Notícias do Mercado

-

17:00

European stocks closed in different ways: FTSE 100 6,722.62 -0.80 -0.01%, CAC 40 4,390.18 +7.84 +0.18%, DAX 9,980.85 +5.98 +0.06%

-

17:00

European stocks close: stocks closed little on consumer price inflation data from the Eurozone

Stock indices closed little on consumer price inflation data from the Eurozone. Eurozone' preliminary consumer price index fell to an annual rate of 0.3% in November from 0.4% in October, in line with expectations.

Investors speculate that the European Central Bank will add further stimulus measures.

Eurozone's unemployment rate remained unchanged at 11.5% in October, in line with expectations.

German adjusted retail sales climbed 1.9% in October, exceeding expectations for a 1.7% rise, after a 2.8% decline in September. September's figure was revised up from a 3.2% fall.

Consumer spending in France dropped 0.9% in October, missing expectations for a 0.2% gain, after a 0.5% decline in September. September's figure was revised up from a 0.8% decrease.

Yesterday's OPEC decision to leave its current production target unchanged still weighed on energy stocks.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,722.62 -0.80 0.1%

DAX 9,980.85 +5.98 +0.06 %

CAC 40 4,390.18 +7.84 +0.18 %

-

16:41

Foreign exchange market. American session: the Canadian dollar traded lower against the U.S. dollar due to falling oil prices

The U.S. dollar traded higher against the most major currencies. Markets in the U.S. were closed for a public holiday on Thursday. There will be released no major economic reports in the U.S.

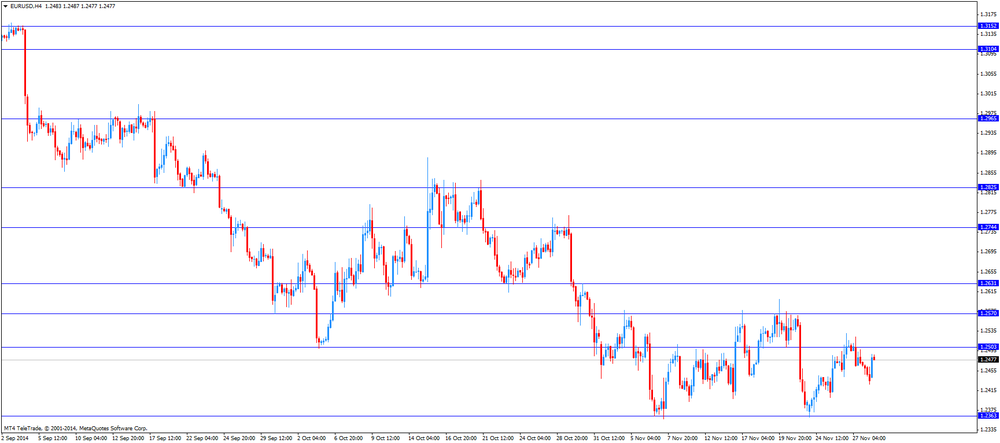

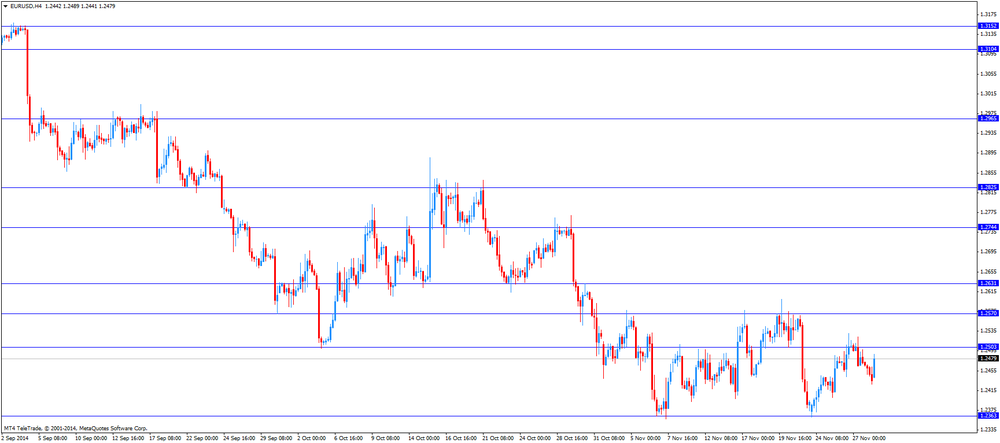

The euro traded lower against the U.S. dollar. Eurozone' preliminary consumer price index fell to an annual rate of 0.3% in November from 0.4% in October, in line with expectations.

Investors speculate that the European Central Bank will add further stimulus measures.

Eurozone's unemployment rate remained unchanged at 11.5% in October, in line with expectations.

German adjusted retail sales climbed 1.9% in October, exceeding expectations for a 1.7% rise, after a 2.8% decline in September. September's figure was revised up from a 3.2% fall.

Consumer spending in France dropped 0.9% in October, missing expectations for a 0.2% gain, after a 0.5% decline in September. September's figure was revised up from a 0.8% decrease.

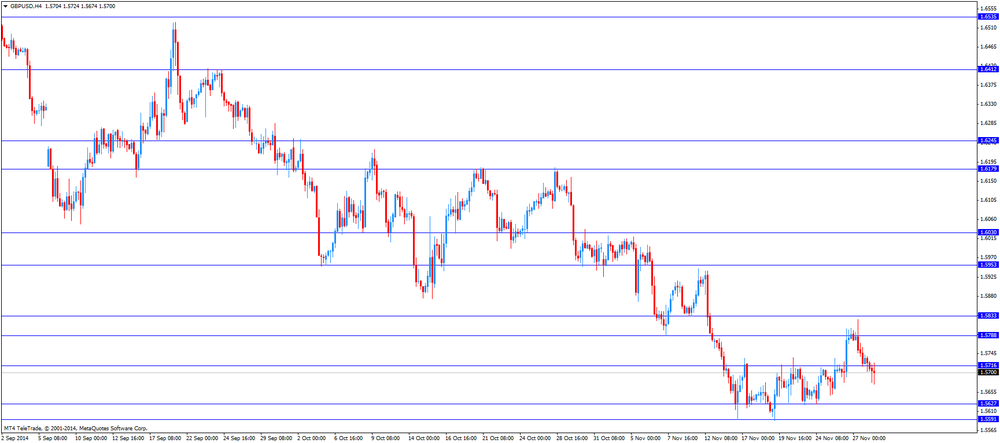

The British pound traded lower against the U.S. dollar after the housing market data from the U.K. The Nationwide Building Society released its house price inflation figures for the U.K. on Friday. The U.K. house price index increased 0.3% in November, after a 0.5% rise in October.

On a yearly basis, the U.K. house price inflation climbed 8.5% in November, after a 9.0% gain in October.

The Canadian dollar traded lower against the U.S. dollar due to falling oil prices. Canada's GDP increased 0.4% in September, in line with expectations, after a 0.1% fall in August.

On a yearly basis, Canada's GDP expanded at an annual rate of 2.8% in the third quarter, after a 3.6% gain in the second quarter.

The annual increase of GDP was driven by an increase in exports and a rise in household spending.

Canada's raw materials purchase price index dropped 4.3% in October, missing expectations for a 1.5% gain, after a 2.1% decline in September. September's figure was revised down from a 1.8% decrease.

The Swiss franc traded lower against the U.S. dollar. The KOF leading indicator decreased to 98.7 in November from 99.5 in October, missing expectations for an increase to 100.1. October's figure was revised down from 99.8.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi fell against the greenback despite the solid data from New Zealand, but recovered its losses in the morning trading session. The number of building permits in New Zealand increased 8.8% in October, after a 11.9% drop in September. September's figure was revised up from a 12.2% decline.

The ANZ business confidence index for New Zealand rose to 31.5 in November from 26.5 in October.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie decreased against the greenback. Private sector credit in Australia climbed 0.6% in October, beating expectations for a 0.5% rise, after a 0.5% increase in September.

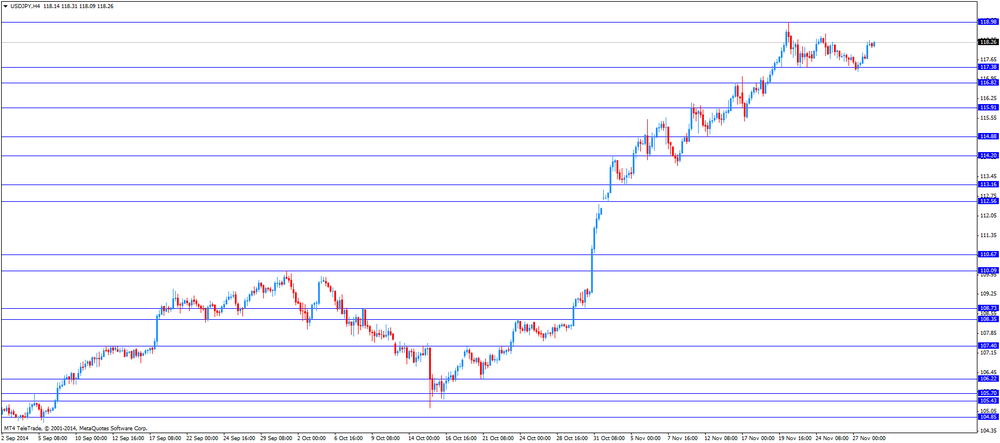

The Japanese yen dropped against the U.S. dollar. In the overnight trading session, the yen fell against the greenback after the mixed economic data from Japan. Japan's national consumer price index (CPI) rose 2.9% in October, missing expectations for a 3.1% gain, after a 3.2 increase in September.

Japan's national CPI excluding fresh food increased 2.9% in October, in line with expectations, after a 3.0% rise in September.

Tokyo's CPI climbed 2.1% in November, after a 2.5% rise in October.

Tokyo's CPI excluding fresh food gained 2.4% in November, exceeding expectations for a 2.3% rise, after a 2.5% increase in October.

Household spending in Japan dropped at annual rate of 4.0% in October, beating forecasts of a 4.8% decrease, after a 5.6% fall in September.

Japan's unemployment rate increased to 3.5% in October from 3.6% in September. Analysts had expected the unemployment rate to remain unchanged.

Preliminary industrial production in Japan climbed 0.2% in October, beating expectations for a 0.4% decrease, after a 2.9% gain in September.

On a yearly basis, preliminary industrial production fell 0.1% in October, beating forecasts for a 0.2% decrease, after a 0.8% increase in September.

-

16:40

Oil rebounded

Brent crude rebounded after OPEC triggered the biggest one-day plunge in three years yesterday by failing to cut its output in response to a glut.

Brent and West Texas Intermediate headed for their biggest weekly drops since 2011. OPEC will maintain its collective output target at 30 million barrels a day, Saudi Arabia's Oil Minister Ali Al-Naimi said after discussions in Vienna yesterday. The group's policy will ensure a crash in the U.S. shale industry, predicted Leonid Fedun, the vice president of Russia's OAO Lukoil.

"We have a situation where OPEC is prepared to live with low oil prices," said Harry Tchilinguirian, BNP Paribas SA's London-based head of commodity markets strategy. "OPEC is forfeiting its role as a swing supplier to balance the market, and is giving back the role to market mechanism."

Brent for January settlement gained 67 cents, or 0.9 percent, to $73.25 a barrel at 9:34 a.m. New York time on the London-based ICE Futures Europe exchange. The contract dropped $5.17 to $72.58 yesterday, the lowest close since August 2010. Prices are down 8.9 percent this week, heading for the biggest weekly loss since May 2011. Brent has decreased 15 percent this month and 34 percent in 2014.

WTI for January delivery declined $4.25, or 5.8 percent, to $69.44 on the New York Mercantile Exchange, compared with the Nov. 26 close. There was no floor trading yesterday because of the Thanksgiving holiday and transactions from yesterday will be booked today for settlement purposes. Floor trading will close at 1:45 p.m. today. Prices are down 9.3 percent this week, also the most since 2011.

-

16:20

Gold has updated weekly low

Gold prices fell to a week low amid falling oil prices, inflation threatening. The cost of oil futures had fallen to four-year low after OPEC's decision not to cut production in order to stabilize the market.

"Quotes of precious metals are reduced because cheap oil threatens deflation," - said analyst Victor Tyanpiriya ANZ.

Dollar exchange rate increases relative to the currencies of commodity producers, also preventing increase of quotations of gold.

"Gold is moving in the same direction with the oil, but I think that the fall will stop at at $ 1,180," - said a trader in Tokyo, recalling the referendum in Switzerland on Sunday.

In a referendum would be considered a proposal to ban the country's central bank to sell gold reserves and oblige him to keep at least 20 percent of assets in gold, compared with 8 percent in October. According to a recent survey, the proposal is 38 percent of the Swiss, but if the result of the vote will be positive, the central bank will need in the coming years to buy 1,500 tons of gold, which will cause a rise in prices, experts say.

Gold prices are likely to remain vulnerable in the short term amid signs that the strengthening of the US economic recovery will push the Fed to more rapid and sharp increase in interest rates than expected.

Expectations of growth rates on loans put pressure on gold as a precious metal with difficulty competing with the yield of interest-earning assets at higher rates.

The cost of the December gold futures on the COMEX today fell to 1184.70 dollars per ounce.

-

15:24

Britain's Prime Minister David Cameron warned that the UK could leave the EU if the UK’s concerns “fall on deaf ears”

Britain's Prime Minister David Cameron said in a speech on Friday that lower EU migration would be a priority in future negotiations on the UK's remaining in the EU. He warned that he would "rule nothing out" if the UK's concerns "fall on deaf ears".

-

14:42

-

14:38

Canada's GDP increased 0.4% in September

Statistics Canada released GDP (gross domestic product) data on Friday. Canada's GDP increased 0.4% in September, in line with expectations, after a 0.1% fall in August.

On a yearly basis, Canada's GDP expanded at an annual rate of 2.8% in the third quarter, after a 3.6% gain in the second quarter.

The annual increase of GDP was driven by an increase in exports and a rise in household spending.

Exports increased by an annualized 6.9% in the third quarter, business capital investment climbed by an annualized 5.9%, while household spending rose by an annualized 2.8%.

-

14:34

U.S. Stocks open: Dow 17,843.01 +15.26 +0.09%, Nasdaq 4,794.24 +6.92 +0.14%, S&P 2,073.66 +0.83 +0.04%

-

14:29

Before the bell: S&P futures -0.11%, Nasdaq futures +0.27%

U.S. stock-index futures were little changed, as the equities market reopens after the Thanksgiving holiday. Energy producers tumbled and airlines stocks rose after OPEC's decision to keep its output target unchanged.

Global markets:

Nikkei 17,459.85 +211.35 +1.23%

Hang Seng 23,987.45 -16.83 -0.07%

Shanghai Composite 2,682.92 +52.43 +1.99%

FTSE 6,706.07 -17.35 -0.26%

CAC 4,367.11 -15.23 -0.35%

DAX 9,960.33 -14.54 -0.15%

Crude oil $69.30 (-5.97%)

Gold $1186.00 (-0.89%)

-

14:12

DOW components before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

96.25

+0.03%

1.1K

Nike

NKE

97.92

+0.12%

0.1K

Merck & Co Inc

MRK

59.82

+0.12%

1.8K

Johnson & Johnson

JNJ

107.36

+0.14%

3.0K

Goldman Sachs

GS

188.27

+0.19%

2.3K

Intel Corp

INTC

36.97

+0.19%

4.0K

3M Co

MMM

158.63

+0.20%

2.0K

Microsoft Corp

MSFT

47.85

+0.21%

5.2K

Procter & Gamble Co

PG

89.07

+0.21%

3.4K

Verizon Communications Inc

VZ

50.15

+0.22%

2.5K

Home Depot Inc

HD

97.95

+0.26%

0.3K

AT&T Inc

T

35.23

+0.28%

4.4K

Boeing Co

BA

135.16

+0.28%

0.6K

International Business Machines Co...

IBM

162.40

+0.28%

2.4K

Walt Disney Co

DIS

92.29

+0.40%

7.7K

E. I. du Pont de Nemours and Co

DD

71.76

+0.41%

2.6K

UnitedHealth Group Inc

UNH

98.57

+0.47%

0.1K

American Express Co

AXP

91.90

+0.49%

1.0K

Visa

V

258.69

+0.56%

4.5K

Cisco Systems Inc

CSCO

27.59

+0.60%

30.9K

Wal-Mart Stores Inc

WMT

85.53

+0.65%

23.8K

United Technologies Corp

UTX

110.91

+0.68%

0.3K

Travelers Companies Inc

TRV

104.37

0.00%

0.5K

The Coca-Cola Co

KO

44.28

-0.02%

5.9K

JPMorgan Chase and Co

JPM

60.29

-0.08%

0.8K

Pfizer Inc

PFE

31.07

-0.10%

1.7K

General Electric Co

GE

26.74

-0.48%

90.0K

Caterpillar Inc

CAT

104.50

-1.22%

6.9K

Chevron Corp

CVX

111.37

-3.25%

38.9K

Exxon Mobil Corp

XOM

91.35

-3.31%

126.3K

-

14:07

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Starbucks (SBUX) target raised to $100 from $90 at Piper Jaffray

Amazon.com (AMZN) target raised to $400 from $350 at Piper Jaffray

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2450(E401mn), $1.2475/80(E923mn), $1.2500/15(E930mn), $1.2530/50(E700mn)

USD/JPY: Y116.50($2.5bn), Y116.60($400mn), Y117.10($530mn), Y117.75/80($1.2bn)

EUR/JPY: Y145.80

AUD/USD: $0.8500(A$750mn), $0.8535(A$500mn), $0.8650(A$554mn)

USD/CAD: Cad1.1170/90($400mn), Cad1.1250($301mn)

-

13:30

Canada: GDP (m/m) , September +0.4% (forecast +0.4%)

-

13:30

Canada: Raw Material Price Index, October -4.3% (forecast +1.5%)

-

13:30

Canada: Industrial Product Prices, m/m, October -0.5% (forecast +0.3%)

-

13:01

Foreign exchange market. European session: the euro rose against the U.S. dollar after the economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand ANZ Business Confidence November 26.5 31.5

00:05 United Kingdom Gfk Consumer Confidence November -2 -1 -2

00:30 Australia Private Sector Credit, m/m October +0.5% +0.5% +0.6%

00:30 Australia Private Sector Credit, y/y October +5.4% +5.7%

05:00 Japan Housing Starts, y/y October -14.3% -14.5% -12.3%

07:00 Germany Retail sales, real adjusted October -2.8% +1.7% +1.9%

07:00 Germany Retail sales, real unadjusted, y/y October +2.3% +1.5% +1.7%

07:45 France Consumer spending October -0.5% +0.2% -0.9%

07:45 France Consumer spending, y/y October +0.2% -0.2%

08:00 Switzerland KOF Leading Indicator November 99.5 Revised From 99.8 100.1 98.7

10:00 Eurozone Unemployment Rate October 11.5% 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) November +0.4% +0.3% +0.3%

The U.S. dollar traded mixed against the most major currencies. Markets in the U.S. were closed for a public holiday on Thursday. There will be released no major economic reports in the U.S.

The euro rose against the U.S. dollar after the economic data from the Eurozone. Eurozone' preliminary consumer price index fell to an annual rate of 0.3% in November from 0.4% in October, in line with expectations.

Eurozone's unemployment rate remained unchanged at 11.5% in October, in line with expectations.

German adjusted retail sales climbed 1.9% in October, exceeding expectations for a 1.7% rise, after a 2.8% decline in September. September's figure was revised up from a 3.2% fall.

Consumer spending in France dropped 0.9% in October, missing expectations for a 0.2% gain, after a 0.5% decline in September. September's figure was revised up from a 0.8% decrease.

The British pound traded lower against the U.S. dollar after the housing market data from the U.K. The Nationwide Building Society released its house price inflation figures for the U.K. on Friday. The U.K. house price index increased 0.3% in November, after a 0.5% rise in October.

On a yearly basis, the U.K. house price inflation climbed 8.5% in November, after a 9.0% gain in October.

The Canadian dollar fell against the U.S. dollar ahead of Canadian gross domestic product (GDP). Canada's GDP is expected to rise 0.4% in September, after a 0.1% decline in August.

Canada's raw materials purchase price index is expected to increase 1.5% in October, after a 1.8% drop in September.

The Swiss franc traded higher against the U.S. dollar despite the weaker-than-expected KOF leading indicator. The KOF leading indicator decreased to 98.7 in November from 99.5 in October, missing expectations for an increase to 100.1. October's figure was revised down from 99.8.

EUR/USD: the currency pair rose to $1.2489

GBP/USD: the currency pair declined to $1.5674

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Raw Material Price Index October -1.8% +1.5%

13:30 Canada GDP (m/m) September -0.1% +0.4%

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580/70, $1.2530, $1.2500

Bids $1.2430, $1.2400, $1.2360, $1.2300

GBP/USD

Offers $1.6005/00, $1.5945, $1.5900, $1.5825, $1.5800

Bids $1.5625, $1.5590, $1.5550, $1.5525/20

AUD/USD

Offers $0.8800, $0.8750, $0.8700, $0.8630, $0.8600

Bids $0.8480, $0.8400

EUR/JPY

Offers Y148.50, Y148.00

Bids Y146.25, Y146.00, Y145.50, Y145.00

USD/JPY

Offers Y119.50, Y119.20, Y119.00, Y118.55

Bids Y117.80. Y117.00, Y116.85/80, Y116.50

EUR/GBP

Offers stg0.8066, stg0.8000, stg0.7980, stg0.7950

Bids stg0.7885/75, stg0.7860/50, stg0.7800

-

12:00

European stock markets mid-session: energy stocks weigh on indices after oil price drop

European indices declined in today's session as yesterday's OPEC decision to leave output-rates unchanged weighed heavily on the energy sector. The following drop in Crude oil prices revived fears of deflation in the Eurozone. Eurozone's harmonized CPI was in-line with expectations with +0.3% in November as was the Unemployment rate for October at 11.5%.

Data on U.K.'s Consumer Confidence showed a decline at -2 not meeting forecast of -1. Germany's Retail sales beat forecast reading +1.9% in October (forecast +1.7%). France's Consumer spending declined by -0.9%. Analysts predicted a small growth of 0.2%.

The FTSE 100 index is currently lower -0.69% at 6,676.96 points, France's CAC 40 lost -0.48% trading at 4,361.26 and Germany's DAX 30 is heading for the first negative clsing in 11 days at -0.41% quoted at 9,934.40 points.

-

11:20

Oil: prices after OPEC meeting under pressure

Oil prices were under pressure after the decision of the OPEC to leave output on current levels challenging U.S. shale drillers and other higher-cost producers. Overnight, oil prices declined to their lowest in more than four years with Brent dropping the most since 2011. In today's trading session with Brent Crude recovered slightly and is trading +0.59% at USD73.01 a barrel and WTI Crude slumped -6.09% currently quoted at USD69.20. Crude collapsed into a bear market last month amid the highest U.S. output in three decades and signs of slowing global demand growth. A total of 58 percent of respondents in a Bloomberg Intelligence survey this week had forecast no change to the target.

-

11:00

Gold trading lower for a third consecutive day

Gold, currently trading at USD1,184.00 a troy ounce again lost. A stronger U.S. dollar and falling oil prices after the OPEC meeting weighed on the precious metal. A stronger dollar makes gold less attractive for buyers and falling oil prices put pressure on gold as it's less attractive as an inflation-hedge. Also traders keep an eye on the Swiss referendum on SNB's gold reserves scheduled for November 30 that would force the central bank to hold at least 20 percent of its assets in gold and store them locally. Last week's polls showed that the majority of voters is against the initiative, only 38% supporting "Save our Swiss gold". If the vote passes it would be likely boosting gold price, if not the precious metal will see further pressure.

GOLD currently trading at USD1,184.00

-

10:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2450(E401mn), $1.2475/80(E923mn), $1.2500/15(E930mn), $1.2530/50(E700mn)

USD/JPY: Y116.50($2.5bn), Y116.60($400mn), Y117.10($530mn), Y117.75/80($1.2bn)

EUR/JPY: Y145.80

AUD/USD: $0.8500(A$750mn), $0.8535(A$500mn), $0.8650(A$554mn)

USD/CAD: Cad1.1170/90($400mn), Cad1.1250($301mn)

-

10:00

Eurozone: Unemployment Rate , October 11.5% (forecast 11.5%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, November +0.3% (forecast +0.3%)

-

10:00

European Stocks. First hour: European indices trading negative

European stocks are trading lower in today's session. Data on U.K.'s Consumer Confidence showed a decline at -2 not meeting forecast of -1. Germany's Retail sales beat forecast reading +1.9% in October (forecast +1.7%). France's Consumer spending declined by -0.9%. Analysts predicted a small growth of 0.2%. A drop in oil prices weighed on energy shares. Market participants are now waiting for data on Eurozone's Unemployment rate and preliminary Harmonized CPY being published at 10:00 GMT.

The FTSE 100 index is currently trading with a loss of -0.71% at 6,675.61.58 points, Germany's DAX 30, after 11 days of consecutive gains lost -0.33% or 33.05 points being quoted at 9,941.82. France's CAC 40 lost -0.51%, currently trading at 4,360.02 points.

-

09:20

Press Review: Dollar Advances as OPEC Output Freeze Seen Hurting Euro, Aussie

REUTERS

Japan inflation slows in October, highlights challenge facing Abe

(Reuters) - Japan's annual core consumer inflation slowed for a third straight month in October due to falling oil prices, highlighting the economic gloom facing Premier Shinzo Abe as he campaigns for a new mandate to implement his stalled recovery plan.

"Inflation could continue to slow because oil prices are falling," said Hidenobu Tokuda, senior economist at Mizuho Research Institute. "Other data show the economy is recovering, but this is not really because of Abe's policies."

Source: http://www.reuters.com/article/2014/11/28/us-japan-economy-idUSKCN0JC08Y20141128

BLOOMBERG

Dollar Advances as OPEC Output Freeze Seen Hurting Euro, Aussie

The dollar rose against all 16 of its major peers amid speculation OPEC's decision to keep oil output unchanged will stimulate the U.S. economy while weighing on the euro and commodity currencies.

The yen fell against the dollar for the first time in four days after a government report showed household spending dropped and inflation slowed. The 12-nation Organization of Petroleum Exporting Countries kept its output target at 30 million barrels a day even after the steepest slump in oil prices since the global recession. Australia's dollar declined with the Norwegian krone and Canadian dollar.

REUTERS

Rouble hits record low after OPEC keeps output unchanged

Nov 27 (Reuters) - The rouble fell to record lows against the dollar and euro on Thursday after OPEC decided against cutting crude-oil output to boost flagging prices.

At 1710 GMT, the rouble was down around 2.6 percent against the dollar at 48.60 roubles per dollar and around 2.5 percent weaker against the euro at 60.69 roubles per euro.

It had earlier strengthened against both currencies in nervous trade before the OPEC meeting in Vienna, one of the most closely watched in years.

Source: http://www.reuters.com/article/2014/11/27/russia-markets-rouble-idUSL6N0TH0P920141127

-

08:00

Switzerland: KOF Leading Indicator, November 98.7 (forecast 100.1)

-

07:55

Global Stocks: Asian stocks gained – Floor trading on Wall Street closed on Thanksgiving

U.S. markets were closed yesterday for the Thanksgiving holiday.

Hong Kong's Hang Seng is trading +0.20% at 24,052.57. China's Shanghai Composite closed at 2,682.92 points, a gain of +1.99% heading for the biggest monthly gain in two years. Chinese stocks were boosted by the benchmark interest cut of the PBoC last week.

Japan's Nikkei gained +1.23% closing at a two-week high at 17,459.85 points. Export stocks were fuelled by a weaker yen, transport stocks were supported by lower oil prices. Industrial production rose unexpectedly by +0.2% beating analyst forecasts who predicted a decline by -0.4%.

-

07:45

France: Consumer spending , October -0.9% (forecast +0.2%)

-

07:45

France: Consumer spending, y/y, October -0.2%

-

07:30

Foreign exchange market. Asian session: the greenback is trading stronger against its major peers

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 New Zealand ANZ Business Confidence November 26.5 31.5

00:05 United Kingdom Gfk Consumer Confidence November -2 -1 -2

00:30 Australia Private Sector Credit, m/m October +0.5% +0.5% +0.6%

00:30 Australia Private Sector Credit, y/y October +5.4% +5.7%

05:00 Japan Housing Starts, y/y October -14.3% -14.5% -12.3%

07:00 Germany Retail sales, real adjusted October -3.2% +1.7% +1.9%

07:00 Germany Retail sales, real unadjusted, y/y October +2.3% +1.5% +1.7%

The U.S. dollar traded stronger against its major peers as the economic outlook for Europe, China and Japan remain weak.

The Australian dollar further declined against the greenback. Private sector credit rose 0.6%, 0.1% above forecasts

The New Zealand dollar traded weaker against the U.S. dollar. New Zealand's building permits rose 8.8% month-on-month in October after reading -12.2% last month. ANZ Business Confidence rose to from 26.5 to 31.5 in November.

The Japanese yen dropped against the U.S. dollar after a mixed set of key data. Household spending fell -4.0% and inflation slowed fuelling doubts that the inflation target of 2% can be achieved with Japan's economy in recession. The unemployment rate beating forecasts by 0.1% reading 3.5% in October. Retail sales gained 1.4%, not meeting analyst forecasts of +1.5%. National Consumer Prices rose by +2.9% below the forecast of +3.1%.

EUR/USD: the euro traded weakeragainst the greenback

USD/JPY: the U.S. dollar rose against the Japanese yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Consumer spending October -0.8% +0.2%

07:45 France Consumer spending, y/y October +0.2%

08:00 Switzerland KOF Leading Indicator November 99.8 100.1

10:00 Eurozone Unemployment Rate October 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) November +0.4% +0.3%

13:30 Canada Industrial Product Prices, m/m October -0.4% +0.3%

13:30 Canada Raw Material Price Index October -1.8% +1.5%

13:30 Canada GDP (m/m) September -0.1% +0.4%

-

07:00

Germany: Retail sales, real unadjusted, y/y, October +1.7% (forecast +1.5%)

-

07:00

Germany: Retail sales, real adjusted , October +1.9% (forecast +1.7%)

-

06:20

Options levels on friday, November 28, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2587 (4614)

$1.2552 (1364)

$1.2518 (62)

Price at time of writing this review: $ 1.2449

Support levels (open interest**, contracts):

$1.2429 (6270)

$1.2399 (4274)

$1.2364 (7353)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 110101 contracts, with the maximum number of contracts with strike pric $1,2800 (6170);

- Overall open interest on the PUT options with the expiration date December, 5 is 123460 contracts, with the maximum number of contracts with strike price $1,2200 (7813);

- The ratio of PUT/CALL was 1.12 versus 1.03 from the previous trading day according to data from November, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.6001 (1360)

$1.5903 (982)

$1.5806 (874)

Price at time of writing this review: $1.5712

Support levels (open interest**, contracts):

$1.5697 (1730)

$1.5599 (1418)

$1.5499 (957)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 40812 contracts, with the maximum number of contracts with strike price $1,6200 (1595);

- Overall open interest on the PUT options with the expiration date December, 5 is 40163 contracts, with the maximum number of contracts with strike price $1,6000 (2020);

- The ratio of PUT/CALL was 0.98 versus 1.00 from the previous trading day according to data from November, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:01

Japan: Housing Starts, y/y, October -12.3% (forecast -14.5%)

-

02:35

Nikkei 225 17,421.9 +173.40 +1.01%, Hang Seng 23,948.6 -55.68 -0.23%, Shanghai Composite 2,627.54 -2.94 -0.11%

-

00:48

Commodities. Daily history for Nov 27’2014:

(raw materials / closing price /% change)

Light Crude 73.69 -0.54%

Gold 1,196.60 -0.04%

-

00:48

Stocks. Daily history for Nov 27’2014:

(index / closing price / change items /% change)

Nikkei 225 17,248.5 -135.08 -0.78%

Hang Seng 24,004.28 -107.70 -0.45%

Shanghai Composite 2,630.49 +26.14 +1.00%

FTSE 100 6,723.42 -5.75 -0.09%

CAC 40 4,382.34 +8.92 +0.20%

Xetra DAX 9,974.87 +59.31 +0.60%

-

00:46

Currencies. Daily history for Nov 27’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $ 1,2466 -0,31%

GBP/USD $1,5734 -0,36%

USD/CHF Chf0,9640 +0,30%

USD/JPY Y117,70 -0,02%

EUR/JPY Y146,73 -0,33%

GBP/JPY Y185,19 -0,38%

AUD/USD $0,8543 -0,05%

NZD/USD $0,7865 -0,08%

USD/CAD C$1,1329 +0,74%

-

00:31

Australia: Private Sector Credit, y/y, October +5.7%

-

00:30

Australia: Private Sector Credit, m/m, October +0.6% (forecast +0.5%)

-

00:20

Schedule for today, Friday, Nov 28’2014:

(time / country / index / period / previous value / forecast)

00:00 New Zealand ANZ Business Confidence November 26.5 31.5

00:05 United Kingdom Gfk Consumer Confidence November -2 -1

00:30 Australia Private Sector Credit, m/m October +0.5% +0.5%

00:30 Australia Private Sector Credit, y/y October +5.4%

05:00 Japan Housing Starts, y/y October -14.3% -14.5%

07:00 Germany Retail sales, real adjusted October -3.2% +1.7%

07:00 Germany Retail sales, real unadjusted, y/y October +2.3% +1.5%

07:45 France Consumer spending October -0.8% +0.2%

07:45 France Consumer spending, y/y October +0.2%

08:00 Switzerland KOF Leading Indicator November 99.8 100.1

10:00 Eurozone Unemployment Rate October 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) November +0.4% +0.3%

13:30 Canada Industrial Product Prices, m/m October -0.4% +0.3%

13:30 Canada Raw Material Price Index October -1.8% +1.5%

13:30 Canada GDP (m/m) September -0.1% +0.4%

-

00:05

United Kingdom: Gfk Consumer Confidence, November -2 (forecast -1)

-

00:00

New Zealand: ANZ Business Confidence, November 31.5

-