Notícias do Mercado

-

20:00

Dow 16,667.56 +61.29 +0.37%, Nasdaq 4,225.17 +39.36 +0.94%, S&P 500 1,910.05 +9.52 +0.50%

-

17:18

European stocks close: stocks increased due to the better-than-expected U.S. durable goods orders

Stock indices increased due to the better-than-expected U.S. durable goods orders. U.S. durable goods orders rose 0.8% in April, after a 2.9% gain in March. March’s figure was revised up to 2.9% from 2.6%. April’s increase of durable goods orders was driven by demand for defence goods

The consumer confidence index in the U.S. climbed to 83.0 in May, from 81.7 in April. April’s figure was revised down from 82.3.

The European Central Bank President Mario Draghi said at the conference in Sintra on Tuesday the ECB is aware of risks from low inflation. He added that the ECB had the tools to get inflation in the Eurozone back close to 2%. His comments have fanned expectations for further stimulus measures by the ECB in June.

Aveva Group Plc shares increased 9.1% after reporting the better-than-expected annual profit.

InterContinental Hotels Group Plc shares climbed 3.7% after the company rejected a takeover bid.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,844.94 +29.19 +0.43%

DAX 9,940.82 +48.00 +0.49%

CAC 40 4,529.75 +2.82 +0.06%

-

17:01

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the release of strong U.S. economic data

The U.S. dollar traded higher against the most major currencies after the release of strong U.S. economic data. U.S. durable goods orders rose 0.8% in April, after a 2.9% gain in March. March’s figure was revised up to 2.9% from 2.6%. Analysts had expected a 0.4% decrease. April’s increase of durable goods orders was driven by demand for defence goods

U.S. core durable goods orders excluding transportation climbed 0.1% in April, after a 2.4% gain in March. March’s figure was revised up to a 2.4% increase from a 2.0% rise. Analysts had forecasted a 0.2% gain.

U.S. core durable goods orders excluding defence dropped 0.8% in April, after a 1.8% rise in March.

The Conference Board released its index of consumer confidence. The consumer confidence index climbed to 83.0 in May, from 81.7 in April. April’s figure was revised down from 82.3.

Standard & Poor’s/Case-Shiller house price index increased at an annualized rate of 12.4% in March, after a 12.9% rise in February. Analysts had expected an 11.9% increase.

U.S. flash services purchasing manager index surged to 58.4 in April, from 55.0 in March. Analysts had expected an increase to 55.6.

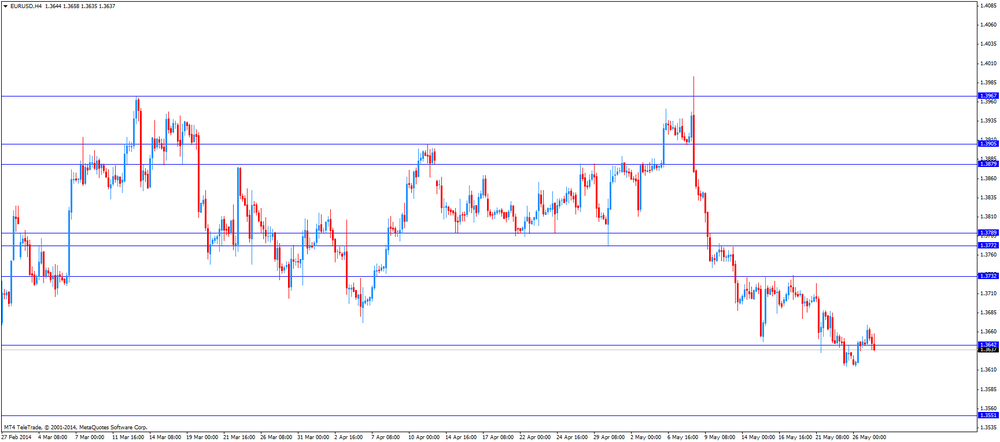

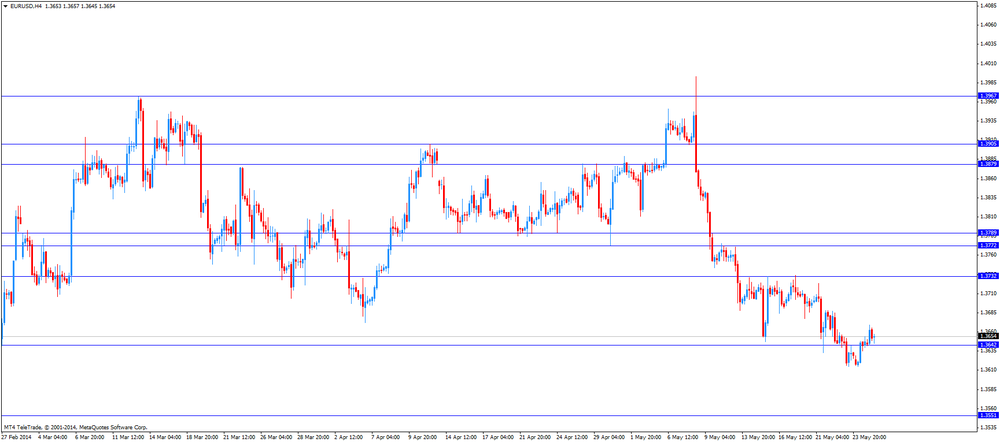

The euro dropped against the U.S. dollar due to strong U.S. economic data. The European Central Bank President Mario Draghi said on Tuesday the ECB is aware of risks from low inflation. He added that the ECB had the tools to get inflation in the Eurozone back close to 2%. His comments have fanned expectations for further stimulus measures by the ECB in June.

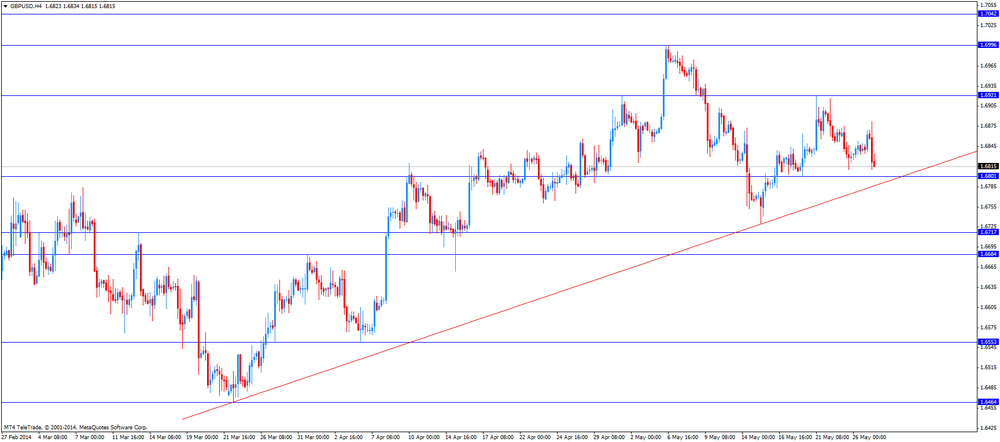

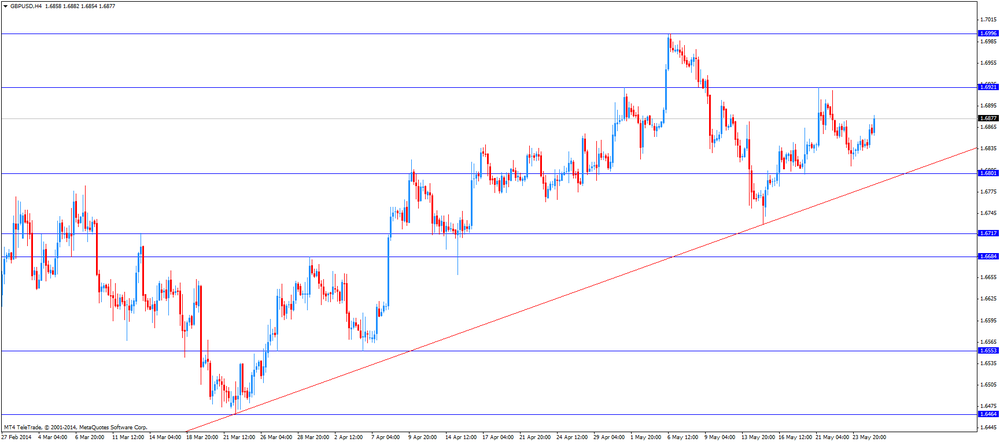

The British pound declined against the U.S. dollar after the release of U.K. mortgage approvals and strong U.S. economic data. U.K. mortgage approvals climbed by 42,200 in April, missing expectations for a 45,200 gain. March’s figure was revised down to a 45,000 rise from a previously estimated 45,900 increase.

The Swiss franc traded lower against the U.S. dollar. Switzerland's trade surplus rose to 2.425 billion Swiss francs in April, from 1.996 billion Swiss francs in March. March’s figure was revised down from a previously estimated surplus of 2.050 billion Swiss francs. Analysts had expected the trade surplus to climb to 2.052 billion Swiss francs.

The number of employed people in Switzerland remained unchanged at 4.190 million in the first quarter. Analysts had forecasted an increase to 4.210 million.

The New Zealand dollar declined against the U.S in the absence of any major economic reports in New Zealand.

The Australian dollar climbed to 1-week highs against the U.S. dollar in the absence of any major economic reports in Australia, but later lost all its gains.

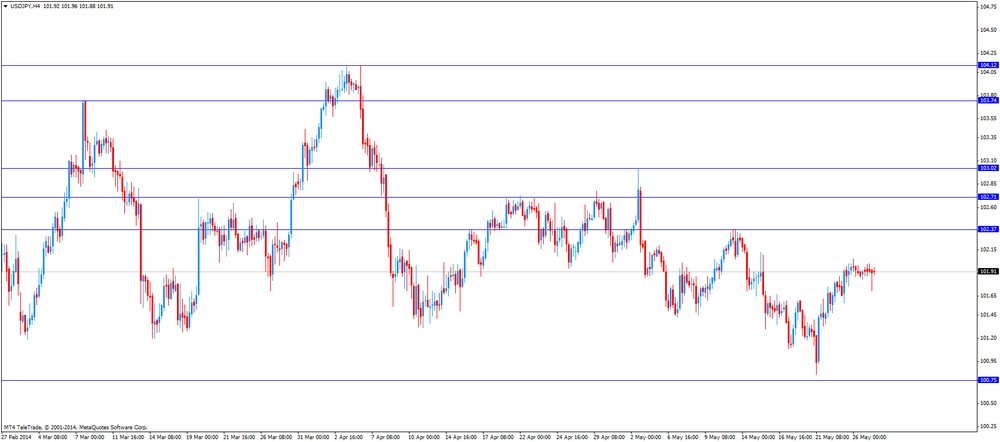

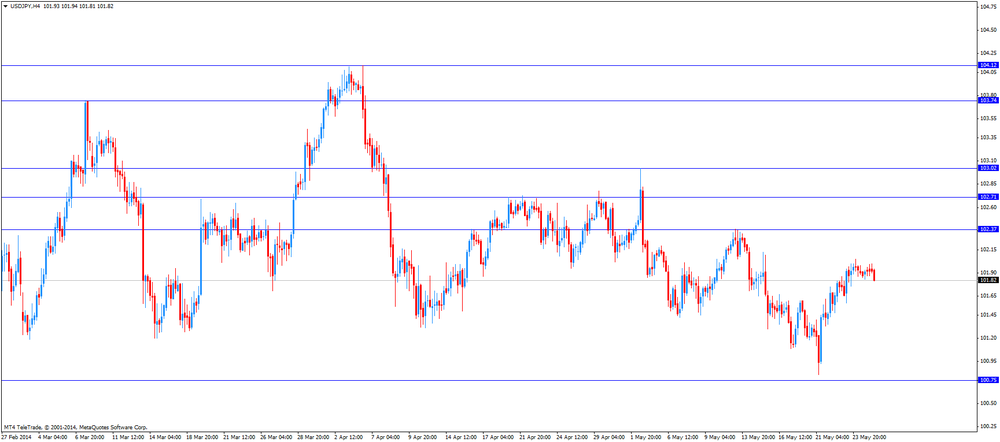

The Japanese yen increased against the U.S. dollar after the release of corporate services price index in Japan, but later lost all its gains. The corporate services price index in Japan climbed 3.4% in April, from 0.7% in March. Analysts had expected a 3.3% increase.

-

17:00

European stocks closed in plus: FTSE 100 6,841.58 +25.83 +0.38%, CAC 40 4,531.76 +4.83 +0.11%, DAX 9,938.43 +45.61 +0.46%

-

16:40

Oil fell

West Texas Intermediate crude declined from a five-week high on speculation that U.S. inventories are sufficient to meet increasing fuel demand. Brent slipped below $110 after elections in Ukraine.

Futures fell as much as 0.7 percent in New York. U.S. crude supplies, which rose in April to the highest level since the government began publishing weekly data in 1982, are near a record for the time of year. Stockpiles at Cushing, Oklahoma, the delivery point for WTI, dropped to a six-year low in the week ended May 16. Ukraine’s President-elect Petro Poroshenko vowed to wipe out the separatists.

“There are ample crude supplies here in the U.S.,” said Phil Flynn, senior market analyst at Price Futures Group in Chicago. “The picture has been muddied because of tightness at Cushing. WTI will be under pressure because there is so much supply elsewhere.”

WTI for July delivery fell 27 cents, or 0.3 percent, to $104.08 a barrel at 10:49 a.m. on the New York Mercantile Exchange. Futures touched $104.50 for a second day, the highest intraday level since April 21. The volume of all futures traded was 12 percent below the 100-day average.

There was no floor trading in New York yesterday because of the U.S. Memorial Day holiday and electronic transactions will be booked today for settlement purposes.

Brent for July settlement decreased 11 cents to $110.21 a barrel on the London-based ICE Futures Europe exchange. Volume was 13 percent lower than the 100-day average. The range was $109.75 to $110.80. The North Sea crude traded at a $6.13 premium to WTI, compared with $6.19 at the close on May 23.

-

16:20

Gold fell

The price of gold has fallen sharply against the dollar strengthening after strong data on orders for durable goods .

Orders for durable goods rose markedly in the last month , helped by a surge in military spending and economic recovery after a harsh winter .

Ministry of Commerce announced that the seasonally adjusted volume of orders for April rose by 0.8 %, compared with an increase of 2.9 % in March. Economists had expected the value of this indicator decreased by 0.4%.

Experts note that orders for durable goods may signal about future production activities , as factories are ramping up production to meet demand , or reduce it , when orders are falling.

Most economists predict that the U.S. economy recovered during the spring of this year after a weak first quarter. Earlier this month, the Fed chief Janet Yellen said that the harsh winter behind us, and many recent indicators suggest that the recovery of costs and production is on the way , according to this , we can expect sustained growth in the current quarter .

Net import volume of China from Hong Kong gold in April 2014 amounted to 65.4 tons versus 80.6 tons in March and 75.9 tons in April last year, according to official information of Hong Kong authorities.

Gold imports to China last month fell by background cooling investment demand for the precious metal in the country, which is its largest consumer in the world.

Exports from China to Hong Kong declined to 15.4 tons from 25.3 tons a month earlier.

As analysts , reducing demand for gold in China, in India last year outstripped consumption of this precious metal , may have an impact on world prices for him, since the beginning of the year increased by 6.8%.

" Consumer demand for bars and coins in China falls as prices rise and investment in it lose their appeal ," - said analyst Shanghai Leading Investment Management Duan Shihui .

Last year , when gold fell to a record in 30 years 28% , the demand for gold jewelry in China jumped 32%.

The cost of the June gold futures on the COMEX today dropped to $ 1266.00 per ounce.

-

15:00

U.S.: Consumer confidence , May 83.0 (forecast 83.2)

-

15:00

U.S.: Richmond Fed Manufacturing Index, May 7 (forecast 5)

-

14:45

U.S.: Services PMI, April 58.4 (forecast 55.6)

-

14:40

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3620, $1.3625, $1.3650, $1.3700/05

USD/JPY Y101.00, Y102.00, Y102.30

GBP/USD $1.6900

EUR/GBP stg0.8050, stg0.8100

AUD/USD $0.9175, $0.9200, $0.9240, $0.9250-55, $0.9265-70

NZD/USD $0.8550

USD/CAD C$1.0905, C$1.0920

-

14:38

U.S. Stocks open: Dow 16,659.54 +53.27 +0.32%, Nasdaq 4,210.66 +24.85 +0.59%, S&P 1,908.63 +8.10 +0.43%

-

14:27

U.S. durable goods orders climbs 0.8% in April

The Commerce Department released the U.S. durable goods orders. U.S. durable goods orders rose 0.8% in April, after a 2.9% gain in March. March’s figure was revised up to 2.9% from 2.6%. Analysts had expected a 0.4% decrease. April’s increase of durable goods orders was driven by demand for defence goods

U.S. core durable goods orders excluding transportation climbed 0.1% in April, after a 2.4% gain in March. March’s figure was revised up to a 2.4% increase from a 2.0% rise. Analysts had forecasted a 0.2% gain.

U.S. core durable goods orders excluding defence dropped 0.8% in April, after a 1.8% rise in March.

-

14:27

Before the bell: S&P futures +0.40%, Nasdaq futures +0.39%

U.S. stock futures advanced as an unexpected rise in durable goods orders boosted optimism in the world’s largest economy.

Global markets:

FTSE 6,846.6 +30.85 +0.45%

CAC 4,525.1 -1.83 -0.04%

DAX 9,926.65 +33.83 +0.34%

Nikkei 14,636.52 +34.00 +0.23%

Hang Seng 22,944.3 -18.88 -0.08%

Shanghai Composite 2,034.57 -6.91 -0.34%

Crude oil $104.30 (-0.05%)

Gold $1276.60 (-1.19%)

-

14:14

Upgrades and downgrades before the market open

Upgrades:

Cisco Systems (CSCO) upgraded to Buy from Hold at Deutsche Bank; tgt raised to $30 from $25

Downgrades:

Other:

-

14:12

DOW components before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

102.09

+0.09%

0.1K

Microsoft Corp

MSFT

40.18

+0.15%

1.7K

The Coca-Cola Co

KO

40.64

+0.15%

2.9K

Intel Corp

INTC

26.33

+0.16%

6.2K

International Business Machines Co...

IBM

186.29

+0.19%

1.4K

Visa

V

212.50

+0.20%

0.4K

Procter & Gamble Co

PG

80.69

+0.21%

1.4K

Boeing Co

BA

132.70

+0.22%

1.5K

Exxon Mobil Corp

XOM

101.60

+0.28%

2.3K

Verizon Communications Inc

VZ

49.91

+0.34%

7.9K

Home Depot Inc

HD

79.46

+0.35%

0.2K

Travelers Companies Inc

TRV

93.19

+0.36%

0.1K

Wal-Mart Stores Inc

WMT

75.89

+0.37%

0.2K

Walt Disney Co

DIS

83.63

+0.37%

8.4K

General Electric Co

GE

26.61

+0.38%

6.7K

AT&T Inc

T

35.46

+0.40%

0.7K

Johnson & Johnson

JNJ

101.42

+0.44%

1.2K

Goldman Sachs

GS

161.00

+0.52%

0.4K

E. I. du Pont de Nemours and Co

DD

68.47

+0.54%

0.1K

Pfizer Inc

PFE

29.66

+0.58%

35.4K

JPMorgan Chase and Co

JPM

54.85

+0.59%

0.9K

Nike

NKE

76.32

+0.62%

5.6K

American Express Co

AXP

89.35

+0.64%

0.2K

Cisco Systems Inc

CSCO

24.95

+1.75%

150.7K

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, March +12.4% (forecast +11.9%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , April +0.1% (forecast +0.2%)

-

13:30

U.S.: Durable Goods Orders , April +0.8% (forecast -0.4%)

-

13:30

U.S.: Durable goods orders ex defense, April -0.8%

-

13:21

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead of U.S. economic data.

Economic calendar (GMT0):

06:00 Switzerland Trade Balance April 1.99 2.05 2.42

07:15 Switzerland Employment Level Quarter I 4.19 4.21 4.19

08:30 United Kingdom BBA Mortgage Approvals April 45.9 45.2 42.2

The U.S. dollar traded higher against the most major currencies ahead of U.S. economic data. U.S. durable goods orders should decline 0.4% in April, from a 2.9% rise in March. U.S. durable goods orders excluding transportation should climb 0.2% in April, from a 2.4% gain in March.

S&P/Case-Shiller home price indices in the U.S. should rise 11.9% in March, from a 12.9% increase in February.

U.S. consumer confidence should climb to 83.2 in May, from 82.3 in April.

The euro dropped against the U.S. dollar amid the speech of the European Central Bank President Mario Draghi.

The British pound declined against the U.S. dollar after the release of U.K. mortgage approvals. U.K. mortgage approvals climbed by 42,200 in April, missing expectations for a 45,200 gain. March’s figure was revised down to a 45,000 rise from a previously estimated 45,900 increase.

The Swiss franc traded lower against the U.S. dollar. Switzerland's trade surplus rose to 2.425 billion Swiss francs in April, from 1.996 billion Swiss francs in March. March’s figure was revised down from a previously estimated surplus of 2.050 billion Swiss francs. Analysts had expected the trade surplus to climb to 2.052 billion Swiss francs.

The number of employed people in Switzerland remained unchanged at 4.190 million in the first quarter. Analysts had forecasted an increase to 4.210 million.

EUR/USD: the currency pair declined to $1.3635

GBP/USD: the currency pair dropped to $1.681

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders April +2.9% -0.4%

12:30 U.S. Durable Goods Orders ex Transportation April +2.4% +0.2%

12:30 U.S. Durable goods orders ex defense April +1.8%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y March +12.9% +11.9%

13:30 Eurozone ECB President Mario Draghi Speaks

13:43 U.S. Services PMI (Preliminary) April 55.0 55.6

14:00 U.S. Richmond Fed Manufacturing Index May 7 5

14:00 U.S. Consumer confidence May 82.3 83.2

-

13:00

Orders

EUR/USD

Offers $1.3800, $1.3775, $1.3735, $1.3685/90

Bids $1.3600, $1.3550, $1.3525/20, $1.3500

GBP/USD

Offers $1.6975, $1.6950, $1.6930/35, $1.6900

Bids $1.6810/00, $1.6780, $1.6730

AUD/USD

Offers $0.9370, $0.9335, $0.9300, $0.9280

Bids $0.9230, $0.9200, $0.9150, $0.9100

EUR/JPY

Offers Y140.00, Y139.75/80, Y139.50

Bids Y138.50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y103.00, Y102.40, Y102.10

Bids Y101.58, Y101.05/00, Y100.80

EUR/GBP

Offers stg0.8170, stg0.8140, stg0.8120,

Bids stg0.8050, stg0.8035/30, stg0.8005/000

-

12:01

European stock markets mid session: most stocks traded higher ahead of U.S. economic data and the speech of the European Central Bank President Mario Draghi

Most stock indices traded higher ahead of U.S. economic data and the speech of the European Central Bank President Mario Draghi.

U.K. mortgage approvals climbed by 42,200 in April, missing expectations for a 45,200 gain. March’s figure was revised down to a 45,000 rise from a previously estimated 45,900 increase.

Aveva Group Plc shares increased 12.0% after reporting the better-than-expected annual profit.

InterContinental Hotels Group Plc shares climbed 5.2% after the company rejected a takeover bid.

Current figures:

Name Price Change Change %

FTSE 100 6,849.09 +37.01 +0.37%

DAX 9,929.83 +91.38 +0.94%

CAC 40 4,525.93 -1.00 -0.02%

-

11:44

Announcing a new website section: Central banks

Monetary policies of central banks have an impact on the dynamics of exchange rates. Therefore, information about these regulatory bodies is required for a successful trade on the financial markets.

Our new website section provides information on the eight major central banks, their monetary policies and their outlooks.

We hope this website section will help you to make a better decision.

TeleTrade continues to enhance and expand the website section “Market Overview” to make it as convenient as possible for our clients. Stay tuned for updates!

-

10:35

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3620, $1.3625, $1.3650, $1.3700/05

USD/JPY Y101.00, Y102.00, Y102.30

GBP/USD $1.6900

EUR/GBP stg0.8050, stg0.8100

AUD/USD $0.9175, $0.9200, $0.9240, $0.9250-55, $0.9265-70

NZD/USD $0.8550

USD/CAD C$1.0905, C$1.0920

-

10:01

Asian Stocks close: stocks were exhibiting a mixed trend due to growing geopolitical tensions between China and Vietnam

Asian stock indices were exhibiting a mixed trend due to growing geopolitical tensions between China and Vietnam. Vietnam's coastguard accused China of sinking one of its fishing vessels in the disputed waters of the South China Sea.

The corporate services price index in Japan climbed 3.4% in April, from 0.7% in March. Analysts had expected a 3.3% increase.

Indexes on the close:

Nikkei 225 14,636.52 +34.35 +0.23%

Hang Seng 22,944.3 -18.88 -0.08%

Shanghai Composite 2,034.57 -6.91 -0.34%

-

09:41

Foreign exchange market. Asian session: the Japanese yen traded increased against the U.S. dollar after the release of corporate services price index in Japan

Economic calendar (GMT0):

06:00 Switzerland Trade Balance April 1.99 2.05 2.42

07:15 Switzerland Employment Level Quarter I 4.19 4.21 4.19

08:30 United Kingdom BBA Mortgage Approvals April 45.9 45.2 42.2

The U.S. dollar traded lower against the most major currencies. Markets in the U.S. were closed for the Memorial Day holiday.

The New Zealand dollar rose against the U.S in the absence of any major economic reports in New Zealand.

The Australian dollar climbed to 1-week highs against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen increased against the U.S. dollar after the release of corporate services price index in Japan. The corporate services price index in Japan climbed 3.4% in April, from 0.7% in March. Analysts had expected a 3.3% increase.

EUR/USD: the currency pair increased to $1.3665

GBP/USD: the currency pair climbed to$1.6870

USD/JPY: the currency pair declined to Y101.92

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders April +2.9% -0.4%

12:30 U.S. Durable Goods Orders ex Transportation April +2.4% +0.2%

12:30 U.S. Durable goods orders ex defense April +1.8%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y March +12.9% +11.9%

13:30 Eurozone ECB President Mario Draghi Speaks

13:43 U.S. Services PMI (Preliminary) April 55.0 55.6

14:00 U.S. Richmond Fed Manufacturing Index May 7 5

14:00 U.S. Consumer confidence May 82.3 83.2

-

09:30

United Kingdom: BBA Mortgage Approvals, April 42.2 (forecast 45.2)

-

08:42

FTSE 100 6,842.47 +26.72 +0.39%, CAC 40 4,513.26 -13.67 -0.30%, Xetra DAX 9,895.2 +2.38 +0.02%

-

08:17

Switzerland: Employment Level, Quarter I 4.19 (forecast 4.21)

-

07:00

Switzerland: Trade Balance, April 2.42 (forecast 2.05)

-

06:44

European bourses are seen extending gains in Tuesday's session: the FTSE is seen higher by 0.6%, with the CAC and DAX up 0.2%

-

06:15

Options levels on tuesday, May 27, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3777 (3260)

$1.3742 (4266)

$1.3690 (552)

Price at time of writing this review: $ 1.3650

Support levels (open interest**, contracts):

$1.3599 (2833)

$1.3584 (6379)

$1.3563 (3500)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 56873 contracts, with the maximum number of contracts with strike price $1,3850 (6343);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 73732 contracts, with the maximum number of contractswith strike price $1,3500 (6679);

- The ratio of PUT/CALL was 1.30 versus 1.26 from the previous trading day according to data from May, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (1855)

$1.7001 (2727)

$1.6903 (2070)

Price at time of writing this review: $1.6856

Support levels (open interest**, contracts):

$1.6796 (1669)

$1.6698 (2394)

$1.6599 (1605)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 23555 contracts, with the maximum number of contracts with strike price $1,7000 (2727);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 25155 contracts, with the maximum number of contracts with strike price $1,6700 (2542);

- The ratio of PUT/CALL was 1.07 versus 1.05 from the previous trading day according to data from May, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:51

Japan: CSPI, y/y, April +3.4%

-

00:25

Stocks. Daily history for May 26’2014:

(index / closing price / change items /% change)Nikkei 14,602.52 +140.35 +0.97%

Hang Seng 22,963.18 -2.68 -0.01%

Shanghai Composite 2,041.48 +6.91 +0.34%

S&P 1,900.53 +8.04 +0.42%

NASDAQ 4,185.81 +31.47 +0.76%

Dow 16,606.27 +63.19 +0.38%

FTSE 1,376.44 +7.27 +0.53%

CAC 4,526.93 +33.78 +0.75%

DAX 9,892.82 +124.81 +1.28%

-

00:20

Currencies. Daily history for May 26'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3644 +0,11%

GBP/USD $1,6840 +0,06%

USD/CHF Chf0,8947 -0,04%

USD/JPY Y101,92 -0,04%

EUR/JPY Y139,06 +0,09%

GBP/JPY Y171,62 +0,01%

AUD/USD $0,9238 +0,10%

NZD/USD $0,8549 +0,05%

USD/CAD C$1,0857 -0,06%

-

00:00

Schedule for today, Tuesday, May 27’2014:

(time / country / index / period / previous value / forecast)06:00 Switzerland Trade Balance April 2.05 2.05

07:15 Switzerland Employment Level Quarter I 4.19 4.21

08:30 United Kingdom BBA Mortgage Approvals April 45.9 45.2

12:30 U.S. Durable Goods Orders April +2.9% [Revised From +2.6%] -0.4%

12:30 U.S. Durable Goods Orders ex Transportation April +2.4% [Revised From +2.0%] +0.2%

12:30 U.S. Durable goods orders ex defense April +1.8%

13:00 U.S. Housing Price Index, m/m March +0.6% +0.5%

13:00 U.S. Housing Price Index, y/y March +6.9%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y March +12.9% +11.9%

13:30 Eurozone ECB President Mario Draghi Speaks

13:43 U.S. Services PMI (Preliminary) April 55.0 55.6

14:00 U.S. Richmond Fed Manufacturing Index May 7 5

14:00 U.S. Consumer confidence May 82.3 83.2

20:30 U.S. API Crude Oil Inventories May -10.3

-