Notícias do Mercado

-

23:27

Stocks. Daily history for Jan 30’2018:

(index / closing price / change items /% change)

Nikkei -337.37 23291.97 -1.43%

TOPIX -22.32 1858.13 -1.19%

Hang Seng -359.60 32607.29 -1.09%

CSI 300 -45.92 4256.10 -1.07%

Euro Stoxx 50 -36.29 3606.75 -1.00%

FTSE 100 -83.55 7587.98 -1.09%

DAX -126.77 13197.71 -0.95%

CAC 40 -47.81 5473.78 -0.87%

DJIA -362.59 26076.89 -1.37%

S&P 500 -31.10 2822.43 -1.09%

NASDAQ -64.02 7402.48 -0.86%

S&P/TSX -139.21 15955.51 -0.86%

-

21:10

The main US stock indices fell sharply as a result of today's trading

Major US stock indexes finished the session in negative territory, while the Dow Jones Industrial Average and S & P indexes fell by more than 1%, as bond yields increased and companies' shares in the healthcare sector declined.

In addition, as it became known today, the housing price index from S & P / Case-Shiller for 20 cities increased seasonally by 0.7% over the three-month period ending in November, compared with the same period that ended in October , and grew by 6.4% compared to a year earlier. The national index grew seasonally adjusted by 0.7% MoM and 6.2% YoY.

At the same time, the index of consumer confidence from the Conference Board grew in January after a decline in December. The index is now 125.4, compared with 123.1 in December. The index of the current situation slightly decreased - from 156.5 to 155.3, and the index of expectations rose from 100.8 last month to 105.5 this month.

The cost of oil declined significantly on Tuesday, continuing yesterday's trend, which was caused by evidence of rising oil production in the US. In addition, cautious investors sold stocks, bonds and commodities.

Most components of the DOW index recorded a decline (27 of 30). Outsider were shares UnitedHealth Group Incorporated (UNH, -4.04%). The growth leader was the shares of Caterpillar Inc. (CAT, + 1.13%).

Almost all sectors of S & P finished trading in the red. The health sector showed the greatest decline (-1.7%). Only the utilities sector grew (+ 0.1%).

At closing:

DJIA -1.37% 26,076.89 -362.59

Nasdaq -0.86% 7.402.48 -64.02

S & P -1.09% 2,822.43 -31.10

-

20:00

DJIA -1.37% 26,078.14 -361.34 Nasdaq -0.91% 7,398.41 -68.10 S&P -1.04% 2,823.99 -29.54

-

17:00

European stocks closed: FTSE 100 -83.55 7587.98 -1.09% DAX -126.77 13197.71 -0.95% CAC 40 -47.81 5473.78 -0.87%

-

14:35

U.S. Stocks open: Dow -0.77% Nasdaq -0.82%, S&P -0.67%

-

14:27

Before the bell: S&P futures -0.54%, NASDAQ futures -0.53%

U.S. stock-index futures fell on Tuesday, signaling the equities' readiness to extend losses into a second session. There is not one specific reason for the selling; rather, it is the result of some profit-taking following a strong start to 2018.

Global Stocks:

Nikkei 23,291.97 -337.37 -1.43%

Hang Seng 32,607.29 -359.60 -1.09%

Shanghai 3,488.19 -34.81 -0.99%

S&P/ASX 6,022.80 -52.60 -0.87%

FTSE 7,619.89 -51.64 -0.67%

CAC 5,494.30 -27.29 -0.49%

DAX 13,254.91 -69.57 -0.52%

Crude $64.97 (-0.90%)

Gold $1,343.80 (+0.26%)

-

13:49

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

255.8

-0.21(-0.08%)

4369

ALCOA INC.

AA

53.84

-0.65(-1.19%)

911

ALTRIA GROUP INC.

MO

69.09

-0.74(-1.06%)

1164

Amazon.com Inc., NASDAQ

AMZN

1,410.00

-7.68(-0.54%)

107277

American Express Co

AXP

99.29

-0.12(-0.12%)

7471

Apple Inc.

AAPL

166.21

-1.75(-1.04%)

442963

AT&T Inc

T

37.1

-0.16(-0.43%)

11793

Barrick Gold Corporation, NYSE

ABX

14.45

0.10(0.70%)

21730

Boeing Co

BA

338.75

-2.07(-0.61%)

13183

Caterpillar Inc

CAT

160.38

-2.20(-1.35%)

29656

Chevron Corp

CVX

128

-0.48(-0.37%)

3750

Cisco Systems Inc

CSCO

42.7

-0.15(-0.35%)

46389

Citigroup Inc., NYSE

C

79.4

-0.56(-0.70%)

42669

Exxon Mobil Corp

XOM

87.5

-0.51(-0.58%)

10394

Facebook, Inc.

FB

184.05

-1.93(-1.04%)

151878

Ford Motor Co.

F

11.08

-0.04(-0.36%)

122178

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.5

-0.13(-0.66%)

19016

General Electric Co

GE

16.13

-0.15(-0.92%)

224186

General Motors Company, NYSE

GM

42.61

-0.41(-0.95%)

1916

Goldman Sachs

GS

271.1

-1.38(-0.51%)

6693

Google Inc.

GOOG

1,169.99

-5.59(-0.48%)

4491

Hewlett-Packard Co.

HPQ

23.7

-0.11(-0.46%)

464

Home Depot Inc

HD

202.7

-2.22(-1.08%)

11635

HONEYWELL INTERNATIONAL INC.

HON

160.1

-1.37(-0.85%)

793

Intel Corp

INTC

49.62

-0.36(-0.72%)

82415

International Business Machines Co...

IBM

165.75

-1.05(-0.63%)

10248

International Paper Company

IP

63.67

-1.41(-2.17%)

125

Johnson & Johnson

JNJ

143.14

-0.54(-0.38%)

7572

JPMorgan Chase and Co

JPM

115.41

-0.79(-0.68%)

43776

McDonald's Corp

MCD

176.27

-1.50(-0.84%)

181413

Merck & Co Inc

MRK

60.95

-0.68(-1.10%)

19973

Microsoft Corp

MSFT

93.6

-0.32(-0.34%)

133774

Nike

NKE

67.33

-0.25(-0.37%)

6860

Pfizer Inc

PFE

38.4

-0.62(-1.59%)

384041

Procter & Gamble Co

PG

86.71

-0.15(-0.17%)

11332

Starbucks Corporation, NASDAQ

SBUX

56.75

-0.27(-0.47%)

19753

Tesla Motors, Inc., NASDAQ

TSLA

345.8

-3.73(-1.07%)

23251

The Coca-Cola Co

KO

47.62

-0.08(-0.17%)

4712

Travelers Companies Inc

TRV

148.5

-0.46(-0.31%)

1008

Twitter, Inc., NYSE

TWTR

25.04

-0.14(-0.56%)

271018

United Technologies Corp

UTX

136.2

-0.47(-0.34%)

3939

UnitedHealth Group Inc

UNH

233.6

-13.81(-5.58%)

653491

Verizon Communications Inc

VZ

53.85

-0.28(-0.52%)

8681

Visa

V

124.49

-0.35(-0.28%)

7958

Wal-Mart Stores Inc

WMT

109.46

-0.09(-0.08%)

9041

Walt Disney Co

DIS

111.21

-0.33(-0.30%)

7070

Yandex N.V., NASDAQ

YNDX

38.2

-0.30(-0.78%)

2460

-

13:45

Analyst coverage initiations before the market open

Cisco Systems (CSCO) initiated with Hold at Loop Capital

-

13:44

Analyst coverage resumption before the market open

Intel (INTC) resumed with a Buy at Citigroup; target $58

-

13:44

Target price changes before the market open

Amazon (AMZN) target raised to $1500 at Monness Crespi & Hardt

Alphabet (GOOG) target raised to $1350 at Needham

Alphabet A (GOOGL) target raised to $1375 from $1200 at B. Riley FBR

AT&T (T) target raised to $40 from $36 at Scotia; Sector Perform

-

13:34

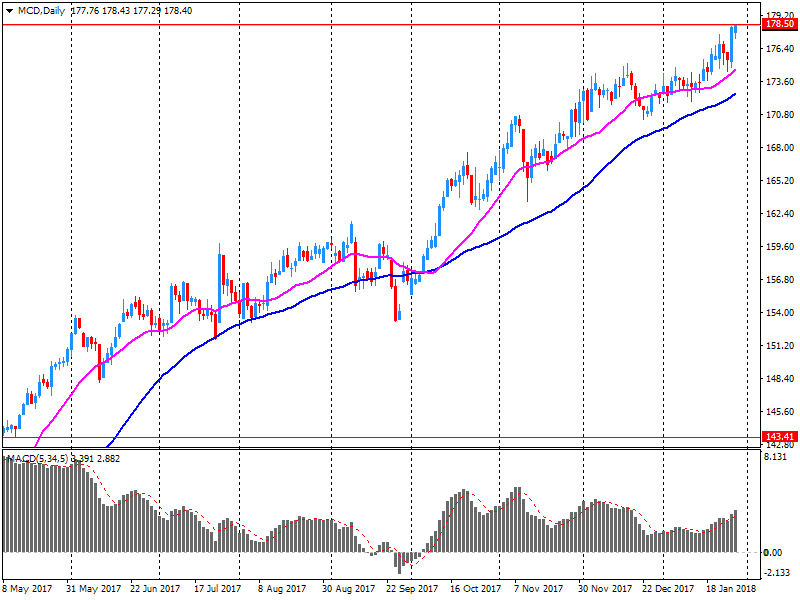

Company News: McDonald's (MCD) quarterly results beat analysts’ expectations

McDonald's (MCD) reported Q4 FY 2017 earnings of $1.71 per share (versus $1.44 in Q4 FY 2016), beating analysts' consensus estimate of $1.59.

The company's quarterly revenues amounted to $5.340 bln (-11.4% y/y), beating analysts' consensus estimate of $5.221 bln.

MCD fell to $176.31 (-0.82%) in pre-market trading.

-

12:29

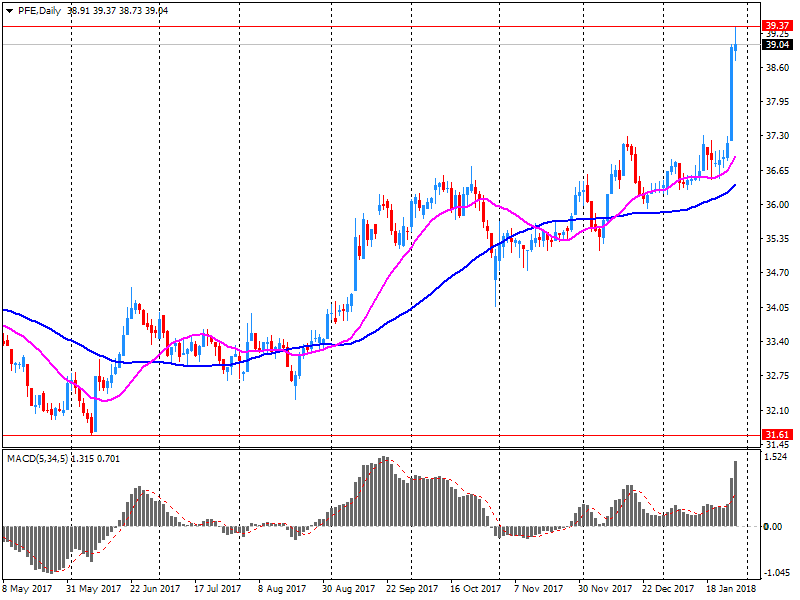

Company News: Pfizer (PFE) quarterly earnings beat analysts’ forecast

Pfizer (PFE) reported Q4 FY 2017 earnings of $0.62 per share (versus $0.47 in Q4 FY 2016), beating analysts' consensus estimate of $0.56.

The company's quarterly revenues amounted to $13.703 bln (+0.6% y/y), generally in-line with analysts' consensus estimate of $13.675 bln.

The company also issued upside guidance for FY 2018, projecting EPS of $2.90-3.00 (versus analysts' consensus estimate of $2.78) at revenues of $53.5-55.5 bln (versus analysts' consensus estimate of $53.82 bln).

PFE fell to $38.90 (-0.31%) in pre-market trading.

-

08:48

Major stock markets in Europe trading in the red zone: FTSE 7642.88 -28.65 -0.37%, DAX 13239.70 -84.78 -0.64%, CAC 5502.44 -19.15 -0.35%

-

06:45

Global Stocks

European stocks ended a volatile session in negative territory on Monday, with losses for banks and commodity companies outweighing a rally for chip makers that came after Apple-supplier AMS AG reported a major jump in revenue and lifted its sales forecasts.

All major U.S. benchmarks closed lower on Monday, with the Dow and the S&P 500 having their worst day this year, as the appetite for equities was dampened by a pickup in borrowing costs.

Asia-Pacific equity markets followed U.S. stock benchmarks lower as global government borrowing costs continued to rise. Indexes in the region hit session lows by midday, with Japan's Nikkei Stock Average NIK, -1.34% falling 1.5%. Benchmarks in Taiwan Y9999, -1.08% , Hong Kong and Australia XJO, -0.82% were each nearly 1% lower in recent trading.

-