Notícias do Mercado

-

23:26

Currencies. Daily history for Sep 22'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2846 +0,14%

GBP/USD $1,6360 +0,45%

USD/CHF Chf0,9599 +2,00%

USD/JPY Y108,82 -0,18%

EUR/JPY Y139,77 -0,07%

GBP/JPY Y178,02 +0,26%

AUD/USD $0,8868 -0,62%

NZD/USD $0,8111 -0,15%

USD/CAD C$1,1038 +0,69%

-

23:00

Schedule for today,Tuesday, Sep 23’2014:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

01:45 China HSBC Manufacturing PMI (Preliminary) September 50.2 50.0

06:58 France Manufacturing PMI (Preliminary) September 46.9 47.1

06:58 France Services PMI (Preliminary) September 50.3 50.2

07:28 Germany Manufacturing PMI (Preliminary) September 51.4 51.3

07:28 Germany Services PMI (Preliminary) September 54.9 54.6

07:58 Eurozone Manufacturing PMI (Preliminary) September 50.7 50.6

07:58 Eurozone Services PMI (Preliminary) September 53.1 53.2

08:30 United Kingdom BBA Mortgage Approvals August 42.8 42.9

08:30 United Kingdom PSNB, bln August -1.1 10.3

12:30 Canada Retail Sales, m/m July +1.1% +0.4%

12:30 Canada Retail Sales ex Autos, m/m July +1.5% -0.1%

13:00 U.S. Housing Price Index, m/m July +0.4% +0.4%

13:00 U.S. Housing Price Index, y/y July +5.1%

13:20 U.S. FOMC Member Jerome Powell Speaks

13:45 U.S. Manufacturing PMI (Preliminary) September 57.9 58.1

14:00 U.S. Richmond Fed Manufacturing Index September 12 10

18:00 U.S. FOMC Member Narayana Kocherlakota

20:30 U.S. API Crude Oil Inventories September +3.3

22:45 New Zealand Trade Balance, mln August -692 -1125

-

16:31

Foreign exchange market. American session: the euro declined against the U.S. dollar after comments by the European Central Bank President Mario Draghi

The U.S. dollar traded mixed to higher against the most major currencies despite the weaker-than-expected U.S. existing home sales. Existing home sales fell 1.8% to a seasonally adjusted 5.05 million units in August from 5.14 million units in July. July's figure was revised down from 5.15 million units. Analysts had expected existing home sales to increase to 5.21 million units.

The greenback remained supported by speculation the Fed will start to hike its interest rate sooner than expected.

The euro declined against the U.S. dollar after comments by the European Central Bank President (ECB) Mario Draghi. Draghi said at the EP's Economic and Monetary Affairs Committee today the economic recovery in the Eurozone is slowing and geopolitical tensions could hurt business and consumer confidence. He reiterated inflation will remain at low levels over the coming months, before increasing during 2015 and 2016 and the ECB is ready to implement additional unconventional instruments.

Germany's Bundesbank released its monthly report today. Bundesbank said the country's economy remains robust. Bundesbank added that the general economic trend will stay positive despite the slowing pace of expansion in the first half of 2014.

Consumer confidence in the Eurozone fell to -11.4 in September from -10 in August, missing expectations for a decline to -11.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The New Zealand dollar traded mixed against the U.S dollar. The kiwi was supported by the election's outcome. New Zealand's ruling National party won a parliamentary majority on Saturday.

The Westpac consumer confidence index for New Zealand declined to 116.7 in September from 121.2 in August.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major economic reports from Australia. In the overnight trading session, the Aussie hits 6-month low against the greenback.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

-

15:55

Existing home sales in the U.S. dropped 1.8% in August

The National Association of Realtors (NAR) released U.S. existing home sales today. Existing home sales fell 1.8% to a seasonally adjusted 5.05 million units in August from 5.14 million units in July. July's figure was revised down from 5.15 million units.

Analysts had expected existing home sales to increase to 5.21 million units.

That was the first decline in five months.

NAR's chief economist Lawrence Yun said that the decline was largely driven by fewer investor purchases.

-

15:47

European Central Bank President Mario Draghi: the central bank is ready to implement additional unconventional instruments.

The European Central Bank (ECB) President Mario Draghi said at the EP's Economic and Monetary Affairs Committee today:

- The economic recovery in the Eurozone is slowing;

- Geopolitical tensions could hurt business and consumer confidence;

- Inflation will remain at low levels over the coming months, before increasing during 2015 and 2016;

- The central bank will soon start purchasing simple and transparent securities and covered bonds;

- "The Governing Council remains fully determined to counter risks to the medium-term outlook for inflation";

- ECB is ready to implement additional unconventional instruments.

- The economic recovery in the Eurozone is slowing;

-

15:00

Eurozone: Consumer Confidence, September -11.4 (forecast -11)

-

15:00

U.S.: Existing Home Sales , August 5.05 (forecast 5.21)

-

14:40

Option expiries for today's 1400GMT cut

EUR/USD: $1.2750(E588mn), $1.2800(E1.3bn), $1.2850(E1.47bn), $1.2875(E536mn), $1.2900-10(E400mn)

USD/JPY: Y107.50($270mn), Y108.05-25($285mn), Y108.75($180mn), Y109.00-10($350mn)

GBP/USD: $1.6400(stg1.16bn), $1.6405(stg299mn), $1.6450(stg281mn)

EUR/GBP: stg0.7750(E850mn), stg0.7800-05(E510mn), stg0.7850(E605mn), stg0.7900(E900mn), stg0.7950(E400mn)

USD/CHF: Chf0.9225($750mn), Chf0.9250($325mn), Chf0.9525($2.2bn)

AUD/USD: $0.8925(A$208mn), $0.9100(A$549mn), $0.9130(A$200mn)

USD/CAD: C$1.0900($1.1bn), C$1.0965($300mn), C$1.1000($1.2bn)

-

13:00

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

10:00 Germany Bundesbank Monthly Report

The U.S. dollar traded higher against the most major currencies. The greenback remained supported by speculation the Fed will start to hike its interest rate sooner than expected.

The existing home sales in the U.S. are expected to increase to 5.21 million units in August from 5.15 million units in July.

The euro traded lower against the U.S. dollar. Germany's Bundesbank released its monthly report today. Bundesbank said the country's economy remains robust. Bundesbank added that the general economic trend will stay positive despite the slowing pace of expansion in the first half of 2014.

European Central Bank President Mario Draghi will speak in the European Parliament later in the day.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

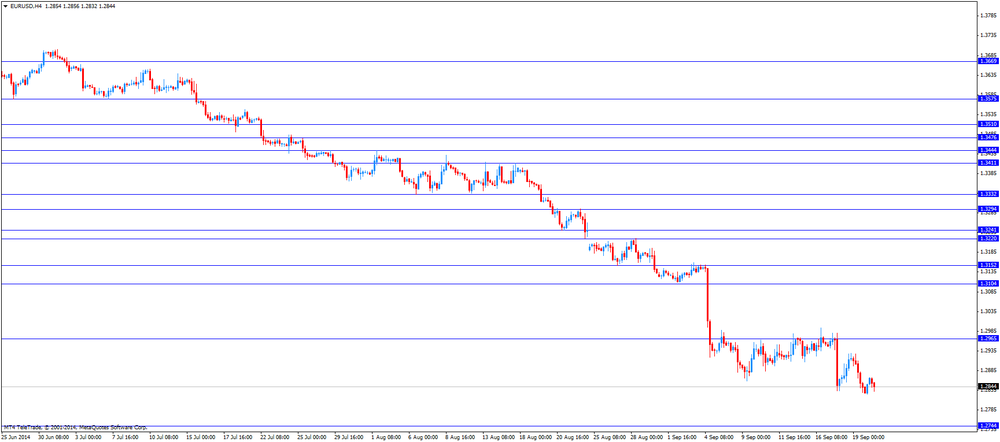

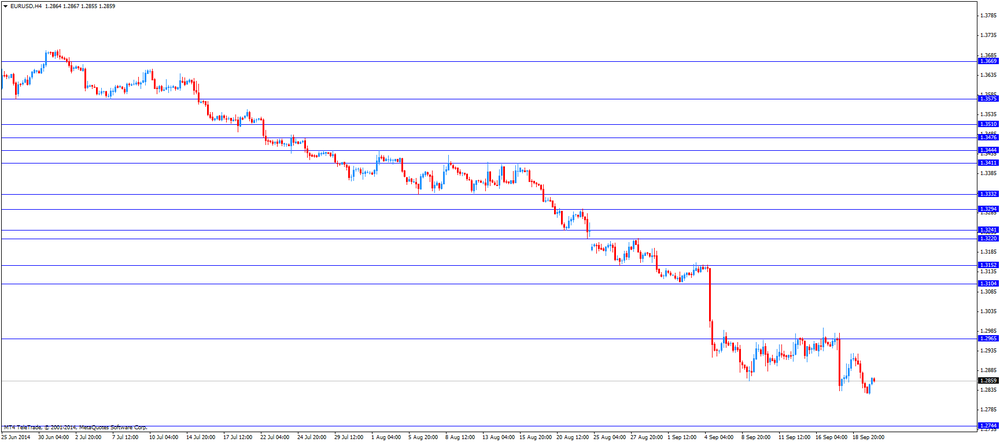

EUR/USD: the currency pair declined to $1.2832

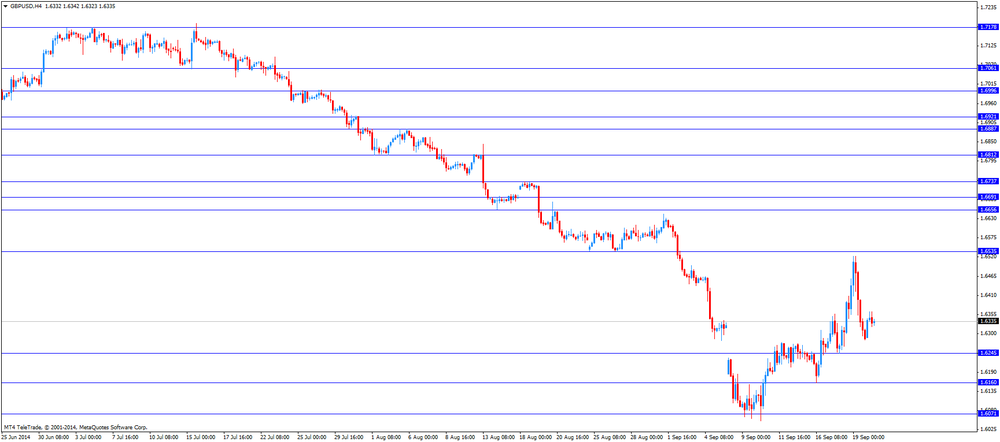

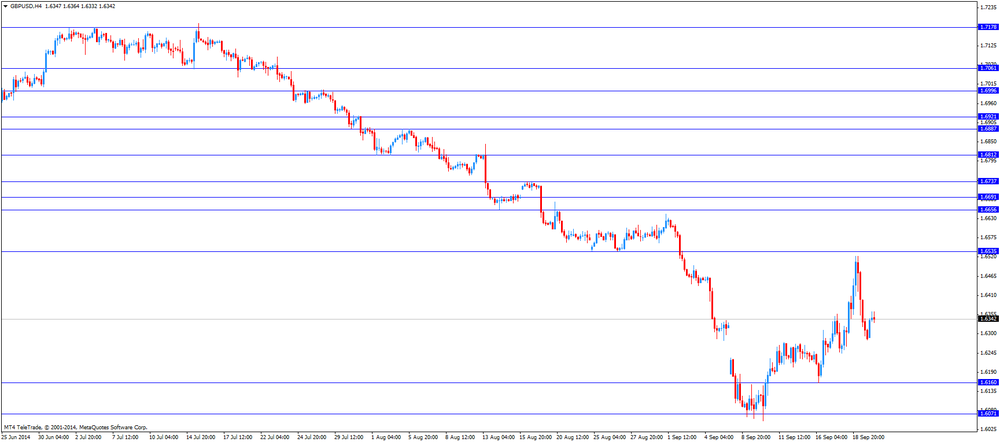

GBP/USD: the currency pair fell to $1.6321

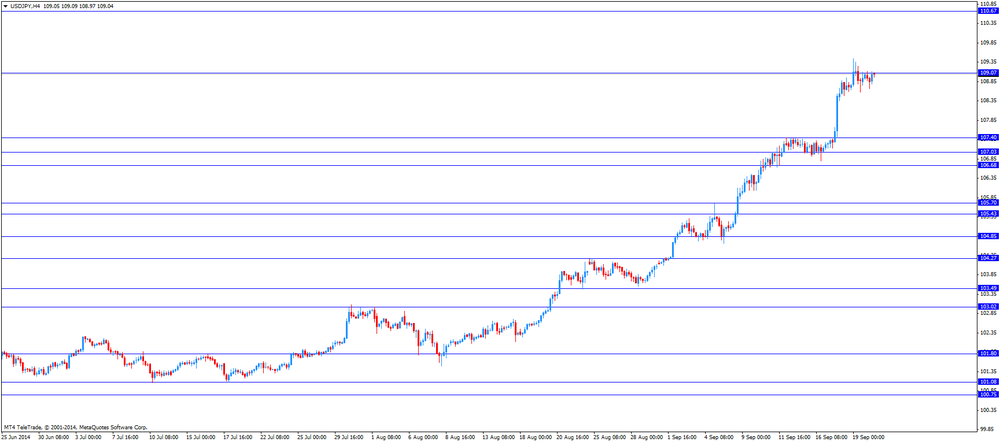

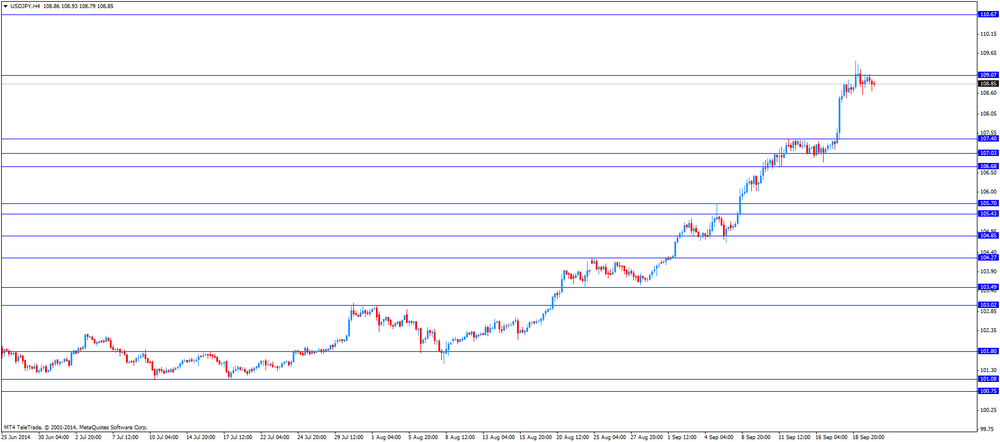

USD/JPY: the currency pair rose to Y109.12

The most important news that are expected (GMT0):

13:00 Eurozone ECB President Mario Draghi Speaks

14:00 Eurozone Consumer Confidence September -10 -11

14:00 U.S. Existing Home Sales August 5.15 5.21

14:05 U.S. FOMC Member Dudley Speak

17:00 Canada Gov Council Member Wilkins Speaks

23:30 U.S. FOMC Member Narayana Kocherlakota

-

12:52

Orders

EUR/USD

Offers $1.2950/56, $1.2930/35

Bids $1.2800

GBP/USD

Offers

Bids 1.6305/00, $1.6210/00, $1.6180

AUD/USD

Offers $0.9120, $0.9100, $0.9050-55, $0.8920-30

Bids $0.8825, $0.8800

EUR/JPY

Offers Y143.80/85, Y143.50, Y142.40/50

Bids Y140.00, Y139.20, Y139.00, Y138.45, Y138.15

USD/JPY

Offers Y110.00, Y109.50

Bids Y108.60/50

EUR/GBP

Offers stg0.7980, stg0.7900, stg0.7880

Bids stg0.7800

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD: $1.2750(E588mn), $1.2800(E1.3bn), $1.2850(E1.47bn), $1.2875(E536mn), $1.2900-10(E400mn)

USD/JPY: Y107.50($270mn), Y108.05-25($285mn), Y108.75($180mn), Y109.00-10($350mn)

GBP/USD: $1.6400(stg1.16bn), $1.6405(stg299mn), $1.6450(stg281mn)

EUR/GBP: stg0.7750(E850mn), stg0.7800-05(E510mn), stg0.7850(E605mn), stg0.7900(E900mn), stg0.7950(E400mn)

USD/CHF: Chf0.9225($750mn), Chf0.9250($325mn), Chf0.9525($2.2bn)

AUD/USD: $0.8925(A$208mn), $0.9100(A$549mn), $0.9130(A$200mn)

USD/CAD: C$1.0900($1.1bn), C$1.0965($300mn), C$1.1000($1.2bn)

-

09:48

Foreign exchange market. Asian session: the New Zealand dollar traded higher against the U.S dollar, supported by the election's outcome

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by speculation the Fed will start to hike its interest rate sooner than expected.

The New Zealand dollar traded higher against the U.S dollar. The kiwi was supported by the election's outcome. New Zealand's ruling National party won a parliamentary majority on Saturday.

The Westpac consumer confidence index for New Zealand declined to 116.7 in September from 121.2 in August.

The Australian dollar hits 6-month low against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded slightly higher against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair rose to $1.2867

GBP/USD: the currency pair increased to $1.6363

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

10:00 Germany Bundesbank Monthly Report

13:00 Eurozone ECB President Mario Draghi Speaks

14:00 Eurozone Consumer Confidence September -10 -11

14:00 U.S. Existing Home Sales August 5.15 5.21

14:05 U.S. FOMC Member Dudley Speak

17:00 Canada Gov Council Member Wilkins Speaks

23:30 U.S. FOMC Member Narayana Kocherlakota

-

06:17

Options levels on monday, September 22, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2981 (2328)

$1.2947 (1552)

$1.2897 (260)

Price at time of writing this review: $ 1.2860

Support levels (open interest**, contracts):

$1.2797 (3430)

$1.2747 (4918)

$1.2714 (2750)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 52702 contracts, with the maximum number of contracts with strike price $1,3000 (4942);

- Overall open interest on the PUT options with the expiration date October, 3 is 57825 contracts, with the maximum number of contracts with strike price $1,3000 (5666);

- The ratio of PUT/CALL was 1.10 versus 1.07 from the previous trading day according to data from September, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.6601 (1442)

$1.6502 (2757)

$1.6404 (341)

Price at time of writing this review: $1.6352

Support levels (open interest**, contracts):

$1.6195 (1985)

$1.6098 (3456)

$1.5999 (2428)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 31813 contracts, with the maximum number of contracts with strike price $1,6700 (3800);

- Overall open interest on the PUT options with the expiration date October, 3 is 41425 contracts, with the maximum number of contracts with strike price $1,6300 (4674);

- The ratio of PUT/CALL was 1.30 versus 1.27 from the previous trading day according to data from September, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-