Notícias do Mercado

-

23:38

USD/CAD Price Analysis: Approaches 1.3500 amid weak oil prices, Canada Retail Sales eyed

- USD/CAD is marching towards 1.3500 as weak oil prices have impacted the Canadian Dollar.

- Monthly Retail Sales data (Feb) are expected to contract by 0.5% vs. an expansion of 1.4% recorded in January.

- USD/CAD is struggling in extending its upside journey after reaching near the 38.2% Fibo retracement at 1.3493.

The USD/CAD pair is gathering strength to recapture the psychological resistance of 1.3500 in the early Tokyo session. The Loonie asset is showing enormous strength despite a corrective move in the US Dollar Index (DXY). The USD Index has corrected sharply below 101.80 after failing to recapture the critical resistance of 102.00.

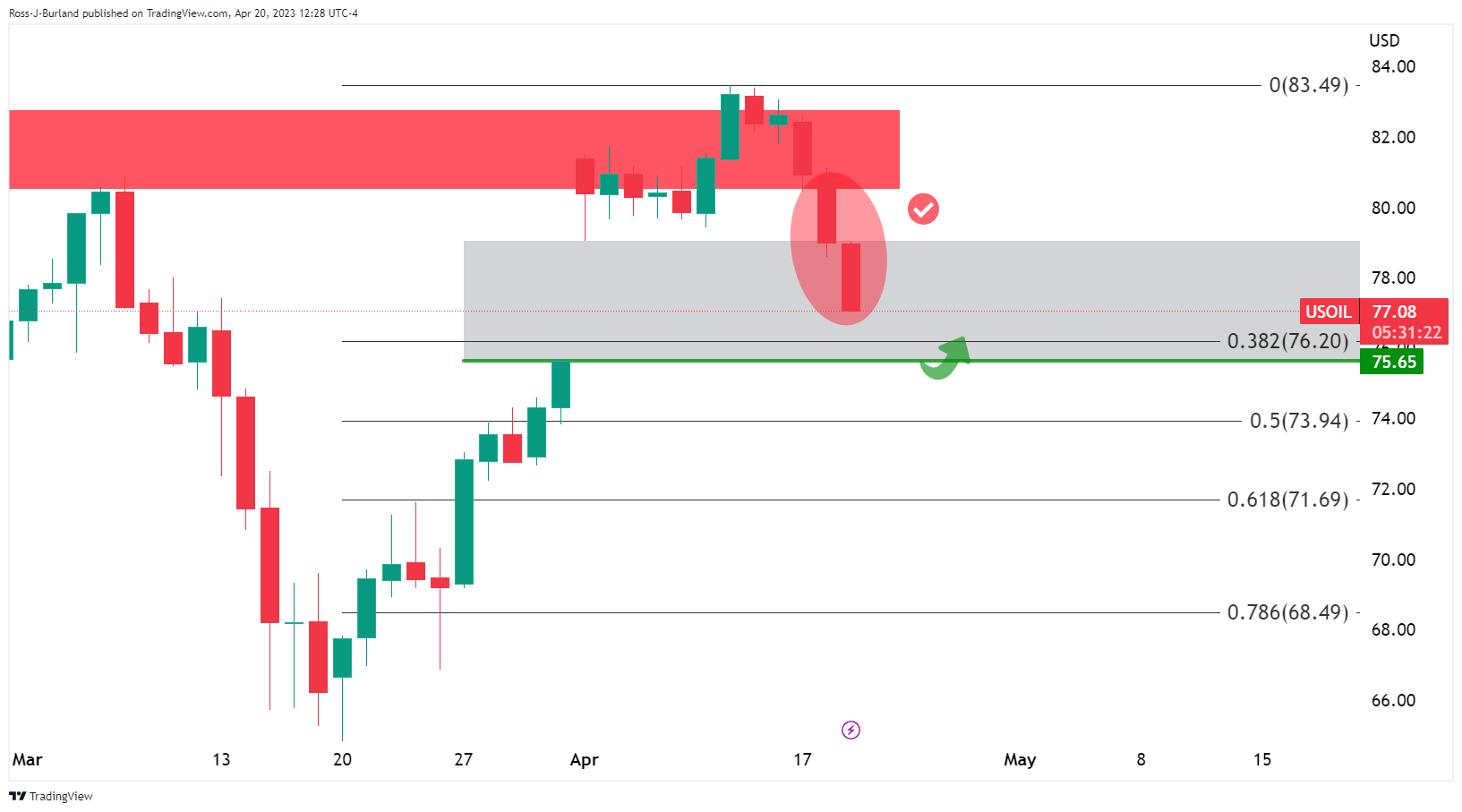

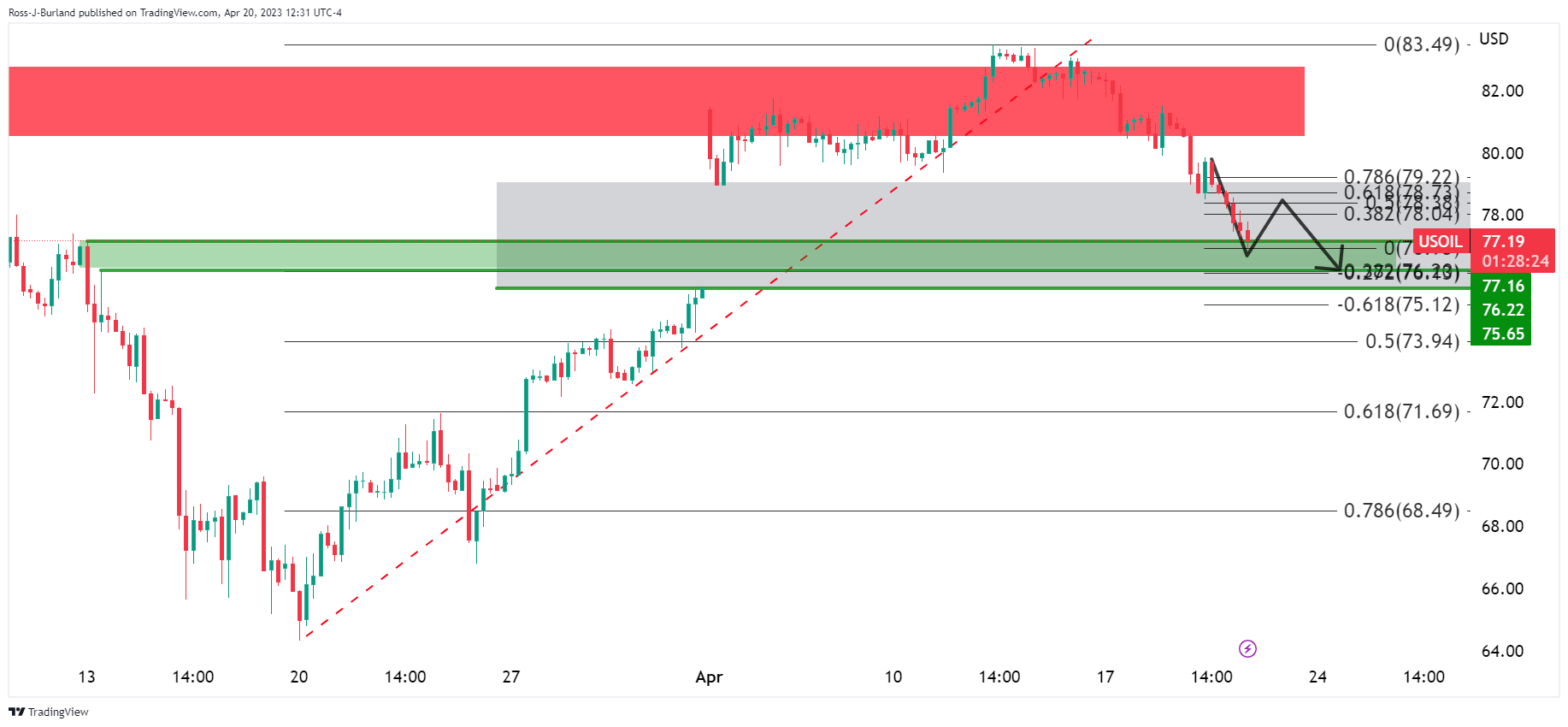

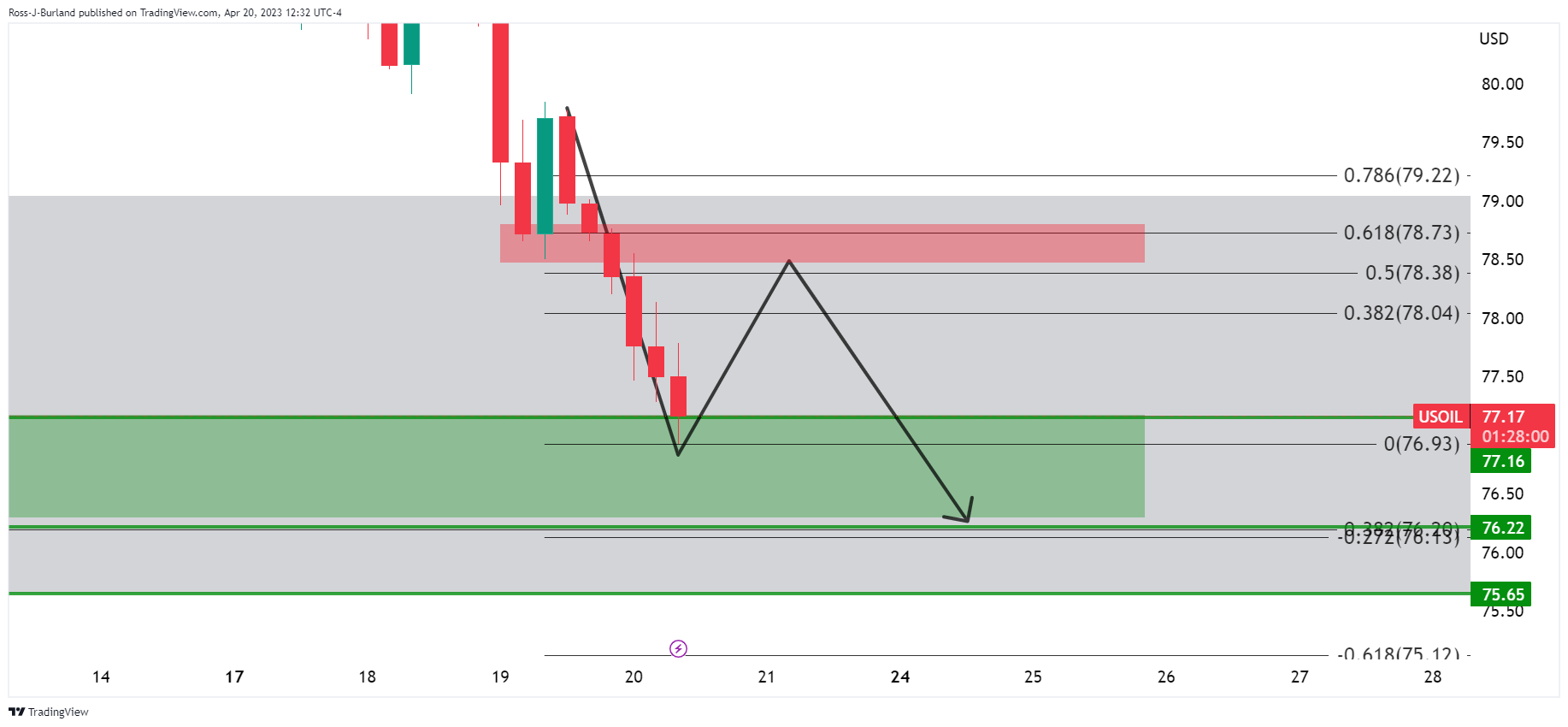

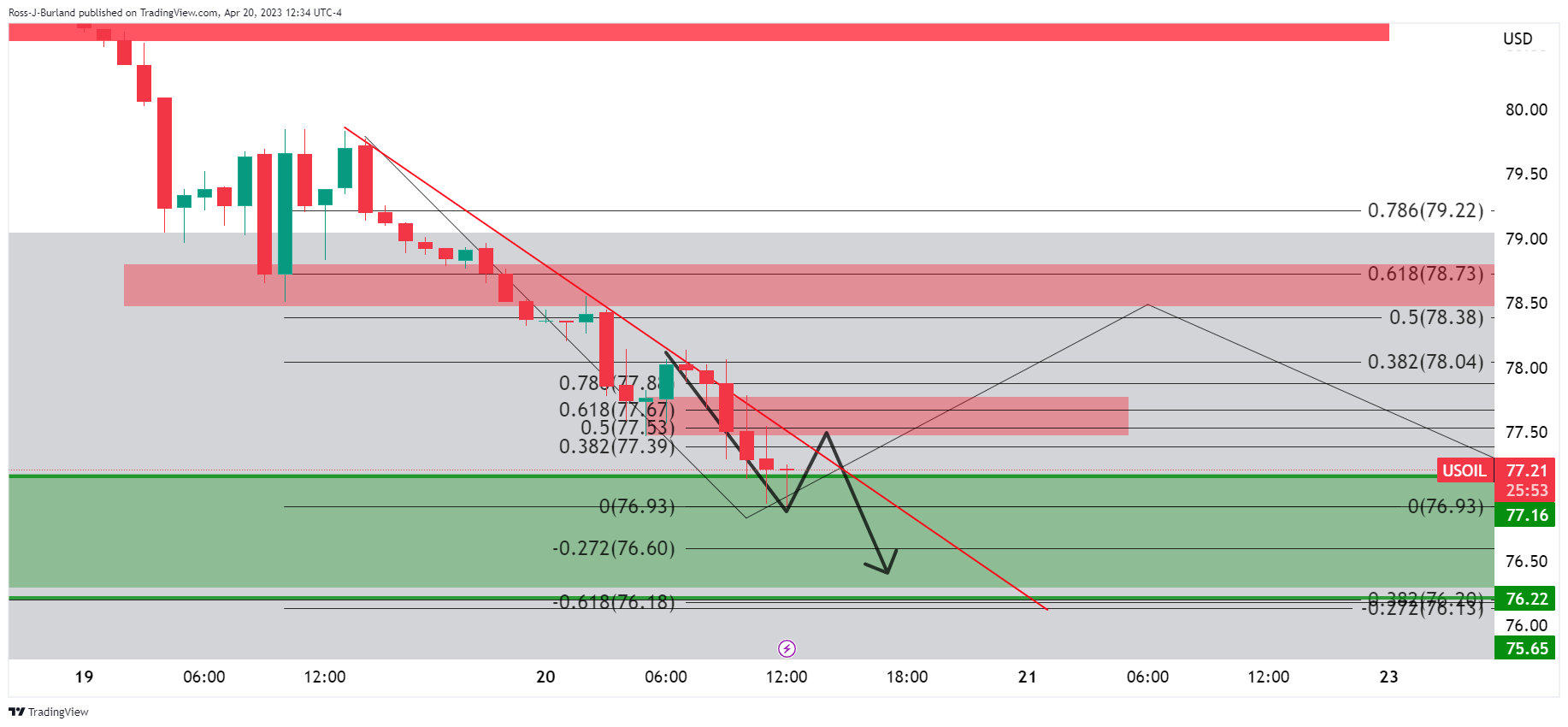

Therefore, the strength in the Loonie asset is coming from the weak Canadian Dollar, which is the outcome of diving oil prices. The oil price is on the verge of slipping below the immediate support of $77.00. The downside journey in the oil price is expected to find an intermediate support of around $75.65. The black gold has surrendered the majority of gains generated after the surprise announcement of production cuts by OPEC+.

Volatility is expected from the Canadian Dollar ahead of the release of Canada’s Retail Sales data. As per the consensus, monthly Retail Sales data (Feb) are expected to contract by 0.5% vs. an expansion of 1.4% recorded in January. Weak retail demand would provide some relief to the Bank of Canada (BoC) ahead.

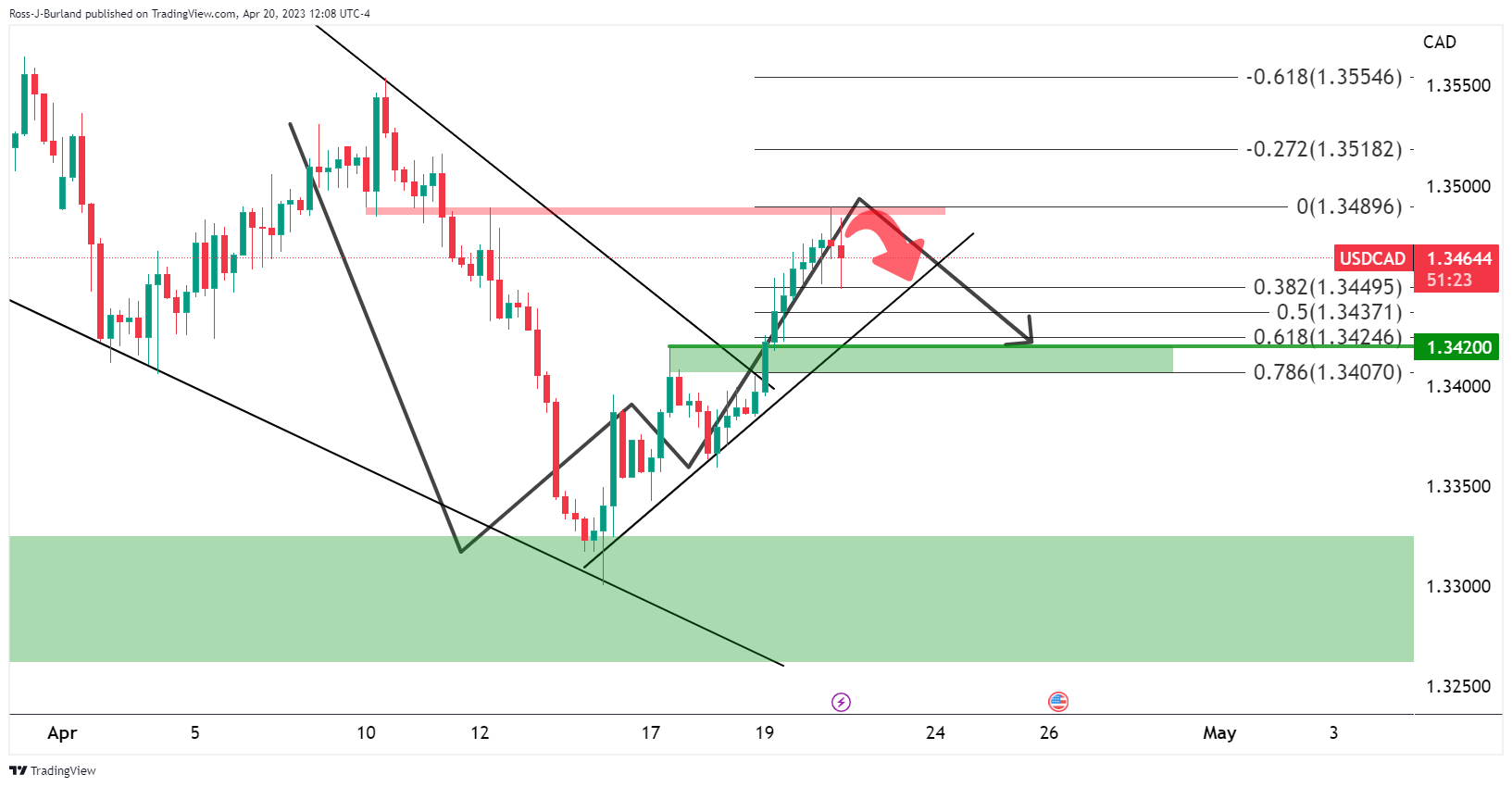

USD/CAD witnessed a steep rise after breaking above the downward-sloping trendline plotted from March 24 high at 1.3804 on a two-hour scale. The Loonie asset is struggling in extending its upside journey after reaching near the 38.2% Fibonacci retracement (plotted from March 24 high at 1.3804 to April 14 low at 1.3300) at 1.3493.

The 20-period Exponential Moving Average (EMA) at 1.3458 is providing support to the US Dollar.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the bullish range of 60.00-80.00, indicating more upside ahead.

A decisive break above 38.2% Fibo retracement at around 1.3500 will drive the asset toward the April 10 high at 1.3554. A breach of the latter will expose the asset to round-level resistance at 1.3600.

On the flip side, a break below the round-level support of 1.3300 will drag the Loonie asset toward February 01 low at 1.3267, followed by 15 November 2022 low at 1.3226.

USD/CAD two-hour chart

-

23:17

EUR/JPY Price Analysis: Dark cloud cover emerges, threatening to drag Euro’s price lower

- Dark cloud cover in the EUR/JPY daily chart suggests a pullback could be underway.

- EUR/JPY sellers are losing momentum as oscillators shifted neutral.

The EUR/JPY retraced Wednesday’s gains on Thursday, as the pair formed a dark cloud cover. The two-candlestick chart pattern suggests the pair could be headed downwards, but a daily close below 147.02 is needed to confirm the chart pattern. As Friday’s Asian session begins, the EUR/JPY is trading at 147.25, registering minuscule gains of 0.04%.

EUR/JPY Price Action

EUR/JPY has managed to extend its rally past the 147.00 area, reaching a YTD high at 147.86; it retreated to the 147.20 area as oscillators turned flat, suggesting buyers are losing momentum. In addition, a forming dark cloud cover could open the door to test 147.00, a crucial area for buyers/sellers, which, once cleared, the latter will eye the 20-day Exponential Moving Average (EMA) at 145.52 as the first support to test.

If the EUR/JPY resumes downwards after challenging 145.52, the following support should be the psychological 145.00 figure, followed by the 50-day Exponential Moving Average (EMA) at 144.15.

On the other hand, if EUR/JPY stays above 147.00, that could pave the way for further upside. The EUR/JPY key resistance areas lie at the YTD high of 147.86, followed by the 148.00 mark. Break above; the EUR/JPY will challenge the 2022 high at 148.40.

EUR/JPY Daily Chart

-

23:07

AUD/USD rebounds from 0.6730 ahead of preliminary Australian S&P PMI

- AUD/USD has shown a rebound from 0.6730 as the upside in the USD Index looks capped.

- An increase in US weekly jobless claims indicates that labor market conditions are not tight enough for now.

- The Australian Dollar has shifted into a bullish trajectory as PBoC is ready to implement a prudent monetary policy.

The AUD/USD pair has shown a decent recovery after a corrective move to near 0.6730 in the early Asian session. The Aussie asset displayed a steep rise on Thursday after Zou Lan, head of monetary policy, at People Bank of China (PBOC) reaffirmed on Thursday that the central bank “will continue implementing prudent monetary policy.”

S&P500 witnessed a steep fall on Thursday after Tesla failed to cheer market participants from its quarterly earnings. The 500-US stock basket delivered a third consecutive bearish closing, portraying a risk aversion theme. Electric Vehicle (EV) maker Tesla reported the lowest quarterly gross margins in two years as the firm is on the path of slashing rates. The firm signaled that more price declines are in pipeline.

The US Dollar Index (DXY) showed a wild gyration in the 101.63-102.13 range and went back inside the woods. The release of the weekly jobless claims confirmed that United States labor market conditions are loosening swiftly and firms are postponing their recruitment plans. As per the report, weekly jobless claims increased to 245K, higher than the consensus and the former release of 240K for the week ending April 14.

The Australian Dollar shifted into a bullish trajectory as PBoC is ready to implement a prudent monetary policy, whenever required, to support the overall demand. Earlier, the PBoC announced an unchanged policy as the Chinese economy is well on track for economic recovery. It is worth noting that Australia is a leading trading partner of China and a quick economic recovery in China will also strengthen the Australian Dollar.

Going forward, preliminary Australian S&P PMI data will be keenly watched. As per the consensus, Manufacturing PMI will drop to 48.8 from the former release of 49.1.

-

23:01

BoE's Tenreyro: UK’s inflation target is `flexible'

Bank of England´s monetary policymaker Silvana Tenreyro said on Thursday that the UK’s inflation target is`flexible'. Her comments follow up from Tuesday´s when she said that the BoE will probably need to start cutting interest rates sooner than previously thought after raising them sharply in recent months despite signs of weaker inflation pressures, monetary policymaker Silvana Tenreyro said on Tuesday.

"I expect that the high current level of Bank Rate will require an earlier and faster reversal, to avoid a significant inflation undershoot," Tenreyro said in the text of a speech she was due to make at the Royal Economic Society's annual conference in Glasgow.

GBP/USD update

GBP/USD has traveled between a low of 1.2404 and a high of 1.2467 on Thursday.

-

22:57

Fed’s Bostic: Inflation is too high, Fed must get it down to 2%

Atlanta Federal Reserve President Raphael Bostic has repeated the rate hike narrative and his comments follow those said on Tuesday when he said that he envisions the central bank approving one more interest rate increase before pausing to see how policy tightening is impacting the economy.

On CNBC, he said “one more move should be enough for us to then take a step back and see how our policy is flowing through the economy, to understand the extent to which inflation is returning back to our target.´´

-

22:17

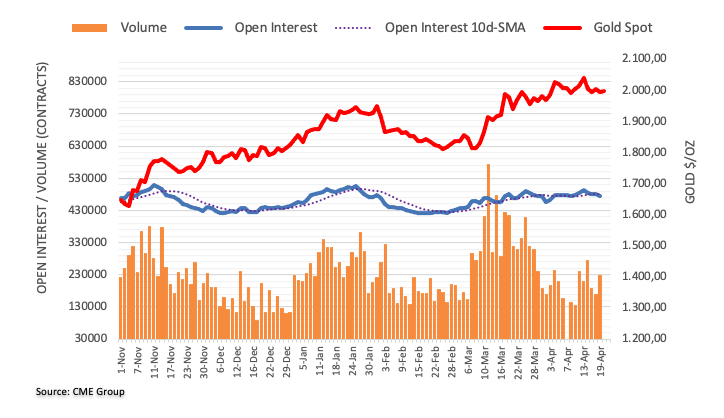

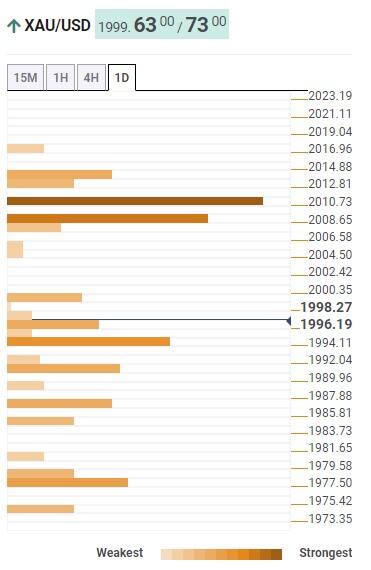

Gold Price Forecast: XAU/USD bears lurking as right shoulder forming

- Gold price forming a Head & Shoulders toppìng formation on the daily chart.

- US data, US Treasury yields, and Federal Reserve sentiment is Gold price the driving force.

The Gold price, XAU/USD, is up around 0.5% near $2,005 and has traveled between a low of $1,990.56 and a high of $2,012.44 so far on Thursday. The price is clustered in a phase of consolidation on the backside of the bullish trend as illustrated in the technical analysis below.

Gold price fundas

Meanwhile, the fundamentals that are playing in surround the state of the US economy and how that is affecting US yields. The yield on the US 10-year note dropped 4bp to 3.55% as the softer Beige Book drove a strong rally in back-month fed fund futures. The moves have supported a bullish correction in the Gold price as the US Dollar fell, as per the DXY index, to a low of 101.632 from a high of 102.126.

Meanwhile, the futures pricing has shown a 90% chance the Federal Reserve will hike rates 25 basis points when policymakers conclude a two-day meeting on May 3, according to CME's FedWatch Tool. In recent Fed speak, Federal Reserve´s Governor Christopher Waller said on Friday that despite a year of aggressive rate increases, the Fed "hasn't made much progress" in returning inflation to their 2% target and argued that rates still need to go up. As such, the likelihood of a rate cut by December has narrowed considerably this week.

Looking ahead, the Federal Open Market Committee will enter a blackout this weekend ahead of the 2/3 May meeting. The latest guidance is very much in line with market pricing and Atlanta Federal Reserve President Bostic said that he favors one more 25bp rate hike and then a pause. Bostic explained that tightening in credit conditions could do some of the Fed’s work. ´´The Atlanta Fed has historically been seen, rightly or wrongly, as a barometer of consensus on the FOMC,´´ analysts at ANZ Bank said.

Federal Reserve Bank of New York President John Williams also said on Wednesday inflation was still at problematic levels, and the US central bank would act to lower it. Looking ahead, the Federal Open Market Committee will enter a blackout this weekend ahead of the 2/3 May meeting.

Meanwhile, analysts at TD Securities explained that the Gold price managed to fend off a break below key trigger levels for CTA liquidations. ´´Retail demand has remained particularly strong following the banking liquidity crisis, but easing fears could see interest subside amid higher prices.´´

´´While slumping rates likely kept gold bulls from liquidating,´´ the analysts said, ´´discretionary traders remain broadly flat, CTAs are still effectively near max long, and Shanghai trade positioning is also near multi-year highs — leaving fewer culprits for the surprising buying activity over the last session.´´

´´In this context, central bank demand remains key to a continued rally, and has shown few signs of buyer fatigue, but 'unofficial' holdings estimates which have been particularly important over the last quarters will only be updated in May,´´ the analysts argued.

Gold price technical analysis

As illustrated above and below, we could have a topping pattern in place for the Gold price.

Gold price H4 chart

The Gold price has slid to the backside of the trendline support and a break of the neckline horizontal support of the Gold price Head & Shoulders pattern is needed to switch the bias fully negative from out of the consolidation.

-

22:02

Forex Today: Mixed markets limit Dollar’s slide, attention turns to global PMIs

Global manufacturing and services PMI data will be released Friday. The S&P Global PMIs will be watched closely by market participants and could have a considerable impact on risk sentiment. Could the US Dollar benefit from downbeat numbers?

Here is what you need to know on Friday, April 21:

The US Dollar continued to move mostly sideways. Weaker-than-expected US economic data weighed on the Greenback that later benefited from a decline in equity prices on Wall Street. The Dow Jones lost 110 points or 0.33%, and the Nasdaq fell 0.80%. US Treasury yields pulled back from weekly highs, with the 10-year yield settling at 3.53%, the lowest in three days.

US S&P Global PMIs Preview: Win-win situation for the Dollar? Why investors may get spooked

The US Labor Department informed Initial Jobless Claims rose to 245K in the week ended April 15, while Continuing Claims increased by 61K in the week ended April 8 to 1.865 million, the highest since November 2021. A different report showed that manufacturing activity in the Philadelphia area unexpectedly contracted in April. The Philly Fed dropped to -31.3 from 23.2 in March, against expectations of an increase to -19.2. Existing Home Sales dropped to 4.44 million (annual rate) against expectations of 4.5 million.

The accounts of the European Central Bank (ECB) March meeting showed that had it not been for the banking crisis, the central bank would have signaled determination to more tightening ahead. The ECB looks set to raise rates further in May, but the size remains open. EUR/USD approached 1.1000 and then pulled back to the 1.0950 zone as the pair continues to move sideways. On Friday, the critical report is the Eurozone S&P Global PMI. Many ECB officials will speak.

GBP/USD posted another daily close near 1.2440 as it remains supported by the 20-day Simple Moving Average. The pair continues to consolidate, unable to retake 1.2500. The UK will report Retail Sales on Friday.

USD/JPY traded near 135.00 but then turned to the downside, hitting 134.00 amid lower government bond yields across the globe. Next week, the Bank of Japan (BoJ) will have its first monetary policy meeting under Governor Ueda. The recent banking crisis and comments from the new governor eased expectations of changes to the monetary policy stance. Japan releases inflation data.

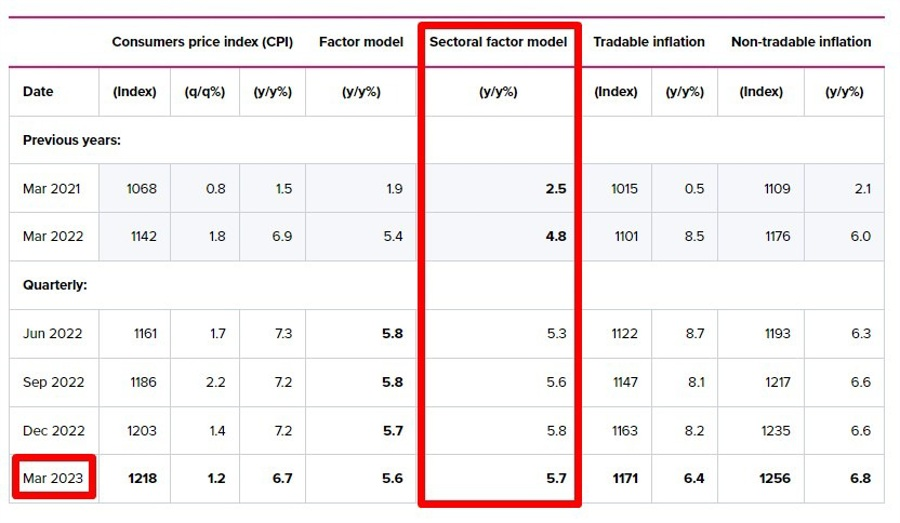

The Kiwi was among the worst performers on Thursday hit by New Zealand inflation data. The Consumer Price Index (CPI) grew by 6.7% in the first quarter, against expectations of 6.9%, the lowest since the fourth quarter 2021. At the last meeting, the Reserve Bank of New Zealand (RBNZ) increased the OCR rate by 50 basis points, surprising on the hawkish side.

NZD/USD bottomed at 0.6148, a one-month low, and then recovered toward 0.6200 boosted by a weaker US Dollar. EUR/NZD reached the highest level since October 2020 above 1.7800, while AUD/NZD broke above 1.0900 for the first time since February.

The Australian Dollar outperformed on Thursday. AUD/USD reached a six-day high at the 0.6770 resistance area and pulled back. The short-term bias is up, without much conviction. An improvement in risk sentiment could help the pair.

USD/CAD continued to move higher and reached weekly highs at 1.3489 before trimming gains. A bearish correction is on the table unless the pair surpasses the 20-day SMA at 1.3487 and the 1.3500 mark. Canadian Retail Sales numbers are due on Friday.

Gold rose supported by lower yields, climbing above $2,000/oz. Silver moved sideways around $25. Bitcoin tumbled more than 3% again. BTC/USD stands at $28,250, still looking under pressure. Concerns about a recession weighed further on crude oil prices, which dropped by more than 2%. WTI slid toward $77.00, hitting the lowest since late March.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

22:00

South Korea Producer Price Index Growth (YoY) registered at 3.3%, below expectations (4.1%) in March

-

22:00

South Korea Producer Price Index Growth (MoM) came in at 0.1%, below expectations (0.4%) in March

-

21:01

USD/CHF Price Analysis: Takes a bearish turn as sellers move in around 0.9000

- USD/CHF prepares to resume its bearish biased, confirmed by oscillators and sellers stepping in at around 0.9000.

- If USD/CHF sellers reclaim 0.8900, look for a test of the YTD low at 0.8859.

- Upside risks lie above 0.9000, with buyers eyeing the 20-day EMA.

USD/CHF reversed its course after hitting a weekly high of 0.9003 and fell, as the sellers remain committed to defending the 0.9000 figure. After consolidating for back-to-back days in the 0.8950-0.9000 range, the USD/CHF exchanges hands at 0.8933, down 0.45%.

USD/CHF Price Action

The USD/CHF posted two positive days and remained in the front foot during the week before turning negative. Sellers are gathering momentum, as shown by the Relative Strength Index (RSI), which is stills in bearish territory. In addition, the Rate of Change (RoC) also turned bearish, suggesting that the USD/CHF pair could resume its downward bias.

If USD/CHF continues lower, the next support would be the April 14 daily low at 0.8866. Once broken, up next would be the YTD low at 0.8859, followed by the 0.8800 figure.

On the other hand, the USD/CHF first resistance would be the confluence of a one-month-old downslope trendline around 0.8990, followed by the 0.9000 figure. A breach of the latter, the USD/CHF can rally towards the 20-day Exponential Moving Average (EMA) at 0.9044 before aiming towards April 10 daily high at 0.9120.

USD/CHF Daily Chart

-

21:00

USD/JPY Price Analysis: Bears lurking near 134.50 for a downside correction

- USD/JPY is carving out the prospects of a deeper correction.

- The bullish bias prevails while on the front side of the broader bullish trendline.

USD/JPY is down 0.26%, losing ground in late New York trade within the day´s range of 134.01 the earlier low and last Asian high of 134.97.

As per the prior analysis, USD/JPY Price Analysis: Bulls move in to test bears near 135.00, the price moved into the resistance and bulls threw in the towel and a break of structure leaves the focus on a fuller correction to the downside as the following illustrates:

USD/JPY, prior analysis

USD/JPY H4 charts

It was stated that the overall bullish scenario, above, forecasted the prospects of a break of the micro trendline and a move to test the low 134s before the bulls engaged again for the push higher, as per the weekly W-formation´s outlook explained and illustrated in the prior analysis. A more bearish scenario, below, highlighted the chances of a breakdown into the broader trendline support.

USD/JPY updates

We are seeing a break in the structure in the 134.20s which leaves the focus on the downside.

However, a bullish correction of the break in structure is underway and the following offers a potential trajectory in the price encompassing a correction and then a downside continuation:

Pulling up the Fibonacci scale, we can see that the prior support aligns with a cluster of Fibos between the 38.2% and 61.8% ratios and a 50% mean reversion in-between.

-

20:01

Argentina Trade Balance (MoM) came in at $-1059M below forecasts ($-158M) in March

-

19:55

GBP/USD bears in the market as profit taking kicks in

- GBP/USD pressured in late New York trade, trading back to flat for the day.

- UK inflation and rates are in focus following the Office for National Statistics showing price pressures everywhere.

GBP/USD is flat in late New York trade, under pressure however, and falling away from 1.2467 highs as profit taking kicks in. GBP/USD has traveled between a low of 1.2404 and a high of 1.2467 so far.

Data on Thursday revealed that the United Kingdom´s inflation is far more persistent and the highest in Western Europe. Headline inflation dropped to 10.1% in March from February's 10.4%. However, this was above expectations for the forecasted drop to 9.8%. The Office for National Statistics showed price pressures all over and has raised the prospect of the Bank of England having to raise rates more than previously expected.

´´The market reacted by repricing peak rates by 30bp from where they were at the end of last week, now suggesting we will get 3 more 25bp hikes between now and September,´´ analysts at Societe Generale said.

´´That matches the hikes expected from the ECB, and contrasts with the single 25bp hike that is priced-in for the Fed (before being reversed by the end of the year). GBP/USD has been tracking rate differentials closely since November (after the chaos of the previous weeks).´´

However, there is a concern over the impact of high prices on households and businesses which is stalling the bid in the Pound Sterling. For instance, real wages in Britain, earnings adjusted for inflation, recently showed one of the biggest drops on record in the three months to February, with a fall of 4.1% year on year. Nevertheless, money markets are pricing in rates peaking at around 5% in November this year vs. last month's expectation of around 4.00%.

´´I struggle with the idea that the UK will have higher rates than the US by the end of this year,´´ Kit Juckes, an economist at Societe Generale said.

´´The idea that the MPC will act three more times before pausing seems implausible even if they are worried that they have done too little so far. And if there is a pause, then a US-led slowdown will probably prevent the hikes re-starting (if there is no US slowdown, the Fed won’t be easing),´´ Juckes argued, adding:

´´The repricing of UK supports Sterling as long as rates, and not growth, drive FX, but I fear the positive impact of the rates outlook for GBP/USD will fade long before.´´

-

19:26

USD/MXN at two-day Low as Mexican Peso strengthens on sluggish US data

- Disappointing macroeconomic data releases from the US weigh on US Dollar.

- Fed’s Mester: Rates must peak above 5% and hold there for a while.

- Mexican Retail Sales missed estimates, according to INEGI, though

The Mexican Peso (MXN) gains ground vs. the US Dollar (USD) and hovers around the 18.0000 figure for the first time in two days. A deceleration in the US, namely the labor market, housing, and manufacturing activity, in Philadelphia, spurred concerns about the status of the economy. At the time of writing, the USD/MXN is trading at 17.9910.

USD/MXN drops as US data discouraged investors from buying US Dollars

Despite a dented market sentiment, the USD/MXN continues to dive. US Initial Jobless Claims for the latest week rose above expectations, signaling that the labor market is easing. At the same time, the Philadelphia Fed Manufacturing Index was reported, which plunged to -31.3 beneath March’s -23.3, a headwind for the American Dollar (USD).

The US housing market continues to deteriorate as Existing Home Sales dropped -2.4% MoM, from 13.8% in February, which appeared to signal that housing had bottomed.

Fed policymakers continued another round of appearances in the media, led by the Cleveland Fed President Loretta Mester. She commented that she is happy with the progress on inflation though she reiterated that it’s too high. She expects rates to be above 5%, adding that the US economy is headed for slow growth, which could turn into a recession.

Retail Sales fell far more than expected on the Mexican front, according to the national statistics agency known as INEGI. Figures on a monthly bases dropped 0.3% vs. estimates of 0.2%, while annually rose by 3.4%, beneath estimates of 4%.

USD/MXN Technical Level

-

18:59

NZD/USD Price Analysis: Bears about to reengage for another push to fresh lows

- NZD/USD shows a likelihood of a continuation to the downside.

- The 0.6180 structure is the line in the sand.

As per the prior analysis, NZD/USD Price Analysis: Bears eye a continuation to 0.6120, the bias remains bearish as the following will illustrate.

NZD/USD prior analysis

NZD/USD was embarking on a run to test a 50% mean reversion level of the prior bearish impulse as follows:

There was a break in structure, however, which opened the prospects of a downside continuation:

0.6120 was eyed as the -272% Fibo in this regard while 0.6100 and 0.6080 came as the next levels of interest.

NZD/USD update

NZD/USD bears have moved in and pierced the 0.6161 structure to open the gates for further downside for the sessions ahead.

We can see the break in the structure and given the current daily wick, it can be expected to be filled in on the lower time frames as follows:

NZD/USD M15 chart

The 0.6180 structure is the line in the sand and a break of this will likely firm up the likelihood of a continuation to the downside to filling the wick and break to fresh lows.

-

18:09

EUR/USD gains ground as US data sparks recession fears

- US Initial Jobless Claims for the latest week jump, as manufacturing activity plunges as reported by the Philadelphia Fed.

- Cleveland’s Fed Loretta Mester is happy with the progress on inflation though rates need to be higher.

- EUR/USD Price Analysis: Could break towards 1.1100 once buyers reclaim 1.1000.

EUR/USD advances, trimming some of its Wednesday’s losses after data from the United States (US) displays further economic deterioration, which reignited recession fears. Hence, investors seeking safety bought the Euro (EUR) to the detriment of the US Dollar (USD). The EUR/USD trades at 1.0969, above its opening price by 0.14%.

EUR/USD boosted by a weaker US economy

Wall Street continues to trade with losses amidst growing concerns of an impending recession in the United States. The latest round of data pointed to a deceleration in the economy, though US Federal Reserve (Fed) officials had reiterated that a recession is not their base scenario.

The US economic calendar revealed that Initial Jobless Claims for the week ending on April 15 rose by 245K, exceeding estimates of 240K, as data from the Department of Labor (DoL) showed. At the same time, the Philadelphia Fed reported that manufacturing activity decelerated in the mid-Atlantic region, with the manufacturing index plunging -31.3 beneath March’s -23.3, a headwind for the American Dollar (USD).

The latest round of US data was that Existing Home Sales dropped 2.4% to a seasonally-adjusted annual rate (SAAR) of 4.44 million in March.

Despite the above, the CME FedWatch Tool still displays that the swaps markets expect a 25 bps hike at the May meeting, with odds at 88.6%, despite falling US Treasury bond yields. Consequently, the US Dollar Index, a measure of the buck’s value vs. a basket of six currencies, is down 0.20%, at 101.739.

Of late, the Cleveland Fed President Loretta Mester is crossing newswires and said she’s happy with the progress made on inflation. Still, inflation is too high and foresees higher interest rates.

On the Eurozone (EU), European Central Bank (ECB) policymakers continued their round of crossing newswires led by its President Christine Lagarde, saying that inflation is too strong, added that the central bank needs to do “all they can” to bring inflation to the 2% target. Earlier, Klass Knot said that the ECB might need to raise rates in June and July on top of a 25 bps hike in May.

EUR/USD Technical Analysis

From a daily chart perspective, the EUR/USD remains supported by the 20-day EMA from March 20 until today. As the EUR/USD dipped toward the 20-day EMA at 1.0903, the pair jumped and recorded a new cycle high. Should this be the case, the 1.1100 is up for grabs, but EUR buyers must reclaim the psychological 1.1000, followed by the YTD high at 1.1075. Conversely, a fall below 1.0900 will expose the 20-day EMA at 1.0896. If EUR/USD drops below the latter, a dive to 1.0800 is on the cards.

-

17:40

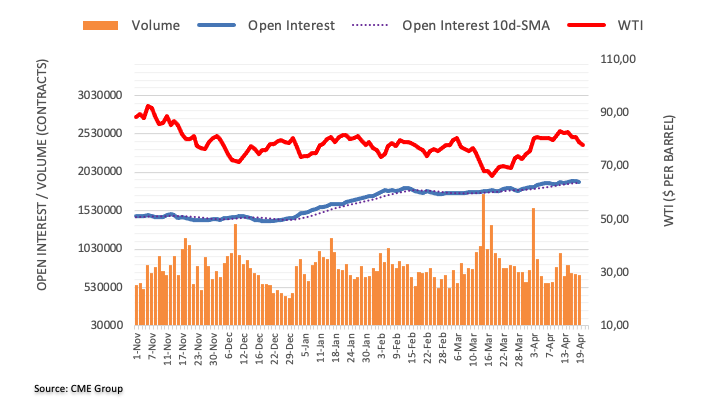

WTI Price Analysis: Bears in control, on verge to close the gap

- WTI is on the way to closing the gap.

- WTI is sliding into a prior 4-hour resistance area.

The price of oil is under pressure on Thursday, extending the losses from mid-week trade, and on the verge of closing the gap as the following will illustrate.

As per the prior analysis, WTI bears move in and eye a close of the gap at $75.65, the price of oil is closing the gap:

WTI prior analysis

´´The bears are in and eye a 38.2%fibonacci correction towards a close of the gap at $75.65bbls.´´

WTI update

We are seeing a deterioration in price.

WTI H4 chart

On the 4-hour chart, we can see the nearest potential support structure for while the price is currently moving into. This could produce a bout of profit-taking and a move up into the sell-off:

The prior support comes in at the 61.8% ratio near $78.70.

WTI H1 chart

On the hourly chart, there could be a lower resistance as per the trendline resistance and the Fibonacci scale3 confluences.

-

17:33

Fed's Mester: Need to hike policy rate to over 5% and hold there for a while

Cleveland Federal Reserve President Loretta Mester reiterated on Thursday that the Fed has more work to do with inflation in the US staying too high, per Reuters.

Additional takeaways

"Fed will need to hike policy rate to over 5% and hold there for a while."

"Fed is much closer to end of rate-hike journey."

"Extent of future Fed rate rises depends on how economy performs."

"Seeing welcome progress in balancing demand and supply in economy."

"Watching to see impact of tighter financial conditions on economy."

"How financial conditions evolve could influence future rate hike view."

"Stresses in banking sector have eased but Fed will act if needed."

"Expecting to see meaningful progress in lowering inflation this year."

"Expecting inflation to ease to 3.75% this year."

"Job market is strong, expecting unemployment rate to rise to 4.50%-4.75%."

Market reaction

These comments don't seem to be having a significant impact on the USD's performance against its major rivals. As of writing, the US Dollar Index was down 0.15% on the day at 101.80.

-

17:10

USD/CAD bears moving in, significant correction eyed

- USD/CAD is starting to recede, correction-eyed.

- BoC and Fed themes are in focus, driving the price.

USD/CAD is flat on the day after moving between a low of 1.3448 and 1.3489 so far, currently trading at 1.3460 and in retreat in midday New York trade. The Canadian Dollar was initially offered on Thursday ahead of a parliamentary appearance by Bank of Canada Governor Tiff Macklem. Additionally, the price of oil has continued to deteriorate, one of Canada's major exports.

Fed hawks back in town

The hawkish theme surrounding the Federal Reserve has come back to the fore, supporting US yields, and the US Dollar, and weighing on the oil price. West Texas Intermediate crude is down 2% on Thursday.

As for the Federal Reserve, the futures pricing has shown an 85.7% chance the Fed will hike rates 25 basis points when policymakers conclude a two-day meeting on May 3, according to CME's FedWatch Tool. The hawkish sentiment was kicked off by Federal Reserve´s Governor Christopher Waller last Friday said that despite a year of aggressive rate increases, the Fed "hasn't made much progress" in returning inflation to their 2% target and argued that rates still need to go up. As such, the likelihood of a rate cut by December has narrowed considerably this week.

The latest guidance is very much in line with market pricing and Atlanta Fed President Bostic said that he favors one more 25bp rate hike and then a pause. Bostic explained that tightening credit conditions could do some of the Fed’s work. ´´The Atlanta Fed has historically been seen, rightly or wrongly, as a barometer of consensus on the FOMC,´´ analysts at ANZ Bank said.

Fed Bank of New York President John Williams also said on Wednesday inflation was still at problematic levels, and the US central bank would act to lower it. Looking ahead, the Federal Open Market Committee will enter a blackout this weekend ahead of the 2/3 May meeting.

US Dollar softer on data

Nevertheless, the US Dollar, as measured by the DXY index, fell on Thursday as weak data reinforced expectations the world's largest economy is likely headed toward a recession. DXY, which tracks the greenback's value against a basket of major currencies, eased 101.632 after sliding on Friday to its lowest level since early February as investors bet that the Federal Reserve could pause in June after another expected rate hike next month.

In the data. Thursday's data showed US Initial Claims climbed modestly to 245,000 while the week before was revised to show 1,000 more claims than previously reported. The Philadelphia Fed showed that factory activity in the mid-Atlantic region plunged to the lowest level in nearly three years in April while, elsewhere, Existing Home Sales also fell after an increase in February for the first time in a year.

US rate futures are now pricing a roughly 69% probability of a pause in June.

Eyes on BoC

Meanwhile, the focus is on the Bank of Canada´s governor Tiffany Macklem. On Tuesday, Macklem said in testimony in the House of Commons that inflation is coming down quickly but that continued strong demand and the tight labour market are putting upward pressure on many service prices, and those are expected to decline only gradually.

On Thursday, Macklem said the there has been a steady improvement in inflation and modest economic growth. He has stated that it is not a major concern' if the Fed raises rates more than BoC, ‘we have an independent monetary policy’.

Meanwhile, money markets expect the BoC to leave its policy rate on hold at 4.50%, a 15-year high, through the end of the year.

USD/CAD technical analysis

The overall bias is bullish as per the bullish pennant on the daily chart above. We also have a W-formation in the pattern that points to a meanwhile correction:

The price is being faded and the Fibonacci scale can be drawn on the prior bullish impulse:

We have the neckline meeting the 61.8% ratio near 1.3420 as a target. That is to say, if the 38.2% ratio does not hold as support near 1.3450.

-

17:10

AUD/USD hits weekly highs at 0.6770; Aussie outperforms

- Australian Dollar outperforms during the American session.

- US Dollar loses momentum after US economic data.

- AUD/USD breaks short-term resistance, tests 0.6770.

The AUD/USD broke above 0.6740/45 and jumped to 0.6771, reaching the highest level in a week. The pair then pulled ack and is hovering around 0.6755, holding firm to daily gains.

The initial boost came from a weaker US Dollar, following the release of US economic data. Jobless Claims and the Philly Fed came in below expectations. US yields are falling. The 10-year yield falls almost 2% and is at 3.52%, a four-day low. The DXY is down by 0.17% after spending most of the day in positive ground.

The Australian Dollar is outperforming during the American session. The AUD/NZD is up by a hundred pips, above 1.0900, at the highest level since late February. EUR/AUD dropped to 1.6220, the lowest level in two weeks.

Short-term outlook

The AUD/USD is above the 0.6740 area, that has become the initial support. While above, the pair could keep testing the 0.6770 zone, the last defense for 0.6800. While above 0.6740, the bias is to the upside.

Technical levels

-

16:33

United States 4-Week Bill Auction down to 3.19% from previous 4.03%

-

16:19

Gold Price Forecast: XAU/USD surges beyond $2,000 spurred by weak USD on poor jobs data

- US Initial Jobless Claims disappoint a prelude that the labor market is easing.

- The latest Federal Reserve Beige Book shows the US economy is slowing down, led by inflation, hiring, and consumption.

- Gold Price Analysis: To remain sideways within the $1,98-$2,015 range.

Gold price climbs and reclaims the $2,000 after traveling towards weekly lows on Wednesday at $1,969.34, though economic data from the United States (US) bolstered the yellow-metal. In addition, US bond yields are falling, weakening the US Dollar (USD). At the time of typing, the XAU/USD is trading at $2,006.91, above its opening price by 0.61%.

US economic data hurt the US Dollar, boost Gold higher

Risk aversion is the game’s name, even though the CBOE Volatility Index (VIX) remains below 17.00. Wall Street remains pressured after the US Bureau of Labor Statistics (BLS) revealed that unemployment claims rose. Initial Jobless Claims for the latest week rose by 245K, exceeded estimates of 240K, and weighed on US bond yields, a tailwind for Gold.

The XAU/USD was underpinned by a worse-than-expected Philadelphia Fed Manufacturing Index report, which collapsed to -31.3, down from March -23.2, a headwind for the greenback, as recessionary fears reignited following the announcement.

Furthermore, the Beige Book revealed on Wednesday that the US economy is decelerating as hiring and inflation are slowing. The book noted that access to credit is narrowing, wages are increasing, and consumer spending is contracting.

Despite the above, the CME FedWatch Tool still displays that the swaps markets expect a 25 bps hike at the May meeting, with odds at 88.6%.

Consequently, the US 2-year Treasury bond yield tumbles eight bps, down at 4.161%, while the 10-year benchmark note rate clings to the 3.538% area, down five bps. The US 10-year TIPS bond yield, a proxy for real yields, which influences XAU/USD prices, caps the advance of Gold, with gains of 4 bps, up at 1.264%.

The US Dollar Index, a measure of the buck’s value vs. a basket of six currencies, is down 0.20%, at 101.739.

What to watch?

Ahead into the week, US Federal Reserve officials will cross newswires, with six Fed policymakers speaking on Thursday, followed by Lisa C’ok’s on Friday, ahead of the media blackout. Data-wise, the US agenda on Friday, will reveal S&P Global PMIs on its final reading for April

Gold Technical Analysis

After dipping below the 20-day Exponential Moving Average (EMA) at $1,988.60, the XAU/USD resumed its uptrend, though downside risks remain. Of note, after peaking at $2,048.79, XAU/USD’s tumbled, and since April 17, the Gold price remains trading within the $1,980-$2,015 range, unable to decisively break below/above the boundaries of that area, meaning a daily close is pending below $1,980 or above $2,015. On the downside, the XAU/USD’s road is busy with immediate resistance with the $2,000 psychological level, followed by the 20-day EMA, and then the weekly low of $1,969.34. Conversely, the XAU/USD will meet resistance at $2,015, which, once cleared, it could pave the way toward the YTD high at $2,048.79.

-

15:44

NFP: Payrolls to slow to 150k in April – TDS

The next US official employment report is due on May 5. Analysts at TD Securities point out that data suggest a slowdown in payrolls to sub-200,000 levels for the first time since 2020.

Key quotes:

“High-frequency data suggest the pace of job creation is likely to take a step down in April, with payrolls set to advance at a sub-200k pace for the first time since 2020. Our interpretation of the daily Homebase series, which tracks small-business payrolls, suggests employment rose 150k.”

“This would be in sync with this week's Beige Book report which noted that employment growth moderated somewhat this period as several Districts reported a slower pace of growth than in recent Beige Book reports.”

“Jobless claims were little changed vs mid-March, but continuing claims have been rising. This story might change in coming months, though layoffs have concentrated on the information sector (tech), with no evidence of large spillovers into other sectors just yet.”

-

15:30

United States EIA Natural Gas Storage Change above expectations (69B) in April 14: Actual (75B)

-

15:02

European Monetary Union Consumer Confidence registered at -17.5 above expectations (-18.5) in April

-

15:00

United States Existing Home Sales (MoM) below forecasts (4.5M) in March: Actual (4.44M)

-

15:00

United States Existing Home Sales Change (MoM) below expectations (1.5%) in March: Actual (-2.4%)

-

14:53

Silver Price Analysis: XAG/USD consolidates around $25.30-35 area, bullish potential intact

Silver lacks any firm directional bias and oscillates in a range above the $25.00 mark.

The technical setup favours bullish traders and supports prospects for further gains.

Dips towards $24.65 confluence support might still be seen as a buying opportunity.Silver attracts some dip-buying in the vicinity of the $25.00 psychological mark and touches a three-day high on Thursday, albeit the intraday uptick lacks bullish conviction. The white metal seesaws between tepid gains/minor losses through the early North American session and is currently placed around the $25.30 region, nearly unchanged for the day.

From a technical perspective, the recent pullback from over a one-year high - levels just above the $26.00 round figure touched last week - stalled on Wednesday near the 23.6% Fibonacci retracement level of the March-April rally. The said support, around the $24.65 region, now coincides with the upward sloping 100-period Simple Moving Average (SMA) on the 4-hour chart and should act as a pivotal point.

Meanwhile, oscillators on the daily chart are holding comfortably in the bullish territory and have just started gaining positive traction on the 4-hour chart. This, in turn, favours bullish traders and supports prospects for the resumption of the recent rally witnessed over the past month or so. Hence, some follow-through strength towards the $25.80 hurdle, en route to the $26.00 mark, looks like a distinct possibility.

On the flip side, weakness below the $25.00 mark might continue to find decent support near the $24.65 confluence. This is closely followed by the $24.40-$24.30 strong horizontal resistance breakpoint, now turned support, which if broken decisively could drag the XAG/USD towards the $24.00 mark. The downward trajectory could get extended further towards the 38.2% Fibo. level, around the $23.75 area.

Silver 4-hour chart

Key levels to watch

-

14:36

ECB to hike in May, size of the move remains open – Nordea

The next meeting of the Governing Council of the European Central Bank is May 4. Jan von Gerich, Chief Analysts at Nordea points out that the majority of the board remains preoccupied with upside inflation risks, and is set to push further rate hikes. He argues that the size of the May hike will largely be determined by the data released just ahead of the meeting.

Key quotes:

“The monetary policy account of the ECB March meeting confirmed that had it not been for the March banking sector worries, the central bank would have been more determined in signalling more tightening ahead. Now that the banking worries have continued to recede, the upside inflation risks evident in the account are likely to push the ECB into hiking rates several times further, subject to incoming data of course.”

“Another rate hike at the May meeting looks like a done deal, but the size of the move remains open. Market pricing is tilted towards a 25bp rate hike and that is also our baseline. However, an important data batch will be released on 2 May, just two days ahead of the ECB May meeting. On that date, the flash estimate for April inflation, the Q2 bank lending survey and the March credit numbers will all be out, and could yet tilt the scale towards a 50bp rate hike. One should thus prepare for large volatility already ahead of 4 May ECB meeting.”

-

14:34

USD/JPY: Upside falters just ahead of the 135.00 region

- USD/JPY trades on the defensive after a move to 135.00.

- Dollar’s weakness and lower US yields weigh on the pair so far.

- US weekly Claims rose more than expected during last week.

Following a failed attempt to retest/surpass the 135.00 hurdle, USD/JPY comes under pressure and retreats to the low-134.00s on Thursday.

USD/JPY weaker on yields, USD-selling

USD/JPY extends the erratic activity so far this week and comes under pressure following recent monthly peaks past the 135.00 barrier (April 19).

The renewed selling pressure in the greenback forces the USD Index (DXY) to give away earlier gains and return to the sub-102.00 region, while the corrective decline in US yields across the curve collaborate further with the daily pullback in spot.

In the Japanese docket, the trade deficit shrank to ¥754.5B in March, while Foreign Bond Investment rose to ¥500.2B in the week to April 15 and the Tertiary Industry Index rose 0.7% MoM in February.

In the US, Initial Claims went up by 245K in the week to April 15 and the Philly Fed Index worsened to -31.3 for the current month.

USD/JPY levels to consider

As of writing the pair is losing 0.28% at 134.29 and faces the next support at 132.01 (low April 13) seconded by 130.62 (monthly low April 5) and finally 129.63 (monthly low March 24). On the other hand, the surpass of 135.13 (monthly high April 19) would expose 137.07 (200-day SMA) and then 137.91 (2023 high March 8).

-

14:03

GBP/USD Price Analysis: Climbs to fresh daily high, above mid-1.2400s amid weaker USD

- GBP/USD attracts some dip-buying on Thursday and turns positive for the third straight day.

- Retreating US bond yields undermines the safe-haven USD and lends support to the major.

- Bets for a 25 bps BoE rate hike in May act as a tailwind for the GBP and remain supportive.

The GBP/USD pair reverses an intraday dip to the 1.2400 round-figure mark and turns positive for the third successive day on Thursday. The pair, however, remain below the weekly high touched on Wednesday and trades around the 1.2450-1.2455 region, just below the weekly high touched on Wednesday.

The US Treasury bond yields stall the recent strong rally to a nearly one-month high, which, along with the disappointing US macro data, exerts some pressure on the US Dollar (USD). Apart from this, rising bets for another 25 bps rate hike by the Bank of England (BoE) in May underpin the British Pound and act as a tailwind for the GBP/USD pair.

That said, the prospects for further policy tightening by the Federal Reserve (Fed) should help limit the downside for the US bond yields. Furthermore, the risk-off impulse - as depicted by a generally weaker tone around the equity markets - could revive demand for the safe-haven Greenback and keep a lid on any meaningful gains for the GBP/USD pair.

From a technical perspective, spot prices this week found a decent support near the 1.2355-1.2350 region. The said area should now act as a pivotal point, which if broken might prompt some technical selling. The GBP/USD pair could then slide to the 1.2300 mark en route to the 100-day Simple Moving Average (SMA), just below the 1.2200 round figure.

On the flip side, bulls might wait for some follow-through buying beyond the overnight swing high, around the 1.2470-1.2475 region, before placing fresh bets. The GBP/USD pair might then surpass the 1.2500 psychological mark and then aim back to retesting the monthly swing high, around the 1.2545 region touched last week.

The momentum could get extended towards the 1.2600 round figure, above which spot prices could climb to the next relevant hurdle near the 1.2660-1.2665 region.

GBP/USD 4-hour chart

Key levels to watch

-

14:00

Russia Central Bank Reserves $ down to $600.2B from previous $600.8B

-

13:35

US: Philadelphia Fed Manufacturing Index drops to -31.3 in April vs. -19.2 expected

- Philadelphia Fed Manufacturing Index came in lower than expected in April.

- US Dollar Index struggles to hold above 102.00 on Thursday.

The diffusion index for current general activity of the Federal Reserve Bank of Philadelphia's Manufacturing Survey dropped to -31.3 in April from -23.2 in March. This marked the lowest reading since May 2020 and was below the market expectation of -19.2.

"The employment index rose 10 points to a near-zero reading," the publication further read. "The prices paid index declined for the second consecutive month, falling 15 points to 8.2. The current prices received index fell 11 points to -3.3, its third consecutive decline and first negative reading since May 2020."

Market reaction

The US Dollar Index lost its traction in the early American session and declined below 102.00. As of writing, the index was down 0.1% on the day at 101.85.

-

13:34

US: Weekly Initial Jobless Claims rise to 245K vs. 240K expected

- Initial Jobless Claims in the US increased by 5,000 in the week ending April 15.

- Continuing Jobless Claims increased by 61,000 in the week ending April 8.

- US Dollar Index turns negative for the day after economic reports.

There were 245,000 initial jobless claims in the week ending April 15, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's 240,000 (revised from 239,000) and came in above the market expectation of 240,000.

“The 4-week moving average was 239,750, a decrease of 500 from the previous week's revised average.”

Continuing Claims increased by 61,000 in the week ended April 8 to 1.865 million, above the 1.82 million of market consensus. It is the highest level for insured unemployment since November 2021.

“The 4-week moving average was 1,827,250, an increase of 15,250 from the previous week's revised average. This is the highest level for this average since December 18, 2021 when it was 1,838,000.”

Market reaction

The US Dollar Index pulled back modestly after the Jobless Claims also alongside the Philly Fed report. The DXY turned negative below 102.00.

-

13:31

Canada Employment Insurance Beneficiaries Change (MoM) rose from previous -5% to 3% in February

-

13:31

Fed's Beige Book supports a 25 bp hike next month – BBH

BBH Global Currency Strategy offers a brief analysis of the Federal Reserve's (Fed) Beige Book released on Wednesday, which showed that economic conditions had somewhat cooled in recent weeks while inflation continued to run relatively hot.

Key quotes:

“On Overall Economic Activity: Nine Districts reported either no change or only a slight change in activity this period while three indicated modest growth. Lending volumes and loan demand generally declined across consumer and business loan types. On Labor Markets: Employment growth moderated somewhat this period as several Districts reported a slower pace of growth than in recent Beige Book reports. Wages have shown some moderation but remain elevated. On Prices: Overall price levels rose moderately during this reporting period, though the rate of price increases appeared to be slowing. Consumer prices generally increased due to still-elevated demand as well as higher inventory and labor costs.”

“WIRP suggests around 90% odds of 25 bp hike at the May 2-3 meeting, up from 80% at the start of this week, 70% at the start of last week, and 50% at the start of the week before that. Despite these rising odds, one cut is still priced in by year-end. While down from two cuts at the start of last week, this needs to be completely priced out. The Fed will have a lot of time and data before having to make a decision in June. Between the May 2-3 and June 13-14 meetings, the Fed will have digested two more job reports, two CPI/PPI reports, and one retail sales report. A pause in June might just be the most likely outcome but it really will depend on how all that data come in. Waller, Mester, Bowman, Logan, Bostic, and Harker all speak today. Cook speaks tomorrow. Then at midnight tomorrow, the media blackout goes into effect and there will be no Fed speakers until Chair Powell’s press conference May 3.”

-

13:31

United States Philadelphia Fed Manufacturing Survey below forecasts (-19.2) in April: Actual (-31.3)

-

13:30

United States Initial Jobless Claims registered at 245K above expectations (240K) in April 14

-

13:30

United States Continuing Jobless Claims came in at 1.865M, above forecasts (1.82M) in April 7

-

13:30

United States Initial Jobless Claims 4-week average dipped from previous 240K to 239.75K in April 14

-

13:17

AUD/USD holds steady above 0.6700, upside remains capped amid weaker risk tone

- AUD/USD attracts some dip-buying on Thursday, though the uptick lacks bullish conviction.

- Retreating US bond yields keeps the USD bulls on the defensive and offers some support.

- Bets for more Fed rate hikes limit the USD losses and caps gains amid the risk-off mood.

The AUD/USD pair reverses an intraday dip to sub-0.6700 levels and climbs to a fresh daily high heading into the North American session on Thursday. Spot prices, however, remain below a technically significant 200-day Simple Moving Average (SMA) and currently trade with only modest intraday gains, around the 0.6720 region.

A sharp intraday slide in the US Treasury bond yields exerts some downward pressure on the US Dollar (USD). The Australian Dollar (AUD), on the other hand, draws support from a hawkish tone from the Reserve Bank of Australia's (RBA) April meeting minutes released earlier this week. This, in turn, acts as a tailwind for the AUD/USD pair, though a combination of factors holds back bulls from placing aggressive bets and keeps a lid on any meaningful upside, at least for the time being.

The markets seem convinced that the Federal Reserve (Fed) will continue raising interest rates and have now fully priced in a 25 bps lift-off in May. Moreover, the Fed funds futures indicate a small chance of another rate hike at the June FOMC meeting and the bets were lifted by the recent hawkish comments by Fed officials. Furthermore, the incoming US macro data pointed to a resilient economy and fueled concerns that the Fed may have more work to do amid easing fears about a banking crisis.

Apart from this, the risk-off impulse - as depicted by a generally weaker tone around the equity markets - benefits the safe-haven Greenback and contributes to capping the risk-sensitive Aussie. This makes it prudent to wait for strong follow-through buying before positioning for any further near-term appreciating move. Market participants now look to the US economic docket, featuring the Weekly Initial Jobless Claims and the Philly Fed Manufacturing Index, for some trading impetus.

Technical levels to watch

-

13:05

EUR/USD Price Analysis: The 2023 high emerges as the big magnet for bulls

- EUR/USD struggles to advance further north of 1.0980 on Thursday.

- The next resistance level of note comes at the YTD peak near 1.1070 .

EUR/USD’s initial bullish attempt runs out of steam near 1.0980 on Thursday.

Further consolidation should not be ruled out for the time being. The breakout of this theme exposes a probable move to 1.1000 ahead of the 2023 high at 1.1075 (April 14). On the downside, the 1.0900 zone emerges as quite a decent contention so far.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0387.

EUR/USD daily chart

-

13:00

Mexico Retail Sales (MoM) below expectations (0.2%) in February: Actual (-0.3%)

-

13:00

Mexico Retail Sales (YoY) registered at 3.4%, below expectations (4%) in February

-

12:44

USD Index Price Analysis: No changes to the current consolidative tone

- DXY resumes the downside following Wednesday’s decent gains.

- Further side-lined trading is likely for the time being.

DXY gives away Wednesday’s gains and resumes the downside amidst the broad-based range bound theme so far this week.

The index, in the meantime, maintains the choppy activity well in place so far this week. The resumption of the uptrend should face initial hurdle at the April high just above 103.00 (April 3), while bouts of weakness remain underpinned by the sub-101.00 region.

Looking at the broader picture, while below the 200-day SMA, today at 106.24, the outlook for the index is expected to remain negative.

DXY daily chart

-

12:40

US: Existing Home Sales to register a new retreat at -2.2% in March – TDS

Analysts at TD Securities offer a brief preview of the upcoming release of the US Existing Home Sales data, due later during the early North American session this Thursday.

Key quotes:

“The demand side of the housing market is likely to continue offering signs of bottoming in the near term as suggested by nascent indications of improvement from mortgage applications and pending home sales. In the meantime, we look for existing home sales to register a new retreat at -2.2% m/m in March to 4.48mn units from 4.58mn in February (consensus: 4.50mn); however, this decline would not be enough to offset the surprising 14.5% surge in February.”

-

12:35

ECB Accounts: Large majority agreed with proposal to raise key rates by 50 bps

The accounts of the European Central Bank's (ECB) March policy meeting revealed on Thursday that a large majority of the Governing Council agreed with Chief Economist Philip Lane's proposal to raise key rates by 50 basis points (bps), per Reuters.

Key takeaways

"Members widely agreed that bank credit had become more expensive."

"More time was needed to fully assess the overall effect of the monetary policy stance on financial conditions."

"Some members would have preferred not to increase the key rates until the financial market tensions had subsided."

"Monetary policy still had some way to go to bring inflation down, including in the case that the baseline of the March ECB staff projections materialised."

"If the inflation outlook embedded in the March ECB staff projections were confirmed, the Governing Council would have further ground to cover in adjusting the monetary policy stance."

"Financial market tensions were seen as a source of significant uncertainty for the economic and inflation outlook."

"Unless the situation deteriorated significantly, the financial market tensions were unlikely to fundamentally change the Governing Council’s assessment of the inflation outlook."

"The point was made that, in the context of tighter monetary policy, pockets of financial vulnerability had to be expected."

"It had to be considered that the transmission of monetary policy impulses was likely to be stronger at times of market stress than in calmer times."

"Members assessed that there were both upside and downside risks to the inflation outlook."

"A number of members seeing risks to inflation as tilted to the upside over the entire horizon."

Market reaction

EUR/USD largely ignored this publication and was last seen trading modestly higher on the day at 1.0973.

-

12:26

USD/CHF hangs near weekly low, just below mid-0.8900s amid risk-off mood

- USD/CHF extends the overnight slide from a one-week high and drifts lower on Thursday.

- The risk-off impulse benefits the safe-haven CHF and exerts some pressure on the major.

- Retreating US bond yields weighs on the USD and contributes to the intraday selling bias.

The USD/CHF pair comes under heavy selling pressure on Thursday and extends the previous day's late pullback from a one-week high, around the 0.9000 psychological mark. The pair maintains its offered tone through the first half of the European session and is currently placed around the 0.8940 region, near the lower end of its weekly trading range.

A generally weaker tone around the equity markets - amid worries about economic headwinds stemming from rising borrowing costs - benefits the safe-haven Swiss Franc (CHF). The anti-risk flow, meanwhile, triggers a sharp intraday downfall in the US Treasury bond yields, which keeps the US Dollar (USD) bulls on the defensive and contributes to the offered tone surrounding the USD/CHF pair.

Any meaningful downside for the USD, however, seems limited amid growing acceptance that the Federal Reserve (Fed) will continue raising interest rates. In fact, the markets seem convinced that the US central bank will hike rates by 25 bps in May and have been pricing in a small chance of another lift-off in June. This should act as a tailwind for the US bond yields and help revive the USD demand.

The aforementioned fundamental backdrop, meanwhile, warrants caution before positioning for any further depreciating move. now look to the US economic docket, featuring Weekly Initial Jobless Claim, the Philly Fed Manufacturing Index and Existing Home Sales data. This, along with speeches by Fedspeaks and the US bond yields, will drive the USD demand and provide some impetus to the USD/CHF pair.

Technical levels to watch

-

12:03

EUR/JPY Price Analysis: Further upside targets 148.00 and above

- EUR/JPY extends the rally to the boundaries of 148.00

- Further up could see the 2022 high at 148.40 revisited.

EUR/JPY keeps the upside bias well in place and trades closer to the key 148.00 mark on Thursday.

Considering the ongoing price action, further gains in the cross remain in store for the time being. That said, the continuation of the upside momentum could extend further and challenge the 2022 peak at 148.40 (October 21) sooner rather than later.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 142.20.

EUR/JPY daily chart

-

11:51

USD/JPY consolidates its recent gains to multi-week high, flat-lines above mid-134.00s

- USD/JPY oscillates in a narrow trading band near a multi-week high touched on Wednesday.

- The risk-off impulse benefits the safe-haven JPY and acts as a headwind amid a softer USD.

- Bets for more Fed rate hikes help limit losses for the USD and lend some support to the pair.

The USD/JPY pair lacks any firm intraday directional bias on Thursday and seesaws between tepid gains/minor losses through the first half of the European session. The pair is currently placed around the 134.65 region, just below a five-week high touched on Wednesday and is influenced by a combination of diverging forces.

A fresh wave of the global risk-aversion trade boosts demand for traditional safe-haven assets and benefits the Japanese Yen (JPY). Apart from this, a modest US Dollar (USD) downtick, led by the ongoing pullback in the US Treasury bond yields from a nearly one-month high touched on Thursday, acts as a headwind for the USD/JPY pair. Meanwhile, an intraday decline in the US bond yields narrows the US-Japan rate differential and lends additional support to the JPY.

That said, the prospects for further policy tightening by the Federal Reserve (Fed) should help limit the downside for the US bond yields and favours the USD bulls. In fact, the markets seem convinced that the Fed will continue raising interest rates and have fully priced in a 25 basis point (bps) lift-off in May. Moreover, the Fed funds futures indicate a small chance of another rate hike at the June FOMC meeting in the wake of the recent hawkish comments by Fed officials.

In contrast, the new Bank of Japan (BoJ) Governor Kazuo Ueda reiterated earlier this week that there is no immediate need to review the 2013 joint statement with the government and that the central bank will maintain current monetary easing. The dovish BoJ stance might further hold back traders from placing aggressive bullish bets around the JPY. The Fed-BoJ policy divergence suggests that the path of least resistance for the USD/JPY pair remains to the upside.

Market participants now look to the US economic docket, featuring the release of the usual Weekly Initial Jobless Claim, the Philly Fed Manufacturing Index and Existing Home Sales data later during the early North American session. This, along with speeches by influential FOMC members and the US bond yields, will drive the USD demand and provide some impetus to the USD/JPY pair. Traders will further take cues from the broader risk sentiment to grab short-term opportunities.

Technical levels to watch

-

11:25

US Dollar holds its ground, oil prices slide on worsening demand outlook

- US Dollar stays resilient against its major rivals in the second half of the week.

- Crude oil prices slide on worsening demand outlook, stronger USD.

- USD could react to macroeconomic data releases from the United States in the American session.

The US Dollar (USD) keeps its footing following Wednesday’s modest rebound as investors continue to stay away from risk-sensitive assets. Meanwhile, the renewed USD strength and growing concerns over a worsening demand outlook drag crude oil prices lower. Signs of sticky inflation in major economies remind market participants that central banks could cling to tight monetary policies at the cost of a slowdown in activity.

The US Dollar Index, which tracks the USD performance against a basket of six major currencies, stays in a tight range near 102.00 on Thursday. On a weekly basis, the index stays in positive territory, looking to snap a five-week losing streak.

Daily digest market movers: US Dollar awaits macroeconomic data releases from US

- The US Department of Labor will release the weekly Initial Jobless Claims data on Thursday, which is forecast to tick up to 240,000.

- March Existing Home Sales and the Federal Reserve Bank of Philadelphia’s Manufacturing Survey will also be featured in the US economic docket.

- Stronger-than-expected Consumer Price Index (CPI) data from the UK revived fears over sticky global inflation and triggered a rally in global bond yields.

- The benchmark 10-year US Treasury bond yield turned north early Wednesday and climbed to its highest level in nearly a month above 3.6% before going into a consolidation phase slightly below that level on Thursday.

- Crude oil prices fell sharply on Wednesday and the barrel of West Texas Intermediate lost more than 2%. WTI stays under selling pressure and trades at its lowest level in over two weeks below $78.

- The Federal Reserve’s Beige Book showed late Wednesday that manufacturing activity was widely reported as flat or down even as supply chains continued to improve. “Overall price levels rose moderately during this reporting period, though the rate of price increases appeared to be slowing,” the publication further read.

- “After the failure of two large regional Fed banks last month roiled the financial sector, I’m waiting to see whether there are other credit shoes to drop,” said Chicago Federal Reserve Bank President Austan Goolsbee in an interview with American Public Media's Marketplace on Wednesday.

- NY Fed President John Williams reiterated that it was too early to assess the economic impact of tighter credit conditions and added that they need to continue to use policy tools to restore price stability.

- St. Louis Federal Reserve President James Bullard told Reuters on Tuesday that interest rates will need to continue to rise in the absence of clear progress on inflation. Bullard further noted that he is still seeing the "adequately restrictive policy rate" at 5.50%-5.75% range and added that is biased to hold rates there for longer until inflation is contained.

- Housing Starts in the US declined by 0.8% on a monthly basis in March following February's increase of 7.3% (revised from 9.8%). In the same period, Building Permits decreased by 8.8%, compared to the market expectation of +1.45%.

- The data from China showed on Tuesday that the world’s second-largest economy expanded by an annualized rate of 4.5% in the first quarter, much stronger than the 2.9% growth recorded in the last quarter of 2022. This reading also came in better than analysts' estimate for an expansion of 4%. Other data revealed that Industrial Production expanded by 3.9% and Retail Sales rose by 10.6% on a yearly basis, compared to analysts' estimate of 7.4%.

- Richmond Fed President Thomas Barkin said on Monday that he wants to see more evidence of inflation settling back to target.

Technical analysis: US Dollar Index stays below key resistance

The US Dollar Index trades slightly below the 20-day Simple Moving Average (SMA), currently located at 102.20. In case the DXY closes the day above that level, it could target 103.00 (static level, psychological level) and 103.50 (50-day SMA, 100-day SMA).

Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart moves sideways near 50, suggesting that sellers refrain from committing to further USD weakness.

On the downside, 101.50 (static level) align as interim support ahead of 101.00/100.80 (psychological level, static level, multi-month low set on April 14). A daily close below that support area could open the door for an extended slide toward 100.00 (psychological level).

How does Fed’s policy impact US Dollar?

The US Federal Reserve (Fed) has two mandates: maximum employment and price stability. The Fed uses interest rates as the primary tool to reach its goals but has to find the right balance. If the Fed is concerned about inflation, it tightens its policy by raising the interest rate to increase the cost of borrowing and encourage saving. In that scenario, the US Dollar (USD) is likely to gain value due to decreasing money supply. On the other hand, the Fed could decide to loosen its policy via rate cuts if it’s concerned about a rising unemployment rate due to a slowdown in economic activity. Lower interest rates are likely to lead to a growth in investment and allow companies to hire more people. In that case, the USD is expected to lose value.

The Fed also uses quantitative tightening (QT) or quantitative easing (QE) to adjust the size of its balance sheet and steer the economy in the desired direction. QE refers to the Fed buying assets, such as government bonds, in the open market to spur growth and QT is exactly the opposite. QE is widely seen as a USD-negative central bank policy action and vice versa.

-

11:09

Malaysia: Exports unexpectedly contracted in March – UOB

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest trade balance figures in Malaysia.

Key Takeaways

“Gross exports posted its first month of contraction since Aug 2020 at 1.4% y/y last month (Feb: +9.8%), primarily reflecting the effects of high statistical base a year ago, dimmer world economic outlook, and global tech downcycle. The outturn came in line with our estimate (-1.5%) but better than Bloomberg consensus (-1.9%). Gross imports also reversed course and fell by 1.8% (Feb: +12.4%, UOB est: -0.5% vs Bloomberg est: -2.2%), the first y/y fall since Nov 2020. As imports dropped at a faster pace than exports, trade surplus widened to MYR26.7bn (from +MYR19.6bn in Feb).”

“In 1Q23, exports gained 2.8% y/y (4Q22: +11.8%) while imports rose 3.7% (4Q22: +18.5%), leaving a cumulative trade surplus of MYR64.4bn (4Q22: +MYR68.0bn). This is expected to translate into a current account surplus of MYR21.5bn last quarter (4Q22: +MYR25.7bn), according to our calculation. Actual 1Q23 current account data will be released on 12 May.”

“The negative turn in Malaysia’s exports last month is in line with our expectation as we have been long warning of a statistical payback after two consecutive years of high base effects, particularly from Mar onwards. Lingering global recession risks amid a tighter monetary policy environment will continue to suppress global demand this year. Expectations for a tightening of credit conditions following the recent global banking sector turmoil will further amplify the global recession risk and dent business confidence in the near term. As such, we maintain our cautious outlook for Malaysia’s exports with 1.5% growth for this year (BNM est: +1.5%, 2022: +25.0%, 2021: +26.1%).”

-

11:05

Gold Price Forecast: XAU/USD edges higher amid weaker US Dollar, lacks follow-through

- Gold price struggles to gain any meaningful traction on Thursday and oscillates in a narrow band.

- Retreating US bond yields weighs on the US Dollar and lends support amid a weaker risk tone.

- Bets for more rate hikes by Federal Reserve act as a headwind and cap gains for the XAU/USD.

Gold price struggles to capitalize on the previous day's late rebound from the $1,969 area, or over a two-week low, and seesaws between tepid gains/minor losses through the first half of the European session on Thursday. The XAU/USD is currently placed just below the $2,000 psychological mark, nearly unchanged for the day, and is influenced by a combination of diverging forces.

Modest US Dollar weakness lends support to Gold price

The US Treasury bond yields extend the overnight pullback from a nearly one-month high and exert some downward pressure on the US Dollar (USD). This, in turn, is seen as a key factor lending some support to the US Dollar-denominated Gold price. Apart from this, a fresh wave of global risk-aversion traders further benefits the safe-haven precious metal. That said, the prospects for further policy tightening by the Federal Reserve (Fed) act as a tailwind for the USD and cap the upside for the non-yielding XAU/USD.

Bets for more Fed rate hikes cap gains for XAU/USD

In fact, the markets seem convinced that the Fed will continue raising interest rates to combat high inflation and have fully priced in a 25 basis point (bps) lift-off in May. Moreover, the Fed funds futures indicate a small chance of another rate hike at the June Federal Open Market Committee (FOMC) meeting and the bets were reaffirmed by the recent hawkish comments by Fed officials. New York Fed President John Williams said on Wednesday that inflation is still at problematic levels and the US central bank will act to lower it.

Furthermore, the Fed’s Beige Book showed that inflation in the United States (US) continued to run relatively high. Adding to this, the incoming US macro data pointed to a resilient economy and further fueled concerns that the Fed may have more work to do to contain inflation amid easing fears of a full-blown banking crisis. This should help limit the downside for the US Treasury bond yields and attract fresh USD buying at lower levels, suggesting that the path of least resistance for the Gold price remains to the downside.

Traders now eye US macro data for short-term opportunities

Market participants now look to the US economic docket, featuring the release of the usual Weekly Initial Jobless Claim, the Philly Fed Manufacturing Index and Existing Home Sales data later during the early North American session. This, along with speeches by influential FOMC members and the US bond yields and the broader risk sentiment, will drive the USD demand and provide some impetus to Gold price. Traders will further take cues from the broader risk sentiment to grab short-term opportunities around the metal.

Gold price technical outlook

From a technical perspective, the overnight breakdown through the $1,980 horizontal support was seen as a fresh trigger for bearish traders. That said, the lack of follow-through selling and the subsequent recovery warrant caution before positioning for any further depreciating move. Meanwhile, any further move up might now confront resistance near the $2,012-$2,015 zone. A sustained strength beyond might trigger a fresh bout of a short-covering and lift Gold price beyond the $2,020 intermediate hurdle, towards the $2,040 horizontal resistance en route to the YTD peak, around the $2,047-$2,049 region.

On the flip side, the $1,980 area, followed by the overnight swing low, around the $1,969 region, now seems to act as immediate support. Given that oscillators on the daily chart have just started drifting in the negative territory, some follow-through selling should pave the way for an extension of the recent retracement slide from a one-year high. The Gold price might then slide towards testing the next relevant support near the $1,956-$1,955 area before eventually dropping to the monthly low around the $1,950 region.

Key levels to watch

-

10:08

US Treasury Sec. Yellen calls for 'constructive and fair' US economic ties with China

Citing excerpts released by the US Treasury, Reuters reported that Treasury Secretary Janet Yellen will say in her speech later on Thursday that the US seeks a 'constructive and fair' economic relationship with China.

Additional takeaways

“US will communicate clearly concerns about China's behavior, secure its national security interests and protect human rights.”

“US will not compromise on national security concerns, even when they force trade-offs with economic interests.”

“US targeted actions against China are driven by security concerns, not meant to gain competitive economic advantage.”

“Calls on China to follow through on promises to work with the US on the macro economy, climate and debt distress.”

Market reaction

Yellen’s staunch remarks seem to be weighing on the Chinese proxy, the Australian Dollar. The AUD/USD pair is retreating from daily highs of 0.6726 to trade at 0.6700, losing 0.19% on the day, as of writing.

-

10:03

USD/CAD sticks to gains near one-week high, around 1.3470-75 area amid tumbling Oil prices

- USD/CAD consolidates its recent strong recovery gains to over a one-week high.

- Tumbling Crude Oil prices undermines the Loonie and lends support to the pair.

- A modest USD downtick caps the upside, though the setup favours bullish traders.

The USD/CAD pair now seems to have entered a bullish consolidation phase and is seen oscillating in a narrow range around the 1.3470-1.3475 region, or over a one-week high touched this Wednesday.

Crude Oil prices tumble to a fresh monthly low amid worries that rising borrowing costs will slow economic growth and dent fuel demand. Apart from this, signs of cooling consumer inflation in Canada undermine the commodity-linked Lonie and assist the USD/CAD pair to build on the recent solid rebound from the 1.3300 mark, or a two-month low touched earlier this week. The upside, however, remains capped in the wake of a mildly softer tone surrounding the US Dollar, led by a modest downtick in the US Treasury bond yields.