Notícias do Mercado

-

23:41

Commodities. Daily history for Jule Aug 27'2014:

(raw materials / closing price /% change)

Light Crude 93.76 -0.13%

Gold 1,283.40 0.00%

-

23:33

Stocks. Daily history for Jule Aug 27'2014:

(index / closing price / change items /% change)

Nikkei 225 15,534.82 +13.60 +0.09%

S&P/ASX 200 5,651.18 +13.56 +0.24%

Shanghai Composite 2,209.47 +2.36 +0.11%

FTSE 100 6,830.66 +7.90 +0.12%

CAC 40 4,395.26 +1.85 +0.04%

Xetra DAX 9,569.71 -18.44 -0.19%

S&P 500 2,000.12 +0.10 0.00%

NASDAQ 4,569.62 -1.02 -0.02%

Dow Jones 17,122.01 +15.31 +0.09%

-

23:21

Currencies. Daily history for Aug 27'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3193 +0,19%

GBP/USD $1,6572 +0,19%

USD/CHF Chf0,9146 -0,28%

USD/JPY Y103,87 -0,20%

EUR/JPY Y137,04 -0,01%

GBP/JPY Y172,13 -0,01%

AUD/USD $0,9332 +0,26%

NZD/USD $0,8374 +0,49%

USD/CAD C$1,0864 -0,81%

-

23:00

Schedule for today, Thursday, Aug 28’2014:

(time / country / index / period / previous value / forecast)

01:00 Australia HIA New Home Sales, m/m July +1.2%

01:30 Australia Private Capital Expenditure Quarter II -4.2% -0.8%

07:15 Switzerland Employment Level Quarter II 4.19 4.21

07:55 Germany Unemployment Change August -12 -6

07:55 Germany Unemployment Rate s.a. August 6.7%

08:00 Eurozone M3 money supply, adjusted y/y July +1.5% +1.5%

08:00 Eurozone Private Loans, Y/Y July -1.7% -1.5%

09:00 Eurozone Business climate indicator August 0.17

09:00 Eurozone Industrial confidence August -3.8

09:00 Eurozone Economic sentiment index August 102.2

10:00 United Kingdom CBI retail sales volume balance August 21 25

12:00 Germany CPI, m/m (Preliminary) August +0.3% 0.0%

12:00 Germany CPI, y/y (Preliminary) August +0.8%

12:30 Canada Current Account, bln Quarter II -12.4 -11.4

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. Initial Jobless Claims August 298 299

12:30 U.S. GDP, q/q (Revised) Quarter II +4.0% +3.9%

14:00 U.S. Pending Home Sales (MoM) July -1.1% +0.6%

22:45 New Zealand Building Permits, m/m July +3.5%

23:05 United Kingdom Gfk Consumer Confidence August -2 -1

23:30 Japan Unemployment Rate July 3.7% 3.7%

23:30 Japan Tokyo Consumer Price Index, y/y August +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y August +2.8% +2.7%

23:30 Japan Household spending Y/Y July -3.0% -2.7%

23:30 Japan National Consumer Price Index, y/y July +3.6%

23:30 Japan National CPI Ex-Fresh Food, y/y July +3.3% +3.3%

23:50 Japan Retail sales, y/y July -0.6% -0.1%

23:50 Japan Industrial Production (MoM) (Preliminary) July -3.4% +1.4%

23:50 Japan Industrial Production (YoY) (Preliminary) July +3.1%

-

20:00

Dow +6.49 17,113.19 +0.04% Nasdaq -2.27 4,568.37 -0.05% S&P -2.16 1,997.86 -0.11%

-

17:00

European stocks close: FTSE 100 6,830.66 +7.90 +0.12% CAC 40 4,395.26 +1.85 +0.04% DAX 9,569.71 -18.44 -0.19%

-

17:00

European stocks close: stocks traded little changed in quiet trade

Stock indices traded little changed in quiet trade. Tensions over Ukraine eased. Russian President Vladimir Putin met Ukrainian President Petro Poroshenko in Minsk yesterday. Russian President Vladimir Putin said talks with Ukrainian president were positive. Ukrainian President Petro Poroshenko said that Russia, Belarus and Kazakhstan are backing a Ukrainian peace strategy.

German Finance Minister Wolfgang Schaeuble said comments by European Central Bank (ECB) President Mario Draghi in Jackson Hole were "overinterpreted". Mario Draghi said in Jackson Hole the ECB could add new stimulus measures should inflation decline further.

The Gfk consumer climate index for Germany dropped to 8.6 in August from 9.0 in July, missing expectations for a decline to 8.9. That was the first decline since January 2013.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,830.66 +7.90 +0.12%

DAX 9,569.71 -18.44 -0.19%

CAC 40 4,395.26 +1.85 +0.04%

-

16:40

Oil: an overview of the market situation

The price of oil rose slightly today, continuing to recover from a 14-month low, which was associated with the release of data on oil reserves in the United States. Weekly Report of the Ministry of Energy has shown that commercial oil stocks in the United States last week fell by 2,070 thousand. Barrels - up to 360,475 million barrels. Gasoline inventories decreased by 960 thousand. Barrels and reached 212,314 million barrels. Commercial distillate inventories rose by 1,252 thousand. Barrels, reaching 122,794 million barrels. Experts expected a decrease of oil reserves by 2500 thousand. Barrels, gasoline inventories reduction by 1600 thousand. Barrels and distillate stocks stability. We also learned that the oil reserves in the terminal Cushing last week rose by 0,508,000. Barrels to 20.663 million. Barrels and refinery utilization in the United States increased to 93.5% versus 93.4% a week earlier

Recall yesterday after markets closed the American Petroleum Institute reported that American crude oil inventories fell by 1.3 million. Barrels - up to 361.5 million barrels for the week ended Aug. 22, compared to expectations for a decline of 2.5 million. Barrels . The report also showed that gasoline inventories decreased by 3.2 million. Barrels and distillate inventories rose by 2.4 million. Barrels.

Experts note that the oversupply on the world market constrains growth. "The demand is lower than expected, and in the absence of disturbing events in the geopolitical sphere of power industry continues to be under pressure," - said the expert CMC Markets Michael McCarthy. Also worth noting is that Iraq and Libya increase production, despite political instability, and Iraq retains almost record amount of exports from southern terminals in the fighting with Islamists in the north. Saudi Arabia in June reduced the export volume to the lowest in almost three years due to increased consumption in power plants and oil refineries in the country.

Meanwhile, we add that yesterday for scheduled maintenance again closed Buzzard field in the North Sea, only to resume work at the weekend. At Buzzard field produced oil brand Forties, which is the main component in the basket of oil Brent. However, work on the repair and maintenance carried out this summer and delay the delivery of the North Sea, was not enough to prevent a drop in the price of Brent.

The cost of the October futures on American light crude oil WTI (Light Sweet Crude Oil) to the present moment has increased to $ 93.85 per barrel on the New York Mercantile Exchange (NYMEX).

October futures price for North Sea Brent crude oil mixture rose $ 0.08 to $ 102.68 a barrel on the London exchange ICE Futures Europe.

-

16:39

Foreign exchange market. American session: the euro traded higher against the U.S. after comments by German Finance Minister Wolfgang Schaeuble

The U.S. dollar traded mixed to lower against the most major currencies due to profit taking. No major economic reports were released in the U.S.

The euro traded higher against the U.S. after German Finance Minister Wolfgang Schaeuble said comments by European Central Bank (ECB) President Mario Draghi in Jackson Hole were "overinterpreted". Mario Draghi said in Jackson Hole the ECB could add new stimulus measures should inflation decline further.

The Gfk consumer climate index dropped to 8.6 in August from 9.0 in July, missing expectations for a decline to 8.9. That was the first decline since January 2013.

The British pound traded higher against the U.S. dollar in the absence of any major economic data in the UK.

The Swiss franc traded higher against the U.S. dollar. The UBS consumption Indicator fell to 1.66 in July from 2.07 in June. June's figure was revised up from 2.06.

The New Zealand dollar traded mixed against the U.S dollar. In the overnight trading session the kiwi increased after Fonterra, a leading multinational dairy company based in New Zealand, affirmed milk price. The company said it expected global milk prices to improve later in the year. The company also announced a joint venture with Beingmate Group to produce infant formula for the Chinese market.

Fonterra is the world's biggest dairy exporter.

New Zealand's food price index declined 0.7% in July, after 1.4% rise in June.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie rose after the weaker-than-expected construction work done data from Australia. Construction work done in Australia declined 1.2% in the second quarter, missing expectations for a 0.4% fall, after a 0.4% decline in the first quarter. The first quarter figure was revised down from a 0.3% increase.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major reports in Japan.

-

16:20

Gold: an overview of the market situation

Gold prices fell slightly today, but remained above $ 1,280 per ounce, which is associated with weak demand in Asia, rises in the stock markets and hopes for the new incentives from the European Central Bank.

"The market is still very cautious. The physical market is not as good as in the last month or even last year. We see a significant amount of speculative trading with the major players and hedge funds, "- said the manager GoldSilver Central Pte Ltd Brian Lang.

Meanwhile, the fall in prices is constrained by a decrease in the dollar. A weak dollar usually helps gold, as it boosts the metal's appeal as an alternative asset and decreases in the price of dollar-denominated commodities for holders of other currencies. The dollar jumped to a 11-month high against the euro after last week, ECB President Mario Draghi said in Jackson Hole, the central bank is ready to take more unconventional measures if necessary to stimulate the weak economy in the eurozone.

The course of trade was also affected by today's data on Germany. According to today's publication of the survey results from GfK, it is expected that consumer confidence in Germany in September weakened. September consumer confidence index dropped to 8.6 compared to 8.9 in August. Experts predicted that the September index was 9.0. It was the first decline in the index since January of 2013. Nevertheless, the value is high enough, says the GfK.

Pressure on prices is weak demand for physical gold in Asia. In July, for the fifth time in a row there was a falling gold imports into China from Hong Kong, to 22.1 tons - the lowest level in more than three years. Analysts say the latest forecast of the World Gold Council, according to which the demand for gold in China this year will reach 900-1000 m, may be too optimistic.

Meanwhile, data showed that the world's largest asset holder of gold investment institutions ETFs SPDR Gold Trust at the end of the day on August 26 fell by 1.49 m and fell to the level of 795.60 m - the lowest figure since August 15 of this year.

From a technical point of view, today and in the coming days, the price of gold price dynamics are likely to be limited to the level of support $ 1,275.0 an ounce resistance level $ 1290.0 per ounce.

The cost of the October gold futures on the COMEX currently dropped to $ 1282.80 per ounce.

-

15:30

U.S.: Crude Oil Inventories, August -2.1

-

14:40

Option expiries for today's 1400GMT cut

EUR/USD $1.3150(E217mn), $1.3200(E696mn), $1.3215(E302mn), $1.3300(E1.0bn)

GBP/USD $1.6500(stg423mn), $1.6600(stg110mn)

EUR/GBP stg0.7940-50(E160mn), stg0.8000(E280mn)

AUD/USD $0.9220(A$150mn), $0.9250(A$200mn), $0.9275(A$100mn), $0.9305(A$111mn)

NZD/USD $0.8365(NZ$200mn), $0.8425(NZ$410mn)

USD/CAD C$1.1000($1.62bn), C$1.1025

-

14:35

U.S. Stocks open: Dow 17,134.60 +27.90 +0.16%, Nasdaq 4,575.33 +4.69 +0.10%, S&P 2,002.09 +2.07 +0.10%

-

14:28

Before the bell: S&P futures -0.04%, Nasdaq futures -0.02%

U.S. stock futures were little changed, after S&P 500 closed above 2,000 for the first time.

Global markets:

Nikkei 15,534.82 +13.60 +0.09%

Hang Seng 24,918.75 -155.75 -0.62%

Shanghai Composite 2,209.47 +2.36 +0.11%

FTSE 6,824.56 +1.80 +0.03%

CAC 4,391.16 -2.25 -0.05%

DAX 9,576.98 -11.17 -0.12%

Crude oil $94.11 (+0.27%)

Gold $1286.00 (+0.06%)

-

14:12

DOW components before the bell

(company / ticker / price / change, % / volume)

Intel Corp

INTC

34.81

+0.03%

0.4K

International Business Machines Co...

IBM

193.10

+0.06%

0.6K

Goldman Sachs

GS

177.51

+0.09%

0.7K

AT&T Inc

T

34.53

+0.09%

1.3K

Verizon Communications Inc

VZ

49.30

+0.10%

2.8K

General Electric Co

GE

26.05

+0.15%

1.9K

Exxon Mobil Corp

XOM

99.80

+0.16%

17.8K

McDonald's Corp

MCD

94.30

+0.20%

0.1K

American Express Co

AXP

89.35

+0.22%

1.5K

Cisco Systems Inc

CSCO

24.87

+0.24%

1.2K

United Technologies Corp

UTX

109.98

+0.27%

0.1K

Boeing Co

BA

128.98

+0.30%

0.1K

Merck & Co Inc

MRK

60.38

+0.30%

0.3K

Pfizer Inc

PFE

29.43

+0.75%

16.6K

Nike

NKE

79.48

0.00%

0.4K

JPMorgan Chase and Co

JPM

59.74

0.00%

22.5K

Microsoft Corp

MSFT

45.00

-0.01%

0.4K

Walt Disney Co

DIS

89.90

-0.13%

2.9K

Home Depot Inc

HD

91.46

-0.19%

0.1K

-

13:08

Foreign exchange market. European session: the euro increased against the U.S. dollar despite the weaker-than-expected Gfk consumer climate index for Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Construction Work Done Quarter II +0.3% -0.4% -1.2%

06:00 Germany Gfk Consumer Confidence Survey September 9.0 8.9 8.6

06:00 Switzerland UBS Consumption Indicator July 2.07 Revised From 2.06 1.66

The U.S. dollar traded lower against the most major currencies. Yesterday's mixed U.S. economic data weighed on the greenback. Durable goods orders in the U.S. jumped 22.6% in July, but the increase was driven by increasing demand for new aircraft drove the rise. Orders for civilian aircraft soared 318%, while orders for transportation equipment rose 74.2%.

Durable goods orders, excluding transportation, fell 0.8% in July, missing expectations for a 0.5% increase, after a 3.0% gain in June.

The consumer confidence index rose to 92.4 in August from a 90.3 in July, beating forecasts for a decline to 89.1. That was the highest level since October 2007.

Tensions over Ukraine eased. Russian President Vladimir Putin met Ukrainian President Petro Poroshenko in Minsk yesterday. Russian President Vladimir Putin said talks with Ukrainian president were positive. Ukrainian President Petro Poroshenko aid that Russia, Belarus and Kazakhstan are backing a Ukrainian peace strategy.

The euro increased against the U.S. dollar despite the weaker-than-expected Gfk consumer climate index for Germany. The Gfk consumer climate index dropped to 8.6 in August from 9.0 in July, missing expectations for a decline to 8.9. That was the first decline since January 2013.

The British pound rose against the U.S. dollar in the absence of any major economic data in the UK.

The Swiss franc rose against the U.S. dollar. The UBS consumption Indicator fell to 1.66 in July from 2.07 in June. June's figure was revised up from 2.06.

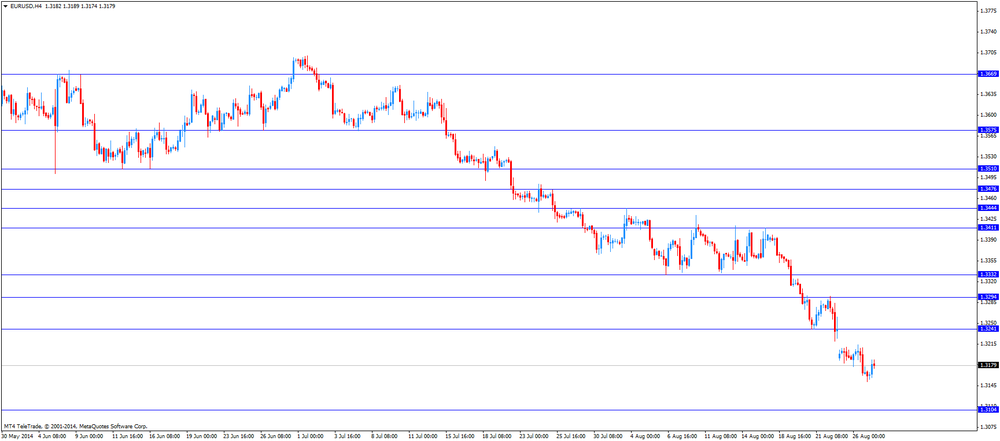

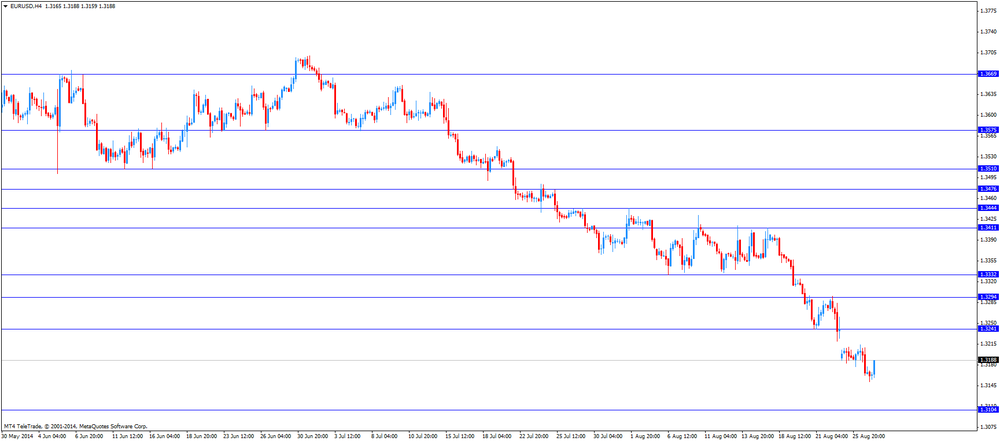

EUR/USD: the currency pair rose to $1.3189

GBP/USD: the currency pair increased to $1.6603

USD/JPY: the currency pair traded mixed

-

13:00

Orders

EUR/USD

Offers $1.3300, $1.3250/60, $1.3220-30, $1.3190/200

Bids $1.3150, $1.3135, $1.3110-00, $1.3080

GBP/USD

Offers

Bids $1.6500

AUD/USD

Offers $0.9400, $0.9380, $0.9350

Bids $0.9300, $0.9255/50, $0.9220/00

EUR/JPY

Offers Y138.20, Y137.90/00, Y137.50

Bids Y136.80, Y136.50, Y136.20, Y136.00

USD/JPY

Offers Y105.50, Y105.00, Y104.50, Y104.20/25

Bids Y103.60/50, Y103.20, Y103.00, Y102.50

EUR/GBP

Offers stg0.7980-85

Bids stg0.7900

-

12:05

European stock markets mid session: stocks traded little changed as tensions over Ukraine eased

Stock indices traded little changed as tensions over Ukraine eased. Russian President Vladimir Putin met Ukrainian President Petro Poroshenko in Minsk yesterday. Russian President Vladimir Putin said talks with Ukrainian president were positive.

Ukrainian President Petro Poroshenko said that Russia, Belarus and Kazakhstan are backing a Ukrainian peace strategy.

The Gfk German consumer climate index dropped to 8.6 in August from 9.0 in July, missing expectations for a decline to 8.9. That was the first decline since January 2013.

Current figures:

Name Price Change Change %

FTSE 100 6,828.22 +5.46 +0.08%

DAX 9,574.81 -13.34 -0.14%

CAC 40 4,387.02 -6.39 -0.15%

-

10:45

Asian Stocks close: most stocks closed higher due to yesterday’s better-than-expected U.S. consumer confidence index

Most Asian stock indices closed higher due to yesterday's better-than-expected U.S. consumer confidence index. The consumer confidence index in the U.S. rose to 92.4 in August from a 90.3 in July, beating forecasts for a decline to 89.1. That was the highest level since October 2007.

BYD Co., the electric-car maker, shares rose 5.9% in Hong Kong on optimism the Chinese government will provide funding to build more charging facilities for electric vehicles.

Otsuka Holdings Co. shares jumped 7.5% after Nomura Holdings Inc. raised the company's rating.

Indexes on the close:

Nikkei 225 15,534.82 +13.60 +0.09%

Hang Seng 24,918.75 -155.75 -0.62%

Shanghai Composite 2,209.47 +2.36 +0.11%

-

10:22

Option expiries for today's 1400GMT cut

EUR/USD $1.3150(E217mn), $1.3200(E696mn), $1.3215(E302mn), $1.3300(E1.0bn)

GBP/USD $1.6500(stg423mn), $1.6600(stg110mn)

EUR/GBP stg0.7940-50(E160mn), stg0.8000(E280mn)

AUD/USD $0.9220(A$150mn), $0.9250(A$200mn), $0.9275(A$100mn), $0.9305(A$111mn)

NZD/USD $0.8365(NZ$200mn), $0.8425(NZ$410mn)

USD/CAD C$1.1000($1.62bn), C$1.1025

-

09:58

Foreign exchange market. Asian session: the New Zealand dollar increased against the U.S dollar after Fonterra affirmed milk price

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Construction Work Done Quarter II +0.3% -0.4% -1.2%

06:00 Germany Gfk Consumer Confidence Survey September 9.0 8.9 8.6

06:00 Switzerland UBS Consumption Indicator July 2.07 Revised From 2.06 1.66

The U.S. dollar traded lower against the most major currencies. Yesterday's mixed U.S. economic data weighed on the greenback. Durable goods orders in the U.S. jumped 22.6% in July, but the increase was driven by increasing demand for new aircraft drove the rise. Orders for civilian aircraft soared 318%, while orders for transportation equipment rose 74.2%.

Durable goods orders, excluding transportation, fell 0.8% in July, missing expectations for a 0.5% increase, after a 3.0% gain in June.

The consumer confidence index rose to 92.4 in August from a 90.3 in July, beating forecasts for a decline to 89.1. That was the highest level since October 2007.

The New Zealand dollar increased against the U.S dollar after Fonterra, a leading multinational dairy company based in New Zealand, affirmed milk price. The company said it expected global milk prices to improve later in the year. The company also announced a joint venture with Beingmate Group to produce infant formula for the Chinese market.

Fonterra is the world's biggest dairy exporter.

New Zealand's food price index declined 0.7% in July, after 1.4% rise in June.

The Australian dollar traded slightly higher against the U.S. dollar after the weaker-than-expected construction work done data from Australia. Construction work done in Australia declined 1.2% in the second quarter, missing expectations for a 0.4% fall, after a 0.4% decline in the first quarter. The first quarter figure was revised down from a 0.3% increase.

The Japanese yen traded higher against the U.S. dollar in the absence of any major reports in Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.6558

USD/JPY: the currency pair fell to Y103.93

-

08:38

DAX 9,594.73 +6.58 +0.07%, CAC 40 4,392.65 -0.76 -0.02%, EUROFIRST 300 1,377.76 +0.93 +0.07%, FTSE 100 6,824.62 +1.86 +0.03%

-

07:00

Germany: Gfk Consumer Confidence Survey, September 8.6 (forecast 8.9)

-

07:00

Switzerland: UBS Consumption Indicator, July 1.66

-

06:27

Options levels on wednesday, August 27, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3277 (1741)

$1.3245 (1263)

$1.3203 (67)

Price at time of writing this review: $ 1.3159

Support levels (open interest**, contracts):

$1.3129 (5753)

$1.3103 (3381)

$1.3071 (6159)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 62213 contracts, with the maximum number of contracts with strike price $1,3400 (6991);

- Overall open interest on the PUT options with the expiration date September, 5 is 61842 contracts, with the maximum number of contracts with strike price $1,3100 (6159);

- The ratio of PUT/CALL was 0.99 versus 1.06 from the previous trading day according to data from August, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.6800 (2557)

$1.6701 (928)

$1.6603 (657)

Price at time of writing this review: $1.6550

Support levels (open interest**, contracts):

$1.6497 (2000)

$1.6399 (987)

$1.6300 (674)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 30222 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 29923 contracts, with the maximum number of contracts with strike price $1,6800 (4026);

- The ratio of PUT/CALL was 0.99 versus 1.02 from the previous trading day according to data from August, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:01

Nikkei 225 15,529.94 +8.72 +0.06%, Hang Seng 25,107.71 +33.21 +0.13%, S&P/ASX 200 5,646.4 +8.78 +0.16%, Shanghai Composite 2,207.03 -0.08 0.00%

-

02:30

Australia: Construction Work Done, Quarter II -1.2% (forecast -0.4%)

-