Notícias do Mercado

-

23:53

GBP/JPY retreats to 169.00 as yields drop ahead of BOJ

- GBP/JPY steadies after reversing from a six-year high, bears struggle to keep the reins.

- Treasury yields brace for the first weekly loss in 11 amid mixed signals from US data, ECB’s Lagardge.

- Sellers also cheer reduction in the UK’s political optimism as British macros lack in number.

- BOJ is likely to keep the monetary policy unchanged but inflation forecasts will be crucial for JPY moves.

GBP/JPY remains sidelined around 169.00, following a U-turn from an 80-month high, as traders await the key Bank of Japan (BOJ) Monetary Policy Meeting decision on Friday.

The cross-currency snapped a three-day uptrend while reversing from a multi-year high the previous day. The pullback move, however, stalls of late.

In addition to the pre-BOJ anxiety, the downbeat Treasury yields and a lack of major positives from the UK could also be held responsible for the GBP/JPY pair’s latest weakness.

That said, the US 10-year Treasury yields dropped to a two-week low on Thursday after the US Gross Domestic Product (GDP) and Personal Consumption Expenditure (PCE) failed to impress bond traders. On the same line were mixed comments from the European Central Bank (ECB) President Christine Lagarde. That said, Japan’s 10-year government bond yields (JGBs) dropped 4.0% on Thursday after refreshing a four-month high during the mid-week.

It’s worth noting that the chatters surrounding a likely shift in the BOJ’s inflation outlook and Japan’s meddling to defend the yen, despite any acceptance from policymakers in Tokyo, could also be linked to the GBP/JPY pair’s recent weakness.

Furthermore, an escalation in the Russia-Ukraine tension and recently easing pressure on the Bank of England (BOE), especially after Rishi Sunak became Prime Minister and the British activity numbers for October came in softer, also exert downside pressure on the quote.

Moving on, all eyes are on the BOJ’s verdict even if the Japanese central bank is likely to keep the six-year-old monetary policy intact. The reason could be attributed to the hopes of an upward revision to the inflation forecasts and Governor Haruhiko Kuroda’s exit in 2023.

Also read: Bank of Japan Preview: Time to start with subtle changes in the monetary policy?

Should the BOJ refrain from any surprises, while the economic predictions also remain dull, the GBP/JPY pair may reverse the latest pullback move.

Technical analysis

Although the RSI (14) and MACD both suggest that the buyers are running out of steam, a 12-day-old support line challenges the GBP/JPY bears around 168.60.

-

23:31

Gold Price Forecast: XAU/USD attempts stabilization above $1,660 as hawkish Fed bets trim

- Gold price is attempting to establish above $1,660.00 as yields dropped significantly.

- A decline in US PCE prices has trimmed hawkish Fed bets.

- The DXY accelerated on the better-than-projected growth rate reported in the third quarter report.

Gold price (XAU/USD) has turned sideways in the early Tokyo session after wild gyrations in New York. The precious metal is focusing on establishment above $1,660.00 despite a firmer recovery in the mighty US dollar index (DXY). The DXY has shrugged off pessimism after displaying an upbeat growth of the economy in the third quarter. From July to September, the economy reported a growth rate of 2.6% vs. the projections of 2.4%.

Meanwhile, the 10-year US Treasury yields have surrendered the critical support of 4% after a steep fall in US Personal Consumption Expenditure (PCE) Prices. The price change for consumer goods and services has dropped to 4.2% against the expectations of 7.9%, which trimmed the alpha generated by US government securities.

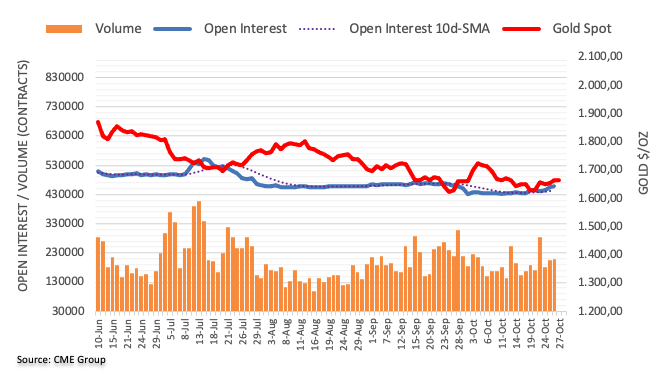

A decline in US PCE Prices has trimmed the odds of a bigger rate hike by the Federal Reserve (Fed). As per the CME FedWatch tool, the chances of the fourth consecutive 75 basis points (bps) rate hike announcement by the Federal Reserve (Fed) have dropped to 87.4%. Lower bets on hawkish Fed policy have supported the gold prices for stabilization.

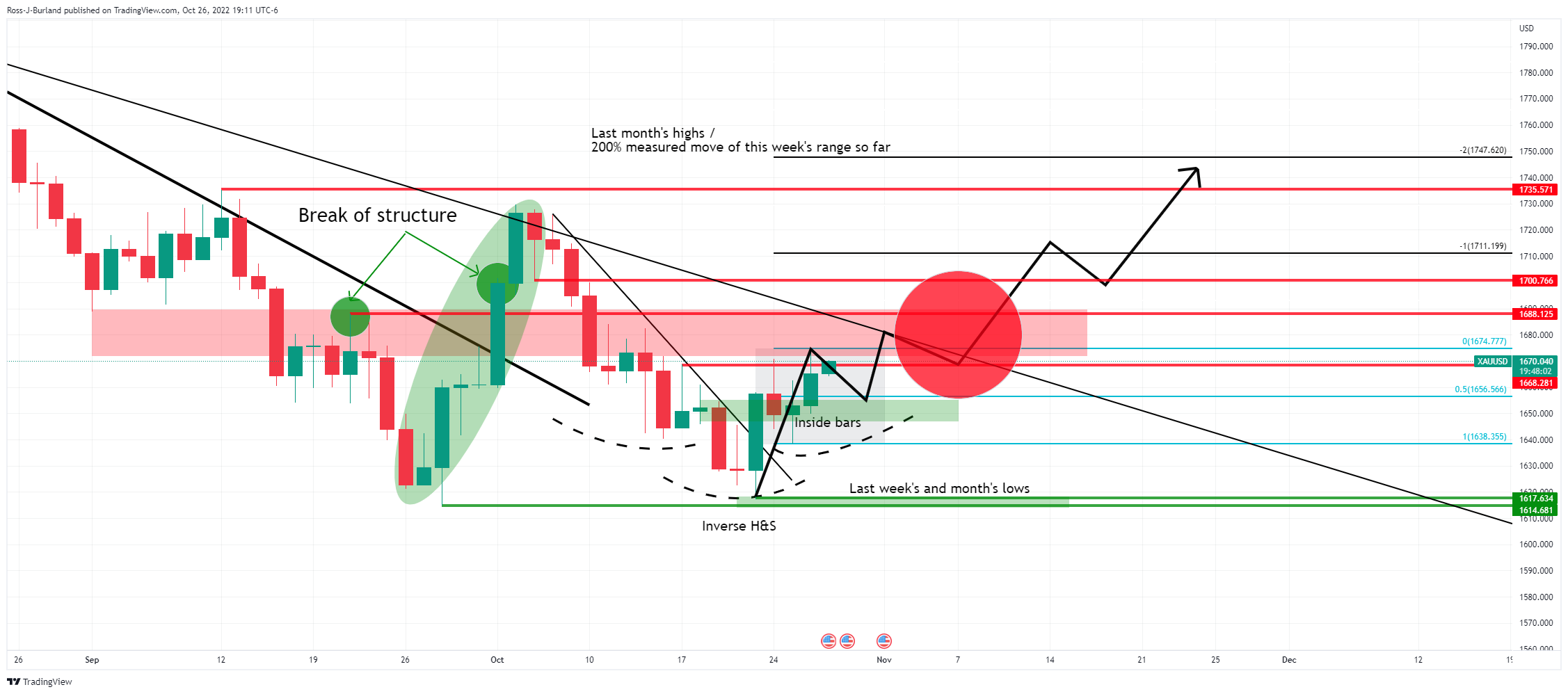

Gold technical analysis

On an hourly scale, gold prices are displaying some corrective moves on the way toward the horizontal resistance plotted from October 11 high at $1,684.05. The correction seems healthy for gold bulls amid the absence of sheer selling pressure.

The 100-period Exponential Moving Average (EMA) at $1,657.32 has acted as major support for the counter.

While, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which indicates a consolidation ahead.

Gold hourly chart

-

23:20

EUR/USD Price Analysis: Keeps pullback from 100-DMA near 0.9950

- EUR/USD remains sidelined after reversing from a six-week high.

- Sustained break of 50-DMA, descending trend line from June keeps buyers hopeful.

- MACD, RSI both suggests further upside, September’s top acts as an extra filter to the north.

- Sellers need validation from monthly support line to retake control.

EUR/USD holds lower ground following a U-turn from the monthly high, making rounds to 0.9965-70 during early Friday morning in Asia. The major currency pair refreshed the six-week high the previous day before the 100-DMA probed bulls.

The pullback, however, failed to nullify the mid-week breakout of the previous resistance line from late June. Also keeping the buyers hopeful are the bullish MACD signals and the firmer RSI (14).

Even if the quote drop below the resistance-turned-support from June 27, around 0.9830 by the press time, the 50-DMA level of 0.9890 support will act as an additional downside filter.

It should be noted that the EUR/USD buyers remain hopeful unless the quote stays above an upward-sloping support line from late September, close to 0.9830 at the latest.

Meanwhile, fresh recovery could aim for the 100-DMA hurdle of 1.0085, a break of which will need validation from the previous monthly top surrounding 1.0920 to convince EUR/USD bulls.

In a case where EUR/USD remains firmer past 1.0920, the August 2022 peak of 1.0368 should be on the buyer’s radar.

Overall, EUR/USD is likely to remain firmer but the road to the north will be a bumpy one.

EUR/USD: Daily chart

Trend: Further upside expected

-

23:05

EUR/JPY Price Analysis: Pulls back from 147.00 amidst a late risk-off impulse

- EUR/JPY registered minimal gains of 0.06% as the Asian session began.

- The EUR/JPY is set to finish the week up by 0.19%.

- EUR/JPY Price Analysis: Rising wedge in the daily chart could send the pair sliding toward the 200-DMA at 137.26.

The EUR/JPY is almost flat as the Asian Pacific session begins, following Thursday’s session, where the cross-currency pair slid more than 1% due to a risk-off impulse in the FX space. The European Central Bank (ECB) hiked rates by 75 bps, though remained vague about subsequent increases, a headwind for the Euro. Therefore, the Japanese Yen got bolstered and capitalized it. At the time of writing, the EUR/JPY is trading at 145.82, up by 0.03%.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart shows the pair retraced some of its weekly gains and is almost flat in the week at +0.13%. However, the uptrend remains intact, even though two Bank of Japan (BoJ) interventions pull back the pair from around 148.00 toward current exchange rates. Though, a formation of a rising wedge, drawn from September/October highs and lows, opens the door for further losses.

For that scenario to play out, sellers must clear the bottom trendline around 145.00, which, once cleared, would expose the 20-day Exponential Moving Average (EMA) at 144.62. A breach of the latter will expose the 50-day EMA, followed by the confluence of October 10 and the 100-day EMA at around 140.69/89. The following support area would be the September 26 cycle low at 137.42.

If the EUR/JPY uptrend resumes, the first resistance would be the October 27 high at 147.69, followed by the YTD high at 148.40. Once cleared, the next resistance would be 150.00.

EUR/JPY Key Technical Levels

-

22:59

AUD/USD drops sharply from 0.6500 as risk-on profile fades, Michigan CSI eyed

- AUD/USD has been dragged to near 0.6460 after facing barricades around 0.6500.

- A decent recovery in the DXY after robust GDP data has weighed on risk-perceived assets.

- The US Treasury yields have dropped sharply as bets for a 75 bps rate hike by the Fed have trimmed.

The AUD/USD pair has witnessed a steep fall after failing to cross the psychological hurdle of 0.6500 in the late New York session. The asset has attempted to cross the 0.6500 resistance multiple times and a spree of failures strengthened the resistance level.

A rebound in the risk-off profile also weighed pressure on the aussie bulls. A significant drop in S&P500 triggered the risk-aversion theme. The 500-stock basket witnessed losses as tech stocks drop sharply after Meta Platform Inc. (META) witnessed a bloodbath and fell to five-year lows.

Meanwhile, the US dollar index (DXY) resurfaced firmly after building a cushion around 109.53 on robust Gross Domestic Product (GDP) numbers. The DXY advanced to near 110.57 and recovered the majority of Wednesday’s losses. The US Bureau of Economic Analysis showed that the US economy has grown at a rate of 2.6% from July to September despite accelerating interest rates by the Federal Reserve (Fed). While the demand for durable goods landed lower at 0.4% than projections of 0.6% but remained higher than the former drop of 0.2%.

The 10-year US Treasury yields dropped sharply to 3.93% after a significant drop in Personal Consumption Expenditure (PCE) Prices for the third quarter. The economic data dived to 4.2% against the projections of 7.9%. As per the CME FedWatch tool, the chances of 75 basis points (bps) rate hike by the Federal Reserve (Fed) have dropped to 87.4%, which has weighed pressure on the returns from US Government bonds.

Going forward, the release of the Michigan Consumer Sentiment Index (CSI) data will remain in focus. The sentiment data is seen stable at 59.8.

On the Australian front, investors are awaiting the announcement of the interest rate decision by the Reserve Bank of Australia (RBA), which is due on Tuesday.

-

22:27

New Zealand ANZ – Roy Morgan Consumer Confidence remains at 85.4 in October

-

22:00

Brazil Interest Rate Decision remains at 13.75%

-

21:55

NZD/USD trips down at the 50-DMA, dives towards the 0.5820 area

- NZD/USD tumbled towards 0.5820s due to broad US Dollar strength.

- US economic data was positive, except for Durable Good Orders missing estimates.

- Market participants eye the US Core PCE, Consumer Sentiment, and Pending Home Sales.

The NZD/USD retreats from weekly highs reached around the 50-day Exponential Moving Average (EMA) and dived towards the 0.5820 area due to overall US Dollar strength across the board, blamed on the US economy beating growing expectations for the third quarter. Also, as shown by Wall Street closing in the red, a risk-off impulse was a headwind for the NZD. Therefore, the USD Dollar appreciated, as shown by the NZD/USD falling 0.10%, trading at 0.5824 at the time of writing.

NZD/USD wobbles trim some of its weekly gains on US data

US equities registered losses between 0.61% and 1.63%, except for the Dow Jones Industrial, up 0.61%. The US Department of Commerce reported that Gross Domestic Product (GDP) for Q3 in the United States (US) grew by 2.6%, blowing estimates of 2.4%, a signal of resilience by the US economy amidst a period of tightening monetary conditions. However, the economy is showing that consumer spending is decelerating, reporting a 1.4% gain vs. 2% achieved in the second quarter.

At the same time, the US Department of Labor reported that unemployment claims increased by 217K but lower than 220K foreseen and above the previous week’s 214K. Even though most data was positive, Durable Goods Orders for September expanded by 0.4% MoM, below 0.6% estimates, showing that inventories are building up.

Hence, the US Dollar Index, a gauge of the buck’s value vs. a basket of rivals, edged up by 0.82%, at 110.585, despite falling US Treasury yields. The 10-year benchmark note rate dropped 7 bps, at 3.929%, as traders speculation for a Fed pivot increased.

An absent New Zealand economic data would leave traders adrift to Australia’s PPI for Q3, alongside US Dollar dynamics. Contrarily, the US docket will feature the Federal Reserve preferred inflation gauge, the Core PCE, the University of Michigan Consumer Sentiment, and Pending Home Sales.

NZD/USD Key Technical Levels

-

21:50

GBP/USD Price Analysis: Bulls holding the fort at 1.1550, more to come from the bears or not?

- GBP/USD has stalled at a critical support and bulls eye a move to 1.1675.

- Bears are eager for the break of 1.1550 to make way to the PoC at 1.1470.

Cable is yet to clear out the longs below, but perhaps the bulls are not throwing in the towel just yet. The point of control, PoC, in GBP/USD is located down at 1.1470 but the sell-off has yet to break the key support structure at 1.1550. The following illustrates the technical landscape from a daily and hourly perspective.

GBP/USD daily charts

The W-formation is troubling for the bulls as a move into the neckline of the reversion pattern as illustrated above. Such a move would put heat onto in-the-money long positions built up over the week in three days of higher highs. We have seen a partial squeeze into those longs but the price has stalled in the US session in what was a volatile start to the day, hitting shorts in the New York open.

The Fibonacci tool has been drawn the current high:

A move into the neckline of the W-formation has a confluence with the 50% mean reversion at 1.1452 before the 61.8% Fibo at 1.1406 on a break below 1.1450. A break of the trendline support opens risk of a break of 1.1270 and then a really significant 1.1060 area. On the upside, with risks of support holding, 1.1675 is the top of a volume cluster.

GBP/USD H1 chart

While above 1.1547, as per the hourly time frame, a break of 1.1584 opens such risk of a move to 1.1675 in the near term

-

21:03

Forex Today: More expectations than action

What you need to take care of on Friday, October 28:

First-tier events flooding the macroeconomic calendar had far less impact than anticipated, despite bringing some fresh, interesting developments. Generally speaking, the American dollar retains its previous weak tone, as US Treasury yields edged sharply lower following the release of the preliminary estimate of the Q3 Gross Domestic Product. The Bureau of Economic Analysis reported that the economy grew at an annualized pace of 2.6% in the three months to September, better than anticipated.

Wall Street got an unexpected boost ahead of the opening but finished the day mixed on the back of earnings reports.

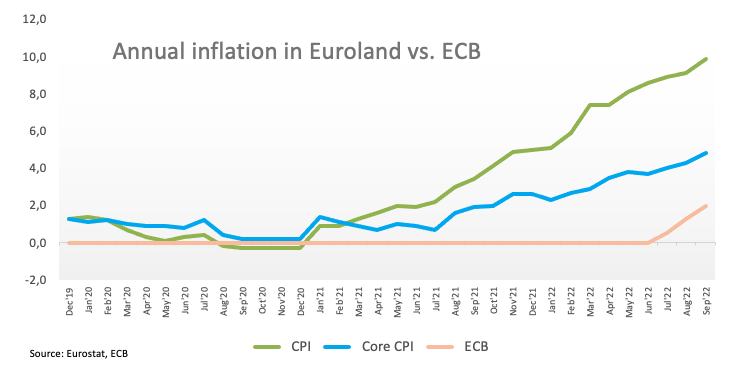

The EUR was the worst performer against the greenback as the ECB announced its monetary policy decision. As widely anticipated, the central bank hiked the three main rates by 75 bps, but the message on growth and economic developments was most discouraging. In one line, policymakers expect inflation to remain elevated and growth to slow further. Upcoming rate hikes will be data-dependant and a meeting-by-meeting decision. The only thing clear about them is that more hikes are needed to reach the ECB’s inflation goal.

Additionally, the ECB introduced changes to the Targeted Longer-Term Refinancing Operations (TLTRO) III program, also meant to tighten financial conditions further. the interest rate on TLTRO III operations will be indexed to the average applicable key ECB interest rates over this period. The existing interest rate calculation method will be maintained for the period from the settlement date of each respective TLTRO III operation until 22 November 2022, albeit with indexing to the applicable key ECB interest rates ending on that date.

GBP/USD trades around 1.1570, marginally lower for the day. AUD/USD also shed some ground and hovers around 0.6460. The USD/CAD, on the other hand, trades little changed around 1.3550.

The greenback also appreciated against the CHF, with the pair now trading at 0.9915, while USD/JPY pivots around 146.10 ahead of the Bank of Japan monetary policy decision.

Gold shed some ground but is little changed at around $1,660 a troy ounce, while crude oil prices ticked higher. WTI settled at $88.90 a barrel.

Dogecoin price: DOGE climbs 20% overnight, whale transactions hit two month peak

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:02

EUR/USD extends losses and dips below the parity level

- Eurodollar's reversal from 1.0090 extends below parity.

- The euro accelerated its downtrend after the ECB's decision.

- EUR/USD: Recent developments make the 0.93 target less likely – MUFG.

The euro has pared recent gains on Thursday to put an end to a four-day rally. The pair retreated from six-week highs right below 1.0100, returning to levels below 1.0000 as the US dollar picked up.

The euro dives after ECB’s decision

The common currency’s reversal accelerated after the release of the European Central Bank’s monetary policy decision. As widely expected, the bank hiked rates by 75 basis points for the second consecutive time, in an attempt to tame historical inflation, raising the deposit rate to 1.50%.

Beyond that, ECB Chair, Christine Lagarde, reiterated the bank's commitment to continue hiking rates, in spite of the downside risks for the economy which could lead to higher unemployment levels.

On the other hand, the US dollar has shrugged off the previous days' weakness to post a moderate recovery. An upbeat US GDP reading, which has shown an unexpected 2.6% economic expansion in the fourth quarter, has eased concerns about a recession providing a fresh boost to the US dollar.

EUR/USD: Recent developments make the 0.9300 target less likely – MUFG

Currency analysts at MUFG bank observe that the recent developments and the USD sell-off make the 0.9300 target less likely: “Overall, recent developments, including the plunge in the price of natural gas in Europe and broad-based USD sell-off have made it less likely that EUR/USD fall as low as our year-end target of 0.9300 even after today’s less hawkish ECB policy update.”

Technical levels to watch

-

20:47

United States 7-Year Note Auction climbed from previous 3.898% to 4.027%

-

20:27

Gold Price Forecast: XAU/USD bulls are backed into a corner as US dollar corrects

- The gold price is under pressure, forced back into a neutral zone on the daily chart.

- The hourly charts show that the price is balanced at a critical juncture.

- Investors look ahead to tomorrow's PCE and next week's Fed.

The price of gold has been pressured on Thursday in a resurgence in the US dollar that is correcting hard from a key daily supporting trendline as illustrated below by the DXY, an index that measures the greenback vs. a basket of major currencies. At the time of writing, the yellow metal is trading at $1,658 and down some 0.4% on the day. Gold has travelled between a high of $1,670.84 to a low of $1,654.89 so far., crucially failing to hold above a key resistance level on the daily chart.

The dollar index regained ground to above 110, boosted from the lowest level in over a month from both a technical basis in a move that started to show up on the charts ahead of key growth data from the US economy and the European Central Bank meeting. Gross Domestic Product data for the US has shown that the US economy is faring better than expected. It grew an annualized 2.6% on quarter in the three months to September of 2022, more than market expectations of 2.4% and rebounding from a contraction in the first half of the year. This has ended two straight quarterly decreases in output, which had raised concerns that the economy was in recession.

Meanwhile, the ECB raised all of its key policy rates by 75bp. The main refinancing rate is now at 2.0%. ''That is a level some officials at the ECB think approximates with longer-run neutrality, assuming inflation over time will return to 2.0%,'' analysts at ANZ Bank argued. ''But inflation is miles from that currently and further rate rises will be warranted. We are currently forecasting an additional 150bp of hikes. We think the ECB may dial down to 50bp hikes from December.''

Additionally, Lagarde's gloomy outlook for the economy has boosted an appetite for the US dollar as being regarded as the cleanest shirt in the laundry basket of currencies. The data and ECB falls ahead of tomorrow's PCE and next week's Federal Reserve meeting whereby the central bank is expected to raise rates at its Nov. 1-2 meeting by 75 basis points to 1.5%, a 13-year high. It is also likely to reel in a key subsidy to commercial banks.

However, there was a technical bounce in the greenback following its slide in recent days as investors started to cheer signs that the US Federal Reserve is considering slowing down its aggressive rate hikes in December:

DXY weekly chart

Gold technical analysis

The price of gold has failed to get above a key resistance area on the daily chart of $1,668 where it needs to close on a daily basis to instil confidence in the upside prospects.

$1,675 the high was achieved on Wednesday as the US dollar continued to slide, but the close of $1,665 was less than convincing and has consequently led to a drop back inside of the range. Nevertheless, the daily chart, above, still shows a number of bullish confluences. We have seen the break of the daily structure back on Oct 3, This led to the yellow metal being forced onto the back side of the daily trendline resistance.

The price moved back into Wednesday 22 Sep bullish peak formation lows in a micro daily bear trend. We have also broken on the backside of the micro (secondary) daily trendline on Fri 22 Oct and we now have two prior inside days. This is a coiled market creating higher daily lows and the bulls could be about to make their move to break and close above $1,668 resistance in a breakout of the inverse head and shoulders neckline. Thereafter, a close above the $1,670 neckline could be the trigger point to start looking for the set-up on lower time frames.

However, should the following playout on the hourly time frame, then the upside bias will be invalidated:

As shown, the price is pressed up against a key hourly trendline support. Should the bears send the price to the other side of it, on a break of $1,655, pressures could really start to build sending the price fatally below $1,650. A break of the 50% mean reversion of the current bullish trend will open the risk of a move to a 61.8% golden ratio near $1,640. If this fails to support, then there is nothing much in the way of a fast drop to the lows and beyond for a bearish continuation.

-

20:18

USD/CAD finds support at 1.3500 and picks up to 1.3550

- The dollar trims losses after bouncing up at the 1.3500 support area.

- The upbeat US data have eased negative pressure on the USD.

- USD/CAD is seen appreciating towards 1.40 – MUFG.

The US dollar has been unable to break support at 1.3500 for the second consecutive day and bounced up on Thursday’s afternoon US session to erase previous losses, turning positive on the daily chart.

The greenback ticks up after upbeat US GDP data

US Gross Domestic Product figures have beaten expectations on Thursday, showing a 2.6% annual expansion, after having contracted over the previous two quarters. These figures have eased concerns about a technical recession in the US, giving a fresh boost to the USD.

Previously, the pair had retreated to test one-month lows at 1.3500 against a strong Canadian dollar. The loonie rallied over the previous sessions, buoyed by higher oil prices as the negative impact of Wednesday’s BoC monetary policy decision faded.

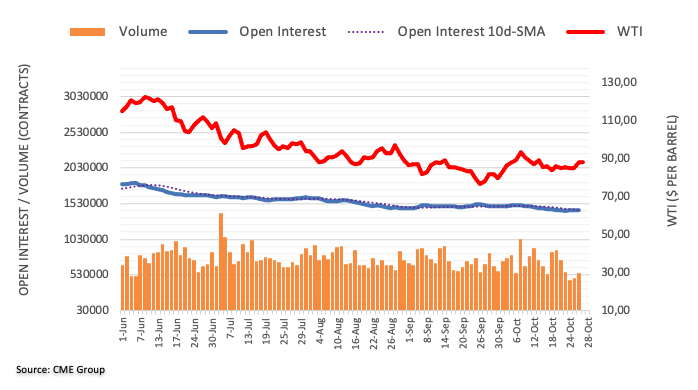

Oil prices have appreciated about 0.7% for the second consecutive day on Thursday, with the US benchmark WTI oil reaching levels right below $90. This has spurred demand for the Canadian dollar, as Canada is one of the world’s major oil producers.

USD/CAD is expected to move back towards 1.4000 – MUFG

Currency analysts at MUFG bank remain bullish on the pair and point out to the 1.40 target: “Yesterday’s decision from the BoC supports our view that yield spreads between the US and Canada will continue to move in favor of USD as the Fed hikes rates for longer and lifts rates higher than the BoC during this hiking cycle (…) We are not convinced yet the US dollar and Fed rate hike expectations have peaked out yet, and still expect USD/CAD to move back towards the 1.4000 level.”

Technical levels to watch

-

19:30

EUR/GBP Price Analysis: Bears are pushing towards the 0.8600 support area

- The euro accelerates its downtrend and approaches 0.8600.

- Bears have taken over after the ECB confirmed market expectations.

- The pair should return above 0.8690 to ease negative pressure.

The euro is accelerating its downtrend on Thursday’s US session, as the pair’s reversal from session highs at 0.8690, extends to the vicinity of 0.8600 to test support at the 100-day SMA.

The bears took hold of the common currency after the European Central Bank confirmed market expectations and hiked interest rates by 0.75% for the second consecutive time, leaving its deposit rate at 1.5%, its highest level since 2009.

The pair squeezed lower immediately after the release of the ECB’s monetary policy decision, against a British pound that remains favored by the investors’ relief after Rishi Sunak’s appointment as British prime minister.

From a technical point of view, the euro’s failure to return above the 50-day SMA has increased downside pressure, pushing the pair toward the 100-day SMA at 0.8600. Below here, the next downside targets would be the downward trendline support, from mid-November lows, now at 0.8535, and the 200-day SMA at 0.8500.

On the upside, a bullish reaction would have to extend past the mentioned 50-day SMA, at 0.8690 to aim for the October 21 high at 0.8780. A confirmation above the mentioned level would negate the bearish trend and open the path toward October 12 high at 0.8870.

EUR/GBP daily chart

Technical levels to watch

-

19:23

USD/JPY Price Analysis: Stalls at key technical level, retraces towards 146.00

- USD/JPY seesawed in a wide range, though it remains unable to stay in the green, losing 0.15%.

- The daily chart keeps buyers in charge, though the USD/JPY might pull back before testing YTD highs.

- Short-term, the USD/JPY is neutral-downward biased, and once it clears the 200-EMA, it could fall below 144.00.

The USD/JPY stalled at the 20-day Exponential Moving Average (EMA) at around 146.90 and tumbled toward its daily low of 145.10 before recovering some ground. Nevertheless, the USD/JPY continued to trade in the red, at 146.12, down by 0.14% amidst a volatile session.

USD/JPY Price Analysis: Technical outlook

The USD/JPY remains neutral-to-upward biased, as shown by the daily chart, though the effect of the Bank of Japan (BoJ) interventions has taken its toll on the major. Also, falling US Treasury bond yields are headwinds for the USD; therefore, further USD/JPY downside is expected.

From a technical perspective, the USD/JPY faces solid resistance at 146.90 and is struggling to extend its losses below the October 26 daily close at 146.37, which, if confirmed, would open the door for further losses. USD/JPY key support levels lie at the October 27 low of 145.10, followed by the 50-day EMA at 143.64, ahead of 140.00.

Short term, the USD/JPY four-hour chart suggests the pair is neutral-to-downward biased, unable to crack the 200-EMA at 145.61 on its first attempt in the Asian session. Worth noting that the USD/JPY tumbled to a fresh three-week low, so if the USD/JPY did not clear the last higher-high around 148.41, a re-test of the 200-EMA is on the cards.

Hence, the USD/JPY first support would be the S1 daily pivot at 145.56, followed by the 200-EMA at 145.61. Once that zone is cleared, the next support would be the S2 daily pivot point at 144.80, followed by 144.00, ahead of the S3 pivot level at 143.37.

USD/JPY Key Technical Levels

-

19:11

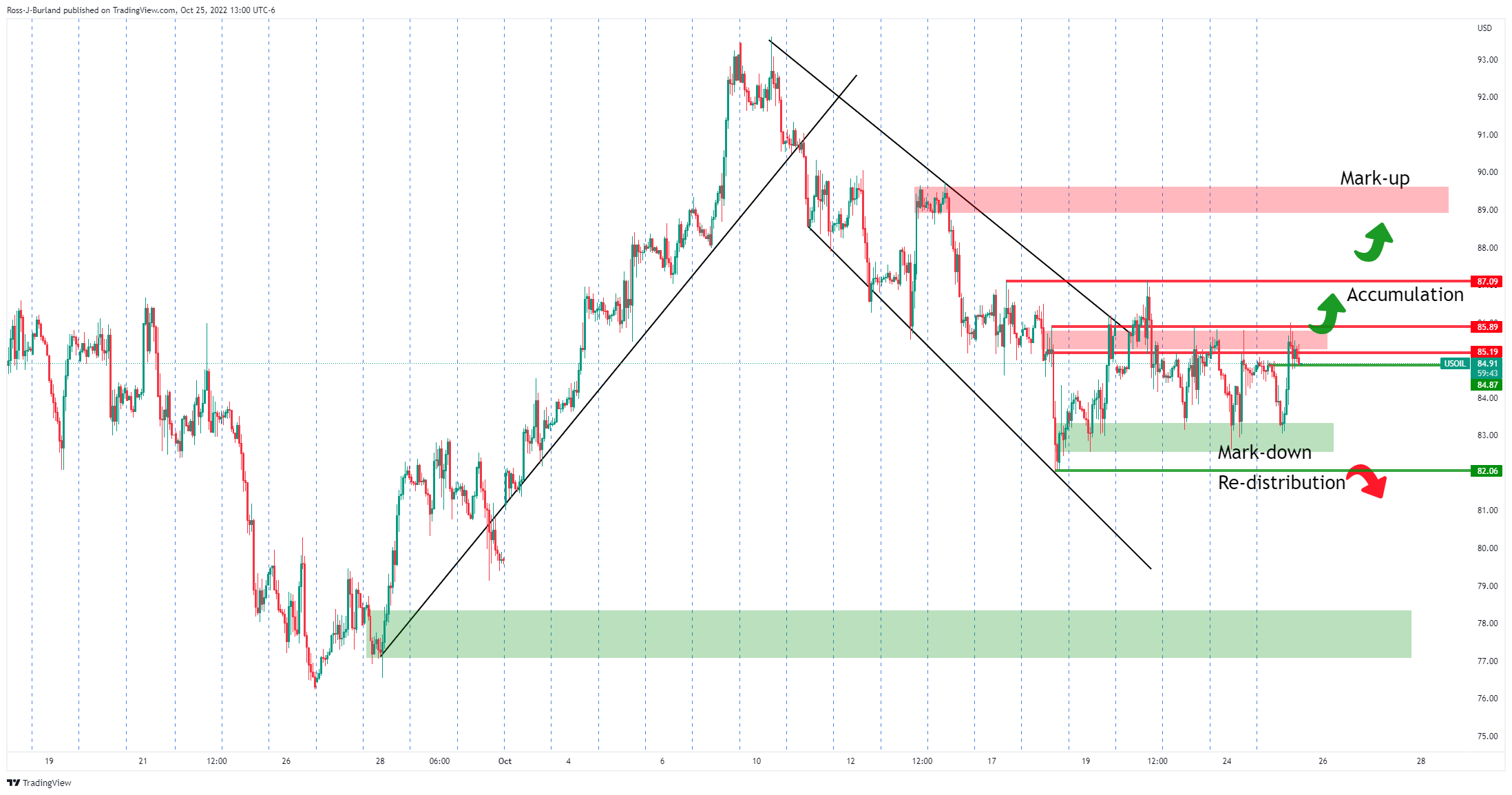

WTI reaches up to key resistance as trend followers stay on the bid

- WTI has moved into key resistance as trend followers stay on the bid.

- Supply concerns have been dominating the energy complex.

At the time of writing, West Texas Intermediate crude oil (WTI), is up by over 0.9% at $89.10 having claimed from a low of $87.35 reaching a high of $89.78 so far. Supply concerns have been dominating the market on the back of the United States reporting better-than-expected economic growth data for the third quarter. At the same time, tight supplies of diesel and other distillates are fuelling the bid.

The United States reported its gross domestic product rose by 2.6% on an annualized in the third quarter, beating the 2.3% consensus forecast but above the second quarter's 0.6% drop. The data comes ahead of PCE on Friday and the Federal Reserve meeting next week. In any case, the data today is expected to keep the Fed on track in its attempt to slow inflation by hiking rates steeply.

Meanwhile, weak distillate supplies are offering support to prices. The Energy Information Administration mid-week reported distillate stocks rose by 0.2 million barrels last week, rising off a 17-year low and offering support to oil. The EIA also noted US oil exports rose to a record last week. The agency reported that US gasoline inventories fell by about 1.5 million barrels last week and distillate stocks remained at record lows, while US exports of crude oil were strong, the bank said. This offset a smaller-than-expected 2.6-million-barrel increase in crude inventories.

Analysts at TD Securities argued that energy prices are being supported by algorithmic trend follower purchases. ''CTAs are building a net long position in Brent crude as uptrend signals strengthen, but extreme volatility is likely to cap participation from this cohort amid weak trend signals and risk parity portfolio deleveraging.

Diesel prices are also being supported by CTA trend followers, but similarly to other energy markets, algo firepower remains capped by extreme volatility in the complex which argues for little follow-through from CTAs.''WTI technical analysis

In a prior analysis, it was stated that ''the price could be on the verge of an upside rally on a break of structure, with bulls accumulating the recent price drop,'' with the price being on the backside of the channel:

As the following will illustrate, the price has moved into the projected resistance as follows:

At this juncture, the bulls will need to get above $90.00 for prospects of a break of the $93.60 mid-October highs.

$88.50 comes as the first key support ahead of $87.00.

-

18:40

NZD/USD erases previous losses and stalls again below 0.5870

- The kiwi loses steam after hitting resistance at 0.5870.

- The US dollar picks up after a two-day sell-off.

- NZD/USD should extend beyond 0.5880 to gain bullish traction – UOB.

The New Zealand dollar has managed to regain lost ground after bouncing from 0.5790 earlier on Thursday, but the pair is struggling to find acceptance above 0.5870 and remains little changed on the daily chart.

Kiwi’s rally loses steam with the USD picking up

A better-than-expected US Gross Domestic Product report contributed to easing negative pressure on the US dollar on Thursday. According to data released by the Commerce Department, the US economy expanded at an unexpected 4.6% pace in the third quarter, putting an end to two consecutive negative quarters and calming recession fears.

The moderately positive USD tone is posing headwinds to the kiwi, which had rallied about 2.5% over the past two days amid broad-based USD weakness as the investors start to price in a certain softening in the Fed’s monetary tightening cycle

The USD Index, which measures the value of the dollar against a basket of the most traded currencies, is trading about 0.6%, back above the 110.00 level following a nearly 2% reversal over the last two days.

NZD/USD: Above 0.5880 further sustained appreciation is likely – UOB

FX analysts at UOB point out that a successful move above 0.5880 might trigger further appreciation: “Despite the rapid rise, upward momentum has not improved by much. That said, NZD could rise, but it has to close above 0.5880 before a further sustained advance is likely. Looking ahead, the next resistance is at 0.5920. Support is at 0.5770, but only a break of 0.5740 would indicate that NZD is not strengthening further.”

Technical levels to watch

-

18:40

AUD/USD trips down below 0.6500, though clings to weekly gains despite upbeat US GDP

- AUD/USD drops on upbeat US data amidst a risk-on mood.

- The US Dollar got bolstered by GDP and unemployment claims data, though Durable Orders missed estimates.

- Australia’s Q3 CPI justifies the Reserve Bank of Australia (RBA) next week’s rate hike.

The AUD/USD tumbled below 0.6500 from weekly highs around 0.6521 after news emerged that the US economy grew at a higher pace than estimated, snapping a “technical recession” after back-to-back quarters of negative Gross Domestic Product (GDP) readings. Therefore, the US Dollar got bolstered, as shown by the AUD/USD diving towards 0.6470, down 0.37%, at the time of writing.

The Q3 preliminary GDP reading smashed estimates

The Australian Dollar lost traction when the US Bureau of Economic Analysis (BEA) reported that the US Advance Q3 GDP rose by 2.6%, crushing estimates of 2.4%. Factors like the trade deficit narrowing in the third quarter summed 2.77% to the GDP’s increase. The same report flashed that consumer spending is slowing down, from 2% in Q2 to 1.4%.

Elsewhere, the US Department of Labor revealed Initial Jobless Claims the week ending on October 22, which jumped by 217K, lower than the 220K foreseen, though slightly up from the previous week. Durable Good Orders offset that, missing estimates, increased by just 0.4%, below 0.6% MoM, expectations

The US Dollar Index, a gauge of the greenback’s value against a basket of peers, climbs 0.53% at 110.277, while US Treasury yields tumble. The US 10-year bond yield is losing six and a half bps, down at 3.943%, weighed by speculations of a Fed pivot.

Aside from this, Australia’s inflation report on Wednesday escalated speculations for another Reserve Bank of Australia’s (RBA) rate hike. Inflation for Q3 rose 7.3% YoY, while the RBA’s favorite inflation gauge, core trimmed mean rose by 6.1% YoY. According to analysts at Westpac said, “Rates markets continued to place a high probability on the RBA raising the cash rate 25bp next week but yields rose for later dates, such as the May 2023 contract, up from 3.88% to 3.95% and above 3% in mid-2023.” Therefore, the RBA’s next meeting

AUD/USD Key Technical Levels

-

18:39

Reports ECB did not mean to imply slower hiking with ‘progress’ remark

European Central Bank hawks are playing down the removal of 'several' from guidance on further hikes according to Reuters sources.

''Doves say guidance tweak paves the ground for ending hikes in December 'in case of improved inflation outlook or possibly in March''.

The reports suggest that the ECB did not mean to imply slower hiking with the ‘progress’ remark and that the vote was not unanimous, while 3 officials wanted a 50bps hike.

The European Central Bank raised interest rates by 75 basis points, stressing that inflation is too high and expected to remain high for an extended period. ECB President Christine Lagarde said that while Russia's invasion of Ukraine and other global uncertainties meant the euro area economy faced a number of risks to the downside, inflation risks were skewed upward.

EUR/USD, which had hit a one-month high of 1.0094 versus the dollar earlier in the day, dropped back below parity after the ECB rate decision while US data beat expectations. EUR/USD is down 1% on the day to 0.9976 at the time of writing.

-

17:57

Silver Price Analysis: XAG/USD, capped below a key resistance area at $19.60/70

- Silver prices tick down after failing to breach the $19.60/70 resistance area.

- The 100-day SMA and 50% Fibonacci retracement are putting a lid on XAG/USD's recovery.

- The near-term bias remains positive, with downside attempts limited at $19.30.

Silver prices have ticked lower on Thursday, as the recovery from Tuesday’s low at $18.80, failed about 100 pips higher, capped by an important resistance hurdle.

Silver bulls, capped at the 100-day SMA

The XAG/USD seems unable to break above the resistance area at $19.60/70, where the 100-day SMA and the 50% Fibonacci retracement of the October 4 to 14 decline are posing a significant resistance to the white metal's recovery.

The pair seems to have lost momentum on Thursday, weighed by a somewhat firmer US dollar, although it maintains the near-term positive bias, with downside attempts limited above the 38.2% Fibonacci retracement, at $19.30 and the 50-day SMA, at $19.10.

On the upside, a confirmation above $19.70 would face another key resistance area in the vicinity of the $20.00 psychological level (September 9, 12, and 21 highs and the 61,8% Fib level of the aforementioned decline) before aiming at $20.85 October 6 and 7 highs.

A bearish reaction below the 50-day SMA, at $19.10 would negate the positive trend and set the pair aiming towards, $18.80 (Oct 25 low) and October 14 low at $18.10.

Technical levels to watch

-

17:25

GBP/USD: The Pound Sterling ebbs below 1.1600 as the US GDP rises

- GBP/USD stumbles below 1.1600 as the US economy grows in Q3, and the US Dollar jumps.

- US Jobless Claims added to the already positive mood, though Goods Orders disappointed.

- Traders turn to the Federal Reserve’s favorite gauge of inflation, the Core PCE.

The GBP/USD dropped from around 1.1600 after hitting six-week highs at 1.1645 due to overall US Dollar strength spurred by upbeat US data showing the economy’s resilience, despite the ongoing tightening of monetary conditions by the Federal Reserve. Also, the ECB’s monetary policy decisions were a tailwind for the US Dollar and weighed on the Pound Sterling. The GBP/USD is trading at 1.1581, below its opening price by 0.36 percent.

The US Dollar got a boost from US economic data

A risk-on impulse was no excuse for the US Dollar to appreciate against the Sterling. The US Bureau of Economic Analysis (BEA) revealed the growth figures for the third quarter, showing that the economy is growing at a faster rate than estimated, at 2.6%, vs. 2.4%, foreseen by a Reuters poll. Additionally, the US Department of Labor revealed that Unemployment claims for the week ending on October 22 rose by 217K, less than estimates of 220K, though more than the previous week, flashing that the labor market is easing.

Nevertheless, the fall in Durable Good orders increasing by just 0.4% MoM, less than the 0.6% increase estimated for September, disappointed market participants. Excluding transportation, new orders shrank b 0.5%, below the previous month’s reading.

Following the release of US economic data and the European Central Bank (ECB) policy decision, the GBP/]USD resumed its slide below 1.1600. Nevertheless, the appointment of the UK’s new Primer Minister, Rishi Sunak, stalled the downfall and kept the pair’s weekly gains at around 2.50%.

What to watch

The US economic docket will feature the US Federal Reserve’s favorite inflation gauge, the Core PCE, estimated at 0.5% MoM and 6.3% YoY, alongside the Consumer Sentiment and Pending Home Sales.

GBP/USD Key Technical Levels

-

17:23

USD/CHF’s recovery from 0.9840 stalls below 0.9900

- US dollar's rebound meets resistance right above 0.9900.

- The greenback trims losses following a two-day sell-off.

- USD/CHF: Below 0.9876, the near-term risk turns negative – Credit Suisse.

The US dollar is attempting to pare losses on Thursday after the sharp reversal witnessed in the previous two days. The pair bounced up from three-week lows at 0.9840, has stalled below 0.9900 after hitting session highs at 0.9925.

The US dollar picks up amid upbeat US data

Data released by the Commerce Department revealed an unexpected rebound in the US economy. US Gross Domestic Product expanded at a 2.6% annual pace in the third quarter, beating expectations of a 2.4% growth and reversing two consecutive contractions in the previous quarters.

On the negative side, however, domestic demand has shown its weakest performance in two years, confirming the negative impact of the sharpest monetary tightening cycle of the latest 40 years.

US stock markets jumped into the green following the data, although they are mixed at the time of writing, with the Dow Jones 1.2% higher the S&P Index practically flat, and the Nasdaq 0.8% down.

US Treasury yields have continued their pullback, with the benchmark 10-year bond trading at 3.9%, down from levels near 4.3% earlier this week.

USD/CHF: Breach of 0.9876 shifts the near-term risk lower – Credit Suisse

FX analysts at Credit Suisse warn about a bearish move past 0.9876, which might pull the pair to the 0.9775 area: “USD/CHF has managed to break below 0.9876. This signals that further near-term weakness is likely to follow. With near-term MACD also reinforcing this bearish signal, we look for a fall to 0.9838/30 initially and then likely for a test of the 55-DMA at 0.9775.”

Technical levels to watch

-

17:00

United States Kansas Fed Manufacturing Activity fell from previous 2 to -22 in October

-

17:00

ECB: Data and a less hawkish guidance consistent with a 50 bps hike in December – Wells Fargo

On Thursday, the European Central Bank had its monetary policy meeting. They raised the key interest rates by 75 basis points as expected. According to analysts at Wells Fargo, through its forward guidance, the central bank was perhaps somewhat less hawkish than at previous recent meetings.

Key Quotes:

“The European Central Bank (ECB) delivered another large rate hike at today's monetary policy announcement, though its forward guidance was perhaps somewhat less hawkish than at previous meetings. With the possibility of an ECB pivot at the meetings ahead, and with changes to long-term refinancing operations potentially impacting the profitability of European banks, today's announcement is overall a modest negative for the euro.”

“Overall, we view the mildly less hawkish guidance and widespread signs of a contracting Eurozone economy as consistent with a smaller 50 basis point Deposit Rate hike to 2.00% in December, especially if CPI inflation recedes to any extent in the interim. That view appears to be shared by market participants, with German two-year government yield down around 18 basis points to 1.85% since the ECB's announcement, and with the euro also down today. If the Federal Reserve fails to pivot at its monetary policy announcement next week, the euro could see further downside in the weeks and months ahead.”

-

16:58

United States 4-Week Bill Auction climbed from previous 3.43% to 3.6%

-

16:54

EUR/USD: Recent developments made it less likely the year-end target of 0.9300 – MUFG

Analysts at MUFG Bank, point out that recent developments and a board-based USD sell-off made it less likely for EUR/USD to reach their year-end target of 0.9300, even after the “less hawkish” European Central Bank meeting.

Key Quotes:

“The main immediate takeaway for financial markets is that the ECB has become the latest G10 central bank to disappoint expectations for a more hawkish policy update. It follows dovish surprises from the RBA and BoC when they delivered smaller rate hikes, and together will further encourage near-term speculation that the Fed will follow suite and slow the pace of hikes at the end of this year as well. Building expectations that broader dovish policy shift from G10 central banks is already underway is providing some much needed relief for risk assets.”

“In the FX market, it has contributed to the USD correcting sharply lower since the end of last week although confirmation of slowdown in tightening from Fed officials has not yet been confirmed. Next week’s FOMC meeting on 2nd November could prove even more pivotal for near-term USD direction. Overall, recent developments including the plunge in the price of natural gas in Europe and broad-based USD sell-off have made it less likely that EUR/USD fall as low as our year-end target of 0.9300 even after today’s less hawkish ECB policy update.”

-

16:47

US: Recent apparent strength may overstate the health of the factory sector – Wells Fargo

Data released in the US on Thursday included the first Q3 GDP estimate and the preliminary September Durable Goods Orders. Analysts at Wells Fargo point out that considering a big picture from all the data and what it means for manufacturing is that recent apparent strength in the data may overstate the health of the factory sector.

Key Quotes:

“After accounting for revisions, durable goods orders actually came in a bit better than expected. The September increase was 0.4% versus the 0.6% expected by consensus, but last month got revised from -0.2% to +0.2%, so the new level is higher. On top of that, in this morning's separately reported third quarter GDP report, we learned that headline growth got a half a percentage point boost from equipment spending, which shot up at a 10.8% annualized rate in the quarter.

“The Federal Reserve raises rates aggressively and manufacturing ramps up? Our take is that this is more emblematic of new demand crumbling under higher rates and recession fears but high backlog is helping sustain shipments a bit longer.”

“Nondefense capital goods shipments fell 0.6% in September, but that was on the heels of an upward revision that lifted August's gain to 3.1% from the 1.8% increase initially reported. This upward revision helped support the large gain in Q3 equipment spending growth. But in also excluding aircraft, core capital goods shipments were downwardly revised and suggests that current equipment spending is losing momentum.”

-

16:37

USD/JPY, unable to break above 147.00, retreats below 146.00

- Limited below 1457.00, the dollar drops for the third consecutive day.

- The greenback weakens as the market assumes a Fed pivot.

- USD/JPY: A decline to 144.00 is increasingly likely – UOB.

The US dollar’s recovery attempt from multi-week lows at 145.00 area witnessed during Thursday’s European morning trade, was capped at 147.00 and the pair pulled lower afterward returning below 146.00 at the time of writing.

Fed pivot expectations keep weighing on the USD

The pair is 0.3% down on the day, on track to close a three-day reversal, its worst performance since late July, as investors start to price in a slowdown on Federal Reserve’s monetary tightening pace. A recent set of disappointing macroeconomic data has raised the alarm about the potential negative effect of an aggressive rate hiking path that has propelled the US dollar about 20% higher over the current year.

The bank is widely expected to hike rates by 75 basis points next week, however, there is growing market speculation about a slowdown to a 0.50% hike in December’s meeting.

In the macroeconomic front, the upbeat US Gross Domestic Product, which bounced up at an unexpected 2.6% annual pace, after two consecutive contractions in the previous quarters, has failed to provide any relevant support to the USD.

USD/JPY: Further decline to 144.00 seems possible – UOB

FX analysts at UOB observe further downside potential in the pair, although still limited at 144.00: “Yesterday (26 Oct), USD lost 1.05% (NY close of 146.35) and downward momentum is building, albeit tentatively. In the coming days, USD could edge lower, but at this stage, the odds of a sustained decline below 144.00 are not high. On the upside, a break of the ‘strong resistance’ level at 148.80 would indicate the build-up in momentum has fizzled out.”

Technical levels to watch

-

16:31

ECB: Another big rate hike in December remains on the table – Commerzbank

The European Central Bank raised the key interest rates by 75 basis points on Thursday, as expected. Analysts at Commerzbank, point out Christine Lagarde sounded dovish at the press conference but they still see that another big rate hike for the December meeting remains on the table.

Key Quotes:

“After the press conference it is less clear than before whether the ECB will raise its key interest rates by another 75 basis points at its next meeting in December. This is because the ECB president already sees downside risks to the ECB's economic projections, probably in view of the weak leading indicators. She said that the Governing Council will address rising recession risks at its next meeting.”

“All in all, we continue to expect the ECB to raise its key rates by another 75 basis points in December. If the recession gradually becomes visible in the hard data after the turn of the year, it should slow down the pace and raise its key rates by 50 in early February and 25 in March. The rate hike process would then end at a deposit rate of 3%.”

-

16:22

Gold Price Forecast: XAU/USD wobbles around $1660 after upbeat US GDP data, ECB’s decision

- Gold price creeps lower as the US Dollar gains traction, despite falling US Treasury yields.

- The US Gross Domestic Product (GDP) accelerated and snapped two-quarters of consecutive contraction.

- The ECB lifted rates by 75 bps for the second consecutive meeting and boosted the greenback.

Gold prices fluctuate around $1660 following positive US economic data that keeps investors’ spirits high as US equities rise. Additionally, the greenback is recovering some ground after diving to a fresh five-week low at 109.535. At the time of writing, XAU/USD is trading at $1662, down by 0.25% from its opening price.

XAU/USD stalls at a key technical level on upbeat US growth data

XAU/USD remains oscillating around the $1660 area, though capped by the release of the US Advance Q3 GDP, which exceeded estimates, with the economy growing by 2.6%, above 2.4% estimates, entering into positive territory, following Q1 and Q2 contractions, which triggered a “technical recession,” as reported by the US Commerce Department.

The GDP got bolstered by the trade deficit narrowing sharply, adding 2.77% to GDP growth. Meanwhile, consumer spending slowed to a 1.4% rate, lower than Q2’s 2.0%, which could comfort Fed officials that demand is slowing down.

At the same time, the US Department of Labor reported that Unemployment claims for the week ending on October 22 rose by 217K, less than estimates of 220K, but more than the previous week, flashing that the labor market is easing.

Earlier, the European Central Bank (ECB) added another 75 bps rate hike to the deposit rate, which stands at 1.50%. The ECB President, Christine Lagarde, commented that the central bank would be data-dependent and take policy decisions “meeting by meeting.” The Euro sold off as a consequence, bolstering the US Dollar.

What to watch

The US economic docket will feature the US Federal Reserve’s favorite inflation gauge, the Core PCE, estimated at 0.5% MoM and 6.3% YoY, alongside the Consumer Sentiment and Pending Home Sales.

XAU/USD Price Forecast: Technical outlook

XAU/USD remains neutral to downward biased and faces solid resistance at the 20-day Exponential Moving Average (EMA) at $1663. If XAU buyers surpass, the latter XAU might challenge the 50-day EMA at $1686. Worth noting that the Relative Strength Index (RSI) is still in bearish territory; therefore

, sellers remain in charge. Key support lies at October 26 daily low at $1649.84, followed by the lows of the week around $1640.

-

16:19

US: A 2.6% growth rate in Q3 overstates the strength of the economy – Wells Fargo

Data released on Thursday showed US GDP expanded at an annualized rate of 2.6% and the Price Index dropped from 9.1% to 4.1%. According to analysts at Wells Fargo, some of the underlying details of the report were not very encouraging. Although the rate of consumer price inflation is receding, it is still way too hot for the Federal Reserve, analysts added.

Key Quotes:

“The underlying details of the report were not very encouraging. For starters, the headline rate of GDP growth was flattered by a 2.8 percentage point boost from real net exports. Real exports of goods and services grew 14.4% in Q3 while real imports fell 6.9%. These growth rates are not sustainable. Imports are certain to reverse course in the current quarter, and clear signs of economic deceleration in some of America's major trading partners and the strength of the U.S. dollar mean that exports likely will weaken going forward.”

“The core PCE deflator, which is the Fed's preferred measure of consumer prices, was up 4.9% in Q3 on a year-ago basis. The outturn implies that "core" prices rose 0.4% in September on a monthly basis. Consequently, we look for the FOMC to continue to tighten monetary policy. Specifically, we look for another 75 bps rate hike at the Committee's next meeting on November 2.”

“We believe that this combination of elevated inflation, which has been eroding household purchasing power, as well as the aggressive pace of monetary tightening will cause the economy to slip into recession starting in the second quarter of 2023.”

-

16:03

USD/CAD hits a one-month low under 1.3500, loonie recovers from the dovish BoC hike

- Bank of Canada delivered a rate hike below expectations on Wednesday.

- Loonie resurges after yesterday’s slide.

- USD/CAD testing critical support around 1.3500.

The USD/CAD dropped more than a hundred pips from the daily high at 1.3625 and currently is testing the critical support area around 1.3500. The loonie is among the top performers on Thursday. It bottomed at 1.3489, the lowest level since October 23.

A firm break under 1.3500 would leave USD/CAD vulnerable to an extension of the downside, with not much support area until 1.3400. If the pair remains above, the dollar could recover ground but only above 1.3640/50, the outlook would improve for the greenback.

After BoC, focus on data

On Wednesday, the Bank of Canada raised the key interest rate by 50 bps, surprising market participants that expected a 75 bps. The loonie lost ground across the board after the dovish rate hike. Although, on Thursday it is recovering, supported by risk appetite and higher crude oil prices. On Friday, the August GDP report is due.

In the US, ahead of the FOMC decision on November 2, GDP data released on Thursday showed the economy expanded at an annualized rate of 2.6% during the third quarter, above 2.4% of market consensus while the GDP Price Index dropped from 9.1% to 4.1%. A different report showed Durable Goods Orders increased by 0.4% in September according to preliminary data. Initial Jobless Claims rose to 217K while Continuing Claims jumped to 1.438M, the highest in months.

The greenback lost momentum after the numbers and trimmed gains across the board. The DXY is up by 0.55%, recovering just half of Wednesday’s losses. The move higher looks vulnerable as US yields are at fresh weekly lows and equity prices rise.

Technical levels

-

15:58

BoJ Preview: Forecasts from nine major banks, unchanged even as JPY weakens

The Bank of Japan (BoJ) will announce its monetary policy decision on Friday, October 28 at 03:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of nine major banks.

Japanese main interest rate will likely be left at -0.1%, despite inflation standing at 3% year-on-year. The yield-curve control (YCC), which aims to keep the yield of the 10-year government bond at around 0%, is also set to remain in place.

Standard Chartered

“We expect the BoJ to keep the policy balance rate unchanged, even as the JPY weakens and other central banks hike, in a bid to anchor core CPI at 2% and to break out of the deflationary cycle; the BoJ aims to sustainably achieve its price stability target of 2%. The government will likely intervene to ease JPY volatility, but this could prove challenging unless the BoJ makes some monetary policy changes.”

ING

“We expect the BoJ to stand pat despite the recent JPY weakness. Governor Kuroda could however warn that the recent currency movements would have a negative impact on the nation’s economy but we doubt the JPY depreciation will trigger any changes in the BoJ’s policy stance.”

TDS

“BoJ is likely to increase the inflation forecast for this FY to above 2.5% but continue to see the breach of its inflation target as temporary. Rapid weakening of the JPY, tests of the YCC band, and broadening inflation pressures, cannot be ignored. Even if the BoJ does not act, there is a risk of more aggressive signalling and the market appears too sanguine about such risks.”

SocGen

“We expect the BoJ to maintain its main monetary policy, i.e. yield curve control (YCC) and ETF purchases. In addition, the BoJ will continue to conduct daily fixed-rate 10y JGB purchases at 0.25%. At the press conference after the policy board meeting, BoJ Governor Kuroda will likely repeat the bank’s explanation that the main reason for the upward revision of the price outlook is the increase in costs associated with high raw material prices and the weak yen – and price increases due to the cost push lack sustainability. On the other hand, we believe there is a growing possibility that FX intervention will be carried out again. Following on from last month's policy board meeting, there is a good chance that the government and the BoJ will once again intervene in foreign exchange after the coming press conference.”

Citibank

“The BoJ looks set to keep monetary policy unchanged. Based on PM Kishida’s recent comments, the Japanese government looks unlikely to apply political pressure on the BoJ for policy adjustments to curb yen depreciation. The Bank is likely to maintain its current monetary policy stance, citing the limited rise in services inflation and wages, as well as the government’s continued support for the bank’s accommodative policy despite the drop in the yen.”

BMO

“One would imagine that there is great debate within the Board, with core inflation soaring to an 8-year high of 3.0% (the Minutes from the September meeting showed that there were already concerns expressed) and the JPY plunging to 32-year lows. Governor Kuroda is likely finding it more difficult to push his view that this rise in inflation is temporary. It is widely expected that the Bank will continue with its program of Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control (YCC), but it would be helpful to tweak the language around the latter. Allowing 10-year JGB yields to stray from the 0% target may be enough to give the JPY some support while staying with its QQE. But that may be asking too much.”

OCBC

“We expect BoJ to stay status quo on policy stance though risks of policy tweaks are not ruled out. Options the BoJ can contemplate are (1) slight upward adjustment in 10y yield target or (2) a slight tweak in the upper bound of the YCC cap higher. But BoJ has earlier said that policy adjustment would require compelling evidence to show wages and prices in Japan are rising in a sustainable manner.”

Danske Bank

“We expect the BoJ to keep its yield curve control firmly in place despite gaining pressures on yields and the yen. Until wage growth increases and boosts consumers purchasing power, BoJ will not loosen its grip on the yield curve willingly.”

BofA

“We expect the BoJ to keep all key targets, as well as its forward guidance, unchanged. The board is also likely to leave, intact, the 25 bps ceiling for the 10-year yield under yield curve control (YCC) and reiterate its pledge to conduct unlimited, daily, fixed-rate bond-buying operations in its defense.”

-

15:50

EUR/USD: Cautious as global growth impulse continues to downshift – TDS

Economists at TD Securities are still cautious near-term on the EUR/USD pair as the global growth impulse is worsening.

A push to 1.02 will likely cap upside

“We are still cautious on EUR/USD as the global growth impulse continues to downshift.”

“A move below 0.99 should be seen as a confirmation of a return to the downtrend channel, while a push to the 1.02 mark will likely cap upside.”

See: The euro needs growth expectations to shift more than it needs higher rates – SocGen

-

15:30

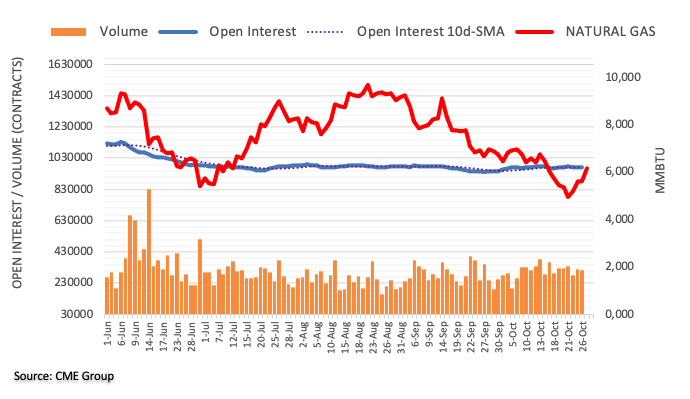

United States EIA Natural Gas Storage Change registered at 52B, below expectations (59B) in October 21

-

15:28

S&P 500 Index eyes a deeper recovery to 3925, potentially 4000 – Credit Suisse

S&P 500 Index has completed a base above 3807/10. Analysts at Credit Suisse look for a deeper recovery to the 63-Day Moving Average (DMA) at 3925, potentially 3999/4000.

Deeper setback on a dip under 3792

“S&P 500 was unable to hold on to its early gains yesterday but the subsequent pullback remains above support around 3810. We look for this latter support to try and hold for strength back to 3886, then the late September high and 50% retracement of the fall from September at 3907/08. With the 63-DMA seen not far above at 3925, we would expect this latter resistance to cap at first. A closing break higher in due course though can see a further push to the 38.2% retracement of the entire 2022 fall at 3999.”

“Below 3792 can see a deeper setback to price and 13-DMA support at 3742/35, but with fresh buyers expected here.”

-

14:49

USD valuation looks stretched, but broader drivers supporting the greenback are still in place – HSBC

The short-term price action is increasingly challenging the view for a stronger US dollar. The USD valuation looks stretched, but the broader drivers supporting the currency are still in place, in the opinion of economists at HSBC.

Are we past the peak?

“The November FOMC meeting will be crucial in assessing whether this USD shift is the start of a more structural trend or whether the price action is more symptomatic of a positioning squeeze, as we have witnessed in March, May and August 2022 already.

“It is also worth bearing in mind the USD’s increasingly stretched valuations, based on a long-term real effective exchange rate (REER) measure. This could inhibit significant USD gains; however, until the broader drivers of the USD – global growth, risk appetite, and relative yields – show a bigger shift, it may be premature to call for a weaker USD.”

-

14:48

Singapore: Industrial Production surprised to the downside – UOB

Senior Economist at UOB Group Alvin Liew reviews the latest industrial production figures in Singapore.

Key Takeaways

“Singapore’s Sep industrial production (IP) came in below expectations as it was flat from Aug (0.0% m/m SA), which translated to a growth of 0.9% y/y in Sep. Compounding the weaker trajectory was the downwardly revised Aug readings which is now at 1.6% m/m, 0.4% y/y. Excluding the volatile biomedical manufacturing, IP actually expanded by 2.8% m/m, 2.0% y/y in Sep.”

“The 0.9% y/y rise in Sep IP was due to the continued strong performances seen in transport engineering, general manufacturing, and precision engineering, offsetting the extended 3rd month decline in electronics, a 2nd month decline in chemicals and a fall in biomedical, of which pharmaceutical production declined by -8.5% y/y. The medical technology component of biomedical continued to rise although the pace was halved.”

“IP Outlook – Based on the Sep IP report, the manufacturing sector grew by just 0.8% y/y in 2Q compared to the 1.5% reported in the advance estimates released on 14 Oct. Assuming no major changes to the other sectors, we now expect 3Q’s GDP growth to be revised lower by 0.2ppt to 4.2% y/y, taking into account the lowered manufacturing expansion. We lower our Singapore 2022 manufacturing growth forecast to 3.5% (from 4.5% previously) and we keep our 2023 forecast unchanged as we expect the sector to contract by 3.7% next year due to the faltering outlook for electronics and weaker external demand. Despite the weaker 2022 manufacturing growth, we are retaining our 2022 GDP growth forecast unchanged at 3.5% as we see the upside surprise from services activities (due to strong pipeline of activities post- reopening of the economy) helping to compensate for the IP downgrade. But with the faltering 2023 manufacturing outlook, we expect GDP growth to ease noticeably to 0.7% next year.”

-

14:44

AUD/USD pares intraday losses, upside remains capped amid broad-based USD strength

- AUD/USD comes under some selling pressure on Thursday amid resurgent USD demand.

- Sliding US bond yields, risk-on mood caps the safe-haven buck and helps limit the slide.

- Bets for more aggressive rate hikes by the RBA might continue to lend support to the pair.

The AUD/USD pair retreats nearly 100 pips from a three-week high touched earlier this Thursday, though the intraday downfall finds some support near the 0.6425 region. The pair quickly recovers a few pips through during the early North American session and is currently placed around the 0.6475-0.6480 area, still down over 0.30% for the day.

The US dollar stages a goodish intraday bounce from its lowest level since September 20 and turns out to be a key factor exerting downward pressure on the AUD/USD pair. The USD maintains its bid tone after the Advance US GDP report showed that the world's largest economy expanded by a 2.6% annualized pace during the third quarter, beating estimates for a print of 2.4%. This marks a sharp reversal from the 0.6% fall in the previous quarter and the 1.6% decline registered in the first three months of the year.

This, however, was partly offset by the fact that the GDP price index rose just 4.1%, well below the 5.3% expected and down more than half from 9.0% in the previous quarter. This could be perceived as the first sign of a moderation in inflationary pressure, which adds to speculations that the Fed will soften its hawkish stance. The expectations led to a fresh leg down in the US Treasury bond yields. This, along with the risk-on impulse, caps the safe-haven buck and offers some support to the risk-sensitive aussie.

Apart from this, rising bets for a more aggressive policy tightening by the Reserve Bank of Australia, bolstered by Wednesday's stronger consumer inflation figures, should act as a tailwind for the AUD/USD pair. Hence, any meaningful pullback might still be seen as a buying opportunity and is more likely to remain short-lived. The upside potential, however, seems limited as the focus shifts to the FOMC meeting next week.

Technical levels to watch

-

14:42

USD Index extends the recovery to the 110.50 area after data, ECB

- The index accelerates its correction to the 110.50 region on Thursday.

- Flash US GDP figures now see the economy expanding 2.6% in Q3.

- The ECB hiked the policy rate by 75 bps, as widely expected.

The USD Index (DXY), which tracks the greenback vs. a basket of its main rivals, manages to pick up extra pace and retests the mid-110.00s region on Thursday.

USD Index bounces off lows in the 109.50 zone

After two consecutive daily pullbacks, the index met some dip buyers on Thursday and edged higher, reclaiming at the same time the 110.00 mark and beyond on the back of fresh weakness in the risk complex.

The recovery in the dollar comes in tandem with another negative session in US yields, which give away the initial optimism and return to the negative ground across the curve.

Extra strength in the dollar also comes from the inability of the ECB to surprise markets on the bullish side, which kind of undermined the recent steep rebound in the European currency.

In the US data space, another revision of the GDP Growth Rate saw the economy expand 2.6% YoY in Q3, while headline Durable Goods Orders rose 0.4% MoM in September and Initial Jobless Claims increased by 217K WoW in the week to October 22.

What to look for around USD

The dollar seems to have met some decent contention around the 109.50 region so far this week.

In the meantime, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the index.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Flash Q3 GDP Growth Rate, Durable Goods Orders, Initial Claims (Thursday) – PCE/Core PCE Price Index, Personal Income/Spending, Pending Home Sales, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.38% at 110.13 and faces the immediate up barrier at 113.88 (monthly high October 13) seconded by 114.76 (2022 high September 28) and then 115.32 (May 2002 high). On the flip side, the breakdown of 109.53 (monthly low October 27) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13).

-

14:35

USD/CHF: Further near-term weakness is likely, next significant support seen at 0.9775 – Credit Suisse

USD/CHF has broken below 0.9876, suggesting that further near-term decline towards the 55-Day Moving Average at 0.9775 is likely, analysts at Credit Suisse report.

Break below 0.9876 shifts the near-term risk lower

“USD/CHF has managed to break below 0.9876. This signals that further near-term weakness is likely to follow. With near-term MACD also reinforcing this bearish signal, we look for a fall to 0.9838/30 initially and then likely for a test of the 55-DMA at 0.9775.”

“Should a solid break below the 55-DMA also follow, this would suggest yet another stronger move lower within the broader mean-reverting environment seen since April, though with tougher support next seen at the potential uptrend from August and the 200-DMA at 0.9627/9585.”

“Resistance is seen at the 13-DMA at 0.9930/38 and next at yesterday’s high at 0.9963, which we look to ideally maintain any sudden move higher to keep the current downside intact.”

-

14:30

Lagarde speech: Many assumptions for downside scenario have not materialised

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 75 basis points in October.

Key takeaways

"May need to go beyond normalisation."

"We might have to raise rates at several meetings."

"Will open 3 additional windows for TLTRO repayment."

"Many of our assumptions for the downside scenario in projections have not materialised."

"We must focus on our mandate, price stability, and deliver on that."

-

14:26

GBP/USD to see some additional strength in the next few weeks – Scotiabank

GBP/USD drops back after test technical resistance in the mid-1.16s. Still, economists at Scotiabank expect the pair to retain a positive toe in the next few weeks.

Broader trends are bullish above 1.14

“Price signals are not obviously bearish and losses look consolidative as markets await the next impulse.”

“Sterling is likely to trade in line with the broader USD tone for now but we still rather feel the pound’s gains this week set it on course for some additional strength in the next few weeks.”

“Broader trends are bullish above 1.14 – now major support – and that leaves the pound with a fair bit of room to manoeuver and still retain a positive tone.”

-

14:20

EUR/USD: Sellers remain in control around the parity level

- EUR/USD looks offered and bounces off lows near 0.9970.

- Further ECB decision on rates will remain data dependent.

- Another revision saw US Q3 GDP Growth Rate at 2.6%.

EUR/USD now comes under further downside pressure and prints new daily lows in the vicinity of 0.9970 on Thursday, where some interim contention seems to have emerged.

EUR/USD weaker post-ECB rate hike

EUR/USD accelerates the daily decline from tops near 1.0100 and revisits the 0.9970 region as Chair C.Lagarde’s press conference is under way.

Indeed, Chairwoman Lagarde emphasized the progress made by the central bank in withdrawing accommodation. The Council see the economic activity in the region slowing significantly in Q3, with the crisis around gas prices magnifying headwinds.

Lagarde noted that the ongoing tight monetary policy results in a weaker global growth, which could lead to higher unemployment in the future.

Regarding inflation, Lagarde reiterated that high energy prices remain almost exclusively behind the ongoing elevated inflation, while the depreciation of the euro also added to the current inflationary pressures. Currently, inflation risks are tilted to the upside vs. the downside risks seen around the economic outlook.

Lagarde also reiterated that the decision on interest rates will remain data dependent and will be made on a meeting-by-meeting basis.

In addition, Lagarde said the anti-fragmentation tool, the TPI, was not discussed at today’s meeting.

Other than the ECB event, US data releases were also noteworthy: Following another revision of the GDP Growth Rate, US economy is now expected to have expanded 2.6% YoY in the July-September period, Durable Goods Orders expanded at a monthly 0.4% in September and Initial Jobless Claims went up by 217K in the week to October 22.

What to look for around EUR

EUR/USD’s upside momentum meets an initial hurdle around 1.0100 and triggered a deep knee-jerk that was later exacerbated following the ECB decision to hike the policy rate by 75 bps, as largely anticipated.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The resurgence of speculation around a potential Fed’s pivot seems to have removed some strength from the latter, however.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: Germany GfK Consumer Confidence, Italy Consumer Confidence, ECB Interest Rate Decision, ECB Lagarde (Thursday) – France/Italy/Germany Flash Inflation Rate, Germany Preliminary Q3 GDP Growth Rate, EMU Final Consumer Confidence, Economic Sentiment

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is retreating 0.84% at 0.9997 and the breakdown of 0.9972 (weekly low October 21) would target 0.9704 (weekly low October 21) en route to 0.9631 (monthly low October 13). On the upside, there is an initial hurdle at 1.0093 (monthly high October 27) followed by 1.0197 (monthly high September 12) and finally 1.0368 (monthly high August 10).

-

14:10

Gold Price Forecast: Haven flows not enough to reverse bearish trend anytime soon – ANZ

Gold price is stalling a two-day upswing towards $1,700. Strategists at ANZ Bank expect the yellow metal to remain under downside pressure.

XAU/USD to remain under pressure

“The hawkish tone of the central banks is keeping US real yields and the US dollar on a strong footing. While recession fears grow due to rising rates and sticky inflation, we should see some haven flows but not enough to reverse the bearish trend anytime soon.”

“We expect gold to remain under pressure.”

See – Gold Price Forecast: XAU/USD to suffer further falls with a top in place – Credit Suisse

-

14:07

Lagarde speech: We have not finished normalization

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 75 basis points in October.

Key takeaways

"We have not finished normalization."

"We are turning our backs to forward guidance to avoid uncertainty."

"We'll have further rate increases."

"We'll look at inflation outlook."

"We'll be attentive to the transmission of the policy."

"Reduction of APP portfolio was discussed at retreat."

"Did not discuss substantive APP issues today."

"Would pursue APP discussion, to decide key principles in December."

-

14:02

GBP/USD keeps the red below 1.1600 mark as USD sticks to gains on upbeat US GDP

- GBP/USD meets with a fresh supply on Thursday amid a goodish pickup in the USD demand.

- An intraday rally in the US bond yields turns out to be a key factor lending support to the buck.