Notícias do Mercado

-

23:53

Japan: Industrial Production (YoY), October -0.1% (forecast -0.2%)

-

23:50

Japan: Retail sales, y/y, October +1.4% (forecast +1.5%)

-

23:50

Japan: Industrial Production (MoM) , October +0.2% (forecast -0.4%)

-

23:31

Japan: Tokyo Consumer Price Index, y/y, November +2.1%

-

23:31

Japan: Tokyo CPI ex Fresh Food, y/y, November +2.4% (forecast +2.3%)

-

23:31

Japan: National CPI Ex-Fresh Food, y/y, October +2.9% (forecast +2.9%)

-

23:30

Japan: Household spending Y/Y, October -4.0% (forecast -4.8%)

-

23:30

Japan: Unemployment Rate, October 3.5% (forecast 3.6%)

-

23:30

Japan: National Consumer Price Index, y/y, October +2.9% (forecast +3.1%)

-

16:45

The number of unemployed people in Germany declined by 14,000 in November

The Federal Labour Office released German labour market data on Thursday. The number of unemployed people in Germany declined by 14,000 in November, beating expectations for a 1,000 decline, after a 23,000 drop in October. October's figure was revised up from a 22,000 decrease.

There were 2.717 million people out of work in November, the lowest level in three years.

Germany's adjusted unemployment rate remained unchanged at 6.6% in November, beating expectations for an increase to 6.7%. October's figure was revised down from 6.7%.

The Federal Labour Office President Frank-Jürgen Weise said that "the labour market developed positively despite only moderate growth in Germany".

-

16:39

Foreign exchange market. American session: the Canadian dollar dropped against the U.S. dollar despite the better-than-expected Canadian current account data

The U.S. dollar traded higher against the most major currencies. Markets in the U.S. are closed for a public holiday.

The euro traded lower against the U.S. dollar. German preliminary consumer price index was flat in November, in line with expectations, after a 0.3% decline in October.

The number of unemployed people in Germany declined by 14,000 in November, beating expectations for a 1,000 decline, after a 23,000 drop in October. October's figure was revised up from a 22,000 decrease.

Germany's adjusted unemployment rate remained unchanged at 6.6% in November, beating expectations for an increase to 6.7%. October's figure was revised down from 6.7%.

The Gfk German consumer confidence index increased to 8.7 in December from 8.5 in November, beating forecasts for a rise to 8.6.

Eurozone's adjusted M3 money supply remained unchanged 2.5% in October, missing expectations for a 2.6% increase.

Eurozone's private loans fell 1.1% in October, missing forecasts of a 1.0% decrease, after a 1.2% drop in September.

The British pound fell against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar dropped against the U.S. dollar despite the better-than-expected Canadian current account data. Canadian current account deficit narrowed to C$8.4 billion in the third quarter from a deficit of C$9.9 billion in the second quarter. The second quarter figure was revised up from a deficit of C$11.9 billion. Analysts had expected a deficit of C$10.3 billion.

That was the best reading in six years.

The New Zealand dollar decreased against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback despite the weaker-than-expected trade data from New Zealand. New Zealand's trade deficit narrowed to NZ$908 million in October from a deficit of NZ$1.35 billion in September, but missing expectations for a deficit of NZ$645 million.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback due to solid economic data from Australia. Private capital expenditure in Australia climbed 0.2% in the third quarter, beating expectations for a 1.6% decline, after a 1.6 gain in the second quarter. The second quarter's figure was revised up from a 1.1% increase.

Australia's new home sales climbed 3.0% in October, after the flat reading in September.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan.

-

15:55

Gfk German consumer confidence index climbed to 8.7 in December

The market research group GfK released its consumer confidence survey on Thursday. The Gfk German consumer confidence index increased to 8.7 in December from 8.5 in November, beating forecasts for a rise to 8.6.

Gfk said that geopolitical tensions and the economic slowdown in the Eurozone had not yet dampened willingness to buy.

-

15:34

German preliminary consumer index dropped the lowest level since February 2010

The Federal Statistics Office released German preliminary consumer inflation data on Thursday. German preliminary consumer index dropped to 0.5% annual rate in November from 0.7% in October, missing forecasts of a decline to 0.6%. That was the lowest level since February 2010.

On a monthly basis, preliminary consumer prices were flat in November, in line with expectations, after a 0.3% fall in October.

These figures added to concerns about deflation in the Eurozone. Deflation can trigger a spiral where businesses and households delay purchases.

Final figures are scheduled to be released on December 11.

-

15:05

Spain’s consumer prices dropped by an annual rate of 0.5% in November

Spain's harmonized consumer price index (HICP) fell by an annual rate of 0.5% in November, after a 0.2% decline in October.

Spain's GDP (gross domestic product) rose 0.5% in the third quarter, unchanged from a preliminary October 30 estimate.

-

14:48

Canadian current account deficit narrowed to C$8.4 billion in the third quarter

Statistics Canada released current account data on Thursday. Canadian current account deficit narrowed to C$8.4 billion in the third quarter from a deficit of C$9.9 billion in the second quarter. The second quarter figure was revised up from a deficit of C$11.9 billion.

Analysts had expected a deficit of C$10.3 billion.

That was the best reading in six years.

The increase was driven by a rise in the surplus on the trade in goods.

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2450($239mn), $1.2600($296mn)

USD/JPY: Y116.95/00($350mn), Y117.50, Y118.25

EUR/JPY: Y145.80

AUD/USD: $0.8435(A$403mn), $0.8545/50(A$330mn)

USD/CHF: Chf0.9480

NZD/USD: $0.7860(NZ$221mn), $0.7950(NZ$654mn)

USD/TRY: Try2.20($405mn), Try2.22($250mn)

-

13:30

Canada: Current Account, bln, Quarter III -8.4 (forecast -10.3)

-

13:10

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the solid data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia HIA New Home Sales, m/m October 0.0% 3%

00:00 Australia Private Capital Expenditure Quarter III +1.1% -1.6% +0.2%

08:55 Germany Unemployment Change November -23 Revised From -22 -1 -14

08:55 Germany Unemployment Rate s.a. November 6.6% Revised From 6.7% 6.7% 6.6%

09:00 OPEC OPEC Meetings

09:00 Eurozone M3 money supply, adjusted y/y October +2.5% +2.6% +2.5%

09:00 Eurozone Private Loans, Y/Y October -1.2% -1.0% -1.1%

10:00 Eurozone Business climate indicator November 0.06 Revised From 0.05 0.18

10:00 Eurozone Economic sentiment index November 100.7 100.3 100.8

10:00 Eurozone Industrial confidence November -5.1 -5.4 -4.3

12:00 Germany Gfk Consumer Confidence Survey December 8.5 8.6 8.7

The U.S. dollar mixed to higher against the most major currencies. Markets in the U.S. are closed for a public holiday.

The euro traded lower against the U.S. dollar despite the solid data from Germany. German preliminary consumer price index was flat in November, in line with expectations, after a 0.3% decline in October.

The number of unemployed people in Germany declined by 14,000 in November, beating expectations for a 1,000 decline, after a 23,000 drop in October. October's figure was revised up from a 22,000 decrease.

Germany's adjusted unemployment rate remained unchanged at 6.6% in November, beating expectations for an increase to 6.7%. October's figure was revised down from 6.7%.

The Gfk German consumer confidence index increased to 8.7 in December from 8.5 in November, beating forecasts for a rise to 8.6.

Eurozone's adjusted M3 money supply remained unchanged 2.5% in October, missing expectations for a 2.6% increase.

Eurozone's private loans fell 1.1% in October, missing forecasts of a 1.0% decrease, after a 1.2% drop in September.

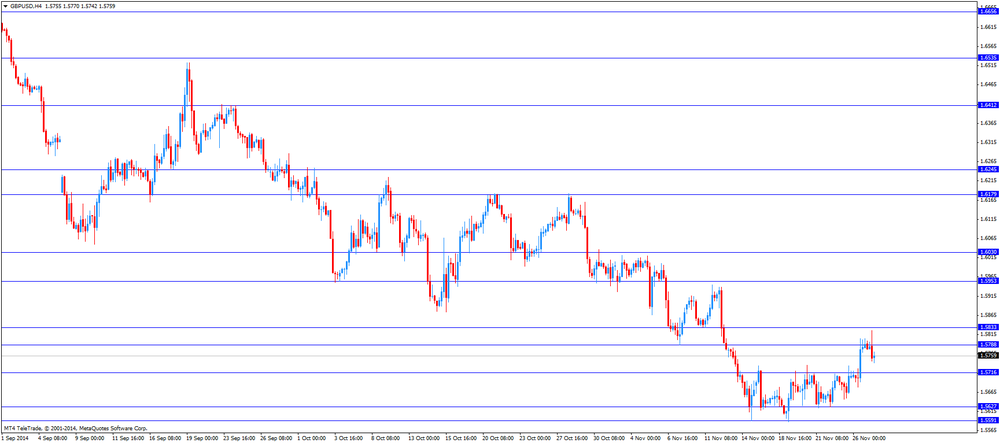

The British pound traded lower against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian current account data. Canadian current account deficit is expected to narrow to C$10.3 billion in the third quarter from a deficit of C$11.9 billion in the second quarter.

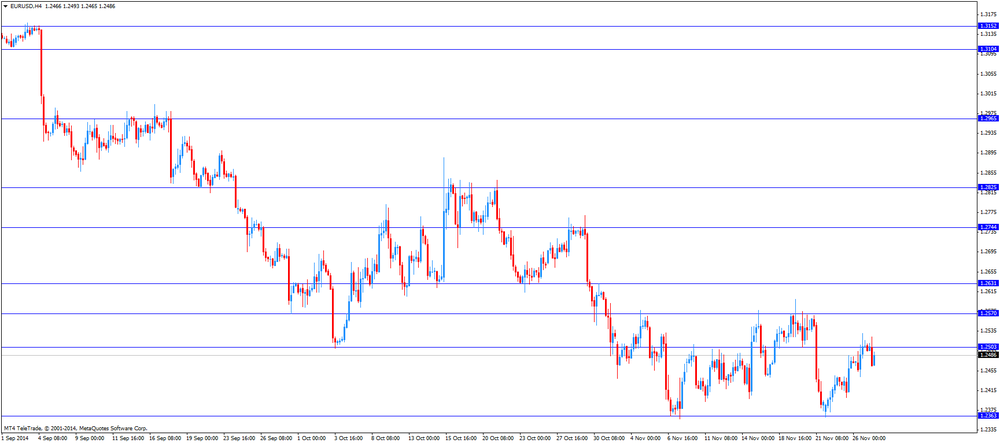

EUR/USD: the currency pair fell to $1.2464

GBP/USD: the currency pair declined to $1.5742

USD/JPY: the currency pair rose to Y117.55

The most important news that are expected (GMT0):

13:30 Canada Current Account, bln Quarter III -11.9 -10.3

13:30 U.S. Bank holiday

21:45 New Zealand Building Permits, m/m October -12.2%

23:30 Japan Household spending Y/Y October -5.6% -4.8%

23:30 Japan Unemployment Rate October 3.6% 3.6%

23:30 Japan Tokyo Consumer Price Index, y/y November +2.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y November +2.5% +2.3%

23:30 Japan National Consumer Price Index, y/y October +3.2% +3.1%

23:30 Japan National CPI Ex-Fresh Food, y/y October +3.0% +2.9%

23:50 Japan Retail sales, y/y October +2.3% +1.5%

23:50 Japan Industrial Production (MoM) (Preliminary) October +2.9% -0.4%

23:50 Japan Industrial Production (YoY) (Preliminary) October +0.8% -0.2%

-

13:01

Germany: CPI, m/m, November 0.0% (forecast 0.0%)

-

13:01

Germany: CPI, y/y , November +0.6% (forecast +0.7%)

-

12:45

Orders

EUR/USD

Offers $1.2600, $1.2580/70, $1.240

Bids $1.2485, $1.2445, $1.2400, $1.2360, $1.2300

GBP/USD

Offers $1.6040, $1.6005/00, $1.5945, $1.5900

Bids $1.5735, $1.5680/75, $1.5590, $1.5550, $1.5525/20

AUD/USD

Offers $0.8800, $0.8750, $0.8700, $0.8630

Bids $0.8510, $0.8500, $0.8480

EUR/JPY

Offers Y148.50, Y148.00, Y147.45

Bids Y146.25, Y146.00, Y145.50, Y145.00

USD/JPY

Offers Y119.50, Y119.20, Y119.00, Y118.55, Y117.90/85

Bids Y117.00, Y116.85/80, Y116.50

EUR/GBP

Offers stg0.8066, stg0.8000, stg0.7980, stg0.7950

Bids stg0.7885/75, stg0.7860/50, stg0.7800

-

12:00

Germany: Gfk Consumer Confidence Survey, December 8.7 (forecast 8.6)

-

10:15

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2450($239mn), $1.2600($296mn)

USD/JPY: Y116.95/00($350mn), Y117.50, Y118.25

EUR/JPY: Y145.80

AUD/USD: $0.8435(A$403mn), $0.8545/50(A$330mn)

USD/CHF: Chf0.9480

NZD/USD: $0.7860(NZ$221mn), $0.7950(NZ$654mn)

USD/TRY: Try2.20($405mn), Try2.22($250mn)

-

10:01

Eurozone: Business climate indicator , November 0.18

-

10:00

Eurozone: Economic sentiment index , November 100.8 (forecast 100.3)

-

10:00

Eurozone: Industrial confidence, November -4.3 (forecast -5.4)

-

09:20

Press Review: Yellen's 'optimal' model calls for rate hike this year, in theory

REUTERS

Yellen's 'optimal' model calls for rate hike this year, in theory

(Reuters) - Federal Reserve Chair Janet Yellen has said the tenor of economic data will decide when the U.S. central bank raises interest rates. Surprisingly, a data analysis based on Yellen's own priorities points to a rate increase by the end of this year.

Yellen has cautioned that the economic models built for policymakers amount to mere guideposts in a complicated decision-making process.

Source: http://www.reuters.com/article/2014/11/26/us-usa-fed-yellen-idUSKCN0JA22L20141126

BLOOMBERG

Why Russia Said 'No Deal' to OPEC on Cutting Oil Production

No country is suffering more from plunging oil prices than Russia. The world's biggest producer of crude, it's set to lose $100 billion a year as prices hover below $80 a barrel. President Vladimir Putin says a "catastrophic" further slump is "entirely possible." So why has Moscow ruled out a possible deal with the Organization of Petroleum Exporting Countries to shore up prices by cutting production?

Igor Sechin, chief executive of state-controlled oil giant Rosneft (ROSN:RM), traveled to Vienna ahead of OPEC's Nov. 27 meeting, prompting speculation that Russia, which isn't an OPEC member, might agree to curb production in tandem with the cartel. But on Nov. 25, after talks with representatives of OPEC members Saudi Arabia and Venezuela, and nonmember Mexico, Sechin told Bloomberg News that the four countries agreed only to "monitor oil prices over the next year."

Why wouldn't Russia be pushing harder than anyone to squeeze oil supplies?

Source: http://www.businessweek.com/articles/2014-11-26/russia-wont-cut-oil-production

REUTERS

ECB's Draghi calls for comprehensive strategy to put euro economy on track

Nov 27 (Reuters) - The euro zone's economy needs a comprehensive strategy including reforms to get it back on track, the president of the European Central Bank said on Thursday, adding that the task could not be left to monetary policy alone.

"Now is certainly not the right moment for complacency, neither in the area of fiscal policies nor with regard to structural reforms," he said in a summary of his remarks delivered to the Finnish parliament released by the Bank of Finland.

Source: http://www.reuters.com/article/2014/11/27/ecb-policy-idUSL6N0TH1BB20141127?feedType=RSS

-

09:00

Eurozone: M3 money supply, adjusted y/y, October +2.5% (forecast +2.6%)

-

08:55

Germany: Unemployment Change, November -14 (forecast -1)

-

08:55

Germany: Unemployment Rate s.a. , November 6.6% (forecast 6.7%)

-

07:30

Foreign exchange market. Asian session: the greenback is trading weaker against its major peers after mixed U.S. data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia HIA New Home Sales, m/m October 0.0% 3.0%

00:00 Australia Private Capital Expenditure Quarter III +1.1% -1.6% +0.2%

The U.S. dollar traded lower against its major peers after a mixed U.S. economic data as investors reconsidered when the FED is going to increase benchmark interest rates as the world largest economy is losing momentum. Pending home sales in the U.S. declined 1.1% in October, missing expectations for a 0.9% increase, after a 0.6% gain in September. September's figure was revised up from a 0.3% rise.

New home sales climbed 0.7% to a seasonally adjusted annual rate of 458,000 units in October from 455,000 units in September. September's figure was revised down from 467,000 units. Analysts had expected new home sales to reach 471,000 units.

The final University of Michigan's consumer sentiment index was 88.8 in November, down from the preliminary estimate of 89.4. Analysts had expected an increase to 90.2.

The Chicago purchasing managers' index declined from 66.2 in October to 60.8 in September, missing expectations for a fall to 63.1.

Personal spending increased 0.2% in October, missing expectations for a 0.4% gain, after the flat reading in September. September's figure was revised up from a 0.2% decrease. Personal income climbed 0.2% in October, missing expectations for 0.4% increase, after a 0.2% rise in September.

The personal consumption expenditures (PCE) price index excluding food and energy increased 0.2% in October, beating forecasts of a 0.1 rise, after a 0.1% gain in September.

The U.S. durable goods orders rose 0.4% in October, beating expectations for a 0.4% decline, after a 0.9% drop in September. August's figure was revised up from a 1.1% decrease.

The increase was driven by the strength of transportation equipment. Demand for transportation products climbed 3.4 % in October

The U.S. durable goods orders excluding transportation fell 0.9% in October, missing expectations for a 0.5% gain, after a 0.2% rise in September. September's figure was revised up from a 0.1% decrease.

The U.S. durable goods orders excluding defence decreased 0.6% in October.

The number of initial jobless claims in the week ending November 22 in the U.S. rose by 21,000 to 313,000 from 292,000 in the previous week. The previous week's figure was revised down from 291,000. Analysts had expected a decline to 287.000.

The Australian dollar recouped losses after the U.S. data after hitting a for-year low. Comments from RBA Deputy Governor Philip Lowe had put pressure on the currency as he said that the aussie is overvalued and will probably decline in line with lower commodity prices and investment. The Australian dollar was further supported by better-than-expected Private Capital Expenditure for the third quarter reading +0.2% beating forecasts at -1.6%. New home sales rose by 3% in October.

The New Zealand dollar traded stronger against the greenback. New Zealand's October trade balance showed a deficit of NZD 908 million, with a forecast of NZD 645 million, improving from NZD1.35 billion deficit in September.

The Japanese yen further recovered against the U.S. dollar after U.S. data after its rapid depreciation in the last weeks.

EUR/USD: the euro traded stronger against the greenback

USD/JPY: the U.S. dollar declined against the Japanese yen

GPB/USD: The British pound traded stroger against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:55 Germany Unemployment Change November -22 -1

08:55 Germany Unemployment Rate s.a. November 6.7% 6.7%

09:00 OPEC OPEC Meetings

09:00 Eurozone M3 money supply, adjusted y/y October +2.5% +2.6%

09:00 Eurozone Private Loans, Y/Y October -1.2% -1.0%

10:00 Eurozone Business climate indicator November 0.05

10:00 Eurozone Economic sentiment index November 100.7 100.3

10:00 Eurozone Industrial confidence November -5.1 -5.4

12:00 Germany Gfk Consumer Confidence Survey December 8.5 8.6

13:00 Germany CPI, m/m November -0.3% 0.0%

13:00 Germany CPI, y/y (Preliminary) November +0.8% +0.7%

13:30 Canada Current Account, bln Quarter III -11.9 -10.3

13:30 U.S. Bank holiday

21:45 New Zealand Building Permits, m/m October -12.2%

23:30 Japan Household spending Y/Y October -5.6% -4.8%

23:30 Japan Unemployment Rate October 3.6% 3.6%

23:30 Japan Tokyo Consumer Price Index, y/y November +2.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y November +2.5% +2.3%

23:30 Japan National Consumer Price Index, y/y October +3.2% +3.1%

23:30 Japan National CPI Ex-Fresh Food, y/y October +3.0% +2.9%

23:50 Japan Retail sales, y/y October +2.3% +1.5%

23:50 Japan Industrial Production (MoM) (Preliminary) October +2.9% -0.4%

23:50 Japan Industrial Production (YoY) (Preliminary) October +0.8% -0.2%

-

06:29

Options levels on thursday, November 27, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2587 (4614)

$1.2567 (1702)

$1.2541 (357)

Price at time of writing this review: $ 1.2507

Support levels (open interest**, contracts):

$1.2475 (3534)

$1.2454 (2536)

$1.2429 (6270)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 110101 contracts, with the maximum number of contracts with strike pric $1,2800 (6170);

- Overall open interest on the PUT options with the expiration date December, 5 is 123460 contracts, with the maximum number of contracts with strike price $1,2200 (7813);

- The ratio of PUT/CALL was 1.12 versus 1.03 from the previous trading day according to data from November, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.6001 (1360)

$1.5903 (982)

$1.5806 (874)

Price at time of writing this review: $1.5790

Support levels (open interest**, contracts):

$1.5697 (1730)

$1.5599 (1418)

$1.5499 (957)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 40812 contracts, with the maximum number of contracts with strike price $1,6200 (1595);

- Overall open interest on the PUT options with the expiration date December, 5 is 40163 contracts, with the maximum number of contracts with strike price $1,6000 (2020);

- The ratio of PUT/CALL was 0.98 versus 1.00 from the previous trading day according to data from November, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:30

Australia: Private Capital Expenditure, Quarter III +0.2% (forecast -1.6%)

-

00:00

Australia: HIA New Home Sales, m/m, October 3%

-