Notícias do Mercado

-

20:01

Dow 16,417.93 -40.63 -0.25%, Nasdaq 4,219.12 +21.54 +0.51%, S&P 500 1,842.21 +3.51 +0.19%

-

19:20

American focus : the euro recovered losses against the U.S. dollar

The euro rose against the dollar after the decline of the European session on the back of higher forecasts for global growth from the IMF. The International Monetary Fund on Tuesday revised upward its forecast for global growth in 2014 amid increasing growth in the U.S. , the euro area and Japan. However, the fund said that the risks associated with deflation and financial sector can undermine the overall recovery .

The IMF raised its forecast for growth in world GDP in 2014 to 3.7% from 3.6 % projected in October.

U.S. head recovery. The IMF raised its forecast for GDP growth in the U.S. this year by 0.2 percentage points to 2.8% , although it has lowered the forecast for 2015 by 0.4 percentage points to 3%. This is due to the ongoing battles in Congress over federal spending and balance .

However, the IMF expressed less optimism about Europe, where the authorities have warned of growing risks of falling prices , threatening stall the already sluggish recovery

As for Japan , the IMF raised its forecast for GDP growth by 0.4 percentage points to 1.7%. According to the Fund , the Government of Japan will continue to face difficulties in terms of budget cuts , which would reassure investors , but not slow recovery.

The IMF also raised its forecast for China's GDP growth , the second largest economy in the world , at 0.3 percentage points, to 7.5%.

The euro exchange rate fell moderately earlier against the dollar, which was associated with the release of weak data on Germany. The results of recent studies , which were presented earlier today institute ZEW, showed that German economic expectations fell in January , contrary to forecasts for growth. But , despite the recession , the mood still remain elevated. According to the report , the sentiment index fell in the business environment in the current month to the level of 61.7 points compared to 62.0 points in December . It is worth noting that many economists predicted that this figure will rise to the level of 63.4 points. Nevertheless , we add that the index remained well above long-term average at 24.4 points.

The data showed that 254 analysts and institutional investors were optimistic about the current economic conditions. We add that the ZEW indicator on current conditions rose in January to a level of 41.2 points, compared to 32.4 points in December .

We also learned that the economic expectations for the eurozone rose in January. The corresponding figure improved by 5.0 points to 73.3 points. Indicator of the current economic situation in the euro area rose by 6.2 points to minus 48.2 points level .

Pound was able to recover from the lows against the dollar. Noticeable influence on the bidding had data that were presented today by the Confederation of British Industry . They showed that the balance of industrial orders fell sharply in January, but the index that assesses the prospects for the next three months was at the highest level over the past two years. According to the report , the January balance promzakazov dropped to -2 points, compared with 12 points last month . Many experts expect that this figure is only slightly worse , but it is up to 11 points. In addition, it was reported that the balance of demands for the next three months rose to 22 points from 14 points , and reached the highest level since April 2012 . We also add that new orders in the three months to January, showed the largest increase in nearly three years .

The data also showed that the quarterly balance of prospects for the companies declined to 21 in the three months to January 24 in the three months to October ( the highest since April 2010 ) . Recall that the British manufacturing sector is gradually recovering from the financial crisis , but remains below its peak in 2008 , underscoring the problem re- rebalancing the economy to reduce dependence on domestic consumption.

-

18:20

European stocks close

European stocks were little changed, erasing earlier gains, as a rally in food and beverage makers offset a decline in mining stocks.

The International Monetary Fund raised its forecast for global growth this year as expansions in the U.S. and the U.K. accelerate. The economy will grow 3.7 percent, compared with an October estimate of 3.6 percent, the IMF said.

German data showed investor confidence slipped in January after gaining for five straight months. The ZEW Center for European Economic Research said its index of investor and analyst expectations, which aims to predict economic developments six months in advance, fell to 61.7 from 62 in December. That missed the median economist estimate for an increase to 64.

National benchmark indexes fell in 10 of the 18 western-European markets. The U.K.’s FTSE 100 dropped less than 0.1 percent. France’s CAC 40 Index increased less than 0.1 percent, and Germany’s DAX rose 0.2 percent.

Unilever gained 2.3 percent to 29.49 euros in Amsterdam after saying fourth-quarter sales excluding acquisitions and currency fluctuations rose 4.1 percent, beating the median analyst estimate that called for a 3.9 percent increase.

A gauge of food and drink stocks in the Stoxx 600 rose 1.2 percent to its highest level since May. Danone, the world’s largest yogurt maker, added 2.1 percent to 52.11 euros. Pernod Ricard SA advanced 3.7 percent to 84.25 euros.

Wirecard AG jumped 5.2 percent to 32.12 euros, the highest price since its October 2000 initial public offering. The provider of software for electronic payments said sales increased to 482.2 million euros ($652.6 million) last year, while earnings before interest, taxes, depreciation and amortization rose 15 percent to 126 million euros. The company predicted “strong growth in all core markets” for 2014.

Henkel AG increased 2 percent to 85.35 euros, its highest price since at least August 1992. The German maker of Schwarzkopf hair products and Loctite glue said it will increase its dividend payout to as much as 35 percent of net income. The company had previously paid out about 25 percent.

Rio Tinto fell 3.1 percent to 3,231.5 pence and BHP slid 1.7 percent to 1,854.5 pence. A gauge of Stoxx 600 mining stocks fell the most among 19 industry groups today.

-

17:00

European stocks closed in different ways: FTSE 100 6,834.26 -2.47 -0.04%, CAC 40 4,323.87 +1.01 +0.02%, DAX 9,730.12 +14.22 +0.15%

-

16:42

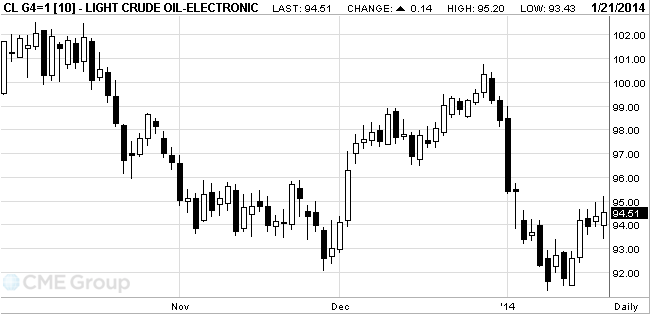

Oil is rising amid predictions IEA

Oil prices rose after the announcement of an improved outlook for the growth rate of world consumption , which was granted by the International Energy Agency .

The International Energy Agency has changed the forecast growth in global oil consumption this year in a big way , increasing the rate of consumption by 50,000 to 1.3 million barrels per day. According to experts of the IEA , this change will figure by accelerating economic growth.

Also contributed to the increase in the price of oil news from China . According to reliable information , the Chinese Central Bank has provided financial system more than 42 billion dollars. Such actions were designed to stop the growth of lending rates , as well as to reassure market participants, who were worried because of the recurrence of the cash shortage .

In addition , on Monday the United States together with the European Union announced an easing of international economic sanctions against Iran. Recall that recently the parties concluded an agreement that in exchange for the lifting of sanctions Tehran start reducing its nuclear program, and retain the previous volume of exported oil . Analysts say that at the moment , the world market goes to 60% less Iranian oil than it was two years ago, and that in the near future supplies will remain at this level.

At the same time, market participants continue to worry about oil supplies from Libya and South Sudan . Earlier, President of South Sudan made a statement that government troops liberated from the rebels regional center Malakal , but soon the rebels gave a rebuttal to this statement. From the reports from Libya , it became known that the local authorities are planning in the coming days to clear all the invaders that are important for the export of oil , the eastern ports . Recall that the three major ports, which previously were shipping every day more than 600,000 barrels of oil for export, at the moment are on the control of armed protesters who are fighting for their political rights .

February futures price of U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 95.20 per barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture rose $ 1.48 , or 1.4 percent, to $ 107.83 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold fell

Gold prices fell to a six-week peak against the background of recovery in stock markets and the possibility of weakening demand in the physical market .

Today, the IMF has improved the assessment of global economic growth in 2013 and forecast for 2014 - up to 3 % and 3.7 % respectively from the expected 2.9% in October and 3.6 %. Growth in the economies of developed countries , according to the IMF amounted to 1.3 % in the past year , and in 2014 will accelerate to 2.2%.

Investors do not want to create large positions in anticipation of the Fed meeting , at which the central bank may continue to reduce the program of buying bonds.

Fed meeting will be held January 28-29 . At the December meeting, the central bank reduced its monthly buying of bonds by $ 10 billion to $ 75 billion . Due to this program, the price of gold in 2011 reached a historic high of $ 1,920 an ounce, but subsequently decreased by 35 percent from that level .

Gold purchases in China, the world's largest consumer of the precious metal , declined last week as prices are rising for four weeks . Surcharge 99.99 fine gold on the Shanghai Futures Exchange fell to $ 13 per ounce to $ 14 on Monday . According to analysts, China's gold imports will decline this year to a record high last year.

Cost February gold futures on the COMEX today dropped to $ 1235.10 per ounce.

-

14:34

U.S. Stocks open: Dow 16,501.40 +42.84 +0.26%, Nasdaq 4,222.81 +25.23 +0.60%, S&P 1,844.86 +6.16 +0.34%

-

14:24

Before the bell: S&P futures +0.41%, Nasdaq futures +0.53%

U.S. stock-index futures advanced, as equity markets reopen following a holiday and investors weigh earnings reports from companies including Verizon Communications Inc. and Delta Air Lines Inc.

Global markets:

Nikkei 15,795.96 +154.28 +0.99%

Hang Seng 23,033.12 +104.17 +0.45%

Shanghai Composite 2,008.31 +17.06 +0.86%

FTSE 6,861.78 +25.05 +0.37%

CAC 4,350.26 +27.40 +0.63%

DAX 9,793.19 +77.29 +0.80%

Crude oil $95.07 (+1.18%)

Gold $1238.20 (-1.09%).

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y103.45, Y103.50, Y104.35, Y104.50, Y105.00, Y105.50

EUR/JPY Y140.00

EUR/USD $1.3400, $1.3450, $1.3475, $1.3500, $1.3525, $1.3595, $1.3600, $1.3675

GBP/USD $1.6300, $1.6355, $1.6380, $1.6385, $1.6440/45, $1.6450

AUD/USD $0.8825, $0.8850, $0.8900, $0.9000

NZD/USD $0.8200, $0.8270, $0.8295, $0.8325

USD/CAD C$1.0900

-

13:30

Canada: Manufacturing Shipments (MoM), November +1.0% (forecast +0.4%)

-

13:30

Canada: Wholesale Sales, m/m, November 0.0% (forecast +0.6%)

-

13:15

European session: the euro fell moderately against the U.S. dollar

Data

8:40 Speech UK executive director for financial stability Andy Haldane of the Bank of England

10:00 Eurozone sentiment in the business environment of the ZEW institute in January 68.3 70.2 73.3

10:00 Germany Consumer Sentiment Index in the business environment of the ZEW institute in January 62.0 63.4 61.7

11:00 UK factory orders balance of the Confederation of British Industry January 12 11 -2

The euro exchange rate fell moderately against the dollar, which was associated with the release of weak data on Germany. The results of recent studies , which were presented earlier today institute ZEW, showed that German economic expectations fell in January , contrary to forecasts for growth. But , despite the recession , the mood still remain elevated. According to the report , the sentiment index fell in the business environment in the current month to the level of 61.7 points compared to 62.0 points in December . It is worth noting that many economists predicted that this figure will rise to the level of 63.4 points. Nevertheless , we add that the index remained well above long-term average at 24.4 points.

The data showed that 254 analysts and institutional investors were optimistic about the current economic conditions. We add that the ZEW indicator on current conditions rose in January to a level of 41.2 points, compared to 32.4 points in December .

We also learned that the economic expectations for the eurozone rose in January. The corresponding figure improved by 5.0 points to 73.3 points. Indicator of the current economic situation in the euro area rose by 6.2 points to minus 48.2 points level .

Pound was able to recover from the lows against the dollar , reaching levels at this opening session. Noticeable influence on the bidding had data that were presented today by the Confederation of British Industry . They showed that the balance of industrial orders fell sharply in January, but the index that assesses the prospects for the next three months was at the highest level over the past two years. According to the report , the January balance promzakazov dropped to -2 points, compared with 12 points last month . Many experts expect that this figure is only slightly worse , but it is up to 11 points. In addition, it was reported that the balance of demands for the next three months rose to 22 points from 14 points , and reached the highest level since April 2012 . We also add that new orders in the three months to January, showed the largest increase in nearly three years .

The data also showed that the quarterly balance of prospects for the companies declined to 21 in the three months to January 24 in the three months to October ( the highest since April 2010 ) . Recall that the British manufacturing sector is gradually recovering from the financial crisis , but remains below its peak in 2008 , underscoring the problem re- rebalancing the economy to reduce dependence on domestic consumption.

The dollar rose against the yen, halting a three-day decline , on expectations that the Fed will continue to minimize the program of quantitative easing QE at the January meeting , to be held January 28-29 . According to the median forecast of economists , the Fed will reduce the amount of government foreclosures and mortgage debt by $ 10 billion and will do so at each subsequent meeting until the end of the QE program this year. Experts note that the " variables still point to a further appreciation of the dollar . State of the U.S. economy will gradually improve . In statements Fed traced more determination against folding QE ».

EUR / USD: during the European session, the pair fell to $ 1.3515 , then recovered slightly

GBP / USD: during the European session, the pair rose to $ 1.6451 , but then fell to $ 1.6398 , then returned to the opening level

USD / JPY: during the European session, the pair rose to Y104.75

At 13:30 GMT , Canada announces the change of volume of production and supply changes in the volume of wholesale trade in November. At 23:30 GMT Australia will release the consumer confidence index from Westpac in January .

-

11:45

European stock rose

European stocks advanced to the highest level in six years, with Unilever leading food and beverage makers higher. U.S. index futures climbed, while Asian shares were little changed.

The Stoxx Europe 600 Index climbed 0.3 percent to 336.56 at 11 a.m. in London, its highest level since January 2008.

German data showed investor confidence slipped in January after gaining for five straight months. The ZEW Center for European Economic Research said its index of investor and analyst expectations, which aims to predict economic developments six months in advance, fell to 61.7 from 62 in December. That missed the median economist estimate for an increase to 64.

Unilever (UNA) gained 3.5 percent to 29.85 euros in Amsterdam after saying fourth-quarter sales excluding acquisitions and currency fluctuations rose 4.1 percent, beating the median analyst estimate that called for a 3.9 percent increase.

A gauge of food and drink stocks in the Stoxx 600 rose to its highest level since May, posting the biggest gain among 19 industry groups. Danone, the world’s largest yogurt maker, added 2.1 percent to 52.15 euros. Pernod Ricard SA added 2 percent to 82.94 euros.

Wirecard jumped 5.2 percent to 32.14 euros, the highest price since its October 2000 initial public offering. The provider of software for electronic payments said sales increased to 482.2 million euros ($652.6 million) last year, while earnings before interest, taxes, depreciation and amortization rose 15 percent to 126 million euros. The company predicted “strong growth in all core markets” for 2014.

SAP fell 1.1 percent to 59.97 euros. The company said operating profit adjusted for some items will probably reach 35 percent of sales by 2017, later than the previous target of 2015. Analysts (SAB) had predicted SAP would miss the 2015 profitability target.

FTSE 100 6,851.7 +14.97 +0.22%

CAC 40 4,340.3 +17.44 +0.40%

DAX 9,758.32 +42.42 +0.44%

-

11:00

United Kingdom: CBI industrial order books balance, January -2 (forecast 11)

-

10:21

Option expiries for today's 1400GMT cut

USD/JPY Y103.45, Y103.50, Y104.35, Y104.50, Y105.00, Y105.50

EUR/JPY Y140.00

EUR/USD $1.3400, $1.3450, $1.3475, $1.3500, $1.3525, $1.3595, $1.3600, $1.3675

GBP/USD $1.6300, $1.6355, $1.6380, $1.6385, $1.6440/45, $1.6450

AUD/USD $0.8825, $0.8850, $0.8900, $0.9000

NZD/USD $0.8200, $0.8270, $0.8295, $0.8325

USD/CAD C$1.0900

-

10:00

Eurozone: ZEW Economic Sentiment, January 73.3 (forecast 70.2)

-

10:00

Germany: ZEW Survey - Economic Sentiment, January 61.7 (forecast 63.4)

-

09:21

Asia Pacific stocks close

Asian stocks rose as the Bank of Japan started a two-day policy meeting and China’s money-market rates dropped after the central bank pumped funds into the financial system.

Nikkei 225 15,795.96 +154.28 +0.99%

S&P/ASX 200 5,331.46 +36.42 +0.69%

Shanghai Composite 2,008.31 +17.06 +0.86%

Industrial & Commercial Bank of China Ltd., the nation’s biggest lender, climbed 2.5 percent in Hong Kong.

LG Display Co., a supplier of panels for Apple Inc. devices, rose 2.3 percent in Seoul after Bank of America Corp.’s Merrill Lynch raised its rating on the stock.

Fortescue Metals Group Ltd., Australia’s third-largest iron-ore miner, sank 4.6 percent in Sydney after a benchmark for the metal’s price fell in China, the biggest consumer of the commodity.

-

09:04

FTSE 100 6,843.74 +7.01 +0.10%, CAC 40 4,331.64 +8.78 +0.20%, Xetra DAX 9,745.72 +29.82 +0.31%

-

07:20

European bourses are initially seen trading mixed Tuesday: the FTSE higher by 0.33%, the DAX down 0.3% and the CAC down 0.12%.

-

07:04

Asian session: The dollar rose against the yen

The dollar rose against the yen, ending a three-day drop, as signs of U.S. economic growth backed the case for the Federal Reserve to pare stimulus.

The Bloomberg Dollar Spot Index gained for a sixth day before the Federal Open Market Committee meets Jan. 28-29. The Fed will reduce purchases of government and mortgage debt by $10 billion at each policy meeting to end its asset-buying program this year, according to the median forecast of economists in a Bloomberg poll.

The euro halted a four-day slide versus the yen before data forecast to show the outlook for business confidence in Germany, Europe’s largest economy, climbed to the highest level in almost eight years. In Germany, an index of investor and analyst expectations jumped to 64 in January from 62 in December, the ZEW Center for European Economic Research in Mannheim will probably say today, according to the median estimate of economists surveyed by Bloomberg. That would be the highest since February 2006.

New Zealand’s dollar remained stronger after the nation’s inflation accelerated more than economists forecast, supporting the view that the Reserve Bank will tighten policy. New Zealand’s consumer prices in the fourth quarter rose 1.6 percent, the fastest annual pace since early 2012, from the year-earlier period. Economists expected annual inflation of 1.5 percent, according to the median forecast in a Bloomberg survey. The Reserve Bank of New Zealand next meets on Jan. 30.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3535-60

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6410-35

USD / JPY: during the Asian session, the pair rose to Y104.70

Today's German and eurozone ZEW Economic Sentiment data are key event risks for the euro and could inject some volatility. CBI trends data at 1100GMT provides the domestic interest today, though most expect continued range trading until the US markets return from their long weekend.

-

06:25

Commodities. Daily history for Jan 17’2013:

Gold $1,241.80 +$3.50 +0.28%

Oil $94.08 -$0.09 -0.10%

-

06:24

Currencies. Daily history for Jan 17'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3551 +0,18%

GBP/USD $1,6426 +0,11%

USD/CHF Chf0,9097 -0,15%

USD/JPY Y104,16 -0,12%

EUR/JPY Y141,16 +0,08%

GBP/JPY Y171,10 0,00%

AUD/USD $0,8809 +0,42%

NZD/USD $0,8324 +0,82%

USD/CAD C$1,0946 -0,25%

-

06:24

Stocks. Daily history for Jan 17’2013:

Nikkei 225 15,641.68 -92.78 -0.59%

S&P/ASX 200 5,295.05 -10.82 -0.20%

Shanghai Composite 1,991.25 -13.70 -0.68%

FTSE 100 6,834.71 +5.41 +0.08%

CAC 40 4,319.48 -8.02 -0.19%

DAX 9,709.49 -33.47 -0.34%

Dow Closed

Nasdaq Closed

S&P Closed

-

06:02

Schedule for today, Tuesday, Jan 21’2013:

08:40 United Kingdom Executive Director for Financial Stability Andy Haldane Speaks

10:00 Eurozone ZEW Economic Sentiment January 68.3 70.2

10:00 Germany ZEW Survey - Economic Sentiment January 62.0 63.4

11:00 United Kingdom CBI industrial order books balance January 12 11

13:30 Canada Manufacturing Shipments (MoM) November +1.0% +0.4%

13:30 Canada Wholesale Sales, m/m November +1.4% +0.6%

21:30 U.S. API Crude Oil Inventories January -4.1

23:30 Australia Westpac Consumer Confidence January -4.8%

-