Notícias do Mercado

-

23:45

GBP/USD Price Analysis: Renews one-week high around 1.2500 within bullish channel

- GBP/USD extends Friday’s U-turn from three-week-old rising channel’s support.

- Cable buyers cheer upside break of weekly resistance line, bullish MACD signals.

- Previous support from mid-March, channel’s top line to prod bulls.

- Immediate trend lines highlight 1.2440 as short-term key support ahead of stated channel’s bottom, 200-SMA.

GBP/USD marches to the highest levels in seven days as bulls attack the 1.2500 threshold during Tuesday’s Asian session. In doing so, the Cable pair justifies the late Monday’s upside break of a one-week-old previous resistance line, as well as the bullish MACD signals, while staying within a three-week-long ascending trend channel.

With this, GBP/USD appears all set to extend the latest run-up towards the previous support line from March 15, around 1.2540. However, the aforementioned channel’s top line, close to 1.2560 by the press time, could challenge the pair buyers afterward.

It’s worth noting, however, that the RSI (14) is approaching the overbought territory and hence the GBP/USD pair’s upside past 1.2560 appears difficult.

In a case where the quote rises past 1.2560, the 1.2600 round figure and the May 2022 peak of around 1.2665 will be in the spotlight.

On the flip side, a convergence of the one-week-old previous resistance line and an upward-sloping trend line from Friday, close to 1.2440, puts a floor under the GBP/USD prices.

Following that, the stated channel’s bottom line and the 200-SMA, respectively near 1.2370 and 1.2325, could challenge the Cable bears before giving them control.

Even so, the monthly bottom around 1.2275 can act as an extra filter towards the south.

GBP/USD: Four-hour chart

Trend: Further upside expected

-

23:33

EUR/USD eyes YTD high as US Dollar weakens on lower US Treasury yields

- Mixed manufacturing US economic data and falling US T-bond yields, a tailwind for the EUR/USD.

- Investors have almost entirely priced in a 25 bps rate hike by the Fed, as shown by the CME FedWatch Tool.

- ECB policymakers call for further tightening, considering a 25 or 50 bps hike at the May meeting.

The Euro (EUR) finished Monday’s session positive, as the US Dollar (USD) weakened across the FX board, influenced by lower US Treasury bond yields. Manufacturing activity in the United States (US) showed mixed signs. Wall Street finished with losses as investors brace for next week’s US Federal Reserve Open Market Committee (FOMC) decision. The EUR/USD is trading at 1.1044, about to test the YTD high at around 1.1075.

EUR/USD steady as US economic data disappoints, ECB hints at tightening

As the Asian session begins, the EUR/USD is almost flat. The US economic docket featured the March Chicago Fed National Activity Index (CFNAI), which plummeted to -0.19, above estimates of -20, unchanged from February’s reading. The three-month moving average ticked up to 0.01%, indicating that the economy continues to expand slowly. Later, the April Dallas Fed Manufacturing Business Index slid to -23.4, well below the -11.00 estimated, as the survey showed that perceptions of broader business conditions worsened.

In the meantime, the CME FedWatch Tool foresees a 95.4% chance that the US Federal Reserve will hike rates to the 5.00%-5.25% range the following week.

US Treasury bond yields dropped, a headwind for the greenback, as shown by the US Dollar Index (DXY). The DXY is dropping 0.40%, down at 101.322, bolstering the Euro’s rally past the 1.1040 area.

Across the pond, European Central Bank (ECB) policymakers continued to cross newswires, with most expressing that further tightening is needed due to high inflation pressures. The ECB Governing Council member Isabel Schnabel commented that an increase of 50 bps at the May meeting is not off the table.

Data-wise, Germany’s IFO Business Climate Conditions and Expectations improved compared to March’s figures, spurring a jump in the EUR/USD pair towards the 1.1000 area.

EUR/USD Key Technical Levels

-

23:27

USD/CAD juggles around 1.3540 despite a sell-off in USD Index and a recovery in oil price

- USD/CAD is demonstrating evidence of volatility contraction despite a perpendicular fall in the USD Index.

- The Fed is expected to pause the policy-tightening spell after a 25bp rate hike in May.

- BoC Macklem seems not interested in raising interest rates further as inflation is consistently declining.

The USD/CAD pair is showing signs of volatility contraction around 1.3540 in the early Tokyo session. The Loonie asset has failed to show a power-pack action despite a breakdown move in the US Dollar Index (DXY) and a solid recovery in the oil price.

S&P500 futures ended Monday’s session on a flat-to-positive note after recovering overnight losses, indicating a cautionary approach in the overall positive market mood. Investors have decided to remain on the sidelines till the release of quarterly earnings from giant tech companies. The US Dollar Index (DXY) showed a perpendicular decline after surrendering the crucial support of 101.63.

A sell-off move in the USD Index also weighed on US Treasury yields. The demand for US government bonds rebounded as rising odds of only one more rate hike left by the Federal Reserve (Fed) eased cautious market sentiment. The yields offered on 10-year US Treasury bonds dropped below 3.50%.

Analysts at Wells Fargo see the Federal Open Market Committee (FOMC) raising rates by 25 basis points, on what they believe will most likely be the last rate hike in this tightening cycle. They point out that incoming data indicate that inflationary pressures remain acute. They further added, “We do not think the statement will fully close the door on further rate hikes, given that inflation remains well above target. Rather, the statement likely will include an acknowledgment that further adjustments in rates are possible.

Meanwhile, the Canadian Dollar is facing immense pressure as Bank of Canada (BoC) Governor Tiff Macklem seems not interested in raising interest rates further as inflationary pressures are consistently declining. However, BoC Governor has left room open for more rates if inflation continues to remain persistent.

On the oil front, oil prices showed a decent recovery backed by a sell-off in the USD Index and growing optimism that China’s May Day holiday will increase travel and fuel demand. It is worth noting that Canada is the leading exporter of oil to the United States and higher oil prices will support the Canadian Dollar.

-

23:17

AUD/USD bulls attack 0.6700 amid holiday in Australia, mixed sentiment

- AUD/USD picks up bids to extend late Monday’s recovery amid sluggish session.

- AZNAC holidays in Australia, New Zealand to restrict market moves in Asia-Pacific, especially amid light calendar elsewhere.

- Market sentiment dwindles amid cautious mood ahead of key data/events, geopolitical fears and rate hike concerns.

- US Dollar drops despite flat S&P 500, softer yields amid Fed blackout.

AUD/USD stretches the latest rebound towards poking the 0.6700 round figure as it consolidates the previous weekly loss amid Tuesday’s holidays in Australia and New Zealand, amid a light calendar elsewhere.

The Aussie pair’s recent recovery could be linked to the U-turn in equities during Monday’s American session and downbeat US Treasury bond yields. However, challenges to sentiment and cautious mood ahead of this week’s crucial US and Australia statistics prod the Aussie pair buyers. That said, the pre-Fed blackout seems to help the markets in paring the previous weekly gains of the US Dollar.

US Dollar failed to cheer Friday’s upbeat activity data amid hopes of no more than a 0.25% rate hike and nearness to the policy pivot. Also weighing on the greenback could be the drama surrounding the US debt ceiling, which is scheduled for expiration in June. Additionally weighing the greenback could be the comparatively less hawkish Fed speak, as well as upbeat Wall Street. That said, S&P 500 Futures remained mostly flat on Tuesday.

On the other hand, the Financial Times (FT) came out with the news suggesting that allies resist the US plan to ban all G7 exports to Russia, which in turn supports a mild risk-on mood. On the other hand, Eurozone plans to ban exports from Russia.

Amid these plays, Wall Street benchmarks closed mixed while the US 10-year and two-year Treasury bond yields remain mostly downbeat, around 3.50% and 4.12% respectively.

Moving on, a light calendar and off in Australia can restrict AUD/USD moves ahead of this week’s US Q1 2023 GDP, US Core PCE inflation and Australia inflation data. Above all, next week’s RBA and Fed meeting are crucial for markets to watch for clear directions.

Technical analysis

Unless successfully crossing the 21-DMA hurdle of around 0.6705, the AUD/USD pair is well set to visit an upward-sloping support line from early March, close to 0.6650 at the latest.

-

23:08

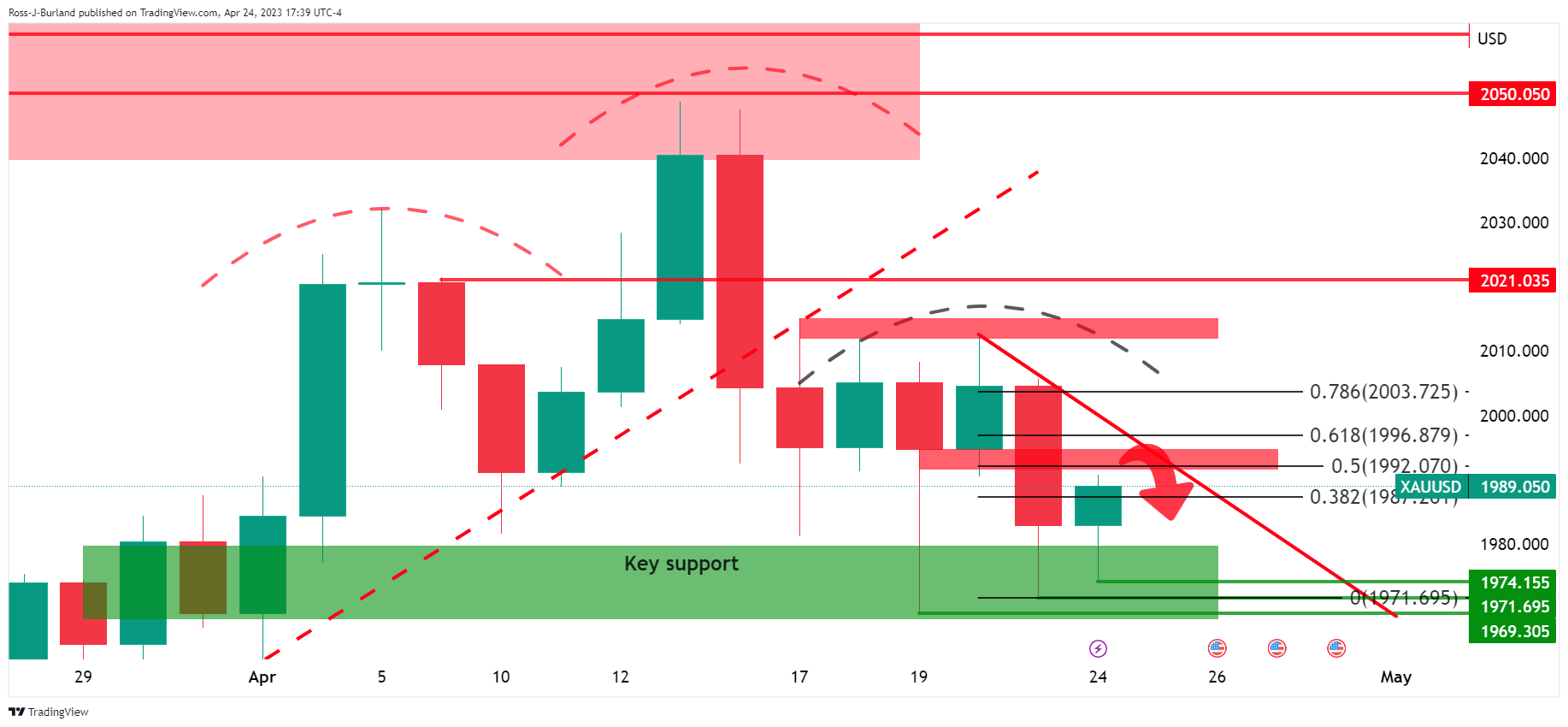

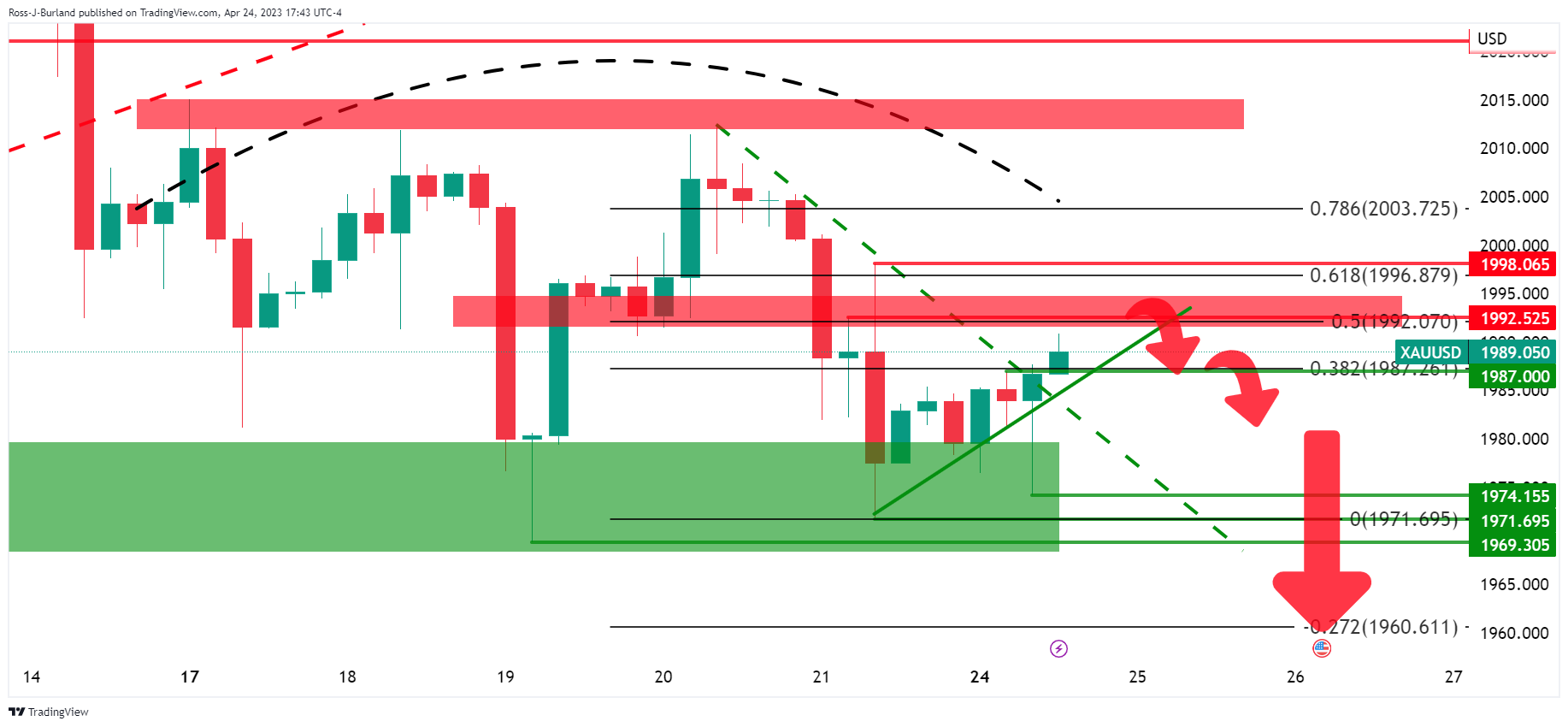

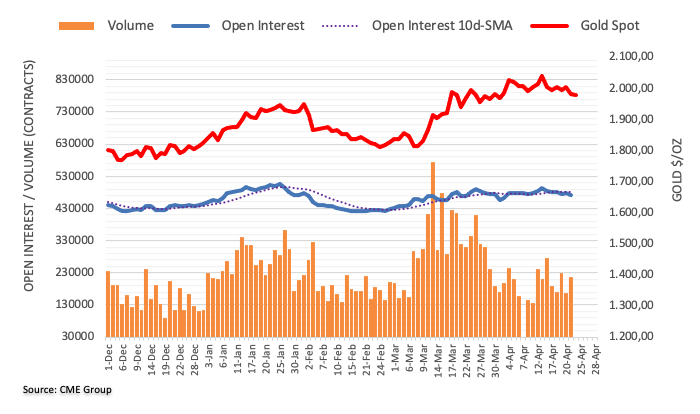

Gold Price Forecast: XAU/USD 50% mean reversion resistance eyed

- Gold price bulls are in the market and there is a scope for a move higher to $2,000.

- If Gold price bears commit, then we could see a 50% mean reversion area hold the fort around $1,992 and a subsequent sell-off from there.

Gold price is robust on Monday as the US Dollar and US Treasury bonds yields fell. Precious metals on Monday recovered from early losses and posted moderate gains. A drop in the US Dollar index printed a 1-week low due to a larger-than-expected increase in the German Apr IFO business climate index and hawkish comments Monday from European Central Bank Governing Council member Pierre Wunsch set off a rally in EUR/USD.

The German Apr IFO business climate index rose +0.4 to a 14-month high of 93.6, stronger than expectations of 93.4. Wunsch said we are "not seeing" inflation going in the right direction yet, and the ECB will only agree to halt interest rate increases once wage growth starts to fall. "We are waiting for wage growth and core inflation to go down, along with headline inflation, before we can arrive at the point where we can pause," the official said.

Meanwhile, the weaker dollar, making the precious metal more affordable for international buyers, offered support. DXY, an index that measures the currency vs. a basket of others was down 0.37/ and fell from a high of 101.9090 to a low of 101.330. Bond yields, bullish for gold since it offers no interest were lower with the US two-year note was paying as low as 4.097% on the day.

Gold technical analysis

That is a daily head and shoulders, a topping pattern forming at the end of the bullish cycle.

Zoomed in, we can see how things could play out.

While below the Fibonacci scale´s 78.6%, the bias is bearish, especially while being on the front side of the trendline resistance.

A deeper look into the right-hand shoulder, on the 4-hour time frame, we can see that the price has broken the micro trendline resistance that would now be expected to act as a counter-trendline. This leaves scope for as move higher into the bearish impulse to target towards $2,000. However, if bears commit, then we could see a 50% mean reversion area hold the fort around $1,992 and a subsequent sell-off from there.

-

22:57

NZD/USD struggles to reclaim 0.6170, upside seems favored amid correction in USD Index

- NZD/USD is facing barricades in extending its rally further, upside remains favored.

- S&P500 settled Monday’s session on a flat note, portraying a cautionary mood.

- Investors have digested the fact that the Fed is going to hike interest rates one more time by 25bps.

The NZD/USD pair is struggling in recapturing the immediate resistance of 0.6170 in the early Asian session. The Kiwi asset displayed a stellar upside move on Monday after delivering a breakout of the consolidation formed in a range of 0.6125-0.6154. A stellar run in the Kiwi asset is being supported by a decline in the US Dollar Index (DXY).

S&P500 settled Monday’s session with nominal gains as investors are anxious ahead of quarterly results from big technology giants such as Google, Meta Platforms, and Microsoft this week. Therefore, investors have underpinned a cautious approach as missed earnings or weaker revenue guidance from these companies could spoil the market mood.

The USD Index displayed a sheer sell-off after a breakdown of the consolidation formed in a 101.64-102.22 range. Investors have digested the fact that the Federal Reserve (Fed) is going to hike interest rates one more time by 25 basis points (bps) as labor market conditions have not softened meaningfully, and economic activities are recovering.

Preliminary United States S&P PMI data released on Friday confirmed a solid economic recovery as Manufacturing PMI landed above 50.0 for the first time in the past few months, indicating an expansion. This solidified the need for further policy-tightening by the Fed.

On the New Zealand Dollar front, investors pumped funds into the antipodean despite easing inflationary pressures in New Zealand. The quarterly Consumer Price Index (CPI) accelerated by 1.2% vs. the consensus of 1.7% and the former release of 1.4%. Annual inflation softened to 6.7% while the street was anticipating a marginal deceleration to 7.1% from the prior release of 7.2%.

It is likely that RBNZ Governor Adrian Orr would consider a pause in the policy-tightening spell as the inflation rate has made an intermediate peak.

-

22:00

Forex Today: US Dollar loses momentum as Treasury yields slide

No economic reports are due during the Asian session on Tuesday. After a quiet beginning of the week, investors will focus on earnings reports while preparing for crucial economic events later in the week, including Australian inflation, US and Eurozone GDP, US Core PCE and the Bank of Japan meeting.

Here is what you need to know on Tuesday, April 25:

On a quiet American session, the US Dollar weakened further as Wall Street indexes rebounded. The Dow Jones gained 0.20%, the S&P 500 rose 0.09% and the Nasdaq lost 0.29%. US bond yields dropped with the 10-year falling to 3.50% and the 2-year to 4.12%. Volatility in the US Treasury market is set to remain elevated amid the debt-ceiling drama and key data and events ahead. The divergence across the curve shows that the difference between the one-month and the three-month bill yields it at record highs.

Tuesday will be a busy day with earnings from Microsoft, Alphabet, Visa, PepsiCo, Novartis, McDonald's, UPS, Verizon, Texas Instruments, General Electric, UBS, Halliburton and Spotify. Economic data due from the US include the S&P/Case-Shiller Home Price and New Home Sales. The focus is on Thursday's GDP reading which includes key consumer inflation numbers. Next week is the FOMC meeting. The Federal Reserve (Fed) is expected to raise rates by 25 basis points and signal a pause.

The US Dollar Index fell to 101.35 reaching weekly lows. It is pointing south, looking vulnerable. USD/CHF posted the lowest daily close since January 2021, below 0.8900.

EUR/USD rose to the 1.1050 zone, approaching year-to-date highs supported by hawkish comments from European Central Bank (ECB) officials ahead of the May 4 meeting.

GBP/USD benefited from a weaker Dollar approaching 1.2500. The trend is up. The UK will inform Public Sector Net Borrowing on Tuesday. EUR/GBP rose for the third day, boosted by higher Eurozone bond yields and is near April highs.

USD/JPY finished a quiet Monday higher but far from the highs and trending lower, below 134.30. The pair remains sensitive to US yields. On Friday, the Bank of Japan will announce its monetary policy decision on Ueda's first meeting as governor.

AUD/USD rebounded after hitting weekly lows at 0.6665 and climbed toward 0.6700. Australia will report inflation on Wednesday and next week it's the Reserve Bank of Australia meeting.

The Kiwi outperformed among commodity currencies. NZD/USD recovered from monthly lows, rising above 0.6150 and AUD/NZD pulled back further to the 1.0850 area.

USD/CAD finished flat at 1.3540. The rally is facing strong resistance at 1.3565 and a correction seems likely.

Gold rose modestly after holding above last week's lows, and reached $1,990$. Silver retook $25.00 after bottoming at $24.75.

Cryptocurrencies performed mixed. Bitcoin gave signs of reaching an interim bottom after rebounding from monthly lows below $27,000 to $27,500. An improvement in market sentiment helped crude oil prices. WTI rose 1%, moving closer to $80.00.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:58

USD/JPY Price Analysis: Clustered market, front side of bull trend but bears engaged

- USD/JPY bulls need to show up ion the front side of the trendline.

- Bears target a break of structures, 133.50 and then 133.20.

U/SD/JPY is up on the day, higher by some 0.13% after popping from a low of 133.89 and rising to 134.73 so far. The bulls have been guarding the trendline support and territories above 133.50.

The following illustrates the bullish bias along the trendline and prospects of a move higher for the forthcoming week:

The 4-hour price action is seeing a test of potential support across the 134s. However, so long as the trendline holds up, the bias is bullish above the 133.50s. The greyed area is an area of price imbalance in the market that could otherwise be mitigated should the bears take back control. Below there, 133.20, the bias will flip firmly bearish.

-

20:55

NZD/USD Price Analysis: Bulls breaking structures left, right and center

- NZD/USD bulls are on the front side of the micro bull trend.

- NZD/USD bulls are moving in and eye a run to the 0.6180s.

NZD/USD has rallied at the start of the week on a softer US Dollar. The pair is 0.45% higher and has rallied from a low of 0.6125 to a high of 0.6166 so far.

The bulls have accumulated the market down low near 0.6120 and the price has subsequently burst through the prior channel´s highs at 0.6161 as the following illustrates:

Zooming in, we can see that the price moved beyond a prior cluster of support but has hit a brick wall just above it at the next layer of old support in the 0.6160s. A pullback into the trendline support is a possibility where buying interest could emerge again somewhere within the Fibonacci scale, in and around trendline support.

-

20:37

USD/CHF Price Analysis: Tumbles further below 0.8900, with sellers eyeing the YTD low

- USD/CHF drops almost 0.50% on Monday on a weak US Dollar.

- USD/CHF: Is a falling-wedge pattern setting the stage for a reversal?

The USD/CHF continues its downward trajectory, extending its losses after last Friday’s doji, suggesting that a bottom was reached at 0.8907. Nevertheless, late in the New York session, the USD/CHF pair is trading at 0.8879, below its opening price by 0.46%, after hitting a high of 0.8928.

USD/CHF Price Action

Even though last week’s high pierced the 0.9000 figure, and buyers could not decisively crack the latter and test the 20-day Exponential Moving Average (EMA), it cemented that the USD/CHF is bearishly biased. However, it appears that a falling wedge, preceded by a downtrend, is forming, which sometimes can act as a reversal pattern. That suggests that the USD/CHF could be poised for an upward correction before falling past the actual YTD low at 0.8859.

If the USD/CHF breaks above the falling-wedge top trendline, the pair could rally initially, towards the measured objective, at around the 100-day EMA at 0.9240. But on the USD/CHF’s way up, buyers need to reclaim key resistance levels. First, the 0.9000 figure, followed by the April 10 high at 0.9120. A breach of the latter will expose the 0.9200 figure.

Conversely, a continuation past the YTD low of 0.8859 is on the cards, based on the Relative Strength Index (RSI) staying at bearish territory, followed by the Rate of Change (RoC) of three periods, indicating a fall of -1.04 in USD/CHF prices.

USD/CHF Daily Chart

-

19:52

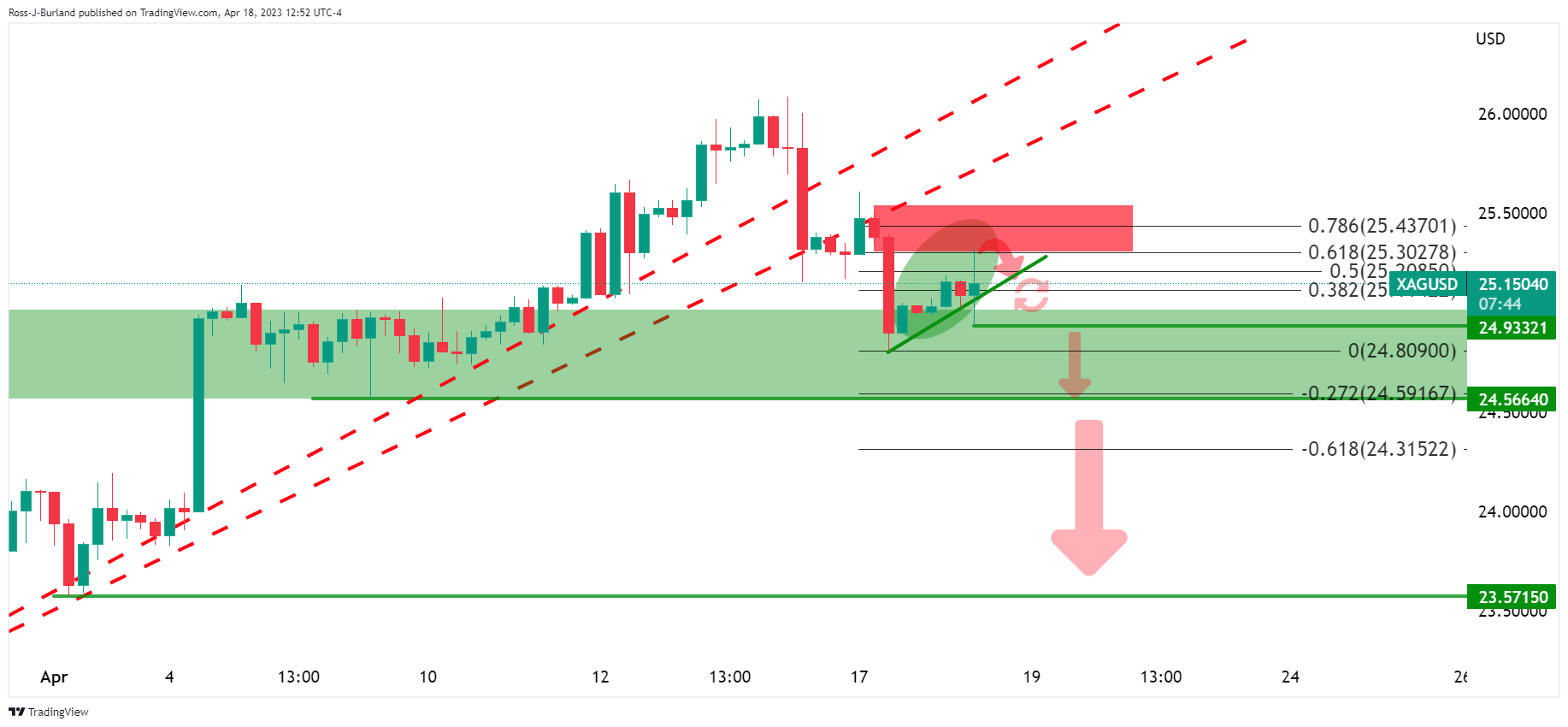

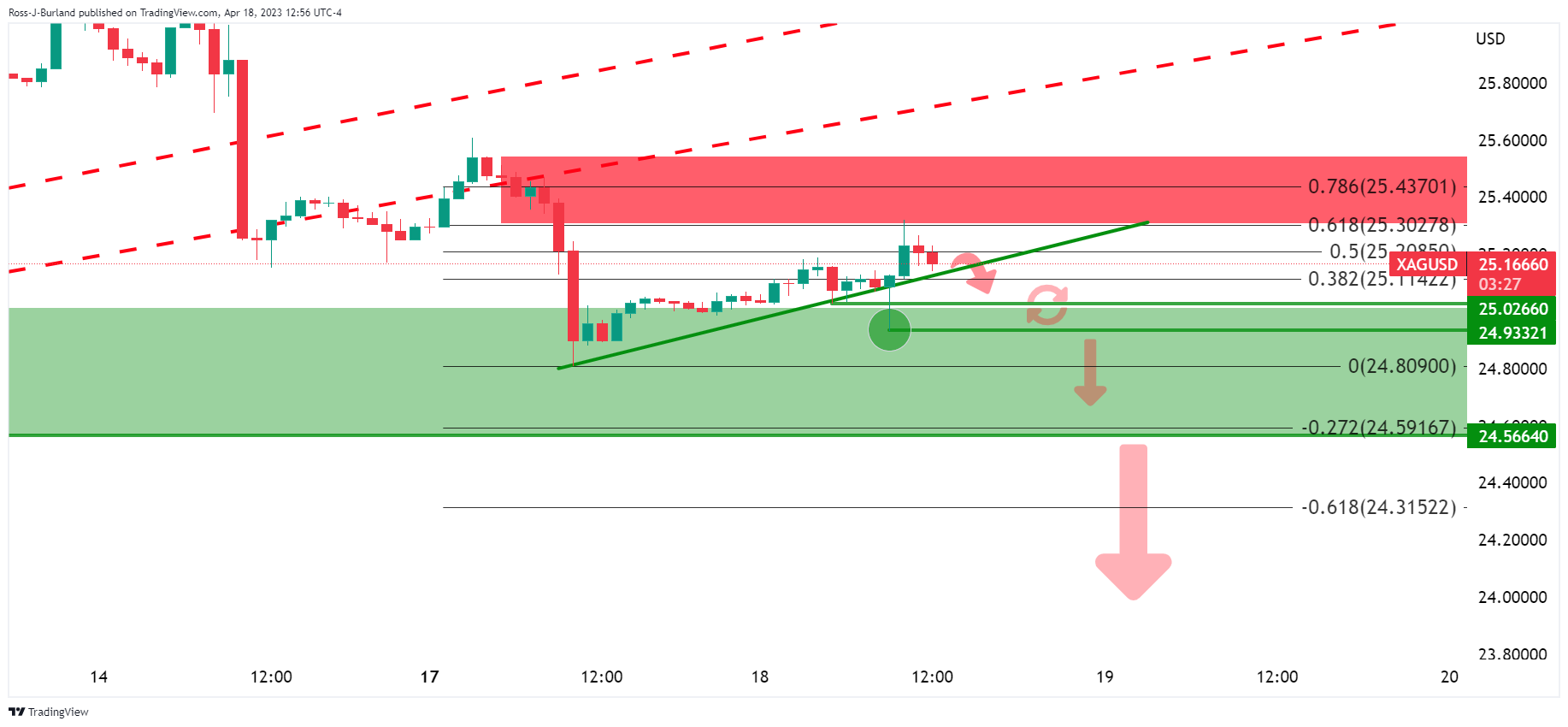

Silver Price Analysis: Bulls take back control within channel

- Silver is higher and bulls are taking over control within the channel.

- A breakout of structure is occurring, bid above $25.00.

As per the prior analysis, Silver Price Analysis: US Dollar´s bearish correction could still support, but bears are moving in, a downside bias was forecasted while being on the backside of the bearish trend:

Silver, prior analysis

Zooming in:

Silver had corrected into a 61.8% Fibonacci area and was being rejected toward trendline support. However, the confirming break-of-structure-point was not until $24.9332 to confirm the downside bias.

Silver H1 chart, prior analysis

Silver, live updates

The telegraphed move came eventually. However:

The price moved right back into the shorts and has traded within a channel. A current break in the structure to the upside is unfolding and there are prospects of a move to the upside again as illustrated above.

-

19:18

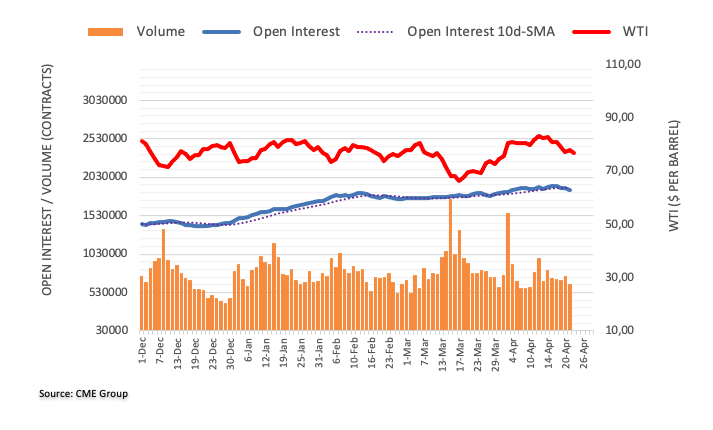

WTI crude oil prices rise more than 1% on growing optimism in China market

- WTI increased due to optimism for higher fuel demand during China’s holiday travel season.

- OPEC+ producer group’s planned supply cuts may tighten the oil market.

- WTI Price Analysis: Neutral to downward bias remains as oil dips below crucial EMAs.

In the mid-Monday North American session, WTI crude oil prices continued to climb, trading at $78.78 per barrel, marking a gain of 1.13%. The price has pierced the 20 and 50-day Exponential Moving Averages (EMAs), indicating bullish momentum, with buyers now setting their sights on the $80.00 per barrel mark.

Growing optimism that China’s May Day holiday will increase travel and fuel demand boosted the market. Booking for overseas trips for the May Day holiday continued to recover, but numbers remain far from reaching pre-Covid levels. Although oil prices jumped, the uneven economic recovery in China from the Covid-19 pandemic keeps oil prices fluctuating.

In addition to the anticipated boost in demand from China’s holiday season, OPEC+ production cuts have also contributed to the rise of WTI crude oil prices. The group plans to continue shrinking output as they meet again in May 2023.

Another factor underpinning WTI’s rise is that Iraq’s northern oil exports are showing few signs of restarting after a month of standstill, as an agreement between Baghdad and the Kurdistan Regional Government (KRG) has not yet been fully resolved, according to four sources.

WTI Technical Analysis

WTI remains neutral to downward biased after falling below the 200-day Exponential Moving Average (EMA). The recent dip below $80.00 a barrel exacerbated a drop beneath the crucial EMAs, at around the $77.29-$78.44 area. But, overall US Dollar (USD) weakness, China’s holiday lifted oil prices higher. Upside risks lie at $80.00, followed by the 200-day EMA at $81.75. Conversely, it could extend its losses beneath the 50-day EMA at $77.29.

-

19:07

GBP/USD rallies on soft US Dollar, eyes on 1.2500

- GBP/USD pops higher as the US Dollar comes under pressure.

- US debt ceiling risks and Treasury yields falling are weighing on the greenback.

GBP/USD is 0.29% higher on the day after rallying from a low of 1.2410 and reaching a high of 1.2478. The US Dollar has been sold off as US yields sink at the start of the week.

The US Dollar, as measured by the DXY index, has fallen from a high of 101.909 and has reached a low of 101.369 in recent trade. US Treasury yields are down, with the 2-year losing 1.12% and the 10-year down 1.7%. Further in, the yield of the 1-month Treasury, which started the month near 4.7%, fell to 3.30% as investors appeared to grow increasingly concerned about a potential standoff over the US debt ceiling.

The House of Representatives is expected to vote on a Republican-led debt and spending bill this week. Additionally, until rate cuts this year are finally priced out, the US Dollar is likely to remain vulnerable. Also, a closely watched part of the US Treasury yield curve measuring the gap between yields on two- and 10-year Treasury notes, seen as an indicator of economic expectations, was at -62.9 basis points.

All eyes on the US data ahead of the FOMC

Meanwhile, we have entered the quiet period for the Fed ahead of the May 2-3 Federal Open Market Commmittee meeting and all eyes are on the data between now and then. ´´Recent resilience in the US economy helped push US Treasury yields higher and we look for that process to continue,´´ analysts at Brown Brothers Harriman explained. ´´If so, the dollar should continue to gain as well,´´ they said.

In the data at the start of the week, the Chicago Fed National Activity Index fell 0.19 in March, beating market expectations for a 0.20 decline. The April reading of the Dallas Fed Manufacturing Index, however, was -23.4, way worse than the -12.0 economists were predicting, down from -15.7 in March.

´´The continued resilience in the economy is noteworthy and suggests the Fed still has a lot more work to do in getting to the desired sub-trend growth,´´ analysts at Brown Brothers Harriman said.

Between now and next Wednesday’s Fed decision, we will have the first quarter Gross Domestic Product this week and then Personal Consumption Expenditure. The following week, ISM manufacturing PMI, then next Tuesday brings JOLTS data and next Wednesday brings ADP private sector jobs. The Nonfarm Payrolls will come after the Fed.

´´ To us, a hike next week is a done deal,´´ the analysts at BBH said. ´´There are about 15% odds of another 25 bp hike in June. At this point, a pause in June might just be the most likely outcome but it really will depend on how all that data come in. After all that, one cut is still priced in by year-end vs. two at the start of last week. In that regard, Powell has said that Fed officials “just don’t see” any rate cuts this year. We concur.´´

GBP/SD technical analysis

GBP/USD bulls are in the market, eyeing a run to test 1.2500 within the breakout of the inverse head and shoulders pattern on the 4-hour chart.

-

18:10

USD/MXN falls below 18.0000 as Mexican inflation cools amid a soft US Dollar

- USD/MXN reached a daily high above 18.0000 before tumbling toward the 17.90s area.

- Fed’s Cook expects inflation to slow down as measured by headline inflation, but core PCE is foreseen to stay sticky.

- USD/MXN Price AnalysisL Downward pressured below 18.00; otherwise, expect upside towards the 20-day EMA.

The USD/MXN loses its appeal and drops below 18.0000, even though buyers eyed higher ceilings at around the 20-day EMA. A risk-off impulse keeps the emerging market currency fluctuating, although the US Dollar (USD) weakened. At the time of writing, the USD/MXN is exchanging hands at 17.9762.

USD/MXN seesaws as sentiment fluctuated: while US and Mexican central bank divergence could weigh on the MXN

After bottoming around the 17.9000 area in the last week, the USD/MXN pierced the 18.00 area before retracing and turning negative on Monday. That after the latest round of mixed US economic data and Mexican inflation slowing in the first half of April suggested that central bank divergence could weigh on the MXN.

Last Friday, the US Federal Reserve Governor, Lisa Cook, expressed that monetary policy is entering an uncertain phase and suggested that headwinds from the banking sector could impact the outlook for rising interest rates. She also anticipates a deceleration in March PCE inflation, though she added that core inflation remains sticky.

The agenda of US economic releases featured the March Chicago Fed National Activity Index (CFNAI), with figures plummeting to -0.19, above estimates of -20, unchanged from February’s reading. Despite the previously mentioned, the three-month moving average ticked up to 0.01%, signaling that the US economy continues to grow slower.

Of late, the Dallas Fed Manufacturing Business Index in April plummeted to -23.4, well below the -11.00 estimated, as the survey showed that perceptions of broader business conditions worsened, according to the poll.

On the Mexican front, annual headline inflation rose 6.24% through mid-April, its lowest level since October 2021. Core inflation stood at 7.75% for the same period. Even though the Bank of Mexico’s (Banxico) target is 3%, expectations that the central bank completed its tightening cycle have arisen.

Aside from this, investors’ odds that the Federal Reserve will hike rates by 25 bps are at 90%, according to the CME FedWatch Tool. However, traders estimate that the US central bank “could” cut rates by the September meeting, followed by another one in December.

USD/MXN Technical Analysis

The USD/MXN continues to track the 20-day EMA as its dynamic resistance for the latest couple of weeks. Although the USD/MXN printed a daily high at around 18.0480 shies of testing 18.0500, it retreated back below the 18.00 mark as it headed for testing the YTD lows at 17.8968. Downside risks emerged below 18.0000, with key support levels at 17.9142, before the abovementioned YTD low. Conversely, buyers reclaiming 18.0000 will pave the way for the USD/MXN to test the 20-day EMA at around 18.1200 before rallying to the 50-day EMA at 18.3310.

-

17:12

AUD/USD holds below 0.6700, at weekly lows

- US Dollar mixed on a relatively quiet Monday.

- Key events ahead: Australia CPI on Wednesday and US Q1 GDP on Thursday.

- AUD/USD weakens, but losses are limited on low volume.

The AUD/USD is falling on Monday for the second day in a row, consolidating below 0.6700. In a quiet session, the US Dollar is mixed and equity prices in Wall Street are falling modestly.

Sideways, looking south

Data released on Monday showed the important Chicago Fed National Activity Index remained unchanged in March at -0.19, and the Dallas Fed Manufacturing Index came in at -23.4 well below the -15.7 of market consensus. The numbers had no significant impact on subdued markets. US yields are falling modestly weighing on the Greenback.

The key event in the US will be on Thursday with growth numbers from the first quarter. No Federal Reserve officials will speak this week ahead of the FOMC May 2-3 meeting.

In Australia, the critical report will be on Wednesday, with Q1 and March Consumer Price Index, the last crucial report ahead of next week’s Reserve Bank of Australia (RBA) meeting. At the moment, the odds favor a new pause from the RBA.

Short-term outlook

Technically the outlook for the Aussie has worsened after the AUD/USD dropped below the 20-day Simple Moving Average (SMA). The pair bottomed on Monday at 0.6665 and then rebounded modestly. The key support is the 0.6630 area, ahead of the March low at 0.6618. A recovery above 0.6700 should strengthen the Aussie, with the next resistance at 0.6740.

Technical levels

-

16:30

Gold Price Forecast: XAU/USD trading flat, poised for potential gains amid light US economic agenda

- Fed Cook: Monetary policy enters uncertain phase, though expect PCE to slow down

- The Chicago Fed National Activity Index improved, but the Dallas Fed manufacturing index deteriorated.

- XAU/USD Price Analysis: Likely to remain sideways, between the 20 and 50-day EMAs.

Gold price is trading sideways amidst the lack of a catalyst during Monday’s North American session, though likely to remain underpinned by US Dollar (USD) weakness and falling US Treasury bond yields. A risk-on impulse keeps the greenback pressured during a week of a light US economic agenda. At the time of writing, the XAU/USD is trading at $1983.50, almost flat.

Gold traders eye uncertain Fed policy as US bond yields tumble

US stocks fluctuate between gainers and losers as the week begins. With US Federal Reserve (Fed) officials getting into the blackout period, Gold traders are leaning to last Friday’s Lisa Cook, Fed Governor words. She said that monetary policy is moving into an uncertain phase and added that banking sector headwinds could weigh on the rate-rising outlook. Cook expects March PCE inflation to decelerate and refrained from asserting the same to core PCE.

US Treasury bond yields, across the board, continue to tumble, a headwind for the greenback. The US Dollar Index (DXY), a measure of the buck’s value against a basket of peers, lost traction, sliding 0.22%, and was last seen at 101.507, a tailwind for XAU/USD.

Expectations of the US Federal Reserve hiking rates by 25 bps in the next week lie at 90%, as shown by the CME FedWatch Tool. Nevertheless, traders estimate that the US central bank “could” cut rates by the September meeting, followed by another one in December.

Over the weekend, reports via the Financial Times reported that central bankers are buying gold, spurred by increased geopolitical tensions, as the World Gould Council said. The reports showed that central banks increased by 152% YoY in 2022.

Data-wise, the US economic docket featured the Chicago Fed National Activity Index (CFNAI) for March, which plunged to -0.19, above estimates of -20, unchanged from February’s reading. The three-month moving average ticked up to 0.01%, which jumped from -0.09 in February, a sign that the economy continues to expand at a slower pace.

Of late, the Dallas Fed Manufacturing Business Index in April plummeted to -23.4, well below the -11.00 estimated, as the survey showed that perceptions of broader business conditions worsened, according to the poll. The rate of change of orders and shipments improved, but both readings remained in negative territory.

XAU/USD Technical Analysis

From a technical perspective, XAU/USD is wavering around the 20-day Exponential Moving Average (EMA) at $1987.64, suggesting that the Gold price will likely remain sideways. On the downside, risks lie at $1950 before dropping and testing the 50-day EMA at $1946.45. A breach of the latter will expose the $1900 figure, ahead of the 100-day EMA at $1897.58. Conversely, upside risks are at the 20-day EMA, followed by the $2000 mark.

-

15:58

Fed likely to signal May’s hike may be the last one – Wells Fargo

Next week, the Federal Reserve will decide on monetary policy. In line with market consensus, analysts at Wells Fargo see the FOMC raising rates by 25 basis points, on what they believe will most likely be the last rate hike in this tightening cycle. They point out that incoming data indicate that inflationary pressures remain acute.

Key quotes:

“We expect the FOMC to raise the target range for the fed funds rate by 25 bps on May 3, bringing it up to 5.00%-5.25% from 0.00%-0.25% only 14 months ago. We also anticipate that the Committee will continue quantitative tightening (QT) at its current pace.”

“We believe the statement and press conference likely will signal that May's hike may very well be the last of this tightening cycle. In March, the so-called "dot plot" showed that 11 of the Committee's 18 participants viewed a fed funds rate of 5.00%-5.25% or lower at year-end 2023 as the most likely outcome, a view that has not seemed to have been swayed by the latest data.”

“If most officials see the May meeting as likely to be the final hike this cycle, then we would expect the statement to no longer include the phrase that "some additional policy firming may be appropriate."

“We do not think the statement will fully close the door on further rate hikes, given that inflation remains well above target. Rather, the statement likely will include an acknowledgement that further adjustments in rates are possible. The outlook will be based on the Committee's assessment of cumulative tightening of monetary policy, the lags of policy on economic activity and inflation, and economic and financial developments.”

-

15:30

United States Dallas Fed Manufacturing Business Index came in at -23.4 below forecasts (-14.6) in April

-

14:54

USD/JPY climbs to fresh daily high, further beyond mid-134.00s despite weaker USD

- USD/JPY gains strong positive traction in reaction to dovish remarks by BoJ’s Ueda.

- Sliding US bond yields continues to weigh on the USD and might act as a headwind.

- The cautious market mood could benefit the JPY and contribute to capping the pair.

The USD/JPY pair kicks off the new week on a positive note and builds on its steady intraday ascent through the early North American session. The momentum lifts spot prices to a fresh daily high, around the 134.70-134.75 region in the last hour and is sponsored by the heavily offered tone surrounding the Japanese Yen (JPY).

The Bank of Japan (BoJ) Kazuo Ueda sounded dovish this Monday and said that the central bank must maintain monetary easing as trend inflation is still below 2%. Ueda added that inflation forecasts must be quite strong and close to 2% in the coming year to consider tweaking yield curve control. This marks a big divergence in comparison to the recent hawkish remarks by several Federal Reserve (Fed) officials, indicating that the US central bank will continue raising interest rates, and turns out to be a key factor pushing the USD/JPY pair higher.

Meanwhile, the prospects for further policy tightening by the Fed fuel worries about economic headwinds stemming from rising borrowing costs and boosting demand for traditional safe-haven assets. This leads to a further decline in the US Treasury bond yields, which drags the US Dollar (USD) to a one-week low and might hold back traders from placing aggressive bullish bets around the USD/JPY pair. Apart from this, the global flight to safety could benefit the JPY and further contribute to capping the upside for the major, at least for the time being.

Traders might also prefer to wait on the sidelines ahead of this week's important US macro releases, starting with the Conference Board's Consumer Confidence Index on Tuesday. This will be followed by the US Durable Goods Orders data on Wednesday, the Advance Q1 GDP prints on Thursday and the US Core PCE Price Index - the Fed's preferred inflation gauge on Friday. Apart from this, traders will take cues from the highly-anticipated BoJ monetary policy meeting on the last day of the week should determine the near-term trajectory for the USD/JPY pair.

Technical levels to watch

-

14:51

EUR/USD in multi-day highs past 1.1000 as European markets draw to a close

- EUR/USD climbs to multi-session peaks near 1.1030.

- Germany’s Business Climate surprised to the downside in April.

- US Chicago Fed Index held steady in March.

EUR/USD manages to reverse the initial pessimism and advances to fresh peaks past the psychological 1.1000 the figure in an auspicious beginning of the week.

EUR/USD stronger on USD-selling

EUR/USD clinches the third consecutive daily gain on the back of the continuation of the downward bias in the dollar and the generalized upbeat sentiment in the global markets.

Furthermore, the underlying uptrend that prevails in spot since mid-March remains propped up by expectations of further tightening by the ECB at its upcoming meetings. On this, a 25 bps rate hike appears already largely priced in in May, while speculation of extra raises at the June and July gatherings also remains on the rise.

In the data universe, Germany’s Business Climate tracked by the IFO institute came in below consensus despite improving marginally to 93.6 for the month of April. In the US, the Chicago Fed National Activity Index disappointed expectations after remaining unchanged at -0.19 in March. Later in the session, the Dallas Fed Manufacturing Index will close the daily docket.

What to look for around EUR

EUR/USD picks up pace and manages to clear the key hurdle at the 1.1000 yardstick at the beginning of the week.

Meanwhile, price action around the single currency should continue to closely follow dollar dynamics, as well as the incipient Fed-ECB divergence when it comes to the banks’ intentions regarding the potential next moves in interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Germany IFO Business Climate (Monday) – Germany GfK Consumer Confidence (Wednesday) – EMU Final Consumer Confidence, Economic Sentiment (Thursday) – Euro group Meeting, Germany labour market report/ Advanced Inflation Rate/Flash Q1 GDP Growth Rate, EMU Flash Q1 GDP Growth Rate (Friday).

Eminent issues on the back boiler: Continuation (or not) of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.29% at 1.1020 and a break above 1.1031 (weekly high April 24) would target 1.1075 (2023 high April 14) en route to 1.1184 (weekly high March 21 2022). On the downside, initial contention emerges at 1.0831 (monthly low April 10) seconded by 1.0788 (monthly low April 3) and finally 1.0766 (55-day SMA).

-

14:20

GBP/USD sticks to modest intraday gains around mid-1.2400s, lacks follow-through

- GBP/USD regains some positive traction on Monday amid the emergence of fresh USD selling.

- A further decline in the US Treasury bond yields is seen as a key factor weighing on the buck.

- Bets for more Fed rate hikes, a weaker risk tone could limit the USD losses and cap the major.

The GBP/USD pair attracts some dip-buying in the vicinity of the 1.2400 mark on Monday and touches a fresh daily high during the early North American session. The pair is currently placed around the 1.2450 region, up nearly 0.20% for the day, though the intraday uptick lacks bullish conviction.

The US Dollar (USD) remains under some selling pressure for the third successive day and drops to a one-week low amid the ongoing downfall in the US Treasury bond yields. This, in turn, is seen as a key factor lending some support to the GBP/USD pair amid rising bets for an additional interest rate hike by the Bank of England (BoE) in May. In fact, the markets now see over a 90% chance of a 25-bps rate hike in May. The bets were lifted by last week's release of stronger UK wage growth data and the stubbornly high inflation figures.

The Federal Reserve (Fed), meanwhile, is also expected to continue raising interest rates to curb inflation. Moreover, the markets have fully priced in a 25 bps lift-off at the next FOMC policy meeting in May and the Fed funds future indicates another rate hike in June. The expectations were reaffirmed by the recent hawkish comments by several Fed officials and the incoming positive US macro data, which suggested that the world's largest economy remained resilient and supports prospects for further policy tightening by the US central bank.

In the absence of any relevant market-moving economic releases on Monday, the aforementioned mixed fundamental backdrop might hold back traders from placing aggressive bullish bets around the GBP/USD pair. Traders also seem reluctant ahead of this week's important US macro data, starting with the Conference Board's Consumer Confidence Index on Tuesday. This will be followed by the US Durable Goods Orders, the Advance US Q1 GDP print and the Core US PCE Price Index on Wednesday, Thursday and Friday, respectively.

Technical levels to watch

-

14:00

Belgium Leading Indicator declined to -7.8 in April from previous -7.6

-

13:38

US: Chicago Fed National Activity Index unchanged at -0.19 in March vs. -0.02 expected

- Chicago Fed National Activity Index was unchanged at -0.19 in March.

- The US Dollar Index remains in negative territory, around 101.60 after the data.

The Federal Reserve Bank of Chicago's National Activity Index (CFNAI) was unchanged at -0.19 in March. This reading came in weaker than the market expectation of -0.02.

“Three of the four broad categories of indicators used to construct the index made negative contributions in March, and two categories deteriorated from February. The index’s three-month moving average, CFNAI-MA3, increased to +0.01 in March from –0.09 in February,” the Chicago Fed noted in its publication.

“The CFNAI Diffusion Index, which is also a three-month moving average, edged up to +0.14 in March from +0.10 in February. Forty-three of the 85 individual indicators made positive contributions to the CFNAI in March, while 42 made negative contributions. Forty-five indicators improved from February to March, while 40 indicators deteriorated. Of the indicators that improved, 13 made negative contributions.”

Market reaction

The US Dollar is trading mixed on Monday. The DXY is falling by 0.08%, as EUR/USD trades above 1.1000. The pair continued to move around 1.1005/10 after the report.

-

13:32

USD/CAD eases from monthly peak amid softer USD, up a little around mid-1.3500s

- USD/CAD touches a fresh monthly high on Monday, albeit lacks follow-through.

- A modest recovery in Oil prices underpins the Loonie and acts as a headwind.

- Sliding US bond yields weigh on the USD and collaborate to capping the upside.

The USD/CAD pair eases from a fresh monthly peak touched earlier this Monday and trades around the 1.3550 area, up less than 0.10% for the day heading into the North American session.

Crude Oil prices bounce off the monthly low amid the prospect of tighter supplies on OPEC+ supply cuts, which, in turn, is seen underpinning the commodity-linked Loonie. The US Dollar (USD), on the other hand, is weighed down by a further decline in the US Treasury bond yields and acts as a headwind for the USD/CAD pair. That said, a combination of factors continues to lend some support to the major and supports prospects for an extension of the recent recovery move from the 1.3300 mark, or a two-month low touched on April 14.

The upside for the black liquid seems limited amid concerns that rising borrowing costs will hamper global economic growth and dent fuel demand. Furthermore, growing acceptance that the Federal Reserve (Fed) will continue raising interest rates to curb inflation, along with a generally weaker risk tone, should lend some support to the safe-haven Greenback. This, in turn, warrants some caution for bearish traders and before positioning for any meaningful corrective pullback in the absence of any relevant market-moving data.

In fact, the markets have fully priced in a 25 bps lift-off at the next FOMC policy meeting in May and the Fed funds future indicates a smaller chance of another rate hike in June. The bets were lifted by the recent hawkish remarks by several Fed officials and the incoming positive US macro data, which suggested that the world's largest economy remained resilient. This, in turn, favours the USD bulls. Traders, however, might refrain from placing aggressive bets and prefer to wait for this week's important US economic releases.

A rather busy week kicks off with the release of the Conference Board's US Consumer Confidence Index on Tuesday, followed by the US Durable Goods Orders data on Wednesday. The focus, however, will remain glued to the release of the US Q1 GDP report on Thursday and the US Core PCE Price Index - the Fed's preferred inflation gauge - on Friday. This will play a key role in influencing the USD demand, which, along with Oil price dynamics, should assist investors to determine the near-term trajectory for the USD/CAD pair.

Technical levels to watch

-

13:32

Canada New Housing Price Index (YoY) dipped from previous 1.4% to 0.2% in March

-

13:31

Canada New Housing Price Index (MoM) above expectations (-0.2%) in March: Actual (0%)

-

13:30

United States Chicago Fed National Activity Index registered at -0.19, below expectations (-0.02) in March

-

13:24

EUR/USD Price Analysis: Extra gains target the 1.1080 region

- EUR/USD reclaims the area beyond the 1.1000 yardstick on Monday.

- Extra upside appears on the cards with the target at the YTD top.

EUR/USD extends the bullish mood north of the key 1.1000 barrier at the beginning of the week.

The pair looks poised to extend the recovery further in the near term at least. That said, the immediate hurdle is expected at the 2023 high at 1.1075 (April 14) seconded by the round level at 1.1100.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0395.

EUR/USD daily chart

-

13:00

Mexico 1st half-month Inflation came in at -0.16% below forecasts (-0.12%) in April

-

13:00

Mexico 1st half-month Core Inflation below expectations (0.22%) in April: Actual (0.18%)

-

12:17

Bundesbank: German economy did better in Q1 of 2023 than expected

"The German economy did better in the first quarter of 2023 than expected a month ago and activity is likely to have picked up again somewhat," Germany's Bundesbank said in its monthly report published on Monday.

"Industry recovered more strongly than expected," the Bundesbank further noted and added that high employment in Germany should keep supporting consumer activity.

In its publication, however, the German central bank also acknowledged that the outlook was still mixed with inflation still weighing on consumption.

Market reaction

EUR/USD clings to modest daily gains a few pips above 1.1000 on Monday.

-

12:16

USD Index Price Analysis: Further range bound ahead of potential losses?

- DXY navigates within the recent side-lined trading below 102.00.

- Further losses could put the 2023 low back on the radar.

DXY extends the move higher and revisits the mid-101.00s following an earlier failed attempt to retake the 102.00 yardstick on Monday.

The recent choppy performance in the index seems to have now refocused back on the downside. Against that, DXY could cling to this consolidative theme ahead of a probable drop to the so far 2023 lows near 100.80 (April 14) ahead of the psychological support at the 100.00 mark.

Looking at the broader picture, while below the 200-day SMA, today at 106.18, the outlook for the index is expected to remain negative.

DXY daily chart

-

12:10

ECB tightening expectations have picked up a bit – BBH

Economists at BBH note that European Central Bank (ECB) officials stressed that increased volatility in inflation and growth are making policymaking more difficult.

Another 25 bp hike is priced in for June 15

"Panetta focused on geopolitics and the Ukraine invasion, noting “Geopolitical shocks may trigger persistent output and inflation volatility, with multiple spillovers. Russia’s aggression against Ukraine has, for instance, disrupted energy and commodities markets, with major implications for inflation.” Elsewhere, Villeroy focused on climate change, noting “Climate transition entails structural changes to the global economy that are both universal and certain, with an overall and possibly negative supply shock. Second, higher volatility is likely, which means shocks on both activity and inflation. This is where we central banks have to do our job in order to maintain a solid anchoring of long-term inflation expectations despite higher volatility. We cannot just look through it, since it is not an unexpected and transitory shock” Both are correct to highlight these long-term issues."

"ECB tightening expectations have picked up a bit. The next policy meeting is May 4 and WIRP suggests about 30% odds of a 50 bp hike then. After that, another 25 bp hike is priced in for June 15 followed by another 25 bp hike July 27. Odds of one final hike in in September or October top out near 45% and so the peak policy rate is now seen between 3.75-4.0%%, up from3.75% at the start of last week and 3.50% at the start of the week before that."

-

12:07

There is additional room for Gold price to drop further – TDS

Analysts at TD Securities note that Gold price dropped below $1,980/oz after the preliminary US Services PMI printed a much stronger-than-expected 53.7 for April.

Strong data suggests more gold downside

"This forced rates up across the curve, which drove the US Dollar sharply higher. It seems we are seeing USD shorts being covered, after specs increased positions amid expectations of a Fed dovish pivot. Similarly, in the gold market, money mangers are also likely increasing recently reduced shorts and are cutting acquired longs."

"With the PMI and potentially other economic data pointing to continued economic strength, the market is starting to bet that rates may continue to increase. As such, there is additional room for gold to drop further. Indeed, we are projecting a $1,975/oz gold price in Q2. Technically, we see significant support at just above $1,960/oz. However, we see the yellow metal trend at $2,100/oz in late H2-2023."

"Traders should keep an eye on data during the Fed's quiet period. Strong data suggests more gold downside, while weakness implies strength for the yellow metal."

-

12:04

EUR/JPY Price Analysis: Next on tap emerges the 150.00 mark

- EUR/JPY extends the rally and prints new 2023 highs on Monday.

- Once the 2022 high is cleared, the cross could challenge 150.00.

EUR/JPY climbs to new YTD peaks past the 148.00 barrier at the beginning of the week.

The strong upside momentum in the cross appears so far unabated. The surpass of the the 2022 peak at 148.40 (October 21) is expected to shift the focus to a potential test of the key 150.00 yardstick in the not-so-distant future.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 142.26.

EUR/JPY daily chart

-

12:02

US Dollar should continue to gain – BBH

Economists at BBH note that markets will pay attention to macroeconomic data releases from the United States with the Federal Reserve going into the quiet period until the May 2-3 FOMC meeting.

Fed tightening expectations have picked up bit

"Between now and next Wednesday’s Fed decision, we won’t get any top tier data but we will get some important clues. This week, Chicago Fed NAI today and Q1 GDP data Thursday will tell us about the real sector, while PCE and ECI data Friday will tell us more about the inflation outlook. Next week, Monday brings ISM manufacturing PMI."

"We will get some more labor market readings as next Tuesday brings JOLTS data and next Wednesday brings ADP private sector jobs. NFP won’t come until after the FOMC decision. Recent resilience in the U.S. economy helped push UST yields higher and we look for that process to continue. If so, the dollar should continue to gain as well."

"Fed tightening expectations have picked up bit. WIRP suggests over 90% odds of 25 bp hike at the May 2-3 meeting, up from 80% at the start of last week and 70% at the start of the week before that. To us, a hike next week is a done deal. There are about 15% odds of another 25 bp hike in June. Between the May 2-3 and June 13-14 meetings, the Fed will have digested two more job reports, two CPI/PPI reports, and one retail sales report."

"At this point, a pause in June might just be the most likely outcome but it really will depend on how all that data come in. After all that, one cut is still priced in by year-end vs. two at the start of last week. In that regard, Powell has said that Fed officials “just don’t see” any rate cuts this year. We concur."

-

11:48

Japan: BoJ expected to keep monetary policy unchanged – UOB

Economist at UOB Group Lee Sue Ann sees the BoJ gradually moving towards an exit of the ultra-accommodative stance.

Key Quotes

“This will be new BoJ Gov Kazuo Ueda’s first policy meeting. Since Ueda is not known as either very dovish or very hawkish in his policy view, we believe the normalising will be carried out at a gradual, well-telegraphed pace, and not a sharp and sudden reversal.”

“We expect Ueda to carry out the unwinding in two broad steps: 1) A protracted period (Apr to Dec 2023) of forward guidance to prepare market for an orderly exit of BOJ’s ultra-easy monetary policy which may also involve a widening of the trading range of the 10-year JGB yield (to +/- 100bps). 2) We expect monetary policy normalization to begin only in early 2024 - YCC to be dropped and negative policy call rate to rise from -0.1% to 0% in Jan 2024 MPM.”

-

11:47

US Dollar keeps its cool ahead of key US GDP data this week

- US Dollar struggles to gather strength but losses remain limited for now.

- Key macroeconomic data releases from the United States this week could drive USD valuation.

- US Dollar Index remains technically bearish in the near term.

The US Dollar (USD) failed to benefit from the stronger-than-expected S&P Global PMI surveys on Friday and the US Dollar Index closed the previous week virtually unchanged. At the beginning of the new week, the USD stays under modest selling pressure against its rivals. Ahead of the key macroeconomic data releases later in the week, including the first quarter Gross Domestic Product (GDP) and April Personal Consumption Expenditures (PCE) Price Index, investors could refrain from betting on further USD weakness.

The US Dollar Index, which tracks the USD performance against a basket of six major currencies, stays calm slightly above 101.50 on Monday.

Daily digest market movers: US Dollar’s subdued action continues on Monday

- The data from the US revealed on Friday that the economic activity in the private sector expanded at a strengthening pace in April with S&P Global Composite PMI rising to 53.5 (flash) from 52.3 in March.

- S&P Global Manufacturing PMI improved to 50.4 in the same period from 49.2 and Services PMI rose to 53.7, surpassing analysts' forecast of 51.5.

- Commenting on the data, "the latest survey adds to signs that business activity has regained growth momentum after contracting over the seven months to January," noted Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

- US stock index trades modestly lower on Monday, suggesting that Wall Street’s main indexes could start the week on the back foot.

- 10-year US Treasury bond yield stays in negative territory but manages to hold above 3.5%.

- The Federal Reserve Bank of Chicago will release the National Activity Index for March on Monday. The Federal Reserve Bank of Dallas will publish the Texas Manufacturing Survey for April as well.

- The CME Group FedWatch Tool shows that markets are currently pricing a nearly 90% probability of one more 25 basis points Federal Reserve (Fed) rate hike at the upcoming meeting.

- The Fed will be in the blackout period until the policy decisions are announced next week, May 3.

- The US Bureau of Economic Analysis will unveil the first estimate of first-quarter GDP growth on Thursday. The US economy is forecast to expand at an annualized rate of 2% in Q1, down from the 2.6% recorded in the last quarter of 2022.

Technical analysis: US Dollar Index remains technically bearish

The US Dollar Index trades slightly below the 20-day Simple Moving Average (SMA), currently located at 102.00. In case the DXY closes the day above that level, it could target 103.00 (static level, psychological level) and 103.40 (50-day SMA, 100-day SMA).

Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart moves sideways slightly below 50, suggesting that buyers remain reluctant to bet on a steady recovery in the DXY.

On the downside, 101.50 (static level) align as interim support ahead of 101.00/100.80 (psychological level, static level, multi-month low set on April 14). A daily close below that support area could open the door for an extended slide toward 100.00 (psychological level).

How does Fed’s policy impact US Dollar?

The US Federal Reserve (Fed) has two mandates: maximum employment and price stability. The Fed uses interest rates as the primary tool to reach its goals but has to find the right balance. If the Fed is concerned about inflation, it tightens its policy by raising the interest rate to increase the cost of borrowing and encourage saving. In that scenario, the US Dollar (USD) is likely to gain value due to decreasing money supply. On the other hand, the Fed could decide to loosen its policy via rate cuts if it’s concerned about a rising unemployment rate due to a slowdown in economic activity. Lower interest rates are likely to lead to a growth in investment and allow companies to hire more people. In that case, the USD is expected to lose value.

The Fed also uses quantitative tightening (QT) or quantitative easing (QE) to adjust the size of its balance sheet and steer the economy in the desired direction. QE refers to the Fed buying assets, such as government bonds, in the open market to spur growth and QT is exactly the opposite. QE is widely seen as a USD-negative central bank policy action and vice versa.

-

11:41

NZD/USD remains below mid-0.6100s, seems vulnerable near one-month low

- NZD/USD rebounds from over a one-month low, though the uptick lacks follow-through.

- A further slide in the US bond yields weighs on the USD and lends support to the major.

- Bets for more Fed rate hikes, a weaker risk tone limit the USD losses and cap the pair.

The NZD/USD pair stages a modest intraday bounce from the 0.6125 area, or its lowest level since March 13 touched earlier this Monday, albeit struggles to capitalize on the move. Spot prices trade with a mild positive bias, around the 0.6140 region during the first half of the European session and for now, seem to have snapped a three-day losing streak.

A further decline in the US Treasury bond yields continues to exert some downward pressure on the US Dollar (USD), which, in turn, is seen as a key factor lending support to the NZD/USD pair. That said, the prospects for further policy tightening by the Federal Reserve (Fed), which, along with a weaker risk tone, help limit the downside for the safe-haven buck and keep a lid on any meaningful upside for the risk-sensitive Kiwi.

The markets seem convinced that the Fed will continue raising interest rates to curb inflation and have fully priced in a 25 bps lift-off at the next FOMC policy meeting in May. Moreover, the Fed funds future indicates a smaller chance of another rate hike in June. The bets were lifted by the recent hawkish comments by several Fed officials and the incoming US macro data, which suggested that the world's largest economy remained resilient.

Meanwhile, worries about economic headwinds stemming from rising borrowing costs temper investors' appetite for riskier assets. This, in turn, could drive some haven flows towards the Greenback and contribute to capping gains for the NZD/USD pair. In the absence of any relevant market-moving economic data, the US bond yields, along with the broader risk sentiment, will influence the USD and provide some impetus to the major.

Market participants now look to this week's rather busy US economic docket, featuring the release of the Conference Board's Consumer Confidence Index on Tuesday, followed by Durable Goods Orders on Wednesday. The focus, however, will remain glued to the Advance US Q1 GDP report on Thursday and the Core PCE Price Index - the Fed's preferred inflation gauge - on Friday, which should determine the near-term trajectory for the NZD/USD pair.

Technical levels to watch

-

10:51

USD/CHF slides below 0.8900 mark amid weaker risk tone, fresh USD selling

- USD/CHF meets with a fresh supply on Monday and is weighed down by a combination of factors.

- A weaker risk tone underpins the safe-haven CHF and exerts pressure amid renewed USD selling.

- Bets for more Fed rate hikes could help limit losses for the buck and lend some support to the pair.

The USD/CHF pair comes under some renewed selling pressure on Monday and drops to a one-week low during the first half of the European session. The pair is currently placed just below the 0.8900 mark and remains well within the striking distance of its lowest level since January 2021 touched earlier this month.

Worries about economic headwinds stemming from rising borrowing costs temper investors' appetite for riskier assets, which is evident from a fresh leg down in the equity markets, which, in turn, benefits the safe-haven Swiss Franc (CHF). The US Dollar (USD), on the other hand, turns lower for the third successive day amid a further decline in the US Treasury bond yields and contributes to the intraday selling bias around the USD/CHF pair.

That said, the prospects for further policy tightening by the Federal Reserve (Fed) could act as a tailwind for the US bond yields and help limit losses for the Greenback. In fact, the markets have nearly fully priced in a 25 bps lift-off at the May FOMC policy meeting and the Fed funds future indicates a smaller chance of another rate hike in June. The bets were reaffirmed by the recent hawkish commentary by a slew of influential FOMC policymakers.

Moreover, the incoming US macro data suggested that the world's largest economy remained resilient and reaffirmed market bets that the Fed will continue raising interest rates to curb inflation. In the absence of any relevant market-moving economic releases from the US, the aforementioned fundamental backdrop warrants some caution before positioning for any further fall for the USD/CHF pair ahead of this week's key US macro data.

This week's rather busy US economic docket kicks off with the release of the Conference Board's Consumer Confidence Index on Tuesday, followed by Durable Goods Orders on Wednesday. The focus, however, will remain glued to the Advance US Q1 GDP report on Thursday and the Core PCE Price Index - the Fed's preferred inflation gauge - on Friday, which will help determine the near-term trajectory for the USD/CHF pair.

Technical levels to watch

-

10:18

ECB’s Panetta: Geopolitics risk persistent inflation volatility

“Geopolitics risk persistent inflation volatility,” the European Central Bank’s executive board member, Fabio Panetta, said on Monday.

Panetta added that “globalization may influence the natural rate of interest.”

Market reaction

The above comments fail to have any impact on the Euro, as EUR/USD is trading close to the intraday high at 1.1021, as of writing. The spot is up 0.27% on the day.

-

09:59

ECB’s Villeroy: Central banks’ core mandate worldwide is price stability

European Central Bank (ECB) Governing Council member and Bank of France head Francois Villeroy de Galhau said on Monday, “central banks’ core mandate worldwide is price stability and climate change already affects the level of prices and activity.”

The ECB is set to announce its policy decision next week and markets are expecting the central bank to raise rates by a quarter point, with the possibility of a 50 bps hike. Eurozone inflation and growth data are due this week.

Market reaction

At the time of writing, EUR/USD is trading 1.0991, up 0.06% on the day.

-

09:51

USD/JPY sticks to modest intraday gains just below mid-134.00s, lacks follow-through

- USD/JPY kicks off the new week on a positive note in reaction to dovish remarks by BoJ’s Ueda.

- The Fed-BoJ policy divergence weighs on the JPY and remains supportive of the intraday gains.

- Sliding US bond yields acts as a headwind for the USD and keeps a lid on any meaningful upside.

The USD/JPY pair builds on Friday's bounce from the vicinity of mid-133.00s and gains some follow-through traction on the first day of a new week. The pair maintains its bid tone through the early part of the European session and currently trades around the 134.30 region, just a few pips below the daily top.

The Japanese Yen (JPY) weakens in reaction to the Bank of Japan (BoJ) Kazuo Ueda's dovish remarks on Monday, saying that the central bank must maintain monetary easing as trend inflation is still below 2%. Ueda added that inflation forecasts must be quite strong and close to 2% in the coming year to consider tweaking yield curve control. In contrast, the Federal Reserve (Fed) is expected to continue raising interest rates to curb stubbornly high inflation. This, in turn, acts as a tailwind for the US Dollar (USD) and is seen lending some support to the USD/JPY pair.

In fact, the markets have fully priced in a 25 bps lift-off at the next FOMC policy meeting in May and the Fed funds future points to a small chance of another rate hike in June. The bets were lifted by the recent hawkish remarks by several Fed officials. Adding to this, the incoming US macro data suggested that the world's largest economy remained resilient and supports prospects for further tightening by the Fed. That said, a fresh leg down in the US Treasury bond yields holds back the USD bulls from placing aggressive bets and caps the USD/JPY pair amid a weaker risk tone.

Worries about economic headwinds stemming from rising borrowing costs temper investors' appetite for riskier assets, which is evident from a generally weaker tone around the equity markets. This, in turn, could drive some haven flows towards the JPY and keep a lid on any meaningful upside for the USD/JPY pair, at least for the time being. In the absence of any relevant market-moving economic releases, the aforementioned mixed fundamental backdrop warrants some caution before positioning for any further intraday appreciating move for the major.

Technical levels to watch

-

09:31

Hong Kong SAR Unemployment rate came in at 3.1%, below expectations (3.3%) in March

-

09:21

IFO’s Economist: German economy far away from substantial upswing

Following the release of the German IFO Business Survey, the institute’s Economist Klaus Wohlrabe said that the “German economy is far away from the substantial upswing.”

Additional quotes

Proportion of German companies that want to raise prices has fallen again.

German economy is lacking momentum.

Industry's export expectations have risen.

Strong economies in China and US seem to support German industry.

Banking turmoil has had no impact on companies' sentiment.

Situation in construction industry has not been worse since December 2015, many cancellations.

Related reads

- EUR/USD Forecast: Euro defines range before next breakout

- ECB’s Wunsch: Central bank to keep raising interest rates unless wage growth slows – FT

-

09:14

USD/CNH: Upside momentum seen improving in the near term – UOB

A more serious advance in USD/CNH needs to break above the 6.9350 level in the short-term horizon, comment Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “Last Friday, we expected USD to trade in a range of 6.8700/6.8900. However, USD rose to a high of 6.9061 and then closed at 6.8974 (+0.18%). Upward momentum has improved a tad and USD is likely to trade with an upward bias. However, any advance is likely to face strong resistance at 6.9100. The major resistance at 6.9350 is not expected to come under threat. Support is at 6.8860, followed by 6.8780.”

Next 1-3 weeks: “Our update from last Thursday (20 Apr, spot at 6.8920) still stands. As highlighted, upward momentum is beginning to improve but USD has to break and stay above 6.9350 before a sustained rise is likely. The chance of USD breaking clearly above 6.9350 is not high for now but it will remain intact as long as the ‘strong support’ level at 6.8600 (no change in level) is not taken out in the next 1-2 days.”

-

09:04

German IFO Business Climate Index improves to 93.6 in April vs. 94 expected

- German IFO Business Climate Index improved modestly in April.

- EUR/USD trades in the upper half of its daily range slightly below 1.1000 after the data.

The headline German IFO Business Climate Index edged higher to 93.6 in April from 93.2 in March. This reading came in slightly weaker than the market expectation of 94.

Meanwhile, the Current Economic Assessment dropped to 95 from 95.4 and the IFO Expectations Index – indicating firms’ projections for the next six months, rose to 92.2 from 91, surpassing analysts' estimate of 91.6.

Market reaction

EUR/USD gained traction and turned positive on the day near 1.0990 with the initial reaction.

About German IFO

The headline IFO business climate index was rebased and recalibrated in April after the IFO Research Institute changed the series from the base year of 2000 to the base year of 2005 as of May 2011 and then changed the series to include services as of April 2018. The survey now includes 9,000 monthly survey responses from firms in the manufacturing, service sector, trade and construction.

-

09:01

Germany IFO – Expectations registered at 92.2 above expectations (91.6) in April

-

09:01

Germany IFO – Current Assessment below forecasts (96.1) in April: Actual (95)

-

09:01

Germany IFO – Business Climate came in at 93.6 below forecasts (94) in April

-

08:59

GBP/USD flat-lines below mid-1.2400s, downside potential seems limited

- GBP/USD lacks any firm intraday direction and oscillates in a narrow trading range on Monday.

- Bets for more Fed rate hikes, a softer risk tone underpin the USD and cap the upside for the pair.

- Expectations for another 25 bps BoE rate hike in May lend support to the GBP and limit losses.

The GBP/USD pair struggles to capitalize on Friday's goodish rebound of over 65 pips from the 1.2365 area and kicks off the new week on a subdued note. Spot prices seesaw between tepid gains/minor losses through the early European session and currently trade around the 1.2435 region, nearly unchanged for the day.

A combination of factors assists the US Dollar (USD) to gain some positive traction on the first day of the new week, which, in turn, is seen acting as a headwind for the GBP/USD pair. The recent hawkish signals by several Federal Reserve (Fed) officials reaffirmed market bets for another 25 bps lift-off at the next FOMC meeting in May. Moreover, the incoming US macro data suggests that the world's largest economy remained resilient and supports prospects for further policy tightening by the Fed. Apart from this, a generally weaker risk tone benefits the Greenback's relative safe-haven status.

The market sentiment remains fragile amid worries about economic headwinds stemming from rising borrowing costs. This is evident from a fresh leg down in the equity markets and drives some haven flows towards the buck. The downside for the GBP/USD pair, however, remains cushioned, at least for the time being, amid rising bets for an additional interest rate hike by the Bank of England (BoE) in May. In fact, the markets now see over a 90% chance of a 25-bps rate hike in May. The bets were lifted by last week's release of stronger UK wage growth data and the stubbornly high inflation figures.

In the absence of any relevant market-moving economic releases, either from the UK or the US, the aforementioned mixed fundamental backdrop warrants some caution before placing aggressive directional bets around the GBP/USD pair. Traders also seem reluctant ahead of this week's key macro data from the US, including the Advance Q1 GDP print on Thursday and the Fed's preferred inflation gauge - the Core PCE Price Index - on Friday. The data will play a key role in influencing the near-term USD price dynamics and help determine the near-term trajectory for the major.

Technical levels to watch

-

08:47

Euro trades at top of its range after hawkish comments from ECB’s Wunsch

- Euro vs US Dollar presses the top of its range after hawkish comments from Belgium central bank President Pierre Wunsch

- The pair is in a medium-term uptrend which is favored to extend.

- The US Dollar benefits from strong macroeconomic data which suggests the Federal Reserve will have to continue raising interest rates.

The Euro (EUR) trades in the upper 1.09s versus the US Dollar (USD) as the new week begins. The single currency is underpinned by market expectations of higher interest rates down the line drawing greater capital inflows into Europe. From a technical perspective, the overall trend is up, giving bulls a wind-in-their-sail’s advantage.

EUR/USD market movers

- The Euro is underpinned by comments from Belgian central bank president Pierre Wunsch, who said “We are waiting for wage growth and core inflation to go down... before we can arrive at the point where we can pause.”

- This supports comments from European Central Bank (ECB) President Christine Lagarde who said there is still “some way to go” before the ECB finishes hiking interest rates.

- The US Dollar benefits from US PMI data pushing into expansionary territory.

- USD further underpinned by hawkish comments from St. Louis Fed’s Bullard who expects more rate hikes due to persistent inflation and overblown recession fears.

- Unexpectedly strong first quarter earnings from US megabanks suggests the sector’s March crisis may be in the rear-view mirror, further supporting the Greenback.

- Data out on May 2 could be key according to European Central Bank’s chief economist Philip Lane. It includes the ECB’s Bank Lending Survey (BLS), giving a snapshot of the health of the region’s banks, and April HICP inflation.

- German IFO survey at 08:00 GMT is the next major release on Monday.

- For the US Dollar the Chicago Fed National Activity Index is the most important release, out at 13:30 GMT.

EUR/USD technical analysis: Triangle in an uptrend

EUR/USD continues in a range bound consolidation within a broader medium-term uptrend that started over eight months ago. The odds favor a continuation of the overarching bull trend.

-638179189866926452.png)