strongest levels in a month. The Kiwi has benefitted in a risk-on environment since the US Dollar was sold off on the back of a switch in sentiment surrounding the Federal Reserve's interest rate path.

Easing US inflation has fueled bets for a less aggressive tightening from the Federal Reserve at the same time that China’s reopening has bolstered the outlook for the global economy. In turn, there is a demand for commodities for which the Kiwi trades as a proxy to.

However, with US markets closed for Martin Luther King Jr. Day, and liquidity even thinner than it normally is in January, the price action has been minimal on the day and week so far. The Kiwi is oscillating on either side of 0.64, although ''with upside risks coming from the fading USD and downside risks coming mostly from softening local data and the Fed’s hawkish rhetoric,'' analysts at ANZ Bank said. ''Today is likely to be all about local data, with the Q4 NZIER QSBO survey due out at 10 am. This is data the RBNZ watch, and if it ends up being as weak as our ANZBO survey was in December, it could see local short-end rates fall further yet, taking the Kiwi with them,'' the analysts said.

The Kiwi has been supported from a monetary policy standpoint after the Reserve Bank of New Zealand embarked on a historic tightening campaign, bringing the cash rate to a 14-year high of 4.25%. This has been the most aggressive policy tightening cycle since 1999 when the cash rate was first introduced. The RBNZ is the only central bank that is more hawkish than the Fed, and rate differentials are much more friendly than say compared to the Aussie, leaving the outlook bullish from a fundamental perspective. ''While the RBNZ has further to go to bring inflation under control, it will need to start thinking about when to take its foot off the brake,'' analysts at Westpac argued.

-

19:02

EUR/JPY Price Analysis: On a correction above 139.00 as bears take a respite

- EUR/JPY bounced off last weekly lows and reclaimed 139.00 amidst a sour market sentiment.

- EUR/JPY Price Analysis: Bearish below the 200-day EMA; otherwise, it could test 141.00.

The EUR/JPY bounces off the last week’s low of 138.01 and climbs above the 139.00 figure, despite a sour sentiment. Hence, the Euro (EUR) gained some ground against the Japanese Yen (JPY), though it would likely be influenced by the Bank of Japan’s (BoJ) Wednesday’s monetary policy decision. At the time of writing, the EUR/JPY is trading at 139.10, up by 0.43%.

EUR/JPY Price Analysis: Technical outlook

Even though the EUR/JPY is printing a leg-up, the overall trend is downwards once the cross dived below the 200-day Exponential Moving Average (EMA) at 140.19. The Relative Strength Index (RSI), although aiming up, it remains at bearish territory, suggesting that sellers remain in charge, while the Rate of Change (RoC), indicates that buyers are in charge. So, EUR/JPY might refrain from opening fresh shorts until having a clearer RSI signal, as the fundamental bias favors the JPY.

If the EUR/JPY fails to clear the 200-day EMA, that will keep the pair’s bias bearish. Therefore, the EUR/JPY first support would be the 139.00 mark. The break below will expose the 138.01 January 13 daily low, followed by the January 3 daily low of 137.38, followed by the 135.51 August 24 swing low.

On the other hand, EUR/JPY reclaiming the 200-day EMA would lif the pair towards the 20-day EMA at 140.99, followed by the 100-day EMA at 142.05, followed by the 50-day EMA at 142.15, ahead of 142.50.

EUR/JPY Key Technical Level

-

18:51

WTI Price Analysis: Bulls press against daily trendline resistance, bears are lurking

- WTI M-formation is in play in thin choppy trade on Monday.

- Daily chart parameters keep the price stuck in a range, testing daily trendline resistance.

Oil has fallen in thin trade at the start of the week with US exchanges closed for the Martin Luther King, Jr, holiday. West Texas Intermediate spot is currently trading around $79.00 and is down by 1.25%.

Technically, the M-formation on the hopurtly chart is a reversion pattern that would be expected to draw in the price into the Fibonacci scale drawn on the prior bearish impulse's range. The 38.2% Fibo aligns with a structure near 79.15 that could act as a resistance on a restest.

If the price were to break there, then a 50% mean reversion will be a likely scenario ahead of the 61.8% Fibonacci that meets the neckline of the M-pattern near 79.38. Above there, the double top of the M-formation comes in at around 79.75. Stops above there will be located around 80.00. However, given that the market is on the backside of the bullish trend, the downside will remain favourable until the bulls can break above 83.32 daily highs and structure:

On the other hand, a break of structure opens risk to a run towards 93.25 / 95.33 and higher in a correction of the 2022 summer commencing bearish cycle:

-

18:02

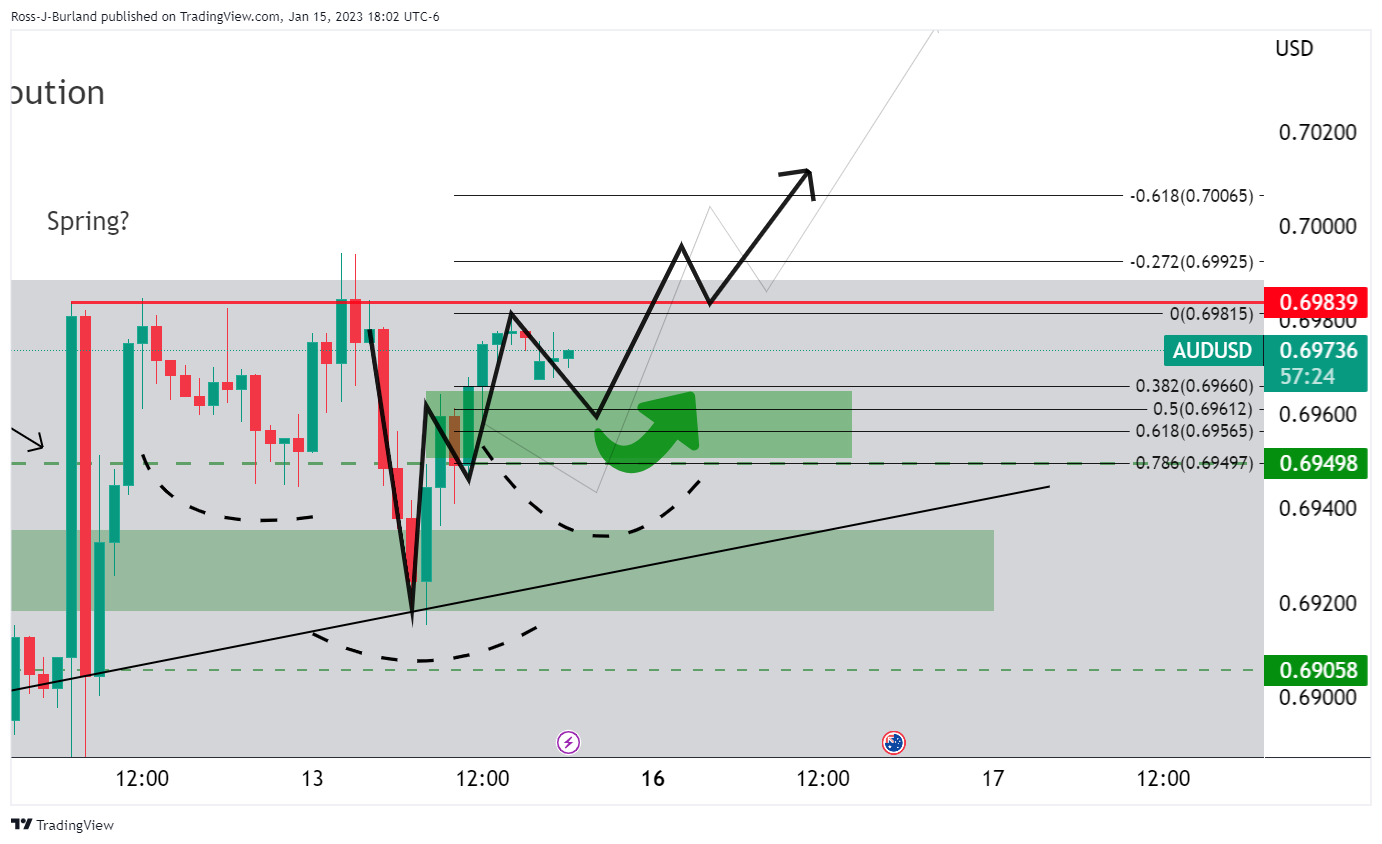

AUD/USD stalls around 0.7000, on risk-off mood and buoyant US Dollar

- The US Dollar stages a recovery on Monday after plunging to seven-month lows against a basket of currencies.

- Australia’s inflation data might spur a reaction by the Reserve Bank of Australia as prices continue to elevate.

- AUD/USD Price Analysis: In a pullback, though expected to resume its uptrend, above 0.7000.

The Australian Dollar (AUD) losses momentum against the US Dollar (USD) and tumbles back below the 0.7000 figure, on low liquidity conditions, on the observance of Martin Luther King Jr. day. A risk-off impulse bolstered the US Dollar (USD), recovering some ground against most G8 currencies. Therefore, the AUD/USD is trading at 0.6952.

Although the US equities cash market is closed, the S&P 500 and Nasdaq Futures portray a dampened market sentiment. Last week’s US economic data, mainly inflation edging lower and consumer sentiment improved, as reported by the University of Michigan (UoM) poll, augmented speculations that the US Federal Reserve would tighten policy by 25 bps. Also, inflation expectations continue to drop as Americans remain optimistic that the US Central Bank could achieve a “soft landing.”

The US Dollar Index (DXY), which measures the greenback’s value against a basket of six currencies, edges up by almost 0.70%, at 128.730, despite the absence of US traders, a headwind for the AUD/USD.

On the Australian front, its economic calendar featured the Melbourne Institute Monthly Inflation gauge, which showed that inflation decelerated by 0.2%. The latest data showed signs that Australia’s inflation figures remained high, both in terms of quarterly and monthly readings. The annual inflation rate in Australia climbed to an over three-decade high of 7.3% in Q3 of 2022 from 6.1% in Q2. Meanwhile, monthly data showed Australia’s CPI rose to a record high of 7.3% YoY in November, well above the Reserve Bank of Australia’s (RBA) 2% to 3% target, fueling expectations for additional tightening by the RBA.

AUD/USD Price Analysis: Technical outlook

After rallying for three consecutive days to fresh multi-month highs at 0.7019, the AUD/USD it’s retracing to the mid-0.69-0.70 range. Although at bullish territory, the Relative Strength Index (RSI) aims down, contrarily to the Rate of Change (RoC), which shows volatility is increasing. Hence, the AUD/USD traders might refrain from opening fresh long positions until the RSI shifts upwards, though the path of least resistance is upwards.

Hence, the AUD/USD key resistance levels would be 0.7000, the new 7-month high hit on January’s 16 sessions at 0.7019, and the August 11 daily high of 0.7136.

-

17:47

GBP/USD bears stay on top in US session, taking out 1.2200

- GBP/USD pressured ahead of key data events this week.

- Bank of England Governor Andrew Bailey said inflation looks set to fall markedly this year as energy prices decrease.

GBP/USD was down 0.27% at 1.2194 after rising to its highest since mid-December to 1.2288 from a low of 1.2170 while traders await UK jobs and inflation data due later this week for clues on Bank of England (BoE) monetary policy plans.

In recent trade, the Bank of England Governor Andrew Bailey said on Monday that inflation looks set to fall markedly this year as energy prices decrease.

However, he said that a shortage of workers in the labour market poses a "major risk" to this scenario.

"I think that going forwards the major risk to inflation coming down ... is the supply side - and in this country particularly, the question of the shrinkage of the labour force," Bailey told lawmakers on parliament's Treasury Committee.

Key UK on tap

Meanwhile, Employment data will be released on Tuesday and inflation numbers on Wednesday. ''We look for another large decline in UK headline Consumer Price Index, largely due to an almost 5% m/m drop in petrol prices but also as retailers pushed through significant discounts in the month to rid themselves of high inventory levels,'' analysts at TD Securities said. ''While our forecast is quite a bit below the BoE's of 10.9% YoY, much of this gap is due to lower petrol prices rather than weaker underlying dynamics.''

As for the jobs data, the analysts say they ''look for an unchanged unemployment rate in the three months to November as the labour market continues to stay persistently tight. At the same time, we think both headline and ex-bonus wage growth accelerated yet again, despite high-frequency data softening further.''

Looking ahead to next month's meeting, a tenth consecutive hike is expected and the money markets are pricing in a 65% chance of a 50 basis point (bps) hike and a 35% chance of a 25 bps increase.

''Even if the BoE has good reason to step up a hawkish tone, there were various instances last year when this failed to boost GBP, given the backdrop of weak investment growth, low productivity and overhanging uncertainties about the UK’s post-Brexit relationship with the EU,'' analysts at Rabobank said.

-

17:18

BoE Gov. Bailey: Inflation looks set to fall markedly this year

Reuters reports that the Bank of England Governor Andrew Bailey said on Monday that inflation looks set to fall markedly this year as energy prices decrease.

However, he said that a shortage of workers in the labour market poses a "major risk" to this scenario.

"I think that going forwards the major risk to inflation coming down ... is the supply side - and in this country particularly, the question of the shrinkage of the labour force," Bailey told lawmakers on parliament's Treasury Committee.

Key quotes

We are likely to see inflation fall in the year ahead as energy prices are coming down.

Major risk to boe's central case for inflation coming down is uk labour shortage.

Likely there will be negative short-term impact from covid in china, don't expect it to be lasting.GBP/USD update

Andrew Bailey's comments are similar to those he made late last year and are having little impact on GBP/USD in the North American session. GBP/USD is down some 0.2% at 1.2202. The range on the day so far has been 1.2170 and 1.2288.

Reuters said that ''the BoE is expected to raise interest rates for a tenth time in a row early next month and the main question for investors is the scale of the increase as the central bank weighs up the risk of a recession with the need to fight inflation.''

-

16:38

USD/JPY rises back above 128.50 on broad US Dollar strength, ahead of the BoJ’s meeting

- The USD/JPY traded below 128.00 for the first time since June 2022.

- USD/JPY traders are bracing for the Bank of Japan’s monetary policy meeting on Wednesday.

- USD/JPY Price Analysis: Downward biased; it could test 125.00 in the near term.

The USD/JPY recovered after hitting an eight-month low around 127.21, reclaiming 128.00 and advancing sharply toward 128.40 on a thin liquidity North American session. An absent US economic docket on the observance of Martin Luther King Jr. day keeps traders leaning on what the US/Japanese calendar presents ahead. At the time of writing, the USD/JPY is trading at 128.55.

US Dollar remains bid, a tailwind for the USD/JPY

US equity futures continue to trade with losses on low volumes. However, with Q4 earnings crossing newswires, equities might continue to lead global investors’ moods. Expectations around the Bank of Japan’s (BoJ) Wednesday’s monetary policy decision continue to mount after tweaking its Yield Curve Control (YCC) at December’s meeting, which expanded the band of the 10-year Japanese Government Bonds (JGBs) from 0.25% to around 0.50%. The BoJ is the only central bank that has not raised rates, though further tightening is likely in the months ahead.

Deutsche Bank (DB) analysts expect the BoJ to continue its easing stance, but they believe that the Outlook Report will update the bank’s inflation forecast to 2% for 2022-2024. Additionally and abandonment of the YCC by the end of Q2 of 2023 is expected.

A day after the BoJ’s decision, the Japanese economic docket will feature the National Consumer Price Index (CPI), with core CPI (excluding food) estimated at 3.9% YoY vs. 3.7% in November, and excluding food and energy is foreseen at 3.1%.

Elsewhere, the US economic calendar will feature the US Empire State Manufacturing Survey, alongside Fed speaking and the Beige book, as the US Central Bank prepares for the year’s first monetary policy. On Wednesday, US Retail Sales and PPI will get a look, while Initial Jobless Claims and Housing data will be revealed on Thursday.

USD/JPY Price Analysis: Technical outlook

Despite the ongoing correction, the USD/JPY daily chart portrays the pair’s downward biased, threatening to erase last Friday’s gains. As long as the exchange rates persist beneath 132.87, the last higher-high achieved for the USD/JPY, the USD/JPY should be poised to test the May 24 swing low of 126.36, followed by the 125.00 figure, ahead of the March 31 pivot low of 121.28.

-

16:35

USD/MXN Price Analysis: A correction to 19.00 is on the cards

- Mexican Peso holds bullish tone against the US Dollar.

- USD/MXN’s technical indicators point to a correction or a consolidation.

- Consolidation below 18.70 would open the doors to 18.50.

The USD/MXN is rising on Monday after hitting the lowest intraday level in almost three years at 18.73. A weaker US Dollar and a positive tone across financial markets are offering support the Mexican Peso and emerging market currencies.

The rebound on Monday was capped by the 18.85 zone, the confluence of a horizontal level, the 20-Simple Moving Average in four hours chart and a downtrend line. A break above would open the doors to a deeper bullish correction in line with some technical indicators. The next resistance is seen at 18.90 before the more important zone of 19.00/05 which should limit the upside.

In the short-term, technical indicators favor a stabilization. Momentum is well below midlines but pointing to the upside. RSI is at or near oversold levels and MACD shows some potential for a deeper correction.

The main trend for USD/MXN is bearish. The downside so far has found support at the 18.70/75 zone. A break lower would clear the way to more losses, targeting the 18.50 zone.

USD/MXN 4-hour chart

-638094836849089910.png)

Technical levels

-

16:00

Gold Price Forecast: XAU/USD to see substantial selling flow on a break below $1,865 – TDS

Strategists at TD Securities do not expect CTA trend followers to exacerbate the rally in Gold much further.

Gold prices are overbought

“Gold prices are overbought, but the demand trends underlying its strength remain unrelenting.”

“We don't expect CTA trend followers to further exacerbate buying activity as long as prices remain below the $1,990 mark. However, a close below the $1,917 range could be consistent with marginal algo liquidations, but more substantial selling flow from trend followers would only be expected if prices break below the $1,865 mark.”

-

15:49

EUR/USD to work its way back to the 1.15 area – ING

Economists at ING are revising their 2023-2024 EUR/USD profile substantially higher.

3Q and 4Q could prove trickier for EUR/USD

“Bearing in mind the importance of EUR/USD in driving FX trends globally, we no longer feel we can justify a sub-consensus profile over the coming years. Instead, we expect EUR/USD to work its way back to medium-term fair value, now around the 1.15 area.”

“In terms of a quarterly profile this year, a good proportion of the year's EUR/USD gains could come in the second quarter when we expect US core inflation to fall sharply, allowing the short end of the US yield curve to adjust lower too.”

“2Q should also be the period when China re-opening trends gain a further leg higher. However, 3Q and 4Q could prove trickier for EUR/USD: the third quarter on the basis that the extension of the US debt ceiling could become a very contentious political debate around that period and be bad for the risk environment and the fourth on the basis that higher energy prices could again hit the Euro.”

-

15:42

EUR/GBP bullish, limited while below 0.8900

- Euro remains supported by ECB official hawkish comments.

- EUR/GBP with bullish bias, moving between 0.8845 and 0.8890.

The EUR/GBP is rising on Monday after a modest slide on Friday and is moving sideways, under the 0.8900 resistance area. The bias continues to point to the upside.

In range, holding onto recent gains

The EUR/GBP found support over the last session at the 0.8845 area. As long as it holds above, more gains seem likely, but the Euro needs to break the critical 0.8900 resistance area.

The bias is bullish with vital support seen at 0.8815/20, the confluence of an uptrend line and the 20-day Simple Moving Average (SMA). A slide below would expose the next relevant support at 0.8770.

From a fundamental perspective, comments from European Central Bank board members continue to be on the hawkish side. On Monday, it was Olli Rhen, Governor of the Bank of Finland, who said that interest rates will continue to rise considerably. This contrasts with the Bank of England that is having a debate about what to do next. Concerns about the health of the UK economy adds pressure to the BoE to stop the tightening cycle. The divergence between the expectations of the central banks is offering support at the moment to the EUR/GBP.

On Tuesday, the UK will report on the labor market and Germany will release the final reading of inflation (December) and the ZEW sentiment survey.

Technical levels

-

15:40

Gold Price Forecast: XAU/USD buyers take a breather around $1910s as the USD recovers

- Gold’s rally stalled shy of reaching $1,930, though it printed a 9-month new high.

- Inflation expectations in the United States eased, though Gold’s appeal will likely continue as the US Dollar weakens.

- XAU/USD Price Analysis: Could continue its rally if it reclaims $1,955, opening the door for the $1,980 - $2,000 range.

Gold price retraces as the North American session begins, even though Wall Street would remain closed in observance of Martin Luther King Jr. day. Nevertheless, the US Dollar (USD) has recovered some ground, snapping two straight days of losses, while the 10-year US Treasury bond yield finished the week around 3.50%. At the time of writing, XAU/USD is trading at $1,915.62, with losses of 0.34%.

Gold’s trade negative on dampened sentiment and Friday’s uptick in US yields

Global equities are trading negatively. US equity futures remain dealing with losses, while last week’s inflation data in the United States (US) pressured the US dollar. The University of Michigan, Consumer sentiment poll showed that 1-year inflation expectations eased to 4% from 4.4%, while for a 5-year horizon, edged up to 3% from 2.9%. Also, a slew of US Federal Reserve (Fed) officials backed the idea of slowing the pace of interest rate hikes.

In the meantime, the US Dollar Index (DXY), which measures the buck’s value against six currencies, has recovered some ground, up 0.15% at 102.332. With the US markets closed for a holiday, US Treasury bond yields remained unchanged, but traders should be aware that US yields ended on a higher note on Friday.

Ahead of the week, the US economic docket will feature the US Empire State Manufacturing Survey, alongside Fed speaking and the Beige book, as the US Central Bank prepares for the year’s first monetary policy. On Wednesday, US Retail Sales and PPI will get a look, while Initial Jobless Claims and Housing data will be revealed on Thursday.

Gold Price Forecast: Technical outlook

From a daily chart perspective, Gold remains upward biased, even though the yellow metal spurred an uptick to overbought conditions, per the Relative Strength Index (RSI). The Rate of Change (RoC) flashes that buyers continue to gather momentum, so the current pullback seems to be used by Gold longs, which could be adding to previous positions, as the non-yielding metal printed a new 9-month high at $1,928.95.

XAU/USD resistance levels lie at $1,930, followed by April’s 22 daily high of $1955.60, followed by April 19 high of $1,981.95, ahead of the $2,000 barrier.

-

15:31

The next month provides a nice window for the USD to consolidate – TDS

In the view of analysts at TD Securities, there is likely potential for USD consolidation in the first quarter of the year.

Scope for a bit of USD consolidation in the weeks ahead

“Earnings, global data surprises, and a bumpy China reopening could stall the Goldilocks optimism in the weeks ahead.”

“The next month provides a nice window for the USD to consolidate. It screens at an extreme discount on a host of measures, though we think any rallies will be shallow, brief, and short-lived.”

-

15:15

AUD/USD: Upside pressure to stay in place towards 0.7088/7136 – Credit Suisse

AUD/USD continues to edge slowly higher. Economists at Credit Suisse stay bullish and look for upside to 0.7088/7136 next.

Notable support seen at 0.6893/75

“Near-term momentum continues to rise and with weekly MACD now also crossing into positive territory, we think the upside pressure is likely to stay in place.”

“Initial resistance moves to 0.7000/09, with the next key resistance zone located at the 50% retracement of the 2021/22 fall and the August high 0.7088/7136, which we think is likely to provide a tougher resistance. A close above here though would inject further upside momentum and clear the way to 0.7282, which is the June high.”

“More notable support is seen at the recent breakout point and the 13-Day Exponential Average at 0.6893/75 and then at the 200DMA at 0.6858, which we look to hold to keep the near-term bias higher.”

-

14:57

EUR/USD: Scope for a move back to 1.06 on a three-month view – Rabobank

The market has become very long EUR, and this exposes EUR/USD to the possibility of sharp pullbacks. Economists at Rabobank see the pair at 1.06 on a three-month view.

One-month forecast of EUR/USD 1.09

“While disappointing Eurozone data could be the trigger for pullbacks in the EUR, in view of the lower prices of energy, we would expect the market to look through this. More likely pullbacks in EUR/USD will be triggered by a continued hawkish position by Fed officials. That said, given the pace at which US headline inflation has come down from its highs recently, the market may continue to largely ignore Fed hawks for a while longer”

“We see plenty of opportunity for USD bulls to become re-engaged particularly in a three- to-six-month view. However, to reflect the change in fundamentals, we have lifted our EUR/USD forecasts from previous levels.”

“Following a one-month forecast of EUR/USD 1.09 we see scope for a move back to 1.06 on a three-month view. This assumes the Fed maintains its forecast of no rate cut until 2024.”

-

14:56

GBP/USD: Extra advance needs to clear 1.2270 – UOB

In the opinion of Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia at UOB Group, further upside in GBP/USD needs to leave behind the 1.2270 level in the next few weeks.

Key Quotes

24-hour view: “We highlighted last Friday that ‘upward momentum has improved a tad but while GBP is likely to trade with an upward bias, it is unlikely to break 1.2270’. GBP subsequently rose to 1.2250, dropped to 1.2153 before rebounding to close at 1.2234 (+0.17%). Despite the choppy price actions, the underlying tone appears to be firm and GBP is likely to edge higher. However, a clear break of 1.2270 still appears unlikely. Support is at 1.2200, followed by 1.2170.”

Next 1-3 weeks: “Our update from last Friday (13 Jan, spot at 1.2215) is still valid. As highlighted, in order to keep the momentum going, GBP must break 1.2270 these 1-2 days or the prospect of further GBP strength would diminish quickly. Conversely, a break of 1.2125 (‘strong support’ level was 1.2100 last Friday) would indicate that GBP is not advancing further. Looking ahead, above 1.2270, there is a significant resistance level at 1.2305.”

-

14:48

EUR/USD looks indecisive and supported around 1.0800

- EUR/USD alternates gains with losses in the low-1.0800s.

- The dollar remains slightly bid around 102.30 gauged by the DXY.

- US stock/bond markets will return to normality on Tuesday.

The absence of direction remains unchanged around EUR/USD at the beginning of the week.

EUR/USD meets support around 1.0800

The sharp recovery in EUR/USD from lows near 1.0480 (January 6) seems to have met some decent resistance around the 1.0880 region, or YTD peaks, so far on Monday.

In the meantime, the inconclusive price action around the pair comes in tandem with the lacklustre bounce in the greenback, all against the backdrop of scarce volatility and reduced trade conditions in response to the holiday in the US.

Data wise in the region, Wholesale Prices in Germany contracted 1.6% MoM in December and rose 12.8% over the last twelve months.

What to look for around EUR

EUR/USD gives away some gains and returns to the negative territory following an earlier climb to new highs around 1.0880.

Price action around the European currency should continue to closely follow dollar dynamics, as well as the impact of the energy crisis on the euro bloc and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: Eurogroup Meeting (Monday) – ECOFIN Meeting, Germany Final Inflation Rate / ZEW Economic Sentiment, EMU ZEW Economic Sentiment, Italy Final Inflation Rate (Tuesday) - EMU New Car Registrations / Final Inflation Rate (Wednesday) – ECB Lagarde, ECB Accounts (Thursday) - ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst diminishing probability of a recession in the region. Impact of the war in Ukraine and the protracted energy crisis on the bloc’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.12% at 1.0818 and the breakdown of 1.0481 (monthly low January 6) would target 1.0443 (weekly low December 7) en route to 1.0459 (55-day SMA). On the upside, the initial hurdle emerges at 1.0874 (monthly high January 16) followed by 1.0900 (round level) and finally 1.0936 (weekly high April 21 2022).

-

14:45

USD/JPY to test 2015 peak of 125.85/124 – SocGen

USD/JPY hit an eight-month low at 127.24. Next objectives are at projections of 126.80 and 2015 levels of 125.85/124.00, economists at Société Générale report.

2015 high of 125.85/124 is significant support

“The pair is expected to head lower towards projections of 126.80 and the peak of 2015 near 125.85/124.00. This could be an important support zone.”

“Daily MACD has flattened recently however signals of a meaningful bounce are not yet visible.”

“The 200DMA at 136.50 should cap upside.”

See: USD/JPY can trade down to 126.50 before BoJ’s meeting – ING

-

14:27

EUR/USD: Ongoing pressure for gains to extend to 1.1000/50 – Scotiabank

EUR/USD closed out last week strongly and will look to build on gains through the 1.0700/50 area in the coming days and weeks, economists at Scotiabank report.

Bull trend develops on the charts

“European fundamental data suggests economic resilience and out-performing European stocks remain attractive for investors.”

“Look for spot to remain well-supported on shallow dips.”

“The overall technical set up in EUR/USD remains bullish– a solid trend higher is evident on the short, medium and long-term charts, backed by solid-looking oscillators. This should mean limited scope for EUR losses (high 1.07s) and ongoing pressure for gains to extend to 1.1000/50.”

-

14:16

EUR/USD: Further consolidation likely below 1.0760 – UOB

Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia suggest a breakdown of 1.0760 could motivate EUR/USD to attempt some consolidation.

Key Quotes

24-hour view: “We highlighted last Friday that ‘despite the relatively large gains, momentum has not improved by much’. We added, ‘the risk for EUR is still on the upside even though 1.0900 is expected to offer solid resistance’. However, EUR did not challenge 1.0900 as it dropped from 1.0867 to 1.0778 before closing at 1.0828 (-0.17%). The price actions appear to be part of a consolidation phase. Today, EUR is likely to trade sideways between 1.0780 and 1.0870.”

Next 1-3: “We highlighted last Friday (13 Jan, spot at 1.0850) that the improved upward momentum suggests further EUR strength. We did not expect the pullback to a low of 1.0778. The price actions have led to an easing in momentum and a break of 1.0760 (no change in ‘strong support’ level) would indicate that EUR could consolidate first before making another attempt to advance toward the resistance at 1.0900 later on.”

-

14:05

AUD/USD to inch higher gradually towards last August high of 0.7090/0.7130 – SocGen

AUD/USD has broken into 0.70 handle for the first time since August. Economists at Société Générale expect the pair to head toward the 0.7090/0.7130 region.

Defending 0.6830 crucial for further up move

“AUD/USD has overcome the 200DMA first time since giving it up in April last year; this affirms persistence in upward momentum.”

“Defending the Moving Average at 0.6830 would be crucial for further up move.”

“The pair is expected to inch higher gradually towards last August's high of 0.7090/0.7130. This could be the next potential resistance zone.”

-

13:51

GBP/USD remains on the defensive, hovers around 1.2200 mark ahead of BoE’s Bailey

- GBP/USD comes under some selling pressure on Monday amid a goodish USD recovery.

- Bets for smaller Fed rate hikes cap the upside for the buck and lend support to the pair.

- Traders now look to BoE Governor Andrew Bailey’s speech for some meaningful impetus.

The GBP/USD pair retreats from a one-month high touched earlier this Monday and remains on the defensive through the early North American session, though lacks follow-through. The pair is currently placed around the 1.2200 mark and is weighed down by a modest US Dollar strength.

In the absence of any relevant economic data, a softer risk tone, amid worries about a deeper global economic downturn, revives demand for the safe-haven greenback. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, rebounds from a seven-month low and exerts some downward pressure on the GBP/USD pair.

The British Pound is further undermined by a bleak outlook for the UK economy, which has been fueling speculations that the Bank of England (BoE) could be nearing the end of its rate-hiking cycle. That said, expectations for a less aggressive policy tightening by the Fed cap the attempted USD recovery and act as a tailwind for the GBP/USD pair.

Investors now seem convinced that the Fed will soften its hawkish stance and have been pricing in a smaller 25 bps rate hike in February amid signs of easing inflationary pressures. The bets were lifted by the latest US CPI report released last week, which showed that consumer prices fell in December for the first time in more than 2-1/2 years.

Furthermore, a holiday in the US, in observance of Martin Luther King Jr. Day, is holding back the USD bulls from placing aggressive bets and lending support to the GBP/USD pair. That said, BoE Governor Andrew Bailey's speech might influence the British Pound and provide some impetus ahead of the monthly UK employment details on Tuesday.

Technical levels to watch

-

13:30

Canada Manufacturing Sales (MoM) came in at 0%, above forecasts (-0.1%) in November

-

13:16

USD/CAD lacks firm intraday direction, oscillates in a range around 1.3400 mark

- USD/CAD attracts some dip-buying on Monday and is supported by a combination of factors.

- Retreating oil prices undermines the Loonie and lends support amid a modest USD strength.

- Bets for smaller Fed rate hikes cap the USD recovery and act as a headwind for the major.

The USD/CAD pair seesaws between tepid gains/minor losses heading into the North American session and is currently trading around the 1.3400 mark, nearly unchanged for the day.

A combination of supporting factors did assist the USD/CAD pair to attract some buyers near the 1.3350 area, though the intraday uptick runs out of steam near the 1.3420 region. A modest pullback in crude oil prices undermines the commodity-linked Loonie and lends support to spot prices. Apart from this, a softer risk tone drives haven flows towards the US Dollar and acts as a tailwind for the major.

The attempted USD recovery from a seven-month low, meanwhile, remains capped in the wake of rising bets for a less aggressive policy tightening by the Fed. In fact, the markets now seem convinced that the US central bank will soften its hawkish stance amid signs of easing inflationary pressure. Furthermore, several FOMC members last week backed the case for a smaller 25 bps rate hike in February.

Given that the US markets are closed in observance of Martin Luther King Jr. Day, the aforementioned mixed fundamental backdrop holds back traders from placing aggressive bets around the USD/CAD pair. Traders also seem reluctant ahead of the release of Canadian consumer inflation data on Tuesday, which will be followed by the Producer Price Index and Retail Sales figures from the US on Wednesday.

In the meantime, traders on Monday will take cues from oil price dynamics. Apart from this, the Bank of Canada's Business Outlook Survey report might influence the Canadian Dollar and contribute to producing short-term opportunities around the USD/CAD pair.

Technical levels to watch

-

13:15

S&P 500 Index could fall 15-20% if the economy enters a full-blown recession – UBS

S&P 500 wrapped up the second week of 2023 with another positive performance. But economists at UBS think that the upcoming 4Q corporate reporting season will provide a reality check.

4Q earnings growth to stall

“Earnings headwinds – an aggressive Fed, a normalization in demand for goods popular during the pandemic, a stronger USD, and higher costs because of more expensive labor – have become strong enough for us to expect no growth in S&P 500 4Q earnings per share compared to the same period last year. Overall, we expect a sharp slowdown in revenue growth to the 4-5% range, and a continued normalization in profit margins from higher-than-average levels last year.”

“Our view on full-year 2023 earnings remains unchanged. Our 2023 EPS estimate is USD215, which is a 4% decline from 2022. We believe the full-year bottom-up consensus EPS estimates look at least 6 percent too high.”

“The S&P 500 forward P/E is at 17.3x compared to the 15-66x range prevailing before the 2Q and 3Q reports. It is also high by historical standards. This suggests that even if results are a bit better than investors expect, the upside market potential may be somewhat limited.”

“Even if the bottom-up EPS estimate of USD230 proves correct, we struggle to justify paying a P/E of more than 18x. That suggests upside potential to 4,140 for S&P 500, only 4% higher than current levels. At the same time, downside risks remain elevated, and stocks could fall 15-20% if the economy enters a full-blown recession.”

-

12:55

EUR/USD to extend its race higher if overcomes resistance near 1.0940 – SocGen

EUR/USD is fast approaching 1.0940 which could be next potential hurdle. Above here, the rebound could persist towards 1.1040/1.1080, economists at Société Générale report.

Next potential hurdles at 1.0940 and 1.1040/1.1080

“The pair has re-established itself beyond the 200DMA in December and is approaching 1.0940, the 50% retracement from 2021. This is an interim resistance.”

“An initial pullback is not ruled out however recent trough near 1.0480 could provide support. The MA at 1.0300/1.0220 should now be an important level in case a deeper pullback materializes.”

“If EUR/USD overcomes the resistance near 1.0940, the rebound could persist towards next projections at 1.1040/1.1080.”

-

12:29

AUD/USD flat-lines above mid-0.6900s amid modest USD strength, cautious market mood

- AUD/USD retreats from a multi-month high touched on Monday, albeit lacks follow-through.

- A softer risk tone lifts the safe-haven USD and weighs on the risk-sensitive Australian Dollar.

- Bets for smaller Fed rate hikes cap the greenback and help limit the downside for the major.

The AUD/USD pair finds some support near the 0.6940 area and stalls its intraday retracement slide from the highest level since August 17 touched earlier this Monday. The pair is currently placed around the 0.6970 area, nearly unchanged for the day, and is influenced by the US Dollar price dynamics.

The USD Index, which measured the greenback's performance against a basket of currencies, stages a goodish rebound from a seven-month low and prompts some selling around the AUD/USD pair. A softer tone risk tone, amid worries about a deeper global economic downturn, benefits the safe-haven buck and drives flows away from the risk-sensitive Aussie. That said, speculations that the Fed may be nearing the end of its rate-hiking cycle keep a lid on any meaningful upside for the USD.

Investors now seem convinced that the US central bank will soften its hawkish stance amid signs of easing inflationary pressures. In fact, the latest US CPI report released last week showed that consumer prices fell in December for the first time in more than 2-1/2 years. This, in turn, lifted bets for a smaller 25 bps Fed rate hike move in February, which continues to act as a headwind for the buck and helps limit deeper corrective pullback for the AUD/USD pair, at least for now.

The Australian Dollar, on the other hand, draws support from rising odds for a further interest rate hike by the Reserve Bank of Australia (RBA) in February, bolstered by stronger domestic inflation figures released last week. This, in turn, makes it prudent to wait for strong follow-through selling before confirming that the AUD/USD pair has topped out in the near term. Traders now look forward to important Chinese macro data, due for release on Tuesday, for a fresh impetus.

Technical levels to watch

-

12:16

USD/CAD: Near-term risks are tilted to the downside – Scotiabank

USD/CAD is consolidating between 1.3350/1.3450. Economists at Scotiabank expect to see a decline in the pair, but it will be slow to materialize.

Bear trend momentum continues to develop

“The USD undertone remains soft and bear trend momentum continues to develop; but short-term DMI signals are weak, suggesting only moderate downside pressure on spot at present. It should also mean limited upside potential for the USD intraday, however.”

“Look for better selling pressure on minor gains to the low 1.34s.”

“A break of 1.3350 targets 1.3270/75.”

-

12:06

Higher EUR/USD and good sentiment in Europe to keep CEE supported – ING

This week we are looking at a lighter calendar in the CEE region. Light calendar means stronger FX, according to economists at ING.

EUR/HUF could test lower levels below 394

“Given the lack of regional momentum, CEE FX will be driven mainly by the global story. In general, we expect higher EUR/USD and good sentiment in Europe to keep CEE supported. Moreover, gas prices are testing lower levels again, which could be positive for the Czech Koruna and Hungarian Forint.”

“Forint should still benefit from lower-than-expected inflation and could test lower levels below 394 EUR/HUF this week. On the other hand, we think the Koruna has the strongest long positioning in the region at the moment and further gains will be difficult. Thus, we expect levels around 24.00 EUR/CZK for this week.”

“The Polish Zloty, which has lagged behind the region so far, should also see slightly stronger levels and could benefit from the regional optimism and move a bit lower below to 4.68 EUR/PLN.”

-

11:49

USD/INR to challenge crucial support zone at 80.50/79.80 – SocGen

The USD/INR pair has embarked on a phase of pullback after forming a lower high at 82.95. Retest of 80.50/79.80 could follow, economists at Société Générale report.

Failure to reclaim 82.95 to trigger a continuation in phase of correction

“Break below the trend line since last February affirms a short-term down move is taking shape.”

“Failure to reclaim 82.95 would mean continuation in phase of correction.”

“A retest of November low and projection at 80.50/79.80 is expected. This could be a significant support zone.”

-

11:47

EUR/USD Price Analysis: Further gains in the pipeline near term

- EUR/USD prints a new monthly high near 1.0880 on Monday.

- The continuation of the uptrend could see 1.0900 revisited.

EUR/USD struggles to get extra upside traction after recording new YTD peaks near 1.0880 at the beginning of the week.

Despite the ongoing indecision in the price action, bulls remain well in control of the sentiment for the time being. That said, further north of the January top at 1.0874 (January 16) should turn up the round level at 1.0900 in the relatively near term.

Furthermore, while above the short-term support line near 1.0570, the pair should retain the bullish view.

In the longer run, the constructive view remains unchanged while above the 200-day SMA at 1.0308.

EUR/USD daily chart

-

11:40

USD/JPY pares intraday recovery gains, hangs near multi-month low set earlier this Monday

- USD/JPY rebounds from a nearly nine-month low touched earlier this Monday.

- A goodish USD recovery turns out to be a key factor lending support to the pair.

- The upside remains capped as traders await the BoJ decision for a fresh impetus.

The USD/JPY pair stages a goodish recovery from its lowest level since late May set earlier this Monday and snaps a two-day losing streak. The pair, however, retreats a few pips from the daily high and slips back below the mid-128.00s during the mid-European session.

The US Dollar rebounds after hitting a seven-month low, which, in turn, is seen as a key factor lending some support to the USD/JPY pair. The intraday USD uptick, meanwhile, lacks any obvious fundamental catalyst and remains capped amid firming expectations for a less aggressive policy tightening by the Fed. In fact, the markets are now pricing in a smaller 25 bps lift-off in February and expect the US central bank to pause its rate-hiking cycle, possibly after the March FOMC meeting.

The speculations were fueled by the latest US consumer inflation figures released last week, which showed that the headline CPI fell in December for the first time in more than 2-1/2 years. This should keep a lid on any meaningful upside for the Greenback. The Japanese Yen, on the other hand, continues to draw support from bets that the Bank of Japan (BoJ) will tweak its yield control policy further, which, in turn, contributes to capping the USD/JPY pair's attempted recovery.

Traders also seem reluctant and prefer to move to the sidelines ahead of the BoJ policy decision, due to be announced during the Asian session on Wednesday. Heading into the key central bank event risk, the US markets will be closed on Monday in observance of Martin Luther King Jr. Day. This further makes it prudent to wait for a strong follow-through buying before confirming that the USD/JPY pair has formed a near-term bottom and positioning for any meaningful recovery. The next key support level is the 126.45 trough low of May 2022. The pair is staeadily channelling lower and despite the recovery today bears still have the upper hand.

Technical levels to watch

-

11:22

USD/JPY will overshoot regardless of whether the BoJ makes further adjustments – SocGen

The biggest over-shooter in FX is the Yen. Kit Juckes, Chief Global FX Strategist at Société Générale, thinks USD/JPY 115 is a reasonable target.

Buying into Yen weakness

“A 20-year regression of USD/JPY against the 5-year US/Japanese yield spread would suggest ‘fair value’ is 118 now, and given the tendency to overshoot, it’s more than a little tempting to conclude USD/JPY 115 is a reasonable target. Even if the BoJ meeting on Wednesday only tells us (say) that they will announce the outcome of their review of the changes they made to yield curve control, in due course!”

“I think YCC has had its day, because it now has a target on its back. That may, before we’re done, cause an overshoot in USD/JPY to the downside. For now, though, we like buying into Yen weakness, so we’ll wait and see if the BoJ disappoints bulls enough on Wednesday to deliver attractive entry levels.”

-

11:01

EUR/USD set to head higher towards 1.15 over the course of 2023 – Deutsche Bank

The Dollar is heading lower. Economists at Deutsche Bank see EUR/USD rising to 1.15 over the course of 2023.

The pieces are falling in place for a more sustained downturn in the Dollar