Notícias do Mercado

-

23:36

Stocks. Daily history for Jan 31’2018:

(index / closing price / change items /% change)

Nikkei -193.68 23098.29 -0.83%

TOPIX -21.42 1836.71 -1.15%

Hang Seng +279.98 32887.27 +0.86%

CSI 300 +19.80 4275.90 +0.47%

Euro Stoxx 50 +2.54 3609.29 +0.07%

FTSE 100 -54.43 7533.55 -0.72%

DAX -8.23 13189.48 -0.06%

CAC 40 +8.15 5481.93 +0.15%

DJIA +72.50 26149.39 +0.28%

S&P 500 +1.38 2823.81 +0.05%

NASDAQ +9.00 7411.48 +0.12%

S&P/TSX -3.84 15951.67 -0.02%

-

23:30

Currencies. Daily history for Jan 31’2018:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2413 +0,09%

GBP/USD $1,4192 +0,31%

USD/CHF Chf0,93115 -0,30%

USD/JPY Y109,17 +0,37%

EUR/JPY Y135,53 +0,46%

GBP/JPY Y154,948 +0,68%

AUD/USD $0,8056 -0,35%

NZD/USD $0,7364 +0,46%

USD/CAD C$1,23134 -0,20%

-

23:06

Schedule for today, Thursday, Feb 01’2018 (GMT0)

00:30 Australia Export Price Index, q/q Quarter IV -3.0% -8%

00:30 Australia Import Price Index, q/q Quarter IV -1.6% -0.8%

00:30 Australia Building Permits, m/m December 11.7% -1.7%

00:30 Japan Manufacturing PMI (Finally) January 54.0 54.4

01:45 China Markit/Caixin Manufacturing PMI January 51.5 51.3

06:45 Switzerland SECO Consumer Climate Quarter I -2

07:00 United Kingdom Nationwide house price index January 0.6% 0.2%

07:00 United Kingdom Nationwide house price index, y/y January 2.6% 2.5%

08:15 Switzerland Retail Sales (MoM) December 1.3%

08:15 Switzerland Retail Sales Y/Y December -0.2%

08:30 Switzerland Manufacturing PMI January 65.2 64.0

08:50 France Manufacturing PMI (Finally) January 58.8 58.1

08:55 Germany Manufacturing PMI (Finally) January 63.3 61.2

09:00 Eurozone Manufacturing PMI (Finally) January 60.6 59.6

09:30 United Kingdom Purchasing Manager Index Manufacturing January 56.3 56.5

11:15 Eurozone ECB's Peter Praet Speaks

13:30 U.S. Continuing Jobless Claims January 1937 1916

13:30 U.S. Initial Jobless Claims January 233 238

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter IV -0.2% 0.8%

13:30 U.S. Nonfarm Productivity, q/q(Preliminary) Quarter IV 3.0% 1%

14:45 U.S. Manufacturing PMI (Finally) January 55.1 55.5

15:00 U.S. Construction Spending, m/m December 0.8% 0.4%

15:00 U.S. ISM Manufacturing January 59.7 58.8

20:00 U.S. Total Vehicle Sales, mln January 17.85 17.2

21:45 New Zealand Visitor Arrivals December 8.00%

21:45 New Zealand Building Permits, m/m December 10.8%

-

22:30

Australia: AIG Manufacturing Index, January 58.7

-

21:07

The major US stock indexes finished trading in positive territory

The main US stock indices grew moderately, helped by the Boeing rally after the publication of the quarterly report, as well as positive data on the US, and the results of the Fed meeting.

The ADP report showed that employment growth in the US private sector slowed in January, but was stronger than projected. According to the report, in January the number of employed increased by 234 thousand people compared with the figure for December at 242 thousand. It was expected that the number of employed will increase by 185 thousand.

In addition, Chicago Purchasing Managers Index fell 2.1 points to 65.7 in January from a revised 67.8 points in December. Despite the fact that in January it lost momentum, the index continued to move in the same direction as in the second half of 2017, which contributes to an encouraging new year. The index has grown by 28.3% since January last year and at the level of 65.7 exceeds the average of the second half of 2017, equal to 63.7.

Contracts for the purchase of previously owned homes in the United States rose for the third consecutive month in December, helped by a healthy labor market. The National Association of Realtors said that its index of unfinished transactions for the sale of housing rose to 110.1 points last month, which is 0.5% more than in November. Economists predicted that the index will increase by 0.4%, following an increase of 0.3% in the previous month (revised from + 0.2%).

As for the Fed meeting, it was decided to leave interest rates unchanged. At the same time, the Fed indicated that it intends to continue the gradual tightening of monetary policy in order to stimulate economic growth. In general, the rhetoric of the statement remained largely unchanged compared to December, indicating a still positive assessment of the prospects for the US economy. It should be noted that this meeting was the last for Fed Chairman Yellen, whose powers expire on Saturday. The new head of the Federal Reserve will be Powell

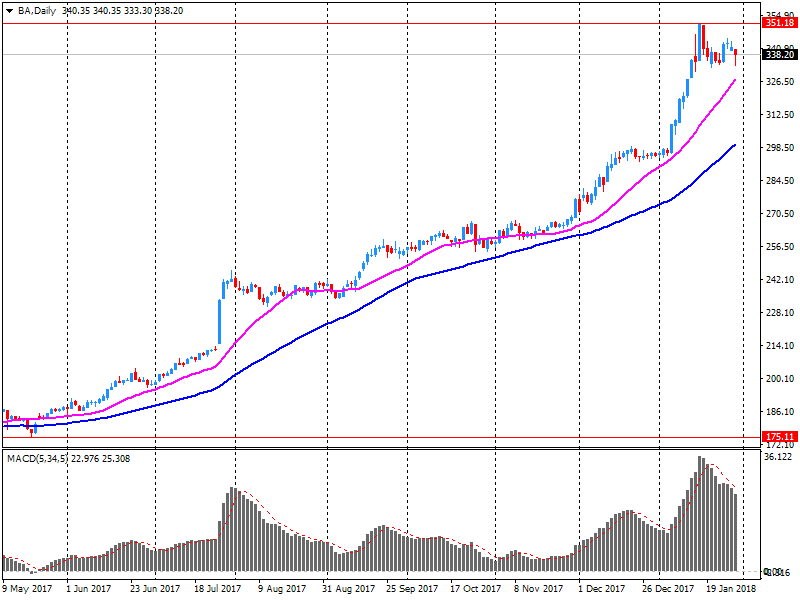

Most components of the DOW index finished trading in positive territory (17 out of 30). The leader of growth was the shares of The Boeing Company (BA, + 5.31%). Outsider were shares of Johnson & Johnson (JNJ, -2.43%).

Almost all sectors of the S & P index recorded an increase. The utilities sector grew most (+ 0.9%). Decrease showed only the health sector (-1.1%).

At closing:

DJIA + 0.28% 26.150.80 +73.91

Nasdaq + 0.12% 7,411.48 +9.00

S & P + 0.05% 2,823.93 +1.50

-

20:01

DJIA +0.10% 26,102.51 +25.62 Nasdaq -0.08% 7,396.85 -5.63 S&P -0.15% 2,818.06 -4.37

-

19:00

U.S.: Fed Interest Rate Decision , 1.5% (forecast 1.5%)

-

17:00

European stocks closed: FTSE 100 -54.43 7533.55 -0.72% DAX -8.23 13189.48 -0.06% CAC 40 +8.15 5481.93 +0.15%

-

15:33

U.S. commercial crude oil inventories increased by 6.8 million barrels from the previous week

At 418.4 million barrels, U.S. crude oil inventories are in the middle of the average range for this time of year.

Total motor gasoline inventories decreased by 2.0 million barrels last week, and are near the top of the average range. Both blending components and finished gasoline inventories decreased last week.

Distillate fuel inventories decreased by 1.9 million barrels last week and are in the middle of the average range for this time of year. Propane/propylene inventories decreased by 0.9 million barrels last week, but are in the middle of the average range. Total commercial petroleum inventories increased by 2.1 million barrels last week.

-

15:30

U.S.: Crude Oil Inventories, January 6.776 (forecast 0.126)

-

15:09

U.S Pending Home Sales Index moved higher 0.5 percent to 110.1 in December

The Pending Home Sales Index, a forward-looking indicator based on contract signings, moved higher 0.5 percent to 110.1 in December from an upwardly revised 109.6 in November. With last month's modest increase, the index is now 0.5 percent above a year ago.

Lawrence Yun, NAR chief economist, says pending sales edged up in December and reached their highest level since last March (111.3). "Another month of modest increases in contract activity is evidence that the housing market has a small trace of momentum at the start of 2018," he said. "Jobs are plentiful, wages are finally climbing and the prospect of higher mortgage rates are perhaps encouraging more aspiring buyers to begin their search now."

-

15:00

U.S.: Pending Home Sales (MoM) , December 0.5% (forecast 0.4%)

-

14:45

U.S.: Chicago Purchasing Managers' Index , January 65.7 (forecast 64.1)

-

14:32

U.S. Stocks open: Dow +0.90% Nasdaq +0.59%, S&P +0.44%

-

14:17

Before the bell: S&P futures +0.39%, NASDAQ futures +0.48%

U.S. stock-index futures rose on Wednesday, after two days of sharp declines, boosted by a controversy-free State of Union speech by the U.S. President Donald Trump, with investors turning their focus back to the Fed's monetary policy and corporate segment's quarterly results.

Global Stocks:

Nikkei 23,098.29 -193.68 -0.83%

Hang Seng 32,887.27 +279.98 +0.86%

Shanghai 3,481.51 -6.50 -0.19%

S&P/ASX 6,037.70 +14.90 +0.25%

FTSE 7,580.65 -7.33 -0.10%

CAC 5,494.16 +20.38 +0.37%

DAX 13,228.74 +31.03 +0.24%

Crude $64.19 (-0.48%)

Gold $1,343.60 (+0.61%)

-

14:02

Canadian GDP increased 0.4% in November. 17 of 20 industrial sectors increased

Real gross domestic product (GDP) increased 0.4% in November, with widespread growth across industries as 17 of 20 industrial sectors increased.

Goods-producing industries rose 0.8% after declining 0.5% in October. November's gain was mainly due to increases in the manufacturing and mining, quarrying and oil and gas extraction sectors, partly as a result of restoration in production capacity. Meanwhile, services-producing industries rose 0.3%, led by the real estate and rental and leasing, wholesale, and retail trade sectors.

The manufacturing sector was up 1.8% in November, the largest monthly increase since February 2014 as the majority of subsectors grew. Non-durable manufacturing rose 1.1%, while durable manufacturing jumped 2.5%.

-

14:00

U.S ADP employment rose more than expected in January

Private sector employment increased by 234,000 jobs from December to January according to the January ADP National Employment Report.

"We've kicked off the year with another month of unyielding job gains," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. "Service providers were firing on all cylinders, posting their strongest gain in more than a year. We also saw robust hiring from midsize and large companies, while job growth in smaller firms slowed slightly."

-

13:44

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

253.6

2.06(0.82%)

1445

Amazon.com Inc., NASDAQ

AMZN

1,451.78

13.96(0.97%)

93961

American Express Co

AXP

99.08

0.37(0.37%)

937

Apple Inc.

AAPL

166.49

-0.48(-0.29%)

501779

AT&T Inc

T

37.5

0.06(0.16%)

18186

Barrick Gold Corporation, NYSE

ABX

14.42

0.11(0.77%)

5468

Boeing Co

BA

356.3

18.59(5.50%)

496388

Caterpillar Inc

CAT

165.02

1.26(0.77%)

27210

Chevron Corp

CVX

125.75

0.52(0.42%)

4127

Cisco Systems Inc

CSCO

42.01

-0.24(-0.57%)

36652

Citigroup Inc., NYSE

C

78.91

0.29(0.37%)

50908

Exxon Mobil Corp

XOM

87.06

0.28(0.32%)

6352

Facebook, Inc.

FB

188.6

1.48(0.79%)

302124

FedEx Corporation, NYSE

FDX

264

2.54(0.97%)

1434

Ford Motor Co.

F

11.13

0.07(0.63%)

34194

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.42

0.29(1.52%)

16894

General Electric Co

GE

16.07

0.12(0.75%)

176932

General Motors Company, NYSE

GM

43

0.30(0.70%)

5876

Goldman Sachs

GS

269.96

1.02(0.38%)

10217

Google Inc.

GOOG

1,173.37

9.68(0.83%)

12718

Hewlett-Packard Co.

HPQ

23.93

0.49(2.09%)

780

Home Depot Inc

HD

203.5

1.69(0.84%)

3240

HONEYWELL INTERNATIONAL INC.

HON

161

2.03(1.28%)

1302

Intel Corp

INTC

49.13

0.34(0.70%)

44367

International Business Machines Co...

IBM

164.62

1.00(0.61%)

13281

Johnson & Johnson

JNJ

142.65

0.22(0.15%)

4090

JPMorgan Chase and Co

JPM

115.79

0.68(0.59%)

36570

McDonald's Corp

MCD

173.75

1.27(0.74%)

16564

Merck & Co Inc

MRK

60.7

0.05(0.08%)

8116

Microsoft Corp

MSFT

93.62

0.88(0.95%)

240160

Nike

NKE

67.6

0.27(0.40%)

3933

Pfizer Inc

PFE

37.94

0.14(0.37%)

26547

Procter & Gamble Co

PG

86.94

-0.01(-0.01%)

7647

Starbucks Corporation, NASDAQ

SBUX

57.35

0.16(0.28%)

9581

Tesla Motors, Inc., NASDAQ

TSLA

348.5

2.68(0.78%)

18714

The Coca-Cola Co

KO

47.44

0.03(0.06%)

1144

Twitter, Inc., NYSE

TWTR

25.7

0.08(0.31%)

143380

United Technologies Corp

UTX

137.12

0.62(0.45%)

740

UnitedHealth Group Inc

UNH

240.24

3.59(1.52%)

9911

Verizon Communications Inc

VZ

54

0.10(0.19%)

1069

Visa

V

124.6

1.05(0.85%)

14679

Wal-Mart Stores Inc

WMT

108.6

0.87(0.81%)

2842

Walt Disney Co

DIS

111.03

0.92(0.84%)

1635

Yandex N.V., NASDAQ

YNDX

38.4

0.30(0.79%)

200

-

13:41

Target price changes before the market open

McDonald's (MCD) target raised to $190 from $180 at Telsey Advisory Group

-

13:40

Downgrades before the market open

Apple (AAPL) downgraded to Market Perform from Outperform at BMO Capital

-

13:30

Canada: GDP (m/m) , November 0.4% (forecast 0.4%)

-

13:30

Canada: Industrial Product Price Index, y/y, December 2.2%

-

13:30

Canada: Industrial Product Price Index, m/m, December -0.1% (forecast -0.1%)

-

13:15

U.S.: ADP Employment Report, January 234 (forecast 185)

-

13:13

Company News: Boeing (BA) quarterly results beat analysts’ expectations

Boeing (BA) reported Q4 FY 2017 earnings of $3.04 per share (versus $2.47 in Q4 FY 2016), beating analysts' consensus estimate of $2.88.

The company's quarterly revenues amounted to $25.368 bln (+8.9% y/y), beating analysts' consensus estimate of $24.780 bln.

The company also issued upside guidance for FY 2018, projecting EPS of $13.80-14.00 (versus analysts' consensus estimate of $11.90) at revenues of $96-98 bln (versus analysts' consensus estimate of $93.6 bln).

BA rose to $355.00 (+5.12%) in pre-market trading.

-

10:56

ECB's Coeure says QE will not last forever but there is a very broad agreement that we have to be patient and prudent

-

10:11

The euro area unemployment rate was 8.7% in December, as expected

The euro area (EA19) seasonally-adjusted unemployment rate was 8.7% in December 2017, stable compared to November 2017 and down from 9.7% in December 2016. This remains the lowest rate recorded in the euro area since January 2009.

The EU28 unemployment rate was 7.3% in December 2017, stable compared to November 2017 and down from 8.2% in December 2016. This remains the lowest rate recorded in the EU28 since October 2008.

-

10:09

Euro area annual inflation is expected to be 1.3% in January

Euro area annual inflation is expected to be 1.3% in January 2018, down from 1.4% in December 2017, according to a flash estimate from Eurostat, the statistical office of the European Union.

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in January (2.1%, compared with 2.9% in December), followed by food, alcohol & tobacco (1.9%, compared with 2.1% in December), services (1.2%, stable compared with December) and non-energy industrial goods (0.6%, compared with 0.5% in December).

-

10:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, January 1%

-

10:00

Eurozone: Unemployment Rate , December 8.7% (forecast 8.7%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, January 1.3% (forecast 1.3%)

-

09:30

Italian unemployment rate down 0.1% to 10.8% m/m

In December 2017, 23.067 million persons were employed, -0.3% over November 2017. Unemployed were 2.791 million, -1.7% over the previous month.

Employment rate was 58.0%, -0.2 percentage points over the previous month, unemployment rate was 10.8% -0.1 percentage points over November 2017 and inactivity rate was 34.8%, +0.3 percentage points in a month.

Youth unemployment rate (aged 15-24) was 32.2%, -0.2 percentage points over the previous month and youth unemployment ratio in the same age group was 8.2%, -0.2 percentage points over November 2017.

-

09:00

Switzerland: Credit Suisse ZEW Survey (Expectations), January 34.5

-

08:55

Germany: Unemployment Change, January -25 (forecast -20)

-

08:55

Germany: Unemployment Rate s.a. , January 5.4% (forecast 5.5%)

-

08:38

Major European stock exchanges trading in the green zone: FTSE 7592.00 +4.02 + 0.05%, DAX 13240.49 +42.78 + 0.32%, CAC 5491.02 +17.24 + 0.32%

-

08:37

French CPI declined less than expected m/m

Over a year, the Consumer Price Index (CPI) should rise by 1.4% in January 2018 after +1.2% in the previous month, according to the provisional estimate made at the end of January 2018. This increase in the year-on-year inflation should come from an acceleration in services prices and in energy prices and a slight rebound in "manufactured product" prices whereas food and tobacco should slow down.

Over one month, consumer prices should edge down by 0.1% after +0.3% in December. Energy prices should sharply accelerate because of the increase in Brent crude and in taxation. Food prices should rise slightly. On the other hand, "manufactured product" prices should fell back significantly, due to the beginning of winter sales. Tobacco prices shoud edge down. Lastly, services prices should slow down.

Year on year, the Harmonised Index of Consumer Prices should increase faster than in the previous month (+1.5% after +1.2% in December). Over one month, it should edge down: −0.1% after +0.4%.

-

07:58

France: CPI, m/m, January -0.1% (forecast -0.3%)

-

07:56

France: CPI, y/y, January 1.5% (forecast 1.1%)

-

07:52

Options levels on wednesday, January 31, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2553 (2636)

$1.2525 (1086)

$1.2501 (2264)

Price at time of writing this review: $1.2451

Support levels (open interest**, contracts):

$1.2366 (784)

$1.2340 (671)

$1.2308 (1538)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 133118 contracts (according to data from January, 30) with the maximum number of contracts with strike price $1,1850 (7037);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4304 (1187)

$1.4279 (739)

$1.4240 (561)

Price at time of writing this review: $1.4204

Support levels (open interest**, contracts):

$1.4094 (149)

$1.4048 (94)

$1.3987 (143)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 44652 contracts, with the maximum number of contracts with strike price $1,3600 (3462);

- Overall open interest on the PUT options with the expiration date February, 9 is 41923 contracts, with the maximum number of contracts with strike price $1,3400 (3038);

- The ratio of PUT/CALL was 0.94 versus 0.92 from the previous trading day according to data from January, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:17

Eurostoxx 50 futures up 0.1 pct, DAX futures up 0.1 pct, CAC 40 futures up 0.1 pct, FTSE futures down 0.2 pct

-

07:17

German retail sales down 1.9% in December

According to provisional data turnover in retail trade in December 2017 was in real terms 1.9% and in nominal terms 0.2% smaller than in November 2016. The number of days open for sale was 24 in December 2017 and 26 in December 2016.

Compared with the previous year, turnover in retail trade was in the whole year 2017 in real terms 2.3% and in nominal terms 4.2% larger than in 2016.

When adjusted for calendar and seasonal variations (Census-X-12-ARIMA), the December 2017 turnover was in real terms 1.9% and in nominal terms 1.5% lower than in November 2017.

-

07:01

Germany: Retail sales, real adjusted , December -1.9% (forecast -0.3%)

-

07:00

Germany: Retail sales, real unadjusted, y/y, December 1.9% (forecast 2.8%)

-

06:59

Switzerland: UBS Consumption Indicator, December 1.69

-

06:53

Trump says rogue regimes, terrorist groups and rivals including China and Russia "challenge our interests, our economy and our values"

-

Only need to look at "depraved character" of North Korean leadership to understand nature of nuclear threat to U.S. and its allies

-

U.S. will not repeat "mistakes of past administrations that got us into this very dangerous position" with North Korea

-

-

06:50

BoJ's Kuroda: firms offering cryptocurrency services must have ample security steps in place

-

Careful consideration is needed for central banks to issue cryptocurrency given impacts on financial intermediation

-

Don't see problem with financial intermediation now

-

-

06:49

BoJ's Iwata: BoJ won't raise rates just because U.S., European Central Bank eyeing exit from easy policy

-

2 pct inflation is very far so current yield curve is appropriate

-

There is misunderstanding in market BoJ will exit easy policy soon

-

No need to raise yield targets now, see no change for some time

-

Important for BoJ to be ready to change yield targets if economy, price, financial conditions change

-

-

06:45

The manufacturing sector in China continued to expand in January

The manufacturing sector in China continued to expand in January, albeit at a slower pace, the National Bureau of Statistics, cited by rttnews, with a Manufacturing PMI score of 51.3.

That missed expectations for 51.5 and was down from 51.6 in December.

It also remained above the boom-or-bust line of 50 that separates expansion from contraction.

The bureau also noted that the non-manufacturing PMI came in with a score of 55.3 - beating forecasts for 54.9 and up from 55.0 in the previous month.

-

06:42

Australian CPI rose less than expected in Q4

The all groups CPI

-

Rose 0.6% this quarter, compared with a rise of 0.6% in the september quarter 2017.

-

Rose 1.9% over the twelve months to the december quarter 2017, compared with a rise of 1.8% over the twelve months to the september quarter 2017.

Overview of CPI movements

-

The most significant price rises this quarter are automotive fuel (+10.4%), tobacco (+8.5%), domestic holiday travel and accommodation (+6.3%) and fruit (+9.3%).

-

The most significant offsetting price falls this quarter are international holiday travel and accommodation (-1.7%), audio visual and computing equipment (-3.5%), and telecommunication equipment and services (-1.4%).

-

-

06:40

President Trump: "After years and years of wage stagnation, we are finally seeing rising wages"

-

06:28

Global Stocks

Asia-Pacific shares broadly turned around early declines as President Donald Trump struck a mostly conciliatory tone in his first State of the Union address. After some of the biggest declines in several months Tuesday, indexes in Australia XJO, +0.34% , Hong Kong and South Korea SEU, +0.94% turned higher, gaining as much as much as 0.5%.

European stocks fell Tuesday, tracking losses across global markets, as investors grew increasingly concerned about a sharp rise in U.S. bond yields and its impact on the cost of borrowing. Heavily-weighted oil companies led the decliners, as crude-oil prices came under pressure.

U.S. stocks sold off for a second straight session on Tuesday, with the Dow suffering its biggest one-day drop in eight months, as heavy losses in health-care and energy shares weighed on the main indexes. The Dow Jones Industrial Average was down as much as 400 points after Amazon, Berkshire Hathaway and JPMorgan Chase announced they would partner in an effort to cut health-care costs and improve services for U.S. employees.

-

05:02

Japan: Construction Orders, y/y, December -8.1%

-

05:02

Japan: Consumer Confidence, January 44.7 (forecast 44.9)

-

05:01

Japan: Housing Starts, y/y, December -2.1% (forecast 1.1%)

-

00:59

China: Non-Manufacturing PMI, January 55.3 (forecast 55.0)

-

00:59

China: Manufacturing PMI , January 51.3 (forecast 51.5)

-

00:32

Australia: Private Sector Credit, y/y, December 4.8%

-

00:31

Australia: Private Sector Credit, m/m, December 0.3% (forecast 0.5%)

-

00:30

Australia: Trimmed Mean CPI q/q, Quarter IV 0.4% (forecast 0.5%)

-

00:30

Australia: CPI, q/q, Quarter IV 0.6% (forecast 0.7%)

-

00:30

Australia: CPI, y/y, Quarter IV 1.9% (forecast 2%)

-

00:30

Australia: Trimmed Mean CPI y/y, Quarter IV 1.8% (forecast 1.9%)

-

00:01

United Kingdom: Gfk Consumer Confidence, January -9 (forecast -13)

-