Notícias do Mercado

-

22:16

GBP/JPY Price Analysis: Trades at fresh six-year highs at 171.20s, eyeing 175.00

- GBP/JPY registered solid gains during the week of 2.72%.

- The Bank of Japan interventions gave GBP/JPY buyers a better entry price around the weekly lows of 165.43.

- The GBP/JPY remains upward biased, about to test the February 2016 high at 175.01.

The GBP/JPY rallies to fresh six-year highs above the 170.00 threshold as the Japanese Yen (JPY) gets hammered by the British Pound, which is posting a solid recovery after ebbing due to the mini-budget proposed by the ex-PM Liz Truss, replaced by Rishi Sunak. The arrival of Sunak was cheered by investors, as shown by the Pound Sterling, appreciating against most G8 currencies. At the time of writing, the GBP/JPY is trading at 171.20.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart shows the pair is upward biased and with a clear path toward testing the February 2016 highs at around 175.01. However, as price action registers higher highs, oscillators, namely the Relative Strength Index (RSI) do not, so a divergence between price action and RSI could open the door for a reversal. The following key resistance areas are the psychological levels 172.00, 173, 00, and 174.00.

Otherwise, the GBP/JPY first support would be the 170.00 figure, which could open the door for further losses once cleared. The following support area would be the October 27 daily low at 168.82, followed by psychological 168.00.

GBP/JPY Key Technical Levels

-

22:00

Mexico Fiscal Balance, pesos fell from previous -30.88B to -111.252B in September

-

21:18

Mexico Fiscal Balance, pesos: -111.25B (September) vs previous -30.88B

-

21:00

Colombia Interest rate in line with expectations (11%)

-

20:45

GBP/CAD's rally from 1.5655 reaches three-month highs above 1.5800

- The pound bounces up on Friday to retest the 1.5800 support area.

- Lower oil prices and a dovish BoC have hit the CAD.

- GBP/CAD: Above 1.5800, the pair eyes 1.6000 area.

The British pound has performed a surprising comeback against the Canadian dollar on Friday, bouncing up from the 1.5655 area to reverse Thursday’s decline and explore levels past 1.5800 for the first time since late June.

The CAD remains under pressure after BoC’s dovish hike

The Bank of Canada surprised the markets on Wednesday, hiking rates by "only" 50 basis points, against expectations of a 0.75% move. Furthermore, the bank's statement signaled the end of the tightening path on the back of the gloomy global economic prospects, which sent the Canadian dollar lower across the board.

Beyond that, the sluggish performance of crude prices, Canada’s main export, has increased pressure on the loonie. The US benchmark WTI oil is trading about 0.5% lower on the day, nearing $88.00 after having peaked at $89.70 on Thursday.

In the UK, the appointment of Rishi Sunak as the UK’s Prime Minister has kept the GBP moderately bid over the past few days. The pledge to restore economic stability at his first speech has calmed investors, spooked as they were by his predecessor’s economic plan.

GBP/CAD: Above 1.5800, the pair might reach the 1.60 area

A confirmation above 0.5800 is likely to strengthen the bullish bias and push the pair toward 1.5970 (the 200-day SMA) ahead of the 1.6000 psychological level and June’s peak.

The pair, however, might take a breather after a nearly 400-pip rally this week. Immediate support lies at 1.5645 (October 27 low) and then, the 100-day SMA at 1.5435. A reversal below this level would cancel the positive bias and open the path toward October 21 low at 1.5315.

Technical levels to watch

-

20:34

United States CFTC Oil NC Net Positions down to 249.1K from previous 251.5K

-

20:33

Japan CFTC JPY NC Net Positions: ¥-102.6K vs previous ¥-94.3K

-

20:33

United Kingdom CFTC GBP NC Net Positions climbed from previous £-51.2K to £-47.8K

-

20:33

Australia CFTC AUD NC Net Positions fell from previous $-35.4K to $-51.4K

-

20:33

European Monetary Union CFTC EUR NC Net Positions climbed from previous €48.1K to €74.9K

-

20:33

United States CFTC S&P 500 NC Net Positions climbed from previous $-223.2K to $-219.1K

-

20:33

United States CFTC Gold NC Net Positions down to $68K from previous $77K

-

20:11

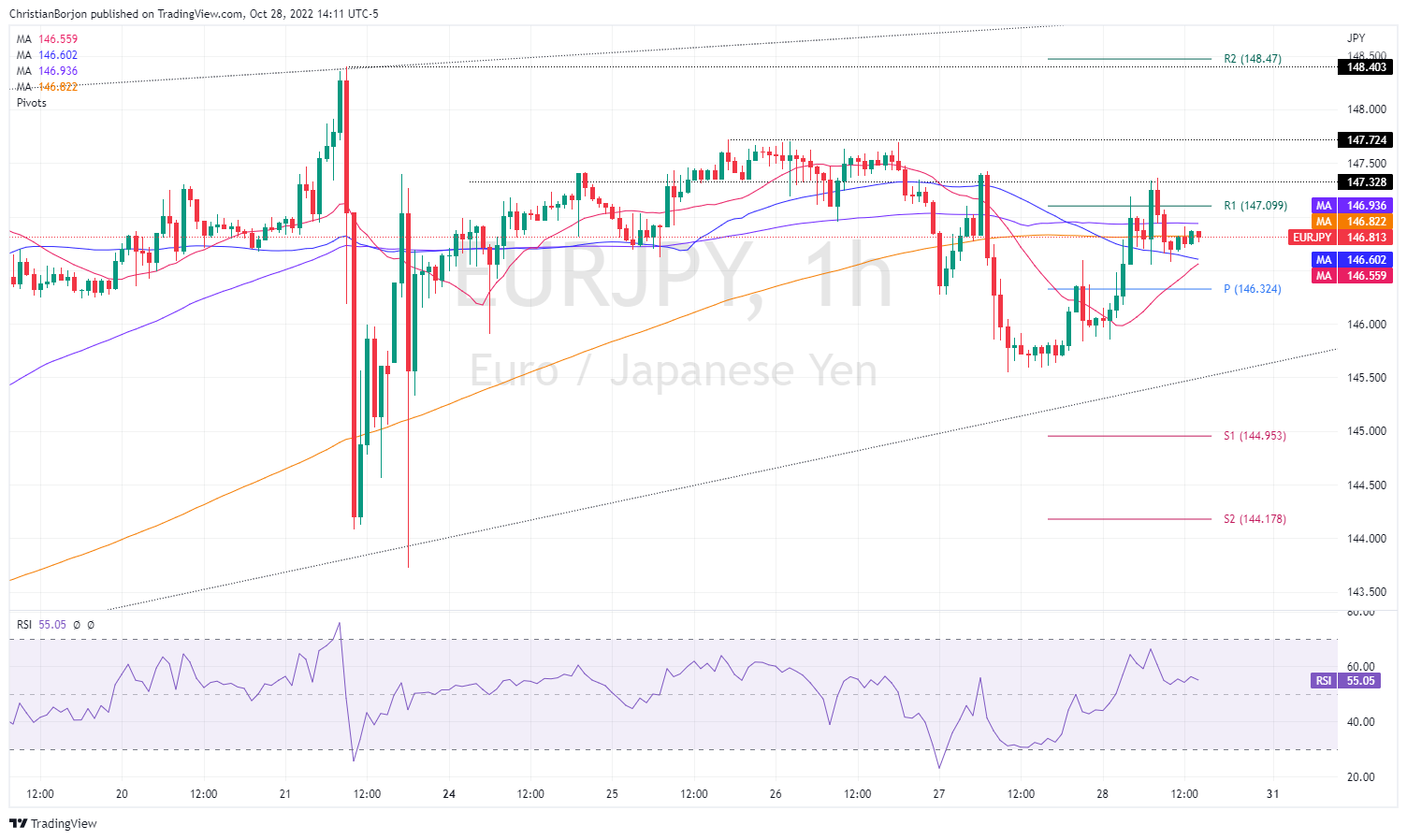

EUR/JPY Price Analysis: Fluctuates around the 200-DMA subdued amid the lack of catalyst

- EUR/JPY is set to finish the week with decent gains of 0.88% after being down 2.40%.

- Short term, an EUR/JPY break above 147.00 will expose the YTD high; otherwise, a fall toward 146.00 is on the cards.

The EUR/JPY rebounds from a one-month-old upslope trendline and climbs back above 146.00, following the European Central Bank (ECB) monetary policy decision, which ended with the ECB lifting rates and laying the ground for subsequent hikes. However, the markets perceived a dovish hike, as the Euro dived against most G8 currencies. At the time of writing, the EUR/JPY is trading at 146.81, gaining 0.76%.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart illustrates the pair as upward biased, even though the Bank of Japan (BoJ) intervention was fruitful with the USD/JPY, dragging alongside some other Japanese Yen (JPY) crosses, including the EUR/JPY. However, since reaching a weekly low at 143.72, the cross-currency pair rallied 300 pips, set for weekly gains of almost 1%.

However, it should be noted that the Relative Strength Index (RSI), albeit in bullish territory, it has a downward slope. So, as price action registers successive series of higher highs, the RSI does the opposite, setting the pair for a negative divergence.

Short term, the EUR/JPY hourly chart portrays the pair as range-bound, with risks skewed to the upside due to the Exponential Moving Averages (EMAs) lying below the spot price, except for the 100-EMA, which sits around 146.93, a difficult resistance level to hurdle. But once it’s cleared, the next resistance would be 147.00, followed by the October 25 daily high at 147.72, ahead of the YTD high at 148.40.

On the flip side, if the EUR/JPY tumbles below the 200-EMA, the next demand area would be the confluence of the 20 and 50-EMAs around 146.55/60, once cleared, could lay the way towards the daily pivot at 146.32, ahead of the 146.00 figure.

EUR/JPY Key Technical Levels

-

19:53

EUR/GBP dives to 0.8575 after rejection at the 0.8650 area

- The euro extends losses after failing to regain 0.8650.

- Sunak's appointment as British PM has buoyed the GBP.

- EUR/GBP: Below 0.8585, the next targets are 0.8530 and 0.8490.

The euro depreciated against the pound for the fourth consecutive day on Friday, to test the support area at 0.8570 after having failed to breach the 0.8650 resistance area earlier today.

The GBP remains, supported by the Sunak effect

Sterling has remained moderately bid across the board this week, buoyed by the positive impact of the appointment of Rishi Sunak becoming as UK’s Prime minister. His commitment restore economic stability has eased the turmoil caused by his predecessor’s economic plan and has offered a good respite to the GBP.

In the absence of relevant macroeconomic releases in the UK, the Eurozone calendar has failed to provide support to the euro. The preliminary German GDP showed that the first economy of the eurozone has dodged recession, although CPI figures have confirmed that consumer inflation continues growing out of control.

Beyond that, the European Central Bank’s monetary policy decision increased negative pressure on the euro earlier this week. The bank hiked rates by 75 basis points and Christine Lagarde, the ECB chair, reiterated the commitment to continue tightening rates for some time, despite the negative economic projections.

EUR/GBP: Next downside targets are 0.8530 and 0.8490

From a technical point of view, the pair is now struggling to breach support at the 0.8585 area, where the 100-day SMA lies. Below here next downside targets would be the downward trendline support, from mid-November lows, now at 0.8535, and the 200-day SMA at 0.8500.

On the upside, a bullish reaction would have to extend past the mentioned 50-day SMA, at 0.8690 to aim for the October 21 high at 0.8780. A confirmation above the mentioned level would negate the bearish trend and open the path toward October 12 high at 0.8870.

EUR/GBP daily chart

Technical levels to watch

-

19:04

Silver Price Forecast: XAG/USD drops below $19.50 as traders brace for next week’s FOMC decision

- Silver prices tumble at the 100-day Exponential Moving Average (EMA), prolonging its losses to the 50-day EMA at $19.08.

- The US Core PCE expanded by 5.1% YoY, above estimates, paving the path for further tightening.

- Investors focus on November’s Fed monetary policy meeting, with expectations of the US central bank hiking 75 bps.

Silver price stumbles at a key resistance level as the New York session progresses due to US economic data justifying further Federal Reserve’s actions, while a risk-on impulse keeps safe-haven assets pressured, but the US Dollar, which bucked the trend, as the next week’s Federal Reserve monetary policy decision lurks. The XAG/USD is trading at $19.17 a troy ounce, down by 2%, after hitting a daily high at $19.63.

US core PCE justifies further Fed’s aggression

Wall Street extends its gains even though the greenback edges higher. A measurement of inflation revealed by the Commerce Department, which is also the Fed’s favorite inflation gauge, increased 0.5% MoM, above the previous month’s reading, justifying the need for additional rate hikes amidst a Fed pivot narrative circulating in the financial markets. Also, the year-over-year number jumped by 5.1%, exceeding forecasts of 4.9%

In a separate report, the Employment Cost Index (ECI), an indicator used by the Fed in addressing inflation on wages, increased by 1.2% in the July-September period, as reported by the Department of Labor.

Aside from inflation data, the University of Michigan Consumer Sentiment, on its October final reading, remained unchanged at 59.9, while inflation expectations barely moved. According to the survey, one-year horizon inflation is estimated at 5% from 5.1%, while for 5-years is estimated at 2.9%.

Of late, the Dallas Fed Trimmed Mean PCE for September edged lower from 6% to 4.3%. At the same time, the Atlanta Fed GDPNow Forecast for Q4 is 3.1%.

Silver is on the defensive as US Treasury yields jumped, underpinning the US Dollar

The market’s reaction to the US data was felt in the fixed-income markets, as treasuries sold off, which was positive news for bond yields. The US 10-year Treasury bond yield is gaining nine bps, up at 4.01%, a headwind for the precious metals segment.

In the meantime, the US Dollar Index, a gauge of the buck’s value vs. a basket of its rivals, advances 0.30% at 110.895, underpinned by

Now market participants turn to the next week’s Federal Reserve Open Market Committee (FOMC), in which most analysts expect the Fed to hike rates by 75 bps, as reported by the CME FedWatch Tool, with odds at an 84.5% chance. However, December’s meeting is split between 50 or 75 bps, with the majority of the investors

Silver Key Technical Levels

-

18:57

NZD/USD, capped at 0.5870, consolidates losses around 0.5800

- The kiwi extends losses after failure at 0.5870.

- The US dollar picks up amid a cautious market mood.

- NZD/USD expected to depreciate further over the coming weeks – Credit Suisse.

The New Zealand dollar is heading south for the second consecutive day on Friday, after having failed to break resistance at 0.5870 earlier today. The pair dives 0.5% on the day, although it remains on track to close a two-week recovery from the 2, ½ year low at 0.5510.

The kiwi loses steam as risk appetite fades

The positive price action witnessed in the first half of the week, lost traction on Thursday with the pair unable to find acceptance above 0.5870 as risk appetite ebbed and the US dollar started to regain lost ground.

US dollar bulls, however, have remained subdued with the investors on a cautious mood ahead of next week’s Fed monetary policy meeting. The market has priced in a 0.75% hike on Wednesday, although the odds for a shorter hike in December have increased substantially over the last few days, which is holding back US dollar longs.

Regarding the macroeconomic data, a set of US indicators has failed to provide a clear direction for the US dollar. US personal spending beat expectations, confirming that consumption, one of the main contributors to US GDP, has remained resilient in spite of the soaring inflation levels.

On the other hand, private wage growth has slowed down in the third quarter, suggesting that inflation might be nearing its peak, which would be consistent with the idea of the Federal Reserve softening its rate hike path.

NZD/USD expected to trend lower in the near term – HSBC

In a bigger picture, FX analysts at HSBC are expecting the pair to extend losses over the coming weeks: “NZD/USD is expected to go lower in the coming weeks on risk aversion (…) With a series of positive spending, migration, and inflation data in New Zealand, the market is not seeing hard-landing risks as pronounced as before. That said, the market is currently priced for an additional increase of 200 bps in policy rate by mid-2023, so damage to the economy may emerge over time.”

Technical levels to watch

-

18:23

AUD/USD attempting to bottom at 0.6390 after a two-day reversal from 0.6500

- The aussie is attempting to bounce up from 0.6390 after a reversal from the 0.6520 high.

- The cautious market mood has weighed on the AUD.

- AUD/USD could extend losses toward the 2020 low at 0.5506.

The Australian dollar is attempting to regain the 0.6400 area on Friday’s afternoon US session. The pair has found support at 0.6390 after having depreciated from the 0.6520 high on Thursday.

The aussie loses ground in a cautious market mood

The pair has given away most of the week’s gains over the last two days, with risk appetite fading and the investors adopting a more cautious stance, awaiting the outcome of the Federal Reserve’s monetary policy meeting due next week.

The Fed is widely expected to hike rates by 75 basis points for the fourth consecutive time, although the market is pricing in a lower rate hike in December, which has kept US dollar bulls subdued.

Friday’s US data has failed to provide a clear direction for the USD. The consumer spending figures have shown an unexpectedly high increase in September, showing that Americans continue going shopping despite the historical inflation levels.

On the other hand, private wage growth decelerated in the third quarter, which might be one of the first indicators suggesting a peak in inflation. Furthermore, Personal Consumption Expenditures remained flat at a 6.2% annual rate while the Core PCE, accelerated less than expected.

AUD/USD could revisit the 2020 low at 0.5506 – Credit Suisse

On the longer-term, FX analysts at Credit Suisse contemplate a sustained aussie depreciation: “With medium-term momentum staying bearish, we look for a fall to the 78.6% retracement of the 2020/21 uptrend and the low from April 2020 at 0.6041/5978 after the pause. Whilst we would not rule out another short pause here, a convincing break lower would raise a prospect for a move all the way to 0.5506 – the low of 2020.”

Technical levels to watch

-

18:22

United States Baker Hughes US Oil Rig Count: 610 vs previous 612

-

17:33

USD/CHF Price Analysis: Testing the key 200-hour EMA, as bulls eye the parity

- USD/CHF advances sharply, eyeing a break of the 200-hour EMA, which could expose parity.

- During the last two days, the USD/CHF has advanced more than 1% after bouncing from the weekly lows of around 0.9841.

- Further upside is expected as November’s Fed meeting looms.

The USD/CHF is gaining some traction in the North American session, surpassing the 20-day Exponential Moving Averages (EMA) at 0.9949, courtesy of positive fundamental data, opening the door for a re-test of parity ahead into the weekend. At the time of writing, the USD/CHF is trading at 0.9970, above its opening price by 0.63%.

USD/CHF Price Analysis: Technical outlook

From a technical perspective, the USD/CHF remains upward biased following the pullback from the YTD high at 1.0147 towards October’s 27 low at 0.9841 due to sellers failing to extend the USD/CHF losses below the 50-day EMA at 0.9809, which, could have exacerbated a fall towards the 100-day EMA at 0.9722. Instead, buyers stepped in, reclaimed the 20-day EMA, and are posing a threat of finishing the week above parity for back-to-back weeks. If that scenario plays out, the USD/CHF would be under upward pressure, and with the Federal Reserve’s meeting looming, a challenge of the YTD high could be on the cards.

Short term, the USD/CHF 1-hour chart depicts buyers are testing the 200-hour EMA at the confluence of the R1 daily pivot at 0.9980, which, if broken, could open the door to test the October 25 high and the R3 daily pivot level at 1.0031. It should be noted that the Relative Strength Index (RSI) is still in bullish territory, so buyers have some room to spare. On the downside, the R1 daily pivot at 0.9940 could cap any losses if the CHF strengthens at a specific time of the New York session, which is unlikely to happen as traders brace for the weekend. If it happens, then the confluence of the 100 and the 20-hour EMAs, around 0.9934/30, would be difficult to surpass, ahead of the 0.9900 figure.

USD/CHF Key Technical Levels

-

17:32

GBP/USD erases daily losses and returns to the 1.1600 resistance area

- The pound reverses its previous downtrend and returns to the 1.1600 area.

- Rumors of Fed pivoting are keeping USD bulls on a leash.

- GBP/USD remains firm, likely to retest 1.1760 – UOB.

The pound bounced up right above 1.1500 earlier on Friday to regain lost ground during the European and US trading sessions and reach the 1.1600 resistance area. In a bigger picture, the pair remains trading in a range for the second consecutive day, consolidating gains after a two-day rally from levels below 1.1300 earlier this week.

Expectations of a softer Fed stance are weighing on USD bulls

Market expectations that the Federal Reserve might start softening its monetary tightening pace over the next months are keeping USD bulls in check.

Investors have already priced in a 0.75% hike in December, but the increasing rumors about the possibility of scaling down monetary tightening in December are curbing demand for the dollar.

Beyond that, the myriad of US macroeconomic data released on Friday has failed to provide a clear direction for the USD.

US personal spending has grown beyond expectations in September (0.6% against the consensus 0.4%) confirming that Americans have continued shopping, despite the soaring inflation, which maintains the US economy in good shape and clears the Fed’s path for another aggressive hike in December.

On the other hand, wage growth slowed down in the third quarter, according to data from the Labor Department, which suggests that inflation might have peaked or is close to doing so.

Furthermore, the US Personal Consumption Expenditures remained flat at a 6.2% yearly pace in September, while the Core PCE, the Fed’s preferred inflation gauge increased below expectations.

GBP/USD might appreciate to test 1.1760 resistance – UOB

FX analysts at UOB see the pair on a firm tone, and likely to test the 1.1760 area over the next weeks: Our expectation for GBP to ‘rise further’ yesterday did not materialize as it traded between 1.1550 and 1.1645 (…) “Yesterday (27 Oct, spot at 1.1630), we held the view that GBP is still strong and is likely to strengthen further. We indicated that the next level to monitor is at 1.1760.”

Technical levels to watch

-

17:28

BoE: Looking for a 75 bps rate hike next week – Rabobank

Next week, the Bank of England will have its monetary policy committee meeting. Analysts at Rabobank look for a 75 basis points rate hike to 3.00% from 2.25%. They explain that it would still be the largest rate hike of this cycle. They expect to see rates peaking at 4.75%.

Key Quotes:

“After the mini-Budget disaster of late-September, we shifted our call for the November MPC from +50 to +100 bps. We have dialled back our forecast to +75 bps, as most of the political and financial market upheaval has subsided. This is also the consensus among economists.”

“The central bank needs to show markets that it is cognizant that confidence in the UK’s institutional framework has been damaged, but there is no need for crisis management anymore. Still, a 75 bps hike would still be Britain’s largest of this cycle. We think it will also be a one-off, allowing the central bank to move back to a more gradual pace of 50 bps and then 25 bps rate increases this winter.”

“While inflation should remain around 10% in upcoming months, the outlook for growth has weakened markedly. Even as the August Monetary Policy Report was already sombre, forecasting a fifteen-month recession, we expect more of this gloominess rather than less.”

-

17:23

Canada: We still have at least some growth in the economy – CIBC

In Canada, August's GDP rose by 0.1% according to data released on Friday, slightly above market consensus for a flat reading, while the advance estimate for September pointed to a 0.1% increase. Analysts at CIBC point out that while growth was fairly modest during the third quarter, it will need to slow further in the fourth quarter and early 2023 to help bring inflation back down to target. The need for a further deceleration supports the notion that while the Bank of Canada is close to the end of its rate hiking cycle, it isn't done quite yet, they conclude.

Key Quotes:

“Including revisions, today's data is a little stronger than we had expected and puts the third quarter growth roughly in line with the Bank of Canada forecast, but slightly above our estimate. While we will be revising our overall 2022 growth expectation to be a tad higher, this does not alter our view that the economy will stall in the months ahead, and the lack of momentum late in Q3 is aligned with that.”

“With these latest growth figures only slightly below estimates of potential growth, we will need to see this further slowing of the economy to bring inflation back to target. This supports the notion that while we are getting closer to the end of the hiking cycle, there is still a little left to do. We continue to expect that the Bank of Canada will hike by a further 50bps before pausing.”

-

17:11

USD/CAD back above 1.3600 after another rebound from 1.3500

- USD/CAD about to end flat a volatile week.

- US dollar gains momentum on Friday despite risk appetite.

- Critical week ahead with FOMC and employment reports.

The USD/CAD is up for the second day in a row and moved further away from the one-month low it reached on Thursday below 1.3500. The pair is holding firm above 1.3600, about to end the week flat.

Loonie fails to break 1.3500 and retreats

Near the end of the week, USD/CAD is hovering around 1.3620/30, at the highest level in two days. The rebound from under 1.3500 reflects difficulties for the loonie to rise further and at the same time, that the dollar is not ready yet for a deeper correction, ahead of a critical week.

For the second time in October, USD/CAD managed to remain above 1.3500. The rebound so far has been limited. The next resistance stands at 1.3650 and above attention would turn to the 20-day Simple Moving Average at 1.3697.

After BoC, now FOMC and job data

Monthly GDP data in Canada came in above expectation with an expansion of 0.1% (consensus: 0%). “GDP registered slightly above expectations in August with a one tick increase. This rise was led by the services industry with gains stemming in part from retail and wholesale trade. The increase in retail outlays is likely to be short‑lived as consumers contend with a decline in purchasing power and rising interest bills”, explained analysts at the National Bank of Canada.

After the surprise dovish rate hike from the Bank of Canada on Wednesday, attention is back on economic numbers. Next week, the Canadian employment report is due on Friday. Also, the US will release employment numbers for October.

The key event in the US will be the FOMC meeting. On Wednesday, the central bank is expected to announce a 75 basis points rate hike. Market participants will look for clues about the next steps of the Fed and those expectations will likely define the direction of the US dollar.

Technical levels

-

16:45

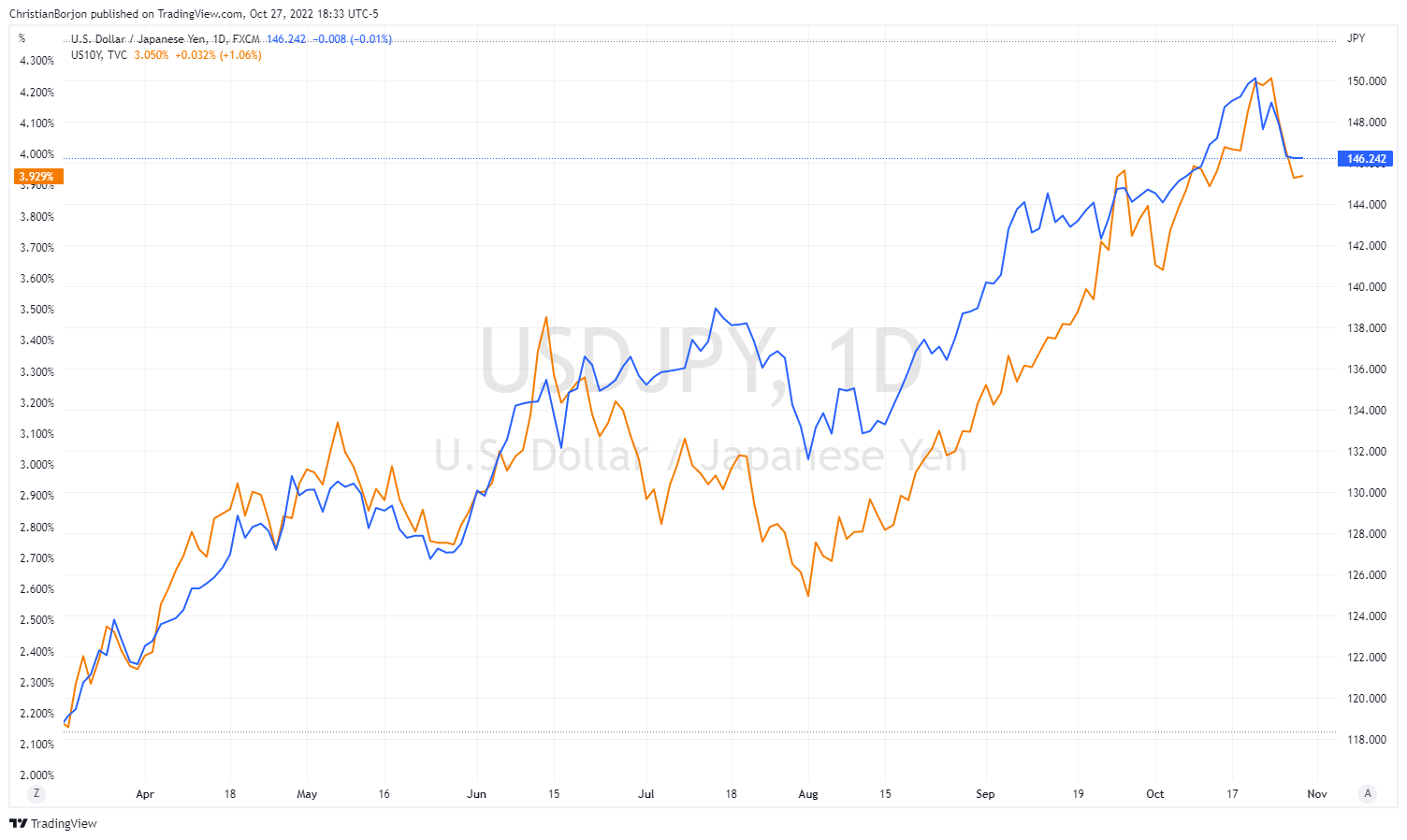

USD/JPY’s rally from 146.00 loses steam above the 147.50 area

- The US dollar stalls around 147.50 after rallying from session lows near 146.00.

- The pair appreciates 0.8% on the day following a two-day reversal.

- US macroeconomic data has left the USD looking for direction.

The sharp greenback rally witnessed during Friday’s Asian and early European trading sessions, has lost steam after hitting 147.85. The pair, however, is consolidating gains above the 100-hour SMA, after a 0.8% daily appreciation.

The dollar treads water after the release of US data

The greenback has lost bullish momentum in the early US trading session, following the release of a set of first-tier US macroeconomic indicators. US consumer spending increased at a 0.6% pace in September, according to data released by the Department of Commerce, which shows that the US economy remains in good health and paves the Fed’s path for another jumbo hike in December.

On the other hand, wage growth slowed down to a 1.2% pace in the third quarter from 1.3% in the previous one, suggesting the possibility that inflation pressures might have peaked.

Furthermore, the Core Personal Consumption Expenditures, the Fed’s preferred gauge to measure inflationary trends, accelerated to a 5.1% annual rate in September, (from 4.9% in August) but below market expectations of a 5.2% reading. The overall PCE remained flat at a 6.2% yearly pace.

A dovish BoJ sends the yen tumbling

Before that, the Japanese yen had pared some of the previous days’ gains, hammered by the dovish rhetoric of the Bank of Japan’s monetary policy decision. The BoJ has confirmed its accommodative policy, as widely expected, leaving its target for short-term rates at -0.1% and reaffirming their commitment to keeping the 10-year bond yield near 0%.

Beyond that, BoJ President Kuroda stated that the bank is not planning “to raise interest rates or head for an exit (from the current policy) any time soon,", which has triggered a broad-based yen reversal.

Technical levels to watch

-

16:33

Yields: Pressure to ease as central bank approach a turning point – Danske Bank

The pressure on long yields is set to ease as central bank rates and inflation approach a turning point, explained analysts at Danske Bank. They expect markets to increasingly price inflation to come under control, amid a deteriorating growth outlook. Therefore they continue to see yields peaking in 2022 (if they don’t have already in October) and long yields declining slightly in 2023.

Key Quotes:

“10Y US Treasury yields last week briefly touched 4.30% and German Bunds 2.5%, meaning we had in fact passed our previous 3-month estimate. However, recent days have seen yields decline again, not least, following the ECB meeting. Hence, the big question is whether we have seen the peak in long yields for now.”

“We tentatively conclude that peak yield was probably reached in October and that long yields could retreat in 2023 as inflation expectations fall slightly and the anticipated recession unfolds. However, the trend is still likely to be up for central bank rates from both the ECB and the US Federal Reserve. In the coming months, we expect long yields to be particularly dependent on how inflation figures develop. We will also be keeping and ear open for announcements from the ECB about any upcoming halt to reinvestments (QT).”

“Much indicates we are now entering a period when the market is beginning to price a peak in inflation and at the same time beginning to glimpse the top of central bank rates. The ECB is expected to deliver its last rate hike in February and the Fed as early as December.”

-

16:32

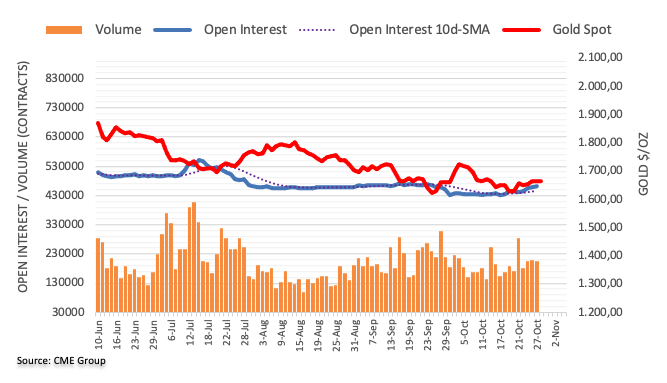

Gold Price Forecast: XAUUSD pressured as core PCE jumps, justifying further Fed action

- Gold price records a fresh three-day low spurred by a strong US Dollar.

- The Fed’s preferred gauge for inflation, the Core PCE, smashed estimates, justifying additional action.

- US Treasury bond yields jumped, with the 10-year eyeing to recoup the 4% threshold.

Gold price slides and extends its losses below $1650 due to stubbornly high US inflation reported namely the Core Personal Consumption Expenditures (PCE), the Federal Reserve’s favorite gauge of inflation, which increased more than estimates, bolstering the US Dollar. Therefore, the XAUUSD is trading at $1641.62, diving 1.23%, eyeing the weekly lows of around $1638.

The Fed’s gauge of inflation justifies additional tightening

On Friday, the US Commerce Department revealed that September’s US inflation, as measured by the Core PCE, which strips volatile items like food and energy, jumped 0.5% MoM, higher than the previous reading, while annually based, escalated by 5.1%, above 4.9% forecasts by street’s analysts. In a separate report, the Employment Cost Index (ECI), an indicator used by the Fed in addressing inflation on wages, increased by 1.2% in the July-September period, as reported by the Department of Labor.

Given the backdrop, the so-called Fed pivot narrative could be tossed away as inflation remains stubbornly high and salaries are rising, despite the Federal Reserve’s effort to tame inflation.

Of late, additional US economic data was reported, with the University of Michigan (UoM) Consumer Sentiment unchanged at 59.9. Consumer’s inflation expectations for the 1-year horizon easied from 5.1% to 5%, and for a 5-years and beyond, were unchanged at 2.9%.

US Dollar bolstered on PCE data, Federal Reserve meeting eyed

After the data was released, the XAU remained on the defensive, as the reasons above will justify further Fed tightening. The US Dollar Index, a measure of the buck’s value against six currencies, is up 0.20%, at 110.78, while US Treasury yields, namely the 10-year benchmark rate, recover five bps up at 3.973%.

In the meantime, Wall Street holds to gains amidst a decent earnings season, keeping US equities in the green.

Now market participants turn to the next week’s Federal Reserve Open Market Committee (FOMC), in which most analysts expect the Fed to hike rates by 75 bps, as reported by the CME FedWatch Tool, with odds at an 84.5% chance. However, December’s meeting is split between 50 or 75 bps, with the majority of the investors

Gold Key Technical Levels

-

16:31

US: Consumers keep spending more than they earned – Wells Fargo

Data released on Friday showed real spending increased by 0.3% in September and August numbers were revised higher from 0.1% to 0.3%; the core PCE climbed to 5.1%. Analysts at Wells Fargo, point out that for the eighth time in nine months, consumers spent more money than they earned after adjusting for inflation in September. They argue that this spending is driven by an unsustainable draw-down of savings and over-reliance on credit, and they suspect it will not end well unless real disposable income picks up.

Key Quotes:

“The core PCE deflator, the teacher’s pet of inflation gauges for Fed policymakers, came in at 5.1% in September, up from 4.9% previously and echoing a similar rise in core CPI inflation. The key distinction is that today’s data do not mark a new cycle high for core PCE inflation. That milestone was reached in February when it hit 5.4%. Still, the quickening pace of core inflation more or less makes another 75 bps hike all but assured at the FOMC meeting this coming Wednesday, Nov. 2. That could mark the last 75 bps hike of this cycle if inflation slows markedly as we expect it to, which would allow for a more gradual pace of tightening.”

“The one caveat is if real disposable personal income growth continues to recover, households will receive a more sustainable source of purchasing power. Our baseline expectation is that while inflation is rolling over, it will be a long and bumpy way down, which will again exert some downward pressure on real disposable income growth in coming months. Furthermore, with most measures of labor demand beginning to top out, wage growth should soon moderate, and with this representing the largest source of income for most households, lower wage gains will bite into nominal personal income growth. Households thus will likely continue to save less of their monthly income to consume.”

-

15:59

USD/CAD: Close above 1.3650 may add to short-term upward momentum – Scotiabank

USD/CAD has rebounding from 1.35 support. The pair needs to surpass the 1.3650 zone to see further gains, economists at Scotiabank report.

USD/CAD finds additional support in the low-1.36s hard to come by

“USD/CAD pressured key support at 1.3505 on Thursday but failing to achieve a sustained break under the figure leaves the market prone to a rebound.”

“USD gains, have, however, been limited and there are signs in early trade here that USD is finding additional support in the low 1.36s hard to come by.”

“Gains through 1.3650 are needed for the USD recovery to extend intraday. A high close today for the USD may add to short-term upward momentum.”

-

15:58

EUR/USD back to the 0.9950 zone, up for the week but not that strong

- EUR/USD heads for weekly gains, but off highs.

- US Dollar without a clear direction on Friday ahead of Fed’s week.

- Wall Street posts important gains.

The EUR/USD is hovering around 0.9950, flat for the day and higher for the week. The euro climbed recently to 0.9990 but quickly pulled back, approaching daily lows as the US dollar moves sideways across the board.

The dollar trades without a clear direction, even after US data on Friday and ahead of a critical week. The DXY is up by 0.25% (mostly due to the USD/JPY rally) and US yields are off highs. In Wall Street, equity prices are up by more than 1.25% on average.

On a weekly basis, EUR/USD is about to end with a 100-pip gain but the fact that is has pulled back more than 150 pips from the high, is a negative sign for euro bulls. The pair peaked near the 20-week Simple Moving Average and then started to move to the downside.

Inflation vs growth

Data released on Friday, showed a new record high inflation reading in Germany during September with the annual rate reaching 10.4%. “There is no relief in sight, and the inflation rate is only likely to fall in the coming year because energy prices are unlikely to rise as strongly as they have this year, also due to government intervention. However, the underlying price pressure is likely to remain strong. Today's price data confirm our expectation of a double-digit euro area inflation rate in October”, said analysts at Commerzbank.

In the US, the Core PCE deflactor came in at 5.1% in September, slightly below the 5.2% of market consensus. It is not a fresh high but still remains elevated. Market participants continue to price in a 75 basis points at next week’s FOMC meeting.

The economic calendar for next week also includes Eurozone inflation and the US official employment report. Volatility appears to be warranted.

Technical levels

-

15:35

A major house price correction could be in the offing, implications for growth and inflation – ABN Amro

A potentially toxic cocktail for the housing market is emerging. Economists at ABN Amro judge that both the price correction as well as the implications for growth and inflation will be more moderate this time.

How vulnerable is the economy to a sharp fall in house prices?

“Falling real incomes and fast rising interest rates are marking an abrupt end to the housing boom – aggravated by looming recessions. Our base case is for a moderate correction, but house prices could ultimately drop by 20-30 percent.”

“The growth impact of deep housing market corrections would be strongest for the UK but milder in the eurozone and US. The drag on inflation would be biggest in the US.”

“Even if there is a major correction, strong financial buffers would prevent this from being systemic. A notable exception is in China, with its mainly self-inflicted problems that are of a different nature.”

-

15:07

EUR/USD and EUR/CHF to decline by a similar level – HSBC

EUR/CHF is set to shrug off developments in Switzerland. Thus, the direction of the EUR/USD pair will determine the next EUR/CHF move, economists at HSBC report.

USD/CHF could move sideways in the coming weeks

“EUR/CHF is set to be driven by EUR/USD, with little scope for Swiss-related drivers to get traction.”

“The Swiss National Bank (SNB) may be mindful of CHF weakness, but the recent moves have been modest and not enough to suggest action. The next SNB policy meeting is on 15 December, where the market is fully priced for a 50 bps hike and the 3 November release of Switzerland October CPI will be worth watching.”

“We expect both EUR/USD and EUR/CHF to decline by a similar level, so this means USD/CHF could move sideways in the coming weeks.”

-

15:03

US: Pending Home Sales decline by 10.2% in September vs -5% expected

- Pending Home Sales in the US fell at a stronger pace than expected in September.

- US Dollar Index trades flat on the day below 111.00 following earlier rally.

Pending Home Sales in the US declined by 10.2% on a monthly basis in September, the data published by the National Association of Realtors showed on Friday. This reading followed August's decrease of 1.9% and came in much worse than the market expectation for a contraction of 5%.

On a yearly basis, Pending Home Sales plunged by 31%, compared to analysts' estimate for a decline of 10.5%.

Market reaction

The dollar stays under modest bearish pressure after this data and the US Dollar Index was last seen trading virtually unchanged on the day at 110.62.

-

15:01

United States UoM 5-year Consumer Inflation Expectation remains at 2.9% in October

-

15:01

United States Michigan Consumer Sentiment Index came in at 59.9, above forecasts (59.8) in October

-

15:00

United States Pending Home Sales (YoY) came in at -31%, below expectations (-10.5%) in September

-

15:00

United States Pending Home Sales (MoM) came in at -10.2%, below expectations (-5%) in September

-

14:47

USD Index trims gains and slips back below 111.00

- The index loses momentum just above 111.00 on Friday.

- US Core PCE rose less than expected 5.1% YoY in September.

- Final Michigan Consumer Sentiment print comes next in the docket.

The USD Index (DXY), a measure of the greenback vs. its main competitors, deflates from the area of 2-day highs past the 111.00 yardstick at the end of the week.

USD Index capped by 111.00

Despite coming under pressure just above 111.00, the index maintains the bullish mood for the second session in a row amidst some recovery in the risk complex on Friday.

The corrective decline in the dollar remained unchanged after US inflation figures tracked by the PCE (the Fed’s favourite gauge) rose 6.2% in the year to September and 5.1% YoY when it comes to the Core PCE.

Additional releases for September saw Personal Income expand 0.4% MoM and Personal Spending increase 0.6% vs. the previous month. Later in the session, the final Michigan Consumer Sentiment and Pending Home Sales will close the weekly calendar.

Moving forward, the greenback should start trading in a prudent stance ahead of the FOMC event on November 2, where consensus remains almost fully favoured to a ¾ point rate raise of the Fed Funds Target Range (FFTR).

What to look for around USD

The dollar’s late recovery appears to have met some initial resistance in the area beyond the 111.00 barrier so far.

In the meantime, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the index.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: PCE/Core PCE Price Index, Personal Income/Spending, Pending Home Sales, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.07% at 110.64 and faces the immediate up barrier at 113.88 (monthly high October 13) seconded by 114.76 (2022 high September 28) and then 115.32 (May 2002 high). On the flip side, the breakdown of 109.53 (monthly low October 27) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13).

-

14:45

GBP/USD to regain the 1.20 zone on hopes to re-establish fiscal credibility – Scotiabank

GBP/USD consolidates as government tries to re-establish fiscal credibility. Economists at Scotiabank believe that the pair could regain the 1.20 area.

Firm support on dips to the low/mid-1.14s area

“We still rather think the GBP has seen the worst of the recent turmoil and restoring credibility to government finances could help the pound regain the 1.20 zone after its recovery through the 1.14 area. But the delayed fiscal update is still a long way off, leaving the GBP subject to swings in the broader USD tone in the meantime.”

“We are bullish on the broader outlook for the GBP above the 1.14 level and expect firm support on dips to the low/mid 1.14 area from here.”

“Intraday gains through 1.1610 should cue renewed GBP gains.”

-

14:26

EUR/USD: Regaining 1.01 should allow gains to develop for a push on to 1.03 – Scotiabank

EUR/USD has bounced from the low-0.99s. The surpass of the 1.0100 zone could open up further gains, economists at Scotiabank report.

The undertone remains positive

“Despite the EUR’s late week drift from the 1.01 area, the undertone here remains positive.”

“Intraday losses have retested key support in the low 0.99s – former trend resistance, now support at – and held above it.”

“The EUR still has its work cut out to rally but regaining 1.01+ in the next few days should allow gains to develop for a push on to 1.03.”

-

13:43

Canada: Real GDP grows by 0.1% in August vs. 0% expected

- Canadian economy grew by 0.1% on a monthly basis in August.

- USD/CAD clings to modest daily gains above 1.3600 after the data.

Real Gross Domestic Product (GDP) in Canada grew by 0.1% on a monthly basis in August, Statistics Canada reported on Thursday. This reading followed July's expansion of 0.1% and came in slightly better than the market expectation of 0%.

"Advance information indicates that real GDP increased 0.1% in September," the publication further read. "Increases in the oil and gas extraction subsector, the manufacturing sector and the public sector were partially offset by declines in construction."

Market reaction

This data failed to help the loonie gather strength and USD/CAD was last seen trading in positive territory slightly above 1.3600.

-

13:31

United States Personal Consumption Expenditures - Price Index (YoY) came in at 6.2%, above forecasts (5.8%) in September

-

13:31

Breaking: US annual Core PCE inflation rises to 5.1% in September vs. 5.2% expected

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, stayed unchanged at 6.2% on a yearly basis in September, the US Bureau of Economic Analysis announced on Friday.

The Core PCE Price Index, the Federal Reserve's preferred gauge of inflation, edged higher to 5.1% on a yearly basis from 4.9% in August, compared to analysts' estimate of 5.2%, and was up 0.5% in September.

Further details of the publication revealed that Personal Spending was up 0.6% in September and Personal Income rose by 0.4%.

Market reaction

The US Dollar Index retreated from daily highs with the initial reaction and was last seen rising 0.15% on the day at 110.76.

-

13:31

United States Core Personal Consumption Expenditures - Price Index (MoM) meets forecasts (0.5%) in September

-

13:31

United States Personal Income (MoM) came in at 0.4%, above expectations (0.3%) in September

-

13:31

United States Employment Cost Index meets forecasts (1.2%) in 3Q

-

13:31

Canada Gross Domestic Product (MoM) above forecasts (0%) in August: Actual (0.1%)

-

13:30

United States Personal Consumption Expenditures - Price Index (MoM) below forecasts (0.5%) in September: Actual (0.3%)

-

13:30

United States Core Personal Consumption Expenditures - Price Index (YoY) registered at 5.1%, below expectations (5.2%) in September

-

13:30

United States Personal Spending came in at 0.6%, above expectations (0.4%) in September

-

13:14

Gold Price Forecast: XAU/USD would benefit from the prospect of less aggressive Fed rate hikes – Commerzbank

Gold is trading at just shy of $1,660. If the market prices out future rate hikes to some extent, the yellow metal could thrive, strategists at Commerzbank report.

Eventful week for gold

“We envisage virtually no recovery potential for the gold price for as long as there is no end in sight to the aggressive rate hikes. Next week’s Fed meeting is therefore likely to have an important bearing on the gold price trend.”

“Another pronounced rate hike of 75 bps is generally anticipated after US inflation remained stubbornly high again in September, core inflation climbing to a 40-year high of 6.6%. That said, if the central bankers were to hint that they will raise their key rate at a less aggressive pace in future – in response to the cooling economy, for instance – the gold price could be lent some tailwind.”

-

13:04

Germany: Annual CPI rises to 10.4% in October vs. 10.1% expected

- Inflation in Germany rose at a stronger pace than expected in October.

- EUR/USD trades in negative territory at around 0.9950 after hot German CPI data.

Annual inflation in Germany, as measured by the Consumer Price Index (CPI), climbed to 10.4% in October from 10% in September, Germany's Destatis reported on Friday. This reading came in higher than the market expectation of 10.1%.

Meanwhile, the Harmonised Index of Consumer Prices (HICP), the European Central Bank's (ECB) preferred gauge of inflation, jumped to 11.6% from 10.9%, compared to analysts' estimate of 10.9%.

On a monthly basis, the CPI and the HICP arrived at 0.9% and 1.1%, respectively, surpassing market forecasts.

Market reaction

The EUR/USD pair showed no immediate reaction to these figures and was last seen losing 0.08% on the day at 0.9955.

-

13:01

Chile Industrial Production (YoY): -1.6% (September) vs -5%

-

13:01

Germany Harmonized Index of Consumer Prices (YoY) came in at 11.6%, above expectations (10.9%) in October

-

13:01

Germany Harmonized Index of Consumer Prices (MoM) registered at 1.1% above expectations (0.6%) in October

-

13:01

Germany Consumer Price Index (YoY) above expectations (10.1%) in October: Actual (10.4%)

-

13:01

Chile Unemployment rate in line with forecasts (8%) in September

-

13:00

Germany Consumer Price Index (MoM) registered at 0.9% above expectations (0.6%) in October

-

12:42

USD Index to challenge the top end of its recent trading range of 110-115 – HSBC

The USD has long led from the front and has not yet hit the “wall.” Economists at HSBC expect the US Dollar Index (DXY) to test the 115 level.

Fed to deliver a widely expected 75 bps hike

“We look for the USD uptrend to extend, with DXY likely to challenge the top end of its recent trading range of 110-115.”

“The key US-centric pinch-point for the USD is the 1-2 November Federal Open Market Committee (FOMC) meeting. The Federal Reserve (Fed) is likely to deliver a widely expected 75 bps hike and is expected to argue a data-dependant outcome in its forward guidance, with the market currently priced in an 88% chance of a 75 bps follow-up hike in December (Bloomberg, 20 October 2022).”

“We think that the tightness in the labour market (likely reflected in the US employment report for October to be released on 4 November) will continue to foster concerns about service-driven inflation pressures even as core goods inflation slows. The renewed pick-up in gasoline prices since mid-September, together with food prices and other energy prices, is putting upward pressure on US CPI. The inflation for October will be released on 10 November.”

-

12:27

EUR/USD Price Analysis: Next on the upside comes 1.0100

- EUR/USD comes under renewed downside pressure well below parity.

- The resumption of the bid bias targets the October top near 1.0100.

EUR/USD extends the corrective downside to the 0.9930/25 band on Friday.

In case bulls regain the upper hand, the surpass of the 1.0100 zone could spark a more serious recovery in the short-term horizon. That said, the immediate barrier is now expected at the September top at 1.0197 (September 12) ahead of the August peak at 1.0368 (August 10).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0502.

EUR/USD daily chart

-

12:21

EUR/USD to trade at parity by year-end – ABN Amro

EUR/USD has come above parity. Still, economists at ABN Amro expect the pair to end the year at 1.00.

Euro to remain under pressure versus the US dollar this year

“An energy crisis and a recession in the eurozone combined with a more aggressive path of rate hikes in the US compared to the eurozone will probably keep the euro under pressure versus the US dollar this year.”

“When financial markets calm down somewhat again, lower safe haven demand for the dollar could result in a recovery of EUR/USD.”

“Our forecasts for EUR/USD for end 2022 stands at 1.00.”

-

12:07

Australia: RBA seen raising the OCR further in November – UOB

Economist at UOB Group Lee Sue Ann suggests the RBA would keep the tightening bias well in place at the November 1 meeting.

Key Quotes

“The latest Federal Budget, unveiled on 25 Oct, displayed strong fiscal discipline, which is crucial and consistent with RBA’s efforts to curb inflation. Notably, both headline and underlying inflation for 3Q22 came in higher than expectations. But we believe inflation will likely peak in 4Q22, in the absence of further significant global shocks.”

“We are penciling in a 25bps hike in the official cash rate (OCR) to 2.85% at this meeting.

-

12:00

Brazil Inflation Index/IGP-M below expectations (-0.8%) in October: Actual (-0.97%)

-

11:53

USD Index Price Analysis: Focus is now on 114.00 and above

- DXY adds to Thursday’s important advance and revisits 111.00.

- The continuation of the recovery should target 114.00.

DXY climbs to 3-day highs just above the 111.00 barrier at the end of the week.

Despite the dollar remains under pressure, the likelihood of further gains remains on the table while above the 8-month support line near 108.50. The proximity of the 100-day SMA also reinforces this area of contention. Against that, the next hurdle of relevance aligns at the October highs around 114.00.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 104.07.

DXY daily chart

-

11:40

EUR/JPY Price Analysis: Upside target remains at the 2022 high

- EUR/JPY regains poise and reclaims part of the ground lost on Thursday.

- Immediately to the upside comes the YTD high at 148.40.

EUR/JPY resumes the upside and surpasses the 147.00 barrier at the end of the week.

Considering the current price action, there is still chances for the cross to advance further in the short-term horizon. That said, the immediate up barrier now emerges at the 2022 high at 148.40 (October 21) ahead of the December 2014 top at 149.78 (December 8).

In the short term the upside momentum is expected to persist while above the October lows near 141.00.

In the longer run, while above the key 200-day SMA at 137.27, the constructive outlook is expected to remain unchanged.

EUR/JPY daily chart

-

11:39

USD Index to stage a stronger rally if Fed disappoints expectations for a slowdown in the pace of hikes – MUFG

The US dollar is staging a modest rebound following the heavy sell-off. Market participants are becoming more confident that the Fed will at least slow the pace of hikes. The Fed needs to disappoint these expectations to provide further fuel to the greenback, economists at MUFG Bank report.

All eyes on next week’s FOMC meeting

“The US Dollar Index has found support at the bottom of its recent trading range between 110.00 and 115.00. However, the scope for the US dollar to extend its rebound ahead of next week’s FOMC meeting should remain limited given that market participants will still be nervous over a potential dovish shift in Fed policy guidance that could quickly pull the rug from under a dollar rebound.”

“For the US dollar to stage a stronger rally, the Fed will need to disappoint market expectations for a slowdown in the pace of hikes later this year.”

-

11:31

South Korea: GDP surprised to the upside in Q3 – UOB

Economist at UOB Group Ho Woei Chen reviews the recently published GDP figures in South Korea.

Key Takeaways

“South Korea’s advance GDP for 3Q22 outperformed market’s expectations at 3.1% y/y and picked up pace from 2.9% in 2Q22. On a seasonally-adjusted q/q basis, GDP expanded by 0.3% in 3Q22 compared to 0.7% in 2Q22, in line with Bloomberg’s consensus forecast. This is the 9th straight quarter of sequential growth. All the major expenditure components registered positive growth momentum.”

“Factoring in the stronger-than-expected 3Q22 GDP, South Korea’s full-year 2022 growth could be marginally better than our forecast of 2.7%. Assuming GDP growth moderates to 2.2% y/y in 4Q22, the full-year growth will be around 2.8%. We retain our forecast for the economy to ease more evidently to 1.7% in 2023 due to the multitude of downside risks. We will review our estimates following the release of the final 3Q22 GDP data on 1 Dec.”

“As for the monetary policy, our ‘terminal rate’ forecast remains at 3.50% as guided by the BoK in the Oct monetary policy meeting. A 50bps rate hike to 3.50% in Nov remains on the table for now as we think that the central bank may see merits to frontload its rate hikes given the high domestic inflation. The BoK made it clear that US Fed rate trajectory does hold some sway over its rate decision due to the impact on the currency market. Ahead of the 24 Nov rate meeting, South Korea’s Oct CPI data on 02 Nov and 01/02 Nov FOMC as well as sentiment towards the KRW could potentially affect the outcome.”

-

11:30

Russia Interest rate decision meets forecasts (7.5%)

-

11:15

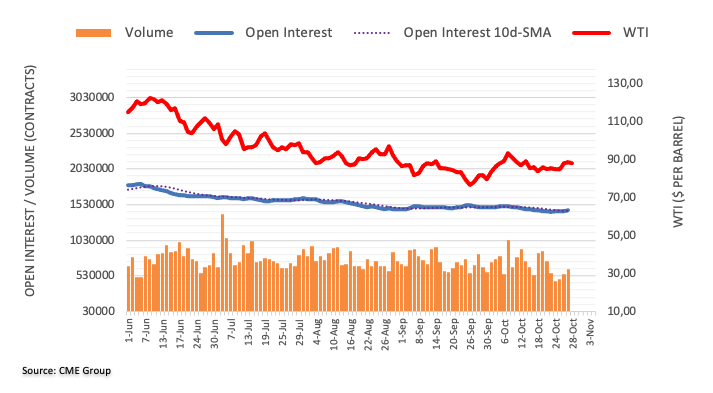

Falling OPEC+ supply should lend support to oil prices – Commerzbank

Reuters and Bloomberg will be publishing their surveys of OPEC production in October at the beginning of next week. Falling supply is set to underpin oil prices, with Brent Crude Oil trading around $96, strategists at Commerzbank report.

Oil market is likely to tighten

“Output is likely to have fallen marginally, in line with the OPEC+ decision, before it is reduced considerably more sharply in November. The deviation from the agreed production target will probably remain sizeable given that many OPEC countries have already been falling significantly short of their targets for months now.”

“The oil market is likely to tighten as a result, especially since the EU’s oil embargo that will come into force in early December should likewise drive down the supply of oil from Russia.”

“We see Brent well supported at its current level of around $96 per barrel.”

-

11:07

Ireland Retail Sales (YoY) declined to -7% in September from previous -5.6%

-

11:07

Ireland Retail Sales (MoM) dipped from previous 2% to -3.1% in September

-

11:01

Portugal Consumer Price Index (YoY) increased to 10.2% in October from previous 9.3%

-

11:01

Portugal Consumer Price Index (MoM) climbed from previous 1.2% to 1.3% in October

-

10:52

Belgium Consumer Price Index (YoY) up to 12.27% in October from previous 11.27%

-

10:52

Belgium Consumer Price Index (MoM): 2.37% (October) vs 0.96%

-

10:50

EUR/USD eyes a fresh challenge of 0.95 over the coming months – HSBC

EUR/USD is trading slightly below parity. Economists at HSBC expect the world’s most popular currency pair to challenge the 0.95 level.

Risk aversion could pull the euro lower

“We expect the EUR to weaken against the USD, with a fresh challenging of 0.95 over the coming months.”

“The increased risk of a recession in the region that this inflation battle creates may also see the EUR struggle. Risk aversion is another force that could pull the EUR lower.”

See: EUR/USD to decline towards the low-0.90s – Danske Bank

-

10:34

Japan’s Suzuki: Govt continues to expect BOJ to conduct appropriate monetary policy

The “goverment continues to expect the Bank of Japan (BOJ) to conduct appropriate monetary policy,” Japanese Finance Minister Shunichi Suzuki said on Friday.

Additional quotes

Must be mindful of adhering to fiscal discipline.

Learned lesson from british experience that once trust in fiscal management is lost, govts could come under attack from markets.

Important to consider exit strategy from fiscal stimulus in future.

Securing stable funding sources is important to increase defence budget.

Govt has topped up budget reserves in order to respond to uncertainties such as risk of global economic slowdown.

Govt, BOJ share basic stance on economy.

-

10:31

Italy 10-y Bond Auction down to 4.24% from previous 4.7%

-

10:31

Italy 5-y Bond Auction declined to 3.48% from previous 4.12%

-

10:20

USD/JPY rallies towards 148.00 on BOJ’s dovish rhetoric, Japan’s stimulus news

USD/JPY extends its relentless rally in the European session this Thursday, as the Bank of Japan’s (BOJ) status-quo on its monetary policy settings combined with the dovish rhetoric from Governor Haruhiko Kuroda revived the yen selling.

Meanwhile, the extended recovery in the US dollar across its major peers, in the wake of the upbeat American advance Q3 GDP and end-of-the-week flows, also aids the renewed upside the pair.

The pair is rallying 1% on the day to trade at 147.71, looking to recapture the 148.00 level. In doing so, the major is staging a solid comeback from the 146.00 support zone, tested on the central bank’s policy announcements.

Meanwhile, Japanese Prime Minister Fumio Kishida said on Friday, “with the package, govt will aim to push down Japan's CPI by 1.2% or more.”

Additional quotes

“Will take steps so Japan doesn't experience the kind of 10% inflation seen in the US, European countries.”

“Will seek cooperation of business lobby Keidanren, union umbrella rengo to ensure wages rise enough to compensate accelerating inflation.”

The country’s Finance Minister Shunichi Suzuki said that they are aiming to enact extra budget by the year-end.

He added that “Japan's fiscal situation has become more severe due to rounds of stimulus to cope with covid.”

USD/JPY technical levels

-

10:17

USD/JPY: Dovish BoJ underpins a weaker yen, but a peak in global risks eases pressure – MUFG

USD/JPY has moved back up closer to the 147.00 level after it hit a low yesterday of 145.11 after the Bank of Japan (BoJ) announced that it left its policy settings unchanged. Nonetheless, the pullback in yields outside of Japan provides some relief to the yen, economists at MUFG Bank report.

BoJ sticks to loose policy

“The continuation of the BoJ’s loose policy settings leaves the yen vulnerable to further weakness and keeps the onus on direct intervention to dampen the pace of yen selling.”

“The Japanese authorities are at least getting some temporary relief from the pullback in yields outside of Japan over the past week which is helping to discourage speculative yen selling alongside the risk of intervention. After peaking at the end of last week, yields outside of Japan have dropped back sharply driven in part by building speculation over a dovish pivot for central bank policies amidst intensifying fears over a sharper slowdown/hard landing for the global economy.”

“The BoJ’s dovish policy stance continues to encourage a weak yen but downside risks are beginning to ease as global yields are beginning to peak in the near-term.”

-

10:10

European Monetary Union Business Climate dipped from previous 0.81 to 0.76 in October

-

10:06

Eurozone Final Consumer Confidence improves to -27.6 in October, meets estimates

Eurozone's Final Consumer Confidence Index came in at -27.6 in October vs. -28.8 recorded previously, according to the latest data release from the European Commission. The data m the market expectations of -27.6.

Meanwhile, the bloc’s Economic Sentiment Indicator for October dropped to 92.5 vs. 92.5 expected and 93.6 previous.

Sentiment in the industry worsened to -1.2 points from -0.3 in October and for services, the economy's biggest sector, to 1.8 from 4.4 n September.

Market reaction

EUR/USD is keeping its range around 0.9950, paying little heed to the mixed Eurozone sentiment data. The pair is shedding 0.10% on the day, at the press time.

-

10:01

Italy Consumer Price Index (YoY) came in at 11.9%, above forecasts (9.6%) in October

-

10:01

Italy Consumer Price Index (EU Norm) (YoY) came in at 12.8%, above forecasts (9.9%) in October

-

10:01

Italy Consumer Price Index (EU Norm) (MoM) came in at 4%, above expectations (1.4%) in October

-

10:01

Italy Consumer Price Index (MoM) above expectations (1.2%) in October: Actual (3.5%)

-

10:00

European Monetary Union Consumer Confidence meets forecasts (-27.6) in October

-

10:00

European Monetary Union Industrial Confidence registered at -1.2 above expectations (-1.8) in October

-

10:00

European Monetary Union Services Sentiment came in at 1.8 below forecasts (3.3) in October

-

10:00

European Monetary Union Economic Sentiment Indicator meets expectations (92.5) in October

-

09:54

GBP/USD to face further downward pressure in the coming weeks – HSBC

Despite policy U-turns, the GBP still faces structural and cyclical challenges. Therefore, economists at HSBC expect GBP/USD to head lower in the coming weeks.

Further tough fiscal decisions will be required

“A series of fiscal policy U-turns, alongside temporary support for the UK government bond (known as ‘gilt’) market from the Bank of England (BoE), have provided relief for the GBP for now. However, with the UK’s fiscal, monetary and political challenges, the GBP is likely to face further downward pressure in the coming weeks.”

“For the British government, further tough fiscal decisions will be required, as debt-to-GDP ratios are set to rise and the fiscal deficit could land at about 6% of GDP.”

“For the 3 November BoE meeting, the GBP could suffer from a BoE tone that suggests the economic outlook may be even weaker than previously expected and that the market is too hawkish on rate hikes.”

-

09:32

Portugal Business Confidence down to 1.3 in October from previous 1.6

-

09:31

Portugal Consumer Confidence down to -35.2 in October from previous -32.7

-

09:22

USD Index: Maybe 110 does prove support after all – ING

The dollar holds its ground against its rivals early Friday. For today, the highlight will probably be US price data, including the Q3 Employment Cost Index (ECI) release. Any upside surprise would lift the greenback, economists at ING report.

Dollar to remain bid on dips

“The hot story will be US price data. We get to see the Q322 ECI. Consensus expects the Q3 ECI to soften to the 1.2% QoQ area in today's release. Any upside surprise could push the pricing of the Fed terminal rate (now 4.75% and off a recent high at 5.00%) higher. This would be dollar positive.”

“Maybe 110 does prove support for DXY after all.”

-

09:14

EUR/USD: Bears remain in control around 0.9940 ahead of key data

- EUR/USD sheds further ground and revisits 0.9940/35.

- Germany Flash GDP Growth Rate comes in at 1.2% YoY in Q3.

- PCE, Personal Income/Spending, U-Mich Index due later in the NA session.

The selling bias persists around the European currency and drags EUR/USD back to the 0.9940/35 band at the end of the week.

EUR/USD now looks at data

EUR/USD drops to 3-day lows and extends the pessimism into the second half of the week amidst the continuation of the rebound in the greenback and the generalized loss of momentum in the risk-linked galaxy.

The recovery in the pair lies in contrast to the rebound in the German 10-year bund yields, which manage to regain the 2.05% hurdle following the recent drop to the sub-2.00% area.

In the meantime, investors continue to digest the dovish tone at the ECB meeting on Thursday, after the central bank hiked the refi rate by 75 bps, matching consensus. Staying with the ECB, board member Villeroy suggested that there is no obligation to raise rates by another 75 bps at the next gathering. In addition, his colleague Simkus added that inflation projections are expected to be increased in December.

On the euro docket, flash GDP results see the German economy expanding 1.2% YoY in Q3 and 0.3% QoQ. Additionally, advanced inflation figures in France see the CPI rising 6.2% in the year to October. Later in the session, preliminary figures in Germany are also due along with EMU’s Consumer Confidence and Economic Sentiment.

In the US, the focus of attention will be on the release of the PCE and Core PCE along with Personal Income/Spending, the final October Consumer Sentiment and Pending Home Sales.

What to look for around EUR

EUR/USD remains on the defensive and leaves the door open to further retracement to the 0.9900 neighbourhood in the near term.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The resurgence of speculation around a potential Fed pivot seems to have removed some strength from the latter, however.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: France/Italy/Germany Flash Inflation Rate, German Preliminary Q3 GDP Growth Rate, EMU Final Consumer Confidence, Economic Sentiment

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is retreating 0.27% at 0.9936 and the breakdown of 0.9908 (55-day SMA) would target 0.9704 (weekly low October 21) en route to 0.9631 (monthly low October 13). On the upside, there is an initial hurdle at 1.0093 (monthly high October 27) followed by 1.0197 (monthly high September 12) and finally 1.0368 (monthly high August 10).

-

09:08

Italy Producer Price Index (YoY) registered at 41.8%, below expectations (44.2%) in September

-

09:08

Italy Producer Price Index (MoM) below forecasts (4.4%) in September: Actual (2.8%)

-

09:02

German Preliminary GDP expands 0.3% QoQ in Q3 vs. -0.2% expected

- German GDP arrives at 0.3% QoQ in Q3 vs. -0.2% expected.

- Annualized German GDP stands at 1.1% in Q3 vs. 0.7% expected.

- EUR/USD remains unfazed by the upbeat German Q3 growth figures.

The German economy expanded 0.3% inter-quarter in the third quarter of 2022 when compared to the expectations of -0.2% and 0.1% reported in Q2, the preliminary report published by Destatis showed on Friday.

Meanwhile, the annualized GDP rate rose by 1.1% in Q3 against the previous reading of 1.8% and matched the market expectations of a 0.7% figure.

FX implications

EUR/USD remains unimpressed by the above forecast German growth numbers, as the sentiment remains sour, which revives the US dollar’s safe-haven demand.

The major was last seen trading at 0.9940, down 0.20% on the day.

About German Prelim GDP

The Gross Domestic Product released by the Statistisches Bundesamt Deutschland is a measure of the total value of all goods and services produced by Germany. The GDP is considered as a broad measure of German economic activity and health. A high reading or a better-than-expected number has a positive effect on the EUR, while a falling trend is seen as negative (or bearish).

-

09:01

Norway Registered Unemployment n.s.a meets expectations (1.6%) in October

-

09:01

Norway Registered Unemployment s.a declined to 58.38K in October from previous 59.16K

-

09:01

Italy Producer Price Index (MoM) came in at 1.6%, below expectations (4.4%) in September

-

09:01

Germany Gross Domestic Product (QoQ) above expectations (-0.2%) in 3Q: Actual (0.3%)

-

09:01

Germany Gross Domestic Product w.d.a (YoY) came in at 1.1%, above expectations (0.7%) in 3Q

-

09:01

Germany Gross Domestic Product (YoY) registered at 1.2% above expectations (0.8%) in 3Q

-

08:49

USD/CNH risks a deeper pullback near term – UOB

According to UOB Group’s Markets Strategist Quek Ser Leang and Rates Strategist Victor Yong, USD/CNH could grind lower to the 7.1500 region in the short term.

Key Quotes

24-hour view: “The strong rebound in USD to 7.2686 came as a surprise (we were expecting USD to weaken further). We view the price movement as part of an on-going consolidation and expect USD to trade within a range of 7.2150/7.2650.”

Next 1-3 weeks: “We continue to hold the same view as yesterday (27 Oct, spot at 7.1870). As highlighted, the recent USD strength has ended. The large pullback on Wednesday has room to extend to 7.1500, possibly 7.1300. However, a break of 7.2850 (no change in ‘strong resistance’ level) would indicate that the pullback is not extending lower.”

-

08:48

NZD/USD to go lower in the coming weeks on risk aversion – HSBC

NZD/USD has established above 0.58. However, economists at HSBC expect the pair to edge lower in the coming weeks.

Damage to the economy may emerge over time

“NZD/USD is expected to go lower in the coming weeks on risk aversion.”

“With a series of positive spending, migration, and inflation data in New Zealand, the market is not seeing hard-landing risks as pronounced as before. That said, the market is currently priced for an additional increase of 200 bps in policy rate by mid-2023, so damage to the economy may emerge over time.”

-

08:45

USD Index extends the upside momentum and targets 111.00 ahead of data

- The index adds to Thursday’s advance and approaches 111.00.

- The risk complex remains on the defensive following the ECB event.

- Core PCE, Final Consumer Sentiment next on tap in the docket.

The greenback picks up extra pace in the second half of the week and approaches the key 111.00 region when measured by the USD Index (DXY) on Friday.

USD Index now looks to data

The index advances for the second session in a row and extends the bounce off Thursday’s lows in the 109.50 zone, always on the back of the sour mood surrounding the risk-associated universe.

Indeed, the riskier assets shed further ground as market participants continue to digtest Thursday’s dovish hike by the ECB and the steady stance from the BoJ at its event earlier in the Asian trading hours.

The recovery in the dollar comes in tandem with the rebound in US yields across the curve, partially leaving behind several sessions trading in the negative territory.

Later in the NA session, inflation figures tracked by the PCE and Core PCE will take centre stage seconded by Personal Income/Spending, the final Michigan Consumer Sentiment gauge for the month of October and Pending Home Sales.

What to look for around USD

The dollar extends the rebound from multi-week lows and now shifts the focus to the 111.00 hurdle.

In the meantime, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the index.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: PCE/Core PCE Price Index, Personal Income/Spending, Pending Home Sales, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.27% at 110.87 and faces the immediate up barrier at 113.88 (monthly high October 13) seconded by 114.76 (2022 high September 28) and then 115.32 (May 2002 high). On the flip side, the breakdown of 109.53 (monthly low October 27) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13).

-

08:31

EUR/USD to tick down toward the 0.9910/20 area – ING

EUR/USD stays relatively quiet below parity. Economists at ING expect the pair to edge lower towards the 0.9910/20 zone.

A dovish 75 bps hike?

“The ECB hiked rates by 75 bps, but in some ways, it could have been described as a dovish hike. Certainly, interest rate markets took note of the reference to 'substantial progress being made in withdrawing monetary accommodation' and took 30 bps off the pricing of the terminal ECB rate, which is now priced at 2.50%. We still think that it is too high.”

“For today, EUR/USD might bounce around a little as ECB hawks brief the media that the central bank's statement was not quite as dovish as the market has interpreted. But we think the dollar should stay supported into next week's FOMC meeting and would favour EUR/USD edging down today to the 0.9910/20 area – marking the top of a bear trend channel which was recently broken.”

-

08:04

AUD/USD Price Analysis: Bears seek validation from 0.6430 support

- AUD/USD holds lower ground near intraday bottom, keeps latest pullback from three-week high.

- Bearish MACD signals, clear U-turn from the key resistance lines keep sellers hopeful.

- 100-SMA could probe bears on the way to yearly low.

AUD/USD sellers poke the weekly support line near the intraday low surrounding 0.6430. In doing so, the Aussie pair prints the second consecutive intraday loss during early Friday morning in Europe.

Given the bearish MACD signals, as well as the pair’s sustained pullback from the six-week-old and three-week-long resistance lines near 0.6500, the AUD/USD prices are likely to break the immediate support line near 0.6430.

Following that, the 100-SMA support level near the 0.6330 and the 0.6300 round figure may test the AUD/USD bears before directing them to the yearly low surrounding 0.6170.

Alternatively, a confluence of the aforementioned resistance lines around 0.6500 appears a tough nut to crack for the AUD/USD buyers, a break of which could quickly propel the prices towards the monthly high near 0.6550.

In a case where AUD/USD buyers keep the reins past 0.6550, the mid-September highs near 0.6770 could gain the market’s attention ahead of the previous monthly peak of 0.6915. If the quote remains firmer past 0.6915, the 0.7000 psychological magnet will be crucial to track.

Overall, AUD/USD remains on the bear’s radar even as a short-term rebound can’t be ruled out.

AUD/USD: Four-hour chart

Trend: Further downside expected

-

08:02

BoE could hike only 50 bps, pounding the pound – ING