Notícias do Mercado

-

20:00

Dow +18.46 16,496.87 +0.11% Nasdaq +1.04 4,157.63 +0.03% S&P -0.11 1,841.29 -0.01%

-

19:20

American focus : the euro has grown significantly against the U.S. currency

The euro exchange rate against the dollar has grown significantly in terms of a thin market , as well as comments on the background Draghi, who in an interview with Der Spiegel said that there is no need to further reduce the basic interest rate .

According to the newspaper , according to M.Dragi , crisis is not over , but there are many encouraging signals. ECB lowered its key interest rate by 0.25 percentage points - to a record low of 0.25 % per annum , stating concerns about an "extended period " of low inflation in the eurozone.

Draghi said that he sees no signals deflation , adding that the situation in the euro zone is different from the situation in Japan . Among the positive signals for the European economy - economic growth in some countries , the reduction of trade imbalances between countries in the region , as well as the reduction of budget deficits , said M.Dragi .

Meanwhile, add the pressure on the dollar was the U.S. data , which showed that the indicator upcoming home sales rose in November after months of decline. This is a new sign that the housing market recovery is regaining some of the momentum he lost in the middle of this year.

National Association of Realtors reported that its index of pending sales of existing homes at a seasonally adjusted rose 0.2 % in November compared with the previous month to 101.7 . It was the first increase since May, when the index reached the six year high. Economists had forecast an increase in the monthly measurement of 1.1%.

Pound rose against the dollar , which was associated with the release of positive data on Britain and publication of weak U.S. macroeconomic data . Recall that the report from Hometrack showed that the average asking price for homes in the UK rose by 0.5 percent in December compared with the previous month , after rising 0.5 percent in November .

In terms of regions , housing prices rose by 0.1 per cent in Yorkshire and Humberside and the north- west, rose by 0.2 per cent in Wales, 0.3 per cent in the West Midlands and the Southwest, 0.5 percent in East Anglia , at 0.7 per cent in the south- east and 1.0 percent in London.

Housing prices have not changed in the East Midlands and the north-east .

In annual terms, house prices rose by 4.4 percent after increasing 3.8 percent in the previous month .

Housing prices in London rose 9.1 percent year on year , while prices in the southeast rose 5.0 percent and prices for north lost 0.5 percent.

The Swiss franc rose against the U.S. dollar , which helped data which showed that the current account surplus of Switzerland in the third quarter increased compared with the same period last year , data released by the Swiss National Bank.

The current account surplus rose to 19.7 billion Swiss francs to 13.7 billion Swiss francs in the same period a year ago. In the second quarter , the current account surplus amounted to 20.2 billion Swiss francs.

Merchandise trade surplus of 4.9 billion Swiss francs, compared to 3.6 billion Swiss francs last year. Trade surplus in services was formed 9.1 billion Swiss francs, which was more than 8.9 billion Swiss francs last year.

-

18:20

European stock close

European stocks retreated after six consecutive days of gains that sent the Stoxx Europe 600 Index to its highest level in more than five years.

The Stoxx 600 slipped 0.2 percent. The equity gauge has gained 0.6 percent this month and is heading for its biggest annual rally since 2009.

The Stoxx 600 gained 5.3 percent in the six days through Dec. 27, the most since July 2012. The gauge completed a second weekly gain following better-than-forecast U.S. economic data and after the International Monetary Fund said it will raise its growth outlook for the nation. The index has advanced 17 percent this year. It reached 327.68 at the end of last week, the highest since May 2008.

National benchmark indexes fell in 13 of the 18 western-European markets.

FTSE 100 6,731.27 -19.60 -0.29% CAC 40 4,275.71 -1.94 -0.05% DAX 9,552.16 -37.23 -0.39%

Contracts to purchase previously owned U.S. homes rose less than forecast in November. A gauge of pending home sales climbed 0.2 percent, the first gain in six month, after a 1.2 percent drop in October that was larger than initially reported, the National Association of Realtors said. The median projection of economists called for a 1 percent advance.

Swatch dropped 1 percent to 588 Swiss francs. A fire yesterday caused damage to a workshop of its ETA unit at Grenchen, in the canton of Solothurn. While nobody was harmed, the workshop was entirely destroyed, the company said yesterday, adding that it was too early to put a figure on the damage.

Marks & Spencer Group Plc retreated 1.5 percent to 443.5 pence and Delhaize Group fell 2.1 percent to 43.16 euros. A gauge of Stoxx 600 retailers fell 0.4 percent for the second-largest decline.

IPF jumped 9.8 percent to 499.9 pence. Numis, which placed IPF shares under review last week, upgraded them to buy, saying that risk is priced in after last week’s slump. The lender of small, unsecured cash loans said on Dec. 24 that the Polish Office of Consumer Protection and Competition fined its local unit 2.4 million pounds ($3.9 million) for infringing consumers’ interests.

Vedanta climbed 4.1 percent to 938.5 pence. Its subsidiary Sesa Sterlite, India’s biggest producer of aluminum, zinc and copper, received permission from a committee appointed by the nation’s top court to resume mining at its Karnataka mine.

Outotec Oyj (OTE1V) rose 2.8 percent to 7.61 euros. The Finnish maker of mining machinery and supplier of smelters won an order from OAO GMK Norilsk Nickel, Russia’s biggest mining company.

-

17:00

European stock close: FTSE 100 6,731.27 -19.60 -0.29% CAC 40 4,275.71 -1.94 -0.05% DAX 9,552.16 -37.23 -0.39%

-

16:41

Oil: an overview of the market situation

Oil prices declined moderately today , dropping below $ 112 per barrel (Brent) and $ 100 per barrel (WTI), the early signals about the fact that the supply of oil from Libya, possibly starting to recover . As it became known ,

Also on the bidding continue to affect the data on stocks . Recall that U.S. crude stocks fell the week before the fourth week in a row - by 4.73 million barrels to 367.6 million barrels. Analysts had expected a decline in reserves of 2.65 million barrels. Gasoline inventories fell by 614 thousand barrels and distillates - by 1.85 million barrels.

"Restoring the U.S. economy supports expectations of growth in demand for oil , - the head Petromatrix GmbH Olivier Jacob . - Distillate inventories by the end of 2013 have become minimal for many years, and it could mean a very low level of stocks in the spring ."

Meanwhile , we note that investors paid attention to analysts' estimates , according to which the price of Brent crude oil in the future will decrease the second year in a row on the background of significant growth in demand in the market . According to analysts Bloomberg, in 2014 the average price of Brent crude fell to $ 105 from 108.7 dollars in 2013.

The price of WTI crude oil rose 8.2 percent in December due to falling stocks , helping to reduce the gap c Brent crude to just $ 8.13 per barrel. While the spread between the two brands of oil increased today , is expected to shrink again soon , which will contribute to the launch of the Keystone XL pipeline in the United States . This pipeline will allow growth stocks at Cushing terminal , where the bulk share of refining capacity of the country.

Cost February futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 99.64 a barrel on the New York Mercantile Exchange.

February futures price for North Sea Brent crude oil mixture fell $ 1.07 to $ 111.15 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices fell today , heading for its biggest annual decline in more than three decades , due to the thin trading session ahead of the holidays . Add that with the beginning of this year, prices for the precious metal fell almost 30 percent , as rising risk appetite and the prospect of global economic recovery have tarnished its appeal. Gold is generally seen as a hedge against inflation, which has ceased to be the center of attention for investors at the moment.

Experts point out that at present , the movement of gold prices is exaggerated because of the lack of liquidity, and not some macroeconomic factors.

Fall in gold prices in 2013 put an end to the 12-year growth. Gold, primarily affected by the U.S. central bank's decision to curb its monetary stimulus that raises the opportunity cost of not higher-yielding assets .

Expectations that the U.S. economy will improve, and the growth in the rest of the world will stabilize in 2014 , further reduce the appeal of gold, and investors began to invest their money in riskier assets such as stocks .

In addition, it became known that the gold reserves SPDR Gold Trust - the world's largest gold exchange-traded fund , fell by three tonnes on Friday - up to 801.2 thousand , while reaching the lowest level since January 2009 .

The data also showed that China's net imports of gold from Hong Kong fell by 42 percent - up to 76.393 tons in November to 131.19 tons in October, reflecting a drop in demand after strong purchases in previous months.

Cost February gold futures on the COMEX today dropped to $ 1206.00 per ounce.

-

15:00

U.S.: Pending Home Sales (MoM) , November +0.2% (forecast +1.1%)

-

14:33

U.S. Stocks open: Dow 16,489.52 +11.11 +0.07%, Nasdaq 4,153.32 -3.27 -0.08%, S&P 1,841.28 -0.12 -0.01%

-

14:21

Before the bell: S&P futures -0.01%, Nasdaq futures -0.13%

U.S. stock-index futures were little changed before a report on pending home sales.

Global markets:

Nikkei 16,291.31 +112.37 +0.69 %

Hang Seng 23,244.87 +1.63 +0.01 %

Shanghai Composite 2,097.53 -3.72 -0.18 %

FTSE 6,726.29 -24.58 -0.36 %

CAC 4,273.35 -4.30 -0.10 %

DAX 9,552.16 -37.23 -0.39 %

Crude oil $99.78 (-0.54%).

Gold $1204.60 (-0.77%).

-

13:40

Option expiries for today's 1400GMT cut

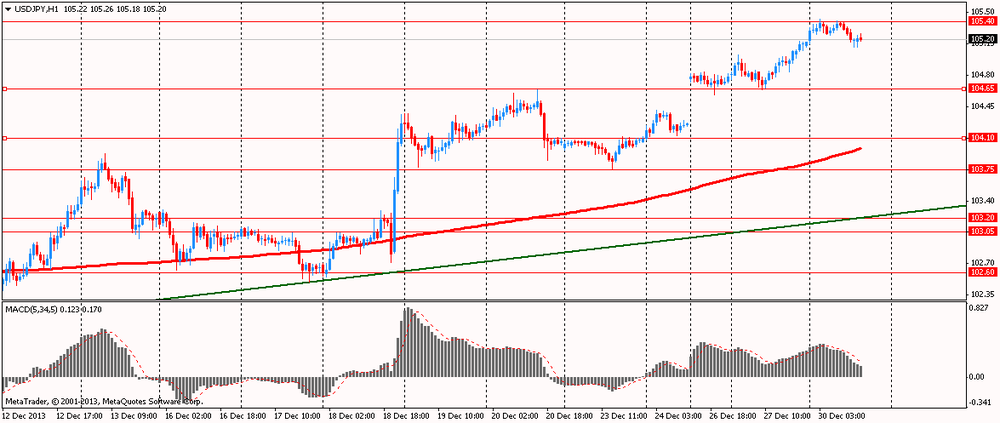

USD/JPY Y103.50, Y103.85, Y104.00, Y104.25, Y104.50, Y104.75, Y105.00, Y105.65

EUR/USD $1.3700, $1.3725

GBP/USD $1.6500

EUR/GBP stg0.8420

USD/CAD C$1.0800

-

13:18

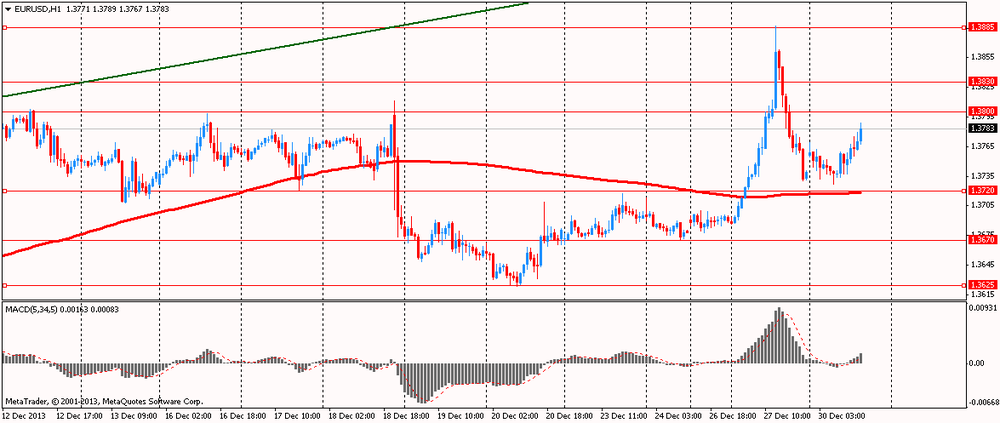

European session: the euro rose

The euro rose against the dollar , supported by statements of ECB head Mario Draghi, who in an interview with Der Spiegel said that there is no need to further reduce the basic interest rate . According to the newspaper , according to M.Dragi , crisis is not over , but there are many encouraging signals. ECB lowered its key interest rate by 0.25 percentage points - to a record low of 0.25 % per annum , stating concerns about an "extended period " of low inflation in the eurozone.

Draghi said that he sees no signals deflation , adding that the situation in the euro zone is different from the situation in Japan . Among the positive signals for the European economy - economic growth in some countries , the reduction of trade imbalances between countries in the region , as well as the reduction of budget deficits , said M.Dragi .

According to him , the pace of improvement in the region exceeded the expectations of the ECB.

Eurozone economic recovery that began in the second quarter of this year after a prolonged recession , almost petered out in the third quarter against the background of a sudden contraction of the French GDP and reduce Italy's GDP . In the second quarter Eurozone GDP rose by 0.3 % in the third - only 0.1 %.

Meanwhile, recent signals of the European economy are more positive. Thus, the growth of business activity in the manufacturing sector and the eurozone consumer confidence in December exceeded expectations . In addition to further reduce the base rate of the ECB has other tools to stimulate growth, in particular , to provide banks with another portion of long-term loans .

The Japanese yen has weakened substantially against the U.S. dollar and the euro , while the USD / JPY pair rose earlier to a new five-year highs Y105.42. Although many investors in the market see no reason for concern about downside risks to the U.S. dollar , they also point to the risks associated with a favorable scenario for the U.S. dollar , which include a potential rise in interest rates in the U.S. and change policies Japanese Prime Minister Shinzo Abe . Nevertheless , investors believe that the probability of these risks materializing is very low .

EUR / USD: during the European session, the pair rose to $ 1.3781

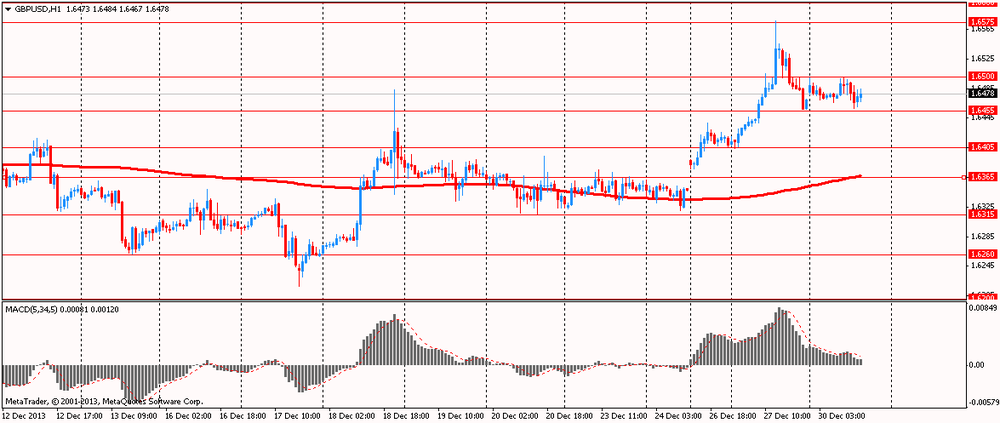

GBP / USD: during the European session, the pair rose to $ 1.6500 , then back up to $ 1.6458

USD / JPY: during the European session, the pair fell to Y105.11

At 15:00 GMT the U.S. will release the change in the volume of pending home sales for November.

-

13:03

Orders

EUR/USD

Offers $1.3920, $1.3900, $1.3845/55, $1.3830, $1.3790-810

Bids $1.3725/15, $1.3700, $1.3650

AUD/USD

Offers $0.9020, $0.9000, $0.8985/90, $0.8955/60, $0.8950, $0.8890

Bids $0.8825/20, $0.8800

GBP/USD

Offers $1.6600, $1.6580, $1.6550/55, $1.6520, $1.6500/05

Bids $1.6450/45, $1.6410/00, $1.6380/70, $1.6355/50, $1.6320/15

EUR/JPY

Offers Y146.50, Y146.00, Y145.70/80, Y145.30/35

Bids Y144.50, Y144.25/20, Y144.00, Y143.85/80, Y143.60/50, Y143.35/25

USD/JPY

Offers Y106.00, Y105.80

Bids Y104.50, Y104.20, Y104.00, Y103.80/75

EUR/GBP

Offers stg0.8467, stg0.8450, stg0.8435/40, stg0.8415/20, Stg0.8400, stg0.8385/90

Bids stg0.8320, stg0.8300/290, stg0.8260/50, stg0.8250, stg0.8220

-

11:31

European stocks were little changed

European stocks were little changed after the Stoxx Europe 600 Index climbed to its highest level since May 2008. U.S. stock-index futures were little changed and Asian shares gained.

The Stoxx 600 slipped less than 0.1 percent to 327.55 at 9:37 a.m. in London. The equity gauge has gained 0.9 percent this month.

The Stoxx 600 gained 2 percent last week, completing its second weekly increase, following better-than-forecast U.S. economic data and after the International Monetary Fund said it will raise its growth outlook for the nation. The index has advanced 17 percent this year and is heading for its biggest annual rally since 2009.

Vedanta climbed 2.5 percent to 924 pence. Its subsidiary Sesa Sterlite, India’s biggest producer of aluminum, zinc and copper, received permission from a committee appointed by the nation’s top court to resume mining at its Karnataka mine.

Swatch dropped 1.4 percent to 585.50 Swiss francs. A fire yesterday morning caused considerable damage to a workshop of its ETA unit at Grenchen, in the Swiss canton of Solothurn. While nobody was harmed, the workshop was entirely destroyed, the company said yesterday, adding that it was too early to put a figure on the damage.

Sanofi retreated 0.8 percent to 75.92 euros. The U.S. Food and Drug Administration said its Genzyme unit didn’t submit evidence from “adequate and well-controlled studies” showing that the benefits of Lemtrada outweigh its serious adverse effects, the Paris-based company said in a statement.

FTSE 100 6,738.18 -12.69 -0.19 %

CAC 40 4,272.3 -5.35 -0.13 %

DAX 9,577.7 -11.69 -0.12 %

-

10:25

Option expiries for today's 1400GMT cut

USD/JPY Y103.50, Y103.85, Y104.00, Y104.75, Y105.00, Y105.65

EUR/USD $1.3700, $1.3725

EUR/GBP stg0.8420

-

09:57

Asia Pacific stocks close

Asian stocks rose, with the regional benchmark gauge heading for a 10-day advance, as Japan’s Nikkei 225 Stock Average capped its biggest annual gain since 1972 after the yen extended losses past 105 to the dollar.

Nikkei 225 16,291.31 +112.37 +0.69%

Hang Seng 23,244.87 +1.63 +0.01%

S&P/ASX 200 5,356.8 +32.74 +0.61%

Shanghai Composite 2,097.53 -3.72 -0.18%

Nikon Corp., a Japanese camera maker that counts North America as its biggest market, added 1.3 percent.

Forge Group Ltd., an engineering services firm, soared 55 percent in Sydney as its contract at the Roy Hill mine starts.

Nippon Paper Industries Co., Japan’s second-biggest company in the sector, slid 5.9 percent on a report operating profit probably dropped.

-

08:40

FTSE 100 6,744.08 -6.79 -0.10%, CAC 40 4,283.42 +5.77 +0.13%, Xetra DAX 9,584.27 -5.12 -0.05%

-

07:37

European bourses are seen higher Monday: the FTSE up 0.1%, the DAX up 1.2% and the CAC up 1.1%.

-

07:03

Asian session: The dollar touched a five-year high

00:00 Japan Bank holiday

The dollar touched a five-year high versus the yen and headed for an annual gain against major peers amid optimism a sustained U.S. economic recovery will allow the Federal Reserve to cease bond purchases by the end of 2014.

The Bloomberg U.S. Dollar Index is set for its biggest annual advance in five years before reports this week that may show improvements in housing and manufacturing. Pending home sales in the U.S. probably gained 1 percent in November from the previous month, when they fell 0.6 percent, according to the median estimate of economists surveyed by Bloomberg News before today’s report by the National Association of Realtors. The S&P/Case-Shiller index of property prices in 20 cities climbed 13.5 percent in October from a year earlier, a separate poll showed ahead of figures due tomorrow.

The Institute for Supply Management may say on Jan. 2 its gauge of manufacturing in the world’s biggest economy was at 56.9 this month, indicating continued expansion after growing in November at the fastest pace in more than two years.

The euro is poised for the strongest advance among major developed currencies as European Central Bank officials damp prospects for interest-rate cuts. ECB President Mario Draghi sees no need for further cuts to the institution’s benchmark rate amid “encouraging signs” that the euro crisis may be resolved, Der Spiegel reported, citing an interview published Dec. 28. Policy makers in the region lowered the key rate last month by a quarter-percentage point to a record low of 0.25 percent.

Japan’s yen was poised for a yearly slide versus most major counterparts as Asian stocks strengthened, curbing demand for haven assets.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3725-70

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6465-00

USD / JPY: during the Asian session, the pair rose to Y105.40

-

06:03

Schedule for today, Monday, Dec 30’2013:

00:00 Japan Bank holiday

15:00 U.S. Pending Home Sales (MoM) November -0.6% +1.1%

-