Notícias do Mercado

-

23:45

New Zealand: Building Permits, m/m, July +0.1%

-

23:25

Commodities. Daily history for Jule Aug 28'2014:

(raw materials / closing price /% change)

Light Crude 94.57 +0.02%

Gold 1,290.00 -0.03%

-

23:24

Stocks. Daily history for Jule Aug 28'2014:

(index / closing price / change items /% change)

Nikkei 225 15,459.86 -74.96 -0.48%

Hang Seng 24,741 -177.75 -0.71%

Shanghai Composite 2,195.82 -13.65 -0.62%

FTSE 100 6,805.8 -24.86 -0.36%

CAC 40 4,366.04 -29.22 -0.66%

Xetra DAX 9,462.56 -107.15 -1.12%

S&P 500 1,996.74 -3.38 -0.17%

NASDAQ 4,557.7 -11.93 -0.26%

Dow Jones 17,079.57 -42.44 -0.25%

-

23:20

Currencies. Daily history for Aug 28'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3183 -0,08%

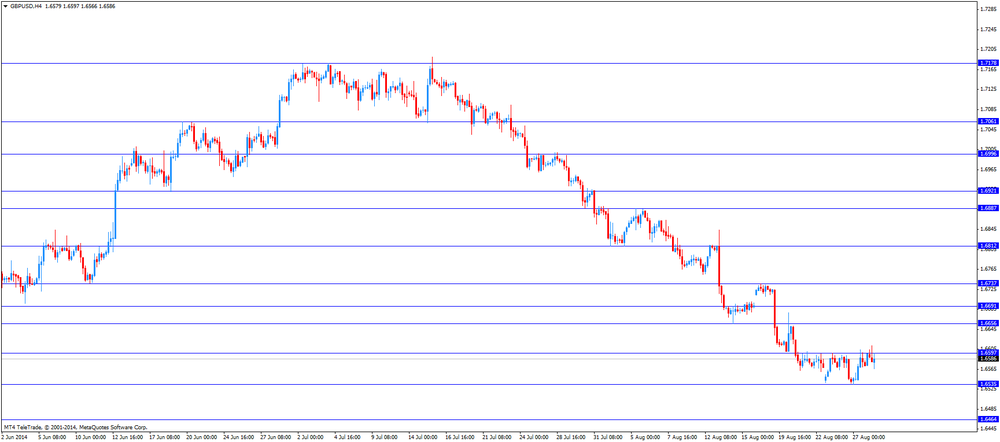

GBP/USD $1,6587 +0,09%

USD/CHF Chf0,9149 +0,03%

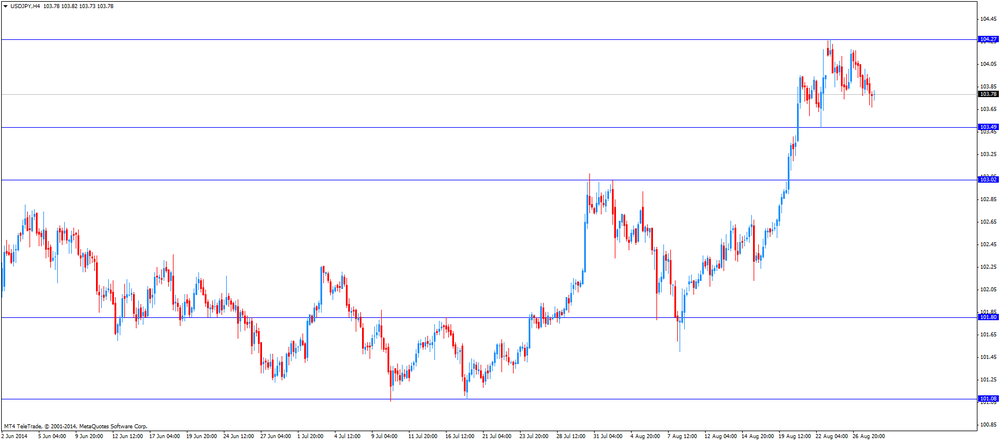

USD/JPY Y103,71 -0,15%

EUR/JPY Y136,72 -0,23%

GBP/JPY Y172,02 -0,06%

AUD/USD $0,9356 +0,26%

NZD/USD $0,8381 +0,08%

USD/CAD C$1,0859 -0,05%

-

23:00

Schedule for today, Friday, Aug 29’2014:

(time / country / index / period / previous value / forecast)

01:00 New Zealand ANZ Business Confidence August 39.7

01:30 Australia Private Sector Credit, m/m July +0.7% +0.5%

01:30 Australia Private Sector Credit, y/y July +5.1%

05:00 Japan Housing Starts, y/y July -9.5% -10.5%

06:00 United Kingdom Nationwide house price index August +0.1% 0.0%

06:00 United Kingdom Nationwide house price index, y/y August +10.6%

06:00 Germany Retail sales, real adjusted July +1.0% Revised From +1.3% +0.1%

06:00 Germany Retail sales, real unadjusted, y/y July +0.4%

07:00 Switzerland KOF Leading Indicator August 98.1 97.9

08:30 United Kingdom Business Investment, q/q Quarter II +5.0%

08:30 United Kingdom Business Investment, y/y Quarter II +10.6%

09:00 Eurozone Unemployment Rate July 11.5% 11.5%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August +0.4% +0.3%

12:30 Canada Industrial Product Prices, m/m July -0.1% +0.2%

12:30 Canada Raw Material Price Index July +1.1% +0.7%

12:30 Canada GDP (m/m) June +0.4% +0.3%

12:30 U.S. Personal Income, m/m July +0.4% +0.3%

12:30 U.S. Personal spending July +0.4% +0.2%

12:30 U.S. PCE price index ex food, energy, m/m July +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y July +1.5%

13:45 U.S. Chicago Purchasing Managers' Index August 52.6 56.3

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) August 79.2 80.4

-

20:00

Dow -43.12 17,078.89 -0.25% Nasdaq -10.03 4,559.59 -0.22% S&P -3.09 1,997.03 -0.15%

-

17:00

European stocks close: FTSE 100 6,805.8 -24.86 -0.36% CAC 40 4,366.04 -29.22 -0.66% DAX 9,462.56 -107.15 -1.12%

-

17:00

European stocks close: stocks closed lower due to escalating tensions over Ukraine

Stock indices closed lower due to escalating tensions over Ukraine. Market participants continue to monitor developments in Ukraine. Ukrainian government accused Russian forces of crossing the Ukrainian border late on Wednesday. Russia has denied the allegations.

The weaker-than-expected economic data also weighed on markets. German preliminary consumer price inflation was flat in August, in line with expectations, after a 0.3% rise in July.

On a yearly basis, German preliminary consumer price index rose 0.8% in August, in line with expectations, after a 0.8% gain in July.

The number of unemployed people in Germany climbed by 2,000 in August, missing expectations for a decrease of 6,000.

German unemployment rate remained unchanged at 6.7% in August.

Eurozone's M3 money supply increased 1.8% in July, beating expectations for a 1.5% increase, after a 1.6% rise in June. June's figure was revised up from a 1.5% gain.

Private loans in the Eurozone declined 1.6% in July, missing expectations for a 1.5% fall, after a 1.8% decline in June. June's figure was revised down from a 1.7% drop.

Eurozone's business climate indicator fell to 0.16 in August from 0.17 in July.

Eurozone's Industrial confidence decreased to -5.3 in August from -3.8 in July.

Eurozone's economic sentiment index dropped to 100.6 in August from 102.1 in July. July's figure was revised down from 102.2.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,805.8 -24.86 -0.36%

DAX 9,462.56 -107.15 -1.12%

CAC 40 4,366.04 -29.22 -0.66%

-

16:41

Oil: an overview of the market situation

Oil prices rose slightly today, closer to $ 103 per barrel (Brent), not much above 14-month low. This is due to an adequate margin and weak demand as global economic growth remains moderate.

Support prices have data on the United States, so far, that the gross domestic product of the United States increased by 4.2% in the second quarter, exceeding the expectations of growth of 3.9%, after expanding by 4.0% in the three months to April. In addition, the United States Department of Labor reported that the number of initial claims for unemployment insurance for the week ending August 22 fell by 1,000 to 298,000 from a revised 299,000 the previous week. Analysts had expected the number of hits will be at the level of 299 thousand. Strong data confirmed the comments of Fed Chairman Janet Yellen, the data on the last week in Jackson Hole, that the United States economy is recovering and the situation on the labor market is improving.

Meanwhile, the impact on prices of increased tension in Ukraine. According to reports, the separatists have intensified fighting in the east of the country. Against this background, the Ukrainian president Poroshenko called an emergency meeting of security to guard against what he called Russia's "invasion."

In addition, market participants continue to analyze yesterday's data on oil reserves in the United States. Recall inventory of oil in the United States fell last week to 2.07 million barrels to 360.5 million barrels. However, oil reserves in Cushing terminal, which stores the physical volume of oil traded on the NYMEX, increased by 508 thousand. Barrels for the week ended August 22, to 20.7 million barrels. The rise has been going on for four weeks. Volumes of gasoline in the United States decreased by storage 960 thousand. Barrels to 212.3 million barrels, with expected to fall by 1.6 million.

Traders also act out the news about the closing of Buzzard field in the North Sea on the additional repairs, speculating on the timing of the resumption of production at the field.

The cost of the October futures on American light crude oil WTI (Light Sweet Crude Oil) to the present moment has increased to $ 94.50 per barrel on the New York Mercantile Exchange (NYMEX).

October futures price for North Sea Brent crude oil mixture rose $ 0.15 to $ 102.72 a barrel on the London exchange ICE Futures Europe.

-

16:29

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. economic data

The U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. economic data. The U.S. revised gross domestic product jumped 4.2% in the second quarter instead of the previously reported 4.0%. That was the fastest increase since the third quarter of 2013. Analysts had expected an increase of 3.9%.

The number of initial jobless claims in the week ending August 22 fell by 1,000 to 298,000 from 299,000 in the previous week. The previous week's figure was revised up from 298,000. Analysts had expected the number of initial jobless claims to remain unchanged.

The U.S. pending home sales rose 3.3% in July, exceeding expectations for a 0.6% gain, after a 1.3% fall in June. June's figure was revised down from a 1.1% decline. That was the highest level since August 2013.

The euro traded lower against the U.S. dollar due to the weaker-than-expected economic data from the Eurozone. The number of unemployed people in Germany climbed by 2,000 in August, missing expectations for a decrease of 6,000.

German unemployment rate remained unchanged at 6.7% in August.

German preliminary consumer price inflation was flat in August, in line with expectations, after a 0.3% rise in July.

On a yearly basis, German preliminary consumer price index rose 0.8% in August, in line with expectations, after a 0.8% gain in July.

Eurozone's M3 money supply increased 1.8% in July, beating expectations for a 1.5% increase, after a 1.6% rise in June. June's figure was revised up from a 1.5% gain.

Private loans in the Eurozone declined 1.6% in July, missing expectations for a 1.5% fall, after a 1.8% decline in June. June's figure was revised down from a 1.7% drop.

Eurozone's business climate indicator fell to 0.16 in August from 0.17 in July.

Eurozone's Industrial confidence decreased to -5.3 in August from -3.8 in July.

Eurozone's economic sentiment index dropped to 100.6 in August from 102.1 in July. July's figure was revised down from 102.2.

The British pound traded mixed against the U.S. dollar. The Confederation of Business Industry released retail sales for the U.K. The CBI retail sales volume balance rose to +37 in August from +21 in July. Analysts had expected an increase to +25.

The Canadian dollar traded mixed against the U.S. dollar after the weaker-than-expected Canadian current account data. Canadian current account deficit declined to C$11.9 billion in the second quarter from a deficit of C$12.0 billion in the second quarter, missing expectations for a fall to a deficit of C$11.4 billion. The first quarter figure was revised up from a deficit of C$12.4 billion.

The Swiss franc traded lower against the U.S. dollar. The number of employed people climbed to 4,200 million in the second quarter from 4,192 million in the first quarter. Analysts had expected the number of employed people to increase to 4,210 million.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major reports in New Zealand.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback after the better-than-expected private capital expenditure data from Australia. Private capital expenditure in Australia rose 1.1% in the second quarter, beating expectations for a 0.8% decline, after a 2.5% fall in the first quarter. The first quarter figure was revised up from a 4.2% drop.

The Housing Industry Association released new home sales data for Australia. New home sales in Australia dropped 5.7% in July, after a 1.2% rise in June.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major reports in Japan.

-

16:20

Gold: an overview of the market situation

The price of gold has grown considerably today, reaching a one-week high at the same time, due to the escalation of tensions between Russia and Ukraine. However, strong economic data the United States dropped the demand for safe-haven assets, which put pressure on the price of the precious metal.

Today it was reported that the Ukrainian president Poroshenko canceled a trip to Turkey because of "the invasion of Russian troops on the territory of Ukraine." Indicating the intention Poroshenko call for an emergency meeting of the organization of the UN Security Council and the Council of the EU to resolve the situation. We also learned that the President urgently convene a meeting of the National Security and Defence. Russia has not yet submitted any comments, but Moscow has repeatedly denied allegations that its troops conducting military operations in Ukraine.

As for the data on the United States, they have shown that in the second quarter growth of the American economy has been more resilient than previously thought, putting the recovery back on track. Gross domestic product (overall goods and services produced in the economy) rose to a seasonally adjusted annual rate of up to 4.2% in the second quarter, said on Thursday the Ministry of Commerce. DOC previously estimated growth rate in the second quarter to 4%, based on incomplete data on international trade, stocks and other sectors. Economists had expected growth for the second quarter will be reduced to 3.9%. Positive data fueled optimism about the state of health of the economy and reinforced expectations that the Fed will raise rates earlier than previously thought.

"Adverse factors for gold is more than favorable, at least in the short term. Demand among investors and jewelers are still weak, although there are signs of increasing in India, "- said analyst Edward Meir INTL FCStone.

Demand in India, especially for silver, grew up in connection with the upcoming holiday season. The last two days the demand was high, but now all is quiet. The physical market in Singapore margins on gold bars are stable at $ 0.80-1.00 to the spot price in London.

From a technical point of view, today and in the coming days, the price of gold price dynamics will be limited to the level of support $ 1,280.0 an ounce resistance level $ 1300.0 per ounce.

The cost of the October gold futures on the COMEX currently increased to $ 1289.20 per ounce.

-

16:05

U.S. pending home sales better-than-expected in in July

The National Association of Realtors (NAR) released pending home sales figures on Thursday. The U.S. pending home sales rose 3.3% in July, exceeding expectations for a 0.6% gain, after a 1.3% fall in June. June's figure was revised down from a 1.1% decline.

That was the highest level since August 2013.

NAR reported that low mortgage rates, moderating home-price growth and more homes for sale were supporting sales.

-

15:00

U.S.: Pending Home Sales (MoM) , July +3.3% (forecast +0.6%)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3200(E250mn), $1.3250-55(E290mn)

USD/JPY Y103.50($570mn), Y104.00($300mn)

EUR/JPY Y136.75(E200mn)

AUD/USD $0.9290(A$389mn), $0.9350(A$150mn)

USD/CAD C$1.0910-15($392mn), C$1.0940($301mn), C$1.0965($251mn), C$1.1000-25($500mn)

-

14:34

U.S. Stocks open: Dow 17,065.05 -56.96 -0.33%, Nasdaq 4,552.41 -17.21 -0.38%, S&P 1,994.34 -5.78 -0.29%

-

14:28

Before the bell: S&P futures -0.30%, Nasdaq futures -0.28

U.S. stock futures fell as concern over the Ukraine crisis overshadowed data showing the economy expanded more than previously forecast in the second quarter.

Global markets:

Nikkei 15,459.86 -74.96 -0.48%

Hang Seng 24,741 -177.75 -0.71%

Shanghai Composite 2,195.82 -13.65 -0.62%

FTSE 6,813.85 -16.81 -0.25%

CAC 4,372.26 -23.00 -0.52%

DAX 9,456.26 -113.45 -1.19%

Crude oil $94.00 (+0.13%)

Gold $1293.60 (+0.78%)

-

14:06

DOW components before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

93.84

0.00%

3.9K

Verizon Communications Inc

VZ

49.39

-0.08%

4.7K

International Business Machines Co...

IBM

192.03

-0.11%

0.4K

AT&T Inc

T

34.70

-0.14%

1.5K

Chevron Corp

CVX

128.40

-0.19%

0.1K

Walt Disney Co

DIS

90.20

-0.19%

0.8K

American Express Co

AXP

89.04

-0.22%

1.7K

Exxon Mobil Corp

XOM

99.29

-0.24%

0.7K

Intel Corp

INTC

34.70

-0.26%

2.6K

Procter & Gamble Co

PG

83.09

-0.26%

0.8K

Johnson & Johnson

JNJ

102.92

-0.29%

1.6K

Pfizer Inc

PFE

29.40

-0.31%

1.3K

Microsoft Corp

MSFT

44.72

-0.33%

1.8K

General Electric Co

GE

26.04

-0.34%

13.4K

Home Depot Inc

HD

91.53

-0.37%

0.5K

Cisco Systems Inc

CSCO

24.70

-0.40%

0.2K

Goldman Sachs

GS

177.00

-0.46%

2.9K

The Coca-Cola Co

KO

41.40

-0.48%

2.0K

Boeing Co

BA

127.50

-0.55%

2.4K

JPMorgan Chase and Co

JPM

59.23

-0.60%

11.4K

Caterpillar Inc

CAT

107.77

-0.72%

0.1K

United Technologies Corp

UTX

108.31

-0.72%

102.00

Visa

V

215.50

-0.75%

4.3K

Travelers Companies Inc

TRV

93.98

-0.82%

0.1K

-

14:02

U.S. gross domestic product rose 4.2% in the second quarter

The U.S. Commerce Department released revised gross domestic product (GDP). The U.S. GDP jumped 4.2% in the second quarter instead of the previously reported 4.0%. That was the fastest increase since the third quarter of 2013.

Analysts had expected an increase of 3.9%.

The U.S. GDP declined 2.1% in the first quarter.

-

14:01

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Visa (V) downgrade from Outperform to Mkt Perform at Raymond James

Other:

-

13:31

U.S.: PCE price index, q/q, Quarter II +2.0%

-

13:31

U.S.: PCE price index ex food, energy, q/q, Quarter II +2.0%

-

13:30

U.S.: Initial Jobless Claims, August 298 (forecast 299)

-

13:30

U.S.: GDP, q/q, Quarter II +4.2% (forecast +3.9%)

-

13:30

Canada: Current Account, bln, Quarter II -11.9 (forecast -11.4)

-

13:08

Foreign exchange market. European session: the euro traded lower against the U.S. dollar due to the weaker-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia HIA New Home Sales, m/m July +1.2% -5.7%

01:30 Australia Private Capital Expenditure Quarter II -2.5% -0.8% +1.1%

07:15 Switzerland Employment Level Quarter II 4.19 4.21 4.19

07:55 Germany Unemployment Change August -11 -6 +2

07:55 Germany Unemployment Rate s.a. August 6.7% 6.7%

08:00 Eurozone M3 money supply, adjusted y/y July +1.6% +1.5% +1.8%

08:00 Eurozone Private Loans, Y/Y July -1.8% -1.5% -1.6%

09:00 Eurozone Business climate indicator August 0.17 0.16

09:00 Eurozone Industrial confidence August -3.8 -5.3

09:00 Eurozone Economic sentiment index August 102.1 100.6

10:00 United Kingdom CBI retail sales volume balance August 21 25 37

12:00 Germany CPI, m/m (Preliminary) August +0.3% 0.0% 0.0%

12:00 Germany CPI, y/y (Preliminary) August +0.8% +0.8% +0.8%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. gross domestic product. The U.S. revised GDP is expected to rise 3.9% in the second quarter.

The euro traded lower against the U.S. dollar due to the weaker-than-expected economic data from the Eurozone. The number of unemployed people in Germany climbed by 2,000 in August, missing expectations for a decrease of 6,000.

German unemployment rate remained unchanged at 6.7% in August.

German preliminary consumer price inflation was flat in August, in line with expectations, after a 0.3% rise in July.

On a yearly basis, German preliminary consumer price index rose 0.8% in August, in line with expectations, after a 0.8% gain in July.

Eurozone's M3 money supply increased 1.8% in July, beating expectations for a 1.5% increase, after a 1.6% rise in June. June's figure was revised up from a 1.5% gain.

Private loans in the Eurozone declined 1.6% in July, missing expectations for a 1.5% fall, after a 1.8% decline in June. June's figure was revised down from a 1.7% drop.

Eurozone's business climate indicator fell to 0.16 in August from 0.17 in July.

Eurozone's Industrial confidence decreased to -5.3 in August from -3.8 in July.

Eurozone's economic sentiment index dropped to 100.6 in August from 102.1 in July. July's figure was revised down from 102.2.

The British pound traded lower against the U.S. dollar. The Confederation of Business Industry released retail sales for the U.K. The CBI retail sales volume balance rose to +37 in August from +21 in July. Analysts had expected an increase to +25.

The Swiss franc traded lower against the U.S. dollar. The number of employed people climbed to 4,200 million in the second quarter from 4,192 million in the first quarter. Analysts had expected the number of employed people to increase to 4,210 million.

EUR/USD: the currency pair declined to $1.3170

GBP/USD: the currency pair fell to $.1.6566

USD/JPY: the currency pair decreased to Y103.55

The most important news that are expected (GMT0):

12:30 Canada Current Account, bln Quarter II -12.4 -11.4

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. Initial Jobless Claims August 298 299

12:30 U.S. GDP, q/q (Revised) Quarter II +4.0% +3.9%

14:00 U.S. Pending Home Sales (MoM) July -1.1% +0.6%

22:45 New Zealand Building Permits, m/m July +3.5%

23:30 Japan Tokyo Consumer Price Index, y/y August +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y August +2.8% +2.7%

23:30 Japan Household spending Y/Y July -3.0% -2.7%

23:30 Japan National Consumer Price Index, y/y July +3.6%

23:30 Japan National CPI Ex-Fresh Food, y/y July +3.3% +3.3%

23:50 Japan Retail sales, y/y July -0.6% -0.1%

23:50 Japan Industrial Production (MoM) (Preliminary) July -3.4% +1.4%

23:50 Japan Industrial Production (YoY) (Preliminary) July +3.1%

-

13:00

Germany: CPI, y/y , August +0.8% (forecast +0.8%)

-

13:00

Germany: CPI, m/m, August 0.0% (forecast 0.0%)

-

12:45

Orders

EUR/USD

Offers $1.3350, $1.3325/35, $1.3250/60, $1.3220-40

Bids $1.3150, $1.3135, $1.3110-00

GBP/USD

Offers $1.6700

Bids $1.6500

AUD/USD

Offers $0.9450, $0.9415/20, $0.9400, $0.9380

Bids $0.9325/20, $0.9300, $0.9280, $0.9255/50

EUR/JPY

Offers Y138.20, Y137.90/00, Y137.50, Y137.00

Bids Y136.20, Y136.00, Y135.50

USD/JPY

Offers Y105.00, Y104.50, Y104.20/25, Y104.00

Bids Y103.60/50, Y103.20, Y103.00, Y102.80

EUR/GBP

Offers stg0.8040, stg0.7980-85, stg0.7970

Bids stg0.7900

-

12:11

European stock markets mid session: stocks traded lower ahead of the U.S. economic data and after the weak economic data from the Eurozone

Stock indices traded lower ahead of the U.S. economic data and after the weak economic data from the Eurozone. The number of unemployed people in Germany climbed by 2,000 in August, missing expectations for a decrease of 6,000.

German unemployment rate remained unchanged at 6.7% in August.

Eurozone's M3 money supply increased 1.8% in July, beating expectations for a 1.5% increase, after a 1.6% rise in June. June's figure was revised up from a 1.5% gain.

Private loans in the Eurozone declined 1.6% in July, missing expectations for a 1.5% fall, after a 1.8% decline in June. June's figure was revised down from a 1.7% drop.

Eurozone's business climate indicator fell to 0.16 in August from 0.17 in July.

Eurozone's Industrial confidence decreased to -5.3 in August from -3.8 in July.

Eurozone's economic sentiment index dropped to 100.6 in August from 102.1 in July. July's figure was revised down from 102.2.

Market participants continue to monitor developments in Ukraine. Ukrainian government accused Russian forces of crossing the Ukrainian border late on Wednesday.

Current figures:

Name Price Change Change %

FTSE 100 6,799.54 -31.12 -0.46%

DAX 9,433.96 -135.75 -1.42%

CAC 40 4,354.98 -40.28 -0.92%

-

11:00

United Kingdom: CBI retail sales volume balance, August 37 (forecast 25)

-

10:44

Asian Stocks close: stocks closed lower in quiet trade

Asian stock indices closed lower in quiet trade. No major economic reports were released in Asia and the U.S.

Market participants continue to monitor developments in Ukraine. Ukrainian government accused Russian forces of crossing the Ukrainian border late on Wednesday.

The National Bureau of Statistics released China's industrial profits. China's industrial profits increased 13.5% in July, after a 17.9% rise in June.

Qantas Airways Ltd. shares jumped 7.0% after the company said it expects to return to profit in first half of 2015. The company also posted a narrower-than-forecasted annual loss.

Indexes on the close:

Nikkei 225 15,459.86 -74.96 -0.48%

Hang Seng 24,741 -177.75 -0.71%

Shanghai Composite 2,195.82 -13.65 -0.62%

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3200(E250mn), $1.3250-55(E290mn)

USD/JPY Y103.50($570mn), Y104.00($300mn)

EUR/JPY Y136.75(E200mn)

AUD/USD $0.9290(A$389mn), $0.9350(A$150mn)

USD/CAD C$1.0910-15($392mn), C$1.0940($301mn), C$1.0965($251mn), C$1.1000-25($500mn)

-

10:01

Eurozone: Business climate indicator , August 0.16

-

10:01

Eurozone: Industrial confidence, August -5.3

-

10:00

Eurozone: Economic sentiment index , August 100.6

-

09:51

Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar after the better-than-expected private capital expenditure data from Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia HIA New Home Sales, m/m July +1.2% -5.7%

01:30 Australia Private Capital Expenditure Quarter II -2.5% -0.8% +1.1%

07:15 Switzerland Employment Level Quarter II 4.19 4.21 4.19

07:55 Germany Unemployment Change August -11 -6 +2

07:55 Germany Unemployment Rate s.a. August 6.7% 6.7%

08:00 Eurozone M3 money supply, adjusted y/y July +1.6% +1.5% +1.8%

08:00 Eurozone Private Loans, Y/Y July -1.8% -1.5% -1.6%

The U.S. dollar traded mixed to lower against the most major currencies. No major economic reports were released in the U.S. yesterday.

The New Zealand dollar traded higher against the U.S dollar in the absence of any major reports in New Zealand.

The Australian dollar traded higher against the U.S. dollar after the better-than-expected private capital expenditure data from Australia. Private capital expenditure in Australia rose 1.1% in the second quarter, beating expectations for a 0.8% decline, after a 2.5% fall in the first quarter. The first quarter figure was revised up from a 4.2% drop.

The Housing Industry Association released new home sales data for Australia. New home sales in Australia dropped 5.7% in July, after a 1.2% rise in June.

The Japanese yen traded slightly higher against the U.S. dollar in the absence of any major reports in Japan.

EUR/USD: the currency pair rose to $1.3217

GBP/USD: the currency pair increased to $1.6604

USD/JPY: the currency pair fell to Y103.67

The most important news that are expected (GMT0):

09:00 Eurozone Business climate indicator August 0.17

09:00 Eurozone Industrial confidence August -3.8

09:00 Eurozone Economic sentiment index August 102.2

10:00 United Kingdom CBI retail sales volume balance August 21 25

12:00 Germany CPI, m/m (Preliminary) August +0.3% 0.0%

12:00 Germany CPI, y/y (Preliminary) August +0.8% +0.8%

12:30 Canada Current Account, bln Quarter II -12.4 -11.4

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. Initial Jobless Claims August 298 299

12:30 U.S. GDP, q/q (Revised) Quarter II +4.0% +3.9%

14:00 U.S. Pending Home Sales (MoM) July -1.1% +0.6%

22:45 New Zealand Building Permits, m/m July +3.5%

23:30 Japan Tokyo Consumer Price Index, y/y August +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y August +2.8% +2.7%

23:30 Japan Household spending Y/Y July -3.0% -2.7%

23:30 Japan National Consumer Price Index, y/y July +3.6%

23:30 Japan National CPI Ex-Fresh Food, y/y July +3.3% +3.3%

23:50 Japan Retail sales, y/y July -0.6% -0.1%

23:50 Japan Industrial Production (MoM) (Preliminary) July -3.4% +1.4%

23:50 Japan Industrial Production (YoY) (Preliminary) July +3.1%

-

09:01

Eurozone: Private Loans, Y/Y, July -1.6% (forecast -1.5%)

-

09:00

Eurozone: M3 money supply, adjusted y/y, July +1.8% (forecast +1.5%)

-

08:55

Germany: Unemployment Change, August +2 (forecast -6)

-

08:55

Germany: Unemployment Rate s.a. , August 6.7%

-

08:39

DAX 9,539.61 -30.10 -0.31%, CAC 40 4,386.99 -8.27 -0.19%, EUROFIRST 300 1,375.47 -1.36 -0.10%, FTSE 100 6,822.5 -0.26 0.00%

-

08:16

Switzerland: Employment Level, Quarter II 4.19 (forecast 4.21)

-

06:31

Options levels on thursday, August 28, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3320 (3166)

$1.3284 (2525)

$1.3256 (1947)

Price at time of writing this review: $ 1.3215

Support levels (open interest**, contracts):

$1.3186 (4448)

$1.3163 (4114)

$1.3141 (6022)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 64061 contracts, with the maximum number of contracts with strike price $1,3400 (6871);

- Overall open interest on the PUT options with the expiration date September, 5 is 63122 contracts, with the maximum number of contracts with strike price $1,3100 (6442);

- The ratio of PUT/CALL was 0.99 versus 0.99 from the previous trading day according to data from August, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.6900 (2308)

$1.6800 (2557)

$1.6701 (885)

Price at time of writing this review: $1.6600

Support levels (open interest**, contracts):

$1.6498 (2025)

$1.6399 (1002)

$1.6300 (705)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 30492 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 29912 contracts, with the maximum number of contracts with strike price $1,6800 (4026);

- The ratio of PUT/CALL was 0.98 versus 0.99 from the previous trading day according to data from August, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:01

Nikkei 225 15,460.53 -74.29 -0.48%, Hang Seng 24,995.04 +76.29 +0.31%, S&P/ASX 200 5,633.3 -17.88 -0.32%, Shanghai Composite 2,210.48 +1.02 +0.05%

-

02:30

Australia: Private Capital Expenditure, Quarter II +1.1% (forecast -0.8%)

-

02:00

Australia: HIA New Home Sales, m/m, July -5.7%

-