Market news

-

23:31

Japan: Tokyo CPI ex Fresh Food, y/y, November -0.4% (forecast -0.4%)

-

23:30

Japan: Tokyo Consumer Price Index, y/y, November 0.5% (forecast -0.3%)

-

23:30

Japan: National Consumer Price Index, y/y, October 0.1% (forecast -0.4%)

-

23:30

Japan: National CPI Ex-Fresh Food, y/y, October -0.4% (forecast -0.4%)

-

23:30

Commodities. Daily history for Nov 24’2016:

(raw materials / closing price /% change)

Oil 47.98 +0.04%

Gold 1,183.60 -0.48%

-

23:29

Stocks. Daily history for Nov 24’2016:

(index / closing price / change items /% change)

Nikkei 225 18,333.41 +170.47 +0.94%

Shanghai Composite 3,241.49 +0.3516 +0.01%

S&P/ASX 200 5,485.08 0.00 0.00%

FTSE 100 6,829.20 +11.49 +0.17%

CAC 40 4,542.56 +13.35 +0.29%

Xetra DAX 10,689.26 +26.82 +0.25%

S&P 500 2,204.72 +1.78 +0.08%

Dow Jones Industrial Average 19,083.18 +59.31 +0.31%

S&P/TSX Composite 15,075.20 -5.71 -0.04%

-

23:28

Currencies. Daily history for Nov 24’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0555 +0,02%

GBP/USD $1,2449 +0,10%

USD/CHF Chf1,0166 0,00%

USD/JPY Y113,35 +0,77%

EUR/JPY Y119,59 +0,75%

GBP/JPY Y141,09 +0,84%

AUD/USD $0,7406 +0,08%

NZD/USD $0,7001 -0,03%

USD/CAD C$1,3488 +0,01%

-

23:00

Schedule for today,Friday, Nov 25’2016

09:30 United Kingdom GDP, q/q (Revised) Quarter III 0.7% 0.5%

09:30 United Kingdom GDP, y/y (Revised) Quarter III 2.1% 2.3%

11:00 United Kingdom CBI retail sales volume balance November 21 12

14:45 U.S. Services PMI (Preliminary) November 54.8 54.8

-

21:45

New Zealand: Trade Balance, mln, October -846 (forecast -950)

-

17:00

European stocks closed: FTSE 100 +11.49 6829.20 +0.17% DAX +26.82 10689.26 +0.25% CAC 40 +13.35 4542.56 +0.29%

-

16:39

WSE: Session Results

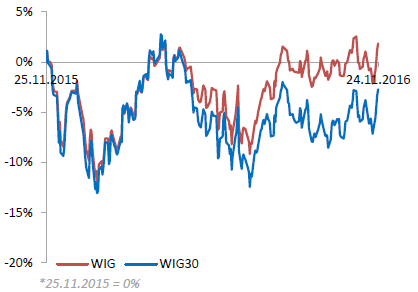

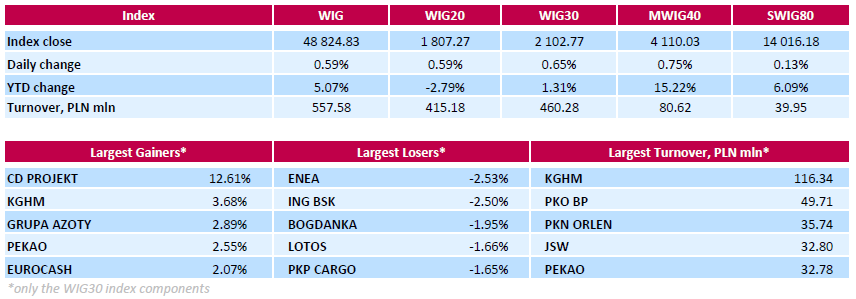

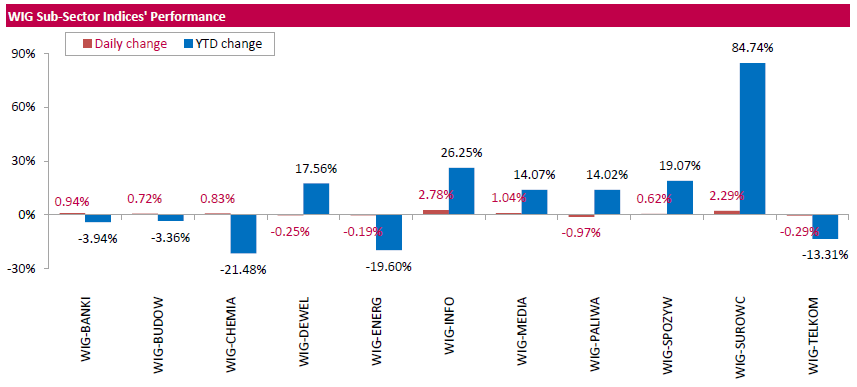

Polish equity market continued its upward trend on Thursday. The broad market measure, the WIG Index, advanced by 0.59%. The WIG sub-sector indices were mainly higher with information technology (+2.78%) outperforming.

The large-cap stocks' measure, the WIG30 Index, rose by 0.65%. Within the index components, videogame developer CD PROJEKT (WSE: CDR) became the session's best performer, as it stocks skyrocketed by 12.61%, helped by the announcement the analysts of one of the market participants re-initiated the stock with a 'Buy' recommendation and a target price of PLN 61 (compared to yesterday's closing price of PLN 43.22). Other major gainers were copper producer KGHM (WSE: KGH), chemical producer GRUPA AZOTY (WSE: ATT) and bank PEKAO (WSE: PEO), which gained 3.68%, 2.89% and 2.55% respectively. On the other side of the ledger, genco ENEA (WSE: ENA) and bank ING BSK (WSE: ING) recorded the sharpest declines, as the stocks corrected by 2.53% and 2.5% respectively after recent growth.

-

16:03

Gold testing offers

After ending the previous session modestly higher, the price of gold showed a substantial move back to the downside, testing offers.

Gold for December delivery plunged $10 to $1,1179 an ounce after rising $1.40 to $1,211.20. With the steep drop, the price of gold fell to a nine-month low.

The sharp pullback by the price of gold came as the U.S. dollar moved higher in reaction to the latest batch of U.S. economic data.

-

15:36

DXY targets 120 L/T. USD bull marlet to continue - BofA Merrill

"The Bloomberg US dollar index is approaching all-time highs. The number of USD crosses above their 200-day moving average has broken out higher. The number of USD crosses reaching overbought on RSI (bullish momentum) continues to rise.

The USD cumulative advance-decline line recently signaled for tactical USD strength and would turn outright bullish with a trend line break. The index can confirm with a close above 1255.

DXY monthly wedge breakout continues The long-term DXY chart implies significant upside for the DXY. This week's breakout through 100 ended the two-year range and makes 120 a long-term target".

Copyright © 2016 BofAML, eFXnews™

-

15:23

Sources: OPEC to discuss next week the reduction of the total oil production to 32.5 million barrels / day

-

production cut could reach 1.3 million barrels / day

-

The proposed level of OPEC production restrictions implies a reduction of 1.143 million barrels / day (according to independent sources)

-

OPEC intends to ask Russia to cut oil production by 300,000 barrels / day

-

OPEC asks countries outside the cartel to cut oil production by 500 000-600 000 barrels / day

-

OPEC is prepared to go to greater cuts due to a slower than expected rebalancing of the oil market

-

-

14:51

WSE: The final hour

Today in the US we have a day off and it's usually a good enough reason for the disappearance of the volatility in the Euroland markets. Except for the very beginning of trading, the indexes fluctuate slightly around their equilibrium levels. For example, the DAX long time fluctuates around 0.1 percent and it is clear that neither party has an idea for start of trading.

Although there is a stoic in the core markets during the absence of the Americans, our parquet in the last part of session behaves somewhat less. As expected, levels above 1,800 points in the case of the WIG20 force already more cautious. Similarly, the WIG and the sWIG80 approached the lows of the session.

An hour before the end of trading the WIG20 index was at the level af 1,803 points (+0.40%).

-

14:10

Belgium’s business barometer has levelled out in November

The National Bank of Belgium's business barometer has levelled out in November, after having risen marginally over the two previous months.

The business climate gained strength in business-related services and trade, respectively for the second and third month running. By contrast, confidence weakened somewhat in the manufacturing and building industries.

The improvement in the economic situation for business-related services has its roots in a fresh upward revision of forecasts for firms' own activity and, to a lesser extent, expectations regarding general market demand.

The pick-up observed in the trade sector can be largely explained by distinctly more positive forecasts for orders placed with suppliers.

-

14:00

Belgium: Business Climate, November -1.8 (forecast -1.6)

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0300 (EUR 816 M) 1.0500 (EUR 1,760 M) 1.0675 (EUR 412 M) 1.0700-1.0715 (EUR 1,619 M) 1.0750-1.0765 (EUR 715 M) 1.0785-1.0800 (EUR 917 M)

GBP/USD 1.2400-1.2410 (GBP 206 M) 1.2435-1.2450 (GBP 232 M)

EUR/GBP 0.8400 (EUR 660 M) 0.8450 (EUR 300 M)

USD/JPY 111.25 (USD 360 M) 111.75-111.80 (USD 275 M)

AUD/USD 0.7300 (AUD 203 M) 0.7390-0.7400 (AUD 389 M) 0.7450 (AUD 1,197 M) 0.7550 (AUD 796 M)

NZD/USD 0.7000 (NZD 806 M)

-

13:33

Canadian corporations earned $80.7 billion in operating profits in the third quarter

Canadian corporations earned $80.7 billion in operating profits in the third quarter, up 14.0% from the previous quarter. The increase was led by a $6.5 billion gain in profits in finance and insurance industries.

On a year-over-year basis, overall operating profits for Canadian corporations were down 1.1% compared with the third quarter of 2015.

In the non-financial industries, third quarter operating profits rose 6.6% to $54.6 billion on a $9.7 billion increase in operating revenues. Overall, profits were up in 11 of 17 non-financial industries.

Operating profits were up 27.1% to $12.7 billion in manufacturing. Operating profits rose in 9 of 13 manufacturing industries. Most of that growth came from petroleum and coal products manufacturing.

Petroleum and coal products manufacturing posted an operating profit of $1.2 billion in the third quarter, following an operating loss of $0.8 billion in the second quarter.

-

13:13

Gold Falls to 9 1/2 -Month Low on Strong Dollar

Gold was down 0.1% at $1.186.80 a troy ounce in volatile morning trade in London. It shed over 2% on Wednesday to close below $1,200 an ounce for the first time since February.

-

13:11

OPEC offered the non-OPEC countries a production cut of 500 thousand barrels / day - Novak

OPEC previously proposed non-OPEC countries production cut of 500K barrels / day instead of 880K. This was reported today to journalists by the head of the Ministry of Energy of the Russian Federation Alexander Novak.

-

13:00

Orders

EUR/USD

Offers : 1.0575-80 1.0600 1.0620 1.0635 1.0650 1.0665 1.0685 1.0700

Bids : 1.0515-20 1.0500 1.0475-80 1.0450 1.0430 1.0400

GBP/USD

Offers : 1.2450 1.2480-85 1.2500 1.2520 1.2535 1.2550 1.2570 1.2585 1.2600

Bids : 1.2400 1.2380 1.2360 1 .2340 1.2315-20 1.2300 1.2285 1.2250

EUR/GBP

Offers : 0.8520 0.8550 0.8580-85 0.8600 0.8635-40

Bids : 0.8475-80 0.8450 0.8420 0.8400

EUR/JPY

Offers : 118.20 118.45-50 118.70 119.00 119.50 120.00

Bids : 117.80 117.60 117.30 117.00 116.80 116.50 116.25-30 116.00

USD/JPY

Offers : 113.50-55 113.80-85 114.00 114.20 114.50

Bids : 113.00 112.80-85 112.60 112.40 112.00 111.85 111.50 111.30 111.00

AUD/USD

Offers : 0.7420 0.7445-50 0.7480 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids : 0.7370 0.7355-60 0.7325-30 0.7300 0.7285 0.7250

-

12:11

WSE: Mid session comment

The first half of today's trading shows quite good level of turnover as for the day without the Americans. In the segment of blue chips we have approx. PLN 220 million of turnover and in the whole market approx. PLN 320 million.

Today special mention deserve shares of CD Projekt (WSE: CDR), which take up to new highs and support approaching previous highs by the mWIG40 index. The blue chips are not worse, and the WIG20 maintains its positive behavior against the European environment. A day without Americans traditionally should lead to a peaceful trading and so in fact we observe. Thus the session is marked by consolidation in the near distance from yesterday's closing. The same behavior of the main European indices remains unsatisfactory due to the impotence of breakthrough the clear important resistance.

At the halfway point of today's session the WIG20 index was at the level of 1,801 points (+ 0.29%).

-

12:03

Stable consumer climate in Germany says GFK

Overall, consumer mood appears to be stable in November. Economic expectations and propensity to buy have increased slightly, while income expectations have experienced a minimal decline. The overall consumer climate indicator forecasts 9.8 points for the last month of this year, after a figure of 9.7 points in November.

Overall, consumers' assessments appear to be extremely stable this month. For the second time in succession, consumers have become more optimistic about overall economic prospects. Income expectations have stabilized, falling only very marginally after two more significant declines in a row. Moreover, propensity to buy has risen back above the 50-point mark. Consequently, the consumer climate has enjoyed marginal growth.

-

12:00

Germany: Gfk Consumer Confidence Survey, December 9.8 (forecast 9.7)

-

11:58

Major stock indices in Europe little changed

Stock indices of the major economies of Western Europe noting the increase in the shares of European pharmaceutical companies.

As IFO swoed the index of German business confidence in the economy in November remained at the level of 110.4 points, while analysts expected 110.5 points.

The German economy in the 3rd quarter increased by 0.2% compared with the previous three months. The dynamics coincided with the preliminary estimate and market expectations.

Also, Spanish data pointed to the growth of the economy in the third quarter by 0.7% compared with the previous quarter. The indicator has coincided with the market forecast. It is noted that for the past six quarters Spain's GDP grew by 0.8%.

As follows from the FOMC minutes, Fed officials actively discussed the rise in interest rates and came to the conclusion that this increase "may be appropriate soon enough."

According to the markets the chances of such a development in December is estimated at 100%.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,1% - to 341.09 points.

The value of securities of pharmaceutical companies Shire PLC and Novartis AG rose more than 0.4%.

Quotes of Banco Popolare climbed 1.8% after Goldman Sachs analysts worsened earnings for the period to 2020, but kept the rating of "buy".

Shares of Remy Cointreau, the second largest producer of alcohol in France rose by 1.8%. The company increased its net profit in the first half by 15% - up to 76 million euros.

Shares of Volkswagen rose 0.96% after CEO Herbert Diss said the company will no longer sell diesel models in the US.

At the moment:

FTSE 6799.57 -18.14 -0.27%

DAX 10669.90 7.46 0.07%

CAC 4533.95 4.74 0.10%

-

10:43

The euro area have remained fairly stable - ECB financial stability review

Euro area systemic stress has remained relatively low over the past six months, despite bouts of market turbulence. Since mid-2013, both the volatility and the level of the euro area composite indicator of systemic stress have gradually edged upwards.

The ratcheting-up of this indicator has been associated with a range of local and global stress events and has continued over the past six months. Factors that pushed it up include higher political uncertainty following the outcomes of the UK referendum on EU membership and the US election as well as market concerns about euro area banks' longer-term profitability prospects.

At the same time, continued accommodative monetary policy in advanced economies and abating market concerns about the possibility of a sharp slowdown in China have dampened spikes in systemic stress. All in all, despite relatively volatile global financial markets, bank and sovereign systemic stress indicators for the euro area have remained fairly stable at low levels

-

10:41

Raiffeisen Bank Sees Year-End EUR/HUF at Around 315

-

10:10

ECB Constancio: no reason to change baseline scenario

-

09:36

UK consumer credit is growing at its fastest rate since November 2006 - BBA

Gross mortgage borrowing of £12.2bn in the month was 4% lower than in October 2015.

Net mortgage borrowing is 2.5% higher than a year ago.

Consumer credit is now showing annual growth of over 7% reflecting strong retail sales growth in October supported in the case of personal loans by favourable interest rates.

Dr Rebecca Harding, BBA Chief Economist, said:

"Consumer credit is now growing at its fastest rate since November 2006, reflecting strong retail sales growth. Consumer confidence remains robust as borrowers take advantage of record low interest rates.

"Mortgage approvals ticked up a little October. There has only been a relatively modest increase in activity since the Bank of England cut rates in August.

-

09:30

United Kingdom: BBA Mortgage Approvals, October 40.85 (forecast 38.8)

-

09:17

German business sentiment weakened marginally in November

German business sentiment weakened marginally in November, reports said citing survey data from Ifo institute on Thursday, cited by rttnews.

The Ifo business confidence index fell to 110.4 in November from 110.5 in October. The reading was expected to remain at 110.5.

The current conditions indicator came in at 115.6. Economists had expected the score to remain unchanged at 115.

The expectations index dropped to 105.5 from 106.1 in prior month. The expected score was 106.

-

09:01

Germany: IFO - Expectations , November 105.5 (forecast 106)

-

09:00

Germany: IFO - Business Climate, November 110.4 (forecast 110.5)

-

09:00

Germany: IFO - Current Assessment , November 115.6 (forecast 115)

-

08:54

Oil is traded higher

This morning, the New York futures for Brent increased 0.23% to $ 48.05 and WTI rose by + 0.12% to $ 49.01 per barrel. Thus, the black gold is trading in the green zone amid uncertainty in the run-up to the OPEC summit and low activity in connection with the celebration of Thanksgiving Day.

Many experts believe that OPEC will be able to reach some sort of mutual agreement on the reduction of production in spite of the lack of unity among the members of the cartel with respect to whom and how much to reduce its volume. At the same time traders are skeptical that it will be enough to reduce the oversupply in the world market.

-

08:25

Major stock exchanges trading in the green zone: FTSE + 0.1%, DAX + 0.3%, CAC40 + 0.2%, FTMIB + 0,4%, IBEX + 0.3%

-

08:17

WSE: After opening

WIG20 index opened at 1798.00 points (+0.08%)*

WIG 48656.65 0.24%

WIG30 2094.92 0.27%

mWIG40 4085.85 0.15%

*/ - change to previous close

The futures market (contracts FW20Z1620) opened with a new dose of optimism, 8 points above yesterday's close. It was quite high opening, especially in relations with the peaceful environment, where the contract for the DAX was neutral with respect to yesterday's close.

The cash market starts today with no surprises. After what we have seen in the first minutes of contracts trading, the WIG20 increase in the first stage of today's session over 1,800 points. For now, the main driving force among the blue chips remains, of course, KGHM, which grows more than 2 percent. in response to a further strong increase in raw material prices.

After fifteen minutes of trading the WIG20 index was at the level of 1,797 points (+0,07%).

-

08:09

Today’s events

-

At 16:10 GMT the ECB Board Member Peter Preat will make a speech

-

At 17:15 GMT SNB Vice Chairman Fritz Zurbrugg deliver a speech

-

United States celebrate Thanksgiving Day

-

-

08:08

EU’s Schulz Not Seeking New Mandate In January – RTRS Source

-

07:44

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0575 (EUR 225m) 1.0600 (1.42bln) 1.0650 (2.85bln) 1.0700 (323m) 1.0725 (368m) 1.0750 (856m) 1.0800 (779m) 1.0850 (928m) 1.0900 (1.22bln)

USD/JPY 108.00 (USD 389m) 109.60-65 (552m)

GBP/USD 1.2200 (GBP 239m) 1.2300 (317m) 1.2500 (410m) 1.2650 (223m) 1.2700 (585m)

EUR/GBP 0.8675 (EUR 426m)

EUR/JPY 115.35 (EUR 352m) 118.00 (203m)

AUD/USD 0.7200 (AUD 600m) 0.7260 9249m) 0.7374 (200m) 0.7425 (251m) 0.7600 (357m) 0.7649-59 (313m)

USD/CAD 1.3215-25 (USD 411m) 1.3325 (380m) 1.3350-55 (695m) 1.3400 (861m) 1.3500 (974m)

-

07:29

WSE: Before opening

Wednesday's session on the New York stock exchanges has brought little changes, but the Dow Jones, which at the end of the day increased by 0.31 percent to 19 083.76 points, reached the highest level in history.

Today's session due to the Thanksgiving holiday in the US should be reasonably calm. There is also no important reports in the macro calendar today.

The behavior of the Asian parquets in the morning is slightly downward. It stands out only the Japanese Nikkei, but this is due to the need to make up for the lack of yesterday's trading. Most parquets in Asia are slightly losing value. We may see continuing rise of metals prices, despite the persistent strength of the dollar. The same this morning copper gained another 2% and should support the behavior of such companies as KGHM.

In the case of the Warsaw Stock Exchange the yesterday's good behavior, in contrast to the weakness of Western Europe, was a big plus. The WIG20 index reached the area of 1,800 pts., which might have to tone down the appetite for growth. We approached the levels where previous waves of growth turned away, and the session without Wall Street does not serve growth solutions.

-

07:24

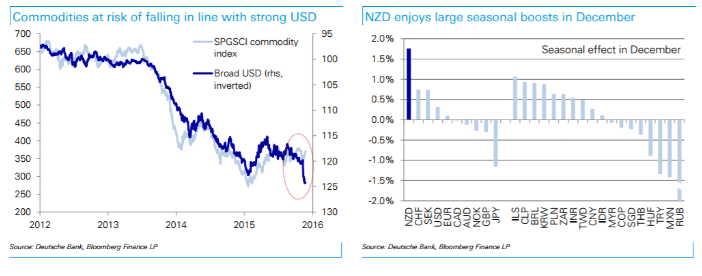

3 Reasons To Sell AUD/USD - Deutsche Bank

"A fortnight after the US election, we expect continuing weakness in the dollar bloc. While we would sell the entire bloc against the US dollar, we argue that the outlook remains most bearish for the Aussie.

First, rising US rates will likely continue to weigh on the commodity currencies, but the Aussie should suffer from the sharpest yield convergence in the next months.

Second, in terms of trade, the broad commodity complex is at risk of snapping back into line with the strong USD (chart 1). Idiosyncratically, however, Australian miners are most imminently at risk from a bursting of the speculative bubble in base metals and bulk commodities.

Third, the Aussie faces the strongest headwinds from being the most consensus net long in G10 as well as from its extreme overvaluation, which is second only to the RMB and CHF. At the other end, CAD is best protected by sizeable net shorts and modest undervaluation. The kiwi benefits from neither but consistently sees a significant seasonal boost of almost 2% in December".

-

07:20

BOJ's Nakaso: Too Early to Discuss Exiting Monetary Easing

-

07:19

Moody's: Japanese Corporates Face Restrained Recovery In 2017

-

07:18

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0.2%, FTSE + 0.3%

-

07:16

Most Federal Reserve officials expect it to become appropriate to raise interest rates relatively soon - Minutes

Most Federal Reserve officials expect it to become appropriate to raise interest rates relatively soon, according to the minutes of the November meeting of the Federal Open Market Committee.

The minutes noted that the expectation for a near-term rate hike is contingent on incoming data providing some further evidence of continued progress toward the Fed's objectives.

Some meeting participants argued that a rate hike should occur at the next meeting in December in order to preserve credibility following the committee's recent communications, rttnews says.

The Fed said a few participants advocated increasing rates at the November meeting, including voting members Kansas City Fed President Esther George and Cleveland Fed President Loretta Mester.

Those preferring a rate hike viewed labor market conditions as at or close to those consistent with maximum employment and expected the recent progress toward the committee's inflation objective to continue.

-

07:16

Germany: GDP (YoY), Quarter III 1.5% (forecast 1.7%)

-

07:14

The index of business activity in the manufacturing sector of Japan below forecast

Commenting on the Japanese Manufacturing PMI survey data, Amy Brownbill, economist at IHS Markit, which compiles the survey, said:

"Manufacturing conditions in Japan continued to improve mid-way through the final quarter of 2016. Output increased for the fourth month running, helped by a boost in new orders. Data suggested that international demand was the key driver behind the expansion in total new sales.

Meanwhile, employment growth eased from October's 30-month high and was only marginal overall, suggesting manufacturers were less confident towards the outlook. Finally, cost inflation has recorded for the first time since December 2015, linked by firms to greater raw material prices, particularly fuel-related items. "

-

07:08

German economic growth is losing some momentum

German economic growth is losing some momentum. As the Federal Statistical Office (Destatis) already reported in its first release of 15 November 2016, the gross domestic product (GDP) increased 0.2% - upon price, seasonal and calendar adjustment - in the third quarter of 2016 compared with the previous quarter. In the first half of the year, the GDP had increased somewhat more, by 0.4% in the second quarter and 0.7% in the first quarter.

-

07:00

Germany: GDP (QoQ), Quarter III 0.2% (forecast 0.2%)

-

06:27

Options levels on thursday, November 24, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0829 (3533)

$1.0753 (1375)

$1.0691 (993)

Price at time of writing this review: $1.0545

Support levels (open interest**, contracts):

$1.0467 (3539)

$1.0413 (4418)

$1.0346 (2013)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 76698 contracts, with the maximum number of contracts with strike price $1,1400 (6331);

- Overall open interest on the PUT options with the expiration date December, 9 is 64829 contracts, with the maximum number of contracts with strike price $1,0500 (4418);

- The ratio of PUT/CALL was 0.85 versus 0.85 from the previous trading day according to data from November, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (1854)

$1.2604 (1495)

$1.2508 (1800)

Price at time of writing this review: $1.2433

Support levels (open interest**, contracts):

$1.2392 (1405)

$1.2295 (4023)

$1.2197 (1099)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 35053 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 36717 contracts, with the maximum number of contracts with strike price $1,2300 (4023);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from November, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:01

Global Stocks

European stocks ended with a small loss Wednesday, the first pullback in three sessions, as bank shares declined. "Markets in Europe have again struggled to keep track of record breaking U.S. markets, rolling over into the afternoon session on the back of a selloff in bond markets and a sharp rise in the U.S. dollar," said Michael Hewson, chief market analyst at CMC Markets UK, in a note.

Dow industrials and the S&P 500 notched a third straight record close on Wednesday, boosted in part by industrials, while the Nasdaq lagged behind in trading ahead of the Thanksgiving Day holiday. It's the third session in a row both the Dow and the S&P 500 have turned in record closes.

Asian markets were broadly down Thursday, in response to strong overnight U.S. economic data Thursday that pointed to rate rises, more dollar strength and the possibility of more capital flight from Asia. Durable goods orders in the U.S. rose 4.8% in October from a month earlier, well above the 2.7% gain predicted by economists surveyed by The Wall Street Journal. A gauge of U.S. consumer sentiment rose in November, signaling rising confidence in the economy.

-

05:02

Japan: Coincident Index, September 112.7 (forecast 112.1)

-

05:01

Japan: Leading Economic Index , September 103 (forecast 100.5)

-

00:30

Japan: Manufacturing PMI, November 51.1 (forecast 51.7)

-