Notícias do Mercado

-

23:41

Commodities. Daily history for Nov 24’2014:

(raw materials / closing price /% change)

Light Crude 75.67 -0.15%

Gold 1,197.30 +0.13%

-

23:31

Stocks. Daily history for Nov 24’2014:

(index / closing price / change items /% change)

Hang Seng 23,893.14 +456.02 +1.95%

Shanghai Composite 2,532.88 +46.09 +1.85%

FTSE 100 6,729.79 -20.97 -0.31%

CAC 40 4,368.44 +21.21 +0.49%

Xetra DAX 9,785.54 +52.99 +0.54%

S&P 500 2,069.41 +5.91 +0.29%

NASDAQ Composite 4,754.89 +41.92 +0.89%

Dow Jones 17,817.9 +7.84 +0.04%

-

23:28

Currencies. Daily history for Nov 24’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2442 +0,41%

GBP/USD $1,5704 +0,28%

USD/CHF Chf0,9662 -0,34%

USD/JPY Y118,27 +0,47%

EUR/JPY Y147,18 +0,93%

GBP/JPY Y185,72 +0,75%

AUD/USD $0,8616 -0,58%

NZD/USD $0,7860 -0,23%

USD/CAD C$1,1277 +0,35%

-

23:00

Schedule for today, Tuesday, Nov 25’2014:

(time / country / index / period / previous value / forecast)

01:00 Japan BOJ Governor Haruhiko Kuroda Speaks

02:00 China Leading Index October +0.9%

02:00 New Zealand RBNZ Inflation Expectations q/q Quarter IV +2.2%

04:45 Japan BOJ Governor Haruhiko Kuroda Speaks

07:00 Germany GDP (QoQ) (Finally) Quarter III +0.1% +0.1%

07:00 Germany GDP (YoY) (Finally) Quarter III +1.4% +1.2%

09:05 Australia RBA Assist Gov Lowe Speaks

09:30 United Kingdom BBA Mortgage Approvals October 39.3 38.5

13:30 Canada Retail Sales, m/m October -0.3% +0.6%

13:30 Canada Retail Sales ex Autos, m/m October -0.3% +0.4%

13:30 U.S. PCE price index, q/q Quarter III +1.2%

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +1.3%

13:30 U.S. GDP, q/q (Revised) Quarter III +3.5% +3.3%

14:00 U.S. Housing Price Index, m/m September +0.5%

14:00 U.S. Housing Price Index, y/y September +4.8%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y September +5.6% +4.7%

15:00 U.S. Richmond Fed Manufacturing Index November 20 17

15:00 U.S. Consumer confidence November 94.5 95.9

21:30 U.S. API Crude Oil Inventories November +3.7

-

20:00

Dow 17,809.10 -0.96 -0.01%, Nasdaq 4,748.54 +35.57 +0.75%, S&P 500 2,067.46 +3.96 +0.19%

-

17:00

European stocks closed in different ways: FTSE 100 6,729.79 -20.97 -0.31%, CAC 40 4,368.44 +21.21 +0.49%, DAX 9,785.54 +52.99 +0.54%

-

17:00

European stocks close: most stocks closed higher on the better-than-expected Ifo figures from Germany

Most stock indices closed higher on the better-than-expected Ifo figures from Germany. German Ifo business climate index rose to 104.7 in November from 103.2 in October, beating expectations for a decline to 103.0.

Investors speculate that the European Central Bank (ECB) is moving closer to launch the quantitative easing programme after the ECB President Mario Draghi said on Friday the central bank is prepared to add further stimulus measures if needed.

Germany's Bundesbank President Jens Weidmann expressed doubt at a conference in Madrid on Monday that a potential government bond-buying program would be sufficient to boost the economy in the Eurozone.

The European Central Bank confirmed on Monday that it bought €2.238bn in covered bonds over the previous week.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,729.79 -20.97 -0.31%

DAX 9,785.54 +52.99 +0.54%

CAC 40 4,368.44 +21.21 +0.49%

-

16:40

Oil fluctuated

Brent and West Texas Intermediate were little changed as investors weighed the odds of a production cut from OPEC this week.

Iran may propose that OPEC cut its output target by as much as 1 million barrels a day, Mehr News reported. Hedge funds have turned less bullish on oil in the absence of any clear signal from the Organization of Petroleum Exporting Countries that it will act to bolster prices. The 20 analysts surveyed last week by Bloomberg are divided, with half predicting a cut and the rest no action.

"Whether they are going to cut is up in the air," said Paul Crovo, a Philadelphia-based oil analyst at PNC Capital Advisors. "I won't make big bets either way. There is a lot of expectation that OPEC does need to cut. That's the perception, and it's going to drive the market."

Brent for January settlement added 6 cents, or 0.1 percent, to $80.42 a barrel at 10:41 a.m. New York time on the London-based ICE Futures Europe exchange. Futures closed at $80.36 on Nov. 21, the highest since Nov. 12. The volume of all futures was 49 percent below the 100-day average.

WTI for January delivery rose 24 cents, or 0.3 percent, to $76.75 barrel on the New York Mercantile Exchange. Volume was about 43 percent below the 100-day average. The European benchmark crude traded at a premium of $3.71 to WTI.

-

16:39

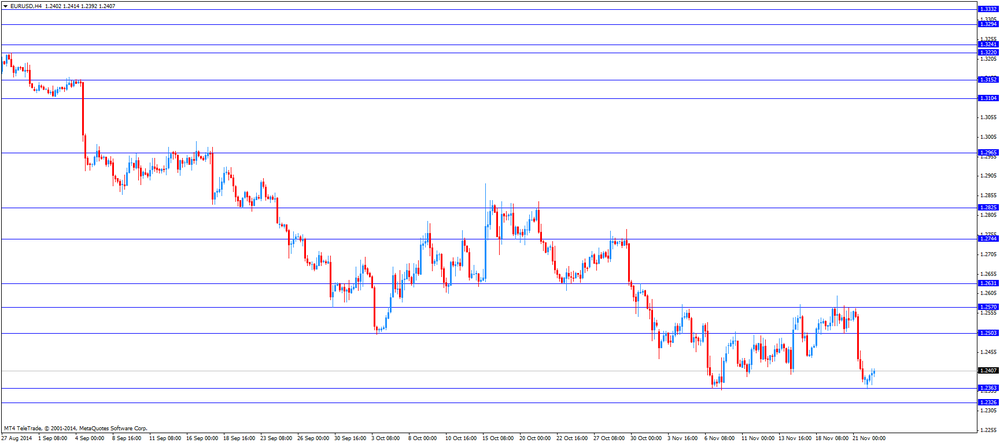

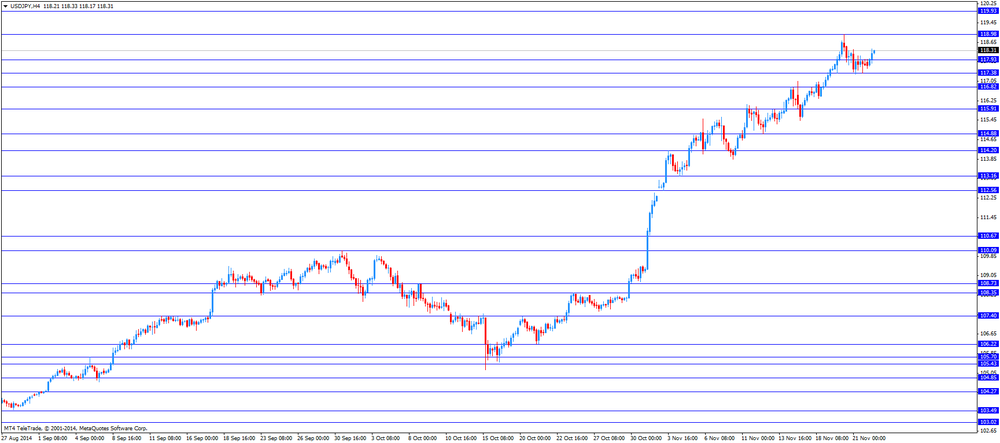

Foreign exchange market. American session: the U.S. dollar mixed against the most major currencies after the weaker-than-expected U.S. preliminary services purchasing managers' index

The U.S. dollar mixed against the most major currencies after the weaker-than-expected U.S. preliminary services purchasing managers' index (PMI). The U.S. preliminary services PMI declined to 56.3 in November from 57.1 in October, missing expectations for an increase to 57.3. This is the lowest level since April 2014.

The euro rose against the U.S. dollar after the better-than-expected Ifo figures from Germany. German Ifo business climate index rose to 104.7 in November from 103.2 in October, beating expectations for a decline to 103.0.

The European Central Bank confirmed on Monday that it bought €2.238bn in covered bonds over the previous week.

The British pound increased against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. The number of employed people climbed to 4,230 million in the third quarter from 4,196 million in the second quarter. Analysts had expected the number of employed people to increase to 4,220 million.

The New Zealand dollar fell against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar declined against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

-

16:23

Bundesbank President Jens Weidmann expressed doubt a potential government bond-buying program would be sufficient to boost the economy in the Eurozone

Germany's Bundesbank President Jens Weidmann expressed doubt at a conference in Madrid on Monday that a potential government bond-buying program would be sufficient to boost the economy in the Eurozone.

He noted that "the monetary policy can influence short-term demand, it cannot permanently boost growth prospects".

Weidmann pointed out that Europe's economies needed to raise productivity.

Weidmann is a European Central Bank Governing Council member.

-

15:44

Slovakia and Russia will sign new 15-year oil deal

The Slovak Economy Ministry's spokeswoman Miriam Ziakova said on Monday that Slovakia and Russia will sign a new 15-year oil deal on December 5. Russia will ship up to 6 million tonnes of oil a year to Slovakia.

The current oil contract expires at the end of this year.

-

15:38

The European Central Bank confirmed on Monday that it bought €2.238bn in covered bonds over the previous week.

-

15:31

U.S. preliminary services PMI fell to 56.3 in November

Markit released its preliminary services purchasing managers' index (PMI) figures for the U.S. on Monday. The U.S. preliminary services PMI declined to 56.3 in November from 57.1 in October, missing expectations for an increase to 57.3. This is the lowest level since April 2014.

The chief economist at Markit Chris Williamson that the services PMI figures "add to signs that the economic upturn has lost considerable momentum". But he added that "the pace of expansion remains robust by historical standards".

-

14:45

U.S.: Services PMI, November 56.3 (forecast 57.3)

-

14:34

U.S. Stocks open: Dow 17,825.15 +15.09 +0.08%, Nasdaq 4,725.03 +12.06 +0.26%, S&P 2,066.08 +2.58 +0.13%

-

14:28

Before the bell: S&P futures +0.28%, Nasdaq futures +0.36%

U.S. stock-index futures rose, indicating equities may extend all-time highs after a fifth week of gains, as confidence in the global economy grew amid support from central banks.

Global markets:

Hang Seng 23,893.14 +456.02 +1.95%

Shanghai Composite 2,533.89 +47.10 +1.89%

FTSE 6,747.34 -3.42 -0.05%

CAC 4,380.75 +33.52 +0.77%

DAX 9,807.76 +75.21 +0.77%

Crude oil $76.24 (-0.35%)

Gold $1197.10 (-0.07%)

-

14:14

DOW components before the bell

(company / ticker / price / change, % / volume)

Wal-Mart Stores Inc

WMT

84.69

+0.05%

7.8K

3M Co

MMM

160.26

+0.06%

1.3K

The Coca-Cola Co

KO

44.53

+0.07%

29.3K

Microsoft Corp

MSFT

48.03

+0.10%

7.3K

Caterpillar Inc

CAT

106.60

+0.14%

0.3K

General Electric Co

GE

27.03

+0.15%

7.7K

Johnson & Johnson

JNJ

108.11

+0.23%

0.5K

McDonald's Corp

MCD

96.90

+0.23%

0.3K

Walt Disney Co

DIS

89.18

+0.25%

0.7K

Cisco Systems Inc

CSCO

26.95

+0.26%

8.4K

Home Depot Inc

HD

98.58

+0.31%

1.2K

JPMorgan Chase and Co

JPM

60.65

+0.33%

1.7K

Goldman Sachs

GS

190.23

+0.34%

1.3K

Merck & Co Inc

MRK

59.86

+0.34%

0.9K

Boeing Co

BA

133.25

+0.35%

1.3K

International Business Machines Co...

IBM

161.50

+0.36%

0.9K

Procter & Gamble Co

PG

88.92

+0.36%

0.4K

Nike

NKE

97.80

+0.39%

5.7K

Pfizer Inc

PFE

30.57

+0.39%

3.2K

Intel Corp

INTC

35.91

+0.90%

58.3K

E. I. du Pont de Nemours and Co

DD

72.15

0.00%

0.1K

AT&T Inc

T

35.25

-0.09%

17.5K

Exxon Mobil Corp

XOM

96.40

-0.42%

9.8K

Chevron Corp

CVX

118.01

-0.48%

2.9K

Verizon Communications Inc

VZ

49.85

-0.72%

38.7K

United Technologies Corp

UTX

109.18

-1.02%

3.4K

-

14:08

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Verizon (VZ) downgraded to Neutral from Buy at Citigroup

Exxon Mobil (XOM) downgraded to Mkt Perform from Mkt Outperform at JMP Securities

Chevron (CVX) downgraded to Outperform from Strong Buy at Raymond James

Other:

Apple (AAPL) target raised from $120 to $135 at Susquehanna

-

14:00

Belgium: Business Climate, November -6.1 (forecast -5.3)

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400, $1.2425(E418mn), $1.2500(E1.1bn)

USD/JPY: Y117.25

AUD/USD: $0.8610(A$1.0bn), $0.8800(A$840mn)

USD/CAD: Cad1.1250

EUR/JPY: Y146.00(E568mn)

-

13:01

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the better-than-expected Ifo figures from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

08:15 Switzerland Employment Level Quarter III 4.20 4.22 4.23

09:00 Germany IFO - Business Climate November 103.2 103.0 104.7

09:00 Germany IFO - Current Assessment November 108.4 108.2 110.0

09:00 Germany IFO - Expectations November 98.3 98.5 99.7

The U.S. dollar mixed against the most major currencies ahead of the U.S. preliminary services purchasing managers' index (PMI). The U.S. preliminary services PMI is expected to climb to 57.3 in November from 57.1 in October.

The euro traded higher against the U.S. dollar after the better-than-expected Ifo figures from Germany. German Ifo business climate index rose to 104.7 in November from 103.2 in October, beating expectations for a decline to 103.0.

The euro dropped against the greenback on Friday after comments by the European Central Bank (ECB) President Mario Draghi. He reiterated that the ECB is prepared to add further stimulus measures if needed. Investors speculate that the central bank is moving closer to launch the quantitative easing programme.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. The number of employed people climbed to 4,230 million in the third quarter from 4,196 million in the second quarter. Analysts had expected the number of employed people to increase to 4,220 million.

EUR/USD: the currency pair rose to $1.2414

GBP/USD: the currency pair climbed to $1.5693

USD/JPY: the currency pair increased to Y118.38

The most important news that are expected (GMT0):

14:00 Belgium Business Climate November -6.8 -5.3

14:45 U.S. Services PMI (Preliminary) November 57.1 57.3

23:50 Japan Monetary Policy Meeting Minutes

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580, $1.2520, $1.2475/80

Bids $1.2350, $1.2300

GBP/USD

Offers $1.5800, $1.5780/85, $1.5745/50

Bids $1.5590, $1.5550, $1.5525/20, $1.5500

AUD/USD

Offers $0.8800, $0.8750

Bids $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y148.50, Y148.00, Y147.50, Y147.00

Bids Y145.50, Y145.00

USD/JPY

Offers Y119.50, Y119.20, Y119.00, Y118.60/80

Bids Y117.00, Y116.85/80, Y116.50

EUR/GBP

Offers stg0.8066, stg0.8000, stg0.7980

Bids stg0.7885/75, stg0.7860/50

-

12:00

European stock markets mid-session: DAX and CAC40 extend rally, FTSE100 slightly down

European stocks are mainly positive near two-month highs after continuing Friday's rally fuelled by ECB president Mario Draghi's dovish comments and hints that the ECB is going to fight disinflation and the peoples Bank of China's surprise cut in benchmark interest rates. Today German IFO Business climate that measures attitudes toward business prospects over the next six months in Germany, Eurozone's biggest economy and indicator for the whole Eurozone's economic growth, published at 09:00 GMT were better-than-expected for November reading 104.7 beating forecasts by 1.7. The FTSE 100 index is currently trading almost unchanged -0.09% at 6,725.27 points, whereas Germany's DAX 30 gained +0.68% trading at 9,799.01 points and France's CAC 40 is up +0.85% currently quoted at 4,384.12 points.

-

11:20

Oil: Prices little changed

Oil prices were little changed in today's session with Brent Crude trading -0.04% at USD80.33 a barrel and WTI Crude losing -0.04% currently quoted at USD76.49 finding support in China's interest rate cuts and speculation about the OPEC cutting production.

Market participants try to assess the potential outcome of the OPEC meeting, which will take place in Vienna. Experts note that the main producers of OPEC do not want to reduce production quotas, and other members of the cartel, including Venezuela, Iran, Ecuador, Nigeria and Algeria called for measures to stabilize oil prices. Morgan Stanley analysts pointed out that the probability that the leadership of OPEC still decide to cut production, has recently increased. But there is no consensus, analysts seem divided.

Increasingly weak oil prices which have fallen by almost a third in five months add further pressure on the leading OPEC members Saudi Arabia and Kuwait that still seem resisting calls from other members to cut output as they fear losing market shares to U.S. shale drillers. The OPEC with its 12 member countries responsible for 40% of world's oil production is scheduled to meet in three days in Vienna on November 27 to discuss 2015 production target and whether to adjust the current volume of production at 30 million. B / d at the beginning of 2015.

-

11:00

Gold again trading closely around USD1,200

Gold, currently trading below the key-level of USD1200.00 a troy ounce is trading little changed but still lower on Monday. The stronger greenback supported by a stronger U.S. economy and speculations about the FED increasing the benchmark interest rates weigh on gold as it makes the metal more expensive for holders of other currencies. On the other hand stimulus policies from China and Europe are supporting gold prices. The sudden decision of China to lower their rates, which increased the likelihood of increased demand from the world's biggest consumer of the metal let the precious metal climb over USD1200 for the first time in 3 weeks on Friday.GOLD currently trading below USD1,200.00

-

10:09

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400, $1.2425(E418mn), $1.2500(E1.1bn)

USD/JPY: Y117.25

AUD/USD: $0.8610(A$1.0bn), $0.8800(A$840mn)

USD/CAD: Cad1.1250

EUR/JPY: Y146.00(E568mn)

-

09:27

Press Review: SNB Gold Vote Is ‘Dangerous’

BLOOMBERG

SNB Gold Vote Is 'Dangerous,' Jordan Says in Sermon on Hill

Swiss National Bank President Thomas Jordan took to a church pulpit to warn voters that passing an initiative requiring the central bank to hold a fixed portion of its assets in gold risked harming the economy.

"The initiative is dangerous because it would weaken the SNB," he said yesterday, speaking at a location on a historic hill in the town of Uster, Switzerland. It "would make it considerably harder for us to intervene with determination in a crisis situation and fulfill our stability mandate," he said.

REUTERS

Exclusive: China ready to cut rates again on fears of deflation - sources

China's leadership and central bank are ready to cut interest rates again and also loosen lending restrictions, concerned that falling prices could trigger a surge in debt defaults, business failures and job losses, said sources involved in policy-making.

Friday's surprise cut in rates, the first in more than two years, reflects a change of course by Beijing and the central bank, which had persisted with modest stimulus measures before finally deciding last week that a bold monetary policy step was required to stabilize the world's second-largest economy.

Source: http://www.reuters.com/article/2014/11/24/us-china-economy-policy-exclusive-idUSKCN0J803320141124

-

09:16

European Stocks. First hour: European stocks trading higher on good IFO data

European stocks started slightly positive near two-month highs after being boosted on Friday by ECB president Mario Draghi's dovish comments and hints that the ECB is going to fight disinflation. The peoples Bank of China's surprise cut in benchmark interest rates further fuelled bullish sentiment. German IFO Business climate that measures attitudes toward business prospects over the next six months in Germany, Eurozones biggest economy, published at 09:00 GMT was better-than-expected for November reading 104.7 beating forecasts by 1.7. Data on IFO current assessment was better at 110.0 versus its forecasts of 108.2 and IFO Expectations rose to 99.7 with a forecast of 98.5.

The FTSE 100 index is currently trading little changed at +0.01% at 6,751.12 points, Germany's DAX 30 is up +0.78% trading at 9,808.50 points and France's CAC 40 gained +0.70% currently quoted at 4,377.66 points.

-

09:00

Germany: IFO - Business Climate, November 104.7 (forecast 103.0)

-

09:00

Germany: IFO - Current Assessment , November 110.0 (forecast 108.2)

-

09:00

Germany: IFO - Expectations , November 99.7 (forecast 98.5)

-

08:15

Switzerland: Employment Level, Quarter III 4.23 (forecast 4.22)

-

08:00

Global Stocks: U.S. and Asian indices continued to rally

The DOW Jones and S&P 500 were trading higher in Friday's trading session after China's cut in interest rates and hints from the ECB to further support growth and fight disinflation. The DOW Jones closed at 17,810.06, a plus of +0.51%, the S&P500 edged up by +0.52% closing at 2,063.50 points.

Hong Kong's Hang Seng trading +1.95% at 23,895.01 and China's Shanghai Composite closing at 2,533.89 points, a gain of 1.89% rallied after U.S. indices reached a new record and the Peoples Bank of China's unexpected benchmark interest rate cut.

Japan's Nikkei was closed for a public holiday.

-

07:30

Foreign exchange market. Asian session: the greenback is trading weaker to mixed against its major peers

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Japan Bank holiday

The U.S. dollar is trading near a two-year high against the euro after European Central Bank President Mario Draghi said last Friday the ECB will do what is necessary to fight disinflation. The annual rate on inflation in the Eurozone was 0.4% in October, well below the ECB's target of 2%. Markets are awaiting IFO data on German business sentiment published at 09:00 GMT.

The Australian dollar and the New Zealand dollar continued to climb after China, Australia's largest and New Zealand's second largest trade partner, unexpectedly cut interest rates for the first time since 2012 to counter economic slowdown.

The Japanese yen is trading mixed against the U.S. dollar after recovering from its lows on Thursday after Japan's Finance Minister Taro Aso said on Friday that the Japanese yen has fallen too quickly. Japanese markets are closed today for a public holiday.

EUR/USD: the euro slightly recovered against the greenback

USD/JPY: the U.S. dollar traded mixed against the Japanese yen

GPB/USD: The British pound traded stronger against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Employment Level Quarter III 4.20 4.22

09:00 Germany IFO - Business Climate November 103.2 103.0

09:00 Germany IFO - Current Assessment November 108.4 108.2

09:00 Germany IFO - Expectations November 98.3 98.5

14:00 Belgium Business Climate November -6.8 -5.3

14:45 U.S. Services PMI (Preliminary) November 57.1 57.3

23:50 Japan Monetary Policy Meeting Minutes

-

06:15

Options levels on monday, November 24, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2515 (1418)

$1.2466 (348)

$1.2421 (133)

Price at time of writing this review: $ 1.2399

Support levels (open interest**, contracts):

$1.2358 (2874)

$1.2343 (6462)

$1.2324 (3935)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 107092 contracts, with the maximum number of contracts with strike pric $1,2800 (6027);

- Overall open interest on the PUT options with the expiration date December, 5 is 105658 contracts, with the maximum number of contracts with strike price $1,2200 (6804);

- The ratio of PUT/CALL was 0.99 versus 1.03 from the previous trading day according to data from November, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.5901 (733)

$1.5803 (901)

$1.5706 (1256)

Price at time of writing this review: $1.5667

Support levels (open interest**, contracts):

$1.5593 (1459)

$1.5496 (929)

$1.5398 (1066)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 40126 contracts, with the maximum number of contracts with strike price $1,6000 (1890);

- Overall open interest on the PUT options with the expiration date December, 5 is 40467 contracts, with the maximum number of contracts with strike price $1,5900 (2304);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from November, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:01

Hang Seng 23,841.33 +404.21 +1.72%, S&P/ASX 200 5,357.9 +53.60 +1.01%, Shanghai Composite 2,505.83 +19.04 +0.77%

-