Market news

-

23:30

Commodities. Daily history for Nov 22’2016:

(raw materials / closing price /% change)

Oil 47.90 -0.27%

Gold 1,212.00 +0.07%

-

23:29

Stocks. Daily history for Nov 22’2016:

(index / closing price / change items /% change)

Nikkei 225 18,162.94 +56.92 +0.31%

Shanghai Composite 3,249.58 +31.43 +0.98%

S&P/ASX 200 5,413.33 0.00 0.00%

FTSE 100 6,819.72 +41.76 +0.62%

CAC 40 4,548.35 +18.77 +0.41%

Xetra DAX 10,713.85 +28.72 +0.27%

S&P 500 2,202.94 +4.76 +0.22%

Dow Jones Industrial Average 19,023.87 +67.18 +0.35%

S&P/TSX Composite 15,100.38 +60.51 +0.40%

-

23:28

Currencies. Daily history for Nov 22’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0627 -0,02%

GBP/USD $1,2422 -0,53%

USD/CHF Chf1,0111 +0,25%

USD/JPY Y111,13 +0,29%

EUR/JPY Y118,08 +0,25%

GBP/JPY Y138,03 -0,28%

AUD/USD $0,7400 +0,86%

NZD/USD $0,7060 -0,07%

USD/CAD C$1,3439 +0,17%

-

23:00

Schedule for today,Wednesday, Nov 23’2016

00:30 Australia Construction Work Done Quarter III -3.7% -1.7%

08:00 France Services PMI (Preliminary) November 51.4 51.9

08:00 France Manufacturing PMI (Preliminary) November 51.8 51.4

08:30 Germany Services PMI (Preliminary) November 54.2 54

08:30 Germany Manufacturing PMI (Preliminary) November 55.0 54.8

09:00 Eurozone Services PMI (Preliminary) November 52.8 53

09:00 Eurozone Manufacturing PMI (Preliminary) November 53.5 53.3

13:30 U.S. Chicago Federal National Activity Index October -0.14

13:30 U.S. Durable Goods Orders October -0.1% 1.5%

13:30 U.S. Durable Goods Orders ex Transportation October 0.2% 0.2%

13:30 U.S. Durable goods orders ex defense October 0.7%

14:45 U.S. Manufacturing PMI (Preliminary) November 53.4 53.4

15:00 U.S. New Home Sales October 593 593

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) November 87.2 91.6

15:30 U.S. Crude Oil Inventories November 5.274

18:00 U.S. FOMC meeting minutes

-

21:06

Major US stock indexes recorded a moderate increase

Major US stock indexes again finished trading at record highs. Dow crossed 19,000 points, the S & P 500 broke through 2200 points mark for the first time in history, due to the ongoing rally because of the election of Donald Trump, the US president.

In addition, as it became known, home sales in the US secondary market rose in October to its highest level in more than 9.5 years, against the backdrop of pent-up demand, offering more evidence of accelerating economic growth in the fourth quarter, but the recent spike in mortgage rates may slow Activity in the housing market. The National Association of Realtors reported that home sales in the secondary market increased by 2.0% to an annual rate of 5.6 million units, the highest level of sales pace since February 2007. The September figure was revised up to 5.49 million units from a previously reported 5.47 million units.

However, the report submitted by the Federal Reserve Bank of Richmond showed that activity in the manufacturing sector in the region has improved in November, beating analysts' estimates, and peaking in July. According to the report, the November index of manufacturing activity rose to +4 points versus -4 points in October. It was predicted that the figure will be 1 point. Recall value greater than 0 indicates the improvement of conditions in the manufacturing sector, while below 0 indicates worsening conditions. The data are taken from a survey of about 100 manufacturers in the Richmond area.

Oil prices held above $ 48 on speculation that OPEC will be able to reach an agreement to limit the production of next week. On the eve of the representative of Libya's OPEC Mohammed Own ended positively described the first day of the two-day meeting of the expert group of the cartel. In addition, OPEC sources said that the cartel experts have made some progress in the course of the first day of talks on the details of the Algerian agreements. Some of the agency's interlocutors also expressed optimism about the prospects for the conclusion of the final to limit production level agreement.

DOW index components closed mostly in positive territory (24 of 30). Most remaining shares rose Verizon Communications Inc. (VZ, + 2.55%). Outsider were shares of Visa Inc. (V, -2.11%).

Most of the S & P sectors recorded increase. The leader turned out to be the basic materials sector (+ 0.9%). the health sector fell the most (-1.6%).

At the close:

Dow + 0.35% 19,023.67 +66.98

Nasdaq + 0.33% 5,386.35 +17.49

S & P + 0.21% 2,202.90 +4.72

-

20:00

DJIA +0.29% 19,011.89 +55.20 Nasdaq +0.18% 5,378.78 +9.92 S&P +0.12% 2,200.84 +2.66

-

17:00

Основные фондовые индексы Европы завершили сессию в плюсе: FTSE 100 +41.76 6819.72 +0.62% DAX +28.72 10713.85 +0.27% CAC 40 +18.77 4548.35 +0.41%

-

16:42

WSE: Session Results

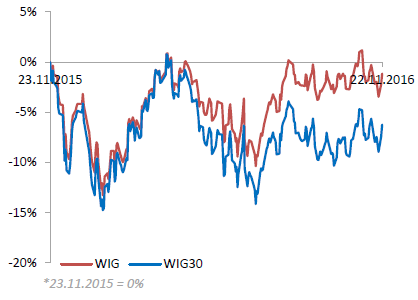

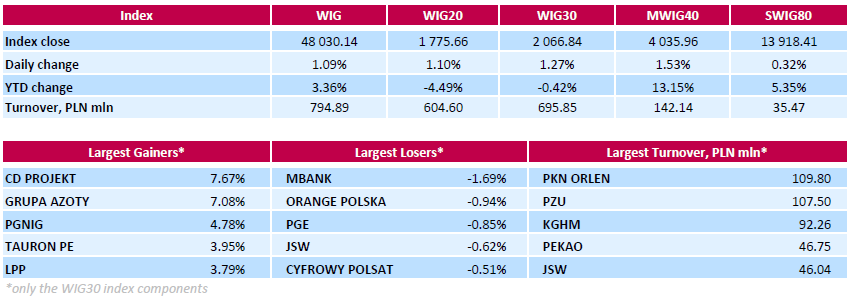

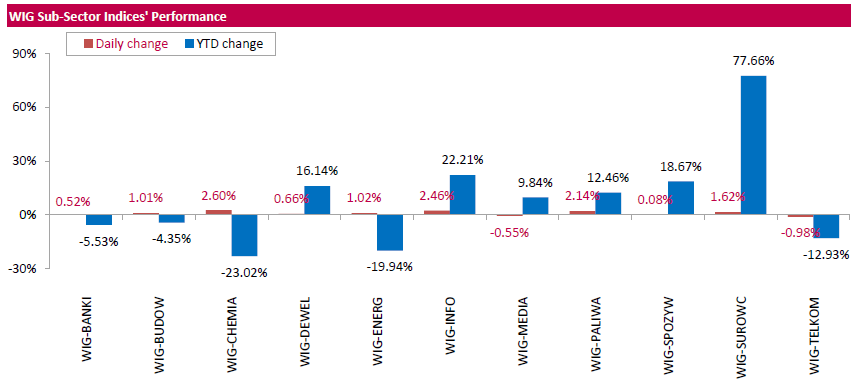

Polish equity market closed higher on Tuesday. The broad market measure, the WIG index, rose by 1.09%. Sector performance within the WIG was mainly positive as nine sectors recorded advances, with chemicals (+2.60%) outpacing.

The large-cap stocks added 1.27%, as measured by the WIG30 Index. In the index basket, the advancers pack was led by videogame developer CD PROJEKT (WSE: CDR) with gains of 7.67%, followed by chemical producer GRUPA AZOTY (WSE: ATT), which surged by 7.08%. Quotations of oil and gas producer PGNIG (WSE: PGN), genco TAURON PE (WSE: TPE) and clothing retailer LPP (WSE: LPP) also were on upstream, climbing by 4.78%, 3.95% and 3.79% respectively. On the contrary, banking name MBANK (WSE: MBK), telecommunication services provider ORANGE POLSKA (WSE: OPL) and genco PGE (WSE: PGE) were the weakest performers, suffering losses of 1.69%, 0.94% and 0.85% respectively.

-

16:13

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes hit records highs for the second straight day on Tuesday, with the Dow topping 19,000 points and the S&P 500 moving past 2,200 points for the first time ever as the Donald Trump-fueled rally continued. Trump's pro-growth policies, including promises of tax cuts, higher spending on infrastructure and simpler regulations in the banking and healthcare industries, have led a rally, especially in those sectors, since the election on Nov 8.

Most of Dow stocks in positive area (18 of 30). Top gainer - Verizon Communications Inc. (VZ, +1.95%). Ещз дщыук - Johnson & Johnson (JNJ, -2.17%).

Most S&P sectors in positive area. Top gainer - Basic Materials (+0.6%). Top loser - Healthcare (-1.5%).

At the moment:

Dow 18951.00 +41.00 +0.22%

S&P 500 2196.25 +3.25 +0.15%

Nasdaq 100 4870.00 +16.00 +0.33%

Oil 48.33 +0.09 +0.19%

Gold 1208.40 -1.40 -0.12%

U.S. 10yr 2.32 -0.02

-

16:05

WTI traded initialy up on renewed expectations of OPEC deal

Crude oil futures continued to soar Tuesday morning, bolstered by renewed expectations of a deal between OPEC and Russia to curb oil supplies.

Hopes for a sustained global economic recovery have also boosted oil prices.

U.S. stocks are set to extend record highs when Wall Street opens for business this morning.

WTI light sweet crude for January is up 74 cents at $49 a barrel, having rocketed higher by about 10 percent in the past few weeks.

Investor bets on rising U.S. short-term rates hit the highest ever last week in the eurodollar-futures market, at $2.1 trillion. That breaks a record set in 2014, said Cheng Chen, U.S. rates strategist at TD Securities, citing data from the Commodity Futures Trading Commission going back to 1993.

-

15:23

Dow Jones Industrial Average at new historical high

The Dow Jones Industrial Average breached 19000 for the first time early Tuesday, a day after major U.S. stock indexes hit a series of records.

The blue-chip index was recently up 47 points, or 0.3%, at 19004. The S&P 500 added 0.2%, and the Nasdaq Composite gained 0.3%. The three indexes, plus the small-cap Russell 2000, all closed at records Monday, says Dow Jones Newswire.

-

15:06

Consumer confidence indicator increased sharply in the euro area

In November 2016, the DG ECFIN flash estimate of the consumer confidence indicator increased sharply in the euro area (by 1.9 points to -6.1) and, to a lesser extent, in the EU (by 0.7 points to -5.8) compared to October.

Economic Sentiment increases strongly in both the euro area and the EU.

In October, the Economic Sentiment Indicator (ESI) increased by 1.4 points in both the euro area (to 106.3) and the EU (to 106.9).

-

15:05

US existing-home sales ascended in October for the second straight month

Existing-home sales ascended in October for the second straight month and eclipsed June's cyclical sales peak to become the highest annualized pace in nearly a decade, according to the US National Association of Realtors. All major regions saw monthly and annual sales increases in October.

Sales grew 2.0 percent to a seasonally adjusted annual rate of 5.60 million in October from an upwardly revised 5.49 million in September.

Lawrence Yun, NAR chief economist, says the wave of sales activity the last two months represents a convincing autumn revival for the housing market. "October's strong sales gain was widespread throughout the country and can be attributed to the release of the unrealized pent-up demand that held back many would-be buyers over the summer because of tight supply," he said. "Buyers are having more success lately despite low inventory and prices that continue to swiftly rise above incomes."

-

15:02

Richmond survey: Manufacturers anticipated positive business conditions

Fifth District manufacturing activity expanded in November, after a three-month contraction period. New orders increased in the most recent survey period, while shipments remained flat. Hiring activity continued to strengthen mildly across firms and wage increases were more widespread. Prices of raw materials and finished goods rose at a somewhat slower pace in November.

Manufacturers anticipated positive business conditions during the next six months. Producers expected faster growth in shipments and in the volume of new orders. Survey participants looked for backlogs to grow in the months ahead and anticipated increased capacity utilization. Firms looked for slightly longer vendor lead times during the next six months.

-

15:00

Eurozone: Consumer Confidence, November -6.1 (forecast -7.8)

-

15:00

U.S.: Existing Home Sales , October 5.6 (forecast 5.43)

-

14:59

U.S.: Richmond Fed Manufacturing Index, November 4 (forecast 1)

-

14:53

WSE: After start on Wall Street

The afternoon trading phase brought not much to the settled already picture of the market. The optimism before the opening on Wall Street pulled quotations in Europe, although levels of resistance have not been punctured.

At the opening of the US exchanges the demand side continues to maintain the advantage and the major indexes are rising by approx. 0.2-0.5%.

Trading in Warsaw is focused mainly on maintaining existing achievements with the participation of commodity companies or companies dependent on commodity prices. The volatility so far is only 14 points.

An hour before the close of the session the WIG20 was at the level of 1,774 points (+1,06%).

-

14:33

U.S. Stocks open: Dow +0.17%, Nasdaq +0.29%, S&P +0.18%

-

14:29

Before the bell: S&P futures +0.22%, NASDAQ futures +0.34%

U.S. stock-index futures gained, supported by strong commodity prices and the lingering effects of the post-election rally.

Global Stocks:

Nikkei 18,162.94 +56.92 +0.31%

Hang Seng 22,678.07 +320.29 +1.43%

Shanghai 3,249.58 +31.43 +0.98%

FTSE 6,832.12 +54.16 +0.80%

CAC 4,561.57 +31.99 +0.71%

DAX 10,742.54 +57.41 +0.54%

Crude $48.11 (-0.27%)

Gold $1,213.30 (+0.29%)

-

14:24

Company News: Volkswagen (VOW3) unveiled TRANSFORM 2025+

As reported by the company on its website, Volkswagen Board of Directors approved the program TRANSFORM 2025+, which will set the course for the development of the brand over the next decade and beyond.

According to the report, the new strategy aims at a better positioning of the brand in different regions and sectors, thanks to a significant improvement in efficiency and productivity. At the same time, the brand intends to carry out a major investment in the use of electric transport and connectivity.

The strategy foresees the following:

- Consistent restructuring of the core business and the development of new directions. By 2025 the company hopes to win the leading role in the electric segment, with annual sales of one million electric vehicles.

- A return to sustainable, profitable growth. The Board expects that the operating margin will rise to 6% by 2025.

- Billions of dollars in investment. Over the next few years, the Volkswagen brand will keep its investments stable at around € 4.5 billion, the main directions of investment - electric development. The brand intends to develop its own digital platform.

-

14:05

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Ford Motor (F) initiated with a Sell at Berenberg

General Motors (GM) initiated with a Sell at Berenberg

-

14:03

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.05

0.36(1.173%)

3327

Amazon.com Inc., NASDAQ

AMZN

786

6.00(0.7692%)

62795

American Express Co

AXP

71.99

0.45(0.629%)

208

Apple Inc.

AAPL

111.82

0.09(0.0806%)

112343

AT&T Inc

T

37.87

0.13(0.3445%)

15944

Barrick Gold Corporation, NYSE

ABX

15.49

0.10(0.6498%)

28789

Boeing Co

BA

148.76

1.74(1.1835%)

616

Caterpillar Inc

CAT

93.21

0.31(0.3337%)

21894

Chevron Corp

CVX

110

-0.18(-0.1634%)

12786

Cisco Systems Inc

CSCO

30.13

0.08(0.2662%)

1261

Citigroup Inc., NYSE

C

55.51

-0.03(-0.054%)

24931

Deere & Company, NYSE

DE

92.62

0.32(0.3467%)

225

Exxon Mobil Corp

XOM

86.4

-0.09(-0.1041%)

4848

Facebook, Inc.

FB

122.1

0.33(0.271%)

168207

Ford Motor Co.

F

11.81

0.02(0.1696%)

22641

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.85

0.34(2.3432%)

514059

General Motors Company, NYSE

GM

33.22

0.21(0.6362%)

387

Goldman Sachs

GS

211.38

0.30(0.1421%)

3787

Google Inc.

GOOG

771.74

2.54(0.3302%)

7661

Hewlett-Packard Co.

HPQ

16.2

0.20(1.25%)

900

Intel Corp

INTC

35

0.02(0.0572%)

7912

Johnson & Johnson

JNJ

114.5

-0.50(-0.4348%)

11133

JPMorgan Chase and Co

JPM

78.29

0.24(0.3075%)

3175

Merck & Co Inc

MRK

61.93

-0.37(-0.5939%)

515

Microsoft Corp

MSFT

60.99

0.13(0.2136%)

6215

Nike

NKE

51.4

0.12(0.234%)

806

Pfizer Inc

PFE

31.72

0.15(0.4751%)

14721

Procter & Gamble Co

PG

83.13

0.49(0.5929%)

828

Starbucks Corporation, NASDAQ

SBUX

56.19

0.09(0.1604%)

1495

Tesla Motors, Inc., NASDAQ

TSLA

184.8

0.28(0.1517%)

14497

The Coca-Cola Co

KO

41.35

-0.01(-0.0242%)

6582

Twitter, Inc., NYSE

TWTR

18.72

0.12(0.6452%)

35577

Verizon Communications Inc

VZ

48.45

0.14(0.2898%)

2118

Visa

V

81.9

0.21(0.2571%)

1412

Wal-Mart Stores Inc

WMT

69.62

0.25(0.3604%)

13015

Walt Disney Co

DIS

97.6

-0.03(-0.0307%)

517

Yahoo! Inc., NASDAQ

YHOO

41.31

0.20(0.4865%)

300

Yandex N.V., NASDAQ

YNDX

18.77

0.17(0.914%)

6553

-

13:51

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0600 (EUR 239m) 1.0635 (426m) 1.0650 (559m)

USD/JPY 108.00 (USD 1.05bln) 108.85 (200m) 109.50 (226m) 111.00 (783m)

GBP/USD 1.2400 (GBP 227m)

EUR/JPY 117.35 (EUR 230m)

USD/CAD 1.3180 (USD 215m) 1.3360-65 (270m) 1.3500-10 (623m)

-

13:33

Canadian retail sales rise in line with expectations in September

Following four months of little change, retail sales rose 0.6% to $44.4 billion in September on the strength of higher sales at motor vehicle and parts dealers.

Sales were up in 7 of 11 subsectors, representing 65% of retail trade.

After removing the effects of price changes, retail sales increased 0.6%.

The largest increase in dollar terms was a 2.4% advance at motor vehicle and parts dealers. This was the first gain in three months and was mainly attributable to new car dealers (+2.8%).

Sales at gasoline stations rose 0.9%, marking the fifth gain in six months for the subsector. The gain in September reflected higher prices at the pump.

Following a 0.4% decrease in August, sales at general merchandise stores (+0.4%) bounced back in September.

The gains at building material and garden equipment and supplies dealers (+0.7%) and sporting goods, hobby, book and music stores (+0.2%) more than offset the declines in August.

-

13:30

Canada: Retail Sales ex Autos, m/m, September 0% (forecast 0.5%)

-

13:30

Canada: Retail Sales, m/m, September 0.6% (forecast 0.6%)

-

13:30

Canada: Retail Sales YoY, September 2.5%

-

13:20

Putin: Russia Inflation Seen at 5.7%-5.8% In 2016

-

13:05

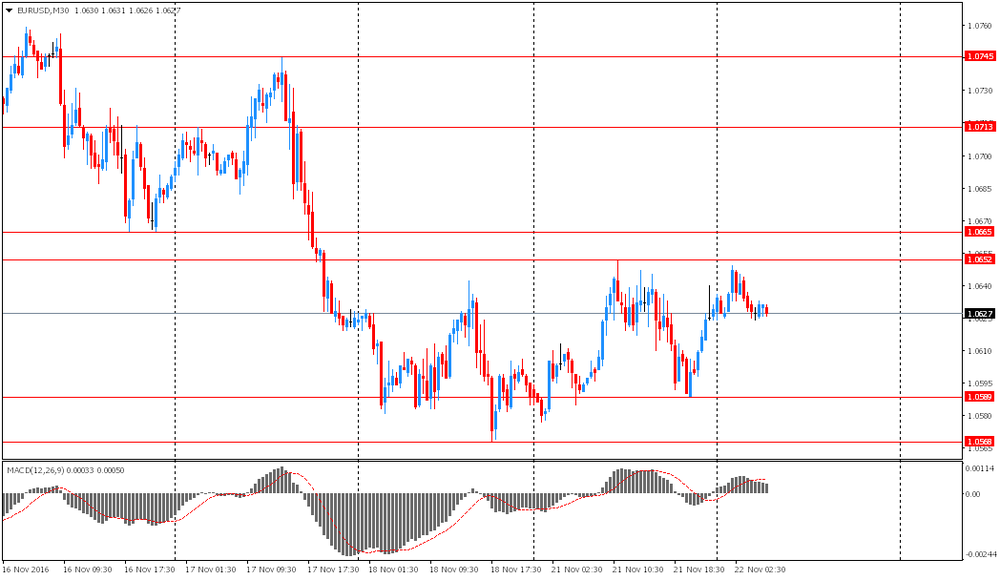

EUR/USD Seen Falling to $1.05 Ahead of Italy Referendum - ING

-

12:53

Orders

EUR/USD

Offers : 1.0650 1.0665 1.0685 1.0700 1.0730 1.0750-60 1.0780 1.0800 1.0825-30 1.0850

Bids : 1.0620 1.0600 1.0575-80 1.0550 1.0535 1.0520 1.0500

GBP/USD

Offers : 1.2500 1.2520 1.2535 1.2550 1.2570 1.2585 1.2600 1.2620 1.2650

Bids : 1.2455-60 1.2420 1.2400 1.2380 1.2360 1.2340 1.2315-20 1.2300

EUR/GBP

Offers : 0.8520 0.8545-50 0.8575 0.8600 0.8630-35 0.8660 0.8680-85 0.8700

Bids : 0.8500 0.8480-85 0.8460-65 0.8450 0.8420 0.8400

EUR/JPY

Offers : 118.00-05 118.45-50 119.00 119.50 120.00

Bids : 117.60 117.30 117.00 116.80 116.50 116.25-30 116.00

USD/JPY

Offers : 111.30-35 111.50 111.70 111.85 112.00 112.20 112.

Bids : 110.65 110.50 110.20 110.00 109.80 109.50 109.30 109.00

AUD/USD

Offers : 0.7400-05 0.7420 0.7445-50 0.7480 0.7500-05 0.7520 0.7545-50

Bids : 0.7355-60 0.7325-30 0.7300 0.7285 0.7250 0.7220 0.7200

-

12:29

RBA Deputy Governor Kent: lower unemployment masks the weakness

-

Bias towards part-time employment is structural

-

The deterioration of full-time employment due to the slowdown in activity in the mining industry

-

Impact of the recession in the mining industry and labor market weakens

-

-

12:03

WSE: Mid session comment

The first half of today's session was the picture of a pretty good trade. We may see, however, that a large increase from the beginning of the session, raises some problems with maintaining of this output. Our market has already repeatedly show that far more good is to climb slower than dynamic jump, which later forces more of work on its maintenance than magnification. Optimism in Warsaw matches well with preserving of the environment. Major European indices are right at the important resistance levels and today once again are trying to attack them using commodity companies. One drawback may be today the size of the market, which together with the last hour volatility indicates the drift of the market in the side area.

On the halfway point of the session the WIG20 index was at the level of 1,774 points (+1,03%). The turnover was amounted to PLN 290 million.

-

11:42

Major stock indices in Europe show a positive trend

Stock indices in Europe are approaching the record highs in nearly a month, on the background mining and energy sectors rally.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.7% to 342.43 points.

Shares of mining corporations BHP Billiton and Anglo American rose 4.4%, Rio Tinto and Glencore - more than 3%.

BP shares price increased by 1%, Royal Dutch Shell +0,9%, Total +3%. Brent crude oil increased by 0.6% - to $ 49.2 per barrel.

Enel shares (+ 4%) rose after the company announced cost-cutting and asset sales by 3 billion euros.

British De La Rue, the largest producer of banknotes in the world, rose by 1.6% due to positive expectations.

Shares of Lufthansa lost 0.5% on news that the airline pilots plan to go on strike on Wednesday for what may follow the cancellation of hundreds of flights.

Compass Group shares show one of the worst perfomance in FTSE 100 falling by 4.2% despite an increase in profit for the fiscal year.

At the moment:

FTSE 6845.16 67.20 0.99%

DAX 10742.37 57.24 0.54%

CAC 4562.10 32.52 0.72%

-

11:06

UK manufacturers expect to increase average selling prices - CBI

The survey of 430 manufacturers found that total order books returned to levels seen throughout the summer, and well above the long-run average. Meanwhile, export orders dipped a little, but remained above average.

Output volumes rose at a slower pace over the past three months. Expectations for production over the coming quarter are robust, however, reaching their highest level since February 2015.

In the wake of sterling's sharp depreciation, manufacturers expect to increase average selling prices over the next three months, at the fastest pace since January 2014.

-

11:00

United Kingdom: CBI industrial order books balance, November -3 (forecast -9)

-

10:52

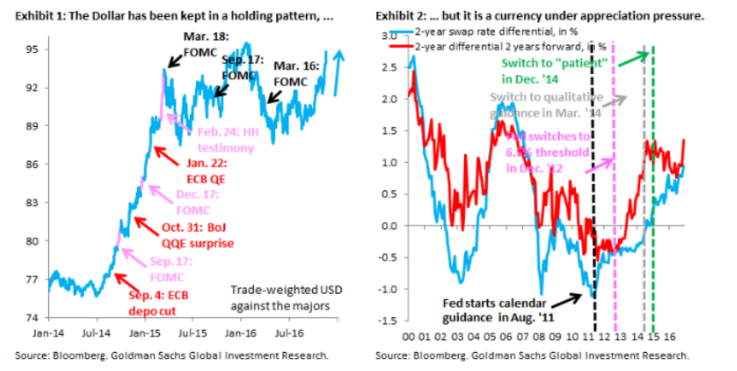

Whats the dollar trade? - Goldman Sachs

"In our last FX Views, we argued that the US election represents a "reset" for two reasons.

First, the possibility of meaningful fiscal stimulus in an economy where slack is close to zero raises upward pressure on inflation, as Chair Yellen and NY Fed President Dudley acknowledged this week.

Second, President-elect Trump can make a number of appointments to the Fed in fairly short order, which could shift the reaction function hawkish. Both things have pushed front-end interest rates up (Exhibit 2), and the Dollar is now near the top of the range it has traded in since March 2015.

As in 2014, when the Dollar was on the move, the question is now how much further it can go in the near term. Federal funds futures are one lens through which to look at this. They have obviously moved a lot, but the market in our view is still catching up to the changed landscape. The market is pricing 64 bps in tightening through 2017, well below our US team's forecast of 100 bps. More importantly, through end-2019 the market is pricing 130 bps, or just over five hikes.This strikes us as low and points to further upside for the Dollar, including in the near term.

We are through our year-end targets for EUR/$ (1.08) and $/JPY (108), which were controversial just a short time ago, and the risk to our 12-month forecasts - 1.00 for EUR/$ and 115 for $/JPY - is now firmly in the direction of more Dollar strength.

Sterling downside has fallen out of favor, but we think remains one of the most actionable themes. This is why we went short Sterling and the Euro against the Dollar as one of our Top Trades for 2017.

...By choosing to also include EUR on the short leg of the trade, we are essentially taking an agnostic view with regard to EUR/GBP. Indeed, our new EUR/GBP forecast is 0.90, 0.88 and 0.88 in 3-, 6- and 12-months. The slew of elections slated to take place across Europe this year present a number of catalysts for the trade, and we have kept our call for EUR/USD parity on a 12-month horizon unchanged. Given that the ECB is so far from its inflation target, it should not respond to any rising inflationary pressures in the same way as the Fed, although premature tapering from the ECB is a risk to the trade".

Copyright © 2016 Goldman Sachs, eFXnews™

-

10:03

Moody's: South Korea Has Fiscal Firepower to Fight Challenges

-

09:39

Oil is trading higher

This morning the New York futures for Brent increased 0.31% to $ 49.05 and WTI rose 0.27% to $ 48.37 per barrel. Thus, the black gold is trading in the green zone near the October highs. At the moment, market participants are expecting a OPEC deal to limit production, but analysts warned that the failure of this initiative will lead to an increase in the oversupply in early 2017.

-

09:35

UK Public sector net borrowing decreased

Public sector net borrowing (excluding public sector banks) decreased by £5.6 billion to £48.6 billion in the current financial year-to-date (April to October 2016), compared with the same period in 2015.

Public sector net borrowing (excluding public sector banks) decreased by £1.6 billion to £4.8 billion in October 2016, compared with October 2015.

Public sector net debt (excluding public sector banks) at the end of October 2016 was £1,641.6 billion, equivalent to 83.8% of gross domestic product (GDP); an increase of £50.9 billion compared with October 2015.

This month, debt as a percentage of GDP fell by 0.5 percentage point compared with October 2015. This is the fifth successive month of debt falling on the year as a percentage of GDP and indicates that GDP is currently increasing (year-on-year) faster than net debt excluding public sector banks.

-

09:30

United Kingdom: PSNB, bln, October -4.3 (forecast -5.9)

-

08:40

Major stock exchanges trading in the green zone: FTSE + 0.6%, DAX + 0.6%, CAC40 + 0.7%, FTMIB + 0.8%, IBEX + 0.6%

-

08:23

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0600 (EUR 239m) 1.0635 (426m) 1.0650 (559m)

USD/JPY 108.00 (USD 1.05bln) 108.85 (200m) 109.50 (226m) 111.00 (783m)

GBP/USD 1.2400 (GBP 227m)

EUR/JPY 117.35 (EUR 230m)

USD/CAD 1.3180 (USD 215m) 1.3360-65 (270m) 1.3500-10 (623m)

-

08:15

WSE: After opening

WIG20 index opened at 1765.41 points (+0.52%)*

WIG 47838.77 0.69%

WIG30 2059.44 0.91%

mWIG40 3985.87 0.27%

*/ - change to previous close

The future contracts December series (FW20Z1620) started the day of substantial increases by 0.8% to 1,770 points. Contracts on the German DAX gained at the opening on a smaller scale the order of 0.4%.

The cash market began with the growth gap with still good turnover and concentration on of raw materials companies. The boosters is growing fast and the main index goes above exponential average of 21 sessions.

After fifteen minutes of trading the Warsaw index of the largest companies reached the level of 1,777 points (+ 1.18%).

-

08:07

Today’s events

-

At 07:45 GMT RBA assistant governor Christopher Kent will deliver a speech

-

At 10:30 GMT, Britain will hold an auction of 10-year bonds

-

Japan celebrates Labor Day

-

-

07:49

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.4%, CAC 40 + 0.3%, FTSE + 0.3%

-

07:34

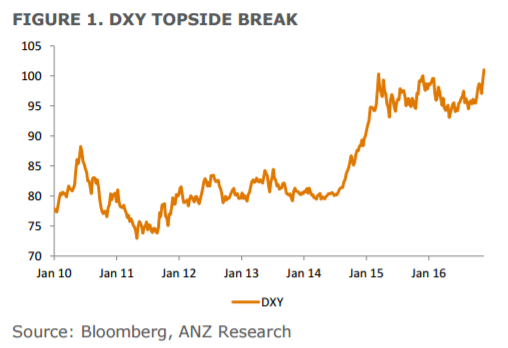

ANZ targets EUR/USD at 1.07 at year end. Some reasons for caution on shorts

"The dollar's appreciating trend has intensified as the anticipated policy dynamics of an expansionary fiscal stance and higher interest rates under a Trump presidency have proved to be a powerful dynamic for the currency. DXY is now at its strongest level since Q1 2003 and market expectations are growing that the dollar may rise materially further over the medium term as fiscal expansion is overlaid on an economy operating at or very close to full employment. The sharp rise in bond yields has also assisted dollar strength.

That said, we are cautious about getting caught up in the whirlwind and revising up our dollar forecasts higher just now based on anticipated US economic policy.

We anticipated a move into a 1.00-1.05 range for EUR/USD next year, as whoever was elected president would pursue a more expansionary agenda. That view still remains the case and there are a number of reasons why we are hesitant to revise up our forecasts.

Based on the DXY, the dollar is at its highest level since 2003. But it is interesting that in 2003 the dollar was in a pronounced depreciation phase amid (then) President Bush's policy agenda of steel tariffs (2002) and tax cuts, whilst inflation was also rising. Currently, US inflation is rising and the US Presidentelect's indicated policy priorities of renegotiating trade arrangements, threatening higher tariffs, and cutting taxes is having exactly the opposite effect on the USD. At present, various PPP estimates, ranging from producer prices to the Big Mac index, imply the euro is around 20% undervalued versus USD.

For now though, the expectation that an expansionary fiscal policy will come when the economy is operating at full employment should continue to lend support to the USD. Barring some shock, the FOMC should announce a 25bps rate rise in the fed funds target on 14 December whilst the ECB is expected to extend its QE program when it meets on 8 December. There is also the potential for a rise in uncertainty should the referendum in Italy fail on 4 December, not to mention elections in the Netherlands, France, and Germany next year. The European dimension is an important element in our expectation of further dollar gains in the coming months and that could deteriorate further. Would an additional 5-10% political risk premium be required if the European political environment deteriorates in the near term? Probably, but as opinion polls have shown this year, forecasting political outturns is very difficult. With that in mind and given the direction of travel in policy divergence, we continue to maintain a bullish disposition towards the USD vs EUR".

ANZ targets EUR/USD at 1.07, 1.06, and at 1.04 by the end of Q4 '16, Q1 '17, and Q2 '17 respectively.

Copyright © 2016 ANZ, eFXnews™

-

07:30

Fitch maintains China's rating at 'A+'

Fitch Ratings maintained the sovereign ratings of China with a 'stable' outlook citing robust external finances and macroeconomic track record, cited by rttnews.

The agency retained China's rating at 'A+'.

Nonetheless, Fitch noted that the recent economic growth trajectory has been accompanied by a build-up of imbalances and vulnerabilities that poses risks to its basic economic and financial stability.

In its assessment, vulnerabilities will rise over 2016-18 forecast horizon, as policy settings continue to prioritize rapid economic growth over macroeconomic stability

-

07:26

Options levels on tuesday, November 22, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0845 (2936)

$1.0778 (932)

$1.0726 (696)

Price at time of writing this review: $1.0604

Support levels (open interest**, contracts):

$1.0494 (4131)

$1.0432 (6198)

$1.0397 (1673)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 73947 contracts, with the maximum number of contracts with strike price $1,1200 (6186);

- Overall open interest on the PUT options with the expiration date December, 9 is 66257 contracts, with the maximum number of contracts with strike price $1,0500 (6198);

- The ratio of PUT/CALL was 0.90 versus 0.90 from the previous trading day according to data from November, 21

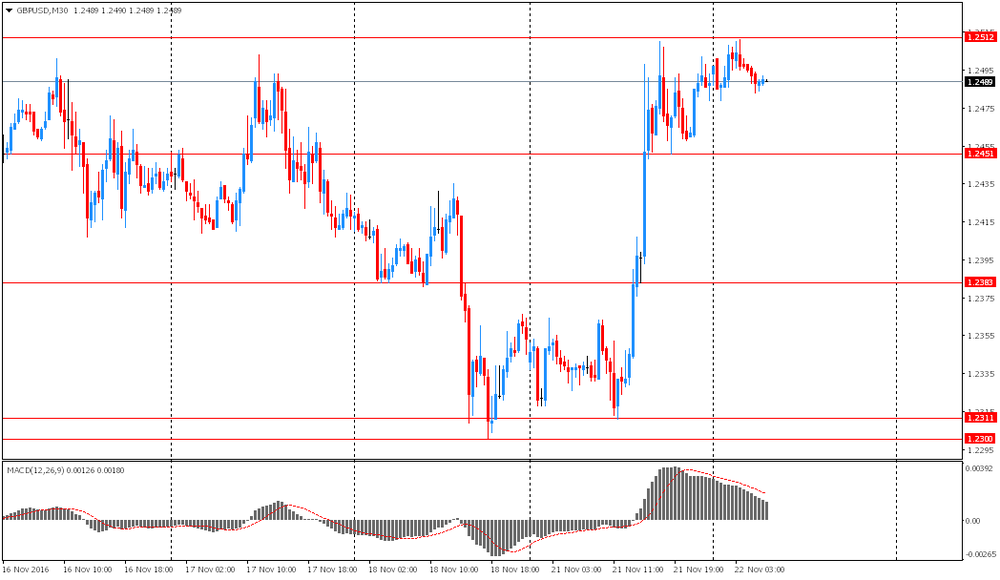

GBP/USD

Resistance levels (open interest**, contracts)

$1.2704 (1840)

$1.2607 (1578)

$1.2511 (1895)

Price at time of writing this review: $1.2471

Support levels (open interest**, contracts):

$1.2392 (1407)

$1.2295 (3931)

$1.2197 (1263)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 34938 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 36784 contracts, with the maximum number of contracts with strike price $1,2300 (3931);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from November, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:26

Asian session review: volatility created by the Japan earthquake near Fukushima

At the beginning of the session, the yen strengthened sharply after reports of an earthquake in Japan with a magnitude of 7.3 points, at 67 kilometers from the island of Honshu, Fukushima Prefecture, at 6 am local time. The authorities have warned of tsunami formation. A little later, there occurred aftershocks with a magnitude of 5.5.

Also, the Bank of Japan Chairman, Kuroda, stated once again that the Japanese economy is in a gradual recovery trend. He also said the BOJ will adjust policy as needed, and that the current interest rate policy is more stable and flexible. Mr. Kuroda said that he and the governing concil are closely monitoring the impact of loose monetary policy to market conditions for Japanese government bonds, but have not yet seen a sharp reduction in market liquidity.

EUR / USD: during the Asian session, the pair was trading in the $ 1.0625-50 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.2480-10 range

USD / JPY: during the Asian session, the pair was trading in the Y110.25-90 range

-

07:22

WSE: Before opening

Indexes on Wall Street ended Monday's session with increases and subsequent historical peaks of trading. The Dow Jones Industrial at the end of the day gained 0.47 percent, the S&P 500 rose by 0.75 percent and the Nasdaq Composite gained 0.89 percent. The leaders on Monday's growth on Wall Street were oil companies in the wake of rising prices of oil. The market is optimistic due to the belief that Trump is able to move the economy back on faster than Hillary Clinton track.

Yesterday's weakening of the dollar and higher commodity prices led to a recovery in the segment of emerging markets and our market was exceptionally strongly benefited from this fact. Today morning rising prices of copper and oil. Indexes in Asia are gaining in value, especially as regards to emerging countries, as in Japan booster is modest and reaches 0.3%. We may also see increasing the valuation of contracts for the S&P500 index, where the psychological barrier of 2,200 points was defeated.

Today's macro calendar remains quite empty, ends the period of publication of results and approaching Thanksgiving Day. Listing on the Warsaw market should start positively. Later, much more will depend on whether the adverse for emerging markets trends in the dollar and bond's yields begin to turn away, as it did yesterday.

-

07:19

BOJ Kuroda: The Japanese economy is in a gradual recovery trend

-

Impetus to achieving a rate of inflation of 2%

-

The Bank of Japan will adjust policy as needed, and the current interest rate policy is more sustainable and flexible

-

It is too early to discuss steps to increase the balance

-

Carefully observe the impact of loose monetary policy to market conditions for Japanese government bonds

-

-

07:10

USD/JPY little changed after early JPY gains on Japan earthquake news. 7.3 magnitude

-

07:06

Swiss trade balance surplus below expectations

According to the positive results since February 2016, exports in October fell by 1.1% on a working-day basis. The increase in chemical-pharmaceutical products dampened the export decline. In the meantime, imports rose (+ 6.7%). The trade balance closed with a surplus of CHF 2.7 billion.

-

07:00

Switzerland: Trade Balance, October 2.68 (forecast 3.89)

-

06:00

Global Stocks

Europe's main equity benchmark finished slightly higher Monday, as gains for energy and mining stocks offset drops by Italian banks and U.K. manufacturer Essentra PLC. Italy is holding a constitutional referendum on Dec. 4, and a defeat for Prime Minister Mateo Renzi's Democratic Party would make it more difficult for the government to pass reforms, potentially prompting Renzi to dissolve his government.

U.S. stocks closed higher at fresh records Monday, aided by a jump in oil prices and a pullback in the dollar, giving the Dow industrials, S&P 500 and Nasdaq their third simultaneous all-time closing highs this year. The last time all three indexes closed at record highs at the same time was two sessions back in mid-August, and before then had not occurred since 1999.

Asian shares were broadly higher early Tuesday, with the Australian market rising to a one-month high, as oil prices rallied on expectations that key oil-producing countries will agree to a deal to slash production.

-