Notícias do Mercado

-

16:41

Foreign exchange market. American session: the Canadian dollar traded lower against the U.S. dollar due to falling oil prices

The U.S. dollar traded higher against the most major currencies. Markets in the U.S. were closed for a public holiday on Thursday. There will be released no major economic reports in the U.S.

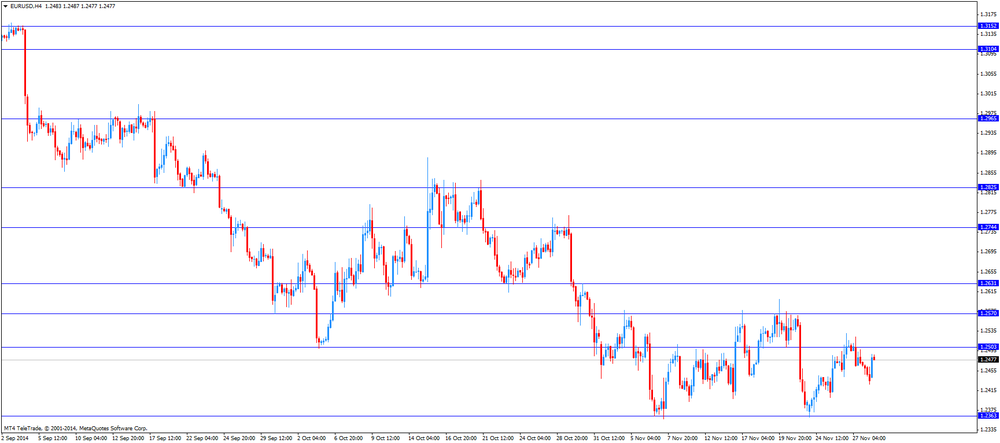

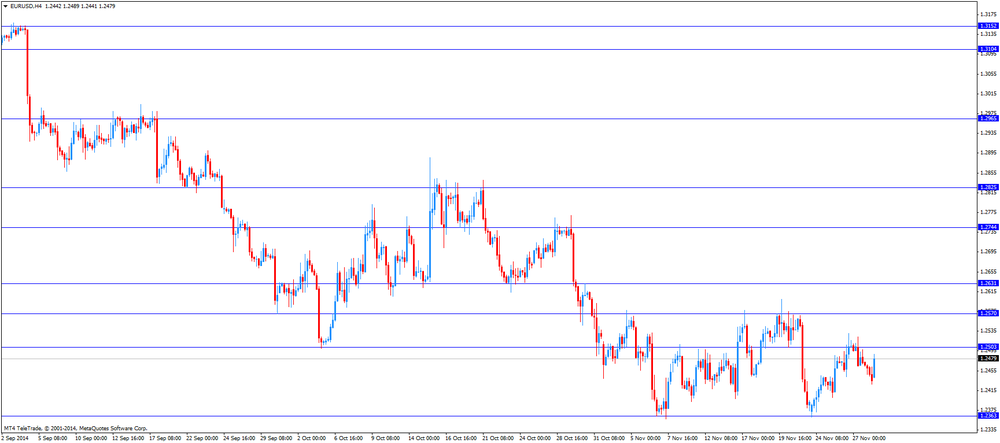

The euro traded lower against the U.S. dollar. Eurozone' preliminary consumer price index fell to an annual rate of 0.3% in November from 0.4% in October, in line with expectations.

Investors speculate that the European Central Bank will add further stimulus measures.

Eurozone's unemployment rate remained unchanged at 11.5% in October, in line with expectations.

German adjusted retail sales climbed 1.9% in October, exceeding expectations for a 1.7% rise, after a 2.8% decline in September. September's figure was revised up from a 3.2% fall.

Consumer spending in France dropped 0.9% in October, missing expectations for a 0.2% gain, after a 0.5% decline in September. September's figure was revised up from a 0.8% decrease.

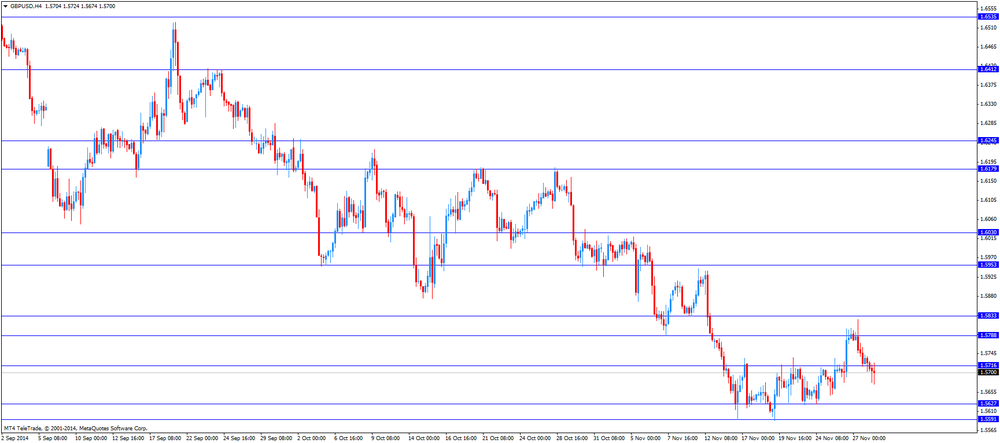

The British pound traded lower against the U.S. dollar after the housing market data from the U.K. The Nationwide Building Society released its house price inflation figures for the U.K. on Friday. The U.K. house price index increased 0.3% in November, after a 0.5% rise in October.

On a yearly basis, the U.K. house price inflation climbed 8.5% in November, after a 9.0% gain in October.

The Canadian dollar traded lower against the U.S. dollar due to falling oil prices. Canada's GDP increased 0.4% in September, in line with expectations, after a 0.1% fall in August.

On a yearly basis, Canada's GDP expanded at an annual rate of 2.8% in the third quarter, after a 3.6% gain in the second quarter.

The annual increase of GDP was driven by an increase in exports and a rise in household spending.

Canada's raw materials purchase price index dropped 4.3% in October, missing expectations for a 1.5% gain, after a 2.1% decline in September. September's figure was revised down from a 1.8% decrease.

The Swiss franc traded lower against the U.S. dollar. The KOF leading indicator decreased to 98.7 in November from 99.5 in October, missing expectations for an increase to 100.1. October's figure was revised down from 99.8.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi fell against the greenback despite the solid data from New Zealand, but recovered its losses in the morning trading session. The number of building permits in New Zealand increased 8.8% in October, after a 11.9% drop in September. September's figure was revised up from a 12.2% decline.

The ANZ business confidence index for New Zealand rose to 31.5 in November from 26.5 in October.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie decreased against the greenback. Private sector credit in Australia climbed 0.6% in October, beating expectations for a 0.5% rise, after a 0.5% increase in September.

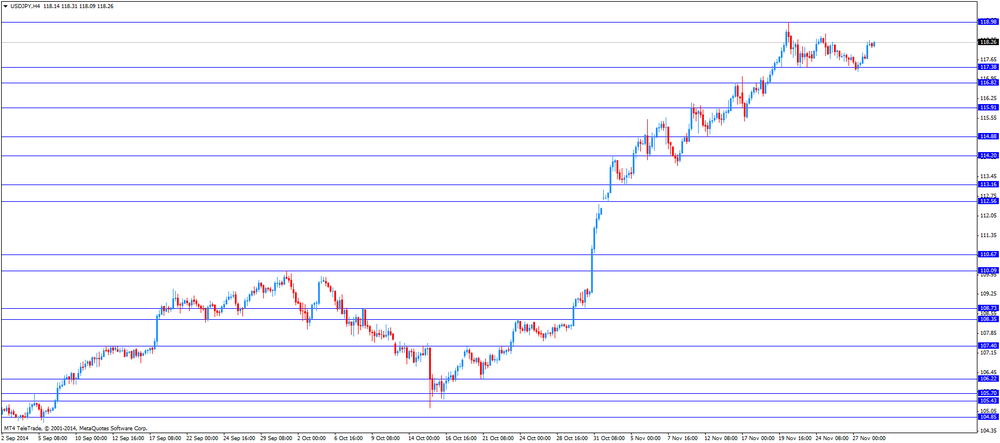

The Japanese yen dropped against the U.S. dollar. In the overnight trading session, the yen fell against the greenback after the mixed economic data from Japan. Japan's national consumer price index (CPI) rose 2.9% in October, missing expectations for a 3.1% gain, after a 3.2 increase in September.

Japan's national CPI excluding fresh food increased 2.9% in October, in line with expectations, after a 3.0% rise in September.

Tokyo's CPI climbed 2.1% in November, after a 2.5% rise in October.

Tokyo's CPI excluding fresh food gained 2.4% in November, exceeding expectations for a 2.3% rise, after a 2.5% increase in October.

Household spending in Japan dropped at annual rate of 4.0% in October, beating forecasts of a 4.8% decrease, after a 5.6% fall in September.

Japan's unemployment rate increased to 3.5% in October from 3.6% in September. Analysts had expected the unemployment rate to remain unchanged.

Preliminary industrial production in Japan climbed 0.2% in October, beating expectations for a 0.4% decrease, after a 2.9% gain in September.

On a yearly basis, preliminary industrial production fell 0.1% in October, beating forecasts for a 0.2% decrease, after a 0.8% increase in September.

-

15:24

Britain's Prime Minister David Cameron warned that the UK could leave the EU if the UK’s concerns “fall on deaf ears”

Britain's Prime Minister David Cameron said in a speech on Friday that lower EU migration would be a priority in future negotiations on the UK's remaining in the EU. He warned that he would "rule nothing out" if the UK's concerns "fall on deaf ears".

-

14:42

-

14:38

Canada's GDP increased 0.4% in September

Statistics Canada released GDP (gross domestic product) data on Friday. Canada's GDP increased 0.4% in September, in line with expectations, after a 0.1% fall in August.

On a yearly basis, Canada's GDP expanded at an annual rate of 2.8% in the third quarter, after a 3.6% gain in the second quarter.

The annual increase of GDP was driven by an increase in exports and a rise in household spending.

Exports increased by an annualized 6.9% in the third quarter, business capital investment climbed by an annualized 5.9%, while household spending rose by an annualized 2.8%.

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2450(E401mn), $1.2475/80(E923mn), $1.2500/15(E930mn), $1.2530/50(E700mn)

USD/JPY: Y116.50($2.5bn), Y116.60($400mn), Y117.10($530mn), Y117.75/80($1.2bn)

EUR/JPY: Y145.80

AUD/USD: $0.8500(A$750mn), $0.8535(A$500mn), $0.8650(A$554mn)

USD/CAD: Cad1.1170/90($400mn), Cad1.1250($301mn)

-

13:30

Canada: GDP (m/m) , September +0.4% (forecast +0.4%)

-

13:30

Canada: Raw Material Price Index, October -4.3% (forecast +1.5%)

-

13:30

Canada: Industrial Product Prices, m/m, October -0.5% (forecast +0.3%)

-

13:01

Foreign exchange market. European session: the euro rose against the U.S. dollar after the economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand ANZ Business Confidence November 26.5 31.5

00:05 United Kingdom Gfk Consumer Confidence November -2 -1 -2

00:30 Australia Private Sector Credit, m/m October +0.5% +0.5% +0.6%

00:30 Australia Private Sector Credit, y/y October +5.4% +5.7%

05:00 Japan Housing Starts, y/y October -14.3% -14.5% -12.3%

07:00 Germany Retail sales, real adjusted October -2.8% +1.7% +1.9%

07:00 Germany Retail sales, real unadjusted, y/y October +2.3% +1.5% +1.7%

07:45 France Consumer spending October -0.5% +0.2% -0.9%

07:45 France Consumer spending, y/y October +0.2% -0.2%

08:00 Switzerland KOF Leading Indicator November 99.5 Revised From 99.8 100.1 98.7

10:00 Eurozone Unemployment Rate October 11.5% 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) November +0.4% +0.3% +0.3%

The U.S. dollar traded mixed against the most major currencies. Markets in the U.S. were closed for a public holiday on Thursday. There will be released no major economic reports in the U.S.

The euro rose against the U.S. dollar after the economic data from the Eurozone. Eurozone' preliminary consumer price index fell to an annual rate of 0.3% in November from 0.4% in October, in line with expectations.

Eurozone's unemployment rate remained unchanged at 11.5% in October, in line with expectations.

German adjusted retail sales climbed 1.9% in October, exceeding expectations for a 1.7% rise, after a 2.8% decline in September. September's figure was revised up from a 3.2% fall.

Consumer spending in France dropped 0.9% in October, missing expectations for a 0.2% gain, after a 0.5% decline in September. September's figure was revised up from a 0.8% decrease.

The British pound traded lower against the U.S. dollar after the housing market data from the U.K. The Nationwide Building Society released its house price inflation figures for the U.K. on Friday. The U.K. house price index increased 0.3% in November, after a 0.5% rise in October.

On a yearly basis, the U.K. house price inflation climbed 8.5% in November, after a 9.0% gain in October.

The Canadian dollar fell against the U.S. dollar ahead of Canadian gross domestic product (GDP). Canada's GDP is expected to rise 0.4% in September, after a 0.1% decline in August.

Canada's raw materials purchase price index is expected to increase 1.5% in October, after a 1.8% drop in September.

The Swiss franc traded higher against the U.S. dollar despite the weaker-than-expected KOF leading indicator. The KOF leading indicator decreased to 98.7 in November from 99.5 in October, missing expectations for an increase to 100.1. October's figure was revised down from 99.8.

EUR/USD: the currency pair rose to $1.2489

GBP/USD: the currency pair declined to $1.5674

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Raw Material Price Index October -1.8% +1.5%

13:30 Canada GDP (m/m) September -0.1% +0.4%

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580/70, $1.2530, $1.2500

Bids $1.2430, $1.2400, $1.2360, $1.2300

GBP/USD

Offers $1.6005/00, $1.5945, $1.5900, $1.5825, $1.5800

Bids $1.5625, $1.5590, $1.5550, $1.5525/20

AUD/USD

Offers $0.8800, $0.8750, $0.8700, $0.8630, $0.8600

Bids $0.8480, $0.8400

EUR/JPY

Offers Y148.50, Y148.00

Bids Y146.25, Y146.00, Y145.50, Y145.00

USD/JPY

Offers Y119.50, Y119.20, Y119.00, Y118.55

Bids Y117.80. Y117.00, Y116.85/80, Y116.50

EUR/GBP

Offers stg0.8066, stg0.8000, stg0.7980, stg0.7950

Bids stg0.7885/75, stg0.7860/50, stg0.7800

-

10:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2450(E401mn), $1.2475/80(E923mn), $1.2500/15(E930mn), $1.2530/50(E700mn)

USD/JPY: Y116.50($2.5bn), Y116.60($400mn), Y117.10($530mn), Y117.75/80($1.2bn)

EUR/JPY: Y145.80

AUD/USD: $0.8500(A$750mn), $0.8535(A$500mn), $0.8650(A$554mn)

USD/CAD: Cad1.1170/90($400mn), Cad1.1250($301mn)

-

10:00

Eurozone: Unemployment Rate , October 11.5% (forecast 11.5%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, November +0.3% (forecast +0.3%)

-

09:20

Press Review: Dollar Advances as OPEC Output Freeze Seen Hurting Euro, Aussie

REUTERS

Japan inflation slows in October, highlights challenge facing Abe

(Reuters) - Japan's annual core consumer inflation slowed for a third straight month in October due to falling oil prices, highlighting the economic gloom facing Premier Shinzo Abe as he campaigns for a new mandate to implement his stalled recovery plan.

"Inflation could continue to slow because oil prices are falling," said Hidenobu Tokuda, senior economist at Mizuho Research Institute. "Other data show the economy is recovering, but this is not really because of Abe's policies."

Source: http://www.reuters.com/article/2014/11/28/us-japan-economy-idUSKCN0JC08Y20141128

BLOOMBERG

Dollar Advances as OPEC Output Freeze Seen Hurting Euro, Aussie

The dollar rose against all 16 of its major peers amid speculation OPEC's decision to keep oil output unchanged will stimulate the U.S. economy while weighing on the euro and commodity currencies.

The yen fell against the dollar for the first time in four days after a government report showed household spending dropped and inflation slowed. The 12-nation Organization of Petroleum Exporting Countries kept its output target at 30 million barrels a day even after the steepest slump in oil prices since the global recession. Australia's dollar declined with the Norwegian krone and Canadian dollar.

REUTERS

Rouble hits record low after OPEC keeps output unchanged

Nov 27 (Reuters) - The rouble fell to record lows against the dollar and euro on Thursday after OPEC decided against cutting crude-oil output to boost flagging prices.

At 1710 GMT, the rouble was down around 2.6 percent against the dollar at 48.60 roubles per dollar and around 2.5 percent weaker against the euro at 60.69 roubles per euro.

It had earlier strengthened against both currencies in nervous trade before the OPEC meeting in Vienna, one of the most closely watched in years.

Source: http://www.reuters.com/article/2014/11/27/russia-markets-rouble-idUSL6N0TH0P920141127

-

08:00

Switzerland: KOF Leading Indicator, November 98.7 (forecast 100.1)

-

07:45

France: Consumer spending , October -0.9% (forecast +0.2%)

-

07:45

France: Consumer spending, y/y, October -0.2%

-

07:30

Foreign exchange market. Asian session: the greenback is trading stronger against its major peers

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 New Zealand ANZ Business Confidence November 26.5 31.5

00:05 United Kingdom Gfk Consumer Confidence November -2 -1 -2

00:30 Australia Private Sector Credit, m/m October +0.5% +0.5% +0.6%

00:30 Australia Private Sector Credit, y/y October +5.4% +5.7%

05:00 Japan Housing Starts, y/y October -14.3% -14.5% -12.3%

07:00 Germany Retail sales, real adjusted October -3.2% +1.7% +1.9%

07:00 Germany Retail sales, real unadjusted, y/y October +2.3% +1.5% +1.7%

The U.S. dollar traded stronger against its major peers as the economic outlook for Europe, China and Japan remain weak.

The Australian dollar further declined against the greenback. Private sector credit rose 0.6%, 0.1% above forecasts

The New Zealand dollar traded weaker against the U.S. dollar. New Zealand's building permits rose 8.8% month-on-month in October after reading -12.2% last month. ANZ Business Confidence rose to from 26.5 to 31.5 in November.

The Japanese yen dropped against the U.S. dollar after a mixed set of key data. Household spending fell -4.0% and inflation slowed fuelling doubts that the inflation target of 2% can be achieved with Japan's economy in recession. The unemployment rate beating forecasts by 0.1% reading 3.5% in October. Retail sales gained 1.4%, not meeting analyst forecasts of +1.5%. National Consumer Prices rose by +2.9% below the forecast of +3.1%.

EUR/USD: the euro traded weakeragainst the greenback

USD/JPY: the U.S. dollar rose against the Japanese yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Consumer spending October -0.8% +0.2%

07:45 France Consumer spending, y/y October +0.2%

08:00 Switzerland KOF Leading Indicator November 99.8 100.1

10:00 Eurozone Unemployment Rate October 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) November +0.4% +0.3%

13:30 Canada Industrial Product Prices, m/m October -0.4% +0.3%

13:30 Canada Raw Material Price Index October -1.8% +1.5%

13:30 Canada GDP (m/m) September -0.1% +0.4%

-

07:00

Germany: Retail sales, real unadjusted, y/y, October +1.7% (forecast +1.5%)

-

07:00

Germany: Retail sales, real adjusted , October +1.9% (forecast +1.7%)

-

06:20

Options levels on friday, November 28, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2587 (4614)

$1.2552 (1364)

$1.2518 (62)

Price at time of writing this review: $ 1.2449

Support levels (open interest**, contracts):

$1.2429 (6270)

$1.2399 (4274)

$1.2364 (7353)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 110101 contracts, with the maximum number of contracts with strike pric $1,2800 (6170);

- Overall open interest on the PUT options with the expiration date December, 5 is 123460 contracts, with the maximum number of contracts with strike price $1,2200 (7813);

- The ratio of PUT/CALL was 1.12 versus 1.03 from the previous trading day according to data from November, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.6001 (1360)

$1.5903 (982)

$1.5806 (874)

Price at time of writing this review: $1.5712

Support levels (open interest**, contracts):

$1.5697 (1730)

$1.5599 (1418)

$1.5499 (957)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 40812 contracts, with the maximum number of contracts with strike price $1,6200 (1595);

- Overall open interest on the PUT options with the expiration date December, 5 is 40163 contracts, with the maximum number of contracts with strike price $1,6000 (2020);

- The ratio of PUT/CALL was 0.98 versus 1.00 from the previous trading day according to data from November, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:01

Japan: Housing Starts, y/y, October -12.3% (forecast -14.5%)

-

00:46

Currencies. Daily history for Nov 27’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $ 1,2466 -0,31%

GBP/USD $1,5734 -0,36%

USD/CHF Chf0,9640 +0,30%

USD/JPY Y117,70 -0,02%

EUR/JPY Y146,73 -0,33%

GBP/JPY Y185,19 -0,38%

AUD/USD $0,8543 -0,05%

NZD/USD $0,7865 -0,08%

USD/CAD C$1,1329 +0,74%

-

00:31

Australia: Private Sector Credit, y/y, October +5.7%

-

00:30

Australia: Private Sector Credit, m/m, October +0.6% (forecast +0.5%)

-

00:20

Schedule for today, Friday, Nov 28’2014:

(time / country / index / period / previous value / forecast)

00:00 New Zealand ANZ Business Confidence November 26.5 31.5

00:05 United Kingdom Gfk Consumer Confidence November -2 -1

00:30 Australia Private Sector Credit, m/m October +0.5% +0.5%

00:30 Australia Private Sector Credit, y/y October +5.4%

05:00 Japan Housing Starts, y/y October -14.3% -14.5%

07:00 Germany Retail sales, real adjusted October -3.2% +1.7%

07:00 Germany Retail sales, real unadjusted, y/y October +2.3% +1.5%

07:45 France Consumer spending October -0.8% +0.2%

07:45 France Consumer spending, y/y October +0.2%

08:00 Switzerland KOF Leading Indicator November 99.8 100.1

10:00 Eurozone Unemployment Rate October 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) November +0.4% +0.3%

13:30 Canada Industrial Product Prices, m/m October -0.4% +0.3%

13:30 Canada Raw Material Price Index October -1.8% +1.5%

13:30 Canada GDP (m/m) September -0.1% +0.4%

-

00:05

United Kingdom: Gfk Consumer Confidence, November -2 (forecast -1)

-

00:00

New Zealand: ANZ Business Confidence, November 31.5

-