Notícias do Mercado

-

20:00

Dow -20.55 16,831.29 -0.12% Nasdaq +11.22 4,409.15 +0.26% S&P -0.1 1,960.86 -0.01%

-

17:00

European stock close: FTSE 100 6,743.94 -13.83 -0.20% CAC 40 4,422.84 -14.15 -0.32% DAX 9,833.07 +17.90 +0.18%

-

17:00

European stocks close: stocks traded little changed after Eurozone's inflation data

Stock indices traded little changed after Eurozone's inflation data. Eurozone's inflation remained unchanged at 0.5% in June. Analysts had expected an increase to 0.6%.

German retail sales declined 0.6% in May, missing expectations for a 0.8% rise, after a 0.9% decrease in April. On a yearly basis, German retail sales rose 1.9% in May, missing expectations for a 2.8% gain, after a 3.2% increase in April. April's figure was revised down from a 3.4% rise.

M3 money supply in the Eurozone increased 1.0% in May, beating expectations for a 0.7% gain, after a 0.8% rise in April.

Private loans in the Eurozone decreased 2.0% in May, missing expectations for a 1.7% fall, after a 1.8% drop in April.

Royal Philips NV shares declined 4.5% after reporting the company want to merge its LED-component and automotive-lighting units into a stand-alone company.

Osram Licht AG increased 7.2% after JPMorgan Chase & Co. upgraded the company's rating.

EasyJet Plc fell 6.4% after Bank of America Corp. downgraded the company's rating.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,743.94 -13.83 -0.20%

DAX 9,833.07 +17.90 +0.18%

CAC 40 4,422.84 -14.15 -0.32%

-

16:41

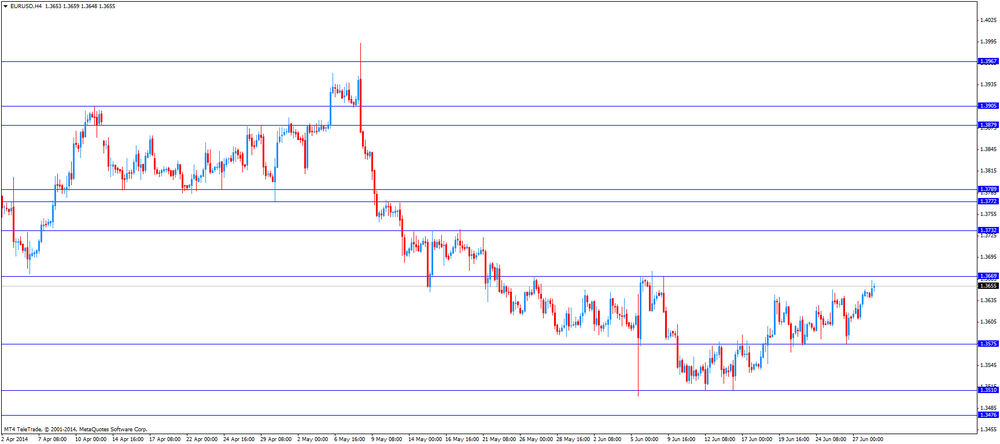

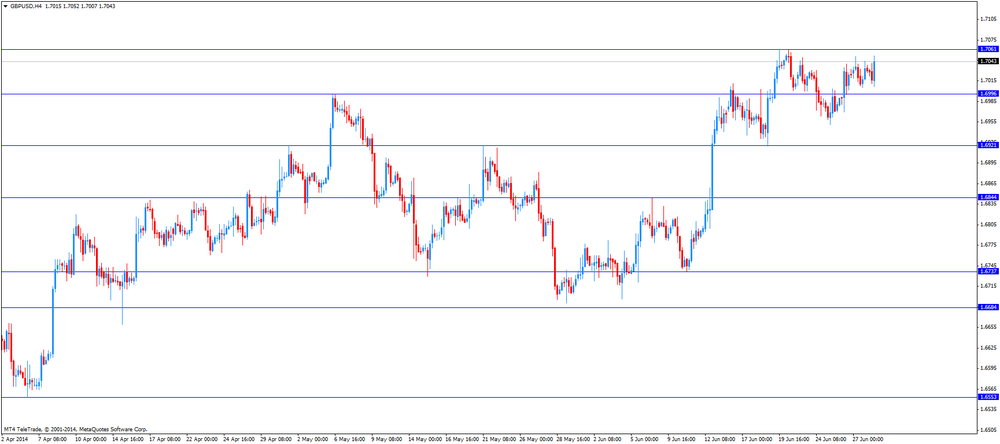

Foreign exchange market. American session: the British pound hits 6-year highs against the U.S. dollar after the mixed U.S. economic data

The U.S. dollar traded lower against the most major currencies after the mixed U.S. economic data. Chicago purchasing managers' index dropped to 62.6 in June from 65.5 in May, missing expectations for a decline to 63.2.

Pending home sales in the U.S. increased 6.1% in May, exceeding expectations for a 1.4% rise, after a 0.4% gain in April. That It was the largest gain since August 2010.

The euro rose against the U.S. dollar after mixed economic data from Eurozone. Eurozone's inflation remained unchanged at 0.5% in June. Analysts had expected an increase to 0.6%.

German retail sales declined 0.6% in May, missing expectations for a 0.8% rise, after a 0.9% decrease in April. On a yearly basis, German retail sales rose 1.9% in May, missing expectations for a 2.8% gain, after a 3.2% increase in April. April's figure was revised down from a 3.4% rise.

M3 money supply in the Eurozone increased 1.0% in May, beating expectations for a 0.7% gain, after a 0.8% rise in April.

Private loans in the Eurozone decreased 2.0% in May, missing expectations for a 1.7% fall, after a 1.8% drop in April.

The British pound hits 6-year highs against the U.S. dollar after the mixed U.S. economic data. The number of mortgage approvals in the U.K. was 61,707 in May, after 62,806 approvals in April. That was the lowest number of approvals since August 2013.

Net lending to individuals in the U.K. increased by ₤2.7 billion in May, beating expectations for a rise by ₤2.5 billion, after ₤2.4 billion in April.

The Canadian dollar traded higher against the U.S. dollar after the mixed U.S. economic data. The GDP in Canada rose 0.1% in April, missing forecast for a 0.2% increase, after a 0.1% gain in March.

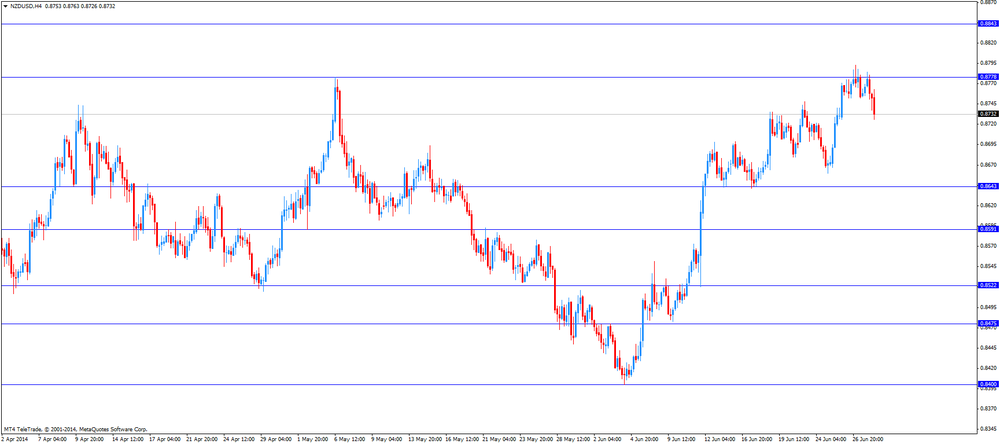

The New Zealand dollar traded higher against the U.S dollar. The ANZ business confidence index for New Zealand dropped to 42.8 in June from 53.5 in May.

Building permits in New Zealand dropped 4.6% in May, after a 1.9% rise in April. April's figure was revised up from a 1.5% gain.

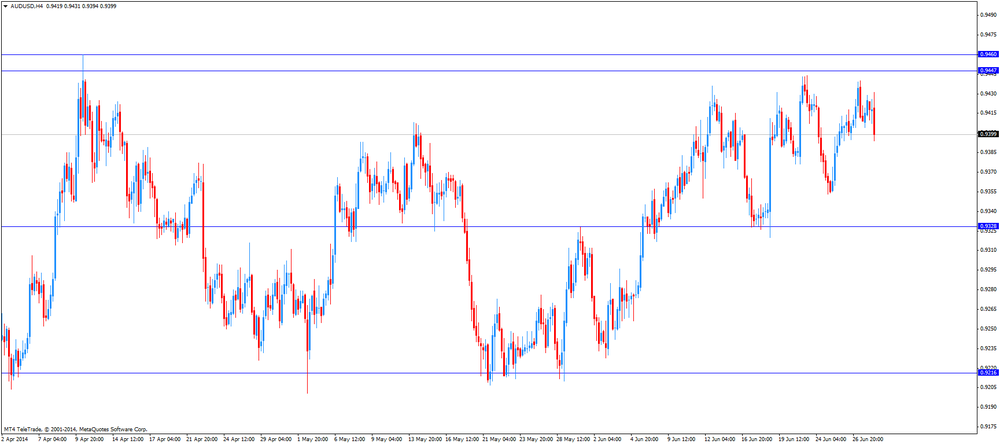

The Australian dollar increased against the U.S. dollar after the mixed U.S. economic data. New home sales in Australia decreased 4.3% in May, after a 2.9% rise in April.

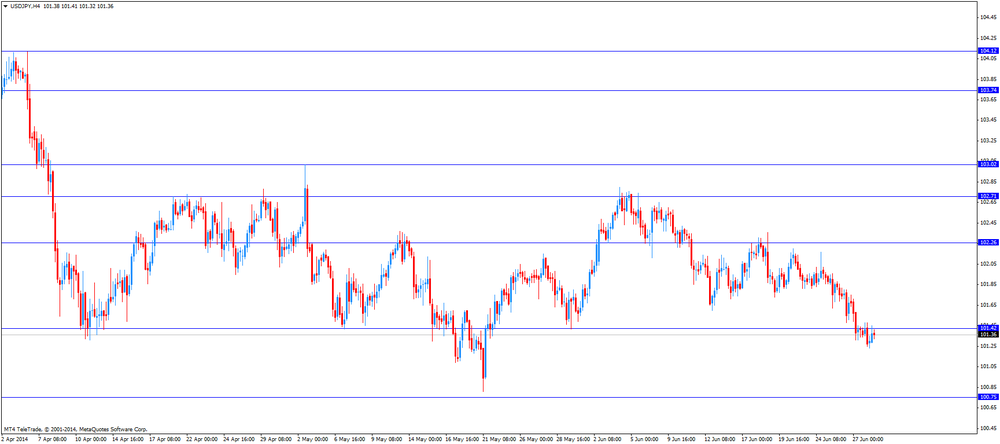

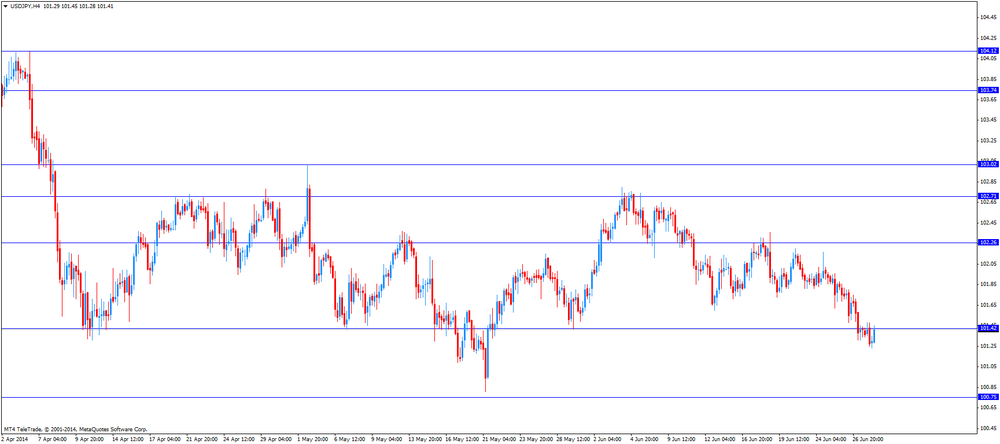

The Japanese yen traded slightly higher against the U.S. dollar after the mixed U.S. economic data. Japan's industrial production rose 0.5% in May, missing expectations for a 0.9% increase, after a 2.8% decline. On a yearly basis, industrial production in Japan increased 0.8% gain in May, after a 3.8% rise in April.

Housing starts in Japan dropped 15.0% in May, after a 3.3% decline in April. Analysts had expected a 10.1% decrease.

-

16:40

Oil: an overview of the market situation

Cost of oil futures declined moderately today, continuing to retreat from the nine-month high, amid signs that oil exports from southern Iraq will not suffer from escalation.

Oil market today continues to record profits, the resulting fall on fears of oil exports from Iraq. Radical Islamists seized several towns in the east and north-east of Iraq and now lead an offensive against Baghdad. However, the oil fields in southern Iraq, which supplies about 95% of its oil exports, remain under the control of government forces. Recall that in the last month, Iraq produced about 3.5 million barrels of oil per day, in connection with what was the second largest OPEC oil producer after Saudi Arabia.

The course of trade is also affected by expectations of market participants key risk events. Tomorrow China should publish official manufacturing index for June, which, according to many forecasts, will reach a maximum of six months. Meanwhile, on Thursday, investors will be closely watching the political meeting of the European Central Bank, and wait for the release of the report on employment in the U.S. non-farm payrolls, which will give further views on the strength of the labor market.

Also note that analysts Reuters significantly increased oil price forecasts on the background of military action in Iraq, occupying the second place in the OPEC oil producer, and Ukraine. 26 forecast of analysts surveyed by was 108 dollars per barrel of Brent crude this year, compared with 105.90 dollars in the May poll. From the beginning, the average price of Brent was $ 108.72 per barrel. Forecasts for Brent for 2015 and 2016 are equal to, respectively, $ 104.80 and $ 102.10. Analysts on average forecast that the average price of U.S. benchmark WTI this year will rise to $ 100.40 a barrel from $ 98.05 in 2013. From the beginning, WTI traded at an average of $ 100.72.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 105.33 a barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell by 63 cents to $ 112.38 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices declined moderately, but still retreated from session lows. Many market participants are waiting for new catalysts for the growth of the market, which is likely to prove the monthly employment data in the U.S. and the ECB meeting later this week.

On Thursday, investors will wait for the release of the report on employment in the U.S. non-farm payrolls, which will give further views on the strength of the labor market. Analysts expect the U.S. economy grew by 211,000 jobs this month, while the unemployment rate must have remained the same at 6.3%.

Gold prices supported amid expectations that the Fed will keep interest rates for an extended period of time after data last week showed that the U.S. economy shrank at an annualized rate of 2.9% in the first quarter.

It is worth noting that the price of gold is close to the maximum in the last 2 months due to a weaker dollar and geopolitical tensions. Iraqi army uses tanks and armored vehicles to liberate the city from Sunni militants in the north of Tikrit. In the area of the city in eastern Ukraine Slovyansk fighting continues with the militia, despite the declared truce.

"From a technical point of view, the gold market looks good: support - $ 1,300 and resistance - $ 1,335. Growth is possible, but significant movements occur only at the end of the week after the employment report in the U.S. and the ECB meeting, "- said precious metals trader in Hong Kong.

Meanwhile, experts have warned that price volatility may increase at the end of the week, when it published a series of new economic data. Market participants will be absent from the United States on Friday of the Independence Day celebrations, which will be an additional factor of volatility on Thursday. In the absence of significant news from the geopolitical front gold prices will vary oppositely dollar.

The cost of the August gold futures on the COMEX today dropped to $ 1317.2 per ounce.

-

15:00

U.S.: Pending Home Sales (MoM) , May +6.1% (forecast +1.4%)

-

14:45

U.S.: Chicago Purchasing Managers' Index , June 62.6 (forecast 63.2)

-

14:34

U.S. Stocks open: Dow 16,851.84 +5.71 +0.03%, Nasdaq 4,397.93 +18.88 +0.43%, S&P 1,960.96 +3.74 +0.19%

-

14:31

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3575, $1.3595, $1.3600, $1.3620, $1.3630, $1.3650

USD/JPY Y101.20, Y101.30, Y101.45, Y101.50, Y101.65, Y101.70

GBP/USD $1.7000

AUD/USD $0.9270, $0.9350, $0.9390, $0.9400, $0.9430, $0.9500

USD/CAD Cad1.0680, Cad1.0700, Cad1.0800

USD/CHF Chf0.8900, Chf0.8975

EUR/CHF Chf1.2200

EUR/GBP stg0.8000, stg0.8100

-

14:22

Before the bell: S&P futures -0.02%, Nasdaq futures +0.05%

U.S. stock-index futures were little changed as investors assessed valuations before data that may show the economy is improving.

Global markets:

Nikkei 15,162.10 +67.10 +0.44%

Hang Seng 23,190.72 -30.80 -0.13%

Shanghai Composite 2,048.33 +11.92 +0.59%

FTSE 6,748.05 -9.72 -0.14%

CAC 4,430.47 -6.52 -0.15%

DAX 9,843.78 +28.61 +0.29%

Crude oil $106.10 (-0.56%)

Gold $1314.40 (-0.42%)

-

14:05

DOW components before the bell

(company / ticker / price / change, % / volume)

Pfizer Inc

PFE

29.68

+0.03%

71.3K

AT&T Inc

T

35.43

+0.06%

56.8K

General Electric Co

GE

26.45

+0.08%

0.2K

United Technologies Corp

UTX

116.69

+0.09%

9.4K

Chevron Corp

CVX

130.49

+0.10%

20.0K

Walt Disney Co

DIS

85.43

+0.15%

18.8K

Cisco Systems Inc

CSCO

24.75

+0.20%

52.9K

3M Co

MMM

143.69

0.00%

0.2K

Goldman Sachs

GS

166.78

0.00%

4.6K

American Express Co

AXP

94.93

0.00%

0.1K

Boeing Co

BA

128.54

0.00%

7.0K

Caterpillar Inc

CAT

108.78

0.00%

6.3K

E. I. du Pont de Nemours and Co

DD

65.44

0.00%

9.3K

Exxon Mobil Corp

XOM

101.21

0.00%

44.6K

Johnson & Johnson

JNJ

104.99

0.00%

30.4K

UnitedHealth Group Inc

UNH

82.00

0.00%

10.1K

Merck & Co Inc

MRK

57.53

0.00%

29.9K

The Coca-Cola Co

KO

42.19

0.00%

38.5K

Wal-Mart Stores Inc

WMT

75.34

0.00%

16.6K

Procter & Gamble Co

PG

79.00

-0.03%

28.7K

JPMorgan Chase and Co

JPM

57.50

-0.05%

2.2K

International Business Machines Co...

IBM

181.60

-0.06%

11.1K

Nike

NKE

77.62

-0.08%

8.1K

Travelers Companies Inc

TRV

93.83

-0.10%

4.5K

Microsoft Corp

MSFT

42.20

-0.12%

86.3K

McDonald's Corp

MCD

101.32

-0.14%

9.5K

Home Depot Inc

HD

81.00

-0.16%

13.4K

Intel Corp

INTC

30.86

-0.23%

51.0K

Verizon Communications Inc

VZ

49.19

-0.26%

66.8K

-

14:00

Upgrades and downgrades before the market open

Upgrades:

Yahoo! (YHOO) upgraded to Overweight from Neutral at Piper Jaffray; tgt raised to $43 from $37

Downgrades:

Other:

FedEx (FDX) target raised to $168 from $161 at Oppenheimer

-

13:30

Canada: GDP (m/m) , April +0.1% (forecast +0.2%)

-

13:02

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after mixed economic data from Eurozone

Economic calendar (GMT0):

00:30 Australia MI Inflation Gauge, m/m June +0.3% 0.0%

00:30 Australia MI Inflation Gauge, y/y June +2.9% +3.0%

00:30 Australia HIA New Home Sales, m/m May +2.9% -4.3%

01:00 New Zealand ANZ Business Confidence June 53.5 42.8

01:30 Australia Private Sector Credit, m/m May +0.5% +0.4% +0.4%

01:30 Australia Private Sector Credit, y/y May +4.6% +4.7%

05:00 Japan Housing Starts, y/y May -3.3% -10.1% -15.0%

06:00 Germany Retail sales, real adjusted May -0.9% +0.8% -0.6%

06:00 Germany Retail sales, real unadjusted, y/y May +3.2% Revised From +3.4% +2.8% +1.9%

08:00 Eurozone M3 money supply, adjusted y/y May +0.8% +0.7% +1.0%

08:00 Eurozone Private Loans, Y/Y May -1.8% -1.7% -2.0%

08:30 United Kingdom Net Lending to Individuals, bln May 2.4 2.5 2.0

08:30 United Kingdom Mortgage Approvals May 63 62 61.7

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) June +0.5% +0.6% +0.5%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. Chicago purchasing managers' index should decline to 63.2 in June from 65.5 in May.

Pending home sales in the U.S. should climb 1.4% in May, after a 0.4% gain in April.

The euro traded higher against the U.S. dollar after mixed economic data from Eurozone. Eurozone's inflation remained unchanged at 0.5% in June. Analysts had expected an increase to 0.6%.

German retail sales declined 0.6% in May, missing expectations for a 0.8% rise, after a 0.9% decrease in April. On a yearly basis, German retail sales rose 1.9% in May, missing expectations for a 2.8% gain, after a 3.2% increase in April. April's figure was revised down from a 3.4% rise.

M3 money supply in the Eurozone increased 1.0% in May, beating expectations for a 0.7% gain, after a 0.8% rise in April.

Private loans in the Eurozone decreased 2.0% in May, missing expectations for a 1.7% fall, after a 1.8% drop in April.

The British pound increased against the U.S. dollar after the U.K. economic data. The number of mortgage approvals was 61,707 in May, after 62,806 approvals in April. That was the lowest number of approvals since August 2013.

Net lending to individuals in the U.K. increased by ₤2.7 billion in May, beating expectations for a rise by ₤2.5 billion, after ₤2.4 billion in April.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian GDP. The GDP in Canada should rise 0.2% in April, after a 0.1% gain in March.

EUR/USD: the currency pair climbed to $1.3663

GBP/USD: the currency pair was up to $1.7052

USD/JPY: the currency pair increased to Y101.45

The most important news that are expected (GMT0):

12:30 Canada GDP (m/m) April +0.1% +0.2%

13:45 U.S. Chicago Purchasing Managers' Index June 65.5 63.2

14:00 U.S. Pending Home Sales (MoM) May +0.4% +1.4%

23:50 Japan BoJ Tankan. Manufacturing Index Quarter II 17 16

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter II 24 19

-

13:00

Orders

EUR/USD

Offers $1.3695/700, $1.3690

Bids $1.3565, $1.3550/40

GBP/USD

Offers $1.7110-20, $1.7090-100, $1.7080

Bids $1.6920, $1.6900

AUD/USD

Offers $0.9500, $0.9450

Bids $0.9380, $0.9350, $0.9320, $0.9300

EUR/JPY

Offers Y139.50, Y139.20, Y139.00, Y138.65/70

Bids Y138.00, Y137.50, Y137.20, Y137.00

USD/JPY

Offers Y102.00, Y101.80, Y101.45/50

Bids Y101.20, Y101.10/00, Y100.80, Y100.50

EUR/GBP

Offers stg0.8075-85

Bids stg0.7985-80, stg0.7950

-

12:02

European stock markets mid session: stocks traded little changed after Eurozone’s inflation data and retail sales from Germany

Stock indices traded little changed after Eurozone's inflation data and retail sales from Germany. Eurozone's inflation remained unchanged at 0.5% in June. Analysts had expected an increase to 0.6%.

German retail sales declined 0.6% in May, missing expectations for a 0.8% rise, after a 0.9% decrease in April. On a yearly basis, German retail sales rose 1.9% in May, missing expectations for a 2.8% gain, after a 3.2% increase in April. April's figure was revised down from a 3.4% rise.

M3 money supply in the Eurozone increased 1.0% in May, beating expectations for a 0.7% gain, after a 0.8% rise in April.

Private loans in the Eurozone decreased 2.0% in May, missing expectations for a 1.7% fall, after a 1.8% drop in April.

Royal Philips NV shares declined 3.3% after reporting the company want to merge its LED-component and automotive-lighting units into a stand-alone company.

Osram Licht AG increased 3.7% after JPMorgan Chase & Co. upgraded the company's rating.

EasyJet Plc fell 5.9% after Bank of America Corp. downgraded the company's rating.

Current figures:

Name Price Change Change %

FTSE 100 6,753.51 -4.26 -0.06%

DAX 9,832.36 +17.19 +0.18%

CAC 40 4,421.73 -15.26 -0.34%

-

10:34

Asian Stocks close: stocks traded mixed on sluggish trading day

Asian stock indices traded mixed on sluggish trading day. Investors are awaiting key events later in the week. China will release manufacturing data for June on Tuesday. The Reserve Bank of Australia will release its interest decision on Tuesday. The U.S. labour market report will be released on Thursday.

Japan's industrial production rose 0.5% in May, missing expectations for a 0.9% increase, after a 2.8% decline in April. On a yearly basis, industrial production in Japan increased 0.8% gain in May, after a 3.8% rise in April.

Housing starts in Japan dropped 15.0% in May, after a 3.3% decline in April. Analysts had expected a 10.1% decrease.

Indexes on the close:

Nikkei 225 15,162.1 +67.10 +0.44%

Hang Seng 23,190.72 -30.80 -0.13%

Shanghai Composite 2,048.33 +11.92 +0.59%

-

10:30

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3575, $1.3595, $1.3600, $1.3620, $1.3630, $1.3650

USD/JPY Y101.20, Y101.30, Y101.45, Y101.50, Y101.65, Y101.70

GBP/USD $1.7000

AUD/USD $0.9270, $0.9350, $0.9390, $0.9400, $0.9430, $0.9500

USD/CAD Cad1.0680, Cad1.0700, Cad1.0800

USD/CHF Chf0.8900, Chf0.8975

EUR/CHF Chf1.2200

EUR/GBP stg0.8000, stg0.8100

-

10:00

Eurozone: Harmonized CPI, Y/Y, June +0.5% (forecast +0.6%)

-

09:59

Foreign exchange market. Asian session: the Australian and New Zealand dollar declined against the U.S. dollar due to the weaker-than-expected economic data

Economic calendar (GMT0):

00:30 Australia MI Inflation Gauge, m/m June +0.3% 0.0%

00:30 Australia MI Inflation Gauge, y/y June +2.9% +3.0%

00:30 Australia HIA New Home Sales, m/m May +2.9% -4.3%

01:00 New Zealand ANZ Business Confidence June 53.5 42.8

01:30 Australia Private Sector Credit, m/m May +0.5% +0.4% +0.4%

01:30 Australia Private Sector Credit, y/y May +4.6% +4.7%

05:00 Japan Housing Starts, y/y May -3.3% -10.1% -15.0%

06:00 Germany Retail sales, real adjusted May -0.9% +0.8% -0.6%

06:00 Germany Retail sales, real unadjusted, y/y May +3.2% Revised From +3.4% +2.8% +1.9%

08:00 Eurozone M3 money supply, adjusted y/y May +0.8% +0.7% +1.0%

08:00 Eurozone Private Loans, Y/Y May -1.8% -1.7% -2.0%

08:30 United Kingdom Net Lending to Individuals, bln May 2.4 2.5 2.0

08:30 United Kingdom Mortgage Approvals May 63 62 61.7

The U.S. dollar traded mixed against the most major currencies. The U.S. currency remained under pressure after the release of some weak economic data last week. The U.S. GDP dropped 2.9% in the first quarter, missing expectations for a 1.7% decline, after a 1.0% decline the previous quarter.

The New Zealand dollar declined against the U.S dollar after the release of weaker-than-expected economic data from New Zealand. The ANZ business confidence index for New Zealand dropped to 42.8 in June from 53.5 in May.

Building permits in New Zealand dropped 4.6% in May, after a 1.9% rise in April. April's figure was revised up from a 1.5% gain.

The Australian dollar traded lower against the U.S. dollar due to the weaker-than-expected economic data from Australia. New home sales in Australia decreased 4.3% in May, after a 2.9% rise in April.

The Japanese yen traded slightly higher against the U.S. dollar after the weaker-than-expected economic data from Japan. Japan's industrial production rose 0.5% in May, missing expectations for a 0.9% increase, after a 2.8% decline in April. On a yearly basis, industrial production in Japan increased 0.8% gain in May, after a 3.8% rise in April.

Housing starts in Japan dropped 15.0% in May, after a 3.3% decline in April. Analysts had expected a 10.1% decrease.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.7025

USD/JPY: the currency pair declined Y101.25

AUD/USD: the currency pair decreased to $0.9407

NZD/USD: the currency pair declined to $0.8737

The most important news that are expected (GMT0):

12:30 Canada GDP (m/m) April +0.1% +0.2%

13:45 U.S. Chicago Purchasing Managers' Index June 65.5 63.2

14:00 U.S. Pending Home Sales (MoM) May +0.4% +1.4%

23:50 Japan BoJ Tankan. Manufacturing Index Quarter II 17 16

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter II 24 19

-

09:30

United Kingdom: Mortgage Approvals, May 61.7 (forecast 62)

-

09:30

United Kingdom: Net Lending to Individuals, bln, May 2.7 (forecast 2.5)

-

09:01

Eurozone: Private Loans, Y/Y, May -2.0% (forecast -1.7%)

-

09:00

Eurozone: M3 money supply, adjusted y/y, May +1.0% (forecast +0.7%)

-

08:47

DAX 9,830.56 +15.39 +0.16%, CAC 40 4,440.77 +3.78 +0.09%, EUROFIRST 300 1,372.36 +1.07 +0.08%, FTSE 100 6,761.21 +3.44 +0.05%

-

07:00

Germany: Retail sales, real adjusted , May -0.6% (forecast +0.8%)

-

07:00

Germany: Retail sales, real unadjusted, y/y, May +1.9% (forecast +2.8%)

-

06:40

European bourses are seen flat to modestly higher Monday: the FTSE is seen up 0.2%, the DAX 0.1% and the CAC 0.2%.

-

06:13

Options levels on monday, June 30, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3718 (6837)

$1.3689 (2255)

$1.3670 (3716)

Price at time of writing this review: $ 1.3644

Support levels (open interest**, contracts):

$1.3610 (1210)

$1.3579 (3978)

$1.3540 (4918)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 33684 contracts, with the maximum number of contracts with strike price $1,3700 (6837);

- Overall open interest on the PUT options with the expiration date July, 3 is 41933 contracts, with the maximum number of contracts with strike price $1,3500 (5587);

- The ratio of PUT/CALL was 1.24 versus 1.31 from the previous trading day according to data from June, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.7300 (383)

$1.7200 (2090)

$1.7101 (2735)

Price at time of writing this review: $1.7024

Support levels (open interest**, contracts):

$1.6996 (1804)

$1.6899 (2270)

$1.6800 (1776)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 24924 contracts, with the maximum number of contracts with strike price $1,7005 (5665);

- Overall open interest on the PUT options with the expiration date July, 3 is 27130 contracts, with the maximum number of contracts with strike price $1,6700 (2412);

- The ratio of PUT/CALL was 1.09 versus 1.16 from the previous trading day according to data from June, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:32

Australia: Private Sector Credit, y/y, May +4.7%

-

02:30

Australia: Private Sector Credit, m/m, May +0.4% (forecast +0.4%)

-

02:00

New Zealand: ANZ Business Confidence, June 42.8

-

01:30

Australia: MI Inflation Gauge, m/m, June 0.0%

-

01:30

Australia: MI Inflation Gauge, y/y, June +3.0%

-

01:30

Australia: HIA New Home Sales, m/m, May -4.3%

-

00:50

Japan: Industrial Production (MoM) , May +0.5%

-

00:50

Japan: Industrial Production (YoY), May +0.8%

-

00:30

Commodities. Daily history for June 27’2014:

(raw materials / closing price /% change)Gold $1,315.00 -7.80 -0.08%

ICE Brent Crude Oil $113.30 +0.16 +0.14%

NYMEX Crude Oil $105.74 -0.10 -0.09%

-

00:25

Stocks. Daily history for June 27’2014:

(index / closing price / change items /% change)Nikkei 15,095 -213.00 1.39%

Hang Seng 23,222 +24.00 0.10%

Shanghai Composite 2,037 -2.00 0.08%

S&P 1,961 +4.00 0.19%

Nasdaq 4,398 +19.00 0.43%

Dow 16,852 +6.00 0.03%

FTSE 6,758 +23.00 0.34%

CAC 4,437 -3.00 0.06%

DAX 9,815 +10.00 0.10%

-

00:20

Currencies. Daily history for June 27'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3648 +0,27%

GBP/USD $1,7033 +0,05%

USD/CHF Chf0,8906 -0,31%

USD/JPY Y101,41 -0,26%

EUR/JPY Y138,38 -0,01%

GBP/JPY Y172,75 -0,19%

AUD/USD $0,9425 +0,03%

NZD/USD $0,8776 +0,01%

USD/CAD C$1,0663 -0,26%

-

00:00

Schedule for today, Monday, June 27’2014:

(time / country / index / period / previous value / forecast)00:30 Australia MI Inflation Gauge, m/m June +0.3%

00:30 Australia MI Inflation Gauge, y/y June +2.9%

00:30 Australia HIA New Home Sales, m/m May +2.9%

01:00 New Zealand ANZ Business Confidence June 53.5

01:30 Australia Private Sector Credit, m/m May +0.5% +0.4%

01:30 Australia Private Sector Credit, y/y May +4.6%

05:00 Japan Housing Starts, y/y May -3.3% -10.1%

06:00 United Kingdom Nationwide house price index June +0.7% +0.7%

06:00 United Kingdom Nationwide house price index, y/y June +11.1%

06:00 Germany Retail sales, real adjusted May -0.9% +0.8%

06:00 Germany Retail sales, real unadjusted, y/y May +3.4% +2.8%

08:00 Eurozone M3 money supply, adjusted y/y May +0.8% +0.7%

08:00 Eurozone Private Loans, Y/Y May -1.8% -1.7%

08:30 United Kingdom Net Lending to Individuals, bln May 2.4 2.5

08:30 United Kingdom Mortgage Approvals May 63 62

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) June +0.5% +0.6%

12:30 Canada GDP (m/m) April +0.1% +0.2%

13:45 U.S. Chicago Purchasing Managers' Index June 65.5 63.2

14:00 U.S. Pending Home Sales (MoM) May +0.4% +1.4%

23:30 Australia AIG Manufacturing Index June 49.2

23:50 Japan BoJ Tankan. Manufacturing Index Quarter II 17 16

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter II 24 19

-