Notícias do Mercado

-

23:31

EUR/USD Price Analysis: Eyes two-month high at 1.0200 amid hawkish ECB bets

- The shared currency bulls have shifted into a positive trajectory after climbing above parity.

- Investors are underpinning the euro bulls as hawkish ECB bets soar.

- Advancing 20-EMA adds to the upside filters.

The EUR/USD pair is displaying back-and-forth moves in a narrow range of 1.0073-1.0088 in the early Asian session. The asset has turned sideways after a perpendicular rally as positive market sentiment improved demand for risk-perceived currencies.

The major is expected to remain in the grip of bulls ahead of the interest rate decision by the European Central Bank (ECB). As per the projections, ECB President Christine Lagarde may announce a rate hike by 75 basis points (bps).

The US dollar index (DXY) plunged further on Wednesday to near 109.60 as the appeal for safe-haven assets trimmed dramatically. Also, the alpha generated by 10-year US government bonds plummeted to 4%.

On a four-hour scale, the shared currency bulls have strengthened after shifting their business above the horizontal support placed around October highs at parity, which has become a support now. Now, the euro bulls are eyeing to smash a two-month high at 1.0200 ahead.

The 20-period Exponential Moving Average (EMA) at 0.9950 is aiming higher, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates more upside ahead.

A minor corrective move to near September 20 high at 1.0051 will be a bargain buy for the market participants. This will send the asset firmly towards August 3 low at 1.0123, followed by a two-month high at 1.0200.

On the flip side, the greenback bulls will grab attention if the asset drops below October 25 low at 0.9848. It may drag the asset toward October 20 low at 0.9755 and Friday’s low at 0.9705.

EUR/USD four-hour chart

-638024202216793548.png)

-

23:06

AUD/JPY Price Analysis: Conquers the 50-day EMA, reclaims 95.00 on upbeat mood

- AUD/JPY has climbed for two-straight days after the Bank of Japan (BoJ) intervention and is up by 0.87% in the week.

- The AUD/JPY daily chart is upward-biased, and if it clears 95.44, a retest of 96.40 is on the cards, ahead f the YTD high at 98.60.

The AUD/JPY rebounded at the 50-day Exponential Moving Average (EMA) and rose to Wednesday’s daily high at 95.44 before trimming some gains. However, the cross-currency finished the day with a half-percentage point gain. As the Thursday Asian Pacific session begins, the AUD/JPY is trading at 95.03, flat.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chart delineates the pair trading upwards, as the upward bias remains intact. Worth noticing that on its way toward 95.00, the cross-currency pair cleared the 50-day EMA, shifting the bias from neutral-upwards to upwards, opening the door for further gains. Also, the Relative Strength Index (RSI) is in bullish territory, and the slope turned flat, meaning that the AUD/JPY might consolidate before resuming the ongoing uptrend.

Upwards, the AUD/JPY’s first resistance would be October’s 26 daily high at 95.44, followed by the 96.00 figure, and the September 22 daily high at 96.40. Conversely, the AUD/JPY’s first support would be the 50-day EMA at 94.64. A breach of the latter will send the cross sliding towards the 100-day EMA at 94.17, followed by the 20-day EMA at 93.45.

AUD/JPY Key Technical Levels

-

22:57

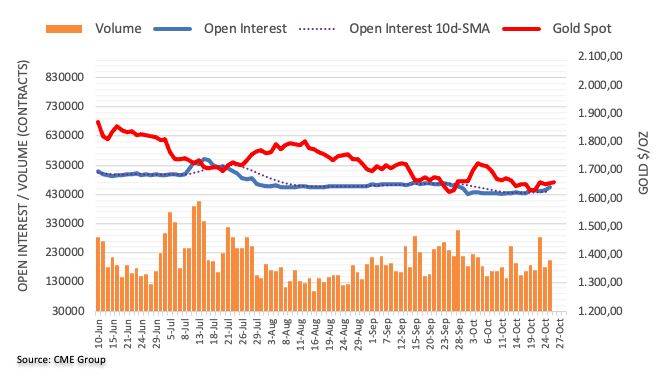

Gold Price Forecast: XAU/USD displays lackluster performance above $1,660 ahead of US GDP data

- Gold price is juggling around $1,665.00 as investors await US GDP data.

- Positive market sentiment has punished US Treasury yields and the DXY.

- A decline in New Home Sales data has also weighed pressure on the DXY.

Gold price (XAU/USD) has turned sideways around $1,665.00 in the early Tokyo session as investors are awaiting the release of the US Gross Domestic Product (GDP) data. The precious metal witnessed a gradual decline in the late New York session after failing to sustain above $1,670.00.

Market sentiment remained upbeat despite the S&P500 failure to continue its three-day winning streak after tech-giant Microsoft (MSFT) provided weak guidance on sales growth. The US dollar index (DXY) witnessed a steep fall and dropped to near 109.50. Also, the 10-year US Treasury yields witnessed selling pressure and dropped to the psychological support of 4%.

Lower New Home Sales data against its prior release also weighed pressure on the DXY. The households have purchased 0.603M new houses vs. the prior release of 0.677M due to soaring interest obligations led by the extremely hawkish Federal Reserve (Fed)’s monetary policy.

Going forward, the US GDP data will hog the limelight. The annualized GDP is expected to improve significantly to 2.4% vs. a decline of 0.6% reported earlier. This week, the PMIs reported by S&P remained downbeat. Therefore, the placement of the GDP figures around the projections will be worth watching.

Gold technical analysis

On an hourly scale, the gold prices have corrected minutely after testing the supply zone placed in a narrow range of $1,671.17-1,672.70. The 20-period Exponential Moving Average (EMA) at $1,633.16 is acting as major support for the counter.

The Relative Strength Index (RSI) (14) has dropped from the bullish range of 60.00-80.00, however, the upside bias is still solid.

Gold hourly chart

-

22:52

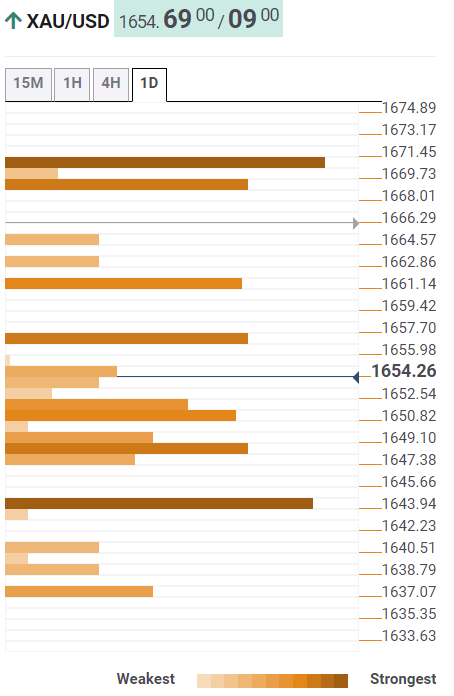

USD/CAD Price Analysis: Bulls are lurking at key MTF support areas

- USD/CAD bulls are lurking at key support structures.

- The US dollar bulls could be about to move back in.

USD/CAD bears moved in following an initial spike on the back of the Bank of Canada, but as the less dovish hike's implications began to sink in, the loonie firmed from a peak formation vs the greenback.

The US dollar is now at a crossroads as per the DXY chart below, but should the bulls hold onto the front side of the trendline, then that would be expected to fuel a bid back into USD/CAD, that has, after all, broken its hourly structure as the following analysis will show:

DXY daily chart

If the dollar recovers this week, with the European Central Bank on Thursday and US PCE Friday, then the downside in the CAD will be on play on the back side of H1 USD/CAD's trendline:

USD/CAD weekly & daily charts

The daily chart, above, could be on the verge of a correction...and the weekly chart's M-formation is compelling from support:

-

22:32

EUR/JPY Price Analysis: Euro clings above 147.00 as a negative divergence emerges

- The EUR/JPY extends its rally to three consecutive days of gains, up 1.37% in the week.

- A negative divergence between EUR/JPY price action and RSI in the daily chart opens the door for further downside.

- Short term, the EUR/JPY is subdued, trapped in the 146.60-147.72 range

The EUR/JPY edged higher during Wednesday’s trading session, courtesy of mixed market sentiment, helping the Japanese Yen to curtail earlier losses, though it finished with gains of 0.11%. As the Asian Pacific session begins, the EUR/JPY is trading at 147.55, down by a minuscule 0.04%.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart illustrates the pair as neutral to upward biased, though it’s important to point out that price action is registering higher highs, while the Relative Strength Index (RSI) is not. Therefore, a negative divergence might be forming, which has negative implications for the Euro. However, the EUR/JPY needs to tumble below the October 25 daily low at 146.62, followed by a break below the October 24 daily open at 145.64; otherwise, upside risks remain. On the flip side, if the EUR/JPY extends its gain and the RSI clears the previous peak at 70.82, a challenge of the YTD highs at 148.40 is on the cards.

In the short term, the EUR/JPY hourly chart illustrates a shrinking price action, followed by the last Friday’s and Monday’s interventions by the Bank of Japan (BoJ), as the EUR/JPY seesawed in a wide range of 400 pips between the high/low of the day. So in the last couple of days, the EUR/JPY is range bound, fluctuating between the 146.60-147.72 range.

Key resistance lies at the top of the range around 147.72, which, once broken, the EUR/JPY can rally towards the R1 daily pivot at 147.82. The break above will expose the R2 pivot level at 148.17, followed by the R3 daily pivot at 148.61.

On the flip side, the EUR/JPY first demand zone will be the 20-Exponential Moving Average (EMA) at 147.49, followed by the 50-EMA at 147.30 and the 100-EMa at 147.00 flat.

EUR/JPY Key Technical Levels

-

21:56

RBNZ Orr: We have our eyes firmly focused on meeting our inflation target

The governor of the Reserve Bank of New Zealand Adrian Orr said the nation is relatively well-positioned, but argued that inflation remains excessive in absolute terms and that global economic challenges are large and imminent.

Key comments

- It is highly unlikely that we are at maximum sustainable employment if inflation is still high and variable

- New Zealand's financial system remains well-placed to support the economy.

- We have our eyes firmly focused on meeting our inflation target.

More to come...

-

21:08

Forex Today: Gear up for another volatile day

What you need to take care of on Thursday, October 27:

Another moved journey ended with the American dollar plummeting against its major rivals. The EUR/USD pair reclaimed parity and approaches 1.0100 ahead of the release of the preliminary estimate of the Q3 US Gross Domestic Product and the European Central Bank monetary policy decision.

GBP/USD trades at around 1.1630, despite some fiscal turmoil in the UK. On Wednesday, Chancellor Jeremy Hunt announced the medium-term budgetary plan will be delayed to November 17. The new government is struggling with a fiscal hole of around £35 billion. The delay was discussed with Bank of England Governor Andrew Bailey, according to Hunt. The BOE will announce its monetary policy decision next week, and market players are quickly reducing their bets on another large rate hike.

Meanwhile, news from China indicated that the country put Wuhan under partial lockdown, where the coronavirus started.

The Canadian dollar was the worst performer vs the greenback. The Bank of Canada hiked its benchmark interest rate by 50 bps, missing the market’s expectation of a 75 bps to 3.75%. Policymakers noted mounting concerns about a potential global economic downturn were behind such a decision. USD/CAD trades around 1.3560.

AUD/USD, on the other hand, surged towards 0.6500, despite worrisome Australian inflation levels.

The USD/JPY pair kept easing, now trading around 146.30, while USD/CHF declined to 0.9864.

Spot gold is up, now at $1,665 a troy ounce, while crude oil prices surged, with WTI changing hands at $88.10 a barrel.

Wall Street closed mixed near its daily opening, trimming early gains. Nevertheless, the greenback remained pressured amid easing government bond yields.

Thursday will be quite a busy day, as the US is expected to report that the economy grew in the three months to September. The preliminary estimate of the Q3 Gross Domestic Product is foreseen at 2.4%, reversing the negative trend from the previous two quarters. It will also mean the country is no longer in a technical recession and could be read as an opportunity for the US Federal Reserve to maintain the aggressive tightening pace, giving the dollar some room to recover. The country will also release September Durable Goods Orders, seen up by a modest 0.6%.

At the same time, the European Central Bank will announce its latest monetary policy decision. The central bank is expected to hike rates by 75 bps, accompanied by a dovish message, as it seems unlikely President Christine Lagarde and Co. will keep raising rates at such an outstanding rate.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:02

USD/JPY extends losses to levels near 146.00

- The dollar dives below 147.00 and approaches 146.00.

- Hopes of a Fed pivot have sent the US dollar tumbling.

- USD/CHF to consolidate between 144.00 and 152.00 – UOB.

The US dollar depreciated for the second consecutive day on Wednesday, breaking below 147.00 to reach levels right above 146.00, the area where the pair bottomed after the suspected BoJ interventions.

Fed pivot expectations are hurting the greenback

The greenback continues depreciating across the board, weighed by increasing expectations that the Federal Reserve might be contemplating slowing down its tightening pace over the next months.

The market is still pricing a 75 basis point hike next week, but the odds for December have been downgraded to a 0.50% rate hike. The mounting evidence that the aggressive tightening cycle is starting to bite into economic growth is adding pressure on the central bank to soften the monetary normalization plan.

US Treasury bonds retreated further on Wednesday. The 10-year yield has reached the 4.00% area, from 4.25% at the beginning of the week, which added negative pressure on the US dollar.

USD/JPY: Downside, contained at 144.00 – UOB

FX analysts at UOB maintain the consolidative view on the pair, with downside attempts limited at 144.00: “We continue to hold the same view as yesterday (25 Oct, spot at 148.80). As highlighted, the recent volatile price actions have resulted in a mixed outlook. Further volatility is not ruled out and USD could trade within a wide range of 144.00/152.00 for the time being.”

Technical levels to watch

-

21:02

GBP/USD Price Analysis: Bulls eye 1.1750s, but bears are ready to pounce

- GBP/USD bulls take charge mid-week on risk-on sentiment.

- The bears are lurking at the critical weekly structure.

GBP/USD bulls are taking charge following a significant rally mid-week that has left the emphasis, for the near term, on a correction, but with the risk of a continuation towards weekly structure as the following technical analysis across multi-timeframe charts will illustrate:

GBP/USD weekly chart

The weekly chart shows that the price could move in on the 1.1750s before the week is out but the W-formation is a bearish reversion pattern.

GBP/USD daily charts

The price rallied out of a micro daily symmetrical triangle following the peak formation in a V-bottom. However, the W-formation, which we will go into more detail below, is a bearish reversion pattern as the price heads towards a more dominant trendline resistance:

While on the front side of this major trendline, the outlook remains bearish:

The W-formation is troubling, but a move-in to test the September highs is on the cards prior to a move into the neckline of the reversion pattern as illustrated above. Such a move would be consistent with putting heat onto in-the-money long positions built up over the week in three days of higher highs. The Fibonacci has been drawn from a hypothetical high that marries the September highs. A move into the neckline of the W-formation based on such a measurement will have a confluence with the 50% mean reversion before the 61.8% Fibo on a break below 1.1450. A break of the trendline resistance opens risk of a break of 1.1270 and then a really significant 1.1060 area.

-

20:55

NZD/USD climbs sharply, eyeing the 50-DMA around 0.5880 as the US Dollar slide prolongs

- NZD/USD is rallying more than 100 pip on Fed pivot commentary.

- September’s overall US housing data weigh on the US Dollar, as shown by the US Dollar Index, down 2% in the week.

- The NZ Business confidence missed estimates, as companies’ worries about inflation persist; forecasts of an RBNZ 75 bps rate hike jumped.

The New Zealand Dollar is advancing for the second straight day vs. the buck amidst a mixed market mood, while the US Dollar free-fall continued while the NZD got a lift from Wednesday’s Australian CPI report, which underpinned the AUD. At the time of writing, the NZD/USD is trading at 0.5831, above its opening price by almost 2%.

Expectations for a Federal Reserve pivot undermine the greenback. US Treasury yields tumbled across the curve, with the 10-year benchmark note rate down seven bps, at 3.034%, headwinds for the buck. The US Dollar Index, a gauge of the greenback’s value vs. a basket of peers, drops 1.05%, sitting at 109.726.

In the week, US housing economic data remains at the center of the US economic docket. New-Home Sales for September fell by 10.9% MoM, less than a contraction of 15%, as home buyers remain scared by higher borrowing costs, with mortgage rates lifting by 7.16% due to the Fed’s aggression. The lack of Fed officials crossing newswires due to the blackout period ahead of the next week’s monetary policy decision keeps investors speculating on the outcome of the discussions regarding December’s decision.

Meanwhile, the November Federal Reserve Open Market Committee (FOMC) meeting has fully priced in an 89.3% chance for a 75 bps rate hike, lower than the previous day’s 96.2%. Concerning December’s meeting, odds for a 50 bps increased from 47.4% on Tuesday to 55.3% as investors repriced the pace of hikes.

Aside from this, during Wednesday’s Asian session, the New Zealand Business Confidence for October missed estimates, dropping to 42.7, sinking more than the previous month’s reading of -36.7. According to Westpac analysts, the low level of business confidence isn’t a surprise even though spending levels in the economy are stead, rising costs and staff shortages oppose difficult challenges to hurdle.

The survey mentioned that inflation is the focal point, and Westpac analysts foresee another 75 bps rate hike from the Reserve Bank of New Zealand (RBNZ) at the upcoming meeting in November,

Therefore, due to a possible Fed pivot, the NZD/USD might continue to edge higher unless Friday’s US PCE registers a higher reading, which could deter Fed officials from pivoting, opening the door for further NZD/USD downward pressures.

NZD/USD Key Technical Levels

-

20:26

EUR/GBP trims losses, but remains capped below 0.8700

- The euro remains negative on the day, capped below 0.8700.

- The Sunak effect keeps supporting the pound's rally.

- EUR/GBP expected to appreciate towards 0.9000 – SocvGen.

The euro ticked up from the one-week lows at 0.8645 witnessed earlier on Wednesday, although it remains negative on the daily chart. Bullish attempts are capped below 0.8700 and the pair consolidates losses after retreating from 0.8770 highs earlier this week.

The pound maintains the positive tone

Sterling remains moderately bid, still buoyed by the positive market reaction to Rishi Sunak becoming UK’s Prime minister and his pledge to restore economic stability. The delay of a keenly awaited fiscal plan, which was due on October 31, to mid-November has not dented investor’s appetite for the pound, which has rallied to fresh six-week highs against the US dollar

The euro, however, has managed to trim losses with all eyes on the European Central Bank’s monetary policy decision, due on Thursday. The bank is widely expected to hike rates by 75 basis points for the second consecutive time, which has offered some support to the euro.

EUR/GBP is seen appreciating towards 0.90 – SocGen

Kit Juckes, Chief Global FX Strategist at Société Générale sees the pair returning to 0.90: “With the economy surely already in recession and set to suffer from possibly even tighter fiscal policy, sterling is unlikely to enjoy much more of a relief bounce and over time, EUR/GBP is likely to meander slowly up to 0.90 or so.”

Technical levels to watch

-

20:17

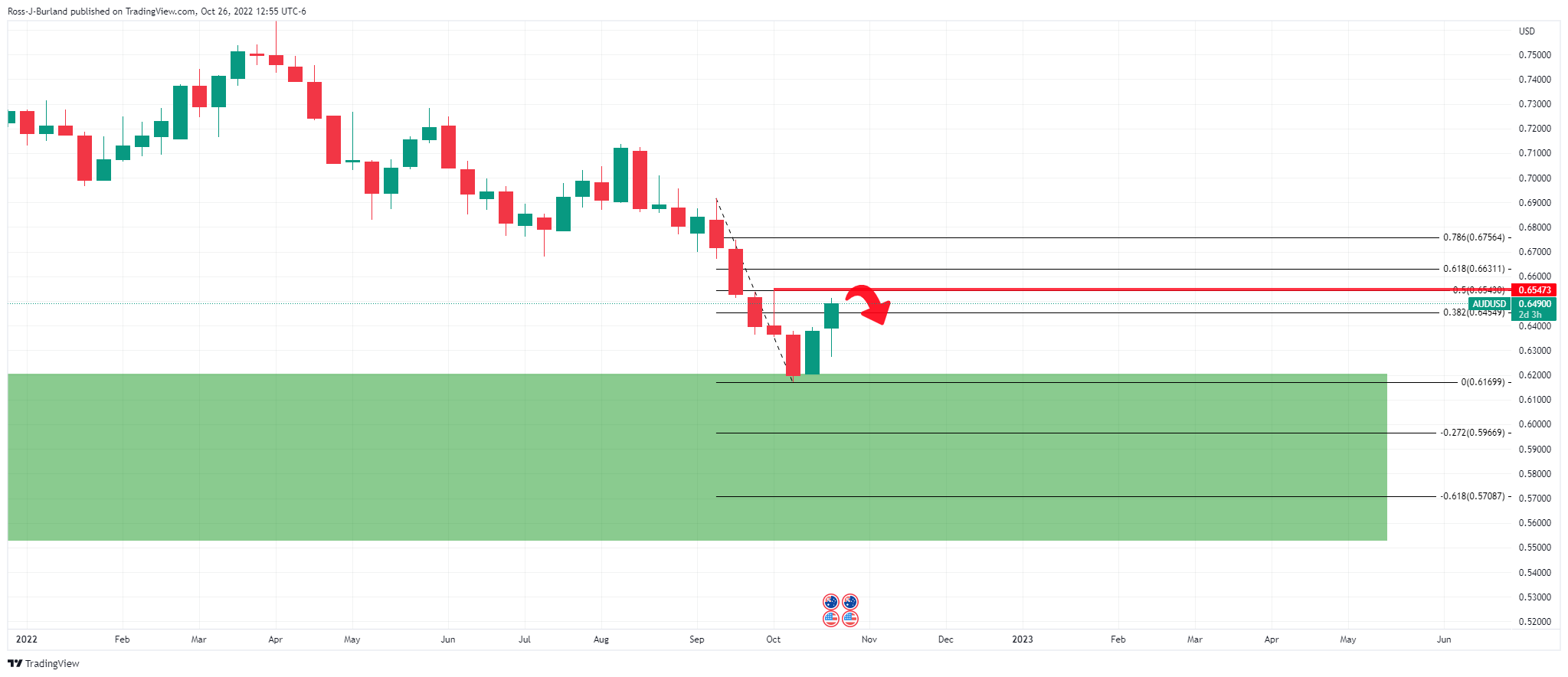

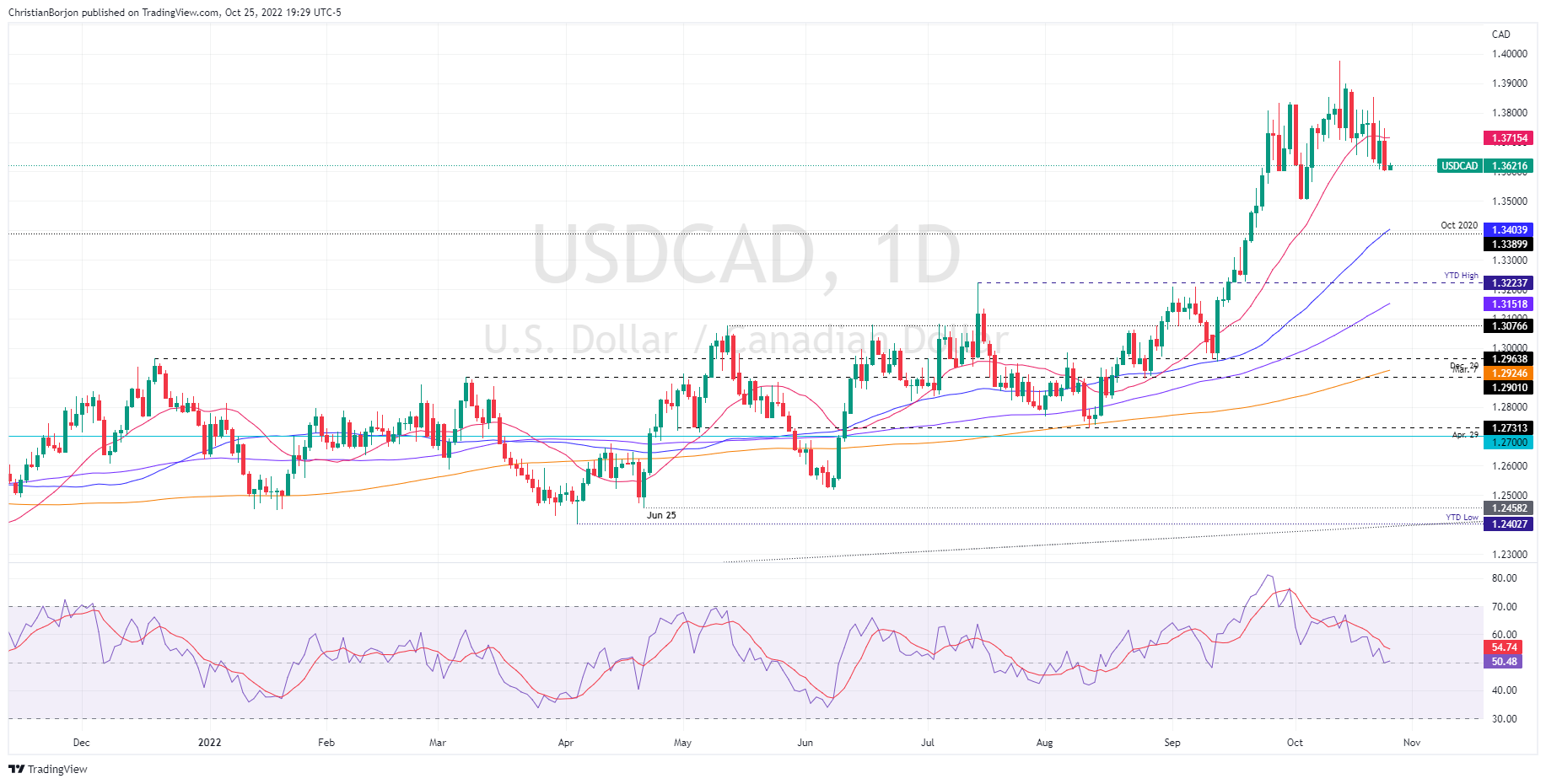

AUD/USD Price Analysis: Bears lurking at a critical resistance juncture

- AUD/USD bulls are moving in on a critical area of resistance.

- Key supports are located at 0.6450, 0.6390 and 0.6270 while the markets bearish below 0.6550.

AUD/USD rallied on the back of strong Aussie inflation data on Wednesday and capitulation of the US dollar bulls with the market headed for a test of the key support structure in the DXY and US 10-year yields:

(US 10-year daily chart above, DXY daily chart below)

However, there are prospects of a stronger dollar for longer so long as the trendline supports hold and all the while the woes out of Europe and economic dire straits in China remain a thorn in the side of risk sentiment.

Meanwhile, the Aussie remains upbeat following the Consumer Price Index data as follows:

AUD/USD during CPI

AUD/USD after:

AUD/USD weekly chart

So long as the US dollar commits to the upside, the outlook remains bleak for risk sentiment, stocks and high beta currencies such as the Aussie. The weekly chart remains bearish at this juncture despite the corrective attempts.

Zooming in, we can see the prospects of a failure at resistance:

AUD/USD daily & H4 charts

For the immediate future, the price outlook is bullish but a capitulation of the bulls can be expected. The daily chart is seeing the price head into a key resistance level and failures there could see the price move in on the longs that have built up for the week. If the market breaks key structures, falling out of the symmetrical triangle could be significant, especially around the Federal Reserve, leading to a downside continuation as per the weekly chart. Key supports are located at 0.6450, 0.6390 and 0.6270 while the markets bearish below 0.6550.

-

19:44

EUR/USD extends gains above parity and nears 1.0100

- The euro rallies further to reach five-week highs at 1.0085.

- Fed pivot expectations are hurting the USD.

- EUR/USD: Holding above 1.0000 the pair could reach 1.03 – Scotiabank.

The euro is performing a surprising recovery after having appreciated more than 3% on a four-day rally. The common currency has stretched higher on Wednesday’s US session, breaching the previous session top at 1.0050 to reach 1.0085.

Fed tightening slowdown is hammering the USD

The US dollar has been on the defensive over the last sessions weighed by market expectations of a certain softening on the Federal Reserve’s tightening path. A batch of downbeat US indicators has revived concerns that escalating interest rates are dampening growth.

A news report by the Wall Street Journal suggesting that Fed officials might be discussing how to communicate lower rate hikes in the months ahead has given further backing to that thesis. This new scenario is weighing on the USD, which has surged about 20% this year, buoyed by the Fed’s hawkish stance.

On the other end, the market awaits a second consecutive jumbo rate hike by the European Central Bank on Thursday. With inflation at record highs, the ECB a 0.75% rate hike is priced in, which has been fuelling demand for the common currency over the last few days.

EUR/USD: Holding parity suggest further gains toward 1.03 – Scotiabank

Currency analysts at Scotiabank see risks skewed to the upside if the pair consolidates above 1.000: “Gains yesterday through key trend resistance off the Feb EUR high are holding and what was resistance now becomes key support (0.9935) (…) Note that parity (0.9998) is the 23.6% retracement of the 2022 EUR decline; holding parity suggests more gains towards 1.03 (38.2% retracement at 1.0284).”

Technical levels to watch

-

19:24

GBP/JPY Price Analysis: Climbs above 170.00 after hitting a six-year high

- GBP/JPY climbs after retracing from reaching six-year highs at around 170.60.

- If GBP buyers clear the YTD high, the next resistance would be February’s 2016 highs at 175.00.

- Short term, the GBP/JPY is upward biased, though a daily close below 170.00 could pave the way for further losses.

The GBP/JPY surged and passed above 170.00, hitting a fresh year-to-date high at 170.60, but retraced some of its gains and edged towards the 169.90 area, remaining above its opening price. At the time of writing, the GBP/JPY is trading at 170.14.

GBP/JPY Price Analysis: Technical outlook

The daily chart shows that the GBP/JPY is upward biased, though failure to hold to gains above 170.00 could expose the cross to selling pressure. Worth noticing that as GBP/JPY price action registered a series of higher highs, the Relative Strength Index (RSI) did not, so divergence between price action and the RSI means buyers are losing momentum.

If the GBP/JPY holds above 170.00, the following key resistance would be 175.01, February’s 2016 high. On the flip side, the first demand zone would be October 25, high at 169.94, followed by the 169.00 figure, and the October 25 low at 167.78.

Short term, the GBP/JPY one-hour chart illustrates the pair advancing steadily, above the 20-Exponential Moving Average, consolidating some pips below the R1 daily pivot at around 170.10. Worth noting that once the cross-currency pierced the 170.00 figure and reached a six-year high, it retraced and consolidated around the 20-EMA at 169.95. Further reinforcing the upward bias, the Relative Strength Index (RSI) is in bullish territory, aiming higher.

The GBP/JPY first resistance would be the YTD high at 170.60. Once cleared, the following supply zone would be 171.00. Conversely, the GBP/JPY first support would be 170.00. Once cleared, the next support would be 169.50, followed by the October 26 low of 169.60.

GBP/JPY Key Technical Levels

-

19:13

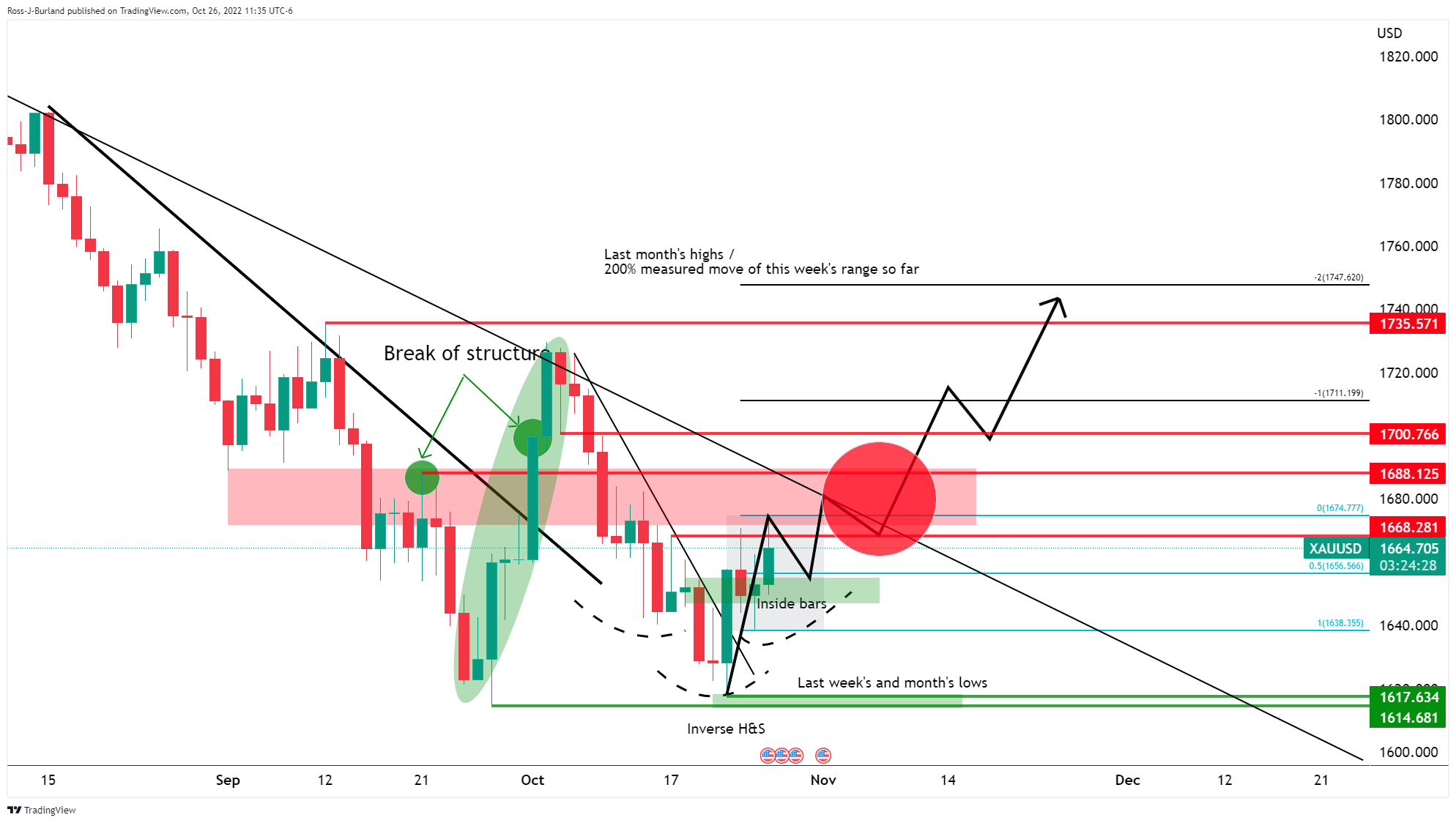

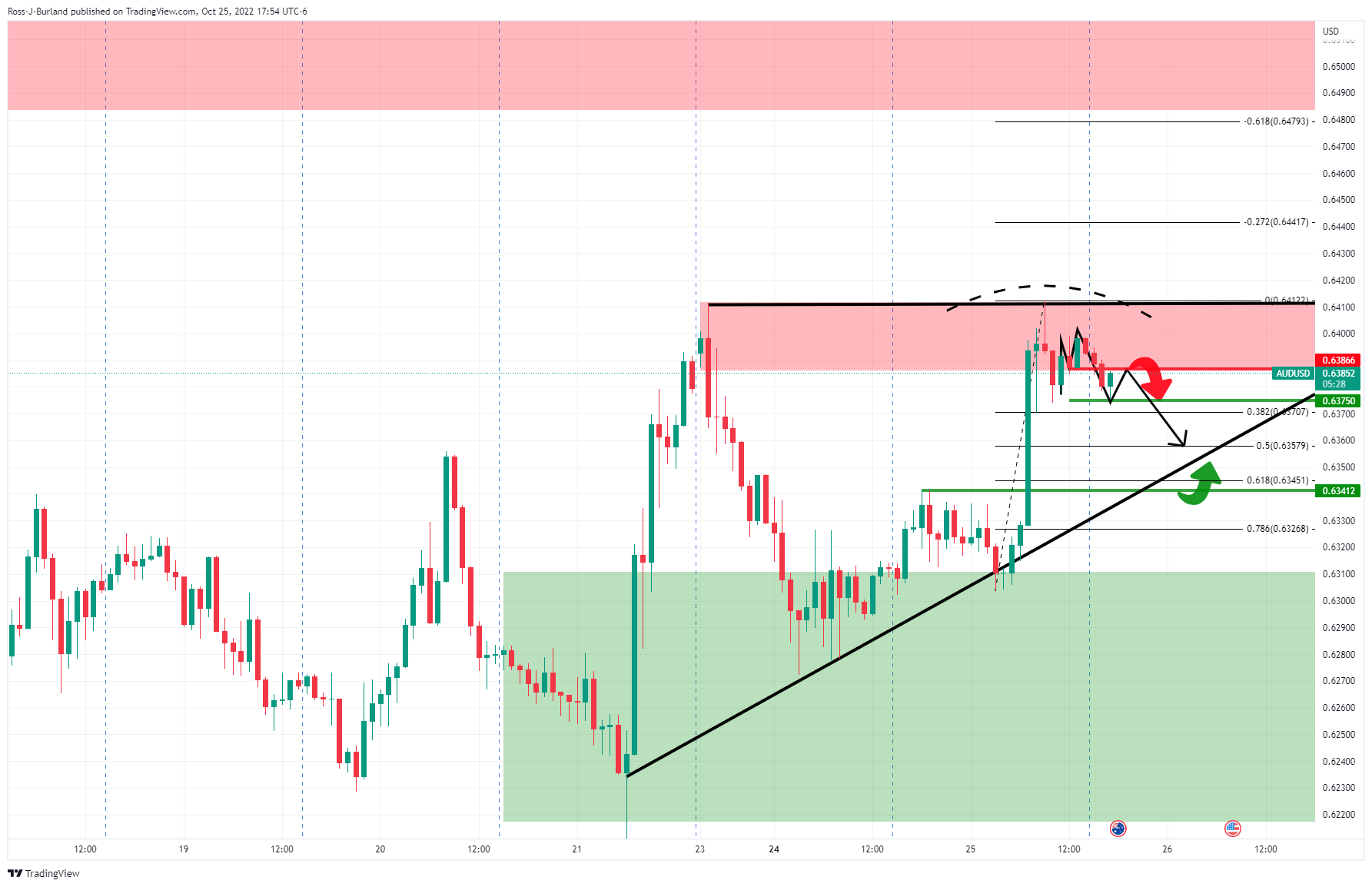

Gold Price Forecast: XAU/USD bulls on the verge of a significant breakout

- Gold is on the verge of a significant bullish turnaround, but it all depends on the Fed.

- Technically, the bulls need to hang on above hourly support and break a daily H&S neckline.

The gold price is higher by some 0.70% on the day as the US dollar continues to bleed out in a risk-on environment following the Bank of Canada's dovish rate hike ahead of next week's Federal Reserve interest rate decision. US bond yields have slipped on expectations that the Federal Reserve will temper its aggressive rate-hike stance starting December which has enabled the precious metal to firm up within a broader bearish technical picture.

DXY and yields on the backfoot

At the time of writing, XAU/USD is trading at $1,665 having travelled between a low of $1,649.81 the low and $1,675.00 the high. The DXY, an index that measures the greenback vs. a basket of currencies is losing some 1.00% on the day having dropped from a high of 111.135 to a low of 109.649 while the US 10-year yield is down 1.95% from a high of 4.113%, clinging on to 4%, just a touch above the lows of 3.997% as it moves in on technical support:

This Benchmark has now dropped to a one-week low, but the bond market might not be too hasty to totally write off a hawkish Fed and price in a Fed pivot entirely until the outcome of next week's meeting. This leaves the M-formation compelling on the daily charts as a reversion pattern that coexists with critical trendline and horizontal support which will likely see the vicinity of 4.00% as a robust area in the meantime, hamstringing gold prices as the DXY will find support:

DXY weekly chart

All depends on data and the Fed

Meanwhile, ''we reiterate that precious metals have yet to discount the implications of a prolonged period of restrictive rates that should continue to weigh on prices,'' analysts at TD Securities argued.

On the other hand, data will be key as central bankers, such as with the BoC today, will be reluctant to raise rates further which would be a positive environment for gold. Nevertheless, the Fed is still widely expected to raise the interest rate by 75 basis points in November and the yellow metal is sensitive to rising US interest rates, as they increase the opportunity cost of holding non-yielding bullion. Ahead of the event, US Gross Domestic Product data on Thursday, followed by US core inflation numbers on Friday could be the clincher before the event as investors might wish to front run it due to what clarity on the Fed rate-hike trajectory might come in the data. There will also be the European Central Bank meeting. it is worth noting that the ECB has failed to see the euro rally in several past meetings, fuelling a bid in the greenback.

Gold technical analysis

The daily chart, above, shows a number of bullish confluences. We had a break in daily structure back on Oct 3 to take the gold price on the back side of the daily trendline resistance. The price moved back into Wednesday 22 Sep bullish peak formation lows in a micro daily bear trend. We have broken on the backside of the micro (secondary) daily trendline on Fri 22 Oct and we have two prior inside days that are being broken today (bullish). This could be cementing the formation of an inverse head and shoulders for a 150% measured move of this week's range so far to target last month's highs of near $1,735. A close above the $1,670 neckline could be the trigger point to start looking for the set-up on lower time frames.

The daily chart is bullish but the hourly charts are starting to paint a different story. The bulls need to commit over the next day to the trendline supports or face the pressures below as illustrated above.

-

19:05

USD/CHF testing three-week lows at 0.9855 after pulling back from 0.9930

- The dollar fails at 0.9930 and returns to the 0.9855 support area.

- Hopes of slowing down by the Fed are weighing on the USD.

- Downside risks have increased below 0.9925.

The US dollar resumed its downtrend against the Swiss franc on Wednesday. The mild recovery attempt witnessed during the European session has been capped at 0.9930, and the pair gave away gains, later on, to test the 0.9855 area at the moment of writing.

The USD dives on Fed pivot expectations

The greenback is depreciating across the board for the second consecutive day, with investors starting to price in a slowdown on the Federal Reserve’s tightening path. A recent batch of negative indicators in the US has boosted concerns about the impact of the Fed’s hawkish policy in economic growth.

The market is still awaiting a 75 basis points hike next week, although the expectations for December have been downgraded to a 0.50% hike. This is hurting the USD, which had been surging over the last months, propelled by the Fed’s radical tightening pace.

USD/CHF: Downside risks have increased below 0.9925

Below 0.9925, the consolidative pace of the last three weeks has been broken, adding negative pressure on the pair. Immediate support lies now at 0.9850 (200-day SMA) before 0.9785 (October 4, 6 lows) and 0.9740 (September 29 low)

On the upside, the pair should return above the mentioned 0.9925 and the 100-day SMA, at 0.965 to ease negative pressure before setting its focus at the 1.0000 psychological level.

Technical levels to watch

-

18:22

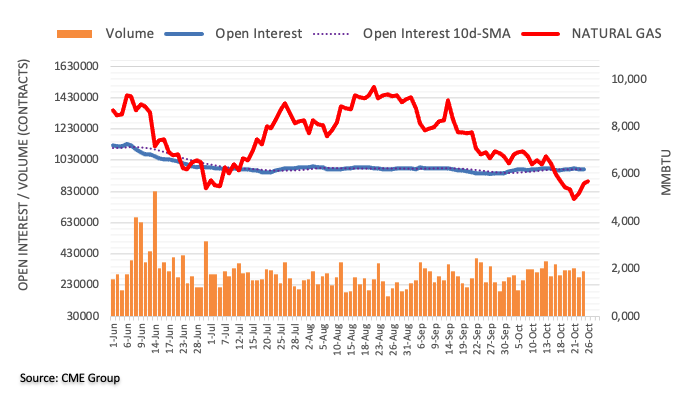

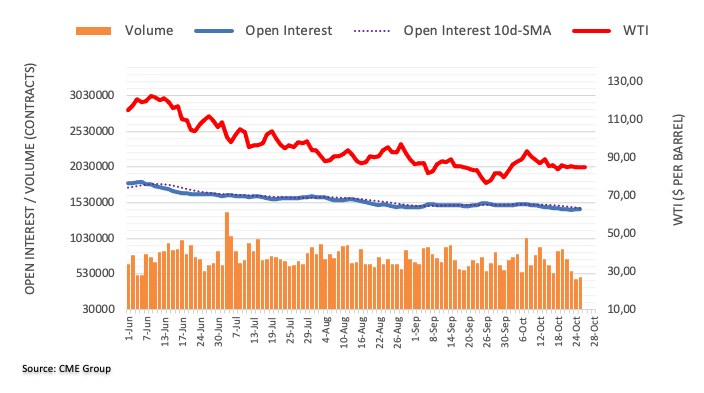

WTI reaches two-week highs at around $88.00 on soft US Dollar

- Western Texas Intermediate (WTI), the US crude oil benchmark, has risen close to 4%.

- US inventories added 2.6 million barrels, above estimates but lower than Tuesday’s API’s 4.5 million build-ups.

- WTI Price Analysis: A move toward $90.00 is almost certain after regaining the 20/50-DMAs.

WTI soared during the New York session, propelled by the overall US Dollar weakening, tumbling more than 1%, while WTI’s exports hit an all-time high due to domestic refiners operating at a higher level. At the time of writing, WTI is trading at $88.05 per barrel after hitting a daily high of $88.38.

The US Dollar Index, a gauge of the buck’s value against a basket of peers, is stumbling for the second consecutive day, more than 1%, down from 111.135 highs to 109.774, a tailwind for the oil price.

Also, given the backdrop of the Organization of Petroleum Exporters Countries (OPEC) decision to cut oil output bolstered WTI price as the market prepares for tighter supply in the coming months. Additionally, the shortage of Russian products due to an oil embargo will have implications for inflation, according to Goldman Sachs, in a note quoted by Bloomberg.

In the meantime, US crude stockpiles rose by 2.6 million barrels, exceeding estimates but lower than data reported by the American Petroleum Institute (API), which showed a sharp increase of 4.5 million in US inventories. Furthermore, exports rose to 5.1 million BPD, the highest ever, while US imports dropped.

WTI Price Analysis: Technical outlook

WTI is neutral biased, though once it reclaimed the 20 and 50-day Exponential Moving Averages (EMAs) in the same trading session, a test of the $90.00 per barrel is on the cards. Notable, the Relative Strength Index (RSI) jumped in the last two days after oscillating around the 50-midline. So, as the RSI gathers bullish momentum, if oil buyers reclaim the $90.00 figure, a move towards the 100-day EMA at $94.05 would likely happen.

-

18:12

Silver Price Analysis: XAG/USD treads water above $19.50

- Silver prices' recovery stalls at $19.50 area.

- A weaker USD underpins the precious metals recovery.

- XAG/USD needs to breach an important resistance hurdle at $19.65/75.

Silver prices are trading higher for the second consecutive day on Wednesday, with the white metal extending its recovery from the $18.80 low on Tuesday to two-week highs at $1975, where it seems to have found a significant resistance hurdle.

USD weakness underpinning precious metals’ recovery

The XAG/USD appreciated earlier on Wednesday, fueled by a broad-based US dollar weakness, as the investors start to price in a slowdown on the Federal Reserve’s monetary tightening path.

The positive price action, however, has stalled right below the $19.65/75 area, where the 100-day SMA meets the 50% Fibonacci retracement level of the October 4-14 decline and the September 23 high.

A successful break above that area would put the pair aiming for the $20.00 psychological level (and the 61,8% Fib level of the aforementioned decline) before aiming at $20.85 October 6 and 7 highs.

On the downside, the 50-day SMA, at $19.00 is defending the pair from further decline, so far, with the next potential support area at $18.80 (Oct 25 low) ahead of the October 14 low at Oct 14.

XAG/USD daily chart

Technical levels to watch

-

18:03

United States 5-Year Note Auction fell from previous 4.228% to 4.192%

-

17:39

GBP/USD soars above 1.1600, hitting a fresh six-week high

- GBP/USD rallies sharply above 1.1600 due to a vote of confidence to UK’s PM Rishi Sunak.

- Speculations for a Fed pivot increase as recently featured data shows the housing market is crashing.

- GBP/USD: From a technical perspective is neutral-to-downward biased unless it reclaims the 100-DMA around 1.1750.

The Pound Sterling extended its rally against the US Dollar for two consecutive days, above its opening price by more than 1%, on news that the UK new Prime Minister Rishi Sunak may delay the announcement of a fiscal plan on October 31, to mid-November. Also, further US economic data shows deterioration in the housing market, weakening the USD, a tailwind for the GBP. At the time of writing, the GBP/USD is trading at 1.1620.

Sentiment remains positive, with Wall Street trading in the green. US economic data revealed by the US Commerce Department that home sales dropped at a 10.9% MoM pace in September, while August’s previous figures of 685K units were downward revised to 677K, signaling that the Federal Reserve aggression continues to dampen the housing market.

In the meantime, the financial markets’ perception of a Fed pivot continues to weigh in the greenback. The US Dollar Index, a measure of the buck’s value vs. a basket of six currencies, drops by almost 1%, down at 109.87, bolstering the GBP/USD.

Aside from this, Fed officials, in the blackout period ahead of the Federal Reserve Open Market Committee (FOMC) meeting in November, GBP/USD traders could shed some light on US economic data. On Thursday, the US calendar will feature the preliminary reading of the Gross Domestic Product (GDP) for Q3, which is expected at 2.4%. Of note, the last report of the Atlanta GDPNow estimates for Q3 GDP an increase of 2.9%.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is neutral-to-downward biased until the major reclaims the 100-day Exponential Moving Average (EMA) at 1.1748. Nevertheless, with the Relative Strength Index (RSI) aiming higher, at 61.68, a move towards 1.1700 is on the cards. But traders should be aware of sudden market mood shifts, with sentiment remaining fragile in the last couple of weeks.

Therefore, the GBP/USD first resistance would be 1.1700, followed by the 100-day EMA at 1.1748, which will expose the 1.1800 figure once cleared. On the other hand, the GBP/USD first support would be 1.1600, followed by the 1.1500 figure, ahead of the October 26 daily low at 1.1430.

-

17:27

USD/CAD drops back below 1.3600 as the post-BoC reaction fades

- The USD resumes its downward trend and returns below 1.3600.

- The Canadian dollar spiked down after the BoC's "bearish hike".

- USD/CAD seen at 136 by year-end despite BoJ slowing down – BofA.

The US dollar resumed its bearish trend on Wednesday, retreating below 1.3600 after having spiked up to 1.3650 following the Bank of Canada’s bearish monetary policy decision earlier today.

The Canadian dollar dips after BoC's monetary policy decision

The Bank of Canada announced a 50 basis point hike, instead of the 75 bp hike the market had anticipated, and pointed out to further monetary tightening ahead even If, as they reckon, the economy might be entering a slight recession over the coming quarters.

According to the statement, future hikes will be influenced by the bank’s assessment of "how tighter monetary policy is working to slow demand, how supply challenges are resolving and how inflation and inflation expectations are responding”

On the other hand, the US dollar remains vulnerable, as the market starts to assume a slowdown in the Federal Reserve’s monetary tightening cycle. Although a 75 bp hike in November is already priced in, the recent downbeat macroeconomic data in the US suggests that the bank’s sharp rate hike is damaging economic growth, which might add pressure to the bank to approve a 0.50% hike in December.

USD/CAD, seen at 1.36 by year-end – BofA

Currency analysts at Bank of America see the pair at 1.36 by year-end, despite BoC slowing down: “We expect the actual delivery of a BoC downshift to allow CAD rates to continue to outperform those of the US. USD/CAD appeared to be overbought in September due to the August inflation surprise and broad risk-off sentiment in the market. The latest inflation prints should provide some short-term tailwind for CAD ahead of the BoC meeting (…) We keep our year-end forecast at 1.36 for USD/CAD.”

Technical levels to watch

-

17:08

BoC: Central bank to raise key interest rate to 4.25% – CIBC

The Bank of Canada raised the key interest rate by 50 basis points to 3.75% surprising market participants that expected a larger increase. Analysts at CIBC still expected the rate to peak at 4.25%, despite the “slight dabbing of the brakes” compared to previous hikes.

Key Quotes:

“The Bank of Canada hiked interest rates by a further 50bp to take the overnight rate to 3.75% today, although that move reflected a slight dabbing of the brakes relative to the prior pace of rate increases and what was expected by the market heading into today's decision (75bp was almost fully priced in). The press conference put some emphasis on avoiding the damaging consequences of an overshoot and the need to slow rate increases in the face of an economy that has started to slow in response to past increases.”

“While the Bank of Canada slightly under-delivered today in terms of the size of rate hike delivered, its downgraded view of potential growth and continued commitment that interest rates "will" need to rise further doesn't suggest to us that the peak in interest rates will be any lower than we were expecting heading into today's announcement.”

“The press conference opening statement suggested that we are getting closer to the end of the hiking cycle and that, barring a large surprise, steps of 75bps are now behind us. This is consistent with our forecast of a peak rate of 4.25%, and that rates will have to stay at that level at least through the end of 2023 to help bring inflation back down to target.”

-

17:00

Russia Industrial Output registered at -3.1%, below expectations (-1%) in September

-

16:56

BoC's Macklem: Cannot rely on global developments to bring down inflation

Bank of Canada (BoC) Governor Tiff Macklem responded to questions from the press following the bank's decision to raise the policy rate by 50 basis points to 3.75%.

Key takeaways

"We do expect rates will have to go up further, we will determine the pace depending on developments."

"We cannot rely on global developments to bring down inflation in Canada."

"We don't expect a severe economic contraction."

Market reaction

USD/CAD continues to trade in negative territory following the press conference and was last seen losing 0.35% on the day at 1.3560.

-

16:54

US: New home sales are likely to continue to decline in the months ahead – Wells Fargo

Data released on Wednesday showed that New Homes Sales fell 10.9% in the United States in September to an annual rate of 603K, above 583K of market consensus. Analysts at Wells Fargo point out sales are likely to continue to decline in the months ahead.

Key Quotes:

“August's robust growth in sales, which was driven by a temporary late-summer dip in mortgage rates, was revised slightly lower to a 24.7% gain.”

“Overall, homes priced over $400K comprised 66% of new home sales in September, up from 59% in August. The increase was driven by the share of sales for homes priced between $500-$749K rising to 30% from 24% the month prior.”

“New home sales are likely to continue to decline in the months ahead. Mortgage applications for purchase have dropped in every week so far in October and, as of October 21, are down 41.8% over the past year. The weakness in mortgage demand is explained by rising mortgage rates which have moved up markedly and are currently hovering above 7%, much higher than in August and September.”

-

16:47

EUR/USD hits fresh six-week highs above 1.0070

- US dollar extends slide across the board as Wall Street turns positive.

- US yields decline adding to dollar’s weakness.

- EUR/USD up for the fifth consecutive day, at six-week highs.

The EUR/USD rose further and printed a fresh six-week high at 1.0080, amid broad-based dollar weakness. It remains near the high, holding onto important daily gains the day before the European Central Bank meeting.

ECB meeting looms

The US dollar extended its correction lower on Wednesday during the American session amid a decline in US yields that reached fresh weekly lows. The DXY was falling almost 1%, trading below 110.00.

The European Central Bank will have its monetary policy meeting on Thursday. A 75 bps rate hike is expected. The decision, statement and Lagarde’s press conference will likely have an impact on euro’s crosses.

Analysts at Rabobank doubt about the possibility of the ECB sustaining a policy of large rate hikes after Thursday. They consider that taking into account the economic context, the central bank may be forced to slow the pace of its moves. “We continue to see scope for EUR/USD to drop to 0.95 into the winter months.”

Also on Thursday, the US will report the first reading of Q3 GDP growth and the weekly jobless claims report.

Going for the 100-day SMA

The EUR/USD is about to post the fifth daily gain in a row and it is consolidating above the parity and also the 55-day Simple Moving Average. The next target might be the 10-day SMA at 1.0092. Above the next resistance is seen at 1.0130.

On the flip side, a slide back under 0.9990 should alleviate the bullish pressure and could open the doors to a bigger decline initially to 0.9905 and then the 20-day SMA at 0.9825.

Technical levels

-

16:47

AUD/USD hits fresh three-week highs above 0.6500 as the USD dives

- The Aussie bounces up at 0.6450 and returns above 0.6500.

- The US dollar dives on hopes of a Fed pivot.

- Australian CPI accelerates to a 32-year high.

The Australian dollar remains strongly bid for the second consecutive day on Wednesday. The pair has resumed the upside trend, after testing support at 0.6450 earlier today, and exploring levels past 0.6500 for the first time since early October.

Hopes of a Fed pivot are hurting the US dollar

The greenback remains on the defensive amid the increasing evidence that the Federal Reserve’s tightening cycle might damage economic growth before inflation is tamed.

Tuesday’s macroeconomic data showed that US housing prices slowed down for the second consecutive month in August, with rising mortgage prices pushing buyers out of the market.

The Fed is widely expected to approve the fourth consecutive 0.75% hike after the November 1 and 2 meeting, but the market is starting to price in a 0,50% hike in December. A report by the Wall Street Journal confirmed this scenario last week, suggesting that Fed officials are discussing how to communicate lower rate hikes for the months ahead. This is taking a toll on the US dollar, which has surged across the board over the last months, propelled by a hawkish Fed.

On the other hand, Australian data showed earlier on Wednesday that the CPI expanded at its fastest pace in 32 years in the third quarter. The yearly inflation accelerated by 7.3% against the 7% anticipated by the analysts, which adds pressure on the RBA to keep increasing interest rates thus buoying demand for the aussie.

Technical levels to watch

-

16:34

BoC's Macklem: A significant slowing of the economy will occur

Bank of Canada (BoC) Governor Tiff Macklem responds to questions from the press following the bank's decision to raise the policy rate by 50 basis points to 3.75%.

Key takeaways

"A significant slowing of the economy will occur."

"We are seeing clearer evidence economy is slowing."

"Next time the bank raises rates, it could be another larger-than-normal hike, might be a normal-sized one."

"It was appropriate to slow the pace of increase in our policy rates from very big steps to a big step."

Market reaction

The loonie manages to stay resilient against the weakening dollar following these remarks and the USD/CAD pair was last seen losing 0.4% on the day at 1.3552.

-

16:11

BoC's Macklem: Getting closer to end of tightening phase

Following the Bank of Canada's (BoC) decision to hike the policy rate by 50 basis points, Governor Tiff Macklem said they are getting closer to the end of the tightening phase but added that they are not there yet.

Additional takeaways

"We are still far from the goal of ensuring inflation is low, stable and predictable."

"There are no easy outs to restoring price stability, we are trying to balance the risks of under- and over-tightening."

"We expect growth to stall in the next few quarters; once we get through this slowdown, growth will pick up."

"We noted the emergence of financial stresses in some markets in recent months."

"Seeing early encouraging signs that underlying inflation is coming down."

Market reaction

The USD/CAD pair, which jumped to a daily high of 1.3650 with the initial reaction to the BoC's dovish hike, lost its traction and was last seen losing 0.5% on the day at 1.3545.

-

15:52

ECB Preview: Forecasts from 15 major banks, no obstacles to a 75 bps hike

The European Central Bank (ECB) is set to announce its decision on monetary policy on Thursday, October 27 at 12:15 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of 15 major banks.

Economists expect the ECB to raise borrowing costs by 75 bps for the second time in a row. That would put the main refinancing rate at 2% and the deposit rate at 1.50%.

SocGen

“We now expect another 75 bps hike by the ECB in October and more rate hikes through next spring, barring a deeper recession, for a terminal rate of 3% by mid-2023. Faster rate hikes also move quantitative tightening (QT) up the agenda, and we now expect a gradual start by mid-2023. However, with the balance sheet playing an important role for financial stability (see the UK) and avoiding fragmentation, QT options and communication will need to be assessed carefully. Focusing initially on private sector assets, allowing greater capital key flexibility and/or a faster TLTRO reduction could help smooth any market volatility or increased fragmentation.”

Danske Bank

“ECB meeting is set to bring another 75 bps rate hike in all three policy rates. We expect Lagarde to say that the probability of the ECB staff's downside risk scenario from the September projection exercise is becoming more likely but fall short of giving new significant policy signals. We expect the ECB to continue to hike its policy rates until early next year, with the risk of potential further hikes if fiscal initiatives support the growth outlook in such a way that inflation remains too high over the medium-term.”

ING

“A 75 bps hike looks like a done deal but the ECB has a lot on its plate at its October meeting. Quantitative Tightening talks are premature but it will seek to mop up bank liquidity. Rates, sovereign and money market spread upside dominates with the 10Y Bund set to test 2.5%. None of this should be enough to support the EUR.”

Nordea

“We expect the ECB to raise rates by 75 bps and signal that more hikes will be in store, point to incoming data and the new forecasts available in December determining the size of the next move but to generally sound hawkish, debate when and how to start reducing the ECB’s huge bond portfolio but leave the decision until the December meeting and announce technical changes to encourage banks to early repayments of the TLTROs and possibly also measures to ease the tensions in the government bond markets.”

Commerzbank

“We expect the ECB Council to decide to raise key interest rates by a further 75 bps as well as to change the TLTRO conditions so that commercial banks will no longer be able to make safe profits on TLTROs.”

TDS

“We expect the Governing Council to hike ECB rates by 75 bps, taking the Depo Rate to 1.50%. Messaging at this meeting is likely to remain focused on record-high inflation rather than soft growth.”

Rabobank

“A 75 bps rate hike seems like a done deal. We have also upgraded our expectations for the next few meetings, and now see the deposit rate reach 3% by March. The ECB seems determined to end the TLTRO arbitrage. We expect the ECB to try to minimise market impact, but we predominantly see risks of a more negative €STR-deposit rate spread. Quantitative tightening may be explored, but any tangible plans are unlikely.”

Nomura

“We forecast the ECB Governing Council will raise all three key interest rates by 75 bps. This would bring the depo rate to 1.50%, the refi rate to 2.00% and the marginal lending rate to 2.25%.”

Deutsche Bank

“We expect another 75 bps hike, followed by 75 bps in December, 50 bps in February and 25 bps in March, reaching a terminal rate of 3%. The press conference as ever will be a focal point and there’ll be lots of attention on technical things surrounding TLTROs and excess reserves.”

ANZ

“Faced with rising and broadening inflation, we expect the ECB to raise rates by 75 bps and maintain its hawkish guidance. There may be a focus on when 50 bps rise will be appropriate. At some point, quantitative tightening will need to be part of the normalisation process. The ECB will proceed with caution given the widening trend in regional spreads and recent turmoil in the gilts market. We think QT is an early 2023 story. Containing inflation is central to the euro area’s economic stability. There is hope that headline HICP may peak in the coming months following the fall in gas prices. However, core inflation and wages are rising.”

Citibank

“We expect the ECB to hike policy rate by 75 bps, taking the deposit rate to 1.5%. More rate hikes are likely to be signaled. It is probably too early to take complicated decisions on unwinding asset purchases.”

BMO

“We look for a 75 bps increase: the deposit facility to 1.50%, marginal lending facility to 2.25%, and the refi rate to 2.00%. This would be the second in a series of moves to get to terminal; or, as President Lagarde laid out in September, ‘it’s probably more than two, including this one, but it’s probably also going to be less than five’. Many ECB members have taken on increasingly hawkish tones. With headline inflation of 9.9% and core CPI at 4.8% (both a record) and headed higher, the Governing Council will likely be forced to front-load more aggressive hikes to fulfill its mandate of price stability. Even France’s François Villeroy de Galhau, whose views are more middle-of-the-road, declared that he expects the ECB to ‘go quickly’ to reach a 2% deposit rate by year-end.”

Wells Fargo

“We expect the ECB to deliver another 75 bps increase to its Deposit Rate, bringing that rate to 1.50%. We doubt any announcement on quantitative tightening would come before December, while we currently do not expect any implementation of quantitative tightening to begin before March 2023.”

Crédit Agricole

“We expect the Governing Council to meet the market expectations and deliver a 75 bps hike but to signal that the policy normalisation would slow down from here while a potential QT is not imminent. This much would warrant a cautious view on the EUR from current levels.”

BofA

“We expect the ECB to hike 75 bps with a clear signal of more to come, in line with recent communication and market pricing. We argue it is too early for QT (quantitative tightening), but the language around APP (Asset Purchase Programmes) reinvestments is likely to change, preparing the ground for discussions. An announcement on punitive tiering or changing TLTRO (Targeted Long Term Refi Operations) terms seems likely to us, even if the details follow later. In FX, we do not believe the hawkish ECB steps and tone will be enough to support the EUR, given market expectations and remaining challenges.”

-

15:51

USD/JPY extends slide under 147.00 as dollar remains under pressure

- Yen gains strength as central banks slowdown rate hikes.

- US Dollar continues on correction mode, DXY drops by 0.68%.

- USD/JPY falls for the third day out of the last four days.

The USD/JPY extended losses during the American session and hit fresh lows under 146.50 as the dollar continues to correct lower across the board and amid a less weak yen.

Less aggressive central banks?

Following the decision of the Bank of Canada to raise the key interest rate by 50 basis points, below the market consensus of 75 bps, the USD/JPY bottomed at 146.43, the lowest level in two days. The increase in interest below consensus adds to the expectations that the Federal Reserve might signal a slower pace of hikes after November.

US yields hit news weekly lows recently with the 10-year at 3.99% but then rebounded back above 4.00%, helping USD/JPY move off lows.

The yen is among the top performers on Wednesday even as Wall Street is holding onto most recent gains. The Dow Jones is up by more than 200 points or 0.66%, at fresh monthly highs.

Economic data from the US showed a 10.9% decline in New Home Sales in September to an annual rate of 603K, above the market consensus of 585K. On Thursday the US will release the first reading of Q3 GDP growth. The Bank of Japan will announce its decision on monetary policy on Friday.

Technical levels

-

15:37

USD/CAD oscillates above 1.3600 after BoC’s dovish 50 bps rate hike

- The Bank of Canada hikes rates by 50 bps, less than the 75 bps expected, and the USD/CAD tumbles.

- The BoC will continue its Quantitative Tightening (QT) program.

- USD/CAD jumped toward its daily high at 1.3650 in the release of the headline.

The USD/CAD rises following the Bank of Canada (BoC) monetary decision to lift rates by 50 bps on Wednesday, disappointing market participants, expecting a ¾ of percent increase due to Canada’s economy struggling with inflationary levels not seen in 30 years. Also, the BoC announced that it would continue its policy of quantitative tightening. The USD/CAD is trading at around 1.3619, above its opening price by 0.08%.

Summary of the BoC monetary policy statement

The BoC said global inflation remains high and broadly based, feeling the impact of higher commodity prices sparked by Russia’s attack on Ukraine. The BoC acknowledged that tightening monetary conditions to temper inflation is “weighing on economic activity around the world. As economies slow and supply disruptions ease, global inflation is expected to come down.”

Regarding the international outlook, the BoC expects no growth in the US economy and a recession in the Euro area. While China’s economy appears to have picked up, the property market will keep growth contained.

Domestically, the BoC sees the economy operating in excess demand with a tight labor market. Enough supplies for goods and services keep inflationary pressures high. And the full reopening of the economy “led to a sharp rise in the price of services.”

Even though Canada’s CPI declined to 6.9% from 8.1%, price pressures remain broadly based, impacting the Bank’s preferred measures of core inflation, which “are not yet showing meaningful evidence that underlying price pressures are easing.”

Therefore, the BoC Governing Council agreed that policy rates will need to rise further and would be influenced by the BoC’s Council assessment of the effects of tighter conditions working to slow demand, lower inflation, and how supply disruptions resolve.

USD/CAD Market’s Reaction

The USD/CAD 5 minutes chart shows the pair jumped from around 1.3580 to its daily high of 1.3650, on the headline, due to market participants’ expectations for a hefty rate hike. Of note, the USD/CAD retraced to 1.3600, erasing 50 pips of gains, though it would likely remain consolidated, as the Bank of Canada (BoC) Governor Tiff Macklem will hit the stand, at around 15:00 GMT.

Source: Refinitiv

-

15:36

GBP/USD to extend its rally towards 1.20 on a break above 1.1605/20 – Scotiabank

Sterling is one of the better G10 currency performers on the day. Economists at Scotiabank expect the GBP/USD to return to the 1.20 area on a break past the 1.1605/20 zone.

Breaking and holding above 1.14 is a bullish medium-term signal

“Cable breaking and holding above 1.14 is a bullish medium-term signal for the pound.”

“We expect firm support on dips to the low 1.14s/high 1.13s from here.”

“GBP gains are stalling in the 1.16 zone today, however, extending gains through the 1.1605/10 zone targets a return to the 1.20 area for cable.”

-

15:30

United States EIA Crude Oil Stocks Change above expectations (1.029M) in October 21: Actual (2.588M)

-

15:03

Gold Price Forecast: XAU/USD to suffer further falls with a top in place – Credit Suisse

Gold remains solidly below $1,691/76, reinforcing its “double top.” Subsequently, strategists at Credit Suisse expect XAU/USD to extend its losses.

Weekly close above 55-Day Moving Average at $1,699 to alleviate downside pressure

“Gold below $1,691/76 has reinforced its existing large ‘double top’. Hence, with a top in place, we expect XAU/USD to come under renewed pressure. We note that the next support is seen at $1,614, then $1,560 and eventually our core objective at $1,451/40.”

“Only a convincing weekly close above the 55-DMA at $1,699 would ease the pressure on the yellow metal, with next resistance then seen at the even more important 200-DMA, currently at $1,813, which we would expect to cap at the very latest.”

-

15:00

Breaking: Bank of Canada hikes policy rate by 50 bps vs 75 bps expected

The Bank of Canada (BoC) hiked its benchmark interest rate by 50 basis points (bps) to 3.75% at the end of the October policy meeting this Wednesday. The decision to slow the pace of policy tightening comes amid growing worries about a deeper global economic downturn and disappointed market participants anticipating a 75 bps rate hike.

Market reaction

The surprise move weighs heavily on the Canadian dollar and triggers an aggressive short-covering around the USD/CAD pair, which rallies nearly 150 pips from a three-week low touched earlier this Wednesday.

-

15:00

Canada BoC Interest Rate Decision came in at 3.75%, below expectations (4%)

-

15:00

United States New Home Sales Change (MoM) came in at -10.9%, above expectations (-13.9%) in September

-

15:00

United States New Home Sales (MoM) above forecasts (0.585M) in September: Actual (0.603M)

-

14:35

USD/CAD to slip under 1.35 on a BoC's hawkish hike – Scotiabank

USD/CAD losses checked near 1.35 ahead of the Bank of Canada (BoC) policy decision. Economists at Scotiabank expect the pair to drop below the 1.35 mark on a hawkish hike.

A dovish hike will drive USD/CAD back towards 1.38/1.39

“Assuming a 75 bps increase, a dovish hike – that is, 75 bps with guidance towards slower/limited hikes moving ahead and the rate cycle near its peak – will hurt the CAD and drive spot back towards 1.38/1.39.”

“A neutral hike – 75 bps with little or no guidance – likely keeps USD/CAD in its current range.”

“A hawkish hike – 75 bps and clear indications from the statement that there is a lot more work to do to curb inflation – should see spot edge under 1.35.”

See – BoC Preview: Forecasts from 10 major banks, taking what is offered, a 75 bps hike

-

14:27

USD Index bounces off multi-week lows near 110.00

- The sharp sell-off in the index meets support just below 110.00.

- US yields keep the corrective downside well in place so far on Wednesday.

- US trade deficit expected to widen to $92.22B in September.

The dollar remains entrenched in the negative territory on Wednesday, although it manages to rebound from lows in the sub-110.00 area when gauged by the USD Index (DXY).

USD Index weaker on Fed’s pivot, risk appetite

The intense improvement in the risk-associated universe continues to weigh on the greenback midweek, always amidst the continuation of the corrective retracement in US yields across the board.

In the meantime, the selling bias prevails around the dollar as investors continue to assess the probability that the Fed might introduce a pivot in its normalization plans as soon as in the next months. On this, some rate-setters have already hinted at a potential debate on the matter as soon as at the December meeting.

In the US data space, MBA Mortgage Applications contracted 1.7% in the week to October 21 and advanced Goods Trade Balance showed a $92.22B deficit during September. Later in the session, New Home Sales also for the month of September are due.

What to look for around USD

The dollar’s sharp decline seems to have met some initial contention around the 110.00 neighbourhood so far this week.

In the meantime, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to be the main factor underpinning the dollar, although this view could be put to the test amidst rising speculation of the introduction of a Fed’s pivot in the relatively short-term horizon.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: MBA Mortgage Applications, New Home Sales, Building Permits, Advanced Goods Trade Balance (Wednesday) – Flash Q3 GDP Growth Rate, Durable Goods Orders (Thursday) – PCE/Core PCE Price Index, Personal Income/Spending, Pending Home Sales, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 0.70% at 110.11 and the breach of 109.94 (monthly low October 26) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13). On the other hand, the next up barrier lines up at 113.88 (monthly high October 13) seconded by 114.76 (2022 high September 28) and then 115.32 (May 2002 high).

-

14:22

EUR/USD: Holding parity suggests more gains towards 1.03 – Scotiabank

EUR/USD regains parity. The pair could extend its gains towards the 1.03 mark, economists at Scotiabank report.

Regaining parity is a boost for the euro

“Gains yesterday through key trend resistance off the Feb EUR high are holding and what was resistance now becomes key support (0.9935).”

“Note that parity (0.9998) is the 23.6% retracement of the 2022 EUR decline; holding parity suggests more gains towards 1.03 (38.2% retracement at 1.0284).”

See – EUR/USD: Break of 1.00 could trigger quite a sharp short squeeze to 1.02 – ING

-

14:11

GBP/USD eases from multi-week top, still well bid around mid-1.1500s amid weaker USD

- A combination of factors lifts GBP/USD to a fresh six-week high on Wednesday.

- New UK PM pledges to fix his predecessor's policy errors and underpins sterling.

- Reduced bets for more aggressive Fed rate hikes continue to weigh on the USD.

- A softer risk tone helps limit losses for the safe-haven buck and caps the major.

The GBP/USD pair retreats a few pips from a six-week high touched earlier this Wednesday and is trading around mid-1.1500s during the early North American session.

The new British Prime Minister Rishi Sunak pledges to fix mistakes by the Truss administration and boosts investors' confidence. This leads to a further decline in the UK government borrowing costs and continues to underpin the British pound. Apart from this, the heavily offered tone surrounding the US dollar pushes the GBP/USD pair higher for the second successive day.

Investors scaled back their expectations for a more aggressive policy tightening by the Fed in reaction to the incoming US macro data, which pointed to a slowdown in the world's largest economy. This is evident from the ongoing downfall in the US Treasury bond yields, which drags the USD to its lowest level since September 20 during the mid-European session on Wednesday.

That said, a softer risk tone, as depicted by a generally negative sentiment around the equity markets, offers some support to the safe-haven buck and keeps a lid on any further gains for the GBP/USD pair. Investors also seem reluctant and might prefer to move to the sidelines ahead of the important US economic releases, including the Advance Q3 GDP report, on Thursday.

From a technical perspective, a convincing break through the 1.1475-1.1480 supply zone and a subsequent strength beyond the 1.1500 psychological mark favours bullish traders. Hence, any meaningful pullback could now be seen as a buying opportunity and is more likely to remain limited near the said resistance breakpoint, now turned support.

Next on tap is the release of the New Home Sales data from the US. This, along with the US bond yields and the broader risk sentiment, will influence the USD price dynamics and provide some impetus to the GBP/USD pair.

Technical levels to watch

-

13:36

US: International trade deficit widens to $92.2 billion in September

- International trade deficit of the US widened in September.

- US Dollar Index stays deep in negative territory but holds above 110.00.

The data published by the US Census Bureau showed on Wednesday that the US international trade deficit widened by $4.9 billion to $92.2 billion in September from $87.3 billion in August.

"Exports of goods for September were $177.6 billion, $2.8 billion less than August exports," the publication further revealed. "Imports of goods for September were $269.8 billion, $2.2 billion more than August imports."

Market reaction

The US Dollar Index recovered slightly from multi-week lows it touched earlier in the day and was last seen losing 0.45% on the day at 110.38.

-

13:33

When is the BoC monetary policy decision and how could it affect USD/CAD?

BoC Monetary Policy Decision – Overview

The Bank of Canada (BoC) is scheduled to announce its monetary policy decision this Wednesday at 14:00 GMT. The Canadian central bank is widely expected to lift its policy rate by 75 bps to 4% at the end of the October meeting to keep inflation expectations anchored. Apart from this, investors will take cues from the accompanying monetary policy statement and the post-meeting press conference for clues about the central bank's policy outlook

Analysts at Citibank offer a brief preview of the event and explain: “While it is a very close call between a 50 bps hike or a 75 bps hike, we still lean towards expecting a 50 bps hike but still expect a significant hawkish emphasis that rates are still likely to rise further and expect another 50 bps hike in December taking the policy rate to 4.25% before a pause, but with risks that hikes continue into 2023 and reach a higher terminal rate.”

How Could it Affect USD/CAD?

Ahead of the key central bank event risk, a combination of factors drag the USD/CAD pair to a three-week low during the first half of the European session on Wednesday. An uptick in crude oil prices underpins the commodity-linked loonie and exerts downward pressure on the major amid the prevalent US dollar selling bias.

The BoC could signal a dovish tilt amid looming recession risk, which could prompt some short-covering and lift the USD/CAD pair back above the 1.3600 mark. That said, BoC Governor Tiff Macklem had said that the primary goal of the bank is to restore price stability, suggesting that the immediate market reaction is likely to be short-lived.

Conversely, hints towards a more aggressive tightening, despite cooling inflation and deteriorating economic outlook, should be enough to provide a fresh boost to the Canadian dollar. This, in turn, would pave the way for an extension of the USD/CAD pair's recent sharp pullback from the 1.3975-1.3980 area, or the highest level since May 2020 touched earlier this month.

Key Notes

• BOC Preview: Getting ready for a dovish pivot?

• BoC Preview: Forecasts from 10 major banks, taking what is offered, a 75 bps hike

• USD/CAD to bounce but not as much as expected if the BoC does pitch for 50 bps – MUFG

About the BoC Interest Rate Decision

BoC Interest Rate Decision is announced by the Bank of Canada. If the BoC is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the CAD. Likewise, if the BoC has a dovish view on the Canadian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

-

13:31

United States Wholesale Inventories came in at 0.8%, below expectations (1%) in September

-

13:30

United States Goods Trade Balance fell from previous $-87.2B to $-92.2B in September

-

13:26

EUR/USD Price Analysis: The next hurdle comes at 1.0050

- EUR/USD surpasses the parity in a sustainable fashion.

- There is scope for a visit to the 1.0050 level in the near term.

The weekly upside in EUR/USD remains healthy and manages to leave behind the key parity zone on Wednesday.

The surpass of this key region could spark a more serious recovery in the short-term horizon. Against that, the immediate barrier is expected at the weekly top at 1.0050 (September 20).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0516.

EUR/USD daily chart

-

13:21

EUR/CAD could return to a 1.40-1.45 range on a break past 1.3825 – Scotiabank

EUR/CAD’s renaissance is gathering some momentum. In the opinion of economists at Scotiabank, the pair could return to the 1.40-1.45 range.

EUR/CAD recovery gathers momentum

“The longer run (monthly) chart strongly suggests a major low and bullish reversal developed around the Aug push below 1.30. A strong gain for the Oct month overall will “confirm” the bullish reversal.”

“Short-term gains above the 200-day MA (1.3586) will add to positive momentum; note that this point roughly converges with the 38.2% Fib retracement of the 2022 decline (1.3548) and a break higher allows the cross to challenge major resistance on the daily chart at 1.3825 – the collection of highs from the spring/early summer. Above here should see the cross return to a 1.40-1.45 range.

“Key support is 1.3420/25.”

-

12:50

EUR/USD set to drop toward 0.95 into the winter months – Rabobank

EUR/USD is back above parity. Economists at Rabobank see risk that this move could be short-lived.

European Central Bank may be forced to slow the pace of its moves

“Structurally higher rates of inflation in the post pandemic period could suggest higher for longer US policy rates, which could mean that relative USD strength could persist for some time, even when it retreats from its highs. In addition to this, we see a strong risk that the EUR is not fully priced for the economic impact of Europe’s energy crisis.”

“Yesterday Germany’s IFO economic institute warned that Germany is headed into recession and forecast that its economy will contract by 0.6% in Q4. This raises the question of how long the ECB can sustain a policy of large rate hikes. A 75 bps move is expected later this week. Beyond that, it may be forced to slow the pace of its moves.”

“We continue to see scope for EUR/USD to drop to 0.95 into the winter months.”

-

12:18

USD/CAD to bounce but not as much as expected if the BoC does pitch for 50 bps – MUFG

The Bank of Canada (BoC) meets today to decide on the size of the increase in the key policy rate. USD/CAD could bounce if the BoC delivers a 50 basis points hike instead of 75 bps as expected, economists at MUFG Bank report.

Therei is more logic in hiking by 50 bps rather than 75 bps

“Given the work done by the BoC and given the downside risks to growth that is becoming more evident in the data we think there’s more logic in hiking by 50 bps rather than 75 bps.”

“The revised forecasts to be released today as well may be the justification for slowing the pace with most forecasts now indicating a technical recession in 2023.”

“If the BoC does pitch for 50 bps, with 75 bps more than priced, we would expect USD/CAD to bounce although with USD sentiment particularly negative at present, the move might not be as large as it would have been say last week prior to the speculation of a Fed shift in tone next week.”

See – BoC Preview: Forecasts from 10 major banks, taking what is offered, a 75 bps hike

-

12:12

USD Index Price Analysis: Further weakness could revisit 108.40

- DXY accelerates losses and briefly pierces the 110.00 mark.

- A deeper correction could see the 108.40 region revisited.

DXY drops for the second session in a row and prints new multi-week lows in the sub-110.00 region on Wednesday.

The loss of 110.00 could force the index to retarget the 8-month support line near 108.40, an area coincident with the 100-day SMA. Below this zone, the downside pressure in the dollar is predicted to gather extra steam.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 103.93.

DXY daily chart

-

12:09

USD/CHF keeps the red below 0.9900 mark amid broad-based USD weakness

- USD/CHF continues losing ground for the second straight day and drops to a three-week low.

- Reduced bets for more aggressive Fed rate hikes weigh on the USD and exert some pressure.

- The lack of follow-through selling warrants some caution before positioning for further losses.

The USD/CHF pair remains under some selling pressure for the second successive day on Wednesday and retreats further from its highest level since May 2019 touched last week. The downward trajectory drags spot prices to a three-week low, around the 0.9855 area during the first half of the European session and is sponsored by the heavily offered tone surrounding the US dollar.

In fact, the USD Index, which measures the greenback's performance against a basket of currencies, dives to over a one-month low amid reduced for a more aggressive policy tightening by the Fed. Investors now expect that the US central bank will be forced to soften its hawkish stance amid signs of a slowdown in the world's largest economy. This is evident from a further decline in the US Treasury bond yields, which continues to weigh on the greenback and exerts downward pressure on the USD/CHF pair.