Market news

-

18:00

DJIA +0.25% 19,131.49 +48.31 Nasdaq +0.26% 5,394.52 +13.84 S&P +0.33% 2,211.93 +7.21

-

17:15

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes hit record highs on Black Friday, helped by gains in consumer stocks at the start of the crucial holiday shopping season. Since the U.S. election, the three main U.S. indexes have hit all-time highs and closed at record levels multiple times in the past few days, most recently on Wednesday, when industrials boosted the Dow and S&P to record-high closes.

Most of Dow stocks in positive area (22 of 30). Top gainer - Cisco Systems, Inc. (CSCO, +1.40%). Top loser - Caterpillar Inc. (CAT, -0.63%).

Most S&P sectors in positive area. Top gainer - Conglomerates (+1.3%). Top loser - Basic Materials (-0.7%).

At the moment:

Dow 19106.00 +52.00 +0.27%

S&P 500 2207.50 +6.75 +0.31%

Nasdaq 100 4866.50 +17.00 +0.35%

Oil 46.34 -1.62 -3.38%

Gold 1180.40 -8.90 -0.75%

U.S. 10yr 2.38 +0.02

-

17:01

European stocks closed: FTSE 100 +11.55 6840.75 +0.17% DAX +10.01 10699.27 +0.09% CAC 40 +7.71 4550.27 +0.17%

-

16:53

WSE: Session Results

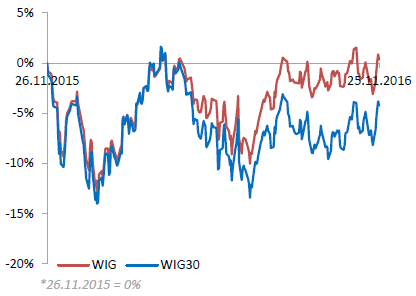

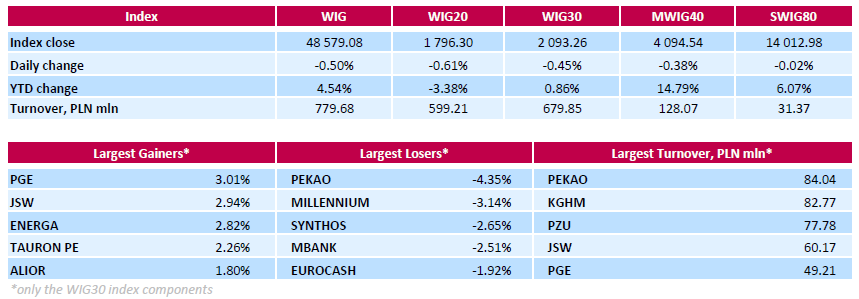

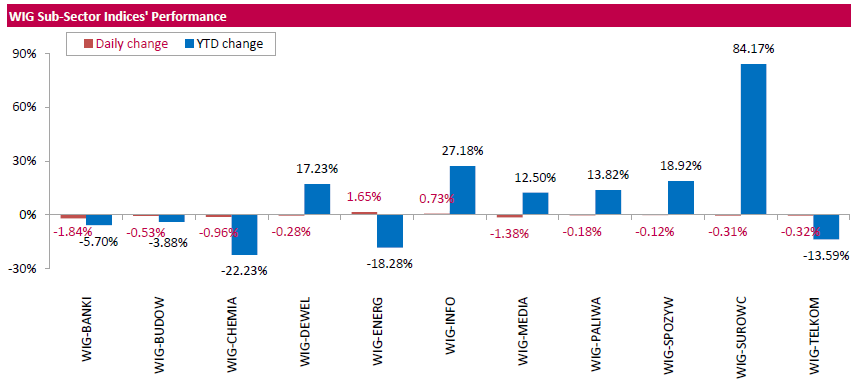

Polish equity market retreated on Friday. The broad market benchmark, the WIG index, fell by 0.5%. The WIG sub-sector indices were mainly lower with banking sector (-1.84%) underperforming.

The large-cap stocks' measure, the WIG30 Index, dropped by0.45%. In the WIG30 index basket, banking name PEKAO (WSE: PEO) was hit the hardest, down 4.35%. Poland's deputy prime minister Mateusz Morawiecki stated that the Polish state-run insurer PZU (WSE: PZU; +1.46%) and Polish Development Fund (PFR) are in the final stage of talks with Italy's UniCredit over buying its stake in PEKAO. Other largest decliners were chemical producer SYNTHOS (WSE: SNS) and two banks MILLENNIUM (WSE: MIL) and MBANK (WSE: MBK), which lost between 2.51% and 3.14%. On the other side of the ledger, gencos PGE (WSE: PGE) and ENERGA (WSE: ENG) were among the biggest advancers, climbing by a respective 3.01% and 2.82%, as Poland's energy minister Krzysztof Tchorzewski stated the country's state-run utilities will not be expected to invest more money to support the country's troubled coal mining firms.

-

15:58

Sharp pullback for the price of gold

After ending the previous session modestly higher, the price of gold showed a substantial move back to the downside during trading on Wednesday.

Gold for December delivery plunged $21.90 to $1,189.30 an ounce after rising $1.40 to $1,211.20 an ounce on Tuesday. With the steep drop, the price of gold fell to a nine-month low.

The sharp pullback by the price of gold came as the U.S. dollar moved higher in reaction to the latest batch of U.S. economic data, rttnews says.

-

15:40

Goldman Sachs (GS) can get a $ 2 billion profit for the assets in South Korea

One of the world's largest investment banks, Goldman Sachs Group (GS) can get a great return on the investment of $ 400 million in the manufacturer of industrial gases.

The bank is going to sell its stake in one of the largest industrial gas producers in South Korea. A potential deal could bring $ 2 billion, according to The Wall Street Journal, citing a person familiar with the details of the transaction.

Goldman, which owns a controlling stake in Daesung Industrial Gases, sent out the financial details of the operation to potential buyers, including private equity firms, the South Korean conglomerate and global competitors in the production of industrial gases, to assess the interest in the asset.

The purchase of this business is an intriguing prospect for private equity firms in Asia as controlling stakes in companies operating in high-yielding sectors are rarely put up for sale in this region. South Korean banks are also willing to finance the deal with high levels of profitability and low interest rates.

-

15:12

The impact on financial markets of a victory for far-right candidate Marine Le Pen in next year's French presidential elections would be a far more seismic event than the Brexit vote or Donald Trump winning the U.S. presidency, analysts say

-

14:53

WSE: After start on Wall Street

In the afternoon phase of today's session, the descent of the WIG20 index under 1,800 points was deepened by a dozen points and the level of today's decline is proportional to market optimism on the previous sessions of the week. Than for a new impetus to the fight against resistance we may count only in the new week, but after today's hesitance the market probably will hide again in the middle of a few weeks consolidation. One of the biggest outsiders in the first line of companies today is Bank Pekao (WSE: PEO) the valuation of which losing more than 4 per cent.

The opening on Wall Street maintains the S&P500 index above the level of 2,200 points, although we get the feeling that above this level bulls running out of arguments to continue trading.

On the threshold of the last trading hours this week the WIG20 index was at 1,793 points (-0.75%).

-

14:51

U.S. service sector companies reported another robust increase - Markit

Adjusted for seasonal influences, the Markit Flash U.S. Services PMI Business Activity Index1 registered 54.7 in November. This was down only fractionally from 54.8 in October and the secondstrongest seen over the past 12 months. As a result, the average reading so far in Q4 points to the fastest upturn in business activity since the final quarter of 2015.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit said: "The November PMI surveys provide the first snapshot of US business conditions in the wake of the surprise election result, and show a reassuring picture of sustained solid economic expansion and hiring. "With businesses in the vast service sector also showing improved confidence about the year ahead as election uncertainty cleared, the surveys give a clear green light for the Fed to hike interest rates in December".

-

14:46

U.S.: Services PMI, November 54.7 (forecast 54.8)

-

14:35

-

14:34

U.S. Stocks open: Dow +0.28%, Nasdaq +0.08%, S&P +0.17%

-

14:27

Before the bell: S&P futures +0.22%, NASDAQ futures +0.14%

U.S. stock-index futures advanced. The S&P 500 and the Dow were poised to hit record highs on Black Friday, with the focus on retailers at the start of the crucial holiday shopping season.

Global Stocks:

Nikkei 18,381.22 +47.81 +0.26%

Hang Seng 22,723.45 +114.96 +0.51%

Shanghai 3,261.49 +19.76 +0.61%

FTSE 6,837.87 +8.67 +0.13%

CAC 4,536.90 -5.66 -0.12%

DAX 10,676.28 -12.98 -0.12%

Crude $47.54 (-0.88%)

Gold $1,186.50 (-0.24%)

-

13:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.5

-0.01(-0.0317%)

3582

ALTRIA GROUP INC.

MO

64.21

0.19(0.2968%)

177200

Amazon.com Inc., NASDAQ

AMZN

785.4

5.28(0.6768%)

25400

Apple Inc.

AAPL

111.12

-0.11(-0.0989%)

20877

AT&T Inc

T

38.97

0.24(0.6197%)

11893

Boeing Co

BA

150

0.26(0.1736%)

702

Caterpillar Inc

CAT

96.49

0.31(0.3223%)

16910

Chevron Corp

CVX

110.6

-0.40(-0.3604%)

3210

Cisco Systems Inc

CSCO

29.65

-0.06(-0.202%)

1340

Citigroup Inc., NYSE

C

56.9

0.21(0.3704%)

10656

Deere & Company, NYSE

DE

101.62

-0.55(-0.5383%)

16308

Exxon Mobil Corp

XOM

86.31

-0.61(-0.7018%)

278

Facebook, Inc.

FB

121.06

0.22(0.1821%)

76920

Ford Motor Co.

F

86.31

-0.61(-0.7018%)

278

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.34

0.13(0.802%)

1175264

General Electric Co

GE

31.39

0.05(0.1595%)

2300

General Motors Company, NYSE

GM

33.83

-0.03(-0.0886%)

1130

Goldman Sachs

GS

212.26

-0.05(-0.0236%)

3042

Google Inc.

GOOG

764.9

3.91(0.5138%)

2715

HONEYWELL INTERNATIONAL INC.

HON

86.31

-0.61(-0.7018%)

278

Intel Corp

INTC

35.25

0.05(0.142%)

3428

International Business Machines Co...

IBM

161.84

-0.14(-0.0864%)

240

Johnson & Johnson

JNJ

113.5

0.43(0.3803%)

863

JPMorgan Chase and Co

JPM

79

0.14(0.1775%)

3029

Merck & Co Inc

MRK

61.8

0.16(0.2596%)

1711

Microsoft Corp

MSFT

60.42

0.02(0.0331%)

4998

Nike

NKE

51.5

0.16(0.3116%)

3346

Pfizer Inc

PFE

31.6

0.18(0.5729%)

20055

Procter & Gamble Co

PG

82.86

0.18(0.2177%)

269216

Starbucks Corporation, NASDAQ

SBUX

57.63

0.04(0.0695%)

283

Tesla Motors, Inc., NASDAQ

TSLA

193.75

0.61(0.3158%)

4449

The Coca-Cola Co

KO

41.15

0.03(0.073%)

396076

Twitter, Inc., NYSE

TWTR

18.28

0.06(0.3293%)

5460

Verizon Communications Inc

VZ

50.36

0.13(0.2588%)

925

Visa

V

79.8

0.23(0.2891%)

1200

Wal-Mart Stores Inc

WMT

71.35

0.52(0.7342%)

157158

Walt Disney Co

DIS

98.59

0.33(0.3358%)

8858

Yahoo! Inc., NASDAQ

YHOO

41.1

0.14(0.3418%)

3430

-

13:55

Upgrades and downgrades before the market open

Upgrades:

Deere (DE) upgraded to Neutral from Underperform at Longbow

Downgrades:

Other:

Deere (DE) target raised to $98 from $80 at RBC Capital Mkts

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0600 (EUR 1.82bln) 1.0650 (756m) 1.0700 (510m) 1.0800 (1.03bln)

USD/JPY 110.50 (USD 1.06bln)

USD/CAD 1.3500 (USD 867m)

-

13:38

Mixed US data: trade balance little changed, wholesale inventories improved

The international trade deficit was $62.0 billion in October, up $5.5 billion from $56.5 billion in September. Exports of goods for October were $122.1 billion, $3.4 billion less than September exports. Imports of goods for October were $184.1 billion, $2.1 billion more than September imports.

Advance Wholesale Inventories Wholesale inventories for October, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $586.9 billion, down 0.4 percent (±0.4 percent) from September 2016, and were down 0.5 percent (±1.4 percent)* from October 2015. The August 2016 to September 2016 percentage change was revised from up 0.1 percent (±0.2 percent)* to down 0.1 percent (±0.2 percent)

-

13:11

Fitch improved the outlook for the Russian transportation sector to "stable"

The international rating agency Fitch revised its outlook for the Russian rail sector and ratings of companies in the sector for 2017 to "stable" from "negative."

"The outlook revision is supported by our expectations of improving economic conditions and acceptable financial position of most rated companies in the sector".

-

13:09

U.K. post-Brexit economic data shows growth

According to Dow Jones, British firms appeared largely unfazed by the prospect of the U.K.'s exit from the European Union, official data showed Friday, with business investment slowing only slightly in the three months following June's Brexit vote.

The figures add to signs that the U.K. economy held up better than many had anticipated after the referendum, offering the first solid answer to fears that British companies would hold the economy back by scrapping or delaying their investment plans. But officials and analysts warn that a slowdown may still be in the cards when the U.K. launches official divorce proceedings early next year as planned.

-

12:52

Orders

EUR/USD

Offers : 1.0620-25 1.0645-50 1.0665 1.0685 1.0700 1.0730 1.0750

Bids : 1.0580 1.0560 1.0530 1.0515 1.0500 1.0475-80 1.0450 1.0400

GBP/USD

Offers : 1.2450-55 1.2470 1.2485 1.2500 1.2520 1.2535 1.25501.2570 1.2585 1.2600

Bids : 1.2400 1.2380 1.2360 1 .2340 1.2315-20 1.2300 1.2285 1.2250

EUR/GBP

Offers : 0.8550 0.8580-85 0.8600 0.8630-35 0.8650

Bids : 0.8520 0.8500 0.8475-80 0.8450 0.8420 0.8400 0.8380-85 0.8350

EUR/JPY

Offers : 119.850 120.00 120.45-50 121.00 121.50-55

Bids : 119.30 119.00 118.80 118.50 118.00 117.80 117.60 117.30 117.00

USD/JPY

Offers : 113.60 113.80 114.00 114.20 114.50 114.85 115.00 115.55-60

Bids : 113.20 113.00 112.80-85 112.50-60 112.20 112.00 111.85 111.50 111.30 111.00

AUD/USD

Offers : 0.7445-50 0.7475-80 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids : 0.7420 0.7400 0.7370 0.7355-60 0.7325-30 0.7300 0.7285 0.7250

-

12:04

Major stock indices in Europe almost flat

The decline of oil prices had a negative impact on the securities of the energy sector, while shares of Italian lenders put pressure on the index of the banking sector in Europe.

The composite index of the largest companies in the region Stoxx Europe 600 fell by 0.08% to 341.57 points. The indicator increased by 0.7% since the beginning of this week.

European oil and gas companies index sank 0.71% as oil prices dropped more than 1% on the back of a strong dollar.

Mining shares are mixed amid falling prices for oil and copper, as well as the rise of the value of gold.

Shares of Royal Dutch Shell and BP fell 0.5%.

Shares of Rio Tinto rose 1%, Randgold Resources +1,2%, Glencore - have fallen in price 0,2%, Boliden -0.5%.

Shares of Italian banks fell by 0.45% due to concerns about the outcome of the referendum on the reform of the Constitution, which may collapse the government of the reformist Prime Minister Matteo Renzi. European banking index fell by 0.55%. the referendum will be held Dec 4

At the same time, the health sector index rose 0.61%.

Support to the sector had a sharp rally of Swiss biotech company Actelion after news that Johnson & Johnson made its takeover attempt. Actelion shares rose nearly 9% and ready to show the maximum one-day rise since mid-2014.

Daily Mail shares fell 3,7% after Barclays lowered to "underperform".

At the moment:

FTSE 6827.59 -1.61 -0.02%

DAX 10681.69 -7.57 -0.07%

CAC 4536.98 -5.58 -0.12%

-

12:03

WSE: Mid session comment

The session in Warsaw due to limited activity of the global players have to be calm, but slowly this baseline scenario faces a growing risk. We descend on minima session with a fall of the WIG20 by about 1 percent. The combination of meeting the WIG20 index with the levels of resistance and the upper limit of consolidation together with neutral attitude of core markets have given mix, which turned out to be stronger on the side of local factors. The market clearly hesitated at the height of 1,800 points and at this stage ignores even the strengthening of the zloty against the dollar and the euro.

After a few better sessions the WSE returns today to the relative weakness of that we have had in many months.

At the halfway point of today's quotations, the WIG20 index was st the level of 1,788 points (-1,03%).

-

11:07

UK retail sales volumes well above average - CBI

The survey of 126 firms, of which 61 were retailers, showed that sales volumes for the time of year were considered well above average and are expected to grow at a broadly similar pace in December.

The volume of orders placed upon suppliers inched up for the first time in eight months with a further slight increase expected for the year to December.

The increase in retail sales volumes was driven by the clothing and non-store goods sectors, as well hardware and DIY. Growth in internet sales volumes increased at a healthy pace over the same period, with expectations for growth in the year to December the strongest for two years.

-

11:00

United Kingdom: CBI retail sales volume balance, November 26 (forecast 12)

-

10:17

Italian retail trade index decreased by 0.6%

In September 2016 the seasonally adjusted retail trade index decreased by 0.6% with respect to August 2016 (-0.3% for food goods and -0.8% for non-food goods). The average of the last three months decreased with respect to the previous three months (-0.4%). The unadjusted index decreased by 1.4% with respect to September 2015

-

10:15

Renzi: Technocratic government is not in Italy's interest

-

Will not be available for talks with Berlusconi if he loses the vote

-

2017 will be a key year for Europe with issues on immigration and economic policy which have not been dealt with properly

-

Referendum vote is not about my future

-

-

09:36

UK business investment improves above expectations

Gross fixed capital formation (GFCF), in volume terms, was estimated to have increased by 1.1% to £79.0 billion between Quarter 2 (Apr to June) 2016 and Quarter 3 (July to Sept) 2016.

Between Quarter 2 2016 and Quarter 3 2016, business investment, in volume terms, was estimated to have increased by 0.9%, from £43.8 billion to £44.2 billion.

Between Quarter 3 2015 and Quarter 3 2016, GFCF was estimated to have increased by 1.2%, from £78.0 billion to £79.0 billion.

-

09:35

UK index of services rose 2.9% y/y. GBP/USD little changed

This release shows that services output increased by 0.2% between August 2016 and September 2016. The Index of Services was estimated to have increased by 2.9% in September 2016 compared with September 2015. All of the 4 main components of the services industries increased in the most recent month compared with the same month a year ago.

The 0.2% growth in services between August 2016 and September 2016 follows growth of 0.3% between July 2016 and August 2016, which is revised up 0.1 percentage points from the previous estimat

-

09:33

UK Q3 GDP unrevised at the second estimate

UK GDP in volume terms was estimated to have increased by 0.5% between Quarter 2 (Apr to June) 2016 and Quarter 3 (July to Sept) 2016, unrevised from the preliminary estimate of gross domestic product published on 27 October 2016. This is the 15th consecutive quarter of positive growth since Quarter 1 (Jan to Mar) 2013.

The reporting period for this release covers Quarter 3 2016, and therefore includes data for the whole period after the EU referendum. Since the result, growth in gross domestic product (GDP) has been in line with recent trends. This suggests limited effect so far from the referendum.

Between Quarter 3 2015 and Quarter 3 2016, GDP in volume terms increased by 2.3%, unrevised from the previously published estimate

-

09:30

United Kingdom: GDP, q/q, Quarter III 0.5% (forecast 0.5%)

-

09:30

United Kingdom: GDP, y/y, Quarter III 2.3% (forecast 2.3%)

-

09:10

Italian industrial sales decline significantly in September

In September 2016 the seasonally adjusted turnover index decreased by -4.6% compared to the previous month (-5.5% in domestic market and -2.8% in non-domestic market). The percentage change of the average of the last three months compared to the previous three months was +2.3% (+2.5% in domestic market and +1.8% in non-domestic market).

In September 2016 the seasonally adjusted industrial new orders index decreased by -6.8% compared with August 2016 (-9.3% in domestic market and -3.1% in non-domestic market). The percentage change of the average of the last three months compared to the previous three months was +1.7% (+6.6% in domestic market and -4.4% in non-domestic market).

-

08:23

Major stock exchanges trading in the green zone: FTSE 100 6,840.99 11.79 + 0.17%, DAX 10,699.15 9.89 + 0.09%, CAC 40 4,551.17 8.61 + 0.19%

-

08:22

Oil is trading lower

This morning the New York futures for Brent dropped in price by 1.06% to $ 48.48 and WTI fell 1.06% to $ 47.45 per barrel. Thus, the black gold is trading in the red zone on expectations about the final OPEC agreement that shall be taken at the official meeting of OPEC on November 30 in Vienna. Yesterday's trading was influenced by the US holiday and very low volumes.

-

07:53

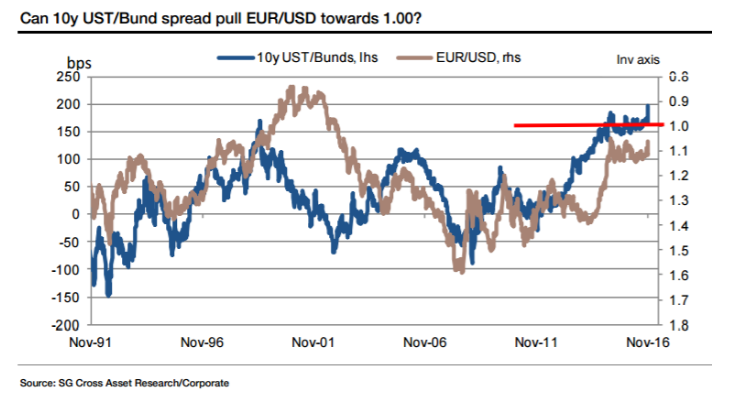

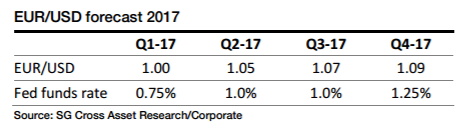

Societe Generale says its now or never for EUR/USD parity

"The bullish US macro-economic 'reset' following the election success of Donald Trump has governed financial markets and sparked the bond market rout and USD buying but it is the threat of political tail risk and splintering of Europe that could decide if EUR/USD tests parity for the first time since 2002.

1. Same place, different time The election victory of Trump was the catalyst for EUR/USD to retreat below 1.06 and close in on levels only observed three times since early 2015. EUR/USD traded at a 1.0458 low shortly after the ECB launched the first purchases of government bonds in March 2015. This marked a bottom that would be followed by a rise to 1.1467 in May. The 1.05 level was revisited in the lead-up to the ECB meeting nearly a year ago on 3 December when President Draghi had signalled strong policy action. In the event, the ECB disappointed and EUR/USD shot up from a 1.0524 low to a high of 1.1376 in February.

2. Parallels with 2013 Italian election? The last leg of EUR/USD to below 1.06 coincided with the widening of 10y Italian BTP/Bund yields to just over 180bp on Friday, the highest level since May 2014. This coincided with a rise in the co-movement (Rsq) between the two variables to 0.44. This compares with an Rsq of just 0.15 for EUR/USD and the 10y US/EUR IRS spread. Closer analysis shows that 10y Italian yields became unstuck and started moving away from 1.40% towards 2.10% two weeks before the US election, but this was not picked up by EUR/USD as it rallied from 1.0880 to 1.1140 before the US election on 7 November. However, this has changed over the past week.

3. And then there is the US The timing and scale of the USD upswing caught virtually everyone by surprise. A clear out of dollar assets was anticipated on a Trump victory, but the U-turn we got instead was not pencilled in until later once the administration had laid out the specifics of its pro-growth and low-tax election agenda.

We expect EUR/USD to touch parity in 1Q 2017 before rising back to 1.09 by the end of 2017. The forecast is based on two rate increases by the Fed next year, but this comes with the risk of more. Before the election of Trump we had anticipated a peak for the Fed funds rate this cycle of 1.25%-1.50%, but we now look for 1.75%-2.0%. For the ECB, our economists believe tapering will start in March with the objective of ending asset purchases in early 2018, market conditions permitting".

Copyright © 2016 Societe Generale, eFXnews™

-

07:48

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0600 (EUR 1.82bln) 1.0650 (756m) 1.0700 (510m) 1.0800 (1.03bln)

USD/JPY 110.50 (USD 1.06bln)

USD/CAD 1.3500 (USD 867m)

-

07:23

Whether EUR/USD Will Hit Parity Depends on ECB's QE Pace - Mizuho Bank

-

07:21

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.1%, FTSE + 0.3%

-

07:21

Dairy products led a rise in total exports from New Zeeland

Dairy products led a rise in total exports in October, but meat and offal exports were down from the same month last year, Statistics New Zealand said today.

In October 2016, total goods exports rose $85 million (2.2 percent). Dairy exports rose $122 million (13 percent) to $1.1 billion. Butter rose $61 million (29 percent) and milk powder rose $57 million (12 percent).

"We exported more butter for a higher price this month than October last year," international statistics manager Jason Attewell said. "We also exported more milk powder, but prices were similar."

In October, meat and edible offal exports, our second-largest export commodity group, fell $71 million (18 percent) from October 2015. Beef and lamb exports to the key market of China were down.

Other significant commodity group changes were forestry products, up $74 million (25 percent), and fruit, up $42 million (40 percent), led by kiwifruit (up $33 million).

-

07:17

Japan national consumer price index higher than expected

The National Consumer Price Index published by the Statistics Bureau of Japan, rose 0.1% in October, higher than the forecast of 0.0% and the previous value of -0.5% year on year. This indicator reflects the assessment of price movements obtained by comparison of the retail prices of the relevant basket of goods and services and is the most important barometer of changes in purchasing trends.

Also, core CPI was in line with expectations and amounted to -0.4%. The previous value 0.5%. As can be seen from the data, inflation in Japan was ultimately a little better than expected. Some of the readings in line with expectations, some of them up, no one below.

-

06:30

WSE: before opening

Yesterday's holiday in the US and the lack of quotations on Wall Street causes that this morning in Europe is not going to be particularly exciting. Quiet trading is also seen in Asia.

The contracts on the S&P500 recorded now cosmetic loss. Minimally shifts appear on the currency market, where Eurodollar gaining 0.1 percent. Today's macro calendar does not contain critical data, so we may assume that in the environment there will be little change until the game will join players from the USA.

On the Warsaw market last four sessions were successful for the WIG20 index. Yesterday's rise in the absence of Wall Street indicates that the market is optimistic. However, from the point of view of technical analysis, resistance zone located above the level of 1810 points may encouraged to take profits.

Warsaw index since almost half of a year is moving in a trend channel with a horizontal limits set roughly at about 1,700 points from the bottom and 1,800 points from the top. So a really strong impulse is necessary to break the index out this template behavior. Such negative impulse could be unfavorable for the Prime Minister Renzi decision of the Italian referendum on December 4. In turn, the positive would be a classic rally of St. Claus on global stock markets, which, in fact we have not seen in three years.

-

06:10

Options levels on friday, November 25, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0829 (3533)

$1.0753 (1375)

$1.0691 (993)

Price at time of writing this review: $1.0569

Support levels (open interest**, contracts):

$1.0467 (3539)

$1.0413 (4418)

$1.0346 (2013)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 76698 contracts, with the maximum number of contracts with strike price $1,1400 (6331);

- Overall open interest on the PUT options with the expiration date December, 9 is 64829 contracts, with the maximum number of contracts with strike price $1,0500 (4418);

- The ratio of PUT/CALL was 0.85 versus 0.85 from the previous trading day according to data from November, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (1854)

$1.2604 (1495)

$1.2508 (1800)

Price at time of writing this review: $1.2447

Support levels (open interest**, contracts):

$1.2392 (1405)

$1.2295 (4023)

$1.2197 (1099)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 35053 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 36717 contracts, with the maximum number of contracts with strike price $1,2300 (4023);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from November, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:01

Global Stocks

European stocks scored modest gains Thursday, with mining shares battling against dollar strength during a quieter-than-usual session with U.S. markets closed for the Thanksgiving holiday. "The usual Thanksgiving calm has descended across markets, as European investors reconcile themselves to a day of low volumes and quiet trading," said Chris Beauchamp, chief market analyst at IG, in an note.

U.S. stock futures edged up on Thursday, as traders focused on their Thanksgiving Day celebrations rather than making big bets. U.S. stock markets and the bond market are closed Thursday for the holiday, and equity trading hours will be shortened on Friday.

Asian share markets were broadly higher early Friday, with Japan's Nikkei leading after the yen hit a fresh eight-month low against the dollar, helping boost the competitiveness of the country's exports.

-