Market news

-

23:32

Currencies. Daily history for Nov 23’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0553 -0,70%

GBP/USD $1,2437 +0,12%

USD/CHF Chf1,0166 +0,54%

USD/JPY Y112,48 +1,20%

EUR/JPY Y118,69 +0,51%

GBP/JPY Y139,91 +1,34%

AUD/USD $0,7400 0,00%

NZD/USD $0,7003 -0,81%

USD/CAD C$1,3486 +0,35%

-

23:03

Schedule for today,Thursday, Nov 24’2016

00:30 Japan Manufacturing PMI (Preliminary) November 51.4 51.7

05:00 Japan Coincident Index (Finally) September 112 112.1

05:00 Japan Leading Economic Index (Finally) September 100.9 100.5

07:00 Germany GDP (QoQ) (Finally) Quarter III 0.4% 0.2%

07:00 Germany GDP (YoY) (Finally) Quarter III 3.1% 1.7%

09:00 Germany IFO - Current Assessment November 115 115

09:00 Germany IFO - Expectations November 106.1 106

09:00 Germany IFO - Business Climate November 110.5 110.5

09:30 United Kingdom BBA Mortgage Approvals October 38.3 38.8

12:00 Germany Gfk Consumer Confidence Survey December 9.7 9.7

13:00 U.S. Bank holiday

14:00 Belgium Business Climate November -1.8 -1.6

21:45 New Zealand Trade Balance, mln October -1436 -950

23:30 Japan Tokyo Consumer Price Index, y/y November 0.1% -0.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y November -0.4% -0.4%

23:30 Japan National Consumer Price Index, y/y October -0.5% -0.4%

23:30 Japan National CPI Ex-Fresh Food, y/y October -0.5% -0.4%

-

16:05

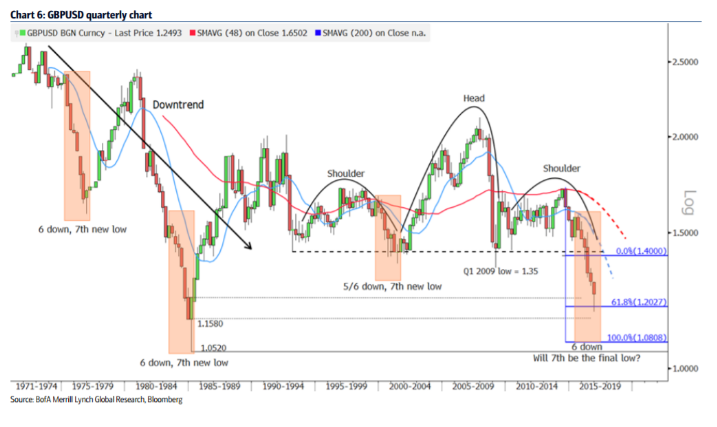

Cable low and bottom will be in 1Q17, if history repeats says BofA Merrill

"If history proves anything, it often repeats or at least rhymes. In the three GBP/USD declines highlighted below there was a six-quarter decline followed by a seventh quarter that marked the low. This occurred in the late 1970s, mid 1980s and in the early 2000s. Refuting a seventh quarter low is the accelerated 2008 decline, which saw 5/6 quarters decline with the sixth (1Q2009) making the final low.

In our view, recent quarterly price action is more similar to the prior highlighted occurrences".

Copyright © 2016 BofAML, eFXnews™

-

15:30

U.S.: Crude Oil Inventories, November -1.255 (forecast 0.671)

-

15:11

The initial reaction of consumers to Trump's victory was to express greater optimism - UoM survey

The initial reaction of consumers to Trump's victory was to express greater optimism about their personal finances as well as improved prospects for the national economy.

The post-election gain in the Sentiment Index was +8.2 points above the November pre-election reading, pushing the Index +6.6 points higher for the entire month above the October reading.

The post-election boost in optimism was widespread, with gains recorded among all income and age subgroups and across all regions of the country. The upsurge in favorable economic prospects is not surprising given Trump's populist policy views, and it was perhaps exaggerated by what most considered a surprising victory as well as by a widespread sense of relief that the election had finally ended.

-

15:10

US new home sales down 1.9% in October

Sales of new single-family houses in October 2016 were at a seasonally adjusted annual rate of 563,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.9 percent (±13.1%)* below the revised September rate of 574,000, but is 17.8 percent (±16.9%) above the October 2015 estimate of 478,000.

The median sales price of new houses sold in October 2016 was $304,500; the average sales price was $354,900. The seasonally adjusted estimate of new houses for sale at the end of October was 246,000. This represents a supply of 5.2 months at the current sales rate.

-

15:00

U.S.: New Home Sales, October 563 (forecast 593)

-

15:00

U.S.: Reuters/Michigan Consumer Sentiment Index, November 93.8 (forecast 91.6)

-

14:56

Acceleration in production growth across the U.S. manufacturing sector - Markit

November data highlighted a sustained acceleration in production growth across the U.S. manufacturing sector, and the latest upturn was the fastest since early-2015. Higher levels of output were supported by a continued rebound in new business volumes, with strong domestic demand helping to offset subdued export sales growth. Manufacturers also reported a moderate rise in staffing numbers and another robust increase in purchasing activity.

At 53.9 in November, up from 53.4 in October, the seasonally adjusted Markit Flash U.S. Manufacturing Purchasing Managers' Index™ (PMI™) 1 signalled a further solid improvement in overall business conditions across the manufacturing sector.

-

14:45

U.S.: Manufacturing PMI, November 53.9 (forecast 53.4)

-

14:11

U.S. house prices rose 1.5 percent in the third quarter

U.S. house prices rose 1.5 percent in the third quarter of 2016 according to the Federal Housing Finance Agency (FHFA) House Price Index (HPI). House prices rose 6.1 percent from the third quarter of 2015 to the third quarter of 2016. FHFA's seasonally adjusted monthly index for September was up 0.6 percent from August. The HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. FHFA has produced a video of highlights for this quarter.

"Our data indicate that the deceleration in home price growth that we observed in late spring proved to be short-lived," said FHFA Supervisory Economist Andrew Leventis. "While price growth in select markets has cooled somewhat, for the U.S. as a whole, the third quarter showed no evidence of a widespread slowdown."

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0575 (EUR 225m) 1.0600 (1.42bln) 1.0650 (2.85bln) 1.0700 (323m) 1.0725 (368m) 1.0750 (856m) 1.0800 (779m) 1.0850 (928m) 1.0900 (1.22bln)

USD/JPY 108.00 (USD 389m) 109.60-65 (552m)

GBP/USD 1.2200 (GBP 239m) 1.2300 (317m) 1.2500 (410m) 1.2650 (223m) 1.2700 (585m)

EUR/GBP 0.8675 (EUR 426m)

EUR/JPY 115.35 (EUR 352m) 118.00 (203m)

AUD/USD 0.7200 (AUD 600m) 0.7260 9249m) 0.7374 (200m) 0.7425 (251m) 0.7600 (357m) 0.7649-59 (313m)

USD/CAD 1.3215-25 (USD 411m) 1.3325 (380m) 1.3350-55 (695m) 1.3400 (861m) 1.3500 (974m)

-

13:37

-

13:36

US initial claims a little higher than expected

In the week ending November 19, the advance figure for seasonally adjusted initial claims was 251,000, an increase of 18,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 235,000 to 233,000. The 4- week moving average was 251,000, a decrease of 2,000 from the previous week's revised average.

The previous week's average was revised down by 500 from 253,500 to 253,000. There were no special factors impacting this week's initial claims. This marks 90 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

13:33

Big rise for US durable goods orders in October

New orders for manufactured durable goods in October increased $11.0 billion or 4.8 percent to $239.4 billion, the U.S. Census Bureau announced today. This increase, up four consecutive months, followed a 0.4 percent September increase. Excluding transportation, new orders increased 1.0 percent. Excluding defense, new orders increased 5.2 percent. Transportation equipment, also up four consecutive months, led the increase, $9.5 billion or 12.0 percent to $88.2 billion.

Inventories of manufactured durable goods in October, up four consecutive months, increased $0.1 billion or virtually unchanged to $383.7 billion. This followed a virtually unchanged September increase.

Nondefense new orders for capital goods in October increased $10.2 billion or 14.5 percent to $80.1 billion. Shipments decreased $0.4 billion or 0.6 percent to $71.5 billion. Unfilled orders increased $8.7 billion or 1.3 percent to $703.1 billion. Inventories decreased $0.6 billion or 0.4 percent to $169.6 billion.

-

13:30

U.S.: Initial Jobless Claims, 251

-

13:30

U.S.: Durable Goods Orders , October 4.8% (forecast 1.5%)

-

13:30

U.S.: Continuing Jobless Claims, 2043

-

13:30

U.S.: Durable goods orders ex defense, October 5.2%

-

13:30

U.S.: Durable Goods Orders ex Transportation , October 1% (forecast 0.2%)

-

13:01

Orders

EUR/USD

Offers : 1.0620 1.0635 1.0650 1.0665 1.0685 1.0700 1.0730 1.0750-60 1.0780 1.0800 1.0825-30 1.0850

Bids : 1.0600 1.0575-80 1.0550 1.0535 1.0520 1.0500

GBP/USD

Offers : 1.2420 1.2450 1.2480-85 1.2500 1.2520 1.2535 1.2550 1.2570 1.2585 1.2600

Bids : 1.2380 1.2360 1 .2340 1.2315-20 1.2300 1.2285 1.2250 1.2200

EUR/GBP

Offers : 0.8580-85 0.8600 0.8630-35 0.8660 0.8680-85 0.8700

Bids : 0.8545-50 0.8520 0.8500 0.8480-85 0.8460-65 0.8450 0.8420 0.8400

EUR/JPY

Offers : 118.20 118.45-50 118.70 119.00 119.50 120.00

Bids : 117.80 117.60 117.30 117.00 116.80 116.50 116.25-30 116.00

USD/JPY

Offers : 111.20 111.30-35 111.50 111.70 111.85 112.00 112.20 112.50

Bids : 110.80 110.65 110.50 110.20 110.00 109.80 109.50 109.00

AUD/USD

Offers : 0.7445-50 0 .7480 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids : 0.7415-20 0.7400 0.7385 0.7355-60 0.7325-30 0.7300 0.7285 0.7250

-

12:51

UK Hammond: Economy Has Shown "Strength And Resilience" Since Brexit Vote. Autumn statement:

-

Govt Debt As Share Of Economic Output Must Be Falling By 2020

-

Cyclically Adjusted Borrowing Below 2% of GDP by 2020

-

Aim To Close Budget Deficit As Soon As Possible, But Not By 2020

-

Credible Fiscal Policy Essential For Maintaining Market Confidence

-

Potential Growth 2.4 Percentage Points Lower As Result of Brexit

-

2018 Economic Growth Forecast Cut To 1.7% From 2.1%

-

2017 Economic Growth Forecast Cut To 1.4% From 2.2%

-

2016 Economic Growth Forecast Rised To 2.1 From 2.0%

-

Will Maintain Commitment to Fiscal Discipline, But Recognise Need for Investment

-

More Urgent Than Ever To Tackle Long-Term Weaknesses

-

-

10:42

Germany's 10-Year Borrowing Cost Highest Since March Auction

-

10:40

Hungary seen loosening monetary conditions even more - Raiffeisen

Raiffeisen Bank expects Hungary's central bank to keep loosening monetary conditions, until EUR/HUF returns steadily above 310. Loosening would come in the form of squeezing out banks' money from central bank facilities, forex swap tenders, cuts to the mandatory reserve ratio and the overnight deposit rate, Raiffeisen adds.

-

09:06

Fastest pace of economic growth in the eurozone this year. EUR/USD unchanged so far

The pace of economic growth in the eurozone accelerated to the fastest so far this year in November. Rising order books meanwhile prompted firms to take on extra staff at the jointfastest rate since early-2008, and prices charged inched higher, indicating that inflationary pressures are at their highest for over five years.

The preliminary 'flash' Markit Eurozone PMI, based on approximately 85% of final survey replies, rose to 54.1, up from 53.3 in October. The latest reading signalled the strongest monthly increase in output since last December.

Identical rates of expansion were seen across both the manufacturing and service sectors, with the latter seeing the best expansion for 11 months. Although manufacturing output growth eased slightly, the rise was still the second-largest in 2016 so far, markit says.

-

09:00

Eurozone: Manufacturing PMI, November 53.7 (forecast 53.3)

-

09:00

Eurozone: Services PMI, November 54.1 (forecast 53)

-

08:43

German composite PMI little changed in November

German private sector companies reported ongoing output growth in November. The Markit Flash Germany Composite Output Index posted 54.9, little-changed from October's ten-month high of 55.1 and above the average this year so far (54.2). While service providers recorded an acceleration in activity growth, manufacturers noted a slight slowdown.

The overall expansion in output was attributed by panellists to improved order intakes and increased capacity. November data highlighted a further solid rise in new business placed with German private sector firms. Despite slowing slightly since the previous month, the rate of increase remained robust.

A number of companies commented on new clients, while survey data also suggested that part of the expansion was driven by solid demand from foreign markets. Indeed, manufacturers signalled a sharp rise in new export orders during the month.

-

08:40

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0575 (EUR 225m) 1.0600 (1.42bln) 1.0650 (2.85bln) 1.0700 (323m) 1.0725 (368m) 1.0750 (856m) 1.0800 (779m) 1.0850 (928m) 1.0900 (1.22bln)

USD/JPY 108.00 (USD 389m) 109.60-65 (552m)

GBP/USD 1.2200 (GBP 239m) 1.2300 (317m) 1.2500 (410m) 1.2650 (223m) 1.2700 (585m)

EUR/GBP 0.8675 (EUR 426m)

EUR/JPY 115.35 (EUR 352m) 118.00 (203m)

AUD/USD 0.7200 (AUD 600m) 0.7260 9249m) 0.7374 (200m) 0.7425 (251m) 0.7600 (357m) 0.7649-59 (313m)

USD/CAD 1.3215-25 (USD 411m) 1.3325 (380m) 1.3350-55 (695m) 1.3400 (861m) 1.3500 (974m)

-

08:30

Germany: Services PMI, November 55 (forecast 54)

-

08:30

Germany: Manufacturing PMI, November 54.4 (forecast 54.8)

-

08:06

French services activity rises for the fifth month in a row - Markit

November's flash France PMI data indicated private sector output rose at a fractionally quicker rate, led by stronger growth in the service sector as manufacturers raised production at a weaker pace than the previous month.

The Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, registered 52.3, compared to October's reading of 51.6. The latest reading pointed to a further solid rate of growth.

Underlying the expansion was a further rise in service sector activity, the fifth in as many months. Moreover, the rate of increase accelerated from October to a solid pace. Manufacturing output rose for the third consecutive month, although the rate of growth eased from October and was marginal.

-

08:00

France: Manufacturing PMI, November 51.5 (forecast 51.4)

-

08:00

France: Services PMI, November 52.6 (forecast 51.9)

-

07:37

Options levels on wednesday, November 23, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0839 (3361)

$1.0772 (1080)

$1.0722 (791)

Price at time of writing this review: $1.0637

Support levels (open interest**, contracts):

$1.0562 (3552)

$1.0512 (3805)

$1.0447 (4773)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 75043 contracts, with the maximum number of contracts with strike price $1,1200 (6196);

- Overall open interest on the PUT options with the expiration date December, 9 is 64124 contracts, with the maximum number of contracts with strike price $1,0500 (4773);

- The ratio of PUT/CALL was 0.85 versus 0.90 from the previous trading day according to data from November, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (1850)

$1.2604 (1579)

$1.2507 (1839)

Price at time of writing this review: $1.2413

Support levels (open interest**, contracts):

$1.2294 (3906)

$1.2196 (1098)

$1.2098 (1111)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 34990 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 36668 contracts, with the maximum number of contracts with strike price $1,2300 (3931);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from November, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:15

TD thinks that negative shocks are priced in on GBP/USD. Autumn statement

"Market participants will also keep a close eye on this week's release of the Autumn Statement in the UK.

This sets out the government's fiscal agenda. The market is expecting modest proposals, probably combining a mix of growth-enhancing infrastructure spending and wider deficits. The latter reflects weaker growth and enhanced spending, but TD expects a somewhat conservative budget.

Namely, our take is that the government offers modest stimulus that merely lessens the degree of austerity built into prior forecasts. We suspect this is unlikely to lead to the full handover from monetary to fiscal, so the net result is that longer-term GBP will continue to bear the brunt of the economic adjustment.

Even so, near-term, GBP currently reflects much of the negative in the price (and with market positioning overextended) GBP could consolidate on the release".

Copyright © 2016 TD Securities, eFXnews™

-

07:11

Today’s events

-

At 10:30 GMT Germany will hold an auctin of 10-year bonds

-

At 11:30 GMT the Bank of England Kristin Forbes will make a speech

-

At 12:30 GMT UK Treasury will publish the autumn forecast

-

-

07:09

Moody's says Australian corporate sector for 2017 "stable"

Analysts pointed out that most companies show a solid balance sheets and sufficient liquidity. The corporations does not need refinance and its observed a slight increase in revenue. Moody's forecasts for Aussie GDP growth in 2017 is 3.0%.

-

07:01

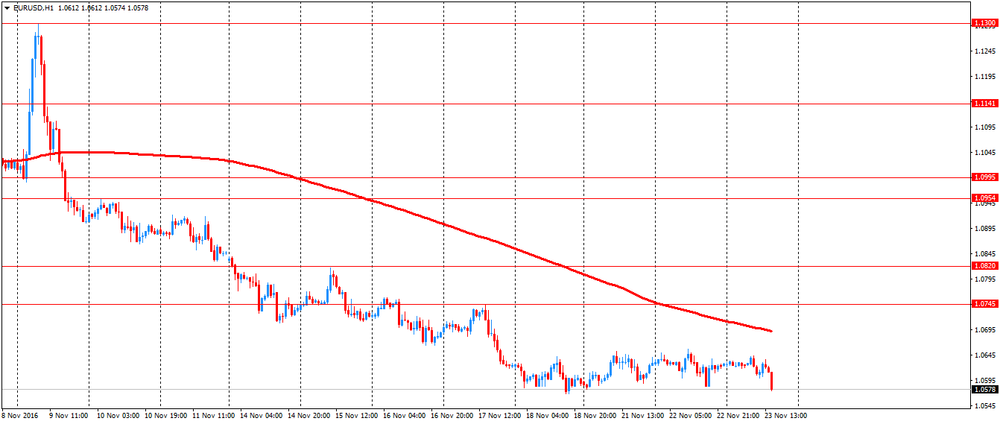

EUR/USD Targets 1.066 and 1.071 So Long as 1.0565 Holds

-

07:00

RBA, Chris Kent: Australia has a sustainable economic growth and real development prospects

A speech by RBA Assistant Gov. Christopher Kent late Tuesday, titled "Australia's Economic Transition - State by State," gave the Australian dollar a lift, said Elias Haddad, senior currency strategist at the Commonwealth Bank of Australia.

Mr. Kent reiterated the RBA's view that about 80% of a decline in Australian mining investment has been completed and the terms of trade "will shift from substantial headwind of recent years to a slight tail breeze" for the economy, Mr. Haddad added.

-

06:57

The number of construction projects handed over in Australia declined in the third quarter

Construction work done fell by -4.9% in the third quarter, while analysts expected a decline to -1.7%. The value of the second quarter was revised from -3.7% to -3.1%.

Published by the Australian Bureau of Statistics the data reflect the number of completed construction works for the previous month. This is a key indicator in the construction sector of Australia.

-

00:31

Australia: Construction Work Done, Quarter III -4.9% (forecast -1.7%)

-