Notícias do Mercado

-

23:27

Currencies. Daily history for Nov 25’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2474 +0,26%

GBP/USD $1,5706 +0,01%

USD/CHF Chf0,9639 -0,24%

USD/JPY Y117,97 -0,25%

EUR/JPY Y147,15 -0,02%

GBP/JPY Y185,28 -0,24%

AUD/USD $0,8529 -1,02%

NZD/USD $0,7808 -0,67%

USD/CAD C$1,1256 -0,19%

-

23:00

Schedule for today, Wednesday, Nov 26’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Construction Work Done Quarter III -1.2% -1.7%

04:00 Switzerland UBS Consumption Indicator October 1.41

09:30 United Kingdom Business Investment, q/q Quarter III +3.3% +2.3%

09:30 United Kingdom Business Investment, y/y Quarter III +6.7%

09:30 United Kingdom GDP, q/q (Revised) Quarter III +0.7% +0.7%

09:30 United Kingdom GDP, y/y (Revised) Quarter III +3.0% +3.0%

11:00 United Kingdom CBI retail sales volume balance November 31 28

13:30 U.S. Initial Jobless Claims November 291 287

13:30 U.S. Personal Income, m/m October +0.2% +0.4%

13:30 U.S. Personal spending October -0.2% +0.4%

13:30 U.S. PCE price index ex food, energy, m/m October +0.1% +0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y October +1.5%

13:30 U.S. Durable Goods Orders October -1.1% Revised From -1.3% -0.4%

13:30 U.S. Durable Goods Orders ex Transportation October -0.1% Revised From -0.2% +0.5%

13:30 U.S. Durable goods orders ex defense October -1.5%

14:45 U.S. Chicago Federal National Activity Index November 66.2 63.1

14:55 U.S. Reuters/Michigan Consumer Sentiment Inde (Finally) November 89.4 90.2

15:00 U.S. New Home Sales October 467 471

15:00 U.S. Pending Home Sales (MoM) October +0.3% +0.9%

15:30 U.S. Crude Oil Inventories November +2.6

21:45 New Zealand Trade Balance, mln October -1350 -645

-

17:42

Bank of Japan minutes: exports remained weak four of the BoJ's nine board members voted against plans the stimulus measures boost in October

The Bank of Japan (BoJ) released its minutes from the latest meeting. The minutes showed that four of the BoJ's nine board members voted against plans to expand stimulus measures.

Some members said the boost of stimulus measures may not yield as much results as the BoJ's first stimulus measures.

Some members of the BoJ's board said that more stimulus measures were necessary to achieve the 2% inflation target.

-

17:15

Bank of England Governor Mark Carney reiterated that inflation in the U.K. could fall below 1% in the next few months

The Bank of England (BoE) Governor Mark Carney testified in front of the Treasury Select Committee. He said that the economy in the U.K. faces risks from geopolitical tensions and a slowdown of global growth. Carney reiterated that inflation in the U.K. could fall below 1% in the next few months.

Carney pointed out that the next monetary policy move will interest rate hike, despite recent decline in inflation.

The BoE governor Carney cautioned that interest rate hike may have more impact as a result of high household debt in the U.K.

-

16:41

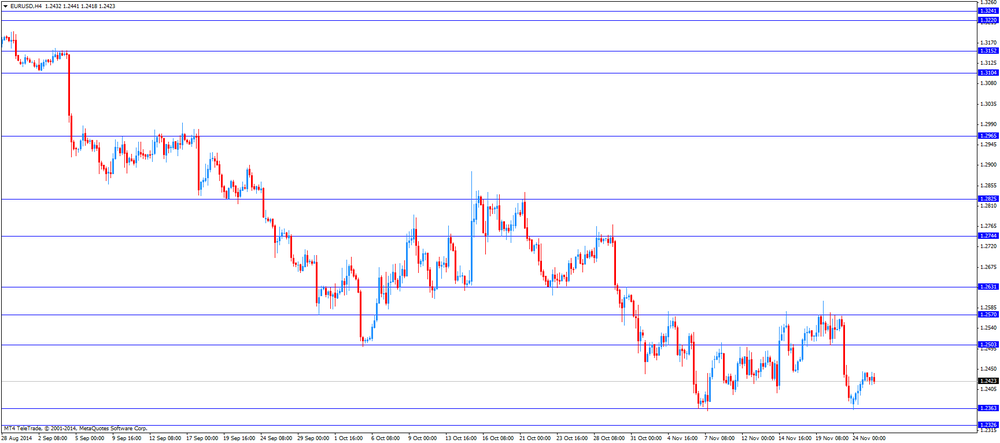

Foreign exchange market. American session: the U.S. dollar mixed to lower against the most major currencies after the weaker-than-expected U.S. consumer confidence

The U.S. dollar mixed to lower against the most major currencies after the weaker-than-expected U.S. consumer confidence. The U.S. revised GDP grew 3.9% in the third quarter, higher than the previous estimated growth of 3.5%.

The U.S. consumer confidence index unexpectedly declined to 88.7 in November from 94.1 in October, missing expectations for a rise to 95.9. October's figure was revised down from 94.5.

The S&P/Case-Shiller home price index increased by 4.9% in September, beating expectations for a 4.7% rise, after a 5.6% gain in August.

The euro rose against the U.S. dollar after the German GDP. Germany's final GDP grew 0.1% in third quarter, in line with expectations.

The Organization for Economic Cooperation and Development (OECD) released its economic outlook report on Tuesday. OECD said that the slowdown in Europe is dragging down the global economy. OECD also said that the European Central Bank should implement quantitative easing measures.

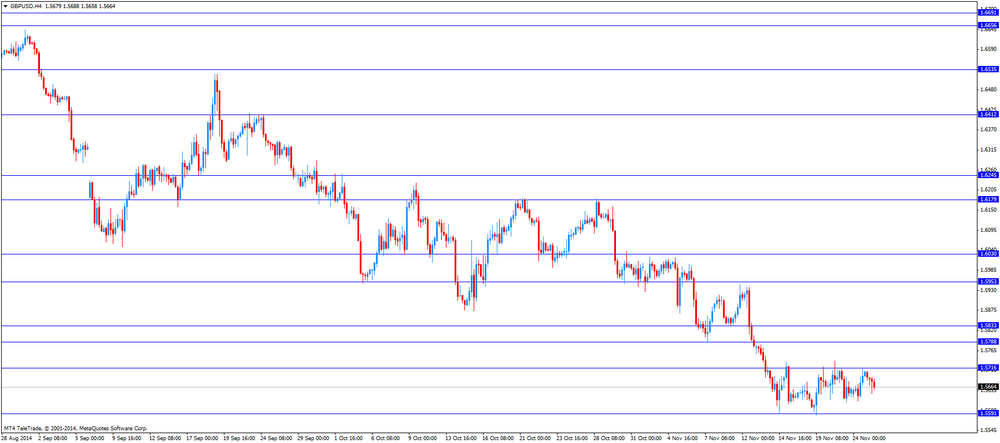

The British pound increased against the U.S. dollar. The Bank of England (BoE) Governor Mark Carney testified in front of the Treasury Select Committee. He said that the economy in the U.K. faces risks from geopolitical tensions and a slowdown of global growth. Carney reiterated that inflation in the U.K. could fall below 1% in the next few months.

The number of mortgage approvals decreased to 37,076 in October from 39,127 in September, missing expectations for a decline to 38,500. That was the lowest level since May 2013. September's figure was revised down from 39,300.

The Canadian dollar traded higher against the U.S. dollar after the Canadian retail sales. Canadian retail sales increased by 0.8% in September, exceeding expectations for a 0.6% rise, after a 0.2% decline in August. August's figure was revised up from a 0.3% drop.

The increase was driven by cars, furniture and appliances.

Canadian retail sales excluding automobiles were flat in September, missing forecasts of a 0.4% gain, after 0.2% drop in August. August's figure was revised up from a 0.3% decrease.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight and morning trading session, the kiwi fell against the greenback after the weak Reserve Bank of New Zealand' inflation expectations. Inflation expectations declined to 2.1% in the third quarter from 2.2% in the second quarter.

The Australian dollar traded mixed against the U.S. dollar. In the overnight and morning trading session, the Aussie fell against the greenback. The Reserve Bank of Australia Deputy Governor Philip Lowe said in his speech to economists in Sydney today that the Australian dollar should decline with lower commodity prices and investment.

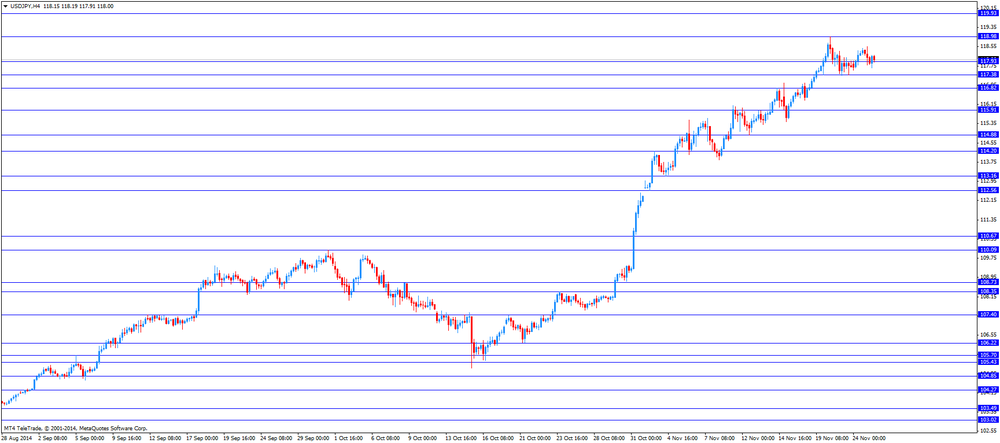

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen rose against the greenback after comments by the Bank of Japan (BoJ) Governor Haruhiko Kuroda. He said in a speech to business leaders in Nagoya on Tuesday that 2% inflation target will be achieved in or around the fiscal year starting April 2015.

Kuroda defends that the boost of stimulus measures in October was necessary to beat deflation.

The BoJ governor declined to comment on the yen's recent rapid fall.

The minutes of the BoJ's October meeting showed that some officials were against plans to expand its stimulus measures.

-

16:17

Canadian retail sales jumped 0.8% in September

Statistics Canada released retail sales data on Tuesday. Canadian retail sales increased by 0.8% in September, exceeding expectations for a 0.6% rise, after a 0.2% decline in August. August's figure was revised up from a 0.3% drop.

The increase was driven by cars, furniture and appliances. Motor vehicle and parts sales climbed 3.4% in September, furniture and home furnishing sales increased 1.3%, while electronics and appliance sales rose 1.2%.

Canadian retail sales excluding automobiles were flat in September, missing forecasts of a 0.4% gain, after 0.2% drop in August. August's figure was revised up from a 0.3% decrease.

-

16:03

Bank of Japan Governor Haruhiko Kuroda defends the boost of stimulus measures in October

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech to business leaders in Nagoya on Tuesday that the boost of stimulus measures in October was necessary to beat deflation.

Kuroda declined to comment on the yen's recent rapid fall.

The BoJ governor noted that a weak yen is positive for exporters, but it weighs on household incomes because of rising import costs.

Kuroda pointed out that the central bank will adjust its monetary policy if needed to achieve its 2% inflation target by next year.

-

15:44

U.S. consumer confidence index unexpectedly declined to 88.7 in November

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index unexpectedly declined to 88.7 in November from 94.1 in October, missing expectations for a rise to 95.9. October's figure was revised down from 94.5.

That was the lowest level since June.

The director of economic indicators at The Conference Board Lynn Franco said that consumer confidence declined due to "reduced optimism in the short-term outlook". She added that "consumers were somewhat less positive about current business conditions and the present state of the job market".

-

15:01

S&P/Case-Shiller home price index rose by 4.9% in September

The S&P/Case-Shiller home price index increased by 4.9% in September, beating expectations for a 4.7% rise, after a 5.6% gain in August.

On a monthly basis, the index rose at a seasonally adjusted rate of 0.3%.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities. House prices declined in nine cities, increased in nine cities, and were unchanged in the remaining two cities.

-

15:00

U.S.: Richmond Fed Manufacturing Index, November 4 (forecast 17)

-

15:00

U.S.: Consumer confidence , November 88.7 (forecast 95.9)

-

14:52

U.S. revised GDP grew 3.9% in the third quarter

The U.S. Commerce Department released gross domestic product (GDP) figures on Tuesday. The U.S. revised GDP grew 3.9% in the third quarter, higher than the previous estimated growth of 3.5%.

Consumer spending and inventory investment were stronger than previously estimated. Export growth was slower than previously estimated.

-

14:01

U.S.: Housing Price Index, m/m, September 0.0%

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, September +4.9% (forecast +4.7%)

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2350(E1.8bn), $1.2400(E481mn), $1.2500(E1.0bn)

USD/JPY: Y117.25($455mn), Y117.50($1.2bn), Y119.00($250mn)

AUD/USD: $0.8625(A$340mn), $0.8700(A$338mn)

USD/CAD: Cad1.1200($260mn), Cad1.1300($560mn)

-

13:31

U.S.: PCE price index, q/q, Quarter III +1.3%

-

13:30

U.S.: GDP, q/q, Quarter III +3.9% (forecast +3.3%)

-

13:30

U.S.: PCE price index ex food, energy, q/q, Quarter III +1.4%

-

13:30

Canada: Retail Sales, m/m, October +0.8% (forecast +0.6%)

-

13:30

Canada: Retail Sales ex Autos, m/m, October 0.0% (forecast +0.4%)

-

13:05

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the weaker-than-expected number of mortgage approvals from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Japan BOJ Governor Haruhiko Kuroda Speaks

02:00 China Leading Index October +0.9% +0.9%

02:00 New Zealand RBNZ Inflation Expectations q/q Quarter IV +2.2% +2.1%

04:45 Japan BOJ Governor Haruhiko Kuroda Speaks

07:00 Germany GDP (QoQ) (Finally) Quarter III +0.1% +0.1% +0.1%

07:00 Germany GDP (YoY) (Finally) Quarter III +1.4% +1.2% +1.2%

09:05 Australia RBA Assist Gov Lowe Speaks

09:30 United Kingdom BBA Mortgage Approvals October 39.1 Revised From 39.3 38.5 37.1

The U.S. dollar mixed against the most major currencies ahead of the U.S. revised gross domestic product (GDP) and consumer confidence. The U.S. revised GDP is expected to rise 3.3% in third quarter.

The U.S. consumer confidence is expected to climbs to 95.9 in November from 94.5 from October.

The euro traded mixed against the U.S. dollar after the German GDP. Germany's final GDP grew 0.1% in third quarter, in line with expectations.

The Organization for Economic Cooperation and Development (OECD) released its economic outlook report on Tuesday. OECD said that the slowdown in Europe is dragging down the global economy. OECD also said that the European Central Bank should implement quantitative easing measures.

The British pound traded lower against the U.S. dollar after the weaker-than-expected number of mortgage approvals from the U.K. The number of mortgage approvals decreased to 37,076 in October from 39,127 in September, missing expectations for a decline to 38,500. That was the lowest level since May 2013. September's figure was revised down from 39,300.

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian retail sales. Canadian retail sales are expected to increase 0.6% in September, after 0.3% decline in August.

Canadian retail sales excluding automobiles are expected to rise 0.4% in September, after 0.3% drop in August.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5647

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m October -0.3% +0.6%

13:30 Canada Retail Sales ex Autos, m/m October -0.3% +0.4%

13:30 U.S. PCE price index, q/q Quarter III +1.2%

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +1.3%

13:30 U.S. GDP, q/q (Revised) Quarter III +3.5% +3.3%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y September +5.6% +4.7%

15:00 U.S. Consumer confidence November 94.5 95.9

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580, $1.2520, $1.2475/80

Bids $1.2400, $1.2360, $1.2300

GBP/USD

Offers $1.5800, $1.5780/85, $1.5745/50

Bids $1.5590, $1.5550, $1.5525/20, $1.5500

AUD/USD

Offers $0.8800, $0.8750, $0.8700, $0.8630

Bids $0.8540, $0.8500

EUR/JPY

Offers Y148.50, Y148.00, Y147.40

Bids Y145.50, Y145.00

USD/JPY

Offers Y119.50, Y119.20, Y119.00, Y118.55

Bids Y117.35, Y117.00, Y116.85/80, Y116.50

EUR/GBP

Offers stg0.8066, stg0.8000, stg0.7980, stg0.7950

Bids stg0.7885/75, stg0.7860/50

-

10:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2350(E1.8bn), $1.2400(E481mn), $1.2500(E1.0bn)

USD/JPY: Y117.25($455mn), Y117.50($1.2bn), Y119.00($250mn)

AUD/USD: $0.8625(A$340mn), $0.8700(A$338mn)

USD/CAD: Cad1.1200($260mn), Cad1.1300($560mn)

-

09:40

RBA’s Deputy Governor Lowe: Australia’s link to Asia is its strength

Australia's strong links to Asia, a growing population and vast resources are key to Australia's future economic success even if the mining sector faces problems RBA's Deputy Governor Philip Lowe said in his speech to economists in Sydney today. He further mentioned that the Australian dollar should decline with lower commodity prices and investment. A global raise in interest rates is something we should hope to see sooner rather than later, he stated. Australia's benchmark rate at 2.5% is currently attracting investors supporting the aussie.

AUD/USD currently trading at new four-year lows

-

09:30

United Kingdom: BBA Mortgage Approvals, October 37.1 (forecast 38.5)

-

09:18

Press Review: ECB’s Coeure Says Officials Won’t Rush as They Debate All Assets

ECB's Coeure Says Officials Won't Rush as They Debate All Assets

The European Central Bank won't make a hasty decision to add more stimulus and will hinge any measures on incoming economic data, Executive Board member Benoit Coeure said.

"We'll have to understand how what we've already decided works -- we're not going to rush to a new decision without knowing," Coeure said yesterday in an interview with Bloomberg Television's Francine Lacqua. "We have to look at the data around us, and we have to discuss thoroughly all possible options in particular when it comes to buying new assets. There's unanimous agreement in the Governing Council that there might be situations where we'd have to do more."

BLOOMBERG

Brent Drops a Second Day as OPEC Weighs Sparing Three From Cuts

Brent crude fell for a second day as OPEC considered exempting three members from potential production cuts when it meets this week. West Texas Intermediate also dropped in New York.

Futures dropped as much as 0.7 percent in London. Iraq, Iran and Libya won't have to trim supplies should the Organization of Petroleum Exporting Countries agrees to reduce output, according to two people with knowledge of the proposal. If the market is oversupplied, it isn't the first time, Saudi Arabia's Oil Minister Ali Al-Naimi said in Vienna yesterday as the 12-nation group prepared for discussions on Nov. 27.

REUTERS

U.S. prosecutors to interview London FX traders

(Reuters) - U.S. prosecutors will travel to London in the coming weeks to interview traders about currency market manipulation, the latest sign that authorities are closer to filing criminal charges stemming from the long-running probe, sources told Reuters.

Officials from the U.S. Department of Justice will interview current or former employees at HSBC Holdings plc among other banks, people familiar with the matter told Reuters.

Source: http://www.reuters.com/article/2014/11/25/us-banks-forex-probe-exclusive-idUSKCN0J90DO20141125

-

07:30

Foreign exchange market. Asian session: the greenback is trading mixed against its major peers

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:00 Japan BOJ Governor Haruhiko Kuroda Speaks

02:00 China Leading Index October +0.9% +0.9%

02:00 New Zealand RBNZ Inflation Expectations q/q Quarter IV +2.2% +2.1%

04:45 Japan BOJ Governor Haruhiko Kuroda Speaks

07:00 Germany GDP (QoQ) (Finally) Quarter III +0.1% +0.1% +0.1%

07:00 Germany GDP (YoY) (Finally) Quarter III +1.4% +1.2% +1.2%

The U.S. dollar steadied against the euro after good data on German business sentiment improving for the first time after six successive months of declines giving indication that Eurozone's largest economy finally may end its downturn. Today investors are awaiting U.S. data on GDP, housing prices and a consumer confidence report.

The Australian dollar was trading lower erasing almost all of its recent gains amid falling iron ore prices weighing on Australia's economy. Markets await RBA Assistant Governors Lowe's speech scheduled for 09:05 GMT.

The New Zealand dollar fell against its major peers after data on expectations for inflation fell to 2.1% from 2.3% in the previous quarter.

The Japanese yen recovered against the U.S. dollar after reaching lows at USD118.98 on Thursday last week. On Friday Japan's Finance Minister Taro Aso said that the Japanese yen has fallen too quickly. In today's speech Bank of Japan Governor Haruhiko Kuroda said that Japan's economy will reach the targeted 2% of inflation in or around the fiscal year starting in April 2015 and that the recent fall of the yen is positive for exporters but hurts households.

EUR/USD: the euro steadied against the greenback

USD/JPY: the U.S. dollar declined against the Japanese yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:05 Australia RBA Assist Gov Lowe Speaks

09:30 United Kingdom BBA Mortgage Approvals October 39.3 38.5

13:30 Canada Retail Sales, m/m October -0.3% +0.6%

13:30 Canada Retail Sales ex Autos, m/m October -0.3% +0.4%

13:30 U.S. PCE price index, q/q Quarter III +1.2%

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +1.3%

13:30 U.S. GDP, q/q (Revised) Quarter III +3.5% +3.3%

14:00 U.S. Housing Price Index, m/m September +0.5%

14:00 U.S. Housing Price Index, y/y September +4.8%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y September +5.6% +4.7%

15:00 U.S. Richmond Fed Manufacturing Index November 20 17

15:00 U.S. Consumer confidence November 94.5 95.9

21:30 U.S. API Crude Oil Inventories November +3.7

-

07:00

Germany: GDP (QoQ), Quarter III +0.1% (forecast +0.1%)

-

07:00

Germany: GDP (YoY), Quarter III +1.2% (forecast +1.2%)

-

06:28

Options levels on tuesday, November 25, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2558 (4186)

$1.2507 (1386)

$1.2475 (214)

Price at time of writing this review: $ 1.2426

Support levels (open interest**, contracts):

$1.2396 (2703)

$1.2356 (4069)

$1.2317 (5134)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 109267 contracts, with the maximum number of contracts with strike pric $1,2800 (6108);

- Overall open interest on the PUT options with the expiration date December, 5 is 112258 contracts, with the maximum number of contracts with strike price $1,2200 (7465);

- The ratio of PUT/CALL was 1.03 versus 0.99 from the previous trading day according to data from November, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.5901 (763)

$1.5803 (894)

$1.5708 (1285)

Price at time of writing this review: $1.5667

Support levels (open interest**, contracts):

$1.5596 (1488)

$1.5498 (1328)

$1.5399 (1035)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 40250 contracts, with the maximum number of contracts with strike price $1,6000 (1896);

- Overall open interest on the PUT options with the expiration date December, 5 is 40650 contracts, with the maximum number of contracts with strike price $1,5900 (2303);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from November, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:02

New Zealand: RBNZ Inflation Expectations q/q, Quarter IV +2.1%

-

02:01

China: Leading Index , October +0.9%

-