Notícias do Mercado

-

16:33

Foreign exchange market. American session: the euro hits 3-month lows against the U.S. dollar

The U.S. dollar rose against the most major currencies. The U.S. currency was still boosted by the better-than-expected U.S. economic data, published on Tuesday. U.S. durable goods orders rose 0.8% in April, after a 2.9% gain in March. The U.S. consumer confidence index climbed to 83.0 in May, from 81.7 in April.

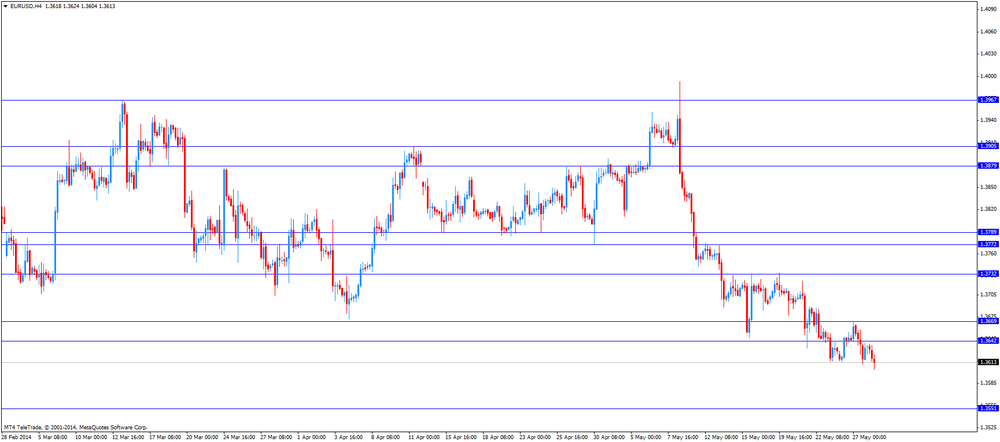

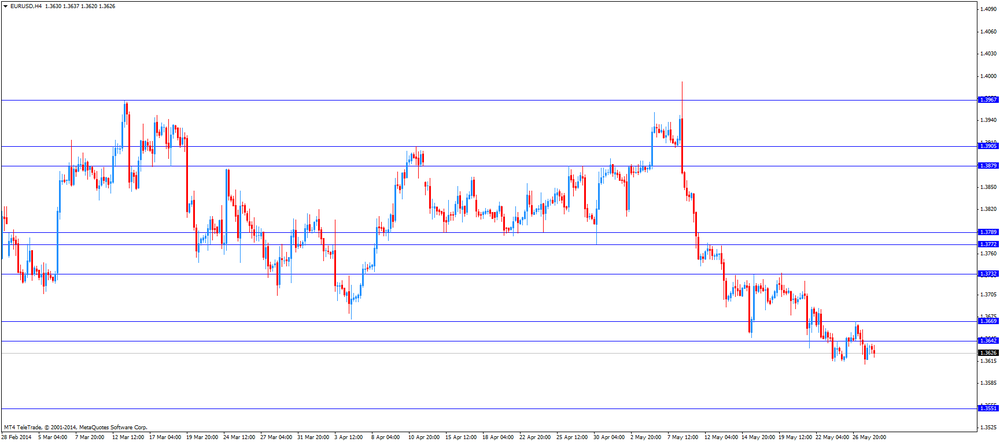

The euro hits 3-month lows against the U.S. dollar. The decrease of the euro was driven by the disappointing economic data in the Eurozone and expectations for further stimulus measures from the European Central Bank. The number of people unemployed in Germany surged by 24,000 this month to 2.905 million. That was the largest increase in five years in May. Analysts had expected a decline by 14,000.

The German unemployment rate remained unchanged at 6.7%. This figure was expected by analysts.

Consumer spending in France fell 0.3% in April, after a 0.4% gain in March. Analysts had expected a 0.5 increase. On a yearly basis, consumer spending in France dropped 0.5% in April, after a 1.2% fall in March.

Adjusted M3 money supply in the Eurozone climbed 0.8% in April, after a 1.1% increase in March. Analysts had forecasted a 1.2% gain.

Private loans in the Eurozone declined 1.8% in April (March: -2.2%), beating expectations of a 2.1% fall.

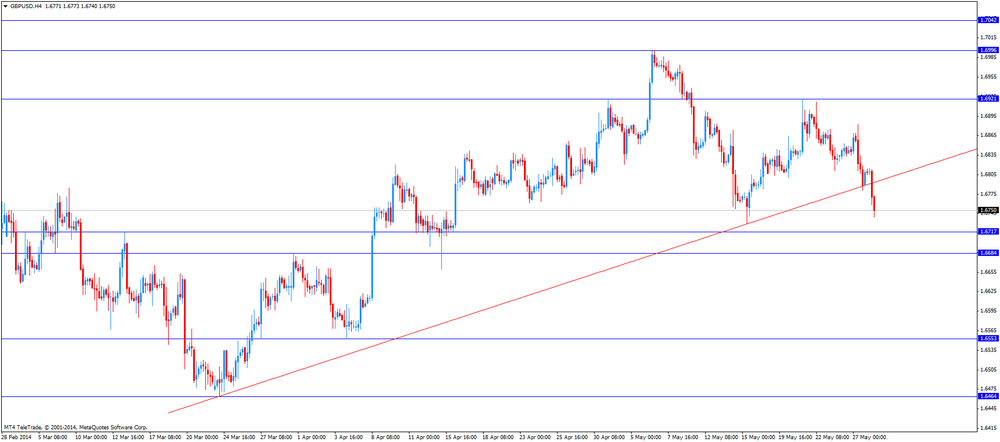

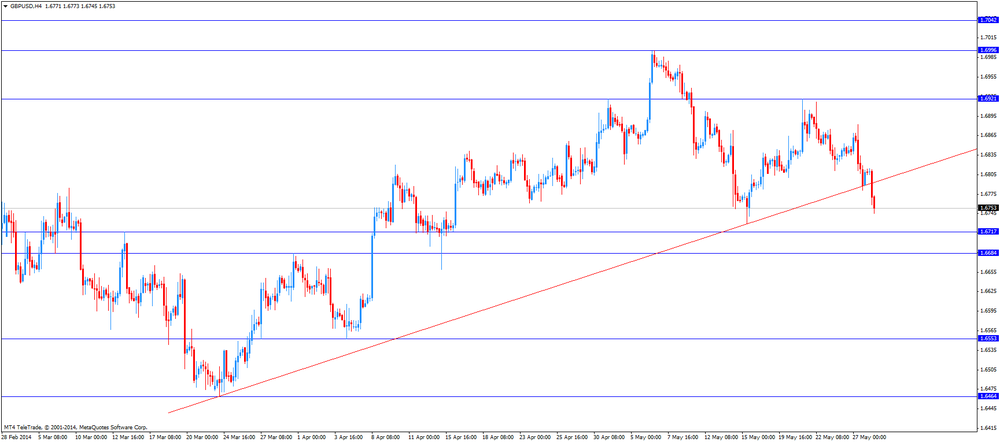

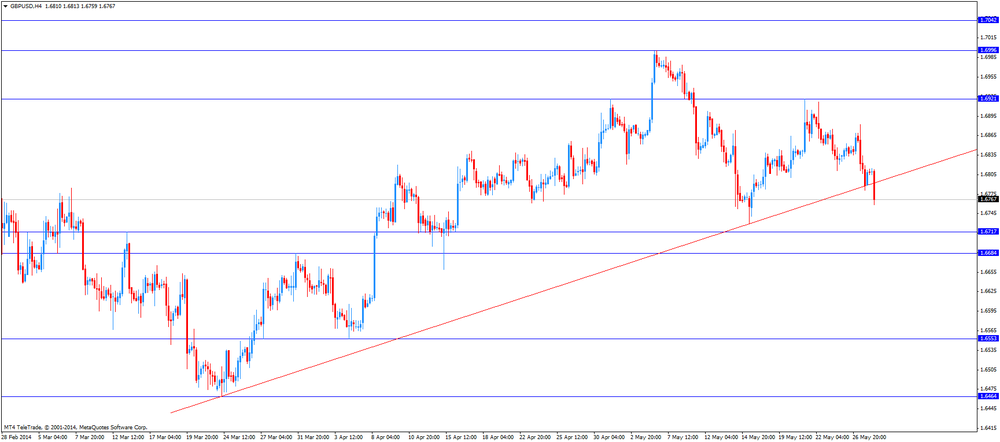

The British pound hits 6-week lows against the U.S. dollar due to the weaker-than-expected U.K. retail sale volumes. The Confederation of British Industry released the U.K. retail sale volumes on Wednesday. The U.K. retail sale volumes dropped unexpectedly in May. The CBI retail sales volume balance was +16 in May, from +30 in April. It means that retail sales volume climbed in May from last year.

The Swiss franc traded lower against the U.S. dollar. Switzerland's gross domestic product climbed 0.5% in the first quarter (Q4 2013: +0.2%), meeting analysts’ expectations.

On a yearly basis, Switzerland's gross domestic product rose 2.0% in the first quarter (Q4 2013: +1.7%), missing analysts’ expectations of a 2.1% gain.

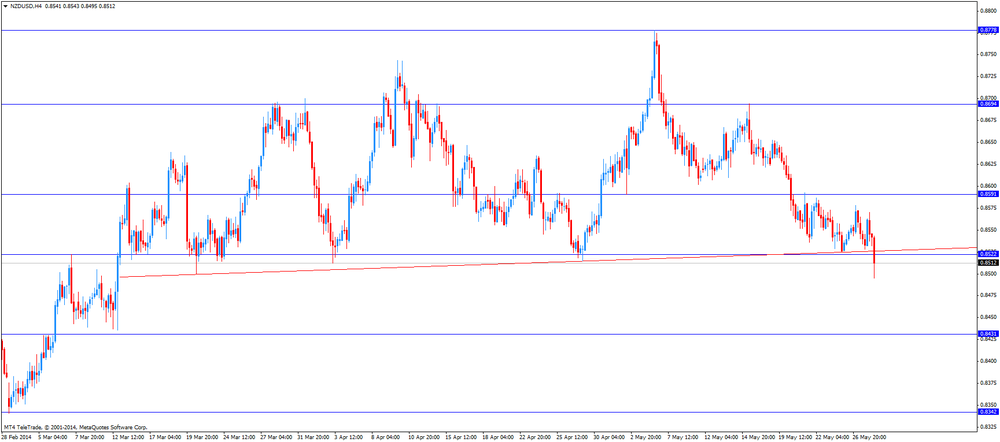

The New Zealand dollar hits 2.5-month lows against the U.S due to the weaker-than-expected New Zealand’s economic data. The ANZ business confidence index for New Zealand dropped to 53.5 in Mai, from 64.8 in April.

The Australian dollar traded lower against the U.S. dollar. Construction work done in Australia increased 0.3% in the first quarter, from a 1.1% decline in the fourth quarter of 2013. The fourth quarter of 2013 figure was revised down to a 1.1% fall from a 1% decrease. Analysts had expected a 0.3% fall.

Australia’s April leading index from Westpac Bank and the Melbourne Institute fell 0.5% to a score of 98.0. That was the weakest reading since late 2011.

The Japanese yen traded higher against the U.S. dollar after comments from the Bank of Japan governor Haruhiko Kuroda. He said that the monetary easing is possible even with interest rates at around zero percent. Market participants speculate that the Bank of Japan will implement further monetary easing measures to reach its inflation target.

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3600, $1.3620-25, $1.3650, $1.3660-70, $1.3700

USD/JPY Y101.00, Y101.10-20, Y102.00, Y102.40

EUR/JPY Y138.45

EUR/GBP stg0.8085, stg0.8100, stg0.8105

AUD/USD $0.9200, $0.9250

NZD/USD $0.8570, $0.8600

USD/CAD C$1.0900, C$1.0975

-

13:05

Foreign exchange market. European session: the euro fell against the U.S. dollar after the release of the disappointing economic data in the Eurozone

Economic calendar (GMT0):

00:00 Japan BOJ Governor Haruhiko Kuroda Speaks

00:30 Australia Leading Index March 0.0% -0.5%

01:00 New Zealand ANZ Business Confidence May 64.8 53.5

01:30 Australia Construction Work Done Quarter I -1.1% -0.3% +0.3%

05:45 Switzerland Gross Domestic Product (QoQ) Quarter I +0.2% +0.5% +0.5%

05:45 Switzerland Gross Domestic Product (YoY) Quarter I +1.7% +2.1% +2.0%

06:00 Switzerland UBS Consumption Indicator April 1.84 1.72

06:45 France Consumer spending April +0.4% +0.5% -0.3%

06:45 France Consumer spending, y/y April -1.2% -0.5%

07:55 Germany Unemployment Change May -25 -14 24

07:55 Germany Unemployment Rate s.a. May 6.7% 6.7% 6.7%

08:00 Eurozone M3 money supply, adjusted y/y April +1.1% +1.2% +0.8%

08:00 Eurozone Private Loans, Y/Y April -2.2% -2.1% -1.8%

10:00 United Kingdom CBI retail sales volume balance May 30 36 16

The U.S. dollar traded higher against the most major currencies. The U.S. currency was still boosted by the better-than-expected U.S. economic data, published on Tuesday. U.S. durable goods orders rose 0.8% in April, after a 2.9% gain in March. The U.S. consumer confidence index climbed to 83.0 in May, from 81.7 in April.

The euro fell against the U.S. dollar after the release of the disappointing economic data in the Eurozone. The number of people unemployed in Germany surged by 24,000 this month to 2.905 million. That was the largest increase in five years in May. Analysts had expected a decline by 14,000.

The German unemployment rate remained unchanged at 6.7%. This figure was expected by analysts.

Consumer spending in France fell 0.3% in April, after a 0.4% gain in March. Analysts had expected a 0.5 increase. On a yearly basis, consumer spending in France dropped 0.5% in April, after a 1.2% fall in March.

Adjusted M3 money supply in the Eurozone climbed 0.8% in April, after a 1.1% increase in March. Analysts had forecasted a 1.2% gain.

Private loans in the Eurozone declined 1.8% in April (March: -2.2%), beating expectations of a 2.1% fall.

Expectations for further stimulus measures by the European Central Bank continued to weigh on the euro.

The British pound hits 2.5-week lows against the U.S. dollar due to the weaker-than-expected U.K. retail sale volumes. The Confederation of British Industry released the U.K. retail sale volumes on Wednesday. The U.K. retail sale volumes dropped unexpectedly in May. The CBI retail sales volume balance was +16 in May, from +30 in April. It means that retail sales volume climbed in May from last year.

The Swiss franc traded lower against the U.S. dollar. Switzerland's gross domestic product climbed 0.5% in the first quarter (Q4 2013: +0.2%), meeting analysts’ expectations.

On a yearly basis, Switzerland's gross domestic product rose 2.0% in the first quarter (Q4 2013: +1.7%), missing analysts’ expectations of a 2.1% gain.

EUR/USD: the currency pair declined to $1.3604

GBP/USD: the currency pair dropped to $1.6740

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

23:50 Japan Retail sales, y/y April +11.0% -3.2%

-

13:00

Orders

EUR/USD

Offers $1.3800, $1.3775, $1.3735, $1.3685/90

Bids $1.3600, $1.3550, $1.3525/20, $1.3500

GBP/USD

Offers $1.6950, $1.6930/35, $1.6900, $1.6885, $1.6840

Bids $1.6730, $1.6700, $1.6660, $1.6600

AUD/USD

Offers $0.9370, $0.9335, $0.9300, $0.9280

Bids $0.9200, $0.9150, $0.9100

EUR/JPY

Offers Y140.00, Y139.75/80, Y139.50

Bids Y138.50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y103.00, Y102.40, Y102.15

Bids Y101.65/58, Y101.05/00, Y100.80

EUR/GBP

Offers stg0.8200, stg0.8170, stg0.8140

Bids stg0.8080, stg0.8050, stg0.8035/30, stg0.8005/000

-

12:14

-

11:14

Announcing a new website section: Central banks

Monetary policies of central banks have an impact on the dynamics of exchange rates. Therefore, information about these regulatory bodies is required for a successful trade on the financial markets.

Our new website section (Central banks) provides information on the eight major central banks, their monetary policies and their outlooks.

We hope this website section will help you to make a better decision.

TeleTrade continues to enhance and expand the website section “Market Overview” to make it as convenient as possible for our clients. Stay tuned for updates!

-

11:00

United Kingdom: CBI retail sales volume balance, May 16 (forecast 36)

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3600, $1.3620-25, $1.3650, $1.3660-70, $1.3700

USD/JPY Y101.00, Y101.10-20, Y102.00, Y102.40

EUR/JPY Y138.45

EUR/GBP stg0.8085, stg0.8100, stg0.8105

AUD/USD $0.9200, $0.9250

NZD/USD $0.8570, $0.8600

USD/CAD C$1.0900, C$1.0975

-

09:55

Foreign exchange market. Asian session: the New Zealand dollar hits 2.5-month lows against the U.S due to the weaker-than-expected New Zealand’s economic data

Economic calendar (GMT0):

00:00 Japan BOJ Governor Haruhiko Kuroda Speaks

00:30 Australia Leading Index March 0.0% -0.5%

01:00 New Zealand ANZ Business Confidence May 64.8 53.5

01:30 Australia Construction Work Done Quarter I -1.1% -0.3% +0.3%

05:45 Switzerland Gross Domestic Product (QoQ) Quarter I +0.2% +0.5% +0.5%

05:45 Switzerland Gross Domestic Product (YoY) Quarter I +1.7% +2.1% +2.0%

06:00 Switzerland UBS Consumption Indicator April 1.84 1.72

06:45 France Consumer spending April +0.4% +0.5% -0.3%

06:45 France Consumer spending, y/y April -1.2% -0.5%

07:55 Germany Unemployment Change May -25 -14 24

07:55 Germany Unemployment Rate s.a. May 6.7% 6.7% 6.7%

08:00 Eurozone M3 money supply, adjusted y/y April +1.1% +1.2% +0.8%

08:00 Eurozone Private Loans, Y/Y April -2.2% -2.1% -1.8%

The U.S. dollar traded higher against the most major currencies. The U.S. currency was still boosted by the better-than-expected U.S. economic data, published on Tuesday. U.S. durable goods orders rose 0.8% in April, after a 2.9% gain in March. The U.S. consumer confidence index climbed to 83.0 in May, from 81.7 in April.

The New Zealand dollar hits 2.5-month lows against the U.S due to the weaker-than-expected New Zealand’s economic data. The ANZ business confidence index for New Zealand dropped to 53.5 in Mai, from 64.8 in April.

The Australian dollar traded higher against the U.S. dollar, but later lost all its gains. Construction work done in Australia increased 0.3% in the first quarter, from a 1.1% decline in the fourth quarter of 2013. The fourth quarter of 2013 figure was revised down to a 1.1% fall from a 1% decrease. Analysts had expected a 0.3% fall.

Australia’s April leading index from Westpac Bank and the Melbourne Institute fell 0.5% to a score of 98.0. That was the weakest reading since late 2011.

The Japanese yen traded higher against the U.S. dollar after comments from the Bank of Japan governor Haruhiko Kuroda. He said that the monetary easing is possible even with interest rates at around zero percent.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y101.90

NZD/USD: the currency pair dropped to $0.8534

The most important news that are expected (GMT0):

10:00 United Kingdom CBI retail sales volume balance May 30 36

23:50 Japan Retail sales, y/y April +11.0% -3.2%

-

09:01

Eurozone: Private Loans, Y/Y, April -1.8% (forecast -2.1%)

-

09:00

Eurozone: M3 money supply, adjusted y/y, April +0.8% (forecast +1.2%)

-

08:55

Germany: Unemployment Rate s.a. , May 6.7% (forecast 6.7%)

-

08:55

Germany: Unemployment Change, May 24 (forecast -14)

-

07:47

France: Consumer spending , April -0.3% (forecast +0.5%)

-

07:00

Switzerland: UBS Consumption Indicator, April 1.72

-

06:46

Switzerland: Gross Domestic Product (QoQ) , Quarter I +0.5% (forecast +0.5%)

-

06:46

Switzerland: Gross Domestic Product (YoY), Quarter I +2.0% (forecast +2.1%)

-

06:28

Options levels on wednesday, May 28, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3776 (3400)

$1.3742 (4343)

$1.3690 (580)

Price at time of writing this review: $ 1.3631

Support levels (open interest**, contracts):

$1.3592 (6261)

$1.3571 (3654)

$1.3544 (4994)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 56914 contracts, with the maximum number of contracts with strike price $1,3850 (6036);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 75046 contracts, with the maximum number of contractswith strike price $1,3500 (6299);

- The ratio of PUT/CALL was 1.32 versus 1.30 from the previous trading day according to data from May, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (1854)

$1.7001 (2676)

$1.6902 (2019)

Price at time of writing this review: $1.6810

Support levels (open interest**, contracts):

$1.6698 (2570)

$1.6599 (1889)

$1.6500 (969)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 23599 contracts, with the maximum number of contracts with strike price $1,7000 (2676);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 26040 contracts, with the maximum number of contracts with strike price $1,6700 (2570);

- The ratio of PUT/CALL was 1.10 versus 1.07 from the previous trading day according to data from May, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:30

Australia: Construction Work Done, Quarter I +0.3% (forecast -0.3%)

-

02:01

New Zealand: ANZ Business Confidence, May 53.5

-

01:30

Australia: Leading Index, March -0.5%

-

00:20

Currencies. Daily history for May 27'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3633 -0,08%

GBP/USD $1,6808 -0,19%

USD/CHF Chf0,8966 +0,21%

USD/JPY Y102,01 +0,09%

EUR/JPY Y139,08 +0,01%

GBP/JPY Y171,46 -0,09%

AUD/USD $0,9257 +0,21%

NZD/USD $0,8562 +0,15%

USD/CAD C$1,0857 0,00%

-

00:00

Schedule for today, Wednesday, May 28’2014:

(time / country / index / period / previous value / forecast)00:00 Japan BOJ Governor Haruhiko Kuroda Speaks

00:30 Australia Leading Index March 0.0%

01:00 New Zealand ANZ Business Confidence May 64.8

01:30 Australia Construction Work Done Quarter I -1.0% -0.3%

05:45 Switzerland Gross Domestic Product (QoQ) Quarter I +0.2% +0.5%

05:45 Switzerland Gross Domestic Product (YoY) Quarter I +1.7% +2.1%

06:00 Switzerland UBS Consumption Indicator April 1.84

06:45 France Consumer spending April +0.4% +0.5%

06:45 France Consumer spending, y/y April -1.2%

07:55 Germany Unemployment Change May -25 -14

07:55 Germany Unemployment Rate s.a. May 6.7% 6.7%

08:00 Eurozone M3 money supply, adjusted y/y April +1.1% +1.2%

08:00 Eurozone Private Loans, Y/Y April -2.2% -2.1%

10:00 United Kingdom CBI retail sales volume balance May 30 36

23:50 Japan Retail sales, y/y April +11.0% -3.2%

-