Notícias do Mercado

-

23:47

New Zealand trade deficit widens in March, NZD/USD stays pressured

As per the latest New Zealand (NZ) foreign trade numbers from the New Zealand Statistics, the headline Trade Balance dropped to $-1,273M MoM in March versus $-796M prior (revised). That said, the annual trade deficit increased to $16.4B versus $-15.72B prior figures (revised from $-15.64B).

Further details suggest that Exports rose to $6.51B during the said month versus $5.06B (revised) prior whereas Imports increased to $7.78B compared to $5.86B previous readings.

Market reaction

NZD/USD offers no major reaction to the data while pausing the corrective bounce near 0.6145 by the press time. That said, the Kiwi pair dropped heavily the previous day, mainly led by the risk aversion wave led by banking fears.

About New Zealand Trade Balance

The Trade Balance released by Statistics New Zealand is a measure of the balance amount between imports and exports, and it is published in New Zealand dollar terms. A positive value shows a trade surplus while a negative value shows a trade deficit. Any variation in the figures influences the domestic economy. If a steady demand in exchange for exports is seen, that would turn into a positive growth in the trade balance, and that should be positive for the NZD.

-

23:46

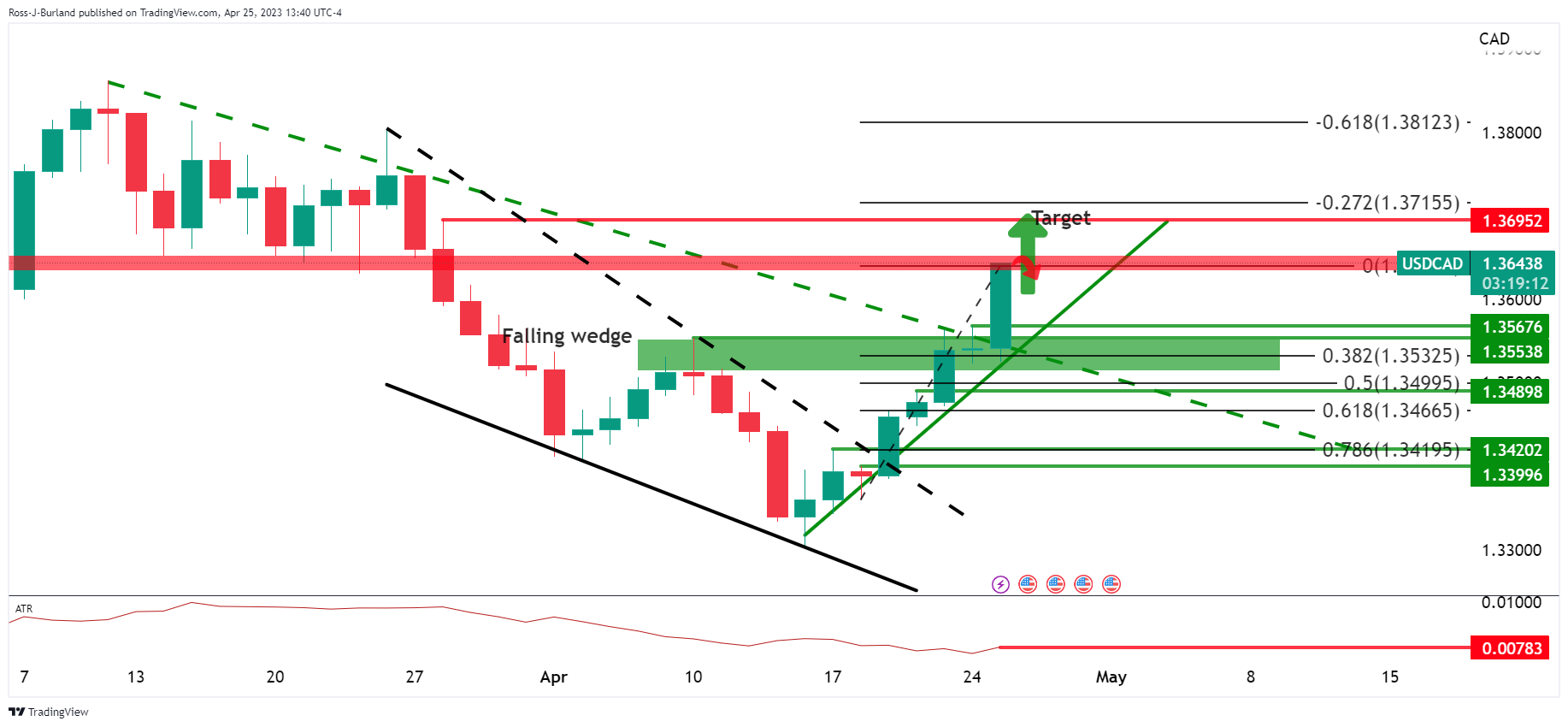

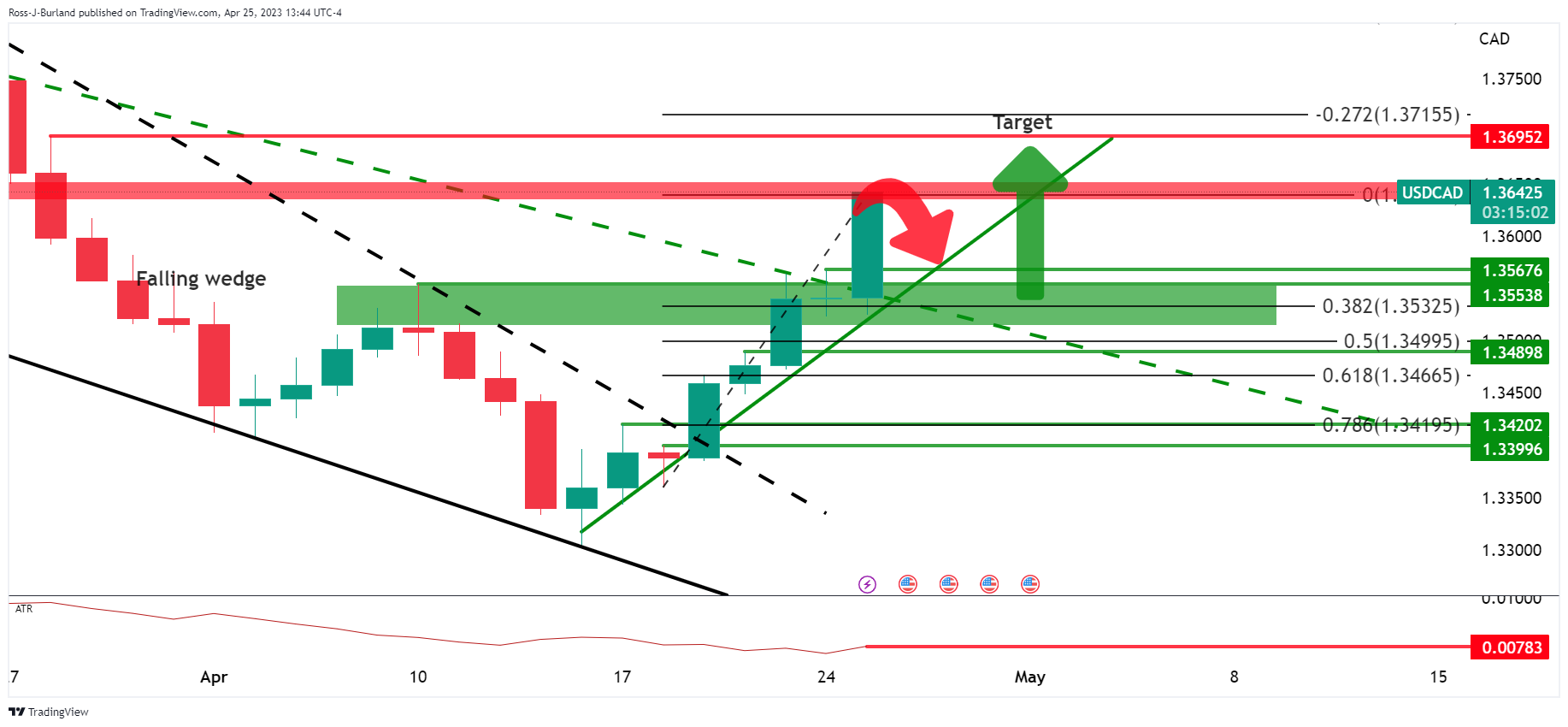

USD/CAD Price Analysis: Breaks through 50-day EMA resistance, reclaims 1.3600

- The USD/CAD is ready to test a one-month-old resistance trendline at around 1.3650.

- USD/CAD Price Analysis: Upward biased, it could test the 1.3700 figure.

The USD/CAD reclaims the 1.3600 mark after dropping to a daily low of 1.3524. The pair tested the 50-day Exponential Moving Average (EMA) at 1.3532 before reversing its course and posting gains of 0.64% on Tuesday. As the Asian session begins, the USD/CAD exchanges hands at around 1.3620.

USD/CAD Price Analysis

After Tuesday’s price action, the USD/CAD is poised to test a resistance trendline at around 1.3635-50, which could pave the way for further upside once broken. In addition, the Relative Strength Index (RSI), in bullish territory, aims upward, suggesting buyers are moving in. Another reason for the USD/CAD to continue its uptrend is the Rate of Change (RoC), indicating that buying pressure increased in the last three days.

That said, the USD/CAD first resistance would be 1.3650. Once cleared, the USD/CAD next resistance would be 1.3700, followed by the March 24 cycle high at 1.3804 and the YTD high at 1.3862.

Conversely, the USD/CAD could shift downwards if it fails to crack the one-month-old resistance trendline. Hence, the USD/CAD first support would be the psychological 1.3600 figure. The seller’s next stop would be the 50-day EMA at 1.3532 before testing the 20-day EMA at 1.3517, followed by the 100-day EMA at 1.3506.

USD/CAD Daily Chart

-

23:46

New Zealand Exports up to $6.51B in March from previous $5.23B

-

23:46

New Zealand Trade Balance NZD (MoM) declined to $-1273M in March from previous $-714M

-

23:45

New Zealand Imports climbed from previous $5.95B to $7.78B in March

-

23:45

New Zealand Trade Balance NZD (YoY): $-16.4B (March) vs previous $-15.64B

-

23:30

AUD/JPY Price Analysis: Bears occupy driver’s seat below 89.00 ahead of Australia inflation

- AUD/JPY seesaws within a tight range near the lowest levels in a fortnight after falling the most in six weeks.

- Clear downside break of 50-DMA, one-month-old ascending trend line keeps sellers hopeful.

- Looming bear cross on MACD also signals AUD/JPY downside as Australia’s Consumer Price Index data for Q1 and March loom.

AUD/JPY licks its wounds at the lowest levels in two weeks as the pair traders await Australia’s headline inflation data during early Wednesday. That said, the cross-currency pair seesaws around 88.70 after falling the most in six weeks the previous day.

The quote’s heavy fall on Tuesday could be linked to a break of the one-month-old ascending trend line and the 50-DMA. Adding strength to the downside bias could be the impending bear cross. However, the RSI (14) line is below 50 and hence suggests some bottom-picking in case the Aussie data offers a positive surprise.

As a result, the monthly low of around 87.60 gains major attention ahead of the late 2022 low of near the 87.00 round figure.

Following that, a south run towards refreshing the yearly low, currently around 86.05 can’t be ruled out.

On the flip side, the 21-DMA restricts immediate advances of the AUD/JPY pair around 89.25.

Should the quote rises past 21-DMA, the 50-DMA hurdle of around 89.75 and the previous support line surrounding 89.90 will precede the 90.00 psychological magnet to challenge the AUD/JPY pair buyers.

Even if the quote rises past the 90.00 round figure, a downward-sloping resistance line from September 2022, near 90.60, will be the key hurdle for the AUD/JPY bulls to cross before retaking control.

AUD/JPY: Daily chart

Trend: Further downside expected

-

23:26

AUD/NZD retreats from 1.0800 as RBNZ proposes to ease qualitative restrictions, Aussie CPI eyed

- AUD/NZD has retreated after a short-lived pullback to near 1.0800 ahead of Australian Inflation.

- The RBNZ has proposed to loosen the loan-to-value ratio (LVR) restrictions as they may be unnecessarily reducing efficiency.

- RBA policymakers are expecting a further slowdown in the Australian economy, which will decelerate stubborn inflation.

The AUD/NZD pair has sensed selling pressure after a less-confident pullback move to near 1.0800 in the Asian session. The cross is going through an immense sell-off for the past two trading sessions in hopes that the Reserve Bank of Australia (RBA) will continue to keep interest rates steady next week.

Investors will get more clarity for the monetary policy action after the release of the Australian Consumer Price Index (CPI) data. According to the estimates, quarterly inflation (Q1) has accelerated by 1.3% at a slower pace than the velocity of 1.9% recorded in the last quarter of CY2022. Annual inflation is expected to soften to 6.9% from the former release of 7.8%.

Apart from that, the monthly inflation indicator (Mar) is expected to decelerate to 6.6% from the prior release of 6.8%. Australia’s monthly CPI has softened significantly from its peak of 8.4%, recorded in December. This allowed the Reserve Bank of Australia (RBA) to pause its rate-hiking spell after pushing interest rates to 3.60%. RBA policymakers are expecting a further slowdown in the Australian economy, which will decelerate stubborn inflation.

On the New Zealand front, the Reserve Bank of New Zealand (RBNZ) has proposed to loosen the loan-to-value ratio (LVR) restrictions. RBNZ Deputy Governor and head of financial stability Christian Hawkesby cited on Wednesday, "Our assessment is that the risks to financial stability posed by high-LVR lending have reduced to a level where the current restrictions may be unnecessarily reducing efficiency. In particular, impeding the provision of credit to some otherwise creditworthy borrowers, this is not proportionate to the level of risk that we see.”

-

23:14

EUR/USD licks its wounds near 1.0970 after banking woes propelled the biggest daily fall in six weeks

- EUR/USD steadies after the heavy fall as traders await US data.

- Risk aversion supersedes hawkish ECB comments to weigh on Euro pair.

- Fears of banking sector fallouts return as First Republic Bank refrains from earnings guidance.

- US Durable Goods Orders, central bankers’ comments will be important to watch for clear directions.

EUR/USD bears take a breather after witnessing the biggest daily loss in 1.5 months, making rounds to 1.0980-70 during the early hours of Wednesday’s Asian session.

In doing so, the Euro pair seeks fresh clues after the banking fears roiled the market sentiment and fuelled the US Dollar’s demand. With this, the major currency pair even ignored hawkish comments from the European Central Bank (ECB) Officials, as well as mixed US data. It’s worth noting that an update surrounding the major central bank’s Dollar operations also underpinned the US Dollar’s rebound and exerted downside pressure on the quote.

The First Republic Bank’s (FRB) disappointing earnings reports joined the executives’ resistance in taking questions and no earnings guidance to trigger the fresh wave of banking jitters and weighed on the market sentiment the previous day.

Adding strength to the risk aversion were calls that the central bankers are well set for higher rates even as the economics aren’t suitable. Furthermore, the geopolitical concerns surrounding Russia and China also spoil the risk appetite and provide a tailwind to the US Dollar.

In doing so, the EUR/USD ignores hawkish comments from the ECB policymakers. That said, ECB Chief Economist Philip Lane mentioned that the current data suggest we have to raise interest rates again at the upcoming meeting. The policymaker also added, “Beyond May 4 meeting, further rate hikes will depend on data.” Further, ECB Governing Council member and Bank of France head Francois Villeroy de Galhau said that they are likely at the inflation peak today while also adding, “Inflation will probably come down towards 2% at the end of 2024.”

Apart from the ECB talks, the mixed US data also failed to prod the EUR/USD bears. On Tuesday, US Conference Board's Consumer Confidence Index edged lower to 101.3 for April, versus 104.0 prior and Additional details of the publication stated that the Present Situation Index ticked up to 151.1 during the said month from 148.9 prior whereas the Consumer Expectations Index dropped to 68.1 from 74 previous readings. Further, the one-year consumer inflation expectations eased to 6.2% in April from 6.3% in March. In a different release, the US New Home Sales rose to 0.683M MoM in March versus 0.634 expected and 0.623M revised prior while the S&P/Case-Shiller Home Price Indices and Housing Price Index both rose past market forecast to 0.4% and 0.5% respectively for February.

Amid these plays, Wall Street closed in the red and the US Treasury bond yields were down too, which in turn allowed the US Dollar Index (DXY) to snap a three-day downtrend.

Moving on, US Durable Goods Orders for March will be important to watch as it offers clues for Thursday’s US Gross Domestic Product (GDP) for the first quarter (Q1).

Technical analysis

Despite the latest retreat, EUR/USD bears need validation from a three-week-old ascending support line, around 1.0965 to convince sellers. On the contrary, an upward-sloping resistance line from early February, near 1.1085 at the latest, challenges the Euro pair’s recovery.

-

23:06

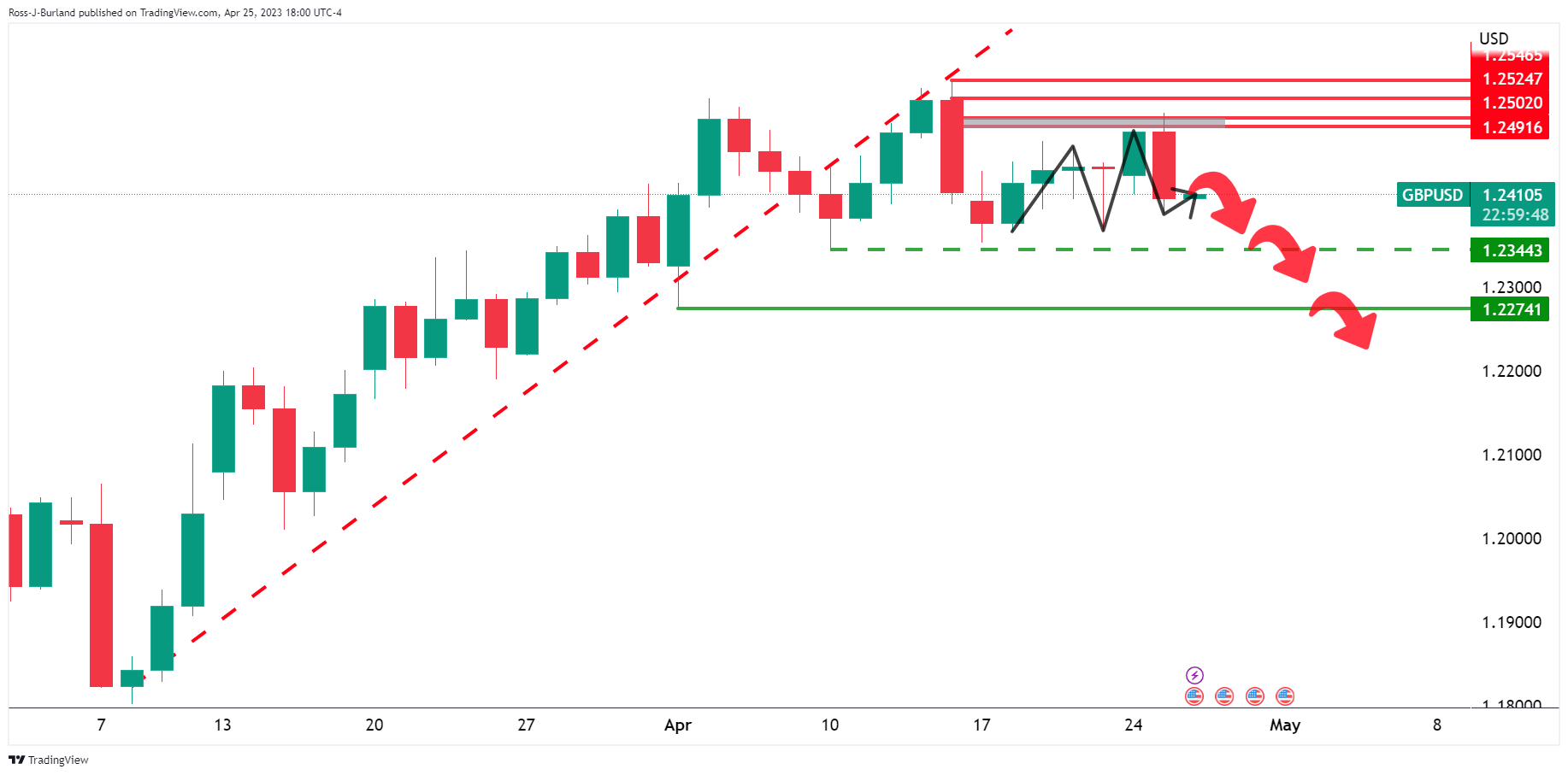

GBP/USD Price analysis: Bears stacked up to test trendline support

- GBP/USD bears are moving in and eye a downside break of trendline support.

- The 4-hour 38.2% Fibonacci could be significant in the session ahead.

The safe-haven US dollar rose on Tuesday as market sentiment turned risk-averse amid further worries about the banking sector. This has flipped the technicals in GBP/USD bearish once again.

GBP/USD daily chart

The Daily M-formation is in play. The bears will need to commit to any pullbacks, however, on the lower time frames as follows:

GBP/USD H4 chart

The pair is testing trendline support but should the bears show up at the 38.2% Fibonacci in any decent size, meeting the 4-hour charts M-formaiton´s neckline, then the bias will start to move bearish again.

-

23:01

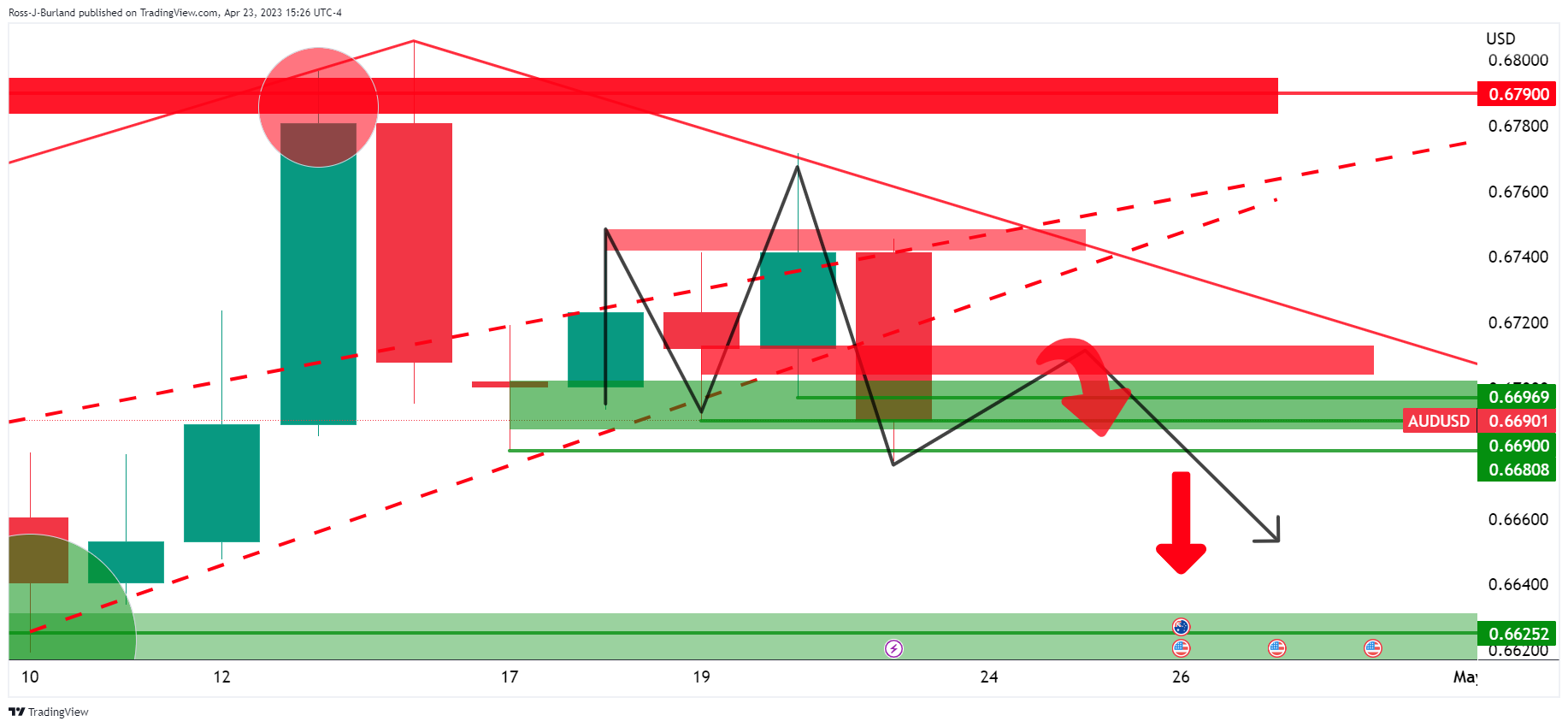

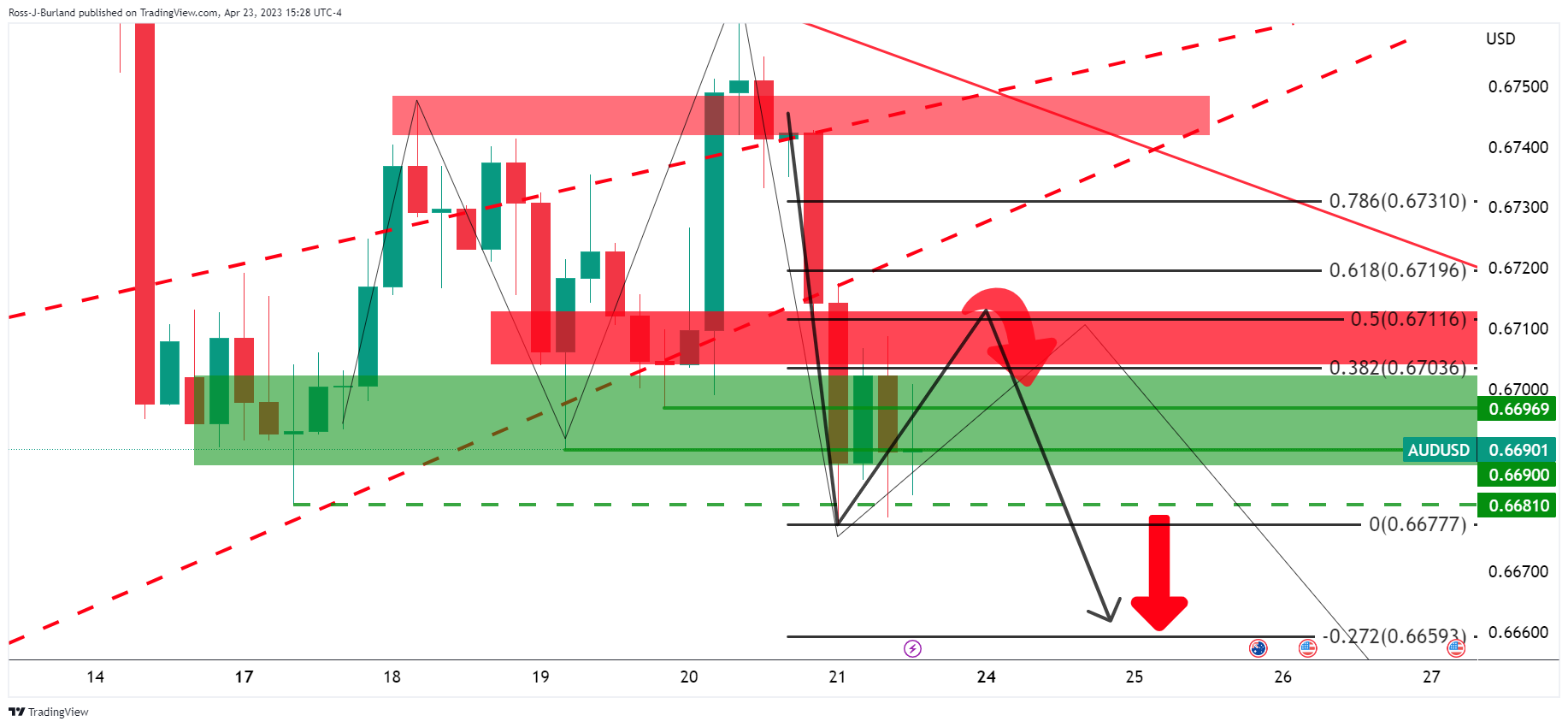

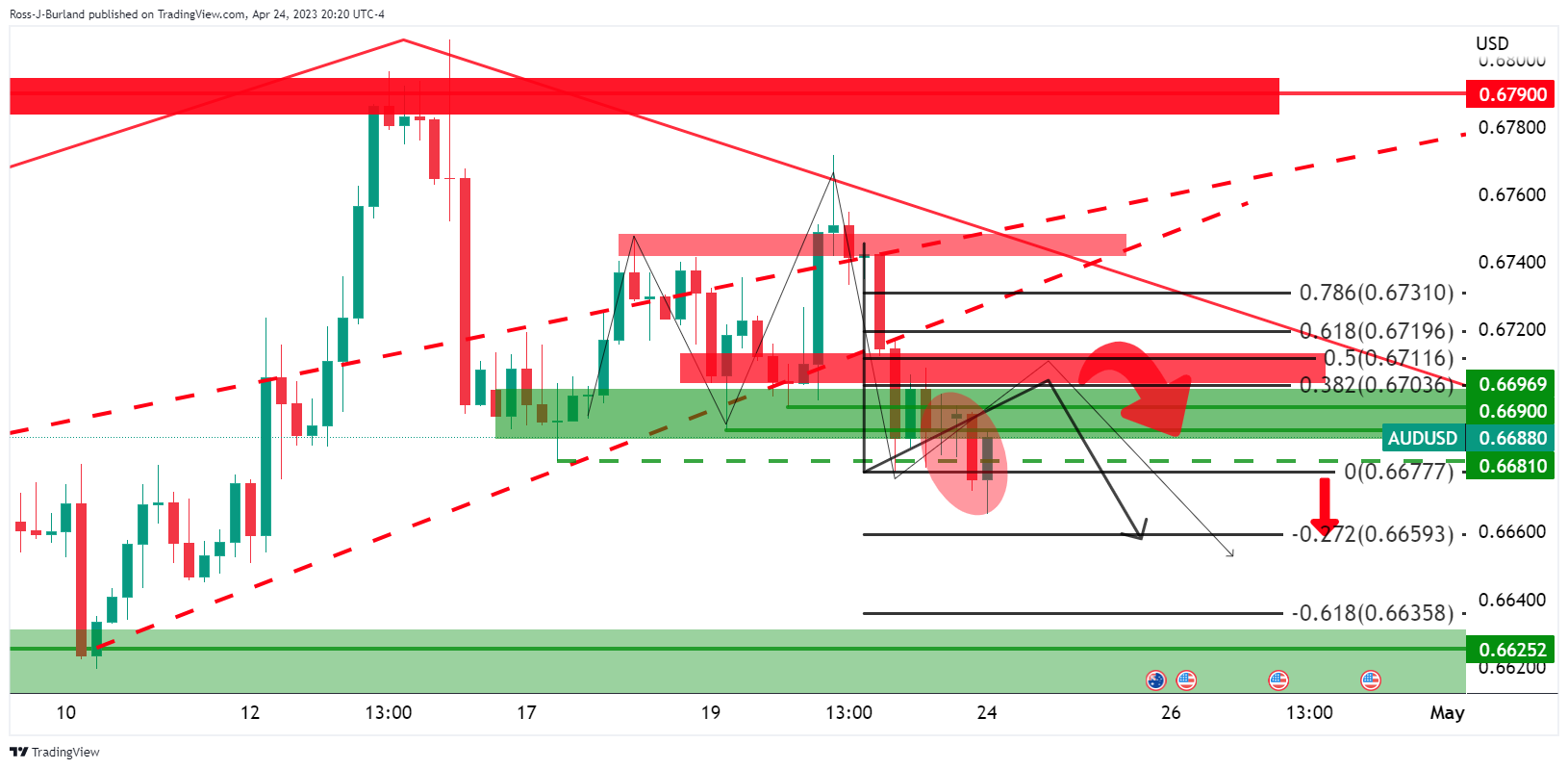

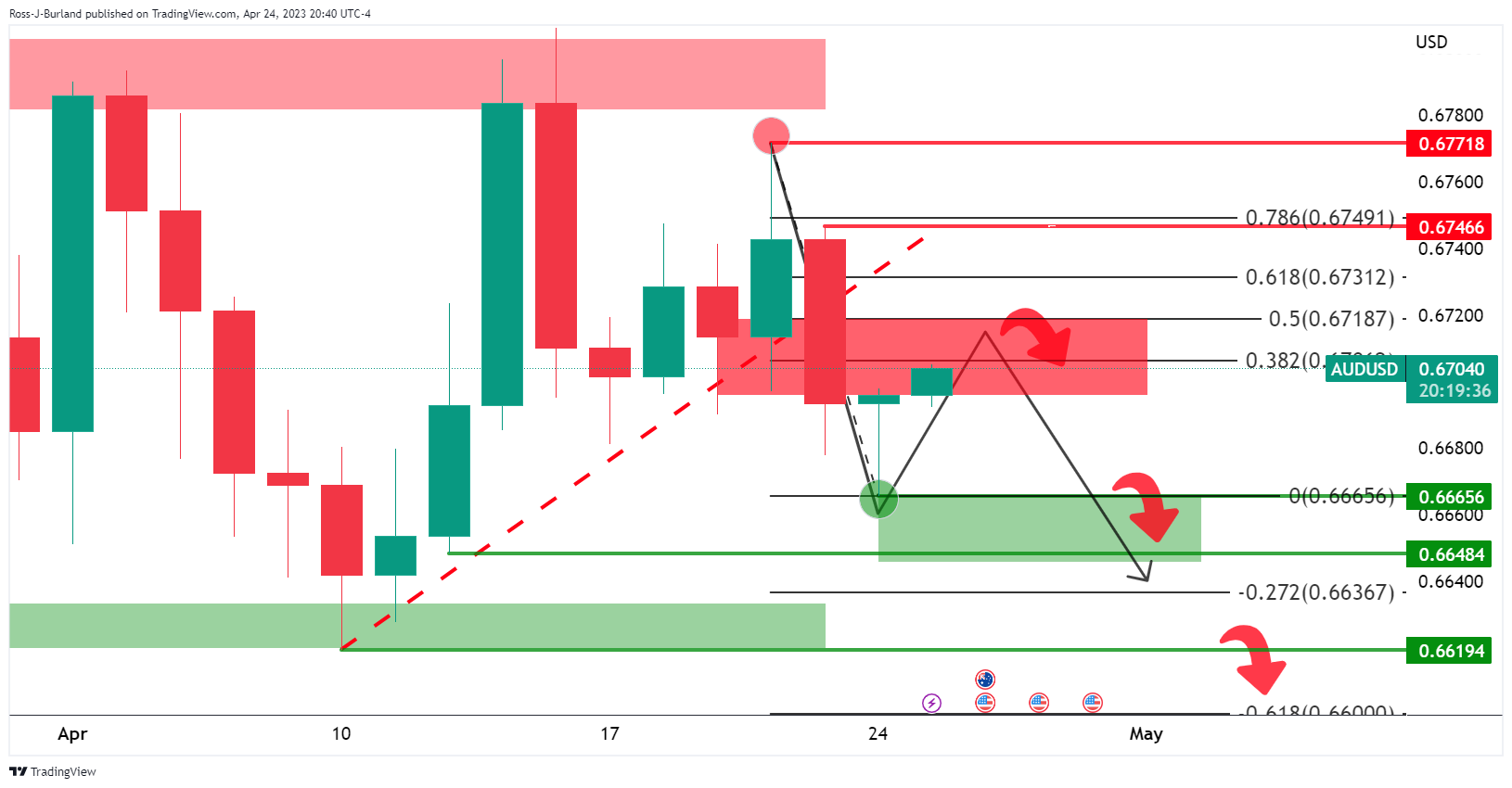

AUD/USD defends 0.6600 ahead of Australian Inflation and US Durable Goods Orders data

- AUD/USD has shown some recovery after a fresh five-month low of 0.6614 amid strength in the USD Index.

- The USD index showed a V-shape recovery as investors are worried about interest rate guidance from the Fed.

- A further deceleration in Australian inflation will allow the RBA to stick to its stance of policy-tightening pause.

The AUD/USD pair has shown a minor recovery after printing a fresh five-week low of 0.6614 in the early Asian session. The Aussie asset has rebounded to near 0.6625, however, the downside seems favored considering the strength in the US Dollar Index (DXY) and negative market sentiment.

The USD index showed a V-shape recovery from a fresh weekly low of 101.20 as investors are worried about interest rate guidance from the Federal Reserve (Fed). Next week, the Fed will announce May’s monetary policy in which an interest rate hike by 25 basis points (bps) is widely anticipated and the street was earlier expecting that the Fed will pause its quantitative tightening regime after this interest rate hike.

Meanwhile, fresh recovery in United States economic activities as Manufacturing PMI has landed in expansion territory, the core Consumer Price Index (CPI) is still persistent, and a recovery in the housing market indicate that Fed chair Jerome Powell could remain hawkish while guiding about forward interest rates.

S&P500 settled Tuesday’s session on a bearish note despite upbeat earnings from Microsoft and Google. Banking jitters renewed after First Republic Bank reported a sharp decline in customers’ deposits and it is required to bank fundraising for disbursing loans. The events triggered a risk aversion theme in the overall market.

Going forward, US Durable Goods Orders data will be keenly watched. Monthly the Durable Goods Orders data (March) is seen expanding by 0.8% vs. a contraction of 1.0%.

On the Australian Dollar front, inflation data will remain in focus. As per the consensus, quarterly inflation (Q1) accelerated by 1.3% at a slower pace than the velocity of 1.9% recorded in the last quarter of CY2022. Annual inflation is expected to soften to 6.9% from the former release of 7.8%.

Investors should note that the Reserve Bank of Australia (RBA) paused its rate-hike spell in its April policy meeting. A further deceleration in Australian inflation will allow the RBA to stick to its stance of policy-tightening pause.

-

22:48

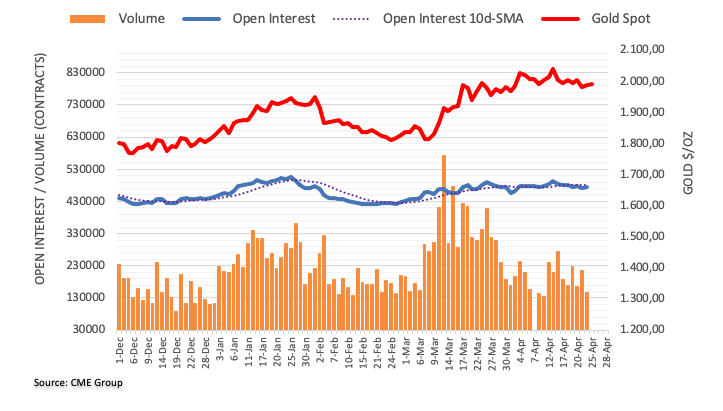

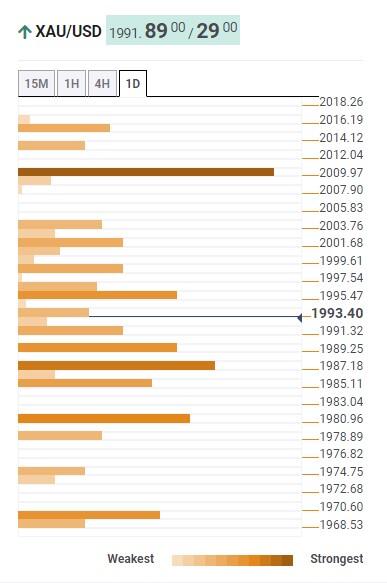

Gold Price Forecast: XAU/USD surges to weekly high above $2000 amidst deteriorating risk appetite

- Gold price clings to gains above the 20-day EMA, boosted by risk aversion.

- Mixed data in the United States suggests that the economy is slowing.

- XAU/USD Price Analysis: Downside expected beneath $2000., with sellers eyeing $1950.

Gold price advanced and printed a new weekly high at around $2003, though it faltered to hold its gains above the $2000 mark. Deteriorated risk appetite sponsored by fears around the United States (US) banking system, increased flows to safe-haven assets. Therefore, the XAU/USD climbs 0.41%, trading at $1997.10, after hitting a low of $1976.26.

Sentiment takes a hist on First Republic Bank. US Consumer confidence drops and New Home Sales, advanced

Wall Street finished the session with losses. Investors’ woes about First Republic Bank admitting a loss of $100 billion worth of deposits in Q1 2023 reignited worries of a spread contagion around the system. Another tranche of US economic data revealed earlier witnessed Consumer Confidence sliding to a level last seen in July 2022, at 101.3, vs. expectations of 104.0, and New Home Sales in March rising, 9.6% MoM, exceeding estimates of 1.1%.

On other data, the Dallas Fed Services Index dropped to -14.4 in April, an improvement compared to March’s -18, while the Richmond Fed Indices, both readings plunged, a signal that the economy is decelerating.

Despite all that, the greenback slightly capped the XAU/USD’s rally. The US Dollar Index (DXY), a gauge of the buck’s value vs. a basket of six currencies, edges high 0.55%, at 101.872, although US Treasury bond yields continued to tumble.

That comes as speculations of a Federal Reserve (Fed) rate hike for May, had diminished, as reported by the CME FedWatch Tool. Odds for a 25 bps lie at 74.7%, less than Monday’s 90.5% chance, as reflected by US bond yields. However, investors have begun discounting two 25 bps rate cuts by the year’s end, as shown by the CME probabilities table.

XAU/USD Technical Analysis

Gold remains supported by the 20-day Exponential Moving Average (EMA) at $1989.07, a dynamic demand zone from which XAU/USD has bounced. The XAU/USD uptrend is intact, and further upside is expected as the Relative Strength Index (RSI) bounces off the 50 levels and aims toward the 60 level. Moreover, the Rate of Change (RoC) indicates sellers are losing momentum. That said, the XAU/USD path of least resistance is upwards. The XAU/USD first resistance would be the $2000 mark. A breach of the latter and Gold could climb towards the April 5 swing high at $2032.13, followed by the YTD high at $2048.79.

-

22:44

RBNZ proposes to ease LVR restrictions

The Reserve Bank of New Zealand has decided to loosen the loan-to-value ratio (LVR) restrictions, as stated today by the Deputy Governor and head of financial stability Christian Hawkesby on Wednesday.

"Our assessment is that the risks to financial stability posed by high-LVR lending have reduced to a level where the current restrictions may be unnecessarily reducing efficiency. In particular, impeding the provision of credit to some otherwise creditworthy borrowers, which is not proportionate to the level of risk that we see," Hawkesby said.

The loosening means for owner-occupiers that banks will now be able to advance up to 15% of their new lending (up from 10%) to customers borrowing on a loan-to-value ratio of in excess of 80%. For investors, the tight restriction that they must have 40% deposits to buy will be moved lower to 35%.

NZD/USD update

- NZD/USD bears take back control on banking sector concerns

NZD/USD fell to a low of 0.6133 in Tuesday´s trade after suffering a risk-off blow with the US Dollar tearing higher since the early Europen session. NZD/USD fell from a high of 0.6187 on the day.

-

22:04

Forex Today: Risk aversion lifts the Yen and the US Dollar

During Wednesday’s Asian session, the highlight will be Australian inflation data. Those numbers will be a key input before next week’s RBA meeting. New Zealand will inform trade data and credit card spending. Later in the day, the US Durable Goods Orders report is due. The US Dollar could continue to benefit amid a deterioration in market sentiment.

Here is what you need to know on Wednesday, April 26:

The Japanese Yen rose sharply on Tuesday amid risk aversion on renewed banking concerns and a rally in government bonds. The US Dollar also rose. A week before the FOMC meeting, banking concerns are back, an episode that could become somewhat similar to what happened in March.

First Republic Bank earnings calls triggered concerns about the banking sector's health. Bank’s executives delivered prepared remarks and refused to take questions. The bank lost $102 billion in customer deposits and borrowed $92 billion during the first quarter. The stock lost almost 50% on Tuesday. Bank stocks dropped sharply.

Global equity markets fell and bonds rose, boosting the Yen and the Dollar. The Dow Jones tumbled 1.02% and the Nasdaq lost 1.98%. The US 10-year bond yield settled at 3.39%, the lowest since April 12.

Economic data from the US came in mostly above expectations, with positive signs from the housing sector. The S&P/Case-Shiller Home Price index rose for the first time in eight months and New Home Sales surged 9.6% in March to a 683.000 annual pace, marking the third increase in the last four months. CB Consumer Confidence dropped, but the present situation indicator improved. The critical report will be on Thursday with the first reading of Q1 GDP and consumer inflation.

EUR/USD reversed from weekly highs above 1.1050 to 1.0960 as Eurozone yields tumbled on risk aversion. Inflation and GDP data are due on Friday.

On Tuesday, Bank of England Huw Pill said that recent events moderated calls for higher interest rates. The UK informed an increase in borrowing of 20.709 billion pounds in March, slightly below expectations. It was the second-highest March borrowing since 1993, with the debt-to-GDP ratio reaching 100%, the highest since the 1960s.

A rate hike at the next Bank of England meeting is priced in. GBP/USD dropped from 1.2500 to the 1.2400 zone amid Dollar strength. EUR/GBP surged to 0.8875, the highest in a month, then sharply reversed to 0.8840.

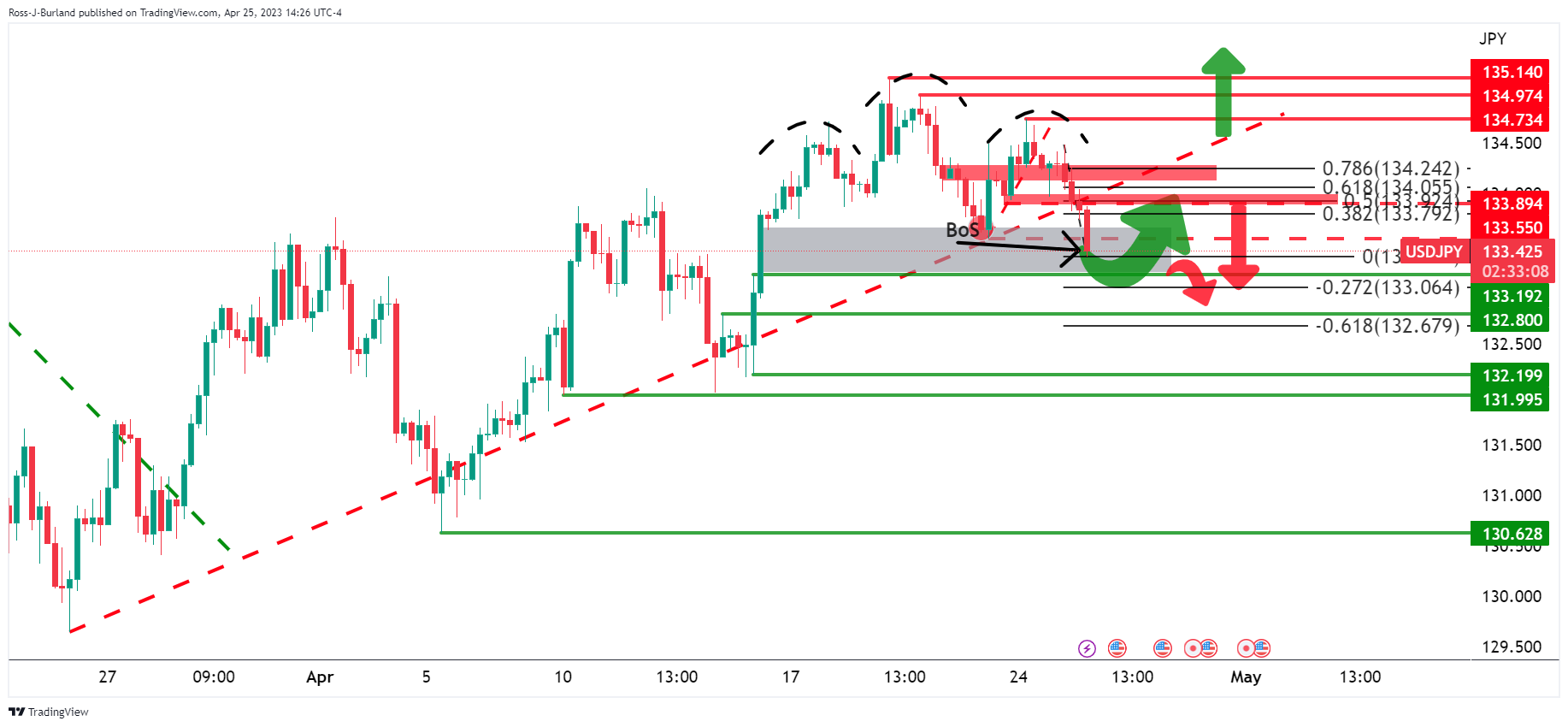

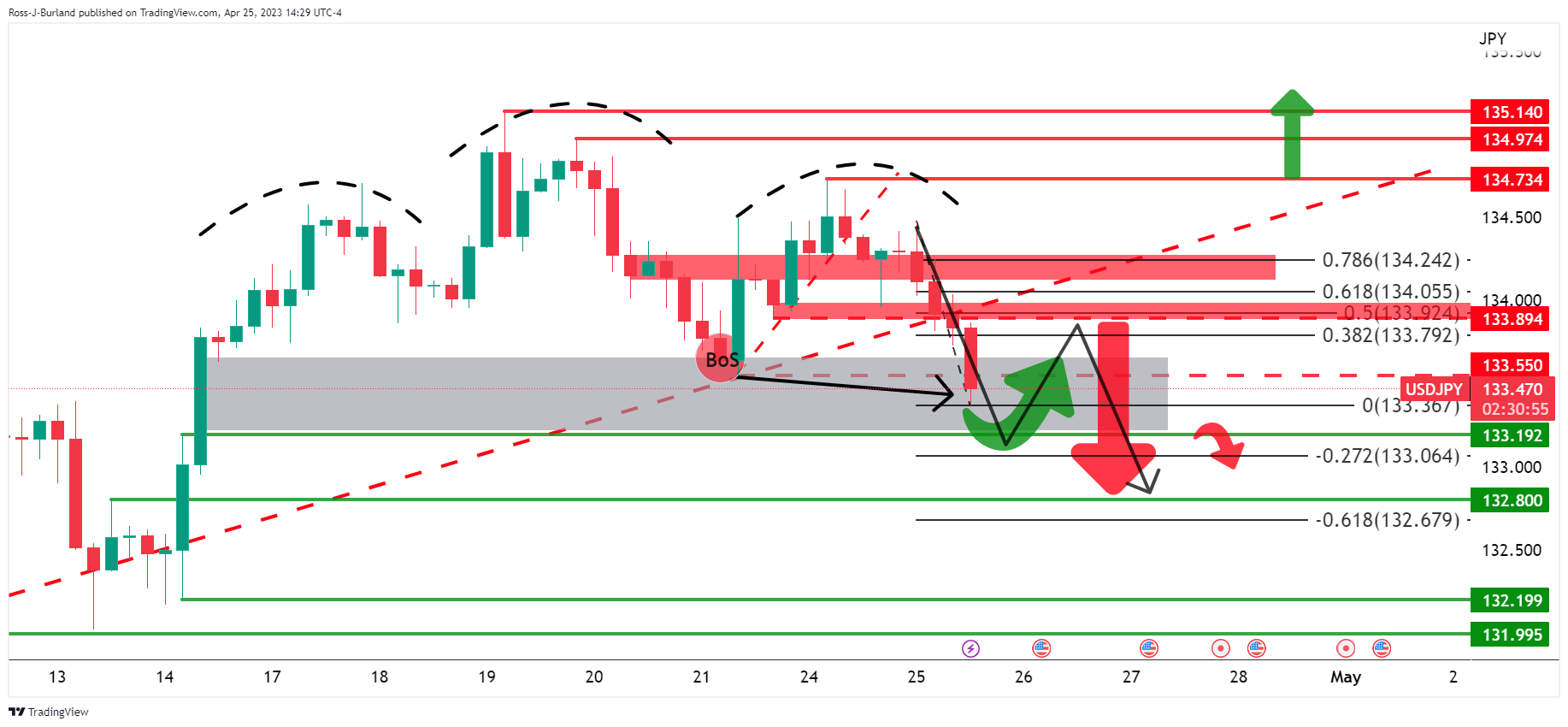

Ahead of Friday’s monetary policy decision, Bank of Japan (BoJ) Governor Kazuo Ueda suggested no imminent change. Speaking before parliament he said they should continue with monetary easing given current economic conditions. Despite Ueda’s comments, the Japanese Yen ended Tuesday sharply higher boosted by a decline in global government bond yields.

The Japanese Yen jumped on Wednesday. USD/JPY bottomed at 133.35, the lowest in ten days. CHF/JPY reached the highest level since 1980 at 151.51 and then reversed sharply, falling below 150.00

AUD/USD posted the lowest close in a month, below 0.6650. Australia will report inflation on Wednesday and the Reserve Bank of Australia (RBA) meets next week.

NZD/USD approached 0.6200 and then reversed amid a stronger US Dollar, falling below 0.6150. Trade data from New Zealand is due on Wednesday.

USD/CAD rose for the fifth consecutive day, climbing above 1.3600 for the first time since late March, boosted by the deterioration in market sentiment and lower crude oil prices.

Cryptocurrencies rose despite the decline in equity markets. Bitcoin climbed toward $28,000. Gold ended near $2,000 on a volatile session while Silver rebounded sharply from weekly lows to $25.00.

The earnings season continues on Wednesday with Meta, Thermo Fisher Scientific, Boeing, GSK, Vale, Pionerr and Hilton.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

22:00

South Korea Consumer Sentiment Index came in at 95.1, above forecasts (90.9) in April

-

21:35

NZD/USD bears take back control on banking sector concerns

- NZD/USD drops back towards Monday´s open as risk-off sentiment weighs.

- Banking sector worries have sunk equities and high beta currencies.

NZD/USD is down some 0.45% into the closing of the US session and Tuesday´s trade after suffering a risk-off blow with the US Dollar tearing higher since the early Europen session. NZD/USD rallied from a low of 0.6133 and reached a high of 0.6187 on the day.

´´The reversal has come amid a slide in regional bank stocks, which has, in turn, led markets to question how locked in a May Fed hike actually is, and driven safe-haven buying of USDs,´´ analysts at ANZ Bank explained.

Consequently, high beta currencies, such as NZD have fallen as equities drop. The US Dollar index, DXY, benefitted from the risk-off flows and was last up 0.51% at 101.84, a touch off the highs at 101.949. Plunging deposits at First Republic Bank have reignited worries over the health of the banking sector. Additionally, UBS reported a 52% slide in quarterly income as it prepared to swallow fallen rival Credit Suisse.

´´Volatility thus remains elevated, and we may get even more locally today with the release of March trade data, which will only serve as a reminder to markets of NZ’s yawning current account gap – something that we see as a downside risk to our expectation of a mild NZD appreciation in 2023,´´ the analysts at ANZ Bank explained, adding, ´´we also get AU Consumer Price Index data today, which is key given the NZD’s correlation to the AUD.´´

-

21:33

United States API Weekly Crude Oil Stock down to -6.083M in April 21 from previous -2.675M

-

21:07

S&P 500 bears seeking a break of critical support structure

- S&P 500 under pressure on banking sector concerns.

- Plunging deposits at First Republic Bank have reignited worries over the health of the banking sector.

- S&P 500 is on the backside of bull trend, eyes on critical structures.

The S&P 500 is firmly down on Tuesday and is printing fresh lows in late trade to 4,074.22. The index has traveled between a high of 4,126.43 and a low of 4,074.07 so far and is losing 1.57% at the time of writing.

US stocks are on track to end lower on a slew of earnings reports that have come out largely negative has weighed on risk sentiment, especially in the banking sector, bourne out of worrying earnings from First Republic Bank and UBS.

Plunging deposits at First Republic Bank have reignited worries over the health of the banking sector and UBS reporting a 52% slide in quarterly income as it prepares to swallow fallen rival Credit Suisse has not helped to encourage any hunger for risk in the financial markets. The revival of banking sector concerns could be an ongoing theme and that leaves the outlook fundamentally bearish for US equities and the S&P 500 index.

Meanwhile, Tuesday's economic calendar came with a number of several data points on the housing market and combined with consumer confidence falling to its lowest since July, while the Richmond Fed's survey of manufacturing activity came in at -10 versus a consensus of +4, bears have moved in.

S&P 500 index

The S&P 500 index has broken structure on the backside of the prior supporting trendline and is embarking on a test of the 4,069 critical support. A pullback could be on the cards at this juncture from such a major support level:

-

20:20

USD/MXN flashes signs of recovery and climbs above 18.1000 on risk aversion

- USD/MXN rallies on sentiment deterioration, triggering flows toward the safety of the US Dollar.

- Reports by Federal Reserve’s Regional Banks showed the US economy is stagnating.

- Banxico is set to pause its tightening cycle, as the latest inflation report in Mexico showed that prices are easing.

The USD/MXN shows flashes of recovery and rallies more than 0.70% on sentiment deterioration, thus denting appetite for the emerging market currency, the Mexican Peso (MXN). The First Republic Bank, which took over the troubled Silicon Valley Bank (SVB), missed estimates and reignited March’s fears of a banking crisis. Therefore, the USD/MXN climbed and is trading at 18.1057.

USD/MXN sees rally on sentiment downturn as Banxico pauses tightening cycle amid easing inflation

Wall Street is set to finish the day with substantial losses. Reports that First Republic Bank witnessed greater-than-expected withdrawals in the first quarter turned the mood sour. Several Federal Reserve (Fed) Regional Banks released their Manufacturing and Services Indices, indicating that the slowdown in the US economy is persisting. Moreover, the Conference Board (CB) released the Consumer Confidence report for April, which was lower than the estimated 104 at 101.3. The report revealed that consumers are increasingly pessimistic about the economy and expect the labor market to weaken.

The USD/MXN reacted upwards once the North American session began, bouncing from daily lows at around 17.9504 and rising towards the daily high at 18.1444 before stabilizing around current exchange rates.

In the meantime, the greenback appreciated, as shown by the US Dollar Index (DXY) gaining 0.53$, at 101.942, despite US Treasury bond yields falling. The CME FedWatch Tool indicates that the odds for a 25 bps rate hike at the May meeting diminished from 84% in the early New York session to 76.6%.

In other data, US New Home Sales in March rose by 683K above estimates of 632K, a signal that easing mortgage rates is helping curb the housing market.

Due to the lack of economic data in the Mexican economic agenda, the latest inflation report showed that it slowed down to 6.24% in April, its lowest level since October 2021. Nevertheless, core inflation remained at 7.75% for the first half of April, suggesting that the Bank of Mexico (Banxico) could pause its tightening cycle.

USD/MXN Technical Analysis

The USD/MXN continues tracking the 20-day EMA at 18.1170, as its dynamic resistance for the last couple of weeks. As of writing, it’s bracing to the EMA abovementioned, though it would need a daily close above it, to pave the way for further upside. If that scenario continues, the USD/MXN’s next resistance would be the 50-day EMA At 18.3222, followed by the April MTD high at 18.4010. Conversely, the USD/MXN could dip towards 18.0000 before testing the daily low at 17.9505.

-

20:10

USD/JPY Price Analysis: Bears in the market, eye the 133.20s

- USD/JPYs 1-hour chart shows the price is on the front side of the bearish trendline.

- The 133.70s and resistance could see any correction back under pressure.

- A subsequent move to the 133.20s could be on the cards.

Risk sentiment has soured and combined with falling longer-term US Treasury yields has led to a bid in the Yen that has started to see a topping in USD/JPY´s rally. However, as the following analysis illustrates, the price is still on the front side of the bullish trend on the longer-term outlook which leaves 132.00 key in this regard,

USD/JPY daily charts

Nevertheless, the price is meeting daily resistance and the bears are in the market. A break of the daily micro trendline support opens risks of a test of 132.00 and then the 130.60s. Below there, 129.60s and 127.20s will be eyed.

USD/JPY H4 charts

The market is still front side, of the bullish trend as shown above.

However, we have seen a break in structure, BoS, 133.42. The head and shoulders leave the outlook bearish for the meanwhile while below the 78.6% Fibonacci near 134.25. Nevertheless, bears could be encouraged to reengage below there.

A correction into the 50% mean reversion area near 133.90 could be met by supply for an onward bearish breakdown.

USD/JPY H1 chart

On the 1-hour chart, the price is on the front side of the bearish trendline and the M-formation´s neckline aligns with the 133.70s and resistance. A subsequent move to the 133.20s could be on the cards if the bears stay committed over the coming sessions.

-

18:49

USD/CAD bulls eye a run towards 1.3700 as risk sentiment sours

- Risk sentiment has soured as banking worries resurface, resulting in a resurgence in the US Dollar.

- USD/CAD bulls drive toward the falling wedge target.

USD/CAD rallied on Tuesday from a low of 1.3524 to a high of 1.3637 and is up over 0.7% on the day. The US Dollar is firmly bid as risk sentiment soured in Europe on returning banking worries and is sinking all ships with the high beta currencies, such as CAd, taking the brunt of it.

The US Dollar index, DXY, was last up 0.6% at 101.92, a touch off the highs at 101.949 that were bourne out of worrying earnings from First Republic Bank and UBS. Plunging deposits at First Republic Bank have reignited worries over the health of the banking sector and UBS reporting a 52% slide in quarterly income as it prepares to swallow fallen rival Credit Suisse has not helped to encourage any hunger for risk in the financial markets.

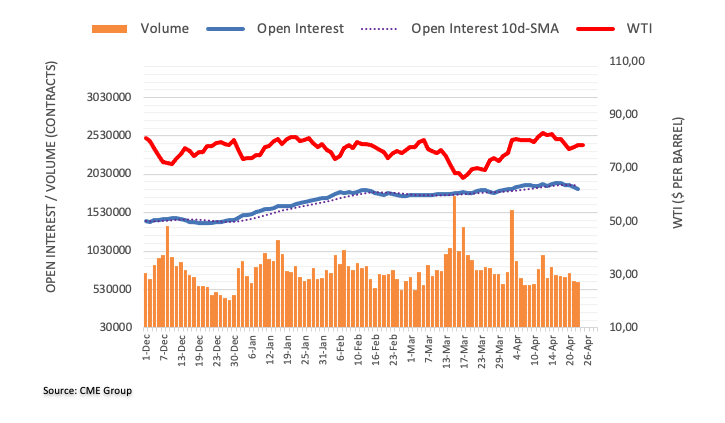

Meanwhile, the price of oil, one of Canada's major exports, has dropped with WTI falling from a high of $79.02bbls to a low of $76.57bbls. US Dollar strength today is pressuring energy prices and the concerns that a slowdown in the global economy will curb energy demand are weighing on the black gold which is hurtling towards the OPEC production cut bullish gap´s origin near $75.65bbls, WTI.

Domestically, the Bank of Canada is due to release its monetary policy deliberations for the April 12 interest rate decision on Wednesday and these will be parsed for any indication of a lower bar to resume tightening after the more hawkish messaging over the last two weeks, analysts at TD Securities explained. The analysts added that the BoC´s governor, Tiff Macklem, has already acknowledged discussing hikes in his media roundtable, and argued that ´´a more hawkish tone from the minutes could see markets price a higher probability of additional rate hikes in upcoming BoC meetings.´´

To note, the central bank left its benchmark rate on hold for a second straight meeting at a 15-year high of 4.50% and raised its growth forecast for 2023 to 1.4% from 1.0% in January.

USD/CAD technical analysis

Adverse risk sentiment and the subsequent rally in the Greenback on Tuesday have propelled the price toward the target without looking back. USD/CAD has broken old trendline resistance that would now be expected to act as a counter-trendline for the bulls to lean against should there be a meanwhile and significant correction.

However, the daily candle is a strong momentum candle so if there is profit-taking at the end of the day, then a correction may only be a shallow one leaving a small wick. We could see the bulls re-engaged for the next bullish impulse on Wednesday to the target, 1.3695. This is well within reach for a single day considering the daily ATR of 78 pips.

With that being said, a firmer correction would leave the trendline support and then 1.3570, 1.3550 and the 38.2% Fibonacci at 1.3532 ahead of a 50% mean reversion near 1.3500 at risk:

-

18:41

Silver Price Analysis: XAG/USD drops to three-week lows below $25.00, heading for a pullback

- XAG/USD breaks below the $25.00-$25.50 range, though a daily close could pave the way for further downside.

- XAG/USD Price Analysis: Oscillators suggest that sellers are regaining control; therefore, a fall toward $24.00 is likely.

Silver price slides beneath the $25.00 figure after printing a daily high earlier at around $25.36. Though flows toward the US Dollar (USD) exacerbated a fall toward the 20-day Exponential Moving Average (EMA) at around current prices. At the time of writing, the XAG/USD is trading at $24.86.

XAG/USD Price Action

The XAG/USD remains upward biased due to solid support at the 20-day EMA at $24.65. After piercing the latter, the XAG/USD jumped towards the $24.70s area, though oscillators tell a different story. The Relative Strength Index (RSI) aims downward, approaching the 50-mid line, which, once crossed, would indicate that sellers regained control. Also, the Rate of Change (RoC) shows that selling pressure has increased in the last three days. Hence, the XAG/USD is set for a pullback before resuming its uptrend.

The XAG/USD’s next support would be the April 25 daily low at $24.49. A breach of the latter will expose the psychological $24.00 level. Once cleared, the 50-day EMA at $23.69 would be tested, with the 100-day EMA up at $22.97.

Conversely, if XAG/USD cracks and achieves a daily close above $25.00, traders could expect further consolidation between $25.00-$25.50, as it has happened during the last four trading days.

XAG/USD Daily Chart

-

18:31

US Dollar still heading toward a depreciation path longer term – Wells Fargo

Analysts at Wells Fargo point out the US Dollar can trade around current levels during the second quarter, and see it depreciating during the second half of 2023.

Key quotes:

“The U.S. dollar is experiencing multiple cross-currents that can result in a stable greenback through the end of Q2-2023. Longer term, we believe the Fed will lower interest rates more aggressively than peer central banks, which can place broad depreciation pressure on the dollar over the second half of 2023 and into 2024.”

“We also believe emerging market currencies can continue to experience widespread currency strength going forward, with the best opportunities existing within high yielding currencies in Latin America and Emerging Europe.”

-

18:04

EUR/USD plummets below 1.1000 amid decelerating US economy and banking crisis fears

- US Consumer Confidence fell to its lowest level since July 2022.

- Economic activity reports by Regional Fed Banks portray a gloomy outlook for the US economy.

- ECB sources commented that the EU’s central bank is tilting towards a 25 bps rate hike.

EUR/USD dropped below the 1.1000 figure as risk aversion took center stage in Tuesday’s session. Successive reports that the economy in the United States (US) is decelerating, and reignited fears of March’s banking crisis, triggered a flight to safety. Therefore, the EUR/USD pair is trading at 1.0971, below after hitting a daily high of 1.1067, down 0.68%.

US Consumer Confidence hits new low as gloomy economic outlook persists, ECB hints a rate hike

Several Federal Reserve’s (Fed) Regional Banks revealed their Manufacturing and Services related Indices, with most reports suggesting an ongoing deceleration across the country. Additionally, the latest Consumer Confidence report for April, announced by the Conference Board (CB), came at 101.3, below the 104 estimated. The survey showed that consumers are becoming pessimistic about the economy, expecting the labor market to soften. That said, recessionary fears triggered flows toward the US Dollar; thus, the EUR/USD weakened.

The US Dollar Index (DXY), a measure of the American Dollar value against a basket of currencies, edged up 0.63%, at 101.942, even though US Treasury bond yields are collapsing. Odds that the Fed will hike 25 bps at the upcoming May meeting are at 84%, as reported by the CME FedWatch Tool. The report showed that investors are bracing for 50 bps rate cuts by the end of 2023.

In other data, US New Home Sales in March rose by 683K above estimates of 632K, a signal that easing mortgage rates is helping curb the housing market.

Across the pond, the Eurozone (EU) docket was empty, though late comments from European Central Bank (ECB) officials suggest at least a 25 bps interest rate increase is on the cards. The ECB Chief Economist Philip Lane noted that current data indicate a raise of rates is needed, though and guided that further hikes will depend on data. Later, Francois Villeroy added that inflation is at its peak and will reach the ECB’s target by the end of 2024.

Of late, some ECB insiders noted that the next meeting is tilting towards a 25 bps rate hike, but a negative print on April’s inflation could trigger a 50 bps rate hike, according to Econostream.

EUR/USD Technical Analysis

The EUR/USD is forming a bearish-engulfing candle pattern, suggesting that sellers outweigh buyers at the time of writing. However, a daily close below April 24 open price at 1.0990 is needed to pave the way for a pullback. Once that scenario plays out, the EUR/USD first support would be the 20-day Exponential Moving Average (EMA) at 1.0928. A breach of the latter will expose the April 17 cycle low at 1.0900. the EUR/USD’s next floor will be the confluence of the April 10 low and the 50-day EMA at around 1.0829/31 before slipping towards 1.0800.

-

18:03

United States 2-Year Note Auction increased to 3.969% from previous 3.954%

-

16:47

AUD/USD extends slide below 0.6630, hits two-week lows

- Australian Dollar falls as Wall Street wavers.

- US Dollar gains momentum despite lower US yields.

- AUD/USD under pressure, testing level under the 0.6630 support.

The AUD/USD is falling sharply on Tuesday amid a stronger US Dollar and a mixed market sentiment. The pair is trading at 0.6627, the lowest level since April 11. It is testing a relevant support area at 0.6630.

AUD under pressure ahead of Australian inflation

The AUD/USD started to decline on Asian hours, as Iron one prices continued to sink. After a pause, the pair resumed the decline amid US Dollar strength. The US Dollar Index is up by 0.50%, above 101.80, about to test Monday’s highs.

The Greenback is rising even as US yields decline. Such behavior reflects more demand for safety. In Wall Street, stocks are falling with the Dow Jones down 0.39% and the Nasdaq 1%, amid mixed US data and renewed banking concerns.

US data released on Tuesday showed an increase in the S&P/Case-Shiller Home Price Index in February of 0.4% from a year ago; a 9.6% surge in New Home Sales in March and a decline to six-month lows in CB Consumer Confidence in April.

On Wednesday, Australia will report inflation data. The consensus is for the Consumer Price Index to have risen 1.3% in the first quarter; and for the annual rate to decline from 6.8% in February to 6.6% in March. Those numbers will be relevant ahead of next week’s Reserve Bank of Australia meeting.

Testing 0.6630

The AUD/USD bottomed at 0.6627. It is testing levels below the 0.6630 support area. A consolidation below that zone would expose 0.6600. A break lower would target the March low at 0.6560.

A recovery above 0.6670 would alleviate the bearish pressure. The next resistance is 0.6710.

Technical levels

-

16:33

GBP/USD sinks from weekly high as risk aversion takes hold

- US Consumer Confidence continued deteriorating as Americans became more “pessimistic” about the economic outlook.

- Federal Reserve Regional Manufacturing and Services Indices show mixed readings, though flashing a deceleration in the US economy.

- BoE Chief Economist says Brits need to accept they’re “poorer”; calls for higher rates to tackle inflation.

GBP/USD reverses its earlier course after hitting a weekly high of 1.2507 and drops towards the 1.2400 figure amidst a risk-off impulse that triggered flows towards safe-haven assets. Therefore, the US Dollar (USD) remains in the driver’s seat, although US Treasury bond yields are collapsing. The GBP/USD is trading at 1.2401, down 0.67%.

US Consumer Confidence Drops, Fed’s Manufacturing and Services Indices Decelerate, BoE Chief Economist Urges Higher Rates

Sentiment remains deteriorating as the latest tranche of economic data from the United States (US) increased investors’ worries. Consumer Confidence in the United States dipped to its lowest level since July at 101.3, vs. estimates of 104.0. “Consumers became more pessimistic about the outlook for both business conditions and labor markets,” said Ataman Ozyildirim, senior director of economics at the Conference Board.

Further data, like the Philadelphia Fed Non-Manufacturing Activity plunging to -22.8, sparked recessionary fears. Of late, the Dallas Fed revealed the Services Activity Index for April, showing a slight improvement, to -14.4 vs. -18.8 in March, after yesterday’s report showed that the Manufacturing Index plunged to -23.4, as business conditions worsened.

Other data revealed that New Home Sales for March rose by 9.6%, exceeding 1.1% estimates, as increasing speculation that the Federal Reserve will pause its tightening cycle has kept mortgage rates stable.

Given the backdrop, the GBP/USD extended its losses due to risk aversion, even though US Treasury bond yields are plunging. Conversely, the greenback is rising 0.48%, as shown by the US Dollar Index at 101.815.

Across the pond, the UK agenda revealed the CBI Industrial Trend Order, which stood at -20, neither improving nor worsening, though flashed that the economy is stagnating. Meanwhile, the Bank of England (BoE) Governor Ben Broadbent commented that there’s no evidence that QE sparked the jump in inflation.

Of late, the BoE Chief Economist Huw Pill commented that British people need to accept that they are “poorer.” Pill added that recent events call for higher rates and foresees UK’s inflation would dip to 2% in two years.

GBP/USD Technical Analysis

From a technical perspective, the GBP/USD appears to have formed a head-and-shoulders chart pattern that could drive prices to test the confluence of the 100 and 200-day EMAs at around 1.2170. But firstly, the GBP/USD must break below the head-and-shoulders neckline at approximately 1.2360/70, so it could confirm its validity. If that scenario plays out, the GBP/USD next support would be the 50-day EMA at 1.2289 and then the 1.2200 figure. Conversely, if GBP/USD stays above 1.2400, it could pave the way for a bullish continuation towards 1.2500.

-

15:23

US: New Home Sales rise by 9.6% in March vs. 1.1% expected

- New Home Sales in the US increase at a much stronger pace than expected in March.

- US Dollar Index extends its rebound toward 102.00.

Sales of new single‐family houses rose by 9.6% in March to a seasonally adjusted annual rate of 683,000, the data published jointly by the US Census Bureau and the Department of Housing and Urban Development showed on Tuesday.

This reading followed February's decline of 3.9% came in much better than the market expectation for an increase of 1.1%.

Market reaction

The US Dollar continues to gather strength in the American session and the US Dollar Index was last seen rising 0.5% on the day at 101.85.

-

15:08

US: CB Consumer Confidence Index declines to 101.3 in April from 104 in March

- CB Consumer Confidence Index declined slightly in April.

- US Dollar Index clings to daily recovery gains above 101.50.

Consumer sentiment in the US weakened modestly in April with the Conference Board's Consumer Confidence Index edging lower to 101.3 from 104.0 in March (revised from 104.2).

Further details of the publication revealed that the Present Situation Index improved modestly to 151.1 from 148.9 and the Consumer Expectations Index declined to 68.1 from 74.

Finally, the one-year consumer inflation expectations ticked down to 6.2% in April from 6.3% in March.

Market reaction

The US Dollar Index extends its rebound after this data and was last seen rising 0.4% on the day at 101.72.

-

15:00

United States Richmond Fed Manufacturing Index below forecasts (-9) in April: Actual (-10)

-

15:00

United States New Home Sales Change (MoM) above forecasts (1.1%) in March: Actual (9.6%)

-

15:00

United States New Home Sales (MoM) came in at 0.683M, above forecasts (0.634M) in March

-

14:51

USD Index climbs to daily highs near 101.60 as risk-off prevails

- The index gathers extra pace and revisits the 101.60 zone.

- The resurgence of the risk aversion underpins the US Dollar.

- Next on tap in the docket comes the CB’s Consumer Confidence.

The demand for the Greenback intensifies on the back of persistent risk aversion and lifts the USD Index (DXY) to daily highs in the 101.60/70 band on Tuesday.

USD Index stronger on risk-off mood

Banking jitters resurface and favours the re-emergence of the risk-off sentiment, which in turn morphs into extra upside pressure for the Buck.

The move higher in the index comes so far in tandem with further weakness in US yields across the curve, as the fly-to-safety feeling props up the demand for bonds on Tuesday.

Meanwhile, investors seem convinced of another 25 bps rate hike by the Federal Reserve at its meeting on May 3 amidst hawkish Fedspeak and with inflation still way above the Fed’s 2.0% target. At the same time, a source of potential weakness for the Dollar comes from rising speculation of an impasse in the Fed’s hiking cycle soon after the May event.

In the US data space, the the FHFA’s House Price Index expanded 0.5% MoM in February, while the Consumer Confidence tracked by the Conference Board and New Home Sales are due later in the NA session.

What to look for around USD

The dollar faces renewed upside pressure on the back of the re-emergence of the risk aversion mood on Tuesday.

Looking at the broader picture, the index continues to navigate in a consolidative phase against steady expectations of another rate increase in May by the Fed.

In favour of a pivot in the Fed’s hiking cycle following the May event appears the persevering disinflation and nascent weakness in some key fundamentals.

Key events in the US this week: House Price Index, CB Consumer Confidence, New Home Sales (Tuesday) – MBA Mortgage Applications, Durable Goods Orders, Advanced Goods Trade Balance (Wednesday) – Flash Q1 GDP Growth Rate, Initial Jobless Claims, Pending Home Sales (Thursday) – PCE/Core PCE, Employment Cost, Personal Income, Personal Spending, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is gaining 0.36% at 101.68 and faces the next hurdle at 102.80 (weekly high April 10) followed by 103.05 (monthly high April 3) and then 103.23 (55-day SMA). On the flip side, the breach of 100.78 (2023 low April 14) would open the door to 100.00 (psychological level) and finally 99.81 (weekly low April 21 2022).

-

14:44

Gold Price Forecast: XAU/USD volatile, between stronger Dollar and lower Treasury yields

- Gold rebounds despite a stronger US Dollar.

- Falling US Treasury yields are helping the yellow metal.

- XAU/USD remains under the 20-day SMA, keeps avoiding daily close under $1.980.

Gold price rebounded sharply during the last hour, rising more than $10. XAU/USD bottomed at $1,975 and then jumped to $1,994. As of writing, it trades at $1,987 marginally lower for the day, on a volatile session. Despite the big swings, price remains in a recent familiar range.

Gold price rebound is losing momentum as the US Dollar prints fresh daily highs across the board. The DXY is up by 0.35%, trading at 101.70. At the same time, US Treasury yields are falling again. The US 10-year yields stands at 3.43% and the 2-year at 4.03%, both at two-week lows.

The combination of a stronger US Dollar and lower Treasury yields is favoring large swings in XAU/USD. Incoming economic data from the US, particularly Q1 GDP and consumer inflation on Thursday, could add fuel to volatility.

On a wider perspective, gold is showing some signs of weakness as it remains below the 20-day Simple Moving Average (SMA) which stands near $2,000. At the same time, it has avoided a daily close under $1,980. A close under the mentioned level would point to an extension of the bearish correction.

XAU/USD Daily chart

-

14:08

Mexico: Inflation data strengthens scenario of Banxico remaining on hold – TD Securities

Data released on Monday showed inflation continues to ease in Mexico. Analysts at TD Securities point out that the numbers strengthen their scenario of the Bank of Mexico (Banxico) remaining on hold at its next monetary policy meeting.

Key quotes:

“Core inflation surprised slightly to the downside in the first half of April. This inflation component posted a 0.18% biweekly change (below the 0.22% expected by the consensus). Thus, core inflation dropped to 7.75% in annual terms from previous 8.03%.”

“We think the slight downward surprise posted by core inflation strengthens our scenario of Banxico remaining on hold in its next monetary policy meeting (May 18). In particular, the recent performance of core inflation appears in line with Banxico's Q2 forecasts (7.5%).”

-

14:05

US: Housing Price Index rises 0.5% in February vs. -0.2% expected

- House prices in the US increased modestly in February.

- US Dollar Index clings to modest daily gains slightly above 101.50.

House prices in the US rose by 0.5% on a monthly basis in February, the monthly data published by the US Federal Housing Finance Agency showed on Tuesday. This reading followed January's increase of 0.1% (revised from +0.2%) and came in better than the market expectation for a decrease of 0.2%.

Meanwhile, the S&P/Case-Shiller Home Price Index arrived at +0.4% on a yearly basis in February, down from +2.6% recorded in January.

Market reaction

These data don't seem to be having an impact on the US Dollar's performance against its rivals. As of writing, the US Dollar Index was up 0.25% on the day at 101.55.

-

14:00

United States Housing Price Index (MoM) above expectations (-0.2%) in February: Actual (0.5%)

-

14:00

United States S&P/Case-Shiller Home Price Indices (YoY) registered at 0.4% above expectations (0.1%) in February

-

13:55

United States Redbook Index (YoY): 1.8% (April 21) vs 1.1%

-

13:32

EUR/USD Price Analysis: Attention remains on the 2023 peak

- EUR/USD comes under some pressure following recent tops.

- Immediately to the upside emerges the 2023 high at 1.1075.

EUR/USD surrenders part of the recent positive streak following the breakout of the 1.1000 barrier.

The pair looks poised to extend the recovery further in the near term. That said, the immediate hurdle is expected at the 2023 high at 1.1075 (April 14) seconded by the round level at 1.1100.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0400.

EUR/USD daily chart

-

13:30

Brazil Current Account came in at $0.286B, above expectations ($-9.5B) in March

-

13:00

Brazil Retail Sales (MoM) registered at -0.1%, below expectations (0%) in February

-

12:23

USD Index Price Analysis: A drop below 101.00 remains likely

- DXY regains some buying interest and attempt a decent bounce.

- Next on the downside appears the 101.00 region ahead of YTD lows.

DXY reverses three consecutive sessions with losses and rebound from daily lows near 101.20 on Tuesday.

The recent choppy performance in the index seems to have now refocused back on the downside. Against that, DXY could cling to this consolidative theme ahead of a probable drop to the 101.00 zone. The loss of the latter could expose a move to the so far 2023 lows near 100.80 (April 14).

Looking at the broader picture, while below the 200-day SMA, today at 106.15, the outlook for the index is expected to remain negative.

DXY daily chart

-

12:16

USD/MYR faces a solid resistance at 4.4410 ahead of 4.4550 – UOB

In the view of Markets Strategist Quek Ser Leang at UOB Group, further upside in USD/MYR should meet a firm up-barrier at 4.4410 and 4.4550 in the near term.

Key Quotes

“Last Monday (17 Apr, spot at 4.4160), we highlighted that USD/MYR ‘is likely to edge higher but any advance is expected to face solid resistance at 4.4450’. While USD/MYR rose as expected, it did not quite threaten the resistance at 4.4450 (high has been 4.4400).”

“The underlying appears to be firm, and the bias for USD/MYR this week is still on the upside. That said, there are a couple of strong resistance levels at 4.4410 and 4.4550. Support is at 4.4190, followed by 4.3790.”

-

12:12

EUR/JPY Price Analysis: Room for extra gains

- EUR/JPY clinches fresh tops near 148.60 on Tuesday.

- Next of note on the upside comes the 150.00 yardstick.

EUR/JPY corrects lower following the move to fresh highs in the 148.60/65 band, an area last seen back in later December 2014.

The underlying strong upside momentum in the cross appears so far unabated despite the ongoing knee-jerk. Further north of recent tops at 148.63 (April 25), the cross could embark on a potential visit to the key 150.00 mark in the not-so-distant future.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 142.31.

EUR/JPY daily chart

-

11:39

USD/THB faces extra consolidation near term – UOB

Markets Strategist Quek Ser Leang at UOB Group expects USD/THB to remain side-lined in the short-term horizon.

Key Quotes

“Last Monday (17 Apr, spot at 34.33), we held the view that USD/THB ‘is likely to trade with an upward bias but a sustained rise above 34.55 is unlikely’. Our expectation did not materialize as USD/THB traded in a quiet manner between 34.22 and 34.51.”

“The price movements appear to be consolidative and this week, we expect USD/THB to trade in a range, likely between 34.07 and 34.55.”

-

11:15

Australia: Headline inflation to ease to 1.2% q/q – TD Securities

Previewing Australian inflation data that will be released early Wednesday, analysts at TD Securities note that they are below consensus on both the headline Consumer Price Index (CPI) and trimmed mean measure in Q1.

RBA to keep rates unchanged again in May

"We expect headline inflation to ease to 1.2% q/q (cons: 1.3%, RBA: 1.5%) from 1.9% last quarter. This would bring the annual print to 6.8% y/y, from 7.8% y/y in Q4."

"The Jan-Feb monthly CPIs point to a quick easing in price pressures, and it is unlikely that the Q1 print would meet the RBA implied forecasts. To achieve the RBA's Q1'23 7.1% y/y forecast, this would require the monthly Mar'23 CPI to print ~1.35% m/m, significantly above the March outcomes in prior years."

"For CPI trimmed mean inflation, we project it at 1.2% q/q, 6.5% y/y (cons: 1.4% q/q, 6.7% y/y) as broad-based price pressures remain. If both quarterly prints print in line with our forecasts, this should bolster our call for the RBA to keep rates unchanged again in May."

-

11:00

US Dollar corrects as focus shifts to US tech earnings, economic data

- US Dollar pauses decline but any recovery attempts appear short-lived.

- Top-tier economic data and tech earnings from the United States this week to affect USD valuation.

- The daily technical setup for the US Dollar Index continues to favor bears in the near term.

The United States Dollar (USD) is correcting from weekly lows, as bulls find their footing amid broad risk-aversion. Rising tensions over the approaching US debt ceiling deadline and a lack of clarity on the Federal Reserve (Fed) interest rates outlook weigh on the market sentiment. Investors readjust their US Dollar positions, bracing for a week of high-profile quarterly earnings and closely watched economic data from the United States.

Earnings this week include a spate of potential market movers, including tech and tech-adjacent Alphabet Inc, Microsoft Corp, Meta Platforms Inc and Amazon.com. On the macroeconomic front, the first quarter Gross Domestic Product (GDP) and April Personal Consumption Expenditures (PCE) Price Index will be closely scrutinized in the second half of this week. In the meantime, the mid-tier US Conference Board Consumer Confidence data and housing data will entertain US Dollar traders.

The US Dollar Index, which tracks the USD performance against a basket of six major currencies, trades marginally higher on the day, near 101.50.

Daily digest market movers: US Dollar sellers take a breather

- On Monday, the Federal Reserve Bank of Chicago announced that the National Activity Index remained unchanged at -0.19 in March. Meanwhile, the Federal Reserve Bank of Dallas' Texas Manufacturing Survey showed that the headline Business Index plunged to -223.4 in April from -15.7 in March.

- Wall Street's main indices closed mixed on Monday, as Nasdaq underperformed on worries about tech earnings ahead.

- Troubled US bank, First Republic Bank, shares sank over 20% after market hours, as it said deposits plunged by more than $100 billion in the first quarter.

- Concerns persist over the approaching US debt ceiling deadline. The House of Representatives is expected to vote on a Republican-led debt and spending bill this week.

- 10-year US Treasury bond yields keep falling toward the 3.40% after breaching the 3.50% key level on Monday.

- Markets are currently pricing a roughly 90% probability of a 25 basis points Federal Reserve (Fed) rate hike at the upcoming meeting, according to the CME Group FedWatch Tool.

- The Fed is in the blackout period ahead of its May 3 monetary policy announcements.

- This Tuesday, the Conference Board's Consumer Confidence data for April from the United States will be reported alongside the New Home Sales data.

- Earnings from US tech giants Microsoft Corp, which backs ChatGPT, and Google parent Alphabet Inc, top the watchlist on Tuesday.

- The US Bureau of Economic Analysis will unveil the first estimate of first-quarter GDP growth on Thursday. The US economy is forecast to expand at an annualized rate of 2% in Q1, down from the 2.6% recorded in the last quarter of 2022.

Technical analysis: US Dollar Index remains vulnerable

The US Dollar Index (DXY) is challenging the 101.50 psychological level on the road to recovery from weekly troughs. The recovery could gain traction if DXY manages to yield a daily closing above the bearish 21-Day Moving Average (DMA). It is worth noting that the index has failed to settle above the 21 DMA since March 15 on a daily candlestick closing basis.

Acceptance above the latter could initiate a fresh upswing toward the 102.50 psychological barrier, beyond which the confluence of the downward-sloping 50 and 100 DMAs at around 103.30 will be on buyers’ radars.

With the 14-day Relative Strength Index (RSI), however, still below the 50.00 level, the recovery attempts in DXY are likely to be sold into. Immediate support is seen at the intraday low of 101.19, below which the 101.00 round number will challenge the bullish commitments. Deeper declines will seek validation from the multi-month low reached on April 14 at 100.78.

How is US Dollar correlated with US stock markets?

Stock markets in the US are likely to turn bearish if the Federal Reserve goes into a tightening cycle to battle rising inflation. Higher interest rates will ramp up the cost of borrowing and weigh on business investment. In that scenario, investors are likely to refrain from taking on high-risk, high-return positions. As a result of risk aversion and tight monetary policy, the US Dollar Index (DXY) should rise while the broad S&P 500 Index declines, revealing an inverse correlation.

During times of monetary loosening via lower interest rates and quantitative easing to ramp up economic activity, investors are likely to bet on assets that are expected to deliver higher returns, such as shares of technology companies. The Nasdaq Composite is a technology-heavy index and it is expected to outperform other major equity indexes in such a period. On the other hand, the US Dollar Index should turn bearish due to the rising money supply and the weakening safe-haven demand.

-

10:57

BoE’s Broadbent: Had we seen inflation shocks coming, BoE would have tightened policy sooner

Bank of England (BoE) Deputy Governor, Ben Broadbent, said on Tuesday, “had we seen inflation shocks coming, BoE would have tightened policy sooner.”

Additional comments

“BoE policy has not been optimal.”

“If we had started raising rates 6 months earlier, it might have lowered peak inflation by a maximum half a percentage point.”

-

10:43

Eurozone GDP preview: A surprise in the making? – Rabobank

Analysts at Rabobank expect an upside surprise in the Eurozone preliminary Gross Domestic Product (GDP) data for the first quarter due for release this Friday.

Key quotes

“GDP figures the Eurozone will be published on Friday April 28. We believe that the consensus is too pessimistic and we now expect a relatively strong growth figure for the first quarter.”

“However, we do not expect this strong growth to be sustained throughout the year, as the credit impulse has waned and the global growth landscape is likely to become a drag.”

“Lagarde flags risks of geopolitical changes to central bank policy and inflation. For now, we stick to our base case scenario of 5.4% in 2023 and 3.5% in 2024, but keep an eye on the changing geopolitical landscape.”

-

10:23

Major central banks cut dollar operations with Fed as market stress eases

In a joint statement on Tuesday, The European Central Bank (ECB), the Bank of Japan (BoJ), the Bank of England (BoE) and the Swiss National Bank (SNB) will reduce the frequency of their dollar operations with the US Federal Reserve (Fed) from May 1 as the volatility in financial markets has receded.

Key takeaways

“The BoE, the BoJ, the ECB and the SNB, in consultation with the Fed, have jointly decided to revert the frequency of their 7-day operations from daily to once per week.”

This decision was taken in view of the improvements in US Dollar funding conditions and the low demand at recent US Dollar liquidity-providing operations.

"These central banks stand ready to re-adjust the provision of US dollar liquidity as warranted by market conditions.”

-

09:46

BoJ Preview: New face, new game? – TDS

Analysts at TD Securities (TDS) offer a brief preview of what they expect from Friday’s Bank of Japan (BoJ) monetary policy announcements, the first decision under new Governor Kazuo Ueda.

Key quotes

“For the first meeting under Governor Ueda, the BoJ is expected to keep all of its policy levers unchanged. We think it is highly likely that a formal policy review is announced. That should put the next YCC shift as early as June. Generally, we think assuming a YCC change sooner rather than later is a prudent strategy. Lifting the yield cap to 1% as its next move has a lot of appeal.”

“The BoJ will not provide advance warning to a YCC change and will instead prefer to do it when it is least expected. As such, one cannot fully rule out a change at any meeting. We also think they would prefer to make a shift when the Fed has neared or completed its tightening cycle as there is less natural upward pressure to push global yields higher.”

“For this reason, we like owning some yen upside through the meeting via a 1m 132/129 USDJPY put-spread. We also like the tactical setup going into the Fed meeting and NFP meeting next month. The yen should trade with an asymmetric bias given the correlation persistence that it shows to the red/green SOFR strips (i.e. cut pricing), with particular focus to calendar spreads beyond U4.”

-

09:30

Singapore: Inflation lost momentum in March – UOB

Senior Economist at UOB Group Alvin Liew reviews the latest inflation figures in Singapore.

Key Takeaways

“Headline and core CPI inflation eased and further converged in Mar 2023. Headline CPI rose by 0.5% m/m NSA, from 0.6% in Jan. Despite the m/m increase, CPI inflation rose at a slower pace of 5.5% y/y in Mar (from 6.3% in Feb). Similarly, core inflation (which excludes accommodation and private road transport) rose sequentially in Mar by 0.2% m/m (after staying flat in Feb at 0.0% m/m). Core inflation, like the headline, also eased noticeably in Mar despite the sequential increase, coming in at 5.0% y/y (from 5.5% y/y in Feb).”

“Inflation Outlook – The MAS kept its inflation forecasts (that were first made in the 14 Oct 2022 MPS) unchanged in today’s Mar CPI report, just as it did in the recent Monetary Policy Statement release (14 Apr). The central bank stated that “MAS Core Inflation will stay elevated in the next few months, as accumulated business costs continue to feed through to consumer prices”, and it also expected core inflation “to slow more discernibly in the second half of this year.” The MAS also noted both upside and downside risks to inflation (versus just upside risks previously in the Feb 2023 CPI report). We continue to expect headline inflation to average 5.0% and core inflation to average 4.0% in 2023. Excluding the 2023 GST impact, we expect headline inflation to average 4.0% and core inflation to average 3.0%.”

-

09:29

EUR/USD trims gains and returns to 1.1020, as dollar recovers

- EUR/USD gives away part of the recent 3-day advance.

- The greenback regains some traction and weighs on the pair.

- US Consumer Confidence will be in the limelight later in the day.

Fresh selling pressure now drags EUR/USD to the low-1.1000s on the back of some tepid recovery in the dollar on Tuesday.

EUR/USD continues to target the 2023 high

EUR/USD now succumbs to the better mood around the dollar and snaps three consecutive sessions with gains on Tuesday.

Despite the knee-jerk, the pair remains poised for the continuation of the uptrend in the short-term horizon. Indeed, this view remains underpinned by firmer speculation that the ECB will raise the policy rate in June and July, which in turn appears propped up by the unabated hawkish narrative from ECB’s rate setters.

The absence of data releases in the euro docket on Tuesday will surely leave the attention to the US calendar, where the Consumer Confidence tracked by the Conference Board will be in the centre of the debate seconded by New Home Sales, and the FHFA’s House Price Index.

What to look for around EUR

Renewed weakness now prompts EUR/USD to retreat from recent peaks in response to some signs of life from the greenback.

Meanwhile, price action around the single currency should continue to closely follow dollar dynamics, as well as the incipient Fed-ECB divergence when it comes to the banks’ intentions regarding the potential next moves in interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Germany GfK Consumer Confidence (Wednesday) – EMU Final Consumer Confidence, Economic Sentiment (Thursday) – Euro group Meeting, Germany labour market report/ Advanced Inflation Rate/Flash Q1 GDP Growth Rate, EMU Flash Q1 GDP Growth Rate (Friday).

Eminent issues on the back boiler: Continuation (or not) of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.16% at 1.1027 and faces the next support at 1.0909 (weekly low April 17) seconded by 1.0831 (monthly low April 10) and finally 1.0788 (monthly low April 3). On the upside, a break above 1.1075 (2023 high April 14) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022).

-

09:22

Euro makes a date with 1.1075 year-to-date highs on confidence-boosting bank earnings

- Euro vs US Dollar almost reaches 2023 highs at 1.1075 before rolling over.

- Single currency is boosted by Eurozone bank earnings, showing the sector is in good health.

- Technicals show the uptrend remains intact and is expected to continue.

The Euro (EUR) is pulling back after almost touching year-to-date highs above 1.1000 against the US Dollar (USD) during the early European session, on Tuesday. The single currency is supported by confidence-boosting Eurozone bank earnings, which suggest the sector has weathered the March crisis better than expected. Hawkish comments from rate-setters at the European Central Bank (ECB) further aid the Euro, as expectation of higher interest rates would lift capital inflows into Europe. From a technical perspective, the overall trend is up, with the probabilities favoring longs over shorts.

EUR/USD market movers

- The Euro gains strength from comments by Pierre Wunsch, president of Belgium’s Banque Nationale, who said “We are waiting for wage growth and core inflation to go down... before we can arrive at the point where we can pause (hiking rates).”

- The ECB’s chief economist Philip Lane has gone on the record saying interest rates will rise at the May 4 meeting but whether beyond that depends on the data.

- Previously, the Irishman said a lot is riding on the state of Eurozone banks, as assessed by the ECB’s Bank Lending Survey out on May 2, as well as April flash HICP inflation data released on the same day.

- Strong first quarter earnings by European banks due to higher interest margins, however, suggest the BLS will paint a favorable picture.

- Banco Santander’s recently released Q1 earnings, for example, beat profit estimates of 2.4B with 2.57B.

- ECB President Christine Lagarde recently said there is still “some way to go” before Frankfurt is done with hiking interest rates.

- The US Dollar is at a disadvantage since Federal Reserve (Fed) officials are in the two-week blackout period before the May 4 meeting, during which time they are not allowed to comment.

- Prior to the blackout, St. Louis Fed’s Bullard was hawkish, saying he expects more rate hikes due to persistent inflation and overblown recession fears.

- Unexpectedly strong first quarter earnings by US banks suggests the sector’s March crisis may be in the rear-view mirror, further supporting the Greenback.

- The key data release for the US Dollar is Consumer Confidence for April, out at 14:00 GMT. There is no major macroeconomic data out for the Euro.

EUR/USD technical analysis: Nearing year-to-date highs

EUR/USD breaks out of a right-angled triangle (more clearly seen on the 4-hour chart) and unfolds another leg higher, in line with the broader medium-term uptrend that began over eight months ago. The pair is fast approaching the year-to-date highs at 1.1075. The odds favor a continuation of the dominant Euro bullish trend.

-638180075791018996.png)

EUR/USD: Daily ChartA decisive break above 1.1075, which was touched on April 14, would confirm a continuation of the Euro’s uptrend to the next key resistance level at around 1.1190, where the 200-week Simple Moving Average (SMA) sits.

For the sake of clarity, the definition of a ‘decisive break’ either includes a ‘breakout candle’ – a long green bullish daily candle that extends above the 1.1075 highs and closes near its high, or three smaller bullish green candles in a row that break above the highs.

Alternatively, a break and daily close below the key lower high at 1.0830 would bring into doubt the validity of the uptrend and could see losses extend down to a confluence of support at 1.0775-1.0800, marking a possible reversal of the dominant trend.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance. -

09:06

USD/CNH: Upside momentum expected to improve – UOB

Extra gains in USD/CNH are likely on a breakout of the 6.9350 region in the near term, comment UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang.

Key Quotes

24-hour view: “We expected USD to trade with an upward bias yesterday but we held the view that ‘any advance is likely to face strong resistance at 6.9100’. While USD rose above 6.9100, it fell quickly from a high of 6.9125. Upward pressure has more or less faded and USD is unlikely to advance further. Today, it is more likely to trade sideways between 6.8820 and 6.9080.”

Next 1-3 weeks: “Our update from last Thursday (20 Apr, spot at 6.8920) still stands. As highlighted, upward momentum is beginning to improve but USD has to break and stay above 6.9350 before a sustained rise is likely. The chance of USD breaking clearly above 6.9350 is not high for now but it will remain intact as long as the ‘strong support’ level at 6.8600 (no change in level) is not taken out.”

-

09:03

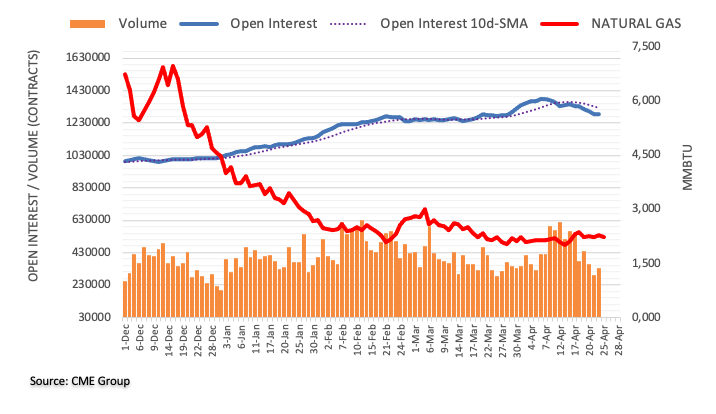

Natural Gas Futures: Further range bound on the cards

In light of advanced prints from CME Group for natural gas futures markets, open interest extended the downtrend and shrank by 880 contracts on Monday. On the other hand, volume reversed two consecutive daily drops and rose by around 42.3K contracts.

Natural Gas remains bolstered by $2.00