Notícias do Mercado

-

23:01

EUR/USD holds steady around 1.0980 as upbeat US PMIs ease recession fears

- S&P Global PMI figures ease recessionary fears, boost US economy.

- Traders’ moods fluctuating to risk-on/off dominated the New York session.

- EU’s PMI results are mixed; manufacturing activity shranks, while Services and Composite Indices exceed expectations.

- Markets remain cautious amid uncertain rate outlooks from the Fed and the ECB.

The EUR/USD prepares to finish the week on a higher note, though it remains below the 1.1000 figure, albeit economic data from the United States (US) bolstered the US Dollar (USD). However, late into the Wall Street close, the greenback lost strength, US equities rose, and the Euro (EUR) recovered some ground. Hence, the EUR/USD is trading at 1.0988 after reaching a low of 1.0937.

US business activity picked up, but not so in the EU

Sentiment across the New York (NY) session fluctuated between risk-on/off. Investors’ recessionary fears about the US were pushed away by April’s S&P Global PMI figures, which showed the economy’s resilience, despite the US Federal Reserve (Fed) 475 bps of tightening. Manufacturing and Services PMIs exceeded estimates, with the former at 50.4, above 49 expectations, while the latter jumped to 53.7 from 51.5 estimates. Therefore, the Composite Index aimed higher to 53.5.

The market initially reacted to buying the US Dollar, which gained some ground vs. the Euro, as it dived to 1.0942. Nevertheless, buyers moved in and lifted the EUR/USD pair, though they failed to crack the 1.1000 mark.

This happened after Thursday’s data, namely, US unemployment claims, housing data, and the Philadelphia Fed Manufacturing Index, flashed a gloomy scenario, triggering flows towards safety, except for the US Dollar.

Aside from this, on the Eurozone (EU) side, Thursday’s calendar featured a surplus in the Balance of Trader of €4.6B, better than January’s deficit of €-31.6B, which was upward revised, alongside the Consumer Confidence, which improved a tick, to -17.5 above -18.5 estimates.

On Friday, the EU’s PMI was mixed, with the Manufacturing Index at 45.5, standing at contractionary territory missing estimates, while the Services and Composite Indices exceeded the consensus, expanding.

Fed and ECB May decisions loom

Meanwhile, central bankers from both sides of the Atlantic continued their hawkish rhetoric. For one part, Federal Reserve (Fed) officials agreed that inflation is too high, though there’s a myriad of opinions regarding how much tightening is left. On the European Central Bank (ECB), the baseline was made by its ECB Chief Economist Philip Lane, with most policymakers yet undecided about lifting rates by 50 or 25 bps.

EUR/USD Technical Analysis

From a daily chart perspective, the EUR/USD remains supported by the 20-day EMA from March 20 until today. Yet EUR/USD tested the April 21, 2022 high-turned-support at 1.0936, bounced off, and clung to the 1.0980s area amidst the lack of an impactful catalyst that could break the EUR/USD’s trading range. Should the EUR/USD reclaim 1.1000, a test to the YTD high is on the cards, followed by 1.1100. Conversely, a fall below 1.0900 will expose the 20-day EMA at 1.0911. If EUR/USD drops below the latter, a dive to 1.0800 is likely.

-

22:04

Silver: XAG/USD drops as a doji emerge, while indicators suggest a potential pullback

- Silver price retreats after hitting daily high on upbeat US economic data.

- Upward momentum for XAG/USD remains despite recent losses.

- XAG/USD may drop unless it holds above a critical support level.

Silver price retraces after hitting a daily high of $25.37, last seen at around $25.05, as US Treasury bond yields edged up, following upbeat US economic data. At the time of writing, the XAG/USD is trading at $25.05, down 0.83%.

XAG/USD Price Analysis

XAG/USD remains upward biased, although it posted back-to-back days of losses, led by Thursday’s price action, which printed a doji, followed by a bearish candlestick, about to close below the April 20 low of $25.06. However, the uptrend remains in play unless the XAG/USD drops below the confluence of the April 19 low and the 20-day EMA around $25.58/65.

If XAG/USD clears April’s 20 high at $25.49, it could exacerbate a rally to the YTD high of $26.08. A breach of the latter will expose the last year’s high at $26.95, shy of the $27.00 figure.

Conversely, the XAG/USD could test February’s 2 high-turned-support at $24.63, immediately followed by the 20-day EMA. If the Relative Strength Index (RSI) continues to drop, as it has done since six-days ago, a test of the $24.00 figure is on the cards. Downside risks remain eyed at the 50-day EMA at

XAG/USD Daily Char

-

21:32

Australia CFTC AUD NC Net Positions fell from previous $-37.9K to $-42.4K

-

21:31

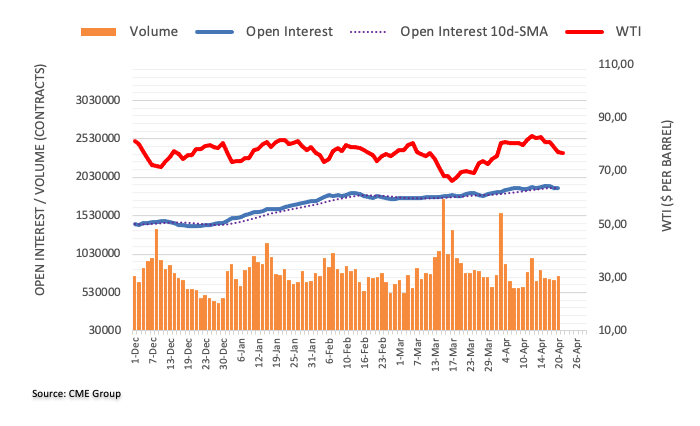

United States CFTC Oil NC Net Positions up to 244.6K from previous 235.6K

-

21:31

Japan CFTC JPY NC Net Positions climbed from previous ¥-57.2K to ¥-56.9K

-

21:31

European Monetary Union CFTC EUR NC Net Positions up to €164.4K from previous €163.3K

-

21:31

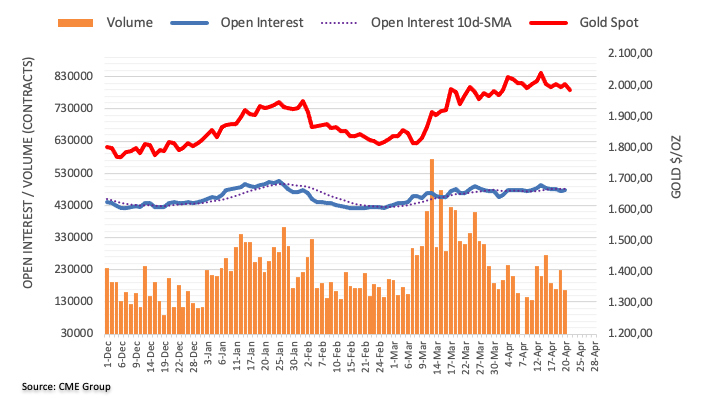

United States CFTC Gold NC Net Positions down to $189.9K from previous $192.7K

-

21:31

United States CFTC S&P 500 NC Net Positions down to $-344.3K from previous $-307.6K

-

21:31

United Kingdom CFTC GBP NC Net Positions: £1.3K vs £-2.4K

-

21:29

Canada: Signs that higher interest rates are having an impact on consumer spending – CIBC

Data released on Friday showed retail sales in Canada dropped 0.2% in February, a better-than-expected number but excluding auto fell 0.7%, more than forecast. Analysts at CIBC consider that the sluggishness in ex-auto spending is a sign that higher interest rates are having an impact. They see the Bank of Canada on hold for the rest of the year.

Key quotes:

“The start of the year surge in retail spending appears to be gradually fading, with a modest 0.2% decline in February (consensus -0.7%) estimated to be followed by a sharper 1.4% drop in March.”

“While the advance estimate for March suggests a steep 1.4% drop, that was derived from responses covering only 28% of companies normally surveyed, and as such could be heavily revised.”

“Even though the economy as a whole has performed better than expected recently, the sluggishness in ex-auto retail spending volumes is a sign that higher interest rates are indeed having an impact on consumer spending decisions, despite the excess levels of savings held by households. This sluggishness in spending should help keep goods price inflation under control (assuming supply chain issues don’t worsen again), allowing the Bank of Canada to stay on hold for the remainder of this year before gradual cuts start early in 2024.”

-

21:24

EUR/USD: Seen moving into a higher range after breaking 1.1000 – MUFG

The EUR/USD is moving with a bullish bias according to analysts at MUFG Bank. They see the pair trading in the range 1.0700 -1.1400 over the next weeks.

Key quotes:

“The EUR has continued to outperform other G10 currencies. The EUR is benefitting from the easing of last year’s negative terms of trade shock. The incoming economic data flow from the euro-zone is continuing to surprise to the upside although not as strongly as at the start of this year.”

“Fears over a sharper growth slowdown have also been eased by the quick action taken by the Swiss authorities to deal with concerns over the health of Credit Suisse that have helped reduce financial stability risks in Europe.”

“The better than expected growth outlook for the euro-zone economy is putting pressure on the ECB to raise rates further. We still expect the ECB to step down the pace of hikes at their next policy meeting on 4th May by delivering a 25bps hike but one can’t rule out another larger 50bps hike.”

“We expect EUR/USD to move up into a higher trading range after breaking above the 1.1000-level on a more sustained basis.”

-

19:49

Forex Today: Dollar rises timidly on cautious markets

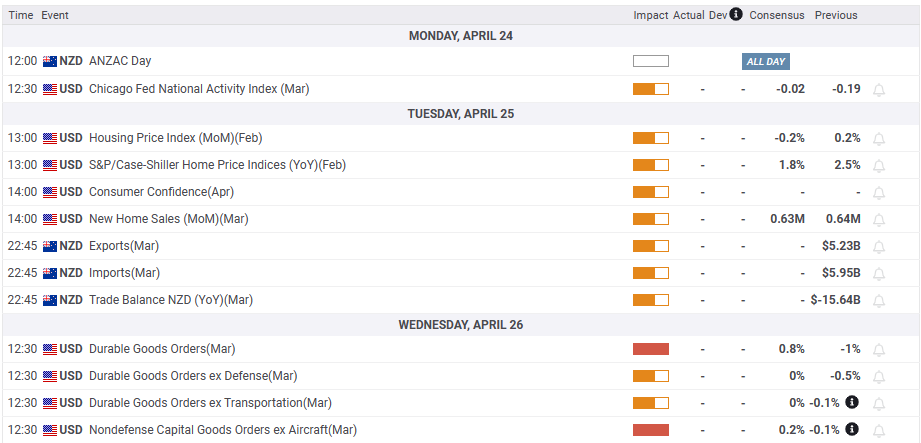

Markets are on pause, awaiting catalysts. It will be the week before the central bank’s weeks. Major currency pairs are moving sideways, with a mixed US Dollar, holding on to recent losses versus EUR and GBP. The pattern could continue next week, considering that the first week of May is crucial with monetary policy decisions in Australia, the US and the Euro Zone and the US official employment report. The economic calendar is light next week, being the most relevant reports Australian and German inflation, US GDP and the monetary policy meeting in Japan. End-of-month flows could add to volatility.

Here is what you need to know for next week:

On Saturday, the Federal Reserve (Fed) blackout period begins, ahead of the May 2-3 meeting. The lack of comments from Fed officials could lead to quieter markets next week; however, there will be important economic reports. According to the CME FedWatch Tool, the odds of a 25 basis points rate hike were 88% after the US preliminary April PMI, up from 77% a week ago. It is seen as the last rate hike of the current tightening cycle.

The critical report in the US will be first-quarter GDP growth (advance estimate), with market consensus pointing to an expansion at a 3.9% annualized rate. Also important will be the Core Personal Consumption Expenditure included in the GDP report and on Friday in the Personal Income and Spending report. It is the Fed’s preferred inflation gauge.

Wall Street finished the week with modest losses, moving without a clear direction. Main indexes pulled back from monthly highs. The rally that started mid-May has run into resistance.

The US Dollar Index (DXY) rose for the first time in six weeks, but the trend is down. The DXY remains above the key 101.50 support. Since Tuesday, it has been moving sideways, as markets await the next catalysts. The Dollar benefited as market participants pared Fed rate cut bets for the third and fourth quarters.

The Japanese Yen was among the worst performers affected by higher government bond yields across the globe. The US 10-year yield settled at 3.55%, the highest weekly close since early March, but far from highs. Next week, the Bank of Japan will have its first monetary policy meeting under Kazue Ueda. No change is expected in the policy stance. Current forecasts see an adjustment to the Yield Curve Control, as early as June.

USD/JPY posted a modest weekly gain, after being rejected from above 135.00. EUR/JPY and GBP/JPY also ended with small appreciations, showing some signs of a potential reversal.

EUR/USD traded all week under 1.1000 and above 1.0900, in a modest range, ending a seven-week positive streak. The bias continues to the upside, supported by expectations of more rate hikes from the European Central Bank (ECB) and a weaker US Dollar.

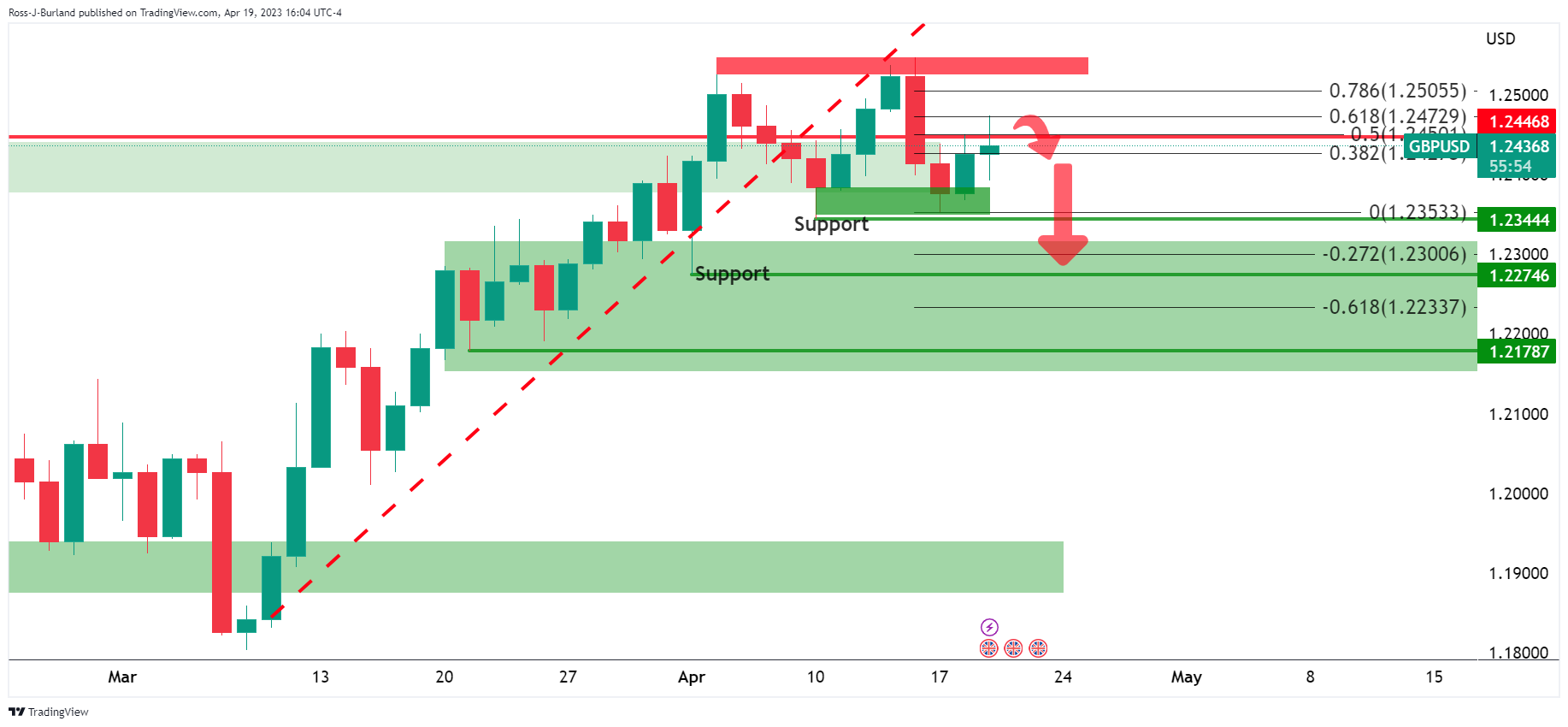

Despite upbeat UK economic data (except Retail Sales) and higher-than-expected inflation numbers that boosted expectations of more tightening from the Bank of England, the Pound posted minor gains versus the Dollar. GBP/USD moved all week near 1.2400. The pair continues to move sideways. EUR/GBP pulled back a bit after surging in the previous week.

AUD/USD remains capped by the 20-week Simple Moving Average (SMA) and is unable to move away from the 0.6700 area. The relatively hawkish Reserve Bank of Australia (RBA) minutes and positive employment data from Australia failed to lift the Aussie. AUD/NZD soared for the second week in a row but was boosted by a decline in the New Zealand Dollar.

The Kiwi remained weak, affected by New Zealand Q1 inflation figures. NZD/USD posted the third weekly loss in a row, around 0.6140. The bias is to the downside, with the price looking at the 0.6100 support area. Next week, Reserve Bank of New Zealand's chief economist Paul Conway will speak about monetary policy.

USD/CAD rose more than 1% during the week climbing above 1.3500, to the 20-week SMA. The Loonie was the worst among majors, suffering from the decline in crude oil prices and the divergence between a Bank of Canada (BoC) on hold, and the rest of the central banks still raising rates.

During the week, the Brazilian Real fell the most (USD/BRL rose from 4.90 to 5.05), followed by the Colombian Peso, with USD/COP increasing 2.48%, trimming some of its recent losses.

It was a terrible week for cryptocurrencies. Bitcoin had the worst week since November; BTC/USD fell from $30,300 to $27,850. Ethereum retreated from above $2,100 to $1,880.

Gold pulled back, having the most significant weekly loss in two months, closing below $2,000. Silver also retreated and stabilized around $25.00 on Friday. Crude oil prices dropped more than 5% despite robust economic data. Uncertainty around global economic activity and interest rates weighed on the outlook for crude oil.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:45

GBP/USD Price Analysis: Doji candlesticks around 1.2430 flashes bulls/bears’ indecision

- GBP/USD cracking 1.2400 could trigger a bearish resumption, exposing 100 and 200-day EMAs at 1.2173.

- Buyers pushing GBP/USD above 1.2400 could spark upward momentum and test YTD high at 1.2546.

After a tranche of UK and US economic data, GBP/USD stays in sideways choppy trading, keeping the pair scrambling for direction following the last three days of uncertainty. From a technical perspective, three doji’s in a row suggests neither buyers’ nor sellers’ commitment to open fresh positions. Hence, GBP/USD is trading at 1.2439 after printing a low at 1.2367, below the 20-day Exponential Moving Average (EMA).

GBP/USD Price Action

Friday’s session was titled downwards, but since the early North American session, the GBP/USD aimed up, about to erase its earlier losses. Although the GBP/USD warrants further upside, price action in the last few days suggests buyers might be losing momentum. Indicators, like the Relative Strength Index (RSI), turned flat though tilted downwards, heading into neutral territory. At the same time, the Rate of Change (RoC) edged lower when compared to Thursday’s price action, suggesting that buying pressure is fading.

Therefore, the GBP/USD path of least resistance is downwards. The GBP/USD needs to crack the 1.2400 figure for a bearish resumption. Once cleared, the pair could dive towards the 20-day EMA at 1.2386, followed by the confluence of the April 3 low and the 50-day EMA at 1.2274/76. A breach of the latter and the GBP/USD could plunge toward the confluence of the 100 and 200-day Emas, around 1.2173.

On the flip side, if GBP/USD stays above 1.2400, it could test the April 19 cycle high at 1.2474. Buyers reclaiming the latter, upside risks will clear at 1.2500, followed by the YTD high at 1.2546.

GBP/USD Daily Chart

-

19:15

NZD/USD plunges more than 1%, hits 6-week low on improved US business activity

- US Dollar benefits from upbeat Manufacturing and Services PMIs for April.

- Fed’s Harker signals the end of rate hikes, but Mester suggests higher rates are needed.

- NZD/USD Price Analysis: Bearish biased and can test YTD lows if it dives below 0.6084.

The NZD/USD fell to six-week lows around 0.6126 as business activity in the United States (US) improved, triggering flows toward the American Dollar (USD). Therefore, the New Zealand Dollar (NZD) weakened, also undermined by lower inflation, as reported during the week. At the time of writing, the NZD/USD is trading at 0.6140, down more than 1%.

USD gains on positive PMIs, mixed signals from Fed officials; NZD/USD at risk of testing YTD lows

US equities fluctuated between gains and losses after S&P Global revealed an expansion in the US economy, bolstering the US Dollar (USD). S&P Global Manufacturing and Services PMIs for April exceed estimates above the 50 level, which usually delineates expansion/contraction in the economy. Therefore, the Composite PMI edged higher, at 53.5, above the prior reading of 52.3.

Federal Reserve officials hawkish rhetoric weighed in the NZD/USD for the third time in the week. Although the Philadelphia Fed President Patrick Harker signaled that the Fed is about to finish hiking rates, his colleague Cleveland’s Fed President Loretta Mester noted that rates should go above 5%, due to high inflationary pressures.

Given the lack of economic data from New Zealand, which reported inflation and was lower than the Reserve Bank of New Zealand (RBNZ) estimates of 1.8% QoQ, at 1.2%, could spark a pause on the RBNZ tightening cycle. The RBNZ delivered a hawkish 50 bps hike at its latest meeting.

Ahead of the week, the US economic docket will feature Fed Governor Lisa Cook as traders prepare for the weekend.

NZD/USD Technical Analysis

After hitting a weekly high of 0.6379, the NZD/USD formed an inverted hammer in the daily chart, suggesting that the major could be headed down. Indeed, the NZD/USD dropped below the 50 and 20-day Exponential Moving Averages (EMAs), each at 0.6289 and 0.6227, respectively. The Relative Strength Index (RSI) turned bearish while the Rate of Change (RoC) indicated that sellers were gathering momentum. Hence, the NZD/USD path of least resistance is downwards. The first support would be the 0.6100 figure, followed by March’s low of 0.6084, before testing the YTD low at 0.5912.

What to watch?

-

19:10

BoE’s Ramsden: Still signs of stubbornly high inflation – The Times

Bank of England (BoE) Deputy Governor Dave Ramsden said in an interview with The Times that the central bank must stop the risk of high inflation becoming embedded in the economy. He added there were still signs of stubbornly high inflation.

Ramsden mentioned there was a greater risk of the BoE doing too little rather than too much.

Market reaction

Ramsden comments had no impact so far on the Pound. GBP/USD is trading at a daily high late on Friday near the 1.2440 area, on its way to a modest daily gain. EUR/GBP stays flat around 0.8830.

-

18:02

United States Baker Hughes US Oil Rig Count increased to 591 from previous 588

-

17:32

USD/CAD surges above 1.3500 as US economic data trumps growth worries

- USD/CAD extended its gain in the week, bolstered by April’s PMIs reaching expansionary territory.

- The Canadian Dollar weakened as Retail Sales sank, though above estimates.

- USD/CAD Price Analysis: Bullish above 1.3520; otherwise, sellers could retest 1.3500.

The USD/CAD reclaims the 1.3500 figure, advances after optimistic economic data in the US, pushed back against worries about growth. Meanwhile, Canadian Retail Sales missed estimates, indicating a slowdown in the economy. Hence, the USD/CAD is trading at 1.3532 after traveling to a low of 1.3468.

USD/CAD underpinned by upbeat US PMIs

Wall Street continued to trade with losses after S&P Global reported that the activity of businesses in the United States (US) jumped. On its final reading, April’s S&P Global Manufacturing and Services PMIs rose above estimates at expansionary territory. Consequently, the Composite Index in the previous reading was 53.5, above 52.3.

Therefore, the USD/CAD rose sharply to the daily high above the R4 pivot point at 1.3558 before retracing to the R3 pivot at 1.3535. US bond yields edged up on growing concerns that business activity improvement could impact inflation to the upside, warranting higher interest rates.

The US Dollar Index, a gauge for the buck’s value against six currencies, erased some of its previous day losses, up 0.03%, at 101.825, a tailwind for the USD/CAD.

On Thursday, Federal Reserve policymakers continued their hawkish rhetoric. Philadelphia Fed President Patrick Harker suggested the US central bank is close to ending its campaign to control inflation. At the same time, Cleveland’s Loretta Mester believes rates should go above 5% due to high inflation. The current benchmark rate is between 4.75% and 5%.

On the Canadian front, Retail Sales for February plunged but were above forecasts of 0.6% MoM contraction, which stood at -0.2%, according to Statistics Canada. The data reinforce the Bank of Canada’s (BoC) decision to keep rates unchanged at their latest meeting.

Investors brace for further Fed tightening

The CME FedWatch Tool, which forecasts the next move of the US Federal Reserve (Fed), keeps odds at 88% for a 25 bps rate hike at the May 2-3 meeting.

The US economic docket will feature the Federal Reserve Governor Lisa Cook will cross newswires ahead of the media blackout that Fed officials would begin, ending with the Fed Chair Powell press conference on May 3.

USD/CAD Technical Analysis

The USD/CAD extended its rally to four out of five days a week, clearing on its uptrend, the 20, 100, and 50-day Exponential Moving Averages, each at 1.3488, 1.3501, and 1.3524, respectively. The Relative Strength Index (RSI) also crossed into bullish territory, suggesting further Canadian Dollar (CAD) weakness, meaning USD/CAD upside. If USD/CAD achieves a daily close above the 50-day EMA, the pair’s next resistance would be a ten-month-old prior’s support turned resistance trendline at around 1.3560-70. Once cleared, the next resistance would be 1.3600. Conversely, the USD/CAD could dive towards the 100-day EMA at 1.3501 before extending its losses towards the 20-day EMA at 1.3488.

-

16:55

US Treasury Sec. Yellen: Banking system has stabilized in past few week

US Treasury Secretary Janet Yellen said on Friday that the US banking system has stabilized during the last few weeks. She added they continue to be vigilant and monitor conditions closely. She spoke at the Financial Stability Oversight Council Meeting, which will vote on two proposals: a framework for financial stability risk identification, assessment, and response; and a interpretive guidance on nonbank financial company designations.

Key quotes:

“Last month, the government took necessary actions to decisively manage the fallout from the failure of two regional banking institutions. Our goal was to mitigate the serious risk of contagion and protect the broader banking system and economy. The situation has stabilized in the past few weeks. And our banking system remains sound, with strong capital and liquidity positions. Of course, we continue to be vigilant and monitor conditions closely.”

“Still, these developments have reminded many of the fear and uncertainty that can accompany financial disruptions. For all in this room, I am certain that the developments underscored the importance of our work on financial stability: to continue to improve the resilience of a financial system that can support the economy through both good and bad times.”

-

16:45

Colombia Trade Balance came in at $-554.9M below forecasts ($-500M) in February

-

16:26

Colombia Trade Balance above forecasts ($-500M) in February: Actual ($-0.9M)

-

16:04

Gold Price Forecast: XAU/USD sinks below $2,000 as US PMIs improve and recession fears fade

- Gold price dives on a surprisingly positive US S&P Global PMIs.

- Improvement in business activity in the US bolstered the US Dollar.

- The US Federal Reserve is expected to hike rates by 25 bps at the May meeting – FedWatch Tool.

Gold price plunges below $2,000 and hit a daily low of $1,971.74 after the release of economic data from the United States (US) showed that the economy continues to expand, despite recent reports flashing a recession. Therefore, XAU/USD is trading at $1,982.78, losses 1.07%, at the time of writing.

US business activity picked up, Gold tumbles

S&P Global reported the final PMI readings for the US, which surprised most investors, which were caught off guard, as shown by the market’s reaction. The S&P Global Manufacturing PMI was 50.4, above 49 estimates, while the Services rose to 53.7, exceeding the consensus of 51.5. Therefore, the Composite reading was 53.5, above its previous reading.

As a result, XAU/USD spiked to $1,997.95 before tanking toward a two-day low of $1971.30, $1.5 above the S3 daily pivot point and shy of testing the weekly low of $1,968.80. Conversely, US Treasury bond yields climbed, as the report signals that inflation could rise, with 2s and 10s, gaining each three basis points, at 4.184% and 3.564%, respectively.

In the meantime, the CME FedWatch Tool, which forecasts the next move of the US Federal Reserve (Fed), keeps odds at 88% for a 25 bps rate hike at the May 2-3 meeting. Hence, the greenback is pairing some of its Thursday’s losses, as shown by the US Dollar Index (DXY), which tracks the buck’s performance vs. six peers, up at 0.14% at 101.936.

On Thursday, Federal Reserve officials crossed newswires. Philadelphia Fed President Patrick Harker suggested the US central bank is close to ending its campaign to control inflation. At the same time, Cleveland’s Loretta Mester believes rates should go above 5% due to high inflation. The current benchmark rate is between 4.75% and 5%.

Next on the agenda, the Federal Reserve Governor Lisa Cook will cross newswires ahead of the media blackout that Fed officials would begin, ending with the Fed Chair Powell press conference on May 3.

XAU/USD Technical Analysis

From a technical perspective, Gold finally broke below the 20-day Exponential Moving Average (EMA) at 1988.01, which could pave the way for further downside. It should be said the 20-day EMA has been dynamic support for Gold buyers, meaning that sellers must keep prices below $1,988. If XAU/USD sellers want to cement their case, a break below the weekly low of $1,969.34 could keep them on the path toward the $1,950 area before testing the 50-day EMA at $1,944.87. Otherwise, XAU’s buyers, once reclaiming $1,990, could pave the way for a retest of $2,000.

-

15:27

EUR/USD drops to 1.0940 after US PMI data

- US Dollar jumps across the board after PMI survey.

- EUR/USD retreats but holds above daily lows.

The US Dollar rose sharply across the board following the release of the S&P Global PMI, sending EUR/USD under 1.0950. The pair fell from near 1.1000 toward daily lows.

Data boosts US Dollar

“US Flash PMI data signals solid growth in private sector output as the headline figure registered an 11-month high of 53.5 in April (Mar: 52.3). Companies noted that improved demand conditions supported growth”, said S&P Global. The Composite PMI was expected at 52.8. The S&P Global Manufacturing PMI rose from 49.2 in March to 50.4 while the Service PMI from 52.6 to 53.7, both surpassing expectations.

US yields jumped to daily highs after the report. The DXY turned positive, rising toward 102.00. EUR/USD dropped from 1.0993, the highest in a week to 1.0941. The pair remained above daily lows.

Earlier on Friday, the preliminary April PMI for the Euro Zone showed mixed numbers. The Manufacturing Index dropped from 47.3 to 45.5 while the Service rose unexpectedly from 55 to 56.6. While Manufacturing hit the lowest level since May 200, the Service rose to the strongest since April 2022.

Short-term outlook

The EUR/USD weakened during the last hour but so far it stays above the 1.0920/30 area. A break lower would leave the Euro vulnerable to more losses, targeting initially the weekly low at 1.0908. The next support stands at 1.0880.

If the Euro remain above 1.0930, it would likely continue to trade sideways. The upside remains capped below 1.1000. A consolidation above 1.1000 is needed to clear the way to more gains.

Technical levels

-

15:05

USD/JPY jumps to fresh daily peak, eyes mid-134.00s on upbeat US PMI prints

- USD/JPY rebounds swiftly from the weekly low amid a fresh wave of USD buying.

- The upbeat US PMIs reaffirm bets for more Fed rate hikes and boost the Greenback.

- Spot prices remain on track to register modest gains for the second successive week.

The USD/JPY pair attracts some dip-buying in the vicinity of the 133.55 region during the early North American session and recovers its early lost ground to the weekly low. Spot prices touch a fresh daily peak, around the 134.30 region, and for now, seem to have stalled this week's retracement slide from the highest level since mid-March.

The US Dollar (USD) jumps back closer to the weekly high following the release of the US PMI prints, which, in turn, is seen as a key factor pushing the USD/JPY pair higher. In fact, S&P Global reported this Friday that business activity in the US private sector expanded at a strengthening pace in April, with the Composite PMI rising to 53.5 from 52.3 in March. Adding to this, the gauge for the manufacturing moves in the expansion territory and comes in at 50.4, while Services PMI edges higher to 53.7, also surpassing consensus estimates.

The data reaffirmed expectations that the Federal Reserve (Fed) will continue raising interest rates, which leads to a goodish intraday recovery in the US Treasury bond yields and benefits the Greenback. The Japanese Yen (JPY), however, might continue to draw support from expectations that the Bank of Japan (BoJ) could begin to phase out its massive stimulus programme later this year. The bets were lifted by the domestic consumer inflation figures released earlier this Friday, which might contribute to capping the upside for the USD/JPY pair,

Hence, it will be prudent to wait for strong follow-through buying before traders start positioning for the resumption of the recent move-up from the vicinity of mid-130.00s, or the monthly low. Nevertheless, the USD/JPY pair remains on track to end in the green for the second straight week.

Technical levels to watch

-

15:00

WTI reverses part of the weekly decline and advances past $78.00

- Prices of the WTI bounces off lows in the sub-$77.00 region.

- Crude oil snapped four consecutive weeks with gains.

- Recession fears continue to weigh on traders’ sentiment.

Prices of the barrel of the WTI manage to regain some buying interest and advance past the $78.00 mark on Friday.

WTI stronger despite USD-buying, recession risks remain

WTI prices advance for the first time this week following a sharp rejection from post-OPEC+ 2023 peaks north of the $83.00 mark (April 12). Furthermore, crude oil remains en route to close the first week with loses after four consecutive gains.

Alternating trends in the dollar seems to have lent some support to the commodity as well and despite traders remain concerned over a potential economic slowdown and its negative impact on the demand for crude oil.

The above appears equally propped up by unabated expectations of extra tightening by the Federal Reserve at the May gathering, while the positive GDP outlook in China is seen limiting the potential downside of the commodity.

Later in the session, driller Baker Hughes will publish its weekly report on US oil rig count in the week to April 21.

WTI significant levels

At the moment the barrel of WTI is up 1.18% at $78.04 and faces the next hurdle at $82.50 (200-day SMA) followed by $83.49 (2023 high April 12) and finally $92.90 (monthly high November 7 2022). On the other hand, a breach of $76.78 (wekly low April 21) would open the door to $76.30 (55-day SMA) and then $70.00 (round level).

-

14:45

United States S&P Global Services PMI came in at 53.7, above expectations (51.5) in April

-

14:45

United States S&P Global Manufacturing PMI came in at 50.4, above forecasts (49) in April

-

14:45

United States S&P Global Composite PMI above expectations (52.8) in April: Actual (53.5)

-

14:26

AUD/USD rebounds from weekly lows back above 0.6700

- US Dollar Index drops but commodity currencies are under pressure on Friday.

- Key data ahead: US S&P Global PMI

- AUD/USD is down for the day, holds above 0.6680.

The AUD/USD pair bottomed during the European session at 0.6678, the lowest level since April 12, but quickly rose above 0.6680. Recently it climbed back above 0.6700, and it continues to trim losses ahead of important US economic data.

At 13:45 GMT, the preliminary April US S&P Global PMI will be released. Those numbers will be relevant for market participants looking for clues about the economic outlook.

Ahead of the meeting, the US Dollar Index is falling 0.10%, trading at 106.80. The slide is driven by a rebound in EUR/USD and an extension of the decline in USD/JPY. The commodity currencies block is falling on Friday.

Earlier, the April PMI from Australia showed the Manufacturing Index at 48.1, below 49.1 in March, and the Service Index at 52.6, up from 48.6 in March, the highest reading since June 2022.

Short-term outlook

The pair is holding above the 0.6680 support area. If it consolidates below, the outlook would weaken for the Aussie. While above, AUD/USD is seen moving sideways.

On the upside, the Aussie needs to rise and hold above 0.6750, to strengthen the outlook. Above, the next resistance area stands at 0.6775, and the last defense to 0.6800.

Technical levels

-

14:24

GBP/USD pares intraday losses, down a little around 1.2420 ahead of US PMIs

- GBP/USD comes under some selling pressure on Friday, albeit the fall lacks bearish conviction.

- The disappointing UK Retail Sales data, mixed UK PMIs undermine the GBP and exert pressure.

- Retreating US bond yields keeps a lid on the intraday USD uptick and lends support to the pair.

The GBP/USD pair stalls its intraday decline near the 1.2375 region and recovers over 40 pips from a three-day low touched earlier this Friday. Spot prices, however, keep the red through the early North American session and currently trade around the 1.2415-1.2420 area, still down nearly 0.20% for the day.

The British Pound weakens across the board following the disappointing UK macro releases, which, along with an intraday US Dollar (USD) uptick, exert some downward pressure on the GBP/USD pair. In fact, the UK Office for National Statistics reported that domestic Retail Sales contracted by 0.9% in March and sales excluding fuel dropped by 1% during the reported month, both missing consensus estimates. Adding to this, the flash UK Manufacturing PMI delivers a negative surprise and drops further into contraction territory, to 46.6 in April, offsetting the better-than-expected Services PMI, which rose to 54.9 in April.

The USD, on the other hand, initially drew support from growing acceptance that the Federal Reserve (Fed) will continue raising interest rates. This was seen as another factor weighing on the GBP/USD pair, though the intraday downfall stalls ahead of the 1.2350 strong horizontal support. The ongoing downfall in the US Treasury bond yields, along with a modest recovery in the global risk sentiment, act as a headwind for the safe-haven Greenback. Apart from this, rising bets for an additional interest rate hike by the Bank of England (BoE) in May contribute to limiting losses for the major, at least for the time being.

The aforementioned mixed fundamental backdrop warrants some caution for aggressive traders and before positioning for a firm near-term direction. Market participants now look forward to the release of the flash US PMI prints. This, along with the US bond yields and the broader risk sentiment, will influence the USD price dynamics and allow traders to grab short-term opportunities around the GBP/USD pair.

Technical levels to watch

-

14:10

EUR/USD Price Analysis: Next on the upside emerges the 2023 peak

- EUR/USD leaves behind initial losses and approaches 1.1000.

- Further gains are seen targeting the 2023 peak near 1.1070.

EUR/USD adds to Thursday’s advance and trades at shouting distance from the key 1.1000 mark.

Further consolidation should not be ruled out for the time being. The breakout of this theme exposes a probable move to 1.1000 ahead of the 2023 high at 1.1075 (April 14). On the downside, the 1.0900 zone emerges as quite a decent contention so far.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0391.

EUR/USD daily chart

-

13:44

USD Index Price Analysis: Next on the downside comes 100.80

- DXY keeps the side-lined trading well in place on Friday.

- The breakdown of this theme exposes a drop to the YTD low.

DXY trades without clear direction below the 102.00 region at the end of the week.

The index maintains the choppy activity well in place so far this week. Occasional bouts of weakness could spark a potential decline to the 2023 lows in the 100.80/75 band (April 14) ahead of the psychological support at the 100.00 mark.

Looking at the broader picture, while below the 200-day SMA, today at 106.21, the outlook for the index is expected to remain negative.

DXY daily chart

-

13:40

When are the S&P Global's flash US PMIs and how could the data affect EUR/USD?

US PMI Overview

S&P Global will release the flash version of the US Manufacturing and Services PMIs at 13:45 GMT this Friday. The gauge for the manufacturing sector is expected to remain in contraction territory for the seventh straight month and edge lower to 49 in April from 49.2 in the previous month. The Services PMI, meanwhile, is anticipated to show a slight deceleration in growth and come in at 51.5 for the current month, down from March's final reading of 52.6. Furthermore, the composite PMI is expected to show a rise in overall business activity and rise to 52.8 from 52.3 previously.

How Could It Affect EUR/USD?

Heading into the key release, the US Dollar (USD) struggles to gain any meaningful traction amid a softer tone surrounding the US Treasury bond yields. This, in turn, assists the EUR/USD pair to edge higher for the second successive day on Friday. That said, the prospects for further policy tightening by the Federal Reserve (Fed) act as a tailwind for the buck and should keep a lid on any meaningful upside for the major. A stronger US PMI print will reaffirm expectations that the US central bank might continue raising interest rates and lend support to the Greenback.

Conversely, weaker US macro data will add to worried about economic headwinds stemming from rising borrowing costs and lift bets for an imminent pause in the Fed's rate-hiking cycle. This, in turn, could lead to a further decline in the US Treasury bond yields and prompt fresh selling around the buck. Apart from this, expectations for additional rate hikes by the European Central Bank (ECB) in the coming months could underpin the shared currency, suggesting that the path of least resistance for the EUR/USD pair is to the upside.

Eren Sengezer, European Session Lead Analyst at FXStreet, offers a brief technical outlook for the major and writes: “EUR/USD failed to return within the ascending regression channel and the Relative Strength Index (RSI) indicator on the four-hour chart dropped below 50, pointing to a bearish tilt in the short-term outlook.”

Eren also outlines important technical levels to trade the EUR/USD pair: “On the downside, the 100-period Simple Moving Average aligns as key support at 1.0930. EUR/USD is yet to make a four-hour close below that level since the beginning of the latest uptrend in mid-March. 1.0900 (psychological level, static level), 1.0870 (Fibonacci 38.2% retracement of the latest downtrend) and 1.0825 (200-period SMA) could be seen as next bearish targets if 1.0930 fails. ”

“The lower limit of the ascending channel continues to act as key resistance at 1.0970 before 1.1000 (psychological level, static level) and 1.1030 (mid-point of the ascending channel),” Eren adds further.

Key Notes

• EUR/USD Forecast: Euro could weaken further once below 1.0930

• EUR/USD faces further consolidation near term – UOB

• EUR/USD Analysis: Remains confined in a range below 1.1000 ahead of Eurozone/US PMIs

About the US Manufacturing PMI

The Manufacturing Purchasing Managers Index (PMI) released by S&P Global captures business conditions in the manufacturing sector. As the manufacturing sector dominates a large part of total GDP, the manufacturing PMI is an important indicator of business conditions and the overall economic condition in the United States. Readings above 50 imply the economy is expanding, making investors understood it as a bullish for the USD, whereas a result below 50 points for an economic contraction, and weighs negatively on the currency.

About the US ISM Services PMI

The Services Purchasing Managers Index (PMI) released by S&P Global captures business conditions in the services sector. As the services sector dominates a large part of total GDP, the services PMI is an important indicator of the overall economic condition in US. A result above 50 signals is bullish for the USD, whereas a result below 50 is seen as bearish.

-

13:35

Canada: Retail Sales decline by 0.2% in February vs. -0.6% expected

- Retail Sales in Canada fell at a stronger pace than expected in February.

- USD/CAD stays in positive territory above 1.3500 after the data.

The data published by Statistics Canada showed on Friday that Retail Sales declined by 0.2% on a monthly basis following January's 1.4% increase. This reading came in better than the market expectation for a decrease of 0.6%.

Further details of the publication revealed that Retail Sales ex-Autos fell by 0.7% in the same period.

Market reaction

This report doesn't seem to be having an impact on the Canadian Dollar's valuation. As of writing, USD/CAD was up 0.4% on the day at 1.3530.

-

13:31

Canada Retail Sales (MoM) came in at -0.2%, above expectations (-0.6%) in February

-

13:30

Canada Retail Sales ex Autos (MoM) below expectations (-0.1%) in February: Actual (-0.7%)

-

13:28

India FX Reserves, USD climbed from previous $584.76B to $586.41B in April 14

-

13:28

India Bank Loan Growth increased to 15.7% in April 10 from previous 15%

-

13:05

Malaysia: Inflation eased to multi-month lows in March – UOB

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the releases of the latest inflation figures in Malaysia.

Key Takeaways

“Headline inflation decelerated for the seventh straight month to a nine-month low of 3.4% y/y in Mar (from +3.7% in Feb). The reading came in below our estimate (+3.5%) and Bloomberg consensus (+3.6%). The slowdown mainly reflected the effects of lower energy prices, high statistical comparison base a year ago, and continued subsidies by the government as prices of most food items and services appeared to remain sticky.”

“Barring any potential changes in domestic price and subsidy policy, we believe the existing disinflationary process will persist throughout the remaining months of the year. But the pace of easing may be more moderate than previously anticipated given the stickiness of core inflation, which has surpassed headline inflation for a sixth consecutive month and implying resilience of domestic demand. We reiterate our 2023 full-year inflation projection of 2.8% (BNM est: 2.8%-3.8%, 2022: 3.3%) with the government’s gradual subsidy rationalization, international commodity price movement, exchange rate fluctuation, extreme weather conditions and stronger demand post China’s reopening serving as key wildcards for the outlook.”

“Backed by sticky core inflationary pressures, still positive domestic growth momentum and domestic financial stability, we continue to see room for Bank Negara Malaysia (BNM) to further normalize its monetary policy back to prepandemic level. Hence, we keep our view for a final interest rate hike of 25bps at the 2-3 May monetary policy meeting, which will take the Overnight Policy Rate (OPR) back to the pre-pandemic level of 3.00%. Thereafter, BNM will leave the OPR unchanged for the rest of the year, in cognizant of a softer inflation outlook globally in 2H23, an expected end to global rate hike cycle by mid2023, and rising recession risks in advanced economies.”

-

13:02

EUR/JPY Price Analysis: Tough resistance aligns around 148.00

- EUR/JPY adds to the pessimism seen in the second half of the week.

- The surpass of 148.00 could expose a move to the 2022 high.

EUR/JPY extends further the corrective decline after faltering near the 148.00 hurdle earlier in the session.

Despite the ongoing knee-jerk, further gains in the cross remain in store for the time being. That said, the continuation of the upside momentum should challenge 148.00 once again, while the breakout of this level could pave the way for a probable visit to the 2022 peak at 148.40 (October 21).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 142.24.

EUR/JPY daily chart

-

12:56

USD/CNH: Gains expected to accelerate above 6.9350 – UOB

In the view of UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia, USD/CNH could see its upside gather extra impulse on a breakout of the 6.9350 level.

Key Quotes

24-hour view: “We highlighted yesterday that USD ‘could retest the 6.9100 level before a more sustained pullback is likely’. However, USD traded in a relatively quiet manner between 6.8745 and 6.9026. The price actions appear to be part of a consolidation and today, we expect USD to trade in a range of 6.8700/6.9000.”

Next 1-3 weeks: “Our update from yesterday (20 Apr, spot at 6.8920) still stands. As highlighted, upward momentum is beginning to improve but USD has to break and stay above 6.9350 before a sustained rise is likely. The chance of USD breaking clearly above 6.9350 is not high for now but it will remain intact as long as the ‘strong support’ level at 6.8600 is not taken out in the next few days."

-

11:53

Gold Price Forecast: XAU/USD keeps the red below $2,000 amid modest US Dollar strength

- Gold price meets with a fresh supply on Friday and drifts back closer to the $1,980 level.

- Bets for more rate hikes by Federal Reserve underpin the US Dollar and exert pressure.

- Sliding US bond yields caps gains for the USD and lends support amid a softer risk tone.

Gold price comes under renewed selling pressure on the last day of the week and maintains its heavily offered tone through the first half of the European session. The XAU currently trades just above the $1.980 level, down over 1% for the day, and remains well within the striking distance of over a two-week low touched on Wednesday.

Renewed US Dollar buying weighs on Gold price

Growing acceptance that the Federal Reserve (Fed) will continue raising interest rates assists the US Dollar (USD) to catch fresh bids on Frida, which, in turn, is seen driving flows away from the US Dollar-denominated Gold price. In fact, the current market pricing indicates over an 80% chance of a 25 bps lift-off at the next Federal Open Market Committee (FOMC) in May and a small possibility of another rate hike in June. The bets were lifted by the overnight hawkish comments by Cleveland Fed President Loretta Mester, saying that the central bank still has more rate increases ahead of it.

Recession fears could help limit losses for XAU/USD

Mester, however, noted the aggressive move to boost the borrowing cost over the last year is nearing its end amid signs of an economic slowdown in the United States (US). Data released on Thursday showed that the Philadelphia Fed Manufacturing Index sank more than expected in April, to the lowest level since May 2020. Adding to this, the US Department of Labor (DOL) reported that the number of Americans filing claims for unemployment benefits unexpectedly rose to 245K during the week ended April 15. Furthermore, US Existing Home Sales also slowed substantially in March.

The data comes amid worried about economic headwinds stemming from rising borrowing costs and tempers investors' appetite for riskier assets, which is evident from a softer tone around the equity markets and might lend support to the safe-haven Gold price. The global flight to safety, meanwhile, leads to a further decline in the US Treasury bond yields and keeps a lid on any meaningful upside for the USD. This might hold back traders from placing aggressive bearish bets around the XAU/USD and turn out to be a key factor limiting the downside, at least for the time being.

Traders eye flash PMIs from the United States for fresh impetus

Market participants now look forward to the release of the flash US PMI prints, due later during the early North American session. Traders will further take cues from the US bond yields, which might influence the USD price dynamics and provide some impetus to Gold price. Apart from this, the broader risk sentiment should further contribute to producing short-term trading opportunities around the XAU/USD on the last day of the week.

Gold price technical outlook

From a technical perspective, any subsequent slide is likely to find some support near the weekly swing low, around the $1,969 region. Some follow-through selling should pave the way for an extension of the recent retracement slide from a one-year high. The Gold price might then slide towards testing the next relevant support near the $1,956-$1,955 area before eventually dropping to the monthly low around the $1,950 region.

On the flip side, the $2,010 area now seems to have emerged as an immediate strong barrier. A sustained strength beyond might trigger a fresh bout of a short-covering and lift Gold price beyond the $2,020 intermediate hurdle, towards the $2,040 horizontal resistance en route to the YTD peak, around the $2,047-$2,049 region.

Key levels to watch

-

10:53

USD/CAD clings to gains near two-week high, above 1.3500 amid modest USD strength

- USD/CAD climbs to a nearly two-week high and draws support from a combination of factors.

- The recent slump in Crude Oil prices continues to undermine the Loonie and acts as a tailwind.

- Bets for more Fed rate hikes and a softer risk tone lift the USD back closer to the weekly high.

The USD/CAD pair gains traction for the third successive day on Friday, also marking the fifth day of a positive move in the previous six, and touches a nearly two-week high, around the 1.3535 region during the first half of the European session.

Crude Oil prices languish near the monthly low amid worries that a deeper global economic downturn will dent fuel demand and undermines the commodity-linked Loonie. Apart from this, signs of cooling consumer inflation in Canada undermine the Canadian Dollar and assist the USD/CAD pair to build on its recent bounce from the 1.3300 mark, or a two-month low touched last Friday. This, along with the emergence of fresh US Dollar (USD) buying acts as a tailwind for the major.

In fact, the USD Index, which tracks the Greenback against a basket of currencies, climbs back closer to the weekly high amid growing acceptance of further policy tightening by the Federal Reserve (Fed). In fact, the markets seem convinced that the US central bank will hike rates by 25 bps in May and have been pricing in a small chance of another rate hike in June. This, along with a generally weaker tone around the equity markets, further benefits the Greenback's safe-haven status.

Friday's follow-through move-up could further be attributed to some technical buying above the 1.3500 psychological mark. This, along with the aforementioned fundamental backdrop suggests that the path of least resistance for the USD/CAD pair is to the upside. Traders now look to the flash US PMI prints, which along with the US bond yields and the broader risk sentiment, will drive the USD demand. Apart from this, Oil price dynamics should provide some impetus to the major.

Technical levels to watch

-

10:45

USD/JPY remains poised for extra gains near term – UOB

Further upside in USD/JPY looks likely and with the immediate target at 135.75, note UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia.

Key Quotes

24-hour view: “Yesterday, we held the view that USD ‘could test the 135.15 level before the risk of a more sustained pullback increases’. However, USD pulled back directly to a low of 134.00. The pullback in USD could extend but a break of the strong support level at 133.50 is unlikely. On the upside, a breach of 134.75 (minor resistance is at 134.40) would indicate that USD is not weakening further.”

Next 1-3 weeks: “Our update from yesterday (20 Apr, spot at 134.65) still stands. As highlighted, the bias is still towards a higher USD. The next level to aim for is a 135.75. Overall, only a break of 133.50 (no change in ‘strong support’ level) would indicate that the USD strength that started on Monday (17 Apr, spot at 133.80) has run its course.”

-

10:25

EUR/USD trades slightly on the defensive near 1.0960

- EUR/USD keeps the erratic performance well in place so far.

- Germany, EMU flash PMIs came mixed for the month of April.

- ECB’s Visco ruled out a credit crunch situation at the moment.

The single currency comes under some mild selling pressure and drags EUR/USD back to the mid-1.0900s as markets approach the European midday on Friday.

EUR/USD offered on mixed PMIs, USD-buying

EUR/USD fades Thursday’s decent advance and trades with modest losses at the end of the week against the backdrop of the persistent consolidative mood in the global markets, as catalysts for the price action remain absent.

in the meantime, the hawkish narrative from ECB’s rate setters continue to point to further tightening in May and probably June and July, as inflation – mainly de Core CPI – remains stubbornly elevated.

Still around the ECB, Board member Visco called for some prudence when it comes to price in further interest rate increases, while his colleague De Guindos showed some confidence in that core prices will eventually lose traction, at the time when he reiterated that future decisions on the interest rate will remain data dependent.

In the domestic calendar, advanced Manufacturing PMIs in Germany and the euro area are expected to drop to 44 and 45.5, respectively, in April. On the opposite side, flash Services PMIs are seen improving to 55.7 and 56.6, respectively.

Across the ocean, advanced Manufacturing and Services PMIs are also due along with the speech by FOMC’s L. Cook.

What to look for around EUR

EUR/USD keeps the range bound trade well in place always below the 1.1000 region so far on Friday.

Meanwhile, price action around the single currency should continue to closely follow dollar dynamics, as well as the incipient Fed-ECB divergence when it comes to the banks’ intentions regarding the potential next moves in interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Advanced Manufacturing/Services PMIs (Friday).

Eminent issues on the back boiler: Continuation (or not) of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.05% at 1.0959 and faces the next support at 1.0831 (monthly low April 10) seconded by 1.0788 (monthly low April 3) and finally 1.0760 (55-day SMA). On the upside, a break above 1.1075 (2023 high April 14) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022).

-

10:10

EUR/GBP sticks to gains near multi-day top, just below mid-0.8800s post-Eurozone/UK PMIs

- EUR/GBP scales higher for the second straight day and climbs back closer to the weekly high.

- The dismal UK Retail Sales data is weighing on the GBP and acts as a tailwind for the cross.

- The mixed PMI prints from the Eurozone and the UK fail to provide any meaningful impetus.

The EUR/GBP cross gains positive traction for the second successive day on Friday and touches a four-day high, around the 0.8840-0.8845 region during the first half of the European session.

The British Pound’s relative underperformance on the last day of the week follows the disappointing release of the UK monthly Retail Sales figures and the mixed UK PMI prints. In fact, the UK Office for National Statistics reported that domestic Retail Sales contracted by 0.9% in March and sales excluding fuel dropped by 1% during the reported month, both missing consensus estimates.

Adding to this, the flash UK Manufacturing PMI delivers a negative surprise and drops further into contraction territory, to 46.6 in April. The weaker reading, to a larger extent, was offset by the better-than-expected Services PMI, which rose to 54.9 in April. This, however, fails to impress the GBP bulls or hinder the intraday positive move for the EUR/GBP cross, at least for the time being.

The shared currency, on the other hand, reacts little to the preliminary Eurozone PMI print. The data, meanwhile, indicated that the Eurozone economy is holding up fairly, which should allow the European Central Bank to push forward with its policy tightening. This, in turn, is seen as another factor pushing the EUR/GBP cross higher and remains supportive of the move up.

That said, rising bets for an additional interest rate hike by the Bank of England (BoE) might hold back traders from placing aggressive bullish bets around the EUR/GBP cross. In fact, the markets now see over a 90% chance of a 25-bps rate hike in May and the bets were lifted by the stronger UK consumer inflation figures released on Thursday. This, in turn, could cap any further gains.

Technical levels to watch

-

09:32

Hong Kong SAR Consumer Price Index came in at 1.7%, below expectations (1.8%) in March

-

09:32

UK Preliminary Services PMI unexpectedly jumps to 54.9 in April

- UK Manufacturing PMI contracts to 46.6 in April, a negative surprise.

- Services PMI in the UK comes in at 54.9 in April, a positive surprise.

- GBP/USD defends 1.2400 on divided UK business PMIs.

-

09:30

United Kingdom S&P Global/CIPS Services PMI came in at 54.9, above forecasts (52.9) in April

-

09:30

United Kingdom S&P Global/CIPS Manufacturing PMI below forecasts (48.5) in April: Actual (46.6)

-

09:30

United Kingdom S&P Global/CIPS Composite PMI came in at 53.9, above forecasts (52.5) in April

-

09:22

Euro trades in mid 1.09s, lifted slightly by PMI data

- Euro vs US Dollar trades in the mid 1.09s, rising slightly after the release of euro area S&P Global PMIs.

- Euro further supported by comments from ECB’s Lagarde that Governing Council “still has some way to go.”

- US Dollar pressured after poor labor and manufacturing data on Thursday.

The Euro (EUR) snakes along in the mid 1.09s against its biggest counterpart, the US Dollar (USD), during the early European session on Friday. With the banking crisis now seemingly in the rear-view mirror the focus is back on the fight with inflation, and both currencies are benefiting from expectations of higher interest rates. More broadly, the EUR/USD pair appears to be undergoing a correction after making new year-to-date highs of 1.1075 on April 14.

From a technical perspective, the Euro-Dollar pair is in a medium-term uptrend which is expected to continue once the correction has finished. Scoping in, the steadily diminishing volatility on intraday charts is tracing out a triangle pattern, which suggests there will be a breakout move on the horizon.

EUR/USD Market Movers

- The Euro rallies intraday after S&P Global Services PMI showed an unexpected gain, coming out at 56.6 when a fall to 54.5 had been forecast. Manufacturing still lags, however, showing a contraction to 45.5.

- The single currency gains further support after European Central Bank (ECB) President Lagarde says that there is still “some way to go” before the ECB finishes hiking interest rates.

- USD drops a touch after US data disappoints, with 5K more Initial Jobless Claims than expected and the Philadelphia Fed Manufacturing Survey hitting its lowest point for almost three years.

- Nevertheless, the most recent major US economic report, the Fed’s Beige Book, states, “Economic activity was little changed in recent weeks.” Indicating stability.

- USD continues to benefit from policymakers like St. Louis Fed’s Bullard talking up further rate hikes due to persistent inflation and overblown recession fears.

- Unexpectedly strong first quarter earnings from US megabanks draws attention away from the sector’s March crisis, further supporting the Greenback.

- The Euro remains underpinned by expectations that the ECB will continue with interest rate hikes, though their size is up for debate.

- European Central Bank’s chief economist Philip Lane has said the health of the region’s banks, as reported in the ECB Bank Lending Survey (BLS) (out on May 2), will be a key determinant of whether the ECB hikes aggressively or not.

- Lane further sees April HICP (also released May 2) inflation as likewise key to determining the next hike.

- Friday’s calendar shows a speech by ECB vice president De Guindos at 17:45.

- For USD the calendar’s highlights include are S&P Global PMI’s at 13:45 GMT.

EUR/USD technical analysis: Triangle in an uptrend

EUR/USD has been posting higher lows and higher highs since the September 2022 lows, and this medium-term uptrend is likely to continue. Following a correction in February 2023, EUR/USD recouped its losses in March and made new year-to-date highs above 1.1000 on April 13.

-638176618097210287.png)

EUR/USD: Daily ChartDrilling down to the 4-hour chart (below) and price action looks to be tracing out a triangle price pattern which will eventually break out either higher or lower. Triangles are usually composed of five waves. This one now looks complete. If so, then a breakout is likely close at hand.

-638176618541744770.png)

EUR/USD: 4-hr ChartThe Chaikin Money Flow oscillator, is an indicator that is supposed to help give clues as to the eventual direction of a breakout from a range bound market, and it has kept below the zero-line during most of the evolution of the triangle, suggesting a slight bias towards expecting a downside break.

That said, the triangle has a flatter top suggesting it might be of the right-angled variety with a slight bullish bias.

Either way, if price pierces below the 1.0917 lows it will probably confirm a downside breakout, with a target at around 1.0850. Alternatively, a breach of 1.0990 high would confirm an upside breakout, which would likely retouch the 1.1075 year-to-date highs.

Taking a bigger-picture perspective, a break and daily close above the 1.1075 year-to-date highs of April 14 would indicate the overarching uptrend was kicking off again and suggest a move up to the next key resistance level at around 1.1190, where the 200-week Simple Moving Average (SMA) is situated.

For bears, a break and close below the important lower high at 1.0830 would bring into doubt the validity of the uptrend and could see losses extend down to a confluence of support at 1.0775-1.0800, and a possible reversal of the dominant trend.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance. -

09:18

Silver Price Analysis: XAG/USD trades with modest losses around $25.00, downside seems limited

- Silver drifts lower on the last day of the week, though lacks any follow-through selling.

- The technical setup still favours bullish traders and supports prospects for further gains.

- A convincing break below the $24.40-30 area is needed to negate the positive outlook.

Silver comes under some selling pressure on the last day of the week and extends its steady intraday descent through the first half of the European session. The white metal slips below the $25.00 psychological mark, though manage to hold its neck above the 100-period Simple Moving (SMA) on the 4-hour chart.

Technical indicators on the 4-hour chart have just started gaining negative traction, though are holding comfortably in the bullish territory on the daily chart. This, in turn, supports prospects for the emergence of some dip-buying at lower levels and suggests that the path of least resistance for the XAG/USD is to the upside. Hence, any subsequent slide is more likely to find decent support near the 23.6% Fibonacci retracement level of the March-April rally, around the $24.65 zone.

This is followed by the $24.40-$24.30 strong horizontal resistance breakpoint, now turned support, which if broken might negate the positive outlook and shift the near-term bias in favour of bearish traders. The XAG/USD might then turn vulnerable to weaken further below the $24.00 mark and test the 38.2% Fibo. level. Some follow-through selling should pave the way for an extension of the recent pullback from a one-year high, around the $26.10 region touched last week.

On the flip side, the $25.50-$25.60 region now seems to have emerged as an immediate strong resistance, above which the XAG/USD is likely to make a fresh attempt to conquer the $26.00 mark. Some follow-through buying will mark a fresh bullish breakout and set the stage for a further near-term appreciating move.

Silver 4-hour chart

Key levels to watch

-

09:08

BoJ likely to maintain dovish policy guidance next week – Reuters

Citing four people familiar with the Bank of Japan’s (BoJ) thinking, Reuters reported on Friday that the Japanese central bank is likely to maintain the ultra-loose monetary policy, by making no change to interest rate targets and yield allowance band, at next week's meeting.

“The BoJ likely to maintain dovish policy guidance, may discuss tweaking reference on COVID-19 impact in coming meetings,” the sources added.

Market reaction

At the time of writing, USD/JPY is battling 134.00, having reversed losses from daily lows of 133.71. The above headlines could help the rebound in the major.

-

09:02

Eurozone Preliminary Manufacturing PMI declines to 45.5 in April vs. 48.0 expected

- Eurozone Manufacturing PMI arrives at 45.5 in April vs. 48.0 expected.

- Bloc’s Services PMI climbs to 56.6 in April vs. 54.5 expected.

- EUR/USD recovers ground above 1.0950 despite the mixed Eurozone PMIs.

The Eurozone manufacturing sector activity unexpectedly contracted further in April, the latest manufacturing activity survey from S&P Global research showed on Friday.

The Eurozone Manufacturing Purchasing Managers Index (PMI) arrived at 45.5 in April vs. 48.0 expected and 47.3 previous. The index reached a 35-month low.

The bloc’s Services PMI advanced to 56.6 in April vs. 54.5 forecasts and March’s 55.0, hitting a 12-month high.

The S&P Global Eurozone PMI Composite jumped to 54.4 in April vs. 53.7 expected and 53.7 previous. The measure recorded a new 11-month high.

FX implications

EUR/USD erases losses to trade at 1.0965 following the release of the mixed Eurozone PMIs.

-

09:00

European Monetary Union S&P Global Manufacturing PMI below forecasts (48) in April: Actual (45.5)

-

09:00

European Monetary Union S&P Global Services PMI above expectations (54.5) in April: Actual (56.6)

-

09:00

European Monetary Union S&P Global Composite PMI registered at 54.4 above expectations (53.7) in April

-

09:00

European Monetary Union S&P Global Services PMI below expectations (54.5) in April: Actual (54.4)

-

09:00

US PMIs: Analyzing April S&P Global Composite release

- April S&P Global Manufacturing and Services PMIs preliminary releases are seen declining after the previous jump.

- Big deviations to the data are likely to ramp up volatility and impact the Federal Reserve pricing.

- EUR/USD bulls stay hopeful whilst above 1.0900 ahead of the release, eyeing the 1.1000 mark.

S&P Global Purchasing Managers Index (PMI) measures private sector business activity in major economies on a monthly basis and in advance of comparable official economic data. On Friday, April 21, the company will unveil the April preliminary estimates of manufacturing PMI and services PMI for the United States (US).

Global businesses are still trying to recover from the pandemic-related setback that saw the world come to a halt three years ago. It has been a bumpy road, with back and forths in the middle, but central bank decisions to tighten their monetary policies took its toll on businesses, with activity contracting for most of 2022.

In March, however, business activity in the United States unexpectedly rebounded, as demand surged, especially in the services industry. The S&P Global preliminary US Composite PMI jumped to 53.3 in March, up from 50.1 in February. The Services PMI Index rose to 53.8 from 50.6, while the Manufacturing PMI climbed to 49.3 from 47.3.

Despite the encouraging resurgence in business activity last month, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, warned that inflation remains a nagging issue, adding that “the purchasing managers surveyed indicated that selling prices were increasing at a quicker rate despite lower costs in the manufacturing sector and that the services sector is also raising prices, mainly as a result of faster wage growth.”

What to expect in the next S&P Global PMI report?

The gauge for manufacturing PMI is expected to decline to 49.0 in April, compared with the final readout of 49.2 recorded in March.

The services PMI, meanwhile, is anticipated to slow its pace of expansion, arriving at 51.5 in April vs. the previous month’s final print of 52.6.

However, the composite PMI is expected to increase to 52.8 in the current month, as against the final March figure of 52.3.

When will be April flash US S&P Global PMIs report released and how could it affect EUR/USD?

The S&P Global PMI report is scheduled for release at 13:45 GMT, on April 21. Ahead of the key release, the US Dollar is struggling to extend its recovery momentum, keeping the sentiment around the EUR/USD pair buoyed. A stronger US PMI print will confirm a 25 basis points (bps) Federal Reserve rate hike in May while deferring rate cut expectations toward the end of this year. At the time of writing, markets are pricing an 82% probability of a quarter percentage point Fed rate hike next month, with rate cuts seen as early as July.

On the other hand, weaker US business activity data will accentuate concerns about the US economy dipping into a recession, which could fuel Fed rate cuts bets. The US Dollar is likely to show resilience in the face of the dovish Fed outlook, as it will continue to benefit the Greenback's relative safe-haven status.

The divergent monetary policy outlooks between the Federal Reserve and European Central Bank (ECB) suggest that the path of least resistance for the EUR/USD pair appears to be the upside. That said, any immediate market reaction could peter out, as the end-of-the-week flows could come into play. It is worth noting that the Fed policymakers enter their ‘blackout period’ from April 22 ahead of the May 2-3 policy meeting, and therefore, the last words from the officials could also have a significant impact on the US Dollar valuations. This, in turn, warrants some caution for aggressive traders and before positioning for a firm near-term direction.

Yohay Elam, Senior Analyst at FXStreet, explains how the US Dollar could react to the data, “If the S&P Global PMIs, and especially the Services PMI, miss expectations, concerns about a downturn could take over. When the US economy sneezes, the rest of the world catches a cold – rushing to the safety of the US Dollar,”

“Conversely, if the figures beat estimates, investors may fear a tougher stance from Fed officials. While a 25 bps hike in May is priced in, another one in June is still uncertain. Any figure that would raise the chances of another increase in borrowing costs could push expectations higher, further boosting the Greenback,” Yohay adds.

Meanwhile, Dhwani Mehta, Asian Session Lead Analyst at FXStreet, offers a brief technical outlook for the EUR/USD pair and writes: “the bull-bear tug-of-war is likely to extend, as the pair continues to waver in a tight range at around 1.0950. The 14-day Relative Strength Index (RSI) is holding above the midline, offering an edge to Euro buyers while the 1.1000 mark remains a tough nut to crack for sellers heading into the US PMIs showdown.”

Dhwani also outlines important technical levels to trade the EUR/USD pair: “On the upside, a sustained move above the psychological 1.1000 level is needed to initiate a fresh upswing toward the yearly high of 1.1076. Alternatively, immediate support awaits at the bullish 21-Day Moving Average (DMA) at 1.0912, below which the 1.0850 psychological support could be tested before the bears approach the 1.0835 static support.

S&P Global PMI-related content

- Gold Price Forecast: For how long can XAU/USD defend 21 DMA? Eyes on US S&P Global PMIs

- US S&P Global PMIs Preview: Win-win situation for the Dollar? Why investors may get spooked

- EUR/USD Analysis: Remains confined in a range below 1.1000 ahead of Eurozone/US PMIs

About the US Manufacturing PMI

The Manufacturing Purchasing Managers Index (PMI) released by S&P Global captures business conditions in the manufacturing sector. As the manufacturing sector dominates a large part of total GDP, the manufacturing PMI is an important indicator of business conditions and the overall economic condition in the United States. Readings above 50 imply the economy is expanding, making investors understood it as a bullish for the USD, whereas a result below 50 points for an economic contraction, and weighs negatively on the currency.

About the US Services PMI

The Services Purchasing Managers Index (PMI) released by S&P Global captures business conditions in the services sector. As the services sector dominates a large part of total GDP, the services PMI is an important indicator of the overall economic condition in US. A result above 50 signals is bullish for the USD, whereas a result below 50 is seen as bearish.

-

08:58

ECB’s de Guindos: ECB will stick to communicating monetary policy on meeting by meeting basis

European Central Bank (ECB) Vice President Luis de Guindos is delivering a speech at "Catedra de Economía y Sociedad" organized by Fundación La Caixa in Madrid.

Key quotes

I'm convinced that core inflation will also come down, but starting point is very high.

ECB will stick to communicating monetary policy on meeting by meeting basis, data dependency, will not shift to forward-guidance for months.

Market reaction

These comments fail to have little impact on the Euro. The EUR/USD pair is trading at 1.0952, losing 0.12% on the day, as of writing.

-

08:43

NZD/USD dives to five-week low, further below mid-0.6100s

- NZD/USD drops to a five-week low on Friday and is pressured by a combination of factors.