Market news

-

23:29

Commodities. Daily history for Jan 09’2017:

(raw materials / closing price /% change)

Oil 51.79 -0.33%

Gold 1,181.20 -0.31%

-

23:28

Stocks. Daily history for Jan 09’2017:

(index / closing price / change items /% change)

Hang Seng +55.68 22558.69 +0.25%

CSI 300 +16.23 3363.90 +0.48%

Euro Stoxx 50 -12.20 3308.97 -0.37%

FTSE 100 +27.72 7237.77 +0.38%

DAX -35.02 11563.99 -0.30%

CAC 40 -22.27 4887.57 -0.45%

DJIA -76.42 19887.38 -0.38%

S&P 500 -8.08 2268.90 -0.35%

NASDAQ +10.76 5531.82 +0.19%

S&P/TSX -107.10 15388.95 -0.69%

-

23:27

Currencies. Daily history for Jan 09’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0573 +0,46%

GBP/USD $1,2160 -1,00%

USD/CHF Chf1,0152 -0,19%

USD/JPY Y116,01 -0,86%

EUR/JPY Y122,66 -0,49%

GBP/JPY Y141,07 -1,86%

AUD/USD $0,7352 +0,69%

NZD/USD $0,7014 +0,74%

USD/CAD C$1,3214 -0,12%

-

23:01

Schedule for today, Tuesday, Jan 10’2017 (GMT0)

00:30 Australia Retail Sales, M/M November 0.5%

01:30 China PPI y/y December 3.3% 4.5%

01:30 China CPI y/y December 2.3% 2.3%

05:00 Japan Consumer Confidence December 40.9

06:45 Switzerland Unemployment Rate (non s.a.) December 3.3%

07:45 France Industrial Production, m/m November -0.2% 0.6%

13:30 Canada Building Permits (MoM) November 8.7%

15:00 U.S. Wholesale Inventories November -0.1% 0.9%

15:00 U.S. JOLTs Job Openings November 5.534

-

20:00

U.S.: Consumer Credit , November 24.53 (forecast 18.48)

-

20:00

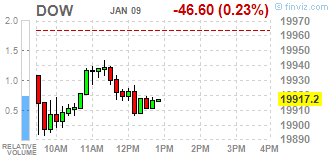

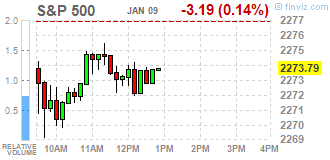

DJIA 19903.43 -60.37 -0.30%, NASDAQ 5532.90 11.84 0.21%, S&P 500 2270.53 -6.45 -0.28%

-

17:52

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed on Monday. Declines in bank and energy companies distancing the Dow from the 20,000 mark, while gains in technology stocks pushed the Nasdaq to a record intraday high.

Most of Dow stocks in negative area (20 of 30). Top gainer - E. I. du Pont de Nemours and Company (DD, +1.83%). Top loser - Exxon Mobil Corporation (XOM, -2.01%).

Most of S&P sectors also in negative area. Top gainer - Healthcare (+0.4%). Top loser - Conglomerates (-1.0%).

At the moment:

Dow 19836.00 -61.00 -0.31%

S&P 500 2267.50 -4.00 -0.18%

Nasdaq 100 5020.00 +16.00 +0.32%

Oil 52.40 -1.59 -2.94%

Gold 1183.00 +9.60 +0.82%

U.S. 10yr 2.32 -0.04

-

17:01

European stocks closed: FTSE 7237.77 27.72 0.38%, DAX 11563.99 -35.02 -0.30%, CAC 4887.57 -22.27 -0.45%

-

16:27

WSE: Session Results

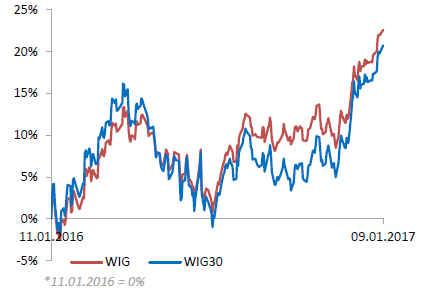

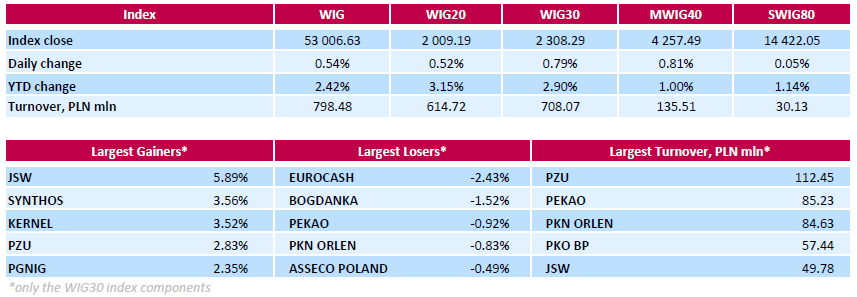

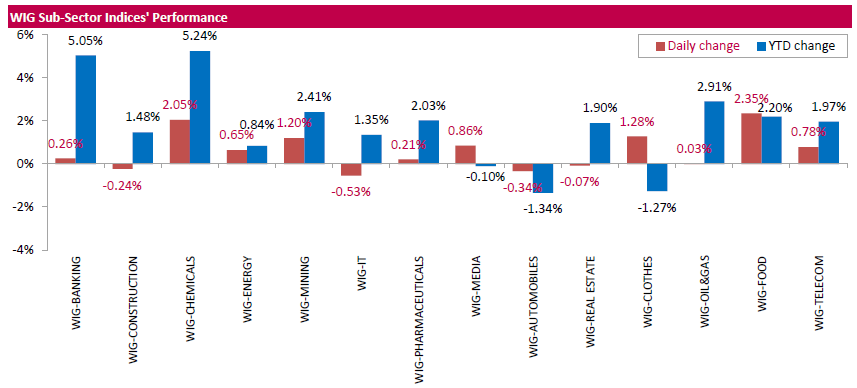

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, rose by 0.54%. The WIG sub-sector indices were mainly higher with food stock gauge (+2.35%) outperforming.

The large-cap stocks' measure, the WIG30 Index, surged by 0.79%. A majority of the index components returned gains, with the way up led by coking coal miner JSW (WSE: JSW), which advanced 5.89% as the stock continued to recover after significant declines in late December through early January, which pushed its quotation down nearly 20%. Other major advancers were chemical producer SYNTHOS (WSE: SNS), agricultural producer KERNEL (WSE: KER) and insurer PZU (WSE: PZU), which soared 3.56%, 3.52% and 2.83% respectively. At the same time, FMCG-wholesaler EUROCASH (WSE: EUR) led a handful of decliners with a 2.43% drop, followed by thermal coal miner BOGDANKA (WSE: LWB), bank PEKAO (WSE: PEO), oil refiner PKN ORLEN (WSE: PKN) and IT-company ASSECO POLAND (WSE: ACP), tumbling between 0.49% and 1.52%.

-

15:47

Gold prices kicked off the week higher

Gold prices kicked off the week higher in London as the precious metal continued to recover from its multi-month lows reached last month, says Dow Jones.

Spot gold was up 0.3% at $1,176.20 a troy ounce. Other precious metals also rose.

Investors are regaining a taste for the metal, which is traditionally seen as a haven asset, amid uncertainties linked to Chinese economic growth and the start of Donald Trump's presidency in the U.S.

Following a losing streak that lasted roughly seven weeks at the end of last year, gold exchange-traded funds have started seeing inflows last week, according to Commerzbank analysts.

-

15:19

UnitedHealth (UNH) buys Surgical Care Affiliates

Optum Company, which is part of UnitedHealth Group (UNH), to grow in size with the acquisition of Surgical Care Affiliates (SCAI).

Under the terms of the agreement, SCAI shares will be purchased for $ 57 / share, which implies a 17% premium to Friday's closing price, and the purchase will be financed through a combination of cash and shares. In particular, from 51% to 80% of the purchase price will be financed by UNH ordinary shares, while the remaining part will be paid in cash. UnitedHealth Group have the opportunity later to determine what portion of the transaction will be paid in shares.

The transaction is expected to be completed during the first half of 2017. UnitedHealth Group estimates that the purchase will have a neutral impact on its adjusted net earnings per share in 2017 and light in 2018.

UNH shares fell in premarket trading to $ 161.58 (-0.51%).

-

15:07

Rosengren: 'We Are Starting to Approach What We Want' in U.S. Inflation

-

'I Think We Are Basically At Full Employment Now'

-

2017 Rate Projections Seem Reasonable

-

Rate Policy Also 'Depends on What Happens Internationally'

-

With Rate Policy, 'A Lot Depends on What the Fiscal Policy We Get Is'

-

Continues to Be Concerned About Commercial Real-Estate Prices

-

Fannie, Freddie Outlook 'Probably Won't Be Resolved Quick' Enough to Impact Fed Balance Sheet

-

'I'm a Strong Believer in an Independent Federal Reserve'

-

'We Are Not Targeting' Stock Market Levels, But Do Incorporate It Into Forecasts

-

-

15:01

U.S.: Labor Market Conditions Index, December -0.3

-

14:53

WSE: After start on Wall Street

The market in the United States opened quietly, and the S&P500 index began from discount of 0.14%. After the first transaction the bears took advantage and the S&P500 lost 0.3 percent, what turns out to be a weaker than expected scenario. The Warsaw WIG20 index is today one of the strongest indices in Europe and an hour before the close of trading the WIG20 index was at the level of 2,002 points (+0.17%).

-

14:34

U.S. Stocks open: Dow -0.29%, Nasdaq +0.14%, S&P -0.20%

-

14:28

Before the bell: S&P futures -0.15%, NASDAQ futures +0.01%

U.S. stock-index futures were flat amid tumbling oil prices and due to lack of macroeconomic data.

Global Stocks:

Nikkei Closed.

Hang Seng 22,558.69 +55.68 +0.25%

Shanghai 3,171.60 +17.28 +0.55%

FTSE 7,229.73 +19.68 +0.27%

CAC 4,873.75 -36.09 -0.74%

DAX 11,535.19 -63.82 -0.55%

Crude $52.95 (-1.93%)

Gold $1,181.20 (+0.66%)

-

14:06

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

178

-0.23(-0.129%)

200

ALCOA INC.

AA

30.7

0.02(0.0652%)

4033

ALTRIA GROUP INC.

MO

68.28

0.05(0.0733%)

1314

Amazon.com Inc., NASDAQ

AMZN

796.48

0.49(0.0616%)

20147

American Express Co

AXP

76.1

0.63(0.8348%)

26338

AMERICAN INTERNATIONAL GROUP

AIG

66.82

0.01(0.015%)

1594

Apple Inc.

AAPL

118.11

0.20(0.1696%)

130921

AT&T Inc

T

41.34

0.02(0.0484%)

3188

Barrick Gold Corporation, NYSE

ABX

17.24

0.31(1.8311%)

98796

Boeing Co

BA

159.05

-0.05(-0.0314%)

416

Caterpillar Inc

CAT

92.62

-0.42(-0.4514%)

4240

Chevron Corp

CVX

116.36

-0.48(-0.4108%)

1005

Cisco Systems Inc

CSCO

30.29

0.06(0.1985%)

1233

Citigroup Inc., NYSE

C

60.08

-0.47(-0.7762%)

7374

Deere & Company, NYSE

DE

105.8

-0.69(-0.6479%)

690

Exxon Mobil Corp

XOM

88.26

-0.24(-0.2712%)

2814

Facebook, Inc.

FB

123.47

0.06(0.0486%)

74025

Ford Motor Co.

F

12.8

0.04(0.3135%)

26810

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.79

-0.11(-0.7383%)

36704

General Electric Co

GE

31.63

0.02(0.0633%)

10804

General Motors Company, NYSE

GM

35.85

-0.14(-0.389%)

31567

Goldman Sachs

GS

243.11

-1.79(-0.7309%)

14812

Google Inc.

GOOG

808

1.85(0.2295%)

4601

Home Depot Inc

HD

134

0.47(0.352%)

1649

Intel Corp

INTC

36.55

0.07(0.1919%)

2054

International Business Machines Co...

IBM

169.37

-0.16(-0.0944%)

361

Johnson & Johnson

JNJ

116.8

0.50(0.4299%)

570

JPMorgan Chase and Co

JPM

85.68

-0.44(-0.5109%)

28451

McDonald's Corp

MCD

121.09

0.33(0.2733%)

211

Microsoft Corp

MSFT

62.95

0.11(0.175%)

3971

Nike

NKE

53.89

-0.02(-0.0371%)

9005

Pfizer Inc

PFE

33.5

0.02(0.0597%)

8029

Procter & Gamble Co

PG

84.19

-0.84(-0.9879%)

34478

Starbucks Corporation, NASDAQ

SBUX

57.39

0.26(0.4551%)

17699

Tesla Motors, Inc., NASDAQ

TSLA

228.95

-0.06(-0.0262%)

6671

The Coca-Cola Co

KO

41.25

-0.49(-1.1739%)

81072

UnitedHealth Group Inc

UNH

161.58

-0.83(-0.5111%)

1720

Visa

V

82.2

-0.01(-0.0122%)

697

Wal-Mart Stores Inc

WMT

68.5

0.24(0.3516%)

2310

-

13:43

Upgrades and downgrades before the market open

Upgrades:

American Express (AXP) upgraded to Buy from Neutral at BofA/Merrill

Downgrades:Procter & Gamble (PG) downgraded to Sell from Neutral at Goldman

Coca-Cola (KO) downgraded to Sell from Neutral at Goldman

Other:Coca-Cola (KO) initiated with an Equal Weight at Barclays

-

13:39

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0430 (EUR 288 M) 1.0460 (EUR 209 M) 1.0500-1.0510 (EUR 548 M) 1.0530 (EUR 313 M) 1.0610-1.0625 (EUR 444 M) 1.0690 (EUR 309 M)

GBP/USD 1.2310 (GBP 349 M)

EUR/GBP 0.8630 (EUR 200 M) 0.8650 (EUR 2,287 M) 0.8670-0.8680 (EUR 275 M) 0.8725 (EUR 299 M)

USD/JPY 117.40-117.50 (USD 268 M)

USD/CHF 1.0075 (USD 330 M)

AUD/USD 0.7300 (AUD 260 M)

USD/CAD 1.3435-1.3450 (USD 646 M)

-

13:29

The pound fell sharply against the dollar and euro Monday after U.K. Prime Minister Theresa May said Britain would make a definitive break from the European Union - Dow Jones

-

13:00

Orders

EUR/USD

Offers 1.0560-65 10585 1.0600-05 1.0620 1.0650 1.0680 1.0700

Bids 1.0520 1.0500 1.0480 1.0450 1.0420 1.0400 1.0380-85 1.0365 1.0350

GBP/USD

Offers 1.2200 1.2220 1.2250 1.2280 1.2300 1.2320 1.2350

Bids 1.2165 1.2150 1.2130 1.2100 1.2080-85 1.2050 1.2030 1.2000

EUR/GBP

Offers 0.8685 0.8700 0.8720 0.8750 0.8780 0.8800

Bids 0.8640 0.8620 0.8600 0.8580-85 0.8560 0.8520-25 0.8500

EUR/JPY

Offers 123.60 123.85 124.00-10 124.30 124.50 124.80 125.00

Bids 123.00 122.80 122.50 122.30 122.00 121.75 121.50 121.00

USD/JPY

Offers 117.50 -55 117.80 118.00 118.20 118.50

Bids 117.00 116.80 116.50 116.00 115.75-80 115.50

AUD/USD

Offers 0.7330-35 0.7350-55 0.7375-80 0.7400 0.7420-25 0.7450

Bids 0.7300 0.7280 0.7250 0.7230 0.7200

-

12:31

-

12:01

WSE: Mid session comment

During the first half of today's session the volatility was low and the graph of the WIG20 repeatedly pushed the level of 2,000 points. The Warsaw market today is more powerful than the environment where the German DAX lost approx. 0.6 percent.

At the halfway point of today's quotations the WIG20 index was at the level of 2,001 points (+0,13%) and the turnover in the segment of largest companies was amounted to PLN 273 million.

-

11:14

Oil is trading lower

This morning, the New York futures for Brent fell by 0.67% to $ 56.72 and WTI fell 0.72%, to $ 53.61. Thus, the black gold prices traded in the red zone amid rising exports from Iran, and the number of drilling rigs in the United States.

Iran has decided to increase the supply of raw materials. Members of OPEC and non-OPEC states have entered into the first agreement to jointly cut production in the hope of restoring the balance in the global market and to support the prices of raw materials.

-

10:31

Societe Generale asking when the USD will peak

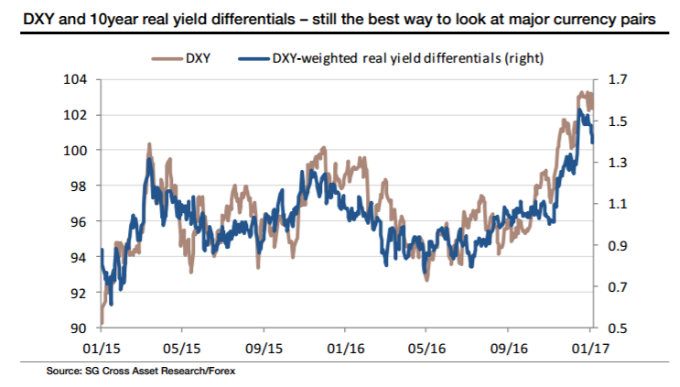

"Over the last few years, the relationship between FX rates and interest rate differentials has shifted. The chart below shows DXY-weighted 10year real yield differentials next to the DXY index. Not perfect, but not bad. This fit is better than for 10year nominal yields, and better than for 10 or 2 year swap differentials for that matter and for now, it's going to remain a corner-stone of how we think about FX trends in 2016. This relationship is interesting and useful but of course, it largely swaps one problem - trying to forecast FX trends by looking at the wrong things - while creating another - trying to forecast trends in real yield

As for timing on a dollar peak, our best guess is 99 days of President Trump's inauguration. That's absurdly precise but markets have embraced the idea that the new president is good for business confidence and will be good for the economy through policies that reduce taxation, increase spending, and reduce regulation. By the time his first hundred days are over, we might well be in a state of sever over-excitement. 99 days after inauguration takes us to 29 April, the day before the first round Presidential vote in France.

We're pencilling in parity for the EUR/USD and the year's widest level for relative real yields for that period too".

Copyright © 2017 Societe Generale, eFXnews™

-

10:07

Euro area unemployment rate stable in November

The euro area (EA19) seasonally-adjusted unemployment rate was 9.8% in November 2016, stable compared to October 2016 and down from 10.5% in November 2015. This is the lowest rate recorded in the euro area since July 2009. The EU28 unemployment rate was 8.3% in November 2016, down from 8.4% in October 2016 and from 9.0% in November 2015. This is the lowest rate recorded in the EU28 since February 2009. These figures are published by Eurostat, the statistical office of the European Union.

Eurostat estimates that 20.429 million men and women in the EU28, of whom 15.898 million were in the euro area, were unemployed in November 2016. Compared with October 2016, the number of persons unemployed decreased by 41 000 in the EU28 and by 15 000 in the euro area. Compared with November 2015, unemployment fell by 1.552 million in the EU28 and by 972 000 in the euro area.

-

10:00

Eurozone: Unemployment Rate , November 9.8% (forecast 9.8%)

-

09:23

Italian unemployment rate rose 0.3% in November

Employment rate was 57.3%, +0.1 percentage points over October, unemployment rate was 11.9%, +0.2 percentage points in a month and inactivity rate was 34.8%, -0.2 percentage points over the previous month.

Youth unemployment rate (aged 15-24) was 39.4%, +1.8 percentage points over October and youth unemployment ratio in the same age group was 10.6%, +0.7 percentage points in a month.

In November 2016, 22.775 million persons were employed, +0.1% compared with October. Unemployed were 3.089 million, +1.9% over the previous month.

-

09:21

UK House prices finished 2016 strongly

House prices in the three months to December were 6.5% higher than in the same three months of 2015. Prices in the last three months (OctoberDecember) were 2.5% higher than in the preceding quarter.

Martin Ellis, Halifax housing economist, said: "House prices finished 2016 strongly. Prices in the final quarter of the year were 2.5% higher than in the previous quarter. The annual rate of growth increased, rising for the second consecutive month, from 6.0% in November to 6.5%. "Slower economic growth, pressure on employment and a squeeze on spending power, together with affordability constraints, are expected to reduce housing demand during 2017. UK house prices should, however, continue to be supported by an ongoing shortage of property for sale, low levels of housebuilding, and exceptionally low interest rates".

-

09:20

Major stock markets in Europe trading mixed: FTSE + 0.33%, DAX -0.23%, CAC40 -0.2%, FTMIB + 0.02%, IBEX - 0.2%

-

09:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 2.42bln) 1.0600 (505m) 1.0700 (2.41bln) 1.0800 (281m) 1.0850 (690m)

USD/JPY 115.00 (USD 1.3bln) 116.00 (700m) 117.00 (420m) 117.25 (380m) 118.00 (839m)

USD/CAD 1.3245 (USD 300m) 1.3300 (1.26bln)

NZD/USD 0.7005 (NZD 173m)

-

08:30

United Kingdom: Halifax house price index 3m Y/Y, December 6.5% (forecast 5.8%)

-

08:30

United Kingdom: Halifax house price index, December 1.7% (forecast 0.2%)

-

08:17

WSE: After opening

WIG20 index opened at 1999.15 points (+0.02%)*

WIG 52783.13 0.12%

WIG30 2292.94 0.12%

mWIG40 4233.58 0.24%

*/ - change to previous close

The cash market started the new week from the neutral level, similar like the German DAX. The first transactions brought a slight weakening, however, we still look at the round level of 2,000 points. The turnover in the segment of the largest companies are not large, which may mean that investors have not returned yet after the three-day break.

After fifteen minutes of trading the WIG20 index was at the level of 1,996 points (-0,13%).

-

08:16

Switzerland: Retail Sales Y/Y, November 0.9%

-

08:16

Switzerland: Retail Sales (MoM), November 0.7%

-

08:12

Today’s events

-

At 14:00 GMT FOMC member Eric Rosengren will give a speech

-

At17:45 GMT FOMC member Dennis Lockhart will give a speech

-

-

07:46

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.2%, CAC40 -0.1%, FTSE -0.1%

-

07:37

German industrial production rose less than expected in November

In November 2016, production in industry was up by 0.4% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In October 2016, the corrected figure shows an increase of 0.5% (primary +0.3%) from September 2016.

In November 2016, production in industry excluding energy and construction was up by 0.4%.

Within industry, the production of intermediate goods increased by 0.9% and the production of consumer goods by 0.3%. The production of capital goods shows a decrease by 0.1%. Energy production was down by 0.4% in November 2016 and the production in construction increased by 1.5%.

-

07:36

German foreign trade balance showed a surplus of 22.6 billion euros in November

Germany exported goods to the value of 108.5 billion euros and imported goods to the value of 85.8 billion euros in November 2016. These are the highest monthly figures ever calculated both for exports and for imports. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports increased by 5.6% and imports by 4.5% in November 2016 year on year. After calendar and seasonal adjustment, exports increased by 3.9% and imports by 3.5% compared with October 2016.

The foreign trade balance showed a surplus of 22.6 billion euros in November 2016. In November 2015, the surplus amounted to 20.5 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 21.7 billion euros in November 2016.

-

07:20

WSE: Before opening

Today's session for the Warsaw market will mean the need to adapt to the changes that took place on Friday, when the Warsaw Stock Exchange was not working. On Friday were published data from the US labor market, which were slightly worse than expected, although the positive revisions for November improved sentiment. After the publication slightly strengthened the dollar and increased interest rates on bonds. Slightly cheaper was gold, while oil and copper have reacted rather stable. Stock markets around the world rose a little bit. In the US on Friday, the indices S&P500 and Nasdaq set new highs, but with the rather small increases of 0.35% and 0.6% respectively. The DJIA index rose by 0.3%, but the psychological level of 20,000 points has not been defeated. Today in the morning changes in Asia are rather small and peaceful and quotations of futures on the US indices rise slightly.

From the point of view of the Warsaw Stock Exchange it means rather quiet entry into the new week with a continuous looking at the level of 2,000 points.

In the macro calendar today there is no publication which could have a significant impact on the markets. Today begins the resulting season in the US, after the session Alcoa will give their results.

-

07:02

Germany: Current Account , November 24.6

-

07:01

Germany: Trade Balance (non s.a.), bln, November 22.6

-

07:00

Germany: Industrial Production s.a. (MoM), November 0.4% (forecast 0.8%)

-

06:45

Sturgeon reiterates hard Brexit threat of Scottish independence vote - theguardian

-

06:45

Global Stocks

Modest gains on Wall Street pushed the S&P 500 and Nasdaq Composite to record levels, while the Dow closed a fraction below the closely watched 20,000 level, following a December U.S. jobs report that investors interpreted as generally positive. All three benchmarks posted solid weekly gains, continuing the postelection rally on Wall Street. The U.S. economy created 156,000 jobs last month, below the consensus of 180,000 forecast by the economists polled by MarketWatch. However, sharp upward revisions for November jobs number and a slight trimming of October number means the latest payrolls were more or less in line, according to analysts.

Shares in Asia were broadly higher Monday, catching a further uplift from end-of-week gains in the U.S. The advance also follows strength last week in the region, where the Hang Seng saw its biggest weekly gain in three months and the Shanghai Composite SHCOMP, +0.47% snapped a five-week losing streak.

-

06:44

China's foreign exchange reserves continue to decline

As stated Saturday by the People's Bank of China, China's foreign exchange reserves at the end of December amounted to $ 3.011 compared to $ 3.052 Tril. earlier. China's foreign exchange reserves fell the sixth consecutive month in December, amounting to $ 320 billion. This decline was in line with the estimates of economists surveyed by Bloomberg.

-

06:41

Australian construction industry declined for a third consecutive month in December

The national construction industry declined for a third consecutive month in December with the Australian Industry Group/Housing Industry Association Australian Performance of Construction Index (Australian PCI) registering 47.0 points in the month (50 points is the threshold that separates expansion from contraction in the Australian PCI®).

This was an increase of 0.4 points from November, indicating a marginal easing in the industry's rate of contraction during the final month of 2016. All four sectors of the Australian PCI contracted (i.e. below 50 points) in December. House building declined for a fifth consecutive month as activity in the sector moderated further from robust mid-year levels. Apartment building also continued to contract, although the sector's pace of decline was the slowest in three months

-

06:39

Germany's Gabriel says EU break-up no longer unthinkable - Reuters

-

06:10

Options levels on monday, January 9, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0688 (2066)

$1.0668 (583)

$1.0624 (253)

Price at time of writing this review: $1.0522

Support levels (open interest**, contracts):

$1.0467 (1093)

$1.0425 (2392)

$1.0373 (3212)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 51749 contracts, with the maximum number of contracts with strike price $1,1500 (3206);

- Overall open interest on the PUT options with the expiration date March, 13 is 59606 contracts, with the maximum number of contracts with strike price $1,0000 (5261);

- The ratio of PUT/CALL was 1.15 versus 1.13 from the previous trading day according to data from January, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.2511 (577)

$1.2415 (250)

$1.2319 (126)

Price at time of writing this review: $1.2195

Support levels (open interest**, contracts):

$1.2088 (501)

$1.1991 (1470)

$1.1893 (2840

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 15186 contracts, with the maximum number of contracts with strike price $1,2800 (3001);

- Overall open interest on the PUT options with the expiration date March, 13 is 18285 contracts, with the maximum number of contracts with strike price $1,1500 (2979);

- The ratio of PUT/CALL was 1.20 versus 1.17 from the previous trading day according to data from January, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:30

Australia: Building Permits, m/m, November 7.0%

-

00:30

Australia: ANZ Job Advertisements (MoM), December -1.9%

-

00:00

Unemployment in Europe

The euro area (EA19) seasonally-adjusted unemployment rate was 9.8% in November 2016, stable compared to October 2016 and down from 10.5% in November 2015. This is the lowest rate recorded in the euro area since July 2009. The EU28 unemployment rate was 8.3% in November 2016, down from 8.4% in October 2016 and from 9.0% in November 2015. This is the lowest rate recorded in the EU28 since February 2009. These figures are published by Eurostat, the statistical office of the European Union.

Eurostat estimates that 20.429 million men and women in the EU28, of whom 15.898 million were in the euro area, were unemployed in November 2016. Compared with October 2016, the number of persons unemployed decreased by 41 000 in the EU28 and by 15 000 in the euro area. Compared with November 2015, unemployment fell by 1.552 million in the EU28 and by 972 000 in the euro area. -