Notícias do Mercado

-

16:40

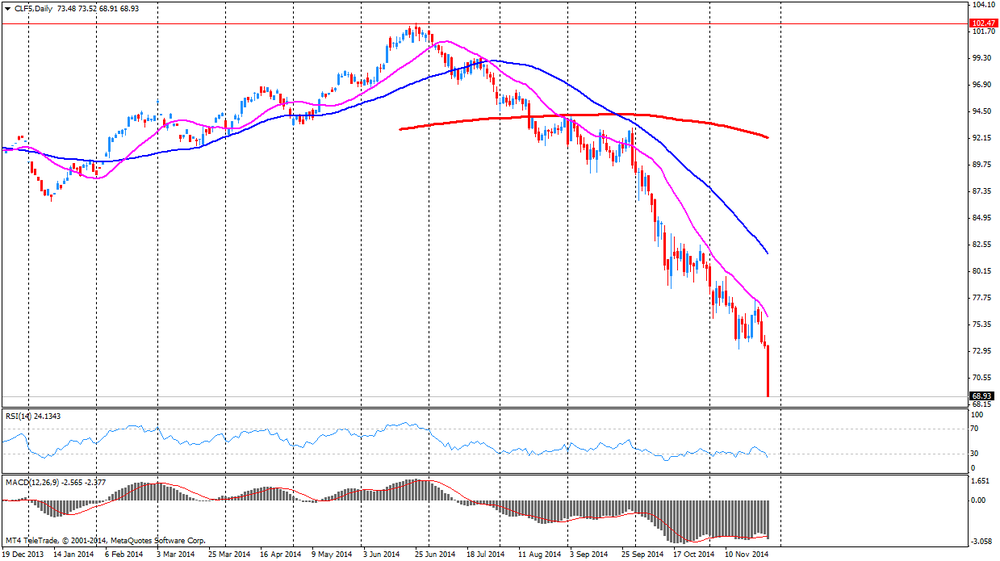

Oil fell

Brent fell below $75 a barrel for the first time since September 2010 after OPEC refrained from cutting production limits at its meeting in Vienna. West Texas Intermediate also slid.

Futures tumbled as much as 4.4 percent in London and 3.9 percent in New York after Saudi Oil Minister Ali Al-Naimi said the group maintained its collective ceiling of 30 million barrels a day.

Crude collapsed into a bear market last month amid the highest U.S. output in three decades and signs of slowing global demand growth. A total of 58 percent of respondents in a Bloomberg Intelligence survey this week had forecast no change to the target.

The decision is "going to end in great consternation for the cartel because these prices are going to continue to tumble," John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy, said by phone. "They have chosen to toughen out and challenge the higher-cost producers."

Brent for January settlement declined as much as $3.39 to $74.36 a barrel on the London-based ICE Futures Europe exchange, the lowest since Aug. 31, 2010. It was at $74.71 at 10:25 a.m. New York time.

-

16:20

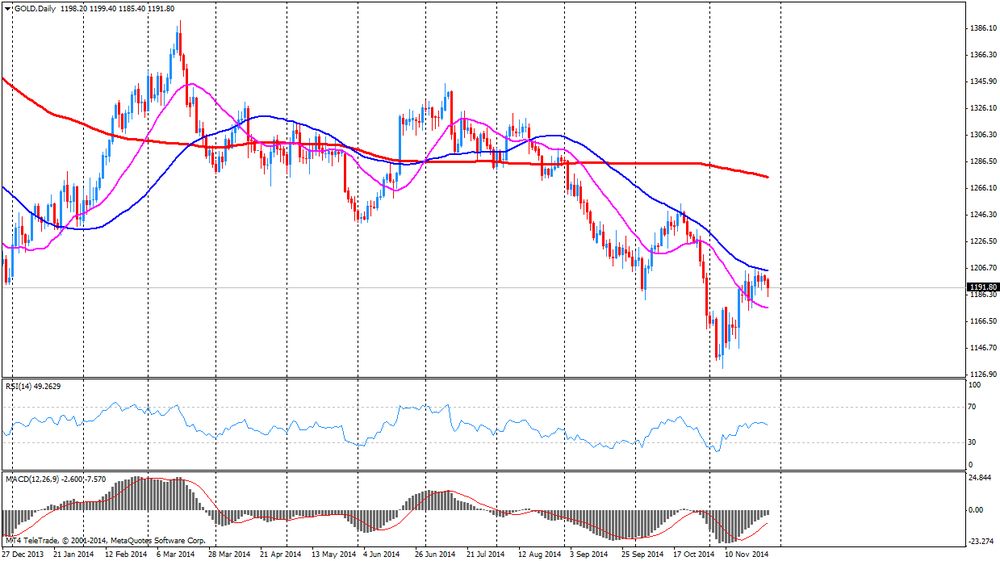

Gold decline

Gold prices decline due to outflows from secured gold ETF funds and on the eve of the referendum in Switzerland devoted to gold stocks.

"Gold is trading near $ 1,200, and for movement in any direction to overcome the mark of $ 1,180 or $ 1,205. The activity of the precious metals market will be weak on Thanksgiving Day and the day before the referendum in Switzerland, which will be held on the weekend," - said a dealer MKS Group Jason Cherizola.

The world's largest reserves of gold secured fund ETF SPDR Gold Trust on Wednesday fell by 0.29 percent to 718.82 tons, approaching the six-year low.

In Switzerland, on Sunday held a referendum on a proposal to ban the country's central bank to sell gold reserves and oblige him to keep at least 20 percent of assets in gold, compared with 8 percent in October. According to a recent survey, the proposal is 38 percent of the Swiss, but if the result of the vote will be positive, the central bank will need in the coming years to buy 1,500 tons of gold, which will cause a rise in prices, analysts said.

Trading volumes are likely to remain reduced on Thursday as US markets are closed today due to the Thanksgiving holiday.

The cost of the December gold futures on the COMEX today fell to 1184.70 dollars per ounce.

-

11:20

Oil: trading at 4-year lows ahead of the OPEC meeting today

Oil prices are trading at 4-year lows ahead of the OPEC meeting today in Vienna starting at 09:00 GMT. In today's trading session with Brent Crude is trading -2.42% at USD75.87 a barrel and WTI Crude declined -2.06% currently quoted at USD72.17. Yesterday Saudi Arabia's Oil Minister Ali al-Naimi and United Arab Emirates Suhail bin Mohammed al-Mazroui, said they expected the oil market to stabilize itself. Strong signs that that a cut in output is unlikely. The leading OPEC members resist to cut output as they fear losing market shares to U.S. shale drillers. Economic slowdown in the Eurozone and China put further pressure on prices.

-

11:00

Gold recovered and is trading below USD1,200 again

Gold, currently trading below the key-level of USD1200.00 a troy ounce again recovered from losses earlier in the session. Traders keep an eye on the Swiss referendum on SNB's gold reserves scheduled for November 30 that would force the central bank to hold at least 20 percent of its assets in gold and store them locally. Last week's polls showed that the majority of voters is against the initiative, only 38% supporting "Save our Swiss gold". If the vote passes it would be likely boosting gold price, if not the precious metal will see further pressure. According to data compiled by Bloomberg assets in the largest exchange-traded product backed by the metal shrank to the smallest in more than six years. Gold found support in a weakening greenback.

GOLD currently trading below USD1,200.00

-

09:20

Press Review: Yellen's 'optimal' model calls for rate hike this year, in theory

REUTERS

Yellen's 'optimal' model calls for rate hike this year, in theory

(Reuters) - Federal Reserve Chair Janet Yellen has said the tenor of economic data will decide when the U.S. central bank raises interest rates. Surprisingly, a data analysis based on Yellen's own priorities points to a rate increase by the end of this year.

Yellen has cautioned that the economic models built for policymakers amount to mere guideposts in a complicated decision-making process.

Source: http://www.reuters.com/article/2014/11/26/us-usa-fed-yellen-idUSKCN0JA22L20141126

BLOOMBERG

Why Russia Said 'No Deal' to OPEC on Cutting Oil Production

No country is suffering more from plunging oil prices than Russia. The world's biggest producer of crude, it's set to lose $100 billion a year as prices hover below $80 a barrel. President Vladimir Putin says a "catastrophic" further slump is "entirely possible." So why has Moscow ruled out a possible deal with the Organization of Petroleum Exporting Countries to shore up prices by cutting production?

Igor Sechin, chief executive of state-controlled oil giant Rosneft (ROSN:RM), traveled to Vienna ahead of OPEC's Nov. 27 meeting, prompting speculation that Russia, which isn't an OPEC member, might agree to curb production in tandem with the cartel. But on Nov. 25, after talks with representatives of OPEC members Saudi Arabia and Venezuela, and nonmember Mexico, Sechin told Bloomberg News that the four countries agreed only to "monitor oil prices over the next year."

Why wouldn't Russia be pushing harder than anyone to squeeze oil supplies?

Source: http://www.businessweek.com/articles/2014-11-26/russia-wont-cut-oil-production

REUTERS

ECB's Draghi calls for comprehensive strategy to put euro economy on track

Nov 27 (Reuters) - The euro zone's economy needs a comprehensive strategy including reforms to get it back on track, the president of the European Central Bank said on Thursday, adding that the task could not be left to monetary policy alone.

"Now is certainly not the right moment for complacency, neither in the area of fiscal policies nor with regard to structural reforms," he said in a summary of his remarks delivered to the Finnish parliament released by the Bank of Finland.

Source: http://www.reuters.com/article/2014/11/27/ecb-policy-idUSL6N0TH1BB20141127?feedType=RSS

-