Notícias do Mercado

-

17:01

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the release of strong U.S. economic data

The U.S. dollar traded higher against the most major currencies after the release of strong U.S. economic data. U.S. durable goods orders rose 0.8% in April, after a 2.9% gain in March. March’s figure was revised up to 2.9% from 2.6%. Analysts had expected a 0.4% decrease. April’s increase of durable goods orders was driven by demand for defence goods

U.S. core durable goods orders excluding transportation climbed 0.1% in April, after a 2.4% gain in March. March’s figure was revised up to a 2.4% increase from a 2.0% rise. Analysts had forecasted a 0.2% gain.

U.S. core durable goods orders excluding defence dropped 0.8% in April, after a 1.8% rise in March.

The Conference Board released its index of consumer confidence. The consumer confidence index climbed to 83.0 in May, from 81.7 in April. April’s figure was revised down from 82.3.

Standard & Poor’s/Case-Shiller house price index increased at an annualized rate of 12.4% in March, after a 12.9% rise in February. Analysts had expected an 11.9% increase.

U.S. flash services purchasing manager index surged to 58.4 in April, from 55.0 in March. Analysts had expected an increase to 55.6.

The euro dropped against the U.S. dollar due to strong U.S. economic data. The European Central Bank President Mario Draghi said on Tuesday the ECB is aware of risks from low inflation. He added that the ECB had the tools to get inflation in the Eurozone back close to 2%. His comments have fanned expectations for further stimulus measures by the ECB in June.

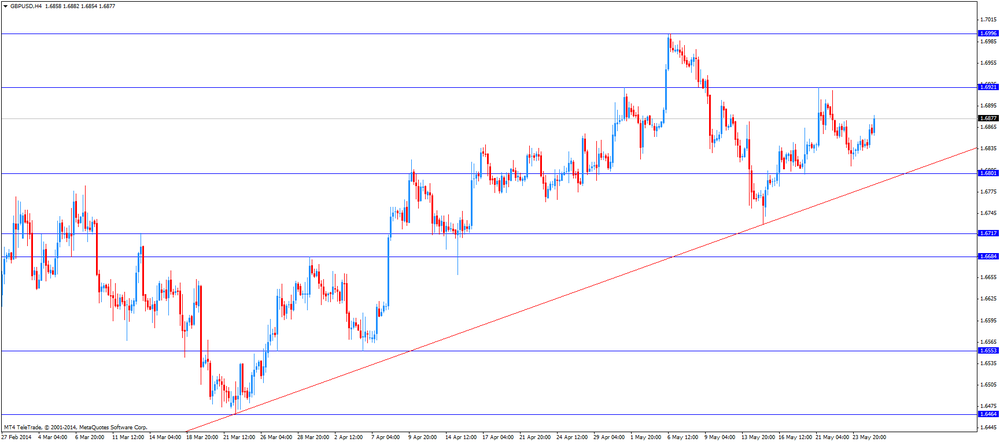

The British pound declined against the U.S. dollar after the release of U.K. mortgage approvals and strong U.S. economic data. U.K. mortgage approvals climbed by 42,200 in April, missing expectations for a 45,200 gain. March’s figure was revised down to a 45,000 rise from a previously estimated 45,900 increase.

The Swiss franc traded lower against the U.S. dollar. Switzerland's trade surplus rose to 2.425 billion Swiss francs in April, from 1.996 billion Swiss francs in March. March’s figure was revised down from a previously estimated surplus of 2.050 billion Swiss francs. Analysts had expected the trade surplus to climb to 2.052 billion Swiss francs.

The number of employed people in Switzerland remained unchanged at 4.190 million in the first quarter. Analysts had forecasted an increase to 4.210 million.

The New Zealand dollar declined against the U.S in the absence of any major economic reports in New Zealand.

The Australian dollar climbed to 1-week highs against the U.S. dollar in the absence of any major economic reports in Australia, but later lost all its gains.

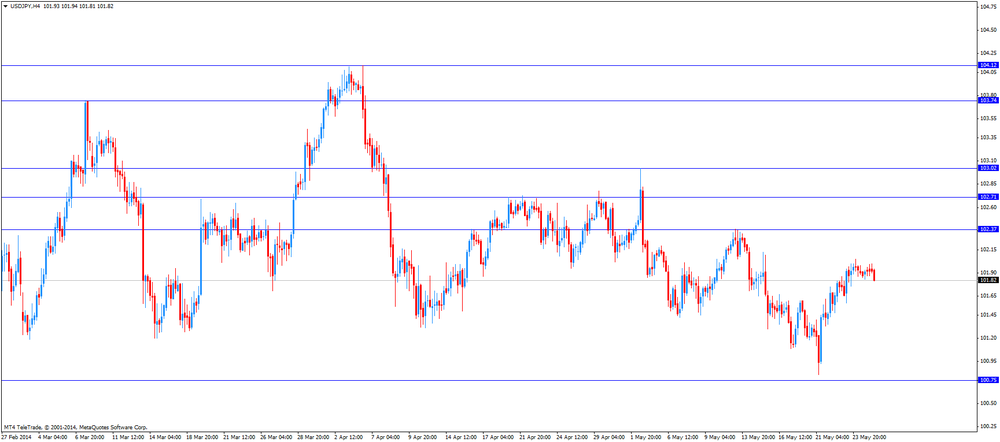

The Japanese yen increased against the U.S. dollar after the release of corporate services price index in Japan, but later lost all its gains. The corporate services price index in Japan climbed 3.4% in April, from 0.7% in March. Analysts had expected a 3.3% increase.

-

15:00

U.S.: Consumer confidence , May 83.0 (forecast 83.2)

-

15:00

U.S.: Richmond Fed Manufacturing Index, May 7 (forecast 5)

-

14:45

U.S.: Services PMI, April 58.4 (forecast 55.6)

-

14:40

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3620, $1.3625, $1.3650, $1.3700/05

USD/JPY Y101.00, Y102.00, Y102.30

GBP/USD $1.6900

EUR/GBP stg0.8050, stg0.8100

AUD/USD $0.9175, $0.9200, $0.9240, $0.9250-55, $0.9265-70

NZD/USD $0.8550

USD/CAD C$1.0905, C$1.0920

-

14:27

U.S. durable goods orders climbs 0.8% in April

The Commerce Department released the U.S. durable goods orders. U.S. durable goods orders rose 0.8% in April, after a 2.9% gain in March. March’s figure was revised up to 2.9% from 2.6%. Analysts had expected a 0.4% decrease. April’s increase of durable goods orders was driven by demand for defence goods

U.S. core durable goods orders excluding transportation climbed 0.1% in April, after a 2.4% gain in March. March’s figure was revised up to a 2.4% increase from a 2.0% rise. Analysts had forecasted a 0.2% gain.

U.S. core durable goods orders excluding defence dropped 0.8% in April, after a 1.8% rise in March.

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, March +12.4% (forecast +11.9%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , April +0.1% (forecast +0.2%)

-

13:30

U.S.: Durable Goods Orders , April +0.8% (forecast -0.4%)

-

13:30

U.S.: Durable goods orders ex defense, April -0.8%

-

13:21

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead of U.S. economic data.

Economic calendar (GMT0):

06:00 Switzerland Trade Balance April 1.99 2.05 2.42

07:15 Switzerland Employment Level Quarter I 4.19 4.21 4.19

08:30 United Kingdom BBA Mortgage Approvals April 45.9 45.2 42.2

The U.S. dollar traded higher against the most major currencies ahead of U.S. economic data. U.S. durable goods orders should decline 0.4% in April, from a 2.9% rise in March. U.S. durable goods orders excluding transportation should climb 0.2% in April, from a 2.4% gain in March.

S&P/Case-Shiller home price indices in the U.S. should rise 11.9% in March, from a 12.9% increase in February.

U.S. consumer confidence should climb to 83.2 in May, from 82.3 in April.

The euro dropped against the U.S. dollar amid the speech of the European Central Bank President Mario Draghi.

The British pound declined against the U.S. dollar after the release of U.K. mortgage approvals. U.K. mortgage approvals climbed by 42,200 in April, missing expectations for a 45,200 gain. March’s figure was revised down to a 45,000 rise from a previously estimated 45,900 increase.

The Swiss franc traded lower against the U.S. dollar. Switzerland's trade surplus rose to 2.425 billion Swiss francs in April, from 1.996 billion Swiss francs in March. March’s figure was revised down from a previously estimated surplus of 2.050 billion Swiss francs. Analysts had expected the trade surplus to climb to 2.052 billion Swiss francs.

The number of employed people in Switzerland remained unchanged at 4.190 million in the first quarter. Analysts had forecasted an increase to 4.210 million.

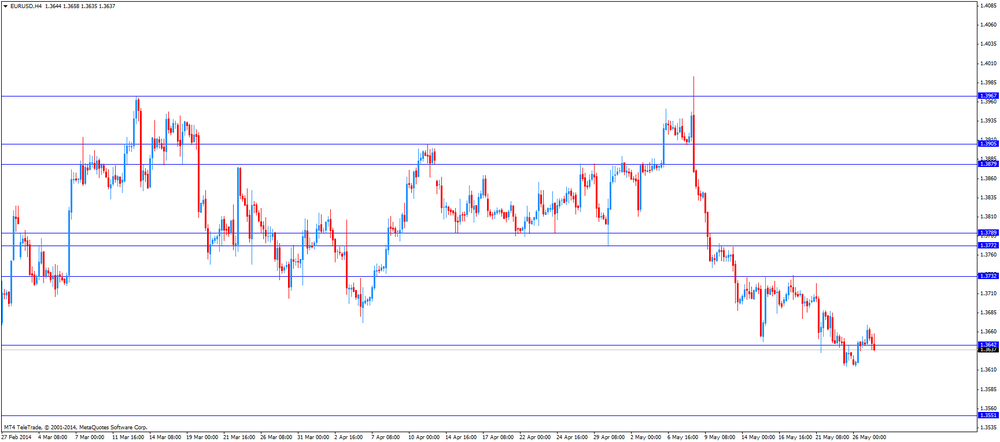

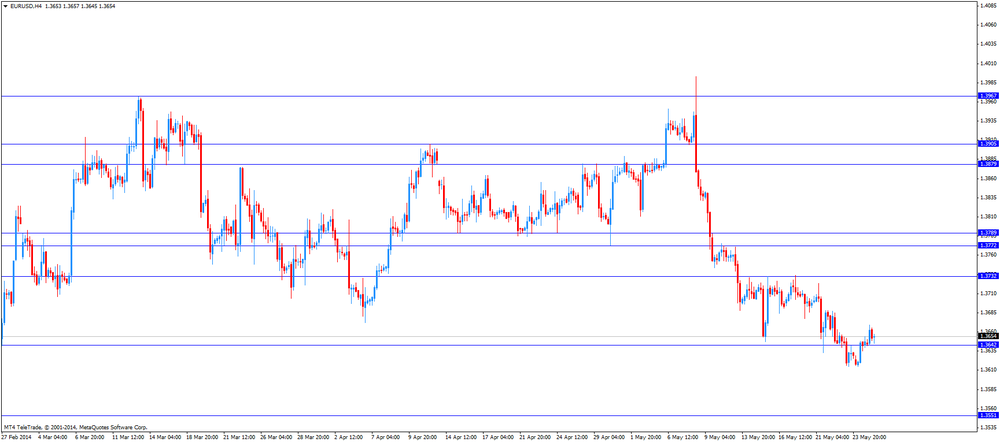

EUR/USD: the currency pair declined to $1.3635

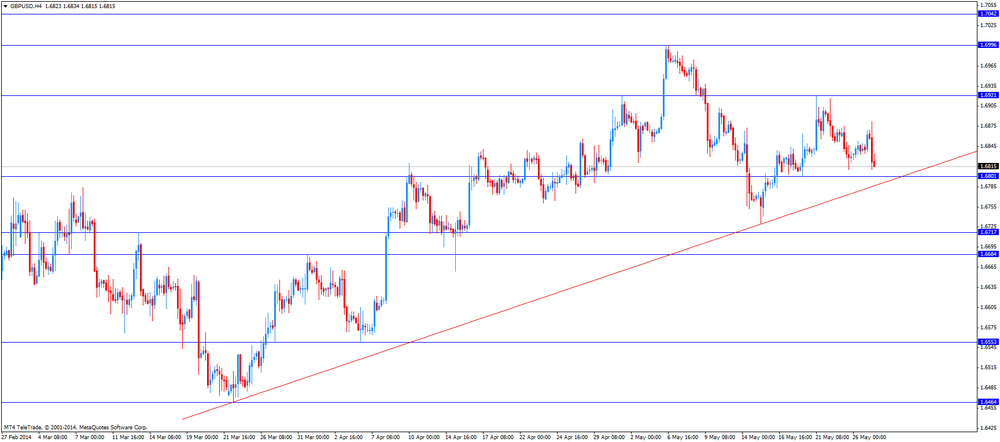

GBP/USD: the currency pair dropped to $1.681

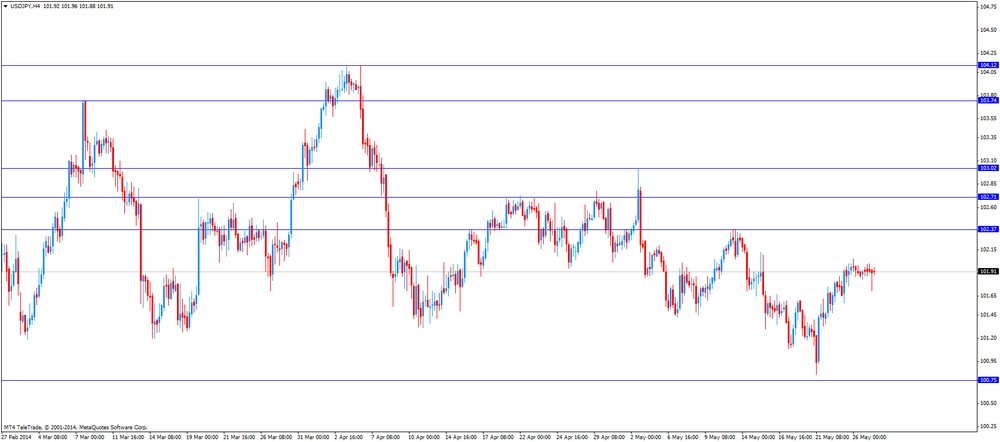

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders April +2.9% -0.4%

12:30 U.S. Durable Goods Orders ex Transportation April +2.4% +0.2%

12:30 U.S. Durable goods orders ex defense April +1.8%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y March +12.9% +11.9%

13:30 Eurozone ECB President Mario Draghi Speaks

13:43 U.S. Services PMI (Preliminary) April 55.0 55.6

14:00 U.S. Richmond Fed Manufacturing Index May 7 5

14:00 U.S. Consumer confidence May 82.3 83.2

-

13:00

Orders

EUR/USD

Offers $1.3800, $1.3775, $1.3735, $1.3685/90

Bids $1.3600, $1.3550, $1.3525/20, $1.3500

GBP/USD

Offers $1.6975, $1.6950, $1.6930/35, $1.6900

Bids $1.6810/00, $1.6780, $1.6730

AUD/USD

Offers $0.9370, $0.9335, $0.9300, $0.9280

Bids $0.9230, $0.9200, $0.9150, $0.9100

EUR/JPY

Offers Y140.00, Y139.75/80, Y139.50

Bids Y138.50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y103.00, Y102.40, Y102.10

Bids Y101.58, Y101.05/00, Y100.80

EUR/GBP

Offers stg0.8170, stg0.8140, stg0.8120,

Bids stg0.8050, stg0.8035/30, stg0.8005/000

-

11:44

Announcing a new website section: Central banks

Monetary policies of central banks have an impact on the dynamics of exchange rates. Therefore, information about these regulatory bodies is required for a successful trade on the financial markets.

Our new website section provides information on the eight major central banks, their monetary policies and their outlooks.

We hope this website section will help you to make a better decision.

TeleTrade continues to enhance and expand the website section “Market Overview” to make it as convenient as possible for our clients. Stay tuned for updates!

-

10:35

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3620, $1.3625, $1.3650, $1.3700/05

USD/JPY Y101.00, Y102.00, Y102.30

GBP/USD $1.6900

EUR/GBP stg0.8050, stg0.8100

AUD/USD $0.9175, $0.9200, $0.9240, $0.9250-55, $0.9265-70

NZD/USD $0.8550

USD/CAD C$1.0905, C$1.0920

-

09:41

Foreign exchange market. Asian session: the Japanese yen traded increased against the U.S. dollar after the release of corporate services price index in Japan

Economic calendar (GMT0):

06:00 Switzerland Trade Balance April 1.99 2.05 2.42

07:15 Switzerland Employment Level Quarter I 4.19 4.21 4.19

08:30 United Kingdom BBA Mortgage Approvals April 45.9 45.2 42.2

The U.S. dollar traded lower against the most major currencies. Markets in the U.S. were closed for the Memorial Day holiday.

The New Zealand dollar rose against the U.S in the absence of any major economic reports in New Zealand.

The Australian dollar climbed to 1-week highs against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen increased against the U.S. dollar after the release of corporate services price index in Japan. The corporate services price index in Japan climbed 3.4% in April, from 0.7% in March. Analysts had expected a 3.3% increase.

EUR/USD: the currency pair increased to $1.3665

GBP/USD: the currency pair climbed to$1.6870

USD/JPY: the currency pair declined to Y101.92

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders April +2.9% -0.4%

12:30 U.S. Durable Goods Orders ex Transportation April +2.4% +0.2%

12:30 U.S. Durable goods orders ex defense April +1.8%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y March +12.9% +11.9%

13:30 Eurozone ECB President Mario Draghi Speaks

13:43 U.S. Services PMI (Preliminary) April 55.0 55.6

14:00 U.S. Richmond Fed Manufacturing Index May 7 5

14:00 U.S. Consumer confidence May 82.3 83.2

-

09:30

United Kingdom: BBA Mortgage Approvals, April 42.2 (forecast 45.2)

-

08:17

Switzerland: Employment Level, Quarter I 4.19 (forecast 4.21)

-

07:00

Switzerland: Trade Balance, April 2.42 (forecast 2.05)

-

06:15

Options levels on tuesday, May 27, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3777 (3260)

$1.3742 (4266)

$1.3690 (552)

Price at time of writing this review: $ 1.3650

Support levels (open interest**, contracts):

$1.3599 (2833)

$1.3584 (6379)

$1.3563 (3500)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 56873 contracts, with the maximum number of contracts with strike price $1,3850 (6343);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 73732 contracts, with the maximum number of contractswith strike price $1,3500 (6679);

- The ratio of PUT/CALL was 1.30 versus 1.26 from the previous trading day according to data from May, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (1855)

$1.7001 (2727)

$1.6903 (2070)

Price at time of writing this review: $1.6856

Support levels (open interest**, contracts):

$1.6796 (1669)

$1.6698 (2394)

$1.6599 (1605)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 23555 contracts, with the maximum number of contracts with strike price $1,7000 (2727);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 25155 contracts, with the maximum number of contracts with strike price $1,6700 (2542);

- The ratio of PUT/CALL was 1.07 versus 1.05 from the previous trading day according to data from May, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:51

Japan: CSPI, y/y, April +3.4%

-

00:20

Currencies. Daily history for May 26'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3644 +0,11%

GBP/USD $1,6840 +0,06%

USD/CHF Chf0,8947 -0,04%

USD/JPY Y101,92 -0,04%

EUR/JPY Y139,06 +0,09%

GBP/JPY Y171,62 +0,01%

AUD/USD $0,9238 +0,10%

NZD/USD $0,8549 +0,05%

USD/CAD C$1,0857 -0,06%

-

00:00

Schedule for today, Tuesday, May 27’2014:

(time / country / index / period / previous value / forecast)06:00 Switzerland Trade Balance April 2.05 2.05

07:15 Switzerland Employment Level Quarter I 4.19 4.21

08:30 United Kingdom BBA Mortgage Approvals April 45.9 45.2

12:30 U.S. Durable Goods Orders April +2.9% [Revised From +2.6%] -0.4%

12:30 U.S. Durable Goods Orders ex Transportation April +2.4% [Revised From +2.0%] +0.2%

12:30 U.S. Durable goods orders ex defense April +1.8%

13:00 U.S. Housing Price Index, m/m March +0.6% +0.5%

13:00 U.S. Housing Price Index, y/y March +6.9%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y March +12.9% +11.9%

13:30 Eurozone ECB President Mario Draghi Speaks

13:43 U.S. Services PMI (Preliminary) April 55.0 55.6

14:00 U.S. Richmond Fed Manufacturing Index May 7 5

14:00 U.S. Consumer confidence May 82.3 83.2

20:30 U.S. API Crude Oil Inventories May -10.3

-