Market news

-

22:30

Commodities. Daily history for Oct 17’2016:

(raw materials / closing price /% change)

Oil 50.07 +0.26%

Gold 1,256.40 -0.02%

-

22:29

Stocks. Daily history for Oct 17’2016:

(index / closing price / change items /% change)

Nikkei 225 16,900.12 0.00 0.00%

Shanghai Composite 3,041.24 -22.56 -0.74%

S&P/ASX 200 5,388.68 0.00 0.00%

FTSE 100 6,947.55 -66.00 -0.94%

CAC 40 4,450.23 -20.69 -0.46%

Xetra DAX 10,503.57 -76.81 -0.73%

S&P 500 2,126.50 -6.48 -0.30%

Dow Jones Industrial Average 18,086.40 -51.98 -0.29%

S&P/TSX Composite 14,596.52 +11.53 +0.08%

-

22:28

Currencies. Daily history for Oct 17’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0998 +0,25%

GBP/USD $1,2183 -0,04%

USD/CHF Chf0,989 -0,11%

USD/JPY Y103,90 -0,25%

EUR/JPY Y114,27 -0,02%

GBP/JPY Y126,58 -0,28%

AUD/USD $0,7631 +0,22%

NZD/USD $0,7170 +1,19%

USD/CAD C$1,3126 -0,09%

-

22:06

Schedule for today, Tuesday, Oct 18’2016

00:30 Australia New Motor Vehicle Sales (MoM) September 0.1%

00:30 Australia New Motor Vehicle Sales (YoY) September 2.9%

00:30 Australia RBA Meeting's Minutes

08:30 United Kingdom Producer Price Index - Output (MoM) September 0.1% 0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) September 0.8% 1.1%

08:30 United Kingdom Producer Price Index - Input (MoM) September 0.2% 0.4%

08:30 United Kingdom Producer Price Index - Input (YoY) September 7.6% 7.4%

08:30 United Kingdom Retail Price Index, m/m September 0.4% 0.1%

08:30 United Kingdom Retail prices, Y/Y September 1.8% 2%

08:30 United Kingdom HICP, m/m September 0.3% 0.1%

08:30 United Kingdom HICP, Y/Y September 0.6% 0.9%

08:30 United Kingdom HICP ex EFAT, Y/Y September 1.3% 1.4%

12:30 Canada Manufacturing Shipments (MoM) August 0.1%

12:30 U.S. CPI, m/m September 0.2% 0.3%

12:30 U.S. CPI, Y/Y September 1.1% 1.5%

12:30 U.S. CPI excluding food and energy, m/m September 0.3% 0.3%

12:30 U.S. CPI excluding food and energy, Y/Y September 2.3% 2.3%

14:00 U.S. NAHB Housing Market Index October 65 63

20:00 U.S. Net Long-term TIC Flows August 103.9

20:00 U.S. Total Net TIC Flows August 140.6

-

21:45

New Zealand: CPI, y/y, Quarter III 0.2% (forecast 0.1%)

-

21:45

New Zealand: CPI, q/q , Quarter III 0.2% (forecast 0%)

-

19:01

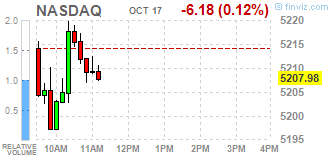

DJIA 18093.66 -44.72 -0.25%, NASDAQ 5204.29 -9.87 -0.19%, S&P 500 2128.49 -4.49 -0.21%

-

16:02

European stocks closed: FTSE 6947.55 -66.00 -0.94%, DAX 10503.57 -76.81 -0.73%, CAC 4450.23 -20.69 -0.46%

-

15:51

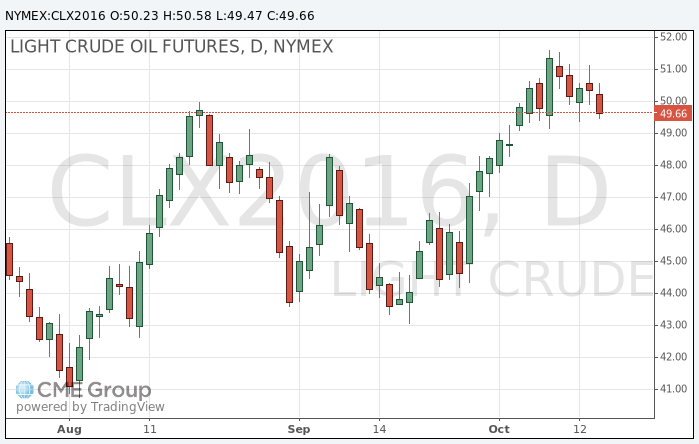

Oil trading in the red zone

Oil prices are falling, as investors are hesitating on the background of US oil rigs growths and the assumption that the positive from pre OPEC production cuts have already been priced in.

Morgan Stanley's analysts believes that even this factor (production cut) alone should be enough to ensure that oil prices remain in the range of 48-53 dollars per barrel before the official OPEC meeting. The members of the cartel will meet on November 30 in Vienna.

Net long positions rise confirms that traders expect a rise in prices, Commerzbank analysts said. At the same time, they note that the situation can change quickly.

"The subsequent behavior of investors will largely depend on whether OPEC can maintain market confidence in its program of production cut".

Some observers believe that in the short term, the oil market will be supported by the OPEC meeting, but in the medium term, prices will depend on how much production will be reduced.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 49.47 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of mark Brent fell to 51.16 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

15:32

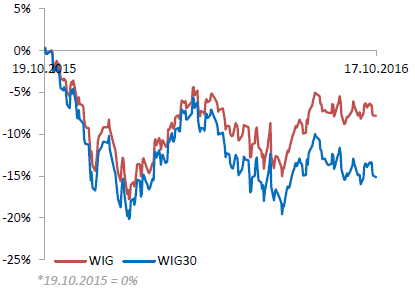

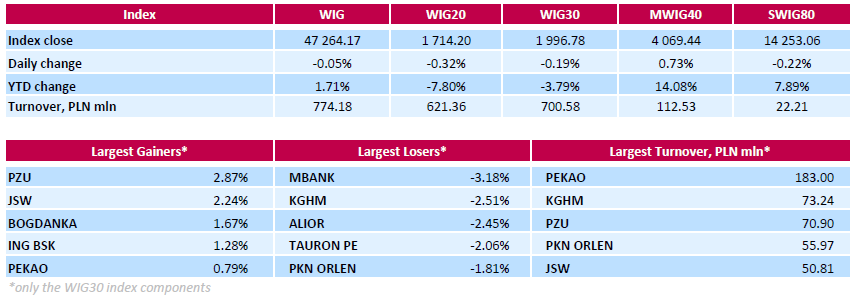

WSE: Session Results

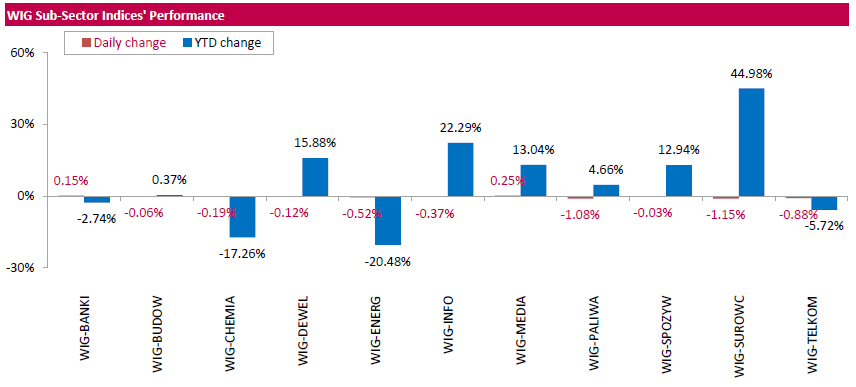

Polish equity market closed flat on Monday. The broad market measure, the WIG Index, edged down 0.05%. The WIG sub-sector indices were mainly lower with materials measure (-1.15%) underperforming.

The large-cap stocks' measure, the WIG30 Index, fell by 0.19%. In the index basket, banking sector name MBANK (WSE: MBK) topped the decliners' list, tumbling by 3.18%. Among other major laggards were copper producer KGHM (WSE: KGH), bank ALIOR (WSE: ALR) and genco TAURON PE (WSE: TPE), plunging by 2.51%, 2.45% and 2.06% respectively. On the other side of the ledger, insurer PZU (WSE: PZU) led the gainers, jumping by 2.87%, helped by the announcement the company is in talks to buy a 30-percent stake in bank PEKAO (WSE: PEO; +0.79%) from Italy's banking group Unicredit. It was followed by two coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB), climbing by 2.24% and 1.67% respectively.

-

15:24

Gold traded moderately higher today

Gold price rose moderately as a result of the weakening dollar. The dollar index has recently lost about 0.1%. A weaker dollar makes gold more attractive for holders of other currencies.

Pressure on the dollar had statistical data on the US. The research results, published by the Federal Reserve Bank of New York showed that the region's manufacturing index dropped significantly in October, contrary to the predicted improvement. According to the data, the manufacturing index this month fell to -6.8 points compared to -1.99 points in September. Economists had expected the index to increase 1.5 points.

Speculators, however, are beginning to look more pessimistic on the prospects for gold. Hedge funds reduced last week their net long position in gold to 153,776.

The reduction of long positions occurred amid increasing uncertainty about the US presidential election and the policy of the Federal Reserve, according to ING analysts.

The cost of December futures for gold on COMEX rose to $ 1258.1 per ounce.

-

15:21

UK's Fox agrees bilateral trade policy dialogue with New Zealand - Forexlive. GBP/USD up 40 pips so far

-

15:19

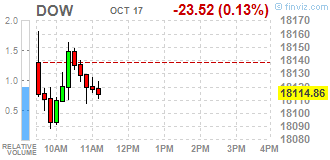

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes lower on Monday morning as a dip in energy and healthcare stocks more than offset the boost to financials from Bank of America (BAC) strong results.

Most of Dow stocks in negative area (20 of 30). Top gainer - International Business Machines Corporation (IBM, +0.66%). Top loser - Merck & Co., Inc. (MRK, -1.14%).

Almost all S&P sectors also in negative area. Top gainer - Utilities (+0.3%). Top loser - Conglomerates (-0.5%).

At the moment:

Dow 18036.00 -23.00 -0.13%

S&P 500 2124.50 -2.50 -0.12%

Nasdaq 100 4803.25 -1.00 -0.02%

Oil 49.59 -0.76 -1.51%

Gold 1257.20 +1.70 +0.14%

U.S. 10yr 1.78 -0.02

-

15:03

USD/JPY: US Earnings Season In The Driver's Seat This Week - Credit Agricole

"There is very little on in Japan this week to drive the JPY, so it will remain a function of investor sentiment. USD/JPY is one of the G10 crosses most sensitive within our FX Risk Index.

So the US earnings season will be important for the JPY and with the S&P500 trading at 18 times estimated earnings, investors will need to see some strong results to maintain this ratio.

However, as there is a general tendency of actual earnings releases to beat expectations it will be about company CEOs' forward guidance. Elsewhere, it will be about global growth conditions to drive sentiment, especially as there is limited room of major central banks such as the ECB making a case of rising liquidity expectations. The central bank announces its monetary policy this week. When it comes to growth, conditions remain muted as for instance confirmed by this week's trade data out of China.

As a result of the above outlined conditions caution may be warranted when it comes to USD/JPY. A combination of both better risk sentiment and rising US yields may be needed to push the pair higher".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

14:08

Five locations in Denmark evacuated over bomb threats - Livesquawk

-

13:49

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0980 (EUR 545m) 1.1000 (232m) 1.1050 (285m) 1.1050 (285m) 1.1115(262m) 1.1150 (222m) 1.1200-05 (491m)

GBPUSD 1.2500 (GBP 260m) 1.2750 (196m)

USDJPY 101.85 (USD 300m) 103.00 (240m) 103.75 (374m) 104.1 (402m) 104.50 (290m)

USDCHF: 0.9700 (250m) 0.9885 (225m)

EURGBP: 0.8600 (EUR 200m)

AUDUSD 0.7450 (AUD 268m) 0.7500 (590m) 0.7750 (433m)

USDCAD: 1.3100 (USD 251m) 1.3200 (274m)

NZDUSD: 0.7120 (NZD 479m)

-

13:32

U.S. Stocks open: Dow +0.06%, Nasdaq -0.01%, S&P +0.04%

-

13:19

Before the bell: S&P futures -0.04%, NASDAQ futures -0.08%

U.S. stock-index futures were little changed after paring an earlier drop, amid earnings reports from Bank of America (BAC) и Hasbro (HAS) .

Global Stocks:

Nikkei 16,900.12 +43.75 +0.26%

Hang Seng 23,037.54 -195.77 -0.84%

Shanghai 3,041.24 -22.56 -0.74%

FTSE 6,962.73 -50.82 -0.72%

CAC 4,454.99 -15.93 -0.36%

DAX 10,530.95 -49.43 -0.47%

Crude $50.40 (+0.10%)

Gold $1254.60 (-0.07%)

-

13:19

US Industrial Production edged up 0.1 percent in September, below forecast

Industrial production edged up 0.1 percent in September after falling 0.5 percent in August. For the third quarter as a whole, industrial production rose at an annual rate of 1.8 percent for its first quarterly increase since the third quarter of 2015. Manufacturing output increased 0.2 percent in September and moved up at an annual rate of 0.9 percent in the third quarter.

In September, the index for utilities declined 1.0 percent; mining posted a gain of 0.4 percent, which partially reversed its August decline. At 104.2 percent of its 2012 average, total industrial production in September was 1.0 percent lower than its year-earlier level.

Capacity utilization for the industrial sector edged up 0.1 percentage point in September to 75.4 percent, a rate that is 4.6 percentage points below its long-run (1972-2015) average.

-

13:15

U.S.: Industrial Production (MoM), September 0.1% (forecast 0.2%)

-

13:15

U.S.: Capacity Utilization, September 75.4% (forecast 75.6%)

-

13:15

U.S.: Industrial Production YoY , September -1%

-

12:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

26.41

-0.03(-0.1135%)

2440

Amazon.com Inc., NASDAQ

AMZN

820.16

-2.80(-0.3402%)

9355

Apple Inc.

AAPL

117.76

0.13(0.1105%)

65136

Barrick Gold Corporation, NYSE

ABX

15.74

0.05(0.3187%)

17587

Citigroup Inc., NYSE

C

48.4

-0.21(-0.432%)

6889

Facebook, Inc.

FB

128.04

0.16(0.1251%)

42243

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.55

-0.11(-1.1387%)

34084

General Electric Co

GE

28.82

-0.07(-0.2423%)

8064

Goldman Sachs

GS

170.57

0.05(0.0293%)

2260

Google Inc.

GOOG

778.4

-0.13(-0.0167%)

460

HONEYWELL INTERNATIONAL INC.

HON

108.01

-0.99(-0.9083%)

340

Intel Corp

INTC

37.5

0.05(0.1335%)

9600

Johnson & Johnson

JNJ

116.99

-0.57(-0.4849%)

1633

JPMorgan Chase and Co

JPM

67.25

-0.27(-0.3999%)

18347

McDonald's Corp

MCD

113.8

-0.29(-0.2542%)

4000

Microsoft Corp

MSFT

57.35

-0.07(-0.1219%)

3987

Nike

NKE

51.24

-0.38(-0.7361%)

4309

Pfizer Inc

PFE

32.77

0.11(0.3368%)

100

Tesla Motors, Inc., NASDAQ

TSLA

197.3

0.79(0.402%)

18252

The Coca-Cola Co

KO

41.65

-0.02(-0.048%)

3846

Travelers Companies Inc

TRV

114.5

-0.58(-0.504%)

213

Twitter, Inc., NYSE

TWTR

16.94

0.06(0.3555%)

242367

Verizon Communications Inc

VZ

50.33

0.05(0.0994%)

275

Yahoo! Inc., NASDAQ

YHOO

41.3

-0.14(-0.3378%)

1810

Yandex N.V., NASDAQ

YNDX

18.99

0.06(0.317%)

100

-

12:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

JPMorgan Chase (JPM) downgraded to Mkt Perform from Outperform at BMO Capital

JPMorgan Chase (JPM) downgraded to Neutral from Buy at Buckingham Research; target $74

Other:

Alphabet (GOOG) target raised to $1070 from $940 at Credit Suisse

McDonald's (MCD) target lowered to $122 from $129 at Nomura

Freeport-McMoRan (FCX) resumed with a Underperform at BofA/Merrill

Amazon (AMZN) target raised to $1050 from $920 at Credit Suisse

-

12:36

Foreign investment in Canadian securities increased in August

Foreign investment in Canadian securities totalled $12.7 billion in August, led by acquisitions of Canadian bonds on the secondary market. At the same time, Canadian investment in foreign securities slowed to $1.6 billion. This resulted in a net inflow of funds of $11.1 billion into the Canadian economy in the month.

This activity marked the eight straight month of net inflow of funds in Canada's international transactions in securities. Since the beginning of the year, foreign investment in Canadian securities has exceeded Canadian investment in foreign securities by $96.9 billion.

-

12:34

Business activity continued to decline in New York State

Business activity continued to decline in New York State, according to firms responding to the October 2016 Empire State Manufacturing Survey.

The headline general business conditions index slipped five points to -6.8. The new orders index edged up but remained negative at -5.6, indicating an ongoing drop in orders, and the shipments index increased to -0.6, suggesting that shipments were essentially flat.

Labor market conditions remained weak, with both employment levels and the average workweek reported as lower.

Price indexes increased somewhat, and continued to signal moderate input price increases and a slight increase in selling prices. Indexes for the six-month outlook suggested that manufacturing firms expect conditions to improve in the months ahead.

-

12:30

U.S.: NY Fed Empire State manufacturing index , October -6.8 (forecast 1.5)

-

12:30

Canada: Foreign Securities Purchases, August 12.74

-

12:25

European session review: slow start of the week so far

The following data was published:

(Time / country / index / period / previous value / forecast)

9:00 Eurozone Consumer Price Index m / m in September 0.2% 0.4% 0.4%

9:00 Eurozone Consumer Price Index y / y (final data) September 0.2% 0.4% 0.4%

9:00 Eurozone consumer price index base value, y / y (final data) September 0.8% 0.8% 0.8%

The euro rose moderately against the US dollar, reaching the psychological level of $ 1.1000, helped by inflation data for the euro area. The statistical agency Eurostat reported that consumer prices in the eurozone rose by 0.4% after rising 0.2% in September, Annual inflation was -0.1%. Meanwhile, the growth rate of annual inflation accelerated in September to 0.4% from 0.2% in the previous month. Last Change (MoM and YoY) in line with expectations and preliminary estimate. The base index, which excludes energy and food prices, rose 0.8% year on year, confirming the forecasts and coincided with the previous estimate. In August, the index also increased by 0.8%. The maximum rise in prices in the euro area (in annual terms) was seen in restaurants and cafes (+ 0.08%). Expenses for the rent increased by 0.05%. The cost of tobacco products also increased by 0.05%. Most of the decrease in prices for fuel for transport (-0.12%), gas (-0.11%) and heating oil (-0.10%).

Later today traders expect the United States report on industrial production, as well as speeches form ECB President Draghi and Fed Fisher. According to forecasts, up to September, industrial production rose by 0.2% after falling 0.4% a month earlier.

The pound traded steadily against the dollar, while remaining near the opening level, which was due to the lack of new catalysts. Given the current situation, the pound has growth potential in unexpected positive news.. This week a lot of data will be published, which will allow a better assessment of the state of the British economy. The inflation data, which will be released on Wednesday, will shed light on how the weakening of the pound affects the price. Economists expect that in the next few months will accelerate inflation, putting pressure on consumer spending. Economists also pay attention to the data on retail sales, which will be released on Thursday and show changes in the behavior of British consumers after Brexit.

EUR / USD: during the European session, the pair rose to $ 1.1003

GBP / USD: during the European session, the pair fell to $ 1.2134

USD / JPY: during the European session, the pair traded in a narrow range

-

11:49

Orders

EUR/USD

Offers 1.1000 1.1025-30 1.1055 1.1070 1.1085 1.1100-05 1.1130 1.1150

Bids 1.0975 1.0950 1.0920 1.0900 1.0880 1.0850 1.0820-25 1.0800

GBP/USD

Offers 1.2200 1.2220-25 1.2250 1.2265 1.2285 1.2300 1.2325-30 1.2350

Bids 1.2165 1.2145-50 1.2130 1.2100 1.2085 1.2050 1.2000

EUR/GBP

Offers 0.9050 0.9070-75 0.9100 0.9155 0.9200

Bids 0.9000 0.8985 0.8960-65 0.8930 0.8900 0.8850-55

EUR/JPY

Offers 114.60 114.80 115.00 115.50 115.80 116.00 116.25-30 116.50

Bids 114.15 114.00 113.70 113.50 113.00 112.60 112.00

USD/JPY

Offers 104.30 104.50 104.80 105.00 105.50 106.00

Bids 104.00 103.75-85 103.50 103.35 103.20 103.00 102.80 102.50

AUD/USD

Offers 0.7620 0.7635 0.7650 0.7685 0.7700 0.7720

Bids 0.7580 0.7550 0.7530 0.7500 0.7485 0.7450

-

11:31

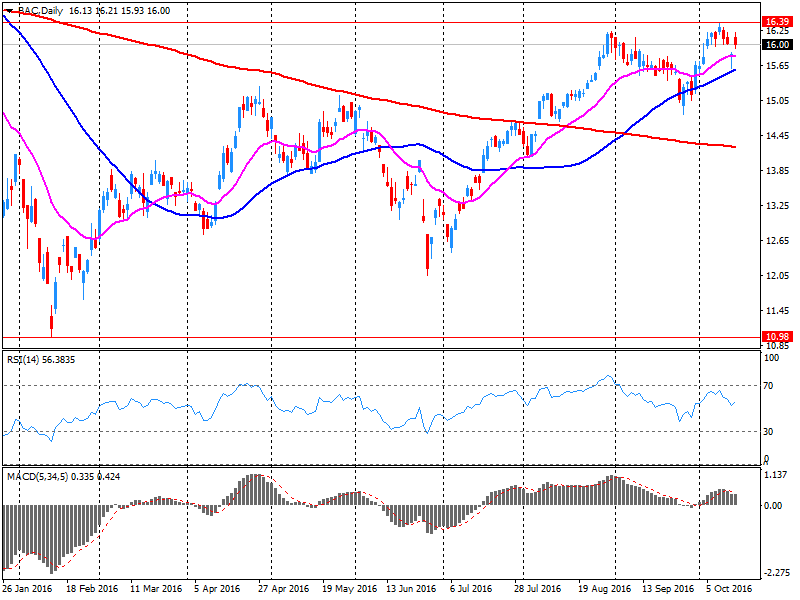

Company News: Bank of America (BAC) Q3 results beat analysts’ expectations

Bank of America reported Q3 FY 2016 earnings of $0.41 per share (versus $0.37 in Q3 FY 2015), beating analysts' consensus estimate of $0.34.

The company's quarterly revenues amounted to $21.635 bln (+3.1% y/y), beating analysts' consensus estimate of $21.039 bln.

BAC rose to $16.14 (+0.88%) in pre-market trading.

-

11:20

Earnings Season in U.S.: Major Reports of the Week

October 17

Before the Open:

Bank of America (BAC). Consensus EPS $0.34, Consensus Revenue $21038.91 mln.

After the Close:

IBM (IBM). Consensus EPS $3.23, Consensus Revenue $19011.02 mln.

October 18

Before the Open:

Goldman Sachs (GS). Consensus EPS $3.83, Consensus Revenue $7406.94 mln.

Johnson & Johnson (JNJ). Consensus EPS $1.65, Consensus Revenue $17735.15 mln.

UnitedHealth (UNH). Consensus EPS $2.08, Consensus Revenue $46061.01 mln.

After the Close:

Intel (INTC). Consensus EPS $0.72, Consensus Revenue $15605.45 mln.

Yahoo! (YHOO). Consensus EPS $0.14, Consensus Revenue $861.32 mln.

October 19

After the Close:

American Express (AXP). Consensus EPS $0.96, Consensus Revenue $7712.31 mln.

October 20

Before the Open:

Travelers (TRV). Consensus EPS $2.35, Consensus Revenue $6236.80 mln.

Verizon (VZ). Consensus EPS $0.99, Consensus Revenue $31112.02 mln.

After the Close:

Microsoft (MSFT). Consensus EPS $0.68, Consensus Revenue $21714.09 mln.

October 21

Before the Open:

General Electric (GE). Consensus EPS $0.30, Consensus Revenue $29680.03 mln.

Honeywell (HON). Consensus EPS $1.62, Consensus Revenue $9776.42 mln.

McDonald's (MCD). Consensus EPS $1.49, Consensus Revenue $6287.79 mln.

-

10:46

Major stock indices in Europe show a negative trend

European stocks traded in the red zone for the fourth time in the last five sessions. The pressure on the shares put fears for the global economy, weak accountability of several European companies, as well as the negative dynamics of the oil market.

Investors are also watching for CB leaders in an attempt to get hints about changes in monetary policy. On Friday, Fed Chairman Yellen noted that he supports the idea of continuing low interest rates, as this may allow the economy to gain momentum and mitigate the effects of a prolonged period of weak growth. Meanwhile, today the Federal Reserve Bank of Boston President Rosengren said that the low level of unemployment in the US in the near future will lead to full employment and it will make the voting members of the FOMC more confident about the growth of interest rates. "I think that in November the Fed will still be inactive, however, in December, it would be reasonable to raise interest rates", - said Rosengren. Also he noted Rosengren predicted 2% inflation target by the end of 2017.

In addition, attention gradually shifted to the ECB meeting. Most likely, the base rate will be left at the zero level, and the amount of monthly asset purchases - at the level of 80 billion euros. Most economists also expect that the Central Bank will extend the QE program, which should be completed in March 2017, but this decision is unlikely to be taken before December. Meanwhile, ECB President Draghi may announce changes in the structure of the program, aimed at preventing possible shortages of acquired assets.

The statistical agency Eurostat reported that consumer prices in the eurozone rose by 0.4% after rising 0.2% in September, Annual inflation was -0.1%. Meanwhile, the growth rate of annual inflation accelerated in September to 0.4% from 0.2% in the previous month. Last Change (MoM and YoY) in line with expectations and preliminary estimate. The base index, which excludes energy and food prices, rose 0.8% year on year, confirming the forecasts and coincided with the previous estimate. In August, the index also increased by 0.8%. The maximum rise in prices in the euro area (in annual terms) was seen in restaurants and cafes (+ 0.08%). Expenses for the rent increased by 0.05%. The cost of tobacco products also increased by 0.05%. Most of the decrease in prices for fuel for transport (-0.12%), gas (-0.11%) and heating oil (-0.10%).

The composite index of the largest companies in the region Stoxx Europe Index 600 lost 0.7 percent.

Pearson Plc's capitalization declined by 10.6 per cent after the company, which publishes the influential newspaper "Financial Times, reported a reduction in quarterly earnings and warned of difficult trading conditions.

Cost of Marine Harvest has fallen to 3.6 percent, as the company lowered its production target figures for 2016.

Shares of Banco Popolare and Banca Popolare di Milano fell by 1.3 per cent and 5.6 per cent after its shareholders have approved their merger, clearing the way for the formation of the third-largest lender in Italy.

Quotes of retailer Hennes & Mauritz fell 1.5 percent. The company reported that comparable sales rose in September by 1%, as the unusually warm weather negatively affected the sales of winter clothes.

At the moment:

FTSE 100 6953.91 -59.64 -0.85%

DAX -68.67 10511.71 -0.65%

CAC 40 4445.60 -25.32 -0.57%

-

10:39

BOJ says strong yen may be affecting consumer sentiment

-

09:03

Final EuroZone CPI unchanged from preliminary release

Euro area annual inflation was 0.4% in September 2016, up from 0.2% in August. In September 2015 the rate was -0.1%. European Union annual inflation was also 0.4% in September 2016, up from 0.3% in August. A year earlier the rate was -0.1%. These figures come from Eurostat, the statistical office of the European Union. In September 2016, negative annual rates were observed in ten Member States.

The lowest annual rates were registered in Bulgaria (-1.1%), Croatia (-0.7%) and Slovakia (-0.5%). The highest annual rates were recorded in Belgium (1.8%), Estonia (1.7%) and Austria (1.1%). Compared with August 2016, annual inflation fell in nine Member States, remained stable in two and rose in sixteen.

The largest upward impacts to euro area annual inflation came from restaurants & cafés (+0.08 percentage points), rents and tobacco (both +0.05 pp), while fuels for transport (-0.12 pp), gas (-0.11 pp) and heating oil (-0.10 pp) had the biggest downward impacts.

-

09:01

Eurozone: Harmonized CPI, September 0.4% (forecast 0.4%)

-

09:00

Eurozone: Harmonized CPI, Y/Y, September 0.4% (forecast 0.4%)

-

09:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, September 0.8% (forecast 0.8%)

-

08:23

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0980 (EUR 545m) 1.1000 (232m) 1.1050 (285m) 1.1050 (285m) 1.1115(262m) 1.1150 (222m) 1.1200-05 (491m)

GBP/USD 1.2500 (GBP 260m) 1.2750 (196m)

USD/JPY 101.85 (USD 300m) 103.00 (240m) 103.75 (374m) 104.1 (402m) 104.50 (290m)

USD/CHF: 0.9700 (250m) 0.9885 (225m)

EUR/GBP: 0.8600 (EUR 200m)

AUD/USD 0.7450 (AUD 268m) 0.7500 (590m) 0.7750 (433m)

USD/CAD: 1.3100 (USD 251m) 1.3200 (274m)

NZD/USD: 0.7120 (NZD 479m)

-

08:13

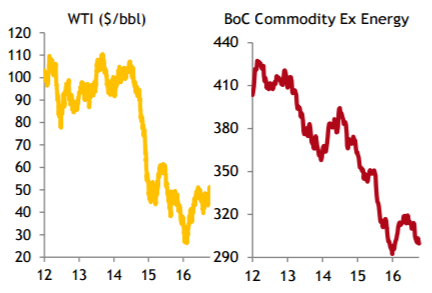

CIBC: Stay Short The Loonie Even As Oil Creeps Higher

"If crude oil's slide was the nail in the coffin for a strong Canadian dollar, why isn't the loonie rising from the dead as oil stages a comeback? Because it's a rally for the wrong reasons, of insufficient magnitude, and its role in weakening the exchange rate has been overstated in the first place.

Oil's rally is a story about a pending supply cut by OPEC, not a signal of accelerating demand. Had it been a demand-pull story, we would historically have seen other cyclical commodities on the mend, but that's not generally the case. The Bank of Canada's exenergy commodity price index, weighted to the country's activity in the resource space, remains moribund (Chart). Canada's export basket does not live by oil alone, and the weakness in prices for such commodities as copper, potash and uranium, for example, are signposts that global markets aren't yet in great shape. Their softness will still be weighing on Canada's nominal trade balance, one of the drivers for the currency.

The oil rally also isn't nearly enough to get now-delayed mega-projects back on the drawing board. Rig counts in Canada have bottomed, but they're also turning higher stateside, with a US shale oil return representing a wall of supply that will keep higher cost oil sands projects off the table for a few years to come.

Oil can't bear all the blame, because even when we flirted with triple digit WTI prices in 2011-13, Canada was running a large trade and current account deficit. Instead, most of the drop in the Canadian dollar was an overdue correction from an overvalued level attained after the Bank of Canada went solo with rate hikes in 2010.

Much of what the Bank of Canada will say in the week ahead should already be priced in. Governor Poloz is unlikely to cut rates immediately, and the market should already have taken note of hints of a downgrade in the BoC's medium term growth forecast.

But if there's any reaction in the currency, it will be a modest weakening. The OIS futures market has not priced in any chance of an ease in the quarters ahead. While our base case also has a flat path for Canadian overnight rates, don't be surprised if the market prices in some chance of a cut in the months ahead. New mortgage rules should reduce the BoC's fear that a rate cut would fuel a more worrisome housing bubble, and might raise concerns of that a slowing in homebuilding will eat into growth.

Look for a dovish tone in the Bank's message to at least open the door a crack to a rate cut if necessary, a contrast to a more hawkish Fed. That's reason enough to stay short the loonie even as oil creeps higher.

CIBC targets USD/CAD ta 1.35 by the end of the year".

Copyright © 2016 CIBC, eFXnews™

-

08:07

Italian August trade balance declines significantly - Istat

In August 2016 seasonally-adjusted data, compared to July 2016, raised for both flows: +2.6% for exports and +4.4% for imports. Exports increased by 3.9% for EU countries and by 0.9% for non EU countries. Imports grew by +5.7% for non EU countries and by 2.5% for EU countries. During the quarter June-August 2016, seasonally-adjusted data, in comparison with the previous quarter, increased by 1.1% for exports and by 2.7% for imports.

In August 2016, compared with the same month of the previous year, exports increased by 11.4% and imports by 9.4%. Outgoing flows grew by 11.8% for EU countries and by 11.0% for non EU countries. Incoming flows increased by 12.8 for EU area and by 5.2% for non EU area. The trade balance in August amounted to +2,5 billion Euros (+0,4 billion Euros for EU area and +2,1 billion Euros for non EU countries).

The import price index measures the evolution of prices for industrial products bought by industrial and commercial enterprises in Italy, both in the euro zone and the non-euro zone. Since March 2010 indices are compiled in the reference base 2010.

In August 2016 the total import price index stayed unchanged with respect to the previous month (the index stayed unchanged both in euro zone and in non-euro zone); the total twelve-month rate of change decreased by 2.5% (respectively decreased by 1.5% for the euro zone and by 3.3% for the non-euro zone).

The quarterly total index increased by 1.0% compared with the previous period, by 0.4% for the euro zone and by 1.6% for the non-euro zone.

-

08:01

Russia ready to act on oil production freeze - Forexlive

-

oil prices good for current projects, too low for future

-

sees positive trend in oil talks

-

Saudi and Iran seem more flexible in talks

-

-

07:46

Major stock markets trading in the red zone: FTSE -0.1%, DAX -0.4%, CAC40 -0.4%, FTMIB -0.2%, IBEX -0.5%

-

07:39

Oil is trading lower

This morning, the New York futures for Brent have fallen 0.52% to $ 50.08 and crude oil futures WTI have down 0.42% to $ 51.72 per barrel. Thus, the black gold is traded in the red zone on the background of the growing number of drilling rigs in the United States, and a strong dollar.

According to Baker Hughes the number of active oil rigs increased by four units.

The dollar's rise to a seven-month high against a basket of major currencies due to expectations of a Fed hike this year, also put pressure on the oil quotations.

OPEC will meet on November 30 to discuss the reduction of oil production. The participants of the cartel hope that States that are not members of the organization, in particular Russia, to join a potential agreement on production cuts.

-

07:05

Today’s events

-

At 12:45 GMT the ECB member Yves Mersch will make a speech

-

At 13:00 GMT the Bundesbank Monthly Report

-

At 17:45 GMT the Bank of England Deputy Governor for Monetary Policy Ben Broadbent will deliver a speech

-

At 19:15 GMT the Federal Reserve Vice Chairman Stanley Fischer will deliver a speech

-

At 20:35 GMT the ECB president Mario Draghi will deliver a speech

-

-

06:50

UK Rightmove house prices rose 0.9%

-

Price of property coming to market rebounds by 0.7% (+£2,277) after falling 2.0% over previous two months

-

First-time buyers in danger of being marooned by rising prices cutting them off from home-ownership:

-

Monthly jump of 3.3% (+£6,240) in price of newly-marketed property with two bedrooms or fewer

-

New seller asking prices now almost £20,000 (+10.5%) higher than a year ago in this sector

-

Higher prices mean higher deposits and repayments, negating the benefits of falling mortgage rates

-

Broadly positive picture overall as the market continues to shake off post-Brexit vote uncertainty:

-

Seven out of 10 regions see asking price rises or standstills this month, compared with eight falls last month

-

First full week of September sees visits to Rightmove up 8% on same period in 2015

-

-

06:48

Negative start of trading expected on the major stock exchanges in Europe: DAX futures -0.4%, CAC40 -0.4%, FTSE -0.3%

-

06:47

Britain can't get full single market access with free movement concessions - Merkel

-

06:41

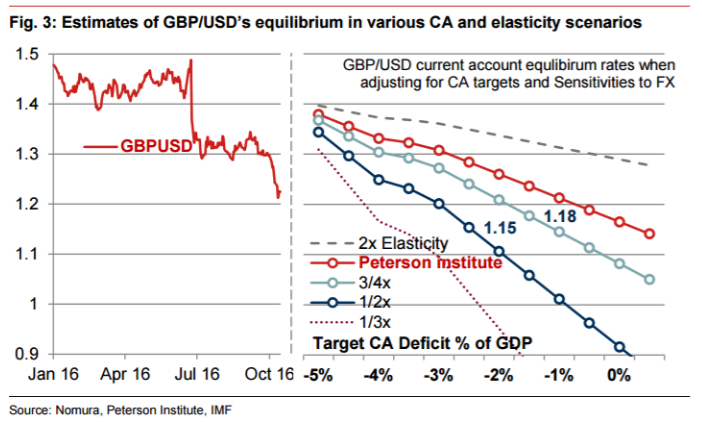

GBP: Moving Towards A 'Hard Brexit'; Stay Short For 1.20 & Sell Any Rallies - Nomura

"Since the Conservative party conference in Birmingham just under two weeks ago the market has progressed again through the five stages of "Brexit grief" into acceptance of a Hard Brexit.

The rhetoric from ministers with "red lines" on immigration has considerably lowered the possibility of a "Soft Brexit" in the market's pricing and we have moved more towards the "Clean Break" or "Hard Brexit" outcome. With the market's acceptance of this it has naturally seen GBP suffer. But it is more than just that. It has changed the dynamic we see between UK rates markets and FX that leads us to conclude that we have not yet seen the bottom in GBP, with portfolio inflows less likely to provide the necessary inflows to the UK to plug the current account deficit

We have strategically been short GBP all throughout this time initially targeting 1.25 in GBP/USD before the flash crash, then targeting 1.20 in its aftermath.

From these levels it is less attractive for some to enter fresh shorts, but given the new market dynamic we continue to recommend selling GBP initially to 1.20 and further and for EUR/GBP to break above 0.92.

We head yet again into another weekend with potential for further political headlines. At some point there may be some good news that leads to a GBP positioning squeeze higher (as the market is very short GBP). The current High Court case on parliament's ability to vote on Article 50 is a likely headline risk if it rules in favour of a vote being required. What is also an interesting question will be how much of a squeeze? Prior to the flash crash we would have said a considerable amount (3-4% perhaps), but now with many short positions in the exotic options space likely to have been cleared out perhaps it won't be such a position squeeze. Over the last few sessions we are inclined to say that GBP has been trading in a way that would imply that short-term positioning is a lot cleaner.

So if there is any rally it should be shortlived and will be used by the market as an opportunity to sell at better levels unless of course it is due to a complete reversal of position from politicians on the current "Hard Brexit" stance".

Copyright © 2016 Nomura, eFXnews™

-

06:24

Rosengren Signals Willingness to Keep Rates Steady in November

-

Comments in WSJ Interview

-

Jobless Rate Drifting Below 4.7

-

Market Expectations for December Rate Move Are 'Reasonable'

-

Suggests Using Balance Sheet to Steepen Yield Curve

-

-

06:21

Japan's industrial production rebounded less than initially estimated in August

According to rttnews, Japan's industrial production rebounded less than initially estimated in August, final figures from the Ministry of Economy, Trade and Industry said on Monday.

Industrial production rose a seasonally adjusted 1.3 percent month-over-month in August instead of a 1.5 percent increase reported earlier. This was followed by a 0.4 percent drop in July.

Shipments dropped 1.1 percent over the month, revised from a 1.3 percent decline estimated initially. At the same time, inventories increased 0.3 percent in August, revised up from 0.1 percent.

On an annual basis, industrial production expanded 4.5 percent from July, when it fell by 4.2 percent. It was the first rise in five months.

The capacity utilisation grew at a faster pace of 2.6 percent monthly in August, following a 0.6 percent gain in the preceding month.

-

06:20

Nicola Sturgeon: Scotland may seek separate EU trade deal

-

05:06

Options levels on monday, October 17, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1179 (2285)

$1.1143 (1437)

$1.1087 (731)

Price at time of writing this review: $1.0985

Support levels (open interest**, contracts):

$1.0922 (7738)

$1.0892 (5078)

$1.0857 (3051)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 35327 contracts, with the maximum number of contracts with strike price $1,1300 (3749);

- Overall open interest on the PUT options with the expiration date November, 4 is 44395 contracts, with the maximum number of contracts with strike price $1,1000 (7738);

- The ratio of PUT/CALL was 1.26 versus 1.25 from the previous trading day according to data from October, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.2504 (968)

$1.2407 (709)

$1.2311 (1059)

Price at time of writing this review: $1.2156

Support levels (open interest**, contracts):

$1.2089 (1461)

$1.1992 (568)

$1.1894 (458)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 28544 contracts, with the maximum number of contracts with strike price $1,2800 (2210);

- Overall open interest on the PUT options with the expiration date November, 4 is 28504 contracts, with the maximum number of contracts with strike price $1,2300 (1462);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from October, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:46

Japan: Industrial Production (YoY), August 4.5%

-

04:43

Global Stocks

European stocks stepped higher Friday, as bank shares rose and mining stocks got a lift from upbeat inflation news out of China. Economic data out of China on Friday were more upbeat. Consumer price inflation rose more strongly than expected to 1.9%, while producer prices edged up 0.1% in September. That marks the first time the factory-price gauge has been positive in more than four years.

U.S. stocks on Friday finished barely higher as an early rise, buoyed by gains in bank shares, faded into the close. The three main equity benchmarks finished the week with a second-straight weekly loss. Comments from Federal Reserve Chairwoman Janet Yellen midday Friday, where she suggested the fed could overshoot its 2% inflation target, and a strengthening dollar DXY, -0.05% up 0.6%, helped to limit gains for U.S. equities.

Asian shares were broadly lower Monday morning, with the Nikkei giving up early gains, driven by a sharp decline in electric utilities stocks after a nuclear-power skeptic's weekend win in a Japanese gubernatorial race.

-

04:31

Japan: Industrial Production (MoM) , August 1.3%

-