Market news

-

23:37

Commodities. Daily history for Nov 23’2016:

(raw materials / closing price /% change)

Oil 47.94-0.04%

Gold 1,187.80-0.13%

-

23:37

Stocks. Daily history for Nov 23’2016:

(index / closing price / change items /% change)

Shanghai Composite 3,241.47 -6.88 -0.21%

S&P/ASX 200 5,484.36 0.00 0.00%

FTSE 100 6,817.71 -2.01 -0.03%

CAC 40 4,529.21 -19.14 -0.42%

Xetra DAX 10,662.44 -51.41 -0.48%

S&P 500 2,204.72 +1.78 +0.08%

Dow Jones Industrial Average 19,083.18 +59.31 +0.31%

S&P/TSX Composite 15,080.91 -19.47 -0.13%

-

23:32

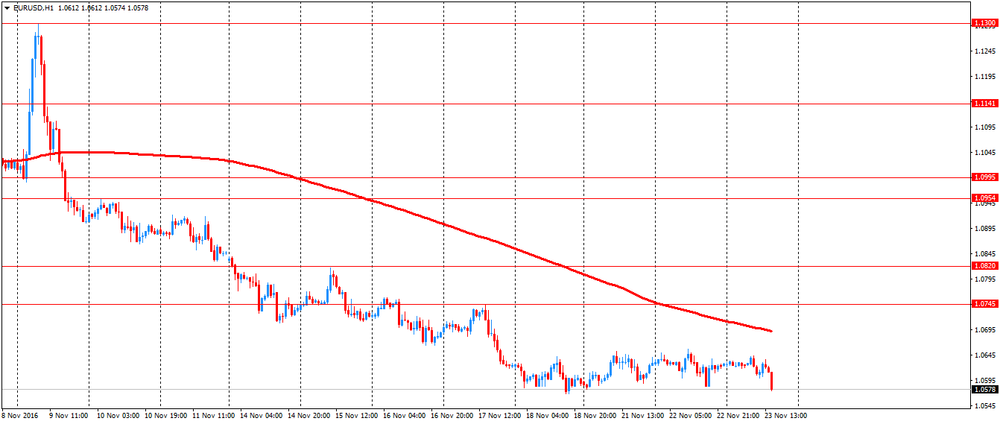

Currencies. Daily history for Nov 23’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0553 -0,70%

GBP/USD $1,2437 +0,12%

USD/CHF Chf1,0166 +0,54%

USD/JPY Y112,48 +1,20%

EUR/JPY Y118,69 +0,51%

GBP/JPY Y139,91 +1,34%

AUD/USD $0,7400 0,00%

NZD/USD $0,7003 -0,81%

USD/CAD C$1,3486 +0,35%

-

23:03

Schedule for today,Thursday, Nov 24’2016

00:30 Japan Manufacturing PMI (Preliminary) November 51.4 51.7

05:00 Japan Coincident Index (Finally) September 112 112.1

05:00 Japan Leading Economic Index (Finally) September 100.9 100.5

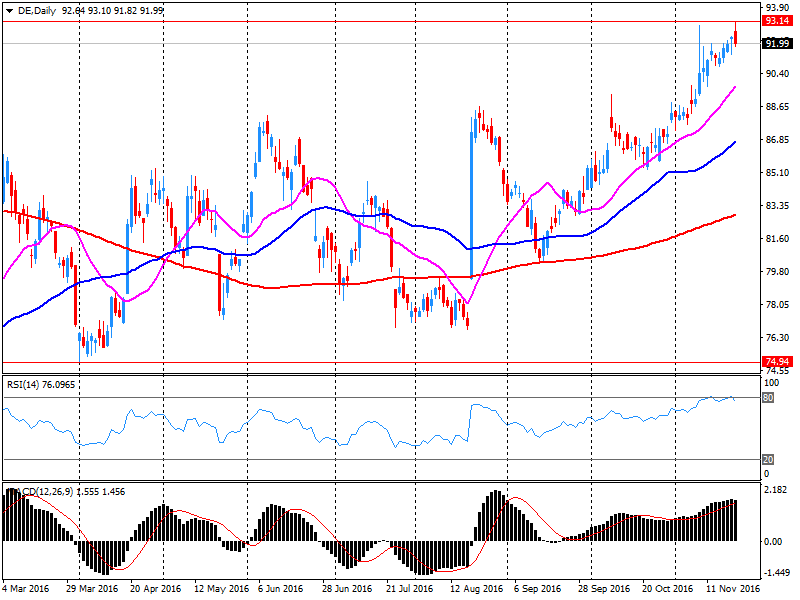

07:00 Germany GDP (QoQ) (Finally) Quarter III 0.4% 0.2%

07:00 Germany GDP (YoY) (Finally) Quarter III 3.1% 1.7%

09:00 Germany IFO - Current Assessment November 115 115

09:00 Germany IFO - Expectations November 106.1 106

09:00 Germany IFO - Business Climate November 110.5 110.5

09:30 United Kingdom BBA Mortgage Approvals October 38.3 38.8

12:00 Germany Gfk Consumer Confidence Survey December 9.7 9.7

13:00 U.S. Bank holiday

14:00 Belgium Business Climate November -1.8 -1.6

21:45 New Zealand Trade Balance, mln October -1436 -950

23:30 Japan Tokyo Consumer Price Index, y/y November 0.1% -0.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y November -0.4% -0.4%

23:30 Japan National Consumer Price Index, y/y October -0.5% -0.4%

23:30 Japan National CPI Ex-Fresh Food, y/y October -0.5% -0.4%

-

21:07

Major US stock indices showed mixed trends

Major US stock indexes finished trading mixed, but only with a slight change. The Dow Jones newly updated records, while the drop in shares of technology giants kept the Nasdaq in negative territory.

As it became known today, new orders for capital goods produced in the United States rebounded in October, due to the growth in demand for machinery and a number of other equipment, is the latest sign of the acceleration in economic growth at the beginning of the 4th quarter. The Commerce Department reported that non-defense capital goods orders excluding aircraft, planned indicator of business spending, rose 0.4% after it decreased by 1.4% in September.

In addition, the number of Americans who applied for unemployment benefits rose to a 43-year low last week, but remain below the level that is consistent with the tightening of the labor market. Primary applications for state unemployment benefits increased by 18,000 and reached a seasonally adjusted 251,000 for the week ending November 19, the Labor Department reported Wednesday.

However, the final results of the studies submitted by Thomson-Reuters and Institute of Michigan, showed that in November US consumers felt more optimistic about the economy than last month. According to the data, in November consumer sentiment index rose to 93.8 points compared with a final reading of 87.2 points in October and November preliminary value of 91.6 points. It was predicted that the index was 91.6.

It should also be noted that sales of new single-family homes unexpectedly fell up to October. However, experts believe that this is a temporary phenomenon for the new housing market, taking into account the ongoing improvement in the labor market. The US Commerce Department said, the seasonally adjusted new home sales fell in October by 1.9%, reaching 563.000 units (in terms of annual growth). The pace of sales for September were revised to 574,000 units from 593,000 units. It was expected that sales of single-family homes, which accounted for about 9.1% of total sales of property, amount to 593,000 units.

Oil recovered earlier lost ground, and went back to the opening level, helped by data from the US Department of Energy and the statements of the Minister of Oil of Iraq. US Department of Energy reported that crude oil inventories declined moderately by the end of last week, despite the expected increase. According to the data, during the week from 12 to 18 November crude oil inventories fell to 1.255 million. Barrels to 489.029 million. Barrels. Analysts on average had forecast growth stocks at 0.671 million. Barrels.

DOW index components closed mostly in positive territory (19 of 30). Most remaining shares rose Caterpillar Inc. (CAT, + 2.77%). Outsider were shares of Microsoft Corporation (MSFT, -1.28%).

Sector S & P index closed trading mixed. The leader turned out to be the industrial goods sector (+ 0.8%). Most utilities sector fell (-0.9%).

At the close:

Dow + 0.31% 19,082.36 +58.49

Nasdaq -0.11% 5,380.68 -5.67

S & P + 0.08% 2,204.63 +1.69

-

20:01

DJIA +0.19% 19,060.37 +36.50 Nasdaq -0.37% 5,366.48 -19.87 S&P -0.07% 2,201.31 -1.63

-

18:11

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed. The Dow hit an all-time high for the third straight day on Wednesday, helped by a record-setting surge in industrial stocks, but a drop in technology heavyweights kept the S&P 500 and the Nasdaq in negative territory.

Most of Dow stocks in positive area (18 of 30). Top gainer - Caterpillar Inc. (CAT, +2.48%). Top loser - Microsoft Corporation (MSFT, -1.24%).

Most S&P sectors in negative area. Top gainer - Industrial goods (+0.6%). Top loser - Utilities (-0.6%).

At the moment:

Dow 19031.00 +36.00 +0.19%

S&P 500 2199.25 -1.00 -0.05%

Nasdaq 100 4844.25 -30.50 -0.63%

Oil 48.14 +0.11 +0.23%

Gold 1190.50 -20.70 -1.71%

U.S. 10yr 2.36 +0.04

-

17:00

European stocks closed: FTSE 100 -2.01 6817.71 -0.03% DAX -51.41 10662.44 -0.48% CAC 40 -19.14 4529.21 -0.42%

-

16:47

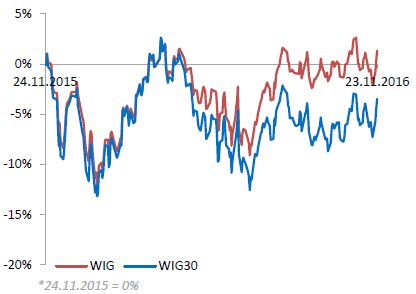

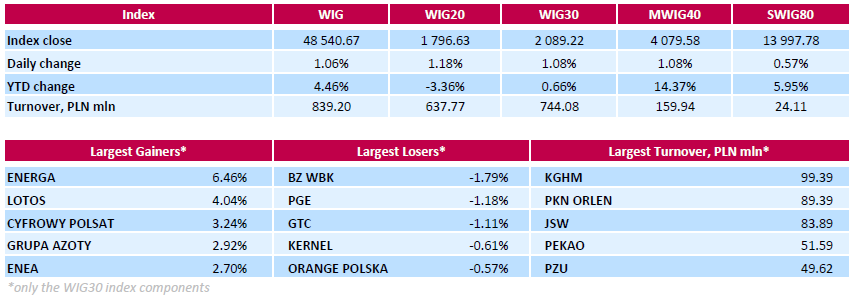

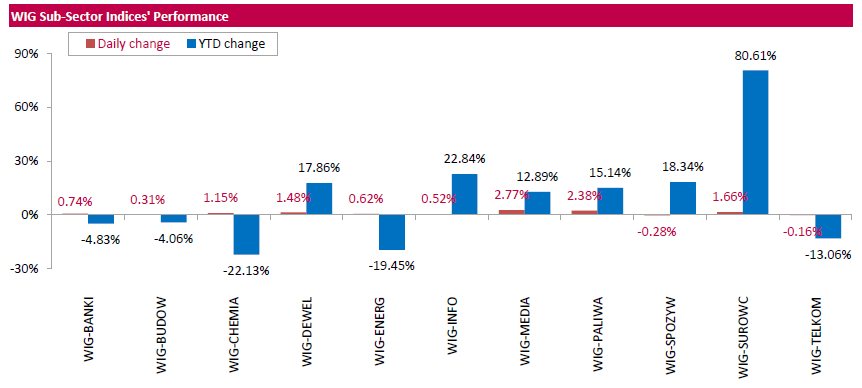

WSE: Session Results

Polish equity market closed higher on Wednesday. The broad market measure, the WIG index, surged by 1.06%. Sector performance within the WIG was mainly positive as nine sectors recorded advances, with media (+2.77%) outpacing.

The large-cap stocks' measure, the WIG30 Index, rose by 1.08%. In the index basket, genco ENERGA (WSE: ENG) posted the strongest advance, up 6.46%. The company stated it is in talks with the European Investment Bank (EIC) on a EUR 250 mln issue of hybrid bonds in order to finance distribution and generation investments. The deal with EIB is expected to be struck near the end of first quarter of 2017. Other major outperformers were media group CYFROWY POLSAT (WSE: CPS), chemical producer GRUPA AZOTY (WSE: ATT), genco ENEA (WS: ENA) and two oil refiners LOTOS (WSE: LTS) and PKN ORLEN (WSE: PKN), which added between 2.69% and 4.04%. On the other side of the ledger, bank BZ WBK (WSE: BZW) and genco PGE (WSE: PGE) led a handful of losers, dropping by 1.79% and 1.18% respectively.

-

16:05

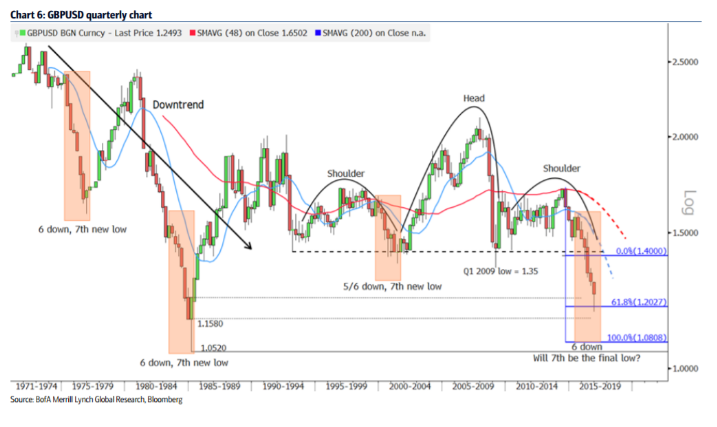

Cable low and bottom will be in 1Q17, if history repeats says BofA Merrill

"If history proves anything, it often repeats or at least rhymes. In the three GBP/USD declines highlighted below there was a six-quarter decline followed by a seventh quarter that marked the low. This occurred in the late 1970s, mid 1980s and in the early 2000s. Refuting a seventh quarter low is the accelerated 2008 decline, which saw 5/6 quarters decline with the sixth (1Q2009) making the final low.

In our view, recent quarterly price action is more similar to the prior highlighted occurrences".

Copyright © 2016 BofAML, eFXnews™

-

15:38

Bigger than expected decline for US crude oil inventories

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.3 million barrels from the previous week. At 489.0 million barrels, U.S. crude oil inventories are at the upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 2.3 million barrels last week, and are well above the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories increased by 0.3 million barrels last week and are well above the upper limit of the average range for this time of year. Propane/propylene inventories rose 1.8 million barrels last week and are near the upper limit of the average range. Total commercial petroleum inventories decreased by 0.1 million barrels last week.

-

15:30

U.S.: Crude Oil Inventories, November -1.255 (forecast 0.671)

-

15:11

The initial reaction of consumers to Trump's victory was to express greater optimism - UoM survey

The initial reaction of consumers to Trump's victory was to express greater optimism about their personal finances as well as improved prospects for the national economy.

The post-election gain in the Sentiment Index was +8.2 points above the November pre-election reading, pushing the Index +6.6 points higher for the entire month above the October reading.

The post-election boost in optimism was widespread, with gains recorded among all income and age subgroups and across all regions of the country. The upsurge in favorable economic prospects is not surprising given Trump's populist policy views, and it was perhaps exaggerated by what most considered a surprising victory as well as by a widespread sense of relief that the election had finally ended.

-

15:10

US new home sales down 1.9% in October

Sales of new single-family houses in October 2016 were at a seasonally adjusted annual rate of 563,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.9 percent (±13.1%)* below the revised September rate of 574,000, but is 17.8 percent (±16.9%) above the October 2015 estimate of 478,000.

The median sales price of new houses sold in October 2016 was $304,500; the average sales price was $354,900. The seasonally adjusted estimate of new houses for sale at the end of October was 246,000. This represents a supply of 5.2 months at the current sales rate.

-

15:00

U.S.: New Home Sales, October 563 (forecast 593)

-

15:00

U.S.: Reuters/Michigan Consumer Sentiment Index, November 93.8 (forecast 91.6)

-

14:56

Acceleration in production growth across the U.S. manufacturing sector - Markit

November data highlighted a sustained acceleration in production growth across the U.S. manufacturing sector, and the latest upturn was the fastest since early-2015. Higher levels of output were supported by a continued rebound in new business volumes, with strong domestic demand helping to offset subdued export sales growth. Manufacturers also reported a moderate rise in staffing numbers and another robust increase in purchasing activity.

At 53.9 in November, up from 53.4 in October, the seasonally adjusted Markit Flash U.S. Manufacturing Purchasing Managers' Index™ (PMI™) 1 signalled a further solid improvement in overall business conditions across the manufacturing sector.

-

14:53

WSE: After start on Wall Street

The afternoon reading of data from the US economy surprised positively. The preliminary reading of durable goods orders - an increase of 1 percent - without transportation - can be considered as the good result.

The data on the number of new unemployed surprise at minus, but is mitigated by the fact that the report appears after strong data from the previous week. Data improve the situation of the dollar and the same spoil the situations of our national currency.

The EURUSD pair drops of 0.7 percent, which responses with increase of USDPLN pair by 1.1 percent. The zloty also weakened against the euro - the EURPLN pair is rising by 0.3 percent.

At the opening of trading on Wall Street, the S&P500 index has returned above the level of 2,200 points, although currently we can see slight declines in the US stock indices.

In the Warsaw market the withdrawal of the WIG20 has stopped at the level from the session opening and in Europe is visible attempt to rebuild after finding a local bottom. Our market still underlines visible from the beginning of the week relative strength against the major European parquet.

An hour before the close of trading in Warsaw the WIG20 index was at the level of 1,781 points (+0,35%).

-

14:45

U.S.: Manufacturing PMI, November 53.9 (forecast 53.4)

-

14:35

U.S. Stocks open: Dow +0.04%, Nasdaq -0.48%, S&P -0.26%

-

14:30

Before the bell: S&P futures -0.17%, NASDAQ futures -0.27%

U.S. stock-index futures fell, as expectations the Fed would rise rates grew following some upbeat data on durable goods orders.

Global Stocks:

Nikkei Closed

Hang Seng 22,676.69 -1.38 -0.01%

Shanghai 3,241.47 -6.88 -0.21%

FTSE 6,801.91 -17.81 -0.26%

CAC 4,523.88 -24.47 -0.54%

DAX 10,643.10 -70.75 -0.66%

Crude $47.57 (-0.96%)

Gold $1,193.90(-1.43%)

-

14:13

-

14:11

U.S. house prices rose 1.5 percent in the third quarter

U.S. house prices rose 1.5 percent in the third quarter of 2016 according to the Federal Housing Finance Agency (FHFA) House Price Index (HPI). House prices rose 6.1 percent from the third quarter of 2015 to the third quarter of 2016. FHFA's seasonally adjusted monthly index for September was up 0.6 percent from August. The HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. FHFA has produced a video of highlights for this quarter.

"Our data indicate that the deceleration in home price growth that we observed in late spring proved to be short-lived," said FHFA Supervisory Economist Andrew Leventis. "While price growth in select markets has cooled somewhat, for the U.S. as a whole, the third quarter showed no evidence of a widespread slowdown."

-

14:08

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

172.31

0.40(0.2327%)

1000

ALCOA INC.

AA

31

-0.34(-1.0849%)

3493

Amazon.com Inc., NASDAQ

AMZN

781.75

-3.58(-0.4559%)

15651

Apple Inc.

AAPL

111.5

-0.30(-0.2683%)

45963

Barrick Gold Corporation, NYSE

ABX

14.69

-0.66(-4.2997%)

157527

Boeing Co

BA

149.14

-0.38(-0.2541%)

1507

Caterpillar Inc

CAT

94.9

1.28(1.3672%)

28687

Citigroup Inc., NYSE

C

56.33

0.23(0.41%)

28410

Deere & Company, NYSE

DE

101.25

9.24(10.0424%)

744598

Exxon Mobil Corp

XOM

86.31

-0.37(-0.4269%)

3940

Facebook, Inc.

FB

121.27

-0.20(-0.1647%)

58742

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.82

-0.30(-1.9841%)

220077

General Electric Co

GE

31.17

-0.01(-0.0321%)

21407

General Motors Company, NYSE

GM

33.75

-0.06(-0.1775%)

472

Goldman Sachs

GS

211.4

0.29(0.1374%)

5561

Google Inc.

GOOG

765

-3.27(-0.4256%)

1876

Hewlett-Packard Co.

HPQ

15.24

-0.71(-4.4514%)

19855

Intel Corp

INTC

35.46

-0.02(-0.0564%)

2936

International Business Machines Co...

IBM

162.3

-0.37(-0.2275%)

1389

Johnson & Johnson

JNJ

112.2

-0.54(-0.479%)

7381

JPMorgan Chase and Co

JPM

78.63

0.10(0.1273%)

5710

McDonald's Corp

MCD

119.68

-0.01(-0.0084%)

135

Merck & Co Inc

MRK

60

-1.70(-2.7553%)

100944

Microsoft Corp

MSFT

61.05

-0.07(-0.1145%)

7920

Pfizer Inc

PFE

31.13

-0.20(-0.6384%)

10610

Procter & Gamble Co

PG

82.77

0.01(0.0121%)

1041

Starbucks Corporation, NASDAQ

SBUX

56.7

-0.42(-0.7353%)

1742

Tesla Motors, Inc., NASDAQ

TSLA

190.8

-0.37(-0.1935%)

17882

The Coca-Cola Co

KO

41.25

-0.12(-0.2901%)

7300

Twitter, Inc., NYSE

TWTR

18.49

-0.14(-0.7515%)

150673

Wal-Mart Stores Inc

WMT

70.38

0.26(0.3708%)

600

Walt Disney Co

DIS

97.75

0.04(0.0409%)

1967

Yahoo! Inc., NASDAQ

YHOO

40.99

-0.02(-0.0488%)

508

Yandex N.V., NASDAQ

YNDX

18.63

-0.32(-1.6887%)

4100

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0575 (EUR 225m) 1.0600 (1.42bln) 1.0650 (2.85bln) 1.0700 (323m) 1.0725 (368m) 1.0750 (856m) 1.0800 (779m) 1.0850 (928m) 1.0900 (1.22bln)

USD/JPY 108.00 (USD 389m) 109.60-65 (552m)

GBP/USD 1.2200 (GBP 239m) 1.2300 (317m) 1.2500 (410m) 1.2650 (223m) 1.2700 (585m)

EUR/GBP 0.8675 (EUR 426m)

EUR/JPY 115.35 (EUR 352m) 118.00 (203m)

AUD/USD 0.7200 (AUD 600m) 0.7260 9249m) 0.7374 (200m) 0.7425 (251m) 0.7600 (357m) 0.7649-59 (313m)

USD/CAD 1.3215-25 (USD 411m) 1.3325 (380m) 1.3350-55 (695m) 1.3400 (861m) 1.3500 (974m)

-

13:44

Upgrades and downgrades before the market open

Upgrades:

Volkswagen AG (VOW3) upgraded to Buy from Sell at Goldman

Downgrades:

Twitter (TWTR) downgraded to Negative from Mixed at OTR Global

Other:

-

13:37

-

13:36

US initial claims a little higher than expected

In the week ending November 19, the advance figure for seasonally adjusted initial claims was 251,000, an increase of 18,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 235,000 to 233,000. The 4- week moving average was 251,000, a decrease of 2,000 from the previous week's revised average.

The previous week's average was revised down by 500 from 253,500 to 253,000. There were no special factors impacting this week's initial claims. This marks 90 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

13:35

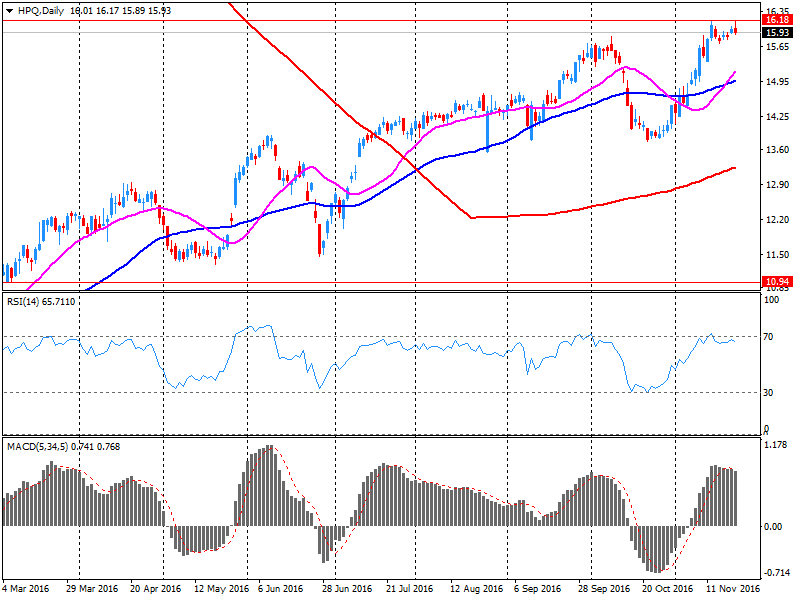

Company News: HP (HPQ) posts Q4 earnings in line with analysts' estimate

HP Inc. reported Q4 FY 2016 earnings of $0.36 per share (versus $0.93 in Q4 FY 2015), in-line with analysts' consensus estimate of $0.36.

The company's quarterly revenues amounted to $12.512 bln (+5.2% y/y), beating analysts' consensus estimate of $11.880 bln.

The company issued downside guidance for Q1 FY 2017, projecting EPS of $0.35-0.38 versus analysts' consensus estimate of $0.38.

HP reaffirmed guidance for FY 2017, forecasting EPS of $1.55-1.65 versus analysts' consensus estimate of $1.60.

HPQ fell to $15.69 (-1.63%) in pre-market trading.

-

13:33

Big rise for US durable goods orders in October

New orders for manufactured durable goods in October increased $11.0 billion or 4.8 percent to $239.4 billion, the U.S. Census Bureau announced today. This increase, up four consecutive months, followed a 0.4 percent September increase. Excluding transportation, new orders increased 1.0 percent. Excluding defense, new orders increased 5.2 percent. Transportation equipment, also up four consecutive months, led the increase, $9.5 billion or 12.0 percent to $88.2 billion.

Inventories of manufactured durable goods in October, up four consecutive months, increased $0.1 billion or virtually unchanged to $383.7 billion. This followed a virtually unchanged September increase.

Nondefense new orders for capital goods in October increased $10.2 billion or 14.5 percent to $80.1 billion. Shipments decreased $0.4 billion or 0.6 percent to $71.5 billion. Unfilled orders increased $8.7 billion or 1.3 percent to $703.1 billion. Inventories decreased $0.6 billion or 0.4 percent to $169.6 billion.

-

13:30

U.S.: Initial Jobless Claims, 251

-

13:30

U.S.: Durable Goods Orders , October 4.8% (forecast 1.5%)

-

13:30

U.S.: Continuing Jobless Claims, 2043

-

13:30

U.S.: Durable goods orders ex defense, October 5.2%

-

13:30

U.S.: Durable Goods Orders ex Transportation , October 1% (forecast 0.2%)

-

13:18

Company News: Deere (DE) quarterly results beat analysts’ expectations

Deere reported Q4 FY 2016 earnings of $0.90 per share (versus $1.08 in Q4 FY 2015), beating analysts' consensus estimate of $0.39.

The company's quarterly revenues amounted to $5.650 bln (-4.8% y/y), beating analysts' consensus estimate of $5.363 bln.

DE rose to $102.55 (+11.46%) in pre-market trading.

-

13:01

Orders

EUR/USD

Offers : 1.0620 1.0635 1.0650 1.0665 1.0685 1.0700 1.0730 1.0750-60 1.0780 1.0800 1.0825-30 1.0850

Bids : 1.0600 1.0575-80 1.0550 1.0535 1.0520 1.0500

GBP/USD

Offers : 1.2420 1.2450 1.2480-85 1.2500 1.2520 1.2535 1.2550 1.2570 1.2585 1.2600

Bids : 1.2380 1.2360 1 .2340 1.2315-20 1.2300 1.2285 1.2250 1.2200

EUR/GBP

Offers : 0.8580-85 0.8600 0.8630-35 0.8660 0.8680-85 0.8700

Bids : 0.8545-50 0.8520 0.8500 0.8480-85 0.8460-65 0.8450 0.8420 0.8400

EUR/JPY

Offers : 118.20 118.45-50 118.70 119.00 119.50 120.00

Bids : 117.80 117.60 117.30 117.00 116.80 116.50 116.25-30 116.00

USD/JPY

Offers : 111.20 111.30-35 111.50 111.70 111.85 112.00 112.20 112.50

Bids : 110.80 110.65 110.50 110.20 110.00 109.80 109.50 109.00

AUD/USD

Offers : 0.7445-50 0 .7480 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids : 0.7415-20 0.7400 0.7385 0.7355-60 0.7325-30 0.7300 0.7285 0.7250

-

12:51

UK Hammond: Economy Has Shown "Strength And Resilience" Since Brexit Vote. Autumn statement:

-

Govt Debt As Share Of Economic Output Must Be Falling By 2020

-

Cyclically Adjusted Borrowing Below 2% of GDP by 2020

-

Aim To Close Budget Deficit As Soon As Possible, But Not By 2020

-

Credible Fiscal Policy Essential For Maintaining Market Confidence

-

Potential Growth 2.4 Percentage Points Lower As Result of Brexit

-

2018 Economic Growth Forecast Cut To 1.7% From 2.1%

-

2017 Economic Growth Forecast Cut To 1.4% From 2.2%

-

2016 Economic Growth Forecast Rised To 2.1 From 2.0%

-

Will Maintain Commitment to Fiscal Discipline, But Recognise Need for Investment

-

More Urgent Than Ever To Tackle Long-Term Weaknesses

-

-

12:05

WSE: Mid session comment

Morning, preliminary readings of PMI indices did not arouse strong emotions. Industry data from Germany and France were slightly worse than expected, but the service sector showed better-than-expected level. The reading for the whole euro zone was better than expected in the case of industry and services. The data are calm in pronunciation and will quickly be forgotten.

In the first half of the trading, wave of supply in the major European markets brought the indices DAX and CAC40 to new session lows and declines exceeded 0.7 percent. Poorly behaves also contract on the S&P500, what may warn of a potential correction that may occur on Wall Street after the recent successes of the bulls.

Our market is still relatively stronger and remains over the line with a turnover approaching the level of PLN 400 million (the WIG index). This is a clear plus for the bulls, which may have a positive effect when European parquets will reach the bottom of the session and will start the process of rebuilding.

At the halfway point of today's trading the WIG20 index stood at the level of 1,779 points (+ 0,20%).

-

11:39

Major stock indices in Europe trading mixed

Stock indices in Western Europe show a mixed trend as investors assess the statistical data from the euro zone and are waiting for US economic data.

Euro zone services PMI rose from 53.2 points to 54.1 points - the highest since December 2015, according to preliminary data of Markit Economics.

"Preliminary estimates indicate that November will see the best monthly growth of business activity in the current year, - said a Chris Williamson - IHS Markit.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0.39% - to 339.69 points.

The value of mining companies continued following raw material prices; capitalization of BHP Billiton and Fresnillo rose more than 2.5%.

However, the share prices of European banks fall on Wednesday, while Barclays lost 0.4% of market value, Credit Suisse - 0,9%, BNP Paribas - 0,5%.

Shares of Italian banks were among the outsiders in the run-up to the constitutional referendum. UniCredit Securities lost more than 3%, while shares of Banco Popolare di Milano fell by 5%.

Daimler shares fell 0.8% after reports that one of the leaders of the automaker was fired after being accused of insulting the Chinese people.

At the moment:

FTSE 6848.11 28.39 0.42%

DAX 10648.38 -65.47 -0.61%

CAC 4521.76 -26.59 -0.58%

-

10:42

Germany's 10-Year Borrowing Cost Highest Since March Auction

-

10:40

Hungary seen loosening monetary conditions even more - Raiffeisen

Raiffeisen Bank expects Hungary's central bank to keep loosening monetary conditions, until EUR/HUF returns steadily above 310. Loosening would come in the form of squeezing out banks' money from central bank facilities, forex swap tenders, cuts to the mandatory reserve ratio and the overnight deposit rate, Raiffeisen adds.

-

09:28

Oil is trading flat

This morning, New York crude oil futures for Brent and WTI traded almost flat as traders expect new informations on the production cut from the OPEC meeting. However, analysts warned that the failure of this initiative will lead to an increase in the oversupply in early 2017. At present, there are discusions between cartel members and Russia to agree on a coordinated restriction of production to support the market, balancing supply and demand.

-

09:06

Fastest pace of economic growth in the eurozone this year. EUR/USD unchanged so far

The pace of economic growth in the eurozone accelerated to the fastest so far this year in November. Rising order books meanwhile prompted firms to take on extra staff at the jointfastest rate since early-2008, and prices charged inched higher, indicating that inflationary pressures are at their highest for over five years.

The preliminary 'flash' Markit Eurozone PMI, based on approximately 85% of final survey replies, rose to 54.1, up from 53.3 in October. The latest reading signalled the strongest monthly increase in output since last December.

Identical rates of expansion were seen across both the manufacturing and service sectors, with the latter seeing the best expansion for 11 months. Although manufacturing output growth eased slightly, the rise was still the second-largest in 2016 so far, markit says.

-

09:00

Eurozone: Manufacturing PMI, November 53.7 (forecast 53.3)

-

09:00

Eurozone: Services PMI, November 54.1 (forecast 53)

-

08:43

German composite PMI little changed in November

German private sector companies reported ongoing output growth in November. The Markit Flash Germany Composite Output Index posted 54.9, little-changed from October's ten-month high of 55.1 and above the average this year so far (54.2). While service providers recorded an acceleration in activity growth, manufacturers noted a slight slowdown.

The overall expansion in output was attributed by panellists to improved order intakes and increased capacity. November data highlighted a further solid rise in new business placed with German private sector firms. Despite slowing slightly since the previous month, the rate of increase remained robust.

A number of companies commented on new clients, while survey data also suggested that part of the expansion was driven by solid demand from foreign markets. Indeed, manufacturers signalled a sharp rise in new export orders during the month.

-

08:40

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0575 (EUR 225m) 1.0600 (1.42bln) 1.0650 (2.85bln) 1.0700 (323m) 1.0725 (368m) 1.0750 (856m) 1.0800 (779m) 1.0850 (928m) 1.0900 (1.22bln)

USD/JPY 108.00 (USD 389m) 109.60-65 (552m)

GBP/USD 1.2200 (GBP 239m) 1.2300 (317m) 1.2500 (410m) 1.2650 (223m) 1.2700 (585m)

EUR/GBP 0.8675 (EUR 426m)

EUR/JPY 115.35 (EUR 352m) 118.00 (203m)

AUD/USD 0.7200 (AUD 600m) 0.7260 9249m) 0.7374 (200m) 0.7425 (251m) 0.7600 (357m) 0.7649-59 (313m)

USD/CAD 1.3215-25 (USD 411m) 1.3325 (380m) 1.3350-55 (695m) 1.3400 (861m) 1.3500 (974m)

-

08:30

Germany: Services PMI, November 55 (forecast 54)

-

08:30

Germany: Manufacturing PMI, November 54.4 (forecast 54.8)

-

08:19

WSE: After opening

WIG20 index opened at 1772.69 points (-0.17%)*

WIG 48117.17 0.18%

WIG30 2070.44 0.17%

mWIG40 4044.82 0.22%

*/ - change to previous close

The WIG20 futures today's trading began with 4 points above yesterday's close, but this advantage was given fairly quickly. Contracts for major European parquets suggested a slight withdrawal indexes.

The cash market began trading neutrally among the blue chips. Rapid improvement in the first minutes coincides with a positive surprise of the PMI reading from France, although it is rather the case given the absence of a similar reaction in Euroland. Among blue chips positively stands out Energa (WSE: ENG) with an increase of nearly 5 per cent and again KGH. Withdrawal we may see in PGE, which is under pressure of "sell" recommendation from Deutsche Bank.

After fifteen minutes of trading, the WIG20 index was at the level of 1,778 points (+0,15%).

-

08:06

French services activity rises for the fifth month in a row - Markit

November's flash France PMI data indicated private sector output rose at a fractionally quicker rate, led by stronger growth in the service sector as manufacturers raised production at a weaker pace than the previous month.

The Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, registered 52.3, compared to October's reading of 51.6. The latest reading pointed to a further solid rate of growth.

Underlying the expansion was a further rise in service sector activity, the fifth in as many months. Moreover, the rate of increase accelerated from October to a solid pace. Manufacturing output rose for the third consecutive month, although the rate of growth eased from October and was marginal.

-

08:00

France: Manufacturing PMI, November 51.5 (forecast 51.4)

-

08:00

France: Services PMI, November 52.6 (forecast 51.9)

-

07:52

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0.3%, FTSE + 0.5%

-

07:37

Options levels on wednesday, November 23, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0839 (3361)

$1.0772 (1080)

$1.0722 (791)

Price at time of writing this review: $1.0637

Support levels (open interest**, contracts):

$1.0562 (3552)

$1.0512 (3805)

$1.0447 (4773)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 75043 contracts, with the maximum number of contracts with strike price $1,1200 (6196);

- Overall open interest on the PUT options with the expiration date December, 9 is 64124 contracts, with the maximum number of contracts with strike price $1,0500 (4773);

- The ratio of PUT/CALL was 0.85 versus 0.90 from the previous trading day according to data from November, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (1850)

$1.2604 (1579)

$1.2507 (1839)

Price at time of writing this review: $1.2413

Support levels (open interest**, contracts):

$1.2294 (3906)

$1.2196 (1098)

$1.2098 (1111)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 34990 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 36668 contracts, with the maximum number of contracts with strike price $1,2300 (3931);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from November, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:32

WSE: Before opening

Wall Street has had another upward session, but it should be noted nightly withdrawal of the contract on the S&P500, which although losing only cosmetic value, but recalls that the meeting with 2,200 points it is not completed.

Wednesday is actually the last day of regular trading this week in the US - on Thursday, there are no sessions, and Friday sessions are shortened.

For this reason, it has been accelerated publication of macro data - including important reading of the number of new unemployed. Previously we will see a preliminary readings of PMI indices in Europe. Economic indicators and labor market data in the US remind that after the holiday weekend markets will come in the new month, the beginning of which brings the monthly data from the US labor market and readings of PMI and ISM indices from the US economy.

In the Warsaw market the last two sessions were successful, although part of the strength of the Warsaw Stock Exchange, with the accent on the WIG20, comes from adjustments of the dollar to emerging market currencies, including the zloty. Thus, the market performance largely depends on the condition of the zloty and the behavior of the dollar.

-

07:16

Russia has not yet received an invitation to 30 Nov OPEC meeting - Novak

-

07:15

TD thinks that negative shocks are priced in on GBP/USD. Autumn statement

"Market participants will also keep a close eye on this week's release of the Autumn Statement in the UK.

This sets out the government's fiscal agenda. The market is expecting modest proposals, probably combining a mix of growth-enhancing infrastructure spending and wider deficits. The latter reflects weaker growth and enhanced spending, but TD expects a somewhat conservative budget.

Namely, our take is that the government offers modest stimulus that merely lessens the degree of austerity built into prior forecasts. We suspect this is unlikely to lead to the full handover from monetary to fiscal, so the net result is that longer-term GBP will continue to bear the brunt of the economic adjustment.

Even so, near-term, GBP currently reflects much of the negative in the price (and with market positioning overextended) GBP could consolidate on the release".

Copyright © 2016 TD Securities, eFXnews™

-

07:11

Today’s events

-

At 10:30 GMT Germany will hold an auctin of 10-year bonds

-

At 11:30 GMT the Bank of England Kristin Forbes will make a speech

-

At 12:30 GMT UK Treasury will publish the autumn forecast

-

-

07:09

Moody's says Australian corporate sector for 2017 "stable"

Analysts pointed out that most companies show a solid balance sheets and sufficient liquidity. The corporations does not need refinance and its observed a slight increase in revenue. Moody's forecasts for Aussie GDP growth in 2017 is 3.0%.

-

07:01

EUR/USD Targets 1.066 and 1.071 So Long as 1.0565 Holds

-

07:00

RBA, Chris Kent: Australia has a sustainable economic growth and real development prospects

A speech by RBA Assistant Gov. Christopher Kent late Tuesday, titled "Australia's Economic Transition - State by State," gave the Australian dollar a lift, said Elias Haddad, senior currency strategist at the Commonwealth Bank of Australia.

Mr. Kent reiterated the RBA's view that about 80% of a decline in Australian mining investment has been completed and the terms of trade "will shift from substantial headwind of recent years to a slight tail breeze" for the economy, Mr. Haddad added.

-

06:57

The number of construction projects handed over in Australia declined in the third quarter

Construction work done fell by -4.9% in the third quarter, while analysts expected a decline to -1.7%. The value of the second quarter was revised from -3.7% to -3.1%.

Published by the Australian Bureau of Statistics the data reflect the number of completed construction works for the previous month. This is a key indicator in the construction sector of Australia.

-

05:55

Global Stocks

Europe's main equity benchmark marched higher Tuesday, helped by advances for miners and U.K. manufacturer Rotork PLC, while a fake news release rocked French builder Vinci SA.

Major U.S. stock indexes closed at record highs for a second straight session Tuesday, with the Dow industrials and the S&P 500 also clearing noteworthy psychological barriers. U.S. stocks closed higher Tuesday as the Dow industrials and S&P 500 cleared psychological milestones but major indexes simultaneously reached record highs for a second straight day.

Asian shares traded in positive territory Wednesday, taking a lead from record gains in the U.S. overnight that were driven by continuing post-election exuberance.

-

00:31

Australia: Construction Work Done, Quarter III -4.9% (forecast -1.7%)

-