Notícias do Mercado

-

23:30

Currencies. Daily history for Nov 26’2014:

(pare/closed(GMT +2)/change, %)

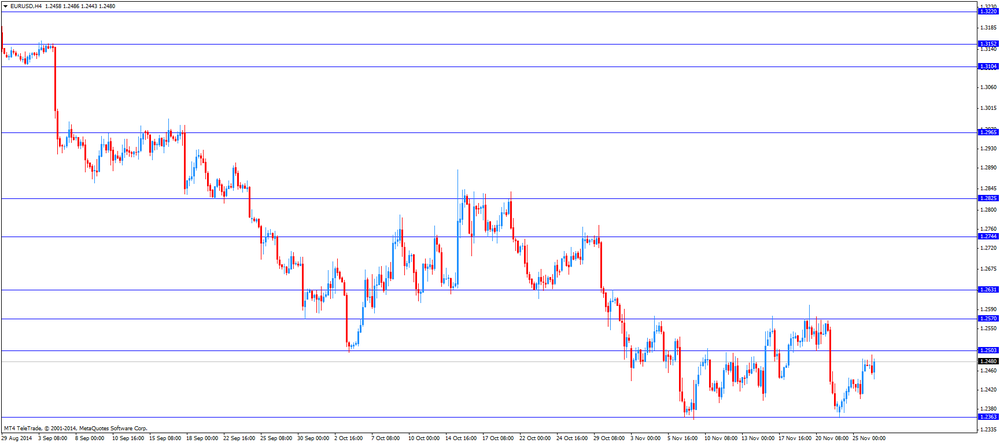

EUR/USD $1,2505 +0,25%

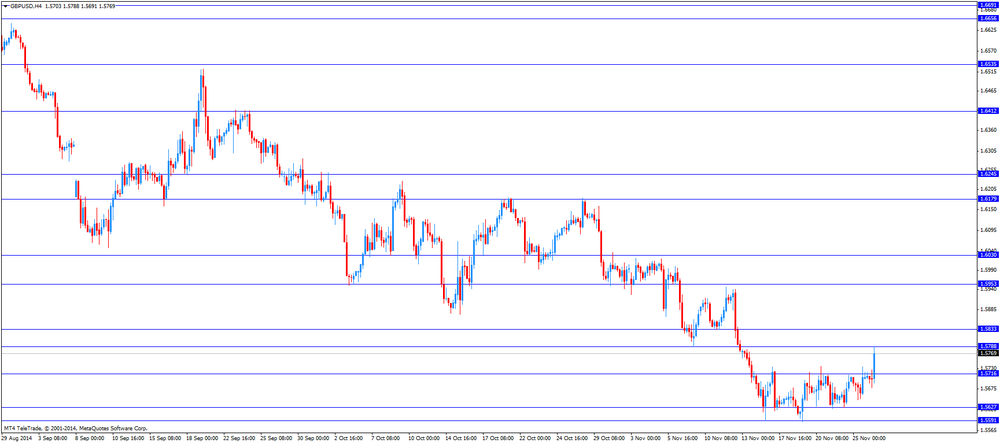

GBP/USD $1,5791 +0,54%

USD/CHF Chf0,9611 -0,29%

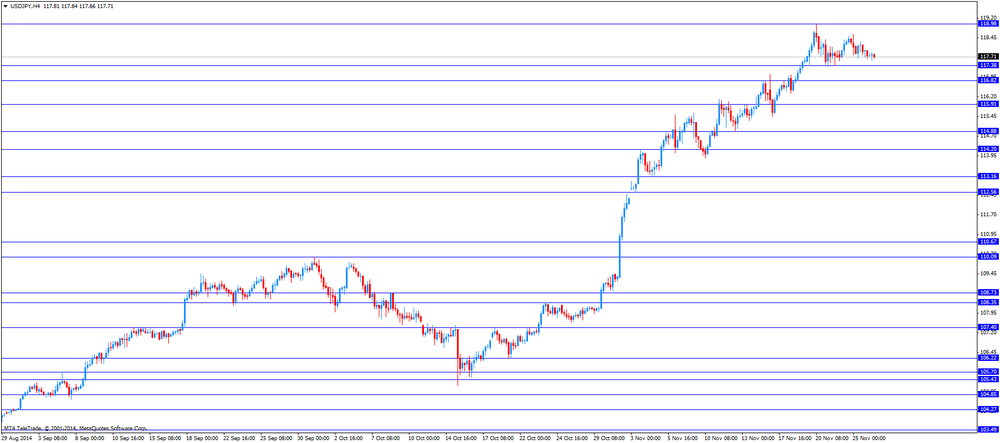

USD/JPY Y117,72 -0,21%

EUR/JPY Y147,21 +0,04%

GBP/JPY Y185,89 +0,33%

AUD/USD $0,8547 +0,21%

NZD/USD $0,7871 +0,80%

USD/CAD C$1,1245 -0,10%

-

23:00

Schedule for today,Thursday, Nov 27’2014:

(time / country / index / period / previous value / forecast)

00:00 Australia HIA New Home Sales, m/m October 0.0%

00:00 Australia Private Capital Expenditure Quarter III +1.1% -1.6%

08:55 Germany Unemployment Change November -22 -1

08:55 Germany Unemployment Rate s.a. November 6.7% 6.7%

09:00 OPEC OPEC Meetings

09:00 Eurozone M3 money supply, adjusted y/y October +2.5% +2.6%

09:00 Eurozone Private Loans, Y/Y October -1.2% -1.0%

10:00 Eurozone Business climate indicator November 0.05

10:00 Eurozone Economic sentiment index November 100.7 100.3

10:00 Eurozone Industrial confidence November -5.1 -5.4

12:00 Germany Gfk Consumer Confidence Survey December 8.5 8.6

13:00 Germany CPI, m/m November -0.3% 0.0%

13:00 Germany CPI, y/y (Preliminary) November +0.8% +0.7%

13:30 Canada Current Account, bln Quarter III -11.9 -10.3

13:30 U.S. Bank holiday

21:45 New Zealand Building Permits, m/m October -12.2%

23:30 Japan Household spending Y/Y October -5.6% -4.8%

23:30 Japan Unemployment Rate October 3.6% 3.6%

23:30 Japan Tokyo Consumer Price Index, y/y November +2.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y November +2.5% +2.3%

23:30 Japan National Consumer Price Index, y/y October +3.2% +3.1%

23:30 Japan National CPI Ex-Fresh Food, y/y October +3.0% +2.9%

23:50 Japan Retail sales, y/y October +2.3% +1.5%

23:50 Japan Industrial Production (MoM) (Preliminary) October +2.9% -0.4%

23:50 Japan Industrial Production (YoY) (Preliminary) October +0.8% -0.2%

-

17:01

European stocks close: stocks closed mixed on comments by the European Central Bank (ECB) Vice President Vitor Constancio

Stock indices closed higher on comments by the European Central Bank (ECB) Vice President Vitor Constancio. He said on Wednesday that the ECB could buy government bonds early next year if the central bank decides to add new stimulus measures.

Constancio added that the decision to buy government bonds will send an important signal the central bank is willing to achieve its 2% inflation target.

The U.K. revised GDP climbed by 0.7% in the third quarter, in line with expectations.

On a yearly basis, the U.K. GDP gained 3.0% in the third quarter, in line with expectations.

Seadrill Ltd. shares dropped 18% after the company suspended dividends due to falling oil prices.

Thomas Cook Group Plc shares fell 18% after reporting the weaker-than-estimated profit.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,729.17 -1.97 -0.03%

DAX 9,915.56 +54.35 +0.55%

CAC 40 4,373.42 -8.89 -0.20%

-

16:42

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded lower against the most major currencies after the mixed U.S. economic data. Pending home sales in the U.S. declined 1.1% in October, missing expectations for a 0.9% increase, after a 0.6% gain in September. September's figure was revised up from a 0.3% rise.

New home sales climbed 0.7% to a seasonally adjusted annual rate of 458,000 units in October from 455,000 units in September. September's figure was revised down from 467,000 units. Analysts had expected new home sales to reach 471,000 units.

The final University of Michigan's consumer sentiment index was 88.8 in November, down from the preliminary estimate of 89.4. Analysts had expected an increase to 90.2.

The Chicago purchasing managers' index declined from 66.2 in October to 60.8 in September, missing expectations for a fall to 63.1.

Personal spending increased 0.2% in October, missing expectations for a 0.4% gain, after the flat reading in September. September's figure was revised up from a 0.2% decrease.

Falling gasoline prices and a strengthening labour market were supporting consumer spending in the U.S.

Personal income climbed 0.2% in October, missing expectations for 0.4% increase, after a 0.2% rise in September.

The personal consumption expenditures (PCE) price index excluding food and energy increased 0.2% in October, beating forecasts of a 0.1 rise, after a 0.1% gain in September.

The U.S. durable goods orders rose 0.4% in October, beating expectations for a 0.4% decline, after a 0.9% drop in September. August's figure was revised up from a 1.1% decrease.

The increase was driven by the strength of transportation equipment. Demand for transportation products climbed 3.4 % in October

The U.S. durable goods orders excluding transportation fell 0.9% in October, missing expectations for a 0.5% gain, after a 0.2% rise in September. September's figure was revised up from a 0.1% decrease.

The U.S. durable goods orders excluding defence decreased 0.6% in October.

The number of initial jobless claims in the week ending November 22 in the U.S. rose by 21,000 to 313,000 from 292,000 in the previous week. The previous week's figure was revised down from 291,000. Analysts had expected a decline to 287.000.

The euro traded higher against the U.S. dollar in the absence of any major economic reports. The European Central Bank (ECB) Vice President Vitor Constancio said on Wednesday that the ECB could buy government bonds early next year if the central bank decides to add new stimulus measures.

The British pound traded mixed against the U.S. dollar. The U.K. revised GDP climbed by 0.7% in the third quarter, in line with expectations.

On a yearly basis, the U.K. GDP gained 3.0% in the third quarter, in line with expectations.

The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance declined to 27% in November from 31% in October, missing expectations for a decrease to 28%.

The Swiss franc traded higher against the U.S. dollar. Switzerland's UBS consumption indicator declined to 1.29 points in October from 1.39 points in September. September's figure was revised down from 1.41 points.

The New Zealand dollar rose against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi declined against the greenback due to the strength of the U.S. currency.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback. Construction work done in Australia fell 2.2% in the third quarter, missing expectations for a 1.7% decline, after a 1.2% drop in the second quarter.

In the morning trading session, the Aussie fell against the greenback.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports from Japan.

-

15:57

New home sales climbed 0.7% in October

The U.S. Commerce Department released new home sales data on Wednesday. New home sales climbed 0.7% to a seasonally adjusted annual rate of 458,000 units in October from 455,000 units in September.

September's figure was revised down from 467,000 units.

Analysts had expected new home sales to reach 471,000 units.

The slow wage growth weighs on the housing market.

The median home sales price in October jumped 15.4% to $305,000.

-

15:41

U.S. pending home sales declined 1.1% in October

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. Pending home sales in the U.S. declined 1.1% in October, missing expectations for a 0.9% increase, after a 0.6% gain in September. September's figure was revised up from a 0.3% rise.

The NAR's chief economist Lawrence Yun said that demand "would be more robust if it weren't for lagging wage growth and tight credit conditions".

-

15:30

U.S.: Crude Oil Inventories, November +1.9

-

15:20

U.S. personal spending and income rose 0.2% in October

The U.S. Commerce Department released personal spending and income figures on Wednesday. Personal spending increased 0.2% in October, missing expectations for a 0.4% gain, after the flat reading in September. September's figure was revised up from a 0.2% decrease.

Consumer spending makes more than two-thirds of U.S. economic activity.

Falling gasoline prices and a strengthening labour market were supporting consumer spending in the U.S.

Personal income climbed 0.2% in October, missing expectations for 0.4% increase, after a 0.2% rise in September.

The personal consumption expenditures (PCE) price index excluding food and energy increased 0.2% in October, beating forecasts of a 0.1 rise, after a 0.1% gain in September.

On a yearly basis, the PCE price index excluding food and index rose 1.6% in October, after a 1.5% increase in September. That was the largest increase since December 2012.

The PCE index are below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

15:00

U.S.: New Home Sales, October 458 (forecast 471)

-

15:00

U.S.: Pending Home Sales (MoM) , October -1.1% (forecast +0.9%)

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, November 88.8 (forecast 90.2)

-

14:54

U.S. durable goods orders rose 0.4% in October

The U.S. Commerce Department released durable goods orders data today. The U.S. durable goods orders rose 0.4% in October, beating expectations for a 0.4% decline, after a 0.9% drop in September. August's figure was revised up from a 1.1% decrease.

The increase was driven by the strength of transportation equipment. Demand for transportation products climbed 3.4 % in October

The U.S. durable goods orders excluding transportation fell 0.9% in October, missing expectations for a 0.5% gain, after a 0.2% rise in September. September's figure was revised up from a 0.1% decrease.

The U.S. durable goods orders excluding defence decreased 0.6% in October.

-

14:45

U.S.: Chicago Federal National Activity Index, November 60.8 (forecast 63.1)

-

13:55

European Central Bank Vice President Vitor Constancio: the ECB could start to buy government bonds early next year

The European Central Bank (ECB) Vice President Vitor Constancio said in a speech in London on Wednesday that the ECB could buy government bonds early next year if the central bank decides to add new stimulus measures. He added that the decision to buy government bonds will send an important signal the central bank is willing to achieve its 2% inflation target.

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2350(E536mn), $1.2400(E1.21bn), $1.2430(E405mn), $1.2450(E540mn), $1.2475(E904mn), $1.2500(E1.92bn), $1.2525(E439mn), $1.2550(E596mn)

USD/JPY: Y117.25($250mn), Y117.45/50($400mn), Y118.50($580mn), Y118.70($288mn)

GPB/USD: $1.5700(stg308mn)

USD/CAD: Cad1.1210($695mn), Cad1.1245($375mn), Cad1.1275($430mn), Cad1.1285($665mn)

AUD/USD: $0.8500(A$1.0bn), $0.8530(A$293mn), $0.8550(A$842mn), $0.8600(A$2.7bn), $0.8650(A$338mn)

EUR/GBP: stg0.7900(E242mn), stg0.7950(E560mn), stg0.7985(E401mn)

USD/CHF: Chf0.9670($225mn)Chf0.9725($560mn)

EUR/CHF: Chf1.2000(E275mn)

EUR/NOK: Nok8.4950(E227mn)

NZD/USD: $0.7775(NZ$201mn), $0.7800(NZ$306mn)

AUD/NZD: $1.1000(A$240mn)

-

13:33

U.S.: PCE price index ex food, energy, Y/Y, October +1.6%

-

13:33

U.S.: Durable goods orders ex defense, October -0.6%

-

13:32

U.S.: Durable Goods Orders ex Transportation , October -0.9% (forecast +0.5%)

-

13:31

U.S.: Personal Income, m/m, October +0.2% (forecast +0.4%)

-

13:31

U.S.: Personal spending , October +0.2% (forecast +0.4%)

-

13:31

U.S.: PCE price index ex food, energy, m/m, October +0.2% (forecast +0.1%)

-

13:31

U.S.: Durable Goods Orders , October +0.4% (forecast -0.4%)

-

13:30

U.S.: Initial Jobless Claims, November 313 (forecast 287)

-

13:04

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after comments by the European Central Bank Vice President Vitor Constancio

comments by the European Central Bank Vice President Vitor Constancio

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Construction Work Done Quarter III -1.2% -1.7% -2.2%

07:00 Switzerland UBS Consumption Indicator October 1.39 1.29

09:30 United Kingdom Business Investment, q/q Quarter III +3.3% +2.3% -0.7%

09:30 United Kingdom Business Investment, y/y Quarter III +6.7% +6.3%

09:30 United Kingdom GDP, q/q (Revised) Quarter III +0.7% +0.7% +0.7%

09:30 United Kingdom GDP, y/y (Revised) Quarter III +3.0% +3.0% +3.0%

11:00 United Kingdom CBI retail sales volume balance November 31 28 27

The U.S. dollar mixed against the most major currencies ahead of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 4,000 to 287,000.

The Chicago purchasing managers' index is expected to decline to 63.1 in November from 66.2 in October.

The final Reuters/Michigan Consumer Sentiment Index is expected to rise to 902.4 in November.

Personal income in the U.S. is expected to rise 0.4% in October, after a 0.2% gain in September.

Personal spending in the U.S. is expected to climb 0.4% in October, after a 0.2% fall in September.

The U.S. durable goods orders are expected to decrease 0.4% in October, after a 1.1% drop in September.

The U.S. durable goods orders excluding transportation are expected to increase 0.5% in October, after a 0.1% fall in September.

New home sales in the U.S. are expected to rise to 471,000 units in October from 467,000 units in September.

Pending home sales in the U.S. are expected to climb 0.9% in October, after a 0.3% increase in September.

The euro traded mixed against the U.S. dollar after comments by the European Central Bank (ECB) Vice President Vitor Constancio. He said on Wednesday that the ECB could buy government bonds early next year if the central bank decides to add new stimulus measures.

The British pound rose against the U.S. dollar after the U.K. revised GDP (gross domestic product) data. The U.K. revised GDP climbed by 0.7% in the third quarter, in line with expectations.

On a yearly basis, the U.K. GDP gained 3.0% in the third quarter, in line with expectations.

The Confederation of British Industry released its monthly Distributive Trades survey today. The CBI retail sales balance declined to 27% in November from 31% in October, missing expectations for a decrease to 28%.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's UBS consumption indicator declined to 1.29 points in October from 1.39 points in September. September's figure was revised down from 1.41 points.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.5788

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 U.S. Initial Jobless Claims November 291 287

13:30 U.S. Personal Income, m/m October +0.2% +0.4%

13:30 U.S. Personal spending October -0.2% +0.4%

13:30 U.S. PCE price index ex food, energy, m/m October +0.1% +0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y October +1.5%

13:30 U.S. Durable Goods Orders October -1.1% Revised From -1.3% -0.4%

13:30 U.S. Durable Goods Orders ex Transportation October -0.1% Revised From -0.2% +0.5%

13:30 U.S. Durable goods orders ex defense October -1.5%

14:45 U.S. Chicago Federal National Activity Index November 66.2 63.1

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) November 89.4 90.2

15:00 U.S. New Home Sales October 467 471

15:00 U.S. Pending Home Sales (MoM) October +0.3% +0.9%

15:30 U.S. Crude Oil Inventories November +2.6

21:45 New Zealand Trade Balance, mln October -1350 -645

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580, $1.2520, $1.2490/85

Bids $1.2400, $1.2360, $1.2300

GBP/USD

Offers $1.5800, $1.5780/85

Bids $1.5590, $1.5550, $1.5525/20, $1.5500

AUD/USD

Offers $0.8800, $0.8750, $0.8700, $0.8630, $0.8600

Bids $0.8510, $0.8500

EUR/JPY

Offers Y148.50, Y148.00, Y147.40

Bids Y145.50, Y145.00

USD/JPY

Offers Y119.50, Y119.20, Y119.00, Y118.55

Bids Y117.35, Y117.00, Y116.85/80, Y116.50

EUR/GBP

Offers stg0.8066, stg0.8000, stg0.7980, stg0.7950

Bids stg0.7885/75, stg0.7860/50

-

11:00

United Kingdom: CBI retail sales volume balance, November 27 (forecast 28)

-

10:02

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2350(E536mn), $1.2400(E1.21bn), $1.2430(E405mn), $1.2450(E540mn), $1.2475(E904mn), $1.2500(E1.92bn), $1.2525(E439mn), $1.2550(E596mn)

USD/JPY: Y117.25($250mn), Y117.45/50($400mn), Y118.50($580mn), Y118.70($288mn)

GPB/USD: $1.5700(stg308mn)

USD/CAD: Cad1.1210($695mn), Cad1.1245($375mn), Cad1.1275($430mn), Cad1.1285($665mn)

AUD/USD: $0.8500(A$1.0bn), $0.8530(A$293mn), $0.8550(A$842mn), $0.8600(A$2.7bn), $0.8650(A$338mn)

EUR/GBP: stg0.7900(E242mn), stg0.7950(E560mn), stg0.7985(E401mn)

USD/CHF: Chf0.9670($225mn)Chf0.9725($560mn)

EUR/CHF: Chf1.2000(E275mn)

EUR/NOK: Nok8.4950(E227mn)

NZD/USD: $0.7775(NZ$201mn), $0.7800(NZ$306mn)

AUD/NZD: $1.1000(A$240mn)

-

09:57

-

09:32

United Kingdom: Business Investment, y/y, Quarter III +6.3%

-

09:32

United Kingdom: Business Investment, q/q, Quarter III -0.7% (forecast +2.3%)

-

09:30

United Kingdom: GDP, q/q, Quarter III +0.7% (forecast +0.7%)

-

09:30

United Kingdom: GDP, y/y, Quarter III +3.0% (forecast +3.0%)

-

09:15

Press Review: EU Finds Seed Money for $392 Billion Investment Plan

BLOOMBERG

EU Finds Seed Money for $392 Billion Investment Plan

The European Commission today will propose a 315 billion-euro ($392 billion) investment plan based on guarantees and a small amount of seed money in order to offer European Investment Bank funds to a wider range of projects.

The EIB will contribute 5 billion euros in start-up cash, accompanied by 16 billion euros in European Union guarantees, according to the plan, which commission President Jean-Claude Juncker will unveil in Strasbourg, France. The start-up money, which is expected to have an impact of 15 times its size, will serve as capital for a new EIB unit that can share risk with private investors.

Source: http://www.bloomberg.com/news/2014-11-25/eu-finds-seed-money-for-392-billion-investment-plan.html

BLOOMBERG

Oil Volatility Here to Stay Regardless of OPEC Decision

Whatever the outcome of tomorrow's OPEC meeting, options traders are betting on oil-price swings.

That's because the decision from the Organization of Petroleum Exporting Countries isn't likely to make much difference. Slowing global demand and a U.S. shale-drilling boom has created a glut that won't fade any time soon, said Torbjoern Kjus of DNB ASA in Norway.

REUTERS

Russian c.bank to move towards rate cut after curbing inflationary expectations

Nov 26 (Reuters) - Russia's central bank will move towards cutting rates after it stabilises inflationary expectations, First Deputy Governor Ksenia Yudayeva said on Wednesday.

Annual inflation has risen to more than 8 percent because of a weaker rouble and an import ban on some Western food imports, put in place in retaliation to Western sanctions over Russia's role in the Ukraine crisis.

Source: http://www.reuters.com/article/2014/11/26/russia-cenbank-inflation-idUSL6N0TG0BU20141126

-

07:26

Foreign exchange market. Asian session: the greenback is trading weaker against its major peers ahead of U.S. data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Construction Work Done Quarter III -1.2% -1.7% -2.2%

04:00 Switzerland UBS Consumption Indicator October 1.41 1.29

The U.S. dollar traded largely lower against its major peers after a disappointing U.S. consumer confidence report which led investors to take profits on the greenback after the recent rally. The U.S. consumer confidence index unexpectedly declined to 88.7 in November from 94.1 in October, missing expectations for a rise to 95.9. October's figure was revised down from 94.5. U.S. revised GDP grew 3.9% in the third quarter, higher than the previous estimated growth of 3.5%. The S&P/Case-Shiller home price index increased by 4.9% in September, beating expectations for a 4.7% rise, after a 5.6% gain in August. Today data on durable goods orders, initial jobless claims, personal income and spending and reports on new and pending home sales and revised data on consumer sentiment will be published.

The Australian dollar recouped little after yesterday's losses and is trading close to its for-year low from yesterday. Comments from RBA Deputy Governor Philip Lowe put pressure on the currency as he said that the aussie is overvalued and will probably decline in line with lower commodity prices and investment. Iron ore, Australia's biggest export, hit new five year lows yesterday. Data on Construction Work Done in the 3rd quarter declined by -2.2%, a stronger-than-predicted decline of -1.7%.

The New Zealand dollar traded stronger against the greenback recovering from its loss after weak inflation data. Later in the day, at 21:45 GMT, data on New Zealand's Trade balance will be published.

The Japanese yen further recovered against the U.S. dollar with BoJ minutes raised doubts on further quantitative easing as it might be seen as financing government deficit. The minutes of the BoJ's October meeting showed that four out of nine officials were against plans to expand its stimulus measures. The yen reached lows at USD118.98 on Thursday last week, losing 7% in November.

EUR/USD: the euro traded steady against the greenback

USD/JPY: the U.S. dollar declined against the Japanese yen

GPB/USD: The British pound traded stronger against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Business Investment, q/q Quarter III +3.3% +2.3%

09:30 United Kingdom Business Investment, y/y Quarter III +6.7%

09:30 United Kingdom GDP, q/q (Revised) Quarter III +0.7% +0.7%

09:30 United Kingdom GDP, y/y (Revised) Quarter III +3.0% +3.0%

11:00 United Kingdom CBI retail sales volume balance November 31 28

13:30 U.S. Initial Jobless Claims November 291 287

13:30 U.S. Personal Income, m/m October +0.2% +0.4%

13:30 U.S. Personal spending October -0.2% +0.4%

13:30 U.S. PCE price index ex food, energy, m/m October +0.1% +0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y October +1.5%

13:30 U.S. Durable Goods Orders October -1.1% Revised From -1.3% -0.4%

13:30 U.S. Durable Goods Orders ex Transportation October -0.1% Revised From -0.2% +0.5%

13:30 U.S. Durable goods orders ex defense October -1.5%

14:45 U.S. Chicago Federal National Activity Index November 66.2 63.1

14:55 U.S. Reuters/Michigan Consumer Sentiment Inde (Finally) November 89.4 90.2

15:00 U.S. New Home Sales October 467 471

15:00 U.S. Pending Home Sales (MoM) October +0.3% +0.9%

15:30 U.S. Crude Oil Inventories November +2.6

21:45 New Zealand Trade Balance, mln October -1350 -645

-

07:00

Switzerland: UBS Consumption Indicator, October 1.29

-

06:27

Options levels on wednesday, November 26, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2458 (4183)

$1.2530 (1452)

$1.2507 (1386)

Price at time of writing this review: $ 1.2478

Support levels (open interest**, contracts):

$1.2433 (6292)

$1.2410 (3552)

$1.2378 (6425)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 109267 contracts, with the maximum number of contracts with strike pric $1,2800 (6108);

- Overall open interest on the PUT options with the expiration date December, 5 is 112258 contracts, with the maximum number of contracts with strike price $1,2200 (7465);

- The ratio of PUT/CALL was 1.03 versus 0.99 from the previous trading day according to data from November, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.6000 (1640)

$1.5901 (742)

$1.5803 (923)

Price at time of writing this review: $1.5715

Support levels (open interest**, contracts):

$1.5693 (1782)

$1.5596 (1475)

$1.5498 (974)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 40250 contracts, with the maximum number of contracts with strike price $1,6000 (1896);

- Overall open interest on the PUT options with the expiration date December, 5 is 40650 contracts, with the maximum number of contracts with strike price $1,5900 (2303);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from November, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:30

Australia: Construction Work Done, Quarter III -2.2% (forecast -1.7%)

-