Notícias do Mercado

-

23:45

New Zealand: Building Permits, m/m, July +0.1%

-

23:20

Currencies. Daily history for Aug 28'2014:

(pare/closed(GMT +2)/change, %)

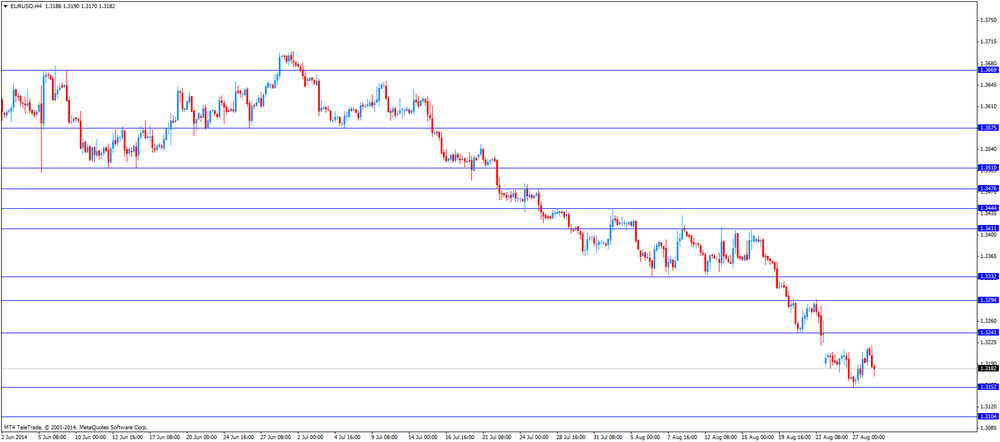

EUR/USD $1,3183 -0,08%

GBP/USD $1,6587 +0,09%

USD/CHF Chf0,9149 +0,03%

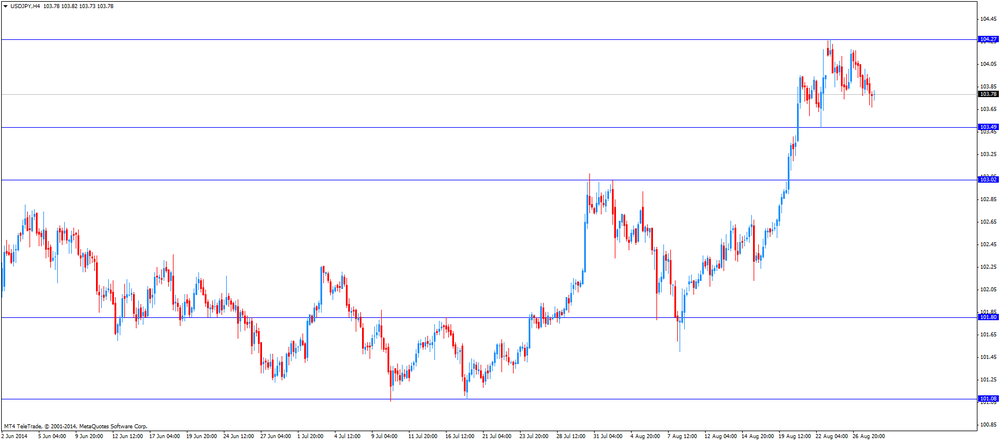

USD/JPY Y103,71 -0,15%

EUR/JPY Y136,72 -0,23%

GBP/JPY Y172,02 -0,06%

AUD/USD $0,9356 +0,26%

NZD/USD $0,8381 +0,08%

USD/CAD C$1,0859 -0,05%

-

23:00

Schedule for today, Friday, Aug 29’2014:

(time / country / index / period / previous value / forecast)

01:00 New Zealand ANZ Business Confidence August 39.7

01:30 Australia Private Sector Credit, m/m July +0.7% +0.5%

01:30 Australia Private Sector Credit, y/y July +5.1%

05:00 Japan Housing Starts, y/y July -9.5% -10.5%

06:00 United Kingdom Nationwide house price index August +0.1% 0.0%

06:00 United Kingdom Nationwide house price index, y/y August +10.6%

06:00 Germany Retail sales, real adjusted July +1.0% Revised From +1.3% +0.1%

06:00 Germany Retail sales, real unadjusted, y/y July +0.4%

07:00 Switzerland KOF Leading Indicator August 98.1 97.9

08:30 United Kingdom Business Investment, q/q Quarter II +5.0%

08:30 United Kingdom Business Investment, y/y Quarter II +10.6%

09:00 Eurozone Unemployment Rate July 11.5% 11.5%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August +0.4% +0.3%

12:30 Canada Industrial Product Prices, m/m July -0.1% +0.2%

12:30 Canada Raw Material Price Index July +1.1% +0.7%

12:30 Canada GDP (m/m) June +0.4% +0.3%

12:30 U.S. Personal Income, m/m July +0.4% +0.3%

12:30 U.S. Personal spending July +0.4% +0.2%

12:30 U.S. PCE price index ex food, energy, m/m July +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y July +1.5%

13:45 U.S. Chicago Purchasing Managers' Index August 52.6 56.3

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) August 79.2 80.4

-

16:29

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. economic data

The U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. economic data. The U.S. revised gross domestic product jumped 4.2% in the second quarter instead of the previously reported 4.0%. That was the fastest increase since the third quarter of 2013. Analysts had expected an increase of 3.9%.

The number of initial jobless claims in the week ending August 22 fell by 1,000 to 298,000 from 299,000 in the previous week. The previous week's figure was revised up from 298,000. Analysts had expected the number of initial jobless claims to remain unchanged.

The U.S. pending home sales rose 3.3% in July, exceeding expectations for a 0.6% gain, after a 1.3% fall in June. June's figure was revised down from a 1.1% decline. That was the highest level since August 2013.

The euro traded lower against the U.S. dollar due to the weaker-than-expected economic data from the Eurozone. The number of unemployed people in Germany climbed by 2,000 in August, missing expectations for a decrease of 6,000.

German unemployment rate remained unchanged at 6.7% in August.

German preliminary consumer price inflation was flat in August, in line with expectations, after a 0.3% rise in July.

On a yearly basis, German preliminary consumer price index rose 0.8% in August, in line with expectations, after a 0.8% gain in July.

Eurozone's M3 money supply increased 1.8% in July, beating expectations for a 1.5% increase, after a 1.6% rise in June. June's figure was revised up from a 1.5% gain.

Private loans in the Eurozone declined 1.6% in July, missing expectations for a 1.5% fall, after a 1.8% decline in June. June's figure was revised down from a 1.7% drop.

Eurozone's business climate indicator fell to 0.16 in August from 0.17 in July.

Eurozone's Industrial confidence decreased to -5.3 in August from -3.8 in July.

Eurozone's economic sentiment index dropped to 100.6 in August from 102.1 in July. July's figure was revised down from 102.2.

The British pound traded mixed against the U.S. dollar. The Confederation of Business Industry released retail sales for the U.K. The CBI retail sales volume balance rose to +37 in August from +21 in July. Analysts had expected an increase to +25.

The Canadian dollar traded mixed against the U.S. dollar after the weaker-than-expected Canadian current account data. Canadian current account deficit declined to C$11.9 billion in the second quarter from a deficit of C$12.0 billion in the second quarter, missing expectations for a fall to a deficit of C$11.4 billion. The first quarter figure was revised up from a deficit of C$12.4 billion.

The Swiss franc traded lower against the U.S. dollar. The number of employed people climbed to 4,200 million in the second quarter from 4,192 million in the first quarter. Analysts had expected the number of employed people to increase to 4,210 million.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major reports in New Zealand.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback after the better-than-expected private capital expenditure data from Australia. Private capital expenditure in Australia rose 1.1% in the second quarter, beating expectations for a 0.8% decline, after a 2.5% fall in the first quarter. The first quarter figure was revised up from a 4.2% drop.

The Housing Industry Association released new home sales data for Australia. New home sales in Australia dropped 5.7% in July, after a 1.2% rise in June.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major reports in Japan.

-

16:05

U.S. pending home sales better-than-expected in in July

The National Association of Realtors (NAR) released pending home sales figures on Thursday. The U.S. pending home sales rose 3.3% in July, exceeding expectations for a 0.6% gain, after a 1.3% fall in June. June's figure was revised down from a 1.1% decline.

That was the highest level since August 2013.

NAR reported that low mortgage rates, moderating home-price growth and more homes for sale were supporting sales.

-

15:00

U.S.: Pending Home Sales (MoM) , July +3.3% (forecast +0.6%)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3200(E250mn), $1.3250-55(E290mn)

USD/JPY Y103.50($570mn), Y104.00($300mn)

EUR/JPY Y136.75(E200mn)

AUD/USD $0.9290(A$389mn), $0.9350(A$150mn)

USD/CAD C$1.0910-15($392mn), C$1.0940($301mn), C$1.0965($251mn), C$1.1000-25($500mn)

-

14:02

U.S. gross domestic product rose 4.2% in the second quarter

The U.S. Commerce Department released revised gross domestic product (GDP). The U.S. GDP jumped 4.2% in the second quarter instead of the previously reported 4.0%. That was the fastest increase since the third quarter of 2013.

Analysts had expected an increase of 3.9%.

The U.S. GDP declined 2.1% in the first quarter.

-

13:31

U.S.: PCE price index, q/q, Quarter II +2.0%

-

13:31

U.S.: PCE price index ex food, energy, q/q, Quarter II +2.0%

-

13:30

U.S.: Initial Jobless Claims, August 298 (forecast 299)

-

13:30

U.S.: GDP, q/q, Quarter II +4.2% (forecast +3.9%)

-

13:30

Canada: Current Account, bln, Quarter II -11.9 (forecast -11.4)

-

13:08

Foreign exchange market. European session: the euro traded lower against the U.S. dollar due to the weaker-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia HIA New Home Sales, m/m July +1.2% -5.7%

01:30 Australia Private Capital Expenditure Quarter II -2.5% -0.8% +1.1%

07:15 Switzerland Employment Level Quarter II 4.19 4.21 4.19

07:55 Germany Unemployment Change August -11 -6 +2

07:55 Germany Unemployment Rate s.a. August 6.7% 6.7%

08:00 Eurozone M3 money supply, adjusted y/y July +1.6% +1.5% +1.8%

08:00 Eurozone Private Loans, Y/Y July -1.8% -1.5% -1.6%

09:00 Eurozone Business climate indicator August 0.17 0.16

09:00 Eurozone Industrial confidence August -3.8 -5.3

09:00 Eurozone Economic sentiment index August 102.1 100.6

10:00 United Kingdom CBI retail sales volume balance August 21 25 37

12:00 Germany CPI, m/m (Preliminary) August +0.3% 0.0% 0.0%

12:00 Germany CPI, y/y (Preliminary) August +0.8% +0.8% +0.8%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. gross domestic product. The U.S. revised GDP is expected to rise 3.9% in the second quarter.

The euro traded lower against the U.S. dollar due to the weaker-than-expected economic data from the Eurozone. The number of unemployed people in Germany climbed by 2,000 in August, missing expectations for a decrease of 6,000.

German unemployment rate remained unchanged at 6.7% in August.

German preliminary consumer price inflation was flat in August, in line with expectations, after a 0.3% rise in July.

On a yearly basis, German preliminary consumer price index rose 0.8% in August, in line with expectations, after a 0.8% gain in July.

Eurozone's M3 money supply increased 1.8% in July, beating expectations for a 1.5% increase, after a 1.6% rise in June. June's figure was revised up from a 1.5% gain.

Private loans in the Eurozone declined 1.6% in July, missing expectations for a 1.5% fall, after a 1.8% decline in June. June's figure was revised down from a 1.7% drop.

Eurozone's business climate indicator fell to 0.16 in August from 0.17 in July.

Eurozone's Industrial confidence decreased to -5.3 in August from -3.8 in July.

Eurozone's economic sentiment index dropped to 100.6 in August from 102.1 in July. July's figure was revised down from 102.2.

The British pound traded lower against the U.S. dollar. The Confederation of Business Industry released retail sales for the U.K. The CBI retail sales volume balance rose to +37 in August from +21 in July. Analysts had expected an increase to +25.

The Swiss franc traded lower against the U.S. dollar. The number of employed people climbed to 4,200 million in the second quarter from 4,192 million in the first quarter. Analysts had expected the number of employed people to increase to 4,210 million.

EUR/USD: the currency pair declined to $1.3170

GBP/USD: the currency pair fell to $.1.6566

USD/JPY: the currency pair decreased to Y103.55

The most important news that are expected (GMT0):

12:30 Canada Current Account, bln Quarter II -12.4 -11.4

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. Initial Jobless Claims August 298 299

12:30 U.S. GDP, q/q (Revised) Quarter II +4.0% +3.9%

14:00 U.S. Pending Home Sales (MoM) July -1.1% +0.6%

22:45 New Zealand Building Permits, m/m July +3.5%

23:30 Japan Tokyo Consumer Price Index, y/y August +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y August +2.8% +2.7%

23:30 Japan Household spending Y/Y July -3.0% -2.7%

23:30 Japan National Consumer Price Index, y/y July +3.6%

23:30 Japan National CPI Ex-Fresh Food, y/y July +3.3% +3.3%

23:50 Japan Retail sales, y/y July -0.6% -0.1%

23:50 Japan Industrial Production (MoM) (Preliminary) July -3.4% +1.4%

23:50 Japan Industrial Production (YoY) (Preliminary) July +3.1%

-

13:00

Germany: CPI, y/y , August +0.8% (forecast +0.8%)

-

13:00

Germany: CPI, m/m, August 0.0% (forecast 0.0%)

-

12:45

Orders

EUR/USD

Offers $1.3350, $1.3325/35, $1.3250/60, $1.3220-40

Bids $1.3150, $1.3135, $1.3110-00

GBP/USD

Offers $1.6700

Bids $1.6500

AUD/USD

Offers $0.9450, $0.9415/20, $0.9400, $0.9380

Bids $0.9325/20, $0.9300, $0.9280, $0.9255/50

EUR/JPY

Offers Y138.20, Y137.90/00, Y137.50, Y137.00

Bids Y136.20, Y136.00, Y135.50

USD/JPY

Offers Y105.00, Y104.50, Y104.20/25, Y104.00

Bids Y103.60/50, Y103.20, Y103.00, Y102.80

EUR/GBP

Offers stg0.8040, stg0.7980-85, stg0.7970

Bids stg0.7900

-

11:00

United Kingdom: CBI retail sales volume balance, August 37 (forecast 25)

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3200(E250mn), $1.3250-55(E290mn)

USD/JPY Y103.50($570mn), Y104.00($300mn)

EUR/JPY Y136.75(E200mn)

AUD/USD $0.9290(A$389mn), $0.9350(A$150mn)

USD/CAD C$1.0910-15($392mn), C$1.0940($301mn), C$1.0965($251mn), C$1.1000-25($500mn)

-

10:01

Eurozone: Business climate indicator , August 0.16

-

10:01

Eurozone: Industrial confidence, August -5.3

-

10:00

Eurozone: Economic sentiment index , August 100.6

-

09:51

Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar after the better-than-expected private capital expenditure data from Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia HIA New Home Sales, m/m July +1.2% -5.7%

01:30 Australia Private Capital Expenditure Quarter II -2.5% -0.8% +1.1%

07:15 Switzerland Employment Level Quarter II 4.19 4.21 4.19

07:55 Germany Unemployment Change August -11 -6 +2

07:55 Germany Unemployment Rate s.a. August 6.7% 6.7%

08:00 Eurozone M3 money supply, adjusted y/y July +1.6% +1.5% +1.8%

08:00 Eurozone Private Loans, Y/Y July -1.8% -1.5% -1.6%

The U.S. dollar traded mixed to lower against the most major currencies. No major economic reports were released in the U.S. yesterday.

The New Zealand dollar traded higher against the U.S dollar in the absence of any major reports in New Zealand.

The Australian dollar traded higher against the U.S. dollar after the better-than-expected private capital expenditure data from Australia. Private capital expenditure in Australia rose 1.1% in the second quarter, beating expectations for a 0.8% decline, after a 2.5% fall in the first quarter. The first quarter figure was revised up from a 4.2% drop.

The Housing Industry Association released new home sales data for Australia. New home sales in Australia dropped 5.7% in July, after a 1.2% rise in June.

The Japanese yen traded slightly higher against the U.S. dollar in the absence of any major reports in Japan.

EUR/USD: the currency pair rose to $1.3217

GBP/USD: the currency pair increased to $1.6604

USD/JPY: the currency pair fell to Y103.67

The most important news that are expected (GMT0):

09:00 Eurozone Business climate indicator August 0.17

09:00 Eurozone Industrial confidence August -3.8

09:00 Eurozone Economic sentiment index August 102.2

10:00 United Kingdom CBI retail sales volume balance August 21 25

12:00 Germany CPI, m/m (Preliminary) August +0.3% 0.0%

12:00 Germany CPI, y/y (Preliminary) August +0.8% +0.8%

12:30 Canada Current Account, bln Quarter II -12.4 -11.4

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. Initial Jobless Claims August 298 299

12:30 U.S. GDP, q/q (Revised) Quarter II +4.0% +3.9%

14:00 U.S. Pending Home Sales (MoM) July -1.1% +0.6%

22:45 New Zealand Building Permits, m/m July +3.5%

23:30 Japan Tokyo Consumer Price Index, y/y August +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y August +2.8% +2.7%

23:30 Japan Household spending Y/Y July -3.0% -2.7%

23:30 Japan National Consumer Price Index, y/y July +3.6%

23:30 Japan National CPI Ex-Fresh Food, y/y July +3.3% +3.3%

23:50 Japan Retail sales, y/y July -0.6% -0.1%

23:50 Japan Industrial Production (MoM) (Preliminary) July -3.4% +1.4%

23:50 Japan Industrial Production (YoY) (Preliminary) July +3.1%

-

09:01

Eurozone: Private Loans, Y/Y, July -1.6% (forecast -1.5%)

-

09:00

Eurozone: M3 money supply, adjusted y/y, July +1.8% (forecast +1.5%)

-

08:55

Germany: Unemployment Change, August +2 (forecast -6)

-

08:55

Germany: Unemployment Rate s.a. , August 6.7%

-

08:16

Switzerland: Employment Level, Quarter II 4.19 (forecast 4.21)

-

06:31

Options levels on thursday, August 28, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3320 (3166)

$1.3284 (2525)

$1.3256 (1947)

Price at time of writing this review: $ 1.3215

Support levels (open interest**, contracts):

$1.3186 (4448)

$1.3163 (4114)

$1.3141 (6022)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 64061 contracts, with the maximum number of contracts with strike price $1,3400 (6871);

- Overall open interest on the PUT options with the expiration date September, 5 is 63122 contracts, with the maximum number of contracts with strike price $1,3100 (6442);

- The ratio of PUT/CALL was 0.99 versus 0.99 from the previous trading day according to data from August, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.6900 (2308)

$1.6800 (2557)

$1.6701 (885)

Price at time of writing this review: $1.6600

Support levels (open interest**, contracts):

$1.6498 (2025)

$1.6399 (1002)

$1.6300 (705)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 30492 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 29912 contracts, with the maximum number of contracts with strike price $1,6800 (4026);

- The ratio of PUT/CALL was 0.98 versus 0.99 from the previous trading day according to data from August, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:30

Australia: Private Capital Expenditure, Quarter II +1.1% (forecast -0.8%)

-

02:00

Australia: HIA New Home Sales, m/m, July -5.7%

-