Notícias do Mercado

-

23:36

Stocks. Daily history for Jan 31’2018:

(index / closing price / change items /% change)

Nikkei -193.68 23098.29 -0.83%

TOPIX -21.42 1836.71 -1.15%

Hang Seng +279.98 32887.27 +0.86%

CSI 300 +19.80 4275.90 +0.47%

Euro Stoxx 50 +2.54 3609.29 +0.07%

FTSE 100 -54.43 7533.55 -0.72%

DAX -8.23 13189.48 -0.06%

CAC 40 +8.15 5481.93 +0.15%

DJIA +72.50 26149.39 +0.28%

S&P 500 +1.38 2823.81 +0.05%

NASDAQ +9.00 7411.48 +0.12%

S&P/TSX -3.84 15951.67 -0.02%

-

21:07

The major US stock indexes finished trading in positive territory

The main US stock indices grew moderately, helped by the Boeing rally after the publication of the quarterly report, as well as positive data on the US, and the results of the Fed meeting.

The ADP report showed that employment growth in the US private sector slowed in January, but was stronger than projected. According to the report, in January the number of employed increased by 234 thousand people compared with the figure for December at 242 thousand. It was expected that the number of employed will increase by 185 thousand.

In addition, Chicago Purchasing Managers Index fell 2.1 points to 65.7 in January from a revised 67.8 points in December. Despite the fact that in January it lost momentum, the index continued to move in the same direction as in the second half of 2017, which contributes to an encouraging new year. The index has grown by 28.3% since January last year and at the level of 65.7 exceeds the average of the second half of 2017, equal to 63.7.

Contracts for the purchase of previously owned homes in the United States rose for the third consecutive month in December, helped by a healthy labor market. The National Association of Realtors said that its index of unfinished transactions for the sale of housing rose to 110.1 points last month, which is 0.5% more than in November. Economists predicted that the index will increase by 0.4%, following an increase of 0.3% in the previous month (revised from + 0.2%).

As for the Fed meeting, it was decided to leave interest rates unchanged. At the same time, the Fed indicated that it intends to continue the gradual tightening of monetary policy in order to stimulate economic growth. In general, the rhetoric of the statement remained largely unchanged compared to December, indicating a still positive assessment of the prospects for the US economy. It should be noted that this meeting was the last for Fed Chairman Yellen, whose powers expire on Saturday. The new head of the Federal Reserve will be Powell

Most components of the DOW index finished trading in positive territory (17 out of 30). The leader of growth was the shares of The Boeing Company (BA, + 5.31%). Outsider were shares of Johnson & Johnson (JNJ, -2.43%).

Almost all sectors of the S & P index recorded an increase. The utilities sector grew most (+ 0.9%). Decrease showed only the health sector (-1.1%).

At closing:

DJIA + 0.28% 26.150.80 +73.91

Nasdaq + 0.12% 7,411.48 +9.00

S & P + 0.05% 2,823.93 +1.50

-

20:01

DJIA +0.10% 26,102.51 +25.62 Nasdaq -0.08% 7,396.85 -5.63 S&P -0.15% 2,818.06 -4.37

-

17:00

European stocks closed: FTSE 100 -54.43 7533.55 -0.72% DAX -8.23 13189.48 -0.06% CAC 40 +8.15 5481.93 +0.15%

-

14:32

U.S. Stocks open: Dow +0.90% Nasdaq +0.59%, S&P +0.44%

-

14:17

Before the bell: S&P futures +0.39%, NASDAQ futures +0.48%

U.S. stock-index futures rose on Wednesday, after two days of sharp declines, boosted by a controversy-free State of Union speech by the U.S. President Donald Trump, with investors turning their focus back to the Fed's monetary policy and corporate segment's quarterly results.

Global Stocks:

Nikkei 23,098.29 -193.68 -0.83%

Hang Seng 32,887.27 +279.98 +0.86%

Shanghai 3,481.51 -6.50 -0.19%

S&P/ASX 6,037.70 +14.90 +0.25%

FTSE 7,580.65 -7.33 -0.10%

CAC 5,494.16 +20.38 +0.37%

DAX 13,228.74 +31.03 +0.24%

Crude $64.19 (-0.48%)

Gold $1,343.60 (+0.61%)

-

13:44

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

253.6

2.06(0.82%)

1445

Amazon.com Inc., NASDAQ

AMZN

1,451.78

13.96(0.97%)

93961

American Express Co

AXP

99.08

0.37(0.37%)

937

Apple Inc.

AAPL

166.49

-0.48(-0.29%)

501779

AT&T Inc

T

37.5

0.06(0.16%)

18186

Barrick Gold Corporation, NYSE

ABX

14.42

0.11(0.77%)

5468

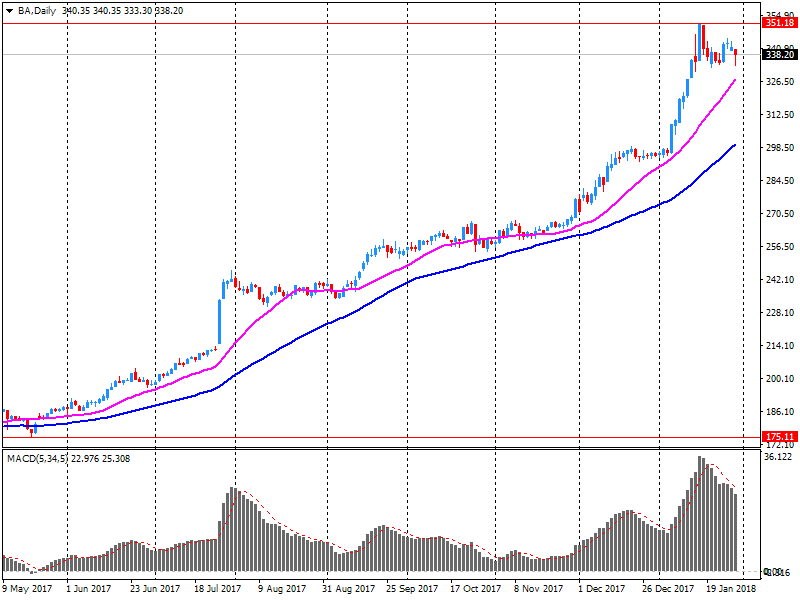

Boeing Co

BA

356.3

18.59(5.50%)

496388

Caterpillar Inc

CAT

165.02

1.26(0.77%)

27210

Chevron Corp

CVX

125.75

0.52(0.42%)

4127

Cisco Systems Inc

CSCO

42.01

-0.24(-0.57%)

36652

Citigroup Inc., NYSE

C

78.91

0.29(0.37%)

50908

Exxon Mobil Corp

XOM

87.06

0.28(0.32%)

6352

Facebook, Inc.

FB

188.6

1.48(0.79%)

302124

FedEx Corporation, NYSE

FDX

264

2.54(0.97%)

1434

Ford Motor Co.

F

11.13

0.07(0.63%)

34194

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.42

0.29(1.52%)

16894

General Electric Co

GE

16.07

0.12(0.75%)

176932

General Motors Company, NYSE

GM

43

0.30(0.70%)

5876

Goldman Sachs

GS

269.96

1.02(0.38%)

10217

Google Inc.

GOOG

1,173.37

9.68(0.83%)

12718

Hewlett-Packard Co.

HPQ

23.93

0.49(2.09%)

780

Home Depot Inc

HD

203.5

1.69(0.84%)

3240

HONEYWELL INTERNATIONAL INC.

HON

161

2.03(1.28%)

1302

Intel Corp

INTC

49.13

0.34(0.70%)

44367

International Business Machines Co...

IBM

164.62

1.00(0.61%)

13281

Johnson & Johnson

JNJ

142.65

0.22(0.15%)

4090

JPMorgan Chase and Co

JPM

115.79

0.68(0.59%)

36570

McDonald's Corp

MCD

173.75

1.27(0.74%)

16564

Merck & Co Inc

MRK

60.7

0.05(0.08%)

8116

Microsoft Corp

MSFT

93.62

0.88(0.95%)

240160

Nike

NKE

67.6

0.27(0.40%)

3933

Pfizer Inc

PFE

37.94

0.14(0.37%)

26547

Procter & Gamble Co

PG

86.94

-0.01(-0.01%)

7647

Starbucks Corporation, NASDAQ

SBUX

57.35

0.16(0.28%)

9581

Tesla Motors, Inc., NASDAQ

TSLA

348.5

2.68(0.78%)

18714

The Coca-Cola Co

KO

47.44

0.03(0.06%)

1144

Twitter, Inc., NYSE

TWTR

25.7

0.08(0.31%)

143380

United Technologies Corp

UTX

137.12

0.62(0.45%)

740

UnitedHealth Group Inc

UNH

240.24

3.59(1.52%)

9911

Verizon Communications Inc

VZ

54

0.10(0.19%)

1069

Visa

V

124.6

1.05(0.85%)

14679

Wal-Mart Stores Inc

WMT

108.6

0.87(0.81%)

2842

Walt Disney Co

DIS

111.03

0.92(0.84%)

1635

Yandex N.V., NASDAQ

YNDX

38.4

0.30(0.79%)

200

-

13:41

Target price changes before the market open

McDonald's (MCD) target raised to $190 from $180 at Telsey Advisory Group

-

13:40

Downgrades before the market open

Apple (AAPL) downgraded to Market Perform from Outperform at BMO Capital

-

13:13

Company News: Boeing (BA) quarterly results beat analysts’ expectations

Boeing (BA) reported Q4 FY 2017 earnings of $3.04 per share (versus $2.47 in Q4 FY 2016), beating analysts' consensus estimate of $2.88.

The company's quarterly revenues amounted to $25.368 bln (+8.9% y/y), beating analysts' consensus estimate of $24.780 bln.

The company also issued upside guidance for FY 2018, projecting EPS of $13.80-14.00 (versus analysts' consensus estimate of $11.90) at revenues of $96-98 bln (versus analysts' consensus estimate of $93.6 bln).

BA rose to $355.00 (+5.12%) in pre-market trading.

-

08:38

Major European stock exchanges trading in the green zone: FTSE 7592.00 +4.02 + 0.05%, DAX 13240.49 +42.78 + 0.32%, CAC 5491.02 +17.24 + 0.32%

-

07:17

Eurostoxx 50 futures up 0.1 pct, DAX futures up 0.1 pct, CAC 40 futures up 0.1 pct, FTSE futures down 0.2 pct

-

06:28

Global Stocks

Asia-Pacific shares broadly turned around early declines as President Donald Trump struck a mostly conciliatory tone in his first State of the Union address. After some of the biggest declines in several months Tuesday, indexes in Australia XJO, +0.34% , Hong Kong and South Korea SEU, +0.94% turned higher, gaining as much as much as 0.5%.

European stocks fell Tuesday, tracking losses across global markets, as investors grew increasingly concerned about a sharp rise in U.S. bond yields and its impact on the cost of borrowing. Heavily-weighted oil companies led the decliners, as crude-oil prices came under pressure.

U.S. stocks sold off for a second straight session on Tuesday, with the Dow suffering its biggest one-day drop in eight months, as heavy losses in health-care and energy shares weighed on the main indexes. The Dow Jones Industrial Average was down as much as 400 points after Amazon, Berkshire Hathaway and JPMorgan Chase announced they would partner in an effort to cut health-care costs and improve services for U.S. employees.

-