Market news

-

23:27

Currencies. Daily history for Jan 09’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0573 +0,46%

GBP/USD $1,2160 -1,00%

USD/CHF Chf1,0152 -0,19%

USD/JPY Y116,01 -0,86%

EUR/JPY Y122,66 -0,49%

GBP/JPY Y141,07 -1,86%

AUD/USD $0,7352 +0,69%

NZD/USD $0,7014 +0,74%

USD/CAD C$1,3214 -0,12%

-

23:01

Schedule for today, Tuesday, Jan 10’2017 (GMT0)

00:30 Australia Retail Sales, M/M November 0.5%

01:30 China PPI y/y December 3.3% 4.5%

01:30 China CPI y/y December 2.3% 2.3%

05:00 Japan Consumer Confidence December 40.9

06:45 Switzerland Unemployment Rate (non s.a.) December 3.3%

07:45 France Industrial Production, m/m November -0.2% 0.6%

13:30 Canada Building Permits (MoM) November 8.7%

15:00 U.S. Wholesale Inventories November -0.1% 0.9%

15:00 U.S. JOLTs Job Openings November 5.534

-

20:00

U.S.: Consumer Credit , November 24.53 (forecast 18.48)

-

15:47

Gold prices kicked off the week higher

Gold prices kicked off the week higher in London as the precious metal continued to recover from its multi-month lows reached last month, says Dow Jones.

Spot gold was up 0.3% at $1,176.20 a troy ounce. Other precious metals also rose.

Investors are regaining a taste for the metal, which is traditionally seen as a haven asset, amid uncertainties linked to Chinese economic growth and the start of Donald Trump's presidency in the U.S.

Following a losing streak that lasted roughly seven weeks at the end of last year, gold exchange-traded funds have started seeing inflows last week, according to Commerzbank analysts.

-

15:19

UnitedHealth (UNH) buys Surgical Care Affiliates

Optum Company, which is part of UnitedHealth Group (UNH), to grow in size with the acquisition of Surgical Care Affiliates (SCAI).

Under the terms of the agreement, SCAI shares will be purchased for $ 57 / share, which implies a 17% premium to Friday's closing price, and the purchase will be financed through a combination of cash and shares. In particular, from 51% to 80% of the purchase price will be financed by UNH ordinary shares, while the remaining part will be paid in cash. UnitedHealth Group have the opportunity later to determine what portion of the transaction will be paid in shares.

The transaction is expected to be completed during the first half of 2017. UnitedHealth Group estimates that the purchase will have a neutral impact on its adjusted net earnings per share in 2017 and light in 2018.

UNH shares fell in premarket trading to $ 161.58 (-0.51%).

-

15:07

Rosengren: 'We Are Starting to Approach What We Want' in U.S. Inflation

-

'I Think We Are Basically At Full Employment Now'

-

2017 Rate Projections Seem Reasonable

-

Rate Policy Also 'Depends on What Happens Internationally'

-

With Rate Policy, 'A Lot Depends on What the Fiscal Policy We Get Is'

-

Continues to Be Concerned About Commercial Real-Estate Prices

-

Fannie, Freddie Outlook 'Probably Won't Be Resolved Quick' Enough to Impact Fed Balance Sheet

-

'I'm a Strong Believer in an Independent Federal Reserve'

-

'We Are Not Targeting' Stock Market Levels, But Do Incorporate It Into Forecasts

-

-

15:01

U.S.: Labor Market Conditions Index, December -0.3

-

13:39

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0430 (EUR 288 M) 1.0460 (EUR 209 M) 1.0500-1.0510 (EUR 548 M) 1.0530 (EUR 313 M) 1.0610-1.0625 (EUR 444 M) 1.0690 (EUR 309 M)

GBP/USD 1.2310 (GBP 349 M)

EUR/GBP 0.8630 (EUR 200 M) 0.8650 (EUR 2,287 M) 0.8670-0.8680 (EUR 275 M) 0.8725 (EUR 299 M)

USD/JPY 117.40-117.50 (USD 268 M)

USD/CHF 1.0075 (USD 330 M)

AUD/USD 0.7300 (AUD 260 M)

USD/CAD 1.3435-1.3450 (USD 646 M)

-

13:29

The pound fell sharply against the dollar and euro Monday after U.K. Prime Minister Theresa May said Britain would make a definitive break from the European Union - Dow Jones

-

13:00

Orders

EUR/USD

Offers 1.0560-65 10585 1.0600-05 1.0620 1.0650 1.0680 1.0700

Bids 1.0520 1.0500 1.0480 1.0450 1.0420 1.0400 1.0380-85 1.0365 1.0350

GBP/USD

Offers 1.2200 1.2220 1.2250 1.2280 1.2300 1.2320 1.2350

Bids 1.2165 1.2150 1.2130 1.2100 1.2080-85 1.2050 1.2030 1.2000

EUR/GBP

Offers 0.8685 0.8700 0.8720 0.8750 0.8780 0.8800

Bids 0.8640 0.8620 0.8600 0.8580-85 0.8560 0.8520-25 0.8500

EUR/JPY

Offers 123.60 123.85 124.00-10 124.30 124.50 124.80 125.00

Bids 123.00 122.80 122.50 122.30 122.00 121.75 121.50 121.00

USD/JPY

Offers 117.50 -55 117.80 118.00 118.20 118.50

Bids 117.00 116.80 116.50 116.00 115.75-80 115.50

AUD/USD

Offers 0.7330-35 0.7350-55 0.7375-80 0.7400 0.7420-25 0.7450

Bids 0.7300 0.7280 0.7250 0.7230 0.7200

-

12:31

-

10:31

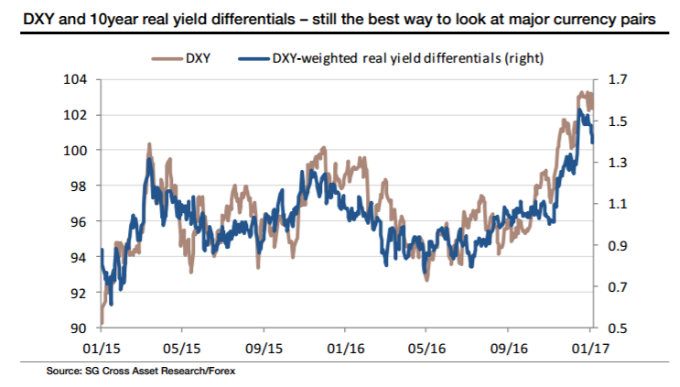

Societe Generale asking when the USD will peak

"Over the last few years, the relationship between FX rates and interest rate differentials has shifted. The chart below shows DXY-weighted 10year real yield differentials next to the DXY index. Not perfect, but not bad. This fit is better than for 10year nominal yields, and better than for 10 or 2 year swap differentials for that matter and for now, it's going to remain a corner-stone of how we think about FX trends in 2016. This relationship is interesting and useful but of course, it largely swaps one problem - trying to forecast FX trends by looking at the wrong things - while creating another - trying to forecast trends in real yield

As for timing on a dollar peak, our best guess is 99 days of President Trump's inauguration. That's absurdly precise but markets have embraced the idea that the new president is good for business confidence and will be good for the economy through policies that reduce taxation, increase spending, and reduce regulation. By the time his first hundred days are over, we might well be in a state of sever over-excitement. 99 days after inauguration takes us to 29 April, the day before the first round Presidential vote in France.

We're pencilling in parity for the EUR/USD and the year's widest level for relative real yields for that period too".

Copyright © 2017 Societe Generale, eFXnews™

-

10:07

Euro area unemployment rate stable in November

The euro area (EA19) seasonally-adjusted unemployment rate was 9.8% in November 2016, stable compared to October 2016 and down from 10.5% in November 2015. This is the lowest rate recorded in the euro area since July 2009. The EU28 unemployment rate was 8.3% in November 2016, down from 8.4% in October 2016 and from 9.0% in November 2015. This is the lowest rate recorded in the EU28 since February 2009. These figures are published by Eurostat, the statistical office of the European Union.

Eurostat estimates that 20.429 million men and women in the EU28, of whom 15.898 million were in the euro area, were unemployed in November 2016. Compared with October 2016, the number of persons unemployed decreased by 41 000 in the EU28 and by 15 000 in the euro area. Compared with November 2015, unemployment fell by 1.552 million in the EU28 and by 972 000 in the euro area.

-

10:00

Eurozone: Unemployment Rate , November 9.8% (forecast 9.8%)

-

09:23

Italian unemployment rate rose 0.3% in November

Employment rate was 57.3%, +0.1 percentage points over October, unemployment rate was 11.9%, +0.2 percentage points in a month and inactivity rate was 34.8%, -0.2 percentage points over the previous month.

Youth unemployment rate (aged 15-24) was 39.4%, +1.8 percentage points over October and youth unemployment ratio in the same age group was 10.6%, +0.7 percentage points in a month.

In November 2016, 22.775 million persons were employed, +0.1% compared with October. Unemployed were 3.089 million, +1.9% over the previous month.

-

09:21

UK House prices finished 2016 strongly

House prices in the three months to December were 6.5% higher than in the same three months of 2015. Prices in the last three months (OctoberDecember) were 2.5% higher than in the preceding quarter.

Martin Ellis, Halifax housing economist, said: "House prices finished 2016 strongly. Prices in the final quarter of the year were 2.5% higher than in the previous quarter. The annual rate of growth increased, rising for the second consecutive month, from 6.0% in November to 6.5%. "Slower economic growth, pressure on employment and a squeeze on spending power, together with affordability constraints, are expected to reduce housing demand during 2017. UK house prices should, however, continue to be supported by an ongoing shortage of property for sale, low levels of housebuilding, and exceptionally low interest rates".

-

09:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 2.42bln) 1.0600 (505m) 1.0700 (2.41bln) 1.0800 (281m) 1.0850 (690m)

USD/JPY 115.00 (USD 1.3bln) 116.00 (700m) 117.00 (420m) 117.25 (380m) 118.00 (839m)

USD/CAD 1.3245 (USD 300m) 1.3300 (1.26bln)

NZD/USD 0.7005 (NZD 173m)

-

08:30

United Kingdom: Halifax house price index 3m Y/Y, December 6.5% (forecast 5.8%)

-

08:30

United Kingdom: Halifax house price index, December 1.7% (forecast 0.2%)

-

08:16

Switzerland: Retail Sales Y/Y, November 0.9%

-

08:16

Switzerland: Retail Sales (MoM), November 0.7%

-

08:12

Today’s events

-

At 14:00 GMT FOMC member Eric Rosengren will give a speech

-

At17:45 GMT FOMC member Dennis Lockhart will give a speech

-

-

07:37

German industrial production rose less than expected in November

In November 2016, production in industry was up by 0.4% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In October 2016, the corrected figure shows an increase of 0.5% (primary +0.3%) from September 2016.

In November 2016, production in industry excluding energy and construction was up by 0.4%.

Within industry, the production of intermediate goods increased by 0.9% and the production of consumer goods by 0.3%. The production of capital goods shows a decrease by 0.1%. Energy production was down by 0.4% in November 2016 and the production in construction increased by 1.5%.

-

07:36

German foreign trade balance showed a surplus of 22.6 billion euros in November

Germany exported goods to the value of 108.5 billion euros and imported goods to the value of 85.8 billion euros in November 2016. These are the highest monthly figures ever calculated both for exports and for imports. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports increased by 5.6% and imports by 4.5% in November 2016 year on year. After calendar and seasonal adjustment, exports increased by 3.9% and imports by 3.5% compared with October 2016.

The foreign trade balance showed a surplus of 22.6 billion euros in November 2016. In November 2015, the surplus amounted to 20.5 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 21.7 billion euros in November 2016.

-

07:02

Germany: Current Account , November 24.6

-

07:01

Germany: Trade Balance (non s.a.), bln, November 22.6

-

07:00

Germany: Industrial Production s.a. (MoM), November 0.4% (forecast 0.8%)

-

06:45

Sturgeon reiterates hard Brexit threat of Scottish independence vote - theguardian

-

06:44

China's foreign exchange reserves continue to decline

As stated Saturday by the People's Bank of China, China's foreign exchange reserves at the end of December amounted to $ 3.011 compared to $ 3.052 Tril. earlier. China's foreign exchange reserves fell the sixth consecutive month in December, amounting to $ 320 billion. This decline was in line with the estimates of economists surveyed by Bloomberg.

-

06:41

Australian construction industry declined for a third consecutive month in December

The national construction industry declined for a third consecutive month in December with the Australian Industry Group/Housing Industry Association Australian Performance of Construction Index (Australian PCI) registering 47.0 points in the month (50 points is the threshold that separates expansion from contraction in the Australian PCI®).

This was an increase of 0.4 points from November, indicating a marginal easing in the industry's rate of contraction during the final month of 2016. All four sectors of the Australian PCI contracted (i.e. below 50 points) in December. House building declined for a fifth consecutive month as activity in the sector moderated further from robust mid-year levels. Apartment building also continued to contract, although the sector's pace of decline was the slowest in three months

-

06:39

Germany's Gabriel says EU break-up no longer unthinkable - Reuters

-

06:10

Options levels on monday, January 9, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0688 (2066)

$1.0668 (583)

$1.0624 (253)

Price at time of writing this review: $1.0522

Support levels (open interest**, contracts):

$1.0467 (1093)

$1.0425 (2392)

$1.0373 (3212)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 51749 contracts, with the maximum number of contracts with strike price $1,1500 (3206);

- Overall open interest on the PUT options with the expiration date March, 13 is 59606 contracts, with the maximum number of contracts with strike price $1,0000 (5261);

- The ratio of PUT/CALL was 1.15 versus 1.13 from the previous trading day according to data from January, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.2511 (577)

$1.2415 (250)

$1.2319 (126)

Price at time of writing this review: $1.2195

Support levels (open interest**, contracts):

$1.2088 (501)

$1.1991 (1470)

$1.1893 (2840

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 15186 contracts, with the maximum number of contracts with strike price $1,2800 (3001);

- Overall open interest on the PUT options with the expiration date March, 13 is 18285 contracts, with the maximum number of contracts with strike price $1,1500 (2979);

- The ratio of PUT/CALL was 1.20 versus 1.17 from the previous trading day according to data from January, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:30

Australia: Building Permits, m/m, November 7.0%

-

00:30

Australia: ANZ Job Advertisements (MoM), December -1.9%

-

00:00

Unemployment in Europe

The euro area (EA19) seasonally-adjusted unemployment rate was 9.8% in November 2016, stable compared to October 2016 and down from 10.5% in November 2015. This is the lowest rate recorded in the euro area since July 2009. The EU28 unemployment rate was 8.3% in November 2016, down from 8.4% in October 2016 and from 9.0% in November 2015. This is the lowest rate recorded in the EU28 since February 2009. These figures are published by Eurostat, the statistical office of the European Union.

Eurostat estimates that 20.429 million men and women in the EU28, of whom 15.898 million were in the euro area, were unemployed in November 2016. Compared with October 2016, the number of persons unemployed decreased by 41 000 in the EU28 and by 15 000 in the euro area. Compared with November 2015, unemployment fell by 1.552 million in the EU28 and by 972 000 in the euro area. -