Notícias do Mercado

-

20:00

Dow +89.78 15,481.98 +0.58% Nasdaq +9.10 3,929.15 +0.23% S&P +10.78 1,755.44 +0.62%

-

19:20

American focus : the euro has appreciated significantly against the dollar

The euro exchange rate against the dollar has increased significantly , in response , so the weak employment data in the U.S.. The Department of Labor reported that the number of people employed in the U.S. increased less than expected. It shows that before the temporary suspension of the U.S. government reduced the growth rate of the economy . Employment growth in September was 148,000 , while employment growth in August was revised up to 193,000 ( higher than originally reported) . The average score of economists before the data output stood at 179,000 . Thus, the data came out much worse than expected. It was also reported that the unemployment rate fell to a five-year low, 7.2% - the lowest since November 2008 This is better than expected at 7.3 %. The decrease in the unemployment rate due to the low proportion of the economically active population - 63.2 %, the lowest level since August 1978 . Note that the employment data had to go out on October 4 , but the temporary cessation of the government led to the release of the data transfer time .

Meanwhile, we add that to stop the dollar's decline could not even better than expected data on construction spending . The Ministry of Commerce reported that the seasonally adjusted construction spending rose in August by 0.6 percent, reaching at this annual level of $ 915.100 billion Economists had expected spending to increase by about 0.4 percent. In addition, the data showed that construction spending in July was revised up to show growth of 1.4 percent, compared with an increase of 0.6 percent , which was originally reported growth. Add that to the upward revision index for July and further growth in August , the annual growth in construction costs rose to the highest level since April 2009

The Canadian dollar rose against the U.S. dollar, which has been associated with the release of U.S. data on employment and Canadian retail sales data .

At Statistics Canada said that Canadian retail sales growth slowed in August compared to the previous month amid weak demand for new cars and a reduction in income

Retail sales rose 0.2% to 40.32 billion Canadian dollars ( $ 39.14 billion ) and were slightly below market expectations of 0.3 % growth for the month. In addition , the data in July were revised downward - Retail sales rose by 0.5 % compared with a preliminary estimate of a 0.6% gain . Compared to the same period in the previous year the retail sales rose 2.7%. Excluding sector of vehicles and auto parts, in August retail sales rose by 0.4 % compared with July and reached 30.95 billion Canadian dollars. In volume terms, retail sales rose by 0.2 %. Sales of food and beverages in stores accounted for the largest increase in dollar terms among the 11 sectors . These sales were up 1.2% to C $ 8.96 billion Canadian dollars. Clothing sales rose 1.9 % to 2.29 billion Canadian dollars.

-

18:20

European stock close

European stocks rallied for a ninth day, their longest winning streak since June 2010, as companies from Novartis AG to Reckitt Benckiser (RB/) Group Plc raised forecasts and the U.S. unemployment rate fell to an almost five-year low.

The Stoxx 600 advanced 0.4 percent to 320.85, extending a five-year high. The gauge has increased 3.4 percent so far this month as U.S. lawmakers agreed to extend the government’s borrowing powers until 2014 and ended a partial government shutdown.

National benchmark indexes advanced in 12 of the 18 western-European markets today.

FTSE 100 6,695.66 +41.46 +0.62% CAC 40 4,295.43 +18.51 +0.43% DAX 8,947.46 +80.24 +0.90%

American payrolls climbed less than projected in September, data released more than two weeks later than scheduled showed today. The addition of 148,000 workers followed a revised 193,000 rise in August that was larger than initially estimated, Labor Department figures showed. The median forecast of economists called for a 179,000 advance. The unemployment rate fell to 7.2 percent, the lowest level since November 2008.

The Federal Open Market Committee will hold a two-day meeting beginning on Oct. 29. The Fed will delay the first reduction in its monthly bond purchases until March because the closure of federal agencies slowed fourth-quarter growth and interrupted the gathering of data.

Novartis AG (NOVN) climbed 2.3 percent to 69.45 Swiss francs after raising its full-year forecasts. Sales will increase at a low-to mid-single-digit percentage rate in constant currencies, and core operating income will match or exceed the previous year, Europe’s biggest drugmaker said. In July, the company forecast a low-single-digit percentage decline in earnings in 2013, with sales rising at a similar rate.

Reckitt Benckiser, the maker of Nurofen painkillers and Durex condoms, jumped 5.2 percent to 4,735 pence. Full-year revenue will grow at least 6 percent, including acquisitions and divestments and excluding results from the pharmaceutical unit. The company had expected non-pharmaceutical revenue growth at the upper end of 5 percent to 6 percent in 2013, including acquisitions and disposals, and stable operating-profit ">Gjensidige Forsikring ASA rallied 8 percent to 109.40 kroner, its highest price since it sold shares to the public in December 2010. Norway’s largest insurer said it will pay an extraordinary dividend of 6 kroner a share ($1.01) and will adopt a policy that targets a pay-out ratio of at least 70 percent of profit after tax from 2014.

BHP Billiton Ltd. (BLT) rose 4.3 percent to 1,954 pence after the world’s largest mining company upgraded its projection for full-year iron-ore production to 212 million tons from its earlier forecast of 207 million tons.

Tele2 slumped 12 percent to 75.65 kronor, leading a gauge of European telecommunications shares to its first loss in nine days. The company posted a third-quarter net loss of 171 million kronor ($26.7 million), missing the 518 million-kronor profit analysts had estimated. Tele2 also reduced its forecasts for 2015 sales to not more than 33.5 billion kronor and for earnings before interest, taxes, depreciation and amortization that year to a maximum of 7.3 billion kronor.

Deutsche Lufthansa AG declined 2.4 percent to 14.50 euros after saying it expects an operating result of 600 million euros to 700 million euros in 2014. That compares with 524 million euros last year, according to a company statement.

-

17:00

European stock close: FTSE 100 6,695.66 +41.46 +0.62% CAC 40 4,295.43 +18.51 +0.43% DAX 8,947.46 +80.24 +0.90%

-

16:40

Gold: an overview of the market situation

The cost of oil futures declined moderately , as market participants continue to analyze yesterday's report on oil . Recall that, according to the Energy Information Administration , oil stocks rose by 4 million barrels to 374.500 million in the week ended Oct. 11. It should also be noted that many market participants are waiting for tomorrow's report on reserves , which is projected to show that oil stocks last week rose again , which could become the fifth consecutive weekly increase .

According to analysts , the value of WTI crude oil will continue to decline until the end of this year on rising U.S. inventories , easing tensions in Iran and the establishment of an interim agreement on the debt ceiling by U.S. politicians.

Add that little support prices today have news about the deterioration of relations between the United States and a key oil producer in OPEC - Saudi Arabia. As the head of Saudi intelligence Prince Bandar bin Sultan, an unnamed European diplomat , the Saudi authorities may limit cooperation with Washington over the U.S. position on Syria and Iran.

Riyadh presumably believes that Washington became friendly with Iran , in addition, according to the Saudi authorities , the United States are unable to resolve the crisis in Syria. The United States also declined , along with Saudi Arabia to support Bahrain to suppress anti-government protests in 2011.

Recall that Saudi Arabia is the most important producer of oil in the Middle East, and plays a key role in maintaining the balance in the oil market to maintain price stability.

The cost of the November futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 98.47 a barrel on the New York Mercantile Exchange.

December futures price for North Sea petroleum mix of mark Brent rose 12 cents to $ 109.92 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices rose significantly , reaching in this three-week high , after weak figures on employment in the United States have raised expectations that the Federal Reserve will keep its incentive program continued in 2014.

The Department of Labor reported that the number of people employed in the U.S. increased less than expected. It shows that before the temporary suspension of the U.S. government reduced the growth rate of the economy .

Employment growth in September was 148,000 , while employment growth in August was revised up to 193,000 ( higher than originally reported) . The average score of economists before the data output stood at 179,000 . Thus, the data came out much worse than expected.

The unemployment rate fell to a five-year low , 7.2 % - the lowest since November 2008 This is better than expected at 7.3 %. The decrease in the unemployment rate due to the low proportion of the economically active population - 63.2 %, the lowest level since August 1978 .

Note that the employment data had to go out on October 4 , but the temporary cessation of the government has resulted in the release of data transfer time .

According to analysts, investor sentiment is likely to remain depressed , which is also confirmed by the decrease in gold reserves in the world's largest exchange-traded fund - SPDR Gold Trust ( yesterday inventories fell by 10.51 tonnes to 871.72 million tonnes , showing the highest one-day drop since the beginning of July).

It should also be noted that physical demand for gold in India, which is the main consumer of the precious metal remains weak in anticipation of the beginning of the holiday season , which is generally considered to be a favorable time to buy jewelry.

The cost of the December gold futures on COMEX today rose to $ 1342.20 per ounce.

-

15:01

U.S.: Construction Spending, m/m, August +0.6% (forecast +0.5%)

-

15:00

U.S.: Richmond Fed Manufacturing Index, October 1

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3600, $1.3650, $1.3700, $1.3710, $1.3725, $1.3750, $1.3775

USD/JPY Y97.30, Y97.50, Y98.00, Y98.30/35, Y98.50, Y98.55, Y98.60, Y98.75, Y98.80, Y99.00

GBP/USD $1.6030, $1.6200, $1.6265

EUR/GBP stg0.8450, stg0.8500

USD/CHF Chf0.9030, Chf0.9185

EUR/NOK Nok8.0780, Nok8.1060

AUD/USD $0.9450, $0.9500, $0.9575, $0.9600, $0.9670, $0.9710, $0.9725

USD/CAD C$1.0290, C$1.0300, C$1.0315

-

14:39

U.S. Stocks open: Dow 15,439.21 +47.01 +0.31%, Nasdaq 3,938.82 +18.77 +0.48%, S&P 1,751.24 +6.58 +0.38%

-

14:30

Before the bell: S&P futures +0.29%, Nasdaq futures +0.37%

U.S. stock futures rose as weaker-than-forecast hiring in September fueled speculation the Federal Reserve will delay trimming monetary stimulus.

Global Stocks:

Nikkei 14,713.25 +19.68 +0.13%

Hang Seng 23,315.99 -122.16 -0.52%

Shanghai Composite 2,210.65 -18.59 -0.83%

FTSE 6,682.75 +28.55 +0.43%

CAC 4,288.42 +11.50 +0.27%

DAX 8,929.43 +62.21 +0.70%

Crude oil $99.22 0.00%

Gold $1328.30 +0.95%

-

14:00

U.S.: Total Net TIC Flows, August -2.9

-

14:00

U.S.: Net Long-term TIC Flows , August -8.9

-

13:32

U.S.: Average workweek, September 34.5 (forecast 34.5)

-

13:32

U.S.: Average hourly earnings , September +0.1% (forecast +0.2%)

-

13:30

U.S.: Nonfarm Payrolls, September 148 (forecast 179)

-

13:30

U.S.: Unemployment Rate, September 7.2% (forecast 7.3%)

-

13:30

Canada: Retail Sales, m/m, August +0.2% (forecast +0.3%)

-

13:30

Canada: Retail Sales ex Autos, m/m, August +0.4% (forecast +0.2%)

-

13:15

European session: the dollar stabilized

06:00 Switzerland Trade Balance September 1.85 2.23 2.5

08:10 United Kingdom MPC Member Bean Speaks

08:30 United Kingdom PSNB, bln September 11.5 9.4

The U.S. dollar traded in a narrow range against most major currencies, as market participants are waiting for the publication of data on the number of jobs outside agriculture, as well as official data on unemployment in the United States . It is expected that the figure will be released above the acceptable threshold of 6.5 % of the Federal Reserve System, and therefore Fed QE3 will continue the program in its entirety. Today, after a delay associated with the shutdown in the United States, will be published by the government's employment report . According to the median forecast of analysts in the U.S. economy in the past month has been created 179 thousand jobs , higher than the August figure of 169 thousand, however , it is expected that the official unemployment rate was 7.3 %.

The observed stability of the dollar reflects the reluctance of investors to open large positions before the employment data do not shed light on how much the U.S. Federal Reserve will continue to purchase bonds at the current rate .

The yen continues to fall against most currencies in anticipation of the publication 25 October inflation data, which are likely to be the highest since 2008 . According to the median forecast of economists , the nationwide consumer price index excluding fresh food , last month, will grow by 0.7 % compared with a year earlier. Recall that the measures for promotion of inflation, which applies the Bank of Japan , have accelerated the consumer price index in August, the fastest pace since November 2008 , to 0.8 %.

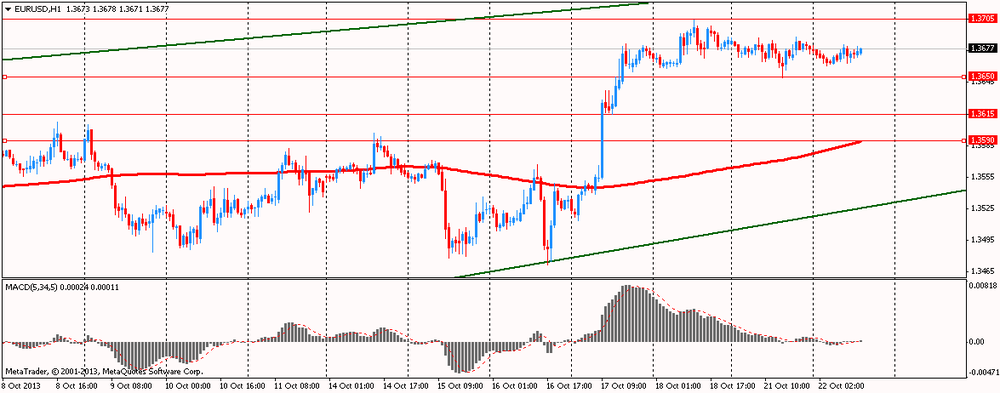

EUR / USD: during the European session, the pair is trading in the range of $ 1.3661 - $ 1.3681

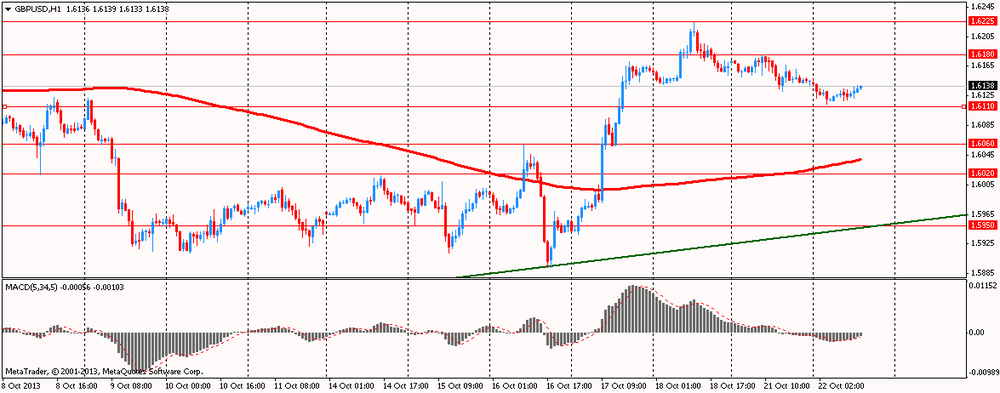

GBP / USD: during the European session, the pair rose to $ 1.6139

USD / JPY: during the European session, the pair rose to Y98.40

At 12:30 GMT in Canada will change in the volume of retail sales , the change in retail sales excluding auto sales for August. At 12:30 GMT the U.S. will release the unemployment rate , change in the number of employed in non-agricultural sector , changes in the number of employees in the private sector of the economy , changes in the number of employees in the manufacturing sector of the economy, change in average hourly wages , the total revision of employment for 2 months in September. At 23:00 GMT Australia will release the index of leading economic indicators from the Conference Board in August.

-

13:00

Orders

EUR/USD

Offers $1.3765, $1.3745/50, $1.3720, $1.3690/700

Bids $1.3650, $1.3625/15, $1.3605/595, $1.3580

GBP/USD

Offers $1.6300, $1.6280, $1.6250/60, $1.6220/25, $1.6200, $1.6180/85, $1.6150

Bids $1.6100, $1.6080, $1.6060/50, $1.6020, $1.6000

AUD/USD

Offers $0.9750, $0.9725/30, $0.9700, $0.9675/80

Bids $0.9625/20, $0.9605/00, $0.9580, $0.9560/50, $0.9500

EUR/GBP

Offers stg0.8550/55, stg0.8520/30, stg0.8510, stg0.8490/500

Bids stg0.8455/50, stg0.8445/40, stg0.8425/15, stg0.8400, stg0.8370/65

EUR/JPY

Offers Y135.50, Y135.00, Y134.80

Bids Y134.00, Y133.80, Y133.55/50, Y133.20, Y133.00

USD/JPY

Offers Y99.20, Y99.00, Y98.80, Y98.50

Bids Y98.00, Y97.80, Y97.50, Y97.35, Y97.20

-

11:33

European stocks were little changed

European stocks were little changed near a five-year high as investors awaited U.S. employment data to gauge the timing of a cut in Federal Reserve bond purchases. U.S. index futures and Asian shares were also little changed.

In the U.S., a report at 8:30 a.m. Washington time may show that payrolls rose by 180,000 last month, the most since April, after a 169,000 gain in August, according to the median forecast of 93 economists in a Bloomberg News survey. The Labor Department release, delayed by the 16-day shutdown that ended last week, was originally slated to be released on Oct. 4.

The unemployment rate held at 7.3 percent in September, according to the median projection in another survey.

The Federal Open Market Committee will hold a two-day meeting beginning on Oct. 29. The Fed will delay the first reduction in its monthly bond purchases until March because the closure of federal agencies slowed fourth-quarter growth and interrupted the gathering of data, economists said in a Bloomberg News survey.

Tele2 slumped 9.9 percent to 77.45 kronor, leading a gauge of European telecommunications shares to its first loss in nine days. The company posted a third-quarter net loss of 171 million kronor ($26.7 million), missing the 518 million-kronor profit analysts had estimated. Tele2 also reduced its forecasts for 2015 sales to not more than 33.5 billion kronor and for earnings before interest, taxes, depreciation and amortization that year to a maximum of 7.3 billion kronor.

Deutsche Lufthansa AG declined 2.5 percent to 14.48 euros after saying it expects an operating result of 600 million euros to 700 million euros in 2014. That compared with 524 million euros last year.

FTSE 100 6,665.53 +11.33 +0.17%

CAC 40 4,275.92 -1.00 -0.02%

DAX 8,861.82 -5.40 -0.06%

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3600, $1.3650, $1.3700, $1.3710, $1.3725, $1.3750, $1.3775

USD/JPY Y97.30, Y97.50, Y98.00, Y98.30/35, Y98.50, Y98.55, Y98.60, Y98.75, Y98.80, Y99.00

GBP/USD $1.6030, $1.6200, $1.6265

EUR/GBP stg0.8450, stg0.8500

USD/CHF Chf0.9030, Chf0.9185

EUR/NOK Nok8.0780, Nok8.1060

AUD/USD $0.9450, $0.9500, $0.9575, $0.9600, $0.9670, $0.9710

USD.CAD C$1.0290, C$1.0300

-

10:00

Asia Pacific stocks close

Asian stocks fell, with regional benchmark index retreating from a five-month high, as investors await the release of delayed U.S. payrolls data to gauge when the Federal Reserve will starting trimming record stimulus.

Nikkei 225 14,713.25 +19.68 +0.13%

Hang Seng 23,304.54 -133.61 -0.57%

S&P/ASX 200 5,373.15 +21.37 +0.40%

Shanghai Composite 2,210.65 -18.59 -0.83%

China Mobile Ltd., the world’s largest phone company, dropped 3.6 percent in Hong Kong after posting its biggest profit decline since 1999.

Shinhan Financial Group Co. fell 2.9 percent in Seoul as BNP Paribas plans to sell part of its stake in South Korea’s biggest bank.

BHP Billiton Ltd., the world’s No. 1 mining company, gained 2.4 percent in Sydney after increasing its forecast for iron-ore production.

-

09:30

United Kingdom: PSNB, bln, September 9.40

-

08:39

FTSE 100 6,666.27 +12.07 +0.18%, CAC 40 4,267.31 -9.61 -0.22%, Xetra DAХ 8,862.26 -4.96 -0.06%

-

07:39

Ожидается негативный старт торгов на основных фондовых площадках Европы: FTSE -2, DAX -7, CAC -5

-

07:24

Asian session: The dollar traded 0.3 percent from an eight-month low

The dollar traded 0.3 percent from an eight-month low versus the euro as investors look to U.S. employment data due today to help assess the timing for a reduction in Federal Reserve stimulus. The U.S. Labor Department may say employers added 180,000 jobs last month after boosting positions by 169,000 in August, according to the median estimate of economists surveyed by Bloomberg News. The unemployment rate probably held at 7.3 percent, matching the lowest in 4 1/2 years.

The yen held losses from yesterday versus its peers as demand for safety waned before figures this week that may show consumer-price gains in Japan held near the fastest pace since 2008. In Japan, government data will probably show on Oct. 25 that nationwide consumer prices excluding fresh food rose 0.7 percent last month from a year earlier, according to the median forecast of economists surveyed by Bloomberg. The rate, the Bank of Japan’s favored measure of inflation, advanced to 0.8 percent in August, the fastest pace since November 2008.

EUR / USD: during the Asian session the pair fell to $ 1.3660

GBP / USD: during the Asian session, the pair fell to $ 1.6115

USD / JPY: during the Asian session the pair rose to Y98.35

The session's main release comes at 1230GMT, when the September Non-farm Payrolls data finally crosses the wires. The UK release calendar kicks off at 0830GMT, with the release of the September Public Sector Finance data.

-

07:00

Switzerland: Trade Balance, September 2.5 (forecast 2.23)

-

06:21

Commodities. Daily history for Oct 21’2013:

GOLD 1,315.70 1.30 0.10%

OIL (WTI) 99.10 -1.71 -1.70%

-

06:20

Stocks. Daily history for Oct 21’2013:

Nikkei 225 14,693.57 132,03 0,91%

Hang Seng 23,379.42 39,32 0,17%

S & P / ASX 200 5,351.8 30,33 0,57%

Shanghai Composite 2,229.24 35,46 1,62%

FTSE 100 6,630.65 +8.07 +0.12%

CAC 40 4,273 -13.03 -0.30%

DAX 8,859.2 -5.90 -0.07%

Dow -9.89 15,389.76 -0.06%

Nasdaq +5.77 3,920.05 +0.15%

S&P +0.11 1,744.61 +0.01%

-

06:20

Currencies. Daily history for Oct 21'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3676 +0,03%

GBP/USD $1,6143 -0,11%

USD/CHF Chf0,9020 -0,06%

USD/JPY Y98,17 +0,29%

EUR/JPY Y134,27 +0,30%

GBP/JPY Y158,47 +0,17%

AUD/USD $0,9651 +0,26%

NZD/USD $0,8447 -0,37%

USD/CAD C$1,0306 +0,11%

-

06:00

Schedule for today, Tuesday, Oct 22’2013:

02:00 China Leading Index September +0.7%

06:00 Switzerland Trade Balance September 1.85

08:30 United Kingdom PSNB, bln September 11.5

12:30 Canada Retail Sales, m/m August +0.6%

12:30 Canada Retail Sales ex Autos, m/m August +1.0%

12:30 U.S. Average workweek September 34.5 34.5

12:30 U.S. Average hourly earnings September +0.2% +0.2%

12:30 U.S. Unemployment Rate September 7.3% 7.3%

12:30 U.S. Nonfarm Payrolls September 169 179

14:00 U.S. Richmond Fed Manufacturing Index October 0

23:00 Australia Conference Board Australia Leading Index August +0.3%

-