Notícias do Mercado

-

23:43

Commodities. Daily history for Sep 22'2014:

(raw materials / closing price /% change)

Light Crude 91.52 0.00%

Gold 1,216.70 -0.10%

-

23:30

Stocks. Daily history for Sep 22'2014:

(index / closing price / change items /% change)

Nikkei 225 16,205.9 -115.27 -0.71%

Hang Seng 23,955.49 -350.67 -1.44%

S&P/ASX 200 5,362.96 -70.10 -1.29%

Shanghai Composite 2,289.87 -39.59 -1.70%

FTSE 100 6,773.63 -64.29 -0.94%

CAC 40 4,442.55 -18.67 -0.42%

Xetra DAX 9,749.54 -49.72 -0.51%

S&P 500 1,994.29 -16.11 -0.80%

NASDAQ Composite 4,527.69 -52.10 -1.14%

Dow Jones 17,172.68 -107.06 -0.62%

-

23:26

Currencies. Daily history for Sep 22'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2846 +0,14%

GBP/USD $1,6360 +0,45%

USD/CHF Chf0,9599 +2,00%

USD/JPY Y108,82 -0,18%

EUR/JPY Y139,77 -0,07%

GBP/JPY Y178,02 +0,26%

AUD/USD $0,8868 -0,62%

NZD/USD $0,8111 -0,15%

USD/CAD C$1,1038 +0,69%

-

23:00

Schedule for today,Tuesday, Sep 23’2014:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

01:45 China HSBC Manufacturing PMI (Preliminary) September 50.2 50.0

06:58 France Manufacturing PMI (Preliminary) September 46.9 47.1

06:58 France Services PMI (Preliminary) September 50.3 50.2

07:28 Germany Manufacturing PMI (Preliminary) September 51.4 51.3

07:28 Germany Services PMI (Preliminary) September 54.9 54.6

07:58 Eurozone Manufacturing PMI (Preliminary) September 50.7 50.6

07:58 Eurozone Services PMI (Preliminary) September 53.1 53.2

08:30 United Kingdom BBA Mortgage Approvals August 42.8 42.9

08:30 United Kingdom PSNB, bln August -1.1 10.3

12:30 Canada Retail Sales, m/m July +1.1% +0.4%

12:30 Canada Retail Sales ex Autos, m/m July +1.5% -0.1%

13:00 U.S. Housing Price Index, m/m July +0.4% +0.4%

13:00 U.S. Housing Price Index, y/y July +5.1%

13:20 U.S. FOMC Member Jerome Powell Speaks

13:45 U.S. Manufacturing PMI (Preliminary) September 57.9 58.1

14:00 U.S. Richmond Fed Manufacturing Index September 12 10

18:00 U.S. FOMC Member Narayana Kocherlakota

20:30 U.S. API Crude Oil Inventories September +3.3

22:45 New Zealand Trade Balance, mln August -692 -1125

-

20:00

Dow -105.37 17,174.37 -0.61% Nasdaq -55.86 4,523.93 -1.22% S&P -16.39 1,994.01 -0.82%

-

17:00

European stocks close: FTSE 100 6,773.63 -64.29 -0.94% CAC 40 4,442.55 -18.67 -0.42% DAX 9,749.54 -49.72 -0.51%

-

17:00

European stocks close: most stocks closed lower on concerns over Chinese economy

Stock indices traded lower. Concerns over a slowdown in Chinese economy weighed on markets. Market participants are awaiting the release of Chinese preliminary HSBC manufacturing purchasing managers' index on Tuesday. Analysts expect the HSBC manufacturing purchasing managers' index to decline to 50.0 in September from 50.2 in August. That could provide more evidence of a slowdown in Chinese economy.

Comments by China's Finance Minister Lou Jiwei damped speculation the government will boost economic stimulus measures.

The European Central Bank President (ECB) Mario Dragh said at the EP's Economic and Monetary Affairs Committee today the economic recovery in the Eurozone is slowing and geopolitical tensions could hurt business and consumer confidence. He reiterated inflation will remain at low levels over the coming months, before increasing during 2015 and 2016 and the ECB is ready to implement additional unconventional instruments.

Germany's Bundesbank released its monthly report today. Bundesbank said the country's economy remains robust. Bundesbank added that the general economic trend will stay positive despite the slowing pace of expansion in the first half of 2014.

Consumer confidence in the Eurozone fell to -11.4 in September from -10 in August, missing expectations for a decline to -11.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,773.63 -64.29 -0.94%

DAX 9,749.54 -49.72 -0.51%

CAC 40 4,442.55 -18.67 -0.42%

-

16:40

Oil: an overview of the market situation

The cost of oil futures has declined today, dropping at the same time below $ 97 per barrel (Brent) and $ 91 per barrel (WTI), as sluggish demand and sufficient proposals outweighed expectations regarding the decline in oil production in the OPEC.

Recall, the OPEC countries to discuss production policy at a meeting on November 27th. Budget some cartel participants based on an oil price of not less than $ 100 per barrel, and the organization's Secretary General, said last week that OPEC may cut production next year.

"If you look at the growth in production over the last year, is seen very strong growth in the United States, mostly from non-traditional sources, and other regions outside the OPEC growth is not due to OPEC", - said economist National Australia Bank Fin Siebel.

The dynamics also affect the application of the PRC Ministry of Finance Lou Jiwei that China is not going to change its monetary policy in response to a single macro-economic indicators. The comments came at a meeting of finance ministers and central bankers of the G20 in Australia over the weekend. Statements Lowe eased speculation that China will increase the incentive to achieve the target of 7.5% growth this year.

Market participants are also awaiting the release of a preliminary purchasing managers index for the industrial sector of China from HSBC Holdings Plc. According to forecasts, in September the index dropped to the level of 50 points, compared to 50.2 points in August.

"Concerns about China's increased - said Raiffeisen Bank analyst Hannes Locker. - China's demand for fuel in the second half of the year is expected to keep steady growth rate of 3.5-4%. But if this has been slow to 2%, this will put additional pressure on the oil market. "

The focus is also the situation in Libya. Oil corporation National Oil Corp said that Libya produces 700 thousand. BOPD after suspending production at the field Shararra, which accounts for 30% of Libyan production. Refinery in Az Zawiyah remains closed after last week caused the missile strikes.

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) fell to $ 90.87 a barrel on the New York Mercantile Exchange (NYMEX).

November futures price for North Sea petroleum mix of mark fell $ 1.55 to $ 96.80 a barrel on the London exchange ICE Futures Europe.

-

16:31

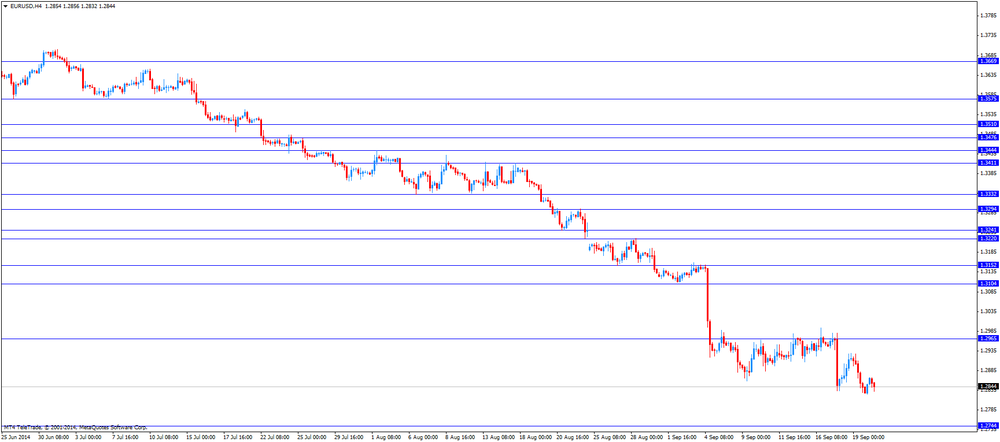

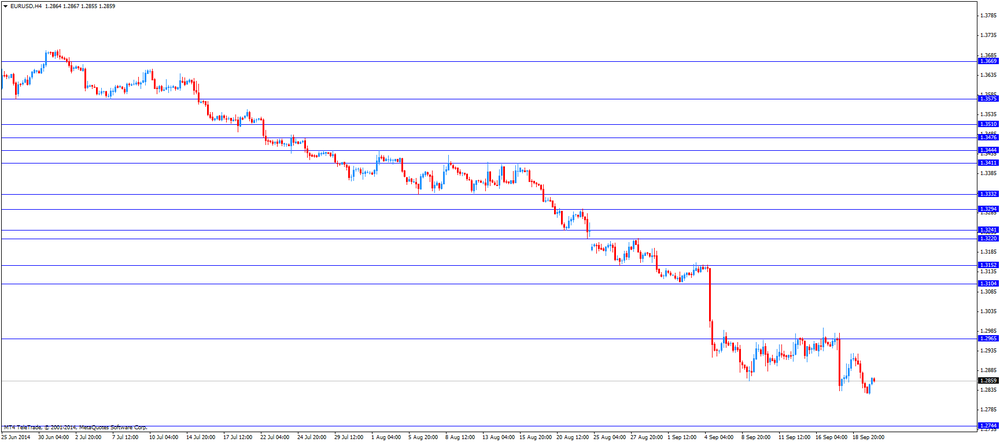

Foreign exchange market. American session: the euro declined against the U.S. dollar after comments by the European Central Bank President Mario Draghi

The U.S. dollar traded mixed to higher against the most major currencies despite the weaker-than-expected U.S. existing home sales. Existing home sales fell 1.8% to a seasonally adjusted 5.05 million units in August from 5.14 million units in July. July's figure was revised down from 5.15 million units. Analysts had expected existing home sales to increase to 5.21 million units.

The greenback remained supported by speculation the Fed will start to hike its interest rate sooner than expected.

The euro declined against the U.S. dollar after comments by the European Central Bank President (ECB) Mario Draghi. Draghi said at the EP's Economic and Monetary Affairs Committee today the economic recovery in the Eurozone is slowing and geopolitical tensions could hurt business and consumer confidence. He reiterated inflation will remain at low levels over the coming months, before increasing during 2015 and 2016 and the ECB is ready to implement additional unconventional instruments.

Germany's Bundesbank released its monthly report today. Bundesbank said the country's economy remains robust. Bundesbank added that the general economic trend will stay positive despite the slowing pace of expansion in the first half of 2014.

Consumer confidence in the Eurozone fell to -11.4 in September from -10 in August, missing expectations for a decline to -11.

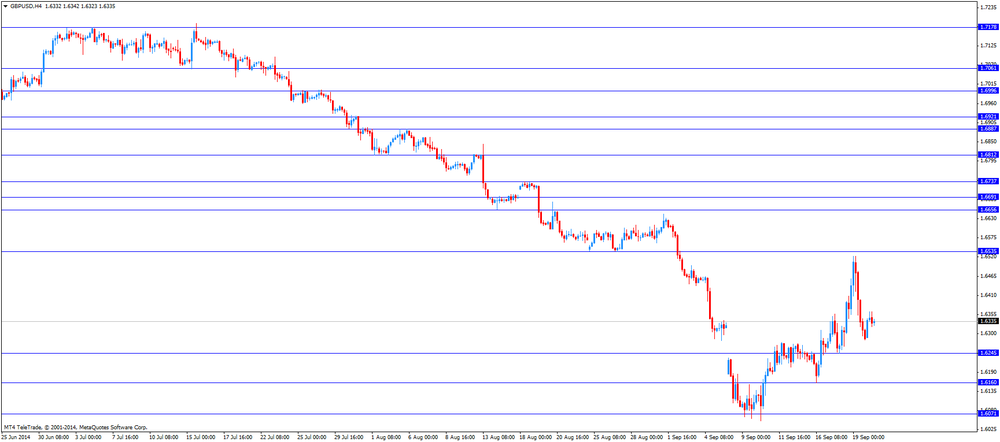

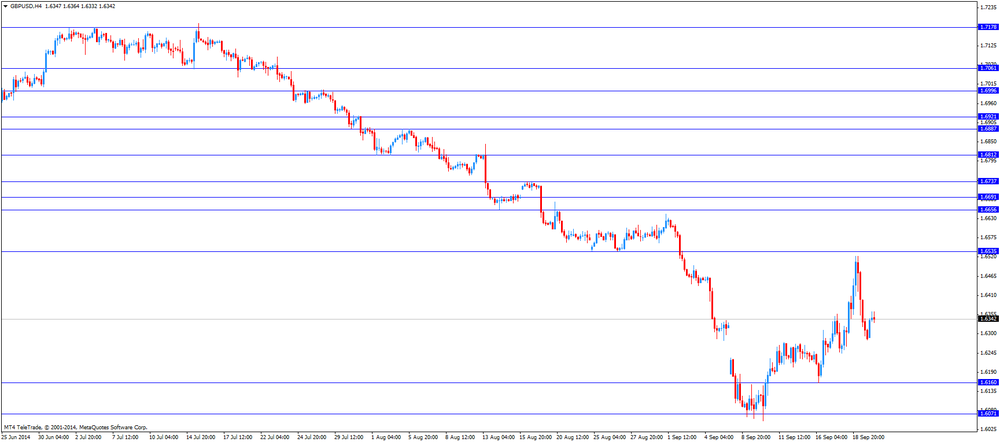

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The New Zealand dollar traded mixed against the U.S dollar. The kiwi was supported by the election's outcome. New Zealand's ruling National party won a parliamentary majority on Saturday.

The Westpac consumer confidence index for New Zealand declined to 116.7 in September from 121.2 in August.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major economic reports from Australia. In the overnight trading session, the Aussie hits 6-month low against the greenback.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

-

16:20

Gold: an overview of the market situation

Gold prices fell slightly today, reaching at the same time the lowest level since early January. Experts point out that speculation as to the timing of rate hikes Federal Reserve fueled sales of the precious metal.

Recall, the Federal Reserve during the two-day meeting to determine policy on Sept. 17 reduced its bond-buying program by $ 10 billion on the way to its full completion in the next month. The Fed also reiterated that rates are likely to remain unchanged for a "long time" after the completion of the program, although the predicted faster pace of rate hikes.

Meanwhile, today in his speech the head of the New York Fed, William Dudley said that there is no need to hurry with the increase in interest rates, taking into account the weak economic growth and inflation expectations at low levels. He suggested that now it is better to wait for the more obvious signals that the economy is recovering United States, before taking action. However, he noted that "low interest rates are not satisfied with the Fed," and that they should be raised as soon as possible.

"Investment flows are directed to the dollar, as well as in the stock market and the bond market is the United States, and is the outflow of the precious metals market, - says Peter Hug from Kitco Metal. - It seems that investors in precious metals have surrendered. "

In such circumstances, there is a sharp decline in investment demand for gold. Assets of the world's largest holder of gold investment institutions ETFs SPDR Gold Trust up on Friday fell by 7.78 tons and fell to the level of 776.44 tonnes - the lowest rate since December 26, 2008. Withdrawal is also observed from the majority of exchange traded funds (ETF). According to Bloomberg, the assets under management of these funds have declined over the past week, nearly 20 tons to 1696 tons.

"It is difficult to return to growth after the Fed news and given the strong economic performance of the United States. Support is very weak, and a high probability of falling prices to $ 1,200, "- said a trader in precious metals in Singapore.

The cost of the October gold futures on the COMEX today dropped to 1213.30 dollars per ounce.

-

15:55

Existing home sales in the U.S. dropped 1.8% in August

The National Association of Realtors (NAR) released U.S. existing home sales today. Existing home sales fell 1.8% to a seasonally adjusted 5.05 million units in August from 5.14 million units in July. July's figure was revised down from 5.15 million units.

Analysts had expected existing home sales to increase to 5.21 million units.

That was the first decline in five months.

NAR's chief economist Lawrence Yun said that the decline was largely driven by fewer investor purchases.

-

15:47

European Central Bank President Mario Draghi: the central bank is ready to implement additional unconventional instruments.

The European Central Bank (ECB) President Mario Draghi said at the EP's Economic and Monetary Affairs Committee today:

- The economic recovery in the Eurozone is slowing;

- Geopolitical tensions could hurt business and consumer confidence;

- Inflation will remain at low levels over the coming months, before increasing during 2015 and 2016;

- The central bank will soon start purchasing simple and transparent securities and covered bonds;

- "The Governing Council remains fully determined to counter risks to the medium-term outlook for inflation";

- ECB is ready to implement additional unconventional instruments.

- The economic recovery in the Eurozone is slowing;

-

15:00

Eurozone: Consumer Confidence, September -11.4 (forecast -11)

-

15:00

U.S.: Existing Home Sales , August 5.05 (forecast 5.21)

-

14:40

Option expiries for today's 1400GMT cut

EUR/USD: $1.2750(E588mn), $1.2800(E1.3bn), $1.2850(E1.47bn), $1.2875(E536mn), $1.2900-10(E400mn)

USD/JPY: Y107.50($270mn), Y108.05-25($285mn), Y108.75($180mn), Y109.00-10($350mn)

GBP/USD: $1.6400(stg1.16bn), $1.6405(stg299mn), $1.6450(stg281mn)

EUR/GBP: stg0.7750(E850mn), stg0.7800-05(E510mn), stg0.7850(E605mn), stg0.7900(E900mn), stg0.7950(E400mn)

USD/CHF: Chf0.9225($750mn), Chf0.9250($325mn), Chf0.9525($2.2bn)

AUD/USD: $0.8925(A$208mn), $0.9100(A$549mn), $0.9130(A$200mn)

USD/CAD: C$1.0900($1.1bn), C$1.0965($300mn), C$1.1000($1.2bn)

-

14:34

U.S. Stocks open: Dow 17,268.82 -10.92 -0.06%, Nasdaq 4,565.63 -14.16 -0.31%, S&P 2,006.73 -3.67 -0.18%

-

14:24

Before the bell: S&P futures -0.34%, Nasdaq futures -0.35%

U.S. stock-index futures fell as China's finance minister damped speculation his government will boost stimulus and as investors awaited data on home sales.

Global markets:

Nikkei 16,205.9 -115.27 -0.71%

Hang Seng 23,955.49 -350.67 -1.44%

Shanghai Composite 2,289.87 -39.59 -1.70%

FTSE 6,785.53 -52.39 -0.77%

CAC 4,452.32 -8.90 -0.20%

DAX 9,784.99 -14.27 -0.15%

Crude oil $92.50 (+0.10%)

Gold $1216.00 (-0.06%)

-

14:09

DOW components before the bell

(company / ticker / price / change, % / volume)

Intel Corp

INTC

34.85

+0.09%

3.3K

Boeing Co

BA

129.59

+0.19%

0.3K

Merck & Co Inc

MRK

60.69

+0.33%

3.9K

Cisco Systems Inc

CSCO

25.32

+0.48%

0.6K

Travelers Companies Inc

TRV

94.61

0.00%

0.1K

3M Co

MMM

146.68

-0.01%

0.3K

Visa

V

216.17

-0.04%

1.2K

Procter & Gamble Co

PG

84.40

-0.08%

0.2K

Home Depot Inc

HD

92.22

-0.13%

1.2K

General Electric Co

GE

26.25

-0.15%

31.4K

Nike

NKE

81.69

-0.15%

2.2K

Exxon Mobil Corp

XOM

96.96

-0.16%

0.2K

AT&T Inc

T

35.40

-0.20%

3.7K

Johnson & Johnson

JNJ

107.77

-0.20%

0.9K

McDonald's Corp

MCD

94.16

-0.21%

10.3K

Walt Disney Co

DIS

90.30

-0.21%

1.8K

E. I. du Pont de Nemours and Co

DD

71.07

-0.25%

1.7K

International Business Machines Co...

IBM

193.50

-0.26%

2.7K

Goldman Sachs

GS

185.69

-0.27%

0.6K

Chevron Corp

CVX

124.45

-0.28%

0.4K

Pfizer Inc

PFE

30.31

-0.30%

0.6K

Verizon Communications Inc

VZ

50.20

-0.30%

44.6K

The Coca-Cola Co

KO

41.89

-0.38%

2.3K

JPMorgan Chase and Co

JPM

60.85

-0.43%

2.8K

Microsoft Corp

MSFT

47.29

-0.48%

50.3K

Caterpillar Inc

CAT

101.90

-0.60%

0.6K

-

14:05

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Yahoo! (YHOO) downgraded to Neutral from Buy at BofA/Merrill

Yahoo! (YHOO) downgraded to to Mkt Perform from Outperform at Bernstein

Other:

Alcoa (AA) target lowered to $18 from $19 at RBC Capital Mkts

-

13:00

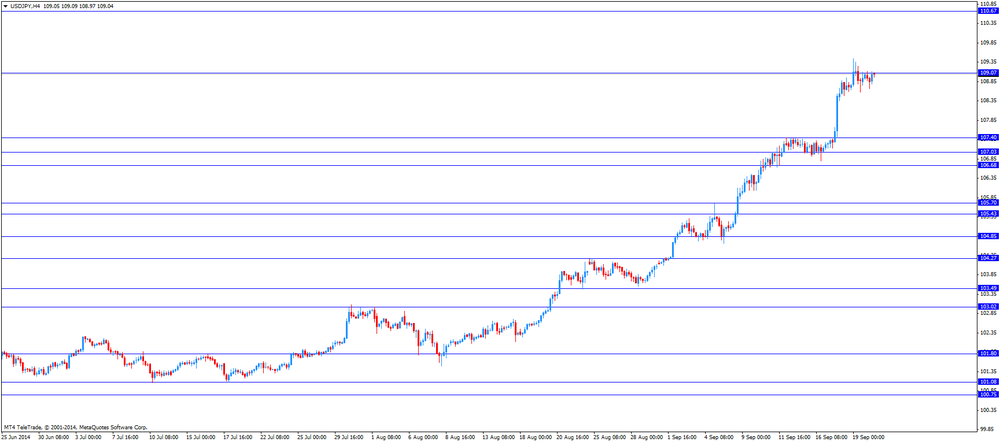

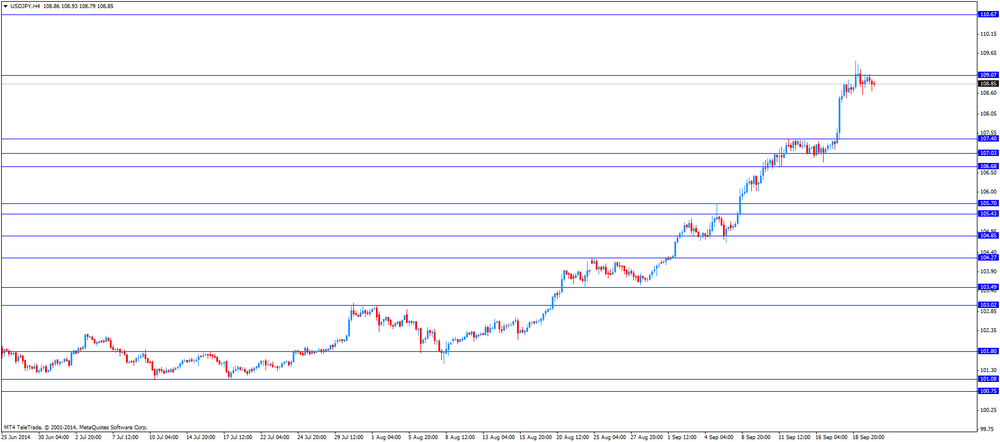

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

10:00 Germany Bundesbank Monthly Report

The U.S. dollar traded higher against the most major currencies. The greenback remained supported by speculation the Fed will start to hike its interest rate sooner than expected.

The existing home sales in the U.S. are expected to increase to 5.21 million units in August from 5.15 million units in July.

The euro traded lower against the U.S. dollar. Germany's Bundesbank released its monthly report today. Bundesbank said the country's economy remains robust. Bundesbank added that the general economic trend will stay positive despite the slowing pace of expansion in the first half of 2014.

European Central Bank President Mario Draghi will speak in the European Parliament later in the day.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair declined to $1.2832

GBP/USD: the currency pair fell to $1.6321

USD/JPY: the currency pair rose to Y109.12

The most important news that are expected (GMT0):

13:00 Eurozone ECB President Mario Draghi Speaks

14:00 Eurozone Consumer Confidence September -10 -11

14:00 U.S. Existing Home Sales August 5.15 5.21

14:05 U.S. FOMC Member Dudley Speak

17:00 Canada Gov Council Member Wilkins Speaks

23:30 U.S. FOMC Member Narayana Kocherlakota

-

12:52

Orders

EUR/USD

Offers $1.2950/56, $1.2930/35

Bids $1.2800

GBP/USD

Offers

Bids 1.6305/00, $1.6210/00, $1.6180

AUD/USD

Offers $0.9120, $0.9100, $0.9050-55, $0.8920-30

Bids $0.8825, $0.8800

EUR/JPY

Offers Y143.80/85, Y143.50, Y142.40/50

Bids Y140.00, Y139.20, Y139.00, Y138.45, Y138.15

USD/JPY

Offers Y110.00, Y109.50

Bids Y108.60/50

EUR/GBP

Offers stg0.7980, stg0.7900, stg0.7880

Bids stg0.7800

-

12:05

European stock markets mid session: stocks traded lower, concerns over a slowdown in Chinese economy weighed on markets

Stock indices traded lower. Concerns over a slowdown in Chinese economy weighed on markets. Market participants are awaiting the release of Chinese preliminary HSBC manufacturing purchasing managers' index on Tuesday. Analysts expect the HSBC manufacturing purchasing managers' index to decline to 50.0 in September from 50.2 in August. That could provide more evidence of a slowdown in Chinese economy.

Comments by China's Finance Minister Lou Jiwei damped speculation the government will boost economic stimulus measures.

Germany's Bundesbank released its monthly report today. Bundesbank said the country's economy remains robust. Bundesbank added that the general economic trend will stay positive despite the slowing pace of expansion in the first half of 2014.

European Central Bank President Mario Draghi will speak in the European Parliament later in the day.

Current figures:

Name Price Change Change %

FTSE 6,785.2 -52.72 -0.77%

DAX 9,791.72 -7.54 -0.08%

CAC 40 4,457.56 -3.66 -0.08%

-

10:40

Asian Stocks close: stocks closed lower ahead of the release of Chinese preliminary HSBC manufacturing purchasing managers’ index on Tuesday

Asian stock closed lower ahead of the release of Chinese preliminary HSBC manufacturing purchasing managers' index on Tuesday. Analysts expect the HSBC manufacturing purchasing managers' index to decline to 50.0 in September from 50.2 in August. That could provide more evidence of a slowdown in Chinese economy.

Comments by China's Finance Minister Lou Jiwei damped speculation the government will boost economic stimulus measures.

Indexes on the close:

Nikkei 225 16,205.9 -115.27 -0.71%

Hang Seng 23,955.49 -350.67 -1.44%

Shanghai Composite 2,289.87 -39.59 -1.70%

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD: $1.2750(E588mn), $1.2800(E1.3bn), $1.2850(E1.47bn), $1.2875(E536mn), $1.2900-10(E400mn)

USD/JPY: Y107.50($270mn), Y108.05-25($285mn), Y108.75($180mn), Y109.00-10($350mn)

GBP/USD: $1.6400(stg1.16bn), $1.6405(stg299mn), $1.6450(stg281mn)

EUR/GBP: stg0.7750(E850mn), stg0.7800-05(E510mn), stg0.7850(E605mn), stg0.7900(E900mn), stg0.7950(E400mn)

USD/CHF: Chf0.9225($750mn), Chf0.9250($325mn), Chf0.9525($2.2bn)

AUD/USD: $0.8925(A$208mn), $0.9100(A$549mn), $0.9130(A$200mn)

USD/CAD: C$1.0900($1.1bn), C$1.0965($300mn), C$1.1000($1.2bn)

-

09:48

Foreign exchange market. Asian session: the New Zealand dollar traded higher against the U.S dollar, supported by the election's outcome

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by speculation the Fed will start to hike its interest rate sooner than expected.

The New Zealand dollar traded higher against the U.S dollar. The kiwi was supported by the election's outcome. New Zealand's ruling National party won a parliamentary majority on Saturday.

The Westpac consumer confidence index for New Zealand declined to 116.7 in September from 121.2 in August.

The Australian dollar hits 6-month low against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded slightly higher against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair rose to $1.2867

GBP/USD: the currency pair increased to $1.6363

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

10:00 Germany Bundesbank Monthly Report

13:00 Eurozone ECB President Mario Draghi Speaks

14:00 Eurozone Consumer Confidence September -10 -11

14:00 U.S. Existing Home Sales August 5.15 5.21

14:05 U.S. FOMC Member Dudley Speak

17:00 Canada Gov Council Member Wilkins Speaks

23:30 U.S. FOMC Member Narayana Kocherlakota

-

06:17

Options levels on monday, September 22, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2981 (2328)

$1.2947 (1552)

$1.2897 (260)

Price at time of writing this review: $ 1.2860

Support levels (open interest**, contracts):

$1.2797 (3430)

$1.2747 (4918)

$1.2714 (2750)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 52702 contracts, with the maximum number of contracts with strike price $1,3000 (4942);

- Overall open interest on the PUT options with the expiration date October, 3 is 57825 contracts, with the maximum number of contracts with strike price $1,3000 (5666);

- The ratio of PUT/CALL was 1.10 versus 1.07 from the previous trading day according to data from September, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.6601 (1442)

$1.6502 (2757)

$1.6404 (341)

Price at time of writing this review: $1.6352

Support levels (open interest**, contracts):

$1.6195 (1985)

$1.6098 (3456)

$1.5999 (2428)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 31813 contracts, with the maximum number of contracts with strike price $1,6700 (3800);

- Overall open interest on the PUT options with the expiration date October, 3 is 41425 contracts, with the maximum number of contracts with strike price $1,6300 (4674);

- The ratio of PUT/CALL was 1.30 versus 1.27 from the previous trading day according to data from September, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:01

Nikkei 225 16,246.41 -74.76 -0.46%, Hang Seng 24,072.18 -233.98 -0.96%, S&P/ASX 200 5,403.2 -29.86 -0.55%, Shanghai Composite 2,323.55 -5.90 -0.25%

-