Market news

-

20:08

Major US stock indexes finished trading in negative territory

Major US stock indices fell noticeably on Thursday, as investors assessed the reports of leading Wall Street banks and President Donald Trump's comments on the strength of the dollar.

As it became known today, the number of Americans applying for unemployment benefits unexpectedly decreased last week, which indicates that the labor market remains strong, despite a sharp slowdown in the number of jobs in March. Initial applications for unemployment benefits fell by 1,000 to 234,000, seasonally adjusted for the week ending April 8, the Ministry of Labor said. This was the third weekly decline in bids and left them not too far from the 44-year low of 227,000 reached in February. Economists predicted that applications would grow to 245,000 people.

However, the preliminary results of the studies submitted by Thomson-Reuters and the Michigan Institute showed that the mood sensor among American consumers grew in April, despite the average decline forecasts. According to the data, in April the consumer sentiment index rose to 98 points compared with the final reading for March at the level of 96.9 points. According to average estimates, the index had to decrease to the level of 96.5 points.

Most components of the DOW index finished trading in the red (26 of 30). Most of all fell Chevron Corporation shares (CVX, -2.65%). Leader of growth were shares of Visa Inc. (V, + 0.52%).

All sectors of the S & P index showed a negative trend. Most of all fell basic materials sector (-1.4%).

At closing:

DJIA -0.67% 20,454.42 -137.44

Nasdaq -0.53% 5,805.15 -31.01

S & P -0.68% 2,329.03 -15.90

-

19:00

DJIA -0.35% 20,520.81 -71.05 Nasdaq -0.16% 5,826.74 -9.42 S&P -0.33% 2,337.28 -7.65

-

16:00

European stocks closed: FTSE 100 -21.40 7327.59 -0.29% DAX -45.70 12109.00 -0.38% CAC 40 -30.01 5071.10 -0.59%

-

14:55

U.S treasury yields retreat further from near 5-month lows in the wake of stronger-than-forecast U. Michigan U.S consumer sentiment data in early April

-

14:28

Merkel would beat social democrats' Schulz in theoretical direct vote for chancellor by 46 pct to - Deutschlandtrend poll

-

14:01

Michigan consumer sentiment tops expectations

Consumer sentiment inched upward in early April mainly due to more favorable views of current economic conditions. The Current Economic Conditions Index rose to its highest level since 2000 and nearly reached its all-time peak of 121.1 set in 1999. The Expectations Index improved only slightly, remaining largely unchanged at favorable levels for the past three months.

While partisanship had no impact on the Current Conditions Index (Democrats and Republicans differed by just 0.4 points), the data suggest the beginning of a convergence on the Expectations Index, with the figure for Democrats rising 7% and falling for Republicans by 7%, although the gap still remained an astonishing 50.5 Index points.

-

14:00

U.S.: Reuters/Michigan Consumer Sentiment Index, April 98 (forecast 96.5)

-

13:46

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0550 (EUR 214m) 1.0575 (310m) 1.0650 (535m) 1.0700 (930m) 1.0750 (455m)

USDJPY: 108.00 (USD 270m) 108.40-50 (1.4bln) 109.00-10 (370m) 109.50 (188m) 109.80 (190m) 110.00 (645m)

GBPUSD: 1.2500 (GBP 222m)

EURGBP: 0.8300 (EUR 212m) 0.8550 (234m)

AUDUSD: 0.7400 (AUD 200m) 0.7500 (362m) 0.7600 (230m) 0.7700 (395m)

USDCAD 1.3100 (USD 440m) 1.3200-05 (646m) 1.3280 (896m) 1.3300 ( 733m) 1.3450 (260m)

NZDUSD: 0.7000 (NZD 200m)

-

13:32

U.S. Stocks open: Dow -0.24%, Nasdaq -0.16%, S&P -0.24%

-

13:24

Before the bell: S&P futures -0.19%, NASDAQ futures -0.11%

U.S. stock-index fell following the U.S. President Donald Trump's comments on the U.S. dollar and interest rates, while investors assessed bank quarterly results.

Stocks:

Nikkei 18,426.84 -125.77 -0.68%

Hang Seng 24,261.66 -51.84 -0.21%

Shanghai 3,276.07 +2.24 +0.07%

FTSE 7,308.91 -40.08 -0.55%

CAC 5,069.83 -31.28 -0.61%

DAX 12,112.57 -42.13 -0.35%

Crude $53.23 (+0.23%)

Gold $1,288.40 (+0.81%)

-

12:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

32.25

0.20(0.62%)

6120

Amazon.com Inc., NASDAQ

AMZN

893.07

-3.16(-0.35%)

10345

Apple Inc.

AAPL

141.65

-0.15(-0.11%)

31409

AT&T Inc

T

40.5

-0.06(-0.15%)

245

Barrick Gold Corporation, NYSE

ABX

20.29

0.07(0.35%)

119119

Caterpillar Inc

CAT

95.25

0.39(0.41%)

2330

Cisco Systems Inc

CSCO

32.6

-0.02(-0.06%)

1398

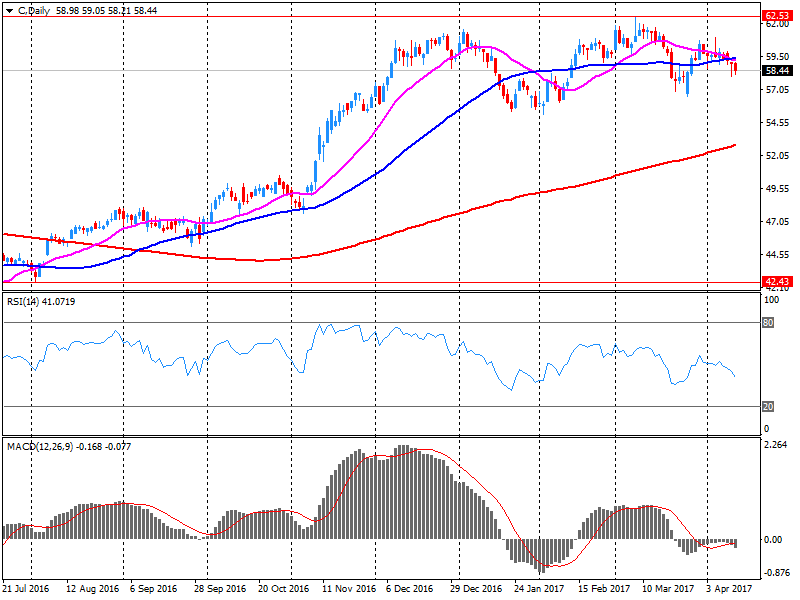

Citigroup Inc., NYSE

C

58.41

-0.10(-0.17%)

273224

Deere & Company, NYSE

DE

110.5

1.15(1.05%)

103

Exxon Mobil Corp

XOM

83.24

0.27(0.33%)

748

Facebook, Inc.

FB

139.5

-0.08(-0.06%)

17729

FedEx Corporation, NYSE

FDX

186.45

0.14(0.08%)

231

Ford Motor Co.

F

11.22

-0.01(-0.09%)

15540

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.87

-0.01(-0.08%)

35119

General Electric Co

GE

29.75

-0.02(-0.07%)

3435

Goldman Sachs

GS

224.99

-0.76(-0.34%)

13660

Intel Corp

INTC

35.45

-0.18(-0.51%)

9512

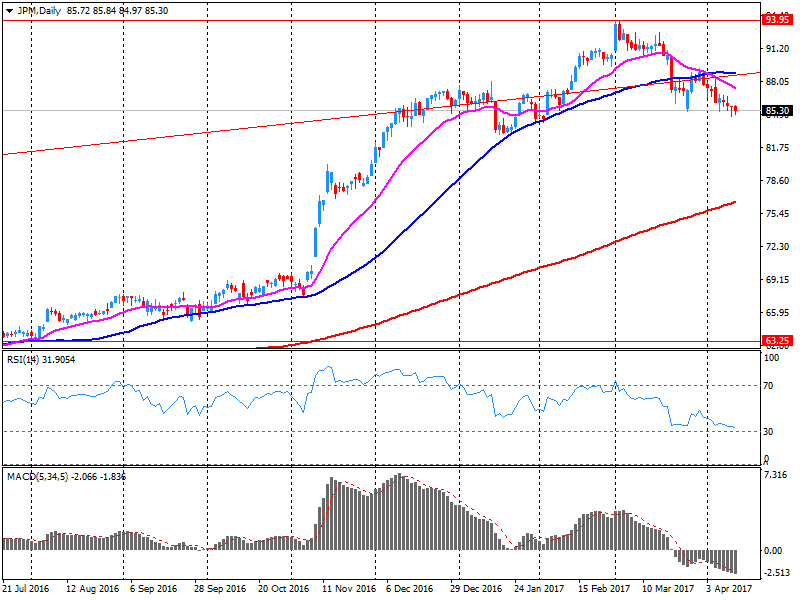

JPMorgan Chase and Co

JPM

85.74

0.34(0.40%)

367876

McDonald's Corp

MCD

130.95

-0.31(-0.24%)

674

Microsoft Corp

MSFT

65.18

-0.05(-0.08%)

1319

Nike

NKE

55.5

-0.07(-0.13%)

350

Pfizer Inc

PFE

33.83

-0.09(-0.27%)

3100

Starbucks Corporation, NASDAQ

SBUX

57.39

-0.19(-0.33%)

5018

Tesla Motors, Inc., NASDAQ

TSLA

296.6

-0.24(-0.08%)

28572

The Coca-Cola Co

KO

42.8

-0.14(-0.33%)

6801

Twitter, Inc., NYSE

TWTR

14.4

-0.02(-0.14%)

7010

Walt Disney Co

DIS

113.44

0.40(0.35%)

2846

Yandex N.V., NASDAQ

YNDX

22.72

-0.06(-0.26%)

1400

-

12:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Yahoo! (YHOO) target raised to $46 from $41 at Pivotal Research Group

-

12:42

Canadian manufacturing sales edged down 0.2%

Manufacturing sales edged down 0.2% in February to $53.6 billion, following three consecutive monthly increases.

The largest declines were in the motor vehicle assembly and petroleum and coal product manufacturing industries. However, these decreases were largely offset by gains in the aerospace products and parts, primary metal and machinery industries.

Sales were down in 10 of the 21 industries, representing 37% of the Canadian manufacturing sector.

Once the effects of price changes are taken into consideration, manufacturing sales in volumes edged up 0.1% in February.

-

12:41

US Producer Price Index declined 0.1 percent in March

The Producer Price Index for final demand declined 0.1 percent in March, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.3 percent in February and 0.6 percent in January. On an unadjusted basis, the final demand index rose 2.3 percent for the 12 months ended March 2017, the largest increase since moving up 2.4 percent for the 12 months ended March 2012.

In March 2017, three-fourths of the decrease in the final demand index is attributable to prices for final demand services, which fell 0.1 percent. The index for final demand goods also inched down 0.1 percent.

Prices for final demand less foods, energy, and trade services edged up 0.1 percent in March, the tenth straight advance. For the 12 months ended in March, the index for final demand less foods, energy, and trade services climbed 1.7 percent.

-

12:40

US unemployment claims continue to decline

In the week ending April 8, the advance figure for seasonally adjusted initial claims was 234,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 234,000 to 235,000. The 4-week moving average was 247,250, a decrease of 3,000 from the previous week's revised average. The previous week's average was revised up by 250 from 250,000 to 250,250.

-

12:30

U.S.: PPI, m/m, March -0.1% (forecast 0%)

-

12:30

U.S.: PPI excluding food and energy, m/m, March 0% (forecast 0.2%)

-

12:30

U.S.: PPI, y/y, March 2.3% (forecast 2.4%)

-

12:30

U.S.: PPI excluding food and energy, Y/Y, March 1.6% (forecast 1.8%)

-

12:30

Canada: New Housing Price Index, MoM, February 0.4% (forecast 0.2%)

-

12:30

U.S.: Initial Jobless Claims, 234 (forecast 245)

-

12:30

U.S.: Continuing Jobless Claims, 2028 (forecast 2028)

-

12:30

Canada: Manufacturing Shipments (MoM), February -0.2% (forecast -0.7%)

-

12:23

Company News: Citigroup (C) quarterly results beat analysts’ estimates

Citigroup reported Q1 FY 2017 earnings of $1.35 per share (versus $1.10. in Q1 FY 2016), beating analysts' consensus estimate of $1.24.

The company's quarterly revenues amounted to $18.120 bln (+3.2% y/y), beating analysts' consensus estimate of $17.748 bln.

C rose to $58.60 (+0.15%) in pre-market trading.

-

12:11

Company News: JPMorgan Chase (JPM) quarterly results beat analysts’ expectations

JPMorgan Chase reported Q1 FY 2017 earnings of $1.65 per share (versus $1.35 in Q1 FY 2016), beating analysts' consensus estimate of $1.53.

The company's quarterly revenues amounted to $25.586 bln (+6.2% y/y), beating analysts' consensus estimate of $24.398 bln.

JPM rose to $85.75 (+0.41%) in pre-market trading.

-

11:59

Orders

EUR/USD

Offers: 1.0670 1.0685 1.0700 1.0730 1.0750 1.0780 1.0800

Bids: 1.0620 1.0600 1.0580 1.0565 1.0550 1.0530 1.0500

GBP/USD

Offers: 1.2580 1.2600 1.2620 1.2650 1.2675-80 1.2700

Bids: 1.2540 1.2520 1.2500 1.2480 1.2465 1.2450 1.2430 1.2400

EUR/JPY

Offers: 116.30 116.50 116.80 117.00 117.30 117.50

Bids: 115.85 115.50 115.20 115.00

EUR/GBP

Offers: 0.8500-05 0.8520 0.8550-55 0.8580 0.8600

Bids: 0.8470-75 0.8450 0.8425-30 0.8400

USD/JPY

Offers: 109.20-25 109.50 109.80 110.00 110.30 110.50

Bids: 108.70-75 108.50 108.30 108.00 1.0780 1.0750

AUD/USD

Offers: 0.7600 0.7620 0.7650 0.7670 0.7700

Bids: 0.7560 0.7530 0.7500 0.7480-85 0.7465 0.7450

-

11:50

Ukraine central bank expects current account deficit of $4.3 bln in 2017-2019

-

Expects foreign reserves to grow to $21.1 bln by end-2017 if it receives imf tranches and related loans

-

Keeps 2017 gdp forecast unchanged at 1.9 pct

-

Raises 2018 gdp forecast to 3.2 pct

-

Keeps 2017 inflation forecast at 9.1 pct

-

Expects inflation to slow to single figures in q4

-

Trade blockade in eastern regions will not affect inflation significantly

-

-

09:48

RBI: cut-off price for 6.97 pct 2026 bond at 101.10 rupees, yield at 6.8080 pct

-

09:16

Czech Central bank Apr 6 mtg minutes: renewed use of fx rate, other unconventional tool could not be ruled out if risk of deflation was to re-emerge, this highly unlikely to happen in near future

-

08:41

Bank of England: net balance of 18.8 pct of lenders expect to tighten supply of unsecured consumer credit, largest share since q4 2008

-

Lenders expect to tighten supply of unsecured consumer credit

-

Lenders report weaker business investment exerted "significant drag" on demand for corporate lending in q1

-

-

08:40

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.0550 (EUR 214m) 1.0575 (310m) 1.0650 (535m) 1.0700 (930m) 1.0750 (455m)

USDJPY: 108.00 (USD 270m) 108.40-50 (1.4bln) 109.00-10 (370m) 109.50 (188m) 109.80 (190m) 110.00 (645m)

GBPUSD: 1.2500 (GBP 222m)

EURGBP: 0.8300 (EUR 212m) 0.8550 (234m)

AUDUSD: 0.7400 (AUD 200m) 0.7500 (362m) 0.7600 (230m) 0.7700 (395m)

USDCAD 1.3100 (USD 440m) 1.3200-05 (646m) 1.3280 (896m) 1.3300 ( 733m) 1.3450 (260m)

NZDUSD: 0.7000 (NZD 200m)

-

08:38

Japan’s Suga: FX Stability Is Important, Watching Market Moves With Sense Of Urgency - Reuters

-

08:35

Russia Central Bank's Yudayeva says high oil price volatility remains a risk for Russian currency market

-

Risks linked to possible outflow from OFZ market low

-

Capital inflow into OFZ market, in our assessment, could be rather stable

-

Strengthening of rouble in q1 was dictated by inflow of fx via foreign trade

-

-

07:25

Swiss PPI rose 1.3% in March, as in the previous month

The Producer and Import Price Index rose in March 2017 by 0.1% compared with the previous month, reaching 100.3 points (base December 2015 = 100). The slight rise is due in particular to higher prices for scrap. Compared with March 2016, the price level of the whole range of domestic and imported products rose by 1.3%. These are some of the findings from the Federal Statistical Office (FSO).

-

07:15

Switzerland: Producer & Import Prices, y/y, March 1.3% (forecast 0.9%)

-

07:15

Switzerland: Producer & Import Prices, m/m, March 0.1% (forecast 0.1%)

-

07:14

French CPI accelerated to +0.6% over a month after a weak rebound in Feb

In March 2017, the Consumer Prices Index (CPI) accelerated to +0.6% over a month after a weak rebound by 0.1% in February. Seasonally adjusted, it was stable, after having decreased by 0.2% in February. Year on year, consumer prices slowed down slightly (+1.2% after +1.3%).

Over a month, the acceleration resulted from a rebound in the prices of manufactured products after the end of winter sales and from a further rise in tobacco prices. Contrariwise, food prices slipped back due to fresh products. Energy prices fell too, because of a downturn in petroleum product prices. Besides, services prices were at a standstill.

-

07:01

France: CPI, y/y, March 1.1% (forecast 1.1%)

-

06:47

Negative start of trading on the main European stock markets expected: DAX -0.3%, CAC40 -0.2%, FTSE without change.

-

06:47

France: CPI, m/m, March 0.6% (forecast 0.6%)

-

06:44

Options levels on thursday, April 13, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0803 (626)

$1.0767 (1070)

$1.0715 (462)

Price at time of writing this review: $1.0667

Support levels (open interest**, contracts):

$1.0603 (131)

$1.0561 (506)

$1.0525 (781)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 53991 contracts, with the maximum number of contracts with strike price $1,1000 (4995);

- Overall open interest on the PUT options with the expiration date June, 9 is 58153 contracts, with the maximum number of contracts with strike price $1,0400 (5249);

- The ratio of PUT/CALL was 1.08 versus 1.07 from the previous trading day according to data from April, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.2806 (1075)

$1.2709 (625)

$1.2612 (425)

Price at time of writing this review: $1.2555

Support levels (open interest**, contracts):

$1.2484 (590)

$1.2388 (702)

$1.2291 (807)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 16085 contracts, with the maximum number of contracts with strike price $1,3000 (1336);

- Overall open interest on the PUT options with the expiration date June, 9 is 18489 contracts, with the maximum number of contracts with strike price $1,1500 (3063);

- The ratio of PUT/CALL was 1.15 versus 1.11 from the previous trading day according to data from April, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:34

Chineze exports and imports rose more than expected in March

China's exports rebounded at a faster than expected pace, while growth in imports slowed in March, data from the General Administration of Customs showed, cited by rttnews.

In dollar terms, exports grew 16.4 percent year-on-year in March, reversing February's 1.3 percent decline. Shipments were expected to rise 3.4 percent.

At the same time, imports advanced 20.3 percent after expanding 38.1 percent in February. Economists had forecast a 15.5 percent increase.

As a result, the trade surplus totaled $23.9 billion in March, smaller the expected surplus of $12.5 billion.

-

06:31

New Zeeland food prices fell 0.3 percent

Food prices fell 0.3 percent in the March 2017 month. After seasonal adjustment, food prices fell 0.4 percent.

In March 2017 compared with February 2017:

-

Fruit and vegetable prices fell 3.0 percent (down 2.0 percent after seasonal adjustment).

-

Meat, poultry, and fish prices rose 0.3 percent.

-

Grocery food prices rose 0.2 percent (up 0.2 percent after seasonal adjustment).

-

Non-alcoholic beverage prices fell 0.4 percent.

-

Restaurant meals and ready-to-eat food prices rose 0.1 percent.

-

-

06:30

Economic confidence is soaring as we unleash the power of private sector job creation and stand up for the American Workers #AmericaFirst @realDonaldTrump

-

06:29

Big jump for Australian employment in March. AUD/USD rally strong

-

Employment increased 16,500 to 12,033,400.

-

Unemployment increased 5,800 to 749,500.

-

Unemployment rate increased by less than 0.1 pts to 5.9%.

-

Participation rate increased by less than 0.1 pts to 64.7%.

-

Monthly hours worked in all jobs decreased 0.4 million hours to 1,668.5 million hours.

Seasonally adjusted estimates (monthly change)

-

Employment increased 60,900 to 12,059,600. Full-time employment increased 74,500 to 8,238,600 and part-time employment decreased 13,600 to 3,821,000.

-

Unemployment increased 4,000 to 753,100. The number of unemployed persons looking for full-time work increased 2,900 to 528,600 and the number of unemployed persons only looking for part-time work increased 1,100 to 224,500.

-

Unemployment rate remained steady at 5.9%.

-

Participation rate increased by 0.2 pts to 64.8%.

-

Monthly hours worked in all jobs increased 3.2 million hours to 1,664.2 million hours.

-

-

06:25

Consumer prices in Germany were 1.6% higher in March 2017

Consumer prices in Germany were 1.6% higher in March 2017 than in March 2016. The inflation rate - measured by the consumer price index - thus decreased. In February 2017, it had been +2.2%. Compared with the previous month, the consumer price index rose by 0.2% in March 2017. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 30 March 2017.

The inflation rate in March 2017 was characterised mainly by the development of energy prices, as had been the case in the previous months. The year-on-year price increase (+5.1%), however, was markedly smaller than in February 2017 (+7.2%). This applies in particular to heating oil (+25.2%; February 2017: +43.8%) and motor fuels (+11.9%; February 2017: +15.6%). One of the reasons for the lower rates in March 2017 is that mineral oil product prices were up a year ago (basis-related effect). For the other energy products, the year-on-year rates of price increase in March 2017 were lower (for example, electricity: +1.5%; gas: -3.3%). Excluding energy prices, the inflation rate in March 2017 would have been +1.2%; excluding the prices of mineral oil products, it would have been +1.0%.

Food prices, too, were higher (+2.3%) in March 2017 than in March 2016. In February 2017, the rate of food price increase had been +4.4%. In March 2017, a considerable year-on-year increase in prices was recorded especially for edible fats and oils (+16.5%, including butter: +33.8%). Consumers paid markedly more than a year earlier also for fish and fish products (+4.2%), vegetables (+4.0%) and dairy products (+3.1%). The price increases regarding other food groups were rather moderate (for example, meat and meat products: +1.4%; confectionery: +1.1%).

-

06:24

US President Trump: U.S. Dollar 'is getting too strong'

-

06:01

Germany: CPI, m/m, March 0.2% (forecast 0.2%)

-

06:01

Germany: CPI, m/m, March 0.2% (forecast 0.2%)

-

06:01

Germany: CPI, y/y , March 1.6% (forecast 1.6%)

-

05:36

Global Stocks

European stocks logged their first day of gains in three sessions on Wednesday, with shares of car makers driving higher, as investor appeared, for now, to set aside the geopolitical worries emanating from Syria.

U.S. stocks closed modestly lower on Wednesday as investors remained cautious amid persistent geopolitical risks. The main indexes briefly trimmed losses as U.S. Secretary of State Rex Tillerson met with the Russian counterpart Sergei Lavrov to discuss the civil war in Syria and nuclear capabilities of North Korea, then ticked back toward the low end of the daily range after President Donald Trump told The Wall Street Journal that he felt the dollar was "getting too strong."

China's trade balance returned to a surplus in March, helped by renewed strength in exports after a surprise deficit in February. The balance between exports and imports came to a surplus of $23.93 billion in March, compared with a deficit of $9.15 billion in February, the General Administration of Customs said Thursday.

-

03:14

China: Trade Balance, bln, March 23.93 (forecast 10)

-

01:31

Australia: Changing the number of employed, March 60.9 (forecast 20)

-

01:30

Australia: Unemployment rate, March 5.9% (forecast 5.9%)

-

01:00

Australia: Consumer Inflation Expectation, April 4.1%

-