Notícias do Mercado

-

20:01

Dow 16,187.73 -185.61 -1.13%, Nasdaq 4,208.55 -34.45 -0.81%, S&P 500 1,825.71 -19.15 -1.04%

-

19:20

American focus : dollar fell against major currencies

The U.S. dollar weakened across the board after the published statistics. Manufacturing activity in the U.S. this month weakened. This is evidenced by the preliminary report of Markit, presented on Thursday . Nevertheless , one of the factors weakening activity can be extremely cold weather . Preliminary Purchasing Managers Index (PMI) for the manufacturing the United States in January fell to 53.7 from December's final value of 55.0 . In Markit reported that the January preliminary value that is based on approximately 85 % of the normal monthly number of responses , " signaled the slowest in three months improving the business environment ."

Another report showed that the index of economic activity for the region of Chicago gave considerably smaller increase in December , as the sub- indices related to employment and production figures have decreased compared to the previous month . According to the report , the economic activity index of the Chicago Fed declined to 0.16 in December from 0.69 in November. More important indicator , namely the three-month moving average fell to 0.33 from 0.36 . Recall that the index is a weighted average of 85 economic indicators of national economic activity. A value of zero indicates economic expansion near the current trend indicators and a positive value indicates about the above-average growth .

With regard to labor market data , the number of applications for unemployment benefits rose slightly last week , although the overall level indicates a marked improvement in the labor market . According to the report , the seasonally adjusted number of initial claims for unemployment benefits rose for the week ending January 18 , 1000 , reaching a level with 326 thousand Many experts expect that the number of applications will increase to 331 thousand to 326 thousand , of which initially reported last week. In addition, it was reported that the average number of applications for benefits over the past four weeks decreased by 3750 - to the level of 331,500 .

Euro rate previously increased significantly against the U.S. dollar in anticipation of data on business activity , and on the background of the publication itself . It is learned that the business activity in the euro area private sector has grown considerably in the month of January , when showing the highest growth in the last 31 months . This was stated in the study results , which were issued by Markit Economics. The data showed that the composite PMI , which assesses the effectiveness of the manufacturing sector and the services sector rose to 53.2 in January from 52.1 in December , reaching its highest level since June 2011 . Economists had expected a rise to 52.5 . We also add that the activity index for the services sector rose to a four-month high in January , namely to 51.9 points from 51 in December. Economists had forecast an increase to 51.5 . Meanwhile, the purchasing managers' index for the manufacturing rose to a 32-month high in January , reaching 53.9 points , compared with 52.7 in December. According to forecasts, this figure should make 53.2 . We add that the production index rose to 56.7 from 54.9 in December. It was the highest value in 33 months.

Pleased also another report which showed that the current account surplus of the eurozone rose unexpectedly in November , registering with the second monthly increase in a row, which primarily was due to a significant increase in exports. According to the report , the current account surplus rose to a seasonally adjusted level of 23.5 billion euros in November , compared with 22.2 billion euros in October. The surplus in trade in goods rose to 18.6 billion euros from 16.6 billion euros. Meanwhile , we add that the surplus on services decreased to 9.5 billion euros from 10.1 billion euros. In addition, data showed that revenue rose to 5 billion euros from 4.9 billion euros, while the current account deficit increased transfers to 9.5 billion euros from 9.4 billion euros in October.

Pound continued its yesterday's gains against the U.S. dollar , while setting a new yearly high . Increased risk appetite supporting sterling today. Positive so far for a pound a week contributes to the continuation of its strengthening levels above $ 1.6600 , where the couple was not since August 2011 . A recent report to the Bank of England combined with data on employment contributed to the development of the current bullish bias. In light of the recent fall in unemployment in the UK to 7.1% , economists note that the unemployment rate has all the chances to reach the target mark of 7.0% Bank of England next month. Nearest labor market report is scheduled for February 19. Meanwhile , its decision on monetary policy the Bank of England will announce on February 6 and inflation report released on February 12 . "

The Swiss franc has risen sharply against the U.S. dollar against the backdrop of the Swiss National Bank raised its capital buffer requirements for banks , they should have to mortgage lending. Note that the SNB is supported by the Government now requires mortgage lenders have to have a 2% higher weighted assets in relation to mortgage risk to maintain their lending , against 1% , introduced in February 2013 . New rules on capital reserves associated with a mortgage, come into force on June 30 this year .

"Strengthening of the franc against the background of this decision may lead to repatriation franc as Swiss banks try to replenish their capital ," - said Valentin Marinov, currency strategist at Citigroup. Despite this, the bank holds a negative outlook on the franc against the euro and the dollar. Other analysts agree that the current dynamics of the currency will be short .

-

18:24

European stocks close

European stocks dropped from a six-year high as a report showed manufacturing in China probably contracted this month, and media and technology companies slid.

The Stoxx Europe 600 Index fell 1 percent to 332.69 at the close of trading, its biggest decline in more than seven weeks.

Preliminary data from HSBC Holdings Plc and Markit Economics showed Chinese manufacturing probably contracted in January, for the first time in six months. The initial reading of 49.6 fell below all 19 economist estimates in a Bloomberg News survey. A number smaller than 50 means activity contracted.

A separate Markit report showed manufacturing in the euro zone expanded this month at the fastest pace since May 2011, while output from services industries expanded for a sixth consecutive month. Both readings exceeded economists’ projections compiled by Bloomberg. A separate release from the European Commission showed that a measure of consumer confidence in the currency bloc rose to its highest level since July 2011.

National benchmark indexes fell in every western-European market except for Greece and Iceland. The U.K.’s FTSE 100 declined 0.8 percent, while France’s CAC 40 dropped 1 percent. Germany’s DAX lost 0.9 percent.

Pearson slumped 8.2 percent to 1,191 pence. The education company said it probably spent about 170 million pounds ($282 million) in 2013 to help focus its business on more profitable units. It had forecast expenditure of 150 million pounds. Pearson lowered its estimated savings to 40 million pounds from its previous prediction of 50 million pounds.

Inditex SA and Asos Plc fell 1.9 percent to 116.65 euros and 7.8 percent to 6,296 pence, respectively, as Goldman Sachs Group Inc. lowered its rating on the stocks to neutral from buy based on their valuations. Inditex, which owns the Zara clothing chain, traded at 29.7 times estimated earnings yesterday, more than the 16.2 multiple for a gauge of retailers on the Stoxx 600. Asos rallied 11 percent from the beginning of the year through yesterday to 107 times profit.

Logitech jumped 18 percent to 14.40 Swiss francs after the maker of computer mice said sales rose to $628 million in the three months ending Dec. 31, exceeding the average analyst estimate for a drop to $594.7 million. Net income climbed to $48.5 million, more than the $31 million projected by analysts. Logitech also increased its operating-income forecast to as much as $125 million for its full financial year, compared with $100 million previously.

Delhaize Group SA rose 7.2 percent to 48.98 euros, its largest rally in more than five months. The owner of the Food Lion supermarkets said fourth-quarter sales in the U.S. and in Belgium, its two main markets, increased 2.8 percent and 2.4 percent, respectively.

-

16:44

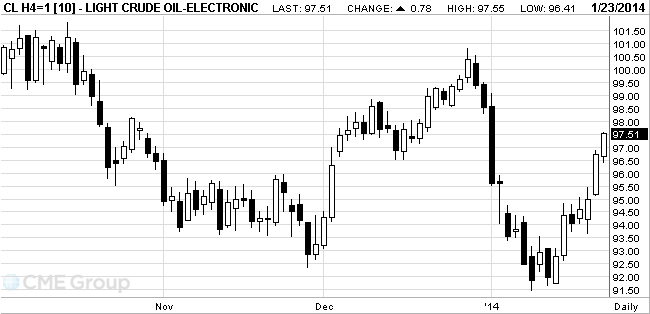

Oil rose

The cost of oil brand West Texas Intermediate rose to three-week high after a government report showed that U.S. inventories of distillates fell as demand rose.

Commercial crude oil inventories in the United States (excluding strategic reserves ) for the week ending January 17 , increased by 1 million barrels , or 0.3 % - to 351.2 million barrels , according to a weekly review of the country's Ministry of Energy .

Analysts believed that oil reserves will grow by only 588,000 barrels. Oil reserves increased for the first time since November.

While total gasoline inventories increased by 2.1 million barrels , or 0.9 %, to 235.3 million barrels . Distillate inventories decreased by 3.2 million barrels , or 2.6 % - to 120.7 million barrels .

The cost of oil is growing against the depreciation of the dollar after the publication of a series of statistical data from the United States .

The dollar index ( dollar to a basket of six currencies of countries - major trade partners of the U.S. ) fell by 0.74 % to 80.59 points.

Investors pay attention to data on the U.S. housing market . Number of home sales in the secondary market in December increased by 1 % compared to November - to 4.87 million. Data were worse than analysts' forecasts , which expect that the number of transactions amounts to 4.99 million.

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 97.79 per barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture fell 42 cents , or 0.4 percent, to $ 107.85 a barrel on the London exchange ICE Futures Europe.

-

16:26

Gold rose sharply

Gold prices rebounded from two-week low after reporting a slowdown in manufacturing activity in China and on the eve of the Fed meeting , at which the central bank may continue to reduce incentives.

Manufacturing activity in China slowed in January for the first time in six months , the index showed PMI, fell to 49.6 points from 50.5 points in December .

Stocks of the world's largest exchange-traded fund backed by gold (ETF) SPDR Gold Trust on Wednesday declined by 1.2 tons to 795.85 tons. Surcharge 99.99 fine gold on the Shanghai Gold Exchange holds near $ 12 per ounce.

Growth of gold comes amid weakening U.S. dollar. Recent data from the U.S. Labor Department showed that the number of applications for unemployment benefits rose slightly last week , although the overall level indicates a marked improvement in the labor market .

According to the report , the seasonally adjusted number of initial claims for unemployment benefits rose for the week ending January 18 , 1000 , reaching a level with 326 thousand Many experts expect that the number of applications will increase to 331 thousand to 326 thousand , of which initially reported last week. In addition, it was reported that the average number of applications for benefits over the past four weeks decreased by 3750 - to the level of 331,500 .

Cost February gold futures on the COMEX today rose to $ 1267.00 per ounce.

-

16:00

U.S.: Crude Oil Inventories, January +1.0

-

15:00

U.S.: Existing Home Sales , December 4.87 (forecast 4.99)

-

15:00

U.S.: Leading Indicators , December +0.1% (forecast +0.1%)

-

14:34

U.S. Stocks open: Dow 16,328.07 -45.27 -0.28%, Nasdaq 4,243.00 0.00 0.00%, S&P 1,839.72 -5.14 -0.28%

-

14:25

Before the bell: S&P futures -0.56%, Nasdaq futures -0.42%

U.S. stock futures fell, after a gauge of China’s manufacturing contracted and investors analyzed corporate earnings.

Global markets:

Nikkei 15,695.89 -125.07 -0.79%

Hang Seng 22,733.9 -348.35 -1.51%

Shanghai Composite 2,042.18 -9.57 -0.47%

FTSE 6,801.51 -24.82 -0.36%

CAC 4,307.92 -17.06 -0.39%

DAX 9,657.13 -62.98 -0.65%

Crude oil $96.97 (+0.25%)

Gold $1252.90 (+1.15%).

-

14:00

U.S.: Manufacturing PMI, January 53.7 (forecast 55.2)

-

14:00

U.S.: Housing Price Index, m/m, November +0.1% (forecast +0.4%)

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y103.90, Y104.00, Y104.30, Y104.40, Y105.00, Y105.25, Y105.40

EUR/USD $1.3410, $1.3450, $1.3475, $1.3500, $1.3545, $1.3565, $1.3575

GBP/USD $1.6500, $1.6630

EUR/GBP stg0.8150, Stg0.8200

AUD/USD $0.8900, $0.8950

-

13:31

U.S.: Chicago Federal National Activity Index, December 0.16

-

13:30

Canada: Retail Sales, m/m, November +0.6% (forecast +0.3%)

-

13:30

Canada: Retail Sales ex Autos, m/m, November +0.4% (forecast +0.3%)

-

13:30

U.S.: Initial Jobless Claims, January 326 (forecast 331)

-

13:16

European session: the euro rose substantially against the U.S. dollar

Data

00:00 Australia Consumer Inflation Expectations January +2.1% +2.3%

01:45 China Manufacturing PMI HSBC ( preliminary data ) January 51.0 50.6 49.6

02:00 China Index of leading indicators in December +1.4% +0.4%

05:00 Japan Monthly Economic Report Bank of Japan in January

07:58 France PMI in the manufacturing sector (preliminary data ) January 47.0 47.6 48.8

07:58 France PMI services sector (preliminary data ) January 47.8 48.2 48.6

08:28 Germany PMI manufacturing sector (preliminary data ) January 54.3 54.7 56.3

08:28 Germany PMI services sector (Restated ) January 53.5 54.1 53.6

08:58 Eurozone business activity in the manufacturing sector (preliminary data ) January 52.7 53.2 53.9

08:58 Eurozone business activity in the services sector (preliminary data ) January 51.0 51.5 51.9

09:00 EU balance of payments , seasonally adjusted , in November billion 21.8 19.2 23.5

09:00 Great Speech member of the Monetary Committee and the Committee on the financial policy of the Bank of England P. Fisher

09:00 Switzerland World Economic Forum Annual

11:00 UK Retail sales according to CBI January 34 28 14

The euro exchange rate rose substantially against the U.S. dollar in anticipation of data on business activity , and the background of the publication itself . It is learned that the business activity in the euro area private sector has grown considerably in the month of January , when showing the highest growth in the last 31 months . This was stated in the study results , which were issued by Markit Economics. The data showed that the composite PMI , which assesses the effectiveness of the manufacturing sector and the services sector rose to 53.2 in January from 52.1 in December , reaching its highest level since June 2011 . Economists had expected a rise to 52.5 . We also add that the activity index for the services sector rose to a four-month high in January , namely to 51.9 points from 51 in December. Economists had forecast an increase to 51.5 . Meanwhile, the purchasing managers' index for the manufacturing rose to a 32-month high in January , reaching 53.9 points , compared with 52.7 in December. According to forecasts, this figure should make 53.2 . We add that the production index rose to 56.7 from 54.9 in December. It was the highest value in 33 months.

Pleased also another report which showed that the current account surplus of the eurozone rose unexpectedly in November , registering with the second monthly increase in a row, which primarily was due to a significant increase in exports. According to the report , the current account surplus rose to a seasonally adjusted level of 23.5 billion euros in November , compared with 22.2 billion euros in October. The surplus in trade in goods rose to 18.6 billion euros from 16.6 billion euros. Meanwhile , we add that the surplus on services decreased to 9.5 billion euros from 10.1 billion euros. In addition, data showed that revenue rose to 5 billion euros from 4.9 billion euros, while the current account deficit increased transfers to 9.5 billion euros from 9.4 billion euros in October.

Pound continued its yesterday's gains against the U.S. dollar , while setting a new yearly high . Increased risk appetite supporting sterling today. Positive so far for a pound a week contributes to the continuation of its strengthening levels above $ 1.6600 , where the couple was not since August 2011 . A recent report to the Bank of England combined with data on employment contributed to the development of the current bullish bias. In light of the recent fall in unemployment in the UK to 7.1% , economists note that the rates b / p has all the chances to reach the target mark of 7.0% Bank of England next month. Nearest labor market report is scheduled for February 19. Meanwhile , its decision on monetary policy the Bank of England will announce on February 6 and inflation report released on February 12 . "

The Swiss franc has risen sharply against the U.S. dollar against the backdrop of the Swiss National Bank raised its capital buffer requirements for banks , they should have to mortgage lending. Note that the SNB is supported by the Government now requires mortgage lenders have to have a 2% higher weighted assets in relation to mortgage risk to maintain their lending , against 1% , introduced in February 2013 . New rules on capital reserves associated with a mortgage, come into force on June 30 this year .

"Strengthening of the franc against the background of this decision may lead to repatriation franc as Swiss banks try to replenish their capital ," - said Valentin Marinov, currency strategist at Citigroup. Despite this, the bank holds a negative outlook on the franc against the euro and the dollar. Other analysts agree that the current dynamics of the currency will be short .

EUR / USD: during the European session, the pair rose to $ 1.3646

GBP / USD: during the European session, the pair rose to $ 1.6615 , and then retreated slightly

USD / JPY: during the European session, the pair fell to Y104.00

At 13:30 GMT , Canada will announce the change in the volume of retail sales for November. At 14:00 GMT the U.S. will release the index of business activity in the manufacturing sector in January , and will report at 15:00 GMT by sales volume in the secondary housing market in December.

-

11:46

Major stock indexes in Europe are mixed

European stocks are mixed , and the Stoxx Europe 600 Index continues to trade near a six-year maximum. U.S. index futures and Asian shares fell .

Initially influenced the course of trading report on China . As it became known , a key performance indicator of China's manufacturing sector fell sharply in January , down to the level at the same time , which indicates a contraction of economic activity, which in the first place , was associated with a decrease in the volume of new orders . This was said today in the preliminary results of the study , which were released Markit Economics and HSBC Bank.

According to the report, the purchasing managers' index for the manufacturing sector fell to a six-month low in January, and it is up to the level of 49.6 points compared to 50.5 points in December . Reading of the index above 50 indicates expansion of the sector , while a reading below 50 suggests contraction activity.

Stoxx 600 added 0.1 percent. Since the beginning of this year , the index rose by 2.5 percent.

On the dynamics of trading also reflected data for the euro area , which showed that business activity in the euro area private sector increased significantly in January , when showing the highest growth in the last 31 months . This was stated in the study results , which were issued by Markit Economics.

The report showed that the composite PMI , which assesses the effectiveness of the manufacturing sector and the services sector rose to 53.2 in January from 52.1 in December , reaching its highest level since June 2011 . Economists had expected a rise to 52.5 . Index reading above 50 indicates expansion of the sector . We also add that the activity index for the services sector rose to a four-month high in January , namely to 51.9 points from 51 in December. Economists had forecast an increase to 51.5 . Meanwhile, the purchasing managers' index for the manufacturing rose to a 32-month high in January , reaching 53.9 points , compared with 52.7 in December. According to forecasts, this figure should make 53.2 .

Inditex and Asos shares fell 1.4 percent and 4.8 percent , respectively , after Goldman Sachs analysts downgraded shares of the company to the level of "neutral" from "buy ."

LEG Immobilien cost decreased by 1.1 per cent , against what Saturea BV sold its 25.7 percent stake in the German company for 42.50 euros per share . With this in mind , in Saturea BV remains only 0.5 percent of the shares.

Logitech shares rose 12 percent after the maker of computer mice, said sales rose to $ 628 million for the three months ended December 31 , beating the average analyst estimate of $ 594.7 million in net income rose to $ 48, 5 million, compared with forecasts of $ 31 million

FTSE 100 6,817.2 -9.13 -0.13%

CAC 40 4,328.78 +3.80 +0.09%

DAX 9,706.58 -13.53 -0.14%

-

11:00

United Kingdom: CBI retail sales volume balance, January 14 (forecast 28)

-

10:21

Option expiries for today's 1400GMT cut

USD/JPY Y103.90, Y104.00, Y104.30, Y104.40, Y105.00, Y105.25, Y105.40

EUR/USD $1.3410, $1.3450, $1.3475, $1.3500, $1.3545, $1.3565, $1.3575

GBP/USD $1.6500, $1.6630

EUR/GBP stg0.8150, Stg0.8200

AUD/USD $0.8900, $0.8950

-

10:03

Asia Pacific stocks close

Asian stocks fell, with the regional benchmark index heading for its first drop in three days, after a gauge of China’s manufacturing unexpectedly contracted.

Nikkei 225 15,695.89 -125.07 -0.79%

Hang Seng 22,732.65 -349.60 -1.51%

S&P/ASX 200 5,262.99 -56.78 -1.07%

Shanghai Composite 2,042.18 -9.57 -0.47%

China Construction Bank Corp. slid 2.7 percent in Hong Kong, pacing losses among Chinese lenders.

Hang Lung Properties Ltd., the Hong Kong developer investing more than $8.5 billion building malls in mainland China, declined 3.7 percent after posting a drop in underlying profit.

Insurance Australia Group Ltd. lost 3 percent after the nation’s largest car and home insurer lowered its growth forecast for gross premiums.

-

09:18

FTSE 100 6,829.92 +3.59 +0.05%, CAC 40 4,330.18 +5.20 +0.12%, Xetra DAX 9,707.04 -13.07 -0.13%

-

09:00

Eurozone: Current account, adjusted, bln , November 23.5 (forecast 19.2)

-

08:59

Eurozone: Manufacturing PMI, January 53.9 (forecast 53.2)

-

08:59

Eurozone: Services PMI, January 51.9 (forecast 51.5)

-

08:29

Germany: Services PMI, January 53.6 (forecast 54.1)

-

08:28

Germany: Manufacturing PMI, January 56.3 (forecast 54.7)

-

07:58

France: Manufacturing PMI, January 48.8 (forecast 47.6)

-

07:58

France: Services PMI, January 48.6 (forecast 48.2)

-

07:18

European bourses are initially seen flat to modestly lower ahead the open Thursday: the FTSE down 0.2%, the DAX down 0.1% and the CAC unchanged.

-

07:06

Asian session: The dollar rose for an eighth day

00:00 Australia Consumer Inflation Expectation January +2.1% +2.3%

01:45 China HSBC Manufacturing PMI (Preliminary) January 51.0 50.6 49.6

02:00 China Leading Index December +1.4% +0.4%

05:00 Japan BoJ monthly economic report January

The dollar rose for an eighth day, the longest winning streak since 2012, amid bets an improving U.S. economy will encourage Federal Reserve policy makers to dial back stimulus when they meet next week.

The dollar gained against most major peers before data forecast to show the number of Americans continuing to apply for jobless benefits fell and existing home sales increased. The number of Americans continuing to receive jobless benefits probably fell to 2.9 million in the period ended Jan. 11 from 3 million, according to the median estimate of economists surveyed by Bloomberg News before the Labor Department data today.

The 18-nation euro held a two-day advance against the yen before a report that may show Germany’s manufacturing industry expanded. An index of purchasing managers in Germany’s manufacturing industry probably climbed to 54.6 in January, a level unseen since June 2011, the median estimate of economists surveyed by Bloomberg shows. A number above 50 indicates expansion and figure below that shows contraction. Economists predict factory output in the euro area expanded for a seventh straight month.

Australia’s dollar slid after data showed Chinese manufacturing contracted this month. The preliminary reading of 49.6 for a Purchasing Managers’ Index released today by HSBC Holdings Plc and Markit Economics compares with a final figure of 50.5 in December and a 50.3 median estimate of 19 analysts in a Bloomberg poll. China is Australia’s biggest trading partner.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3530-55

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6555-75

USD / JPY: during the Asian session, the pair rose to Y104.85

BOE Fisher speaks at 0900GMT ahead of UK CBI sales at 1100GMT and provides the morning's domestic focus. EZ flash PMI's provide the

main market interest. Sterling remains in favour with traders awaiting next key UK data to see if they support further the analysts' view that a UK rate hike could come sooner than 2015.

-

06:32

Commodities. Daily history for Jan 22’2013:

Gold $1,237.40 -1.20 -0.10%

Oil $96.77 +0.04 +0.04%

-

06:31

Stocks. Daily history for Jan 22’2013:

Nikkei 225 15,820.96 +25.00 +0.16%

S&P/ASX 200 5,319.77 -11.70 -0.22%

Shanghai Composite 2,051.75 +43.44 +2.16%

FTSE 100 6,826.33 -7.93 -0.12%

CAC 40 4,324.98 +1.11 +0.03%

DAX 9,720.11 -10.01 -0.10%

Dow 16,373.34 -41.10 -0.25%

Nasdaq 4,243.00 +17.24 +0.41%

S&P 500 1,844.86 +1.06 +0.06%

-

06:31

Currencies. Daily history for Jan 22'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3547 -0,10%

GBP/USD $1,6573 +0,59%

USD/CHF Chf0,9114 +0,15%

USD/JPY Y104,51 +0,22%

EUR/JPY Y141,57 +0,11%

GBP/JPY Y173,20 +0,80%

AUD/USD $0,8849 +0,50%

NZD/USD $0,8307 -0,81%

USD/CAD C$1,1085 +1,08%

-

05:59

Schedule for today, Thursday, Jan 23’2013:

00:00 Australia Consumer Inflation Expectation January +2.1%

01:45 China HSBC Manufacturing PMI (Preliminary) January 51.0 50.6

02:00 China Leading Index December +1.4%

05:00 Japan BoJ monthly economic report January

07:58 France Manufacturing PMI (Preliminary) January 47.0 47.6

07:58 France Services PMI (Preliminary) January 47.8 48.2

08:28 Germany Manufacturing PMI (Preliminary) January 54.3 54.7

08:28 Germany Services PMI (Revised) January 53.5 54.1

08:58 Eurozone Manufacturing PMI (Preliminary) January 52.7 53.2

08:58 Eurozone Services PMI (Preliminary) January 51.0 51.5

09:00 Eurozone Current account, adjusted, bln November 21.8 19.2

09:00 United Kingdom MPC Member Fisher Speaks

09:00 Switzerland World Economic Forum Annual Meetings

11:00 United Kingdom CBI retail sales volume balance January 34 28

13:30 Canada Retail Sales, m/m November -0.1% +0.3%

13:30 Canada Retail Sales ex Autos, m/m November +0.4% +0.3%

13:30 U.S. Initial Jobless Claims January 326 331

13:30 U.S. Chicago Federal National Activity Index December 0.60

13:58 U.S. Manufacturing PMI (Preliminary) January 55.0 55.2

14:00 U.S. Housing Price Index, m/m November +0.5% +0.4%

14:00 U.S. Housing Price Index, y/y November +8.2%

15:00 U.S. Leading Indicators December +0.8% +0.1%

15:00 U.S. Existing Home Sales December 4.90 4.99

16:00 U.S. Crude Oil Inventories January -7.7

-