Notícias do Mercado

-

20:00

Dow -46.5 15,421.16 -0.30% Nasdaq -22.61 3,906.96 -0.58% S&P -7.33 1,747.34 -0.42%

-

19:21

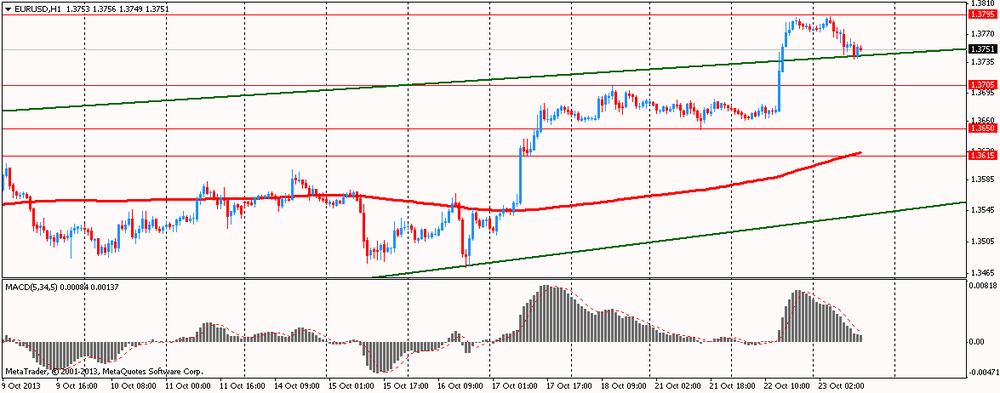

American focus : the euro strengthened against the dollar

The euro rose against the dollar, while restoring previously lost ground, which has helped to publish a report on consumer confidence .

The European Commission said that the level of consumer confidence in the euro area increased further in October , reaching with its highest level in 27 months, which is likely to indicate continued increase in consumer spending , albeit slow pace. According to the report , a preliminary index of consumer confidence in the euro zone rose this month to the level of 14.5 , compared with 14.9 in September. Note that the latter reading is fully confirmed the average forecasts of experts. In addition , we add that the October result was the strongest since July 2011 , when the value of this indicator was -11 . Also note that the index rose for the eleventh consecutive month. However , the level of confidence remains below the average at around 13.3 since 1990 , reflecting the continuing high level of unemployment and low wage growth .

Meanwhile, data showed that the level of sentiment in the EU has remained unchanged during October - the corresponding index was 11.7 points. In September, the figure has exceeded its long-term average at 12.3 , the first time since June 2011. Introduced today, the report shows that spending growth may continue in the third quarter, after retail sales rose in July and August.

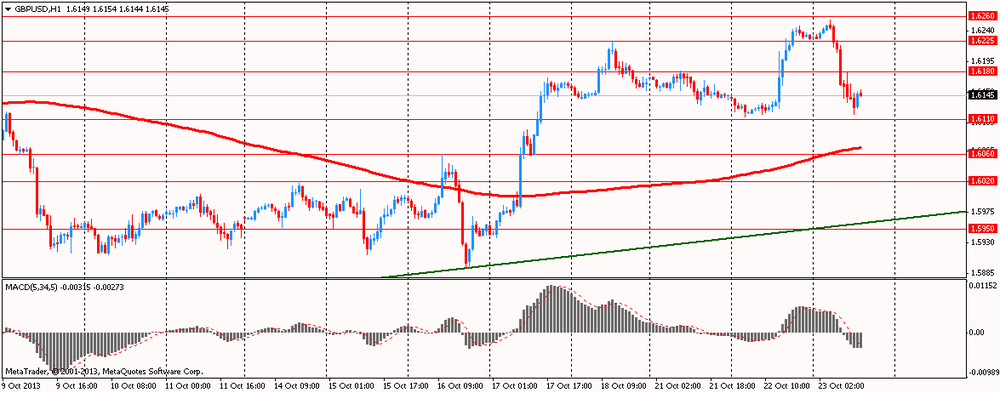

The pound recovered slightly against the dollar, but despite this, it is still trading at a substantial reduction . Note that the pressure on the British currency has had a publication of the minutes of the last meeting of the Bank of England. Minutes showed that in early October Monetary Policy Committee of the Bank of England voted 9 - "for" 0 - "against" keep interest rates and the asset purchase program unchanged.

The interest rate remained at a record low of 0.5 % , while the quantitative easing program totaled 375 billion pounds ( 607.99 billion dollars).

MPC said that he would consider raising the key interest rate at least until the unemployment rate drops to 7 percent from 7.7 percent. While the politicians predict that it will not happen before 2016 , but they noted this month that the improvement in the labor market showed that the economy is gaining momentum faster than expected in August. Investors are betting on a quick rise in interest rates.

All committee members agreed that neither inflation nor financial stability is not affected. "None of the members of the MPC did not consider it necessary to tighten monetary policy at this stage ," - said in a report.

This year, the UK 's economic recovery is gaining momentum , and the International Monetary Fund this month raised its growth forecast for the country.

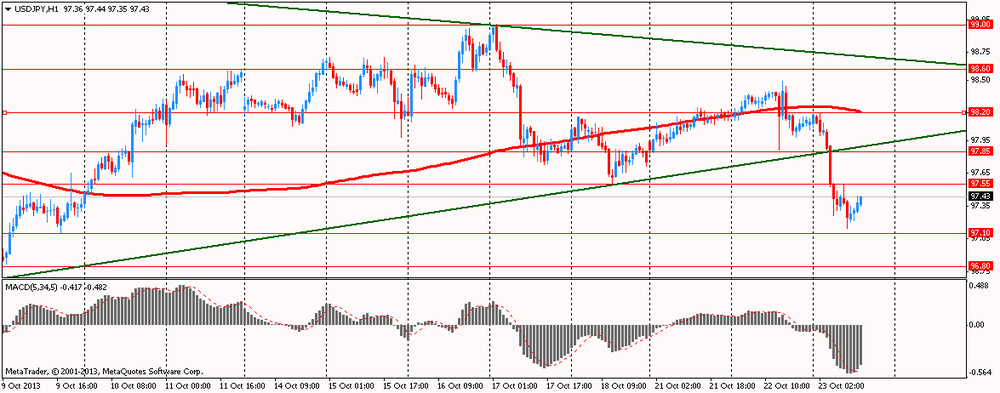

The yen continues to trade near two-week high against the dollar, which has been associated with the release of data on China. It is learned that China's major banks have tripled the number of bad loans written off in the first half of the year , cleaning up their balance sheets before the new wave of possible defaults .

In the first six months of the Industrial and Commercial Bank of China, and its four largest competitors have written off the debt in the amount of 22.1 billion yuan (3.65 billion dollars), which can not be recovered , compared with 7.65 billion yuan a year earlier , the report showed . In the first -half profit rose to a record 76 billion dollars.

Writing off the worst of the bad debts can allow banks to mitigate the ratio of non-performing loans of increasing defaults in the second largest economy in the world. Since 2010 , China has loosened the rules debt relief to small businesses . Politicians call for lenders to increase the capital stock after an unprecedented credit boom that began in 2009 .

The Canadian dollar declined significantly against its U.S. counterpart , which was associated with the application of the Bank of Canada. As expected , the Bank of Canada decided to keep interest rates unchanged at 1% at the October meeting of the Monetary Policy .

In a statement issued after the decision was announced , the Bank of Canada said it expects modest growth in 2013 , but held that the uncertain economic conditions may have a negative impact on exports and business investment in Canada .

According to Central Bank estimates , the growth rate of real GDP should accelerate from 1.6 % in 2013 to 2.3 % in 2014 and 2.6 % in 2015 . The Bank expects that " around the end of 2015 the real economy will gradually return to full use of the productive capacity ."

Although the Central Bank has expressed concern and the current situation , it is still noted that " inflation is stable is below the average target value , which means that the downside risk of inflation becoming ever more important ."

-

18:20

European stock close

European stocks declined, following the longest rally for the region’s equities in 40 months, as companies from Orange SA to STMicroelectronics NV (STM) reported lower quarterly sales.

The Stoxx Europe 600 Index retreated 0.7 percent to 318.61 at 4:30 p.m. in London. The equity benchmark has still gained 2.6 percent so far this month as U.S. lawmakers agreed to extend the government’s borrowing authority until 2014.

The European Central Bank confirmed today that it will require lenders to have a capital ratio of 8 percent. It also changed the rules for what qualifies as capital.

‘Suppurating Sores’

“There are some festering sores suppurating in the European banks which will have to be addressed,” Justin Urquhart Stewart, who helps oversee about $6.8 billion at Seven Investment Management Ltd. in London, wrote in an e-mail. “European markets will take note of the European Central Bank’s 8 percent capital requirement for banks.”

National benchmark indexes in every Western-European market, except Switzerland and Iceland, declined today.

FTSE 100 6,674.48 -21.18 -0.32% CAC 40 4,260.66 -34.77 -0.81% DAX 8,919.86 -27.60 -0.31%

Orange dropped 5.3 percent to 10.09 euros after posting profit excluding some items that declined 7.7 percent as cost cuts failed to offset falling sales. Earnings before interest, taxes, depreciation and amortization of 3.37 billion euros ($4.6 billion) still beat the average analyst estimate of 3.34 billion euros.

STMicroelectronics tumbled 9.6 percent to 5.77 euros after taking a $120 million impairment charge for the third quarter. The company posted a $478 million loss in the year-earlier period. STMicro also delayed a profitability target after splitting up its venture with Ericsson AB.

Bankinter SA and Banco Popular Espanol SA retreated 4.8 percent to 4.33 euros and 2.5 percent to 4.06 euros, respectively, as a gauge of lenders posted the biggest decline on the Stoxx 600.

Heineken NV fell 4.5 percent to 50.46 euros. The world’s third-biggest brewer predicted that full-year profit will decline by a low single-digit percentage. It had forecast profit would be in line with 2012. The brewer of the eponymous lager posted third-quarter sales that missed estimates amid weak consumption in central and eastern Europe.

GlaxoSmithKline Plc lost 1.9 percent to 1,570.5 pence after it said third-quarter sales of pharmaceuticals and vaccines dropped 61 percent in China. The country’s authorities began a probe into alleged corruption involving the company in July. The U.K.’s biggest drugmaker said total revenue rose 1 percent to 6.51 billion pounds ($10.5 billion), missing the 6.64 billion-pound average estimate of analysts.

-

17:00

European stock close: FTSE 100 6,674.48 -21.18 -0.32% CAC 40 4,260.66 -34.77 -0.81% DAX 8,919.86 -27.60 -0.31%

-

16:40

Oil: an overview of the market situation

The price of oil fell today , dropping to $ 96 per barrel (mark WTI), which was the lowest value since July. Note that this trend was triggered by release of data on U.S. oil reserves , which indicated the next increase .

Energy Department data on changes in stocks in the U.S. for the week October 14-20, showed that:

- Oil stocks rose 5.246 million barrels to 379.784 million barrels ;

- Gasoline inventories decreased by 1,805 million barrels . to 215.504 million barrels . ;

- Distillate stocks rose by 1.537 million barrels . to 125.774 million barrels .

- Refining capacity utilization rate 85.9 % versus 86.2 % a week earlier ;

- Oil terminal in Cushing and rose 0.358 million barrels . to 33,344 million barrels .

Recall that on Monday, the U.S. government announced that oil reserves rose by 4 million barrels in the week to October 11.

Meanwhile, we add that the data presented yesterday its Petroleum Institute API. They showed that the capacity utilization fell to 85.6 % from 86.0% , distillate stocks for the week rose by 0.815 million barrels, gasoline inventories last week fell by 0.51 million barrels, while oil stocks for the week rose by 3 , 0 million barrels

" Traders are starting to realize that it is difficult to maintain an optimistic outlook for oil prices with an increase in inventory levels ," - says the president of Strategic Energy & Economic Research Michael Lynch.

We add that the increase in oil inventories was recorded also in China - the second largest importer of raw materials. In September the index rose by 1.43 % compared with August , reaching at this level to 237.6 million barrels.

The cost of the December futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 96.64 a barrel on the New York Mercantile Exchange.

December futures price for North Sea Brent crude oil mixture fell $ 1.41 to $ 108.60 a barrel on the London exchange ICE Futures Europe.

-

16:21

Gold: an overview of the market situation

Gold prices declined moderately today, departing from the four-week high as investors started to close their positions after yesterday's employment report, which was weaker than expected. Recall that on Tuesday, the price of the precious metal rose nearly 2%, reaching the highest level since Sept. 20, while the dollar fell to 8-month low against the data, reinforcing investors' expectations that the Fed will keep the amount of incentive program unchanged until next year.

"Yesterday's growth plays out very quickly, which is another sign that growth is indeed seen as an opportunity to sell, and people do not expect higher prices," said an analyst at ABN Amro Georgette Boulay. "People are selling because they are not too confident about the prospects, but they know that sooner or later, the U.S. economy will get better and the dollar is likely to grow, so this is a temporary phenomenon."

Data presented today also showed that stocks of the world's largest exchange-traded fund backed by gold SPDR Gold Shares on Tuesday rose by more than 6 tons, the biggest daily rise in two months. Recall that on Monday the fund holdings declined by more than 10 tons.

The cost of the December gold futures on COMEX today dropped to $ 1334.10 per ounce.

-

15:30

U.S.: Crude Oil Inventories, October +5.2 (forecast +2.7)

-

15:00

Eurozone: Consumer Confidence, October -14.5 (forecast -14.5)

-

15:00

Canada: Bank of Canada Rate, 1.00% (forecast 1.00%)

-

14:36

U.S. Stocks open: Dow 15,414.74 -52.92 -0.34%, Nasdaq 3,908.61 -20.96 -0.53%, S&P 1,748.98 -5.69 -0.32%

-

14:26

Before the bell: S&P futures -0.41%, Nasdaq futures -0.42%

U.S. stock futures declined as forecasts at companies from Caterpillar Inc. to Broadcom Corp. disappointed investors.

Global Stocks

Nikkei 14,426.05 -287.20 -1.95%

Hang Seng 22,999.95 -316.04 -1.36%

Shanghai Composite 2,183.11 -27.54 -1.25%

FTSE 6,675.6 -20.06 -0.30%

CAC 4,264.14 -31.29 -0.73%

DAX 8,927.64 -19.82 -0.22%

Crude oil $96.63 -1.70%

Gold $1335.50 -0.53%

-

14:04

Upgrades and downgrades before the market open:

Upgrades:

Morgan Stanley (MS) upgraded to Outperform from Neutral at Mediobanca

DuPont (DD) upgraded from Neutral to Overweight at JP Morgan, target raised from $60 to $67

Downgrades:

Goldman Sachs (GS) downgraded to Underperform from Neutral at Mediobanca

Other: -

14:00

Belgium: Business Climate, October -7.7 (forecast -4.1)

-

14:00

U.S.: Housing Price Index, m/m, August +0.3% (forecast +0.8%)

-

14:00

U.S.: Housing Price Index, y/y, August +8.5%

-

13:30

U.S.: Import Price Index, September +0.2% (forecast +0.3%)

-

13:19

European session: the pound fell

08:30 United Kingdom Bank of England Minutes

08:30 United Kingdom BBA Mortgage Approvals September 38.2 39.4 43

The British pound is reduced after the release of the protocol of the Bank of England, which reflected the unanimous sentiment of the Committee members to keep loose monetary policy with just a hint of the fact that the steady improvement of the economy of Britain can serve as a sufficient argument for further revision of the forecasts for the rate increase .

In respect of new policies transparent communication , which the lawyer is the new head of the Bank of England M. Carney , the report states: "At the moment it seems likely that in the 2nd half of 2013 unemployment will be lower and the rate of production - faster than expected in the August inflation report ".

However, says further , " On the basis of the latest statistics on the labor market is still too early to make any confident verdicts on the extent of the growth of productivity."

The yen rose to its highest level in two weeks against the dollar , as the volume of bad loans in China soared to a peak in July , stimulating demand for safer assets . The yen rose against all 16 major currencies.

Euro fell against the U.S. dollar amid evidence that the debts of the governments of the euro area in the 2nd quarter continued to grow. This indicates that , despite the return to the Monetary Union growth, one of the most difficult problems have not been solved.

According to data released on Wednesday the EU statistics agency Eurostat, eurozone public debt in relation to the aggregate euro area GDP in the 2nd quarter increased to 93.4 % versus 92.3 % in the 1st quarter and to 89.9 % in the same period the previous year.

According to the rules of the European Union , governments must keep their debt at a level not exceeding 60 % of GDP.

EUR / USD: during the European session, the pair fell to $ 1.3739

GBP / USD: during the European session, the pair fell to $ 1.6118

USD / JPY: during the European session, the pair fell to Y97.15

At 12:30 GMT the United States will import price index for September. At 14:00 GMT we will know the decision of the Bank of Canada Interest Rate and the accompanying statement will be made of the Bank of Canada. At 14:00 GMT Eurozone will release an indicator of consumer confidence for October. At 14:30 GMT will publish a report on the Bank of Canada's monetary policy. At 14:30 GMT the United States , there are data on stocks of crude oil from the Ministry of Energy . At 15:15 GMT will be a press conference by the Bank of Canada . At 21:45 GMT New Zealand will release the trade balance (for 12 months , from the beginning of the year ) and the trade balance for September.

-

13:00

Orders

EUR/USD

Offers $1.3850, $1.3830/35, $1.3800

Bids $1.3745/40, $1.3720, $1.3710/00

GBP/USD

Offers $1.6320/30, $1.6300, $1.6280, $1.6260, $1.6220/25, $1.6200

Bids $1.6115/00, $1.6080, $1.6060/50, $1.6020, $1.6000

AUD/USD

Offers $0.9750, $0.9720/25, $0.9690/00

Bids $0.9625/20, $0.9605/00, $0.9580, $0.9560/50, $0.9500

EUR/GBP

Offers stg0.8600, stg0.8550/65, stg0.8530/35

Bids stg0.8505/00, stg0.8450/40, stg0.8425/15, stg0.8400

EUR/JPY

Offers Y135.80/85, Y135.50, Y135.00, Y134.60/80

Bids Y133.55/50, Y133.20, Y133.00, Y132.50

USD/JPY

Offers Y98.50, Y98.00, Y97.60/80

Bids Y97.00, Y96.80, Y96.50, Y96.20

-

11:30

European stocks declined

European stocks declined, following the longest rally for the region’s equities in 40 months, as companies from Orange SA to STMicroelectronics NV (STM) reported lower quarterly sales. U.S. index futures and Asian shares also fell.

The Stoxx Europe 600 Index retreated 0.7 percent to 318.88 at 10:49 a.m. in London. The equity benchmark has still increased 2.7 percent so far this month as U.S. lawmakers agreed to extend the government’s borrowing authority until 2014. Standard & Poor’s 500 Index futures lost 0.5 percent today, while the MSCI Asia Pacific Index decreased 0.8 percent.

Orange dropped 4.7 percent to 10.15 euros after posting profit excluding some items that declined 7.7 percent as cost cuts failed to offset falling sales. Earnings before interest, taxes, depreciation and amortization of 3.37 billion euros ($4.6 billion) still beat the average analyst estimate of 3.34 billion euros, according to data compiled by Bloomberg.

STMicroelectronics tumbled 7.4 percent to 5.91 euros after taking a $120 million impairment charge for the third quarter. The company posted a $478 million loss in the year-earlier period. STMicro also delayed a profitability target after splitting up its venture with Ericsson AB.

FTSE 100 6,664.13 -31.53 -0.47%

CAC 40 4,260.48 -34.95 -0.81%

DAX 8,908.25 -39.21 -0.44%

-

10:46

U.K. BBA mortgage approvals rise for second month

Home loan approvals in the United Kingdom rose for a second straight month during September, exceeding economists' expectations, and remained the highest since late 2009, data released by the British Bankers' Association revealed on Wednesday.

Mortgage approvals for house purchase rose to a seasonally adjusted 42,990 from August's revised 38,834.

Economists had expected approvals to total 39,500 for the month. The latest figure is the highest since December 2009, when approvals were 45,318.

-

10:24

Option expiries for today's 1400GMT cut

EUR/USD $1.3650, $1.3670, $1.3695, $1.3700, $1.3710, $1.3725, $1.3750, $1.3760, $1.3800, $1.3810

USD/JPY Y97.50, Y98.00, Y98.10, Y98.20/35, Y98.45/50,

Y98.70, Y98.80/85

AUD/JPY Y95.00

GBP/JPY Y158.40

GBP/USD $1.6125, $1.6150

EUR/GBP stg0.8425, stg0.8500, stg0.8530

USD/CHF Chf0.9000

EUR/CHF Chf1.2400

AUD/USD $0.9600, $0.9610, $0.9650, $0.9660, $0.9700, $0.9730

NZD/USD $0.8400, $0.8450

USD/CAD C$1.0270/75, C$1.0285, C$1.0290/95, C$1.0300, C$1.0315, C$1.0400

-

10:21

Asia Pacific stocks close

Asian stocks fell, with the regional benchmark index retreating from a five-month high, after Chinese shares tumbled as the nation’s money-market rates surged.

Nikkei 225 14,426.05 -287.20 -1.95%

Hang Seng 22,999.95 -316.04 -1.36%

S&P/ASX 200 5,356.1 -17.05 -0.32%

Shanghai Composite 2,183.11 -27.54 -1.25%

China Resources Land Ltd. , the second-largest mainland developer traded in Hong Kong, slipped 1.8 percent.

Japan Exchange Group Inc. sank 3.7 percent after the main bourse operator of the world’s second-largest equity market didn’t boost its full-year profit forecast as analysts had expected.

Hyundai Merchant Marine Co. jumped 14 percent after South Korea’s biggest shipping line by market value refinanced 280 billion won of debt ($265 million).

-

09:30

United Kingdom: BBA Mortgage Approvals, September 43 (forecast 39.4)

-

08:40

FTSE 100 6,674.16 -21.50 -0.32%, CAC 40 4,269.17 -26.26 -0.61%, Xetra DAX 8,916.33 -31.13 -0.35%

-

07:21

European bourses are initially seen trading lower Wednesday: the FTSE nad CAC down 12, with the DAX down 10.

-

07:00

Asian session: The dollar touched the weakest almost two-years

The dollar touched the weakest almost two-years against the euro before U.S data that may add to the case for the Federal Reserve to keep its current pace of asset purchases for longer. A report from the department yesterday showed employers added 148,000 workers in September, trailing the increase of 180,000 seen in a Bloomberg poll of economists.

The Aussie dollar touched a four-month high on Australian inflation data before erasing gains. In Australia, core consumer prices gained more than economists forecast last quarter, increasing the likelihood the Reserve Bank will end its two-year easing of monetary policy. The Aussie erased gains after Chinese stocks dropped amid a jump in money market rates.

The pound touched a three-week high against the greenback before the Bank of England releases minutes today from its Oct. 9-10 meeting. The BOE’s Monetary Policy Committee held its target for asset purchases at 375 billion pounds ($609 billion) and kept its key interest rate at a record-low 0.5 percent.

The yen climbed against all its major counterparts amid demand for refuge assets.

EUR / USD: during the Asian session the pair rose to $ 1.3795

GBP / USD: during the Asian session, the pair rose to $ 1.6255

USD / JPY: during the Asian session the pair fell to Y97.25

The first eurozone data release is expected at 0900GMNT, when the EMU Q2 government debt data is released. At 0900GMT, ECB Governing Council member Ardo Hansson holds a press conference to discuss Financial Stability Review, in Talinn, Estonia. Then, at 1000GMT, the German Economics Ministry releases its updated economic forecasts, in Berlin. At 1300GMT, the Belgium September BNB business survey numbers will cross the wires. The EMU Oct flash consumer confidence index data will be released at 1400GMT. There is a stream of European central bank speakers expected from 1600GMT, when ECB Governing Council member Ewald Nowotny is set to speak during a book presentation in Vienna. At 1700GMT, Bundesbank Board member Rudolf Boehmler will speak during the Forum Bundesbank on "Deutsche Bundesbank as a stability anchor".

There is no early European data set for release Wednesday, with the first release set to be the Bank of England minutes at 0830GMT. Bank of England Executive Director Markets Paul Fisher said in his Oct 2 speech that "we do not intend to maintain a running commentary on whether the market has got it right

or wrong in relation to when Bank Rate will rise."

-

06:21

Commodities. Daily history for Oct 22’2013:

GOLD 1,342.50 26.80 2.04%

OIL (WTI) 97.80 -1.42 -1.43%

-

06:21

Stocks. Daily history for Oct 22’2013:

Nikkei 225 14,713.25 19,68 0,13%

Hang Seng 23,304.54 -133,61 -0,57%

S & P / ASX 200 5,373.15 21,37 0,40%

Shanghai Composite 2,210.65 -18.59 -0.83%

FTSE 100 6,695.66 +41.46 +0.62%

CAC 40 4,295.43 +18.51 +0.43%

DAX 8,947.46 +80.24 +0.90%

Dow +75.46 15,467.66 +0.49%

Nasdaq +9.52 3,929.57 +0.24%

-

06:19

Currencies. Daily history for Oct 22'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3777 +0,73%

GBP/USD $1,6229 +0,53%

USD/CHF Chf0,8949 -0,79%

USD/JPY Y98,40 +0,23%

EUR/JPY Y135,19 +0,68%

GBP/JPY Y159,20 +0,46%

AUD/USD $0,9706 +0,57%

NZD/USD $0,8511 +0,75%

USD/CAD C$1,0288 -0,17%

-

06:00

Schedule for today, Wednesday, Oct 23’2013:

00:30 Australia CPI, q/q Quarter III +0.4%

05:00 Australia RBA Annual Report 2013

08:30 United Kingdom Bank of England Minutes

08:30 United Kingdom BBA Mortgage Approvals September 38.2

13:00 Belgium Business Climate October -6.7

13:00 U.S. Housing Price Index, m/m August +1.0%

13:00 U.S. Housing Price Index, y/y August +8.8%

14:00 Eurozone Consumer Confidence October -14.9

14:00 Canada BOC Rate Statement

14:00 Canada Bank of Canada Rate 1.00%

14:30 Canada Bank of Canada Monetary Policy Report Quarter IV

14:30 U.S. Crude Oil Inventories October

15:15 Canada BOC Press Conference

21:45 New Zealand Trade Balance, mln September -1191

-