Market news

-

23:31

Japan: Tokyo CPI ex Fresh Food, y/y, November -0.4% (forecast -0.4%)

-

23:30

Japan: Tokyo Consumer Price Index, y/y, November 0.5% (forecast -0.3%)

-

23:30

Japan: National Consumer Price Index, y/y, October 0.1% (forecast -0.4%)

-

23:30

Japan: National CPI Ex-Fresh Food, y/y, October -0.4% (forecast -0.4%)

-

23:28

Currencies. Daily history for Nov 24’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0555 +0,02%

GBP/USD $1,2449 +0,10%

USD/CHF Chf1,0166 0,00%

USD/JPY Y113,35 +0,77%

EUR/JPY Y119,59 +0,75%

GBP/JPY Y141,09 +0,84%

AUD/USD $0,7406 +0,08%

NZD/USD $0,7001 -0,03%

USD/CAD C$1,3488 +0,01%

-

23:00

Schedule for today,Friday, Nov 25’2016

09:30 United Kingdom GDP, q/q (Revised) Quarter III 0.7% 0.5%

09:30 United Kingdom GDP, y/y (Revised) Quarter III 2.1% 2.3%

11:00 United Kingdom CBI retail sales volume balance November 21 12

14:45 U.S. Services PMI (Preliminary) November 54.8 54.8

-

21:45

New Zealand: Trade Balance, mln, October -846 (forecast -950)

-

15:36

DXY targets 120 L/T. USD bull marlet to continue - BofA Merrill

"The Bloomberg US dollar index is approaching all-time highs. The number of USD crosses above their 200-day moving average has broken out higher. The number of USD crosses reaching overbought on RSI (bullish momentum) continues to rise.

The USD cumulative advance-decline line recently signaled for tactical USD strength and would turn outright bullish with a trend line break. The index can confirm with a close above 1255.

DXY monthly wedge breakout continues The long-term DXY chart implies significant upside for the DXY. This week's breakout through 100 ended the two-year range and makes 120 a long-term target".

Copyright © 2016 BofAML, eFXnews™

-

14:00

Belgium: Business Climate, November -1.8 (forecast -1.6)

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0300 (EUR 816 M) 1.0500 (EUR 1,760 M) 1.0675 (EUR 412 M) 1.0700-1.0715 (EUR 1,619 M) 1.0750-1.0765 (EUR 715 M) 1.0785-1.0800 (EUR 917 M)

GBP/USD 1.2400-1.2410 (GBP 206 M) 1.2435-1.2450 (GBP 232 M)

EUR/GBP 0.8400 (EUR 660 M) 0.8450 (EUR 300 M)

USD/JPY 111.25 (USD 360 M) 111.75-111.80 (USD 275 M)

AUD/USD 0.7300 (AUD 203 M) 0.7390-0.7400 (AUD 389 M) 0.7450 (AUD 1,197 M) 0.7550 (AUD 796 M)

NZD/USD 0.7000 (NZD 806 M)

-

13:33

Canadian corporations earned $80.7 billion in operating profits in the third quarter

Canadian corporations earned $80.7 billion in operating profits in the third quarter, up 14.0% from the previous quarter. The increase was led by a $6.5 billion gain in profits in finance and insurance industries.

On a year-over-year basis, overall operating profits for Canadian corporations were down 1.1% compared with the third quarter of 2015.

In the non-financial industries, third quarter operating profits rose 6.6% to $54.6 billion on a $9.7 billion increase in operating revenues. Overall, profits were up in 11 of 17 non-financial industries.

Operating profits were up 27.1% to $12.7 billion in manufacturing. Operating profits rose in 9 of 13 manufacturing industries. Most of that growth came from petroleum and coal products manufacturing.

Petroleum and coal products manufacturing posted an operating profit of $1.2 billion in the third quarter, following an operating loss of $0.8 billion in the second quarter.

-

13:00

Orders

EUR/USD

Offers : 1.0575-80 1.0600 1.0620 1.0635 1.0650 1.0665 1.0685 1.0700

Bids : 1.0515-20 1.0500 1.0475-80 1.0450 1.0430 1.0400

GBP/USD

Offers : 1.2450 1.2480-85 1.2500 1.2520 1.2535 1.2550 1.2570 1.2585 1.2600

Bids : 1.2400 1.2380 1.2360 1 .2340 1.2315-20 1.2300 1.2285 1.2250

EUR/GBP

Offers : 0.8520 0.8550 0.8580-85 0.8600 0.8635-40

Bids : 0.8475-80 0.8450 0.8420 0.8400

EUR/JPY

Offers : 118.20 118.45-50 118.70 119.00 119.50 120.00

Bids : 117.80 117.60 117.30 117.00 116.80 116.50 116.25-30 116.00

USD/JPY

Offers : 113.50-55 113.80-85 114.00 114.20 114.50

Bids : 113.00 112.80-85 112.60 112.40 112.00 111.85 111.50 111.30 111.00

AUD/USD

Offers : 0.7420 0.7445-50 0.7480 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids : 0.7370 0.7355-60 0.7325-30 0.7300 0.7285 0.7250

-

12:03

Stable consumer climate in Germany says GFK

Overall, consumer mood appears to be stable in November. Economic expectations and propensity to buy have increased slightly, while income expectations have experienced a minimal decline. The overall consumer climate indicator forecasts 9.8 points for the last month of this year, after a figure of 9.7 points in November.

Overall, consumers' assessments appear to be extremely stable this month. For the second time in succession, consumers have become more optimistic about overall economic prospects. Income expectations have stabilized, falling only very marginally after two more significant declines in a row. Moreover, propensity to buy has risen back above the 50-point mark. Consequently, the consumer climate has enjoyed marginal growth.

-

12:00

Germany: Gfk Consumer Confidence Survey, December 9.8 (forecast 9.7)

-

10:43

The euro area have remained fairly stable - ECB financial stability review

Euro area systemic stress has remained relatively low over the past six months, despite bouts of market turbulence. Since mid-2013, both the volatility and the level of the euro area composite indicator of systemic stress have gradually edged upwards.

The ratcheting-up of this indicator has been associated with a range of local and global stress events and has continued over the past six months. Factors that pushed it up include higher political uncertainty following the outcomes of the UK referendum on EU membership and the US election as well as market concerns about euro area banks' longer-term profitability prospects.

At the same time, continued accommodative monetary policy in advanced economies and abating market concerns about the possibility of a sharp slowdown in China have dampened spikes in systemic stress. All in all, despite relatively volatile global financial markets, bank and sovereign systemic stress indicators for the euro area have remained fairly stable at low levels

-

10:41

Raiffeisen Bank Sees Year-End EUR/HUF at Around 315

-

10:10

ECB Constancio: no reason to change baseline scenario

-

09:36

UK consumer credit is growing at its fastest rate since November 2006 - BBA

Gross mortgage borrowing of £12.2bn in the month was 4% lower than in October 2015.

Net mortgage borrowing is 2.5% higher than a year ago.

Consumer credit is now showing annual growth of over 7% reflecting strong retail sales growth in October supported in the case of personal loans by favourable interest rates.

Dr Rebecca Harding, BBA Chief Economist, said:

"Consumer credit is now growing at its fastest rate since November 2006, reflecting strong retail sales growth. Consumer confidence remains robust as borrowers take advantage of record low interest rates.

"Mortgage approvals ticked up a little October. There has only been a relatively modest increase in activity since the Bank of England cut rates in August.

-

09:30

United Kingdom: BBA Mortgage Approvals, October 40.85 (forecast 38.8)

-

09:17

German business sentiment weakened marginally in November

German business sentiment weakened marginally in November, reports said citing survey data from Ifo institute on Thursday, cited by rttnews.

The Ifo business confidence index fell to 110.4 in November from 110.5 in October. The reading was expected to remain at 110.5.

The current conditions indicator came in at 115.6. Economists had expected the score to remain unchanged at 115.

The expectations index dropped to 105.5 from 106.1 in prior month. The expected score was 106.

-

09:01

Germany: IFO - Expectations , November 105.5 (forecast 106)

-

09:00

Germany: IFO - Business Climate, November 110.4 (forecast 110.5)

-

09:00

Germany: IFO - Current Assessment , November 115.6 (forecast 115)

-

08:09

Today’s events

-

At 16:10 GMT the ECB Board Member Peter Preat will make a speech

-

At 17:15 GMT SNB Vice Chairman Fritz Zurbrugg deliver a speech

-

United States celebrate Thanksgiving Day

-

-

08:08

EU’s Schulz Not Seeking New Mandate In January – RTRS Source

-

07:44

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0575 (EUR 225m) 1.0600 (1.42bln) 1.0650 (2.85bln) 1.0700 (323m) 1.0725 (368m) 1.0750 (856m) 1.0800 (779m) 1.0850 (928m) 1.0900 (1.22bln)

USD/JPY 108.00 (USD 389m) 109.60-65 (552m)

GBP/USD 1.2200 (GBP 239m) 1.2300 (317m) 1.2500 (410m) 1.2650 (223m) 1.2700 (585m)

EUR/GBP 0.8675 (EUR 426m)

EUR/JPY 115.35 (EUR 352m) 118.00 (203m)

AUD/USD 0.7200 (AUD 600m) 0.7260 9249m) 0.7374 (200m) 0.7425 (251m) 0.7600 (357m) 0.7649-59 (313m)

USD/CAD 1.3215-25 (USD 411m) 1.3325 (380m) 1.3350-55 (695m) 1.3400 (861m) 1.3500 (974m)

-

07:24

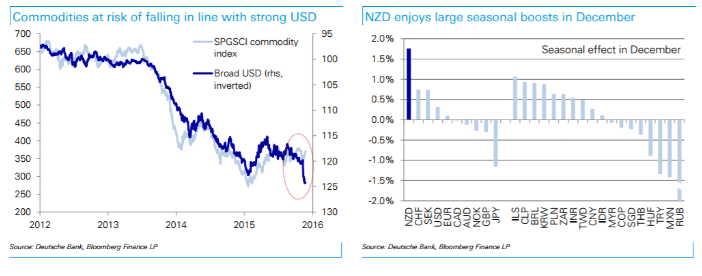

3 Reasons To Sell AUD/USD - Deutsche Bank

"A fortnight after the US election, we expect continuing weakness in the dollar bloc. While we would sell the entire bloc against the US dollar, we argue that the outlook remains most bearish for the Aussie.

First, rising US rates will likely continue to weigh on the commodity currencies, but the Aussie should suffer from the sharpest yield convergence in the next months.

Second, in terms of trade, the broad commodity complex is at risk of snapping back into line with the strong USD (chart 1). Idiosyncratically, however, Australian miners are most imminently at risk from a bursting of the speculative bubble in base metals and bulk commodities.

Third, the Aussie faces the strongest headwinds from being the most consensus net long in G10 as well as from its extreme overvaluation, which is second only to the RMB and CHF. At the other end, CAD is best protected by sizeable net shorts and modest undervaluation. The kiwi benefits from neither but consistently sees a significant seasonal boost of almost 2% in December".

-

07:20

BOJ's Nakaso: Too Early to Discuss Exiting Monetary Easing

-

07:19

Moody's: Japanese Corporates Face Restrained Recovery In 2017

-

07:16

Most Federal Reserve officials expect it to become appropriate to raise interest rates relatively soon - Minutes

Most Federal Reserve officials expect it to become appropriate to raise interest rates relatively soon, according to the minutes of the November meeting of the Federal Open Market Committee.

The minutes noted that the expectation for a near-term rate hike is contingent on incoming data providing some further evidence of continued progress toward the Fed's objectives.

Some meeting participants argued that a rate hike should occur at the next meeting in December in order to preserve credibility following the committee's recent communications, rttnews says.

The Fed said a few participants advocated increasing rates at the November meeting, including voting members Kansas City Fed President Esther George and Cleveland Fed President Loretta Mester.

Those preferring a rate hike viewed labor market conditions as at or close to those consistent with maximum employment and expected the recent progress toward the committee's inflation objective to continue.

-

07:16

Germany: GDP (YoY), Quarter III 1.5% (forecast 1.7%)

-

07:14

The index of business activity in the manufacturing sector of Japan below forecast

Commenting on the Japanese Manufacturing PMI survey data, Amy Brownbill, economist at IHS Markit, which compiles the survey, said:

"Manufacturing conditions in Japan continued to improve mid-way through the final quarter of 2016. Output increased for the fourth month running, helped by a boost in new orders. Data suggested that international demand was the key driver behind the expansion in total new sales.

Meanwhile, employment growth eased from October's 30-month high and was only marginal overall, suggesting manufacturers were less confident towards the outlook. Finally, cost inflation has recorded for the first time since December 2015, linked by firms to greater raw material prices, particularly fuel-related items. "

-

07:08

German economic growth is losing some momentum

German economic growth is losing some momentum. As the Federal Statistical Office (Destatis) already reported in its first release of 15 November 2016, the gross domestic product (GDP) increased 0.2% - upon price, seasonal and calendar adjustment - in the third quarter of 2016 compared with the previous quarter. In the first half of the year, the GDP had increased somewhat more, by 0.4% in the second quarter and 0.7% in the first quarter.

-

07:00

Germany: GDP (QoQ), Quarter III 0.2% (forecast 0.2%)

-

06:27

Options levels on thursday, November 24, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0829 (3533)

$1.0753 (1375)

$1.0691 (993)

Price at time of writing this review: $1.0545

Support levels (open interest**, contracts):

$1.0467 (3539)

$1.0413 (4418)

$1.0346 (2013)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 76698 contracts, with the maximum number of contracts with strike price $1,1400 (6331);

- Overall open interest on the PUT options with the expiration date December, 9 is 64829 contracts, with the maximum number of contracts with strike price $1,0500 (4418);

- The ratio of PUT/CALL was 0.85 versus 0.85 from the previous trading day according to data from November, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (1854)

$1.2604 (1495)

$1.2508 (1800)

Price at time of writing this review: $1.2433

Support levels (open interest**, contracts):

$1.2392 (1405)

$1.2295 (4023)

$1.2197 (1099)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 35053 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 36717 contracts, with the maximum number of contracts with strike price $1,2300 (4023);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from November, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:02

Japan: Coincident Index, September 112.7 (forecast 112.1)

-

05:01

Japan: Leading Economic Index , September 103 (forecast 100.5)

-

00:30

Japan: Manufacturing PMI, November 51.1 (forecast 51.7)

-