Market news

-

20:08

Major US stock indexes finished trading in negative territory

Major US stock indices fell noticeably on Thursday, as investors assessed the reports of leading Wall Street banks and President Donald Trump's comments on the strength of the dollar.

As it became known today, the number of Americans applying for unemployment benefits unexpectedly decreased last week, which indicates that the labor market remains strong, despite a sharp slowdown in the number of jobs in March. Initial applications for unemployment benefits fell by 1,000 to 234,000, seasonally adjusted for the week ending April 8, the Ministry of Labor said. This was the third weekly decline in bids and left them not too far from the 44-year low of 227,000 reached in February. Economists predicted that applications would grow to 245,000 people.

However, the preliminary results of the studies submitted by Thomson-Reuters and the Michigan Institute showed that the mood sensor among American consumers grew in April, despite the average decline forecasts. According to the data, in April the consumer sentiment index rose to 98 points compared with the final reading for March at the level of 96.9 points. According to average estimates, the index had to decrease to the level of 96.5 points.

Most components of the DOW index finished trading in the red (26 of 30). Most of all fell Chevron Corporation shares (CVX, -2.65%). Leader of growth were shares of Visa Inc. (V, + 0.52%).

All sectors of the S & P index showed a negative trend. Most of all fell basic materials sector (-1.4%).

At closing:

DJIA -0.67% 20,454.42 -137.44

Nasdaq -0.53% 5,805.15 -31.01

S & P -0.68% 2,329.03 -15.90

-

19:00

DJIA -0.35% 20,520.81 -71.05 Nasdaq -0.16% 5,826.74 -9.42 S&P -0.33% 2,337.28 -7.65

-

16:00

European stocks closed: FTSE 100 -21.40 7327.59 -0.29% DAX -45.70 12109.00 -0.38% CAC 40 -30.01 5071.10 -0.59%

-

13:32

U.S. Stocks open: Dow -0.24%, Nasdaq -0.16%, S&P -0.24%

-

13:24

Before the bell: S&P futures -0.19%, NASDAQ futures -0.11%

U.S. stock-index fell following the U.S. President Donald Trump's comments on the U.S. dollar and interest rates, while investors assessed bank quarterly results.

Stocks:

Nikkei 18,426.84 -125.77 -0.68%

Hang Seng 24,261.66 -51.84 -0.21%

Shanghai 3,276.07 +2.24 +0.07%

FTSE 7,308.91 -40.08 -0.55%

CAC 5,069.83 -31.28 -0.61%

DAX 12,112.57 -42.13 -0.35%

Crude $53.23 (+0.23%)

Gold $1,288.40 (+0.81%)

-

12:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

32.25

0.20(0.62%)

6120

Amazon.com Inc., NASDAQ

AMZN

893.07

-3.16(-0.35%)

10345

Apple Inc.

AAPL

141.65

-0.15(-0.11%)

31409

AT&T Inc

T

40.5

-0.06(-0.15%)

245

Barrick Gold Corporation, NYSE

ABX

20.29

0.07(0.35%)

119119

Caterpillar Inc

CAT

95.25

0.39(0.41%)

2330

Cisco Systems Inc

CSCO

32.6

-0.02(-0.06%)

1398

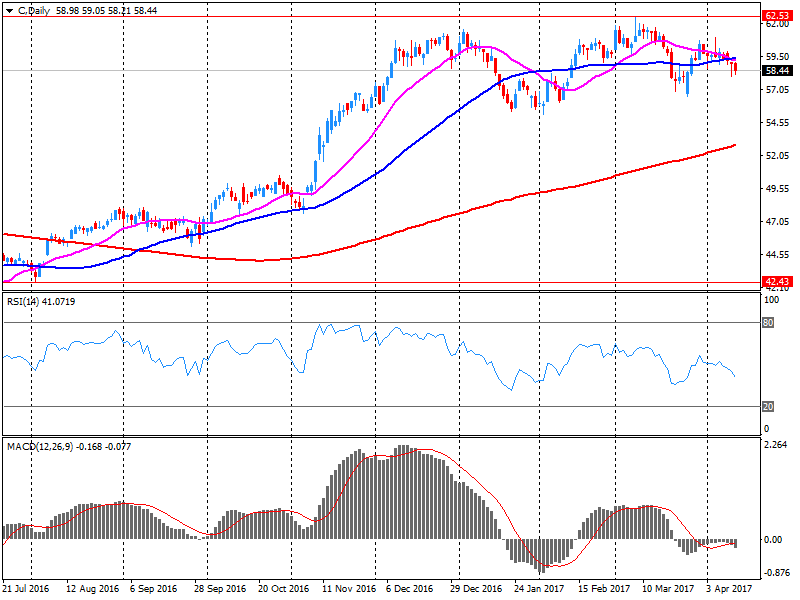

Citigroup Inc., NYSE

C

58.41

-0.10(-0.17%)

273224

Deere & Company, NYSE

DE

110.5

1.15(1.05%)

103

Exxon Mobil Corp

XOM

83.24

0.27(0.33%)

748

Facebook, Inc.

FB

139.5

-0.08(-0.06%)

17729

FedEx Corporation, NYSE

FDX

186.45

0.14(0.08%)

231

Ford Motor Co.

F

11.22

-0.01(-0.09%)

15540

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.87

-0.01(-0.08%)

35119

General Electric Co

GE

29.75

-0.02(-0.07%)

3435

Goldman Sachs

GS

224.99

-0.76(-0.34%)

13660

Intel Corp

INTC

35.45

-0.18(-0.51%)

9512

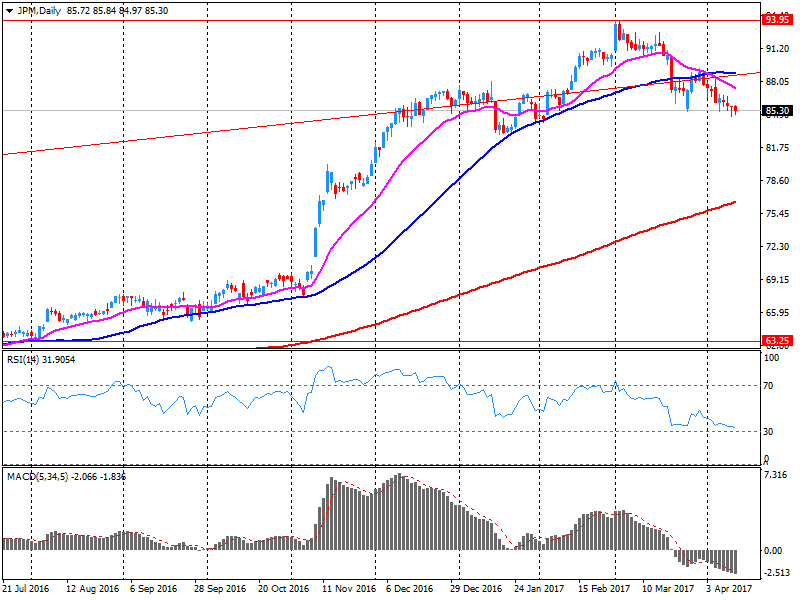

JPMorgan Chase and Co

JPM

85.74

0.34(0.40%)

367876

McDonald's Corp

MCD

130.95

-0.31(-0.24%)

674

Microsoft Corp

MSFT

65.18

-0.05(-0.08%)

1319

Nike

NKE

55.5

-0.07(-0.13%)

350

Pfizer Inc

PFE

33.83

-0.09(-0.27%)

3100

Starbucks Corporation, NASDAQ

SBUX

57.39

-0.19(-0.33%)

5018

Tesla Motors, Inc., NASDAQ

TSLA

296.6

-0.24(-0.08%)

28572

The Coca-Cola Co

KO

42.8

-0.14(-0.33%)

6801

Twitter, Inc., NYSE

TWTR

14.4

-0.02(-0.14%)

7010

Walt Disney Co

DIS

113.44

0.40(0.35%)

2846

Yandex N.V., NASDAQ

YNDX

22.72

-0.06(-0.26%)

1400

-

12:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Yahoo! (YHOO) target raised to $46 from $41 at Pivotal Research Group

-

12:23

Company News: Citigroup (C) quarterly results beat analysts’ estimates

Citigroup reported Q1 FY 2017 earnings of $1.35 per share (versus $1.10. in Q1 FY 2016), beating analysts' consensus estimate of $1.24.

The company's quarterly revenues amounted to $18.120 bln (+3.2% y/y), beating analysts' consensus estimate of $17.748 bln.

C rose to $58.60 (+0.15%) in pre-market trading.

-

12:11

Company News: JPMorgan Chase (JPM) quarterly results beat analysts’ expectations

JPMorgan Chase reported Q1 FY 2017 earnings of $1.65 per share (versus $1.35 in Q1 FY 2016), beating analysts' consensus estimate of $1.53.

The company's quarterly revenues amounted to $25.586 bln (+6.2% y/y), beating analysts' consensus estimate of $24.398 bln.

JPM rose to $85.75 (+0.41%) in pre-market trading.

-

05:36

Global Stocks

European stocks logged their first day of gains in three sessions on Wednesday, with shares of car makers driving higher, as investor appeared, for now, to set aside the geopolitical worries emanating from Syria.

U.S. stocks closed modestly lower on Wednesday as investors remained cautious amid persistent geopolitical risks. The main indexes briefly trimmed losses as U.S. Secretary of State Rex Tillerson met with the Russian counterpart Sergei Lavrov to discuss the civil war in Syria and nuclear capabilities of North Korea, then ticked back toward the low end of the daily range after President Donald Trump told The Wall Street Journal that he felt the dollar was "getting too strong."

China's trade balance returned to a surplus in March, helped by renewed strength in exports after a surprise deficit in February. The balance between exports and imports came to a surplus of $23.93 billion in March, compared with a deficit of $9.15 billion in February, the General Administration of Customs said Thursday.

-