Notícias do Mercado

-

23:28

Currencies. Daily history for Nov 24’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2442 +0,41%

GBP/USD $1,5704 +0,28%

USD/CHF Chf0,9662 -0,34%

USD/JPY Y118,27 +0,47%

EUR/JPY Y147,18 +0,93%

GBP/JPY Y185,72 +0,75%

AUD/USD $0,8616 -0,58%

NZD/USD $0,7860 -0,23%

USD/CAD C$1,1277 +0,35%

-

23:00

Schedule for today, Tuesday, Nov 25’2014:

(time / country / index / period / previous value / forecast)

01:00 Japan BOJ Governor Haruhiko Kuroda Speaks

02:00 China Leading Index October +0.9%

02:00 New Zealand RBNZ Inflation Expectations q/q Quarter IV +2.2%

04:45 Japan BOJ Governor Haruhiko Kuroda Speaks

07:00 Germany GDP (QoQ) (Finally) Quarter III +0.1% +0.1%

07:00 Germany GDP (YoY) (Finally) Quarter III +1.4% +1.2%

09:05 Australia RBA Assist Gov Lowe Speaks

09:30 United Kingdom BBA Mortgage Approvals October 39.3 38.5

13:30 Canada Retail Sales, m/m October -0.3% +0.6%

13:30 Canada Retail Sales ex Autos, m/m October -0.3% +0.4%

13:30 U.S. PCE price index, q/q Quarter III +1.2%

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +1.3%

13:30 U.S. GDP, q/q (Revised) Quarter III +3.5% +3.3%

14:00 U.S. Housing Price Index, m/m September +0.5%

14:00 U.S. Housing Price Index, y/y September +4.8%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y September +5.6% +4.7%

15:00 U.S. Richmond Fed Manufacturing Index November 20 17

15:00 U.S. Consumer confidence November 94.5 95.9

21:30 U.S. API Crude Oil Inventories November +3.7

-

16:39

Foreign exchange market. American session: the U.S. dollar mixed against the most major currencies after the weaker-than-expected U.S. preliminary services purchasing managers' index

The U.S. dollar mixed against the most major currencies after the weaker-than-expected U.S. preliminary services purchasing managers' index (PMI). The U.S. preliminary services PMI declined to 56.3 in November from 57.1 in October, missing expectations for an increase to 57.3. This is the lowest level since April 2014.

The euro rose against the U.S. dollar after the better-than-expected Ifo figures from Germany. German Ifo business climate index rose to 104.7 in November from 103.2 in October, beating expectations for a decline to 103.0.

The European Central Bank confirmed on Monday that it bought €2.238bn in covered bonds over the previous week.

The British pound increased against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. The number of employed people climbed to 4,230 million in the third quarter from 4,196 million in the second quarter. Analysts had expected the number of employed people to increase to 4,220 million.

The New Zealand dollar fell against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar declined against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

-

16:23

Bundesbank President Jens Weidmann expressed doubt a potential government bond-buying program would be sufficient to boost the economy in the Eurozone

Germany's Bundesbank President Jens Weidmann expressed doubt at a conference in Madrid on Monday that a potential government bond-buying program would be sufficient to boost the economy in the Eurozone.

He noted that "the monetary policy can influence short-term demand, it cannot permanently boost growth prospects".

Weidmann pointed out that Europe's economies needed to raise productivity.

Weidmann is a European Central Bank Governing Council member.

-

15:38

The European Central Bank confirmed on Monday that it bought €2.238bn in covered bonds over the previous week.

-

15:31

U.S. preliminary services PMI fell to 56.3 in November

Markit released its preliminary services purchasing managers' index (PMI) figures for the U.S. on Monday. The U.S. preliminary services PMI declined to 56.3 in November from 57.1 in October, missing expectations for an increase to 57.3. This is the lowest level since April 2014.

The chief economist at Markit Chris Williamson that the services PMI figures "add to signs that the economic upturn has lost considerable momentum". But he added that "the pace of expansion remains robust by historical standards".

-

14:45

U.S.: Services PMI, November 56.3 (forecast 57.3)

-

14:00

Belgium: Business Climate, November -6.1 (forecast -5.3)

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400, $1.2425(E418mn), $1.2500(E1.1bn)

USD/JPY: Y117.25

AUD/USD: $0.8610(A$1.0bn), $0.8800(A$840mn)

USD/CAD: Cad1.1250

EUR/JPY: Y146.00(E568mn)

-

13:01

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the better-than-expected Ifo figures from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

08:15 Switzerland Employment Level Quarter III 4.20 4.22 4.23

09:00 Germany IFO - Business Climate November 103.2 103.0 104.7

09:00 Germany IFO - Current Assessment November 108.4 108.2 110.0

09:00 Germany IFO - Expectations November 98.3 98.5 99.7

The U.S. dollar mixed against the most major currencies ahead of the U.S. preliminary services purchasing managers' index (PMI). The U.S. preliminary services PMI is expected to climb to 57.3 in November from 57.1 in October.

The euro traded higher against the U.S. dollar after the better-than-expected Ifo figures from Germany. German Ifo business climate index rose to 104.7 in November from 103.2 in October, beating expectations for a decline to 103.0.

The euro dropped against the greenback on Friday after comments by the European Central Bank (ECB) President Mario Draghi. He reiterated that the ECB is prepared to add further stimulus measures if needed. Investors speculate that the central bank is moving closer to launch the quantitative easing programme.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. The number of employed people climbed to 4,230 million in the third quarter from 4,196 million in the second quarter. Analysts had expected the number of employed people to increase to 4,220 million.

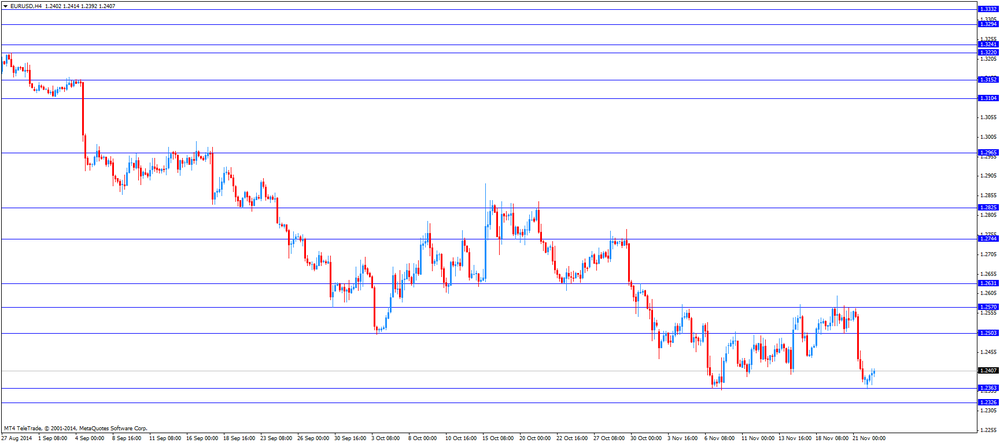

EUR/USD: the currency pair rose to $1.2414

GBP/USD: the currency pair climbed to $1.5693

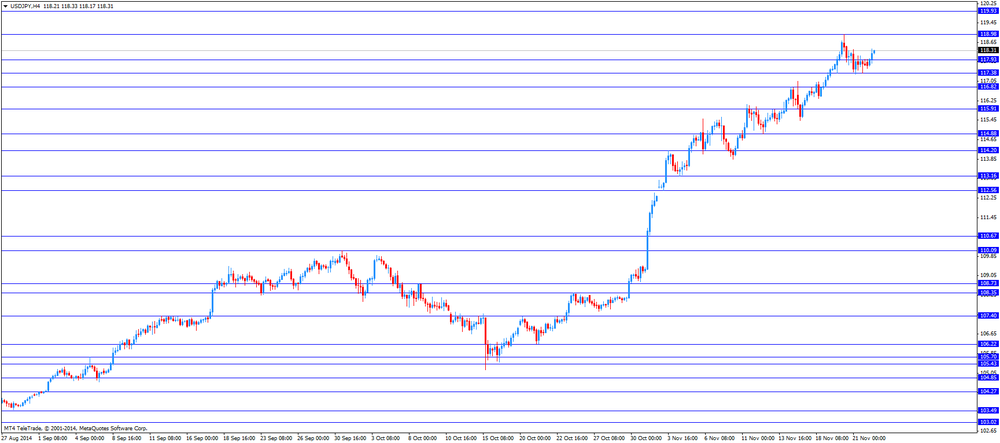

USD/JPY: the currency pair increased to Y118.38

The most important news that are expected (GMT0):

14:00 Belgium Business Climate November -6.8 -5.3

14:45 U.S. Services PMI (Preliminary) November 57.1 57.3

23:50 Japan Monetary Policy Meeting Minutes

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580, $1.2520, $1.2475/80

Bids $1.2350, $1.2300

GBP/USD

Offers $1.5800, $1.5780/85, $1.5745/50

Bids $1.5590, $1.5550, $1.5525/20, $1.5500

AUD/USD

Offers $0.8800, $0.8750

Bids $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y148.50, Y148.00, Y147.50, Y147.00

Bids Y145.50, Y145.00

USD/JPY

Offers Y119.50, Y119.20, Y119.00, Y118.60/80

Bids Y117.00, Y116.85/80, Y116.50

EUR/GBP

Offers stg0.8066, stg0.8000, stg0.7980

Bids stg0.7885/75, stg0.7860/50

-

10:09

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400, $1.2425(E418mn), $1.2500(E1.1bn)

USD/JPY: Y117.25

AUD/USD: $0.8610(A$1.0bn), $0.8800(A$840mn)

USD/CAD: Cad1.1250

EUR/JPY: Y146.00(E568mn)

-

09:27

Press Review: SNB Gold Vote Is ‘Dangerous’

BLOOMBERG

SNB Gold Vote Is 'Dangerous,' Jordan Says in Sermon on Hill

Swiss National Bank President Thomas Jordan took to a church pulpit to warn voters that passing an initiative requiring the central bank to hold a fixed portion of its assets in gold risked harming the economy.

"The initiative is dangerous because it would weaken the SNB," he said yesterday, speaking at a location on a historic hill in the town of Uster, Switzerland. It "would make it considerably harder for us to intervene with determination in a crisis situation and fulfill our stability mandate," he said.

REUTERS

Exclusive: China ready to cut rates again on fears of deflation - sources

China's leadership and central bank are ready to cut interest rates again and also loosen lending restrictions, concerned that falling prices could trigger a surge in debt defaults, business failures and job losses, said sources involved in policy-making.

Friday's surprise cut in rates, the first in more than two years, reflects a change of course by Beijing and the central bank, which had persisted with modest stimulus measures before finally deciding last week that a bold monetary policy step was required to stabilize the world's second-largest economy.

Source: http://www.reuters.com/article/2014/11/24/us-china-economy-policy-exclusive-idUSKCN0J803320141124

-

09:00

Germany: IFO - Business Climate, November 104.7 (forecast 103.0)

-

09:00

Germany: IFO - Current Assessment , November 110.0 (forecast 108.2)

-

09:00

Germany: IFO - Expectations , November 99.7 (forecast 98.5)

-

08:15

Switzerland: Employment Level, Quarter III 4.23 (forecast 4.22)

-

07:30

Foreign exchange market. Asian session: the greenback is trading weaker to mixed against its major peers

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Japan Bank holiday

The U.S. dollar is trading near a two-year high against the euro after European Central Bank President Mario Draghi said last Friday the ECB will do what is necessary to fight disinflation. The annual rate on inflation in the Eurozone was 0.4% in October, well below the ECB's target of 2%. Markets are awaiting IFO data on German business sentiment published at 09:00 GMT.

The Australian dollar and the New Zealand dollar continued to climb after China, Australia's largest and New Zealand's second largest trade partner, unexpectedly cut interest rates for the first time since 2012 to counter economic slowdown.

The Japanese yen is trading mixed against the U.S. dollar after recovering from its lows on Thursday after Japan's Finance Minister Taro Aso said on Friday that the Japanese yen has fallen too quickly. Japanese markets are closed today for a public holiday.

EUR/USD: the euro slightly recovered against the greenback

USD/JPY: the U.S. dollar traded mixed against the Japanese yen

GPB/USD: The British pound traded stronger against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Employment Level Quarter III 4.20 4.22

09:00 Germany IFO - Business Climate November 103.2 103.0

09:00 Germany IFO - Current Assessment November 108.4 108.2

09:00 Germany IFO - Expectations November 98.3 98.5

14:00 Belgium Business Climate November -6.8 -5.3

14:45 U.S. Services PMI (Preliminary) November 57.1 57.3

23:50 Japan Monetary Policy Meeting Minutes

-

06:15

Options levels on monday, November 24, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2515 (1418)

$1.2466 (348)

$1.2421 (133)

Price at time of writing this review: $ 1.2399

Support levels (open interest**, contracts):

$1.2358 (2874)

$1.2343 (6462)

$1.2324 (3935)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 107092 contracts, with the maximum number of contracts with strike pric $1,2800 (6027);

- Overall open interest on the PUT options with the expiration date December, 5 is 105658 contracts, with the maximum number of contracts with strike price $1,2200 (6804);

- The ratio of PUT/CALL was 0.99 versus 1.03 from the previous trading day according to data from November, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.5901 (733)

$1.5803 (901)

$1.5706 (1256)

Price at time of writing this review: $1.5667

Support levels (open interest**, contracts):

$1.5593 (1459)

$1.5496 (929)

$1.5398 (1066)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 40126 contracts, with the maximum number of contracts with strike price $1,6000 (1890);

- Overall open interest on the PUT options with the expiration date December, 5 is 40467 contracts, with the maximum number of contracts with strike price $1,5900 (2304);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from November, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-