Notícias do Mercado

-

23:28

WTI climbs sharply more than 2% as demand for oil increases

- WTI is set to post back-to-back weekly losses, despite gaining more than 2% on Friday.

- US crude oil output shortages were outweighed by gasoline demand; therefore, WTI rose.

Western Texas Intermediate (WTI), the US crude oil benchmark, posted gains of more than 2% after US companies related to the energy sector exceeded earnings estimates. Furthermore, a government report flashed increased demand for fuel while crude oil output decelerated. At the time of writing, WTI is trading at $76.61.

Even though WTI is registering daily gains, it would finish the week with losses of 1.67%, extending its fall to two straight weeks concerning an impending slowdown in the United States (US).

The latest news reported by Reuters said that the US Federal Deposit Insurance Corp (FDIC), the US Secretary of Treasure, and the Federal Reserve held meetings with First Republic Bank, which is failing to reach a deal, to improve its financial position.

US crude output fell in February, as reported by the US Energy Information Administration (EIA) report, with production decelerating to 12.5 million barrels per day (bpd), the lowest level since December. Nonetheless, demand for fuel jumped to nearly 20 million bpd, its highest since November.

Meanwhile, the Baker Hughes report for April 28 reported that rigs drilling for oil in the US remained unchanged at 591, on a day that US companies reported earnings.

WTI Technical Levels

-

22:58

USD/JPY Price Analysis: Trades nearby six-week highs, above 136.20s

- USD/JPY skyrocketed after BoJ’s dovish decision and high US core PCE data.

- USD/JPY Price Analysis: Rallied more than 200 pips, set for a pullback, before challenging YTD high,

The USD/JPY rose sharply after the first monetary policy decision by the Bank of Japan (BoJ) new Governor Kazuo Ueda struck a dovish tone, a greenlight for US Dollar (USD) buyers, against the Japanese Yen. (JPY). Therefore, the USD/JPY extended its gains of more than 1.73%, trading at 136.27.

USD/JPY Price Action

After the US inflation data release, the USD/JPY skyrocketed, past the last week’s high of 135.13, and extended its gains toward the 136.56 area, a six-week high at 136.56.

The USD/JPY resumed its uptrend after the release of inflation data in the US. On its way north, the price jumped more than 200 pips in the day, and it had opened the door to test the YTD high at 137.91. Nevertheless, buyers must reclaim some resistance levels before challenging the YTD high.

The first resistance would be the March 10 high at 136.99, which, once cleared, the USD/JPY will continue towards the March 9 high at 137.35. Up next would be the YTD high before testing 138.00.

On the other hand, the aggressive rally lifted the Relative Strength Index (RSI) indicator shy of reaching the overbought level; while the Rate of Change (RoC) hit levels last seen on February 15. Given the backdrop, the USD/JPY might be headed for a pullback after Friday’s rally.

The USD/JPY first support would be 136.00, followed by the 135.50 area. A breach of the latter, the USD/JPY could dip toward April 19 daily high, turned support at 135.13, ahead of challenging the 135.00 figure.

USD/JPY Daily Chart

-

22:00

Mexico Fiscal Balance, pesos increased to 6.99B in March from previous -74.37B

-

21:52

USD/MXN tumbles below 18.0000 amid solid US earnings and higher inflation concerns

- USD/MXN to finish the week almost flat, with gains of 0.70%.

- Data from the United States justified a 25 bps hike by the Fed at the May meeting, though it did not boost the US Dollar.

- USD/MXN Price Analysis: Downward pressured below 18.00; otherwise, expect a rally to the 20-DMA at 18.10000.

The Mexican Peso (MXN) appreciates during the last trading day of the week, as shown by the USD/MXN tumbling 0.25%, amidst a risk-on impulse due to US stocks posting solid earnings. US data flashed signs that inflation is too high, a green light for another rate increase by the Federal Reserve (Fed). At the time of writing, the USD/MXN is trading at 17.9830 after hitting a high of 18.1089.

USD/MXN holds steady weekly gains of 0.70%, despite lackluster response to US data

Wall Street finished the last trading day of April with solid gains, propelled by earnings from Exxon and Intel. A report by the US Commerce Department showed that inflation in March, as measured by the Fed’s preferred gauge for inflation, the core Personal Consumption Expenditure (PCE), rose by 0.3% MoM in line with estimates. On an annual basis, figures rose by 4.6%, above forecasts of 4.5%, increasing the chances for another quarter of percent rate hike by the US central bank.

Given the backdrop, the swaps market continued to price in a 25 bps hike for the May meeting though investors remain reluctant to believe the Fed’s rhetoric of going higher for longer. The CME FEdWatch Tool odds for a 25 bps lift stood at 84%, but the first rate cut is expected by September.

In the meantime, the US Dollar Index (DXY), which tracks the value of six currencies against the greenback, advances 0.20% to 101.681 but fails to impress USD/MXN buyers as the pair extended its losses past the 18.0000 figure.

In other data, Consumer Sentiment in the US stood at 63.5, an improvement over the latest reading of 62.0, as revealed by the University of Michigan (UoM) poll. Inflation expectations for a one-year horizon rose to 4.6% from 3.6%, and expectations for a 5-year uptick to 3% from 2.9%.

On the Mexican front, the economy expanded by 1.1% QoQ, above the previous 0.5% growth in Q4, 2022, as reported by INEGI. On an annual basis, the Gross Domestic Product (GDP) grew by 3.9%, exceeding the forecasts of 3.3%.

Aside from this, USD/MXN traders would look for clues to next week’s Federal Reserve Open Market Committee (FOMC) decision on Wednesday afternoon, and the US Nonfarm Payrolls report on Friday

USD/MXN Technical Analysis

The downtrend in the USD/MXN pair stays intact after testing the 20-day EMA earlier in the day. However, USD/MXN sellers must drag the exchange rate below the April 25 low of 17.9505 if they want to re-test the YTD low at 17.8968. Conversely, the USD/MXN buyers must crack 18.0000 and the 20-day EMA at around 18.1000 if they want to challenge the 50-day EMA At 18.2910.

-

21:32

Australia CFTC AUD NC Net Positions rose from previous $-42.4K to $-39.5K

-

21:32

Japan CFTC JPY NC Net Positions declined to ¥-68.7K from previous ¥-56.9K

-

21:32

United States CFTC Gold NC Net Positions dipped from previous $189.9K to $185.3K

-

21:32

United States CFTC Oil NC Net Positions dipped from previous 244.6K to 236.4K

-

21:32

European Monetary Union CFTC EUR NC Net Positions rose from previous €164.4K to €169.4K

-

21:31

United Kingdom CFTC GBP NC Net Positions: £5.8K vs £1.3K

-

21:31

United States CFTC S&P 500 NC Net Positions dipped from previous $-344.3K to $-363.3K

-

21:00

Colombia Interest rate above expectations (13%): Actual (13.25%)

-

20:37

Colombia: Central bank has now additional reasons to be cautious in coming months – TDS

The Central Bank of Colombia (BanRep) raised its key interest rate by 25bps to 13.25%. Analysts at TD Securities think this was the last hike in the cycle and they warn that after the recent Cabinet reshuffle form the President, the central bank has now additional reasons to be cautious in coming months.

Key quotes:

“We think BanRep has hit terminal rate at 13.25%. As we expected, the central bank deployed another 25bp rate hike in a decision by majority. The wording of the forward guidance did not provide a hint on the central bank hitting terminal after today's meeting. Once more, it was stated that future decisions will depend on incoming data. However, based on our prospects for inflation, inflation expectations and economic activity in the run up to the next monetary policy decision (June 30), we think this was the last hike in the cycle.”

“BanRep has now additional reasons to be cautious in coming months. Up to April 25, we thought a data-dependent approach in the aftermath of April's monetary policy decision will focus on incoming inflation data, expectation surveys, and activity figures in the interim before the start of a cutting cycle. However, after the Cabinet reshuffle that took place on April 26, certain idiosyncratic factors have returned to the spotlight in the form of renewed fiscal and policy uncertainty.”

-

20:02

EUR/USD: Room for rebound to extend – MUFG

Analysts at MUFG Bank continue to see the EUR/USD pair moving to the upside over the next few days. They expect the pair to break out to the upside and move back closer to pre-Ukraine conflict levels from early last year.

Key quotes:

“The pair has been attempting to break above the top of this year’s trading range between 1.0500 and 1.1000 over the past week, and has spent the most time trading above the 1.1000-level this month since March of last year. We expect the pair to break to out to the upside and move back closer to pre-Ukraine conflict levels from early last year. The fundamental drivers that have helped lift EUR/USD at the start of this year remain in place and have been reinforced recently.”

“The EUR is continuing to benefit from the easing of downside risks to growth in the euro-zone.”

“Renewed concerns over the health of First Republic Bank over the past week ahead of next week’s FOMC meeting makes us more confident that the Fed will deliver a more cautious policy update. We expect one final 25bps hike from the Fed next week and a signal that they are more seriously considering pausing their hiking cycle. The narrowing policy divergence between the ECB and Fed should help to keep lifting EUR/USD to fresh year to date highs.”

-

20:01

NFP: Payroll growth to slow to 195K in April – Wells Fargo

Next week it is not only about central banks, the US official employment report is due on Friday. Analysts at Wells Fargo, see payroll rising by 195K, slightly above the consensus of 181K.

Key quotes:

“Slowly bending, not breaking, has so far been the story of the labor market this year. That is unlikely to change with April's employment report. In March, nonfarm payrolls rose by 236K, the weakest print since December 2020. Signs were more encouraging in the separate household survey, where employment rose by 577K, causing the unemployment rate to tick back down to 3.5%. The labor force participation rate also rose for a fourth straight month.”

“Falling hiring plans and job openings point to demand for workers continuing to trend lower. With some hiring pulled forward by the unusually warm weather to start the year, we look for payroll growth to slow to 195K in April and for the unemployment rate to edge back up to 3.6%. Another 0.3% increase in average hourly earnings would keep the year-over-year rate at 4.2%.”

-

19:55

Canada: A slowing economy should keep the BoC on hold – CIBC

Data released on Friday showed monthly GDP in Canada rose by 0.1% in February, below market consensus. Analysts at CIBC point out that a slowing economy should keep the Bank of Canada (BoC) on hold for the remainder of 2023, rather than pulling the trigger on another rate hike, before cuts arrive early next year.

Key quotes:

“After sprinting out of the gate to start 2023, the Canadian economy had already hit a wall by March. Monthly GDP rose by 0.1% in February, which was a tick below the consensus forecast and a noticeable deceleration from an upwardly revised 0.6% gain in January. Moreover, the March advance estimate suggests that GDP fell slightly to end the quarter, implying little momentum heading into the second quarter.”

“The weak end to the first quarter, combined with the negative but temporary impact of the public sector strike on Q2 GDP, increases the risk of a contraction in economic activity during the second quarter. However, the Bank of Canada will look through that volatility, and focus instead on trying to get and keep inflation and inflation expectations under control. While a weakening economy should prevent policymakers pulling the trigger on another interest rate hike, we don’t see cuts forthcoming until early next year.”

-

19:46

GBP/USD Price Analysis: Climbs to 11-month highs, as buyers eye 1.2600

- The GBP/USD bounced off daily lows at 1.2446 and reclaimed 1.2500.

- GBP/USD Price Analysis: Bullish above 1.2500, with buyers eyeing the 200-week EMA above 1.2800.

The GBP/USD soared to fresh YTD highs at 1.2583 despite fundamental news from the United States (US) increasing the likelihood of a Federal Reserve 25 bps rate hike. Therefore, the GBP/USD is trading at 1.2571, above its opening price by 0.61%.

GBP/USD Price Action

The GBP/USD daily chart remains upward-biased from a technical perspective. After dipping to the 20-day EMA at 1.2477, the GBP/USD surged past the 1.2500 mark, despite the US Dollar (USD) strengthening after high inflation data.

The Relative Strength Index (RSI) indicator is still in bullish territory and aims higher, justifying higher GBP/USD prices. If GBP/USD cracks the 1.2600 figure, it would be cheered by buyers, which will set their eyes on the 200-week EMA at 1.2817.

Conversely, if the GBP/USD tumbles below 1.2500, that will expose the 20-day EMA at 1.2427, followed by 1.2400. A breach of the latter will expose the 50-day EMA at 1.2315, followed by the 1.2300 figure ahead of the confluence of the 200/100-day EMAs, each at 1.2188/1.2203, respectively.

GBP/USD Daily Chart

-

19:32

Forex Today: Busy week ahead with Fed, ECB, RBA, ISM, NFP, and more

Here is what you need to know for next week:

On Friday, Wall Street enjoyed a two-day rally thanks to better-than-expected earnings from big tech companies. However, the positive sentiment may be short-lived given the gloomy global growth outlook and renewed concerns surrounding First Republic Bank. Incoming economic data will be closely watched, although it could potentially be offset by central bank decisions.

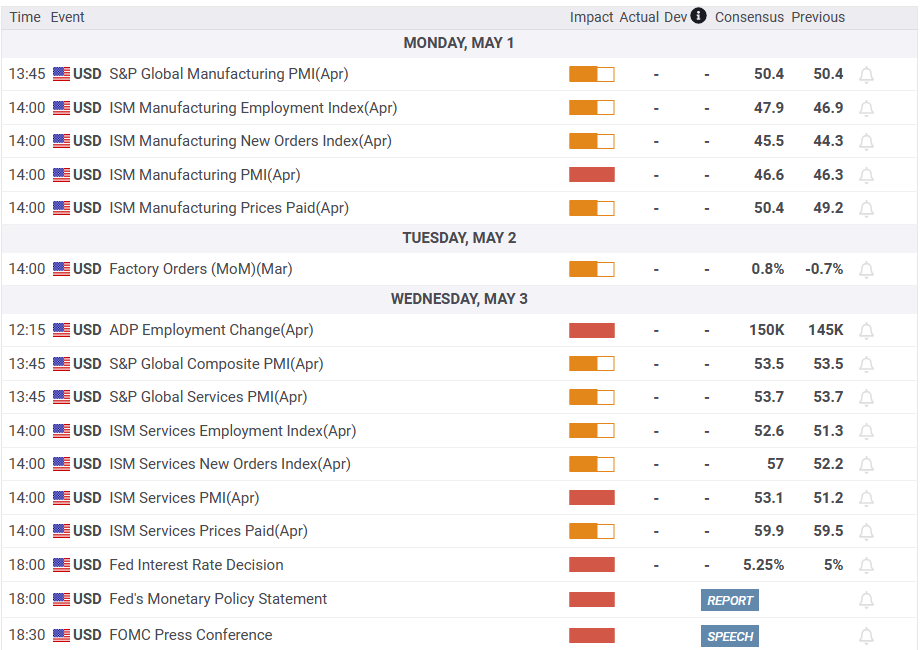

It will be a busy week for the US Dollar, as the economic data set to be released includes the ISM PMIs, the ADP Private Employment, and the official employment report. The Federal Reserve will announce its decision on Wednesday, with market participants expecting a final 25 basis points rate hike. The US Dollar Index finished the week little changed around 101.50. The DXY continues to hover around recent lows, holding above but with gains limited. The economic calendar for next week warrants volatility and may challenge the ongoing consolidation pace.

EUR/USD saw a modest rise during the week, continuing to trade near one-year highs but struggling to consolidate above 1.1050. The Eurozone's Q1 GDP narrowly avoided a recession with a 0.1% expansion. The European Central Bank is expected to raise interest rates by 25 basis points next week, as inflation remains elevated.

The Japanese Yen tumbled on Friday following the Bank of Japan's monetary policy meeting. The central bank dropped its forward guidance for interest rates and launched a review of its policies that will take more than a year. "We're not starting the review with the aim of normalizing," said Uedo at his first post-meeting press conference. USD/JPY soared on Friday from 134.00 to 136.55.

The Pound was the best performer among G10 currencies. GBP/USD broke above 1.2550 and climbed to 1.2583, reaching the highest level since June 2022. On the other hand, EUR/GBP suffered on Friday, recording the biggest daily loss in weeks, falling towards 0.8750.

USD/CAD ended the week with little change after a considerable pullback on Friday, signaling a potential reversal that could continue. The pair reached its peak at 1.3667, the highest level in four weeks, before dropping back below 1.3550, despite weaker-than-expected Canadian GDP data. Next Friday, Canada will release its employment report.New Zealand will release its employment report next week. NZD/USD ended a three-week negative streak after a considerable rally on Friday, with the Kiwi outperforming. The pair rose from 0.6120 to 0.6190.

The Reserve Bank of Australia will make its interest rate decision next week; no change is expected. The key will likely be in the monetary policy statement on Friday. AUD/USD fell during the week but managed to recover 0.6600. The bias is to the downside, but losses seem limited while above 0.6560.

The Colombian Peso is expected to face continued pressure, having been the worst performing currency of the week due to increasing political risk in Colombia. This was triggered by President Petro's decision to remove a moderate finance minister and replace him with a key leftist ally. As a result, USD/COP surged to 4,714 on Friday, experiencing a gain of over 4% for the week.

Commodity prices had a tough week, with corn sliding more than 10%, coffee falling 4%, and soybeans dropping 4%. Crude oil prices dropped 1.5% after trimming losses on Friday. Gold and silver finished the week flat near $1,990 and $25.00, respectively, as they remained mostly sideways. Bitcoin, on the other hand, jumped 7%.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:09

EUR/USD rebounds, Fed considers tightening as US inflation sticks

- EUR/USD bounces back from the daily low and reclaims 1.1000 after US data.

- US inflation on the rise: core PCE at 4.6% in March, unchanged from February.

- EUR/USD Price Analysis: Likely to test 1.1100 above 1.1000; otherwise, it could test the 20-day EMA in the near term.

The EUR/USD recovered from earlier losses that dragged the pair towards its daily low of 1.0962 and is trading at around the 1.1020s area after inflation in the United States (US) proved to be stickier than expected, warranting further tightening by the Federal Reserve (Fed).

EUR/USD climbed despite high inflation in the US, warrants higher rates

Wall Street prints solid gains in the mid-day of the New York session. The US Department of Commerce revealed that the Fed’s preferred gauge for inflation, the core Personal Consumption Expenditure (PCE) in March, rose by 4.6%, unchanged from February’s data. Therefore, further tightening is expected by the Federal Reserve, even though the headline figure slowed to 0.1% MoM less than the prior’s month 0.3%, and the annual figures slowed from 5.1% to 4.2%.

In the initial reaction, the EUR/USD dipped to its daily low, but since then, the shared currency posted an 80-pip gain before stabilizing at current exchange rates.

Other data reported from the University of Michigan (UoM), Consumer Sentiment, remained unchanged at 63.5, while Inflation expectations for 1-year stood at 4.6%, and for a 5-year horizon at 3%.

Regarding the following week’s Federal Reserve’s monetary policy meeting, traders appeared convinced that the US central bank will increase rates by 25 bps, as shown by the CME FedWatch Tool odds of 88%. However, they remained skeptical about the Fed’s rhetoric of going higher for longer, as the swaps market estimates 50 bps rate cuts for the year’s second half.

Therefore, the US Dollar seesawed between gains and losses, as shown by the US Dollar Index, oscillating around 101.500s, registering minuscule gains of 0.10%. BBH analysts say, “Recent data have been dollar-supportive, but until rate cuts this year are finally priced out, the dollar is likely to remain vulnerable.”

Across the pond, Germany’s GDP for Q4 improved to 0%, from Q3’s -0.4% contraction, but missed estimates of 0.2%. In the meantime, the Eurozone (EU) reported GDP at 0.1% for Q4 and also missed the 0.2% projected by the consensus.

EUR/USD Technical Analysis

The EUR/USD remained supported by the 20-day EMA, which, acting as dynamic support, remains sought by buyers, as the pair has bounced from that area since mid-March. Additionally, the Relative STrengh Index (RSI) indicator continued to be in bullish territory, though its slope turned flat, as buyers took a respite after a failing attempt to 1.1100. If EUR/USD breaks the YTD high at 1.1095, 1.1100 would be up for grabs. Once conquered, buyers would look to challenge the 2021 cycle low turned resistance at 1.1186, ahead of 1.1200. On the flip side, the EUR/USD could remain sideways and test the 20-day EMA at 1.0955

-

18:42

EUR/USD: Keeping a buy on dip mentality – TDS

Next week, the European Central Bank will have its monetary policy meeting. Analysts at TD Securities see a 25 basis points rate hike but do not rule out a 50 bps. Regarding EUR/USD, they see it breaking above 1.10 in the months ahead.

Key quotes:

“Easing financial system stress, persistent high inflation, strong wage growth, and avoidance of a winter recession are enough for the ECB to comfortably hike rates by 25bps in May with guidance that more tightening is to come. We wouldn't completely rule out a 50bps hike should Tuesday's data surprise significantly.”

“We maintain a buy on dip mentality for EURUSD, expecting a sustained break of 1.10 in the months ahead. The ECB risks skew towards the hawkish end, while other factors in our MRSI overlay framework, like equities, terms of trade, momentum, and inflation remain supportive of EUR outperformance. We continue to see EUR outperforming European peers like NOK, SEK, CHF, and GBP and like scaling back into EURGBP longs towards 0.88.”

-

18:13

United States Baker Hughes US Oil Rig Count remains at 591

-

17:54

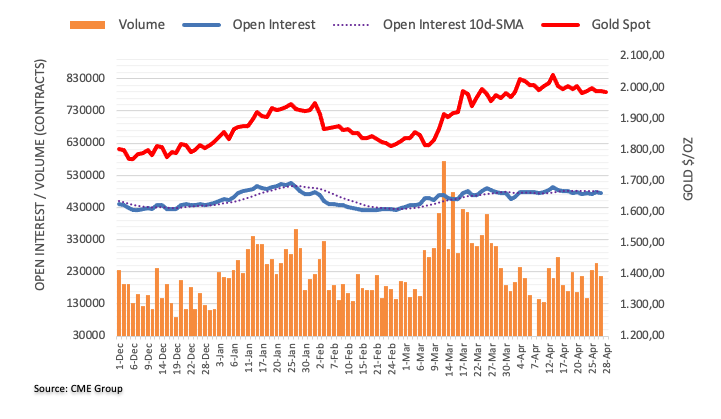

Gold Price Forecast: XAU/USD holds steady around $1990s after data shows persistent inflation

- Gold price makes minor gains as stickier inflation prompts the Federal Reserve to tighten.

- CME FedWatch Tool indicates the odds of a Fed rate hike at 83.1%.

- XAU/USD Price Analysis: To test the YTD high above $2009.75; otherwise, it could challenge the 50-day EMA.

Gold price registers minimal gains, as traders brace for the weekend, gains 0.16%% after data from the United States (US) showed that inflation remains at high levels, justifying the need for further tightening by the US Federal Reserve. After hitting a daily low of 1976.31, the XAU/USD is trading at $1992.93, up 0.28%.

Gold price edged high but was capped within the weekly trading range

US equities continued to climb. A report by the US Department of Commerce showed inflation in the United States had decelerated, with the Personal Consumption Expenditure (PCE) rate slowing from 5.1% to 4.2% in YoY readings. The monthly growth rate increased to 0.1%, below the prior month’s 0.3%. Despite this deceleration, the Fed’s preferred gauge for inflation, the core PCE, remained unchanged at 4.6% YoY, suggesting that inflationary pressures remain stickier than estimates. As a result, investors continued to believe that the Fed would raise rates.

That’s shown by the CME FedWatch Tool, with odds for a 25 bps increase at 83.1, lower than the previous day’s 83.9% chances.

Gold prices remained supported by falling US Treasury bond yields. As of writing, the 2-year Treasury bond yield drops 3.5 bps and yields 4.039%, while the 10-year benchmark note rate sits at 3.443% and collapses 8 bps.

In other data, the University of Michigan (UoM) Consumer Sentiment remained unchanged at 63.5, with inflation expectations for 1-year standing at 4.6% and a 5-year horizon at 3%.

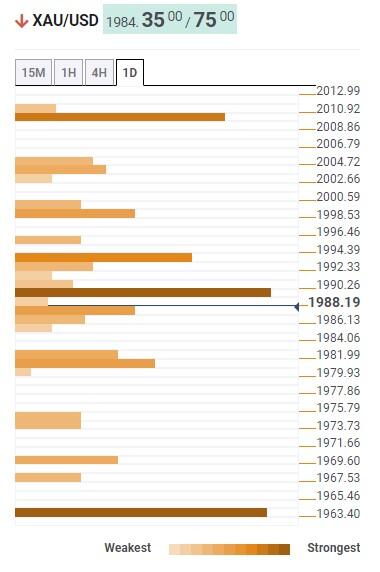

XAU/USD Technical Analysis

During the week, XAU/USD faltered to break below/above the $1970-$2010 range, hovering on each side of the 20-day Exponential Moving Average (EMA) at $1989.35. Although the latter was broken four times weekly, the EMA turned flat, suggesting that sideways trading will continue in the XAU/USD.

If XAU/USD reclaims $2000, further upside is expected, and a challenge to March’s 20 high at $2009.75 in on the cards. A breach of it will expose the YTD high at $2048.79. Conversely, the XAU/USD first support would be $1970. A decisive break will expose the 50-day EMA at $1953.34.

What to watch?

-

16:33

NZD/USD hits three-day high despite US data and Fed hike expectations

- NZD/USD breaks prior's day high and eyes a test of the 20-day EMA at 0.6188.

- The core PCE, the Fed's preferred gauge for inflation, remains stickier, warranting a Fed hike at the May meeting.

- NZD/USD Price Analysis: Downtrend risks negation as NZD/USD eyes 0.6200 with 200-day EMA hovering near 0.6220s.

The NZD/USD extends its uptrend, hitting a three-day high at around 0.6172, as buyers see a break above technical resistance at the 20-day EMA. Although data from the United States (US) further cemented the case for a Federal Reserve (Fed) hike, the New Zealand Dollar (NZD) advances steadily. At the time of writing, the NZD/USD is trading at 0.6182.

NZD/USD breaks prior's day high and targets 0.6188, while Fed's core PCE supports May rate hike

The US Department of Commerce (DoC) revealed that inflation in the United States decelerated, with the Personal Consumption Expenditure (PCE) slowing from 5.1% to 4.2% in YoY readings, while for a monthly basis, edged to 0.1%, below the prior's month 0.3%. Meanwhile, the Fed's preferred gauge for inflation, the core PCE, stood at 4.6% YoY, unchanged compared to the last month's data.

Given the backdrop, investors stood convinced that the Fed would raise rates, as shown by the CME FedWatch Tool. Odds for a 25 bps increase lie at 88.3%, above yesterday's 83.9% chances. Nevertheless, US T-bond yields edged lower, with 2s down 3.5 bps at 4.039%, while 10s dropped 7.5 bps at 3.448%.

Another piece of the puzzle that added to inflationary pressures standing still is the Employment Cost Index (ECI) revealed by the US Department of Labor. The ECI rose from 1.1% in the previous quarter to 1.2% in Q1, 2023.

In other data, the University of Michigan (UoM) Consumer Sentiment remained unchanged at 63.5. Inflation expectations for 1-year stood at 4.6%, and for a 5-year horizon at 3%.

In the meantime, the US Dollar Index (DXY), which measures the performance of six currencies against the American Dollar (USD), has erased some of its earlier gains and remains above its opening price by 0.10%< at 101.583.

On the New Zealand front, the ANZ Roy Morgan Consumer Confidence Index improved to 79.3 in April from 77.7 in March of 2023, though it remained at low levels as people remained concerned about elevated prices

NZD/USD Technical Analysis

From a technical perspective, the NZD/USD is still in a downtrend though it has recovered some ground. The 20-day Exponential Moving Average (EMA) at 0.6187 would be the first resistance that buyers will test as they aim toward 0.6200. Once broke, the latter will be challenged, as the 100-day EMA at 0.6218 would appear in front of the bulls. The downtrend would be at risk at the 200-day EMA at 0.6226. On the flip side, if NZD/USD drops below the April 27 high of 0.6161, further downside is expected.

-

15:00

United States UoM 5-year Consumer Inflation Expectation rose from previous 2.9% to 3% in April

-

15:00

United States Michigan Consumer Sentiment Index in line with expectations (63.5) in April

-

14:53

GBP/USD hits two-week high, looks to build on momentum beyond 1.2500 mark

- GBP/USD turns positive for the third straight day and climbs to a two-week high on Friday.

- The USD trims a part of its intraday gains and turns out to be a key factor lending support.

- Bets for a 25 Fed rate hike in May, the risk-off impulse underpins the buck and cap gains.

The GBP/USD pair attracts fresh buying following an intraday dip to the 1.2445 region and build on its steady intraday ascent through the early North American session. The uptick, marking the third successive day of a positive move, pushes spot prices to a two-week high, around the 1.2515-1.2520 region in the last hour, though lacks bullish conviction.

The US Dollar (USD) retreats from a two-and-half-week-high touched this Friday in reaction to the softer US macro data, which, in turn, is seen lending some support to the GBP/USD pair. In fact, the US Bureau of Economic Analysis reported that the US Personal Consumption Expenditures (PCE) Price Index declined more-than-expected, to 4.2% on a yearly basis in March from 5.1% previous. The Core PCE Price Index (the Fed's preferred inflation gauge), meanwhile, edged lower to 4.6% from 4.7%.

Apart from this, a steep intraday decline in the US Treasury bond yields contributes to keeping a lid on the USD and acts as a tailwind for the GBP/USD pair amid rising bets for another 25 bps rate hike by the Bank of England (BoE) in May. The markets, however, still seem convinced that the Federal Reserve (Fed) will go ahead with a 25 bps lift-off next week. This, along with the prevalent cautious market mood, continues to underpin the safe-haven buck and might cap the upside for the major.

The aforementioned mixed fundamental backdrop makes it prudent to wait for strong follow-through buying before placing fresh bullish bets around the GBP/USD pair and positioning for any further near-term appreciating move. Nevertheless, spot prices remain on track to register gains for the second successive week as the market focus now shifts to the key central bank event risk - the highly-anticipated FOMC policy meeting starting next Tuesday.

Technical levels to watch

-

14:47

United States Chicago Purchasing Managers' Index came in at 48.6, above expectations (43.5) in April

-

14:44

EUR/USD bounces off lows and retakes 1.1000

- EUR/USD meets support near 1.0960 on Friday.

- Disappointing EMU, GDP results weigh on the single currency.

- US headline PCE eased more than expected in April.

After bottoming out in the proximity of 1.0960, EUR/USD manages to regain some composure and now looks to regain the key 1.1000 barrier and beyond at the end of the week.

EUR/USD offered on poor euro docket

A fresh bout of oxygen seems to lift EUR/USD back to the 1.1000 neighbourhood, as the Greenback gives aways some gains and investors continue to digest disappointing results from the EMU and German docket on Friday.

The US dollar, in the meantime, recedes from earlier tops in response to another sign of further disinflation in the US economy following the publication of PCE prints for the month of March.

In the meantime, yields on both sides of the Atlantic fade Thursday’s rebound and refocus on the downside amidst an incipient recovery in the risk complex.

Later in the session, the final prints from the Michigan Consumer Sentiment will close the weekly calendar.

What to look for around EUR

EUR/USD’s upside momentum loses traction on the back of disheartening prints from the euro calendar on Friday.

Meanwhile, price action around the single currency should continue to closely follow dollar dynamics, as well as the incipient Fed-ECB divergence when it comes to the banks’ intentions regarding the potential next moves in interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Euro group Meeting, Germany labour market report/ Advanced Inflation Rate/Flash Q1 GDP Growth Rate, EMU Flash Q1 GDP Growth Rate (Friday).

Eminent issues on the back boiler: Continuation (or not) of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.28% at 1.0997 and faces the next support at 1.0909 (weekly low April 17) seconded by 1.0831 (monthly low April 10) and finally 1.0788 (monthly low April 3). On the flip side, the surpass of 1.1075 (2023 high April 14) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022).

-

14:28

USD/CAD eases from one-month high, still well bid around 1.3640 area amid stronger USD

- USD/CAD catches fresh bids and climbs to a one-month high amid broad-based USD strength.

- The softer US PCE Price Index fails to impress the USD bulls or provide any meaningful impetus.

- An intraday bounce in Oil prices underpins the Loonie and contributes to cap gains for the pair.

The USD/CAD pair regains positive traction following the previous day's downfall and climbs to a fresh one-month top, around the 1.3665-1.3670 area during the early North American session on Friday. Spot prices, however, trim a part of the intraday gains and retreat below mid-1.3600s in reaction to the mixed US macro data.

In fact, the US Bureau of Economic Analysis reported that the Personal Consumption Expenditures (PCE) Price Index declined more-than-expected, to the 4.2% YoY rate in March from 5.1% previous. The Core PCE Price Index (the Fed's preferred inflation gauge), meanwhile, edged lower to 4.6% from 4.7% as compared to consensus estimates for a fall to 4.5%. In the absence of any big surprises, the US Dollar (USD) fades an intraday bullish spike to a two-and-half-week high amid a steep decline in the US Treasury bond yields and turns out to be a key factor acting as a headwind for the USD/CAD pair.

Apart from this, a modest intraday rebound in Crude Oil prices underpins the commodity-linked Loonie and further contributes to capping gains for the USD/CAD pair, at least for the time being. The Canadian Dollar (CAD), however, struggles to gain any meaningful traction in the wake of the softer domestic GDP report, which showed that the economy grew by 0.1% in February as compared to the 0.6% increase reported in the previous month. This, in turn, suggests that the path of least resistance for spot prices is to the upside and any corrective pullback is more likely to get bought into.

Technical levels to watch

-

14:06

Chile Industrial Production (YoY) declined to -5.9% in March from previous -1.1%

-

13:59

Canada: Real GDP expands by 0.1% in February vs. 0.2% expected

- Canadian economy grew at a softer pace than expected in February.

- USD/CAD clings to daily gains near 1.3650 after the data.

The real Gross Domestic Product (GDP) of Canada grew by 0.1% on a monthly basis in February, Statistics Canada reported on Friday. This reading followed January's expansion of 0.6%and came in weaker than the market expectation for a growth of 0.2%.

"Advance information indicates that real GDP edged down 0.1% in March," Statistics Canada further noted in its press relese. "Decreases in retail and wholesale trade sectors, as well as in the mining and quarrying (except oil and gas) subsector were partially offset by increases in the public sector, in professional, scientific and technical services, and in administrative and support, waste management and remediation services."

Market reaction

USD/CAD showed no immediate reaction to this data and was last seen rising 0.35% on the dayat 1.3640.

-

13:50

US: Employment Cost Index rises by 1.2% in Q1 vs. 1.1% expected

- US Employment Cost Index rose more than expected in Q1.

- US Dollar Index clings to strong daily gains above 102.00.

The data published by the US Bureau of Labor Statistics revealed on Friday that the Employment Cost Index, compensation costs for civilian workers, increased by 1.2% in the first quarter.

This reading followed the 1% growth recorded in the previous quarter and came higher than the market expectation of 1%.

Market reaction

The US Dollar Index, which tracks the US Dollar's performance against a basket of six major currencies, preserves its bullish momentum after this data and was last seen rising 0.6% on the day at 102.10.

-

13:49

USD/JPY sticks to BoJ-inspired strong gains, trades above 136.00 post-US PCE Price Index

- USD/JPY rallies over 300 pips intraday and spikes to its highest level since March 10.

- The BoJ’s dovish stance weighs heavily on the JPY and prompts aggressive buying.

- Bets for another 25 bps lift-off in May underpin the USD and contribute to the rise.

- The US Core PCE Price Index fails to provide any meaningful impetus to the major.

The USD/JPY pair builds on its strong intraday rally and climbs to its highest level since March 10, around the 136.40 region during the early North American session. Spot prices, however, retreat a few pips following the release of the US macro data and trade around the 136.00 mark, still up over 1.5% for the day.

The Japanese Yen (JPY) turns out to be the worst-performing G10 currency on Friday in reaction to the Bank of Japan's (BoJ) decision to leave its ultra-loose monetary policy settings unchanged. The Japanese central bank also made no tweaks to its yield curve control (YCC) by a unanimous vote, while the BoJ Governor sounded dovish during the post-meeting press conference. This, along with resurgent US Dollar (USD) demand, provides a goodish lift to the USD/JPY pair and further contributes to the intraday rally of over 300 pips.

In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, touches a two-and-half-week high amid firming expectations for another 25 bps lift-off at the next FOMC meeting in May. The USD, however, eases a bit after the US Bureau of Economic Analysis reported that the US Personal Consumption Expenditures (PCE) Price Index declined more than expected, to 4.2% on a yearly basis in March from 5.1% previously. The Core PCE Price Index (the Fed's preferred inflation gauge), meanwhile, edged lower to 4.6% from 4.7%.

This, along with a sharp intraday declining in the US Treasury bond yields, keeps a lid on any further gains for the Greenback. Apart from this, the risk-off impulse - as depicted by a generally weaker tone around the equity markets - lends some support to the safe-haven JPY and acts as a headwind for the USD/JPY pair amid slightly overbought oscillators on hourly charts. Nevertheless, spot prices remain on track to register strong gains for the third successive week, also marking the fifth week of a positive move in the previous six.

Technical levels to watch

-

13:42

Germany: Annual HICP inflation declines to 7.6% in April vs. 7.8% expected

- Inflation in Germany came in lower than expected in April.

- EUR/USD stays under bearish pressure below 1.1000 on Friday.

Inflation in Germany, as measured by the Consumer Price Index (CPI), declined to 7.2% on a yearly basis in April from 7.4% in March. This reading came in below the market expectation of 7.3%. On a monthly basis, the CPI was up 0.4%, down from +0.8 in March.

The annual Harmonised Index of Consumer Prices (HICP), the European Central Bank's (ECB) preferred gauge of inflation, fell to 7.6% from 7.8% in the same period, compared to analysts' estimate of 7.8%.

Market reaction

EUR/USD continues to trade in negative territory below 1.1000 after German inflation data.

-

13:33

Breaking: US annual Core PCE inflation declines to 4.6% in March vs. 4.5% expected

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, declined to 4.2% on a yearly basis in March from 5.1% in February, the US Bureau of Economic Analysis reported on Friday. This reading came in lower than the market expectation of 4.6%.

The annual Core PCE Price Index, the Federal Reserve's preferred gauge of inflation, edged lower to 4.6% from 4.7% in the same period, compared to analysts' forecast of 4.5%. On a monthly basis, Core PCE inflation and PCE inflation rose 0.3% and 0.1%, respectively.

Further details of the report showed that Personal Spending remained unchanged in March while Personal Income increased by 0.3%.

Market reaction

The US Dollar continues to outperform its rivals after this data and the US Dollar Index was last seen rising 0.55% on the day at 102.05.

-

13:32

United States Personal Spending came in at 0%, above expectations (-0.1%) in March

-

13:32

United States Personal Income (MoM) came in at 0.3%, above forecasts (0.2%) in March

-

13:32

United States Personal Consumption Expenditures - Price Index (YoY) below forecasts (4.6%) in March: Actual (4.2%)

-

13:32

United States Personal Consumption Expenditures - Price Index (MoM) came in at 0.1% below forecasts (0.3%) in March

-

13:31

United States Core Personal Consumption Expenditures - Price Index (YoY) above expectations (4.5%) in March: Actual (4.6%)

-

13:31

United States Core Personal Consumption Expenditures - Price Index (MoM) meets forecasts (0.3%) in March

-

13:31

Canada Gross Domestic Product (MoM) came in at 0.1% below forecasts (0.2%) in February

-

13:30

United States Employment Cost Index above forecasts (1.1%) in 1Q: Actual (1.2%)

-

13:00

Germany Harmonized Index of Consumer Prices (YoY) came in at 7.6%, below expectations (7.8%) in April

-

13:00

Brazil Unemployment Rate came in at 8.8% below forecasts (9%) in March

-

13:00

Germany Consumer Price Index (YoY) registered at 7.2%, below expectations (7.3%) in April

-

13:00

Germany Harmonized Index of Consumer Prices (MoM) came in at 0.6%, below expectations (0.8%) in April

-

13:00

Germany Consumer Price Index (MoM) came in at 0.4%, below expectations (0.6%) in April

-

13:00

India Infrastructure Output (YoY) below expectations (4.6%) in March: Actual (3.6%)

-

12:33

India FX Reserves, USD declined to $584.25B in April 21 from previous $586.41B

-

12:33

Brazil Nominal Budget Balance came in at -79.499B, below expectations (-37.164B) in March

-

12:33

Brazil Primary Budget Surplus came in at -14.182B, below expectations (-9.028B) in March

-

12:30

USD Index Price Analysis: Downside alleviated above 103.15/20

- DXY extends the bounce and reclaims the 102.00 mark and above.

- Next on the upside appears the 103.15/20 band.

DXY adds to Thursday’s gains and surpasses the key barrier at 102.00 the figure at the end of the week.

In the meantime, the index remains broadly side-lined and with a downwards bias. That said, further upside should clear the 103.15/20 band, where the interim 55- and 100-day SMAs coincide to see the bearish perspective somewhat mitigated.

Looking at the broader picture, while below the 200-day SMA, today at 106.07, the outlook for the index is expected to remain negative.

DXY daily chart

-

12:18

EUR/JPY Price Analysis: I can see 150.00 just there

- EUR/JPY climbs sharply to 2023 past 149.00.

- Further upside could visit the 150.00 region in the near term.

EUR/JPY rallies north of the 149.00 hurdle for the first time since early December 2014.

The underlying strong upside momentum in the cross appears unchallenged for the time being. Against that, the continuation of the upward bias should challenge the key 150.00 barrier in the relatively short term.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 142.43.

EUR/JPY daily chart

-

12:12

When is the US March PCE Price Index and how could it affect EUR/USD?

US PCE Price Index Overview

Friday's US economic docket highlights the release of the Personal Consumption Expenditure (PCE) Price Index, scheduled later during the early North American session at 12:30 GMT. The gauge is anticipated to have risen by 0.3% in March, matching the previous month's reading. The yearly rate, meanwhile, is expected to have eased to 4.6% from 5% in February. Moreover, the Core PCE Price Index - the Fed's preferred inflation measure - likely edged lower to a 4.6% YoY rate and rose 0.3% in March.

Analysts at TD Securities (TDS) offer a brief preview of the report and write: “We expect core PCE inflation to have risen at a still firm 0.3% m/m pace in March (in line with consensus and also matching Feb's advance). While below the core CPI's 0.4% m/m gain, the increase will keep the 3m AR pace high at around 4.7%. The y/y rate likely remained unchanged at 4.6%, suggesting the path to normalization in price gains will probably take longer than expected. Conversely, personal spending is expected to be muted (TD: 0.0% m/m, consensus: -0.1%), which would confirm the loss of momentum from consumer outlays toward the end of the quarter. The details of the spending part of the report will be very important, particularly the breakdown between goods and services.”

How Could It Affect EUR/USD?

Ahead of the key macro data, the US Dollar (USD) climbs to a fresh weekly high and drags the EUR/USD pair further below the 1.1000 psychological mark. A surprisingly stronger report will further point to persistent inflationary pressure and reaffirm market bets for another 25 bps lift-off at the next FOMC policy meeting in May. This, in turn, should provide a goodish boost to the Greenback and set the stage for an extension of the pair's retracement slide from a 13-month high touched earlier this week.

Conversely, weaker PCE data will fuel fresh speculations that the US central bank will pause the rate-hiking cycle after May. This might prompt aggressive USD selling and allow the EUR/USD pair to resume its recent well-established uptrend witnessed since mid-March. Nevertheless, the data should infuse volatility in the markets and allow traders to grab short-term opportunities on the last day of the week.

Eren Sengezer, Editor at FXStreet, offers a brief technical outlook and outlines important technical levels to trade the EUR/USD pair: “The 100-period Simple Moving Average and the Fibonacci 23.6% retracement of the latest uptrend form strong support area at 1.0950/1.0970. In case the pair falls below that area and starts using it as resistance, it could extend its downward correction toward 1.0900/1.0880 (psychological level, 200-period SMA).”

“On the upside, sellers could turn hesitant if EUR/USD reclaims 1.1000 (psychological level, static level, 50-period SMA) and stabilizes there. In that case, 1.1050 (static level) and 1.1070 (end-point of the latest uptrend) could be seen as next resistance levels,” Eren adds further.

Key Notes

• US Core PCE Preview: Why this is a lose-lose situation for the US Dollar

• EUR/USD Forecast: Euro trades dangerously close to key support area

• EUR/USD breaks below 1.1000 to print 2-day lows, focus remains on key data

About the US PCE Price Index

The Personal Spending released by the Bureau of Economic Analysis, Department of Commerce is an indicator that measures the total expenditure by individuals. The level of spending can be used as an indicator of consumer optimism. It is also considered as a measure of economic growth: While Personal spending stimulates inflationary pressures, it could lead to raise interest rates. A high reading is positive (or Bullish) for the USD.

-

12:07

USD/CNH: There is a major hurdle at 6.9650 – UOB

Extra gains in USD/CNH should meet a tough barrier at 6.9650 in the short-term horizon, argue Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “Our expectations for USD to rise above 6.9510 did not materialize as it traded sideways in a range of 6.9216/6.9469. The price actions are likely part of a consolidation and today, we expect USD to trade between 6.9150 and 6.9450.”

Next 1-3 weeks: “Our latest narrative from two days ago (26 Apr, spot at 6.9370) still stands. As highlighted, upward momentum in USD has improved further but the major resistance at 6.9650 might not come into view soon. Overall, USD is expected to stay underpinned in the coming days as long as it stays above 6.8950 (no change in ‘strong support’ level).”

-

11:39

Gold Price Forecast: XAU/USD trades with modest losses ahead of US PCE Price Index

- Gold price remains on the defensive for the third straight day amid a stronger US Dollar.

- Reviving safe-haven demand lends some support to the XAU/USD and helps limit losses.

- Traders also seem reluctant and move to the sidelines ahead of the US PCE Price Index.

Gold price edges lower for the third successive day on Friday, albeit lacks follow-through selling and remains confined in a familiar trading range held over the past two weeks or so. The XAU/USD is currently placed just above the $1,980 level and is influenced by a combination of diverging forces.

Resurgent US Dollar demand weighs on Gold price

The US Dollar (USD) regains strong positive traction and touches a fresh weekly high amid firming expectations for another 25 basis points (bps) lift-off at the next Federal Open Market Committee (FOMC) policy meeting in May. In fact, the USD Index, which tracks the Greenback against a basket of currencies, touches a fresh weekly high and exerts some downward pressure on the US Dollar-denominated Gold price. The prospects for further policy tightening by the Federal Reserve (Fed) were reaffirmed by the latest macro data released on Thursday from the United States (US), which indicated persistent price pressures and that the labor market remains healthy.

The US Bureau of Economic Analysis reported that growth in the world's largest economy slowed from 2.6% annualized pace to 1.1% during the first quarter of 2023, missing estimates for a reading of 2.0%. The disappointment, however, was offset by the GDP Price Index, which edged higher to 4% from 3.9%. Moreover, the Personal Consumption Expenditures (PCE) Prices rose from 3.7% to 4.2% during the January-March period, while the Core PCE climbed 4.9%, higher than the 4.7% estimated. Adding to this, data published by the US Department of Labor (DOL) showed that Initial Jobless claims fell to 230K in the week ended April 22 - the lowest in three weeks.

Softer risk tone and sliding US bond yields limit losses for Gold price

That said, a combination of factors lends some support to the Gold price and helps limit the downside, at least for the time being. Worries about economic headwinds stemming from rising borrowing costs temper investors' appetite for riskier assets, which is evident from a generally softer tone around the equity markets. The anti-risk flow triggers a sharp decline in the US Treasury bond yields and turns out to be a key factor acting as a tailwind for the safe-haven Gold price. Traders also seem reluctant to place aggressive directional bets and wait on the sidelines ahead of Friday's release of the US Core PCE Price Index - the Fed's preferred inflation gauge.

Traders keenly await the release of the US Core PCE Price Index

Given that the markets have been pricing in an imminent pause in the Fed's rate-hiking cycle after May, a stronger PCE Price Index report might prompt aggressive short-covering around the USD. Gold price, however, could benefit from its status as a hedge against rising inflation. Conversely, any disappointment will be enough to weigh heavily on the buck and provide a fresh boost to the XAU/USD. This, in turn, suggests that the path of least resistance for the commodity is to the downside and any subsequent slide could get bought into.

Gold price technical outlook

From a technical perspective, any subsequent slide is likely to find some support near last week's swing low, just below the $1,970 level. Some follow-through selling will be seen as a fresh trigger for bearish traders and make the Gold price vulnerable to test the next relevant support near the $1,956-$1,955 area. The XAU/USD could eventually drop to the monthly low around the $1,950 region.

On the flip side, the intraday positive move now seems to confront some resistance near the $2,000 psychological mark ahead of the $2,010 supply zone and the $2,020 horizontal barrier. A sustained strength beyond the latter will be seen as a fresh trigger for bulls and lift the Gold price move towards the $2,040 area. Bulls might eventually aim to challenge the YTD peak, around the $2,047-$2,049 region touched earlier this month.

Key levels to watch

-

11:31

Russia Interest rate decision meets forecasts (7.5%)

-

11:02

Ireland Retail Sales (YoY) increased to 8.6% in March from previous 3.6%

-

11:02

Ireland Retail Sales (MoM): 2% (March) vs 0.7%

-

11:01

Italy Industrial Sales n.s.a. (YoY) below expectations (14.3%) in February: Actual (7.2%)

-

11:01

US Dollar rallies, Argentina to pay for Chinese imports in Yuan

- US Dollar gathers bullish momentum on Friday as markets assess the latest US data.

- USD is up more than 1% against the Japanese Yen following the Bank of Japan’s policy meeting.

- PCE inflation and Employment Cost Index data from United States could drive USD valuation ahead of the weekend.

The US Dollar (USD) has gathered strength in the second half of the week and the US Dollar Index climbed above 102.00 for the first time in a week on Friday. The risk-averse market atmosphere helps the USD find demand as a safe haven while hawkish Federal Reserve (Fed) bets provide an additional boost to the currency.

Ahead of the weekend, the US Bureau of Economic Analysis (BEA) will release the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation, for March. Employment Cost Index data for the first quarter will also be watched closely by market participants.

Daily digest market movers: US Dollar rallies despite disappointing Q1 GDP reading

- The BEA reported on Thursday that the real Gross Domestic Product (GDP) expanded at an annual rate of 1.1% in the first quarter, compared to the market expectation for a 2% growth.

- Despite the weak GDP print, the stronger-than-expected increase in the inflation component of the GDP, which could allow the Fed to delay a policy pivot, helped the USD outperform its rivals.

- Moreover, the 2.26 percentage point negative contribution of the change in private inventories to the GDP seems to be making the growth reading look worse than it actually is, since inventories tend to fluctuate.

- Commenting on the GDP report, "the US economy grew 1.1% in the first quarter of 2023, slower than in the previous quarter (2.6%). However, the main drag came from significantly lower inventory accumulation, while private consumption remained strong. We still expect the economy to contract slightly in the second half of the year due to the Fed's hefty rate hikes," Commerzbank analysts said.

- According to the CME Group FedWatch Tool, the probability of the Fed cutting its policy rate by 25 basis points in September currently holds at around 40%, down from 60% last week.

- Argentina announced that they will start paying for Chinese imports in Yuan rather than USD in an attempt to limit the USD outflows. Argentina will reportedly pay $1 billion of Chinese imports in Yuan in April and will be paying around $790 million worth of imports in Yuan monthly thereafter.

- The Bank of Japan (BoJ) left its policy settings unchanged following the April policy meeting. The BoJ left the 10-year Japanese Government Bond (JGB) yield target unchanged at about 0% while maintaining the policy balance rate at -0.1% without altering YCC band.

- In an unexpected move, the BoJ removed its forward guidance, suggesting that it will be more data-dependent moving forward. In turn, USD/JPY gathered bullish momentum and climbed to its highest level in seven weeks near 136.00.

- Previewing the upcoming PCE inflation report, “the ‘tortoise’ of inflation reports tends to provide little surprises, but it still moves markets, even if it is not the ‘hare.’ There are good reasons to expect the US Dollar to fall and equities to rise in response to the data,” said FXStreet Analyst Yohay Elam.

Technical analysis: US Dollar Index techs point to a bullish tilt

The US Dollar Index (DXY) climbed above the 20-day Simple Moving Average (SMA), which is currently located near 101.80, for the first time in 10 days on Friday. Additionally, the Relative Strength Index (RSI) indicator on the daily chart rose to 50, reflecting the lack of seller interest.

In case the DXY manages to end the week above 101.80, it could stage an extended recovery toward 102.60 (static level) and 103.00 (50-day SMA, 100-day SMA).

If sellers defend 101.80 and don’t allow the index to hold above that level, additional losses toward 101.00/100.80 (psychological level, static level, multi-month low set on April 14) and 100.00 (psychological level) could be witnessed.

How does Fed’s policy impact US Dollar?

The US Federal Reserve (Fed) has two mandates: maximum employment and price stability. The Fed uses interest rates as the primary tool to reach its goals but has to find the right balance. If the Fed is concerned about inflation, it tightens its policy by raising the interest rate to increase the cost of borrowing and encourage saving. In that scenario, the US Dollar (USD) is likely to gain value due to decreasing money supply. On the other hand, the Fed could decide to loosen its policy via rate cuts if it’s concerned about a rising unemployment rate due to a slowdown in economic activity. Lower interest rates are likely to lead to a growth in investment and allow companies to hire more people. In that case, the USD is expected to lose value.

The Fed also uses quantitative tightening (QT) or quantitative easing (QE) to adjust the size of its balance sheet and steer the economy in the desired direction. QE refers to the Fed buying assets, such as government bonds, in the open market to spur growth and QT is exactly the opposite. QE is widely seen as a USD-negative central bank policy action and vice versa.

-

11:01

Portugal Consumer Price Index (MoM) declined to 0.6% in April from previous 1.7%

-

11:01

Italy Industrial Sales s.a. (MoM) came in at 1.3%, above forecasts (0%) in February

-

11:01

Portugal Consumer Price Index (YoY) fell from previous 7.4% to 5.7% in April

-

10:40

AUD/USD drops to its lowest level since March 10, further below 0.6600 ahead of US PCE

- AUD/USD comes under heavy selling pressure on Friday and drops back closer to the YTD low.

- A combination of factors lifts the USD to a fresh weekly high and exerts pressure on the major.

- Investors now look forward to the US Core PCE Price Index for some meaningful opportunities.

The AUD/USD pair attracts fresh selling near the 0.6640-0.6645 area on Friday and extends its intraday descent through the first half of the European session. The downward trajectory drags spot prices to the 0.6580-0.6575 region, or the lowest level since March 10, and is sponsored by resurgent US Dollar (USD) demand.

In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, climbs to a fresh weekly top and draws support from firming expectations for another 25 bps lift-off at the next FOMC meeting in May. The bets for additional rate hikes by the US central bank were reaffirmed by the US macro data released on Thursday, which indicated persistent inflationary pressures and that the US job market remains healthy despite an economic slowdown.

Moreover, the Bank of Japan (BoJ)-inspired sell-off in the Japanese Yen (JPY), along with a generally weaker tone surrounding the equity markets, further benefit the safe-haven buck and drive flows away from the risk-sensitive Aussie. Apart from this,

technical selling below the 0.6600 round-figure mark aggravates the bearish pressure and contributes to the AUD/USD pair's steep intraday decline. Spot prices now move back closer to the YTD low touched in March.Investors now look forward to the release of the US Core PCE Price Index - the Fed's preferred inflation gauge - due later during the early North American session. Given that the markets have been pricing in a pause in the Fed's rate-hiking cycle after May, a stronger reading might prompt aggressive short-covering around the USD and pave the way for a further depreciating move for the AUD/USD pair. Nevertheless, spot prices remain on track to register heavy weekly losses.

Technical levels to watch

-

10:08

ECB Preview: The art of compromise – Danske

Analysts at Danske Bank provide a sneak peek at what to expect from next Thursday’s European Central Bank (ECB) monetary policy announcements.

Key quotes

“Next week, the ECB will meet to deliver another rate hike in its hiking cycle that started in July last year.”

“This time, the question is whether it will slow the hiking pace to 25bp or continue to hike once more by 50bp.”

“We believe it will be a 50bp compromise deal with no specific forward guidance (nor guidance on balance sheet normalization in H2 yet), but repeating a data-dependent approach to future policy decisions.”

“Economic developments since the ECB meeting, coinciding with the banking turmoil, have shown resilient economic activity and another record-high core inflation print.”

“Headline inflation has declined on the back of base effects, but the stickiness of core inflation and wages should pave the way for another 50bp rate hike, in our view.”

-

10:01

Eurozone Preliminary GDP expands by 0.1% QoQ in Q1 vs. 0.2% expected

The preliminary release published by Eurostat revealed on Friday that the Eurozone economy expanded by 0.1% on a quarterly basis in the three months to March of 2023, missing the 0.2% expected and against the no growth seen in the previous quarter.

The bloc’s annual GDP rate grew by 1.3% in the first quarter (Q1) vs. a 1.8% print registered in the final quarter of 2022 while falling short of the 1.4% expectations.

Market reaction

EUR/USD was last seen trading at 1.0985, down 0.37% on the day. The Euro is consolidating the decline, triggered by the downbeat German GDP data and broad-based US Dollar rebound.

About Eurozone Preliminary GDP

The Gross Domestic Product released by Eurostat is a measure of the total value of all goods and services produced by the Eurozone. The GDP is considered as a broad measure of the Eurozone's economic activity and health. Usually, a rising trend has a positive effect on the EUR, while a falling trend is seen as negative (or bearish).

-

10:00

European Monetary Union Gross Domestic Product s.a. (QoQ) registered at 0.1%, below expectations (0.2%) in 1Q

-

10:00

European Monetary Union Gross Domestic Product s.a. (YoY) below expectations (1.4%) in 1Q: Actual (1.3%)

-

10:00

Greece Producer Price Index (YoY) down to -10.9% in March from previous 4.7%

-

10:00

Greece Retail Sales (YoY) rose from previous 1.4% to 2.4% in February

-

09:55

EUR/GBP flirts with 100-day SMA, just above 0.8800 mark ahead of German CPI

- EUR/GBP drifts lower for the second successive day, though lacks follow-through selling.

- The softer German GDP report weighs on the Euro and exerts some pressure on the cross.

- Investors now look to the German consumer inflation figures for some meaningful impetus.

The EUR/GBP cross attracts some sellers following an early uptick to the 0.8835-0.8840 region on Friday and turns lower for the second successive day. Spot prices drop to a fresh weekly low during the early part of the European session, with bears flirting with the 100-day Simple Moving Average (SMA) support around the 0.8800 mark.

The shared currency's relative underperformance could be attributed to the disappointing release of the preliminary German GDP report, which turns out to be a key factor weighing on the EUR/GBP cross. In fact, Germany's Destatis reported this Friday that growth in the Eurozone's largest economy stagnated during the first three months of 2023. Moreover, the annualized GDP showed an unexpected contraction of 0.1%, down sharply from the 0.9% rise recorded in the final quarter of 2022. This, along with a goodish pickup in the US Dollar (USD) demand, exerts additional downward pressure on the Euro.

The British Pound, on the other hand, draws support from growing acceptance that the Bank of England (BoE) will hike interest rates by 25 bps in May. This further contributes to the offered tone surrounding the EUR/GBP cross, though the prospects for more rate hikes by the European Central Bank (ECB) should help limit further losses, at least for the time being. It is worth recalling that the ECB chief economist Philip Lane said on Tuesday that the central bank will need to raise interest rates again in May and leaving interest rates at current levels will be inappropriate despite falling inflation.

This, in turn, makes it prudent to wait for some follow-through selling and sustained weakness below the 100-day SMA before positioning for any further depreciating move. Traders might also prefer to move to the sidelines and wait for the release of the flash German consumer inflation figures. Nevertheless, the EUR/GBP cross remains on track to register modest losses for the second successive week as market participants start repositioning for the highly-anticipated ECB monetary policy meeting next Thursday.

Technical levels to watch

-

09:51

USD/JPY faces extra range bound near term – UOB

USD/JPY is still seen trading within the 132.85-134.70 range in the short-term horizon, comment Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “We expected USD to consolidate in a range of 133.00/134.00 yesterday. However, USD dropped briefly to 133.20, rebounded to 134.19 before closing at 133.94. The price actions still appear to be consolidative and today, we expect USD to trade in a range of 133.30//134.30.”

Next 1-3 weeks: “There is not much to add to our update from Wednesday (26 Apr, spot at 133.60). As highlighted, USD appeared to have entered a consolidation phase and for the time being, it is likely to trade in a range of 132.85/134.70.”

-

09:44

US GDP growth slowed in Q1 but details stronger – RBC

Analysts at RBC Economics offer their afterthoughts on the preliminary estimate of the US Gross Domestic Product (GDP) data released for the first quarter on Thursday.

Key quotes

“US GDP growth slowed to 1.1% (annualized) in Q1 2023, following a larger 2.6% increase in Q4 2022. Details reflected strong consumer fundamentals, with offset from weaker inventory investment.

“Consumer spending rose 3.7% in Q1 supported by a surge in vehicle sales (+45.3%). Service spending also maintained momentum, rising by 2.3%.”

“Business fixed investment ticked slightly higher in Q1 (+0.7%), and solid domestic demand led to stronger imports though exports also rose.”

“The strong fundamentals in Q1 GDP should cement a 25 bp hike from the Federal Reserve next week. However, there are signs that growth momentum began to taper off later in Q1.”

“Higher rates should continue to slow household demand for goods and services in the quarters ahead, moderating growth in prices along the way.“

-

09:39

RBA preview: An extended pause – TDS

In the view of analysts at TD Securities (TDS), the Reserve Bank of Australia (RBA) is likely to bring a halt to its tightening cycle when it meets to decide on its monetary policy next Tuesday.

Key quotes

“The RBA hit the pause button last month, and we expect it to leave the cash rate target unchanged again as the Bank would prefer more time to assess the effects of the rapid rate hikes to date.“

“The continued moderation in monthly CPI prints and lower Q1 trimmed mean (RBA's core inflation measure) give room for the Bank to head for an extended pause.”

“Curve has repriced the RBA and dragged the AUD along with it. But, risks around equity sentiment and US-centric events leave AUD vulnerable still, particularly against crosses where monetary policy is still at play (like EURAUD and AUDNZD).”

“RBA OIS strip points to another on-hold decision, with only 2bps priced for the May meeting. Upside risks to inflation may pressure the Bank to hike in the months ahead, and we like Aus bond flatteners vs US steepeners.”

-

09:33

EUR/USD breaks below 1.1000 to print 2-day lows, focus remains on key data

- EUR/USD loses the grip and breaches the key 1.1000 mark.

- Germany GDP figures surprised to the downside in Q1.

- Germany flash CPI, US PCE next of note in the calendar.

Sellers remain in control of the sentiment surrounding the European currency and drag EUR/USD back below the 1.1000 mark at the end of the week.

EUR/USD loses momentum on weak German GDP

EUR/USD accelerates losses and breaks below the psychological 1.1000 support on Friday in response to discouraging figures from the advanced GDP Growth Rate in Germany during the January-March period.

On the latter, the German economy is expected to contract 0.1% YoY in Q1 and remain flat vs. the previous quarter. Adding to these poor results, the jobs report did not help either after the Unemployment Change rose more than estimated by 24K people amidst a steady jobless rate at 5.6%.

Later in the session, advanced inflation figures in Germany and the preliminary GDP Growth Rate in the broader Euroland will also take centre stage.

In the US, inflation figures measured by the PCE will be in the centre of the debate along with Personal Income, Personal Spending, Employment Cost and the final reading of April’s Michigan Consumer Sentiment.

What to look for around EUR

EUR/USD’s upside momentum loses further traction on the back of disheartening prints from the German calendar on Friday.

Meanwhile, price action around the single currency should continue to closely follow dollar dynamics, as well as the incipient Fed-ECB divergence when it comes to the banks’ intentions regarding the potential next moves in interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Euro group Meeting, Germany labour market report/ Advanced Inflation Rate/Flash Q1 GDP Growth Rate, EMU Flash Q1 GDP Growth Rate (Friday).

Eminent issues on the back boiler: Continuation (or not) of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.41% at 1.0981 and faces the next support at 1.0909 (weekly low April 17) seconded by 1.0831 (monthly low April 10) and finally 1.0788 (monthly low April 3). On the flip side, the surpass of 1.1075 (2023 high April 14) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022).

-

09:31

Portugal Gross Domestic Product (QoQ) rose from previous 0.3% to 1.6% in 1Q

-

09:31

Portugal Gross Domestic Product (YoY) dipped from previous 3.2% to 2.5% in 1Q

-

09:16

NZD/USD remains depressed below mid-0.6100s amid stronger USD, ahead of US PCE Price Index

- NZD/USD edges lower on Friday and remains well within the striking distance of the monthly low.

- A combination of factors lifts the USD to a fresh weekly high and exerts some pressure on the pair.

- The downside remains cushioned as traders move to the sidelines ahead of the US PCE Price Index.

The NZD/USD pair attracts some intraday sellers near the 0.6160 area on Friday and remains on the defensive through the early part of the European session. The pair remains well within the striking distance of its lowest level since March 10 touched earlier this week and is pressured by resurgent US Dollar (USD) demand.

In fact, the USD Index, which tracks the Greenback against a basket of currencies, touches a fresh weekly high and continues to draw support from firming expectations for another 25 bps lift-off at the next FOMC meeting in May. The bets for additional rate hikes by the US central bank were reaffirmed by the US macro data released on Thursday, which indicated persistent inflationary pressures and that the US job market remains healthy despite an economic slowdown.

The Greenback gets an additional boost from the Bank of Japan (BoJ)-inspired sell-off in the Japanese Yen (JPY). Apart from this, a softer risk tone further benefits the safe-haven buck and acts as a headwind for the risk-sensitive Kiwi. The markets, however, have been pricing in a pause in the Fed's rate-hiking cycle after May. This, in turn, is holding back the USD bulls from placing aggressive bets and lending some support to the NZD/USD pair, at least for the time being.

Traders also seem reluctant and remain on the sidelines ahead of Friday's release of the US Core PCE Price Index - the Fed's preferred inflation gauge. The crucial US macro data will play a key role in influencing the near-term USD price dynamics and provide some meaningful impetus to the NZD/USD on the last day of the week. Apart from this, traders will further take cues from the broader risk sentiment to grab short-term opportunities heading into the weekend.

Technical levels to watch

-

09:15

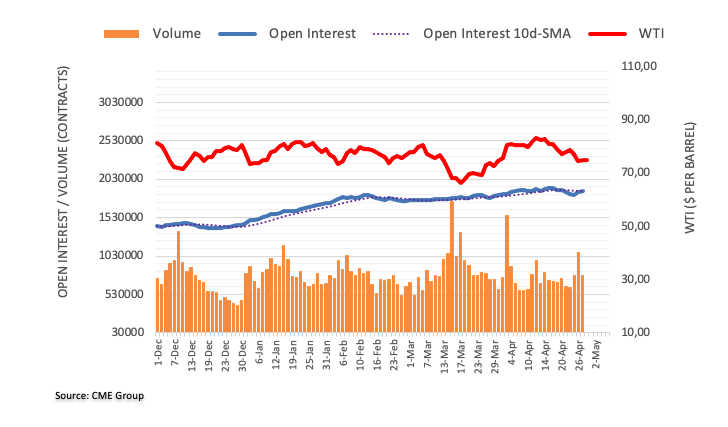

Crude Oil Futures: Room for further upside near term

CME Group’s flash data for crude oil futures markets note traders added nearly 20K contracts to their open interest positions on Thursday, adding to the previous daily build. On the other hand, volume reversed two daily builds in a row and shrank by almost 300K contracts.

WTI: Interim hurdle comes at the 55-day SMA

Thursday’s uptick in prices of the WTI came on the back of increasing open interest, which leaves the door open to extra gains in the very near term. That said, there is a provisional hurdle at the 55-day SMA just above the $76.00 mark per barrel so far.

-

09:10

Turkey Foreign Arrivals fell from previous 21.35% to 12.32% in March

-

09:06

Euro coils in a triangle in the 1.10s ahead of Eurozone GDP data, policy decisions

- Euro vs US Dollar traces out a triangle in the 1.10s amidst uncertainty as to the outlook for interest rates.

- Eurozone GDP and German HICP data could provide an early indication of what the ECB will do at next week’s meeting.

- The trend remains bullish with the 200-day SMA at circa 1.1190 as the next target.

The Euro (EUR) continues trading in the mid 1.10s against the US Dollar (USD) during the early European session, on Friday. The pair coils in a triangle as traders wait for important meetings held by the US Federal Reserve (Fed) and the European Central Bank (ECB) next week, at which rate-setters will decide the future path of interest rates. Given higher interest rates increase demand for currencies, the rate differential between the US and Eurozone is a key determinant of the exchange rate.

Other key factors influencing markets are lingering banking crisis fears and impending data out of the Eurozone, including GDP and HICP inflation for Germany. From a technical standpoint, the overall trend is up and the probabilities favor long holders.

EUR/USD market movers

- The US Dollar benefits from support after the release of US macroeconomic data on Thursday that saw sticky inflation despite a slowdown in growth.

- Fed Funds Futures – a market-based gauge of future interest rates – increased the chances of the Fed hiking its base rate by 0.25% at the May 4 meeting from around 70% to 80%. It also raised the chances of a June hike to above 25%.

- Uncertainty remains as to whether the ECB will hike rates by 0.25% or 0.50% at its May 4 meeting. If the latter, the Euro will probably surge.

- ECB’s chief economist Philip Lane has said the size of the hike will depend on both the state of Eurozone banks, as assessed by the ECB’s Bank Lending Survey out on May 2, as well as April flash HICP inflation data released on the same day. (German HICP is out early on Friday)

- The revelation that troubled US regional lender, First Republic Bank – which benefited from a $30B handout from sector peers during the March crisis – is once again in trouble seems to have set off alarm bells that the bank could fail. US government officials from the FDIC, Treasury and Fed are in talks with industry leaders in an attempt to put together another rescue plan.

- US recession fears won’t go away and may be deep rooted, as reflected by comments from JP Morgan’s CIO, Bob Michele, who sees deposit flight in the US as more systematically linked to lower-income earners burning through savings to meet the rising cost of living, according to an interview with Bloomberg News.

- A key data release for the Euro on Friday is Eurozone first quarter GDP at 9:00 GMT, which is expected to show a 0.2% rise QoQ and 1.4% rise YoY.

- German Harmonized Index of Consumer Prices (HICP) for April out at 12:00 GMT could also be key as it will provide a glimpse of inflation in April for the whole region, released on May 2.

- A meeting of the Eurogroup of Eurozone finance ministers currently underway may also provide commentary that impacts markets.

- The main releases for the US Dollar are University of Michigan (UoM) Consumer Confidence for April, out at 14:00 GMT, also including UoM 5-year Inflation Expectations, and, US Personal Consumption Expenditure Price Index for March at 12:30 GMT, the Federal Reserve’s preferred gauge of inflation.

- Personal Spending and Personal Income for March are both also out at 12:30 GMT.

EUR/USD technical analysis: Triangle almost complete

EUR/USD continues trading sideways in the mid 1.10s as a probable triangle pattern unfolds. Panning out and the broader medium-term uptrend remains intact – and will continue to – as long as the 1.0830 lows hold. Overall the odds favor a continuation of the dominant Euro bullish trend.

-638182655722260147.png)